Forex analysis review |

- AUD/USD Forecast for November 25, 2020

- Forecast for EUR/USD on November 25, 2020

- Forecast for USD/JPY on November 25, 2020

- Forecast and trading signals for GBP/USD on November 25. COT report. Analysis of Tuesday. Recommendations for Wednesday

- Forecast and trading signals for EUR/USD on November 25. COT report. Analysis of Tuesday. Recommendations for Wednesday

- Overview of the GBP/USD pair. November 25. Negotiations on a trade deal have resumed.

- Overview of the EUR/USD pair. November 25. A miracle happened: Donald Trump did a favor and agreed to hand over power to

- EUR/USD. "Price Ping-Pong": Buyers rock the range storming at the 19th figure

- GBP/USD - Impact of COVID, BREXIT, Trump & Biden on speculators

- EURUSD – someone leaked insider information ahead of time

- Analytics and trading signals for beginners. How to trade GBP/USD on November 25? Plan for opening and closing trades on

- EUR / USD decline amid contrast in business activity data in Europe and USA, and ongoing COVID-19 crisis

- NZDUSD continues making higher highs but also new bearish divergencies.

- Gold price reaches first target of $1,800

- Ichimoku cloud indicator Daily analysis of EURUSD

- Dollar may decline upon Yellen's appointment as Treasury Secretary

- Trading Signal for EUR/USD for November 24 - 25, 2020: Key Level 1.1860,

- EURUSD: Janet Yellen's appointment as Treasury Secretary will further undermine the dollar's resilience.

- Outlook on EURUSD for November 24, 2020

- Trading Signal for GBP/USD for November 24 - 25, 2020

- November 24, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- BTC analysis for November 24,.2020 - Bearish divergence on the 30 minute time-frame and potential for the downside rotation

- November 24, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- Analysis of Gold for November 24,.2020 - First downside target at $1.850 has been reached and Gold is heading towards next

- November 24, 2020 : EUR/USD daily technical review and trade recommendations.

| AUD/USD Forecast for November 25, 2020 Posted: 24 Nov 2020 07:17 PM PST AUD / USD The Australian Dollar successfully took advantage of yesterday's weakness of the US Dollar. On the weakening of the dollar index by 0.40%, 75 points (1.02%) were added to the Australian currency. The price reached the target level of 0.7380 this morning and at the same time formed a triple divergence (on the bodies of candles) with the Marlin oscillator. With the greatest probability, the price can now turn down with an attack on the support of the Kruzenshtern line (0.7255), which coincides with the level of the lows on November 19 and 10 (and also on September 4). On the four-hour chart, the price is above the balance line and the Kruzenshtern line. The Marlin oscillator held yesterday's price growth in the sideways direction which may be an early sign of a reversal or correction. Fixing the price under the Kruzenshtern line (0.7342) will be the first sign of a reversal, after which it is advisable to wait for confirmation of this signal and opening short positions. Confirmation may be the departure of Marlin in the negative area, this will be approximately when the price reaches the level of 0.7330. The material has been provided by InstaForex Company - www.instaforex.com |

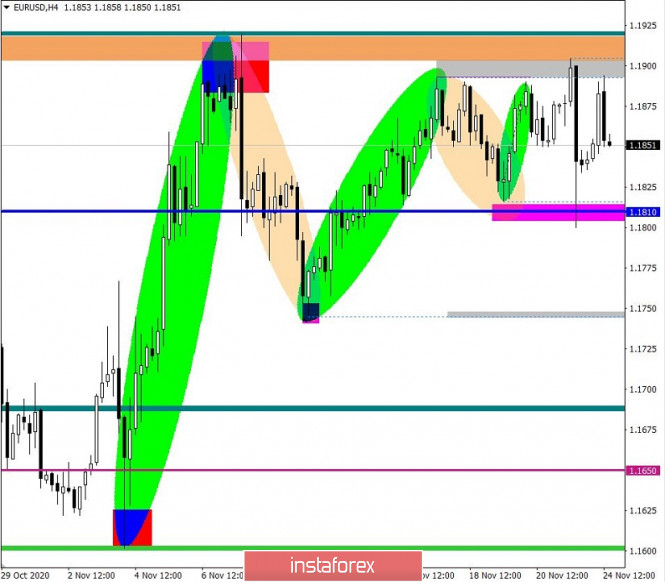

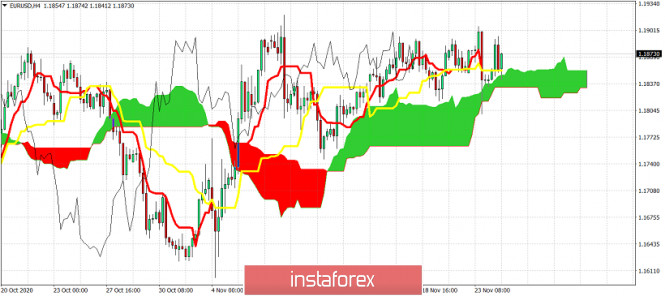

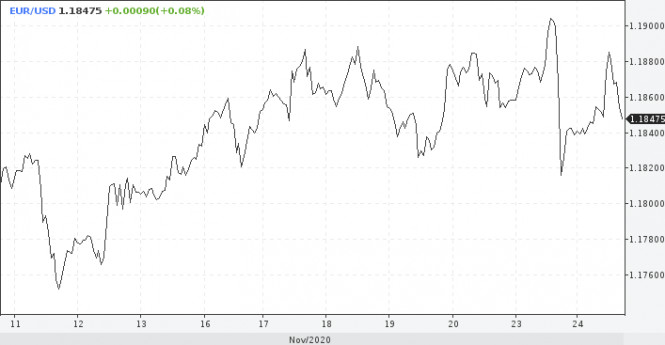

| Forecast for EUR/USD on November 25, 2020 Posted: 24 Nov 2020 07:16 PM PST EUR/USD The euro gained 50 points on Tuesday, practically without any external reasons. Media reports about an alleged increase in risk appetite based on Trump's consent to peacefully transfer powers to Biden and expectations of new vaccine data can hardly be taken seriously, but yesterday's reduced trading volumes raise much more serious concerns about the euro's succeeding growth. With the same success, the price could have dropped to 1.1750 and won back. The speculation continues.

The daily chart shows that the price is trying to push through the resistance of the MACD indicator line, success will allow the price to reach the target along the price channel line at 1.1935. But this may not be the case, since we expect the United States to release good data today: the volume of orders for durable goods in October is forecast to grow by 1.0%, new home sales for the same month are expected to be 970-972,000 against 959,000 earlier, personal spending of consumers may show an increase of 0.4%, GDP for the third quarter in the second estimate is expected to slightly change and could rise from 33.1% to 33.2%.

The four-hour chart shows that the situation is completely rising - the price is above the indicator lines, the Marlin oscillator is increasing in the positive trend zone. But there is a pitfall here - the emerging divergence of the price and the oscillator. We are waiting for the development of events, namely the release of US reports. The material has been provided by InstaForex Company - www.instaforex.com |

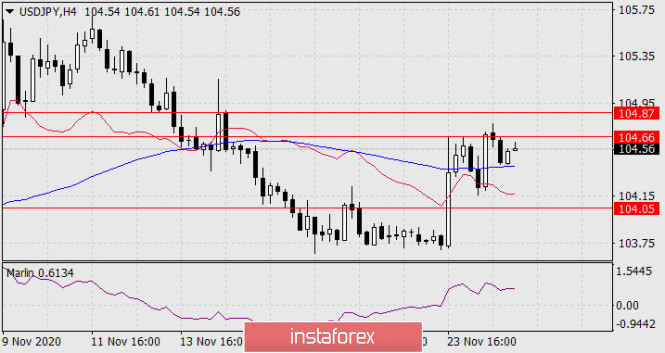

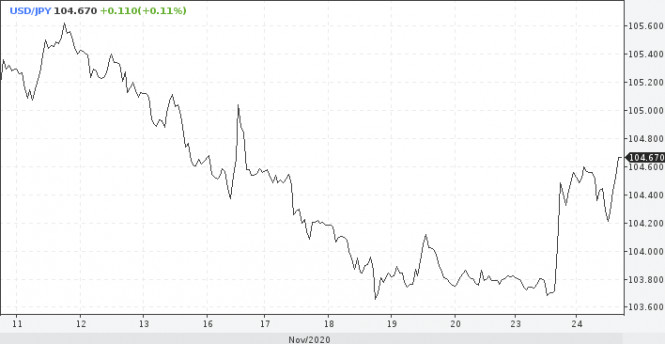

| Forecast for USD/JPY on November 25, 2020 Posted: 24 Nov 2020 07:16 PM PST USD/JPY Yesterday, the USD/JPY pair traded in a 60-point range, closing the day with a 6-point decline. This is how the yen reacted to the euro's growth, probably expecting more balanced decisions from them. But the stock markets have been growing for about two weeks, the S&P 500 is aiming for 3712.00 and the yen, if the euro is neutral, or even more so if it weakens, will reach the 105.90 target along the line of the descending price channel.

There are two strong resistances in front of the price on the daily chart: the nearest price channel line (104.66) and the MACD line (104.87). Exit above the latter opens the way to 105.90. The Marlin oscillator has moved to the upper half of the range - to rise further, which increases the likelihood of a breakout of these resistances.

The four-hour chart shows that the technical situation confirms the market's growing sentiment. The price settled above the MACD line, it turned around from its support when the session opened, the signal line of the Marlin oscillator is in the zone of positive values. The probability of final growth is 70%. The material has been provided by InstaForex Company - www.instaforex.com |

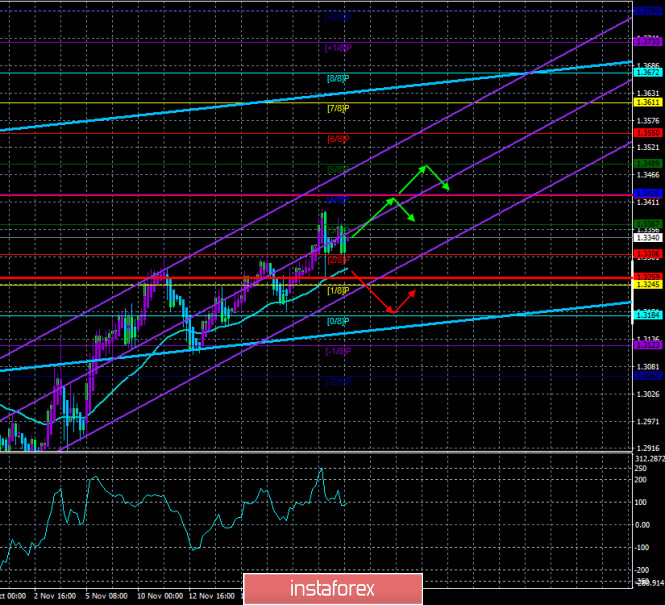

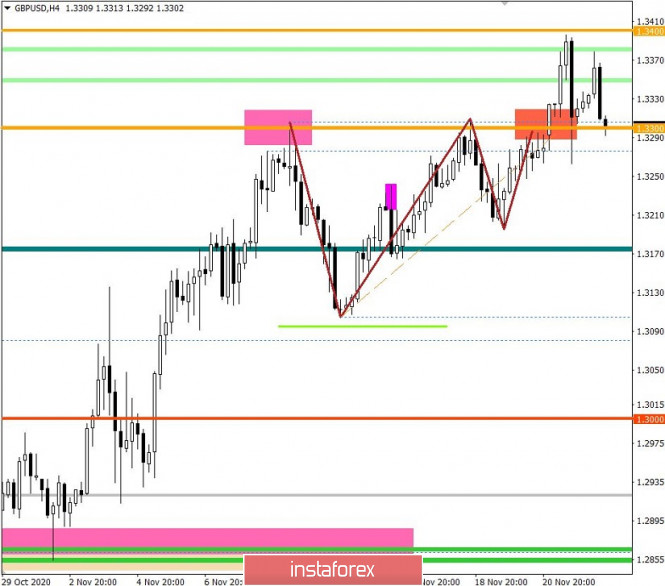

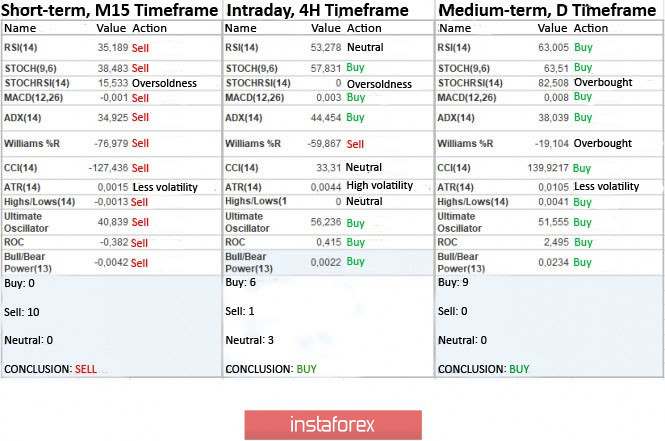

| Posted: 24 Nov 2020 05:46 PM PST GBPUSD 1H The GBP/USD pair moved identically to the EUR/USD pair on Tuesday, November 24. First, the correctional movement after yesterday's fall, then it pulled back down to the Kijun-sen line, rebounded from this line and went back to moving up. The only difference is that the GBP/USD pair is in a rising channel, while EUR/USD is in a horizontal channel. However, we only built the rising channel today. Before that, we had an upward trend line, and the price settled below it, but it immediately went back to moving up. We hope that there will be no such story with the channel. In any case, the upward trend is now visible to the naked eye. And the fact that the price failed to gain a foothold below the critical line twice speaks in favor of maintaining a bullish mood among traders. Therefore, we expect an upward movement at this time. Bears will be able to enter the game only if the price settles below the rising channel and below the critical line. GBPUSD 15M

Both linear regression channels are still directed to the upside on the 15-minute timeframe, so there are no signs of ending the upward trend at this time, despite it pulling back the day before yesterday. The Kijun-sen line also speaks in favor of maintaining the upward trend, below which the pair failed to gain a foothold twice. COT report

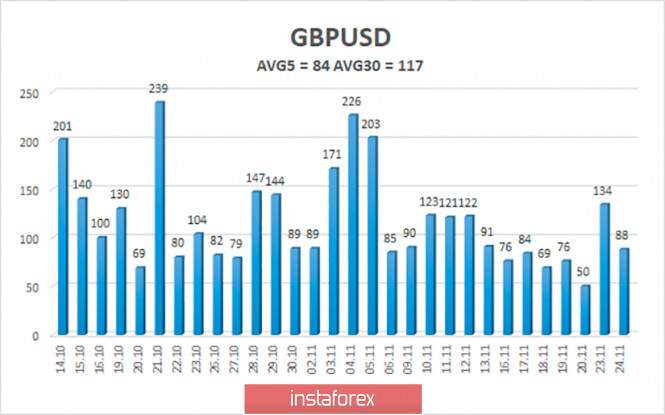

The GBP/USD pair rose by 25 points in the last reporting week (November 10-16), although the volatility was quite high during this time period. However, the Commitment of Traders (COT) report has not provided us with any important information that could help in forecasting and trading for several weeks now. Recall that the red and green lines must move away from each other or sharply change the direction of their movement, so that we can conclude that one trend ends and another begins. In recent months, both lines regularly change their direction, which indicates the absence of signals based on COT reports. What can we say about the most important group of non-commercial traders? This group opened 533 contracts to buy the pound and 616 contracts to sell during the reporting week. Therefore, it doesn't even make any special sense to calculate the change in the net position or the amount by which the attitude of professional traders has changed. A little more than 1000 contracts per week is very little. Therefore, in essence, there are no changes. What do we end up with? There are no changes, and the general picture of things does not make it possible to predict any definite development of the situation. So now it is better to pay more attention to technique and foundation. The fundamentals for the British pound were meager on Tuesday. No important news or reports. Markets are already fed up with reports that negotiations for a trade deal have resumed, and the parties are still unable to resolve all their differences on the most fundamental issues. And so, although the pound continues to be victorious, take note of the fact that there isn't anything particularly positive coming from the UK. Moreover, Bank of England Governor Andrew Bailey draws the attention of the British government to the fact that without a trade deal, the British economy will suffer very much, much more than from the coronavirus pandemic. We mentioned this before, now this idea was voiced by Bailey himself. No macroeconomic reports set for release for the UK today. Now, in principle, there is nothing to expect from Great Britain. Lockdown, Prime Minister Boris Johnson has assured, will end on December 2, but it will still strike a blow to the economy. Of course, traders should continue to monitor possible news regarding the negotiations between Brussels and London, however, to be honest, this topic is already exhausted, and we have not received important news for a long time. However, there will still be quite interesting macroeconomic reports from America. Therefore, traders are advised to review US reports and pay close attention to technical factors. We have two trading ideas for November 25: 1) Buyers for the pound/dollar pair continue to hold the initiative in their hands and did not let the price go below the Kijun-sen line (1.3295). Thus, we advise you to trade upwards while aiming for the resistance levels of 1.3397 and 1.3483 as long as the price is within the rising channel and above the critical line. Take Profit in this case will be from 40 to 120 points. 2) Sellers failed to go below the critical line yesterday. If the price settles below the Kijun-sen line (1.3295) and below the rising channel, you are advised to sell the pound/dollar pair while aiming for the Senkou Span B line (1.3201). Take Profit in this case can be up to 80 points. Forecast and trading signals for EUR/USD Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. Indicator 1 on the COT charts is the size of the net position of each category of traders. Indicator 2 on the COT charts is the size of the net position for the "non-commercial" group. The material has been provided by InstaForex Company - www.instaforex.com |

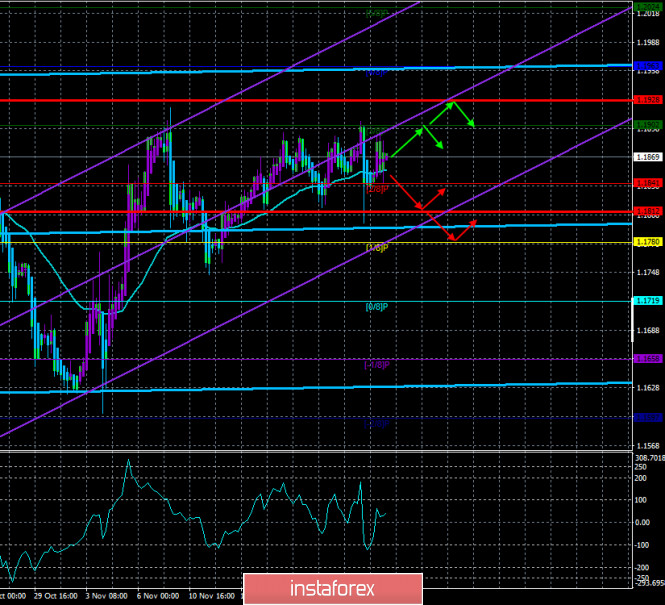

| Posted: 24 Nov 2020 05:45 PM PST EUR/USD 1H After failing to overcome the support level of 1.1816, the EUR/USD pair began a new round of upward movement on the hourly timeframe on Tuesday, November 24, and it reached the resistance area of 1.1886-1.1912 for the fifth time in the last seven days. And once again it could not go beyond it for the fifth time (!!!). Therefore, the price still remains within the horizontal channel of 1.1700-1.1900, in which it has been trading, except for short periods of time, for almost four (!!!) months now. Moreover, after rebounding from the 1.1886-1.1912 area, the pair began a new round of downward movement, which ended very quickly, near the critical Kijun-sen line, from which a rebound also followed and now the price rushed to the 1.1886-1.1912 again. In general, what is happening with the euro/dollar pair is beyond human understanding. Nevertheless, the technical picture remains extremely simple. The pair continues to trade within the horizontal channel and that says it all. Buyers will be able to count on a new upward trend, but not before settling above 1.1886-1.1912. Until then, the bears have the best chances of going down 100-150 points. EUR/USD 15M

The lower linear regression channel turned up on the 15-minute timeframe, but this does not mean anything right now, since the key moment is to rebound from the 1.1884-1.1912 area, which allows us to expect a new round of decline in the pair's quotes. COT report

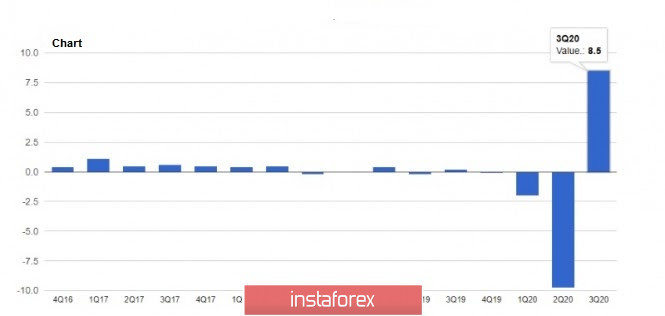

The EUR/USD pair increased by 40 points in the last reporting week (November 10-16). As you can see, price changes are still minimal. There were certain bursts of activity during the US presidential elections, but they ended very quickly and now the pair is just trading in a horizontal channel, with minimal volatility. Therefore, we expect clarification of the current situation from the Commitment of Traders (COT) reports. Unfortunately, COT reports for the last 8-10 weeks now show that non-commercial traders are reducing their net position. This means that their sentiment is becoming more bearish. The green and red lines of the first indicator show the net positions of commercial and non-commercial traders, and when they are far from each other, this is considered a strong signal for a trend change. However, the lines have moved away and they have been moving towards each other for two months now. There is no downward trend. The "non-commercial" group of traders, which is the most important and significant, opened 2,000 Buy-contracts (longs) and 1,500 Sell-contracts (shorts) for the euro during the reporting week. Therefore, there is simply no change in the mood of this group of traders. We are much less interested in other groups of traders. In general, we have a somewhat paradoxical situation, as professional traders have been reducing the number of purchases of the euro currency and increasing sales for more than two months, but the euro does not fall. Nevertheless, based on the data of the report, we still believe that the peak of the entire upward trend was near the 1.2000 level and sooner or later the downward movement will start. A rather important GDP indicator was published in Germany on Tuesday. Significant enough for Germany, but not for the euro. This indicator increased in the third quarter by 8.5% q/q, instead of the expected +8.2%. However, it is absolutely impossible to link this report with the pair's movements. Perhaps, the report provided some kind of support to the euro, but what's the point if the euro started to fall in just a few hours, and the 1.1886-1.1912 area remained unresolved? No other news during the day. No important macroeconomic report from the European Union on Wednesday, November 25. However, the US will release several reports. First, the annual GDP data for the third quarter. Second, orders for durable goods. Third, the personal income and expenses of the US population. Fourth, applications for unemployment benefits. Unfortunately, the market will likely ignore almost all or all of these reports. Traders already know the GDP value, since this is the third estimate. Personal income and expenses with claims for unemployment benefits are not the data that market participants are currently interested in. Durable goods orders can affect the pair's movement only if the real values differ greatly from the forecasted ones. We have two trading ideas for November 25: 1) Buyers failed to go beyond the resistance area of 1.1886-1.1912. Although, they had five attempts to do so. Therefore, you are advised to open new long positions while aiming for the resistance levels of 1.1935 and 1.1976 if the price still settles above the 1.1886-1.1912 area. Take Profit in this case will be no more than 55 points. 2) Bears keep the pair within the horizontal channel and refuse to allow buyers to take it out of it. Therefore, you are advised to open new sell orders while aiming for the support levels of 1.1816 and 1.1775 if the price settles below the Senkou Span B line (1.1833). Take Profit in this case can be up to 50 points. Forecast and trading signals for GBP/USD Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. Indicator 1 on the COT charts is the size of the net position of each category of traders. Indicator 2 on the COT charts is the size of the net position for the "non-commercial" group. The material has been provided by InstaForex Company - www.instaforex.com |

| Overview of the GBP/USD pair. November 25. Negotiations on a trade deal have resumed. Posted: 24 Nov 2020 04:48 PM PST 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - upward. CCI: 103.7178 The British currency in the last few days has also been trading not quite unambiguously. On the one hand, there is a pronounced upward trend. Both linear regression channels are directed upwards, and the price is located above the moving average line. However, the upward movement does not continue, and the price is corrected for the second day in a row. Traders have no idea how to react to the fundamental background right now. No news shows any changes in the negotiation process between Brussels and London. As a result, the British pound, which has been happy in recent weeks and has risen in price solely on expectations of an early signing of a trade agreement, is now in a stupor. It can't grow for another couple of months if, for example, Britain and the EU continue to negotiate so much. Boris Johnson very much damaged his reputation last year, when he said that "it would be better to die in a ditch, that he would ask the European Union to postpone Brexit to a later date". However, the UK Parliament blocked another "wonderful" initiative of Johnson and the Prime Minister had to ask for a delay from Brussels. Boris Johnson did not draw any conclusions from this lesson and in September this year set a deadline for negotiations on a trade deal – October 15. We look at the calendar and find out that today is November 25. There are 37 days left until the end of the "transition period", the extension of which was blocked by Johnson, and negotiations are still ongoing. Thus, it seems that we were right when we said that the negotiations will continue for as long as necessary, and all Boris Johnson's threats to curtail the negotiation process are nothing more than an attempt to put pressure on the European Union. It is far more disadvantageous for Johnson than for the EU to end Brexit without a deal. As a result, the negotiations resumed in video mode. Last week, one of the members of the European delegation fell ill with "coronavirus", so the negotiations were urgently interrupted and curtailed. It is not reported who else was infected with COVID-2019. Michel Barnier, who has been honest with reporters throughout the negotiation process, said on Monday that "big differences" remain between the parties, but both sides continue to look for ways to resolve them. However, we heard the same thing a month ago. Even issues where there are "big differences" remain the same. This is a question of fishing in British waters, a question of fair competition and support for companies by states, as well as a question of resolving disputes between Brussels and London. Thus, it is not clear at all what has changed over the past few weeks, after the "intensification of negotiations"? Meanwhile, Boris Johnson announced the signing of a trade deal with Canada. However, the deal is only temporary and defines trade relations between the countries after Brexit. The total amount of the transaction is $ 27 billion, which is how much the goods and services exchanged between the countries are worth. It is noted that 98% of goods will remain zero tariffs, but in 2021, new trade negotiations will begin to sign a larger agreement with agreements in other areas. So far, London has managed to sign trade agreements with Canada and Japan. With Canada - it is temporary, with Japan - for 1.5 billion dollars. One of the few people in the UK who understands the horror of the current EU trade deal situation is Bank of England Governor Andrew Bailey. Bailey warned that the long-term consequences for the British economy from the lack of a trade deal with the EU would be much "more expensive" than the consequences of the COVID-2019 pandemic. Bailey said that failure to reach an agreement before the end of the "transition period" would cause disruption to international trade and damage the good relations between Brussels and London needed to build future economic relations. Andrew Bailey also warned that the consequences of the second "lockdown" in the Foggy Albion will not be "short-term". At the same time, Chancellor of the Exchequer Rishi Sunak warns Boris Johnson against striking a trade deal "at any cost". Sunak believes that Britain should not sign an agreement that does not suit Britain itself, and insists that it is COVID-2019 that poses the greatest threat to the British economy, and not a "No Deal" scenario. We believe that the British economy will continue to experience serious problems in 2021 in any case. The only difference is whether there will be a trade deal or not. If there is, the negative impact on the economy will be weaker. Thus, no matter how expensive the pound becomes at the end of 2020, the long-term trend for it remains frankly downward. Only the states or traders themselves can help the British currency. We have already talked about traders. Even if all the news is negative for the pound, but traders will buy this currency, the pound will become more expensive, whatever the fundamental background. As for the United States, the problems in this country in 2020 ("four types of crises", which we have repeatedly written about) helped both the euro and the pound a lot. But will these problems persist with Joe Biden coming to power? The US economy may continue to recover in the fourth quarter, in contrast to the British and European economies, which are now closed for "lockdowns". Therefore, from our point of view, the US dollar already has an advantage in the coming months. Then everything will depend on the "peaceful" transfer of power by Donald Trump to Joe Biden, and the first steps of Joe Biden as President. We still believe that the British currency is heavily overbought and should have been heading down for a long time. However, without technical confirmation of this hypothesis, we do not recommend selling the pound and buying the dollar.

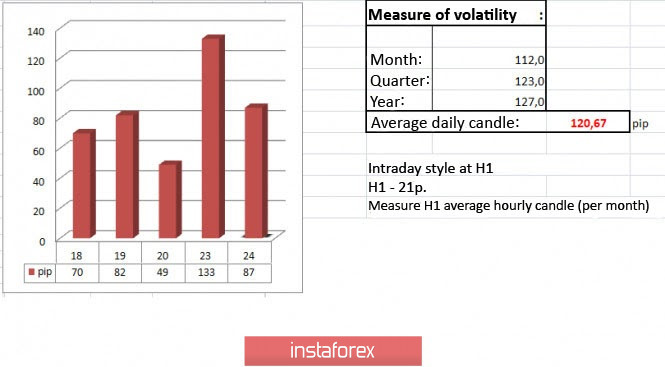

The average volatility of the GBP/USD pair is currently 84 points per day. For the pound/dollar pair, this value is "average". On Wednesday, November 25, thus, we expect movement inside the channel, limited by the levels of 1.3259 and 1.3427. The reversal of the Heiken Ashi indicator up signals the resumption of the upward movement. Nearest support levels: S1 – 1.3306 S2 – 1.3245 S3 – 1.3184 Nearest resistance levels: R1 – 1.3367 R2 – 1.3428 R3 – 1.3489 Trading recommendations: The GBP/USD pair is corrected again on the 4-hour timeframe. Thus, today it is recommended to open new long positions with targets of 1.3427 and 1.3489 after the Heiken Ashi indicator turns up. It is recommended to trade the pair down with targets of 1.3184 and 1.3123 if the price is fixed below the moving average line. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 24 Nov 2020 04:47 PM PST 4-hour timeframe

Technical details: Higher linear regression channel: direction - sideways. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - sideways. CCI: 46.6017 The last few trading days for the EUR/USD pair have been quite chaotic. The day before yesterday, the pair's quotes quite sharply and unexpectedly fell by 100 points in just two hours. Many people thought that the long-awaited downward movement had begun, at least inside the side channel of $1.17-$1.19, in which the price has been trading for more than three months. However, the next day the pair began a new round of upward movement and eventually remained near the upper line of the side channel – 1.1900. Thus, the situation is now ambiguous. On the one hand, the bulls still do not have enough strength to overcome the level of 1.1900 and start forming a new upward trend, on the other hand, they do not let go of the pair and do not allow the bears to start their round of downward movement. There is no point in talking about the fundamental background now. There is no single really important and high-profile topic that has an impact on the movement of the pair. The euro/dollar has been standing in one place in the long term for more than three months, and now the pair have decided to stand in one place in the short term. Traders now have exactly the background at their disposal, which has a very indirect influence on the course of trading. It's done! In America, Donald Trump very generously decided to start the process of transferring power to the victorious Joe Biden. Of course, the owner of the Oval Office decided to start the process of transferring power not because he recognized Biden as the winner. Trump still calls the entire election process and vote counting rigged, but at the same time, he decided to start transferring power to a Democrat "in the interests of the country". Trump also said that the head of the department that is responsible for ensuring the transfer of power, Emily Murphy, was molested and threatened by unknown people. Thus, Trump seems to be forced to start this sad process for himself. The current US President also said that he will continue to fight for his victory in the courts. "What does the GSA (General Services Administration) permit for preliminary work with Democrats have to do with the continuation of our various legal proceedings?", asked Trump. It becomes clear that the current President is not going to give up, however, his attempts to review the election results already look like convulsions. 95% of the courts rejected the claims of the Trump team. It is unlikely that anything will change in the near future. The Americans turned out to be very cheerful people. According to the latest opinion polls, 47% of Americans supported the possibility of nominating Donald Trump for President in 2024. However, the survey involved the opinions of only 2,000 Americans, most of whom are supporters of the Republican party, however, a certain trend can be traced. Do the Americans who removed Trump from the presidency want him to run in 2024? Custom-made opinion poll? False information? Back to the economy. Recently, the markets cheered up when it became known about the creation of several vaccines at once, the effectiveness of which is 90% or more. However, more prudent people immediately felt that in the near future this will not help against the fight against the epidemic. First, some vaccines have not yet passed all the necessary tests and have not received permission from the relevant services for mass use among the population. Second, some vaccines have very specific requirements for transport and storage. Third, it will take at least a year to vaccinate most of the world's population, and this is a too optimistic scenario. Fourth, if 10-15% of the population is vaccinated, it will not make any sense in the context of an entire country. To defeat the pandemic, 70% of people must get sick, then a collective immunity will be formed, or 70% of the population will be vaccinated. Fifth, it will take a huge amount of time to produce the necessary doses of the vaccine for at least the majority of the world's population. Sixth, not all countries and people can afford to buy a vaccine. The world is full of poor countries, people who live below the poverty line. In developed countries, they may receive state assistance, but not all developed countries. Seventh, in any case, the economy will recover for many years to come. The heads of the world's leading central banks share a similar opinion. Christine Lagarde, for example, said that news about the creation of a vaccine does not yet affect the monetary policy of the ECB. The regulator plans to increase the quantitative easing program in December and calls on the European Commission to resolve all issues related to the EU budget for 2021-2027 and the pandemic recovery fund as soon as possible. Lagarde also shows serious concerns about the contraction of the European economy due to the second "wave" of COVID-2019 and the second "lockdown". The head of the ECB notes that the first half of 2021 will be very difficult, and the exit to pre-pandemic levels will not take place until 2022. Thus, the next year for humanity and the economy is almost guaranteed to be no less difficult than 2020. A similar opinion is held by the head of the Fed, Jerome Powell. He also calls on Congress to help the economy as quickly as possible and allocate additional funds to support businesses and all unemployed Americans. Recall that the next package of stimulus measures has not been agreed upon by Democrats and Republicans. And when the election started, the issue was sealed and put on hold until better times. Many experts believe that it will not be possible to agree and adopt it before Joe Biden takes up his new position. Thus, it is still too early for markets to relax. As for the confrontation between the euro and the dollar, the contraction of the EU and US economies in the fourth quarter will be of great importance now. More precisely, the reduction/growth figures in the fourth quarter. Recall that in the EU, "lockdown" is introduced, which means the economy will suffer in any case. But in America, there is no strict quarantine, so its economy can continue to recover. Therefore, the figures for the fourth quarter may differ very much and the US economy may have an advantage. Therefore, the dollar may start to rise in price in the coming months. So far, this is a hypothesis, and the price continues to trade inside various side channels. So in any case, you need to wait for confirmation of this hypothesis by technical signals.

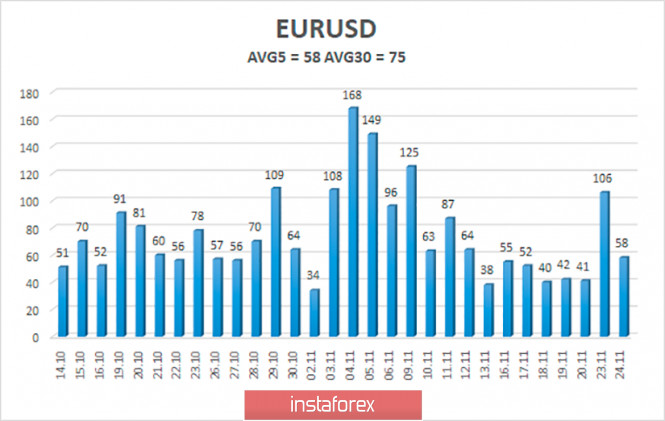

The volatility of the euro/dollar currency pair as of November 25 is 58 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1812 and 1.1928. A reversal of the Heiken Ashi indicator down may signal a new round of downward movement within the side channel of $1.17-$1.19. Nearest support levels: S1 – 1.1841 S2 – 1.1780 S3 – 1.1719 Nearest resistance levels: R1 – 1.1902 R2 – 1.1963 R3 – 1.2024 Trading recommendations: The EUR/USD pair continues to be located just above the moving average line. Thus, today it is recommended to consider long positions with targets of 1.1902 and 1.1928 before the Heiken Ashi indicator turns down. The goals are very close. It is recommended to consider sell orders if the pair is fixed below the moving average with the first targets of 1.1812 and 1.1780. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. "Price Ping-Pong": Buyers rock the range storming at the 19th figure Posted: 24 Nov 2020 03:57 PM PST The Euro-dollar pair is aggressively working on the 19th figure. The buyers yesterday were able to overcome the solid level of 1.1900 but could not gain a foothold above this target. Today, the bulls made another attempt to storm but they were forced again to retreat from the conquered heights. In my opinion, the priority still remains for long positions: dollar bulls make counter attacks but the southern momentum fades as soon as the pair breaks the 1.1850 mark. All this indicates the continued potential of the Northern movement of EUR / USD and the inability of the pair's bears to reverse the trend. Let me remind you that traders have not been able to get out of the area of the 18th figure for the second week. As soon as the price approaches the 19th price level, it attracts sellers. And just after the bears approach the levels of 1.1820 to 1.1840, buyers come to the forefront. This "price ping-pong" leads to the fact that the pair actually stands still, despite the high intraday volatility. The problem is that currencies react impulsively to the current news flow but they cannot win the confidence of traders for a larger attack. Therefore, the upward and downward price spikes quickly fade. This is why the pair has been trading within a wide price range of 1.1830 to 1.1910 since November 16.

The fundamentals for the EUR / USD pairs are controversial for both the euro and the dollar. The American currency has been under pressure from the "coronavirus factor" for several weeks. While the European lockdowns, which were introduced in early November have already begun to show results: the incidence in key EU countries has begun to gradually decline. Whereas in the United States, the indicator of the daily increase in the number of cases continues to gradually move up: if in early November this indicator did not fall below the 100 thousandth mark, then in recent days it does not fall below 170 thousand. Such alarming trends are partially offset by news from the pharmacological front: at least three American vaccines are in the home stretch. According to preliminary data, The news from the US Political Olympus has a certain impact on the dollar also. In this context, we can distinguish two news items of today. First, after a long period of uncertainty, Donald Trump has finally agreed to begin the formal process of transferring Presidential power to Joe Biden. And although he still voices aggressive statements about litigation, the head of the White house gave up under the onslaught of numerous facts not in his favor. In particular, the courts either did not accept many of the Republican's lawsuits or did not satisfy them based on the results of their consideration. In some States, Trump's lawyers achieved a recount - but in the end, the Republican could not pull out a victory in any of the lost precincts. The fact that the incumbent President agreed to begin the transit of power provided little support for greenback. The second good news for the dollar is that the next Treasury Secretary is likely to be Janet Yellen, who led the Fed before Jerome Powell. She is a well-known trader and currency strategist, so the news of her nomination was received with optimism by the market. In particular, according to some analysts, it will lobby for the adoption of a large-scale package of additional assistance to the American economy. By the way, Yellen will be the first person to head the Federal Reserve and the White House Council of economic advisers before becoming head of the Treasury Department. Given this fundamental background, the question arises: why are the EUR / USD bears not even able to approach the base of the 18th figure? In my opinion, the point is that each of these fundamental factors has its own "wormhole". For example, if we talk about the coronavirus vaccination process, we can say that this is a "long game", while COVID is gaining momentum in the States here and now forcing state governors to tighten quarantine restrictions (which negatively affects the dynamics of key macroeconomic indicators). Biden's victory has long been played back by traders and the fact that Trump finally gave up did not make any furor in the market as the dollar received only short-term support. Yellen's appointment has also long been discussed in the American press. She does intend to open the budget tap as much as possible. But to do this, Democrats need to pass the Senate, where Republicans control the majority. As you know, the majority of senators do not support the idea of large-scale incentives.

Thus, the dollar is not able to take full advantage of the "hawkish" fundamental factors even though at first glance everything is conducive to this. The European currency is waiting for the resolution of the budget crisis. As you know, Hungary and Poland blocked the adoption of the EU budget, as Brussels can organize these countries "financial famine" due to non-compliance with the rule of law in domestic politics. But today it became known that political negotiations with Budapest and Warsaw have already reached the final stage. According to the German foreign Minister, the new budget "will appear in a couple of days and will help to quickly allocate billions of euros to help countries affected by the pandemic." Many experts had no doubt that the parties would eventually come to a political decision, but the approval process was still somewhat delayed, so this fundamental factor is still in the spotlight. If the budget process is indeed unblocked in the coming days (apparently, this will happen before Friday), the Euro will get an additional reason for its growth. From the technical point of view, long positions on the EUR/USD pair are also a priority. The price on the daily chart is located between the middle and upper lines of the Bollinger Bands indicator, as well as above all the lines of the Ichimoku indicator (including the Kumo cloud.) All this suggests that the pair can be considered longs with the first goal of 1.1950 - this is the upper line of the Bollinger Bands on the same timeframe. The material has been provided by InstaForex Company - www.instaforex.com |

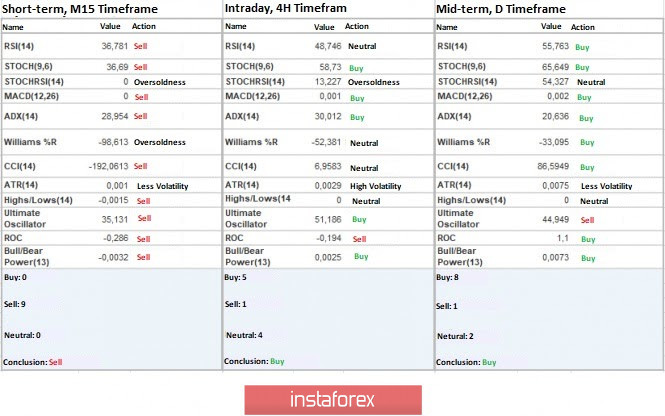

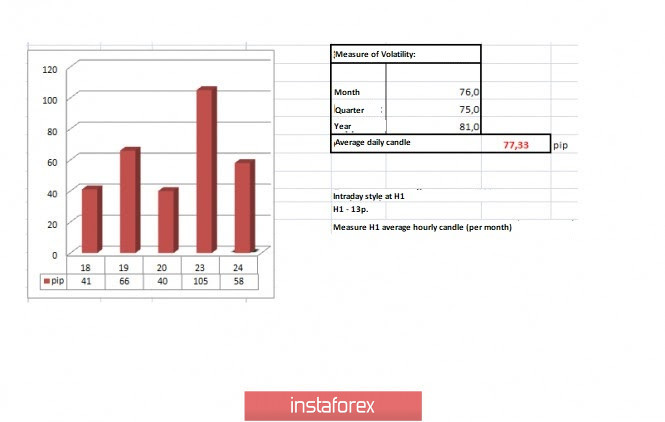

| GBP/USD - Impact of COVID, BREXIT, Trump & Biden on speculators Posted: 24 Nov 2020 03:57 PM PST There is a rich information flow and literally everything can be grabbed. Although, there is no need to rush, because everything is still ahead. As evidenced by the recent rally of more than 120 points in a modest two hours, speculative positions are gaining momentum. The reasons and consequences are hidden in the volume of positions on the US dollar, which instantly broke the record for the past weeks. The dollar strengthened on all fronts, perhaps business activity statistics played on the emotions of the US economic recovery, and perhaps an early insider on Biden and Janet Yellen, which was played by major players. COVID and BREXIT British Prime Minister Boris Johnson officially announced that the national quarantine will end next week, which can be considered as positive news, but not so simple. The quarantine will be replaced by a more stringent three-level system of regional restrictions, designed until the spring of 2021. Here are the restrictions: Level 1 More lenient measures will be provided, bars, pubs, restaurants are open until 11 PM. The maximum number of people allowed in the room is 6. Sports activities are available, including fitness centers, but with restrictions of up to six people at a time. Major events, sports, and performances are allowed, but limited to 50% capacity or a maximum of 4,000 people outdoors / 1,000 indoors (whichever is lower). Level 2 Pubs, bars, and restaurants will be restricted or closed. Fitness centers are closed, but outdoor sports are allowed. Major events, sports, and performances are allowed, but limited to 50% capacity or a maximum of 2,000 people outdoors / 1,000 indoors (whichever is lower). Level 3 Bars, pubs, and restaurants are all closed except for takeaway or delivery. The indoor entertainment center is closed. Tourist tip: avoid leaving the level 3 zone, reduce your trips. No overnight stays outside of the local area, except for work and study. Exercise and sports activities can take place outdoors, but not more risky contact activities. Major events are prohibited. Entry events are allowed. Boris Johnson recalls that the risk of a worsening situation with COVID-19 is still high, and the winter will be harsh. As a matter of fact, we have improved in terms of lifting the strict quarantine, but the containment measures will have an impact on consumers, tourism, and the country's economy for a long time to come. In turn, another rumor on the divorce process Brexit appeared, this time from the Prime Minister of Ireland. He said that the contours of the deal are already clear and by the end of this week, an agreement may be concluded. According to him, there is progress even on issues such as fishing and competition, which is considered surprising, and if this is the case, it is now clear why the pound has recovered so quickly after the decline. It is worth considering that such statements from high-ranking officials have already been met in the history of Brexit, they do not give 100% guarantees that everything will happen. Thus, it is still too early to exclude a hard outcome from consideration. "Fundamental differences still remain, but we continue to work hard on a deal," Michel Barnier, the EU's chief negotiator, tweeted on Monday. From the material above, it can be noticed that there is plenty of leverage for new rallies. Now, you should not focus on the medium-term perspective, since local bursts of activity can be quite large, instead you should work together with speculators. In terms of technical analysis, an intense downward movement in the front of 16: 15-18: 00 * on November 23 (time at the trading terminal *) can be seen, where the quote found a resistance point near the coordinate of 1.3400, and then went down to the limits of 1.3265 on an inertial move. The movement was local in nature, where the recovery of the pound sterling was not long in coming. It is worth noting that holding the price above the level of 1.3300 increases the chances of buyers for a subsequent upward movement. The quote continues to face the maximum of the previous day, but the main peak is considered to be the level of 1.3480 from September 1. In this case, a breakdown of the value of 1.3480 will lead to the resumption of the medium-term upward trend. As for the market dynamics, the speculative hype that leads the quote to accelerate is clearly visible. It is worth recalling that the signal of the upcoming acceleration was received last Friday. The signal was an abnormally low daily activity - 49 points. On the trading chart in general terms (daily period), it can be noticed that the area of 1.3480 reflects not only the maximum of 2020, but also a trace from 2019, where the quote found a resistance level in the same area. Today, in terms of the economic calendar, there are hardly any statistics worth paying attention to for Britain and the United States. Analyzing the current trading chart, it can be seen that the upward potential that took place during the Asian and early European sessions dissipated around noon, when sellers returned to the market again. The level of 1.3300 again plays the role of a barrier and distributor of trading forces, whether sellers will be able to overcome it is not yet clear. The natural basis associated with the level leads to a reduction in the volume of short positions, and this leads to a slowdown. As before, the decisive signal will be a four-hour candle, since depending on whether the level is fixed above or below, the subsequent move in the market will be clear. It is worth noting that the information flow continues to affect the quote's dynamics, so do not forget to track the latest topics of Brexit, COVID for new information. Indicator analysis Analyzing a different sector of timeframes (TF), it is clear that the indicators of technical instruments only signal a sale in a minute interval, while the hourly and daily periods indicate an upward development. The schedule of trading forces may change if the price fixes below 1.3300 on a four-hour period. Weekly volatility / Volatility measurement: Month; Quarter; Year The volatility measurement reflects the average daily fluctuation, based on the calculation for the Month / Quarter / Year. (November 24 was based on the article's time of publication) The dynamics of the current time is 87 points, which is even lower than the average level by 27%, but the speculative hype is clearly visible in the market. In the future, there may still be an acceleration in the market. Key levels Resistance zones: 1.3480; 1.3600; 1.3850; 1.4000 ***; 1.4350 **. Support areas: 1.3300 **; 1.3175 (1.3200); 1.3000 ***; 1.2840 / 1.2860 / 1.2885; 1.2770 **; 1.2620; 1.2500; 1.2350 **; 1.2250; 1.2150 **; 1.2000 *** (1.1957). * Periodic level ** Range level *** Psychological level The material has been provided by InstaForex Company - www.instaforex.com |

| EURUSD – someone leaked insider information ahead of time Posted: 24 Nov 2020 03:57 PM PST The last trading day was one of the most dynamic in recent times. The EUR/USD quote showed activity in just two hours, comparable to the amplitude for the last week. We can say a lot about the fact that the slowdown in the period earlier led to the accumulation of trade forces and that there was an acceleration of activity from the level of interaction of trade forces 1,1890/1,1900/1,1920. It is no secret that yesterday, Mr. Donald Trump ordered the beginning of the transfer of power to Joe Biden. In fact, Trump has accepted defeat and Biden is considered the official winner and the new President of the United States. The information was received tonight but there is an assumption that such valuable information was shared in a narrow circle before the official statement. Under the noise of positive statistics on the US business activity index, traders decided to buy the US Dollar. The above is just a theory, but similar actions with early insider information were repeatedly encountered by traders from Wall Street. The second theory, which will complement the first, is that Joseph Biden plans to nominate former Federal Reserve chair Janet Yellen for the post of Finance Minister. This information could have leaked earlier than the official statement to the same insider circle, and since we are talking about the banking sector, the candidacy of Janet Yellen plays in favor of Wall Street and possible stimulus injections into the economy. Now let's look at price fluctuations from the point of view of technical analysis. The market has been at a standstill since November 17, where the coordinates 1.1815/1.1900 served as variable boundaries. Activity was reduced to the limit. Sometimes it seemed that even speculators left the market. Area of interaction of trade forces 1,1890/1,1900/1,1920 withstood the onslaught of buyers, at the same time, it played the role of a lever that pushed sellers to inertia. In simple words, the sale of the Euro was in the area of accumulation, which already exerted pressure on buyers, and a local break higher than the highs of November 17,18,20 led to the triggering of stop orders. As a result, we got inertia in the direction of 1.1800, where there was a recovery almost immediately. Returning to the market dynamics for November 23, we can see that the highest activity recorded for 10 trading days was at 105 points, which is 35% higher than the average level. Looking at the trading chart in general terms (daily period), it is clear that the quote is at the top of the upward tract from the beginning of November, which returned the quote to the upper limit of the medium-term sideways trend. Today, in terms of the economic calendar, we do not have statistics on Europe and the United States that are worth paying attention to, but based on practice, this does not stop speculators. Analyzing the current trading schedule, you can see that the quotation of the Asian and European sessions actively restored positions in the Euro, which led to another touch of the area of interaction of trade forces 1,1890/1,1900/1,1920. The area, as before, was maintained. The volume of long positions decreased, which returned the quotes to the variable coordinate of 1.1850. The coefficient of speculative operations is growing, which has a positive effect on the market dynamics but the quote is squeezed between the level of 1.1810 and the area of interaction of trading forces 1,1890/1,1900/1,1920. A breakout and fixation of the price outside one of the boundaries of 1.1810 or 1.1920 will most likely indicate a local entry and a major round of acceleration Indicator analysis Analyzing a different sector of timeframes, it is clear that the indicators of technical instruments on the hourly and daily periods signal a purchase due to the next touch of the price of the area of interaction of trading forces. Minute intervals work to return the price to a variable coordinate, 1.1850 signaling a sale. The volatility for the week / Measurement of volatility: month, quarter, and year The measurement of volatility reflects the average daily fluctuation, calculated for the month, quarter, and year. (November 24 was based on the date of publication of the article) The dynamics of the current time is only 58 points, which is quite good for the Euro/Dollar currency pair. A high coefficient of speculative operations can still give acceleration to the market. Key levels Resistance zones: 1,1890-1,1900-1,1920**; 1,2000***; 1,2100*; 1,2450**; 1,2550; 1,2825. Support areas: 1,1810*; 1,1700; 1,1612*;1,1500; 1,1350; 1,1250*;1,1180**; 1,1080; 1,1000***. * Periodic level * * Range level ***Psychological level The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 24 Nov 2020 01:49 PM PST Hourly chart of the EUR/USD pair

The EUR/USD pair moved up for most of the day on Tuesday. However, it turned down at one point and a sell signal appeared (circled in red). Therefore, novice traders had a reason to open short positions today. Unfortunately, the signal turned out to be false, and traders could lose up to 20 points, as the upward movement resumed in the afternoon. At the end of the day, we can say that the price returned to the upper border of the 1.1700-1.1900 horizontal channel. Starting from November 17, the pair's quotes are in close proximity to this line, so it seems that buyers will push this level. However, the price will remain inside the horizontal channel until they do so, which means there are much more chances of a downward movement towards the lower border of the 1.1700 channel. Unfortunately, there is no trendline or trend channel right now to determine the current short-term trend. Better yet, there is now a vague flat inside the flat, since the price has also been trading in a narrow price range for the last week. No major macroeconomic reports or events in both the UK and the US on Tuesday. There was some information that novice traders probably paid attention to. For example, the process of transfer of power from Donald Trump to Joe Biden has begun in America, which significantly reduces the likelihood of political chaos that has been observed in recent months. There is also news that vaccination of the US population may begin as early as next month, however, given the number of daily recorded cases of COVID-2019, this information does not support the dollar. No important news scheduled for Wednesday in the European Union, but several rather important reports will be published in the US. The most important among them, from our point of view, is the report on orders for durable goods in four variations (main indicator, indicator excluding defense orders, indicator excluding transport, indicator excluding defense and aviation orders). If the real numbers turn out to be very different from the forecasted ones, then traders can react to them. But most likely, traders will not be surprised by the GDP indicator, since this is already the third GDP publication in the third quarter and, if there are no surprises, the indicator value will be + 33.1% q/q. If there is more, the dollar will receive support. Less - the euro will receive support. The rest of the indicators are less important and will be in the shadow of the above reports. Possible scenarios for November 25: 1) Long positions are currently irrelevant. Buyers tried to take the pair above the 1.1903 level, but they did not succeed, which means that it is not recommended to buy the euro right now. You are still advised to wait for a new upward trend or go beyond the 1.1903 level in order to open long positions. 2) Trading for a fall at this time remains relevant, since the trend changed to a downward one a few days ago. We advise you to wait for a new sell signal from the MACD indicator and trade down with targets at the support levels of 1.1849 and 1.1791. The MACD indicator is above the zero level, therefore it is sufficiently discharged. On the chart: Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now. Up/down arrows show where you should sell or buy after reaching or breaking through particular levels. The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines). Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. The material has been provided by InstaForex Company - www.instaforex.com |

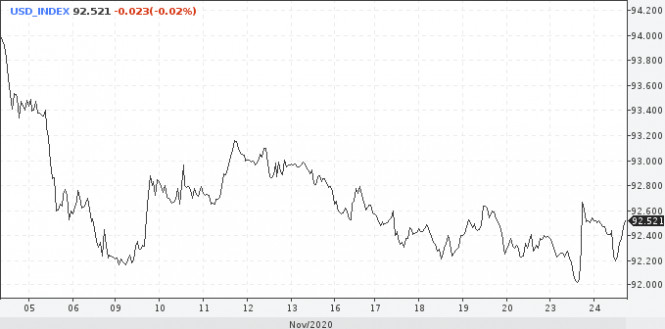

| Posted: 24 Nov 2020 08:46 AM PST

The main currency pair is still under the influence of two oppositely directed factors: the ongoing COVID-19 pandemic and hopes for an early vaccine against the virus. At the moment, investors are at a crossroads, trying to figure out whether to focus on the negative effects of the coronavirus or on a return to normal in the future. On Monday, the greenback tested the lows since September 1, but important support near 92 points held out. Meanwhile, strong US PMI data for November came as a surprise to the market and helped USD to halt its retreat and turn sharply higher. According to preliminary estimates, the composite purchasing managers' index in the US for the current month rose to a maximum in more than five and a half years, at 57.9 points, compared with 56.3 points in October. A sharp greenback reversal could mean a decrease in investor confidence that the Fed will decide to take any aggressive action at the December meeting. Given the outlook for an effective vaccine soon, the rise in the US stock market, and strong US statistics, the regulator will most likely prefer to wait until the renewed congressional staff starts work in January before taking action. EUR / USD was able to briefly break the 1.1900 mark, but then fell sharply to 1.1810, ending Monday's trading near 1.1840. The contrasts in the data on business activity in Europe and the USA favored the decline of the euro against the dollar. The composite PMI of the euro area, according to the first estimate, dipped to 45.1 points this month from 50 points in October. The value of the indicator in November became the lowest in six months. It should be admitted, however, that European purchasing managers' indices were not as bad as economists feared. The manufacturing sector in Germany and the eurozone as a whole has strengthened. Given the scale of recent restrictive measures in the region, it can be said that the situation could be much direr. However, the indicators may still be revised downward. On Tuesday, the US dollar slowed down its recovery from 12-week lows, where it was the day before. The defensive greenback was under pressure from reports that Donald Trump had given the go signal to the head of the General Services Administration (GSA), Emily Murphy, for the handover of power to Joe Biden. Also, the market reacted very positively to the news about the possible appointment of Janet Yellen for the post of Treasury Secretary under Biden. Since the former Fed chair is associated with financial incentives among investors, this news increased risk appetite and allowed the euro to regain some of its recent losses against the dollar. "The strong support level for EUR / USD near 1.1790 is still unbreakable, but the weakening of the bullish momentum indicates that the pair is not ready to break above 1.1920. Now it can trade sideways for some time, and only an exit from the 1.1790-1920 range will signal the beginning of a more directional movement, "UOB experts believe. The material has been provided by InstaForex Company - www.instaforex.com |

| NZDUSD continues making higher highs but also new bearish divergencies. Posted: 24 Nov 2020 08:31 AM PST NZDUSD has climbed to 0.6980. Price is out of the bullish channel but continues to make higher highs and higher lows. At current price levels as explained in previous posts we prefer to be neutral if not bearish as we expect a turn lower towards 0.68.

Red line- bearish divergence Green line - support trend line Black lines -Fibonacci retracements NZDUSD has short-term support at 0.6920-0.6925. A break below this level will be a short-term bearish signal that could bring price to 0.6840. The first important Fibonacci level we expect to be seen is around 0.6840. Nulls remain in control of the trend as long as price remains above the green trend line. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold price reaches first target of $1,800 Posted: 24 Nov 2020 08:19 AM PST Gold price broke down yesterday and is already at our first target area of $1,800. If Gold price makes an equal decline similar to the $1,9650-$1,850 move, then we should expect $1,874 to be seen this week.

Green rectangle- support (broken) now resistance Gold price is moving lower in a sharp decline as expected. Our next target is at $1,874, The RSI is in oversold territory and although we expect price to continue lower, it is not preferred to open new short positions currently. We have warned bulls several times before that a break below $1,850 would open the way for a move towards $1,800 at least and most probably below it. Longer-term support is found at $1,700-$1,680. It is too soon to tell if we will test this area. Another price level of importance is at $1,725 where we find the 38% Fibonacci retracement of the entire rise from August lows. The material has been provided by InstaForex Company - www.instaforex.com |

| Ichimoku cloud indicator Daily analysis of EURUSD Posted: 24 Nov 2020 08:08 AM PST EURUSD so far despite the volatility and the ups and downs, has held above the Ichimoku cloud in the 4 hour chart keeping short-term trend bullish. In our previous analysis we noted that a pull back towards 1.18 was possible and that bears needed to break below 1.18-1.1750 in order for short-term trend to change to bearish.

|

| Dollar may decline upon Yellen's appointment as Treasury Secretary Posted: 24 Nov 2020 06:55 AM PST

The general risk appetite continues to weigh on the position of the US dollar. Investor sentiment is supported by hopes for the early start of the coronavirus vaccine. Markets also gave a very positive reaction to the news that Janet Yellen was nominated for the post of Treasury Secretary under the Biden presidency. The former Fed chair is associated with financial incentives for traders, so the news increased the desire to buy risk. If Yellen, indeed, becomes the head of the Department of Treasury, the dollar will increase to decline. If her candidacy is confirmed in the Senate, she will be the first woman to hold this post. Moreover, Trump has already agreed to a conflict-free transfer of power, which is another reason for the positive markets. The dollar index continues to balance around the important mark of 92 points. The day before, sellers had every chance to break through this mark, which would have allowed talking about a further systematic decrease in the greenback. However, this did not happen, the dollar was literally saved from failure by the confident PMI estimates in services and manufacturing in November. It is clear that this was short-term support. Judging by the news background, theUS dollar remains under significant pressure and it will still have to go under the 92 mark.

The EUR / USD pair was once again pushed back from the 1.19 level by a determined attack from the bears. Since the strengthening of the dollar was not associated with a flight to protective assets, the euro managed to recover most of the lost positions. Restoring risk appetite often plays against the dollar, forcing it to retreat even against the European currency. Thus, the greenback received local support at an important level but continues to retreat today. The pair added about 0.3%. Despite the fact that the data on GDP in Germany was revised for the better, the tone for the euro was set by the decline in the dollar. The markets reacted to the optimistic statistics, which significantly exceeded the forecast, but weakly. Nevertheless, a positive shift in the main Forex pair can be traced, and we are watching another attempt by buyers to break through the level of 1.19. It will not be easy to take it and, more importantly, fix itself over it. Earlier, the estimates for Europe surprised by their weakness, the composite index fell from 50.0 to 45.1. PMI indexes are important at a time of increased uncertainty, and in contrast to the US, Europe looks weaker. This once again did not let the EUR/USD pair above 1.19. However, there is a chance, the euro should take advantage of it. Next, the pair will storm the 1.20 level, at least the markets have long cherished hope for this. According to Morgan Stanley, EUR / USD could rise to 1.25 when the Covid-19 vaccine begins to spread.

The dollar's reversal on Monday was a kind of push for the USD/JPY pair to pull back from the 103 mark. A significant part of this rally is not played out, moreover, it continues, bringing the pair closer to the value of 105. The increase in the USD / JPY exchange rate is often associated with increased purchases in the stock and commodity markets. Investors borrow in Japanese yen to fund purchases of risky assets, which weakens the yen during booming markets. This has not happened in recent months, as investors have found support in dollars and euros. It is worth noting that an additional reason for the yen is a new round of growth in Japanese securities. The Nikkei225 index went on to update almost 30-year highs.

The USD / JPY pair is expected to decline in the medium term due to broad dollar weakness. There will be no serious drop, and the pair will return to its current levels by the end of 2021. Its Decline will be triggered by the fact that the market will start pricing at the beginning of the Fed's rate hike cycle in 2023. This forecast was given in Morgan Stanley. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading Signal for EUR/USD for November 24 - 25, 2020: Key Level 1.1860, Posted: 24 Nov 2020 06:47 AM PST

The single currency appreciated after the publication of the German data. The final GDP reading for the third quarter was better than expected, reaching 8.5% in the three months to September. Yesterday, the EUR / USD pair saw a boost to 1.1903 but was rejected just above the 1.1903 level, we expect it to remain under this downward pressure below this zone. Another issue is the impact of the pandemic on the economy of the region and the political evolution around the EU Recovery Fund, these data will continue to weaken this pair. If you can see the 4-hour chart, we notice that the pair is trading this morning of the American session around the 21 day EMA, at 1.1865 key level that we expect to stay above this level for a bullish move. On the other hand, a break below this 1.1860 zone, we would have a good chance to sell this pair with bearish targets to the 1.1805 and 1.1780 zone. The eagle indicator is showing an overbought signal, which could take place in the next few hours. Our recommendation is to continue selling below 1.19, if it remains below this level it is likely that the euro will continue its decline. A definitive and convincing break from this level (3/8 murray) may be bullish to the 1.1967 and 1.20 zone. Market sentiment shows that there are 73% of traders selling this pair, which could add strength to our bullish outlook, but we should only buy when the pair makes a correction at the 1.1780 support. Trading tip for EUR/USD for November 24-25 Sell if the pair breaks below 1.1860 with take profit at 1.1815 and 1.1779 (1/8 murray) and stop loss above 1.1901. Buy if the pair rebound around EMA 200 at 1.1770 with take profit at 1.1850 and 1.1901 and stop loss below 1.1735. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 24 Nov 2020 06:05 AM PST As it became known today, the future President of the United States Joe Biden nominated Janet Yellen as the new Secretary of the Treasury. This suggests that Biden will act more aggressively on monetary and fiscal policy to return the American economy to pre-crisis growth rates as quickly as possible. Let me remind you that Janet Yellen is a former Chairman of the US Federal Reserve and has established herself as a proponent of a more stimulating approach. Biden said that along with Yellen as Treasury Secretary, he is ready to join the current policy pursued by Fed Chairman Jerome Powell. We, as traders, are concerned about perhaps the only question – how much the US dollar will continue to fall since the appointment of Finance Minister Janet Yellen is unlikely to strengthen the dollar's position on the world stage. During today's press conference, Yellen has already outlined the main points of her work in the proposed new post. And although she will have to go through a confirmation hearing in the Senate, there is little doubt that she will not succeed. Her views on stimulating the economy, as well as her stance on China, do not suit many Republicans. In any case, its appointment will create the prerequisites for greater harmony in relations between the two institutions, which will ensure coordination of fiscal and monetary incentives. And if there is no doubt that the Fed and Yellen (in the future) will only increase stimulus measures to support the economy, the recent report of the European Central Bank on this topic just indicates the risks that such measures carry. According to a report by the European Central Bank, governments and central banks are currently facing an uneasy balance of economic shock, which, on the one hand, turns out to be the coronavirus pandemic, and on the other hand, is growing due to too extensive stimulus programs to support the economy. If fiscal, monetary, and fiscal support measures were vital in the first wave of the pandemic, as households and companies found themselves in very difficult conditions, then scaling up these measures after the crisis is over can lead to very bad consequences. At the very least, it will be quite a challenge to quickly abandon the incentive approach. Therefore, it is necessary to think about it now. A sudden end to support and assistance measures could lead to a cliff in household and corporate incomes, which will have a direct impact on economic activity in 2021. If the measures are maintained and even after the economic stress subsides, this will greatly reduce their effectiveness, which will lead to an incorrect distribution of capital and the preservation of non-viable companies. Therefore, the withdrawal of emergency support measures should be carefully planned, especially in the banking sector. Let me remind you that the European Central Bank has repeatedly stated that it intends to strengthen monetary stimulus in December of this year, which limits the upward potential growth of risky assets in the medium term. Meanwhile, the European currency strengthened its position in the first half of the day after the release of a report indicating a strong recovery in the German economy in the 3rd quarter of this year. The data turned out to be much better than economists' forecasts, which remains quite optimistic about the pace in the 4th quarter of this year. In general, GDP growth was directly related to increased personal consumption, which increased by 10.8% compared to the 2nd quarter. The improvement in the labor market, together with government support measures after quarantine restrictions, also contributed to an improvement in consumer sentiment. The only industry that declined in Germany in the 3rd quarter of this year was construction. As for the figures, Germany's GDP for the 3rd quarter of this year was revised up to 8.5% from 8.2%. Economists had expected GDP growth of 8.2%. Compared to the 3rd quarter of the previous year, GDP decreased by 4.0%, not by 4.3%, as previously expected. There is no doubt that this winter will again be a test for German companies and businesses. And although the indicators for the current sentiment were quite high, the foggy future due to the second wave of the coronavirus pandemic spoils expectations. Given the fact that there is no talk of lifting restrictive measures in the EU, following the example of the UK, it is likely that Germany's GDP will shrink in the 4th quarter compared to the 3rd quarter. However, the restrictions that are imposed apply to a smaller part of the economy and practically do not affect the industrial sector, which is the leading one for the German economy, which leaves hope for a good end to the year. As for the numbers, the IFO Institute's German business sentiment index in November this year was at 90.7 points, while economists had expected the figure to be 90.6 points. In October, the indicator was at the level of 92.5 points. The German expectations index also fell to 91.5 in November from a revised October reading of 94.7 points. But the index of current conditions in November was almost unchanged, falling only to 90.0 points from 90.4 points in October. As for the technical picture of the EURUSD pair, the next attempt to break through the resistance of 1.1890 was unsuccessful, which forced the major players to retreat. Only a real consolidation at the level of 1.1900 forms a new upward push of the pair to the highs of 1.1960 and 1.2010. It will be possible to talk about the return of pressure on risky assets after sellers cope with the support of 1.1800, the breakdown of which will quickly lead to the demolition of several buyers' stop orders and the fall of EURUSD to the lows of 1.1750 and 1.1710. The material has been provided by InstaForex Company - www.instaforex.com |

| Outlook on EURUSD for November 24, 2020 Posted: 24 Nov 2020 05:21 AM PST

EURUSD: Buy on the upward breakout of 1.1906, stop at 1.1860. Sell on breakout of 1.1800, stop at 1.1845. The euro has again taken a neutral position. Monday's sharp fall was broken by the market, but the hike up, which seemed inevitable this morning, is questionable. According to reports, Trump has already recognized Biden's victory and gave the command to start the transfer of power. Biden is set to appoint former Federal Reserve chair Janet Yellen as Treasury Secretary. The vaccine from AstraZeneca and Oxford showed an efficiency of at least 90%, which is already a very good result. If nothing comes up any further and if the vaccine succeeds in its final testing, then it is likely to become the most popular in the world due to the low price and simple storage conditions. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading Signal for GBP/USD for November 24 - 25, 2020 Posted: 24 Nov 2020 05:20 AM PST

Be very careful and buy only above 1.3330, if the pair trades below this level we recommend that you sell this pair with targets up to 1.3270 and 1.3240. An upward rebound at 1.3240 in 1-hour chart, there is the EMA 200 days, it would be a good opportunity to buy this pair. The Aguila indicator is showing a bearish signal in the short term. A consolidation at 1.3180 is likely. The market sentiment for this morning shows that there are 62% of investors with positions in selling, thus giving this pair a bit of upward force or at least it consolidates at support levels of 1.3180. We expect that in the medium term it will reach levels of 1.3427. Trading tip for EUR/USD for November 24-25 Sell if pullback to 1.3425 (6/8 murray) with take profit at 1.3305 and stop loss above 1.3460 Buy if the pair rebounds to 1.3305 (5/8 murray) and 1.3240 (EMA 200) with take profit at 1.3380 and 1.3427, stop loss below 1.3200 Sell with a convincing break below 1.3240 (break out bellow EMA 200) with take profit at 1.3183 and 1.3125 stop loss above 1.3305. The material has been provided by InstaForex Company - www.instaforex.com |

| November 24, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 24 Nov 2020 04:49 AM PST

In July, the GBP/USD pair has expressed an Ascending Flag Pattern above the price level of 1.2780. Shortly after, bullish persistence above the price zone of 1.3300 was achieved. This was supposed to allow bullish pullback to pursue towards 1.3400 as a final projection target for the suggested pattern. However, the GBP/USD pair failed to do so. Instead, another bearish movement was targeting the price level of 1.2840 and 1.2780 where bullish SUPPORT existed allowing another bullish movement initially towards 1.3000 which failed to maintain sufficient bearish momentum. That's why, the recent bullish breakout above 1.3000 has enabled further bullish advancement towards 1.3250-1.3270 where the upper limit of the new movement channel came to meet the GBP/USD pair. Further bullish advancement is being expressed towards 1.3380-1.3400 where the pair looks overbought after failure of the previous price zone to offer sufficient bearish pressure on the pair. Upon the current bullish pullback, price action should be watched around the price levels of (1.3380-1.3400) for signs of bearish pressure as a valid SELL Entry can be offered. Initial bearish target would be located at 1.3300 and 1.3250. While S/L should be placed above 1.3450. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 24 Nov 2020 04:49 AM PST Further Development

Analyzing the current trading chart of BTC, I found that the BTC got exhaustion today and bearish divergence on the Stochastic oscillator on the 30 minute time-frame, which is sign that sellers might join today. The material has been provided by InstaForex Company - www.instaforex.com |

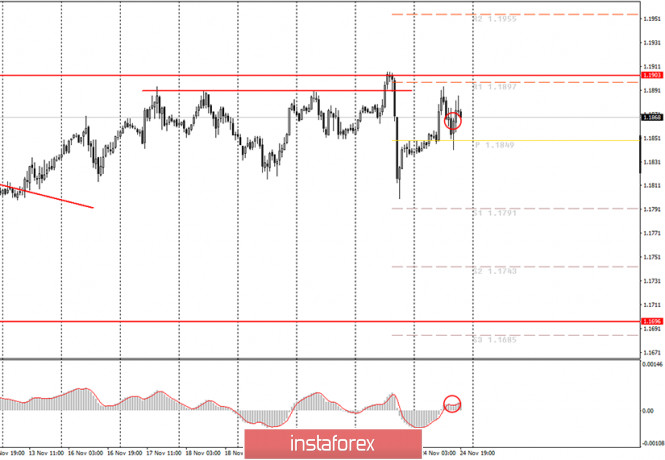

| November 24, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 24 Nov 2020 04:44 AM PST

Intraday traders should have noticed the recent bearish closure below 1.1700. This indicated bearish domination for the market on the short-term. However, the EURUSD pair has failed to maintain sufficient bearish momentum below 1.1625 (38% Fibonacci Level). Instead, another bullish breakout was being demonstrated towards 1.1870 which corresponded to 76% Fibonacci Level. As mentioned in previous articles, the price zone of 1.1870-1.1900 stood as a solid SUPPLY Zone corresponding to the backside of the broken channel. Moreover, the recent bearish H4 candlestick closure below 1.1770 was mentioned in previous articles to indicate a valid short-term SELL Signal. All bearish targets were already reached at 1.1700 and 1.1630 where the current bullish recovery was initiated. The current bullish pullback towards the price zone of 1.1870-1.1900 is supposed to be considered for signs of bearish rejection and another valid SELL Entry. S/L should be placed just above 1.1950. Bearish closure and persistence below 1.1777 (61.8% Fibonacci Level) is needed to enhance further bearish decline at least towards 1.1630. Otherwise, one mor bullish pullback towards 1.1870-1.1900 should be considered for another valid SELL Entry. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 24 Nov 2020 04:42 AM PST BOJ's Kuroda: Central bank measures have helped with global pickup Comments by BOJ governor, Haruhiko Kuroda

There is certainly little doubt that central banks intervened in a more timely manner this time around but there will still be questions on what that has done to the "economic fundamentals" of the market. But to central banksters, this is the only pickup that matters:

Further Development

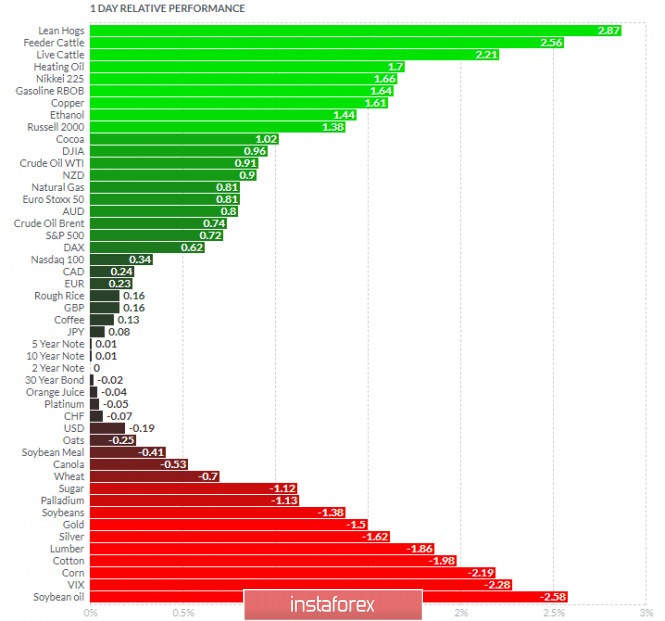

Analyzing the current trading chart of Gold, I found that the Gold reached my yesterday's target at $1,850 and is heading towards the next target at $1,792. 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Lean Hogs and Feeder Cattle today and on the bottom Soybean Oil and VIX. Resistance: $1,821 Support level: $1,792 and $1,760. The material has been provided by InstaForex Company - www.instaforex.com |

| November 24, 2020 : EUR/USD daily technical review and trade recommendations. Posted: 24 Nov 2020 04:41 AM PST