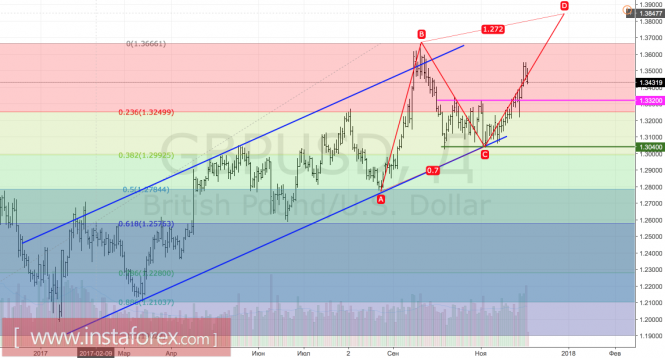

Technical Observation:

After opening slightly lower than the Friday's opening price, Gbp rose merely 90 pips before shading almost 90% the value it gained. I expect this decline to be a mere retracement towards 1.3442 where I'll be looking to rebuy Gbp towards my take profit still fixed at 1.3600. As it is on the week chart above, its still to early to rule out the possibility of retracing even further low, but if I can see a good force from the lower side, then I will consider a buy position towards 1.3600. If the price breaks above this line, then I expect a rise towards 1.4616.

Technical Levels

Resistance levels

R1: 1.3406

R2: 1.347

R3: 1.3645

Pivot

1.3296

Support Levels

S1: 1.2947

S2: 1.3121

S3: 1.3232

Trade Signal

Retracing further. I'm flat

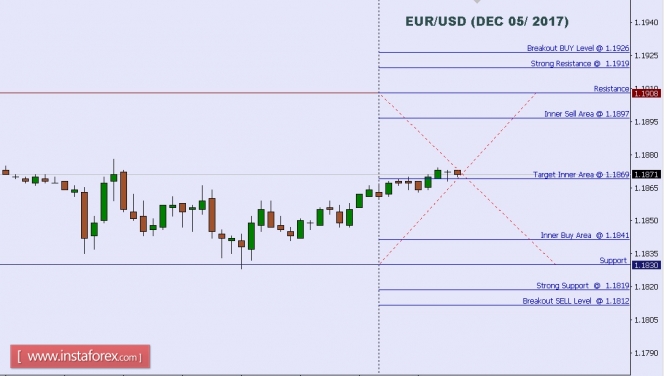

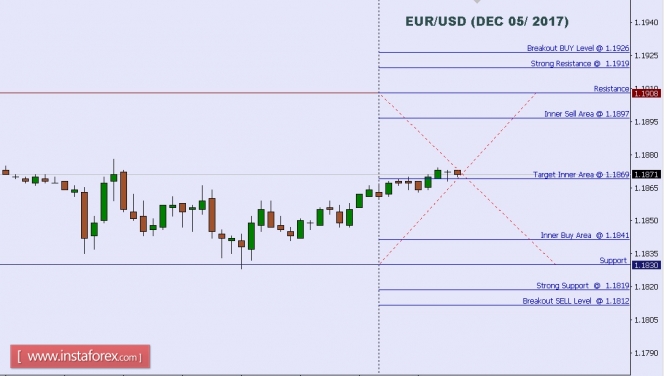

Technical analysis of EUR/USD for Dec 05, 2017

When the European market opens, some Economic Data will be released, such as Revised GDP q/q, Retail Sales m/m, Final Services PMI, German Final Services PMI, Italian Services PMI, French Final Services PMI, and Spanish Services PMI. The US will release the Economic Data, too, such as IBD/TIPP Economic Optimism, ISM Non-Manufacturing PMI, Final Services PMI, and Trade Balance, so, amid the reports, EUR/USD will move in a low to medium volatility during this day.

TODAY'S TECHNICAL LEVEL:

Breakout BUY Level: 1.1926. Strong Resistance:1.1919. Original Resistance: 1.1908. Inner Sell Area: 1.1897. Target Inner Area: 1.1869. Inner Buy Area: 1.1841. Original Support: 1.1830. Strong Support: 1.1819.

Breakout SELL Level: 1.1812.

When the European market opens, some Economic Data will be released, such as Revised GDP q/q, Retail Sales m/m, Final Services PMI, German Final Services PMI, Italian Services PMI, French Final Services PMI, and Spanish Services PMI. The US will release the Economic Data, too, such as IBD/TIPP Economic Optimism, ISM Non-Manufacturing PMI, Final Services PMI, and Trade Balance, so, amid the reports, EUR/USD will move in a low to medium volatility during this day.

TODAY'S TECHNICAL LEVEL:

Breakout BUY Level: 1.1926. Strong Resistance:1.1919. Original Resistance: 1.1908. Inner Sell Area: 1.1897. Target Inner Area: 1.1869. Inner Buy Area: 1.1841. Original Support: 1.1830. Strong Support: 1.1819.

Breakout SELL Level: 1.1812.

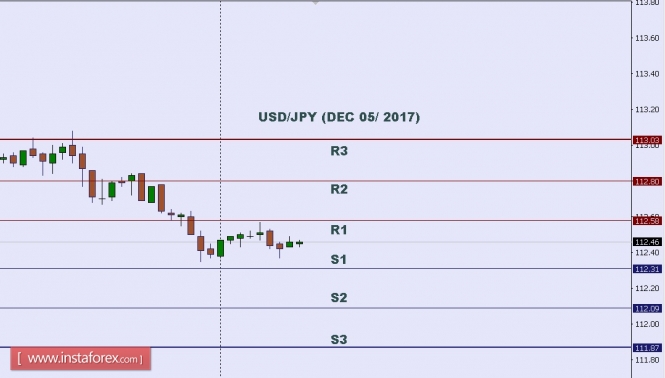

In Asia, Japan will release the BOJ Core CPI y/y and 10-y Bond Auction data, and the US will release some Economic Data, such as IBD/TIPP Economic Optimism, ISM Non-Manufacturing PMI, Final Services PMI, and Trade Balance. So, there is a probability the USD/JPY will move with a low to medium volatility during this day.

TODAY'S TECHNICAL LEVEL:

Resistance. 3: 113.03. Resistance. 2: 113.80. Resistance. 1: 112.58. Support. 1: 112.31. Support. 2: 112.09. Support. 3: 111.87.

Pound is selected from the politics

Over the past two weeks, the British pound added 2% versus the US dollar and more than 1% versus the euro, against a background of lower political risks.

Popular newspaper, like The Times, reported that London and Brussels managed to agree on the amount of compensation for the divorce, as well as on the issue of the Irish border. It seems like investors are satisfied that Theresa May is paying for a mild Brexit loss of government members.

The market will closely follow the phrasing from the table of her talks with Jean-Claude Juncker and Michel Barnier, in order to understand whether it is worth selling due to the fact on initial rumors of buying.

Weekly dynamics of the pound

Source: Bloomberg.

Weekly dynamics of the pound

Source: Bloomberg.

Positive news from Brexit, the problems of promoting tax reform in the United States, as well as the surfaced story of Russia's interference in the US presidential election, helped the GBP/USD pair to rise to a two-month high.

The rate of the sterling, weighted by trade, jumped altogether to a peak record in the last six months. At the same time, some people are concerned that Britain's GDP is growing much slower than its US and European counterparts.

Investors win back political risk and are ready to turn a blind eye to the long-term pessimistic prospects of the UK economy in order to obtain immediate benefits. Therefore, Credit Agricole believes that the hopes for progress on Brexit will push the GBP/USD pair to 1.4, near which it traded in the first half of 2016.

Commerzbank, on the contrary, is confident that investors are already sold on the factor of positive rhetoric of Brussels at the EU summit in mid-December. If they do not get what they expected, we should prepare for a selling of the sterling. On the other hand, if everything goes according to plan, then it's unlikely that the GBP/USD pair will sharply strengthen.

Commerzbank, on the contrary, is confident that investors are already sold on the factor of positive rhetoric of Brussels at the EU summit in mid-December. If they do not get what they expected, we should prepare for a selling of the sterling. On the other hand, if everything goes according to plan, then it's unlikely that the GBP/USD pair will sharply strengthen.

In such circumstances, market attention can shift to macroeconomic data and not related to it, the continuation of the cycle of normalization of the monetary policy of the Bank of England. In this regard, the pound is able to respond sensitively to the release of data on business activity in the services sector, scheduled for December 5. The index of purchasing managers in the manufacturing sector has already pleased the fans of sterling. The figures from the largest sector of the economy of the UK is awaited.

The alignment of forces in the analyzed pair will be influenced by events in the United States. The Senate passed a tax reform project with 51 votes to 49, but now both chambers of Congress are required to find a compromise on the timing of its implementation and on other issues. The dollar could not benefit from the "bullish" news, as uncertainty persists. At the same time, the willingness of former National Security Adviser Michael Flynn to cooperate with the FBI can cast a shadow on the US president, which will negatively affect the USD index. Technically, updating the November, and then the autumn peak, activates the AB = CD pattern with a target of 127.2%. It corresponds to 1.385. However, we should not rule out a retest of the upper limit of the range of the previous consolidation of 1.304-1.332.

GBP/USD, daily chart

The alignment of forces in the analyzed pair will be influenced by events in the United States. The Senate passed a tax reform project with 51 votes to 49, but now both chambers of Congress are required to find a compromise on the timing of its implementation and on other issues. The dollar could not benefit from the "bullish" news, as uncertainty persists. At the same time, the willingness of former National Security Adviser Michael Flynn to cooperate with the FBI can cast a shadow on the US president, which will negatively affect the USD index. Technically, updating the November, and then the autumn peak, activates the AB = CD pattern with a target of 127.2%. It corresponds to 1.385. However, we should not rule out a retest of the upper limit of the range of the previous consolidation of 1.304-1.332.

GBP/USD, daily chart

No comments:

Post a Comment