EUR/JPY Testing major resistance, start to sell

Price is testing major channel resistance and we look to sell below this level of resistance (Swing high resistance, channel resistance, Fibonacci extension) for a short term correction to at least 132.01 support (Fibonacci retracement, horizontal pullback support).

Stochastic (34,3,1) is seeing major resistance below 96% where we expect a further drop from.

Sell below 134.15. Stop loss at 134.92. Take profit at 132.01.

AUD/USD approaching profit target, prepare to sell

Price has bounced above our buying area perfectly yesterday and is fast approaching our profit target. We now start to sell below major resistance at 0.8023 (Fibonacci extension, descending resistance, swing high resistance, Fibonacci retracement) for a drop from here towards 0.7928 support (Fibonacci retracement, Fibonacci extension, swing low support).

Stochastic (34,5,3) is seeing major resistance below 95% where we expect a reaction from.

Sell below 0.8023. Stop loss at 0.8060. Take profit at 0.7928.

Price continues to rise in our bullish channel. We look to buy on weakness above major support at 88.68 (Fibonacci retracement, horizontal overlap support, Fibonacci extension) for a further rise towards 89.47 resistance (Fibonacci extension, horizontal swing high resistance).

RSI (34) remains above our ascending support line signalling that we have not seen the end of our bullish momentum.

Buy above 88.68. Stop loss at 88.33. Take profit at 89.47.

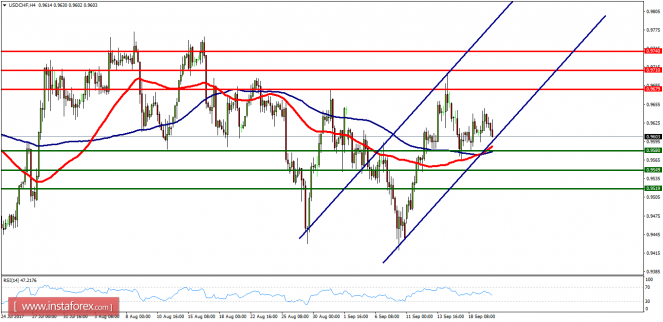

Price continues to slowly climb towards our profit target in our bullish channel. We remain bullish looking to buy above major support at 0.9578 (Fibonacci retracement, horizontal overlap support, Fibonacci extension) for a bounce up to at least 0.9675 resistance (Fibonacci extension, horizontal swing high resistance).

RSI (34) sees an ascending support line holding up our bullish price momentum really well.

Buy above 0.9578. Stop loss at 0.9525. Take profit at 0.9675.

NZD/USD profit target reached perfectly, prepare to sell

Price has bounced up from our buying area and reached our profit target perfectly. We prepare to sell below major resistance at 0.7342 (Fibonacci extension, horizontal swing high resistance) for a push down to at least 0.7251 support (Fibonacci retracement, horizontal swing low support).

Price has bounced up from our buying area and reached our profit target perfectly. We prepare to sell below major resistance at 0.7342 (Fibonacci extension, horizontal swing high resistance) for a push down to at least 0.7251 support (Fibonacci retracement, horizontal swing low support).

Stochastic (34,5,3) is seeing major resistance below 95% where we expect a reaction from to push price down.

Sell below 0.7342. Stop loss at 0.7376. Take profit at 0.7251.

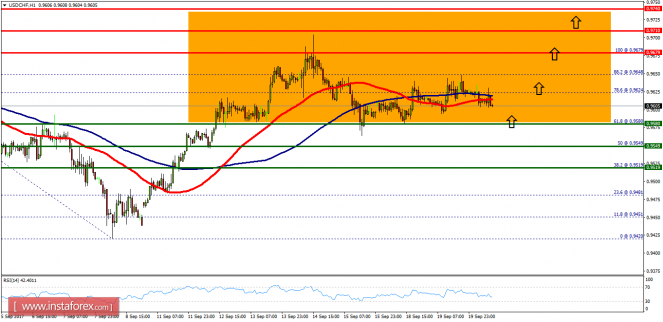

Overview: The USD/CHF pair is still trading around the area of 0.9580-0.9679. The USD/CHF pair broke resistance which turned to strong support at the level of 0.9580 (major support). The level of 0.9580 coincides with a golden ratio (61.8% of Fibonacci), which is expected to act as major support today. The Relative Strength Index (RSI) is considered overbought because it is above 30. The RSI is still signaling that the trend is upward as it is still strong above the moving average (100). This suggests the pair will probably go up in coming hours.

No comments:

Post a Comment