When the European market opens, some Economic Data will be released, such as Unemployment Rate, Italian Monthly Unemployment Rate, Final Manufacturing PMI, German Final Manufacturing PMI, French Final Manufacturing PMI, Italian Manufacturing PMI, and Spanish Manufacturing PMI. The US will release the Economic Data, too, such as ISM Manufacturing Prices, Construction Spending m/m, ISM Manufacturing PMI, and Final Manufacturing PMI, so, amid the reports, EUR/USD will move in a low to medium volatility during this day.

TODAY'S TECHNICAL LEVEL: Breakout BUY Level: 1.1864.

Strong Resistance:1.1857.

Original Resistance: 1.1846.

Inner Sell Area: 1.1835.

Target Inner Area: 1.1807.

Inner Buy Area: 1.1779.

Original Support: 1.1768.

Strong Support: 1.1757.

Breakout SELL Level: 1.1750.

Disclaimer: Trading Forex (foreign exchange) on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Fundamental Analysis of EUR/USD for October 2, 2017

EUR/USD has been quite bearish on the recent week which did show some bullish retracement towards 1.1840-50 resistance area. There has been a Gap today in the market which has been also retested as well and the price is currently progressing downward. There is a good amount of economic reports to be published this week which Is expected to inject a good amount of volatility in the market. As of the recent 2 days of price action, EUR was expected to start with the lead this week but the price action shows a different point of view. Today, EUR Spanish Manufacturing PMI report is going to be published which is expected to show an increase to 53.2 from the previous figure of 52.4, Italian Manufacturing PMI report is expected to increase to 56.9 from the previous figure 56.3, French Final Manufacturing PMI is expected to be unchanged at 56.0, German Final Manufacturing PMI is expected to be unchanged at 60.6, Final Manufacturing PMI is expected to be unchanged at 58.2, Italian Monthly Unemployment Rate is expected to decrease to 11.2% from the previous value of 11.3% and EUR Unemployment Rate is expected to decrease as well to 9.0% from the previous value of 9.1%. On the USD side, today Final Manufacturing PMI report is going to be published which is expected to be unchanged at 53.0, ISM Manufacturing PMI report is expected to decrease to 57.9 from the previous figure of 58.8, Construction Spending report is expected to show an increase to 0.4% from the previous negative value of -0.6% and ISM Manufacturing Prices is expected to increase to 64.5 from the previous figure of 62.0. As of the current situation, EUR has a series of economic reports to be published today where most of the reports are expected to be unchanged but as of the recent performance of EUR economic reports it can be expected that we might see some mixed results and on the USD side as of the reports are forecasted to show growth which can lead to further gains on the USD side in the coming days. This week ECB President Draghi is going to speak on Wednesday and US Non-Farm Employment Change and Unemployment Rate reports are going to be published on Friday. So as the starting of the month with a good amount of high impact events and reports to be published on both currency of this pair, a good amount of volatility is expected to hit the market this week whereas USD is expected to have an upper hand over EUR with the gains.

Now let us look at the technical view, the price started the week with a gap whereas it has also rejected it already and currently showing some bearish pressure. The recent price surged higher towards 1.1840-50 area but could not sustain the bullish pressure and ended up opening the first week of the month with a bearish gap. As of the current scenario, as the price remains below 1.1900-1.1850 resistance area the bearish bias is expected to continue further with a target towards 1.1620 support area.

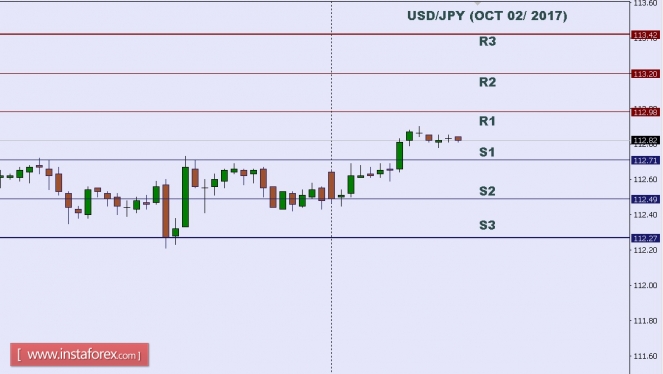

Technical analysis of USD/JPY for Oct 02, 2017

In Asia, Japan will release the Final Manufacturing PMI, Tankan Non-Manufacturing Index, and Tankan Manufacturing Index data, and the US will release some Economic Data, such as ISM Manufacturing Prices, Construction Spending m/m, ISM Manufacturing PMI, and Final Manufacturing PMI. So, there is a probability the USD/JPY will move with low to medium volatility during this day.

TODAY'S TECHNICAL LEVEL:

Resistance. 3: 113.42.

Resistance. 2: 113.20.

Resistance. 1: 112.98.

Support. 1: 112.71.

Support. 2: 112.49.

Support. 3: 112.27.

Disclaimer: Trading Forex (foreign exchange) on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

No comments:

Post a Comment