A similar position is maintained by the president of the Bundesbank, Jens Weidmann. In his opinion, "one should not miss a suitable opportunity to reduce the stimulus," which Weidman said in his speech in Frankfurt. The euro still looks very convincing, but the ECB's discontent with the rising euro exchange rate, which has a positive effect on the market. be dismissed. This week, the euro will be able to continue its correction, and the resumption of its rally is only possible if the US Federal Reserve does not meet the growing market expectations.

United Kingdom

The pound was finished the week with impressive growth, as investors reacted to the unexpectedly hawkish tone of the Bank of England's statement. In their comments, several members of the Monetary Policy Committee immediately expressed their confidence in the need for start-up raising rates, among which were unexpectedly the doves Gertjan Vlieghe and chief economist of the Bank of England, Andrew Haldane.

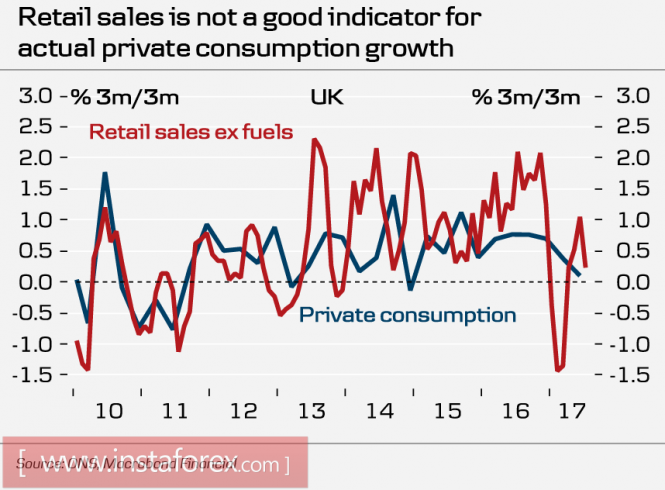

The pound's case for continued growth can be published on Wednesday, when retail sales data for the month of August will be published. It's no secret that high inflation, to which the Bank of England justifies the need to raise rates, is just a reflection of the fall in the trade-weighted rate. A weak pound led to a rise in cost of imports, which ultimately resulted in an increase in consumer prices. However, a number of other indicators, such as an increase in the average wage, are also caused by the lagging behind of growth of prices; so inflation, in fact, stands on unstable foundation.

This point is well monitored by the dynamics of retail sales, which clearly leaves much to be desired.

This week, the fourth round of Brexit talks was due to start, which was postponed for a week. On Friday, Theresa May will speak on the relationship with the EU and the growing tensions. Both parties intend to complete the process with the least losses, and there is a high probability that the Bank of England is in a hurry with the increase of rates, not to offset the inflation, but in order to raise the attractiveness of British assets. The influx of investment in the UK economy is at a very low level, and the situation requires decisive action. At the same time, the pound's rise will reduce inflationary pressures, and the Bank of England risks losing its main argument in the issues concerned with rates.

The rapid growth of the pound will lose momentum on Monday, but it's too early to speak about the possibility of a corrective decline. The market will be fully focused on the forthcoming meeting of the Fed, the pound needs an additional driver, which can strengthen the position of the Bank of England. The scenario of technical correction to 1.3350 is probable, for the continuation of growth the fundamental causes are weak.

Oil and ruble

The growth of prices contributes to strong demand and the general sentiment of the market for risky assets. Oil production in the US has not yet recovered, as well as processing, as the consequences of the hurricane allow bulls to control the ball in the oil market.

Oil and ruble

The growth of prices contributes to strong demand and the general sentiment of the market for risky assets. Oil production in the US has not yet recovered, as well as processing, as the consequences of the hurricane allow bulls to control the ball in the oil market.

No comments:

Post a Comment