Forex analysis review |

- Brent: appetite grows while eating

- Trading recommendations for the GBPUSD currency pair - placement of trading orders (February 19)

- EUR/USD: roller coaster for the European currency

- GBP/USD. 19th of February. Results of the day. Jean-Claude Juncker is not opposed to moving Brexit

- EUR/USD. 19th of February. Results of the day. Complete calm, volatility decreases again

- BITCOIN Analysis for February 19, 2019

- Intraday technical levels and trading recommendations for EUR/USD for February 19, 2019

- February 19, 2019 : GBP/USD is demonstrating bullish breakout outside the H4 bearish channel.

- AUD / USD: RBA Protocol gives more questions than answers

- Control zones of NZD/USD pair on 02/19/19

- Control zones of GBP/USD pair on 02/19/19

- EURUSD: The report from the ZEW Research Center and Eurozone surplus let Euro buyers down

- GBP / USD: plan for the American session on February 19. Weak labor market data did not allow the pound to resume growth

- EUR / USD plan for the US session on February 19. Eurozone's weak data put pressure again on the euro

- Technical analysis of USD/CHF for February 19, 2019

- Side trend in the currency markets continued

- Bitcoin analysis for February 19, 2019

- Technical analysis of AUD/USD for February 19, 2019

- EUR/USD analysis for February 19, 2019

- Analysis of Gold for February 19, 2019

- Simplified wave analysis. Overview of EUR / CHF for February 19

- The cost of oil can temporarily reach $ 70 per barrel

- Simplified wave analysis. Overview of GBP / USD for February 19

- Wave analysis of EUR / USD for February 19. The lack of the necessary news background prevents the euro from rising

- GBP/USD: plan for the European session on February 19. The growth of the British pound depends on Theresa May's negotiations

| Brent: appetite grows while eating Posted: 19 Feb 2019 05:12 PM PST Growth of the global risk appetite against the background of the de-escalation of the US-Chinese trade conflict has made it possible for oil to climb to the area of three-month highs. Black gold is growing along with global stock indexes in the hope that the end of the trade war will increase global demand. Although OPEC has reduced its growth forecast for this indicator to 1.24 million b/d for 2019, investors believe that the recovery of the economies of the eurozone and China will provide an opportunity for it to expand faster. If we add to this the effectiveness of operations to reduce the cartel's production as well as other producing countries by 1.2 million b/d, it becomes clear why Riyadh allows itself to make loud statements that the allies managed to bring the market to a normal state. Leaders bear the greatest burden. Saudi Arabia plans to reduce production to 9.8 million b/d in March, which is 500 thousand b/d more than the country's commitments. Its exports have already declined by 1.3 million b/d in the first half of February. With OPEC's fall in production to 30.81 million b/d in January, the strengthening factor of global risk appetite made it possible for Brent and WTI to play a fifth of their value since the beginning of the year. Dynamics of oil and OPEC production Finally, financial managers who previously preferred to take a wait-and-see position actually waited. By the end of the week, by February 12, they had increased their longs in the North Sea variety by 10%, which is the fastest growth rate since August. Shorts reduced by 5.5%. Thus, speculators have become net buyers of Brent at 32 million barrels in equivalent. The weakness of the US dollar played a significant role in the rise of oil to three-month highs. Fans of the USD index have been helped for a long time by the desire of central bank competitors of the Fed to adhere to ultra-soft monetary policy, but the progress in Washington and Beijing talks reduced the demand for safe-haven assets, causing a serious blow to the US currency. At the same time, HSBC Holdings warns that if something goes wrong in further negotiations between Washington and Beijing, then black gold will plunge into a wave of sales. Indeed, the rise in prices allows American manufacturers to feel at ease. The number of rigs from Baker Hughes rose to 857 in the week to February 15, and the US Energy Information Administration predicts that production in 2020 will reach a record figure of 13 million b/d. Companies registered in the United States are used to hedge risks and the growth of Brent and WTI allows them to increase production even at unprofitable price levels. Sooner or later this circumstance will be felt, however, during at time when the market is in a state of euphoria because of the expectations of the end of the trade war. Technically, the breakthrough of resistance at $64.1 per barrel brought the bulls on Brent to an operational space. They were able to develop a correction as part of the transformation of the Shark pattern to 5-0 and are ready to push futures quotes to the level of 50% of the CD wave. It corresponds to $68.4. Brent daily chart |

| Trading recommendations for the GBPUSD currency pair - placement of trading orders (February 19) Posted: 19 Feb 2019 04:53 PM PST Over the past trading day, the currency pair Pound / Dollar showed a tap of low volatility of 49 points. As a result, it hanged within the periodic level. From the point of view of technical analysis, we have an intensive upward trend from the level of 1.2770, where the quotation reached a periodic level of 1.2920, after which the quotation passed into the stagnant-rollback stage. On the other hand, the news and news background did not have any statistics in itself. And as he wrote in the previous review, there was a day off in the United States, which led to a decrease in trading volumes. From the information flow, I can only single out the verbal threat to the members of the British Cabinet in the direction of Prime Minister Theresa May. The essence of the threat lies in the fact that the cabinet ministers threatened the head of government with a succession of resignations if she did not rule out the possibility of Brexit without a deal. Today, in terms of the economic calendar, traders are waiting for the data on the UK labor market, where unemployment is forecast to remain at the same level of 4.0%, while the average wage, excluding bonuses, is rising from 3.3% to 3.4%. Due to the absence of any more news in the stream, these statistics, which is not bad, can play into the hands of the English currency, and thus, growth can continue. Further development Analyzing the current trading chart, we see a distinct stagnation with a pullback, where the quote is trying to form a cluster within the periodic level of 1.2920. It is likely to assume that an indefinite bump within the level will persist, where traders will stretch from pending orders for breakdown and rebound from the level. Based on the available data, it is possible to break down a number of variations. Let us consider them: - We consider buying positions, in case of a clear price fixing higher than 1.2920, with a further prospect to 1.2960-1.2980. - We consider selling positions, in the case of mining level 1.2920, lower than 1.2890 with a further perspective to 1.2850--1.2800 --- 1.2770. Indicator Analysis Analyzing a different sector of time frames (TF ), we see that there is a variable upward interest against the background of primary mining and stagnation from the level of 1.2920 in the short term. Meanwhile, intraday perspective focuses on recent heavy traffic while medium term retains a downward interest on the general background of the market. Weekly volatility / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation, with the calculation for the Month / Quarter / Year. (February 19 was based on the time of publication of the article) The current time volatility is 30 points. If the news background supports the pound and the level of 1.2920 falls, then the volatility of the day may rush to the upper limit of the daily average. Otherwise, the stagnation may be delayed, and the volatility will remain low. Key levels Zones of resistance: 1.2920 *; 1.3000 ** (1.3000 / 1.3050); 1.3200 * 1.3300; 1.3440 **; 1.3580 *; 1.3700 Support areas: 1.2770 (1.2720 / 1.2770) **; 1.2620; 1.2500 *; 1.2350 **. * Periodic level ** Range Level The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD: roller coaster for the European currency Posted: 19 Feb 2019 04:36 PM PST The euro/dollar impulsively fell to 1.1270 this afternoon, after which buyers seized the initiative and were able to turn the tide in their favor. But in general, the fundamental background remains quite unreliable for the single currency, and not only because of the release of disappointing macroeconomic data. The fact is that the risk of a trade war between the US and the EU has increased again, and this fact exerts significant pressure on European markets. This issue was previously settled in the middle of last year, but recently began to receive alarming signals indicating the "militant" intentions of the White House. If this threat comes true, the European economy will feel a very painful blow, and traders will have to forget about raising the ECB's interest rate for at least the next year and a half. I recall that in the early summer of last year, relations between the European Union and the United States has deteriorated significantly. Trump was dissatisfied with the trade policy, voicing his demands in the language of ultimatums. He said that he was ready to introduce 20 percent duties on cars and auto parts imported from the European Union, if the eurozone does not reduce or eliminate trade barriers against companies from the United States. The automotive industry in Germany, France and Italy was under attack – according to preliminary estimates, the total cost of the designated tariffs is 300 billion dollars. According to experts, in the event that US tariffs are introduced, there will be a "domino effect" : the business climate in the eurozone countries will deteriorate significantly, thereby slowing the growth of key indicators and the economy as a whole. The European Union did not remain in debt and declared that in response it was preparing new duties on American goods, totaling $20 billion. The German foreign minister has even become personal, stating that Europe "will not allow Trump to speak the language of ultimatums with herself" and is able to respond with symmetrical economic measures. The situation was "hanging by a thread" from starting a trade war, and only thanks to the visit of the head of the European Commission in Washington, did the financial world manage to avoid a new round of trade confrontation. The situated escalated again this year. Experts from the US Department of Commerce prepared and submitted a report to the American president regarding the import of cars to the United States from Europe. Over the next three months, Trump must make the appropriate decision: to introduce protective duties or not. Representatives of Brussels, in turn, again promised to introduce retaliatory duties on the import of American goods totaling 20 billion euros. However, according to most experts, the economy of the eurozone (and especially Germany) in any case will be in a more disadvantageous situation: for example, the export of German cars to the USA will be reduced at least twice the size. Thus, the risk of a new trade conflict puts background pressure on the euro, especially after the release of fairly weak data on the growth of the sentiment index in the business environment of Germany and the entire eurozone from the ZEW Institute. Both indicators continue to be in the negative area, despite insignificant fluctuations in the direction of improvement. The uncertainty with Brexit, the slowing down of key macroeconomic indicators and the softening of the ECB's rhetoric - all these factors make investors nervous, which is reflected in general pessimism. However, at the beginning of the US session, EUR/USD bulls were able to raise the pair and return its price to the 13th figure. This is due to two factors. First, the dollar index went down sharply today, responding to optimistic rumors about the prospects for a deal between China and the United States. In just a few hours, the indicator dropped from 96.95 to 96.52 points. Today, preliminary negotiations of representatives of working groups started, and at the end of the week, a dialogue at a higher level will be held with the participation of the US treasury minister, the head of the Ministry of Trade and advisers to the US president. The Chinese delegation is headed by Vice Premier Liu He. The leaders of both countries have already expressed optimism about the possible outcome of these negotiations, but the immediate reason for today's decline in the dollar was a newspaper publication, which stated that the White House is actually ready for a "great truce". According to anonymous sources, in the presidential administration believe that the deal will help Trump to restore its rating, which significantly subsided after the well-known events with the prolonged shutdown. Although this information is unverified, many circumstantial evidence suggests a high probability of a truce. This fact puts pressure on the dollar and at the same time supported the European currency. In addition, the euro follows the pound, which is growing in optimistic rumors about tomorrow's meeting between Theresa May and Jean-Claude Juncker (at 16:30 London time). Once again, here we are dealing with unverified information, however, under the circumstances, traders are ready to believe even rumors, pushing the pound and the euro upwards. Thus, the growth of the EUR/USD pair should now be treated with extreme caution (the same goes for the GBP/USD pair). The fundamental factors that triggered the growth of these currency pairs are unreliable, and the price dynamics themselves are impulsive. Any negative news about the prospects for the US-China talks or the prospects for Brexit could stifle this impulse and turn the price down. Long positions in the EUR/USD pair should be considered when overcoming the resistance level of 1.1370 (the middle line of the Bollinger Bands indicator on the daily chart). The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. 19th of February. Results of the day. Jean-Claude Juncker is not opposed to moving Brexit Posted: 19 Feb 2019 04:16 PM PST 4-hour timeframe The amplitude of the last 5 days (high-low): 98p - 77p - 117p - 113p - 50p. Average amplitude for the last 5 days: 91p (92p). On the second trading day of the week, the British pound sterling received support from the head of the European Commission Jean Claude Juncker. He stated very timely that the decision to postpone Brexit lies with the UK and, if London wants to exercise this right, he should inform Brussels, which, in turn, will not mind. Thus, Juncker did not transparently hinted that London is in no hurry, and there is no deadline for the date of the UK leaving the EU. All this becomes similar to the fact that the European Union is trying to keep the UK in its composition. Indeed, according to Article 50 of the Lisbon Treaty, a country can unilaterally refuse from a decision taken earlier on leaving the EU. A meeting between Juncker and Theresa May will also take place this week. The position on new, additional negotiations, the leaders of the EU have repeatedly voiced: no new negotiations and concessions. Therefore, we can assume that the British prime minister will not achieve anything. Meanwhile, British ministers demanded Theresa May to stop threatening both the EU and Parliament with the "hard" Brexit scenario. The ministers believe that such a tactic could have been successful before, but now, when several large companies have notified the desire to transfer production facilities outside the UK, precisely because of the possible lack of a "contract" between Brussels and London, this tactic has exhausted its usefulness. Moreover, Theresa May continues to put pressure on the "hard" Brexit on the British Parliament itself. Theresa May doesn't seem to have any other plans to satisfy all three parties. Trading recommendations: The GBP/USD currency pair continues its upward movement. Therefore we should consider long positions with targets at 1,3013 and 1,3058. Juncker's recent speech provoked the strengthening of the pound, but it has the character of information, which will not be followed by any real and positive action. Sell positions can be considered again with targets of 1.2830 and 1.2786, if the bears manage to seize the initiative on the instrument and consolidate below the critical line of Kijun-sen. In addition to the technical picture, fundamental data and the timing of their release should also be taken into account. Explanation of illustration: Ichimoku Indicator: Tenkan-sen-red line. Kijun-sen – blue line. Senkou span a – light brown dotted line. Senkou span B – light purple dotted line. Chikou span – green line. Bollinger Bands Indicator: 3 yellow lines. MACD: Red line and histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. 19th of February. Results of the day. Complete calm, volatility decreases again Posted: 19 Feb 2019 04:01 PM PST 4-hour timeframe The amplitude of the last 5 days (high-low): 63p - 82p - 82p - 72p - 45p. Average amplitude for the last 5 days: 69p (66p). The EUR/USD currency pair on Tuesday, February 19, amid the complete absence of any interesting macroeconomic information moves in different directions and once again in low volatility. The point is clear: traders still have nothing to respond to. Thus, with great difficulty, the euro currency is stuck above the critical line, which theoretically allows it to continue strengthening. The fact that the pair attempted to overcome the area of 1.1250 - 1.1290 and failed three times confirms a possible upward movement to the area of 1.1500. However, from a fundamental point of view, there are still few reasons for this. Nevertheless, from a technical point of view, this option remains very attractive. Today it became known that the European Union is absolutely not against postponing the "divorce" with Great Britain. For the European Union, this is much less important than for the UK, although by all means Brussels is trying to avoid a disordered Brexit. On this message, the pound sterling immediately soared up, while the euro behaves very restrained. Thus, a weak "golden cross" remains in the bottom line, which will intensify only after the price consolidates above the Ichimoku cloud (if it happens). Up to this point, long positions can be considered only in small volumes. Without a serious fundamental data, it will be very difficult for the pair to leave the level below the area of 1.1250 - 1.1290. Trading recommendations: The EUR/USD pair has adjusted to the Kijun-Sen line and is trying to resume its upward movement. Thus, long positions with targets of 1.1345 and 1.1391 are now relevant, but in small lots, since the "golden cross" is weak. It will be possible to consider orders for selling when traders overcome the critical line with the goal of 1,1237, but they have to rely on further downward movement. In addition to the technical picture, fundamental data and the timing of their release should also be taken into account. Explanation of illustration: Ichimoku Indicator: Tenkan-sen-red line. Kijun-sen – blue line. Senkou span a – light brown dotted line. Senkou span B – light purple dotted line. Chikou span – green line. Bollinger Bands Indicator: 3 yellow lines. MACD: Red line and histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

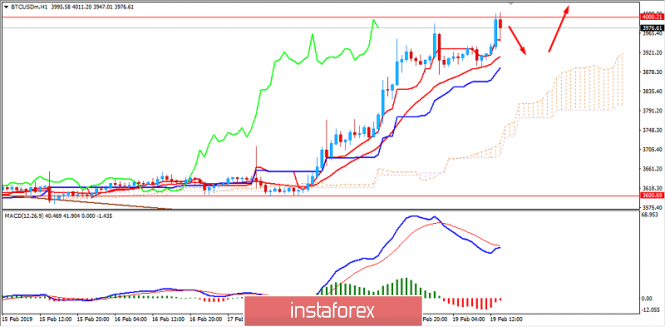

| BITCOIN Analysis for February 19, 2019 Posted: 19 Feb 2019 07:00 AM PST Bitcoin has been riding a rally after consolidating at the edge of $3,600 for a few days. The bullish pressure turned impulsive and non-volatile after the third bounce off the $3,600 was hit which was carried by the dynamic levels like 20 EMA, Tenkan, and Kijun line all the way towards $4,000 resistance area where it is currently holding with certain volatility. Currently the price is moving lower amid bearish pressure from the area of $4,000 from where the price will make a correction under bearish pressure before the price resumes the bullish momentum to break above $4,000 and reach upcoming price area of $4,250 and later towards $4,500 in the coming days. The price may close above $4,000 that will encourage a further continuation of this non-volatile bullish trend in the future. SUPPORT: 3,000, 3,500, 3,600 RESISTANCE: 4,000, 4,250, 4,500 BIAS: BULLISH MOMENTUM: NON-VOLATILE

|

| Intraday technical levels and trading recommendations for EUR/USD for February 19, 2019 Posted: 19 Feb 2019 06:42 AM PST

Since June 2018, the EUR/USD pair has been moving sideways with slight bearish tendency within the depicted bearish Channel (In RED). On November 13, the EUR/USD demonstrated recent bullish recovery around 1.1220-1.1250 where the current bullish movement above the depicted short-term bullish channel (In BLUE) was initiated. Bullish fixation above 1.1430 was needed to enhance further bullish movement towards 1.1520. However, the market has been demonstrating obvious bearish rejection around 1.1430 few times so far. The EUR/USD pair has lost its bullish momentum since January 31 when a bearish engulfing candlestick was demonstrated around 1.1514 where another descending high was established then. On February 5, a bearish daily candlestick closure below 1.1420 terminated the recent bullish recovery. This allowed the current bearish movement to occur towards 1.1300-1.1270 where the lower limit of the depicted DAILY channel comes to meet the pair. The EUR/USD pair was demonstrating weak bullish recovery around the depicted price zone (1.1300-1.1270) with early signs of bearish reversal probability. A bearish flag pattern may become confirmed if bearish persistence below 1.1250 is achieved on the daily-chart basis. Pattern target is projected towards 1.1000. Trade Recommendations: A counter-trend BUY entry was already suggested near the price level (1.1285) (the lower limit of the depicted movement channel).Stop Loss to be located below 1.1225 while T/P level to be located around 1.1350 and 1.1420. The material has been provided by InstaForex Company - www.instaforex.com |

| February 19, 2019 : GBP/USD is demonstrating bullish breakout outside the H4 bearish channel. Posted: 19 Feb 2019 06:24 AM PST

On December 12, the previously-dominating bearish momentum came to an end when the GBP/USD pair visited the price levels of 1.2500 where the backside of the broken daily uptrend was located. Since then, the current bullish swing has been taking place until January 28 when the GBP/USD pair was almost approaching the supply level of 1.3240 where the recent bearish pullback was initiated. Shortly after, the GBP/USD pair lost its bullish persistence above 1.3155. Hence, the short-term scenario turned bearish towards 1.2920 (38.2% Fibonacci) then 1.2820-1.2800 where (50% Fibonacci level) as well as a previous prominent top are located (Highlighted in BLUE). Last week, lack of bullish demand was demonstrated around 1.2920 until Friday when significant bullish recovery was demonstrated around 1.2800-1.2820 (Fibonacci 50% level) resulting in a Bullish Engulfing daily candlestick. This led to the current bullish breakout above the depicted H4 bearish channel. Expected bullish targets are projected towards 1.2970, 1.3040 and 1.3200. Bullish persistence above 1.2920 (38.2% Fibonacci) is mandatory so that the current bullish movement can pursue towards the mentioned bullish targets. The material has been provided by InstaForex Company - www.instaforex.com |

| AUD / USD: RBA Protocol gives more questions than answers Posted: 19 Feb 2019 06:07 AM PST The minutes of the RBA meeting was somewhat controversial, leaving more questions than answers. The rhetoric was "dovish" in nature, although the ambiguity of the wording allows for a different assessment of the prospects for the Australian currency. In today's Asian session, the Reserve Bank of Australia published the minutes of its last meeting. This document turned out to be somewhat controversial, leaving more questions than answers. In general, the protocol's rhetoric was "dovish" in nature, although the ambiguity of the wording allows for a different assessment of the prospects for the Australian currency. At the January meeting of the RBA, the regulator lowered the forecast for economic growth in the country to three percent from the previous value of 3.5%. In the protocol, this situation is explained by the fact that the level of uncertainty at the moment has increased in many ways. First of all, we are talking about the slowdown of the Chinese economy and the world economy as a whole, as well as the Australian consumer activity. Here it is really necessary to note the fact that the volume indicator of retail sales in January collapsed in the negative area for the first time since February 2018. It reached the level of -0.4% with the forecast of a decline to zero. Consumer sentiment index and activity index in the service sector also show weak dynamics, which is partly due to low wage growth. In fact, this figure has been stagnant for a long time despite the decline in unemployment. All of these lead to the fact that inflation in Australia remains consistently low at the level of 1.8% per year, while the target level of the Reserve Bank is set at around two percent. Separately, the regulator stopped on the situation in the Australian housing market. Let me remind you that housing has fallen in price in almost all major cities of Australia especially in Sydney and Melbourne. Prices have been falling for 13 of the last 15 months and over the past three months, the rate of decline has accelerated significantly. Since the peak recorded in the fall of 2017, property in Australia has fallen in price by more than 6 percent. To some surprise, the Australian regulator took a rather ambiguous position on this issue. The ministry noted that the cost of housing has been actively growing for a long time, thus the current price reduction "is likely to have only a small impact on the economy." At the same time, the regulator warned that if the current dynamics is "stronger", this factor will not only reduce the level of consumption. Naturally, members of the RBA did not ignore more global issues. The Central Bank is still concerned about the resumption of the trade war between China and the United States, as this trade conflict is a "significant risk" for the global economic outlook, according to the RBA. Also in Australia, they are seriously concerned about the slowdown in the Chinese economy, the pace of which turned out to be stronger than their own forecasts. Summarizing all the above, the regulator made a very ambiguous conclusion. According to the Central Bank, the interest rate can either increase or decrease in the future and the probability of the implementation of these options is "almost the same". However, at the moment there are no arguments in favor of a rate change (at least in the short term), the regulator will adhere to stability in this matter. The Australian dollar reacted to the published protocol with a minimum decrease by only 30 points, dropping to the bottom of the 71st figure. The indistinct rhetoric of the RBA did not allow the bears of the AUD/USD pair to seize the initiative, hence, the price did not even test the boundaries of the 70th figure. n contrast to the head of the regulator Philip Low, the regulator members voiced a more vague position that does not allow us to unequivocally talk about increasing the likelihood of a rate cut this year. The vast majority of experts surveyed also tend to think that the Central Bank will maintain the status quo in the foreseeable future. More than half of them believe that the rate will remain unchanged throughout this and next year, at least until the first quarter of 2021. It is worth recalling that on Friday (February 22), the head of the Reserve Bank of Australia, Philip Lowe, will speak in the country's parliament where he will report to members of the Standing Committee on Economics of the House of Representatives. The theme of his presentation involves a broad assessment of the current situation so he can more clearly determine the prospects for the country's monetary policy. On the other hand, given the rhetoric of the published protocol, it is unlikely to deviate from the announced course, especially against the background of a possible "truce" between the United States and China. The dynamics of the labor market can also have a significant impact on Aussie. The unemployment rate should remain at the same five-percent mark but the increase in the number of employees will decrease slightly to 15.2 thousand, relative to the previous month. Overall, Aussie continues to trade in the flat, ranging in the 100 price point range at 0.7060-0.7160. The levels of support and resistance are slightly lower and slightly higher than the indicated boundaries. Thus, approaching the "round" mark of 0.70, there is a strong support level of 0.7030 where the lower line of the Bollinger Bands coincided with the upper boundary of the Kumo cloud at this price point on the daily chart. The material has been provided by InstaForex Company - www.instaforex.com |

| Control zones of NZD/USD pair on 02/19/19 Posted: 19 Feb 2019 05:57 AM PST Today, the pair is trading near the a control zone, which is the defining support. If the course fails to consolidate below this zone, the upward movement will continue and the maximum of a week will be updated with a 70% probability. At the height of the Asian trading session, the NZD/USD pair approaches the defining support of the a CZ at 0.6820-0.6813. A test of this zone will indicate further priority. The emergence of demand will oblige to open a long position, the first goal of which will be the local maximum of the current week. The main target for growth will be the 1/2 CZ of 0.6950-0.6943, which was formed from a weekly CZ. The last upward movement is still an impulse that makes purchases profitable at a distance. On the higher timeframe, the movement looks like a long-term zone of accumulation, therefore, the achievement of the February maximum can be decisive for the bullish momentum. This requires a partial closing position when updating the weekly high. An alternative model will be developed in case the pair can break through and consolidate below the 1/2 CZ of 0.6820-0.6813. This will lead to the formation of a bearish momentum and the emergence of new goals on the downward movement. The first goal will be the weekly CZ of 0.6750-0.6736, which will coincide with the zone of the February offer. Daily CZ - daily control zone. The area formed by important data from the futures market that change several times a year. Weekly CZ - weekly control zone. The area formed by marks from important futures market which change several times a year. Monthly CZ - monthly control zone. The area is a reflection of the average volatility over the past year. The material has been provided by InstaForex Company - www.instaforex.com |

| Control zones of GBP/USD pair on 02/19/19 Posted: 19 Feb 2019 05:57 AM PST The movement of the pair yesterday allowed the instrument to remain in the flat phase. It should be noted that the fall was stopped at weekly CZ of 1.2832-1.2793, which makes this an important range for medium-term support. Last week, a local accumulation zone was formed, therefore the 1/2 CZ of 1.2983-1.2964 is currently an important resistance. While the pair is trading below this zone, the bearish momentum is considered to be incomplete. The probability of returning to the February low is 70%. The most favorable prices for the sale of the instrument are within the a CZ as indicated above. Working in the accumulation phase involves finding favorable prices for both buying and selling. Bargain prices are usually located near the extremes of past weeks. If there is a coincidence with the control zones, then such levels must be used to set limit orders. An alternative model will be developed if the pair can break through and consolidate above the level of 1.2983 in today's US session. This will make it possible to consider the completion of the downward impulse, which will make it possible to look already for purchases headed towards a new impulse in tomorrow's European session. Daily CZ - daily control zone. The area formed by important data from the futures market that change several times a year. Weekly CZ - weekly control zone. The area formed by marks from important futures market which change several times a year. Monthly CZ - monthly control zone. The area is a reflection of the average volatility over the past year. The material has been provided by InstaForex Company - www.instaforex.com |

| EURUSD: The report from the ZEW Research Center and Eurozone surplus let Euro buyers down Posted: 19 Feb 2019 05:55 AM PST Eurozone data in the first half of the day once again limited the upward potential in euros, which was observed at the beginning of the week. Now, bulls, without updating the larger support levels and building a new upward price channel, are unlikely to easily break through this week's high near 1.1330 and catch at 1.1370 and 1.1440 highs. The euro began to decline after the report that the surplus of the current account of the balance of payments in the eurozone in December 2018 continued to decline rapidly. This is due primarily to trade sanctions and the weakening of exports. According to the data of the European Central Bank, the positive balance of the current account of the euro zone's balance of payments in December amounted to 16 billion euros against 23 billion euros in November 2018. Let me remind you that back in December 2017, the surplus was 29 billion euros. German data also did not make investors happy. As indicated in the report, the outpacing index of economic expectations for February of this year in Germany rose only slightly after a decline in January. A serious drop was observed in the current conditions index. According to a report by the ZEW Research Center, the index of economic expectations in Germany in February 2019 rose to -13.4 points from -15.0 points in January, while economists predicted that in February the index would be -14.0 points. The index of current conditions in Germany in February fell to 15.0 points from 27.6 points in January. The center noted that there are currently no signs of a quick recovery in the unstable German economy, as evidenced by the slowdown in economic growth last year. Let me remind you that last week a report from Deutsche Bank was published, in which economists expected that Germany's GDP would grow by only 0.5% this year. As for the technical picture of the EURUSD pair, the bearish scenario, which I drew attention in my morning review, began to work out. At the moment, a breakthrough of the level of 1.1290 may lead to a larger decrease in the trading instrument to the area of the lows of last week, up to the update of the support of 1.1235. Buyers of risky assets at the end of today, of course, it is desirable to return to the resistance level of 1.1290, which will build a new lower limit of the upward price channel. The British pound remained "pushed" in one place after the release of the report, in which, on the one hand, at the end of 2018, the number of jobs in the UK continued to increase, while, on the other hand, wage growth remained unchanged and turned out to be worse than expected economists. Given the continuing nervousness regarding the country's future withdrawal from the EU, this report as a whole can be called good. According to the data, the number of unemployed in the UK from October to December 2018 decreased by 14,000 compared with the previous period. The unemployment rate was 4%. As noted above, the quarterly wage growth rate remained unchanged, at 3.4%, while economists had expected growth of 3.5%. Real wages increased by 1.2%. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 19 Feb 2019 05:55 AM PST To open long positions on GBP / USD, you need: Weak data on the labor market did not allow the pound to resume growth, and only a real breakthrough and consolidation above resistance 1.2926 will give a new impetus to GBP / USD, which will lead the pair to a new maximum of 1.2986 and 1.3047, where I recommend fixing the profits. In the case of a downward correction, which can be observed this afternoon, amid lack of clarity in negotiations between the British Prime Minister and EU representatives, long positions in GBP / USD can be returned to a false breakdown from support 1.2868 or rebound from a minimum of 1.2812. To open short positions on GBP / USD, you need: The bears managed to form a false breakdown and return below the support level of 1.2926 in the first half of the day, and while the trade is below this range, there is a possibility of a decrease in the pound, which will lead to a larger scale to the minimum area of 1.2868 and 1.2812, where I recommend fixing the profit. In the case of continued GBP / USD growth in the second half of the day or news on Brexit, new short positions can be considered after updating the highs of 1.2986 and 1.3047. Indicator signals: Moving Averages Trade is conducted in the area of 30-day and 50-medium moving, which indicates the lateral nature of the market or the decline of the pound after the unsuccessful breakdown of the level of 1.2930. Bollinger bands Only a breakthrough of the upper limit of the Bollinger Bands indicator around 1.2945 will lead to a net increase in the pound. The lower limit in the 1.2892 area will limit the fall, but its breakthrough will lead to a strong decline in GBP / USD. Description of indicators

|

| Posted: 19 Feb 2019 05:10 AM PST To open long positions on EUR / USD pair, you need: Weak data on the current positive balance of the account of the balance of payments in the eurozone, as well as, the decrease in the current conditions index in Germany led to a fall in the euro in the first half of the day. Now, trading is conducted below the support level of 1.1288 and customers to return on it. Only this will help to expect a correction to the area of yesterday's high at 1.1332. In case of further EUR/USD decline, it is best to consider new long positions after updating the lower limit of the upward price channel, which now coincides with the support level of 1.1262. To open short positions on EUR / USD pair, you need: Sellers are required to keep the pair below the resistance of 1.1288, which will only dampen the pressure on the euro by the second half of the day and lead to a sale to the area of larger support of 1.1262, where the upper limit of the upward price channel passes. A breakthrough of this area will completely cancel out the plan for the growth of EUR/USD pair and will allow to update the lower limit in the area of 1.1235, where I recommend to take profits. In the case of the euro rise in the second half of the day, it is safe to rely on short positions to rebound from the resistance of 1.1332. More in the video forecast for February 19 Indicator signals: Moving averages Trade again returned under the 30- and 50-moving average, which indicates a possible continued pressure on the euro. Bollinger bands In the case of an upward correction, growth will be limited by the upper limit of the Bollinger Bands indicator in the area of 1.1325. Description of indicators MA (moving average) 50 days - yellow MA (moving average) 30 days - green MACD: fast EMA 12, slow EMA 26, SMA 9 Bollinger Bands 20 The material has been provided by InstaForex Company - www.instaforex.com |

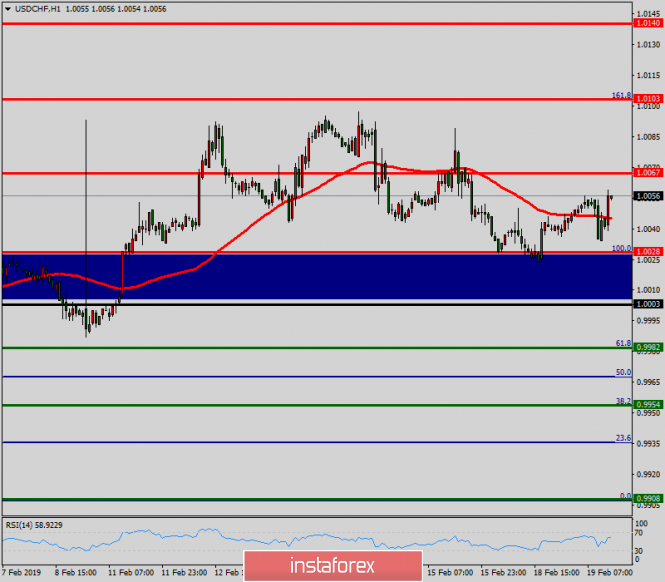

| Technical analysis of USD/CHF for February 19, 2019 Posted: 19 Feb 2019 04:03 AM PST The USD/CHF pair continues to move upwards from the level of 1.0003. Today, the first support level is currently seen at 1.0003, the price is moving in a bullish channel now. Furthermore, the price has been set above the strong support at the level of 0.9982, which coincides with the 50% Fibonacci retracement level. This support has been rejected three times confirming the veracity of an uptrend. According to the previous events, we expect the USD/CHF pair to trade between 1.0003 and 1.0067. So, the support stands at 1.0003, while daily resistance is found at 1.0067. Therefore, the market is likely to show signs of a bullish trend around the spot of 1.0003. In other words, buy orders are recommended above the spot of 1.0003 with the first target at the level of 1.0067; and continue towards 1.0103 and 1.0140. However, if the USD/CHF pair fails to break through the resistance level of 1.0030 today, the market will decline further to 0.9908. The material has been provided by InstaForex Company - www.instaforex.com |

| Side trend in the currency markets continued Posted: 19 Feb 2019 03:58 AM PST Last week, the foreign exchange market continued to show uncertain dynamics. There is a lot of reasons for this, which by their influence and some factors lead to the rope pulling effect. The dollar drops against the main currencies and gets support against others. The main negative for the rate of the American currency is the intrusive signals of some Fed members about the need for a pause in raising interest rates and Lael Brainard even agreed to stop the process of reducing the bank's balance sheet. At the same time, for example, President of the Federal Reserve Bank of Atlanta, Raphael Bostic believes that it is too early to make a decision on changing the exchange rate while assessing the prospects for the country's economy is still very high. In his opinion, the likelihood of a single increase in interest rates is still valid. Another important factor that brings uncertainty is the trade negotiations between Washington and Beijing which dominates the markets. Despite the positive reports of the American president, there is no serious reason to hope that the trade war will take a milder form if it does not stop. The weakening growth of the Chinese economy has already had a negative impact on Europe, which is already aggravated by the Brexit problem. The slowdown in the growth of the eurozone economy against the background of the risk of recession due to inflationary will definitely force the ECB not to take measures in changing the monetary policy, which puts pressure on the common currency rate. At the moment, investors are waiting for updated data on US GDP and a noticeable drop in the growth rate may once again change the wind direction in financial markets, which may start to inflate the sails of the US dollar due to increased demand for it as a safe haven currency. Summarizing, we note that our view on the short term remained the same yesterday. We expect to maintain overall lateral dynamics. A weak US GDP data will increase the demand for the dollar, which may again reach local highs but recall that this movement will be in line with the side trend. Recall that Monday is a holiday in the US which limited the activity on the market. The material has been provided by InstaForex Company - www.instaforex.com |

| Bitcoin analysis for February 19, 2019 Posted: 19 Feb 2019 03:52 AM PST

BTC has been trading upwards. We found strong momentum on the upside and no signs of reversal, which is a sign that buyers are in control. The key resistance levels are seen at the price of $4.0645 and $4.200 (the key supply zone). The potential breakout of these supply zones would confirm a potential test of $4.483 (Fibonacci expansion 100%). The key support is set at the price of $3.750. Trading recommendation: Bullish momentum on the gold. We are neutral on BTC since the price is close to the key resistance zone. Anyway, the momentum is bullish and you should watch only buying opportunities. The material has been provided by InstaForex Company - www.instaforex.com |

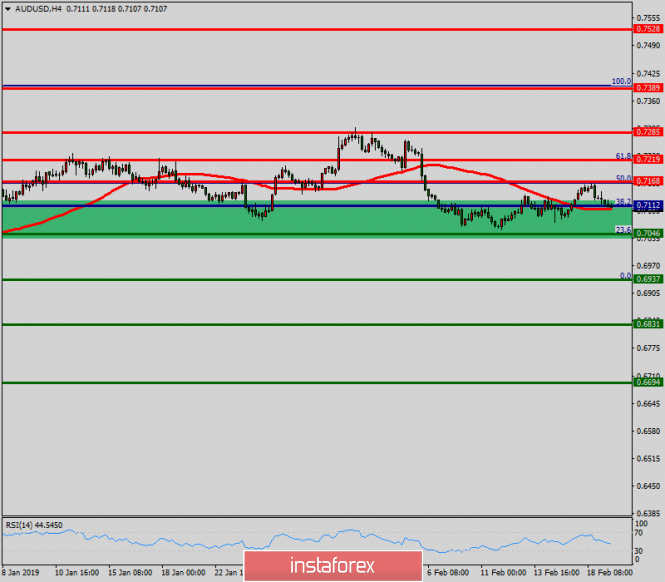

| Technical analysis of AUD/USD for February 19, 2019 Posted: 19 Feb 2019 03:49 AM PST Overview: The AUD/USD pair is set above strong support at the level of 0.7046 which coincides with the 23.6% Fibonacci retracement level and 0.7168. This support has been rejected four times confirming the uptrend. Hence, major support is seen at the level of 0.7046, because the trend is still showing strength above it. Accordingly, the pair is still in the uptrend in the area of 0.7046 and 0.7168. The AUD/USD pair is trading in the bullish trend from the last support line of 0.7112 towards the first resistance level of 0.7168 in order to test it. This is confirmed by the RSI indicator signaling that we are still in the bullish trending market. Now, the pair is likely to begin an ascending movement to the point of 0.7168 and further to the level of 0.7290. The level of 0.7389 will act as major resistance and the double top is already set at the point of 0.7389. At the same time, if there is a breakout at the support levels of 0.7112 and 0.7046, this scenario may be invalidated. Overall, however, we still prefer the bullish scenario. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD analysis for February 19, 2019 Posted: 19 Feb 2019 03:39 AM PST

EUR/USD is trading sideways at the price of 1.1283. Anyway, according to the H1 time – frame, we found potential end of the upward correction (running flat) at the price of 1.1333, which is a sign that buying looks risky. EUR failed to test the high at 1.1340, which is a sign that buyers are weak. We also found the breakout of the intraday support trendline inside of the running flat trendlines, which is another sign of weakness. We expect re-test of the lower diagonal and potential even the breakout. Trading recommendation: We are bearish on EUR/USD from 1.1285 and protective stop at 1.1345. Profit targets are set at the price of 1.1233 and 1.1130. The material has been provided by InstaForex Company - www.instaforex.com |

| Analysis of Gold for February 19, 2019 Posted: 19 Feb 2019 03:17 AM PST

Gold eventually managed to break the key resistance at the price of $1.325.00 and on the way confirms the further upward continuation. We found the breakout of the bullish flag in the background, which is that bearish correction has ended. The key support remains at $1.301.00 and as long as the price doesn't go below, the trend is bullish. Pitchfork channel is confirming the potential test of the median line $1.345.00-1.350.00. Besides, there is the strong Fibonacci resistance at $1.350.00 (FE 100%) R1: $1.332.20 R2: $1.334.80 R3: $1.338.80 Pivot: 1.328.50 S1: $1.325.50 S2: $1.321.40 S3: $1.318.80 Trading recommendation: We are bullish on the Gold from $1.328.00 and protective stop at $1.312.00. Profit target is set at the price of $1.350.00. The material has been provided by InstaForex Company - www.instaforex.com |

| Simplified wave analysis. Overview of EUR / CHF for February 19 Posted: 19 Feb 2019 01:53 AM PST Large TF: The direction of price fluctuations of the cross in the last six months is given by the rising wave. The wave has the form of a standard plane. In the structure, there is a clear sequence (A + B + C). Small TF: The rising wave of January 3 completes the larger structure. From January 30, the price is adjusted. In its process, there is a small probability of a short-term puncture of the lower boundary of the calculated zone. Forecast and recommendations: The period of flat movement of the cross can continue until the end of the current month. The wave algorithm indicates a continuation of price growth, but its potential is small. Purchasing can only be justified with intraday trading. Resistance zones: - 1.1490 / 1.1540 Support areas: - 1.1350 / 1.1300 Explanatory notes for the figures: The simplified wave analysis uses waves consisting of 3 parts (A – B – C). On each of the considered scales of the graph, the last, incomplete wave is analyzed. Zones show calculated areas with the highest probability of reversal. The arrows indicate the wave marking by the method used by the author. The solid background shows the formed structure, the dotted - the expected movement. Note: The wave algorithm does not take into account the duration of tool movements over time. To conduct a trade transaction, you need confirmation signals from the trading systems you use! The material has been provided by InstaForex Company - www.instaforex.com |

| The cost of oil can temporarily reach $ 70 per barrel Posted: 19 Feb 2019 01:20 AM PST

According to experts of a major analytical company JBC Energy, oil prices in the short term may increase to $ 70 per barrel, and then they will return to previous levels. On Monday, February 18, oil quotes reached a three-month high against the background of optimism in negotiations between the US and China, as well as news of active cuts in oil production by Saudi Arabia. After the fall in the cost of Brent oil by more than 42% from the beginning of October to the end of December 2018, this North Sea variety has risen in price by almost 34%. Oil prices were supported by both rally in stock markets and the belief that Washington and Beijing would not impose mutual restrictions. According to analysts, the reduction of world oil supply, as well as progress in trade negotiations between the United States and China, will further contribute to the growth of oil prices. Support for the black gold market will continue to provide the OPEC report, according to which the volume of production by the countries of the cartel fell in January by 800 thousand barrels, to 30.81 million barrels per day. Recall that the lion's share of the decline in oil production fell on Saudi Arabia. JBC Energy believes that there are a number of factors capable of boosting oil prices in the short term. In addition to positive news, these include shipments. For example, in April of this year, the Angolan authorities plan to carry out 43 shipments of raw materials in the amount of 41.3 million barrels, at 1.38 barrels per day. This is less than in March 2019, which is scheduled for 1.45 million barrels per day. By Tuesday, February 19, WTI oil prices showed an increase of 0.85%, to $ 56.06 a barrel. The cost of Brent crude increased by 0.3%, to $ 66.45 a barrel. Earlier, quotes reached a high of $ 66.83, almost approaching the peak of November 2018. |

| Simplified wave analysis. Overview of GBP / USD for February 19 Posted: 19 Feb 2019 12:54 AM PST Large TF: The wave of the main trend of the pound major since April is moving to the "south" of the chart. The trend structure does not look complete, therefore counter price movements are nothing more than a correction. Small TF: In the ascending wave model of December 12, a correction phase develops in recent weeks. In the last days, an intermediate pullback was formed, after which the wave will continue. Forecast and recommendations: The current decline in the pair will continue soon, as supporters of the interday trading style will be able to take advantage of. For longer investments, traders need to wait for the completion of the entire downward wave. Resistance zones: - 1.2970 / 1.3020 Support areas: - 1.2700 / 1.2650 Explanatory notes for the figures: The simplified wave analysis uses waves consisting of 3 parts (A – B – C). On each of the considered scales of the graph, the last, incomplete wave is analyzed. Zones show calculated areas with the highest probability of reversal. The arrows indicate the wave marking by the method used by the author. The solid background shows the formed structure, the dotted - the expected movement. Note: The wave algorithm does not take into account the duration of tool movements over time. To conduct a trade transaction, you need confirmation signals from the trading systems you use! The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 19 Feb 2019 12:33 AM PST Wave counting analysis: On Monday, February 18, trading ended on EUR / USD by 15 bp increase for the pair EUR / USD. Such a low market activity is quite understandable, since there is no news about it yesterday. Thus, the current wave marking has not changed in any way. Like before, I assume the completion of the construction of wave 3 or, possibly, c, and the transition of the pair to the construction of a new upward wave with the first targets located near the level of 23.6% on the older Fibonacci grid. At the same time, the trend segment of the last two or three days does not look quite convincing, which can lead to the complication of the entire wave marking of the instrument. Sales targets: 1.1228 - 127.0% Fibonacci 1.1215 - 0.0% Fibonacci Shopping goals: 1.1356 - 23.6% Fibonacci 1.1444 - 38.2% Fibonacci General conclusions and trading recommendations: The pair allegedly completed the construction of the downward wave 3. Thus, now I recommend buying with targets located near the estimated mark of 1.1356, which corresponds to 23.6% Fibonacci, and higher. A successful attempt to break through the levels of 127.2% and 0.0% Fibonacci will lead to a further decrease in the instrument and complicate the current wave marking. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 19 Feb 2019 12:25 AM PST To open long positions on GBP/USD you need: Today, all attention will be focused on the report on the UK labor market. Good fundamental data will lead to a breakthrough and consolidation above the resistance of 1.2926, which will give new impetus to growth in the area of highs of 1.2986 and 1.3047, where I recommend taking profits. In case of a downward correction, which can be observed today in the first half of the day, amid lack of clarity in negotiations between the British prime minister and EU representatives, long positions in GBP/USD can be returned to a false breakdown from the support of 1.2868 or rebound from a low of 1.2812, where the lower limit of the ascending channel passes. To open short positions on GBP/USD you need: The formation of a false breakdown in the area of the resistance of 1.2926 will be the first signal to open short positions in the pound in order to reduce and test the support of 1.2868, where I recommend to take profits. However, the main goal of sellers will be at least in the area of 1.2812, but even its test will not lead to the resumption of the downward trend. This requires an update of the level of 1.2769. In case of further growth of GBP/USD, after a good report on the labor market is released, you can take a closer look at short positions at the rebound from the high of 1.2986. Indicator signals: Moving averages Trading in the area of 30-day and 50-day moving, which indicates the formation of the lateral nature of the market and bullish advantage. Bollinger bands The pound's growth for today may limit the upper limit of the Bollinger Bands indicator in the area of 1.2940. A break of the lower border around 1.2895 may lead to a larger decrease in the pair. Description of indicators

|

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment