The "bulls" for XAU/USD were not helped by the heightened risks of a slowdown in the US economy in the third quarter following the release of data on retail sales and news of the most serious verbal attack on North Korea by Donald Trump. The president's promise to destroy a dangerous regime (in the event of his attack on the US or its allies) was taken quite calmly by investors. Markets have developed immunity or are they waiting for Pyongyang's response?

Let me remind you that geopolitical risks, low yield of US Treasury bonds and a weak dollar led to the growth of speculative "bull" rates on precious metals towards its highest levels since the beginning of the year (net position on futures and options increased by 6.1% in the week to September 12). Simultaneously, the largest stock fund SPDR Gold Shares marked its fifth consecutive weekly capital inflow (+$177 million).

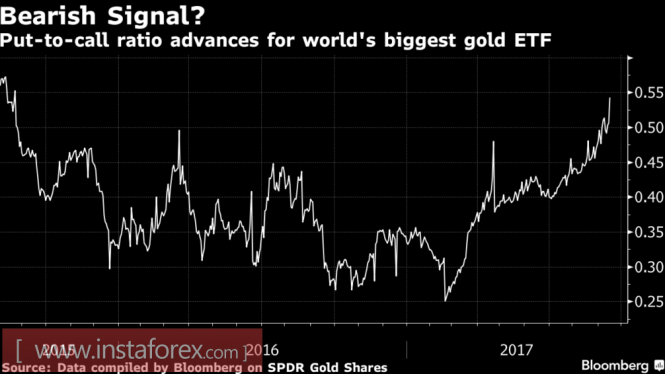

It is interesting that the risks of reversal (the ratio of the cost of put and call options) on the shares of this ETF have reached a 2-year peak, which cannot be ignored when forecasting gold prices. According to TD Securities, precious metals may well fall below $1,300 an ounce. FXTM believes that if this happens, then the decline of prices will sharply accelerate.

Dynamics of the risk of reversal on securities SPDR Gold Shares

Source: Bloomberg.

Thus, excessively inflated speculative positions, an increase in the risk of capital outflow from exchange-traded funds, and the potential continuation of the US Treasury bond yield rally against the backdrop of an increase in the likelihood of tightening the Fed's monetary policy as well as the start of the balancing process provides a vulnerable position to the bulls in XAU/USD. At the same time, nobody has canceled the factor of the weak dollar.

If the Federal Reserve reduces forecasts for GDP, inflation, unemployment and the federal funds rate (which is likely due to the slowdown in retail sales and the index of personal consumer spending), the USD index's downward trend might continue with new strength, which will have a positive effect on gold. However, in order to return to $1,350 an ounce without rejecting the tax reform of Donald Trump, Congress will unlikely accomplish it. I doubt that a new missile from North Korea would be able to suffice in order to restore the uptrend in the XAU/USD.

Technically, the "bulls" are trying to cling to the lower boundary of the ascending short-term channel. If they succeed, the chances of a second test of resistance at $1346-1352 will increase. On the contrary, leaving prices below $1300 per ounce will increase the risks of correction development in the direction of $1280 and below.

Gold, daily chart

No comments:

Post a Comment