Technical Observation:

After the bullish pin bar seen on the weekly chart, Gbp has been trading with an increasing bullish bias momentum and will continue to rise even during this week. The last trading day's candle is a bullish engulfing candle and means the price will continue to rise towards 1.3607 or even higher. As it is on the daily chart and the 4 hour chart above, I'm waiting for a decline towards 1.3293, then buy Gbp towards 1.3607. At the moment, short positions can be recommended.

Technical Levels

Resistance levels

R1: 1.3441

R2: 1.361

R3: 1.3985

After the bullish pin bar seen on the weekly chart, Gbp has been trading with an increasing bullish bias momentum and will continue to rise even during this week. The last trading day's candle is a bullish engulfing candle and means the price will continue to rise towards 1.3607 or even higher. As it is on the daily chart and the 4 hour chart above, I'm waiting for a decline towards 1.3293, then buy Gbp towards 1.3607. At the moment, short positions can be recommended.

Technical Levels

Resistance levels

R1: 1.3441

R2: 1.361

R3: 1.3985

Pivot

1.3234

Support Levels

S1: 1.2483

S2: 1.2858

S3: 1.3065

Trade Signal

Wait and rebuy GBP around 1.3293 with your take profit at 1.3607

Eurozone

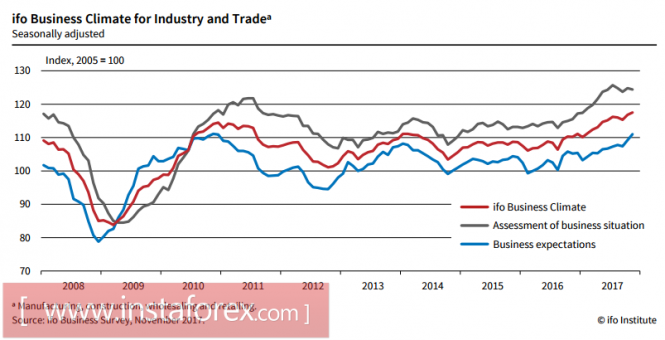

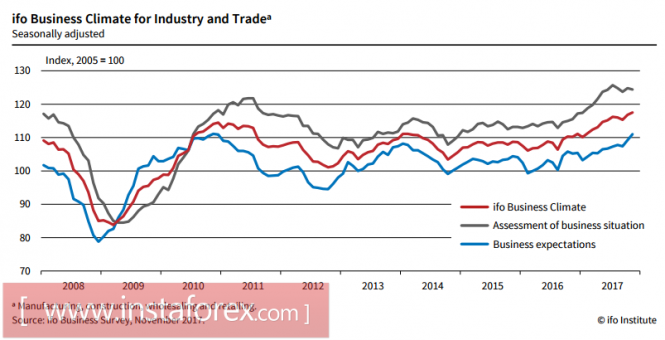

The German business climate index from IFO rose in November to a new record high of 117.5%, provoking a sharp demand for the euro and questioning the market turn in favor of the dollar, which finally began to take shape in recent weeks.

A new record is set in the production sector, the trade index is just below the historical record, and expectations in the long term of six months remain confidently positive.

At the same time, it should be noted that this result may not accurately reflect the real picture, since 90% of the responses were received even before the failure of negotiations on the formation of the German coalition became known.

At the same time, it should be noted that this result may not accurately reflect the real picture, since 90% of the responses were received even before the failure of negotiations on the formation of the German coalition became known.

Against the backdrop of positive reports from IFO and PMI Markit, it is logical to expect that consumer activity in the eurozone is also increasing. On Tuesday, the Gfk report will be published, the September 10.7 points is expected to be exceeded, which in the end will support the euro, as it will increase the chances for inflation.

On Wednesday, the European Commission will present its outlook for economic optimism, and the culmination of the week may be Friday, when preliminary inflation data will be published in November.

Forecasts are more than favorable, growth to 1.6% is forecasted against 1.4% a month earlier, and the release of data, no worse than expectations, will allow the euro to gain a foothold above 1.20 and test the September high for strength.

United Kingdom

Pound positions look weaker. The consumer confidence index from Gfk is close to the four-year lows and on Thursday, the data for November will come out, and according to forecasts the index will drop from -10p to -11p. The volume of mortgage lending at are annual lows, which indicates a low level of income.

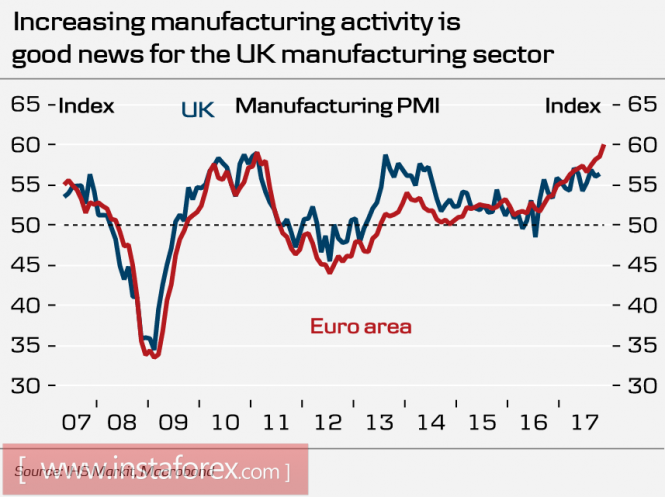

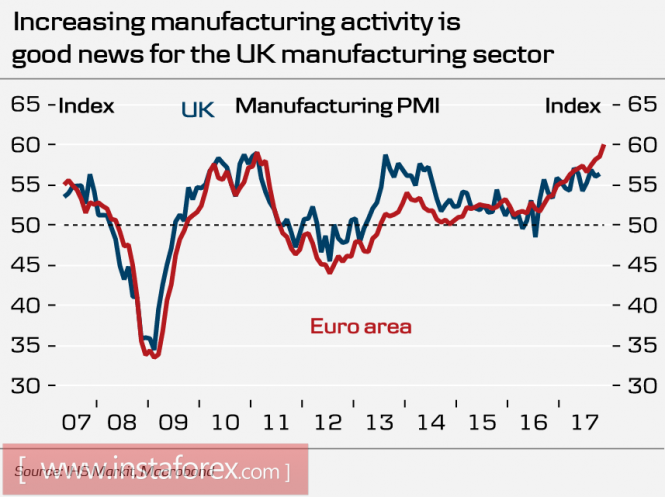

On Friday, the PMI Markit report will be published. Despite the fact that the index is in the confidently positive zone, it still lags behind the similar index for the eurozone, which increases the chances of the euro to rise against the pound.

In fact, the only significant factor supporting the pound is the expectation that the Bank of England will continue to raise rates based on high inflation, but these expectations can gradually disappear, since inflation is unlikely to continue to rise against the backdrop of weak household incomes and a drop in consumer confidence.

The Brexit factor has now come to the back burner, as the parties are holding consultations before the meeting on December 14-15. The pound, despite attempts at growth, does not look like a favorite against the dollar, and the resistance level of 1.3400 has a chance to hold, and by the end of next week there are grounds to expect a turn of GBPUSD to the downward direction with the purpose of the next testing of support 1.30.

Oil

On Wednesday, November 29, the next OPEC meeting will begin, which will have to consolidate the cartel's unified position towards OPEC + startup talks this weekend, which will extend the deal to cut production.

By the evening of Friday, oil prices began to rise again, with the Brent was fixed above 63 dollars per barrel on the background of rumors that Russia and Saudi Arabia in general agreed on a plan to extend the agreement until the end of next year, and only technical issues remained.

There were news that Russia was proposing a new formula for calculating production volumes, which would link the size of the reduction to the state of the oil market. If these rumors are confirmed, as a result, they will have a noticeable positive impact on quotes, since they will reduce the subjective factors that are the basis for negotiations each time and translate regulation into an understandable language of figures. Positive expectations will contribute to the demand for oil, which is able to update the high of November and consolidate above the results of the week above $ 66/bpd.

Harsh everyday life of the trumponomy

The US dollar finished the week with a decline and without compelling reasons to resume growth. Published on Wednesday, the FOMC protocols should not have had a significant impact on the quotes but the markets nevertheless drew attention to the fact that the topic of low inflation in the discussion of current policies caused increased concern on the Cabinet leadership.

The same conclusion was confirmed by Janet Yellen in one of her last speeches as the head of the Fed. She said that there are doubts among FOMC members that low inflation is temporary. Weak consumer activity was confirmed in the report on orders for durable goods for the month of October. Instead of the projected growth of 0.3%, there was a fall of 1.2%.

By Friday, the markets was in a state of confusion. It could be expected that the closing of the week will contribute to the demand for the dollar but the IFO report on Germany led to a sharp increase in the euro with business sentiment growing more than expected.

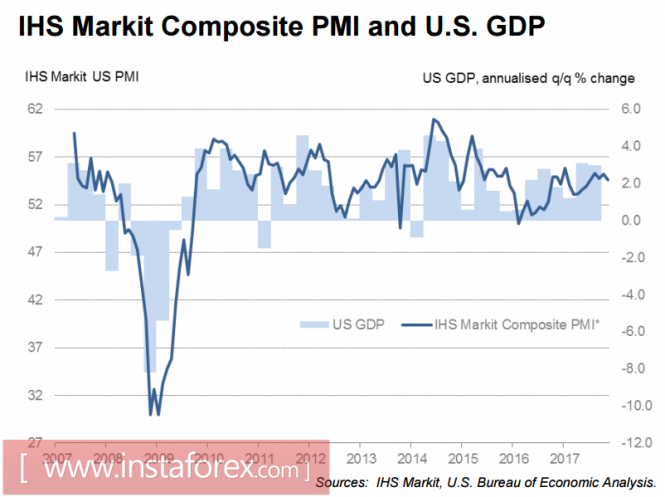

The report published yesterday showed that GDP growth in the euro area could rise to 2.3% which may eventually stimulate the ECB to take more active measures to normalize monetary policy. Activity in the US is slowing down. The PMI composite index for Markit declined in November to 54.6p. This is a 4-month low. The growth in activity in the services sector and in the manufacturing sector has also slowed.

Pound positions look weaker. The consumer confidence index from Gfk is close to the four-year lows and on Thursday, the data for November will come out, and according to forecasts the index will drop from -10p to -11p. The volume of mortgage lending at are annual lows, which indicates a low level of income.

On Friday, the PMI Markit report will be published. Despite the fact that the index is in the confidently positive zone, it still lags behind the similar index for the eurozone, which increases the chances of the euro to rise against the pound.

In fact, the only significant factor supporting the pound is the expectation that the Bank of England will continue to raise rates based on high inflation, but these expectations can gradually disappear, since inflation is unlikely to continue to rise against the backdrop of weak household incomes and a drop in consumer confidence.

The Brexit factor has now come to the back burner, as the parties are holding consultations before the meeting on December 14-15. The pound, despite attempts at growth, does not look like a favorite against the dollar, and the resistance level of 1.3400 has a chance to hold, and by the end of next week there are grounds to expect a turn of GBPUSD to the downward direction with the purpose of the next testing of support 1.30.

Oil

On Wednesday, November 29, the next OPEC meeting will begin, which will have to consolidate the cartel's unified position towards OPEC + startup talks this weekend, which will extend the deal to cut production.

By the evening of Friday, oil prices began to rise again, with the Brent was fixed above 63 dollars per barrel on the background of rumors that Russia and Saudi Arabia in general agreed on a plan to extend the agreement until the end of next year, and only technical issues remained.

There were news that Russia was proposing a new formula for calculating production volumes, which would link the size of the reduction to the state of the oil market. If these rumors are confirmed, as a result, they will have a noticeable positive impact on quotes, since they will reduce the subjective factors that are the basis for negotiations each time and translate regulation into an understandable language of figures. Positive expectations will contribute to the demand for oil, which is able to update the high of November and consolidate above the results of the week above $ 66/bpd.

Harsh everyday life of the trumponomy

The US dollar finished the week with a decline and without compelling reasons to resume growth. Published on Wednesday, the FOMC protocols should not have had a significant impact on the quotes but the markets nevertheless drew attention to the fact that the topic of low inflation in the discussion of current policies caused increased concern on the Cabinet leadership.

The same conclusion was confirmed by Janet Yellen in one of her last speeches as the head of the Fed. She said that there are doubts among FOMC members that low inflation is temporary. Weak consumer activity was confirmed in the report on orders for durable goods for the month of October. Instead of the projected growth of 0.3%, there was a fall of 1.2%.

By Friday, the markets was in a state of confusion. It could be expected that the closing of the week will contribute to the demand for the dollar but the IFO report on Germany led to a sharp increase in the euro with business sentiment growing more than expected.

The report published yesterday showed that GDP growth in the euro area could rise to 2.3% which may eventually stimulate the ECB to take more active measures to normalize monetary policy. Activity in the US is slowing down. The PMI composite index for Markit declined in November to 54.6p. This is a 4-month low. The growth in activity in the services sector and in the manufacturing sector has also slowed.

Trumpomania, which recently created a positive mood in the US economy, is clearly starting to slip. The time of expectations is over and the harsh routine begins. The Fed's policy aimed at gradual normalization should be based on a growing economy but the market does not yet see stable growth signals, except perhaps in the labor market. However, the record low unemployment does not contribute to the growth of purchasing activity.

Wage growth is not enough to create the prerequisites for inflation which in the end, may cast doubt on the ability of the Fed to withstand the schedule. On Wednesday, the second preliminary estimate for US GDP growth in the third quarter will be published. Experts are optimistic and predict a revision from 3.0% to 3.2%. The dollar, in turn, can receive the long-awaited support. Also, the price index for Q3 is expected to be revised from 2.1% to 2.2%. Meanwhile, the index of personal consumption expenditure is of special interest and a revision of it in any direction can push the dollar into motion.

On Thursday, data on real spending on personal consumption for the month of October will be published and positive dynamics is absolutely necessary here. The forecasts are rather pessimistic. It is expected that expenses will grow by 0.3% with a relative to growth by 1% in September. The revenues are expected to grow by 0.3% against 0.4% a month earlier. The slowdown will have a negative effect since it will further reduce inflation expectations and put the Fed in a difficult position, as justifying the rate hike in December will not be easy.

The key day is Friday. Markets traditionally focus on business activity indices from ISM and record growth in recent months contributed to the growth in demand for the dollar. In addition, stock markets have updated to historical highs but Markit shows a completely different picture and therefore the slowdown of indices from ISM is becoming more and more likely.

Thanksgiving Day prevented the release of the weekly CFTC report. The release was postponed to Monday and this time, the attention to it will be high. The last 6 weeks dynamics in the mood of long-term investors was in favor of the dollar, which allowed us to count on its growth. However, the prolonged period of weak inflation can contribute to a change in sentiment. If on Monday, the report shows a slowdown in demand for the dollar, especially against the defensive currencies, this will signal further growth for the yen and the euro against the dollar and significantly complicate the bullish mood.

No comments:

Post a Comment