Technical Observation:

As I said last week, Gbp rose relentlessly to the upper side but is currently stagnating along a short term resistance line 1.3473. Gbp is still very bullish even on the higher time frames, thus, I expect a rise towards 1.42 or even higher. On the way upwards the key lines to look for include 1.3667, 1.4103 and ultimately 1.4630. If these line are breached, then further rise towards 1.45 is expected. I cannot recommend any sell position at moment. But if the price can close below 1.3059, then further decline is expected

Technical Levels

Resistance levels

R1: 1.3406

R2: 1.347

R3: 1.3645

As I said last week, Gbp rose relentlessly to the upper side but is currently stagnating along a short term resistance line 1.3473. Gbp is still very bullish even on the higher time frames, thus, I expect a rise towards 1.42 or even higher. On the way upwards the key lines to look for include 1.3667, 1.4103 and ultimately 1.4630. If these line are breached, then further rise towards 1.45 is expected. I cannot recommend any sell position at moment. But if the price can close below 1.3059, then further decline is expected

Technical Levels

Resistance levels

R1: 1.3406

R2: 1.347

R3: 1.3645

Pivot

1.3296

Support Levels

1.3296

Support Levels

S1: 1.2947

S2: 1.3121

S3: 1.3232

Trade Signal

Long towards 1.4630

S2: 1.3121

S3: 1.3232

Trade Signal

Long towards 1.4630

Adjusted data on US GDP in the third quarter were better than expected, the growth rate was revised to 3.3%, and by all means, the US economy is recovering successfully. This is despite the fact that the Congress has not yet approved the draft of the tax reform.

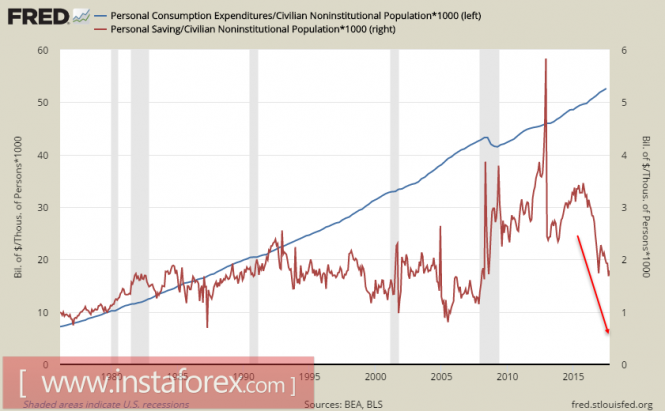

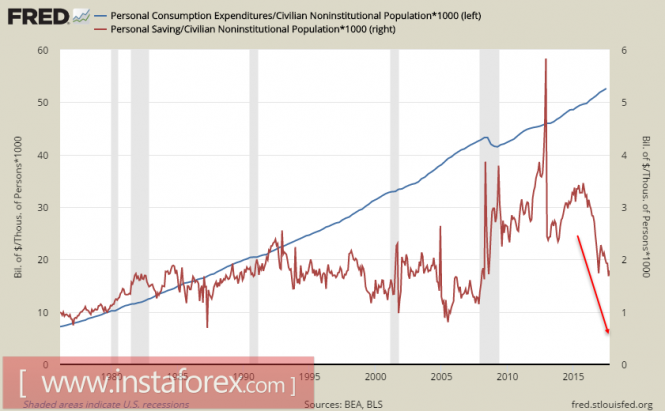

However, the main factor of positive growth is not so much the growth of the economy as the growing consumer activity. According to the updated data, in the third quarter, the personal consumption expenditure index was 1.4%, and not 1.3%, as previously reported.

This was released the day after the data on personal incomes in October also outperformed forecasts, with growth at 0.4% against expectations of 0.3%. The market reacted positively to the reports, while the data on business activity in the manufacturing sector released by ISM on Friday made it possible to revise the forecast for US GDP in the fourth quarter to reach 3.5%, reflecting generally confidently positive expectations.

At the same time, it should be noted that the positive dynamics of consumer activity is not due to fundamental changes. The simplest calculations show that the growth of expenses is not based on revenue growth, but on the growth of lending, which in turn reflects certain hopes associated with the future tax reform.

The growth of expenses in terms of the potentially able-bodied population is growing steadily, while personal savings are falling and have already reached the pre-crisis level of 10 years ago.

The grounds for such fears are: On Friday, the Senate postponed the vote on the tax reform, the stumbling block was the report of the Tax Committee, from which it follows that the reform will not lead to filling the budget and the deficit will remain at the level of at least $1 trillion in a 10-year perspective. The economic analysis of the tax reform plan by the Minister of Finance Mnuchin has not yet been released.

Therefore, the financial effect of the reforms may not be the same as the government represents. Before the markets closed on Friday, the final vote in the Congress did not take place, which ultimately contributed to the depreciation of the dollar. Another reason for the fall of the dollar is that former adviser to Donald Trump, Michael Flynn, who was accused earlier of providing false information to the FBI, is prepared to testify against Donald Trump. If this news is confirmed, the opponents of Trump will have good reasons for initiating the impeachment procedure, which will automatically put an end to the tax reform program.

This scenario can lead to a rapid reduction in inflation expectations and will call into question the possibility of the Fed to implement the outlined plan for the growth rate in 2018, and the dollar will drop sharply against the yen and the euro. Fears remain hypothetical, but the dollar is losing momentum. On Monday, the dynamics of the dollar will be determined. First of all, by political news related to the passage of the tax plan through the Congress and the development of the situation with Flynn. Acceptance of the tax plan is of fundamental importance in the light of approaching the date of December 8. Namely, before this date, the law on financing state institutions due to borrowing is in force.

On Tuesday, the ISM report on business activity in the services sector will be published, after a rapid growth in August-October, a slight slowdown is expected, but the level of PMI will remain high and can support the dollar. In general, the dollar remains the favorite, and any positive news can contribute to a new wave of buying. However, one must assume that the probability of a smooth phased solution of all the issues at the beginning of this week is not very high, and therefore the growth of the euro to 1.20 appears quite certain.

OPEC supports commodity currencies

Eurozone

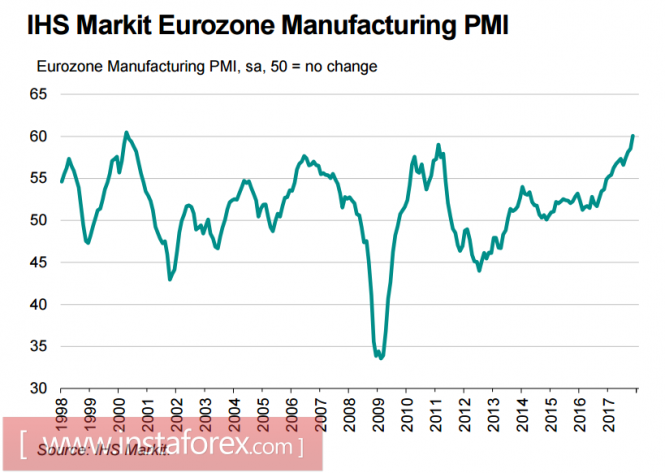

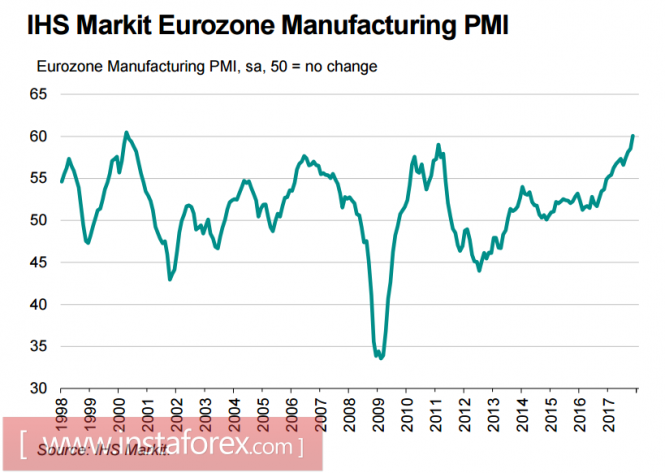

According to IHS Markit, business activity in the eurozone's manufacturing sector has been at its highest level since April 2000, reaching 60.1 points in November against 58.5 points a month earlier. Record growth is noted for all leading economies of the eurozone. In particular, Germany achieved the second highest result in the history of recordings since 1996. In France - it reached a maximum of 7.5 years, in Italy - for 81 months. Also, it should be noted the high growth in employment, investment in equipment is growing steadily, which implies continued growth in 2018.

By the end of the week, the euro was not able to reach the 1.20 mark, but there is every reason to assume that this is not the limit. The next meeting of the ECB will be held on December 14, and the market is increasingly inclined to the fact that the regulator will present a plan to taper the current soft monetary policy and may announce an upcoming rate hike.

On Tuesday, a PMI report in the services sector showed expectations are positive, the euro has its own driver, and growth may continue if there is news of a tax breakdown through the US Senate. If the tax plan is approved, then the dollar will regain its leadership, and the euro will not be able to overcome the level of 1.20, trade in this case will go into the lateral range from downward trends.

United Kingdom

The consumer confidence index from Gfk decreased to -12 points in November, with the indicator already being in negative territory for 20 months. This is the lowest value since July 2016 immediately after the Brexit vote, and reflects consumer concerns about the impact of the recent rate hike by the Bank of England. Retail trade is in decline, as household incomes lag behind inflation.

OPEC supports commodity currencies

Eurozone

According to IHS Markit, business activity in the eurozone's manufacturing sector has been at its highest level since April 2000, reaching 60.1 points in November against 58.5 points a month earlier. Record growth is noted for all leading economies of the eurozone. In particular, Germany achieved the second highest result in the history of recordings since 1996. In France - it reached a maximum of 7.5 years, in Italy - for 81 months. Also, it should be noted the high growth in employment, investment in equipment is growing steadily, which implies continued growth in 2018.

By the end of the week, the euro was not able to reach the 1.20 mark, but there is every reason to assume that this is not the limit. The next meeting of the ECB will be held on December 14, and the market is increasingly inclined to the fact that the regulator will present a plan to taper the current soft monetary policy and may announce an upcoming rate hike.

On Tuesday, a PMI report in the services sector showed expectations are positive, the euro has its own driver, and growth may continue if there is news of a tax breakdown through the US Senate. If the tax plan is approved, then the dollar will regain its leadership, and the euro will not be able to overcome the level of 1.20, trade in this case will go into the lateral range from downward trends.

United Kingdom

The consumer confidence index from Gfk decreased to -12 points in November, with the indicator already being in negative territory for 20 months. This is the lowest value since July 2016 immediately after the Brexit vote, and reflects consumer concerns about the impact of the recent rate hike by the Bank of England. Retail trade is in decline, as household incomes lag behind inflation.

No comments:

Post a Comment