Improving US economic performance and higher likelihood of a third rate hike in 2017 are bearish for gold. Will XAUUSD continue falling?

Federal Reserve announced it would start reducing its $4.5 trillion balance sheet in October and signaled plans for another rate hike in 2017 and three more rate hikes in 2018 at its September 20 meeting. Fed chair Yellen said on Tuesday it would be “imprudent” to leave monetary policy on hold until inflation hits the central bank’s 2% target. Next day Boston Fed President Eric Rosengren said “regular and gradual removal of monetary accommodation seems appropriate”, expressing his support for further rate hikes. Recent data were also positive, reinforcing expectations for a third rate hike this year: US economy expanded at annualized pace 3.1% on quarter in Q2 2017, above the 3% second estimate. Durable goods orders jumped 1.7% on month in August after 6.7% drop in July. Better than expected US economic growth and increased likelihood of a third rate hike in 2017 are bearish for gold.

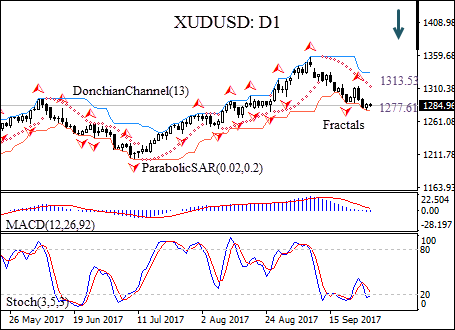

The XAUUSD: D1 is retracing lower after hitting 13-month high in the beginning of September on the daily chart.

Parabolic indicator gives a sell signal.

The Donchian channel indicates no trend yet: it is flat.

The MACD indicator is below the signal line and the gap is widening, this is bearish.

The stochastic oscillator has breached into the oversold zone, which is bullish.

We believe the bearish momentum will continue after the price closes below the lower Donchian boundary at $1277.61. A pending order to buy can be placed below that level. The stop loss can be placed above the fractal high at $1313.53. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. The most risk-averse traders may switch to the 4-hour chart after the trade and place there a stop-loss moving it in the direction of the trade. If the price meets the stop loss level ($1313.53) without reaching the order ($1277.61), we recommend canceling the position: the market sustains internal changes which were not taken into account.

Technical Analysis Summary

Position Sell

Sell stop Below 1277.61

Stop loss Above 1313.53

No comments:

Post a Comment