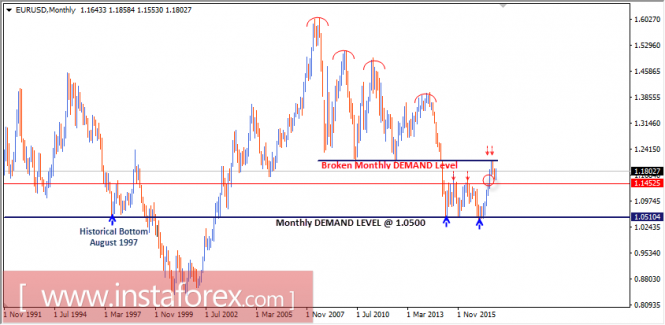

Monthly Outlook In January 2015, the EUR/USD pair moved below the major demand levels near 1.2050-1.2100 (multiple previous bottoms set in July 2012 and June 2010).

Hence, a long-term bearish target was projected toward 0.9450. In March 2015, EUR/USD bears challenged the monthly demand level around 1.0500, which had been previously reached in August 1997.

In the longer term, the level of 0.9450 remains a projected target if any monthly candlestick achieves bearish closure below the depicted monthly demand level of 1.0500.

However, the EUR/USD pair has been trapped within the depicted consolidation range (1.0500-1.1450) until the current bullish breakout was executed above 1.1450.

The current bullish breakout above 1.1450 allowed a quick bullish advance towards 1.2100 where recent evidence of bearish rejection was expressed (note the previous Monthly candlestick of September).

Daily Outlook In January 2017, the previous downtrend was reversed when the Inverted Head and Shoulders pattern was established around 1.0500. Since then, evident bullish momentum has been expressed on the chart.

As anticipated, the ongoing bullish momentum allowed the EUR/USD pair to pursue further advance towards 1.1415-1.1520 (Previous Daily Supply-Zone).

The daily supply zone failed to pause the ongoing bullish momentum. Instead, evident bullish breakout was expressed towards the price level of 1.2100 where the depicted Head and Shoulders reversal pattern was expressed.

If the recent bearish breakout persists below 1.1700 (neckline of the reversal pattern), a quick decline should be expected towards the price zone of 1.1415-1.1520 (Initial targets for the depicted H&S pattern). Bearish target for the depicted Head and Shoulders pattern extends towards 1.1350.

However, to pursue the mentioned target level, significant bearish pressure is needed to be applied against the mentioned zone (1.1415-1.1520).

Trade Recommendations Recent price action around the price zone of 1.1520-1.1415 indicated evident bullish recovery.

This scenario remains valid as long as the recent low around 1.1550 remains unbroken. On the other hand, the current price levels around 1.1850 should be watched for a possible short-term SELL entry if enough bearish momentum is maintained. (Note the shooting-star daily candlestick of yesterday).

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

No comments:

Post a Comment