2018-02-26

Monthly Outlook

In January 2015, the EUR/USD pair moved below the major demand levels near 1.2050-1.2100 (multiple previous bottoms set in July 2012 and June 2010). Hence, a long-term bearish target was projected toward 0.9450.

In March 2015, EUR/USD bears challenged the monthly demand level around 1.0500, which had been previously reached in August 1997.

In the longer term, the level of 0.9450 remains a projected target if any monthly candlestick achieves bearish closure below the depicted monthly demand level of 1.0500.

However, the EUR/USD pair has been trapped within the depicted consolidation range (1.0500-1.1450) until the current bullish breakout was executed above 1.1450 and recently above 1.2075.

Another bullish breakout above 1.2250 was expressed on the chart. This hinders the bearish momentum allowing bullish advancement to occur towards 1.2750 provided that the price level of 1.2250 remains defended by the bulls.

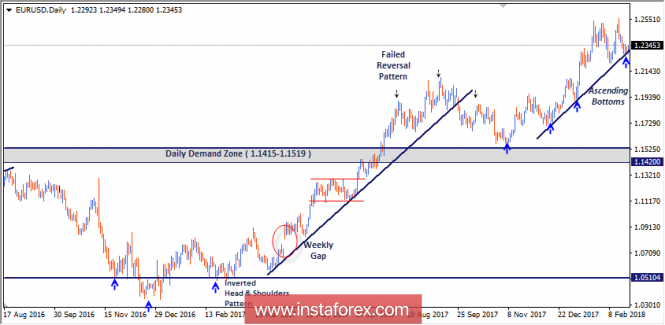

Daily Outlook

In September, a bearish target for the depicted Head and Shoulders pattern was projected towards 1.1350. However, the market failed to apply significant bearish pressure against the mentioned zone (1.1415-1.1520).

Instead, In November, evident bullish recovery was manifested around the price zone of 1.1520-1.1415.

This hindered further bearish decline which allowed the current bullish momentum to occur towards the price level of 1.2100 which failed to pause the ongoing bullish momentum as well.

Daily persistence above 1.2470-1.2500 is needed to confirm a recent bullish flag continuation pattern with projected targets around the price level of 1.2750.

On the other hand, a recent bearish pullback is being expressed below the price level of 1.2450 thus expressing a double-top reversal pattern with a projected target around 1.1990.

The current bearish pullback may extend towards 1.2070-1.1990 (reversal pattern projection targets) if a bearish breakdown of the level of 1.2200 (the depicted uptrend line) is achieved on a daily basis.

NZD/USD Intraday technical levels and trading recommendations for February 26, 2018

2018-02-26

Daily Outlook

In July 2017, an atypical Head and Shoulders pattern was expressed on the depicted chart which indicated an upcoming bearish reversal.

As expected, the price level of 0.7050 failed to offer enough bullish support for the NZD/USD pair. That's why the further bearish decline was expected towards 0.6800 (Reversal pattern bearish target).

Evident signs of bullish recovery were expressed around the depicted low (0.6780). An inverted Head and Shoulders pattern was expressed around these price levels.

The price zone of 0.7140-0.7250 (prominent Supply-Zone) failed to pause the ongoing bullish momentum. Instead, a bullish breakout above 0.7250 was expressed on January 11.

That's why a quick bullish movement was expected towards the depicted supply zone (0.7320-0.7390) where evident bearish rejection and a valid SELL entry were expected.

On February 2, a bearish engulfing daily candlestick was expressed. This enhances the bearish scenario towards the price levels of 0.7230 - 0.7165 where bullish recovery should be expressed.

Trade Recommendations:

The current price zone (0.7320-0.7390) remains a significant supply zone to offer a valid SELL entry.

Stop Loss should be set as a daily candlestick above 0.7450.

Bearish persistence below 0.7300 should be maintained to allow further bearish decline towards 0.7160 and 0.7090.

Technical analysis of EUR/USD for February 26, 2018

2018-02-26

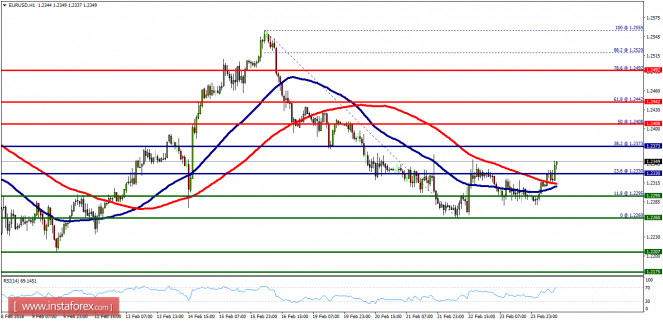

Overview:

The trend of the EUR/USD pair movement was controversial as it took place in a narrow sideways channel, the market showed signs of instability. Amid the previous events, the price is still moving between the levels of 1.2259 and 1.2373. Also, the daily resistance and support are seen at the levels of 1.2408 and 1.2442, respectively. Therefore, it is recommended to be cautious while placing orders in this area. So, we need to wait until the sideways channel has completed. Last week, the market moved from its bottom at 1.2260 and continued to rise towards the top of 1.2352. Today, in the one-hour chart, the current rise will remain within a framework of correction. However, if the pair fails to pass through the level of 1.2404, the market will indicate a bearish opportunity below the strong resistance level of 1.2404. Since there is nothing new in this market, it is not bullish yet. Sell deals are recommended below the level of 1.2404 with the first target at 1.2295. If the trend breaks the support level of 1.2295, the pair is likely to move downwards continuing the development of a bearish trend to the level 1.2260 in order to test the double bottom again.

No comments:

Post a Comment