As a rule, autumn is not the best period for Brent and WTI. The completion of the automotive season in the US leads to a reduction in inventories. In addition, the Energy Information Administration reports that there is an increase of production to 6.08 million bpd in October, encouraged by rising prices of producers of shale oil. Nevertheless, hurricanes allowed for adjustments to the seasonal factor. For a long time, black gold finally felt relief under pressure from the growth of drilling rigs from Baker Hughes. The decline of the indicator for two consecutive weeks reached 749 (-7 on the results of the five-day period by September 15).

As the US refineries restart, the demand for oil should gradually increase and support prices because of optimistic forecasts for the global index from the IEA and OPEC. At the same time, $50 per barrel for WTI is a very dangerous figure. It attracts hedgers like honey bears, so it will be extremely difficult to gain a foothold above this mark.

As the value of black gold rises, the question is returned to the market: what are the limits? It is obvious that the end of the hurricanes "Harvey" and "Irma" and the transition of the market to a normal state will return it to the idea of increasing American production with parallel insurance of price risks. This combination of drivers has repeatedly provoked attacks of "bears." I do not think that something will change in the fall. You can talk endlessly about the fulfillment of the obligations to reduce production by OPEC members. You can also discuss about the extension of the agreement beyond March 2017. However, the fact remains: Americans continue and will continue to use the favorable conjuncture for them.

Dynamics of the US dollar is of no small importance. Since Brent and WTI are quoted in this currency, the growth of the USD index leads to a rise in the cost of imports in the largest consumer countries, and vice versa.

Dynamics of the USD Index and Brent

In this regard, the expectations of the start of the process of normalizing the balance of the Fed and a rise in the probability of an increase in the rate for federal funds from 33% to 58% is of special joy to "bulls" that black gold is not able to bring. On the other hand, the positions of the euro against the backdrop of the ECB's desire to roll back QE look strong. After all, it has the largest share in the USD index. Thus, consolidation in EUR / USD does not put obstacles on the way of black gold to the upward trend.

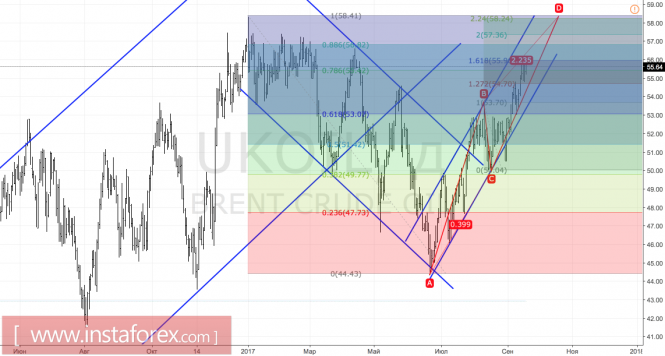

Technically, a resistance break at 55.95 will allow Brent bulls to continue the rally in the direction of the following targets (by 200% and 224%) in the AB = CD pattern. On the contrary, the inability of buyers to take an important level by storm will testify to their weakness and will increase the risks of correction to $ 54.7 and $ 53.1 per barrel.

Brent, daily chart

No comments:

Post a Comment