2018-10-17

Overview:

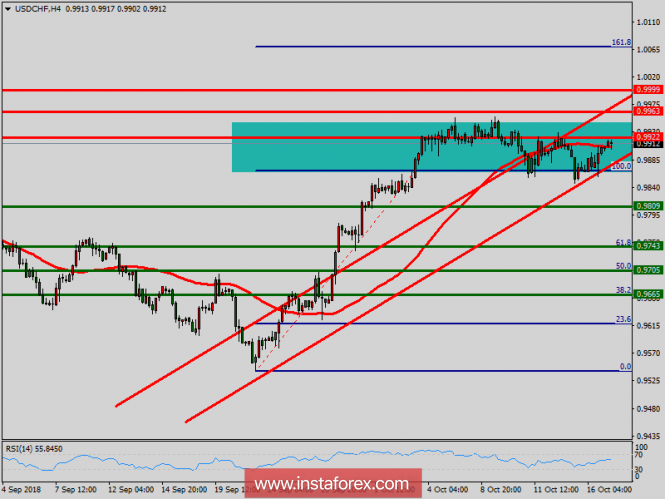

Bullish outlook.

The USD/CHF pair continues to trade upwards from the level of 0.9875. The pair rose from the level of 0.9875 to a top around 0.9865. Today, the first resistance level is seen at 0.9865 followed by 0.9922, while daily support 1 is seen at 0.9743 (61.8% Fibonacci retracement). According to the previous events, the USD/CHF pair is still moving between the levels of 0.9875 and 0.9999; so we expect a range of 124 pips. Furthermore, if the trend is able to break out through the first resistance level at 0.9865, we should see the pair climbing towards the second resistance (0.9922) to test it. Therefore, buy above the level of 0.9865 with the first target at 0.9922 in order to test the daily resistance 2 and further to 0.9963. Besides, it might be noted that the level of 0.9963 is a good place to take profit because it will form a new double top. On the other hand, in case a reversal takes place and the USD/CHF pair breaks through the support level of 0.9875, a further decline to 0.9743 can occur which would indicate a bearish market.

Technical analysis of NZD/USD for October 17, 2018

2018-10-17

Bullish outlook.

The USD/CHF pair continues to trade upwards from the level of 0.9875. The pair rose from the level of 0.9875 to a top around 0.9865. Today, the first resistance level is seen at 0.9865 followed by 0.9922, while daily support 1 is seen at 0.9743 (61.8% Fibonacci retracement). According to the previous events, the USD/CHF pair is still moving between the levels of 0.9875 and 0.9999; so we expect a range of 124 pips. Furthermore, if the trend is able to break out through the first resistance level at 0.9865, we should see the pair climbing towards the second resistance (0.9922) to test it. Therefore, buy above the level of 0.9865 with the first target at 0.9922 in order to test the daily resistance 2 and further to 0.9963. Besides, it might be noted that the level of 0.9963 is a good place to take profit because it will form a new double top. On the other hand, in case a reversal takes place and the USD/CHF pair breaks through the support level of 0.9875, a further decline to 0.9743 can occur which would indicate a bearish market.

Technical analysis of NZD/USD for October 17, 2018

2018-10-17

Overview:

The NZD/USD pair faces resistance at 0.6617, while strong resistance is seen at 0.6617. Support is found at 0.6543 and 0.6496 levels. Today, the NZD/USD pair continues to move downwards from 0.6617 level. The pair could fall from 0.6617 level to the first support around 0.6543. In consequence, if the NZD/USD pair will break support at 0.6543, this level will turn into resistance today. In the H4 time frame, the 0.6543 level is expected to act as minor resistance. Hence, we expect the NZD/USD pair to continue moving in the bearish trend from 0.6543 level towards the target at 0.6496. In the long term, if the pair succeeds in passing through 0.6543 level, the market will indicate the bearish opportunity below 0.6543 level in order to reach the second target at 0.6496. However, the 0.6496-0.6423 mark remains a significant support zone. Thus, the trend will probably rebound again from 0.6423 level as long as this level is not breached. in overall, we still prefer the bullish scenario below the area of 0.6423.

GBP/USD analysis for October 17, 2018

2018-10-17

Recently, the GBP/USD pair has been trading downwards. The price tested the level of 1.3124. According to the H1 time – frame, I found the breakout of the bearish flag and end of the upward correction (abc flat), which is a sign that sellers are in control. I also found that wave C didn't break the high at 1.3256, which is another sign of weakness. My advice is to watch for opening sell deals with the take profit levels at 1.3086 and at the price of 1.3035.

Analysis of Gold for October 17, 2018

2018-10-17

Recently, the Gold has been trading sideways at the price of $1,226.00. Anyway, according to the H4 time – frame, I have found potential end of the downward correction (regular flat), which is a sign that selling looks risky. The short – term trend is bullish and my advice is to watch for a potential breakout of the supply trendline ($1,232.00) to confirm further upward continuation. If you see a breakout of the supply trendline, watch for opening buy deals with the take profit at the price of $1,266.85.

The NZD/USD pair faces resistance at 0.6617, while strong resistance is seen at 0.6617. Support is found at 0.6543 and 0.6496 levels. Today, the NZD/USD pair continues to move downwards from 0.6617 level. The pair could fall from 0.6617 level to the first support around 0.6543. In consequence, if the NZD/USD pair will break support at 0.6543, this level will turn into resistance today. In the H4 time frame, the 0.6543 level is expected to act as minor resistance. Hence, we expect the NZD/USD pair to continue moving in the bearish trend from 0.6543 level towards the target at 0.6496. In the long term, if the pair succeeds in passing through 0.6543 level, the market will indicate the bearish opportunity below 0.6543 level in order to reach the second target at 0.6496. However, the 0.6496-0.6423 mark remains a significant support zone. Thus, the trend will probably rebound again from 0.6423 level as long as this level is not breached. in overall, we still prefer the bullish scenario below the area of 0.6423.

GBP/USD analysis for October 17, 2018

2018-10-17

Recently, the GBP/USD pair has been trading downwards. The price tested the level of 1.3124. According to the H1 time – frame, I found the breakout of the bearish flag and end of the upward correction (abc flat), which is a sign that sellers are in control. I also found that wave C didn't break the high at 1.3256, which is another sign of weakness. My advice is to watch for opening sell deals with the take profit levels at 1.3086 and at the price of 1.3035.

Analysis of Gold for October 17, 2018

2018-10-17

Recently, the Gold has been trading sideways at the price of $1,226.00. Anyway, according to the H4 time – frame, I have found potential end of the downward correction (regular flat), which is a sign that selling looks risky. The short – term trend is bullish and my advice is to watch for a potential breakout of the supply trendline ($1,232.00) to confirm further upward continuation. If you see a breakout of the supply trendline, watch for opening buy deals with the take profit at the price of $1,266.85.

No comments:

Post a Comment