You see, every boom follows a sequence of three stages…

First, only early enthusiasts are courageous enough to invest in the new trend.

That’s stage 1.

Then, institutional investors (the so-called “smart money”) jump in.

That’s stage 2.

Finally, the public joins the party, triggering a massive explosion in price.

That’s stage 3.

If you know how to use this roadmap, you could make an absolute fortune.

And to help you understand how this 1-2-3 sequence works…

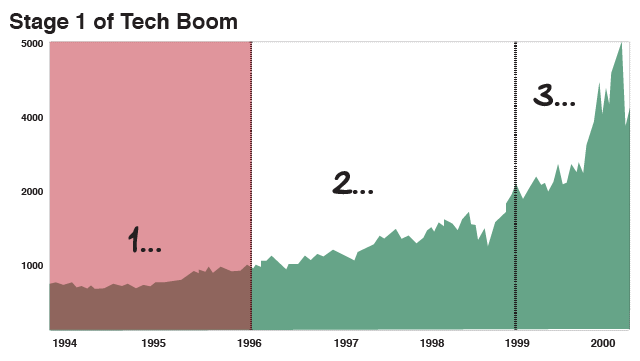

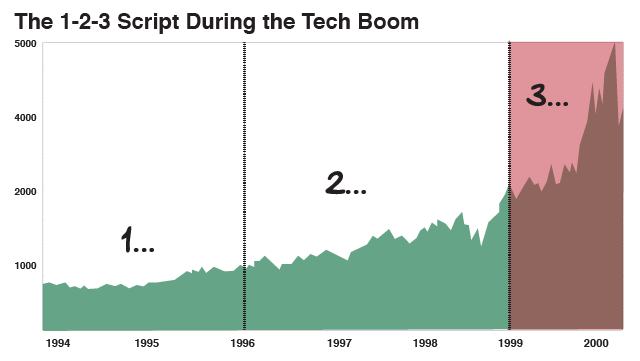

Let me show you what happened during the 1990s boom in tech stocks.

In the mid-1990s, most people didn’t even know what the internet was.

In 1994, the morning show NBC's Today had a segment where one of the anchors asked, “What is the internet, anyway?”

While most people were dismissing the technology as a fad...

Early adopters like myself were heavily investing in it.

In 1995, I correctly predicted every company would need a website. So I started my first internet company to help big corporations get online.

That’s how I ended up building the first websites for American Express, HBO, Sony and Disney, among others.

That was stage 1 of the boom!

Only when Netscape went public in late 1995 did people outside Silicon Valley start taking the internet seriously.

That’s when institutional investors started joining the party…

With pension funds and venture capitalists making a fortune when companies like Yahoo and Amazon went public.

The additional flow of money from the “smart money” helped pushed tech stocks even higher.

That was stage 2 of the boom.

But the public was still not participating.

In June 1998, for example, mainstream economist Paul Krugman predicted the internet’s impact on the economy would be no greater than the fax machine.

It wasn’t until 1999 that the masses finally started to invest heavily in tech stocks…

With more people jumping into the market…

Tech stocks jumped even higher…

Attracting more and more people wanting to get a piece of the action.

And that was the third and most explosive stage of the boom…

With the Nasdaq soaring more than 85% in 1999 alone.

I’m telling you this because my research shows that cryptocurrencies are following this exact same script…

First, early enthusiasts…

Then, institutional investors…

And finally the public.

So keep this sequence in mind…

Because in just a moment, I’ll show you how you can use this simple script to turn $100 into a retirement fortune… in the next 12 months.

There’s no need to risk your hard-earned money trying to guess when these currencies will move…

Because Every Single Boom in History Has Followed this Script

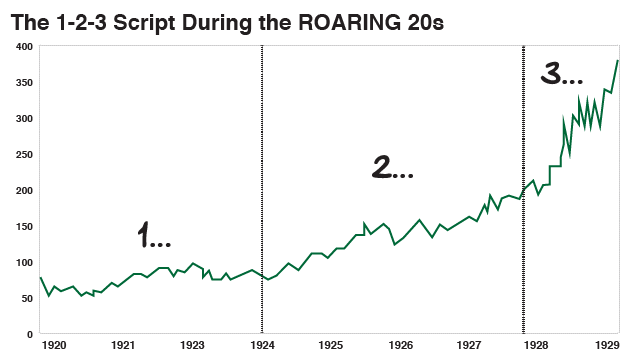

The so-called roaring ’20s followed this same roadmap…

First, only early enthusiasts invested in the new technologies of the time, such as radio, the car and easy access to electric power.

Then in 1924 institutional investors jumped in…

Finally, in the late 1920s the news started reporting stories of overnight fortunes.

And regular folks started to wonder: Why not me?

They started borrowing money just to buy stocks. The result?

Stocks went straight up. In 1928 alone, the stock market doubled.

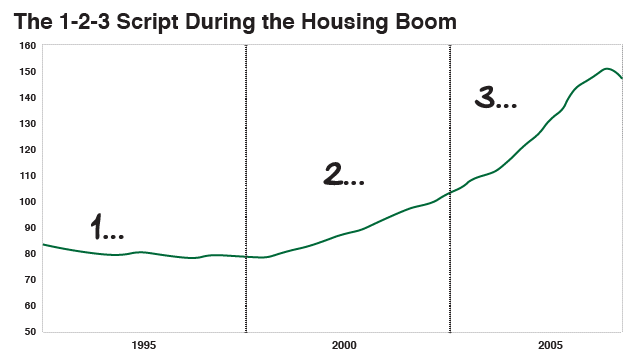

And it’s not just stock booms that follow this 3-step script, either. The US housing boom also followed this roadmap…

Take a look…

The biggest jump in housing prices happened from 2003 to 2006…

When we entered stage 3 of the boom… and flipping houses became a national obsession.

And it’s not just here in the US.

Something similar happened during the historic boom in Japanese stocks…

With the masses pushing stocks straight up during stage 3… in the 1980s.

This script is so reliable that it goes back centuries…

Just look what happened with shares of the South Sea Company in 1720…

And with the boom in tulip bulbs in Holland during the early 1600s.

Isn’t that incredible?

No matter what asset class…

No matter the geographic location…

And no matter what year the boom happened...

Every single boom throughout history has followed the same script.

It works 100% of the time.

And in each one of those booms, people who knew how to use this script walked away with a fortune.

Those who didn’t... lost all their money

So where are we now in this digital currency boom?

Let me you walk you through the three stages, using Bitcoin as an example…

When Bitcoin “went public” in 2010, very few people understood the opportunity.

Much like the internet in 1994, most people dismissed it as a useless technology.

Only early enthusiasts invested in Bitcoin…

People like Brian Z., from San Francisco.

Back in 2010 he bought about 20,000 Bitcoins…

When the digital currency was trading for just over 15 cents.

Well, that initial investment of $3,000 is now worth as astounding $85.9 million!

He now spends his days traveling the world in ultra-luxurious style… staying exclusively in 5-star suites. He says:

“I have everything I’ve ever dreamed of. I fly all over the world visiting friends, I do whatever I want with my time and I never have to worry about money for the rest of my life.”

Imagine if that happened to you!

That could be your reality a few months from now…

But only if you invest in the right smaller cryptocurrencies… the ones that are still cheap.

Because the truth is… the big money in Bitcoin has already been made by early enthusiasts.

That was stage 1 of the boom.

We’ve moved into stage 2 around 2014...

When institutional investors, aka “the smart money,” started investing in Bitcoin.

The Smart Money is Going All In

What started in 2014 has only intensified this year.

You see, the “smart money” is not just looking at Bitcoin anymore.

With hundreds of cryptocurrencies exploding 3,475%, 21,611% and even 81,465%...

They’re now investing in these smaller, lesser-known digital currencies.

Forbes even published the following headline recently…

And went on to say:

“Given how many new crypto millionaires have been minted… old hands in finance who want in on this new world of value are launching funds.”

Aside from these 15 new hedge funds…

There are 70 more in the pipeline!

Once all these 70 funds get set up, billions in new capital will flow into these cryptocurrencies…

Helping push them even higher.

Ronni Moas, founder of Standpoint Research, explains this gold rush:

“The floodgates are opening. I believe there are hedge funds and very deep-pocketed individuals going into this now, really hundreds of millions of dollars.”

And get this…

Fidelity, which has $6.2 trillion in assets under management, has just partnered with Coinbase, the most popular cryptocurrency exchange.

Imagine what will happen if some of those trillions start moving into cryptos!

Simply put, institutional investors are jumping in with both feet. This is all part of stage 2 of my script.

And to Prove My Point,

Here’s an “Inside Scoop”…

Andreessen Horowitz and Sequoia Capital are two of the most highly respected venture capital firms in Silicon Valley.

That’s because they tend to see major technology trends before anyone else.

They’ve made billions by investing very early in social media companies like Facebook, LinkedIn and Twitter.

Simply put, when these guys invest in something new, you should pay close attention.

Well, Forbes has just reported that they’re “secretly” investing in a cryptocurrency fund called MetaStable.

And I knew that way before the media reported on it. How?

Because I’m good friends with one of the founders of the fund.

Andreessen Horowitz and Sequoia Capital are two of the most highly respected venture capital firms in Silicon Valley.

That’s because they tend to see major technology trends before anyone else.

They’ve made billions by investing very early in social media companies like Facebook, LinkedIn and Twitter.

Simply put, when these guys invest in something new, you should pay close attention.

Well, Forbes has just reported that they’re “secretly” investing in a cryptocurrency fund called MetaStable.

And I knew that way before the media reported on it. How?

Because I’m good friends with one of the founders of the fund.

You see, in the last 30 years I’ve built connections that go from the head of Google X (Google’s experimental laboratory)…

To Peter Thiel, founder of PayPal and early investor in Facebook…

To billionaire Mark Cuban, owner of the Dallas Mavericks and “Shark Tank” TV show star.

I’m also connected with just about every big hedge fund manager in Manhattan…

And every major venture capital firm on both the East Coast and in Silicon Valley.

I can see behind the scenes that the “smart money” is now getting heavily involved in cryptocurrencies.

My billionaire friend Mark Cuban is investing in it... Google is in it… and so is billionaire Richard Branson.

With All This Money Flowing In, It’s No Wonder Many Cryptocurrencies are Exploding this Year

Remember when I said you could turn $100 into a retirement fortune?

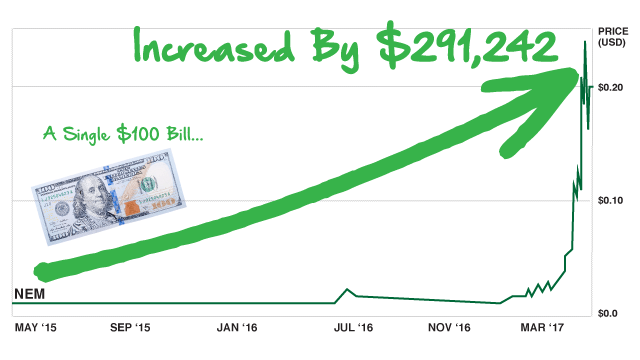

Look what happened with a little-known cryptocurrency called NEM.

It has jumped as high as 291,142% in the last couple of years.

That’s enough to turn a single $100 bill into $291,242.

That’s more than three times what the average retiree has in their retirement account.

Amazing, right?

Imagine adding almost $300,000 to your nest egg…

Starting with just $100… in just a couple of years!

That’s the power of these smaller cryptocurrencies.

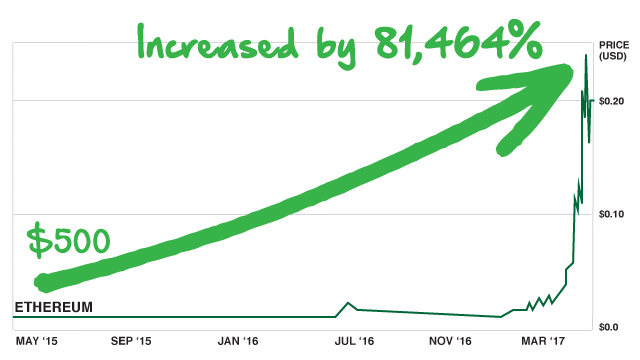

Or look what happened with another digital currency called Ethereum…

Had you put in just $500…

It would have ballooned into a retirement fortune of as much as $407,822… in just a couple of years.

And if you invested a little more, you could’ve literally walked away with millions.

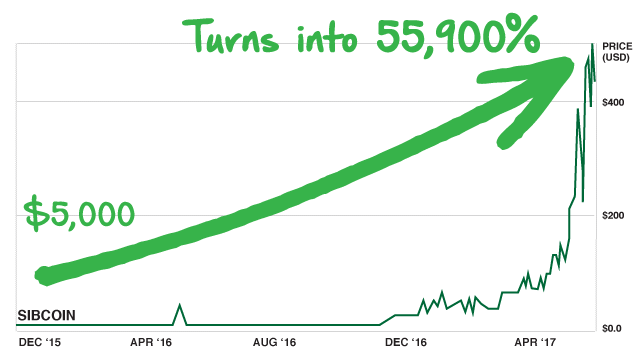

For example, a $5,000 investment in another cryptocurrency called SibCoin…

Could have paid you a $2.8 million fortune… in a matter of months.

Isn’t that incredible?

No wonder the “smart money” wants a piece of the pie.

Look, I recently had lunch with several hedge fund managers and other “Wall Streeters” in New York…

And they were all asking me about cryptocurrencies.

They want to know how to get involved…

Because they know we’ll NEVER see a boom like this again.

No comments:

Post a Comment