On Thursday 14th of December, the event calendar is very busy with important economic released. The main event of the day is ECB interest rate decision and press conference and Bank of England interest rate decision, deposit facility rate decision and press conference. Moreover, the Swiss National Bank will make interest rate decision as well. Other important data are Unemployment rate from Australia, Industrial Production from China, Consumer Price Index from France, Flash Manufacturing, Services and Composite PMI from Germany and Eurozone, Retail Sales from the UK and Retail Sales from the US.

EUR/USD analysis for 14/12/2017:

The Fed raised interest rates by 25 bps, in line with expectations. There were two votes against (Kashkari, Evans), but none of them will have the right to vote in 2018. GDP growth forecasts have been slightly increased, inflation forecasts have been unchanged, the unemployment rate forecast has been lowered; The Fed is still expecting three hikes in 2018. The dove surprise was that, despite including the impact of the tax reform in the forecasts, it does not encourage FOMC members to increase their forecasts. The market reaction to the Fed decision was to depreciate the US Dollar across the board.

Let's now take a look at the EUR/USD technical picture at the H4 time frame. The market reversed from the technical support at the level of 1.1725 and broke above the technical resistance at the level of 1.1807.Currently, the nearest support is 1.1807 and the next target for bulls is seen at the level of 1.1864 and then at 1.1941.

Market Snapshot: DAX testing the support

The price of German DAX index is testing the support at the level of 13,085 and if this support is violated, then the Head & Shoulders pattern might fully develop. The next target is the support at the level of 12,953 and 12,809.

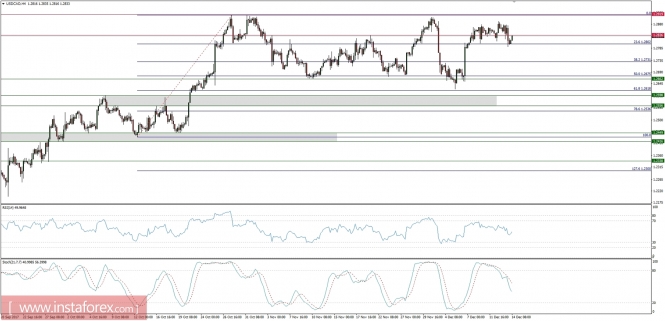

Market Snapshot: USD/CAD ready for a breakout?

The price of USD/CAD is still trading inside of the sideways zone between the levels of 1.2618 - 1.2919. Recently, the price tested the technical support at the level of 1.2800 and now it looks like is preparing for a test and a possible breakout above the level of 1.2919. So far none of the indications confirms this scenario yet.

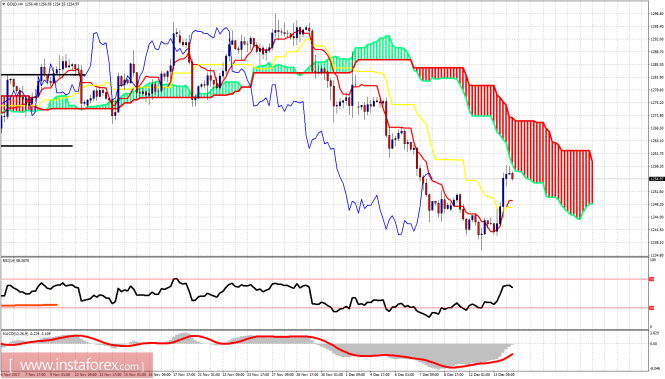

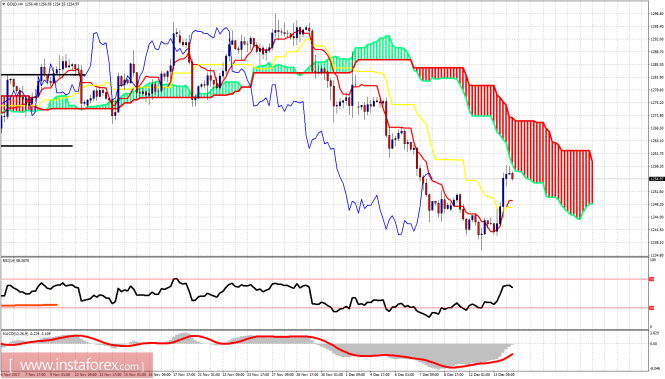

Ichimoku indicator analysis of gold for December 14, 2017

Gold price bounced as expected towards $1,260. We are currently being rejected by the Kumo (cloud) and this is what we initially expected. This could be a nice opportunity to sell Gold for a move down to $1,200.

Gold price is trading below the 4-hour Kumo (cloud). Trend remains bearish. This bounce was expected and we also reached our target area. Maybe this is the time to go short Gold for a move towards $1,200. Support is at $1,250 and at $1,244. A break below these levels will confirm my bearish short-term view. Resistance is at $1,260.

On a daily basis, Gold price has reached the daily tenkan-sen (Red line indicator) and is showing rejection signs. The bullish reversal candle we mentioned worked nicely and gave us a nice almost 20$ move to the upside. Gold is testing resistance now. Bulls need to be cautious because the rejection here will push price towards $1,200. At $1,200-$1,180 we might see a major low being formed.

Elliott wave analysis of EUR/JPY for December 14, 2017

2017-12-14

Wave summary:

EUR/JPY is trying to push prices lower, but it is a harder fight than expected. None the less, we continue to look for more downside pressure and a break below minor support at 132.81 that will call for a decline to 132.21 and lower to important support at 131.14. A break below this later support is needed to confirm that wave (D) completed at 134.50 and wave (E) lower to the ideal target at 123.43 is developing.

Resistance is now seen at 133.62 and should be able to cap the upside, but only a break above resistance at 133.89 will be of concern.

R3: 133.89

R2: 133.62

R1: 133.31

Pivot: 132.81

S1: 132.44

S2: 132.21

S3: 132.00

Trading recommendation:

We are short EUR from 133.40 with stop placed at 133.95.

Elliott wave analysis of EUR/NZD for December 14, 2017

2017-12-14

Wave summary:

EUR/NZD continues to push lower as it failed to break back above minor resistance at 1.6969 (the high was seen at 1.6942, which now acts the minor resistance to break). As long as minor resistance at 1.6942 is able to cap the upside as long will the downside pressure remain, with the possibility of a continuation lower to 1.6720, That said, the decline from 1.7493 is looking tired and a bottom is expected soon.

R3: 1.7079

R2: 1.7000

R1: 1.6942

Pivot: 1.6863

S1: 1.6821

S2: 1.6789

S3: 1.6720

Trading recommendation:

We are short EUR from 1.7200 and will move our stop lower to 1.6955, Take profit will be placed at 1.6740.

Analysis of EURUSD 14.12.2017

Written by: PaxForex analytics dept - Thursday, 14 December 2017

Gold price is trading below the 4-hour Kumo (cloud). Trend remains bearish. This bounce was expected and we also reached our target area. Maybe this is the time to go short Gold for a move towards $1,200. Support is at $1,250 and at $1,244. A break below these levels will confirm my bearish short-term view. Resistance is at $1,260.

On a daily basis, Gold price has reached the daily tenkan-sen (Red line indicator) and is showing rejection signs. The bullish reversal candle we mentioned worked nicely and gave us a nice almost 20$ move to the upside. Gold is testing resistance now. Bulls need to be cautious because the rejection here will push price towards $1,200. At $1,200-$1,180 we might see a major low being formed.

Elliott wave analysis of EUR/JPY for December 14, 2017

2017-12-14

Wave summary:

EUR/JPY is trying to push prices lower, but it is a harder fight than expected. None the less, we continue to look for more downside pressure and a break below minor support at 132.81 that will call for a decline to 132.21 and lower to important support at 131.14. A break below this later support is needed to confirm that wave (D) completed at 134.50 and wave (E) lower to the ideal target at 123.43 is developing.

Resistance is now seen at 133.62 and should be able to cap the upside, but only a break above resistance at 133.89 will be of concern.

R3: 133.89

R2: 133.62

R1: 133.31

Pivot: 132.81

S1: 132.44

S2: 132.21

S3: 132.00

Trading recommendation:

We are short EUR from 133.40 with stop placed at 133.95.

Elliott wave analysis of EUR/NZD for December 14, 2017

2017-12-14

Wave summary:

EUR/NZD continues to push lower as it failed to break back above minor resistance at 1.6969 (the high was seen at 1.6942, which now acts the minor resistance to break). As long as minor resistance at 1.6942 is able to cap the upside as long will the downside pressure remain, with the possibility of a continuation lower to 1.6720, That said, the decline from 1.7493 is looking tired and a bottom is expected soon.

R3: 1.7079

R2: 1.7000

R1: 1.6942

Pivot: 1.6863

S1: 1.6821

S2: 1.6789

S3: 1.6720

Trading recommendation:

We are short EUR from 1.7200 and will move our stop lower to 1.6955, Take profit will be placed at 1.6740.

Analysis of EURUSD 14.12.2017

Written by: PaxForex analytics dept - Thursday, 14 December 2017

The price above 200 MA, indicating a growing trend.

The MACD histogram is above the zero line.

The oscillator Force Index is above the zero line.

If the level of resistance is broken, you should follow recommendations below:

• Timeframe: H4

• Recommendation: Long Position

• Entry Level: Long Position 1.1845

• Take Profit Level: 1.1930 (85 pips)

If the price rebound from resistance level, you should follow recommendations below:

• Timeframe: H4

• Recommendation: Short Position

• Entry Level: Short Position 1.1800

• Take Profit Level: 1.1740 (60 pips)

The MACD histogram is above the zero line.

The oscillator Force Index is above the zero line.

If the level of resistance is broken, you should follow recommendations below:

• Timeframe: H4

• Recommendation: Long Position

• Entry Level: Long Position 1.1845

• Take Profit Level: 1.1930 (85 pips)

If the price rebound from resistance level, you should follow recommendations below:

• Timeframe: H4

• Recommendation: Short Position

• Entry Level: Short Position 1.1800

• Take Profit Level: 1.1740 (60 pips)

No comments:

Post a Comment