Elliott wave analysis of EUR/JPY for January 7, 2019

2019-01-07

As long as minor support at 122.83 is able to protect the downside as long, should we continue to look for more upside progress towards resistance at 125.78 and possibly even closer to strong resistance near 127.09.

A break below 122.83 will indicate a corrective decline towards the support-area between 120.72 - 121.33 before higher again.

R3: 125.78

R2: 124.88

R1: 124.00

Pivot: 123.41

S1: 122.83

S2: 122.60

S3: 121.95

Trading recommendation:

We are long EUR from 122.50 and we will raise our stop to 122.75.

Elliott wave analysis of GBP/JPY for January 7, 2019

2019-01-07

As long as support at 136.62 is able to protect the downside, we should continue to look higher towards strong resistance in the 139.57 - 140.70 area before a more substantial correction should be expected.

A break below minor support at 137.69 will call for a corrective decline towards 137.11, but a break below 136.62 will be needed to call for a deeper correction unfolding.

R3: 140.70

R2: 139.57

R1: 138.27

Pivot: 137.69

S1: 137.11

S2: 136.62

S3: 135.75

Trading recommendation:

We are long GBP from 134.65 and we will raise our stop to 136.50.

Technical analysis for EUR/USD for January 7, 2019

2019-01-07

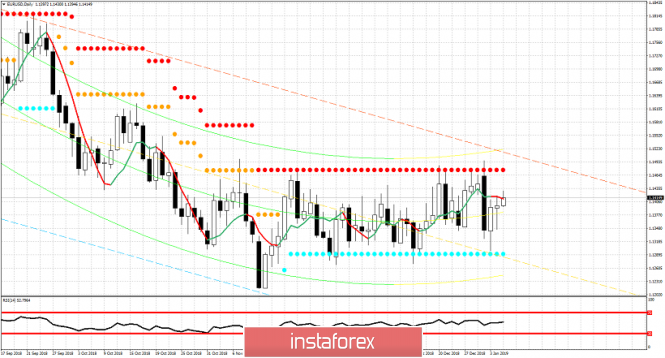

EUR/USD is trading again back above 1.14 and this is a good sign for bulls. However price remains trapped inside the 1.1475-1.1270 trading range its been in for the last two months. A break out above or below it will open the way for 1.17 or 1.1050.

Red dots -maximum strength resistance

Blue dots - medium strength support

EUR/USD is in a neutral sideways trend for some time now. Respecting support at 1.13 is good for bulls but the inability to break and remain above 1.1450-75 is also a sign of weakness. There is no clear direction and traders should be very cautious. Any daily close out of the range would be an important sign. The first upside target is at 1.17 while the first downside target is at 1.1050. I believe the bullish scenario has more chances of success.

Technical analysis for Gold for January 7, 2019

2019-01-07

Gold price made a pull back as expected from $1,298 to $1,276 while in our previous posts we were talking for a pullback towards $1,270. Trend remains bullish as price remains inside the bullish channel and we continue to expect a move towards $1,300 and higher.

Purple lines - bullish channel

Green rectangles - support levels

Gold price pulled back towards the green support level and is now bouncing back towards its recent highs. Our third target of $1,300 has almost been reached. Support is at $1,270-64 area and I believe we can see another pullback towards that area this week. Holding inside the channel would be important for the medium-term bullish trend. We have some bearish divergence signs in the 4-hour chart that imply that any weakness should be temporary. Major support is at $1,240 area and if broken the bullish scenario will be canceled.

Author's today's articles:

Torben Melsted

Born in November 1962. Graduated from CBS, got Diploma in Finance. Began trading on Forex in 1986 and since that time held various positions such as advising clients, hedging client flows on FX and commodity markets. Also worked for major corporations as Financial Risk Manager. Uses Elliott wave analysis in combination with classic technical analysis, and has been using a Calmar Ratio of 5.0 for over 3 years. Has his own blog, where he uses Elliott wave and technical analysis on all financial markets.

Alexandros Yfantis

Alexandros was born on September 14, 1978. He graduated from the ICMA Centre, University of Reading with the MSc in International Securities, investment and Banking in 2001. In 2000, Alexandros got the BSc in Economics and Business Finance from Brunel University, UK. In 2004, he began trading on the Greek stock market, where Alexandros got a specialization in international derivatives. Alexandros Yfantis has worked in a top financial company in Greece, responsible for the day-to-day running of the International markets department. He is a certified Portfolio Manager and a certified Derivatives Trader. Alexandros is also a contributor and analyst using Elliott wave and technical analysis of global financial markets. In 2007, he started Forex trading. He loves his profession and believes that entering a trade should always be accompanied by money management rules. His goal is to find profitable opportunities across the markets while minimizing risk and maximizing potential profit. "I'm still learning" Michelangelo

Subscription's options management Theme's:

Fundamental analysis, Fractal analysis, Wave analysis, Technical analysis, Stock Markets

Author's :

Alexandros Yfantis, Arief Makmur, Dean Leo, Michael Becker, Mohamed Samy, Mourad El Keddani, Petar Jacimovic, Rocky Yaman, Sebastian Seliga, Torben Melsted

Sincerely,

Analysts Service

If you have any questions, you can make a phone call using one of the

InstaForex Toll free numbers right now:

|

|

InstaForex Group is an international brand providing online trading services to the clients all over the world. InstaForex Group members include regulated companies in Europe, Russia and British Virgin Islands. This letter may contain personal information for access to your InstaForex trading account, so for the purpose of safety it is recommended to delete this data from the history. If you have received this letter by mistake, please contact InstaForex Customer Relations Department. InstaForex Group is an international brand providing online trading services to the clients all over the world. InstaForex Group members include regulated companies in Europe, Russia and British Virgin Islands. This letter may contain personal information for access to your InstaForex trading account, so for the purpose of safety it is recommended to delete this data from the history. If you have received this letter by mistake, please contact InstaForex Customer Relations Department.

|

No comments:

Post a Comment