Forex analysis review |

- November 15, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- November 15, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- BTC 11.15.2019 - Downside pressure on the market, potential downward target at $7.500

- Gold 11.15.2019 - Potential new upward movement, resistance found at $1.473

- Gold does not share trading optimism and maintains a margin of safety

- Evening review of EURUSD 11/15/2019

- EUR/USD: plan for the American session on November 15th. Good US retail sales data did not help the dollar much

- GBP/USD: plan for the American session on November 15th. The lack of dynamics in the pound will continue until next week

- GBP/USD 11.15.2019 - First upward objective at the price of 1.2896 reached, potential for more upside

- Trading recommendations for the GBPUSD currency pair – prospects for further movement

- Fractal analysis of the main currency pairs for November 15

- Dark horse: Swiss franc may surprise the market

- Volume analysis of gold

- EUR/USD: the dollar makes a bet on the passivity of the Fed and trade disputes

- The dollar takes its toll

- Trading idea for a pair of USDCAD

- Trading recommendations for the EURUSD currency pair - prospects for further movement

- Technical analysis of EUR/USD for November 15, 2019

- Technical analysis of EUR/USD for November 15, 2019

- Diary of a trader EURUSD 11/15/2019

- Simplified wave analysis of EUR/USD and AUD/USD on November 15

- EURUSD: Bears take profits after a two-week decline in the euro. The Fed is concerned about the US national debt

- Analysis and forecast for EUR/GBP on November 15

- And things are still there (A review of EUR/USD and GBP/USD on 11/15/2019)

- The dollar - a sea of opportunity, the euro - the economic framework

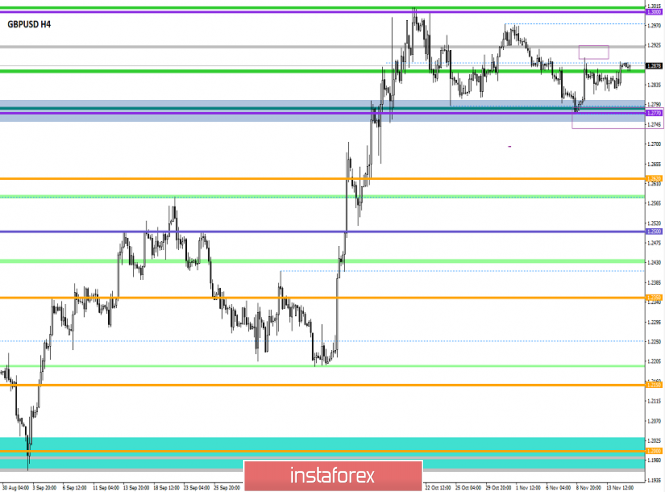

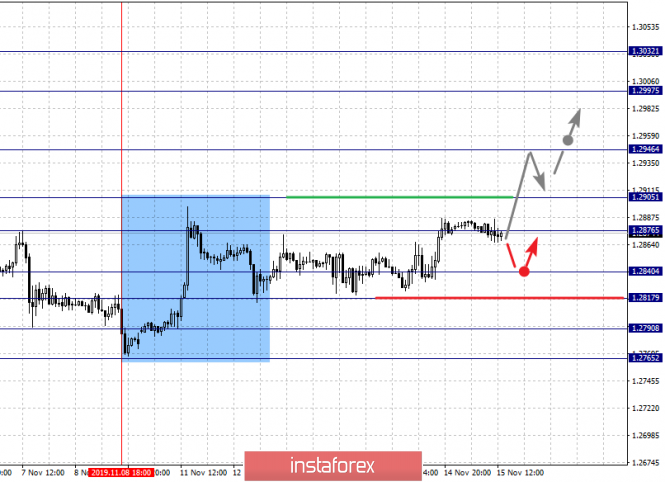

| November 15, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 15 Nov 2019 07:00 AM PST

Few weeks ago, Further Bullish advancement was demonstrated towards 1.2650 then 1.3000 after the neckline of the depicted Double-Bottom pattern (1.2400-1.2415) was breached to the upside. Since October 21, the GBP/USD pair has failed to achieve a persistent bullish breakout above the depicted SUPPLY-zone (1.2980-1.3000) which corresponds to a previous Prominent-TOP that goes back to May 2019. Instead, an ascending wedge reversal pattern was confirmed on October 22. This indicated a high probability of bearish reversal around the mentioned price zone. Hence, a quick bearish movement was anticipated towards 1.2780 (Key-Level) where some bullish recovery was recently demonstrated on October 24. The recent Bullish rejection around the price levels of 1.2780, indicated another temporary bullish movement towards 1.2980-1.3000 where another long-term bearish swing towards 1.2780 was initiated as expected. Since last week, lack of enough bearish pressure has been demonstrated on the chart. Instead, sideway consolidation movement is being expressed between 1.2780-1.2900. The short-term outlook remains bearish as long as consolidations are maintained below 1.2900 on the H4 chart. On the other hand, a quick bearish breakout below 1.2780 is needed to enable further bearish decline towards 1.2600-1.2650 where another episode of bullish recovery should be anticipated. Please note that H4 candlestick closure above 1.2900 invalidates the previous bearish scenario allowing a bullish movement to pursue towards 1.2970 again. Trade Recommendations: Intraday traders should wait for bearish breakout below 1.2780 as a valid SELL entry. Expected Bearish target is projected towards 1.2650 then probably 1.2560. The material has been provided by InstaForex Company - www.instaforex.com |

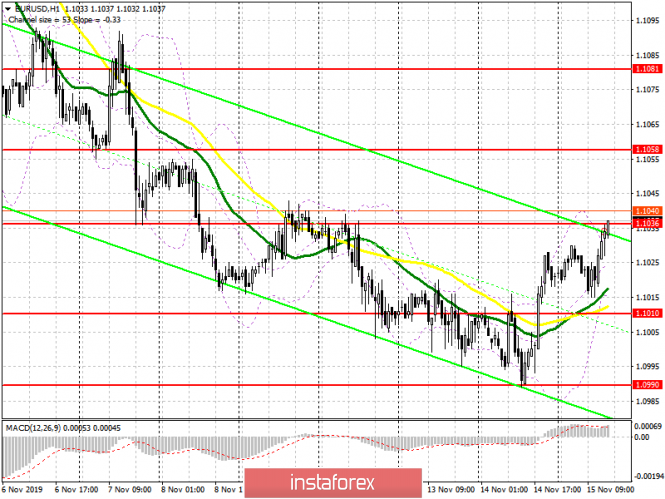

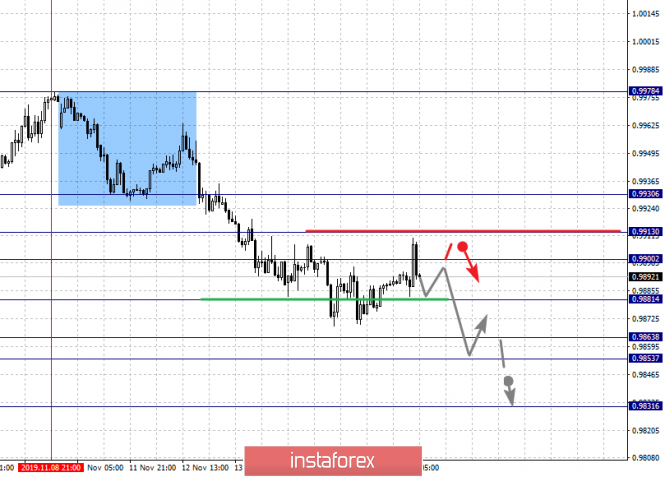

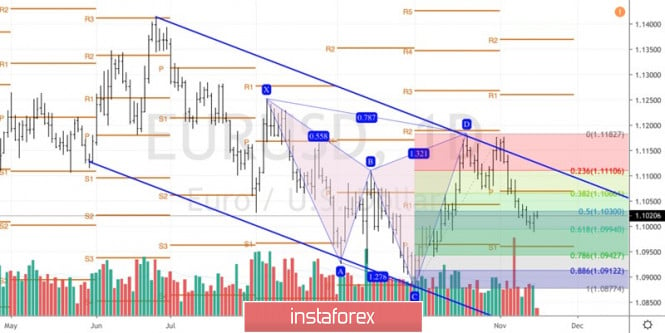

| November 15, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 15 Nov 2019 06:51 AM PST

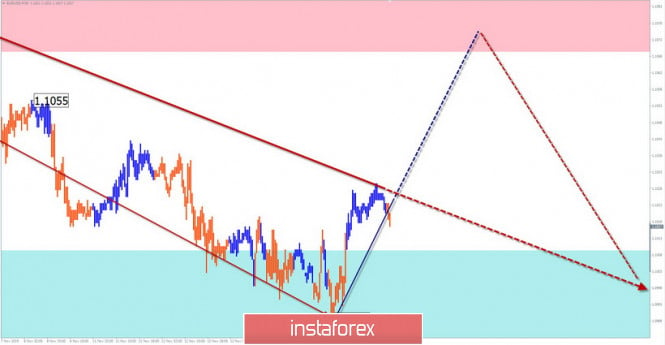

On October 2, a bullish breakout above 1.0940 confirmed the depicted Inverted Head & Shoulders reversal Pattern which enabled further bullish advancement towards (1.1000 -1.1020) This bullish movement has been maintained above the depicted bullish trend. On October 7, temporary sideway consolidation range was demonstrated around the price zone of (1.1000 -1.1020) before further bullish movement was resumed towards 1.1175 where significant bearish rejection was originated. The price zone around (1.1175 - 1.1190) stood as a significant SUPPLY-Zone that demonstrated bearish rejection for two consecutive times in a short-period. Moreover, the short-term technical outlook has turned into bearish after breakdown below 1.1090 was achieved (the depicted uptrend line and 50% Fibonacci Retracement Level). On the other hand, a long-term Double-Top pattern was demonstrated with neckline located around 1.1075-1.1090 which offered valid bearish positions upon last week's retesting. As anticipated, further bearish decline was executed towards 1.1025 and 1.0995 where temporary bullish rejection is being demonstrated. Currently, signs of bullish recovery are manifested around 1.1000 with expected bullish target projected towards 1.1085. Any bullish pullback towards 1.1065-1.1085 should be watched for early bearish rejection and another valid SELL entry. On the other hand, earlier bearish breakout below 1.1000 will probably enable quick bearish decline towards 1.0945 where a prominent demand level was previously located. Trade recommendations : Conservative traders are advised to wait for bullish pullback towards Fibonacci Zone 61.8% - 50% (1.1065-1.1085) for a valid SELL entry. Initial T/P levels to be projected towards 1.1045 and 1.1000, while S/L should be placed above 1.1115. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC 11.15.2019 - Downside pressure on the market, potential downward target at $7.500 Posted: 15 Nov 2019 06:42 AM PST BTC has been trading downwards, exactly what I expected yesterday. The price tested the level of $8.236 and is heading to test our main objective at the price of $7.506. Watch for selling opportunities on the rallies. Our short position from yesterday is still active

MACD oscillator is showing negative reading below the zero, which is sign that sellers are in control. The cause of the most recent downside was in my opinion big climatic action from days ago and gap fill. Major support level is seen at the price of $7.506 and solid intraday resistance at the price of $8.800. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold 11.15.2019 - Potential new upward movement, resistance found at $1.473 Posted: 15 Nov 2019 06:24 AM PST Gold found decent support at the price of $1.464 (middle of the Bollinger band) and the recent balance area. I do expect further upside and potential for re-test of $1.473 and $1.481. Watch for potential buying opportunities

MACD oscillator is showing that slow line is rising and that buyers are in control. The cause of the most recent upside move on the Gold is big bullish divergence on the MACD in the background and momentum lost from sellers. Support levels are seen at the price of $1.464 and $1.460. Resistance levels are seen at the price of $1.473 and $1.481. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold does not share trading optimism and maintains a margin of safety Posted: 15 Nov 2019 06:24 AM PST

Last week was quite unsuccessful for the yellow precious metal. We can even say that this was the worst period for gold in the last two years: it fell by 3.6%. One of the main factors of pressure on the value of the precious metal in November was the recovery in demand for risky assets amid the strengthening of optimistic sentiment regarding the trade deal between Washington and Beijing. This week, gold managed to get support around the mark of $1,450 per ounce and even turn around from it to grow. It seems that the pullback to the area of three-month lows, the precious metal adjusted the growth of the previous strong rally, which was observed in the period from May to September. Recently, stock markets have been noticeably stormy due to conflicting news from the trading front, which adds to the attractiveness of gold as a protective asset. On Tuesday, US President Donald Trump made several rather sharp remarks about the Celestial Empire, which raised concerns about the further course of trade negotiations between Washington and Beijing. However, on Thursday, Larry Kudlow, the White House's chief economic adviser, said the parties were close to a trade agreement. If US stock indices turn to decline, even more investors may come to gold. This can quickly return the quotes to the area above $1,500 before the end of this month, and by the end of the year – to bring them to peak levels above $1,550. The material has been provided by InstaForex Company - www.instaforex.com |

| Evening review of EURUSD 11/15/2019 Posted: 15 Nov 2019 06:24 AM PST

We were waiting for important US data. Retail sales came out slightly weaker than forecast – +0.2% (excluding cars) with a forecast of +0.4%. The New York business activity index was noticeably worse than the forecast: 2.9 instead of the 6.0 forecast. Prices for both imports and exports declined. The data is broadly against the US dollar. The euro is trying to show growth and seems ready to reach 1.1045 – you can buy from this point. We follow the closing of the day and week. The material has been provided by InstaForex Company - www.instaforex.com |

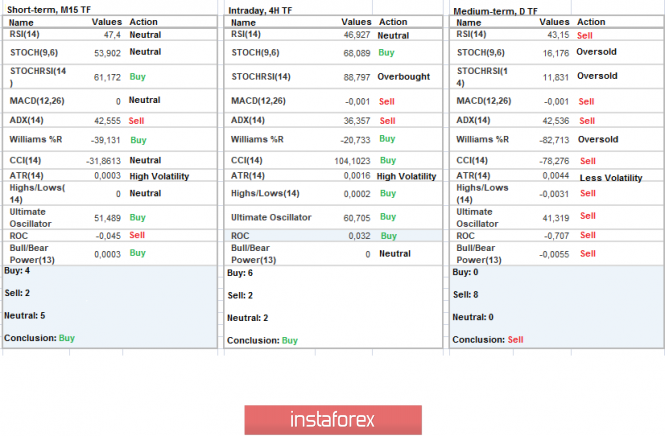

| Posted: 15 Nov 2019 06:24 AM PST To open long positions on EURUSD, you need: Data on the eurozone and consumer prices allowed bulls to hold their positions in the first half of the day, however, from a technical point of view, the situation has not changed much. At the moment, buyers of the euro are trying to break above the resistance of 1.1036, as there was no reaction to the good data on the growth of retail sales from buyers of the US dollar. A break of 1.1036 will lead to an update of the highs in the area of 1.1058 and 1.101, where I recommend taking the profits. In the scenario of a downward movement in the second half of the day, it is best to consider new long positions from the support of 1.1010 or buy immediately on the rebound from the minimum of 1.0990. To open short positions on EURUSD, you need: Sellers will not be in a hurry to return to the market, as even strong retail sales data did not lead to a decrease in the EUR/USD pair. In the second half of the day, I recommend focusing on short positions only after updating the maximum of 1.1058 and forming a false breakdown there or sell immediately for a rebound from the larger level of 1.1081. The main task of the bears will be to close the day under the resistance of 1.1036, which now coincides with the upper limit of the downward price channel formed on November 4 this year. Indicator signals: Moving Averages Trading is conducted above 30 and 50 moving averages, which indicates the continuation of the upward correction. Bollinger Bands If the euro falls in the second half of the day, the lower border of the indicator around 1.1010 will act as support.

Description of indicators

|

| Posted: 15 Nov 2019 06:24 AM PST To open long positions on GBP/USD, you need: From a technical point of view, the situation in the GBP/USD pair has not changed in comparison with the forecast for the European session. The lack of news, both fundamental and on the UK election, keeps volatility low. The primary task of the bulls today is to keep the pair above the level of 1.2855, the formation of a false breakdown at which will be a signal to buy the pound. However, the more important goal is to break through and consolidate above the resistance of 1.2884, which in the first half of the day could not be done. Only in this case, we can expect a new upward momentum in the area of highs of 1.2910 and 1.2938, where I recommend taking the profits. In the scenario of a support breakout of 1.2855, you can buy the pound immediately on the rebound from the lower border of the side channel in the area of 1.2823. To open short positions on GBP/USD, you need: In the second half of the day, sellers of the pound will try their best to prevent the breakdown of the resistance of 1.2884, and the formation of a false one in the European session so far indicates a possible scenario of the pair's decline to the support of 1.2855. The only consolidation below this level will lead to a further fall of GBP/USD in the area of lows of 1.2823 and 1.2794, where I recommend taking the profits. In the scenario of GBP/USD growth above the resistance of 1.2884, you can consider new short positions from the maximum of 1.2910 or sell immediately on the rebound only from the area of 1.2938. Indicator signals: Moving Averages Trading is around the 30 and 50 daily averages, indicating some market uncertainty. Bollinger Bands A break of the upper border of the indicator in the area of 1.2890 may lead to an increase in the pound in the afternoon.

Description of indicators

|

| Posted: 15 Nov 2019 06:13 AM PST GBP did reached our first upward target from yesterday at the price of 1.2896. Since there is the breakout of the important pivot and new momentum upside, there is chance for the next upward target to be on the test at 1.2946.

Stochastic oscillator did enter into the overbought zone now and it seems that buying at this stage looks risky. The cause of the upside move on the GBP is the completion of the ABC downward correction on the Daily time-frame.. Support level is seen at the price of 1.2896 and resistance at 1.2946. The material has been provided by InstaForex Company - www.instaforex.com |

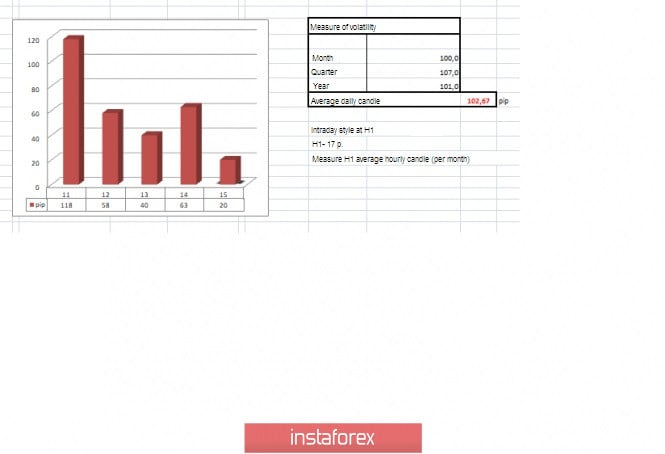

| Trading recommendations for the GBPUSD currency pair – prospects for further movement Posted: 15 Nov 2019 05:00 AM PST The slowdown of several days has formed a certain platform, what it can lead to, is it worth waiting for the breakdown of the control level or we will continue to move in the established flat – you will find answers to these and many other questions in the article. From the point of view of technical analysis, we see that for the fourth day, the quote is moving in a narrow range, where the upper border displays the middle (1.2885) of the main flat formation (1.2770/1.3000), and the lower frame (1.2815) – the formed circle relative to the current fluctuations. The characteristic restraint of the quote gives rise to speculation, is this slowdown a platform for starting? That is, earlier we have already seen a local convergence with the range level (1.2750/1.2770/1.2800), where the quotation managed to bounce only due to the spontaneous information background (November 11), but, as we can see from the result, the desire to keep the upward momentum was not supported by market participants, and the very stagnation in the form of a platform was formed. The trading platform, in this case, serves as a variable range where trading forces are aligned and, based on the subsequent accumulation of one or another interest, acceleration can occur, which, as a fact, will lead to a breakdown of the strongest market value. What am I leading to, if the momentum (November 11) was not the point of working off the level of 1.2770 and served only as a local jump, while maintaining a downward mood, then this platform can work out in terms of acceleration and as a fact of the breakdown of the control level of 1.2770. I perfectly understand that the above material is one of the development theories, but when you look at the dynamics of the volatility of the last 15 trading days, you somehow think spontaneously but is it time to go for a breakdown and accelerate. (Dynamics of daily candles from High to Low: 58 – 65 – 97 – 62 – 75 – 45 – 67 – 58 – 53 – 83 – 53 – 118 – 58 – 40 – 63 points). Analyzing the hourly past day, we see that the primary oscillation was within 1.2815/1.2865, where there was a local leap between 17:00-18:00 hours (time on the trading terminal), which did not lead to something drastic in terms of movement but the accumulation frame moved to the initial point of 1.2885 (50% relative to the flat of 1.2770/1.3000). The subsequent oscillation was within the value of 1.2885, with an amplitude of about 12 points. As discussed in the previous review, some traders continue to hold short positions from November 12, hoping that the range level of 1.2770 will still succumb to the onslaught of the market. It is worth considering that entering the market on November 12 carried a risk, for this reason, money management was carefully selected, without unnecessary trading volumes. At the same time, other traders worked both on the decline and the increase, focusing on the coordinates of 1.2750 – sell and 1.2885 – buy, but not one of the coordinates was not broken. Looking at the trading chart in general terms (daily period), we see all the same oscillation of 1.2770/1.3000, where the price concentration is in the 50% deviation of 1.2885. Let me remind you that the fluctuation between price levels lasts for a month, which, in turn, concentrates the increased interest in the subsequent development. In terms of recovery relative to the entire course of the historical minimum, we have some 22%, which is extremely small, especially for the month. The news background of the past day had in itself the data on retail sales in Britain, where they expected acceleration from 3.1% to 3.7%, but as a result, they received the same figure of 3.1%, which, to put it mildly, is bad. Then came the data on producer prices in the United States, where they predicted a decline from 1.4% to 0.9%, but as a result, they got better data – 1.1%. The latest data came out on applications for unemployment benefits (USA), which increased insignificantly, by 4 thousand: Primary +14; Repeated -10 thousand. The market reaction to the statistical indicators was again beyond logic as if the market lives its own life, and the composition of statistical data, which could help to strengthen the dollar (USD), is ignored by the market. The information background daily is full of the election race in the United Kingdom, where so far the Labor leader promises everyone free internet, citing the fact that only 8-10% of homes in the UK are connected to fiber optics, the business "nervously smokes on the sidelines." Investors in Britain are already experiencing bad times due to the protracted Brexit divorce process, as well as the "communist" in the person of Jeremy Corbyn threatens to impose high taxes on the rich and nationalize the railways, energy and water companies, as well as the royal mail. Bloomberg analysts tried to conduct a survey among bankers and hedge funds on the topic of the current election, but in response received reluctant comments that reflected some kind of concerns. "If Corbyn wins, it will be a fundamental change to everything we have had in this country for so many years," John elder said, founding partner of Family Office Advisors LLP. In turn, Prime Minister Boris Johnson recalled that, in addition to the elections, there is also Brexit, but said that there is still a wagon of time to conclude a deal with the EU. "Yes, we can do this, we will leave the European Union in January, and we will have a wagon of time to establish a free trade partnership. The huge advantage is that we have a high degree of consistency of tariffs, quotas, standards, so a deal with the EU will not be like any other deal," Boris Johnson said. Today, in terms of the economic calendar, we have data on retail sales in the United States, where they predict a slowdown from 4.1% to 3.8%. At the same time, statistical data on industrial production in the States will be published, where the decline should accelerate from -0.1 to -0.4. The upcoming trading week in terms of the economic calendar, the only thing that stands out is the minutes of the Fed meeting. In the UK, significant statistics by weight is not expected, thereby all hope remains on the spontaneous information background, which periodically pleases speculators. The most interesting events displayed below: On Tuesday, November 19th USA 14:30 London time – Number of building permits issued (October): Prev 1.391M – Forecast 1.385M USA 14:30 London time – The volume of construction of new houses (October): Prev. 1.256M – Forecast 1.300M On Wednesday, November 20th United Kindom – Monetary Policy Committee Hearings 20:00 London time – Protocol of the meeting of the US Federal Open Market Committee On Thursday, November 21st USA 14:30 London time – Sales in the secondary housing market (October): Prev 5.38M – Forecast 5.43M On Friday, November 22nd USA 15:45 London time – The composite purchasing managers' index (PMI) from Markit (November) Further development Analyzing the current trading chart, we see a stagnation, where the basis is taken the level of 1.2885, which plays the role of the upper bar. There was a kind of compression (1.2865/1.2885) in the accumulation stage of 1.2815/1.2885. In terms of volatility, we have extremely weak values, as if there is no movement at the root, as well as incoming trading volumes, but this again seems to be a stage of a kind of readiness for action. By detailing the per minute movement, we see a horizontal move with an attempt to gain a foothold below, but more notably, a set of candles from the beginning of the day signals a clear ambiguity in terms of action. In turn, some traders continue to hold positions for sale, with a conservative trading volume. Another part of traders is looking at the coordinate of 1.2885 for clear fixations above it. Having a general picture of actions, it is possible to assume that if we judge not narrowly, then by all signals and background, the pound is entitled to resume the downward course with a priority point in the face of the range level (1.2750/1.2770/1.2800). The main trading volumes will be lower than 1.2750 after the price is fixed. At the same time, there is an active discussion of the area of 1.2885/1.2900, wherein the case of its flight, market interests may change, and the cycle of 1.2770/1.3000 will resume again. Based on the above information, we derive trading recommendations:

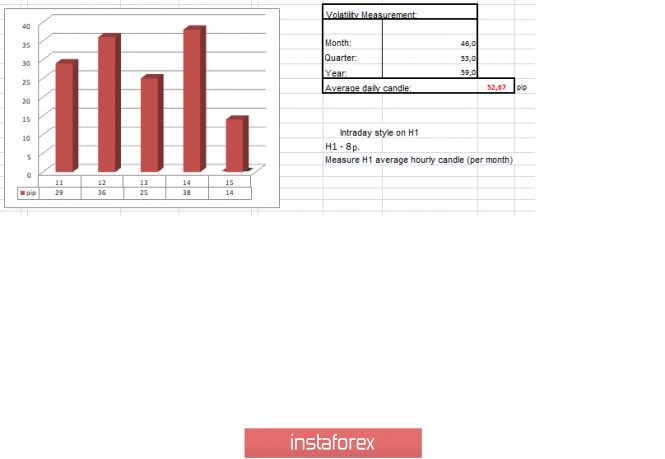

Indicator analysis Analyzing different sector timeframes (TF), we see that the indicators unanimously signal an upward interest, but there is one "but". Short-term gaps operate on a narrow accumulation, and the tap signal is unstable. The intraday outlook was replaced by yesterday's jump, which has no explanation. The medium-term outlook is more neutral than upward. Volatility per week / Measurement of volatility: Month; Quarter; Year. Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year. (November 15 was built taking into account the time of publication of the article) The volatility of the current time is 20 points, which is not just a low value for a given period, but damn low. In these situations, I want to work more on local jumps, the direction does not matter since there is nothing to surge in activity on. For those who wish to speculate, with short-term operations, the moment has come, monitor the existing accumulation (of the current day). Key levels Resistance zones: 1.3000; 1.3170**; 1.3300**. Support zones: 1.2770**; 1.2700*; 1.2620; 1.2580*; 1.2500**; 1.2350**; 1.2205(+/-10p.)*; 1.2150**; 1.2000***; 1.1700; 1.1475**. * Periodic level ** Range level *** The article is based on the principle of conducting transactions, with daily adjustments. The material has been provided by InstaForex Company - www.instaforex.com |

| Fractal analysis of the main currency pairs for November 15 Posted: 15 Nov 2019 04:00 AM PST Forecast for November 5: Analytical review of currency pairs on the scale of H1:

For the euro / dollar pair, the key levels on the H1 scale are: 1.1108, 1.1090, 1.1064, 1.1044, 1.1013, 1.0973, 1.0941 and 1.0903. Here, we are following the development of the downward cycle of November 4. At the moment, the price is in correction and forms a small potential for the top of November 14. The continuation of movement to the bottom is expected after the breakdown of the level of 1.1003. In this case, the first goal is 1.0973. Price consolidation is near this level. Short-term downward movement, as well as consolidation is in the range of 1.0973 - 1.0941. For the potential value for the bottom, we consider the level of 1.0903. Upon reaching this value, we expect a rollback to the correction. Short-term upward movement is expected in the range 1.1044 - 1.1064. The breakdown of the latter value will lead to an in-depth correction. Here, the goal is 1.1090. The range of 1.1090 - 1.1108 is a key support for the descending structure, before it, we expect the initial conditions for the upward cycle to be formed. The main trend is the downward structure of November 4, the correction stage. Trading recommendations: Buy: 1.1045 Take profit: 1.1062 Buy: 1.1065 Take profit: 1.1090 Sell: 1.1003 Take profit: 1.0975 Sell: 1.0971 Take profit: 1.0941

For the pound / dollar pair, the key levels on the H1 scale are: 1.3032, 1.2997, 1.2946, 1.2905, 1.2876, 1.2840, 1.2817, 1.2790 and 1.2765. Here, the price forms the expressed initial conditions for the top of November 8. Short-term upward movement is expected in the range 1.2876 - 1.2905. The breakdown of the latter value will lead to movement to the level of 1.2946. Price consolidation is near this level. The breakdown of the level of 1.2946 should be accompanied by a pronounced upward movement. Here, the target is 1.2997. We consider the level 1.3032 to be a potential value for the top; upon reaching this level, we expect a pullback to the bottom. A short-term downward movement is possibly in the range of 1.2840 - 1.2817. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.2790. This level is a key support for the top, its passage at the price will lead to the formation of a local descending structure. Here, the first goal is 1.2765. The main trend is building potential for the top of November 8. Trading recommendations: Buy: 1.2876 Take profit: 1.2905 Buy: 1.2907 Take profit: 1.2944 Sell: 1.2840 Take profit: 1.2818 Sell: 1.2815 Take profit: 1.2792

For the dollar / franc pair, the key levels on the H1 scale are: 0.9930, 0.9913, 0.9900, 0.9881, 0.9863, 0.9853 and 0.9831. Here, we are following the development of the downward cycle of November 8. At the moment, the price is in correction. The continuation of the movement to the bottom is expected after the breakdown of the level of 0.9881. In this case, the target is 0.9863. Price consolidation is in the range of 0.9863 - 0.9853. For the potential value for the bottom, we consider the level of 0.9831. The expressed movement to which is expected after the breakdown of the level of 0.9851. Short-term upward movement is possibly in the range of 0.9900 - 0.9913. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 0.9930. This level is a key support for the downward structure. The main trend is the downward cycle of November 8, the correction stage Trading recommendations: Buy : 0.9900 Take profit: 0.9911 Buy : 0.9914 Take profit: 0.9930 Sell: 0.9880 Take profit: 0.9865 Sell: 0.9852 Take profit: 0.9831

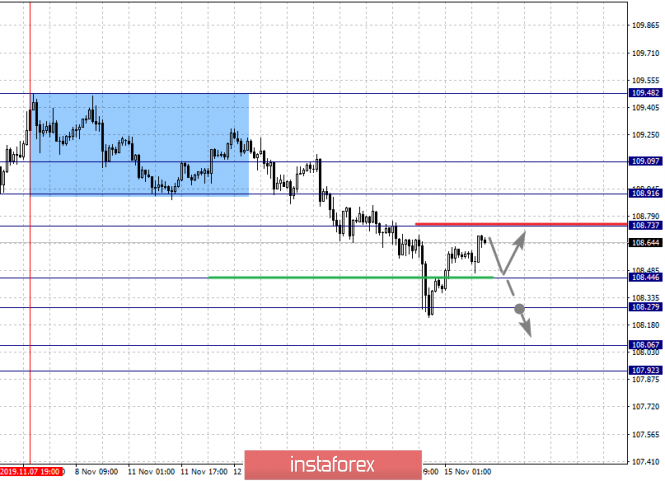

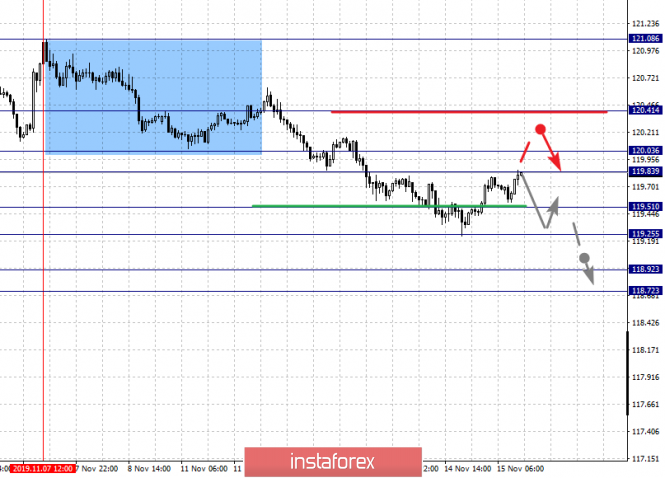

For the dollar / yen pair, the key levels on the scale are : 109.09, 108.91, 108.73, 108.44, 108.27, 108.06 and 107.92. Here, we continue to monitor the development of the downward cycle of November 7. Short-term downward movement is expected in the range of 108.44 - 108.27. The breakdown of the last value should be accompanied by a pronounced downward movement. Here, the target is 108.06. We consider the level of 107.92 to be a potential value for the bottom. Upon reaching this value, we expect consolidation in the range of 108.06 - 107.92, as well as a rollback to correction. Departure to the correction zone is expected after the breakdown of the level of 108.73. Here, the goal is 108.91. Price consolidation is near this level. We consider the level of 109.09 to be a potential value for the top, and we expect the initial conditions for an ascending cycle to be formed to this level. The main trend: the downward structure of November 7, the correction stage Trading recommendations: Buy: 108.73 Take profit: 108.90 Buy : 108.94 Take profit: 109.07 Sell: 108.44 Take profit: 108.29 Sell: 108.25 Take profit: 108.06

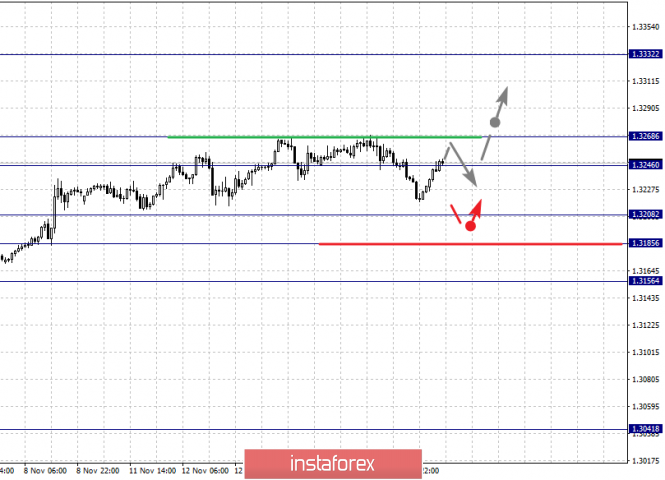

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3332, 1.3268, 1.3246, 1.3208, 1.3185 and 1.3156. Here, we are following the medium-term upward structure from October 29, as well as the local structure for the top from November 5. Short-term movement to the top is expected in the range of 1.3246 - 1.3268. The breakdown of the last value will lead to a pronounced movement. Here, the potential target is 1.3332, and upon reaching this level, we expect a pullback to the bottom. Short-term downward movement is possibly in the range of 1.3208 - 1.3185. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.3156. This level is a key support for the upward structure. The main trend is the medium-term initial conditions for the upward movement of November 29. Trading recommendations: Buy: 1.3246 Take profit: 1.3266 Buy : 1.3270 Take profit: 1.3332 Sell: 1.3208 Take profit: 1.3187 Sell: 1.3183 Take profit: 1.3156

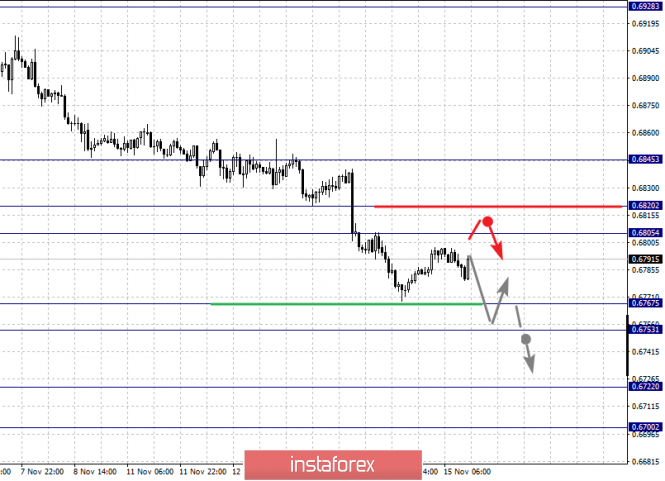

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6845, 0.6820, 0.6805, 0.6767, 0.6753, 0.6722 and 0.6700. Here, we are following the development of the downward cycle of November 5. Short-term downward movement is expected in the range of 0.6767 - 0.6753. The breakdown of the last value should be accompanied by a pronounced downward movement to the level of 0.6722. Price consolidation is near this level. For the potential value for the bottom, we consider the level of 0.6700. Upon reaching this value, we expect a rollback to the top. Short-term upward movement is possibly in the range of 0.6805 - 0.6820. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 0.6845. This level is the key support for the downward structure from November 5. The main trend is the downward structure of November 5. Trading recommendations: Buy: 0.6805 Take profit: 0.6820 Buy: 0.6823 Take profit: 0.6842 Sell : 0.6767 Take profit : 0.6754 Sell: 0.6751 Take profit: 0.6724

For the euro / yen pair, the key levels on the H1 scale are: 120.41, 120.03, 119.83, 119.51, 119.25, 118.92 and 118.72. Here, the subsequent targets for the downward movement is determined from the local structure on November 7. At the moment, the price is in correction. Short-term downward movement is expected in the range of 119.51 - 119.25. The breakdown of the last value should be accompanied by a pronounced downward movement. Here, the potential target is 118.72, and upon reaching this level, we expect a consolidated movement in the range of 118.92 - 118.72. Short-term upward movement is expected in the range of 119.83 - 120.03. The breakdown of the latter value will lead to an in-depth correction. Here, the goal is 120.41. This level is a key support for the downward trend. The main trend is the local structure for the bottom of November 7, the correction stage Trading recommendations: Buy: 119.83 Take profit: 120.01 Buy: 120.06 Take profit: 120.40 Sell: 119.50 Take profit: 119.27 Sell: 119.24 Take profit: 118.92

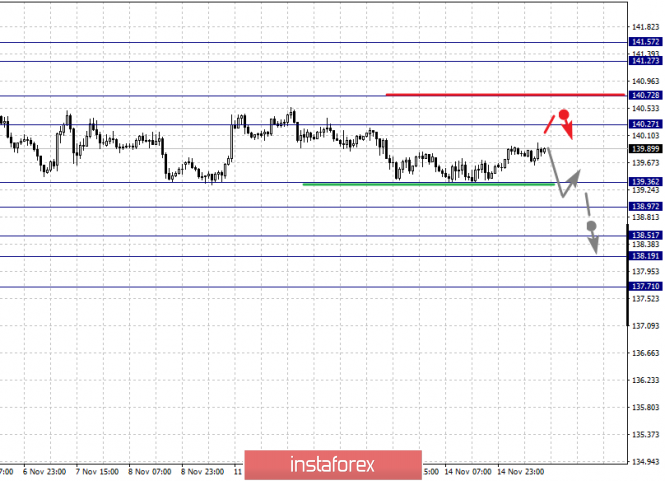

For the pound / yen pair, the key levels on the H1 scale are :141.57, 141.27, 140.72, 140.27, 139.36, 138.97, 138.51, 138.19 and 137.71. Here, we consider the descending of November 5 as the main structure. Short-term downward movement is expected in the range 139.36 - 138.97. The breakdown of the last value will lead to a pronounced movement to the level of 138.51. Price consolidation is in the range of 138.51 - 138.19. For the potential value for the bottom, we consider the level of 137.71. Upon reaching which, we expect a pullback in the correction. Short-term upward movement is possibly in the range of 140.27 - 140.72. The level of 140.72 is a key support for the initial conditions of November 5. Its passage at a price will lead to the development of the upward structure of November 11. Here, the first potential target is 141.27. Price consolidation is in the range of 141.27 - 141.57. The main trend is the downward structure of November 5 Trading recommendations: Buy: 140.72 Take profit: 141.27 Buy: 140.27 Take profit: 140.70 Sell: 139.36 Take profit: 138.98 Sell: 138.95 Take profit: 138.51 The material has been provided by InstaForex Company - www.instaforex.com |

| Dark horse: Swiss franc may surprise the market Posted: 15 Nov 2019 04:00 AM PST Watching a series of confrontations between the dollar and the euro, as well as closely monitoring the dynamics of the pound, the market lost sight of a kind of dark horse - the Swiss franc. Non-dormant experts, analyzing the situation, came to the conclusion that this currency can surprise the market next year. According to preliminary calculations, the "Swiss" can go to the bottom in 2020. Analysts recommend betting on it, since the sale of Swiss currency can bring significant profits to investors. Specialists guarantee 100% income in the event of such a transaction. The peculiarity of these analytical calculations is that they were performed using quantum calculations. Artificial intelligence calculated all the pros and cons of the situation before issuing such a solution. Experts completely trust it in this matter. According to the calculations of three quantum models, whose time horizons extend from one to six months, two "bearish" signals and one neutral signal were received with respect to CHF. When considering the reverse price model, which analyzes the dynamics of exchange rates over six years, experts unanimously announced the swift collapse of the Swiss franc and its further sale. Earlier, the Swiss currency was in the top three of the G-10. According to experts, the franc was overvalued against the US dollar. In the near future we should expect its noticeable weakening, experts sum up. Since the beginning of this year, the Swiss franc fell 0.6% against the US currency. On the morning of Friday, November 15, the Swiss currency was trading at moderately high positions within the range of 0.9908–0.9909. However, in the future, the negative predictions of analysts regarding the pair USD / CHF began to come true. The pair plunged sharply to the levels of 0.9893–0.9894 and is currently in this range. More recently, the Swiss franc was considered a safe haven for those who are concerned about trade conflicts and a slowdown in global economic growth. Investors were attracted by factors such as the stability of the Swiss economy, the current account surplus and the country's public debt to GDP ratio of only 40%, compared with 82.3% in the United States. Furthermore, according to the largest bank JPMorgan Chase & Co, the Swiss was recognized as one of the three best currencies. It served as a defensive asset during the last five economic downward turns in America. However, the Swiss currency can bring a number of surprises now, coming out of the shadows. These changes can be either with a plus sign or with a minus sign, analysts summarize. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 15 Nov 2019 02:04 AM PST Good afternoon, dear traders! I present to your attention a volume analysis of gold. Yesterday's speech by Jerome Powell weakened the US dollar a bit. The day formed a false breakdown of the bar, which absorbed a false breakdown of the daily level from 10/01/19. I.e there was a push down, which indicated that this is a sales zone. The price came to this sales area without large volumes, which means there is no intention to beat this level. Today, a downward movement has already begun, therefore, during the day, the expectation of a pullback to local sales levels, from which the expectation is down to the base of the pin bar of purchases from 12.11.19, which has a large enough volume that stopped the downward movement. Volumetric analysis on H1. We have a Purchasing Bar with a large volume (for Asia), after which the price went down. In addition, there were a lot of purchases in the market in this bar, which is shown by the high delta and the price reaction is down. Thus, there is a limit seller at this level. Thus, now, I recommend to work carefully on the decline inside the day from the sales zone 1468.5 with a near target of 1464 and further 1456.4. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD: the dollar makes a bet on the passivity of the Fed and trade disputes Posted: 15 Nov 2019 01:58 AM PST

As the US economy is still strong and its main competitors are in trouble, the greenback is confident. In addition, the uncertainty regarding the conclusion of a trade agreement between the United States and the Middle Kingdom remains. In his second speech to Congress, Fed Chairman Jerome Powell noted that the US economy is in good shape and has promised to do everything possible to ensure that economic expansion continues as long as possible. At the same time, the October releases on Chinese investment, retail sales, and industrial production were worse than expected. Japanese GDP slowed sharply in the third quarter, and Germany barely escaped a recession. Employment in Australia last month was marked by a maximum decline in three years. At the same time, J. Powell provided some support to the bulls on EUR/USD. He pointed out many factors, including inflation and trade conflicts. By taking them into account, the Fed may lower the interest rate. At the same time, J. Powell did not name a single factor, because of which the US Central Bank can tighten monetary policy. The derivatives market lays in the quotes a 53% probability that the rate on federal funds will remain unchanged until mid-2020. That is, investors believe that for eight months the Fed will sit on the sidelines, which in principle is confirmed by the latest comments from FOMC representatives. So, the head of the Federal Reserve Bank of St. Louis, James Bullard, said that further interest rate cuts are not required. The President of the Federal Reserve Bank of New York, John Williams, believes that monetary policy is in the right place so that the US Central Bank can withstand the uncertainty in the world. According to Fed Chairman J. Powell, despite the fact that the amount of introduced trade tariffs is negligible compared to national GDP, the uncertainty associated with them has a negative impact on business activity and business investment in the United States, that is, it contributes to a slowdown in the US economy. Therefore, the Fed will act on the incoming data. The market is expecting how the trade war between the USA and the Middle Kingdom will be resolved. On the eve of the White House chief economic adviser, Larry Kudlow said that the trade negotiations of the parties have entered the final stage, the deal is close, although not yet implemented. Meanwhile, the Financial Times, citing informed sources, reports that Washington is unhappy that Beijing is taking time and does not offer significant concessions in response to the rollback of tariffs. Thanks to the German GDP and J. Powell, the EUR/USD "bulls" managed to repel the first attack at 1.1000, but their positions are still fragile. "Even if the US and China reach an interim agreement, it is unlikely that key points in trade disputes will be resolved. Tensions will remain high, and the global economy will continue to slow down over the next two quarters. The Fed is close to completing a cycle of easing monetary policy, while the ECB will continue to weaken it. Against this background, the dollar will continue to strengthen," Jonas Holtermann of Capital Economics said. The material has been provided by InstaForex Company - www.instaforex.com |

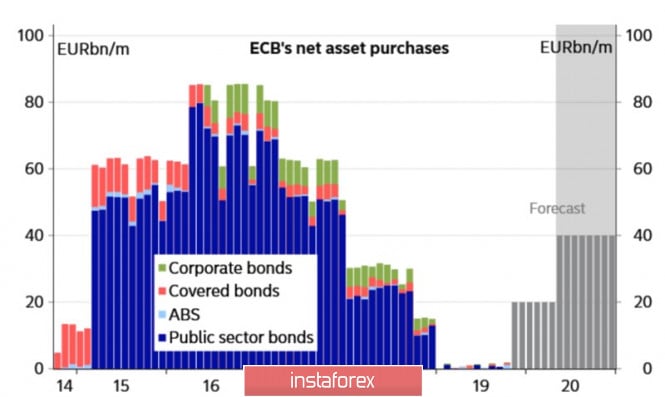

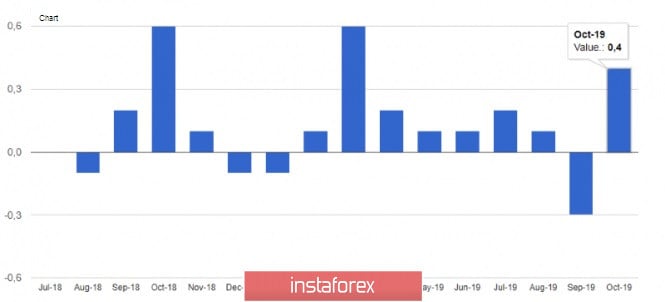

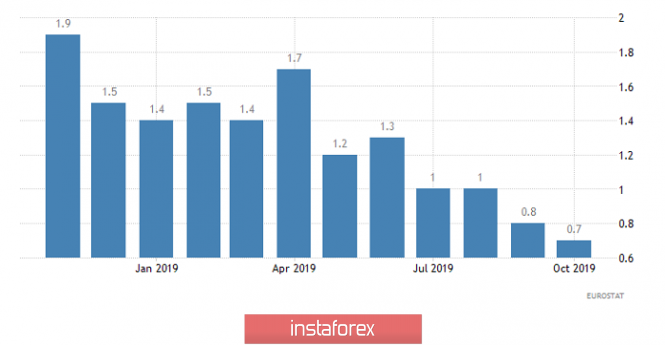

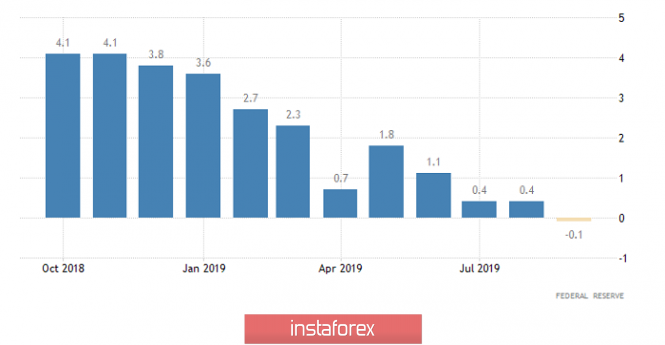

| Posted: 15 Nov 2019 01:58 AM PST The situation in forex changes in the blink of an eye and someone who is not ready to make adjustments to their views resemble a person leaving home in the same clothes at any time of the year. There is a high probability to get wet in the rain without an umbrella or freeze in winter in shorts. If in October the euro was confidently heading north due to the de-escalation of the trade conflict between Washington and Beijing, reducing the risks of promiscuous Brexit to a minimum, a portion of weak statistics in the United States and expectations of the Fed lowering the federal funds rate, in the first half of November, the EUR/USD pair lost most of its achievements. It is not known who will win the parliamentary elections in Britain. According to opinion polls, the conservatives are ahead of the Labor Party by 14 points, however, Donald Trump was considered an outsider in 2016. The US President threatens with new tariffs if China does not sign the agreement. We've seen it before somewhere. Relations between Washington and Beijing are built on the principle of "a step forward, two backward." Who can guarantee that the same thing won't happen this time? Disappointing statistics on the States changed to positive, and the Fed has already reduced the rate. This factor is played back. Moreover, if the eurozone economy continues to feel as bad as it does now, the ECB, according to Nordea Markets, will increase the volume of bond purchases from €20 billion to €40 billion per month in March 2020. Dynamics of asset purchases in the framework of European QE

Thus, the euro has lost its main trump cards, and the problems of the dollar are in the past. Why, in such circumstances, the main currency pair does not move south? If the Tories celebrate victory in the early elections in Britain and Donald Trump and Xi Jinping sign the agreement as part of Phase 1, then it will be possible to return to purchases of EUR/USD. In the meantime, it's better not to try to catch the falling daggers, because the foundation plays on the side of the "bears". It is unlikely that the minutes of the October meetings of the Fed and the ECB, the publication of which will become the key events of the week by November 22, will turn everything upside down. The Fed's position is clear. Most officials feel comfortable with the current level of the federal funds rate. It contributes to their goals of moderate economic growth, symmetrical inflation meandering around the 2% target, and a strong labor market. The split in the ranks of the European Central Bank has been talked about for a long time. That's not news. Another thing is the data on business activity in Germany and the eurozone for October, which will see the light at the end of the five-day period. Positive is able to support EUR/USD buyers. Technically, on the daily chart of the main currency pair, there is a transformation of the "shark" pattern into 5-0. If the euro bulls manage to return quotes above the pivot level of $1.107, the risks of continuing the rally in the direction of the upper border of the downward trading channel and above will increase. On the contrary, the fall of EUR/USD below the supports at 1.0965, 1.094, and 1.091 will allow us to count on the restoration of the "bearish" trend. EUR/USD, the daily chart

|

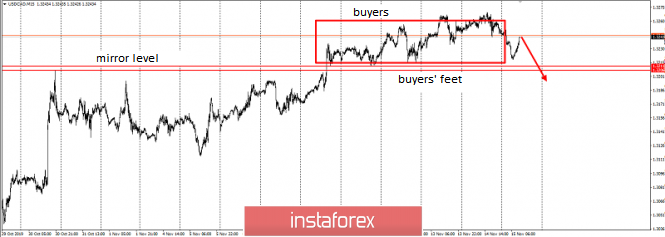

| Trading idea for a pair of USDCAD Posted: 15 Nov 2019 01:45 AM PST Good afternoon, dear traders! I present to you the trading idea for USDCAD. Starting October 28, the instrument is in an upward trend. This is due to two factors. Firstly, USDCAD is not only CAD but also USD, which is the base currency in this tool. The weakness of the Canadian, which occurred on October 30 at a press conference of the Bank of Canada, occurred on a strong dollar. As you probably already noticed, the dollar is strengthening on all fronts for the second week. Thus, the USD / CAD fraction has a bullish trend - a weak Canadian against the background of a strong American. We participated in this trend on November 6. The trend has been going on for 13 consecutive days, and yesterday the first sig ns of the dollar's weakness appeared on the next statements by Powell. Technically, we have a very interesting picture of the classical "mirror level" technical analysis. It should be noted that mirror levels work well on the first test, and you can easily check this fact. Moreover, many Western traders use this pattern in their daily trading. But few people know that the more often the price approaches the "mirror", the greater the probability of its breakdown.Whether it will be true or false - no one knows, but its very fact is a regular phenomenon that can be used in trade "against the crowd". Now everyone who bought USDCAD above 1.32 starting on November 7 will limit their losses under this mirror -like level of support-resistance. A short-range initiative took place in America and Asia yesterday, which can develop into wave "C", the classic structure of ABC, and you can participate in this trend. I suggest choosing lower signals from smaller TFs in order to update the mirror level 1.32118 - 1.32. Good luck with trading and see you in the evening review! The material has been provided by InstaForex Company - www.instaforex.com |

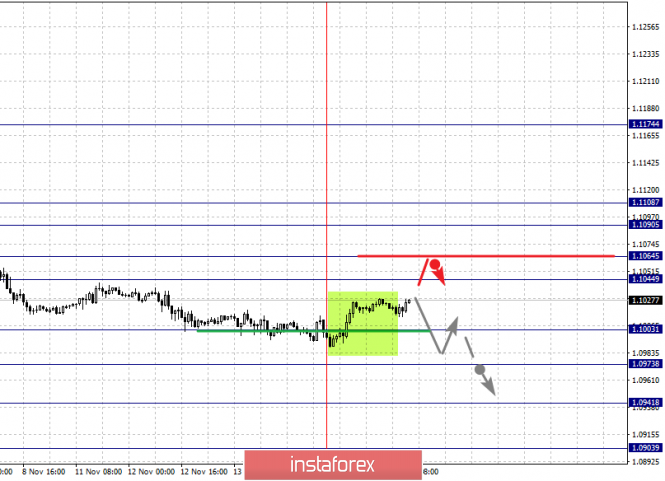

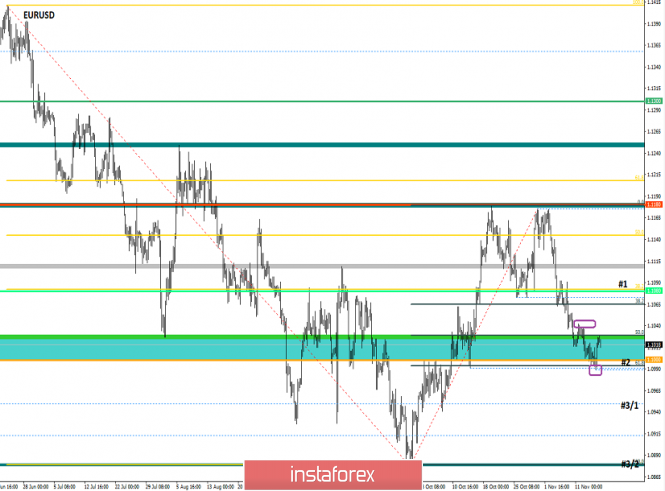

| Trading recommendations for the EURUSD currency pair - prospects for further movement Posted: 15 Nov 2019 01:40 AM PST The psychological level of 1.1000 continues to tickle the nerves of traders for five consecutive days, but as a result, without a clear signal: a breakthrough or a rebound? From the point of view of technical analysis, we see a real battle not for life, but for death, where traders have been trying to break the psychological level of 1.1000 for five consecutive days in a row, but as a result of having useless punctures without the possibility of retention. Thus, the stage [# 2] of restoration with respect to the elongated correction, turned out to be much stronger than many thought and the theory of repetition of the plot with stage # 1 made sense. If we move the chart to the past and look at the time interval of November 5-7, we will see that the 1.1080 step was not so simple, and even during inertia the sellers were not able to take the bar the first time and only we saw the field of subsequent moves transition from step # 1 to step # 2. It's worth considering that before the passage of the first degree we highlighted a significant stop, which reflected the transition of an oblong correction to recovery itself, now we see a slight stagnation / rollback, no more. Of course, if we develop the recovery theory in general terms, then the most durable steps are the first and last, which is between, are variables. However, in this case, we have a variable point in the face of a strong psychological level of 1.1000, which makes the process a little more difficult. In terms of volatility, we do not see drastic changes, compared with November 13. There is a characteristic improvement, but nevertheless, the market dynamics is 27% lower than the average daily indicator. In turn, the emotional component of market participants is at a low start, everyone expects from the current stagnation something more than a sluggish swing. Analyzing the past hourly hour, we see that even with such a low amplitude there were also impulses. Thus, the morning stretch of time was lit up and down in jumps against the backdrop of European statistics. Then a slight stagnation and a final upward surge of 14:00 - 17:00 [UTC+00 time on the trading terminal]. As discussed in the previous review, many traders have already entered short positions, hoping for a breakdown of the control level. Others are waiting for a clear fixation of prices lower than 1.0990, which did not happen. Third traders immediately consider two developments: a breakdown or a rebound, using the coordinates 1.0030 / 1.1035 - Buy and 1.0990 - Sell. Considering the trading chart in general terms [the daily period], we see that the recovery process is preserved in the market, where there is about 50% of mining relative to the elongated correction. In the medium term, downward interest remains as the mood of market participants. The news background of the past day contained a second estimate of European GDP for the third quarter, where the data were confirmed at 1.2% with a forecast of a slowdown to 1.1%. A few hours before the general publication, German GDP was released, where it recorded growth from 0.3% to 0.4%. In the afternoon, the United States reported producer prices, where they forecast a decline from 1.4% to 0.9%, but as a result they got better data, 1.1%, which, by the way, was what we expected in the previous review. Applications for unemployment benefits in the US grew by 4 thousand, but globally this is insignificant: Primary +14; Repeated -10 thousand The market reaction to statistics surprised market participants once again. Thus, in Europe, everything is clear. The reaction was only on data on Germany, but in the United States there was some kind of estrangement from positive data once again. Let me remind you that the statistical data on inflation in the United States also remained without attention. The information background continues to revolve around US-Chinese relations. Earlier, we wrote that the Ministry of Commerce of the People's Republic of China Gao Feng confirmed the negotiations between the two countries. The main issue is the mutual removal of increased duties. So, there was a comment from the White House in the person of economic adviser Larry Cadlow, who said: "We are close to this ... The mood is very good, which was not always in such things." Details of telephone conversations between Washington and Beijing, Cadlow refused to disclose, the only thing he said: "The deal is not ready yet, but we are seeing very good progress, and the negotiations themselves were very constructive." At the same time, Fed Deputy Chairman Richard Clarida said during a conference on monetary policy at the Cato Institute in Washington, that the regulator is considering all sorts of methods that can help in the event of a downturn. "In addition to assessing the effectiveness of existing tools, the review looks at additional tools to mitigate policy when an effective lower bound is mandatory," said Richard Clarida Finally, a few comments regarding Brexit. Recently, on the European side, we have heard more and more often many statements regarding the good agreement that was proposed to Britain, as well as the unity and removal of England. So this time, this time, the newly elected President of the European Parliament David Sassoli gave his comment, who said that the calculations of the Brexit supporters did not materialize, because discussions about Britain's exit stimulated EU members to come to a common opinion. "Like the nationalists on the continent, Brexit supporters thought they would destroy the European Union. Instead, despite the fact that we are discussing all issues in the EU, we had a common opinion on Brexit, "said David Sassoli Today, in terms of the economic calendar, we have data on inflation in Europe, where, according to forecasts, they expect a decrease from 0.8% to 0.7%. In the afternoon, we are waiting for data on retail sales in the United States, where they forecast a slowdown from 4.1% to 3.8%. The flow of statistics is completed by data on industrial production in the States, where the decline should accelerate from -0.1 to -0.4. The upcoming trading week in terms of the economic calendar conditionally starts from Wednesday, when the minutes of the Fed meeting are published, and then, due to the late release of the document, activity should be expected on Thursday, where at the same time the minutes of the ECB meeting will be published. At the same time, do not forget about the information background regarding US-Chinese relations and the eternal Brexit. The most interesting events displayed below ---> Tuesday November 19 USA 13:30 Universal time - Number of building permits issued (Oct): Prev 1,391M ---> Forecast 1,385M USA 13:30 Universal time - The volume of construction of new houses (October): Prev. 1.256M ---> Forecast 1.300M Wednesday, November 20 19:00 Universal time - Protocol of the meeting of the US Federal Open Market Committee Thursday, November 21 12:30 Universal time - Publication of the minutes of the ECB meeting on monetary policy USA 13:30 Universal time - Sales in the secondary housing market (Oct): Prev 5.38M ---> 5.43M forecast Friday November 22 7:00 Universal time - German GDP 8:30 Universal time - The index of business activity in the manufacturing sector (PMI) in Germany (November) EU 9:00 Universal time - Composite Business Activity Index (PMI) by Markit (Nov) USA 14:45 Universal Time - Markit Composite Business Activity Index (PMI) (Nov) Further development Analyzing the current trading chart, we see that due to yesterday's local jump, the quotation managed to grow a little, but felt variable resistance in the region of 1.1030. The existing fluctuation is expressed in stagnation, where conditionally the quote continues to focus on the psychological level of 1.1000. In this situation, considerable indecision to actions can be seen, at the same time, high expectations of the upcoming surge relative to the control level. Thus, the emotional mood and market volatility is at a low start, which is what traders are advised. By detailing the available time interval, we see a narrow fluctuation of 1.1015 / 1.1030, without any significant price spikes. In turn, traders continue to hold short positions with the hope of breaking the ill-fated level of 1.1000. But not everyone turned out to be so strong adherents of the Bears, and alternative positions are being actively discussed. It is likely to assume that there is still a chance of quotes returning back to 1.1000, but we are more interested in the breakdown of this very level, where it is not so simple. Thus, the main positions remain lower, where trading volumes will rise if prices are fixed lower than 1.0990 - no puncture shadow. At the same time, due to alternatives and local moves, an upward movement is considered, but only in the case of price fixing higher than 1.1030-1.1045. Based on the above information, we derive trading recommendations: - Buy positions are considered in terms of alternative operations. Points of consideration will be in the region of 1.1030-1.1045. - Market participants are already holding positions for sale, where it is not worth having excessive trading volumes at this stage. If we don't have any deals, it makes sense to wait until the price fixes below 1.1090 / 1.1080. Perspective: 1.0950 variable stage; The main finishing stage of recovery is 1.0880. Indicator analysis Analyzing a different sector of timeframes (TF), we see a characteristic multidirectionality, where the short-term and intraday periods are stagnant, but the medium-term period reflects the recovery process. Volatility per week / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year. (November 15 was built taking into account the time of publication of the article) The volatility of the current time is 14 points, which is an extremely low value for a given period of time. We continue to take a waiting position in terms of detecting acceleration. Key levels Resistance zones: 1,1000 ***; 1.1080 **; 1,1180 *; 1.1300 **; 1.1450; 1.1550; 1.1650 *; 1.1720 **; 1.1850 **; 1.2100. Support Areas: 1,1000 ***; 1.0900 / 1.0950 **; 1.0850 **; 1,0500 ***; 1.0350 **; 1,0000 ***. * Periodic level ** Range Level *** Psychological level ***** The article is built on the principle of conducting a transaction, with daily adjustment The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of EUR/USD for November 15, 2019 Posted: 15 Nov 2019 01:13 AM PST Overview: In the one-hour time frame, the EUR/USD pair is still bearish as long as the level of 1.1063 is not broken. The level of 1.1063 has rejected sever al times confirming the validity of a bearish market today. So, resistance is seen at 1.1063 which represents the pivot point. The market is still indicating a strong bearish trend from the spot of 1.1063-1.1086. This is confirmed by the RSI indicator signaling that we are still in the bullish trending market. In the short term, we expect the EUR/USD pair to continue to trade in a bearish trend from the new resistance level of 1.1063 to form a bearish channel. Also, it should be noted that the price is still above the moving average (100) and (50) at the same time frame. However, if the pair fails to pass through the level of 1.1063 (pivot), the market will indicate a bearish opportunity below the level of 1.1063. So, the market will decline further to 1.0991 in order to return double bottom. Moreover, a breakout of that target will move the pair further downwards to 1.0940. Consequently, the EUR/USD pair will probably be moved between the levels of 1.1063 and 1.0940. On the other hand, if the EUR/USD pair fails to break through the daily pivot point level of 1.1063, the market will move upwards continuing the development of the bullish trend to the level 1.1175 (double top) next week. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of EUR/USD for November 15, 2019 Posted: 15 Nov 2019 01:10 AM PST Overview: In the one-hour time frame, the EUR/USD pair is still bearish as long as the level of 1.1063 is not broken. The level of 1.1063 has rejected sever al times confirming the validity of a bearish market today. So, resistance is seen at 1.1063 which represents the pivot point. The market is still indicating a strong bearish trend from the spot of 1.1063-1.1086. This is confirmed by the RSI indicator signaling that we are still in the bullish trending market. In the short term, we expect the EUR/USD pair to continue to trade in a bearish trend from the new resistance level of 1.1063 to form a bearish channel. Also, it should be noted that the price is still above the moving average (100) and (50) at the same time frame. However, if the pair fails to pass through the level of 1.1063 (pivot), the market will indicate a bearish opportunity below the level of 1.1063. So, the market will decline further to 1.0991 in order to return double bottom. Moreover, a breakout of that target will move the pair further downwards to 1.0940. Consequently, the EUR/USD pair will probably be moved between the levels of 1.1063 and 1.0940. On the other hand, if the EUR/USD pair fails to break through the daily pivot point level of 1.1063, the market will move upwards continuing the development of the bullish trend to the level 1.1175 (double top) next week. The material has been provided by InstaForex Company - www.instaforex.com |

| Diary of a trader EURUSD 11/15/2019 Posted: 15 Nov 2019 12:48 AM PST

A very sluggish trade continues on the market. We are waiting for a large package of data in the US after 14:30. The main thing – the report on retail trade. EURUSD We are on sale from 1.1070 – however, in the case of growth to 1.1045, we get into a purchase. On the state of the market. Since the fall of 2018, the EURUSD market has fallen into a huge, very sluggish range with a slow decline. A year has passed, and the state of the market remains a sluggish range. For beginning traders who entered the market no earlier than the fall of 2018 – it seems that this will always be the case – a "new reality". In this "new reality" – the pullback, counter – trending systems work perfectly – we stand against the movement, return to the average, open on the oscillators – we buy from below, we sell from above. As long as it works. However, keep in mind that this has not always been the case – and will not always be the case. Look at the history of the euro on the weekly chart – previously, about twice a year, there were strong directional movements – trends – by 1000 points in the 4-sign-and more. And sometime such market behavior will surely return. What is the cause of the current stagnation of the market? A long period of ultra-low rates of the central bank – caused a general decline in yields – and as a result, a strong drop in the efficiency of capital flows between the developed economies of the US and the EU (between the euro and the dollar). What will be the signal? A break above 1.1180 or below 1.0880. The material has been provided by InstaForex Company - www.instaforex.com |

| Simplified wave analysis of EUR/USD and AUD/USD on November 15 Posted: 15 Nov 2019 12:48 AM PST EUR/USD Analysis: Since September 3, an upward stretched plane has been formed on the chart of the European currency. The wave reached the minimum necessary proportions. The decline that began on October 32 does not go beyond the correction of this wave. The price is at the upper limit of the strong zone of a potential reversal. Forecast: Today, the general upward mood of the pair's movement is expected, with the flat nature of fluctuations. In the next session, pressure on the support zone is not excluded. By the end of the day, you can expect an increase in volatility. Potential reversal zones Resistance: - 1.1070/1.1100 Support: - 1.1010/1.0980 Recommendations: Today, intraday trading is more relevant. It is recommended to track the signals of the purchase of the euro.

AUD/USD Analysis: On August 12, a downward wave has been forming on the Aussie chart. The first 2 parts (A + B) are formed in it. The final part (C) started on October 31. The preliminary target zone is located in the region of the 67th price figure. Forecast: Shortly, the downward course is expected to continue. In the first half of the day, a short-term pullback of the price up to the resistance zone is possible. The support zone is preliminary, it shows the lower boundary of the expected daily course. Potential reversal zones Resistance: - 0.6820/0.6850 Support: - 0.6750/0.6720 Recommendations: Purchases today are unpromising. At the end of the upcoming rollback, it is recommended to monitor the reversal signals to find the point of sale of the instrument.

Explanations: In the simplified wave analysis (UVA), the waves consist of 3 parts (A-B-C). The last unfinished wave is analyzed. The solid background of the arrows shows the formed structure, dotted – the expected movement. Attention: The wave algorithm does not take into account the length of time the tool moves! The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 15 Nov 2019 12:47 AM PST After several good fundamental statistics on the US economy and its ignoring by buyers of the dollar, an upward correction began in the EURUSD pair, which has been brewing for a long time. The unsuccessful attempts of the bears to continue the decline of the trading instrument below the level of 1.1000 also discouraged all the desire to hold it. Data on a slight increase in applications for unemployment benefits in the United States last week was ignored by the market even although the number reached its highest in the last few months. Given the level of unemployment, this growth did not cause much concern. According to a report by the US Department of Labor, the number of initial applications for unemployment benefits for the week of November 2 to 9 rose by 14,000 to 225,000. Economists had expected the number of applications to be 215,000. But the moving average for four weeks rose only by 1,750, to 217,000. Secondary applications for the week of October 27 to November 2 fell by 10,000 to 1,683,000. Good data on US producer price growth also points to a gradual return of inflationary pressure, which is expected at the central bank. According to the report of the US Department of Labor, the producer price index in October of this year increased by 0.4% compared to September, while economists had predicted an increase of 0.3%. The increase was due to the rise in energy prices. As for core inflation, which does not take into account volatile categories of goods, including energy, the PPI index in October rose by 0.3% compared to the previous month. Compared to October 2018, the index added 1.1%. Yesterday's speech by the Fed chairman concerned the US national debt. In his view, the US debt is growing faster than the economy, which is by definition unacceptable, and ultimately, the US will have no choice but to put the budget in order. However, what actions the United States will take in this direction, Powell did not note, switching immediately to a trade conflict between the United States and China. According to the head of the Fed, despite the problems that occur in the economy, free trade relations are quite an important point. As for problems in the manufacturing sector, they are directly related to the trade conflict and weak global economic growth, which stems from the protectionist policies of the United States. However, according to Powell, concerns about the expansion of the recession of the manufacturing sector to the rest of the economy are exaggerated. On Thursday afternoon, speeches by other representatives of the Fed also took place. For example, Richard Clarida in an interview said that the likely range of full employment is now 3.6% -4%, but a strong labor market still does not contribute to a large increase in salaries. Clarida is also confident that the current monetary policy regime is quite adequate, and in which case, the Fed has a flexible set of tools to cope with further difficulties. As for the technical picture of the EURUSD pair, yesterday's growth completely negated the downward trend in the euro, which was observed for the second week in a row. Sellers of risky assets acted sluggishly around the psychological mark of 1.1000, which led to profit-taking on short positions towards the end of the week. Now it's up to euro buyers. The breakdown of the resistance of 1.1040 will provide them with a new wave of growth and will lead the trading instrument to highs around 1.1060 and 1.1080. Major support remains near this week's low at 1.0990. Even good data on US retail sales will provide only temporary support to the dollar, which will allow major players to exit the market. Such a scenario will eventually lead to a more powerful upward correction of risk assets to the above targets. The material has been provided by InstaForex Company - www.instaforex.com |

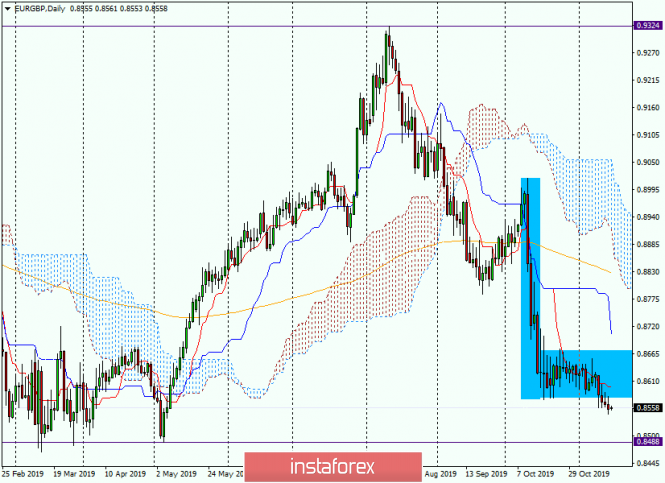

| Analysis and forecast for EUR/GBP on November 15 Posted: 15 Nov 2019 12:47 AM PST Hello, dear colleagues! In today's article, we will analyze one of the most interesting cross-rates of the euro/pound. The increased interest and volatility of this instrument adds to the process between the European Union and the UK, which still cannot be completed. Honestly, you don't already know if the UK will leave the EU or if there will be a second vote on this issue. Former Prime Minister David Cameron brewed porridge, now you can't get out of it! However, it is up to the British to decide, whose opinions on staying in the European Union or leaving it are divided approximately equally. Describing the EUR/GBP pair itself, it should be noted that often movements in this cross-rate have a significant impact on the main currency pairs EUR/USD and GBP/USD. You can say that the tail is wagging the dog, and this will not be far from the truth. Before moving on to the technical part, one more important point. Despite the economic risks associated with the UK's exit from the EU, the pound feels more confident than the single European currency. Perhaps this is since the negativity of the never-ending divorce process is largely already played out by the market. However, technical factors should not be discounted, it is to them right now that we will move on. Daily

As can be seen in this timeframe, the growth from 0.8488 to 0.9324 has been completely leveled. Now it's up to you to break through the support level of 0.8488 and gain a foothold below. After that, the downward dynamics of the cross will continue and may find a second wind. However, it is better to talk about targets below 0.8488 after the breakdown of this support level. Now I want to draw your attention to the figure for the continuation of the technical analysis of the "inverted Flag". The breakdown of the figure's panel indicates a high probability of its development. On the other hand, I would like to note that the figures for technical analysis are practiced less by the market. If the figure nevertheless begins to work, sales should be considered in attempts to return to the borders of the banner. Alternatively, from 0.8600, where the Tenkan line of the Ichimoku indicator is located. If EUR/GBP returns to the flag and exits from it up, we will have to state the reluctance of market participants to work out this figure and prepare for a full correction of the instrument. In this scenario, the opening of short positions looks good from the Kijun line, which lies at 0.8705. Thus, judging by the daily timeframe, the opening of short positions on the cross can be considered near 0.8600 and 0.8700. H4

At a shorter time interval, the euro/pound was in the lateral range for a rather long time, and only a few days ago began to show signs of an exit from it down. However, looking at how uncertainly and without much enthusiasm this happens, there are doubts about the ultimate success of this action. Surely many people know and understand that it is better to sell more expensive and buy cheaper. Since the main trading idea for EUR/GBP is selling, it would be good to see a correction to higher prices and from there prepare to open short positions. To the above levels of 0.8600 and 0.8700, for potential sales, it is worth adding the levels of 0.8655, 0.8675, and 0.8686, where the 200-exponential moving average is located. In conclusion, I note – it is not a fact that we will see prices for opening short positions today. If at all, see. It is not necessary to enter the market on the last trading day of the week. Transferring open positions to Monday is not the best trading option. Successful completion of weekly trading! The material has been provided by InstaForex Company - www.instaforex.com |

| And things are still there (A review of EUR/USD and GBP/USD on 11/15/2019) Posted: 15 Nov 2019 12:47 AM PST The market continues to stagnate, which of course is associated with complete uncertainty, as well as the confusion that macroeconomic data is making which comes out completely different than expected. For example, the second estimate of the GDP of the euro area for the third quarter, unlike the first, showed not a slowdown in economic growth from 1.2% to 1.1%, but that they remained unchanged. This was partly possible due to German GDP, the growth rate of which accelerated from 0.3% to 0.5%, and not to 0.4%, as predicted. Nevertheless, on this, good news from Europe does not end there, as inflation in France, though, has declined, but from 0.9% to 0.8%, while they expected a decrease to 0.7%. And only in Spain did the data coincide with forecasts, and inflation remained unchanged at 0.1%. Thus, the real data showed a slightly more encouraging picture, and a hint of light at the end of the tunnel began to loom in the distance. But all this is concerning what is happening on the continent, while on Foggy Albion it is cloudy and rainy again. The fact is that the growth rate of retail sales did not accelerate from 3.1% to 3.8%, but remained unchanged. Well, at least they did not decline. And then the British business already suffers from a headache in the form of the upcoming parliamentary elections, which promise either a guaranteed exit from the European Union if Boris Johnson wins, or tax increases and nationalization if Jeremy Corbyn wins. Retail Sales (UK): The American statistics, seems only positive at first glance, since data on producer prices were significantly better than forecasts. The truth is this is not surprising, since it was quite expected after inflation suddenly showed growth. Thus, the growth rate of producer prices slowed down from 1.4% to 1.1%, which is against the background of the expected slowdown to 0.9%, looks very impressive. However, this is still a decrease. Nevertheless, the joy that producer prices are dropping, but not as much as expected, overshadowed the data on applications for unemployment benefits, which, frankly, came out worse than forecasts. Due to this, it was predicted that the number of initial applications for unemployment benefits will increase from 211 thousand to 215 thousand, and in fact, it increased to 225 thousand. Manufacturer Prices (United States): In terms of published macroeconomic statistics, a rather interesting day awaits us today. However, there are fears that the market will continue to stagnate anyway. So, one of the most important news today is inflation in Europe, which, in theory, should decline from 0.8% to 0.7%. Nevertheless, if you recall yesterday's data on inflation in France, there is a possibility that inflation in Europe will remain unchanged. Of course this is unlikely, but possible. Along with pan-European inflation data, similar data are released in Italy, where inflation should still remain at the same level of 0.3%. Inflation (Europe): Perhaps, macroeconomic statistics from the United States will be even more interesting, which publishes data on retail sales and industrial production. And frankly, it becomes sad from one glance at the forecasts. Thus, the growth rate of retail sales should slow down from 4.1% to 3.8%, which of course will be somewhat offset by the recent increase in inflation. But not so much, because the scale of the slowdown in retail sales growth is somewhat larger. In addition, an industry decline is expected to increase, from -0.1% to -0.4%. Thus, there are no reasons for optimism regarding American statistics. Industrial Production (United States): The market is extremely sluggish, so you should not expect any sharp jumps, so that the single European currency will grow sadly towards 1.1050. The dynamics of the pound looks even more dull than that of the single European currency, and therefore, you should not expect its serious growth, against the background of weak American statistics. Most likely, we will see uncertain growth in the direction of 1.2925, with a hint of a speedy return to current values. |

| The dollar - a sea of opportunity, the euro - the economic framework Posted: 15 Nov 2019 12:38 AM PST American currency paired with European currency continues to amaze the market. The dollar, as a rule, seeks to strengthen its position, and it succeeds, and the euro is trying to keep the gains, but with varying success. By the end of the week, this struggle continues, experts say. On Thursday, November 14, important events were the publication of data on macroeconomic statistics in Germany, namely the consumer price index, as well as the release of the report of the European statistical agency Eurostat. With regard to the consumer price index of Germany, it increased by 0.1% for the month, and on an annualized basis - by 1.1%. Eurozone industrial production data, on the other hand, disappointed the market, as in annual terms this indicator fell 1.7%. As for the eurozone GDP growth, it increased by only 0.2% compared to the previous quarter of 2019. The single European currency, having experienced a weak report on Germany's GDP on Thursday, remained at a stable level of 1,1004 for some time. The EUR/USD pair sought to gain a foothold in this framework, but the attempt was unsuccessful. After the release of negative data on the eurozone GDP, the single currency completely lost heart. The classic pair went down sharply, playing in the range of 1.0995–1.0996. In the future, the situation leveled out, but market participants remained in suspense. Yesterday, while the dollar was strengthening, the euro was fighting for the level of 1.1000. According to analysts, the "European" managed to cope with this task. The pair EUR/USD broke through the specified level and fixed below the support level of 1.1000, continuing the downward momentum. It can be noted that the pair runs for the ninth day in a row as part of a bearish trend. For this reason, a number of analysts recommend selling this instrument. According to experts, there is practically no reason for the growth of the euro at the moment, while the dollar continues to rush up. Even serious obstacles such as the growing US federal budget deficit and the recent threat of canceling the interim agreement between Washington and Beijing do not prevent this. It can be recalled that the Chinese authorities do not intend to sign an agreement with the United States on unfavorable conditions. In China, they demand the cancellation of previously introduced duties, while they do not assume any obligations for the purchase of agricultural products from America. However, the greenback is not too worried. The main concern for analysts is the upcoming presidential election in the United States, which could deliver a stronger blow to the dollar. Experts considered three scenarios in which the USD rate can either go down or stay afloat. 1) If during the election victory remains for the Democratic Party, then the dollar will collapse, and yields on treasury bonds will fall. 2) If the Republican Party wins the election, the greenback will sharply strengthen, and the yield on American bonds will demonstrate a rally. Experts do not exclude that in this case, America will continue an aggressive trade policy. 3) If there is a split in the US Congress and not one of the parties gains the majority of votes, then the prospects for the dollar will also be negative. The implementation of such a scenario will lead to a weakening of the leading world currency, analysts are sure. However, if the dollar can weaken only in the long term, then the European currency is under the economic pressure and is already sagging. The current situation in the Eurozone economy underlines the need for further stimulus measures by the ECB, experts are sure. They believe that in the medium term this will put significant pressure on the "European". In the EUR / USD pair, confrontation can begin, and only a trend fracture above the resistance level of 1.1025 will return confidence to euro buyers. Note that on the morning of Friday, November 15, the tandem came very close to this bar, reaching 1.1022. Experts believe that a breakthrough above the level of 1.1025 will lead to the closure of short positions and to a rapid rise to a maximum of 1.1100. At the moment, the EUR / USD pair is trading near the levels of 1.1016–1.1017, periodically showing a downward mood. As a result, the current situation is such that the greenback, unlike the "European", does not need to make a lot of effort and prove its worth. Only the upcoming US presidential election can shake the dollar's position, and then only for a short time. The European currency, in contrast, is driven into a tight economic framework in which it is difficult to demonstrate its capabilities. However, experts expect to maintain a balance in the EUR / USD pair not only in the near future, but also in the long term. The material has been provided by InstaForex Company - www.instaforex.com |