Presumably, the trade will continue around the level of 1.1920, and the inability to get beyond this range can cause some players to lock in profits, which will return the trading instrument in the afternoon to the support area of 1.1875. As noted above, the selling prices of the producers of the eurozone may have a negative impact on the plans of the European Central Bank, since the lack of growth is unfavorable for the European economy, which showed some signs of recovery.

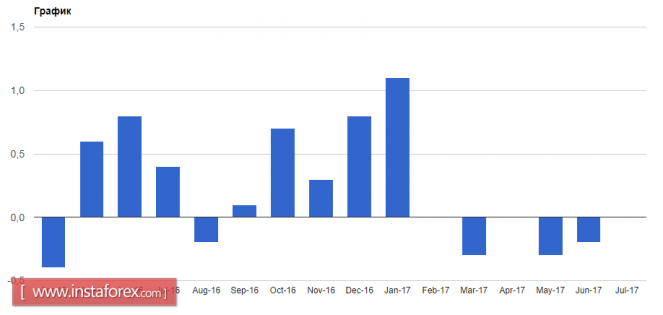

According to the report of the statistics agency, the producer price index remained unchanged in July compared to June, whereas compared to July 2016, it grew by only 2%. Economists had expected that in July, as compared to June, prices rose by 0.1%. Show full picture Despite this, the leading financial institutions, for example Societe Generale, do not see the reasons that could cause the ECB to postpone the decision to reduce the asset purchase program.

The bank expects that such a statement will be made already this Thursday, when the results of the ECB meeting will be known. Societe Generale predicts that the central bank will announce the extension of the program for six months, until June 2018, and will announce the reduction of purchases to 40 billion euros per month from the current level of 60 billion euros per month. Their colleagues from Deutsche Bank are not so optimistic about the forecasts.

According to economists, the European Central Bank in September is unlikely to make any statement on monetary policy, and a change in the program of repurchase of bonds will be announced in October this year. The British pound noticeably declined against the US dollar after the release of weak data on the purchasing managers' index for the UK construction sector, but then managed to restore its position.

So, the index of supply managers for the construction sector in August this year fell to 51.1 points from 51.9 points in July. It is worth noting that finding an index above 50 points indicates an increase in activity. As noted in the report, the main reason for the fall in the index was a reduction in public spending and uncertainty about the prospects for the UK economy.

No comments:

Post a Comment