Forex analysis review |

- March 19, 2019: EUR/USD Intraday technical levels and trading recommendations

- March 19, 2019: GBP/USD Intraday technical levels and trading recommendations

- Technical analysis of NZD/USD for March 19, 2019

- Technical analysis of USD/CAD for March 19, 2019

- Analysis of EUR/USD divergence for March 19: pair is set to continue rising

- Analysis of GBP / USD divergence for March 19. A bullish divergence and rebound interrupted dollar growth

- Latest Forecast for March 19, 2019

- Technical analysis of EUR/USD for 19/03/2019

- Technical analysis of GBP/USD for 19/03/2019

- Technical analysis for Gold for March 19, 2019

- Technical analysis for EUR/USD for March 19, 2019

- Elliott Wave analysis of Bitcoin for 19/03/2019

- Elliott Wave analysis of Ethereum for 19/03/2019

- BITCOIN Analysis for March 19, 2019

- Fundamental Analysis of USD/CAD for March 19, 2019

- Fundamental Analysis of GBP/USD for March 19, 2019

- Fundamental analysis of USD/JPY for March 19, 2019

- Technical analysis: Intraday Levels For EUR/USD, Mar 19, 2019

- Technical analysis: Intraday levels for USD/JPY, Mar 19, 2019

- EUR/USD approaching resistance, potential drop!

- NZD/USD approaching resistance, potential drop!

- Trading plan for EUR/USD for March 19, 2019

- Elliott wave analysis of GBP/JPY for March 19, 2019

- Elliott wave analysis of EUR/JPY for March 19, 2019

- EUR/USD analysis for March 18, 2019

| March 19, 2019: EUR/USD Intraday technical levels and trading recommendations Posted: 19 Mar 2019 08:36 AM PDT

On January 10th, the market initiated the depicted bearish channel around 1.1570. The bearish channel's upper limit managed to push price towards 1.1290 then 1.1235 before the EUR/USD pair could come again to meet the channel's upper limit around 1.1420. Bullish fixation above 1.1430 was needed to enhance further bullish movement towards 1.1520. However, the market has been demonstrated obvious bearish rejection around 1.1430 That's why, the recent bearish movement was demonstrated towards 1.1175 (channel's lower limit) where significant bullish recovery was demonstrated on March 7th. Bullish persistence above 1.1270 (Fibonacci 38.2%) enhanced further bullish advancement towards 1.1290-1.1315 (the Highlighted-Zone) where temporary bearish rejection was demonstrated. Last week, the EUR/USD pair demonstrated a temporary bullish breakout above 1.1315 which was followed by a period of indecision/hesitation that brought the pair again within the depicted supply zone. This week, another bullish breakout attempt is being executed above 1.1327 (61.8% Fibonacci level). This probably enhances a further bullish movement towards 1.1370 and 1.1390 where the upper limit of the depicted movement channel is located. On the other hand, bearish breakout below the price level of 1.1298 (50% Fibonacci) will probably liberate a quick bearish retraction towards 1.1235 (23.6 Fibonacci level)then 1.1180 where the lower limit of the movement channel can be tested again. Trade recommendations : Risky traders can wait for the current bullish pullback to pursue towards 1.1390-1.1400 for a valid SELL signal. T/P levels to be located around 1.1330, 1.1290 and 1.1220. S/L to be located above 1.1450. The material has been provided by InstaForex Company - www.instaforex.com |

| March 19, 2019: GBP/USD Intraday technical levels and trading recommendations Posted: 19 Mar 2019 08:01 AM PDT

On January 2nd, the market initiated the depicted uptrend line around 1.2380. This uptrend line managed to push price towards 1.3200 before the GBP/USD pair came to meet the uptrend again around 1.2775 on February 14. Another bullish wave was demonstrated towards 1.3350 before the bearish pullback brought the pair towards the uptrend again on March 11. A weekly gap pushed the pair slightly below the trend line (almost reaching 1.2960). However, significant bullish recovery was demonstrated rendering the mentioned bearish gap as a false bearish breakout. Moreover, a short-term bearish channel was broken to the upside following the mentioned bullish recovery on March 11 rendering the current outlook for the pair as bullish. As expected, bullish persistence above 1.3060 allowed the GBPUSD pair to pursue the bullish momentum towards 1.3130, 1.3200 then 1.3300. For the current bullish outlook to remain dominant, bullish persistence above 1.3250 ( 50% Fibonacci expansion level ) is mandatory for confirmation of the depicted Flag pattern. Bullish Projection targets to be located around 1.3314 and 1.3415. On the other hand, bearish H4 candlestick closure below 1.3250 (50% Fibonacci Exp. level) invalidates this bullish setup rendering the short term outlook bearish towards 1.3180 then 1.3095 where the depicted uptrend line comes to be tested again. Trade Recommendations: Counter-trend traders should wait for a valid SELL signal (H4 candlestick closure below 1.3250). T/P level to be located around 1.3180 and 1.3090. SL to be set as rebound H4 closure above 1.3250 again. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of NZD/USD for March 19, 2019 Posted: 19 Mar 2019 05:46 AM PDT The NZD/USD pair breached resistance which had turned into strong support at the level of 0.6705. The pair is still moving around the daily pivot point of 0.6882. The level of 0.6705 coincides with a golden ratio, which is expected to act as major support today. The RSI is considered to be overbought, because it is above 70. The RSI is still signaling that the trend is upward as it is still strong above the moving average (100). Besides, note that the pivot point is seen at 0.6882. This suggests that the pair will probably go up in the coming hours. Accordingly, the market is likely to show signs of a bullish trend. In other words, buy orders are recommended to be placed above 0.6800 with the first target at the level of 0.6882. From this point, the pair is likely to begin an ascending movement to 0.6882 and further to 0.6984. The level of 0.6984 will act as strong resistance. On the other hand, if there is a breakout at the support level of 0.6705, this scenario may become invalidated. The material has been provided by InstaForex Company - www.instaforex.com |

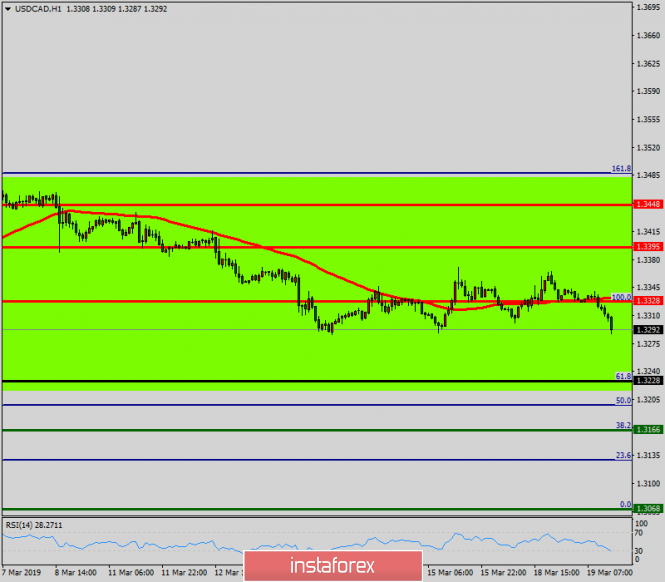

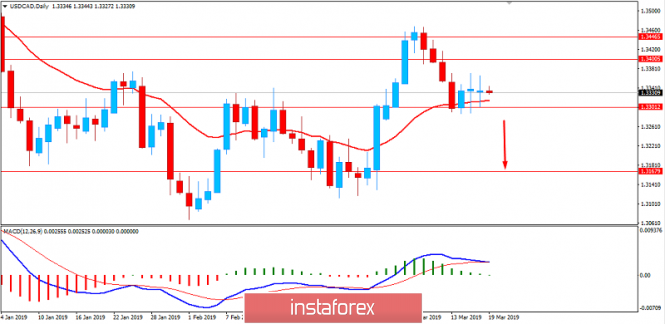

| Technical analysis of USD/CAD for March 19, 2019 Posted: 19 Mar 2019 05:36 AM PDT |

| Analysis of EUR/USD divergence for March 19: pair is set to continue rising Posted: 19 Mar 2019 03:51 AM PDT 4h As seen on the 24-hour chart, the pair consolidated above the retracement level of 127.2% (1.1285). Thus, the growth is expected to continue towards the retracement level of 100.0% (1.1553). Today, no indicators signal emerging divergence on any charts. If the pair closes below the level of 127.2%, it can be a sign of an upward USD reversal and resumption of a fall towards the retracement level of 161.8% (1.0941). The Fibo grid is based on extremums of November 7, 2017 and February 16, 2018. Trading recommendations: Buy deals on the EUR/USD pair can be opened with the target at 1.1374, as the pair closed above the level of 1.1328. The stop loss order should be placed under the retracement level of 38.2%. Sell deals on the EUR/USD pair can be carried out with the target at 1.1269 if the pair holds below the level of 1.1328. The stop loss order should be placed above the Fibo level of 38.2%. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 19 Mar 2019 03:51 AM PDT 4h As seen on the hourly chart, the pair made the fourth drop from the Fibo level of 38.2% (1.3220) and climbed to the level of 23.6% (1.3228). Rejecting the price from this level will enable traders to expect a reversal in favor of the US dollar and a slight decline in the direction of the retracement level of 38.2%. Divergence which was forming on March 19 failed to develop. Closing the pair above the Fibo level of 23.6% will increase the chances of further growth towards the next retracement level of 0.0% (1.3380). The Fibo grid is built on the grounds of the extremums from March 11, 2019, and March 13, 2019. Trading advice: Buy deals on GBP / USD pair can be opened with the target at 1.3380 and a stop-loss order below the level of 23.6% if the pair closes above 1.3281 (hourly chart). Sell deals on GBP / USD pair can be opened with the target at 1.3220 and a stop-loss order above the level of 23.6% if the pair bounces off of the retracement level of 1.3228 (hourly chart). The material has been provided by InstaForex Company - www.instaforex.com |

| Latest Forecast for March 19, 2019 Posted: 19 Mar 2019 01:14 AM PDT As we wrote in the previous reviews, Brexit would be postponed for a long time. On Tuesday morning, the UK British Parliament's speaker announced that the House of Commons would not vote on the agreement with the EU once again. Looking back, the House has defeated this deal twice already with a significant majority of votes, about 400 against 200. Thus, Britain's exit from the EU currently scheduled for March 29 will be postponed until 2020 or further. The key event of this week is the Fed's decision on rates with its accompanying statement that are scheduled for Wednesday. It might support the euro and the pound for an uptrend against the US dollar. We are ready to buy the euro from 1.1360. Alternative: we sell from 1.1175. |

| Technical analysis of EUR/USD for 19/03/2019 Posted: 19 Mar 2019 12:08 AM PDT Technical market overview: The EUR/USD pair has hit the technical resistance at the level of 1.1353, but there is no sign of a reversal yet. The market conditions are now overbought and there is a bearish divergence forming in this time frame between the price and the momentum indicator. Please notice, that the recent move up from the level of 1.1176 is considered to be a corrective bounce in a downtrend, so the down move can resume any time now. Weekly Pivot Points: WR3 - 1.1502 WR2 - 1.1422 WR1 - 1.1372 Weekly Pivot - 1.1287 WS1 - 1.1251 WS2 - 1.1168 WS3 - 1.1131 Trading recommendations: The bias is still to the downside and only sell orders should be opened. The entry level should be as close as possible to the level of 1.1353 with a tight protective stop loss and the first take profit level is seen at 1.1249.

|

| Technical analysis of GBP/USD for 19/03/2019 Posted: 19 Mar 2019 12:01 AM PDT Technical market overview: Despite the lower low made at the level of 1.3183 not much has happened at the market. The GBP/USD pair is still moving inside of the narrow zone located between the levels of 1.3207 - 1.3304 as the horizontal correction continues after a wide swing we witnessed last week. There is no important price or candlestick pattern present currently in this market that would indicate a possible breakout in either direction. The momentum is now neutral but can pick up if the volatility will increase. The longer time frame trend remains bullish, so the bias is still to the upside and the main technical resistance is seen at the levels of 1.3362 and 1.3379. Weekly Pivot Points: WR3 - 1.3917 WR2 - 1.3636 WR1 - 1.3473 Weekly Pivot - 1.3224 WS1 - 1.3055 WS2 - 1.2794 WS3 - 1.2638 Trading recommendations: The market is still in a consolidation phase, so it will be better to wait for a trading setup after the consolidation terminates. The best one would be a breakout in either direction, but due to the fact that the trend is still up, traders should prefer to buy in the local corrections and wait for the market to resume the up move. Only a sustained breakout below the level of 1.2959 would invalidate the short-term bullish bias and deepen the correction.

|

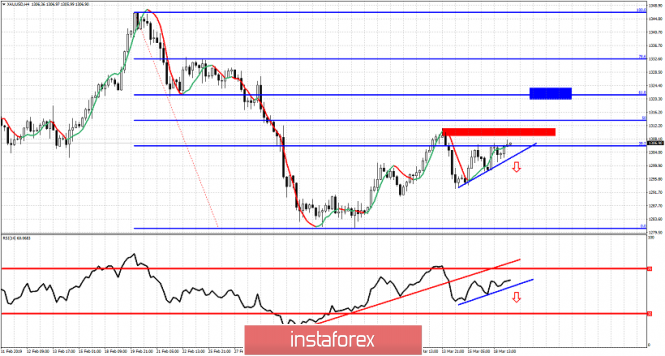

| Technical analysis for Gold for March 19, 2019 Posted: 18 Mar 2019 11:48 PM PDT Gold price so far has held support at $1,292 and has also recaptured $1,300. As long as price is above $1,300-$1,292 support area we could see a move higher towards $1,322 and the next Fibonacci target.

Blue rectangle - target if red rectangle is broken Blue lines - support trend lines Red line - support trend line (broken) Gold price continues to trade above $1,300 and as Dollar is weakening we could see another try to move towards $1,320 or higher. The 61.8% Fibonacci retracement is a possible target as long as price and the RSI hold above their blue support trend lines. Resistance is found at $1,312 and if broken we have confirmation we are heading towards $1,322. So far price respects support and bulls remain in control of the short-term trend. Bears need to break at least below $1,300 in order to hope for more downside. The material has been provided by InstaForex Company - www.instaforex.com |

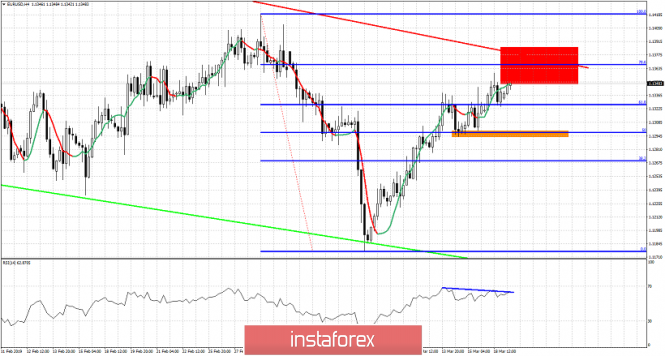

| Technical analysis for EUR/USD for March 19, 2019 Posted: 18 Mar 2019 11:43 PM PDT EUR/USD continues to hold above the 1.13 support area and slowly but steadily has reached our next bounce target area of 1.1350-1.1380. The bearish divergence signs in the 4 hour chart remain and so our bearish medium-term view as long as we trade below 1.14.

Red rectangle - bounce target and resistance Red line - major resistance trend line Green line- support Orange rectangle - short-term support EUR/USD is trading above 1.1330 and continues to make higher highs and higher lows. Support remains important at 1.13 and crucial for the short-term trend. As we noted in our past analysis, short-term trend will change to bearish on a break below 1.13. Medium-term trend remains bearish as long as we trade below 1.14 and below the red trend line resistance. The higher highs are not followed by confirmed new highs in the RSI. This implies that at least a pullback will be seen soon and most probably will bring price below 1.13. The material has been provided by InstaForex Company - www.instaforex.com |

| Elliott Wave analysis of Bitcoin for 19/03/2019 Posted: 18 Mar 2019 11:23 PM PDT Technical market overview: The BTC/USD pair has been trading in a horizontal zone between the levels of $4,000 - $4,080 for some time now, but the bias remains to the downside. The Bearish Engulfing candlestick pattern is the reason behind the bearish bias and the unfinished down cycles of the wave (a), (b) and (c). If the level of $3,891 is violated then the low for the wave (a) will be completed and the market will start the local wave (b) and (c). When those two waves are done, the whole corrective cycle in wave 2 will be completed. Weekly Pivot Points: WR3 - $4,456 WR2 - $4,282 WR1 - $4,180 Weekly Pivot - $4,000 WS1 - $3,897 WS2 - $3,712 WS3 - $3,614 Trading recommendations: Due to the unfinished corrective cycle in the wave (a) (b) and (c) the sell orders should be placed as close as possible to the level of $4,076 with a protective stop loss above the level of $4,112.

|

| Elliott Wave analysis of Ethereum for 19/03/2019 Posted: 18 Mar 2019 11:13 PM PDT Technical market overview: Since the top of the wave (b) at the level of 143.51, the ETH/USD pair is slowly dropping lower making lower lows on its way. The first technical support at the level of 134.68 has already been tested, but this is not the end of the down move as the wave (c) is still being made. The next target is seen at the level of 127.85 and this bearish bias is valid as long as the orange trendline is not violated. Weekly Pivot Points: WR3 - 162.50 WR2 - 153.11 WR1 - 146.18 Weekly Pivot - 134.66 WS1 - 129.36 WS2 - 120.05 WS3 - 112.99 Trading recommendations: The bearish wave progression to the downside has still not been completed, so only sell orders should be placed as close as possible to the level of 140.89 with a target seen at the level of 134.89 and if this level is violated - at 127.85. Please notice , the trendline (marked in orange) cannot be violated, otherwise, the scenario will be updated.

|

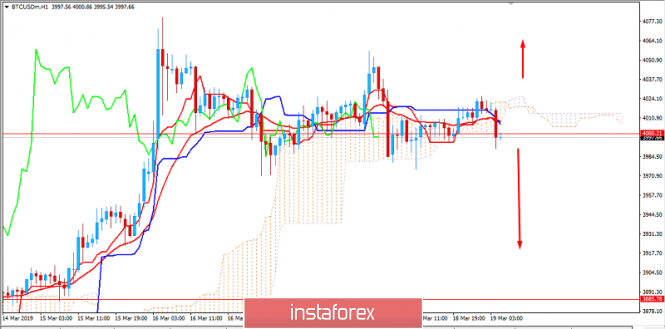

| BITCOIN Analysis for March 19, 2019 Posted: 18 Mar 2019 10:24 PM PDT Bitcoin is trading at the edge of $4,000. The price has been quite volatile and corrective since it broke above it with an impulsive daily close earlier. The price is moving lower with strong bearish momentum currently. Tenkan and Kijun line cross indicates further bearish momentum in the coming days. The price recently broke below the Kumo Cloud support area as it turned quite thin and weak to hold the price higher above $4,000. The Chikou span is also residing below the price line while being held by the Kumo Cloud support. Amid the lack of positive fundamentals recently, BTC depends entirely on market sentiment. Though the price broke above $4,000 with a daily close, a break below the area with a daily close will define the earlier break as false. So, the price is set to move impulsively lower in the coming days. If the price remains above $3,800-80 support area, BTC price will have a chance to climb higher again in the coming days. SUPPORT: 3,500-600, 3,800-80, 4,000 RESISTANCE: 4,250, 4,500 BIAS: BULLISH MOMENTUM: VOLATILE

|

| Fundamental Analysis of USD/CAD for March 19, 2019 Posted: 18 Mar 2019 10:09 PM PDT After a strong bullish momentum, the price is currently trading at the edge of 1.33 with certain indecision and volatility. Canada provided mixed economic reports, so CAD managed to sustain momentum over USD. A positive employment report with a flat unemployment rate encouraged certain gains on the CAD side over USD. Canada is also facing the escalating debt effect which is derailing the economic growth and making the economy more vulnerable to financial instability. After 5 rate hikes since 2017, the Bank of Canada recently kept the ON target rate unchanged at 1.75% citing concerns over the global economic slowdown. Recently Canada's Foreign Securities Purchases showed a significant increase to 28.40B from the previous negative figure of -20.49B which was expected to be at 15.03B. Ahead of Canadian CPI and Retail Sales report to be published on Friday, the pair is going to trade with higher volatility, though CAD could make some gains. On the USD side, the Federal Reserve advocates for a cautious approach towards monetary policy that means a pause in the cycle of monetary tigthening in 2019. However, in 2020 if the US economy does not develop as planned, the regulator could resort even to rate cuts. Previously, some FED officials signaled that the key interest rate could increase to 3.00% to 3.50% with at least 2 rate hikes this year. However, under current economic conditions, the domestic economy is not ready for higher interest rates. The US economy is showing mixed economic results, for example, soft employment growth with rising wages. Recently US NAHB Housing Market Index report was published unchanged at 62 which was expected to increase to 63. Today US Factory Orders are expected to increase to 0.3% from the previous value of 0.1%. Meanwhile, both the BOC and the FED express the dovish rhetoric with an effort to deal with the global crisis and lackluster economic data. So, the pair is set to trade with higher volatility in the coming days. A FOMC Statement will clear up whether the central bank shifts its tone from dovish to hawkish. If the rhetoric remains dovish, USD will lose momentum. On the other hand, CAD will have an opportunity to assert its strength to push the price much lower. Now let us look at the technical view. The price formed an outside indecisive daily bar at the edge of 1.33 area after impulsive bearish momentum after rejecting off 1.3450 with a daily close. The price is still bearish. A break below 1.33 with MACD moving averages crossing over indicate further bearish momentum with a target towards 1.3150 and later towards 1.30 support area. As the price remains below 1.35 with a daily close, this price move will invite bears.

|

| Fundamental Analysis of GBP/USD for March 19, 2019 Posted: 18 Mar 2019 09:40 PM PDT GBP/USD recently turned extremely volatile and corrective while pushing towards 1.3400-1.3500 resistance area amid an impulsive bullish trend. Ahead of BREXIT, the market sentiment on GBP is indecisive and confused, while USD is also struggling to maintain momentum. After two and half years of negotiations with the European Union, the BREXIT scenario is still uncertain. There are different options like a delay, a departure from the EU with Prime Minister Theresa May's deal, a disorderly exit without any deal or another scenario. Prime Minister May called on BREXIT supporters to validate her deal by a European Council Summit. Otherwise, BREXIT may face a delay beyond June 30, 2019. As the recent vote passed on behalf of May, traders are gaining confidence with GBP. Today UK Average Earning Index report is going to be published which is expected to decrease to 3.2% from the previous value of 3.4%, Unemployment Rate is expected to be unchanged at 4.0%, and Claimant Count Change is expected to have a positive result with a decline to 13.1k from the previous figure of 14.2k. Ahead of CPI data tomorrow which is expected to be unchanged at 1.8%, GBP is expected to maintain momentum. On the USD side, the currency has lost ground versus GBP which is leading the price higher in a volatile manner. USD is likely to trade with higher volatility ahead of the FOMC policy update. The US central bank is widely expected to leave the official funds rate unchanged at 2.50%. Currently the Federal Reserve advocates for a cautious approach towards monetary policy that means a pause in the cycle of monetary tigthening in 2019. However, in 2020 if the US economy does not develop as planned, the regulator could resort even to rate cuts. Previously, some FED officials signaled that the key interest rate could increase to 3.00% to 3.50% with at least 2 rate hikes this year. However, under current economic conditions, the domestic economy is not ready for higher interest rates. The US economy is showing mixed economic results, for example, soft employment growth with rising wages. Recently US NAHB Housing Market Index report was published unchanged at 62 which was expected to increase to 63. Today US Factory Orders are expected to increase to 0.3% from the previous value of 0.1%. Meanwhile, GBP is expected to gain further momentum over USD ahead of BREXIT. However, the UK departure from the EU is expected to lead to severe GBP weakness despite USD waning momentum. Now let us look at the technical view. The price is currently heading towards 1.3400-1.3500 resistance area while forming a Bearish Divergence along the way and signaling upcoming bearish momentum from a strong price area. The price showed a bearish rejection yesterday with a daily close residing inside the bullish mother bar which broke above 1.3100 area with a daily close. Currently the price is expected to climb towards 1.3400-1.3500 area from where the price could reject bulls under bearish pressure during a BREXIT decision week. As the price remains below 1.3500 area, this price move could invite bears.

|

| Fundamental analysis of USD/JPY for March 19, 2019 Posted: 18 Mar 2019 08:58 PM PDT USD/JPY has been quite volatile after rejecting off the 112.00 area recently which lead the price to reside below 111.50. It is set to move further downward in the process. Japan posted upbeat economic results while the BOJ kept the interest rate unchanged. Amid that, JPY is expected to gain ground against USD in the process. Japan's government aims to keep the economy growth at a moderate pace but drawbacks like worse economic reports and external trade war pressures dent the economic development. Japan's exports and factory output weakened due to a slowdown in the global growth. What is more, the US-China trade war is still unsettled. The Bank of Japan kept its rate unchanged last week but if needed the rates and monetary policy can be changed to keep the economy progress moderate. Recently, the trade balance report was published with an increase to 0.12T from the previous figure of -0.29T which was expected to be at 0.09T. Besides, the revised industrial production also increased to -3.4% which was expected to be unchanged at -3.7%. Ahead of the Monetary Policy Meeting Minutes tomorrow, JPY gains are expected to be a bit volatile and corrective over USD in the process. On the other hand, ahead of FOMC statement and Federal Funds Rate report which is expected to be unchanged at 2.50%, USD is expected to be quite volatile with the upcoming gains. Currently, the Fed is in the wait and see approach, so the interest rate is unlikely to be changed in 2019. Moreover, rate cuts may be observed in 2020 if the economy does not develop as planned. The US economy is currently dealing with mixed economic results along with a slowdown in jobs growth and rising wages. It is expected to affect the economy significantly. Recently, the US NAHB Housing Market Index report was published unchanged at 62 which was expected to increase to 63. Today the US Factory Orders is expected to increase to 0.3% from the previous value of 0.1%. As of the current scenario, USD, being affected be an economic slowdown and worse economic reports, is expected to lose momentum against JPY. Though Japan's economy is still quite vulnerable but being on the hawkish expectation, the Federal Reserve is indecisive. The current economic projection is expected to lead to certain USD weakness against JPY in the process. Now let us take a look at the technical view. The price is currently residing below 111.50 area with a daily close but it is also held by the dynamic level of 20 EMA as support. The preceding non-volatile bullish trend has been carrying the price towards 112.00 area with strong momentum. However, a daily close below 111.50 indicates further downward momentum with a target towards 110.00-50 support area in the coming days. As the price remains below 112.00 area with a daily close, the bearish bias is expected to continue.

|

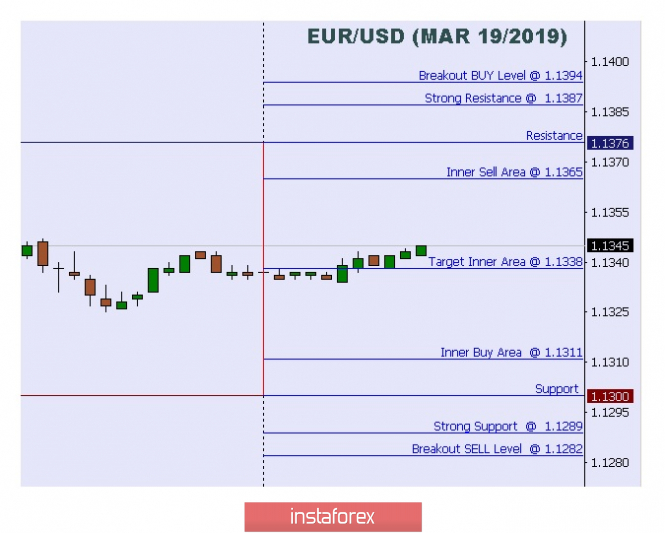

| Technical analysis: Intraday Levels For EUR/USD, Mar 19, 2019 Posted: 18 Mar 2019 08:50 PM PDT

When the European market opens, some economic data will be released such as ZEW Economic Sentiment, German ZEW Economic Sentiment, and Italian Trade Balance. The US will also publish the economic data such as Factory Orders m/m, so amid the reports, the EUR/USD pair will move with low to medium volatility during this day. TODAY'S TECHNICAL LEVELS: Breakout BUY Level: 1.1394. Strong Resistance: 1.1387. Original Resistance: 1.1376. Inner Sell Area: 1.1365. Target Inner Area: 1.1338. Inner Buy Area: 1.1311. Original Support: 1.1300. Strong Support: 1.1289. Breakout SELL Level: 1.1282. (Disclaimer) The material has been provided by InstaForex Company - www.instaforex.com |

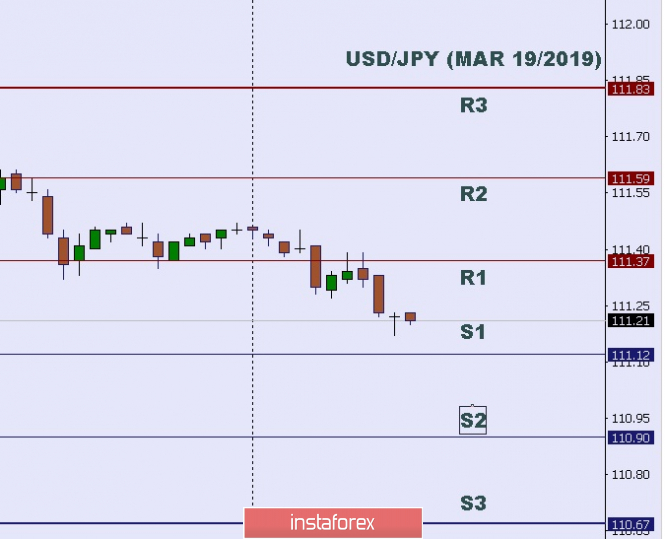

| Technical analysis: Intraday levels for USD/JPY, Mar 19, 2019 Posted: 18 Mar 2019 08:44 PM PDT

In Asia, Japan will not release any economic data today, while the US will publish some economic data such as Factory Orders m/m. So there is a probability the USD/JPY pair will move with low to medium volatility during this day. TODAY'S TECHNICAL LEVELS: Resistance. 3: 112.83. Resistance. 2: 111.59. Resistance. 1: 111.37. Support. 1: 111.12. Support. 2: 110.90. Support. 3: 110.67. (Disclaimer) The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD approaching resistance, potential drop! Posted: 18 Mar 2019 06:57 PM PDT EUR/USD is approaching our first resistance at 1.1362 (horizontal pullback resistance, 76.4% Fibonacci retracement, 100% Fibonacci extension) where a strong drop might occur below this level pushing the price down to our major support at 1.1318 (horizontal swing low support, 23.6% Fibonacci retracement). Stochastic (34,5,3) is also nearing our first resistance where we might see a corresponding drop in price. Trading CFDs on margin carries high risk. Losses can exceed the initial investment, so please ensure you fully understand the risks.

|

| NZD/USD approaching resistance, potential drop! Posted: 18 Mar 2019 06:55 PM PDT NZD/USD is approaching our first resistance at 0.6895 (horizontal swing high resistance, 78.6% Fibonacci retracement, 61.8% Fibonacci extension) where a strong drop might occur below this level pushing the price down to our major support at 0.6842 (horizontal swing low support, 61.8% Fibonacci retracement). Stochastic (34,5,3) is also nearing our first resistance where we might see a corresponding drop in price. Trading CFDs on margin carries high risk. Losses can exceed the initial investment, so please ensure you fully understand the risks.

|

| Trading plan for EUR/USD for March 19, 2019 Posted: 18 Mar 2019 06:45 PM PDT

Technical outlook: The 4H chart presented here indicates that the EUR/USD pair is clearly showing quite a bit of resilience and the bulls are determined to break through the initial resistance seen at the 1.1420 levels. As we have been discussing since last week, the EUR/USD pair seems to have bottomed at the 1.1175 levels on March 07, 2019. It has been drawing higher highs and higher lows since then and at lower degrees, one can count a potential impulse wave probably into its last wave higher. If the above count is complete, the EUR/USD pair is set to complete the wave 1 around the 1.1400/20 levels as highlighted here. It is more likely to take out resistance at 1.1420 than drop lower to the 1.1240 levels. Interim support can be taken at the 1.1175 levels for now, and till it remains in place, we will have a meaningful bottom. Look towards higher levels in the nearest future. Trading plan: Aggressive traders, remain long with a stop loss order at 1.1240 and a target above 1.1420. Conservative traders, remain flat. Good luck! The material has been provided by InstaForex Company - www.instaforex.com |

| Elliott wave analysis of GBP/JPY for March 19, 2019 Posted: 18 Mar 2019 11:44 AM PDT

With the break below short-term important support at 147.36 it was confirmed, that a B-wave triangle had developed and more downside pressure towards 146.25 should be expected before the next impulsive rally will be ready to take over for a break above 148.03 on the way higher to 151.50. R3: 148.39 R2: 148.03 R1: 147.79 Pivot: 147.45 S1: 147.00 S2: 146.70 S3: 146.25 Trading recommendation: Our stop at 147.35 was hit for a 255 pips profit. We will re-buy GBP upon a break above 147.79. The material has been provided by InstaForex Company - www.instaforex.com |

| Elliott wave analysis of EUR/JPY for March 19, 2019 Posted: 18 Mar 2019 11:38 AM PDT

We remain bullish expecting EUR/JPY to continue higher towards 127.50 as the next target. Only a break below support at 126.00 will delay the expected rally for a dip closer to 125.69 before the next rally higher. Only an unexpected break below key support at 125.43 will question our bullish outlook. R3: 126.93 R2: 126.57 R1: 126.25 Pivot: 126.08 S1: 126.00 S2: 125.69 S3: 125,43 Trading recommendation: We are long EUR from 124.80 and will will raise our stop to 125.65. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD analysis for March 18, 2019 Posted: 18 Mar 2019 10:27 AM PDT EUR/USD has been testing the 3-day resistance at the price of 1.1340 but there are still no larger buyers.

According to the daily time-frame, we found bullish divergence active on the stochastic oscillator, which is a sign that the dominant cycle is for the upside. Today, price went higher and it failed to sustain a move above the 3-day high 1.1340, which caused the downward correction. The trend is still bullish and there are not signs of any reversal yet. Key short-term resistance is set at 1.1345 and key support at 1.1277. Trading recommendation: We plan to buy EUR on the potential break of 1.1340 with a target at 1.1400 and protective stop at 1.1277. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment