2017-12-18

NZD/USD is expected to trade with a bullish outlook. The pair accelerated on the upside and broke above its key resistance at 0.6990, which becomes the key support now. The 20-period moving average crossed above the 50-one. The relative strength index is bullish and calls for a further rise.

To sum up, above 0.6990, look for a new challenge with targets at 0.7050 and 0.7070 in extension.

The black line shows the pivot point. Currently, the price is above the pivot point, which is a signal for long positions. If it remains below the pivot point, it will indicate short positions. The red lines are showing the support levels and the green line is indicating the resistance levels. These levels can be used to enter and exit trades.

Resistance levels: 0.7050, 0.7070, and 0.7105

Support levels: 0.6975, 0.6960, and 0.6920

Technical analysis of USD/CHF for December 18, 2017

2017-12-18

USD/CHF is expected to trade with a bearish outlook. The pair retreated from 0.9930 and broke below its 20-period and 50-period moving averages. The relative strength index is below its neutrality level at 50.

The U.S. dollar strengthened further, boosted by optimism on Congress, getting closer to passing a tax-cut plan.

Hence, below 0.9930, look for a further drop with targets at 0.9865 and 0.985 in extension.

Chart Explanation: The black line shows the pivot point. The present price above the pivot point indicates a bullish position, and the price below the pivot points indicates a short position. The red lines show the support levels and the green line indicates the resistance levels. These levels can be used to enter and exit trades.

Strategy: SELL, Stop Loss: 0.9930, Take Profit: 0.9865

Resistance levels: 0.9955, 0.9975, and 1.0015

Support levels: 0.9865, 0.9835, and 0.9795

Technical analysis of GBP/JPY for December 18, 2017

2017-12-18

Our first target which we predicted in our previous analysis has been hit. GBP/JPY is still under pressure. The pair retreated from 151.70 and broke below its 20-period and 50-period moving average. The relative strength index is calling for another decline. The upside potential should be limited by the key resistance at 151.05.

To sum up, as long as this key level holds on the upside, a further decline to 149.85 and even to 149.40 seems more likely to occur.

Alternatively, if the price moves in the direction opposite to the forecast, a long position is recommended above 151.05 with the target at 151.50

Strategy: SELL, Stop Loss: 151.05, Take Profit: 149.85

Chart Explanation: the black line shows the pivot point. The price above the pivot point indicates long positions; and when it is below the pivot points, it indicates short positions. The red lines show the support levels and the green line indicates the resistance levels. These levels can be used to enter and exit trades.

Resistance levels: 151.50, 152.00, and 152.55

Support levels: 149.85, 149.40, and 140.40

NZD/USD Intraday technical levels and trading recommendations for December 18, 2017

2017-12-18

Daily Outlook

A recent bullish breakout above the downtrend line took place on May 22. Since then, the market has been bullish as depicted on the chart.

This resulted in a quick bullish advance towards next price zones around 0.7150-0.7230 (Key-Zone) and 0.7310-0.7380 which was temporarily breached to the upside.

The recent bearish pullback was executed towards the price zone of 0.7310-0.7380 (newly-established demand-zone) which failed to offer enough bullish support for the NZD/USD pair.

Re-consolidation below the price level of 0.7300 enhanced the bearish side of the market. This brought the NZD/USD pair again towards 0.7230-0.7150 (Key-Zone) which failed to pause the ongoing bearish momentum.

An atypical Head and Shoulders pattern was expressed on the depicted chart which initiated bearish reversal.

As expected, the price level of 0.7050 failed to offer enough bullish support for the NZD/USD pair. That's why further bearish decline was expected towards 0.6800 (Reversal pattern bearish target).

Evident signs of bullish recovery were expressed around the recent low (0.6780). That's why a bullish pullback is expected towards 0.7050.

Moreover, further bullish advance should be expected towards 0.7150 if enough bullish momentum is expressed above the price level of 0.7050.

Trade Recommendations:

An inverted Head and Shoulders pattern is being established on the chart indicating a high probability of bullish reversal.

That's why the price zone of 0.6800-0.6830 could be considered for a short-term BUY entry. Bullish persistence above 0.6950 (neckline) is mandatory to pursue towards next bullish targets.

S/L should be moved to 0.6900 to secure some profits. T/P level remains projected towards 0.7050 and 0.7110.

Intraday technical levels and trading recommendations for EUR/USD for December 18, 2017

2017-12-18

Monthly Outlook

In January 2015, the EUR/USD pair moved below the major demand levels near 1.2050-1.2100 (multiple previous bottoms set in July 2012 and June 2010). Hence, a long-term bearish target was projected toward 0.9450.

In March 2015, EUR/USD bears challenged the monthly demand level around 1.0500, which had been previously reached in August 1997.

In the longer term, the level of 0.9450 remains a projected target if any monthly candlestick achieves bearish closure below the depicted monthly demand level of 1.0500.

However, the EUR/USD pair has been trapped within the depicted consolidation range (1.0500-1.1450) until the current bullish breakout was executed above 1.1450.

The current bullish breakout above 1.1450 allowed a quick bullish advance towards 1.2100 where recent evidence of bearish rejection was expressed (Note the previous Monthly candlestick of September).

Daily Outlook

In January 2017, the previous downtrend was reversed when the Inverted Head and Shoulders pattern was established around 1.0500. Since then, evident bullish momentum has been expressed on the chart.

As anticipated, the ongoing bullish momentum allowed the EUR/USD pair to pursue further bullish advance towards 1.1415-1.1520 (Previous Daily Supply-Zone).

The daily supply zone failed to pause the ongoing bullish momentum. Instead, the evident bullish breakout was expressed towards the price level of 1.2100 where the depicted Head and Shoulders reversal pattern was expressed.

If the recent bearish breakout persists below 1.1700 (Neckline of the reversal pattern), a quick bearish decline should be expected towards the price zone of 1.1415-1.1520 (Initial targets for the depicted H&S pattern).

A bearish target for the depicted Head and Shoulders pattern extends towards 1.1350. However, to pursue towards the mentioned target level, a significant bearish pressure is needed to be applied to the mentioned zone (1.1415-1.1520).

However, In November, recent price action around the price zone of 1.1520-1.1415 indicated evident bullish recovery.

This hindered further bearish decline which allowed the current bullish pullback to occur towards the price level of 1.1900.

Trade Recommendations

The price levels around 1.1900-1.1950 were suggested for a valid short-term SELL entry. It's already running in profits.

S/L should be lowered to 1.1870 to offset the associated risk. Remaining T/P levels to be located at 1.1700 and 1.1590.

Technical analysis of GBP/USD for December 18, 2017

2017-12-18

Overview:

The GBP/USD pair is still trading upwards above the levels of 1.3017 and 1.3203. The first support level is currently seen at 1.3017. The trend is still set above the level of 1.3017 and 1.3203 for that the price is moving in a bullish channel now. Furthermore, the price has been set above the strong support at the level of 1.3017, which coincides with the 61.8% Fibonacci retracement level. This support has been rejected three times confirming the veracity of an uptrend.

According to the previous events, we expect the GBP/USD pair to trade between 1.3100 and 1.3655. So, the support is seen at 1.3017, while daily resistance is found at 1.3298. Therefore, the market is likely to show signs of a bullish trend around the spot of 1.3017/1.3203. In other words, buy orders are recommended above the zone of 1.30171.3203 with the first target at the level of 1.3298; and continue towards 1.3655 in coming days.

On the other hand, if the GBP/USD pair fails to break through the resistance level of 1.3298 today, the market will decline further to 1.2823.

EUR/USD analysis for December 18, 2017

2017-12-18

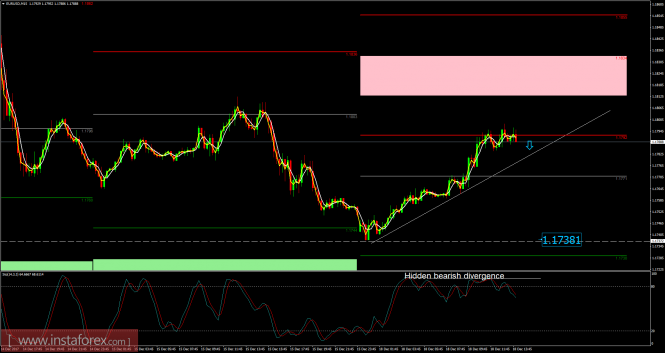

Recently, the EUR/USD pair has been trading upwards. The price tested the level of 1.1798. According to the 15M time – frame, I found successful rejection from pivot resistance 1 at the price of 1.1792. I also found a hidden bearish divergence on the stochastic oscillator, which is sign that buying looks risky.

Resistance levels:

R1: 1.1792

R2: 1.1835

R3: 1.1855

Support levels:

S1: 1.1730

S2: 1.1710

S3: 1.1667

Trading recommendations for today: watch for potential selling opportunities.

Technical analysis of EUR/USD for December 18, 2017

2017-12-18

Overview:

The EUR/USD pair continues to move downwards from the level of 1.1817. The pair dropped from the level of 1.1817 to the bottom around 1.1729. But the pair has rebounded from the bottom of 1.1729 to set around the spot of 1.1793 now. Today, the first support level is seen at 1.1756, the price is moving in a bearish channel now. Furthermore, the price has been set below the strong resistance at the level of 1.1817, which coincides with the 38.2% Fibonacci retracement level. This resistance has been rejected several times confirming the veracity of a downtrend. Additionally, the RSI starts signaling a downward trend. As a result, if the EUR/USD pair is able to break out the first support at 1.1756, the market will decline further to 1.1729 in order to test the weekly support 2. Consequently, the market is likely to show signs of a bearish trend. So, it will be good to sell below the level of 1.1817 with the first target at 1.1756 and further to 1.1729. However, stop loss is to be placed above the level of 1.1872.

No comments:

Post a Comment