Forex analysis review |

- EURUSD approaching resistance, potential big drop coming up!

- Fractal analysis of the main currency pairs as of October 31

- Takeoff and landing: the Australian dollar is trying to gain height

- Fed weakness (review of EUR/USD and GBP/USD dated 10/30/2019)

- Is the Canadian dollar a child of fortune? The loonie has a second wind

- EURUSD: Regular evidence of a slowdown in the eurozone economy. The Fed's decision will not affect markets much

- New horizons for the pound, or Brexit stumbled on an early election

- EUR/USD. October 30. Results of the day. Macroeconomic data from overseas have finally pleased traders

- GBP/USD. Pound fell into suspended animation: traders await final decision on re-election in Britain

- GBP/USD. October 30. Results of the day. Why can the next re-election to the Parliament become a futile event?

- October 30, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- October 30, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- BTC 10.30.2019 -Potential gap fill on the Bitcoin

- Gold 10.30.2019 - Failed test of the Pitchfork median line, watch for downside break

- EUR/USD for October 30,2019 - EUR in consoldiation with the potential for downside break

- Trading recommendations for the GBPUSD currency pair – placement of trade orders (October 30)

- GBP/USD: plan for the American session on October 30th. Volatility in the pound continues to return to normal. The bulls

- EUR/USD: plan for the American session on October 30th. Data on Germany and the eurozone did not allow to break above the

- Technical analysis of AUD/USD for October 30, 2019

- EUR/USD: will the Fed limit itself to three rate cuts?

- Gold bets on the "dovish" Fed

- Trading recommendations for the EURUSD currency pair – placement of trade orders (October 30)

- Trading strategy for EUR/USD on October 30th. The word "recession" continues to scare traders, but not the Fed

- Trading strategy for GBP/USD on October 30th. Liberal Democrats will fight to win the election alongside the conservatives

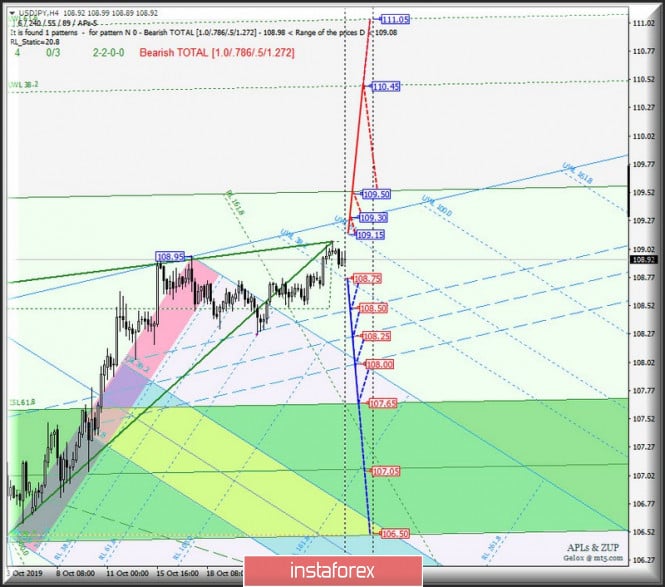

- #USDX vs EUR / USD vs GBP / USD vs USD / JPY (H4). Comprehensive analysis of movement options from October 30, 2019 APLs

| EURUSD approaching resistance, potential big drop coming up! Posted: 30 Oct 2019 07:42 PM PDT Entry : 1.11657 Why is it good: Horizontal swing high resistance Stop Loss: 1.12300 Why is it good: Horizontal swing high resistance, 61.8% fiboancci retracement Take Profit: 1.10670 Why is it good: Horizontal overlap support, 38.2% fibonacci retracement The material has been provided by InstaForex Company - www.instaforex.com |

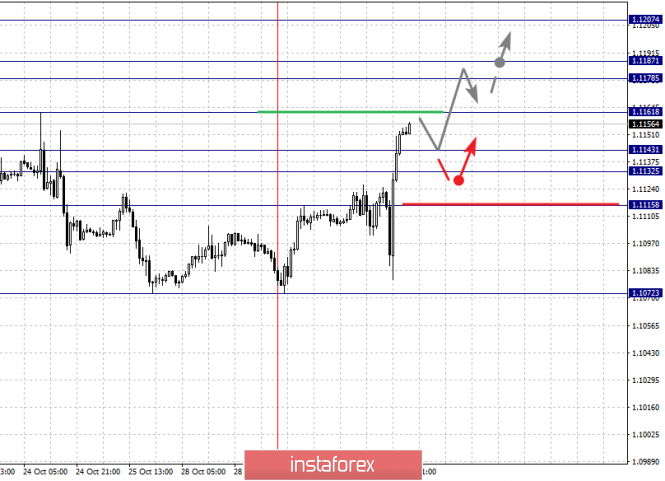

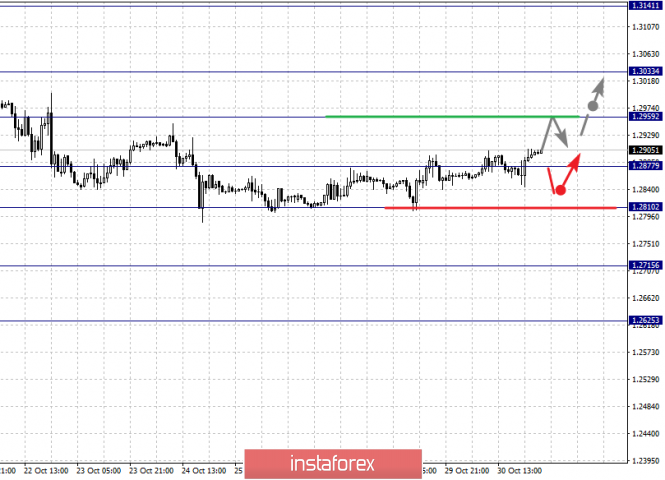

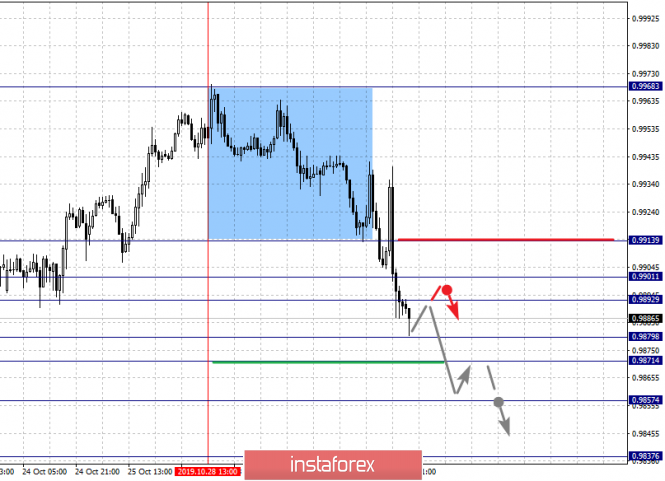

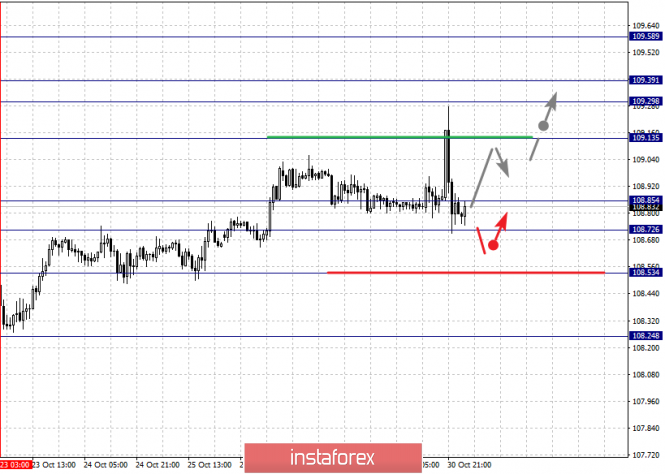

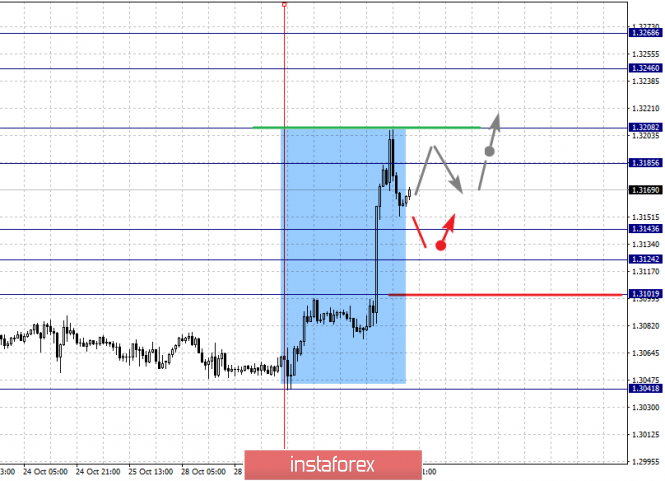

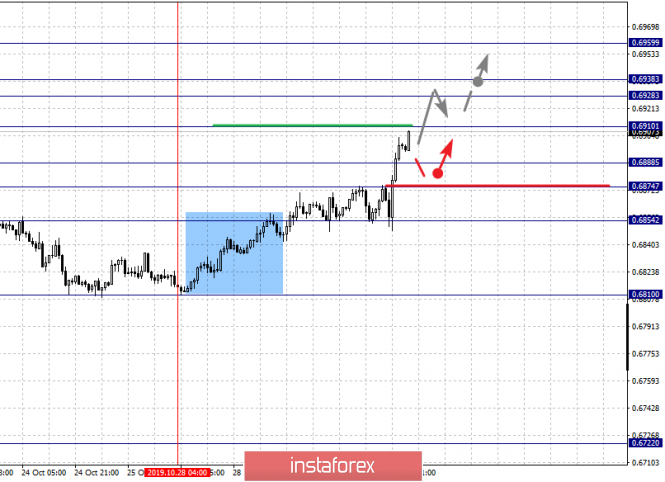

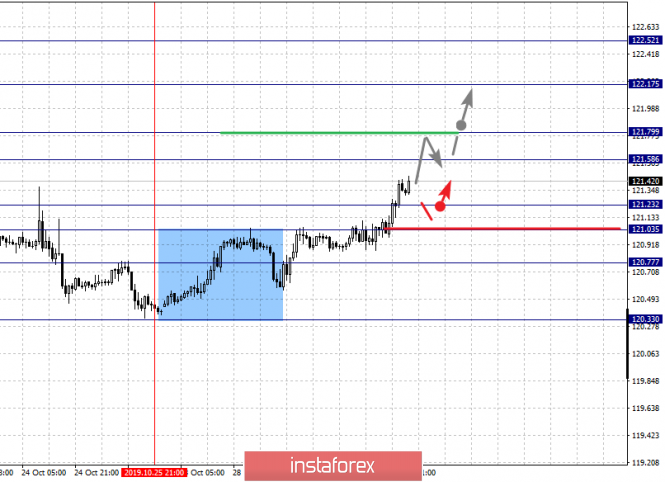

| Fractal analysis of the main currency pairs as of October 31 Posted: 30 Oct 2019 06:16 PM PDT Forecast for October 31: Analytical review of currency pairs in scale H1: For the euro / dollar pair, the key levels on the H1 scale are: 1.1207, 1.1187, 1.1178, 1.1161, 1.1143, 1.1132 and 1.1115. Here, we are following the formation of medium-term initial conditions for the top of October 29. The continuation of the movement to the top is expected after the breakdown of the level of 1.1161. In this case, the target is 1.1187. Price consolidation is in the range of 1.1187 - 1.1178. For the potential value for the top, we consider the level of 1.1207. Upon reaching this value, we expect a pullback to the bottom. Short-term downward movement is expected in the range 1.1143 - 1.1132. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 1.1115. This level is a key support for the upward structure. The main trend is the formation of medium-term initial conditions for the top of October 29. Trading recommendations: Buy: 1.1161 Take profit: 1.1178 Buy: 1.1188 Take profit: 1.1207 Sell: 1.1143 Take profit: 1.1133 Sell: 1.1131 Take profit: 1.1115 For the pound / dollar pair, the key levels on the H1 scale are: 1.3215, 1.3141, 1.3033, 1.2939, 1.2810, 1.2734 and 1.2625. Here, the price has entered an equilibrium state. The continuation of the movement to the top is expected after the breakdown of the level of 1.2959. In this case, the first target is 1.3035. The breakdown of the level of 1.3035 will lead to a pronounced upward movement. Here, the potential target is 1.3141. Price consolidation is in the range of 1.3141 - 1.3215. We expect consolidated movement in the range of 1.2877 - 1.2810. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.2715. This level is a key support for the top. Its breakdown will lead to the formation of potential for the downward cycle. Here, the goal is 1.2625. The main trend is the equilibrium state. Trading recommendations: Buy: 1.2960 Take profit: 1.3031 Buy: 1.3035 Take profit: 1.3140 Sell: 1.2808 Take profit: 1.2717 Sell: 1.2713 Take profit: 1.2627 For the dollar / franc pair, the key levels on the H1 scale are: 0.9913, 0.9901, 0.9892, 0.9879. 0.9871, 0.9857 and 0.9837. Here, we are following the development of the descending structure of October 28. Short-term movement to the bottom is expected in the range of 0.9879 - 0.9871. The breakdown of the latter value will lead to a movement to the level of 0.9857. Price consolidation is near this level. For the potential value for the bottom, we consider the level of 0.9837. Upon reaching this level, we expect a pullback to the top. Short-term upward movement is possibly in the range of 0.9892 - 0.9901. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 0.9913. This level is a key support for the downward structure. The main trend is the descending structure of October 28. Trading recommendations: Buy : 0.9892 Take profit: 0.9900 Buy : 0.9903 Take profit: 0.9913 Sell: 0.9870 Take profit: 0.9858 Sell: 0.9855 Take profit: 0.9838 For the dollar / yen pair, the key levels on the scale are : 109.58, 109.39, 109.29, 109.13, 108.85, 108.72 and 108.53. Here, we are following the development of the upward cycle of October 23. The continuation of the movement to the top is expected after the breakdown of the level of 109.13. In this case, the target is 109.29. Price consolidation is in the range of 109.29 - 109.39. For the potential value for the top, we consider the level of 109.58, upon reaching which, we expect a pullback to the bottom. Short-term downward movement is expected in the range of 108.85 - 108.72. The breakdown of the last value will lead to an in-depth correction. Here, the target is 108.53. This level is a key support for the top. Main trend: local structure for the top of October 23. Trading recommendations: Buy: 109.13 Take profit: 109.29 Buy : 109.40 Take profit: 109.56 Sell: 108.85 Take profit: 108.74 Sell: 108.70 Take profit: 108.55 For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3268, 1.3246, 1.3208, 1.3185, 1.3143, 1.3124 and 1.3101. Here, the price forms the long-term initial conditions for the upward cycle of October 29. Short-term movement to the top is expected in the range of 1.3185 - 1.3208. The breakdown of the latter value will lead to a pronounced movement. Here, the target is 1.3246. For the potential value for the top, we consider the level of 1.3268. Upon reaching this level, we expect a pullback to the bottom. Short-term downward movement is possibly in the range of 1.3143 - 1.3124. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.3101. This level is a key support for the upward structure. The main trend is the formation of initial conditions for the top of October 29. Trading recommendations: Buy: 1.3185 Take profit: 1.3206 Buy : 1.3209 Take profit: 1.3246 Sell: 1.3143 Take profit: 1.3126 Sell: 1.3122 Take profit: 1.3101 For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6959, 0.6938, 0.6928, 0.6910, 0.6888, 0.6874 and 0.6854. Here, we are following the development of the local upward cycle of October 28. The continuation of the movement to the top is expected after the breakdown of the level of 0.6910. In this case, the target is 0.6928. Price consolidation is in the range of 0.6928 - 0.6938. For the potential value for the top, we consider the level of 0.6959. Upon reaching this level, we expect a pullback to the bottom. Short-term downward movement is possibly in the range of 0.6888 - 0.6874. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 0.6854. This level is a key support for the top. The main trend is the local structure for the top of October 28. Trading recommendations: Buy: 0.6910 Take profit: 0.6928 Buy: 0.6938 Take profit: 0.6959 Sell : 0.6888 Take profit : 0.6875 Sell: 0.6873 Take profit: 0.6855 For the euro / yen pair, the key levels on the H1 scale are: 122.52, 122.17, 121.79, 121.58, 121.23, 121.03 and 120.77. Here, we are following the development of the ascending structure of October 25. Short-term upward movement is expected in the range 121.58 - 121.79. The breakdown of the latter value should be accompanied by a pronounced upward movement. In this case, the target is 122.17. Price consolidation is near this level. For the potential value for the top, we consider the level of 122.52. Upon reaching this value, we expect a pullback to the bottom. We expect a short-term downward movement in the range of 121.23 - 121.03. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 120.77. This level is a key support for the top. The main trend is the upward structure of October 25. Trading recommendations: Buy: 121.58 Take profit: 121.78 Buy: 121.81 Take profit: 122.17 Sell: 121.23 Take profit: 121.04 Sell: 121.02 Take profit: 120.78 For the pound / yen pair, the key levels on the H1 scale are : 142.82, 141.23, 139.53, 138.70, 137.79 and 137.08. Here, the price is still in the equilibrium. The continuation of movement to the top is expected after the breakdown of the level of 141.23. In this case, the potential target is 142.82. Upon reaching which, we expect consolidation, as well as a pullback to the bottom. Short-term downward movement, as well as consolidation, are possible in the range of 139.53 - 138.70. The breakdown of the last value will lead to a long correction. Here, the target is 137.79. The range of 137.79 - 137.08 is the key support for the top. The main trend is the medium-term upward structure of October 8, the formation of potential for the downward movement of October 21. Trading recommendations: Buy: Take profit: Buy: 141.25 Take profit: 142.80 Sell: 139.50 Take profit: 138.75 Sell: 138.65 Take profit: 137.80 The material has been provided by InstaForex Company - www.instaforex.com |

| Takeoff and landing: the Australian dollar is trying to gain height Posted: 30 Oct 2019 03:35 PM PDT The Australian currency approached the middle of the week in a somewhat "disassembled" state. Like a fledgling chick, the aussie tried to rise at the beginning of the week, but it slightly got "blown away" in the middle, nearly abandoning its attempts. The current dynamics of the Australian dollar is not very positive, but there is no obvious negative either. On Tuesday, October 29, significant support for the aussie was provided by the positive mood of investors after the news of little progress in trade negotiations between the US and China. Recall that China and America are the main trade and economic partners of Australia, while China remains the largest buyer of its agricultural products and raw materials. According to analysts, the positive changes in US-Chinese trade relations are supporting the Australian economy and its currency. Yesterday, the AUD/USD pair tried to take revenge and win back the previous falls. The pair tried to gain a foothold above 0.6850, but did not stay in this position for long. Soon, the pair began to decline. The reason was the speech of Philip Lowe, head of the Reserve Bank of Australia (RBA). He announced the readiness of the regulator to further reduce interest rates. Lowe noted that the RBA has no right to ignore the actions of central banks of other countries, as this will lead to the strengthening of the Australian dollar. Recall that earlier, the Australian regulator lowered interest rates to record low levels, which caused concern for market participants. They fear that after a cut in the key rate in June, July and October of this year, the RBA will have to lower the cost of borrowing further. In the coming months, however, the market expects the Australian regulator to cut rates. One of the catalysts for such a decision may be not so consoling economic data. Inflation data for the third quarter of 2019 is expected to be released in Australia on Wednesday, October 30. Experts expect inflation to increase by about 1.7%, although this figure is below the target level of 2-3%. It should be noted that the consumer price index in the country has not reached the target range of 2-3% for a long time. This pushes the regulator to introduce monetary stimulus measures. This is a quantitative easing (QE) program. Analysts believe that the RBA may raise this issue at the next meeting, which will be held next week. If this scenario is realized, the pressure on the AUD/USD pair will increase; its decline to the levels of 0.6600–0.6700 is not ruled out. The pair was trading at a fairly stable level of 0.6866–0.6867 on Wednesday morning, October 30. Analysts record the long-term downward dynamics of the aussie. This month, the Australian currency was was supported by the expectation of a trade agreement between the United States and China. In the case of a positive solution to this issue, profit taking will begin in long positions on the Australian dollar and in the AUD/USD pair. A similar situation will return the pair to a global downward trend, experts said. Analysts consider 0.6890 as the closest strong resistance level in the AUD/USD pair. The pair approached this bar twice - in September and October 2019, but could not overcome the threshold. At the moment, the AUD/USD pair is trading at 0.6872-0.6873, having slightly climbed after the morning decline. In the event of a breakdown of the short-term support level of 0.6830, analysts expect the pair to return to the bearish trend. Such a price reversal will be a signal for the resumption of sales of AUD/USD, experts conclude. The material has been provided by InstaForex Company - www.instaforex.com |

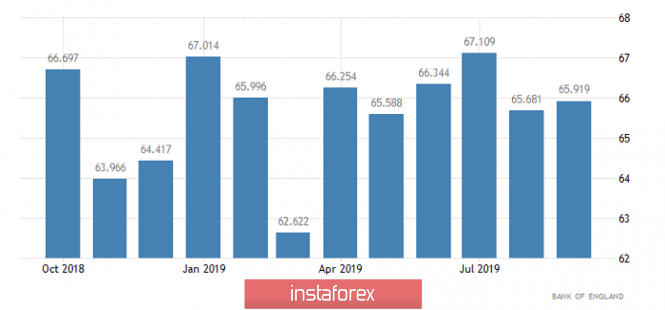

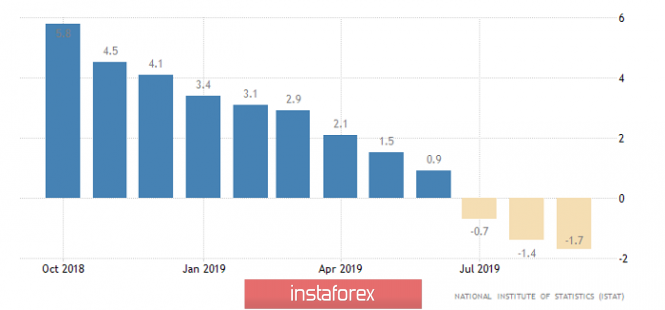

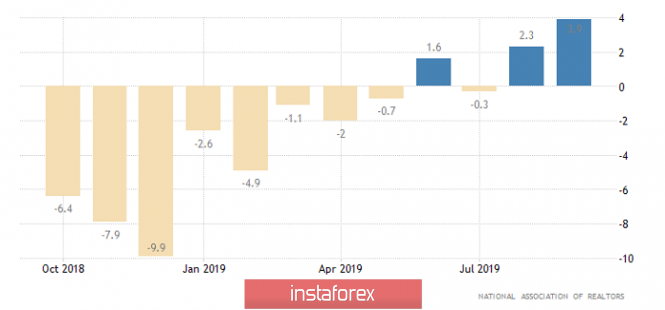

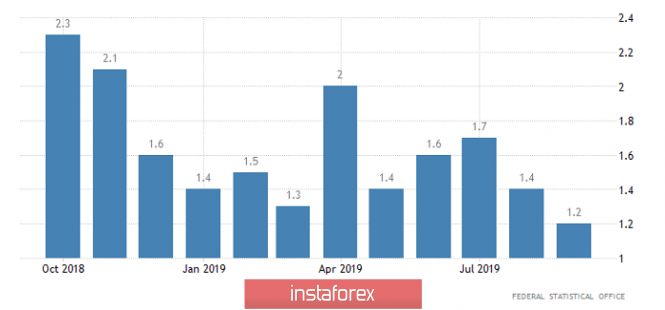

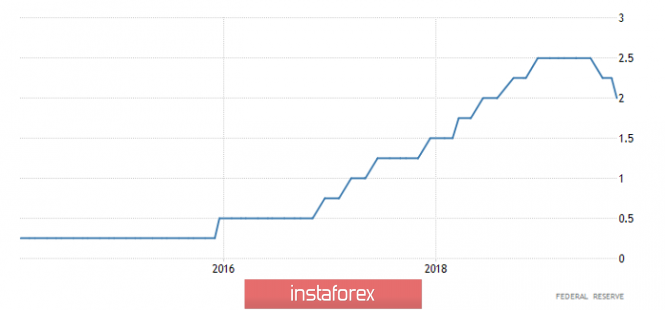

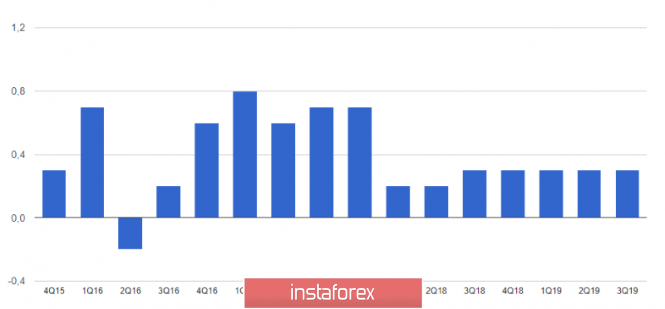

| Fed weakness (review of EUR/USD and GBP/USD dated 10/30/2019) Posted: 30 Oct 2019 03:35 PM PDT Yesterday is extremely difficult to call even a light workout before today. At least since it was much less eventful than what awaits us today. The data itself was not so important. So it is not surprising that at the end of the day both the single European currency and the pound, in fact, remained virtually unchanged. Another thing is that market participants clearly wanted to warm up at least a little, which was reflected in the fluctuations of quotes up and down. The reason for such fluctuations was various macroeconomic data, which, as usual, did not turn out as expected. In particular, Nationwide data were supposed to show the constant growth in housing prices, but in fact they showed an acceleration from 0.2% to 0.4%. But before everyone could rejoice at such wonderful news, the data on consumer lending came out, showing that in September its volume amounted to 828 million pounds against 969 million pounds in August. There is a clear decline in consumer lending, which should have a negative impact on consumer activity. However, there are improvements in the lending market regarding a rather important segment of the UK economy. The fact is that the number of approved mortgage applications has increased from 65,681 to 65,919. But it should be noted that the approved application does not mean that borrowers will take advantage of this opportunity. After all, banks can approve the application, but at a rate that does not suit the potential borrower. So these same approved applications will not necessarily turn into loans already issued. Number of approved mortgage applications (UK): Meanwhile, the continent was not bored either. For example, Spain was happy because the growth rate of retail sales did not remain unchanged, but instead it accelerated from 3.3% to 3.4%. But on the neighboring peninsula, a little thoughtful, as producer prices in Italy continue to decline. The rates of their decline intensified from -1.4% to -1.7%. At the same time, data from Italy have a slightly greater weight, since this is the third economy of the euro area, while Spain is only the fourth. Nevertheless, data on retail sales give hope that inflation in Europe may grow even a little. That's just the steady dynamics of producer prices in Italy causes considerable concern. Producer Prices (Italy): Macroeconomic statistics in the United States generally turned out to be completely different than expected. It was expected that the S&P/CaseShiller data will show an acceleration in the growth rate of housing prices from 2.0% to 2.1%, but they turned out to be unchanged. But the data on unfinished housing sales transactions was pleasing, the growth rate of which increased from 2.5% to 3.9%, instead of falling to 1.4%. This indicates a high growth potential of activity in the real estate market over the next month. Pending Home Sales (United States): Today, a whole bunch of macroeconomic data was expected, as well as the results of the meeting of the Federal Open Market Committee. The only thing today is no news from the UK. At least economic in nature. British politicians can throw out another trick with Brexit and again turn everything upside down. However, this process is completely unpredictable, so we will proceed from what we have. Meanwhile, Spain has already released inflation data, the nature of which coincided with yesterday's data on retail sales, and the price growth rate remained unchanged. Its slowdown was predicted from 0.1% to 0.0%. The unemployment rate in Germany remained unchanged, which, of course, is more important than inflation in Spain. However, much more important is what happens to inflation in Germany itself, where, as expected, it can slow down from 1.2% to 1.1%. This will definitely be an extremely negative factor. Inflation (Germany): Nevertheless, all this pales against the backdrop of what will happen in the United States today. And it's not only about the FOMC meeting, since before the announcement of its results there is still a lot of interesting things. It all starts with ADP data on employment, which should increase by 120 thousand against 135 thousand in the previous month. That is, there is a slowdown in employment growth, which frightens many market participants ahead of the publication of a report by the United States Department of Labor. But the bad news is just beginning, as the first estimate of GDP for the third quarter may show a further slowdown in economic growth. Moreover, for the first time since 2016, growth rates may drop below 2.0%, which will convince even more that the recession is about to begin in the US economy. Well, the results of the meeting of the FOMC meeting will finally finish off the dollar, because almost certainly the refinancing rate will be reduced from 2.00% to 1.75%. It is worth noting that the last time Jerome Powell convinced everyone that the Federal Reserve did not see any signs of an approaching recession. Although the refinancing rate is still reduced. It turns out that, reassuring everyone that there is no threat to economic growth, the Fed reduces the refinancing rate for two consecutive meetings. After this, no words of the Fed representatives will matter, since market participants will be certain that the regulator is only trying to calm everyone down to prevent panic. Since the recession is not just inevitable, it is already beginning, and its scale will be simply terrifying. After all, it is rather difficult to explain such a rapid easing of monetary policy parameters with something else. Unless you agree with the statement that this is the weakness of the Fed against the pressure exerted on it by the financial sector. Refinancing Rate (United States): I must admit that amid the news that will come from the United States, the level of inflation in Germany is not at all interesting to anyone. At least today. So no matter how much it falls there today, the single European currency will still grow, and the reference point is 1.1175. Although rather this is the first stop for a smoke break. British politicians will have to throw out a really extravagant distraction to change this attitude. But one gets the feeling that they are still trying to figure out the mess that they have brewed themselves. So do not wait for the intervention of the British political class. Consequently, the pound has good chances to grow to 1.3000. |

| Is the Canadian dollar a child of fortune? The loonie has a second wind Posted: 30 Oct 2019 03:35 PM PDT The Canadian dollar has been on the rise since the beginning of the week. However, experts suggest that the flight of the loonie can be interrupted by changes in the monetary policy of the Bank of Canada, as well as a deterioration in economic data. In this situation, the market favors the loonie, analysts emphasize. The loonie was in the spotlight on Wednesday, October 30. The market is monitoring the further actions of the Bank of Canada, which is ready to hold a meeting on monetary policy. If the regulator keeps the rate at 1.75%, while the Fed reduces it to 1.50% –1.75%, then the Canadian dollar will push its American counterpart. The loonie claims to be the leader, striving to become the most profitable currency in the "Big Ten." According to analysts, the rise of the Canadian dollar is possible not only in case of maintaining the same rates, but also amid optimistic comments of the regulator regarding the growth of the national economy. At the last meeting, the Bank of Canada left the interest rate unchanged. The regulator focused on strengthening the labor market, increasing wages and the positive state of the economy. Analysts believe that current data on the Canadian economy will not be so rosy. The regulator should take into account a number of negative factors, such as a slowdown in retail sales, a drop in the consumer price index, a decrease in GDP growth and inflation risks. At the moment, the labor market in Canada remains strong, wage growth is quite stable, however, the weakness of the national economy along with the worsening situation in the United States may lead to a change in Bank of Canada's strategy. In such a situation, the regulator will review the current decision on rates. If this happens, a stable short-term low will form in the USD/CAD pair, analysts said. The positive against the Canadian dollar is radiating from the options market. According to experts, the three-month risk reversal with a delta of 25% demonstrates the most favorable period for the growth of the loonie to the US dollar. This has not happened since 2009, experts emphasize. Reducing the risk-reversal in the USD/CAD pair for three-month option contracts is a barometer of long-term investor sentiment. Analysts record a bullish trend for the Canadian dollar, noting that over the past 10 years, investors have never been so optimistic about the loonie. A similar change of mood occurred shortly before the decisions of the Bank of Canada on monetary policy and the Federal Reserve at the key rate. Currently, the loonie has been supported by both a profitable interest rate differential and increased expectations for a trade deal between the United States, Mexico and Canada in November. On Tuesday, October 29, the USD/CAD pair peaked in the past four weeks. On Wednesday morning, the pair fell by 0.08% to 1.3078-1.3880. Yesterday, the USD/CAD pair showed an increase of 0.3% to a high since the beginning of October. The pair hit the 1.3098 bar, but is now pulling back to its lows. Yesterday's growth of the pair from an intraday low was caused by an increase in sales, Scotiabank analysts believe. Experts are certain that the pair is normal. At the moment, the USD/CAD pair is trading in the range of 1.3077–1.3078, showing an upward trend. Analysts agree that the current situation is quite favorable for the loonie. Most of them note excellent prospects for it. The Canadian dollar, which seemed to have opened its second wind, is capable of another leap forward, experts said. They expect a moderate, long rise of the loonie in the short and medium term. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 30 Oct 2019 03:35 PM PDT German labor market data, together with a report on the mood index in the eurozone economy, led to a decline in the euro in the morning, after another unsuccessful attempt to grow above the resistance of 1.1120, which was made against the backdrop of growth indicators in France. The report indicates that France's GDP for the 3rd quarter of this year grew by 0.3% compared with the 2nd quarter, while economists had forecast growth of only 0.2%. However, weak consumer spending is likely to put pressure on the economy in the future. According to data, consumer spending in France immediately fell by 0.4% in September of this year compared with August and increased by only 0.3% compared to September 2018. Economists had expected growth of 0.3%. In August, expenses were revised upwards to 0.1%. As for Germany, the jump in the growth of unemployment benefits is direct evidence that the economy is slowly slipping into recession. Against the backdrop of a stagnating manufacturing sector and a sharp drop in exports, German GDP for the 2nd quarter indicated the possibility of a technical recession by the end of this year. Disappointing labor market data are evidence of this. According to a report by the Federal Employment Agency, the number of applications for unemployment benefits in Germany grew by 6,000 in October this year, while economists expected an increase in applications by 3,000. Unemployment remained unchanged at 5.0%. The number of registered vacancies decreased by 60,000 and amounted to 765,000. Additional pressure on the euro was provided by the report of the European Commission, which pointed to the growth of pessimism of company leaders. The prospects for the manufacturing sector in the eurozone leave much to be desired, and the spread of weakness in the service sector does not add joy. According to the data, the sentiment index in the eurozone economy fell to a level of 100.8 points in October from 101.7 points in September. Company executives note a slowdown in external demand for goods in the manufacturing sector of the eurozone, which is directly related to the trade war between the US and China. Not surprisingly, moods have also worsened among service and retail companies. Spanish inflation data was ignored by the market. The report indicates that Spain's preliminary harmonized by EU standards consumer price index grew by 0.2% in October, as well as in September. Economists had expected growth of 0.3%. As for the technical picture of the EURUSD pair, all attention will be focused on the decision of the US Federal Reserve on interest rates. Many economists expect the rate to be lowered to 1.75%, while there is talk of a "technical pause" in lowering rates that the committee may take before the final December meeting this year. Most likely, this scenario will support the US dollar. The bulls have already attempted to rise above the resistance of 1.1120, which again failed, so only a breakthrough of this range will lead to a strong bullish impulse of risky assets, and only the highs of 1.1150 and 1.1180 will limit the growth of EURUSD. If the Fed leaves the rates unchanged, then a break of support of 1.1090 will definitely lead to a test of lows 1.1075 and 1.1050. The material has been provided by InstaForex Company - www.instaforex.com |

| New horizons for the pound, or Brexit stumbled on an early election Posted: 30 Oct 2019 03:35 PM PDT For the first time since 1923, the United Kingdom will hold general elections in December to break the impasse associated with Brexit, CNBC reports. The corresponding bill in the British Parliament was introduced by Prime Minister Boris Johnson. The opposition agreed with the proposal of the head of government only after the European Union agreed to postpone Brexit for three months - until January 31, 2020. On the eve of the election, 438 deputies of the House of Commons spoke in favor, 20 against it. "This Parliament is broken and dead, so it must be dissolved. There is no support among the deputies in promoting a law that will make ratification of the deal with the EU a reality. Universal voting is needed to put an end to the uncertainty surrounding Brexit, which undermines public confidence, "says B. Johnson. For the elections to take place within the agreed time, the Parliament must be dissolved no later than November 6th. Johnson has five working days left for the bill to go through the remaining stages of approval. The bill approved by the House of Commons should now be considered by the House of Lords, whose members have the right to amend it and return it to the lower house for new reading. The bill will gain the force of law after it is signed by Queen Elizabeth II. Everything indicates that the document will be approved on time, and in December the British will go to the polls for the third time in four years. According to analysts, this election promises to be one of the most unpredictable in the history of the United Kingdom. It is still unknown whether they will help Great Britain break the current political impasse. It is assumed that if the Conservatives win, a "divorce" agreement will be signed with Brussels. If the Labour Party prevails, they will propose a new referendum. According to recent polls, the advantage is still on the Tory side. They are 10% ahead of the Labour Party. However, five weeks before the election, the situation can radically change. "In the short term and during the election campaign, we consider the pound a little vulnerable, given the recent elimination of Brexit risk without a deal. Nevertheless, the early elections were mostly an expected event and, as such, should not cause a serious reaction from the GBP," say Danske Bank strategists. "The EUR/GBP pair will trade in the range of 0.85-0.90 before the election. If Conservatives get a majority in the House of Commons, then EUR/GBP will shift to the lower limit of this range of about 0.8750. The victory of the opposition will strengthen hopes for the abolition of Brexit and support the pound with a probability of a break below 0.85. The suspended Parliament will create new uncertainty, but the growth potential of the EUR/GBP pair is likely to continue to be limited to 0.90, they predict. Specialists at Standard Chartered advise buying the pound against the US dollar amid increasing prospects for early general elections in December. They recommend a long position on GBP/USD with a target at 1.3350 and a stop order at 1.2700. "The prospect of early elections in December removes political obstacles to a deal on Brexit. At the same time, the probability of Britain leaving the EU without a deal is reduced to zero," experts said. The material has been provided by InstaForex Company - www.instaforex.com |

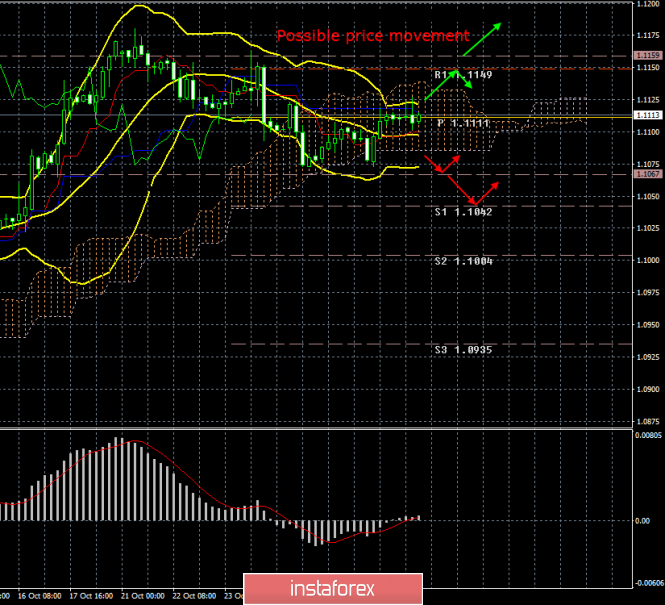

| Posted: 30 Oct 2019 03:35 PM PDT 4-hour timeframe Amplitude of the last 5 days (high-low): 34p - 70p - 50p - 31p - 46p. Average volatility over the past 5 days: 46p (average). The third trading day of the week for the EUR/USD currency pair is held in the same calm trading as the first two. There is no trend movement as such. The euro/dollar is moving quietly along the Kijun-sen critical line, which is the best evidence of an open flat, both in terms of short-term perspective and intraday plan. Thus, since all the macroeconomic publications of the day are already behind us, traders can only wait for the results of the meeting of the Federal Reserve and hope that the market wakes up, and Jerome Powell will tell something important to his listeners. If, however, no concrete hints of the Fed's future actions follow, then all of today with very loud signs of fundamental events could end in complete disappointment. By the way, volatility remains at the "average" level, which borders on the definition of "low". It all began today, not with American news, but with German. In Germany, a not very significant unemployment rate was published, which amounted to 5% (full compliance with the previous value and the forecast). A little later, the consumer price index for Germany for October was released (preliminary value), which fell to 1.1% YOY, as experts predicted. This means that the final value for the month may also slow down, and a little later it will become known about the slowdown of pan-European inflation. Around the same time, data from overseas began to be published, which, however, also did not have a high degree of significance, especially amid the evening events. The annual data on US GDP unexpectedly amounted to +1.9% in the third quarter with forecasts of only +1.6%, the index of expenses for personal consumption increased compared to the previous period and amounted to +2.2% YOY, and a report on the change in the number of employees in the private sector from ADP showed an increase of 125,000 new workers (with a forecast of +120K). Thus, all macroeconomic data from the United States turned out to be better than what traders expected ... and this does not matter, at least in the context of today. There was no reaction to these statistics, since the markets are clearly waiting for the Fed's evening meeting. The Fed itself has already made a decision on monetary policy, it remains only to voice it. Jerome Powell will also make a speech, most likely, without taking into account the latest publications. Thus, nothing has changed. Traders can only guess what decision the Fed's monetary committee will make and what Jerome Powell will say at the press conference. As Powell prepares for his evening speech, US President Donald Trump has already entered the stage, with recent speeches that frame every Fed meeting. Trump speaks before the meeting, after the meeting, in between meetings, writes angry tweets on the social network, and all this focuses on only one topic and contains only one message: "The Fed lowers rates too slowly. The cost of borrowing, thanks to Powell, remains very high. The states cannot fully realize their huge potential due to high rates and an expensive dollar. " This was repeatedly stated by the US president, but often his insinuations are much more laconic - this is a simple criticism of the Fed and personally Jerome Powell. We have repeatedly said that the Fed's monetary policy is of great importance for Trump, since the outcome of a trade war with China and a trade deal that can be concluded between countries depend on it. The more influence Trump can have on monetary policy, the more advantages he will have in his hands in negotiations with China, the more maneuverability he can show in a dialogue with Beijing. But for now, the trump cards are in Beijing's hands, which is subject to the central bank of China, unlike the Fed and Trump. Thus, Trump acts according to the only scenario possible under conditions of impossibility of influence on the Federal Reserve. He constantly criticizes the Fed, blames the regulator for all the troubles and failures, and this ... leads to success. Today, the Fed may lower the rate for the third time in a row. From a technical point of view, there is absolutely nothing to say now, since the market is completely calm and flat. Most of the traders are out of the market, hiding and even during the evening summing up the results of the Regulator's meeting can remain "on the fence". In addition, the euro/dollar is located inside the Ichimoku cloud, which once again signals the absence of trend movement. Moreover, in order to announce the resumption of trend movement, you need to wait until the price consolidates above the Kijun-sen line or overcome the lower boundary of the Ichimoku cloud. In both the first and second cases, the pair will immediately run into other support/resistance levels, which again makes it difficult to develop a new trend. Trading recommendations: EUR/USD continues to adjust, being inside the Ichimoku cloud. Slowly you can take a closer look at euro sales, especially if the bears manage to gain a foothold below the Ichimoku cloud. However, tonight, we recommend that it be wary of opening any positions, since the results of the Fed meeting and the press conference of its chairman may bring surprises, but may not affect the course of trading at all. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. Support / Resistance Classic Levels: Red and gray dotted lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movements: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. Pound fell into suspended animation: traders await final decision on re-election in Britain Posted: 30 Oct 2019 03:35 PM PDT Dollar pairs are waiting for the main event of the day, which will be held at the end of the US session. This, of course, is about the announcement of the results of the October meeting of the Federal Reserve and the subsequent press conference of Jerome Powell. Given the importance of this event, it is better not to trade in dollar pairs today - at least until the position of the Fed head is clear in the light of the latest data on the US labor market, industrial production and inflation. The pair pound-dollar is no exception, and not only because of American events. The pound lives in its "coordinate system" in recent years, where the unconditional priority is the issue of Brexit. Therefore, now GBP/USD traders are waiting not so much for the Fed meeting as for the third reading on the re-election bill in the UK. Despite all the previous voting on this issue, the Parliament has not yet set a final point, which means the intrigue is still preserved. This explains the complete suspended animation of the British currency: the GBP/USD pair has not been moving for almost the third day, demonstrating only slight fluctuations within the 30-point range. But in the end, the price returns to the middle of the 28th figure, drifting in anticipation of a powerful news impulse. As you know, the Lower House of the British Parliament supported in the second reading the bill on the holding of early elections. Now the document was sent to the Upper House of Parliament (House of Lords) for consideration and approval. It is worth noting here that the House of Lords is not an appeal court. Having adopted their amendments, they send the document back to the Lower House of Parliament, where MPs may or may not support it. Next, the bill returns again to the Lords. In other words, the House of Lords can comment, forcing the House of Commons to come back to this issue. However, most experts doubt that the deputies of both houses of the British Parliament will play it like table tennis - at least now, in anticipation of the third reading. For example, last month, the House of Lords approved a bill in just a few days, requiring Johnson's cabinet of ministers to ask Brussels for another postponement of the country's exit from the EU. It is noteworthy that, contrary to various assumptions, this bill was approved in the final reading without a vote - members of the Upper House of Parliament did not introduce a single amendment. The Lords showed amazing solidarity in this matter, as it managed to do so in just a few days. Members of the Upper House may also show similar efficiency now, given the fact that the dissolution of Parliament should occur 25 working days before the election. Traders of the GBP/USD pair currently completely ignore the events, as during the third reading of the bill, deputies will discuss and vote on the amendments presented. Yesterday, Deputy Speaker Lindsay Hoyle did not allow MPs to vote on amendments that are unacceptable to the government. But at the same time, the House of Commons voted so that the deputies had the opportunity to amend on the eve of the third reading. Traders rightly fear that Johnson's so-called "unacceptable" adjustments to the law will lead to the failure of the election. Let me remind you that Downing street has already announced that it will withdraw the bill in case of approval of such amendments, in particular to reduce the age limit for voting in elections to 16 years. However, if Johnson still manages to push his initiative, the pound may react quite rapidly. By and large, the outcome of the December elections will be a determining factor in the fate of the Brexit deal. And given the recent ratings of Conservatives, they have every chance of forming their own majority. The support of Tory representatives has already reached 40%, while the Labour Party has remained at the same level - 24%. Compared with the survey the year before last, support for Conservatives grew by 3%, but the result of the Labor Party did not change. Liberal Democrats, in turn, received 15% support in the latest poll, and Nigel Faraj's Brexit party received 10%. Thus, any hint of approval of the third-reading early election bill will support the British currency. Most likely, this issue will be resolved before the beginning of next week. But it is unlikely that the deputies of the current Parliament will have time to consider the Johnson's deal before November 6 (the expected date of the dissolution of the House of Commons). They are unlikely to want to do this: the re-election will become a kind of "repeat referendum" on the Brexit issue, so MPs will probably not want to get ahead of the events by approving the proposed deal. The material has been provided by InstaForex Company - www.instaforex.com |

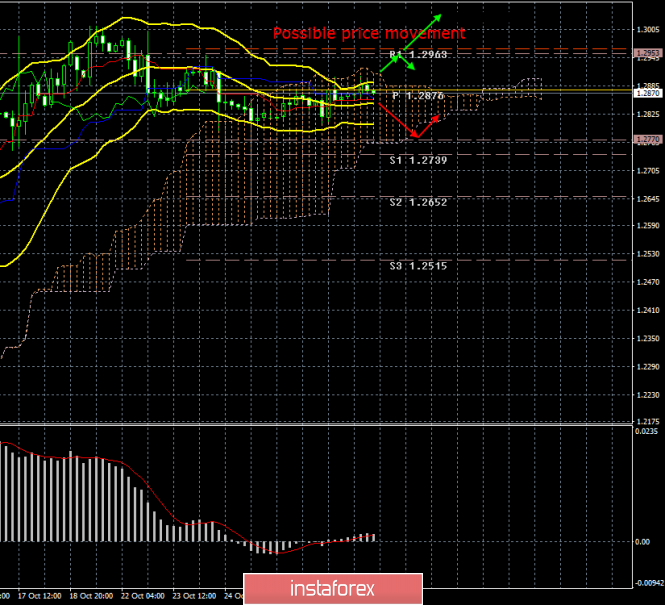

| Posted: 30 Oct 2019 03:35 PM PDT 4- hour timeframe Amplitude of the last 5 days (high-low): 80p - 161p - 59p - 64p - 98p. The average volatility over the past 5 days: 91p (average). What are the goals of the Conservatives, and what are the goals of the Labour Party? In fact, they are one and the same: winning as many deputy mandates as possible. Conservatives are eager to finally realize Brexit, while the Labour Party wants to cancel it or at least hold a second referendum, giving the British people the opportunity to determine what fate they want for their country. However, residents of the UK will have a similar opportunity much earlier, in fact, already on December 12. Indeed, future elections will have a certain hidden meaning, which, however, everyone will know. This time, the elections will mean the commitment of each voter not to a particular party, but to the outcome of Brexit, which each individual voter would like to receive in the end. This is the main problem of the entire Brexit process and future parliamentary re-elections. Often, the majority wins in any election, that is, the balance of power is distributed in the proportions of 30% - 70%, or with a wider gap. That is, based on the results of such elections, we can really speak with confidence about the majority opinion. Also, often the elections have such a system in which at the final stage of the voting there are only two possible options, or two candidates for whom you need to vote. But all this does not apply to parliamentary elections, where there will be at least seven options, and the votes can be distributed in any way. Who said the Conservatives would win a victory that would allow them to make individual decisions in the future? Theresa May also wanted to strengthen the position of the Conservatives in Parliament because of the lack of votes to approve her "deal" on Brexit, and eventually it backfired. Thus, we can even assume that some residents, opponents of Brexit, did not specifically vote for the Conservatives in order to prevent Brexit. And if the Brexit question was not so tough, then the vote would have been given to the Conservatives. The same effect can be observed now. Those residents of Great Britain who want Brexit can vote for Conservatives, while those who do not want are for Labour. Accordingly, the alignment of forces may not change much compared to the results of the re-election initiated by Theresa May and may not at all correspond to all the studies that give the calculation of the ratings of each party in the United Kingdom. Thus, the main conclusion is as follows: the election results cannot be predicted, they can turn out to be very unexpected or even surprising and do not guarantee the resolution of the political crisis and the frank impasse faced by the British government in connection with the "divorce" from the European Union. As we mentioned earlier, the British currency almost stopped responding to any events related to Brexit. Yes, by and large, now there's nothing to react to. Brexit has again been postponed, and Parliament will soon be dissolved and will not make any decisions until December 12. The technical picture of the pound/dollar pair implies a continuation of the flat. It is vital for traders to get any important fundamental data in the near future in order to move the pair off the ground. Maybe they will get them tonight, but maybe Jerome Powell's speech will be boring and uninteresting. It's best to sum up tomorrow. Trading recommendations: GBP/USD pair is part of the lateral correction. Thus, it is best now to wait for the situation to be clarified, the flat to be completed, the pair to leave the Ichimoku cloud, the expansion of the Bollinger bands in one direction, as well as the results of the Fed meeting and Jerome Powell's press conference. Only after all this, it will be possible to draw certain conclusions on the further trend of the pair's movement and consider the opening of the corresponding positions. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. Support / Resistance Classic Levels: Red and gray dotted lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movements: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

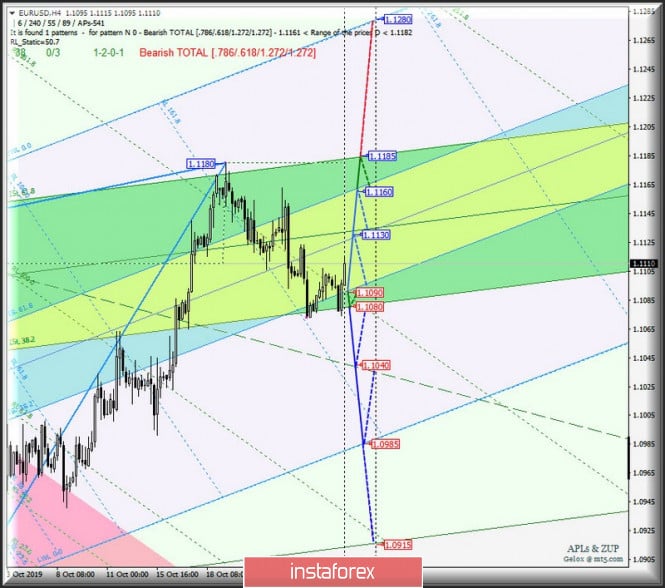

| October 30, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 30 Oct 2019 08:53 AM PDT

Since September 13, the EUR/USD has been trending-down within the previous short-term bearish channel until an Inverted Head & Shoulders Pattern was demonstrated around 1.0880. Shortly After, a bullish breakout above 1.0940 confirmed the mentioned reversal Pattern which opened the way for further bullish advancement towards (1.1000 -1.1020) maintaining bullish movement above the recent bullish trend. On October 7, a sideway consolidation range was demonstrated around the price zone of (1.1000 -1.1020) before another bullish swing could be initiated towards 1.1175 where the current bearish pullback was recently originated. Earlier this week, the short-term technical outlook has turned into bearish after breakdown below 1.1090 was achieved (the depicted uptrend line and 50% Fibonacci Retracement Level). However, recent bullish spikes have been demonstrated above (1.1090 - 1.1100 ). Thus, hindering further bearish decline until now. Intraday destination remains unclear until bearish breakout below 1.1090 is re-established again. On the other hand, the current price levels around 1.1100-1.1120 should be watched for early bearish rejection and a possible Intraday SELL entry. Quick bearish decline should be expected towards 1.1025 and 1.0995 provided that early bearish breakout below 1.1090 is established again. Trade recommendations : Conservative traders can have a valid SELL entry anywhere around the backside of the broken uptrend line (1.1100-1.1120). Initial T/P levels to be projected towards 1.1065, 1.1020 and 1.0995 while S/L should be placed above 1.1160. The material has been provided by InstaForex Company - www.instaforex.com |

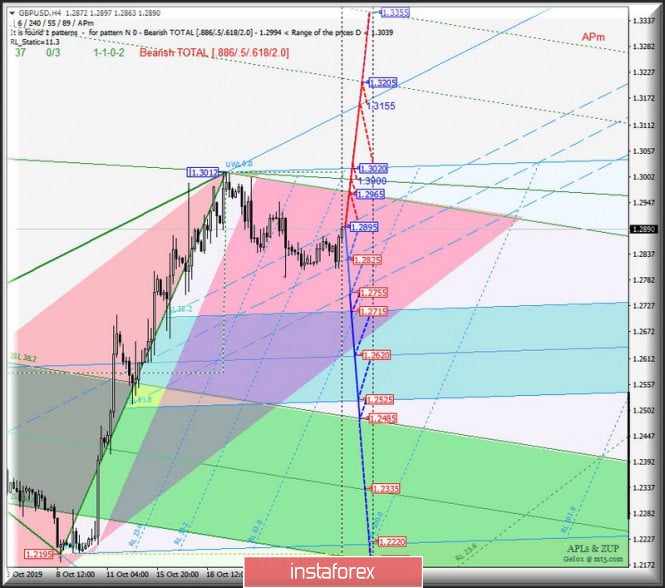

| October 30, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 30 Oct 2019 08:35 AM PDT Few weeks ago, the neckline of the depicted Double-Bottom pattern (1.2400-1.2415) was breached to the upside allowing further bullish advancement to occur towards 1.2800 then 1.3000 where the GBP/USD pair looked OVERBOUGHT. Earlier last week, the GBP/USD pair has failed to achieve a persistent bullish breakout above the depicted SUPPLY-zone (1.2980-1.3000) which corresponds to a previous Prominent-TOP that goes back to May 2019. Moreover, the depicted ascending wedge reversal pattern has been confirmed indicating a high probability of bearish reversal around the price levels of 1.2950-1.2970. That's why, a quick bearish movement was initiated towards 1.2780 (Key-Level) where bullish recovery and a sideway consolidation Range are currently being demonstrated. The current Bullish rejection around the price levels of 1.2780, indicates another temporary bullish movement near 1.2980-1.3000 where another long-term bearish swing can be initiated. On the other hand, earlier bearish breakout below 1.2780 enables further bearish decline towards 1.2600-1.2650 where bullish recovery should be anticipated. Trade Recommendations: Risky traders were advised to look for a valid BUY entry anywhere around 1.2780. S/L should be advanced to entry levels to offset the associated risk. On the other hand, Intraday traders can wait for a bearish breakout below 1.2780 as a valid SELL entry with T/P levels projected towards 1.2650. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC 10.30.2019 -Potential gap fill on the Bitcoin Posted: 30 Oct 2019 07:25 AM PDT BTC has been trading downside and the price tested the level of $9.000. I see potential chance for the gap fill and test of $8.770-$8.356. As long as the swing high at 9.934 is holding, there is the chance for the downside.

Yellow rectangle – Resistance level Falling white line – Expected path Horizontal lines – Support levels Based on the 4H time-frame, there is potential for the gap fill and test of $8.770. BTC is trading in defined downward channel and the sellers are in control for now. My advice is to watch for selling opportunities near the resistance zone $9.165 with the downward targets at $8.770 and $8.350.The material has been provided by InstaForex Company - www.instaforex.com |

| Gold 10.30.2019 - Failed test of the Pitchfork median line, watch for downside break Posted: 30 Oct 2019 07:12 AM PDT Gold is trading inside of the trading range at the price of $1.492. Anyway, I found few failed tests of the median line, which is sign that buyers don't have enough power for stronger upside break. Watch for potential breakout of support at $1.483 to confirm further downside movement.

Yellow lines – Pitchfork upward channel White falling lines – New Expected path Horizontal white lines – Important resistance levels Based on the 4H time-frame, I found that there is failed test of the yellow channel Median Line, which is sign that buyers didn't have enough power for the full-test. RSI oscillator showed us peak on the previous upside push and failed test of ML, which is another sign of the weakness. Downward objectives are set at $1.460 and $1.436. Key resistance is set at $1.517. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD for October 30,2019 - EUR in consoldiation with the potential for downside break Posted: 30 Oct 2019 06:54 AM PDT EUR/USD has been trading sideways at the price of 1.1107. The FOMC meeting minutes are just around the corner and most of the currencies are waiting for the release before the next direction move. Technically speaking there is potential for the downside leg and test of the Medium Pitchfork line at 1.0995-1.0950.

Yellow lines – Pitchfork upward channel Purple lines – New defined downward channel Falling white line – Expected path Based on the 4H time-frame, I found that there is failed test of the yellow channel Median Line, which is sign that buyers didn't have enough power for the full-test. My advice is to watch for potential breakout of the support at 1.1076 to confirm potential test of 1.0994-1.0950. The material has been provided by InstaForex Company - www.instaforex.com |

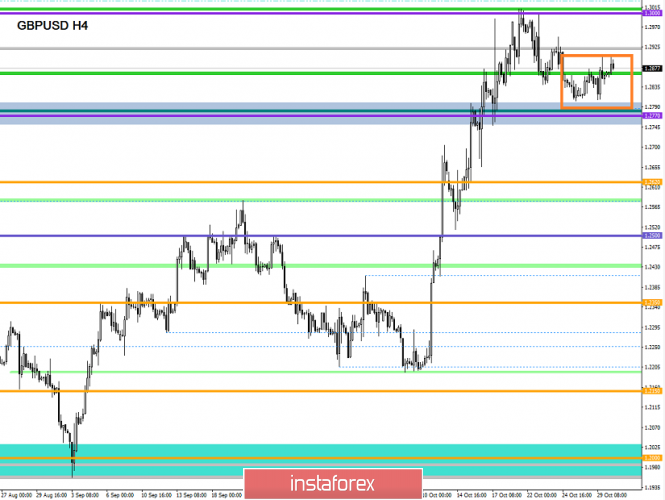

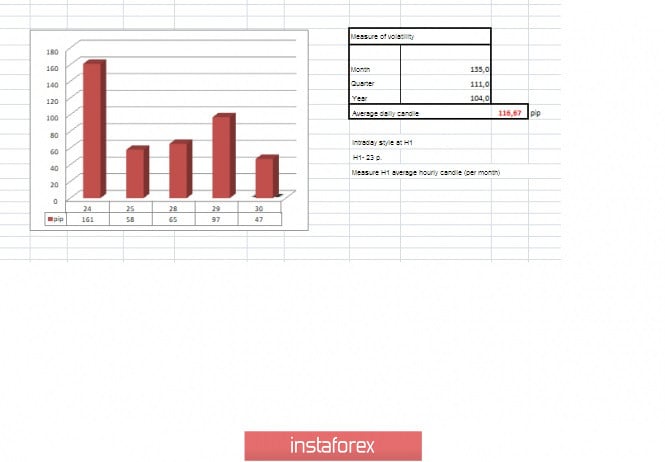

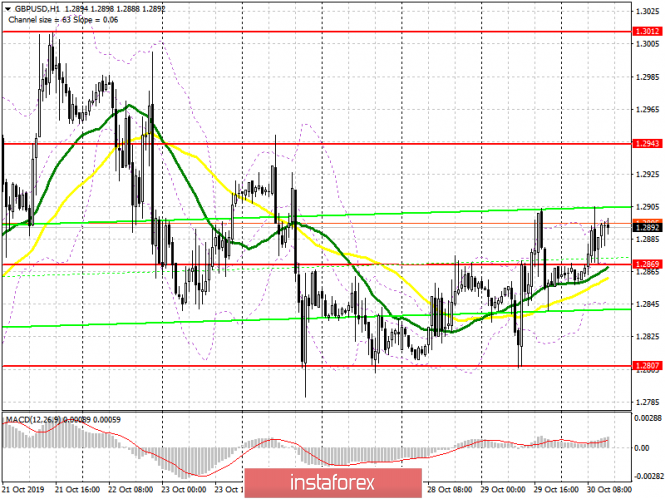

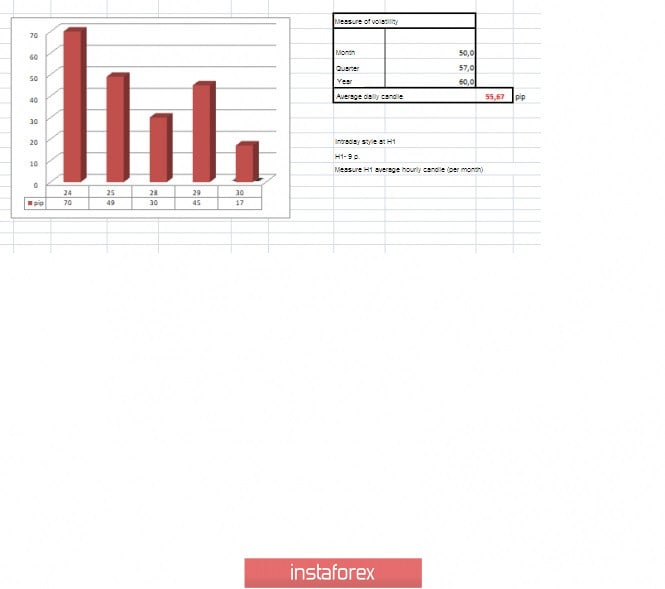

| Trading recommendations for the GBPUSD currency pair – placement of trade orders (October 30) Posted: 30 Oct 2019 06:47 AM PDT The pound/dollar currency pair does not give rest to market participants, keeping the market price still so high that the question arises, is it the stage of recovery? – we will analyze this difficult question in our article. From technical analysis (TA), we see the iron resistance of the quotation concerning a significant overstrain, where the range level of 1.2770 (1.2750/1.2770/1.2800) still plays the role of a solid support. A very controversial point, the level of 1.2770 refers to the strong and proven coordinates, but we have a significant overbought and working off from the stronger level of 1.3000, which refers to the psychological. Thus, the breakdown of the level of 1.2770 could have come much earlier, as well as the recovery process itself, if not for the emotional component of the market. So, it seems that we are close to the point, and it is, in this particular case, working with the GBPUSD pair, a significant role is played by the emotional component, as the pressure in terms of the information background is simply enormous, and many market participants literally turn a blind eye to technical factors. The question of recovery remains open, but theoretically, we are at an intermediate stage, where growth is temporarily limited, and the decline has not yet reached the scale that many expect. In terms of volatility, we see low indicators, but the last three trading days still have an insignificant, but still an increase: 58 – 65 – 97 points. Looking at the hourly past day, we see that the entire volume of volatility fell on the period of 12:00-17:00 hours (time on the trading terminal), where an upward jump in the price of 97 points was recorded. Followed by a rollback on the impulse and an evenly horizontal stroke. As discussed in the previous review, traders have been holding short positions for quite a long time, with the hope of recovery, and even now, with a pullback, positions are still preserved, since the prospect for them is quite large. An alternative plot was considered in terms of fixing the price higher than 1.2865, with local long positions. The main deals of conservative traders were considered after fixing the price below the range level of 1.2770 (1.2750/1.2770/1.2800). Looking at the trading chart in general terms (the day), we see a still holding inertial upward move, with a slight adjustment in terms of stagnation. So, as we wrote at the beginning of the article, there is characteristic indecision, and in this case, it can be designated within 1.2770/1.3000. That is, in the case of maintaining the same emotional pressure, we can see a protracted side process. In terms of the trend, everything is unchanged: the current year (2019) is expressed as a V-shaped movement; 1.5 years is expressed in a downward trend. The news background of the last day contained data on housing prices from S&P/Case-Shiller USA, where their level remained unchanged, 2.0%. There were also statistics on pending home sales in the United States, where growth was recorded from 2.5% to 3.9%. There was no market reaction to the statistics. What influenced the dynamics of the pound in the past day? – Emotion; Brexit; Domestic political showdown. So, Prime Minister Boris Johnson still managed to achieve early parliamentary elections, which will be held in the UK on December 12. Since he succeeded, the recipe is simple, abandon initiatives and move to a bill that needs a simple majority to pass. Voila – 438 members of parliament voted for the elections, 20 – against, 181 – abstained. Of course, it is not so simple, the opposition also made its contribution, which still changed its opinion on Johnson's initiative regarding the early elections. "Exit without an agreement is no longer being considered, so Labor will support the general election tonight," Labor leader Jerome Corbyn said on Twitter @jeremycorbyn In turn, the head of the European Council, Donald Tusk, said that the postponement of Brexit has officially happened, and now Britain has to leave by the deadline of January 31, 2020. Tusk also noted that the allotted time should be used wisely, and he strongly hopes for a successful outcome. Today, in terms of the economic calendar, we had a significant package of statistics on the United States. The ADP report on the level of employment in the private sector was published, where the growth of 120 thousand was expected against 135 thousand, but in the end, the data were better than expectations. Employment growth amounted to 125 thousand according to the ADP report, and the previous indicators changed 135 thousand – 93 thousand. After that, the data of the first estimate of US GDP (Q3) came out almost synchronously, with forecasts of a further slowdown in economic growth, which to some extent coincided, but not quite. So, the data came out better than expected and amounted to 1.9% against the expectation of 1.6% The key event of the day, where all the attention of market participants is concentrated without exception, is the results of the meeting of the Federal Committee for Open Market Operations. Many people are ready to reduce the refinancing rate morally, and there is a possibility that this step has already been taken into account in the price. The most remarkable point is that we have a third consecutive rate cut, and it is extremely fast, which is certainly frightening. At the moment, what market participants are waiting for is a subsequent press conference, where Jerome Powell can enlighten about the plans of the regulator. So, there are rumors that the Fed is preparing to take a break after the third rate cut, where it is possible to suspend the monetary policy easing campaign this year. Further development Analyzing the current trading chart, we see the reaction of the dollar to the released package of statistical data on the States, where everything is not so bad as previously expected. It is worth considering that the quote has grown in advance to the level of the maximum of the last day – 1.2904, and in fact, the recovery against the background will not fundamentally change the picture. Thus, an "artificial" oscillation within the horizontal stroke with variable boundaries of 1.2800 (-50p) and 1.2880 (+40p) is still possible. Open the chart H4, this oscillation is visible. By detailing the per minute movement, we see that during the Pacific-Asian trading session, a remarkable stagnation of 1.2855 / 1.2870 was formed, against which a surge began, but already at the start of the European session (8:30-10:00, time on the trading terminal). There were no more surges, everyone is waiting for the outcome of the Fed meeting. In terms of the emotional state of the market, the ambiguity with low volatility reflects the behavior of the quote. In turn, traders continue to hold short positions, but it is worth considering that these traders do not just have local positions, they are strategic, and have a large stock stop, with conservative capital management. The approach of the main mass is expected after fixing lower than the range level of 1.2770 (1.2750/1.2770/1.2800). Alternative positions are also being considered, possibly on a spike in terms of breaking through the previously announced corridor. It is possible to assume a primary slowdown in the range of 1.2854/1.2900, before the Fed's speech, where local outbursts are possible, depending on the rhetoric of the regulator regarding further actions, and I do not exclude that they will lead to a decrease in the quotation. At the same time, we are closely watching the news feed, as there may be emissions and rumors about the actions of the Fed. Based on the above information, we derive trading recommendations:

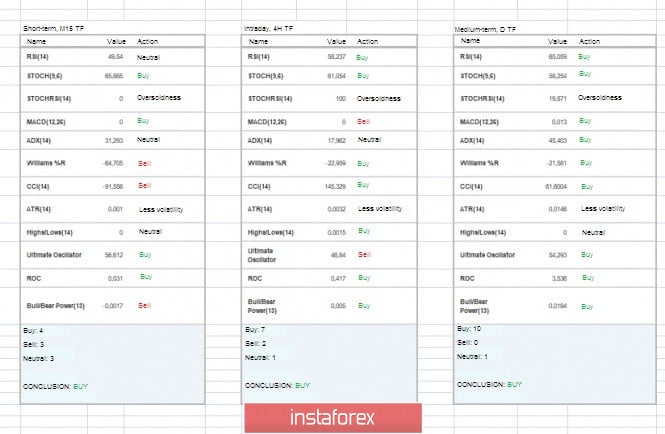

Indicator analysis Analyzing a different sector of timeframes (TF), we see that indicators of indicators at all main time intervals signal an upward interest, which cannot be considered 100% reality. So, the previously marked boundaries of the fluctuations take over the entire flow of short-term and intraday periods, but the medium-term period is steadily following the previously set inertial course. Thus, indicator analysis should be run through your immediate prospects so that there is no unjustified expectation. Volatility per week / Measurement of volatility: Month; Quarter; Year. Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year. (October 30 was built taking into account the time of publication of the article) The volatility of the current time is 47 points, which is a low indicator for this time section. It is likely to assume that there is still a chance of accelerating volatility, but it is closer to the results of the Fed meeting. Key levels Resistance zones: 1.3000; 1.3170**; 1.3300**. Support zones: 1.2770**; 1.2700*; 1.2620; 1.2580*; 1.2500**; 1.2350**; 1.2205(+/-10p.)*; 1.2150**; 1.2000***; 1.1700; 1.1475**. * Periodic level ** Range level *** The article is based on the principle of conducting transactions, with daily adjustments. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 30 Oct 2019 05:47 AM PDT To open long positions on GBP / USD, you need: As UK parties prepare for a crucial political race, volatility in the market is gradually decreasing. Buyers of the pound managed to regain the level of 1.2870, which allows us to count on further growth of the pair in the short term. As long as trading is conducted over this range, the bulls will aim for the upper border of the side channel at 1.2943, where it is recommended taking the profits. However, growth above 1.2943 is possible only after the Federal Reserve cuts interest rates at its meeting today. If buyers again miss the support of 1.2869, it is best to count on new purchases from the lower border of the channel in the area of 1.2807. To open short positions on GBP / USD, you need: The task of the pound sellers will be to return the level of 1.2869, and the only consolidation below this range will be a signal to open short positions. A more important goal of the bears is to test and break the support of 1.2807, which can be achieved only if the Fed leaves rates unchanged today, pausing the cycle of their reduction. In this case, the collapse of GBP/USD in the area of lows 1.2735 and 1.2664 is not excluded. If the demand for the pound persists, only the formation of a false breakdown near the upper border of the side channel 1.2943 will be a signal to sell. Otherwise, it is best to open short positions on a rebound from the monthly high of 1.3012. Indicator signals: Moving Averages Trading is conducted around 30 and 50 daily averages, which indicates the lateral nature of the market. Bollinger Bands A break of the upper border of the indicator in the area of 1.2910 will lead to a new wave of growth for the pair. A low test at 1.2840 could limit the downside potential of the pound.

Description of indicators

|

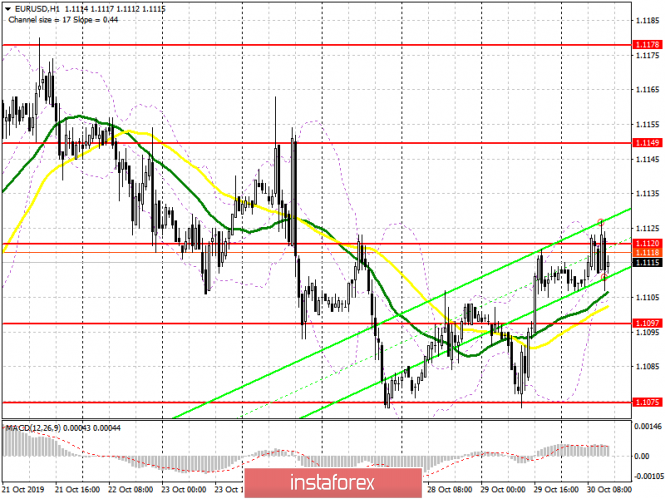

| Posted: 30 Oct 2019 05:47 AM PDT To open long positions on EURUSD, you need: In the first half of the day, buyers of the euro attempted to rise above the level of 1.1120, however, good data on the German labor market were not enough. The decline in the sentiment index in the economy led to the formation of a false breakdown of 1.1120 and the return of sellers to the market. At the moment, the focus is on the US GDP report, but traders will pay more attention to the Fed meeting, at which the management can take a "technical pause" in lowering interest rates, which will support the US dollar. From a technical point of view, nothing has changed. If rates decrease, the bulls will try to break above the large high of 1.1120, which will lead to the resumption of the upward trend in EUR/USD and to the update of the levels around 1.1149 and 1.1178, where I recommend taking the profits. If the pressure on the euro persists, it is best to consider long positions on a false breakdown near the middle of the side channel – 1.1097 or buy on a rebound from its lower border of 1.1075. To open short positions on EURUSD, you need: Sellers of the euro waited for a false breakdown in the resistance area of 1.1120, which limited the upward potential of the pair. The nearest target is the support of 1.1097, however, a good report on US GDP growth may lead to a breakdown of this level and to further sale of the pair to the lower border of the side channel 1.1075, where I recommend taking the profits until the Federal Reserve decides on interest rates. Only the scenario of keeping rates at the same level will keep the demand for the US dollar, which will lead to a breakthrough of 1.1075 and a decrease in the area of lows 1.1050 and 1.1026. In the case of growth above the resistance of 1.1120, the levels of 1.1149 and 1.1178 can be considered for sales. Indicator signals: Moving averages Trading is conducted in the area of 30 and 50 moving averages, which indicates the lateral nature of the market. Bollinger Bands In the case of a decline in the pair, a breakthrough of the lower border of the indicator in the area of 1.1097 will lead to a sell-off of the euro.

Description of indicators

|

| Technical analysis of AUD/USD for October 30, 2019 Posted: 30 Oct 2019 05:30 AM PDT Overview: Pivot point: 0.6823. The AUD/USD pair has faced strong support at the level of 0.6823. Right now, the price is set at 0.6840. So, the strong support has been already faced at the level of 0.6823 and the pair is likely to try to approach it in order to test it again and form a double bottom. Hence, the AUD/USD pair is continuing to trade in a bullish trend from the new support level of 0.6823; to form a bullish channel. According to the previous events, we expect the pair to move between 0.6823 and 0.6925. Also, it should be noted major resistance is seen at 0.6925, while immediate resistance is found at 0.8684. Then, we may anticipate potential testing of 0.8684 to take place soon. Moreover, if the pair succeeds in passing through the level of 0.8684, the market will indicate a bullish opportunity above the level of 0.8684. A breakout of that target will move the pair further upwards to 0.6925. Buy orders are recommended above the area of 0.6823 with the first target at the level of 0.8684; and continue towards 0.6925. On the other hand, if the AUD/USD pair fails to break out through the resistance level of 0.6884; the market will decline further to the level of 0.6761 (daily support 2). The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD: will the Fed limit itself to three rate cuts? Posted: 30 Oct 2019 04:47 AM PDT

The key event for financial markets will be today's Fed decision on monetary policy. That the US Central Bank will lower the federal funds rate for the third time this year (to 1.75%), almost no one doubts. The futures market with a probability of 98.0% expects such a step, and the regulator usually does not disappoint investors in the matter of easing. However, the main question is: what next? On the one hand, the main reason for the weakening of the Fed's monetary policy – the uncertainty of external conditions – is close to resolution. Negotiators from the United States and China are doing everything possible to have time before the APEC summit (to be held on November 16-17 in Chile) to prepare the "first phase" of the trade agreement. Although it's too early to put an end to the story with Brexit, it is clear that no one will allow the implementation of a "hard" scenario. On the other hand, it is obvious that the American economy is beginning to slow down, and this fact can hardly ignore the regulator. The momentum from the $1.5 trillion fiscal stimulus gradually faded, and trade wars led to a reduction in investment. In the third quarter, US GDP may mark only 1.6% growth. This will be the second weakest indicator since Donald Trump came to power. Employment in the non-agricultural sector of the United States in October may increase by less than 100 thousand, and unemployment – leave the area of half a century minimums. A pause in the process of easing the Fed's monetary policy and resuscitation of the European program of quantitative easing (QE) may play in favor of the "bears" in EUR/USD. In 2015-2016, the euro became cheaper amid purchases by the ECB assets, which led to an overflow of capital from Europe to America. If the Federal Reserve leaves the door to reduce the rate open, then the upward movement of EUR/USD in the direction of 1.117 – 1.1185 may continue. According to some experts, concerns about the onset of a recession in the US and the situation on the global market will leave the regulator no choice but to continue the "downgrade game". "We expect that at the October meeting, the Fed leadership will emphasize the direct dependence of decisions on statistics and leave the doors open for further cuts in rates," Bank of America strategists said. "The slowdown in the US economy and lower inflationary expectations are likely to lead to a further reduction in the federal funds rate in the coming months," ING experts said. At the same time, analysts admit that the dollar can resist even the easing of the Fed's policy and the risks of a recession in the United States. "Even when the US economy slides into a recession and fundamental indicators worsen, the greenback is in high demand as a safe haven. Although the dollar is overvalued, unresolved global tensions are one of the factors that could keep it on a growing path," according to Bank of America. "The theory that the dollar should weaken while lowering interest rates in the United States depends on whether the situation in other countries is stable: there should be no radical changes in their policies. Instead, everything happens exactly the opposite: central banks resort to non-standard methods of monetary policy, and in addition to this, everyone rushes in search of liquidity. We believe that negative rates and weak currencies abroad will continue to push investors to look for positive rates and profitable opportunities. We don't see anything that could stop the dollar even in these unusual times," representatives of BMO Global Asset Management said. The material has been provided by InstaForex Company - www.instaforex.com |

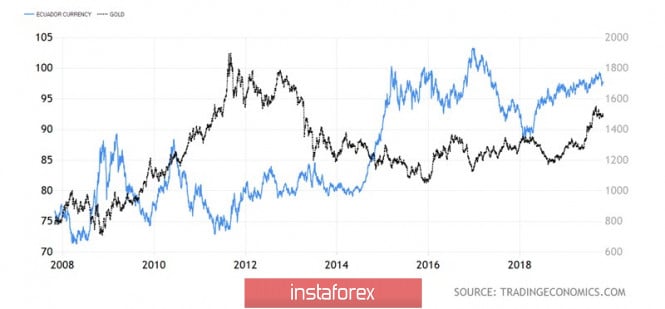

| Posted: 30 Oct 2019 04:46 AM PDT From late May to early September, the value of gold rose by more than 20% due to a combination of three factors: expectations of a reduction in the federal funds rate from 2.5% to 1.75% for preventive purposes, the escalation of the US-China trade conflict and, finally, the growing likelihood of a disorderly Brexit due to the coming to power of Boris Johnson. The first of them is almost played (not many doubt that the Fed will ease monetary policy for the third time in October), Donald Trump is ready to sign an agreement with Beijing, without waiting for a meeting with Xi Jinping, and the chances of Britain leaving the EU without a deal are minimized. When you have played all the trump cards, you need to count on a deep correction against the backdrop of the closure of speculative longs, but the precious metal is not in a hurry to retreat. When the Federal Reserve began to cut rates in the summer, Jerome Powell spoke of a mid-cycle adjustment and cited the experiences of 1995 and 1998, when the Central Bank used three acts of monetary expansion to keep the fire in a cooling economy. Nonetheless, in October, it became apparent: States could not escape the pain of trade wars. The weak statistics on retail sales, inflation, and business activity may be supplemented by negativity from GDP and the labor market. In July-September, the US economy is likely to slow down from 2% to 1.6%, which will be the second-worst quarterly result since Donald Trump was in power. If the Fed chairman leaves the door open for further rate cuts, no one will scold him. On the contrary, the owner of the White House will express his gratitude to him, because in this situation the American dollar will most likely weaken, and gold will rise. The dynamics of gold and the US dollar

This is not to say that the situation with Brexit and the trade wars has become as transparent as possible. Despite the progress in relations between Washington and Beijing, the amount of duties imposed by the States on Chinese imports is higher than 3 months ago. Not the fact that they will be canceled after the meeting of the heads of state in November. Boris Johnson managed to achieve early elections, which increases uncertainty. If the Conservatives win on them, Britain will leave the EU on the terms proposed by the Prime Minister, Labor – we are waiting for a second referendum. In such conditions, it is not advisable to run from long positions in precious metals. Everything can at any moment turn to face the "bulls" at XAU/USD. Gold went into consolidation in the range of $ 1475-1515 per ounce, and only the exit of quotations beyond its limits will clarify its fate. Buyers rely on the "dovish" rhetoric of Jerome Powell and the associated weakening of the US dollar, sellers – to reduce trade and political risks. Technically, the "Splash and Shelf" pattern was formed on the daily gold chart. Falling prices below the lower limit of the consolidation range of $1475-1515 per ounce ("shelf") will create the prerequisites for the development of a correction to an upward trend in the direction of $1440-1450. On the contrary, a successful assault on the resistance at $1515 will increase the risks of implementing targets at $1545 and $1580 according to the "Wolfe Wave" model. Gold, the daily chart

|