On Friday, the lead gainer was the British pound, which continued its rapid growth after the Bank of England's meeting on Thursday. This growth was even greater - 197 points. An additional stimulant was the statement of a Bank of England Monetary Policy Committee member Gertjan Vlieghe on the possible increase in the rate in the coming months. The probability of a hike in the rate in November rose in one day from 33.2% to 49.9%

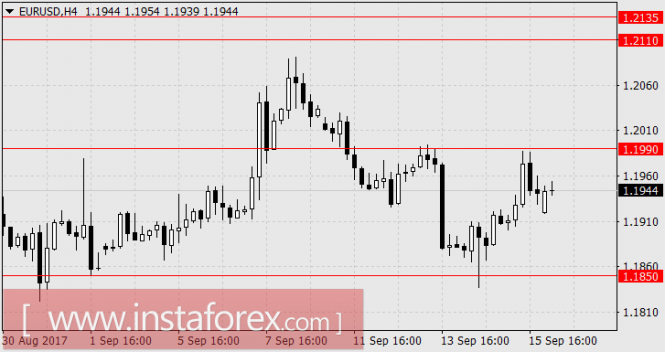

In the euro area, the July trade balance fell from 21.7 billion euros to 18.6 billion, but a 23 point increase was due to a worst performance in the US, where retail sales fell 0.2% in August, against expectations for growth of 0.1%. Core retail sales increased by 0.2% against the forecast of 0.5%. Even more disappointing was industrial production: capacity utilization in August, which fell by 0.8% while Industrial Production itself contracted by 0.9%. In the assessment of the University of Michigan, consumer confidence in September fell from 96.8 to 95.3. Business activity in the manufacturing sector of New York for the current month fell from 25.2 to 24.4 (the forecast was 18.2). Stock indexes on the previous excitement continued to set historical records, but the foreign exchange market has long been "working" against the dollar. We do not see this quite determined opposition from the US. All those signs that appeared and about which we mentioned earlier, eventually proved to be broken down or simply as unused opportunities.

Today, the final consumer price estimates for August will be released - no changes are expected: the total CPI is 1.5% y/y, the basic CPI is 1.2% y/y. Italy's trade balance for July is expected at 3.89 billion euros from 4.50 billion a month earlier. But in the US, the index of business activity in the housing market from NAHB in September is forecasted to decrease to 67 from 68. Tomorrow, upbeat data are expected on the ZEW indices of Germany and the eurozone as well as the growth of the euro zone's balance of payments in general in the July estimate.

On continuing risk appetites, we expect the euro to rise in the range of 1.2110/35, the British pound to 1.3700.

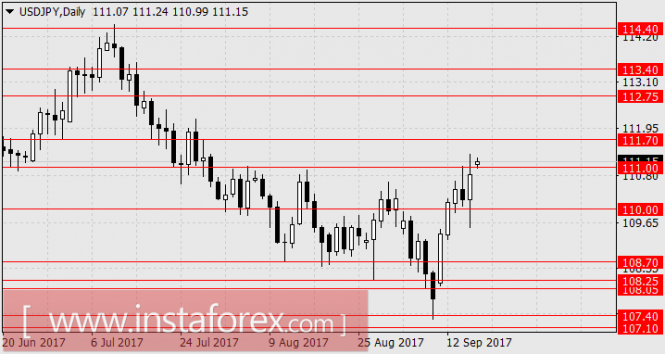

USD/JPY

Today is a public holiday in Japan, but risk appetites for the yen are even more evident than in the euro. Over the past eight days, the yen has reached the range of that of the last days of July, hitting the consolidation zone at the end of March-early April and the second half of May. Our forecast of a sharp increase in the yen from the depths of the overcritical levels (108.70) was justified. The further task of the market is to master the range of 112.75-114.40, which the market failed to make in May and for the second time in July. On Friday, the US stock index S&P 500 added 0.18%, the same day the Japanese Nikkei 225 sharply increased by 0.52%. Today, there is also an upbeat growth in other Asian markets. As the South Korean Kospi SEU gained 1.04%.

In Japan, an alternative through a snap parliamentary elections is considered in October. Japanese Prime Minister Shinzo Abe decided to take advantage of the temporary improvement of his rating (50%), which has risen amid the conflict with North Korea, and also to expand the representation in power with the automatic extension of his powers. On Wednesday, Japan's trade balance for August will be published, a forecast of 0.41 trillion yen against 0.34 trillion in July. On Thursday, the meeting of the Bank of Japan will take place, where the prospects for normalizing monetary policy are expected. But ahead of it, there will be the decision of the Fed on the normalization of the balance with the assessment of economic prospects. Given that the markets are fully prepared to accept the start of the curtailment of Fed purchases of government and mortgage obligations, the market reaction could be moderate.

After consolidation in the range of 111.00/70, we look forward to a further growth in the yen in a range of 112.75-113.40.

No comments:

Post a Comment