Forex analysis review |

- The dollar could be preparing for a new rally

- Trading recommendations for the GBPUSD currency pair - placement of trading orders (February 26)

- Trump scared the oil "bulls"

- Brexit prospects: three options and a "bonus" from Labour

- GBP/USD. February 26th. Results of the day. Theresa May wants to vote for withdrawal from the EU without agreements

- EUR/USD. February 26th. Results of the day. Turtle movements. The pair is lurking on the eve of Powell's speech

- BITCOIN Analysis for February 26, 2019

- Bitcoin analysis for February 26, 2019

- February 26, 2019 : GBP/USD Bullish Flag pattern is being demonstrated.

- GBP/USD analysis for February 26, 2019

- GBP / USD plan for the American session on February 26. Pound buyers keep pushing the market

- Fed: What determines the future direction of the euro?

- EUR / USD: The speech of the Fed Chairman in the Congress as the central event of the day

- EUR / USD plan for the US session on February 26. Euro cannot cope with the level of 1.1370 while traders wait for the speech

- Analysis of Gold for February 26, 2019

- February 26, 2019 : EUR/USD is still holding some bullish gains around the lower limit of its channel.

- Technical analysis of USD/CHF for February 26, 2019

- Technical analysis of EUR/USD for February 26, 2019

- Theresa May retreats and ready to postpone Brexit

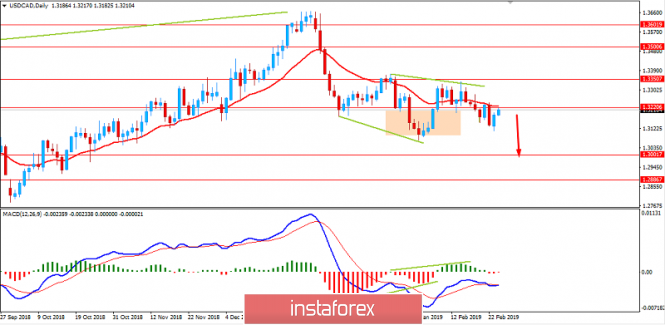

- Fundamental Analysis of USDCAD for February 26, 2019

- The pound may rise to $ 1.38 in the case of a Brexit transaction

- Indicator analysis. Daily review February 26, 2019 for the pair GBP / USD

- Wave analysis of GBP / USD for February 26. The pound continues to grow, risking to break the downward trend

- Wave analysis of EUR / USD for February 26. The euro is trading in a narrow price range.

- EUR and GBP: Fed rates are at the lower limit of the neutral range. The pound is growing on rumors of a deferment of Brexit

| The dollar could be preparing for a new rally Posted: 26 Feb 2019 05:20 PM PST Following the active growth observed in mid-February, the US currency came under pressure against the background of a softening of the Fed's rhetoric and positive expectations about making progress in the United States and China trade negotiations. Does this mean that the strengthening of the greenback, which began in February last year, is nearing completion? Investors expect the Federal Reserve to refrain from hiking interest rates in the current year, and are inclined to believe that the next step for the regulator may be to reduce the cost of borrowing, at least this is indicated by the futures quotations for the federal financing rate. Meanwhile, the minutes of the last meeting of the US central bank show that it may not be such a "dove" as the markets believe. In any case, the prevailing views among FOMC members proceed from the fact that the regulator may have not yet completed the rate hiking process, but simply paused it. In particular, the head of the Federal Reserve Bank of Atlanta, Raphael Bostic, believes that the Fed may raise the federal funds rate by 0.25% this year and by the same amount next year. As for the trade negotiations between Washington and Beijing, the transaction may not take place at all, which will be one of the drivers for strengthening the greenback. Here we should also add America's trade war against Europe, as well as the growing US public debt. In addition, one should not forget about the securities market, which may be on the "bearish" territory after the longest "bullish" cycle in history, which will again push global investors to US government bonds and the dollar. Thus, based on the above, most likely, we should expect the next USD rally, within which the highest levels of November-February (around the mark of 97.50) will be tested. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading recommendations for the GBPUSD currency pair - placement of trading orders (February 26) Posted: 26 Feb 2019 04:55 PM PST For the last trading day, the currency pair Pound / Dollar showed low volatility. However, it is noteworthy that it was only in the upward direction. From the point of view of technical analysis, we see a breakdown of the upper limit of the 1.3000 cluster, and after that, the quote has increased from the psychological level of 1.3000. For information and news background: a possible postponement of Brexit, which was already expressed by Donald Tusk, President of the European Council, wherein he stated; "We discussed a number of legal issues, including the possibility of a delay. I believe that the EU is waiting for the chaotic Brexit, or it will be necessary to extend the negotiations, because there is no unity in the House of Commons. I explained this to Ms. May, but apparently she continues to believe that she will be able to convince the deputies without delay. " In turn, the head of the Bank of England, Mark Carney, voiced out the possible risks in the event of the country's exit without a deal. Today, the focus is on Theresa May's performance, where you can expect everything. But if you really talk about the postponement, then the pound on this news can safely continue to grow. At the same time, Fed Chairman Jerome Powell will speak in Congress, however, the meeting is dedicated to cyber security. Thus, you should not expect anything from him. Further development Analyzing the current trading schedule, we see some rush growth in anticipation of the performance of Theresa May, where the previously holding cluster of 1.3020 / 1.3100 was broken through. It is hard to say whether the bull mood will persist, as there is now speculation, and if the truth in Theresa's speech comes to a postponement, we will easily extend the quotation to 1.3200. Otherwise, if the rhetoric of the Prime Minister remains the same, we will return back to the confines of the 1.3020 / 1.3000 cluster. Based on the available data, it is possible to expand a number of variations. Let's consider them: - Positions to buy, as written in the previous review, traders considered the point 1.3115 for laying long positions. If we do not have deals, then it is possible to take the current maximum of the day and try to enter above it. If the perspective remain unchanged, the first point will be at 1.3200 level. - We consider selling positions in two versions: the first is already in the case of mining the level of 1.3200; the second is in the case of the loss of the current upward mood and fixation below 1.3100. Indicator Analysis Analyzing the different sector of time frames (TF), we see that there is an upward interest in the short, intraday, and medium term. Meanwhile, in anticipation of Theresa May's performance, indicators on smaller TFs can change arbitrarily. Weekly volatility / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation, with the calculation for the Month / Quarter / Year. (February 26 was based on the time of publication of the article) The current time volatility is 68 points. At the time of Theresa May's performance, volatility may increase. Key levels Zones of resistance: 1,3200 *; 1.3300; 1.3440 **; 1.3580 *; 1.3700 Support areas: 1.3000 ** (1.3000 / 1.3050); 1.2920 *; 1.2770 (1.2720 / 1.2770) **; 1.2620; 1.2500 *; 1.2350 **. * Periodic level ** Range Level The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 Feb 2019 04:51 PM PST More than 20% of the Brent and WTI rallies proved enough for Donald Trump to show his displeasure. He has repeatedly complained that high oil prices are reaching the pockets of ordinary Americans, the US president said on Twitter that the current value of black gold is too high, and urged OPEC to relax. It seems that the owner of the White House firmly believes that the main cause of the rally of the main varieties was the cartel's decision to reduce production 1.2 million b/d. I notice a speck in another's eye, I don't see a log in my own! But what about the sanctions against Iran and Venezuela? But what about the breakthrough in the negotiations between Washington and Beijing, which strengthened the global risk appetite and the demand for oil? Last year, Trump twice appealed to OPEC with a request not to raise prices artificially. In the summer, the cartel, under pressure because of the murder of an American journalist, backed off, which immediately affected the economy of the Middle East. In the fall, the US president's appeals were ignored, however, a grace period in respect for deliveries of black gold from Iran under sanctions allowed Brent and WTI bears to lower futures quotes by 35%. Now Americans have no such trump card. More precisely, the period can be extended, but the cartel and its allies are not asleep. In addition, the bulls have Venezuela on hand and a potential improvement in global demand amid rising hopes of ending trade wars. Trump was in a rather unpleasant situation: he wants the stock indices to grow and oil to fall. Quite an absurd desire in terms of intermarket analysis. Yes, oil sellers have strong arguments in the form of growth in US production and exports, as well as the 6th increase in reserves in the week to February 22 (according to forecasts by experts at Bloomberg, the figure will rise by 3 million barrels). Oil companies from the United States use the increase in prices for black gold, actively increase production and at the same time hedge risks. Supply expands faster than demand, which is a "bearish" factor for WTI. Dynamics of oil and US reserves On the other hand, the sanctions against Venezuela make Caracas puzzle over who it would sell 8.36 million barrels of oil worth more than $1.5 billion, while Trump's statements about too high prices are reminiscent of calls from a man who had hid in order to save himself against the hands of other people. If you are entering into an agreement with China, you want the Federal Reserve to stop the cycle of monetary policy normalization, and you put pressure on Venezuela and Iran, then be prepared that the growth of global risk appetite and the reduction of production will push the quotes of Brent and WTI higher. According to Goldman Sachs, the price of black gold may increase by another 13% of the current levels, but this rally is likely to be short-term. Technically, the bulls in the North sea variety did not reach the level of 50% of the CD wave of the Shark pattern. At the same time, their inability to keep quotes above $64.1 per barrel will be a sign of weakness and will allow the bears to develop an attack. Brent, daily chart |

| Brexit prospects: three options and a "bonus" from Labour Posted: 26 Feb 2019 04:00 PM PST Thus, exactly in two weeks - on March 12 - the decisive vote on Brexit will take place. This statement was made today by British Prime Minister Theresa May in the House of Commons. Although this will not be the first "decisive" vote on this issue, it is difficult to overestimate the importance of the March vote, given the main points of May's speech in Parliament. The pound reacted positively to this rhetoric: against the US dollar, the sterling impulsively reached the level of 1.3268, updating its annual high. Such volatility is quite justified, because the head of government for the first time allowed the option of postponing Brexit, including this option in one of three possible. It is worth recalling that just yesterday, in the Egyptian Sharm El-Sheikh, Theresa May said that the postponement of Brexit is "death like", so the country should leave the EU on March 29. Although ahead of it, the British press reported that London is already preparing a request to Brussels to postpone the release date for two months. European journalists, in turn, voiced another version – according to them, the delay is initiated by the European Union itself, and for a longer period. Therefore, yesterday's announcement may have surprised traders as the stance was at odds with what was published. Today, everything fell into place. The British prime minister allowed a "limited extension" of article 50 of the Lisbon Treaty, although she did not specify what kind of time frame was in question. According to her, this issue will be put to the vote only as a last resort. First, the deputies will consider the "updated" draft of the deal - if the majority of Parliament does not support the document, it will submit an opposite proposal for consideration – to withdraw from the EU without concluding any agreement with Brussels. If the two above projects fail, the Cabinet will propose to postpone Brexit. After these words, the pound increased against the dollar and updated its annual high. The growth is impulsive and wavy-like in nature. The fact is that the voiced position of May is the most optimal of all possible options. Let me remind you that on the eve of the previous vote, the British prime minister played a "card of no alternative": either a deal or a chaotic Brexit. Now we are talking about three options, and this fact reduces the likelihood of implementing a "hard" scenario. The deputy ministers do not get tired of demanding more favorable terms of the transaction from May, but at the same time is not ready to break off relations with Europe without any agreements. Therefore, of the three options voiced by the prime minister, only two are real: either the Parliament votes for the deal, or it reschedules the date of withdrawal from the EU. Although Theresa May did not specify which date Brexit could be postponed, her European colleagues did it for her. In particular, representatives of Angela Merkel said that Germany would agree to extend the transition period only until the end of June. At the same time, the Germans are ready to discuss additional proposals on Brexit. The European Commission also welcomed the "rational" choice of the British – but at the same time did not specify how long they are willing to discuss the terms of the "divorce process". It is noteworthy that the Europeans do not actually believe that the British Parliament will support the proposed deal, so most talk about the extension of the transition period as a fait accompli. In addition to the three options mentioned above, there is a fourth. We are talking about a second referendum on Britain's withdrawal from the EU. Recently, Labour radically changed their opinion on this issue: if earlier they refused to lobby for this idea, now they are ready to make appropriate legislative initiatives. According to the British press, these amendments can be made to the Parliament tomorrow. It should be noted at once that this is quite a difficult way, primarily because of legal obstacles (to hold a second referendum, you need to make changes to many laws and codes). If the deputies decide on this option, the pound will receive tremendous support, because according to many surveys, The number of brexit supporters among the British has significantly decreased compared to June 2016. Thus, the events of the next few days will continue to excite GBP/USD traders. If among the deputies, a rise is seen in the number of supporters who approve the Brexit/ Referendum Deal/Transfer, then the upward trend will continue to the boundaries of the 33rd figures. These options exclude the implementation of the "hard" scenario, so they will determine bullish sentiment among traders. In technical terms, the pair entered the Kumo cloud on the weekly chart, breaking through its lower border. The next resistance level on this timeframe is the upper limit of this cloud, which corresponds to the price of 1.3520. But to achieve this target, you need to at least go and gain a foothold in the 33rd figure - up to this point there is a risk of a corrective pullback to the support level of 1.3000. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 Feb 2019 03:58 PM PST 4-hour timeframe The amplitude of the last 5 days (high-low): 177p - 97p - 69p - 111p - 63p. Average amplitude for the last 5 days: 103p (101p). On Tuesday, February 26, the British pound sterling received a new batch of hopes that the date of Brexit will be postponed for at least two months, and with pleasure continued groundless growth from a fundamental point of view. This growth has come to the end with a "pin", which gives hope at least for a strong correction, and at most - for a downtrend. In the meantime, Theresa May will continue to persistently bend her line and invite parliamentarians to vote for Brexit without a "deal". No one raises questions about how this vote will end. To be honest, Theresa May's similar strategy is causing everyone to be bored. The prime minister clearly cannot bring anything new to her actions and continues to adhere to the tactics of threats to Parliament, that if they do not accept her Brexit plan then Brexit will end without any agreements. However, Parliament is not a faceless creature that can make decisions only at the level of "yes/no". About 100 MPs are going to get Theresa May to postpone Brexit for two months. If the prime minister does not make this demand, then several more demonstrative resignations will occur in the Parliament. Last year there were 5 of them. In general, it seems that everything boils down to the question of whether Theresa May is ready to expose the country's Brexit without a "deal"? Although, most likely, Brexit will still be postponed, and the whole saga will be delayed for another two months, and maybe more. Question: how long will the pound sterling grow, given that there is no particularly good news for it? Trading recommendations: The GBP/USD currency pair worked out the level of 1.3235 and rebounded from it. Therefore, a downward correction can now begin. It is recommended to open new longs either after the completion of this correction or in case of overcoming the level of 1.3235. Short positions will become relevant small lots if the pair is consolidated below the critical line. This will be the first step on the way to changing the downward trend. The first target is the Senkou span b line. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanation of illustration: Ichimoku Indicator: Tenkan-sen-red line. Kijun-sen – blue line. Senkou span a – light brown dotted line. Senkou span B – light purple dotted line. Chikou span – green line. Bollinger Bands Indicator: 3 yellow lines. MACD: A red line and a histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 Feb 2019 03:28 PM PST 4-hour timeframe The amplitude of the last 5 days (high-low): 82p - 46p - 46p - 40p - 41p. Average amplitude for the last 5 days: 51p (52p). On Tuesday, February 26, the EUR/USD currency pair continues to move sluggishly and inactively. Basically, you just have to look at the volatility indicators for the last four days and it becomes clear how the pair moves. With great difficulty, today, the pair managed to reach the first resistance level of 1.1377, but failed to make it work. In conditions of reduced volatility and almost flat, any positions are associated with increased risks, as the pair simply does not fulfill the designated goals, and even if it does it is done within a few days, and these periods are not accompanied by a one-time reversal of the indicators pointing downwards. In general, trade is clearly complicated due to low market activity. As for the fundamental events, everything is simple here - they do not exist. In recent days, macroeconomic reports have not been published, there have been no high-profile political or economic events and statements in the EU and, most surprisingly, in the United States. The latest report on inflation in the EU was simply ignored, since the real value of the CPI coincided with the forecast. In general, the market has nothing to respond to. Thus, we can only expect an event that will be able to stir up the EUR/USD pair (GBP/USD is moving quite vigorously). Jerome Powell will hold a speech in Congress for today, and it can be this event. Markets will unequivocally wait for information about US monetary policy for the coming months and the whole of 2019, as well as confirmation or refutation of the "dovish" attitude, which was unambiguously present in Powell's recent speeches and in the Federal Reserve reports. Trading recommendations: The EUR/USD pair resumed the weakest upward movement. Formally, long positions with goals of 1.1377 and 1.1422 are currently relevant, but the movement is extremely weak, which should be taken into account. It is recommended to consider sell orders not earlier than fixing below the Kijun-sen line, but even in this case, given the weak volatility, the downward movement can be extremely weak. Perhaps, the situation will be corrected by Jerome Powell's speech. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanation of illustration: Ichimoku Indicator: Tenkan-sen-red line. Kijun-sen – blue line. Senkou span a – light brown dotted line. Senkou span B – light purple dotted line. Chikou span – green line. Bollinger Bands Indicator: 3 yellow lines. MACD: A red line and a histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

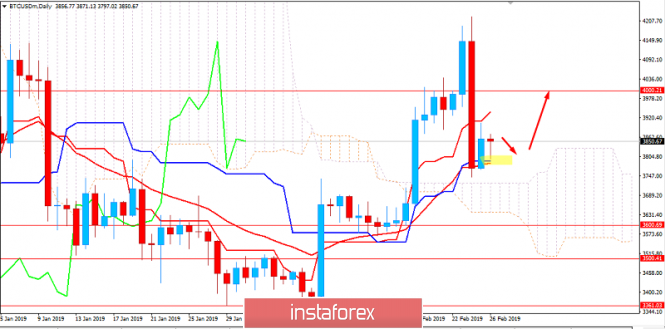

| BITCOIN Analysis for February 26, 2019 Posted: 26 Feb 2019 08:08 AM PST Bitcoin managed to sustain the bullish momentum it gained yesterday after an impulsive bearish daily close below $4,000. Persistent bullish pressure above the Kumo Cloud, 20 EMA, Tenkan, and Kijun line signals strength of bulls which is expected to push the price higher towards $4,000 and much higher later. Though the overall price action is still quite volatile, strong bullish pressure with a dynamic level holding the price as support indicates that upward momentum and bullish bias in Bitcoin is still ready to thrive. A break above $4,000 will lead to a robust upward movement. Apart from the recent False Breakout above $4,000, current bullish formation off the dynamic level is expected to secure the momentum above $4,000 which may lead the price towards $4,250 and later towards $4,500 in the future. SUPPORT: 3,500, 3,600 RESISTANCE: 4,000, 4,250 BIAS: BULLISH MOMENTUM: VOLATILE

|

| Bitcoin analysis for February 26, 2019 Posted: 26 Feb 2019 04:44 AM PST

BTC has been trading sideways at the price of $3.857. Anyway, in our opinion the upward correction came to an end (bearish flag completed), which is a sign that buying looks risky. We do expect more downside on the BTC. Key short-term support is set at the price of $3.611. Short -term resistance at the price of $3.930. Trading recommendation: We are bearish on BTC from $3.854 with stop at $3.945. Profit target is set at the price of $3.611. The material has been provided by InstaForex Company - www.instaforex.com |

| February 26, 2019 : GBP/USD Bullish Flag pattern is being demonstrated. Posted: 26 Feb 2019 04:40 AM PST

On December 12, the previously-dominating bearish momentum came to an end when the GBP/USD pair visited the price levels of 1.2500 where the backside of the broken daily uptrend was located. Since then, the current bullish swing has been taking place until January 28 when the GBP/USD pair was almost approaching the supply level of 1.3240 where the recent bearish pullback was initiated. Shortly after, the GBP/USD pair lost its bullish persistence above 1.3155. Hence, the short-term scenario turned bearish towards 1.2920 (38.2% Fibonacci) then 1.2820-1.2800 (50% Fibonacci level) within the depicted H4 bearish channel. On February 15, significant bullish recovery was demonstrated around 1.2800-1.2820 (Fibonacci 50% level) resulting in a Bullish Engulfing daily candlestick. This initiated the current bullish breakout above the depicted H4 bearish channel. Quick bullish movement was demonstrated towards 1.3155 and remaining bullish targets are projected towards 1.3240 and 1.3290. Bullish persistence above the depicted supply levels (1.3240-1.3155) is a MUST so that the current bullish movement can pursue towards higher bullish targets. Any bearish breakdown below 1.3155 invalidates the whole bullish scenario for the short-term allowing sideway consolidations to occur. Trade Recommendations : Intraday traders was recommended to watch for the recent bullish breakout above 1.3100 for a bullish continuation position aiming for 1.3240 as initial target. S/L should be advanced to 1.3170 to secure some profits. Today, bullish breakout above 1.3240 on H4 chart should be considered for another continuation BUY position. T/P levels to be located around 1.3290, 1.3390. S/L to be located below 1.3155. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD analysis for February 26, 2019 Posted: 26 Feb 2019 04:32 AM PST

GBP/USD has been trading upwards as we expected. The price tested the level of 1.3220 and reached our first target. According to the H1 time – frame, we don't see any signs of reversal, which is sign that GBP/USD is expected to still trade higher. The next key resistance level is set at the price of 1.3293. In case you see the breakout of the 1.3300, the next target will be 1.3540 (Fibonacci expansion 100%) Trading recommendation: We closed half of the position with profit of 1,500,000 pips. On the second half of a position target is placed at 1.3540. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP / USD plan for the American session on February 26. Pound buyers keep pushing the market Posted: 26 Feb 2019 04:23 AM PST To open long positions on the GBP / USD pair, you need: The pound broke above the resistance of 1.3150, which led to the expected target to be near 1.3214, which I paid attention to in my morning forecast. At the moment, the expectations associated with the Brexit postponement can help the GBP/USD pair to consolidate above the resistance of 1.3214, which will give a new upward impulse and lead the pair to the area of maximum 1.3261 and 1.3348, where I recommend taking profits. In the case of a downward correction of the pound in the second half of the day, long positions can return to rebound from the support of 1.3149. To open short positions on the GBP / USD pair, you need: Sellers showed themselves from the resistance level of 1.3214, which I paid attention to in the morning review. While the trade is conducted below this range, the GBP/USD bears can return to the support area of 1.3149, where I recommend taking profits. In the event of further upward movement and consolidation above 1.3214, which will depend on the news from Brexit and the performance of Fed Chairman Jerome Powell, it is best to expect new short positions to rebound from the highs of 1.3261 and 1.3348. More in the video forecast for February 26 Indicator signals: Moving averages Trade is conducted above the 30- and 50-medium moving, which indicates the bullish nature of the market. Bollinger bands In the case of a downward correction, the support will be provided by the average Bollinger Bands indicator around 1.3149. Description of indicators MA (moving average) 50 days - yellow MA (moving average) 30 days - green MACD: fast EMA 12, slow EMA 26, SMA 9 Bollinger Bands 20 The material has been provided by InstaForex Company - www.instaforex.com |

| Fed: What determines the future direction of the euro? Posted: 26 Feb 2019 04:22 AM PST The euro continued trading near the upper limit of the side channel, showing very low market volatility recently. The news, stating that consumer sentiment in Germany should remain stable in March of this year, did not really lead to a rise in the euro while many economists expect expectations of the economy to deteriorate in the future. According to the GfK report, the leading consumer confidence index in Germany was 10.8 points in March 2019 and remained unchanged compared in February, which was fully in line with economists' forecasts. GfK noted that a number of consumers really understand the increased risks of a recession in the German economy. Thus, consumer expectations regarding the economy in February dropped to 4.2 points from 10.7 points. However, the indicator of expectations regarding revenues grew slightly and amounted to 60.0 points in February against 59.9 points in the previous month. The French data also inspired some optimism in traders who are counting on a breakthrough of the strong resistance level of 1.1370 and further growth of the European currency. According to the data, the consumer confidence index in France increased slightly in February of this year, reaching 95 points versus 92 points in January of this year. Economists had expected the January consumer confidence in France to remain unchanged this month. Good consumer confidence has a positive effect on the desire to spend, as well as on the attitude to the economy, which increases consumer spending and stimulates economic growth. As for the technical picture of the EUR/USD pair, it remained unchanged. The main task of buyers of risky assets is to break through the maximum of last week and go beyond the level of 1.1370, which is the upper limit of the side channel. Only this will allow us to expect a larger increase in the euro with testing of highs in the region of 1.1400 and 1.1440. In the case of a bearish scenario, which is also likely under the current market conditions, a breakthrough in support of 1.1325 may lead to an immediate sale and an update of 1.1280 and 1.1240 lows of the EUR/USD pair. In the afternoon, the attention of traders will focus on the speech of US Federal Reserve Chairman Jerome Powell. Today, hearings in the Senate Banking Committee will begin and the following day, he will speak before the Financial Services Committee. The main questions will concern the prospects of raising interest rates this year to reduce the Fed's balance sheet, as well as price stability. The direction in the EUR/USD pair, which is very difficult to determine lately, will depend most likely on what Powell says. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR / USD: The speech of the Fed Chairman in the Congress as the central event of the day Posted: 26 Feb 2019 04:22 AM PST Despite yesterday's growth, the euro/dollar pair continues to trade in flat, without leaving the border of the 13th figure. However, the results of today can affect the tone of trading and "push out" the price beyond the multi-day range. In Tuesday's economic calendar, it is full of events that will take place mainly during the American session. The central event of the day is a speech by Jerome Powell in front of the congressmen, where he will announce the semi-annual report. This is a very important event, which takes place only twice a year. It is worth noting that this report was postponed several times due to the protracted shutdown but today, the Fed chairman will still go to Capitol Hill to take part in the meeting of the US Congress. The head of the Fed will communicate with the American deputies for two days to discuss the economic prospects of the country and the prospects of monetary policy. In addition to the report itself, the head of the Fed will answer the questions posed before the two specialized committees. Here, it is worth paying attention to several aspects in the context of the recently published minutes of the January Fed meeting. Let me remind you that this document was rather "dovish" since, after its release, investors reduced the likelihood of a rate hike this year. This is not surprising given the statements of the members of the regulator saying that the rate should be raised only if inflationary figures exceed basic forecasts. Simultaneously with this conclusion, the Fed has stated that the price pressure in the country is weakening. Hence, the core inflation will be below the target two percent level for a "long time". In general, the dynamics of key indicators suggest that Core CPI will fluctuate in the area of current levels with no hint of strong growth. In turn, this means that the regulator will not change the parameters of monetary policy in the near future. But the question of "how long is the Fed ready to take a pause?" -is open. Thus, Jerome Powell may outline temporary guidelines today. Currency strategists have different opinions on this. According to some experts, the regulator will wait until at least March 2020. According to other analysts, the Fed will still decide on one rate increase in December of this year, if inflation stays at least at current levels. There are more radical scenarios, for example, some economists assume a reduction of the interest rate by 25 basis points and such a scenario does not look very fantastic, given the similar rhetoric of individual members of the Fed, particularly, Raphael Bostic and James Bullard. This is the reason why Jerome Powell's performance today is so important. I doubt that he will allow the rate to decrease (even in a veiled form).In this case, he will cause severe turbulence in the markets and the dollar will sharply fall in price throughout the market. Nevertheless, he can make it clear that the monetary tightening cycle has already been completed. The rate has reached its neutral level and the Fed will continue to wait. In this case, the probability of a rate hike this year will drop to zero and although this scenario has already been taken into account in varying degrees at current prices, its implementation will undoubtedly put pressure on the American currency. Jerome Powell will also probably touch on another burning issue, which concerns the reduction of assets on the Fed's balance sheet. Two weeks ago, Lael Brainard, a member of the Board of Governors of the Federal Reserve, stated that this process should be stopped already this year. In her opinion, she said, "the regulator needs a substantial buffer in order to avoid volatility". Brainard's comments provoked volatility among dollar pairs as the market finally heard a clear position on this issue. If today Powell gives a similar opinion, which is very likely to happen, then the dollar will again be under a certain pressure. In addition to the speech of the Fed, it is also necessary for today to pay attention to the publication of the indicator of consumer confidence in the United States. Last month, this figure fell to 120 points, which was the lowest value since July 2017. Today, experts predict its recovery to 124 points. If their expectations are not met, the EUR/USD pair will receive another reason to test the 14th figure. Thus, it will not be easy for dollar bulls today. Powell is unlikely to change its rhetoric radically, and macroeconomic statistics can only aggravate the general fundamental background for the greenback. In this context, the first priority of EUR/USD buyers is to break through the resistance level of 1.1395 which is the lower limit of the Kumo cloud on the daily chart and gain a foothold in the 14th figure area. The support level of the price will be 1.1301, which is the Tenkan-sen line on a similar timeframe. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 Feb 2019 04:21 AM PST To open long positions on EUR / USD pair, you need: The technical picture of the EUR/USD pair remains unchanged compared to the morning forecast, except for the fact that the pair tried to break above the upper limit of the side channel once again but the attempt was unsuccessful. A breakout and consolidation above the resistance of 1.1367 are still required, which will lead to a larger upward correction already in the area of maximum 1.1394 and 1.1432, where I recommend taking profits. In the event of a EUR/USD decline, long positions can be opened on the condition that a false breakdown is formed in the support area of 1.1324 or on a rebound from a minimum of 1.1279. To open short positions on EUR / USD pair, you need: The absence of important fundamental statistics helps the euro but for today, all attention will be focused on the speech of Fed Chairman Jarom Powell before the Congress. Just like yesterday, the sellers still formed a false breakdown at the level of 1.1367 and counting on a downward correction to the support area of 1.1324, where I recommend taking profits. The main goal remains to be the breakdown to the lower boundary of the side channel and a decline to the area of 1.1279 minimum. However, this movement will depend on the prospects of the US economy that will be outlined by the Fed Chairman today. With the option of a further upward correction and a break of 1.1367, the euro can be sold for a rebound from the maximum of 1.1394 and 1.1432. More in the video forecast for February 26 Indicator signals: Moving averages Trade remains in the region of 30- and 50-moving averages, which indicates the lateral nature of the market. Bollinger bands Bollinger Bands indicator volatility is very low, which does not give signals on market entry. Description of indicators MA (moving average) 50 days - yellow MA (moving average) 30 days - green MACD: fast EMA 12, slow EMA 26, SMA 9 Bollinger Bands 20 The material has been provided by InstaForex Company - www.instaforex.com |

| Analysis of Gold for February 26, 2019 Posted: 26 Feb 2019 04:11 AM PST

Gold has been trading downwards. The price tested the level of $1.324.90. Anyway, according to the H1 time – frame, I found that Gold is in a corrective phase and that a potential bullish flag pattern is in creation which is a sign that upward price is expected. The key short-term support remains at $1.320.50. To open long positions on Gold you need: Aggressive entry: You can buy at $1.324.50 even before the completion of the bearish correction and put SL below $1.320.00. Conservative entry: You can wait breakout of the bearish flag and resistance at $1.329.40 to confirm the upward movement. The protective stop can be placed at $1.320.00 and target at $1.335.00-$1.342.00. The material has been provided by InstaForex Company - www.instaforex.com |

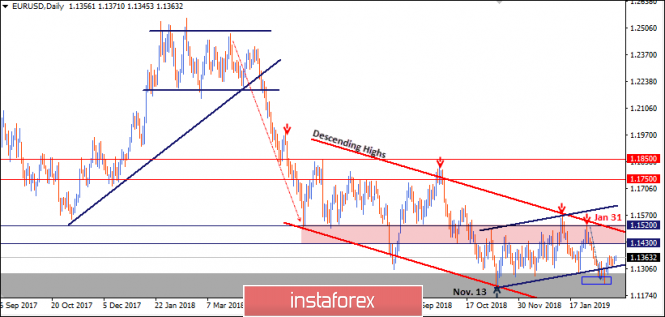

| Posted: 26 Feb 2019 04:03 AM PST

Since June 2018, the EUR/USD pair has been moving sideways with slight bearish tendency within the depicted bearish Channel (In RED). On November 13, the EUR/USD pair demonstrated recent bullish recovery around 1.1220-1.1250 where the current bullish movement above the depicted short-term bullish channel (In BLUE) was initiated. Bullish fixation above 1.1430 was needed to enhance further bullish movement towards 1.1520. However, the market has been demonstrating obvious bearish rejection around 1.1430 few times so far. The EUR/USD pair has lost its bullish momentum since January 31 when a bearish engulfing candlestick was demonstrated around 1.1514 where another descending high was established then. This allowed the current bearish movement to occur towards 1.1300-1.1270 where the lower limit of the depicted DAILY channel came to meet the pair. Since February 20, the EUR/USD pair has been demonstrating weak bullish recovery with sideway consolidations around the depicted price zone (1.1300-1.1270). Temporary bearish breakdown of the depicted technical limit was demonstrated as well. Yesterday, significant bullish recovery has emerged indicating a high probability of a quick bullish visit towards 1.1400-1.1460 where the upper limit of the daily movement channel is located. On the other hand, Please note that a bearish flag pattern may become confirmed if bearish persistence below 1.1250 is achieved on the daily basis. Pattern target is projected towards 1.1000. Trade Recommendations: A counter-trend BUY entry was already suggested near the price level (1.1285) (the lower limit of the depicted movement channel). T/P level to be located around 1.1350 and 1.1420 while S/L should be advanced to entry level (1.1285) to offset the associated risk. The material has been provided by InstaForex Company - www.instaforex.com |

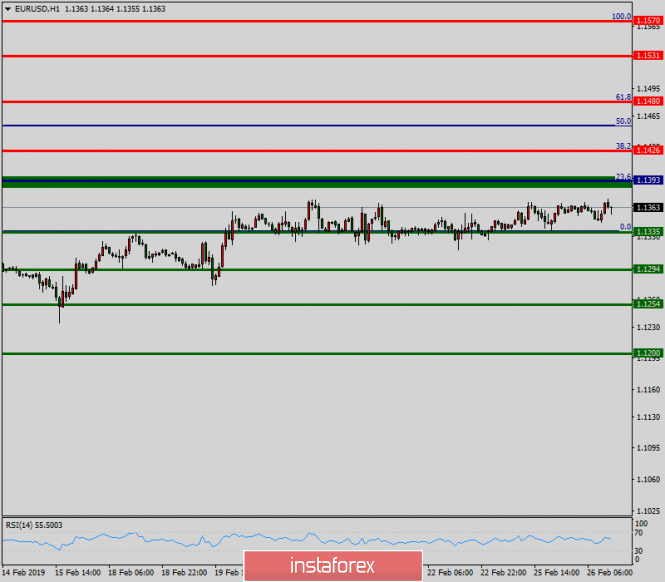

| Technical analysis of USD/CHF for February 26, 2019 Posted: 26 Feb 2019 03:39 AM PST |

| Technical analysis of EUR/USD for February 26, 2019 Posted: 26 Feb 2019 03:33 AM PST The EUR/USD pair below around the weekly pivot point (1.1393). It continued to move downwards from the level of 1.1393 to the bottom around 1.1335. Today, the first resistance level is seen at 1.1393 followed by 1.1426, while daily support 1 is seen at 1.1335. Furthermore, the moving average (100) starts signaling a downward trend; therefore, the market is indicating a bearish opportunity below 1.1393. So it will be good to sell at 1.1393 with the first target of 1.1335. It will also call for a downtrend in order to continue towards 1.1294. The strong daily support is seen at the 1.1254 level. According to the previous events, we expect the EUR/USD pair to trade between 1.1393 and 1.1254 in coming hours. The price area of 1.1393 remains a significant resistance zone. Thus, the trend is still bearish as long as the level of 1.1393 is not broken. On the contrary, in case a reversal takes place and the EUR/USD pair breaks through the resistance level of 1.1393, then a stop loss should be placed at 1.1453. The material has been provided by InstaForex Company - www.instaforex.com |

| Theresa May retreats and ready to postpone Brexit Posted: 26 Feb 2019 01:56 AM PST Main news: The Prime Minister of Britain is ready to postpone the date for Brexit. This is the defeat of British Prime Minister May but perhaps good news for the whole of Britain. On Tuesday morning, unofficial reports were released saying that May is ready to postpone the Brexit date with the official Brexit date already on March 29. The leader of the rival political party, Jeremy Corbyn of Labor party, immediately announced that the opposition will seek a repeat Brexit referendum. Anyway, the question of Britain's release date can give a lot of extra time considering that the output can be postponed for a year as an example. The market is waiting for an impetus for the spring trend. For this week, there is more important news in the US which is the Fed's speech on the semi-annual monetary policy report to Congress on Wednesday, February 27, and the US GDP report for the 4th quarter on February 28. The euro is waiting for an impulse to exit the 4-month consolidation and price trend. |

| Fundamental Analysis of USDCAD for February 26, 2019 Posted: 26 Feb 2019 01:35 AM PST USD/CAD has been quite volatile and indecisive at the edge of 1.3200 area from where the pair is likely to extend bearish momentum. Ahead of a CPI report this week, CAD has been quite weak against USD, so the pair is trading under bullish pressure along the way. On Wednesday, Canada's CPI report is going to be published. Consumer prices are expected to increase to 0.2% from the previous value of -0.1%. Moreover, Common CPI is expected to be unchanged at 1.9%, Median CPI is expected to be unchanged as well at 1.8%, and Trimmed CPI is also expected to be unchanged at 1.9%. A slump of oil prices accounts for CAD weakness as the Canadian economy has a direct link to this commodity. Canada stocks were higher after the close yesterday that indicates optimistic sentiment in Canada's financial markets. The rising stocks outpaced the declining ones which seemed to attract more investors to CAD when investors made trading decisions. On the USD side, the US economy has been operating at full employment with the FED having reached the 2% inflation target. Most of the FED officials are quite positive about growth rates of the domestic economy and want the funds rate to be held unchanged and sustain the growth further. However, the US economic growth has been dented by headwinds like the government shutdown and the trade protectionism. According to FED's Kaplan, the US central bank is currently looking forward to boost employment further. The unemployment rate at 4% is quite favorable and better than what the policymakers expected. At present, the missing element to boost economic growth is solid economic reports from the US. If upbeat data comes true, this will encourage impulsive gains on the USD side in the coming days. Today FED Chairman Powell is going to deliver a semi-annual testimony. His speech is expected to contain optimistic notes. CB Consumer Confidence report is expected to increase to 124.8 from the previous figure of 120.2. Ahead of NFP next week, any positive economic report is expected to reinforce USD as employment increase influences the NFP reports directly. Meanwhile, CAD is expected to regain certain momentum until it resides below 1.3200-1.3350 resistance area if the upcoming economic reports from Canada come in better than expected. Otherwise, any positive outcome in the US economic reports and events may lead to a strong counter-trend with an impulsive bullish move breaking above 1.3350 with a daily close above it for further upward pressure. According to Hidden Divergence method as it is spotted in this pair, the bearish pressure is expected to continue further.

|

| The pound may rise to $ 1.38 in the case of a Brexit transaction Posted: 26 Feb 2019 01:27 AM PST

Today, the pound sterling against the dollar jumped to its highest level since the end of January against the background of news of a possible postponement of Brexit. According to the newspaper The Sun, British Prime Minister Theresa May is ready to offer Parliament to postpone the date of the country's withdrawal from the EU from the end of March to a later date. In addition, it was reported that the European Commission could consider the question of a two-year postponement of Brexit, and representatives of the Labor Party are promoting the idea of holding a second referendum. As for T. May herself, she stated that the UK and the EU countries are set to implement Brexit without delay. Meanwhile, according to Skandinaviska Enskilda Banken (SEB) experts, even if eventually London and Brussels reached an agreement, the problems for the pound will not end there. "Another threat to the British currency lies in the country's weakening economy. Therefore, any pound rally is likely to be limited," the experts said. Analysts at Aberdeen Standard Investments, in turn, believe that the pound could rise to $ 1.38 in the event of a Brexit deal, but for the GBP / USD to consolidate above the 1.40 level, the UK economy will need to overcome some structural damage. The material has been provided by InstaForex Company - www.instaforex.com |

| Indicator analysis. Daily review February 26, 2019 for the pair GBP / USD Posted: 25 Feb 2019 11:58 PM PST Trend analysis (Fig. 1). On Tuesday, the price will move up. The first upper target 1.3200 is the upper fractal. Fig. 1 (daily schedule). Comprehensive analysis: - indicator analysis - up; - Fibonacci levels - up; - volumes - up; - candlestick analysis - up; - trend analysis - up; - Bollinger lines - up; - weekly schedule - up. General conclusion: On Tuesday, the price will move up. The first upper target 1.3200 is the upper fractal. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 25 Feb 2019 11:56 PM PST Wave counting analysis: On February 25, the GBP / USD pair gained about 25 basis points, however, this was enough to exceed the maximum of the assumed wave 2. Thus, the entire wave 2 takes an elongated form and shows readiness to continue its construction. The internal wave structure of this wave took the form of a three-wave. However, the maximum goal of this wave cannot be higher than 100.0% Fibonacci. Going beyond this level will require new adjustments for the current wave marking. While small chances for the resumption of decline remain. The news background is now controversial. There is no positive news on Brexit, unless, of course, the positive postponement of the Brexit period from 2 months to 2 years is considered positive. The objectives for the option with purchases: 1.3109 - 76.4% of Fibonacci The objectives for the option with sales: 1.2734 - 61.8% of Fibonacci 1.2619 - 76.4% of Fibonacci General conclusions and trading recommendations: The wave pattern still assumes the construction of a downward wave, however, after yesterday's breakthrough of the previous maximum, the chances for this have decreased significantly. Thus, now I recommend to wait for a new signal about the completion of the rising wave 2 and sell the pair with targets located near the calculated levels of 1.2826 and 1.2734, which equates to 50.0% and 61.8% Fibonacci. Particular attention is paid to any reports on the topic Brexit. The material has been provided by InstaForex Company - www.instaforex.com |

| Wave analysis of EUR / USD for February 26. The euro is trading in a narrow price range. Posted: 25 Feb 2019 11:55 PM PST Wave counting analysis: On Monday, February 25, trading ended for EUR / USD by an increase of 20 basis points, but it was not possible to get beyond the maximum of the expected wave 4. Thus, there is still reason to assume that wave 4 is complete. However, I recommend not to hurry to start sales without confirming the development of this option. There is an option in which a successful attempt to break through the 50.0% level along the small Fibonacci grid will lead to a lengthening of wave 4, which can still be completely transformed into a wave a of the new uptrend. Today in the US Congress will be the speech of Fed Chairman Jerome Powell, and the movement of the pair after it will depend on the nature of its rhetoric. The objectives for the option with sales: 1.1228 - 0.0% of Fibonacci 1.1215 - 0.0% of Fibonacci The objectives for the option with purchases: 1.1356 - 23.6% of Fibonacci 1.1408 - 61.8% of Fibonacci General conclusions and trading recommendations: The pair supposedly completed building wave 4. Thus, if the level of 23.6% holds, then I recommend selling the pair to build wave 5 of the downtrend with targets located near the calculated levels of 1.1228 and 1.1215 and below. A successful attempt to break through the 50.0% level will indicate that the pair is ready to continue building the upward wave. In this case, you can buy a pair with a target of 1.1408. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 25 Feb 2019 11:53 PM PST The euro remained to be traded in a narrow range, and the British pound updated the next monthly highs after the next rumors about the postponement of Brexit. The absence of important statistics did not prevent euro buyers from maintaining their positions in the area of 1.1365 large resistance level, which last week did not manage to get outside. Data on stocks of wholesale companies, which rose in December, did not lead to changes in the market. According to a report by the US Department of Commerce, inventories in the wholesale trade in December 2018 increased by 1.1% compared with the previous month. Economists had expected growth of 0.4%. Compared to the same period of the previous year, stocks rose by 7.3%. The index of national activity of the Fed Chicago declined in January. The fall was due to a decline in industrial production, as well as personal consumption. According to the data, the index fell to -0.43 points in January against 0.05 points in December. A decrease in the index below zero indicates that the growth of the economy is below average. Production indicators fell in January to -0.45 points from 0.08 points in December. Yesterday a number of speeches by representatives of the Federal Reserve System also took place. The most interesting statements were made by the Governor of the Federal Reserve Bank of Atlanta, Raphael Bostic. Bostic said he expects one rate increase this year and one in 2020, as the Fed rate is close and is at the lower limit of the neutral range. He predicts that there is still room to raise rates, but the manager would prefer that the Fed does not take any incentive position. As for inflation, in his opinion, it does not pose a danger, as it is below the Fed's target of 2%, however, the Fed representative drew attention to some signs of excessive wage growth against the background of a strong labor market. As for the technical picture of the EURUSD pair, it remained unchanged. The main task of buyers of risky assets is to break through the maximum of last week and go beyond the level of 1.1370, which is the upper limit of the side channel. Only this will allow us to expect a larger increase in the euro with a test high in the region of 1.1400 and 1.1440. In the case of a bearish scenario, and it is also likely, under the current market conditions, a breakthrough in support of 1.1325 may lead to an immediate sale of EURUSD and an update of 1.1280 and 1.1240 lows. Oil prices fell slightly after yesterday, US President Donald Trump once again tried to influence OPEC's oil policy, saying oil prices were climbing too high. He urged OPEC to relax and not rush, because, in his opinion, the world does not need too high oil prices. The British pound yesterday made its way above the next monthly highs against the background of the next rumors that Prime Minister Theresa May may be planning to shift Brexit from March 29 to a later date. Statements from Labor Party leader Jeremy Corbyn, the intention to support the second Brexit referendum, also supported the British pound in the afternoon. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment