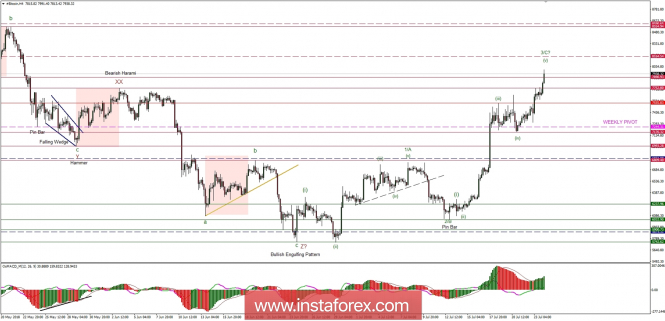

According to the H1 time - frame, I found a complete flag abce downward correction in the background, which is a sign that selling looks risky.

My advice is to watch for potential buying opportunities. The upward target is set at the price of $8.520.

Support/Resistance

$8.000 – Intraday resistance

$7.600 – Intraday support

$8.520 – Objective target

With InstaForex you can earn on cryptocurrency's movements right now.

Just open a deal in your MetaTrader4. *The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The catalyst that caused the recent increase in Bitcoin may be related to the SEC's consideration of the CBOE application for the purchase of Bitcoins via ETF (stock exchange funds). This would allow institutional money to buy BTC for the general public and anyone interested in investing in their fund. This is the main concern for the US regulatory authorities, whose purpose is to determine how to protect the investor in the case of, for example, theft of BTC (insurance).

The catalyst that caused the recent increase in Bitcoin may be related to the SEC's consideration of the CBOE application for the purchase of Bitcoins via ETF (stock exchange funds). This would allow institutional money to buy BTC for the general public and anyone interested in investing in their fund. This is the main concern for the US regulatory authorities, whose purpose is to determine how to protect the investor in the case of, for example, theft of BTC (insurance).

CBOE obtained the approval of the Securities and Exchange Commission for trading in futures, although at that time SEC had similar concerns regarding investor protection. Because CBOE guarantees that they deal with insurance and infrastructure issues, it looks like it may be the first ETF approved to purchase BTC.

Recently, it was announced that over 50% of the money that has entered the cryptographic space since 2018 is institutional money. This assumes that the ETF approval may take place even though the previous applications were rejected by the SEC.

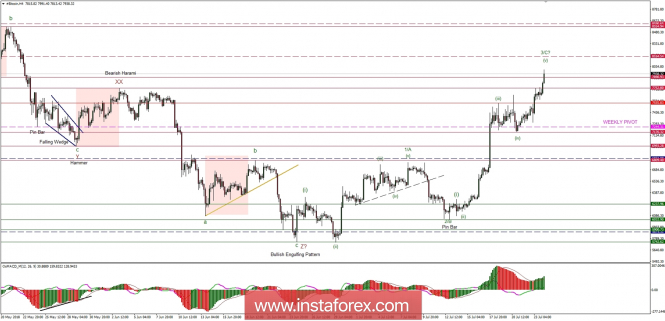

Let's now take a look at the Bitcoin technical picture at the H4 time frame. The market has broken above the technical resistance at the level of $7,753 and even spiked through the level of $7,890. The bullish impulsive wave scenario is unfolding very well. The ongoing impulsive cycle is now almost done as there are visible five waves to the upside and the price is in the last wave up. The clear and visible bearish divergence between the wave three and the wave five is supporting the short-term bearish outlook - the correction is coming.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

No comments:

Post a Comment