Technical Observation:

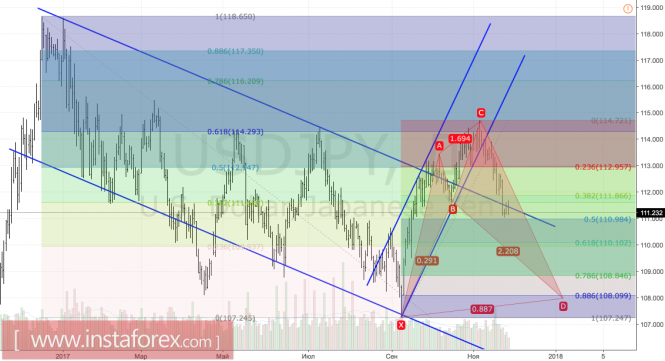

According to the daily chart above, Usd is still very bearish, and while the price is still below the support line 111.64, I expect further decline towards 108.16 or even lower. As it is, I'm waiting for a second pullback towards 111.64 to pick for a short position with my take profit fixed at 108.16. My advice, place a pending sell limit order around 111.64 with your stop loss slightly above the previous day's highest high, 111.77 and a take profit at 108.16. If you went short earlier, then remain short towards 108.13

Technical Levels

Resistance levels

R1: 111.92

R1: 112.63

R3: 113.73

Pivot

111.54

Support Levels

S1: 109.34

S2: 110.43

S3: 110.82

Trade Signal

Place a pending sell limit order around 111.64

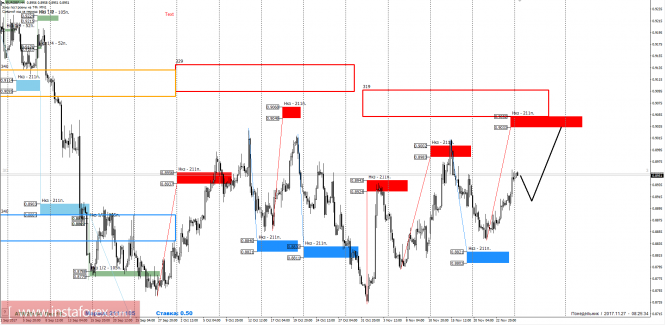

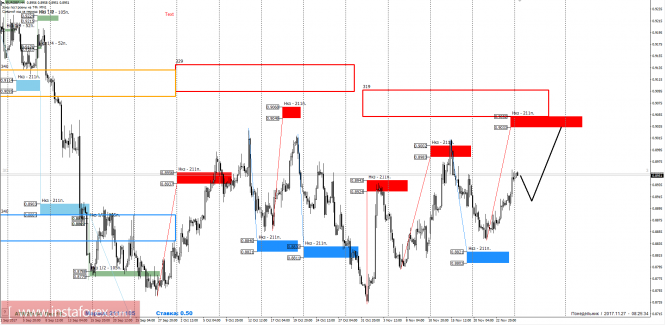

Trading Forecast EUR/GBP 11/27/2017

On Friday last week, the reversal pattern was formed which made the upward movement a priority. The target growth is the weekly KZ 0.9052-0.9033 near the November monthly KZ.

Medium-term plan.

Place a pending sell limit order around 111.64

Trading Forecast EUR/GBP 11/27/2017

On Friday last week, the reversal pattern was formed which made the upward movement a priority. The target growth is the weekly KZ 0.9052-0.9033 near the November monthly KZ.

Medium-term plan.

The upward movement is the priority for this week, which indicates the need to find favorable prices to purchase the instrument.

Reducing the pair is considered corrective, hence, testing one of the lower control zones can be run through to open a long position.

The goal of the upward movement is the weekly KZ 0.9052-0.9033, testing this area will require full or partial fixation of purchases. It is important to note that there is a quarter maximum within the specified zone, which makes it even more significant.

Growth is able to continue from its current levels without forming a deep correction since it was previously in the upward movement. In this case, it is important to break the quarterly high, where a large offer may appear that allows gaining favorable prices for selling.

The goal of the upward movement is the weekly KZ 0.9052-0.9033, testing this area will require full or partial fixation of purchases. It is important to note that there is a quarter maximum within the specified zone, which makes it even more significant.

Growth is able to continue from its current levels without forming a deep correction since it was previously in the upward movement. In this case, it is important to break the quarterly high, where a large offer may appear that allows gaining favorable prices for selling.

Intraday plan.

The pair was fixed above the NKZ 1/2 0.8946-0.8937 on Friday, indicating a change in priority. The nearest support is the NKZ 1/4 0.8913-0.8909, testing this area will allow considering any reversal pattern for purchase. The zone is located within the average daily course which seems to be very accessible today. The determining support is the NKZ 1/2 0.8865-0.8856. As the pair is trading above this zone, the upward movement will remain a priority. The target of the bullish momentum is the weekly KZ 0.9033-0.9052.

Daytime CP is the daytime control zone. The zone formed by important data from the futures market, which change several times a year. Weekly CP is the weekly control zone. The zone formed by important futures market marks, which change several times a year.

Monthly CP is the monthly control zone. The zone is a reflection of the average volatility over the past year.

* The presented market analysis is informative and does not constitute a guide to the transaction.

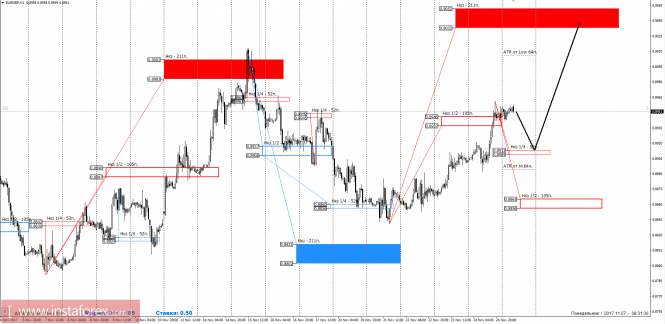

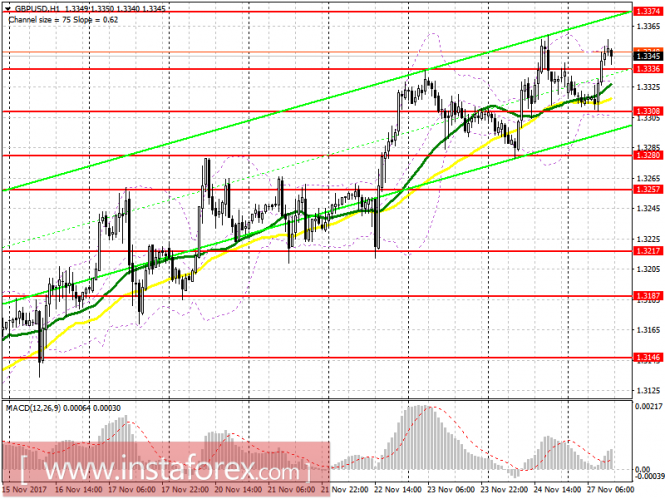

GBP/USD reacting strongly from our selling area, remain bearish

The price has risen and tested our selling area before reacting off it strongly. We remain bearish looking to sell below major resistance at 1.3340 (Fibonacci retracement, horizontal overlap resistance, bearish divergence) and we expect to see a major drop from here towards 1.3050 support (Fibonacci extension, horizontal swing low support).

Stochastic (55,3,1) also sees major resistance at 96% and there's bearish divergence signaling that a reversal is impending.

Sell below 1.3340. Stop loss is at 1.3467. Take profit is at 1.3050.

AUD/USD dropping nicely from our selling area, remain bearish

The price has made a fake breakout before reversing strongly from our selling area. We remain bearish looking to sell on strength below major resistance at 0.7629 (Fibonacci retracement, horizontal overlap resistance, channel resistance,

Fibonacci extension, bearish divergence) and we expect to see a strong drop from this level to push the price down to at least 0.7537 support (Fibonacci extension, horizontal swing low support).

Stochastic (55,3,1) is seeing strong resistance at 96% where we expect a corresponding reaction off. We can also see bearish divergence vs the price signaling that a strong drop is impending.

Sell below 0.7629. Stop loss is at 0.7670. Take profit is at 0.7537.

The yen follows the path of the euro

Fibonacci extension, bearish divergence) and we expect to see a strong drop from this level to push the price down to at least 0.7537 support (Fibonacci extension, horizontal swing low support).

Stochastic (55,3,1) is seeing strong resistance at 96% where we expect a corresponding reaction off. We can also see bearish divergence vs the price signaling that a strong drop is impending.

Sell below 0.7629. Stop loss is at 0.7670. Take profit is at 0.7537.

The yen follows the path of the euro

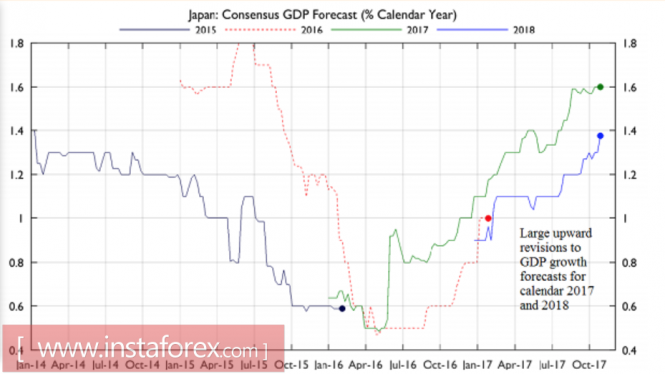

While the focus of investors on foreign exchange is the policy, the most interesting currency of the week will be the Japanese yen. BoJ's strategy of targeting the yield curve made it more sensitive to the rates of the US debt market, with the increase in uncertainty leading to a decline in the USD/JPY quotes. However, this is by no means the only reason for the success of the "bears" in the analyzed pair.

One of the key drivers of the strengthening of the euro this year were Mario Draghi's hints on the normalization of the monetary policy of the ECB in June. Despite the readiness of the regulator to adhere to monetary expansion, he replaced the word "deflation" with "reflation," which signaled an attack by the bulls on the EUR/USD pair. Something similar occurred in November with the Japanese yen. Large banks have long argued that the BoJ buys fewer assets than it is provided for under the terms of the quantitative easing program. However, by the end of autumn, the central bank's representatives paid attention to it.

For example, Haruhiko Kuroda spent a lot of time talking about the shortcomings of the yield curve that targets policy, and the new member of the Board of Directors, Hitoshi Suzuki, said that monetary policy can be changed in 2018. At the same time, the permanent improvement of the health of the economy of Japan, an increase in GDP forecasts and a strong labor market are factors that make it possible to rely on accelerating inflation and the reduction of the real yield of bonds.

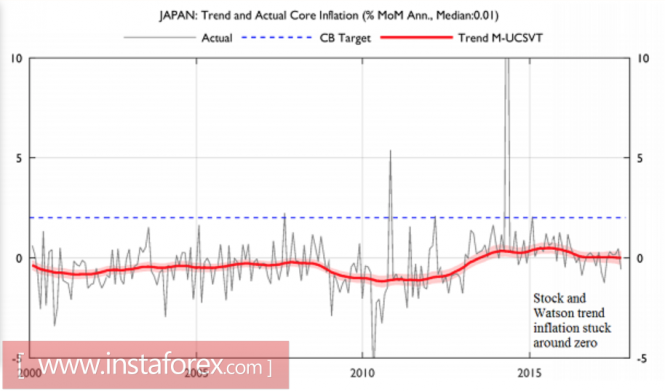

Dynamics of GDP forecasts for Japan

One of the key drivers of the strengthening of the euro this year were Mario Draghi's hints on the normalization of the monetary policy of the ECB in June. Despite the readiness of the regulator to adhere to monetary expansion, he replaced the word "deflation" with "reflation," which signaled an attack by the bulls on the EUR/USD pair. Something similar occurred in November with the Japanese yen. Large banks have long argued that the BoJ buys fewer assets than it is provided for under the terms of the quantitative easing program. However, by the end of autumn, the central bank's representatives paid attention to it.

For example, Haruhiko Kuroda spent a lot of time talking about the shortcomings of the yield curve that targets policy, and the new member of the Board of Directors, Hitoshi Suzuki, said that monetary policy can be changed in 2018. At the same time, the permanent improvement of the health of the economy of Japan, an increase in GDP forecasts and a strong labor market are factors that make it possible to rely on accelerating inflation and the reduction of the real yield of bonds.

Dynamics of GDP forecasts for Japan

Source: Financial Times.

Dynamics of Japanese inflation

Source: Financial Times.

Thus, the yen enters the path that is trodden by the euro, to which, together with the uncertainty prevailing over financial markets, makes the current peak of the USD/JPY pair quite logical. Despite the growing likelihood of creating a strong coalition in Germany, this issue has not been entirely resolved. According to the results of the Bild survey, 52% of the 1,225 respondents believe that the country will receive a new government, but 39% are certain of the opposite.

At least as much as the uncertainty over the passage of the bill on tax reform through the US Congress. Reuters indicates around 2 to 6 that are dissatisfied with the contents of the document of Republican senators, while the distribution of seats in the Upper Chamber (52 to 48) suggests that each vote will be worth its weight in gold.

Donald Trump even intends to give a dinner party, during which he will try to influence the dissidents. In my opinion, if the fiscal stimulus plan does not pass through the Senate, and Angela Merkel fails to create a coalition, then the USD/JPY pair will continue to move upwards in the direction of 108.

In this scenario, one should expect large-scale selling in the US and German stock markets associated with them, a deterioration in the global appetite for risk and the growth in demand for certain assets - "safe haven." On the contrary, the success of both events will increase the risks of returning the quotations of the analyzed pair towards 113. Technically, the support breakthroughs at 111 and 109.95-110.1 will allow the "bears" to count on the implementation of the target by 88.6% on the "Shark" pattern.

USD/JPY, daily chart

Daily review of GBP / JPY and EUR / JPY on 27.11.17. Ichimoku Indicator

Bears were able to maintain the situation under the resistance while preserving certain advantages. However, the recent events further indicate for consolidation with a slight decrease than the full-fledged downward movement. Rivals continuously attempt to change the balance of power.

The zone outside the resistance range of 149.40 (week-old Tenkan + upper day cloud + monthly Fibo Kijun) and the liquidation of the daytime cross (Kijun 149.76 + Fibo Kijun 150.26) can significantly affect the development of the situation.

As for players on the fall, the benchmarks for the decline remained in place and the nearest support was the weekly Fibo Kijun (147.41), then Senkou Span B of the daytime cloud (146.06) and the weekly Kijun (145.74).

The major concern at this moment is the resumption of the resistance to take the H4 cloud, strengthened by the day Tenkan (148.58).

Securing a position above this zone can change the balance of lower timeframes and return the pair towards the testing of resistance of the higher time intervals (149.40-76 - 150.26). This week, the benchmarks for the decline have maintained their position currently at 147.41 - 146.06 - 145.74.

EUR / JPY

Rising players remains hoping for some favorable changes in the situation. As a result, they managed to optimally close the week and returned to resistance in the final levels of the day's cross (Kijun 132.83 + Fibo Kijun 133.23).

The major tasks for the rising players are currently the liquidation of the day's cross and a secured position above the day's cloud (Senkou Span A 132.66), strengthened with a week-long Tenkan (132.83).

The Cloud H4 closed the day before the resistance levels of higher timeframes turned into support (132.83 - 132.51 - 132.10). To maintain the advantages of increasing players in the current situation, it is necessary to gain a foothold in the upper limit. In case the rise may continue, the upward support will serve as a target for the breakdown of H4 cloud and previous maximum extremes.

Indicator parameters:

all time intervals 9 - 26 - 52

The color of indicator lines: Tenkan (short-term trend) - red,

Kijun (medium-term trend) - green,

Fibo Kijun is a green dotted line,

Chinkou is gray,

clouds: Senkou Span B (SSB, long-term trend) - blue,

Senkou Span A (SSA) - pink.

The color of additional lines: support and resistance MN - blue,

W1 - green, D1 - red, H4 - pink, H1 - gray,

horizontal levels (not Ichimoku) - brown,

trend lines - purple.

Trading plan for the US session on November 27 EUR/USD and GBP/USD

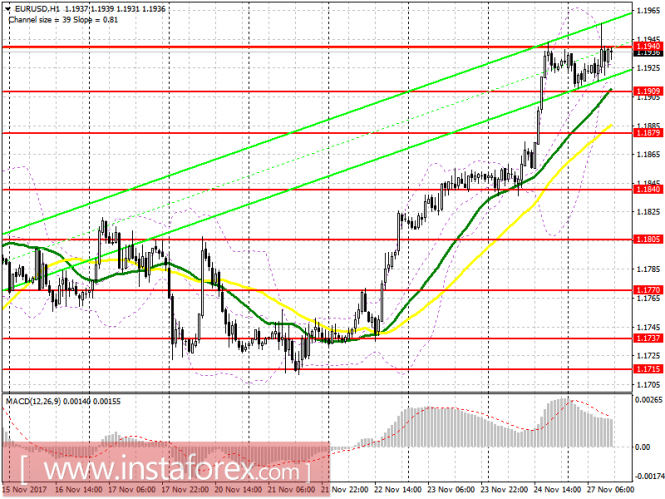

EUR/USD

To open long positions for EURUSD, it is required: The situation in comparison with the morning forecast has remained unchanged.

It would be best to consider new long positions only after a breakdown and consolidation above 1.1940, which was not possible to do in the first half of the day. The main goal of the buyers will be the renewal of 1.1981 with the release to a new monthly high in the region of 1.2004. In the event of a decline in the euro, opening long positions is best done after the test of 1.1879 or on a rebound from 1.1840.

To open short positions for EURUSD, it is required:

The false breakdown and a return to the level of 1.1940 with a divergence to MACD has not yet led to a larger selling of the euro. However, finding the pair below 1.1940 keeps the downside potential for the purpose of breakdown and consolidation under the level of 1.1909, which will result in the update of the larger support at 1.1879. The main goal of the sellers will be the area of 1.1840, where it is advised to lock in the profit for today.

EUR/USD

To open long positions for EURUSD, it is required: The situation in comparison with the morning forecast has remained unchanged.

It would be best to consider new long positions only after a breakdown and consolidation above 1.1940, which was not possible to do in the first half of the day. The main goal of the buyers will be the renewal of 1.1981 with the release to a new monthly high in the region of 1.2004. In the event of a decline in the euro, opening long positions is best done after the test of 1.1879 or on a rebound from 1.1840.

To open short positions for EURUSD, it is required:

The false breakdown and a return to the level of 1.1940 with a divergence to MACD has not yet led to a larger selling of the euro. However, finding the pair below 1.1940 keeps the downside potential for the purpose of breakdown and consolidation under the level of 1.1909, which will result in the update of the larger support at 1.1879. The main goal of the sellers will be the area of 1.1840, where it is advised to lock in the profit for today.

GBP/USD

To open long positions for GBP/USD, it is required: According to the morning forecast, the buyers fulfilled the level of 1.1308 and a steadying above 1.3336.

While the trade is conducted over this range, one can expect a continuation of the upward wave with an update of the monthly high near 1.3374, where it is advised to lock in the profit. If the pound drops below 1.3336, it is advised to revert to long positions only after the 1.3308 update is repeated

To open short positions for GBP/USD, it is required:

To open short positions on the pound, it is best to return after updating the level of 1.3374 or after returning and a consolidation under the intermediate support of 1.3336, which will allow you to count on a test of daily lows around 1.3308.

Indicator description

Moving Average (average sliding) 50 days - yellow

Moving Average (average sliding) 30 days - green

MACD: fast EMA 12, slow EMA 26, SMA

Bollinger Bands 20

No comments:

Post a Comment