Forex analysis review |

- The Fed has no reason to awaken financial markets that are asleep

- GBP/USD. 20th of March. Results of the day. Brexit: all the trump cards are in the hands of the European Union.

- EUR/USD. 20th of March. Results of the day. A new volatility record for the pair. Hope for the Fed is weak

- GBP/USD: the pound is declining due to Juncker and the French

- GBP/USD: Brussels might not give London a grace period for Brexit

- March 20, 2019: GBP/USD Intraday technical levels and trading recommendations

- Bitcoin analysis for March 20, 2019

- EUR/USD analysis for March 20, 2019

- Analysis of Gold for March 20, 2019

- Brexit: The exit of the UK from the EU can be postponed to June 30th. Traders are waiting for the Fed statement

- Gold is waiting for the verdict of the Fed

- Dollar pays no attention to the Fed's caution, American grows stronger!

- GBP / USD plan for the American session on March 20. Inflation in the UK was ignored by traders

- EUR / USD plan for the US session on March 20. All attention to the Fed meeting

- Is it worth selling a dollar against the yen?

- Why wait for the dollar from Jerome Powell and his colleagues?

- Technical analysis of GBP/USD for March 20, 2019

- Technical analysis of EUR/USD for March 20, 2019

- Trading recommendations for the EURUSD currency pair - placement of trading orders (March 20)

- Markets focus on the outcome of the Fed meeting

- Overview of the foreign exchange market on 03/20/2019

- Wave analysis of GBP / USD for March 20. Pound sterling "in the fog"

- Wave analysis of EUR / USD for March 20. All attention to the Fed and Jerome Powell

- The dollar rises to most currencies on Wednesday

- GBP / USD. March 20. The trading system. "Regression Channels". The key events of the day: inflation in the UK and the Fed

| The Fed has no reason to awaken financial markets that are asleep Posted: 20 Mar 2019 05:54 PM PDT In anticipation of an important event for the financial markets, the G7 currency volatility fell, with the exception of the pound. However, in this case, stabilization should not be taken as a hint of an imminent explosion. It is unlikely for the head of the US central bank to appear as a "hawk" before the market , given the slowdown in US growth, the uncertainties around Brexit and trade negotiations. As for the "dovish" promise, it is not necessary to aggravate this as well. The derivatives market is already waiting for a reduction in the federal funds rate in the first half of 2020. If sources are to be believed, then Beijing seems to be dissatisfied with the lack of guarantees for reducing the import tariffs set last year and could withdraw at any time. According to optimists, China will not abandon the deal, because there is a risk that its economic growth will continue to slow down. It is the decline in the pace of development in the Asian state that is seen as the main problem of the global economy, according to BofA Merrill Lynch respondents. In the past nine months, trade disputes ranked first in similar questionnaires. The Federal Reserve needs to make an effort to get the financial markets out of sleep, but does the regulator need it? Everything is proceeding in accordance with the plan and fully satisfies the central bank, namely: talks about changing the system of inflation targeting leads to the fact that inflation expectations and debt market rates diverge in opposite directions. It seems that the March meeting will not cause any serious unrest and it is also not worth waiting for a revolution. The fact is that the top is still able to control the situation and the lower classes are satisfied with current market situation. It is unlikely that we will witness sharp jerks in the EURUSD pair. Expected trading range: $1,125 -1,15. |

| Posted: 20 Mar 2019 05:15 PM PDT 4-hour timeframe The amplitude of the last 5 days (high-low): 319p - 123p - 97p - 116p - 70p. Average amplitude for the last 5 days: 145p (188p). Ahead of the announcement of the Fed's results and the Bank of England, which is scheduled for tomorrow, the British pound sterling fell against the US dollar. We expect the fall of the British pound for quite some time, given the complete chaos in the process of Brexit, which runs the risk of a delay for another three months, this is the minimum. It will be 3 years in total since the referendum. Today it became known that the European Commission surprisingly opposes the option of postponing Brexit until June 30, 2019, which was proposed by Theresa May. According to the European Commission, the maximum possible short-term postponement date for Brexit is May 23rd. After this date, elections to the European Parliament will begin, and the UK should no longer participate in them. If this option is not suitable for London, then the European Commission proposes to move Brexit for a long period of time. The paradox of the situation is that the short-term postponement of Brexit will unlikely change anything in the procedure for ratifying the current version of the "deal" between London and Brussels. A long-term delay will cause a lot of claims to Theresa May, who can not cope with Brexit. ZEveryday, the situation is increasingly aggravated but remains unresolved. In addition, inflation in the UK unexpectedly turned out to be higher than forecast - 1.9% y/y, but the basic inflation rate, on the contrary, was lower - 1.8% y/y. Theoretically, today, the Fed can return the pound sterling to a local high if, to the delight of Donald Trump, it announces that the current rate has been found near the lower limit of the target range, hinting that there will be no more tightening. From a technical point of view, the pair have not yet managed to overcome the strong Senkou Span B line. Trading recommendations: The GBP/USD currency pair started a new round of a downward correction. Thus, in order to open new longs with a target of 1.3335, it is recommended that you wait until the current correction is completed - consolidating the price above the Kijun-Sen line. Short positions can be considered in small lots if the pair overcomes the line Senkou Span B, which will significantly increase the chances of forming a downtrend. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanation of the illustration: Ichimoku indicator: Tenkan-sen - the red line. Kijun-sen - the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dotted line. Chikou Span - green line. Bollinger Bands indicator: 3 yellow lines. MACD Indicator: Red line and histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 20 Mar 2019 04:54 PM PDT 4-hour timeframe The amplitude of the last 5 days (high-low): 61p - 44p - 44p - 40p - 28p. Average amplitude for the last 5 days: 43p (49p). On Wednesday, March 20, the EUR/USD currency pair continued to amaze with its stability. For more than ten consecutive days, the pair has been showing daily moderate growth with low volatility. Moreover, low volatility values continue to decline. For example, the pair went through a "whole" 28 points for the entire day on Tuesday. There is a hope that tonight after the results of the Fed meeting will be announced, volatility will increase. However, we believe that if no "loud" statements are made, then market reaction might simply not follow. And what loud statements can the Fed make? traders have already realized the fact that there are risks of a slowdown in the US economy. The Fed might not tighten monetary policy this year too. The fact that the Fed can stop unloading its balance has also been known for a long time. What else? Nothing else. The only thing is that the Fed can once again shift the attention of traders on the rejection of the rate hike plan, which implies two increases in 2019. Therefore, we believe that the reaction of market participants to the Fed meeting will be more than restrained. It should also be taken into account that in any case, the effect of the Fed's decisions may persist until tomorrow's US trading session, since European markets are already closed during the announcement of the results of the meeting. From a technical point of view, the uptrend continues, and the MACD indicator has started to discharge, as it reacts poorly to low price increases and low volatility. Thus, the key indicator for determining the trend now is the ichimoku and its Kijun-Sen line. Trading recommendations: The EUR/USD continues to move up. Thus, it is recommended that you consider the longs with targets of 1,1372 and 1,1403, since the initiative for the instrument remains in the hands of the bulls. During the announcement of the results of the Fed meeting, it is recommended that you use Stop Loss orders or exit the market. Shorts are recommended to be considered if traders manage to gain a foothold below the critical line. In this case, the trend will change to a downward one, and the first target will be the support level of 1.1250. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanation of illustration: Ichimoku Indicator: Tenkan-sen-red line. Kijun-sen – blue line. Senkou span a – light brown dotted line. Senkou span B – light purple dotted line. Chikou span – green line. Bollinger Bands Indicator: 3 yellow lines. MACD: A red line and a histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD: the pound is declining due to Juncker and the French Posted: 20 Mar 2019 04:12 PM PDT The pound declined in response to today's events, although, by and large, there is no reason for panic: it was just that the market had high expectations. Therefore, with high probability, we can assume that the GBP/USD's downward movement will not receive a large-scale continuation - unless Brussels is surprised by a more stiff position regarding the postponement of Brexit. Just yesterday, there were rumors on the market that Theresa May would send a letter to European Council President Donald Tusk with a request to postpone Brexit's procedure for three months, or more precisely, until June 30. The text of the letter was kept secret until the second half of today. When in the end its content was disclosed, then the pound collapsed by more than a hundred points against the dollar. Such a reaction seemed rather strange, since the rumors that were circulating yesterday were fully confirmed. It turned out that the majority of traders were endowed with a more substantial temporary gap: in other words, the market hoped for a kind of Brexit in which the British government would initiate a postponement of Brexit until next year. However, Theresa May was in no hurry with this decision, she had initially warned members of the House of Commons that the failure of the third vote would delay Britain with "more than a few months." Now the situation has slightly changed: the British prime minister cannot, in principle, bring this issue to a vote in Parliament. Let me remind you that on Monday, the speaker for the House of Commons said that he would not allow a third vote for the draft deal. According to him, another vote would be possible only if "significant changes" are made to the proposed agreement. At the same time, he referred to the 400-year-old convention, where this rule is indicated. Based on the fact that Theresa May requested a three-month postponement of Brexit, she is still hoping for a re-vote on the deal in the near future. Hypothetically, this is possible: parliamentarians can circumvent the above convention by voting for the corresponding amendment. But before that, it is necessary: a) to mobilize Conservatives; b) to convince Unionists. Given the fact that the speaker of Parliament made his statement just before the planned vote, Theresa May simply did not have enough time to implement the two points mentioned above. This explains the "short" delay. But the market regarded this step in its own way, simultaneously taking profit in the GBP/USD pair and in other currency pairs with the participation of the pound. As a result, the British pound plummeted throughout the market, although there are no objective reasons for such a reaction. However, traders could confuse the "correspondence" dispute between Theresa May and the head of the European Commission Juncker. The subject of the dispute is a 1-week time gap. The fact is that the British government is asking for Brexit to be postponed until June 30, while Junker has reduced the maximum allowable delay time to May 23. In other words, he gave London a choice: either Britain's withdrawal from the EU will take place before the end of May, or the country will take part in the elections to the European Parliament, with all the consequences. In my opinion, the weekly time gap will not play a crucial role for the British, so the influence of this fundamental factor will be limited. There is one more nuance that worries traders of the GBP/USD pair, which is the position of the French. According to unconfirmed reports, tomorrow, France will oppose a prolongation of the article 50 of the Lisbon Treaty, that is, against the postponement of Brexit. A little later, officials from Paris denied this information, but rather vaguely: according to the press secretary of the President of France Emmanuel Macron, "will make an appropriate decision on the basis of the summit scheduled for tomorrow." Such an ambiguous answer did not satisfy traders, and the pound remained under background pressure. Thus, rumors rule the market once again, now it's about the possible outcomes of the EU summit. Neither data on the growth of UK inflation, which was released today, or tomorrow's meeting of the Bank of England seem to disturb investors: the focus is on Brexit. In my opinion, EU leaders will approve the extension of the negotiation period until May 23, and London, reluctantly, will agree. In turn, the pound will receive significant support, especially since traders will be able to return to their usual guidelines, assessing the dynamics of key macroeconomic indicators. In this context, the pound can also count on support, given the latest releases: inflation has finally stopped its slowdown (both in monthly and annual terms), and wage growth exceeded the expectations of experts. In addition, the unemployment rate plunged below the four-percent mark, confirming the strengthening of the labor market. In other words, the British currency has the potential for further growth - if only tomorrow's summit will be held according to the most predictable scenario. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD: Brussels might not give London a grace period for Brexit Posted: 20 Mar 2019 04:12 PM PDT The events around Brexit and the upcoming EU summit continue to be the main focus for traders of the pound. Today, British Prime Minister T. May said she asked the EU to postpone the divorce between the UK and the EU to June 30, 2019 from March 29. It is expected that this issue will be considered by European leaders at the summit in Brussels, which starts tomorrow. Representatives of Germany and France have already said that if London wants to get a respite on Brexit, it needs to provide a good reason for this, according to the newspaper The Independent. The European Union's main negotiator for Brexit, Michelle Barnier, in turn, noted that before adopting such a decision, European leaders should consider which option would be in their interest. "There are quite legitimate questions: why do we need a delay, what can be achieved with its help, will it increase the chances of ratifying the agreement on leaving the UK from the EU?" said M. Barnier. He says extending the country's membership in the EU without a clear plan will have consequences for the bloc, both economically and politically. "The British Parliament should decide on the text of the agreement on the country's withdrawal from the EU. If this does not happen, the situation can get out of control," said Jean-Claude Juncker, President of the European Commission. It is possible that Brussels may not provide London with a postponement of Brexit, if the latter is not sufficiently convincing. In this case, the UK will have three options: accept the "divorce" agreement, resort to Article 50 and withdraw the application for exit from the bloc, or leave the EU without a deal. The dynamics of the GBP/USD in the near future will likely depend on how the EU responds to the official request of T. May to postpone the Brexit deadline. Certain adjustments to the bidding can be made at the next Fed meeting, the results of which will be made known tonight and at which unexpected decisions can be made for the market. The material has been provided by InstaForex Company - www.instaforex.com |

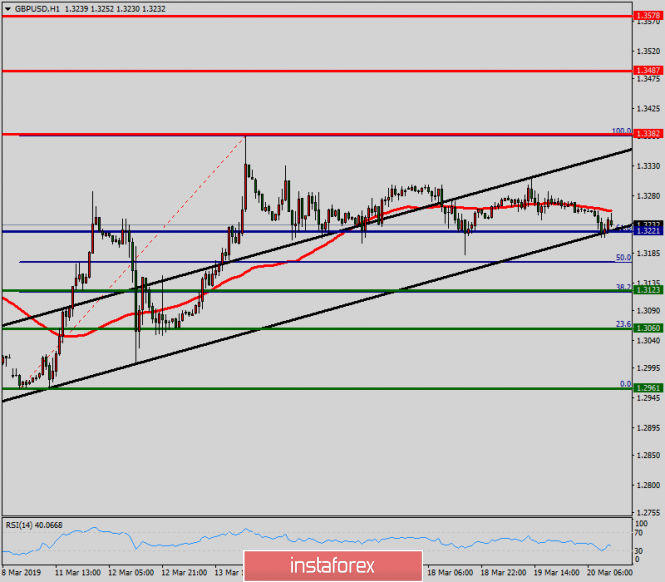

| March 20, 2019: GBP/USD Intraday technical levels and trading recommendations Posted: 20 Mar 2019 08:59 AM PDT

On January 2nd, the market initiated the depicted uptrend line around 1.2380. This uptrend line managed to push price towards 1.3200 before the GBP/USD pair came to meet the uptrend again around 1.2775 on February 14. Another bullish wave was demonstrated towards 1.3350 before the bearish pullback brought the pair towards the uptrend again on March 11. A weekly gap pushed the pair slightly below the trend line (almost reaching 1.2960) . However, significant bullish recovery was demonstrated rendering the mentioned bearish gap as a false bearish breakout. Moreover, a short-term bearish channel was broken to the upside following the mentioned bullish recovery on March 11. That's why, bullish persistence above 1.3060 allowed the GBPUSD pair to pursue the bullish momentum towards 1.3130, 1.3200 then 1.3360 where the current bearish pullback was initiated. Bullish persistence above 1.3250 ( 50% Fibonacci expansion level ) was needed for confirmation of a bullish Flag pattern. However, significant bearish pressure was demonstrated below 1.3250. Hence, the short term outlook turned to become bearish towards 1.3180 then 1.3095 where the depicted uptrend line comes to be tested again. Bearish persistence below 1.3185 (23.6% Fibonacci expansion) is mandatory for further bearish decline. Any bullish breakout above which, gives early warning for sellers. Trade Recommendations: Intraday traders should wait for a valid SELL signal anywhere around (1.3215-1.3250). T/P level to be located around 1.3180 and 1.3090. SL to be set as rebound H4 closure above 1.3200-1.3250 again. The material has been provided by InstaForex Company - www.instaforex.com |

| Bitcoin analysis for March 20, 2019 Posted: 20 Mar 2019 08:40 AM PDT Bitcoin has been trading sideways at the price of $3.987. Our view from yesterday is still valid.

BTC exited from consolidation phase (potential bullish flag pattern), and we anticipate the upward trend to continue. Stochastic oscillator is ready for an upswing. This is a good sign of an ongoing trend. Short-term resistance is seen at the price of $4.020 and $4.170. Key intraday support is seen at the price of $3.928. Trading recommendation: We are bullish on BTC from 3.870, and we added new long position on the breakout of $4.000. Stop loss order is to be placed at $3.770, and take profit order is to be set at $4.170. The material has been provided by InstaForex Company - www.instaforex.com |

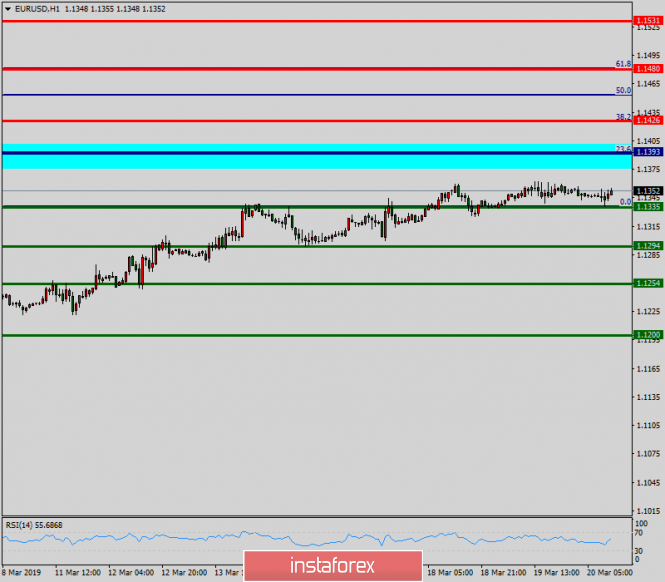

| EUR/USD analysis for March 20, 2019 Posted: 20 Mar 2019 08:31 AM PDT EUR/USD has been trading sideways at around 1.1358. Demand is still buoyant, so be careful when selling.

According to the H1 time – frame, I have found a potential bullish Wolfe wave pattern in progress. The projected target for the upside is at the price of 1.1500. The price should go towards the estimated target level. Currently there is a running flat bearish correction in creation and bearish divergence on the macd oscillator, which are signs that EUR/USD might trade a bit lower before new buyers join the market. Support level is seen at the price of 1.1293 and the key resistance is seen at the price of 1.1512. Trading recommendation: We are bullish on the EUR from 1.1358. Protective stop is placed at the price of 1.1495 and the main target is set at the price of 1.1500 The material has been provided by InstaForex Company - www.instaforex.com |

| Analysis of Gold for March 20, 2019 Posted: 20 Mar 2019 08:19 AM PDT Gold has been trading downwards. The price tested the level of $1.304.77. Bearish momentum is still going on, be careful with buying.

According to the M30 time – frame, I have found double fail tests of the high at $1.310.65, which is a sign that buyers don't have power for any strong push. Gold did break the rising trendline, which is another sign of weakness. Bearish divergence on the MACD oscillator is another sign of waning buying power. Resistance level is seen at the price of $1.310.65 and the support is seen at $1.292.40. Watch for a bearish flag before you sell. Trading recommendation: We closed our long position on Gold on the breakeven and we are looking to short Gold. If you are aggressive, you can sell from $1.302.00 with the take profit at $1.292.50 and protective stop at $1.311.00. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 20 Mar 2019 06:45 AM PDT The British pound began to gradually decline against the US dollar after appearing on the market that British authorities did not intend to ask the EU for a long postponement of Brexit. This was announced by government representatives. The short period of delay will not allow the Prime Minister of the United Kingdom to get the EU to make important changes to the Brexit agreement, which is so expected in parliament. Moreover, a short delay calls, in general, the Brexit procedure itself and the UK's exit from the EU, since in fact, nothing will change in such a short time, except for the next period of uncertainty, which lasts for about 3 years. Already in the afternoon, it became known that the government of the country sent an official petition to the EU leaders to postpone the exit of Great Britain from the union to the date after March 29. During her speech, British Prime Minister Theresa May said she was asking to postpone the official date of Brexit to June 30 and ratify additional documents so that a new vote could be taken on Brexit. However, the duration of the delay will be determined by the EU authorities. Most likely, this will happen tomorrow during the summit. Tomorrow, the decision of the Bank of England on interest rates will be published. Given the excitement around Brexit, traders ignored today's inflation data in the UK, which accelerated slightly in February of this year. This happened due to rising prices for food and alcoholic beverages. According to a report by the National Bureau of Statistics, in February 2019, compared with the same period last year, consumer prices rose 1.9% after rising 1.8% in January. With regard to growth in February, compared with January of this year, inflation increased by 0.5%, while economists expected it to grow by 0.4%. Let me remind you that quite recently, the Bank of England has signaled that it can continue to raise rates in the next few years in order to keep annual inflation near the target level of 2%. I think it is at this point that you should pay attention to the statements that will be published tomorrow, along with the decision on interest rates. It is unlikely that a small jump in inflation will frighten the regulator. In the first half of the day, a report was also published, which indicated that in January of this year, as compared with January of last year, housing prices in London decreased by 1.6%. As for the technical picture of the GBPUSD pair, a breakthrough of a sufficiently dense support area led to the sale of the pound. At the moment, the pressure of bears can be kept in the region of minimum 1.3130, while larger support can be seen in the area of 1.3020. However, we can already say that the current short-term uptrend for the pound is broken, however, as I mentioned above, much will depend on tomorrow's decision at the EU summit. Fed and interest rate In the afternoon, all attention will be focused on the decision of the US Federal Reserve on interest rates. No one doubts that the regulator will leave them unchanged, but the forecast for their further increase may be significantly revised. If the Fed refuses to tighten monetary policy this year, this could lead to a significant weakening of the US dollar, as previously, at least two rate hikes were raised. As for the technical picture of the EURUSD pair, it remained unchanged. Another unsuccessful attempt to update yesterday's high led to a slowdown in euro growth and a decline. The goal remains the support of 1.1335, the breakthrough of which will lead to a larger sale to the minima of 1.1300 and 1.1250. In the case of growth above the resistance of 1.1370, the demand for the euro will significantly increase, which will open a direct road to the highs of 1.1410 and 1.1490, however, such a large increase will occur only with real changes in the monetary policy of the United States, which we will learn in the afternoon. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold is waiting for the verdict of the Fed Posted: 20 Mar 2019 06:41 AM PDT The best start of the American stock market since 1991 and unwilling to break the "bullish" trend provoked the USD index to a 3% gold correction. Investors began to doubt that the 14% rally from August lows levels could continue. Its key drivers were concerns about the slowdown of the global economy under the influence of trade wars and the low rates of the global debt market. If the States and China agree, and the global GDP, headed by the Celestial Empire, goes to a V-shaped recovery, the precious metal will have a hard time. However, other trumps can play on his side. Goldman Sachs believes that different sectors of the American and world economy will lead to a weakening of the US dollar, which will allow the bulls to restore the uptrend by XAU / USD. A leading indicator from the Atlanta Federal Reserve Bank indicates a decline in US GDP growth to less than 1% in the first quarter. At the same time, investors believe that the eurozone has reached the bottom, and large-scale fiscal and monetary stimulus will help China. The situation abroad begins to look better than in the States, which, as a rule, leads to a weakening of the USD index. Enough exchange funds react sensitively to the change of the gold market conjuncture. Their reserves have declined since the beginning of the year from 73.3 million to 71.8 million ounces. At the same time, the sluggish dynamics of the European economy and the negative rates of the German debt market contribute to the high demand for ETF products from the Old World. It has been increasing for three years in a row, and, most likely, will continue to do so. This circumstance allows us to count on the recovery of the uptrend on XAU / USD. Gold dynamics and ETF stocks Structure and dynamics of demand for ETF products If we proceed from the assumption that the economy of the Middle Kingdom will not be restored V, but U-shaped and the US stock market will soon change fear, then the medium-term outlook for the precious metal looks optimistic. Moreover, the rates of the global debt market amid slower GDP growth and inflation are more likely to remain at historically low levels, and the completion of the Fed's monetary policy normalization cycle will help the dollar to weaken. In the short term, the fate of the precious metal will be determined by Jerome Powell and the company. Fed concerns about the state of the US and world economy, lower FOMC forecasts for the federal funds rate and GDP are the "bearish" factors for the US dollar. On the other hand, the dovish rhetoric of the Fed chairman will support US stocks, improve global risk appetite, and continue to put pressure on safe-haven assets. Gold risks falling into consolidation in anticipation of new drivers capable of leading it from this state. Technically, the correction to the CD wave continues as part of the transformation of the "Shark" pattern at 5-0. Rebound from the levels of $ 1307 and $ 1315 per ounce will allow the "bears" to continue the attack. To restore the "bullish" trend, confident assaults of resistances at $ 1333 and $ 1340 are required. The material has been provided by InstaForex Company - www.instaforex.com |

| Dollar pays no attention to the Fed's caution, American grows stronger! Posted: 20 Mar 2019 06:17 AM PDT The dollar returned to growth, which may continue. Investors choose safe currencies after reports of tensions in US-China trade negotiations but growth is hindered by the Fed's caution. Volatility in foreign exchange markets fell sharply due to the "dovish sentiment" from main central banks, including the US Federal Reserve. But even in such a situation, the dollar manages to demonstrate amazing resilience. The negative impact of the pause in the interest rate increase cycle of the Fed has somewhat weakened by cautious actions of the ECB, which was faced with the problems of the eurozone economy. Today, the Fed is expected to maintain its base interest rate unchanged. Expectations of interest rate cuts increased after the production data came out weaker than expected. At the same time, the dollar on Wednesday rose against the Australian dollar, as well as the Canadian dollar and the Japanese yen despite the gloomy prospects. This is partly due to its attractiveness as a safe-haven asset, after the US authorities expressed concern that China refuses to comply with the agreements reached at the trade negotiations. The Australian dollar on this news immediately went to a decline. Otherwise, most currencies remain within the usual trading ranges until the announcement of the Fed decision. Most likely, the dollar will not decline much in price following the Fed meeting since the market has already won back the regulator's decision to keep rates at the same level. |

| GBP / USD plan for the American session on March 20. Inflation in the UK was ignored by traders Posted: 20 Mar 2019 06:03 AM PDT To open long positions on the GBP / USD pair, you need: Despite good inflation data in the UK, pressure on the pound remains prior to tomorrow's important decision of the Bank of England on interest rates and the EU summit, which will discuss the issue related to Brexit. Buyers managed to return from the support level of 1.3220, to which I paid attention in my morning forecast. Now their main task will be a breakthrough and consolidation above the resistance of 1.3266, which will lead to a larger upward trend of the pound to the area of maximum at 1.3316 and 1.3375, where I recommend taking profits. In the event of a further decline in the pound and a break of support at 1.3220, it is best to rely on new purchases at the lower limit of the lateral range in the area of 1.3182 and 1.3131. To open short positions on GBP / USD pair, you need: The bears tried to break below the support of 1.3220 in the first half of the day and formed a resistance level of 1.3266. As long as trading continues below this range, the pressure on the pound will continue, leading to a repeated attempt at the support test of 1.3220. Its breakdown will increase the pressure on the GBP/USD pair and the main task of sellers will be to update the lows around 1.3182 and 1.3131, where I recommend taking profits. In the case of the pound rising above the resistance of 1.3266, short positions can return to rebound from the highs of 1.3316 and 1.3375. More in the video forecast for March 20 Indicator signals: Moving averages Trading is below 30 and 50 moving averages, which indicates the advantage of the pound sellers. Bollinger bands A breakthrough with the lower boundary of the Bollinger Bands indicator near the level of 1.3220 may increase the pressure on the pair. Description of indicators MA (moving average) 50 days - yellow MA (moving average) 30 days - green MACD: fast EMA 12, slow EMA 26, SMA 9 Bollinger Bands 20 The material has been provided by InstaForex Company - www.instaforex.com |

| EUR / USD plan for the US session on March 20. All attention to the Fed meeting Posted: 20 Mar 2019 06:02 AM PDT To open long positions in EUR / USD pair, you need: The situation in the euro has not changed in comparison with the morning forecast, however, buyers managed to show themselves from the support level of 1.1337, to which I paid attention. The main task of the bulls remains a breakthrough and consolidation above the resistance of 1.1370, which will lead to a new wave of growth in the area of 1.4107 maximum, where I recommend fixing the profit. With the scenario of EUR/USD decline in the second half of the day, long positions can only be expected after a false breakdown in today's low of 1.1337 or a rebound from the larger support area of 1.1301 and 1.1278. To open short positions in EUR / USD pair, you need: If the Fed announces a return to soft monetary policy in the afternoon, the pressure on the US dollar will increase. In this scenario, it is best to rely on short positions after the update of the maximum around 1.1407 and 1.1460. If the main approaches of the Fed does not change, the bears can return to the market. The unsuccessful consolidation above the resistance of 1.1370 will be the first signal to open short positions in order to break and consolidate below support 1.1337. A breakthrough of 1.1337 will lead to a larger sale of EUR/USD and lows in the area of 1.1301 and 1.1278, where I recommend taking profits. More in the video forecast for March 20 Indicator signals: Moving averages Trade has moved to the area of 30 and 50 day moving averages, which indicates the lateral nature of the market before the release of important data. Bollinger bands Volatility in the Bollinger Bands indicator is very low, which does not give signals on market entry. Description of indicators MA (moving average) 50 days - yellow MA (moving average) 30 days - green MACD: fast EMA 12, slow EMA 26, SMA 9 Bollinger Bands 20 The material has been provided by InstaForex Company - www.instaforex.com |

| Is it worth selling a dollar against the yen? Posted: 20 Mar 2019 05:17 AM PDT All attention for today will focus on the US Federal Reserve and more specifically to the long-awaited press conference of the head of the US central bank, Jerome Powell. No one is expecting rate changes and market participants are interested in both of the economic forecasts and Powell's comments. Considering the current situation, we need to monitor every step of the dollar today. We should also not lose sight of the dynamics of the yield of US state bonds. In the past few weeks, the USD/JPY pair almost never leaves the narrow range of 111.00-112.00. For some unknown reason, the dollar decided not to react to the political baton of successive polls on the UK leaving the EU. In addition, he ignored the worst report in 17 years on China's industrial production, as well as the decision of Donald Trump to postpone a meeting with his Chinese counterpart Xi Jinping. Recall that the audience was expected to sign a bilateral trade agreement between the countries. It seems that traders needed other fundamental drivers and Powell's upcoming press conference is more than suitable for this role. Market participants believe that the main blow to the dollar will be caused by Fed officials, who are likely to report on a wait-and-see attitude and unwillingness to multiply raise rates during 2019. An excellent prelude to such comments could be the deterioration of estimates of economic growth in America for this year, as a result of heightened risks in the sphere of world foreign trade. The dollar in this situation will very quickly be among the outsiders with the potential for closing the day below 111.00. What do analysts think? Justifying the sale of the dollar against the Japanese yen at Westpac, taking a short position in the US dollar should be based on the fact that the spot market was not able to break through the resistance of 112.00-112.50, according to market strategists. The recommendation from Westpac is as follows: sale from 111.90 with a target at 110.10 and a stop order at 112.55. Experts also named the reasons that prompted them to adhere to such a strategy, namely:

Meanwhile, the USD/JPY pair opened with growth today, testing the resistance level of 111.67. Some analysts do not exclude that in the future, the pair will move to 113.00 after a breakdown in this level. The material has been provided by InstaForex Company - www.instaforex.com |

| Why wait for the dollar from Jerome Powell and his colleagues? Posted: 20 Mar 2019 05:17 AM PDT Today, the Federal Reserve System (FRS) will announce its decision on monetary policy and will publish updated forecasts, including on economic growth and inflation in the country. It is expected that following the results of the next meeting of the American Central Bank will leave the interest rate at the level of 2.25-2.50%. At the same time, macroeconomic forecasts for the current year are likely to be revised downward. In January, the Fed signaled that it intends to take a cautious approach in the matter of changing the interest rate. What does the regulator's call for patience mean? Will he no longer raise the rate this year? The answer to this question can give a "point" forecast. The following options are possible: 1. The revision of the forecast to one increase per year is the most likely scenario that will allow the Fed to return to monetary policy tightening, provided that global economic growth begins to recover and the momentum for the rise of the American economy continues. In this case, the reaction of the dollar may be positive but its growth will be limited. 2. The scenario that does not involve a single rate increase in the current year will have a negative effect on the greenback. At the same time, it will support the possibility of lowering the rate in 2020 or earlier, which could even derail the US currency. 3. Keep the forecast unchanged. If the Fed surprises the markets by leaving two acts of monetary restriction on the table this year, the dollar will be back on the line. In addition to the rates and macroeconomic forecasts, investors are also interested in the question of how far the Fed will reduce the volume of assets on its balance sheet. Earlier, FOMC representatives hinted that this process could already be completed this year and made it clear that they would soon publish a detailed action plan. For the dollar, the soonest completion of the balance reduction program will mean an increase in the volume of currency in circulation, with which the "American" can become cheaper. It is assumed that the extension of the program until 2020 will be a positive moment for the greenback and its curtailment in the near future will be a negative one. Thus, the dollar is waiting for the outcome of the next meeting of the Federal Reserve, which can help determine the future direction of movement. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of GBP/USD for March 20, 2019 Posted: 20 Mar 2019 04:29 AM PDT The NZD/USD has broken resistance at 1.3221 which acts as support this morning. The pair is moving between the levels of 1.3221 and 1.3382. As the trend is still above the 100 EMA, a bullish outlook remains the same as long as the 100 EMA is headed to the upside. Consequently, the level of 1.3221 remains a key resistance zone. Therefore, there is a possibility that the NZD/USD pair will move upwards above 1.3221, which coincides with a ratio 61.8% of Fibonacci retracement. The falling structure does not look corrective. In order to indicate a bearish opportunity above 1.3221, buy above this level with the first target at 1.3382. Moreover, if the pair succeeds to pass through 1.3382, it will move upwards continuing the bullish trend development to 1.3487 in order to test the daily resistance 2. However, if a breakout happens at 1.3123, this scenario may be invalidated. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of EUR/USD for March 20, 2019 Posted: 20 Mar 2019 04:01 AM PDT Overview: Pivot: 1.1393. The EUR/USD pair is trading around the daily pivot point (1.1393). It continued to move downwards from the level of 1.1393 to the bottom around 1.1335. This week, the first resistance level is seen at 1.1393 followed by 1.1426, while the first daily support is seen at 1.1335. Furthermore, the moving average (100) starts signaling a downward trend; therefore, the market is indicating a bearish opportunity below 1.1393. So, it will be good to sell at 1.1393 with the first target of 1.1335. The downtrend is also expected to continue towards 1.1294. The strong daily support is seen at the 1.1254 level. According to the previous events, we anticipate the EUR/USD pair to trade between 1.1393 and 1.1254 in coming hours. The price area of 1.1393 remains a significant resistance zone. Thus, the trend remains bearish as long as the level of 1.1393 is not broken. On the contrary, in case a reversal takes place, and the EUR/USD pair breaks through the resistance level of 1.1393, then a stop loss should be placed at 1.1453. The material has been provided by InstaForex Company - www.instaforex.com |

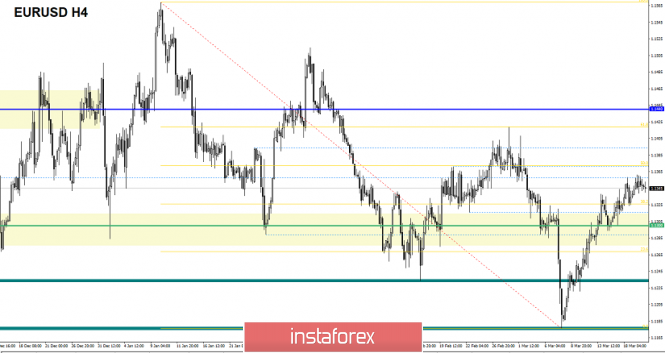

| Trading recommendations for the EURUSD currency pair - placement of trading orders (March 20) Posted: 20 Mar 2019 02:52 AM PDT Over the past trading day, the Euro / Dollar currency pair showed an extremely low volatility of 25 points, to put it bluntly, trampling in one place. From the point of view of technical analysis, we see an upward course, where, yesterday, a congestion has formed in the form of waiting positions. Informational and news background is waiting for the upcoming Fed meeting, for the same reason we saw the congestion. In the divorce proceedings of Britain & the European Union, everything is stable in the form of utter confusion. Earlier, the Speaker of the House of Commons, John Bercou, said that Parliament refused to put the Brexit deal to a vote for the third time, citing an agreement in 1604, according to which the question is not "voted on" again and again, if no key changes appear in its wording. Now London is obliged to request a deferment from Brussels until March 21. In turn, the EU is already displeased. The EU coordinator at the Brexit talks, Michel Barnier, warned that any delay in Brekzit's process would involve "political and economic costs" for the EU, and urged London to present a clear plan. France, on the other hand, is ready to use the right of veto to block the meaningless proposal of Great Britain to extend the terms of leaving the European Union.

Today, as I have repeatedly written, the key day of the week is the meeting of the federal commission on open market operations. Experts suggest that the Fed may demonstrate some measures to mitigate monetary policy, and, of course, at least say something about the fate of the rate. In any outcome, the current lull in the trading chart can be replaced by an increase in volatility at a given event. United States 21:30 MSK - FOMC press conference Further development Analyzing the current trading chart, we see that the accumulation of 1.1340 / 1.1360, remains in the market. What to expect next? Probably, there is a continuation of the current bumpiness with a gradual expansion of the amplitude, but it is already in anticipation of the Fed meeting and the first comments / rumors, volatility can increase.

Based on the available data, it is possible to decompose a number of variations, let's consider them: - We consider buy positions in case of price fixing higher than 1.1365, with the prospect of 1.1380-1.1400-1.1.1420 - We consider selling positions in the case of price fixing lower than 1.1330, with the prospect of 1.1315-1.1300--1.1280. Indicator Analysis Analyzing a different sector of timeframes (TF ), we see that in the short term, indicators of indicators have changed to descending against the background of stagnation. Intraday and mid-term prospects both retain an upward interest against the general background of the market. Weekly volatility / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation , with the calculation for the Month / Quarter / Year. (March 20, was based on the time of publication of the article) The current time volatility is 16 points.It is likely to assume that due to the upcoming Fed meeting, volatility may accelerate. Key levels Zones of resistance: 1.1440; 1.1550; 1.1650 *; 1.1720 **; 1.1850 **; 1.2100 Support areas: 1.1300 **; 1.1214; 1.1120; 1.1000 * Periodic level ** Range Level The material has been provided by InstaForex Company - www.instaforex.com |

| Markets focus on the outcome of the Fed meeting Posted: 20 Mar 2019 02:35 AM PDT Today, the focus of the market will be on the decision of the American regulator on the monetary policy, which will undoubtedly have an impact particularly to the foreign exchange and generally in global markets. As expected, the outcome of the two-day meeting will not only on the decision of interest rates but most importantly on the forecasts and plans of the Central Bank for the near future. After the end of the year, the US stock market showed a strong decline in the wake of fears of expanding the trade war between the US and China, which was further stimulated by the December increase in interest rates, as well as, plans to increase it further twice this year as a whole by 0.50% of members. The Fed began to urgently assure investors that the future monetary policy will be revised which will also be joined by the colleagues of Fed Head Jerome Powell. This somewhat calmed the markets and became the reason for the winter rally and influenced the stock and commodity markets, despite the dollar under pressure. However, the slippage in the negotiations on the terms of mutual trade between Washington and Beijing, as well as the publication of economic statistics, which in general still show good dynamics of economic growth, caused cautious optimism in the markets and a certain ambiguity in understanding the bank's future plans. On the one hand, Powell and most members of the Federal Reserve made it clear that the process of raising interest rates could be stopped and even the regulator's decline in balance could be stopped. But on the other hand, some of the heads of federal banks stated at least one interest rate increase even if the current growth rate was maintained. This is why the March meeting is extremely important. If the Fed clearly and bluntly informs that it stops the cycle of raising interest rates and stops reducing its balance in the second half of this year, this will undoubtedly be positive for the markets and cause a new wave of optimism, which will pull up the demand for risky assets. In this situation, the course of the American dollar will certainly suffer. But if the decision is not concrete given the uncertainty with the indication that the bank's monetary policy decisions will depend on the economic situation, as well as the external factor, then first of all we can expect an increase in disappointments on the state of trade wars and a decrease in stock indices in the world. There will also be an increase in demand for defensive assets and the US dollar. Forecast of the day: The EUR/USD pair consolidates below 1.1355. If the outcome of the Fed meeting is positive for the demand for risky assets, the pair will overcome the mark of 1.1355 and rush to 1.1400. At the same time, a negative and ambiguous decision will lead to a fall in prices to 1.1315 and then possibly to 1.1290. The USD/JPY pair can also rise or fall on the outcome of the Fed meeting. A positive result will lead to an increase in the price to 112.60 after overcoming the level of 111.80 while negative data will trigger a drop to 110.60. |

| Overview of the foreign exchange market on 03/20/2019 Posted: 20 Mar 2019 02:10 AM PDT Waiting is one characteristic that can describe what is happening in the market. The single European currency generally stands still on a tight spot, even the pound responded to the data on the labor market only by a small and short-term increase. Nonetheless, it turned out to be much better than predicted. Not only did the growth rate of average wages with premiums remained unchanged and did not decline as expected, the unemployment rate also fell from 4.0% to 3.9%. Indeed, the growth rate of average wages without taking into account bonuses slowed down but only due to a larger revision of the previous data. It is also worth noting that the American statistics turned out to be slightly worse than forecasts since production orders grew only by 0.1% and not by 0.3% as predicted, however, all these did not make a proper impression. Moreover, market volatility was extremely low. The market is waiting for the outcome of today's meeting of the Federal Commission on open market operations. The fact that immediately after the meeting, a press conference of Jerome Powell will take place adds piquancy to the situation. Practically no one doubts that the head of the Federal Reserve System will declare in almost direct words that the refinancing rate will not be raised this year. But everyone knows this anyway. The regulator has already hinted at this development. The whole point is that there are good reasons to believe that some measures to mitigate monetary policy will be announced today. This is what everyone is waiting for after the European Central Bank has actually resumed its quantitative easing program. Moreover, the Federal Reserve System hinted at the possibility of easing its monetary policy at the very beginning of the year and as soon as this is confirmed, the single European currency will rush to 1.1400. But before Jerome Powell shares his life plans with us, we are waiting for data on inflation in the UK. Of course, this is not as interesting as another attempt to push through the House of Commons bonded divorce agreement but after all the vote was canceled. Hence, we have to be content with what it is and there is nothing to look at because inflation should remain unchanged. Nevertheless, the pound will also revive only after the announcement of the results of the meeting of the Federal Commission on open market operations and it will most likely move towards 1.3325. |

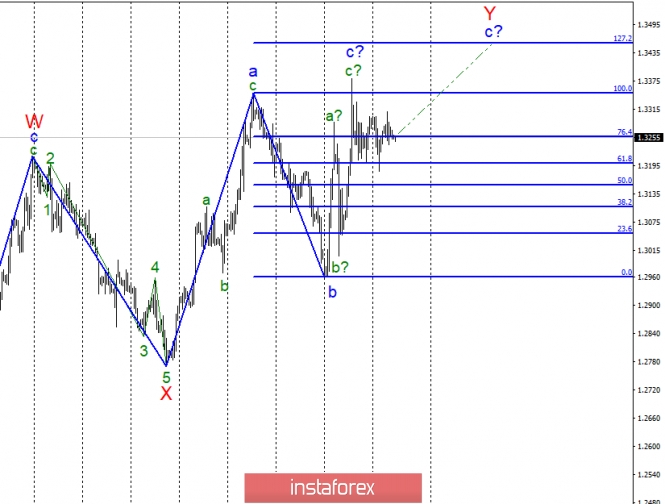

| Wave analysis of GBP / USD for March 20. Pound sterling "in the fog" Posted: 20 Mar 2019 01:52 AM PDT

Wave counting analysis: On March 19, the GBP / USD pair added about 20 bp. The instrument continues to be in limbo, since the current position may well continue to build a wave with in Y, and begin a new descending trend section. In the news plan, too, nothing really changes. There is no new data on Brexit, most likely, it will be transferred for 3 months, until June 30. And how all this will help to reach an agreement with the European Union on an agreement that the Parliament of Great Britain will arrange, it is still difficult even to assume. Today, the inflation rate and the outcome of the Fed meeting, which is important for the pound sterling, can significantly affect the movement of the instrument especially this concerns the evening press conference of the Fed. I expect that today the wave pattern will become clearer, and the pound will come out of the "fog". Purchase goals: 1.3350 - 100.0% Fibonacci 1.3454 - 127.2% Fibonacci Sales targets: 1.2961 - 0.0% Fibonacci General conclusions and trading recommendations: The wave pattern assumes the construction of an upward wave with targets located near the estimated marks of 1.3350 and 1.3454, which corresponds to 100.0% and 127.2% of Fibonacci. However, the probability remains that the upward wave is completed. The news background on Wednesday can clarify the current wave marking. The pound will have chances of growth if Powell and the company declare a relaxation of monetary policy. The material has been provided by InstaForex Company - www.instaforex.com |

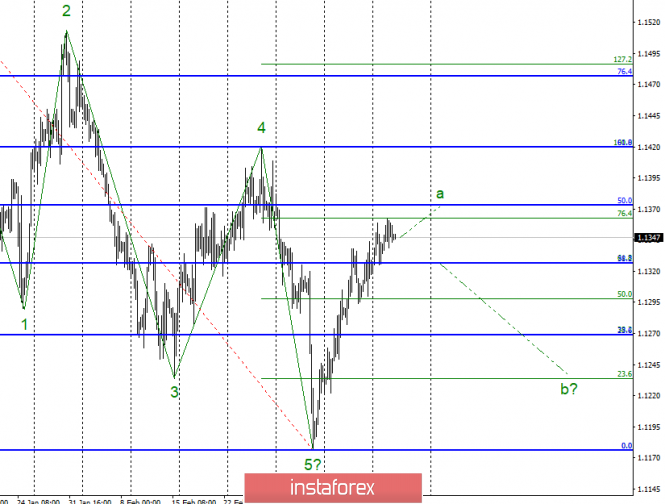

| Wave analysis of EUR / USD for March 20. All attention to the Fed and Jerome Powell Posted: 20 Mar 2019 01:52 AM PDT

Wave counting analysis: On Tuesday, March 19, trading ended on EUR / USD by 15 bp increase for the pair EUR / USD. Thus, even at a very slow pace, wave a continues its construction with targets located near the 50.0% level on the older Fibonacci grid. A very important event for the couple will take place tonight - the Fed's press conference following a two-day meeting. Markets do not expect any changes in monetary policy, but they expect important statements from Jerome Powell. Thus, Powell's strong statements can lead to the beginning of the construction of a correctional wave b, and the weak ones - to the lengthening of wave a. Sales targets: 1.1269 - 38.2% Fibonacci (small grid) 1,1234 - 23.6% Fibonacci (small grid) Purchase goals: 1.1373 - 50.0% Fibonacci General conclusions and trading recommendations: The pair presumably continues to build the first wave of the upward trend. Now I recommend buying a pair with targets located near the mark of 1.1373, which corresponds to 50.0% Fibonacci, but take into account that the construction of a correctional wave b may soon begin. Special care will be needed tonight, as important news from the Fed can lead to sharp reversals on the instrument. The material has been provided by InstaForex Company - www.instaforex.com |

| The dollar rises to most currencies on Wednesday Posted: 20 Mar 2019 01:34 AM PDT Today, the value of the dollar rises in pairs with the rates of major world currencies in anticipation of the outcome of the meeting of the US Federal Reserve System (FRS). According to experts, the change in rates by the American regulator during this meeting should not happen, and all attention will be focused on the final statement, as well as on the comments of US Central Bank Governor Jerome Powell. Market participants expect the Federal Reserve to announce its plans for a program to reduce assets on the Central Bank's balance sheet, which is scheduled later this year. According to experts, the Fed may signal a longer suspension of rate normalization but still does not rule out one increase before the end of 2019. The pound sterling is declining today. Earlier this week, Speaker of the House of Commons, John Bercow, excluded the holding of a regular vote on Britain's withdrawal from the European Union if Theresa May, the country's prime minister, does not make changes to the proposal for Brexit terms. Michel Barnier, the main negotiator with the European Union for Brexit, declared on the eve that any delay in the "Euro-Divorce" process would lead to political and economic costs for the EU, and urged London to present a clear plan. Today, during the operation to protect its currency, which falls in tandem with the dollar, Hong Kong was once again forced to resort to interventions in the foreign exchange market. The Hong Kong Monetary Authority (NKMA) bought out 604 million Hong Kong dollars amid a depreciation of the currency to 7.85 Hong Kong dollars per US dollar. During March, NKMA spent 8 billion Hong Kong dollars to protect the national currency. The dollar index, which tracks the dynamics of the US dollar against six major world currencies, rose 0.1%. By 06:12 London time, EURUSD slipped to $ 1.1349. The USDJPY pair rose by 0.13%, reaching 111.54 yen. The EURJPY pair rose 0.12% to 126.62 yen. The national currency rate of Britain sank in pair with the dollar by 0.09%, to 1.3556 dollars. The EURGBP pair decreased by 0.07%, to 1.1680. The dollar rises in price by 0.2% paired with the national currency of Australia and by 0.3% with the New Zealand dollar. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 20 Mar 2019 01:34 AM PDT 4-hour timeframe Technical details: The upper linear regression channel: direction - up. The lower linear regression channel: direction - up. Moving average (20; smoothed) - up. CCI: -14.6308 The GBP / USD currency pair remains near its local maximums and cannot overcome the Murray level "6/8" (1.3306). Meanwhile, Theresa May is going to Brussels to ask the EU to postpone the exit from the EU until June 30, 2019. Well, this is the most obvious scenario. However, as we have said many times before, by and large, this delay does not solve anything if the current version of the "deal" with the EU is not revised or supplemented so that it suits both the British Parliament and the European Union. Given the reluctance of EU leaders to enter into new negotiations, it will be extremely difficult to achieve this. At the same time, Theresa May remains faithful to her most important method of influencing parliament - threats. Once again, she noted that the parliament should support its version of the agreement, otherwise Brexit may never happen at all or the country will have a "hard" option. In general, nothing new. Yesterday's publications in the UK can even be called moderately positive since the unemployment rate unexpectedly dropped to 3.9%, and the average wage, including bonuses, rose by 3.4%, although forecasts were lower. Today in the UK, inflation will be published in February, and in the evening, the results of the Fed meeting and a press conference will be announced. Nearest support levels: S1 - 1.3245 S2 - 1.3184 S3 - 1.3123 Nearest resistance levels: R1 - 1.3306 R2 - 1.3367 R3 - 1.3428 Trading recommendations: The pair GBP / USD has launched a new round of downward correction, as Murray's level "6/8" remains unresolved. If this level is still overcome, the purchase orders will be relevant to the objectives of 1.3367 and 1.3428. It is recommended to open short positions in case the pair is able to overcome the moving average line. In this case, the trend in the instrument will change to downward and become relevant short positions with targets at 1.3184 and 1.3123. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanations for illustrations: The senior linear regression channel is the blue lines of the unidirectional movement. The junior linear channel is the purple lines of the unidirectional movement. CCI is the blue line in the indicator regression window. The moving average (20; smoothed) is the blue line on the price chart. Murray levels - multi-colored horizontal stripes. Heikin Ashi is an indicator that colors bars in blue or purple. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment