The price is approaching major support at 129.13 (Fibonacci retracement, horizontal overlap support) and we expect to see a bounce above this level to push the price up to at least 130.04 resistance (Fibonacci retracement, horizontal overlap resistance). Stochastic (34,5,3) is seeing strong support above 4.6% where we expect a corresponding bounce from. Buy above 129.13. Stop loss is at 128.46. Take profit is at 130.04.

NZD/USD testing major resistance, prepare to sell

The price is testing major resistance at 0.7261 (Multiple Fibonacci retracements, horizontal swing high resistance) and we expect to see a strong reaction from this level to push the price down to at least 0.7208 support (Fibonacci retracement, horizontal pullback support). Stochastic (34,5,3) is seeing major resistance below 92% and we expect a corresponding reaction off this level. Sell below 0.7261. Stop loss is at 0.7301. Take profit is at 0.7208.

USD/JPY approaching major support, prepare to buy

The price is approaching major support at 108.27 (Fibonacci extension, horizontal swing low support, channel support) where we expect a bounce from to push price up to at least 109.46 resistance (Fibonacci retracement, horizontal overlap resistance). Stochastic (34,5,3) is seeing strong support above 3.4% where we expect a corresponding bounce from. Buy above 108.27. Stop loss is at 107.92. Take profit is at 109.46.

AUD/JPY remain bullish as we continue to test support

The price has continued to test our buying area yesterday. We prepare to buy above major support at 86.92 (Fibonacci retracement, horizontal overlap support) for a bounce up to at least 87.61 resistance (Fibonacci extension, horizontal swing high resistance). Stochastic (34,5,3) is seeing strong support above 3.9% where we expect a bounce from. Buy above 86.92. Stop loss is at 86.52. Take profit is at 87.61.

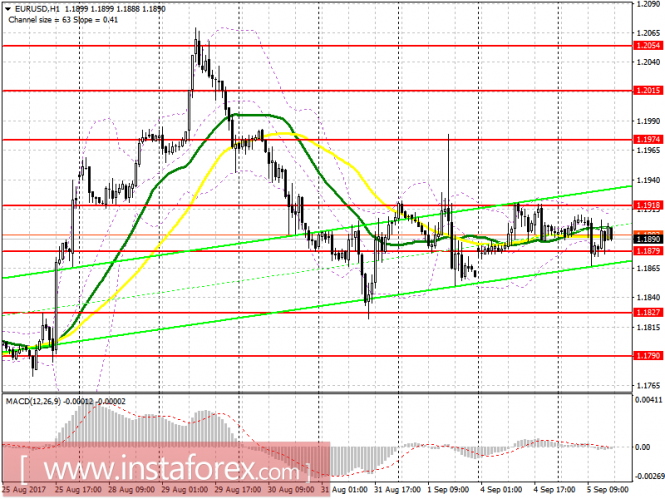

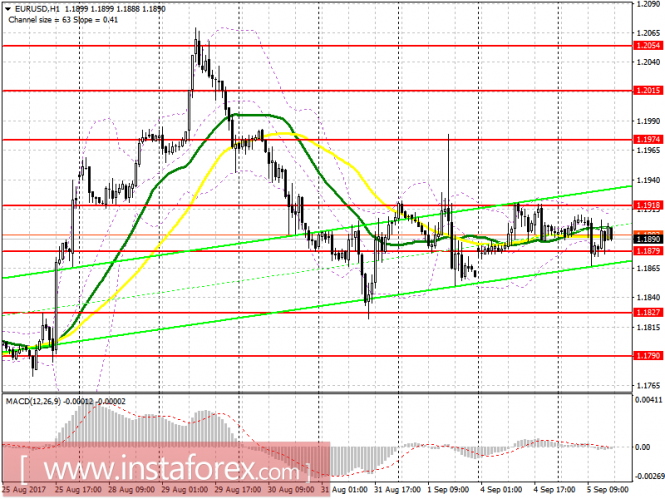

Trading plan for the US session on September 5 EUR/USD and GBP/USD

EUR/USD To open long positions for EURUSD, you need: There are no critical changes in the plan. While the trade is higher than 1.1879, you can count on the bulls' attempt to reach the level of 1.1918, the breakdown with fastening on which will drive the EUR/USD pair to return to the level of Friday's high of 1.1974, where I recommend locking in the profit. If the euro goes below 1.1879, I recommend returning to buying only after updating the level of 1.1827 or to a rebound from 1.1790, if sellers failed to do it in the first half of the day. To open short positions for EURUSD, you need: The unsuccessful attempt to gain a foothold below 1.1879 led to a return of the pair towards the middle of the channel. At the moment, I recommend going back to selling only after a successful attempt to break and consolidate below 1.1879 with an exit at 1.1827 and update the low around 1.1790. If the euro rises in the second half of the day, it's best to monitor selling on a false breakout at 1.1918 or on a rebound from 1.1974.

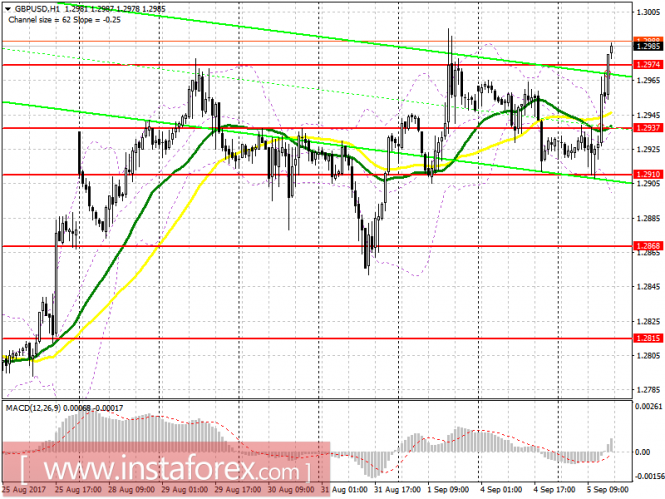

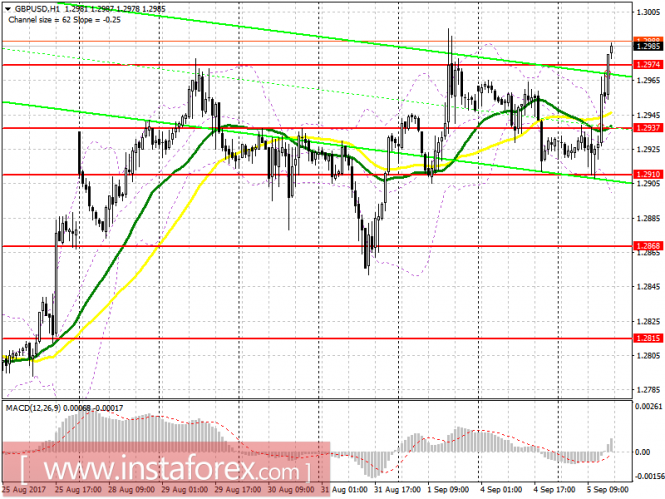

GBP/USD

EUR/USD To open long positions for EURUSD, you need: There are no critical changes in the plan. While the trade is higher than 1.1879, you can count on the bulls' attempt to reach the level of 1.1918, the breakdown with fastening on which will drive the EUR/USD pair to return to the level of Friday's high of 1.1974, where I recommend locking in the profit. If the euro goes below 1.1879, I recommend returning to buying only after updating the level of 1.1827 or to a rebound from 1.1790, if sellers failed to do it in the first half of the day. To open short positions for EURUSD, you need: The unsuccessful attempt to gain a foothold below 1.1879 led to a return of the pair towards the middle of the channel. At the moment, I recommend going back to selling only after a successful attempt to break and consolidate below 1.1879 with an exit at 1.1827 and update the low around 1.1790. If the euro rises in the second half of the day, it's best to monitor selling on a false breakout at 1.1918 or on a rebound from 1.1974.

GBP/USD

To open long positions for GBPUSD, you need: Buyers successfully consolidated above 1.2937 and are trying to take the level of 1.2974, which will lead to further growth of the pound in the region of new weekly highs of 1.3014 and 1.3050, where I recommend locking in profits. In case the GBP/USD pair falls below the level of 1.2974, it is best to return to buying after the test at 1.2955. To open short positions for GBPUSD, you need: When selling the pound, I recommend that it be done only after a resistance of 1.3014 is updated or on the rebound from the level of 1.3050. In case the GBP/USD pair declines below the level of 1.2974, you can also see short positions on the pound with the main purpose of falling to the area of 1.2955, and also for an update at 1.2937.

Indicators MA (average sliding) 50 days - yellow MA (average sliding) 30 days - green MACD: fast EMA 12, slow EMA 26, SMA Bollinger Bands 20

Vacations of investors continue

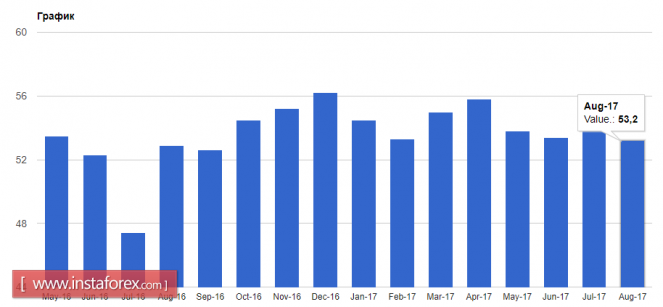

The European currency reacted with a slight decline to the weak data on the euro area services, as well as on retail sales, which continued to slide. According to the statistics agency, the index of supply managers for the service sector of Italy in September this year was at 55.1 points, while economists expected it to growth to 55.3 points. In France, the economists predicted the PMI for France's services. The only country in the eurozone, where the services sector continued to grow, was Germany. According to the report of the statistics agency, the PMI for the services sector proved to be better than expected in 53.5 points in August against 53.4 points in July this year. Such weak data indicate a possible slowdown in the eurozone economy. A slight pressure on the euro was also noticeable after the release of data on retail sales, which in July this year fell by 0.3% compared with June. Statements by Fed official Lael Brainard did not support the US dollar, which surrendered all the won positions to the European currency. Brainard said that the Fed should be cautious about tightening monetary policy, as long as it is not confident in achieving a target inflation rate of 2%. As for the technical picture, it remained unchanged. The British pound did not experience any problems after the data showed that the UK services sector slowed to an 11-month low, continuing its upward movement against the US dollar. Show full picture According to the report, the index of supply managers for the services in the UK fell to 53.2 points, while economists expected growth to 53.8 points.

Indicators MA (average sliding) 50 days - yellow MA (average sliding) 30 days - green MACD: fast EMA 12, slow EMA 26, SMA Bollinger Bands 20

Vacations of investors continue

The European currency reacted with a slight decline to the weak data on the euro area services, as well as on retail sales, which continued to slide. According to the statistics agency, the index of supply managers for the service sector of Italy in September this year was at 55.1 points, while economists expected it to growth to 55.3 points. In France, the economists predicted the PMI for France's services. The only country in the eurozone, where the services sector continued to grow, was Germany. According to the report of the statistics agency, the PMI for the services sector proved to be better than expected in 53.5 points in August against 53.4 points in July this year. Such weak data indicate a possible slowdown in the eurozone economy. A slight pressure on the euro was also noticeable after the release of data on retail sales, which in July this year fell by 0.3% compared with June. Statements by Fed official Lael Brainard did not support the US dollar, which surrendered all the won positions to the European currency. Brainard said that the Fed should be cautious about tightening monetary policy, as long as it is not confident in achieving a target inflation rate of 2%. As for the technical picture, it remained unchanged. The British pound did not experience any problems after the data showed that the UK services sector slowed to an 11-month low, continuing its upward movement against the US dollar. Show full picture According to the report, the index of supply managers for the services in the UK fell to 53.2 points, while economists expected growth to 53.8 points.

No comments:

Post a Comment