Forex analysis review |

- March 22, 2019 : EUR/USD Intraday technical levels and trade recommendations.

- March 22, 2019 : GBPUSD Intraday technical levels and trade recommendations.

- Bitcoin analysis for March 22, 2019

- EUR / USD plan for the European session on March 22. The trick of Fed has failed

- Fractal analysis of major currency pairs on March 22

- GBP/USD analysis for March 22, 2019

- Analysis of Gold for March 22, 2019

- Experts have named the main reasons for the weakening dollar this year

- How long will the dollar decline last? What drives the sterling?

- The dollar follows in the footsteps of the euro

- Brexit situation is even worse than it was. The US data supports the dollar

- GBP / USD. March 22 Trading system "Regression Channels". A Third vote in parliament for the same "deal"

- Technical analysis of USD/CHF for March 22, 2019

- EUR / USD Trading system "Regression Channels" on March 22, Euro is preparing for a new strengthening

- Technical analysis of USD/CAD for March 22, 2019

- Technical analysis of EUR/USD for March 22, 2019

- Overview of the currency market on 03/22/2019

- Trading recommendations for the GBPUSD currency pair - prospects for further movement

- Wave analysis of GBP / USD for March 22. The situation around Brexit gets confusing more and more.

- Burning Forecast 03/22/2019

- Trading Plan 03/22/2019

- Wave analysis of EUR / USD for March 22. We are waiting for a couple of about 13 figures..

- GBP/USD: plan for the European session on March 22. EU leaders rejected the postponement of Brexit from March 29 to June

- Control zones of NZD / USD pair on 03/22/19

- Indicator analysis. Daily review on March 22, 2019 for the pair GBP / USD

| March 22, 2019 : EUR/USD Intraday technical levels and trade recommendations. Posted: 22 Mar 2019 09:47 AM PDT On January 10th, the market initiated the depicted bearish channel around 1.1570. The bearish channel's upper limit managed to push price towards 1.1290 then 1.1235 before the EUR/USD pair could come again to meet the channel's upper limit around 1.1420. That's why, the recent bearish movement was demonstrated towards 1.1175 (channel's lower limit) where significant bullish recovery was demonstrated on March 7th. Bullish persistence above 1.1270 enhanced further bullish advancement towards 1.1290-1.1315 (the Highlighted-Zone) which failed to provide adequate bearish pressure. This week, a bullish breakout attempt was executed above 1.1327 (the upper limit of the current demand zone). This enhanced further bullish movement towards 1.1450 demonstrating a false bullish breakout above the upper limit of the depicted movement channel. On the other hand, Yesterday, significant bearish pressure was demonstrated around 1.1380 leading to the current bearish decline towards 1.1290. The short term outlook for EURUSD pair remains bearish. Hence, Quick bearish breakout below 1.1285 is mandatory to pursue towards the next bearish target around 1.1235 and 1.1180. Trade recommendations : Based on Yesterday's recommendations, sellers around .1385 should lower their SL to 1.1340 to secure some profits. TP levels to be located around 1.1235 and 1.1180. The material has been provided by InstaForex Company - www.instaforex.com |

| March 22, 2019 : GBPUSD Intraday technical levels and trade recommendations. Posted: 22 Mar 2019 09:26 AM PDT

On January 2nd, the market initiated the depicted uptrend line around 1.2380. This uptrend line managed to push price towards 1.3200 before the GBP/USD pair came to meet the uptrend again around 1.2775 on February 14. Another bullish wave was demonstrated towards 1.3350 before the bearish pullback brought the pair towards the uptrend again on March 11. A weekly bearish gap pushed the pair slightly below the trend line (almost reaching 1.2960) before the bullish breakout above short-term bearish channel was achieved on March 11. Bullish persistence above 1.3060 allowed the GBPUSD pair to pursue the bullish momentum towards 1.3130, 1.3200 then 1.3360 where the recent bearish pullback was initiated. Bullish persistence above 1.3250 ( 50% Fibonacci expansion level ) was needed for confirmation of a bullish Flag pattern. However, significant bearish pressure was demonstrated below 1.3250. Hence, the short term outlook turned to become bearish towards 1.3120 - 1.3100 where the depicted uptrend line failed to provide any immediate bullish support. Bearish breakout below 1.3100 (23.6% Fibonacci level) allowed quick bearish decline towards 1.3000 where the current bullish momentum that brought the pair back above 1.3200 was initiated (False bearish breakout). Today, Further bullish advancement is expected towards 1.3250 ( 50% Fibonacci expansion level) where bearish rejection may be anticipated. Trade Recommendations: Intraday traders should wait for a valid SELL entry anywhere around (1.3250). T/P level to be located around 1.3180 and 1.3100. SL to be placed above 1.3320. The material has been provided by InstaForex Company - www.instaforex.com |

| Bitcoin analysis for March 22, 2019 Posted: 22 Mar 2019 08:52 AM PDT BTC went fast lower and tested the level of $3.862 yesterday and today we got upward correction.

According to the H1 time – frame, the analysis from yesterday is still valid and we still expect downside. The is the down break of the upward trendline in the background, which is sign that aggressive sellers did enter the market. Key support levels are seen at the price of $3.864, $3.766 and $3.633. Key resistance is still set at the price of $4.170. Trading recommendation: We are short on BTC with the major take profit at $3.633 and protective stop at $4.060. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR / USD plan for the European session on March 22. The trick of Fed has failed Posted: 22 Mar 2019 08:31 AM PDT To open long positions on EUR / USD pair, you need: Euro buyers quickly came to life yesterday after a sharp rise in the pair amid Fed statements. At the moment, growth is limited by the resistance of 1.1396 and opens two possible scenarios. One of which is a fixation there will allow us to count on the continuation of the upward trend in the area of 1.1427 and the other is an update of the maximum of the week in the area of 1.1459, where I recommend taking profits. With the EUR / USD decline scenario in the first half of the day, long positions can be viewed at a false breakdown from the support of 1.1366 but it is best to return to purchases from 1.1334 and 1.1301 lows. To open short positions on EURUSD you need: The Weak data on PMI indices for the eurozone countries may return pressure on the euro. An unsuccessful consolidation above the resistance of 1.1396 will be the first signal to open short positions in order to reduce to the support area of 1.1366. A breakthrough of which will lead to a larger sale of the EUR/USD pair to the minima of 1.1334 and 1.1301, where I recommend taking profits. In the case of strong growth of the euro above 1.1396, it is best to return to short positions on a rebound from the resistance levels of 1.1427 and 1.1459. Found in the video review. Indicator signals: Moving averages Trade is conducted below the 30- and 50-day moving average, which indicates the formation of a bearish trend in the market. A failure to consolidate above the moving average in the first half of the day will be a signal to sell the euro. Bollinger bands The growth of the euro will be limited by the upper limit of the Bollinger Bands indicator in the area of 1.1395 while the lower boundary of the indicator in the area of 1.1350 may limit the downward correction. Description of indicators MA (moving average) 50 days - yellow MA (moving average) 30 days - green MACD: fast EMA 12, slow EMA 26, SMA 9 Bollinger Bands 20 The material has been provided by InstaForex Company - www.instaforex.com |

| Fractal analysis of major currency pairs on March 22 Posted: 22 Mar 2019 08:26 AM PDT Dear colleagues, For the EUR/USD pair, we are following the descending structure from March 20. The downward movement to the bottom is expected to continue after the breakdown of 1.1265. For the GBP/USD pair, we follow the development of the downward structure from March 19 and the key level of support is at 1.3206. For the pair USD/CHF pair, the price forms the ascending structure from March 20. The upward movement to the top is expected after the breakdown of 0.9974. For the pair USD/JPY, we are expecting to reach the level of 110.09 and the key support level is at 110.58. For the EUR/JPY pair, we are following the development of the downward structure from March 20. The downward movement to the bottom is expected to continue after the breakdown of 125.52 and the key support level is at 125.28. On the GBP/JPY pair, we are following the development of the downward cycle of March 14. The downward movement to the bottom is expected to continue after the breakdown of 144.25. Forecast for March 22: Analytical review of H1-scale currency pairs: For the EUR/USD pair, the key levels on the H1 scale are 1.1378, 1.1341, 1.1318, 1.1280, 1.1265, 1.1238 and 1.1203. Here, we follow the formation of the downward structure of March 20. The downward movement to the bottom is expected to continue after the breakdown of after the price passes the noise range of 1.1280 - 1.1265, which in this case the goal is 1.1238. The potential value for the downward movement can be considered at the level of 1.1203, after reaching this level we can expect to go into a correction. The Short-term upward movement is possible in the range of 1.1318 - 1.1341. The breakdown of the latter value will lead to in-depth movement with the target of 1.1378, this level is key support for the upward structure. The main trend is the formation of the downward structure of March 20. Trading recommendations: Buy 1.1318 Take profit: 1.1340 Buy 1.1345 Take profit: 1.1376 Sell: 1.1265 Take profit: 1.1240 Sell: 1.1236 Take profit: 1.1205 For the GBP/USD pair, the key levels on the H1 scale are 1.3253, 1.3206, 1.3161, 1.3043, 1.3018, 1.2976, 1.2914 and 1.2881. Here, we are following the downward structure of March 19. The downward movement to the bottom is expected to continue after the price passes the noise range of 1.1280 - 1.1265, which in this case the target for consolidation is 1.1238. The breakdown of the level 1.2976 should be accompanied by a pronounced downward movement with the target of 1.2914. We consider the potential value for the downward structure to be at 1.2881. After reaching of which, we can expect a rollback to the top. The Short-term upward movement is possible in the range of 1.3161 - 1.3206. the breakdown of the latter value will lead to a prolonged correction with the target of 1.3253. This level is key support for the downward structure of March 19. The main trend is the downward structure of March 19. Trading recommendations: Buy: 1.3161 Take profit: 1.3204 Buy: 1.3208 Take profit: 1.3250 Sell: 1.3018 Take profit: 1.2978 Sell: 1.2974 Take profit: 1.2915 The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD analysis for March 22, 2019 Posted: 22 Mar 2019 08:21 AM PDT GBP/USD has been trading upward during the past 20 hours and we expect more upside in the next period.

According to the H1 time – frame, we found confirmed inverted head and shoulders pattern (bullish), which is sign that upward movement can continue. Also, there is the fake breakout of the yesterday's low at the price of 1.3145, which is another sign of the strength. The projected upward target is set at 1.3315. Trading recommendation: We are long GBP from 1.3185 and with protective stop at 1.3080. Take profit is set at the price of 1.3315. The material has been provided by InstaForex Company - www.instaforex.com |

| Analysis of Gold for March 22, 2019 Posted: 22 Mar 2019 08:08 AM PDT Gold has been trading upward during the past 20 hours but the upward movement may come to the end.

According to the M30 time – frame, we found that bearish flag in our opinion it is just question of the time when we will see the down break. Intraday support level at the price of $1.308.80 will be critical. Breakout of the support would confirm potential testing of the $1.303.90 and $1.298.00. Key resistance from the other side is seen at the price of $1.319.45. Trading recommendation: We are watching for selling opportunities with targets at $1.303.90 and $1.298.00. The material has been provided by InstaForex Company - www.instaforex.com |

| Experts have named the main reasons for the weakening dollar this year Posted: 22 Mar 2019 07:54 AM PDT Morgan Stanley analysts believe that the three main factors that pushed the dollar rate higher last year could lose their strength in 2019, thereby causing the US currency to weaken. "The divergence in the economic growth of the United States and the rest of the world, the policy of protectionism, as well as a combination of fiscal incentives and a tightening of the monetary rate of the Fed led to a rise in the dollar last year," representatives of the financial institution said. They said that the situation may be the opposite in 2019 and gave the following arguments: First, the US monetary policy is changing. The Fed has refused to raise interest rates this year and plans to complete the program in order to reduce its balance after a couple of quarters. In addition, from the point of view of budgetary incentives, there are no tax cuts planned this year, following last year. Secondly, the trade tensions between Washington and Beijing are easing. Now, the parties are negotiating at the highest level and there is a bit of a possibility that if they make a deal, this will avoid a mutual increase in trade duties. Thirdly, it is expected that measures of fiscal and monetary incentives in China will lead to acceleration or at least to stabilize the pace of economic growth in the country over the coming months. This should provide support for a trade-dependent, including from the Middle Kingdom and the eurozone economy. "Markets may not be prepared for the fact that these three factors will trigger a dollar weakening cycle. In addition, the United States seems vulnerable due to the large size of external commitments," noted by the experts of Morgan Stanley. The material has been provided by InstaForex Company - www.instaforex.com |

| How long will the dollar decline last? What drives the sterling? Posted: 22 Mar 2019 07:19 AM PDT If Theresa May wins the parliamentary vote, she will have another two months until May 22. The sterling rose a quarter percent to $ 1.3140. This has already become a common occurrence. Every time there is news about the transfer, the market responds positively and the pound grows. The dollar is weakening while the pound rose slightly on the news that Prime Minister Theresa May has won time to decide when and how Britain will leave the EU. if the country's parliament next week rejects the proposed Brexit plan for the third time, the leaders of the European Union gave Britain a reprieve for two weeks until April 12. Moreover, in case that Theresa May wins the parliamentary vote, she will have another two months until May 22. The sterling rose a quarter percent to $ 1.3140. This has already become a common occurrence. Every time there is news about the transfer, the market responds positively and the pound. In addition, the Bank of England left the interest rates unchanged. The dollar paired against the yen is also a problem, despite a slight decline in inflation in Japan. In February, the core consumer prices rose 0.7 percent year on year. The data underscores the weakness of the Japanese economic recovery as sharpening trade tensions between the United States and China and China's slowdown in growth affect exports and business sentiment. In relation to the yen, the dollar fell by 110.78 yen. Three out of four Japanese companies expect the trade conflict between the United States and China to last at least until the end of 2019, which contrasts sharply with market hopes that Presidents Donald Trump and Xi Jinping may soon make a deal. In general, markets will need a few more days and sessions in order to understand and regain the recent changes in the position of the Fed. Given the impact of further developments related to trade and geopolitical factors, investors will hope for a more relaxed trading environment in the coming weeks. The material has been provided by InstaForex Company - www.instaforex.com |

| The dollar follows in the footsteps of the euro Posted: 22 Mar 2019 06:49 AM PDT Currencies of the banks were the same. The American dollar reiterated the fate of the single European currency. First, it seriously sinks after the meeting of the Central Bank and then quickly regaining lost positions. During their March meetings, both the ECB and the Fed looked "dovish" to investors. However, if the EUR/USD pair rises after a false breakdown on the lower limit of the medium-term consolidation range of 1.125-1.15 was due to the belief that the eurozone felt the bottom then the rally in the USD index is associated with problems European economy. After lowering FOMC forecasts for US GDP from 2.3% to 2.1% in 2019 and at the federal funds rate, the market finally believed that the monetary policy normalization cycle was over. In December, only two members of the Committee believed in keeping the rate at the level of 2.5% in the current year. This changed in March with eleven of them now. CME derivatives believe that the Fed will resort to monetary expansion with a probability of almost 45%. Expectations of monetary policy easing are a weighty argument in favor of currency sales but before getting rid of the US dollar, you need to think about how to replace it in the portfolio. Theoretically, it could be the euro. The de-escalation of the US-Chinese trade conflict gives hope for the recovery of European exports and leaving in the shadow of temporary difficulties allows us to count on the growth of domestic demand. In fact, the purchasing manager indices signal that the negative has not yet been exhausted. Business activity in the manufacturing sector of the currency bloc fell to its lowest level since 2013 while the dynamics of the service sector leaves much to be desired. According to Markit, the current PMI values are equivalent to GDP growth of 0.2% q/q in the first quarter. This is not the figure that the bulls were counting on the EUR/USD pair. Dynamics of European business activity It seems that European companies are not sure about the end of the US-Chinese trade war and they fear that the United States will impose import duties on the supply of cars from the Old World. Indeed, the conflict between the two largest economies in the world has not been exhausted. According to Bloomberg, Beijing is not pleased with the fact that Washington will not lower tariffs in response to the concessions from the Middle Kingdom. Donald Trump exacerbates the situation when he said that the duties of $ 250 billion will remain in force after the signing of the agreement. Say, you need to control how the Celestial performs its conditions. There is no certainty about Brexit. Bloomberg estimates that about 2.5% of EU GDP is impacted by exports to Britain. Breaking ties will slow the European economy even further. It is not surprising that in such circumstances both of the GBP/USD and EUR/USD pairs move quite synchronously. The key event of the week by March 29 for the US dollar will be the release of data on US GDP for the fourth quarter. According to Morgan Stanley, the second estimate due to the loss of steam from consumer incomes and activity is likely to be reduced from 2.6% to 1.8% q/q, which is bad news for the bears in EUR / USD. Technically, only a repeated rebound from the support at 1.125 followed by the formation of the "Head and Shoulders" pattern will leave the bulls hope for a rematch. EUR / USD daily chart |

| Brexit situation is even worse than it was. The US data supports the dollar Posted: 22 Mar 2019 06:21 AM PDT The British pound collapsed against the US dollar after it became known that the Brexit deal could be disrupted. Let me remind you that quite recently, British Prime Minister May asked to postpone Brexit until June 30. Yesterday, there was news that European leaders were ready to meet the request of the British Prime Minister Theresa May and postpone Brexit but only for seven weeks on a condition that the Brexit deal would be approved by the British Parliament by that time. Now, the UK has time to exit until May 22. According to the EU, if the British Parliament did not approve the Brexit agreement by April 12, the risk of withdrawing without a deal would increase significantly. The next step of the British Prime Minister Theresa May will be the appointment of a new vote in parliament, which is likely to be held next week. However, the House of Commons is unlikely to make concessions only under the pressure of the indiscriminate exit of the country from the EU. This scenario further increases uncertainty. As for the technical picture of the GBP/USD pair, the volatility will remain quite high. A breakthrough on the support of 1.3120 will lead to a new wave of short positions with a return to the weekly minimums of 1.3000 and 1.2920. Under the scenarios of further growth, large resistance levels will be viewed around 1.3225 and 1.3270. Yesterday's fundamental data on the American economy supported the US dollar. According to a report by the US Department of Labor, the number of initial claims for unemployment benefits fell by 9,000 to 221,000 in the week from March 10 to March 16. Economists expected the number of applications to be 225,000. The number of secondary applications in the week from 3 to 9 March decreased by 27,000 to 1,750,000. Production activity in the area of responsibility of the Federal Reserve Bank of Philadelphia has recovered substantially, which is a good sign. The increase was due to an increase in new orders and shipments. Based on the report, the Philadelphia Fed Manufacturing Index rose to 13.7 points in March 2019 against -4.1 in February 2019. Economists had expected the index to be 5 points in March. The index of new orders in March was 1.9 points, while the index of shipments increased to 25 points. According to the Conference Board, the leading indicators index in February 2019 also showed an increase of 0.2% compared with the previous month and amounted to 111.5 points. Economists have been waiting for the growth of the index by 0.1%. While Beijing and the United States are conducting trade negotiations and have reached the "finish line," US President Donald Trump once again stressed that duties on Chinese goods will remain in place for a substantial period even after an agreement has been reached. Such an approach will be maintained until the White House is convinced that the deal with China will bring its results and Beijing fulfills all its conditions. Let me remind you that representatives of the two countries have been discussing the issue of the phased cancellation of fees for quite a long time. As for the technical picture of the EUR/USD pair, growth is limited by the intermediate resistance of 1.1400, however larger levels are seen in the range of 1.1430 -1.1450. In case of a decline in the trading instrument, it is best to return to long positions from the support of 1.1330 and 1.1300. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 22 Mar 2019 05:34 AM PDT 4 hour timeframe Technical details: Senior linear regression channel: direction - up. The younger linear regression channel: direction - up. Moving average (20; smoothed) - down. CCI: -101.5514 The GBP/USD currency pair began to adjust after a breakthrough. The trend of the instrument has changed to downward, but in general, everything looks as if the uptrend remains in force so far. At the same time, it is even difficult to imagine what could force traders to switch back to buying British currency, given the complete chaos in the Brexit procedure. Meanwhile, in Brussels yesterday, the European Union agreed to grant a reprieve to London but only until May 22 as previously reported, only on the condition that the British Parliament will accept the previously agreed deal. The theatrical of the absurdity continues. Now, Theresa May will have to return to London and declare to the Parliament that they have no choice again. More precisely, there is a choice either the "tough" Brexit following the EU condition which will commence on April 12 or the parliament accepts its version of the agreement with Brussels. In general, Theresa May's strategy has not changed in any way and in the near future, we can expect a new vote in parliament for the third in a row for the same agreement, an unprecedented case. Thus, we are entering a new and the next finish line of the entire Brexit. If it is postponed again after May 22nd, it will be just ridiculous. If the British Parliament does not approve the agreement with the EU for the third time, then it will only be necessary to cancel Brexit according to the same article 50 of the Lisbon Treaty or to leave the EU disorderly. Nearest support levels: S1 - 1.3123 S2 - 1.3062 S3 - 1.3000 Nearest resistance levels: R1 - 1.3184 R2 - 1.3245 R3 - 1.3306 Trading recommendations: The GBP/USD pair has begun a round of upward correction but already against a downward correction. Thus, you should wait for the Heiken-Ashi indicator to turn down to open new shorts with targets at 1.3062 and 1.3000. Long positions will again become relevant not earlier than moving the MA. In this case, the bulls will again seize the initiative on the market and the first targets for the longs will be the levels of 1.3245 and 1.3306. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanations for illustrations: The senior linear regression channel is the blue lines of unidirectional movement. The junior linear channel is the purple lines of unidirectional movement. CCI is a blue line in the indicator regression window. The moving average (20; smoothed) is on the blue line on the price chart. Murray levels - multi-colored horizontal stripes. Heiken Ashi is an indicator that colors bars in blue or purple. The material has been provided by InstaForex Company - www.instaforex.com |

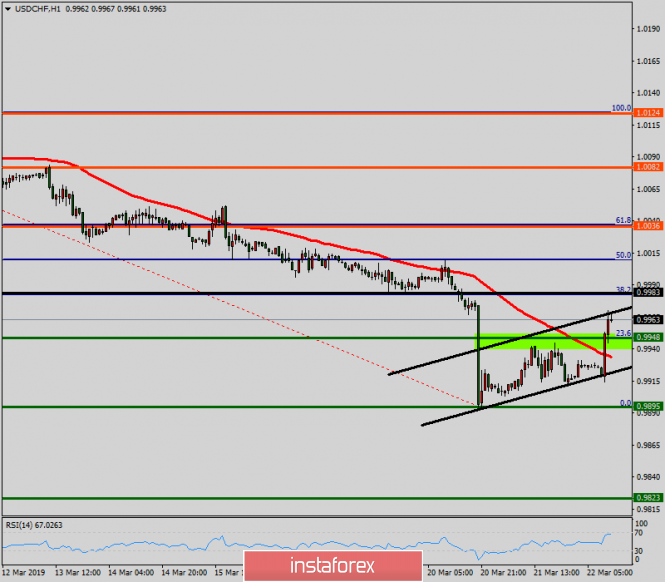

| Technical analysis of USD/CHF for March 22, 2019 Posted: 22 Mar 2019 03:21 AM PDT On the one-hour chart, the USD/CHF pair continues moving in a bullish trend from the support levels of 0.9895 and 0.9948. Currently, the price is in an upward channel. This is confirmed by the RSI indicator signaling that the pair is still in a bullish trend. As the price is still above the moving average (100), immediate support is seen at 0.9948 coinciding with a golden ratio (23.6% of Fibonacci). Consequently, the first support is set at the level of 0.9948. So, the market is likely to show signs of a bullish trend around 0.9948. In other words, buy orders are recommended above the golden ratio (0.9948) with the first target at the level of 0.9983. Furthermore, if the trend is able to breakout through the first resistance level of 0.9983, we should see the pair climbing towards the double top (1.0036) to test it. It would also be wise to consider where to place a stop loss; this should be set below the second support of 0.9895. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 22 Mar 2019 03:14 AM PDT 4 hour timeframe Technical details: Senior linear regression channel: direction - down. Junior linear regression channel: direction - down. Moving average (20; smoothed) - up. CCI: -107.2927 The EUR/USD currency pair had a correction to the moving average line but difficult to break through, hence, the uptrend of the pair remains. On the last trading day of the week, there is no major macroeconomic publications are scheduled. Only preliminary values of indices of business activity in the services and production sectors in the USA and the Eurozone will be published. However, these indicators are unlikely to cause a strong response from market participants. In the last two days, the Eurocurrency showed quite high volatility against the background of the decisions made by the Fed and the subsequent correction. Now, everything can return to normal that is to the minimum volatility of the pair. For the euro, the positive situation right now is that she managed to stay above the moving average as the US economy still looks much more powerful than the European one, despite the Fed's refusal of further increases in the key rate, The US economy still looks much more powerful than the European one. Moreover, at least in America, there was a period when monetary policy was tightened compared to Europe where there was none. Thus, from a fundamental point of view, the advantage still remains on the side of the US dollar. From a technical point of view, the upward movement can resume now if the Heiken Ashi indicator turns up. Otherwise, traders are still waiting for a change in trend to a downward one. Nearest support levels: S1 - 1,1353 S2 - 1.1322 S3 - 1.1292 Nearest resistance levels: R1 - 1.1383 R2 - 1.1414 R3 - 1.1444 Trading recommendations: The EUR / USD currency pair may complete the correction. Thus, the targets for long positions are the levels of 1.1414 and 1.1444 that are still relevant and turning the indicator Heiken Ashi to the top will indicate completion of the downward correction. Sell positions will become relevant not earlier than the fixation of the pair below the moving average line with target levels of 1.1322 and 1.1292, since in this case, the trend of the pair will change to downward. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanations for illustrations: The senior linear regression channel is the blue lines of unidirectional movement. The younger linear regression channel is the purple lines of unidirectional movement. CCI - blue line in the indicator window. The moving average (20; smoothed) is on the blue line on the price chart. Murray levels - multi-colored horizontal stripes. Heiken Ashi is an indicator that colors bars in blue or purple. The material has been provided by InstaForex Company - www.instaforex.com |

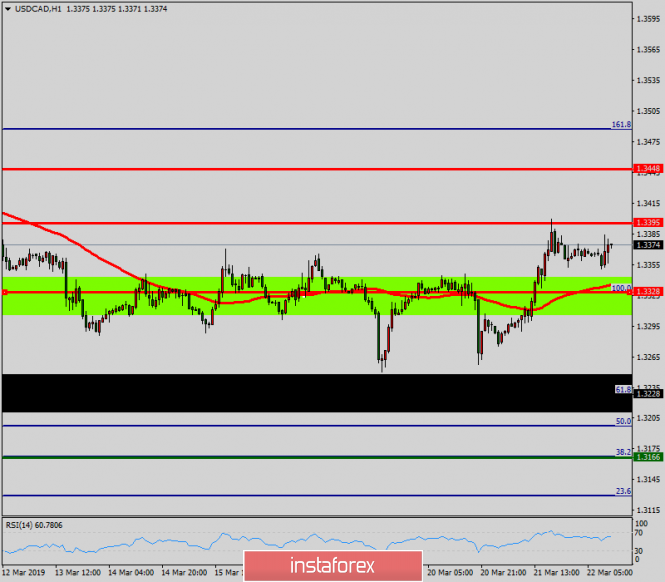

| Technical analysis of USD/CAD for March 22, 2019 Posted: 22 Mar 2019 03:05 AM PDT The USD/CAD pair continues to move upwards from the level of 1.3228. Today, the first support level is currently seen at 1.3228. The price is moving in a bullish channel now. Furthermore, the price has set above the strong support at the level of 1.3228 coinciding with the 61.8% Fibonacci retracement level. This support has been rejected three times confirming the veracity of an uptrend. According to the previous events, we expect the USD/CAD pair to trade between 1.3228 and 1.3328. So, the support stands at 1.3228, while daily resistance is found at 1.3328. Therefore, the market is likely to show signs of a bullish trend around 1.3228. In other words, buy orders are recommended above 1.3228 with the first target at the level of 1.3328 followed by 1.3295. However, if the USD/CAD pair fails to break through the resistance level of 1.3328 today, the price will decline further to 1.3166 -1.3200. The material has been provided by InstaForex Company - www.instaforex.com |

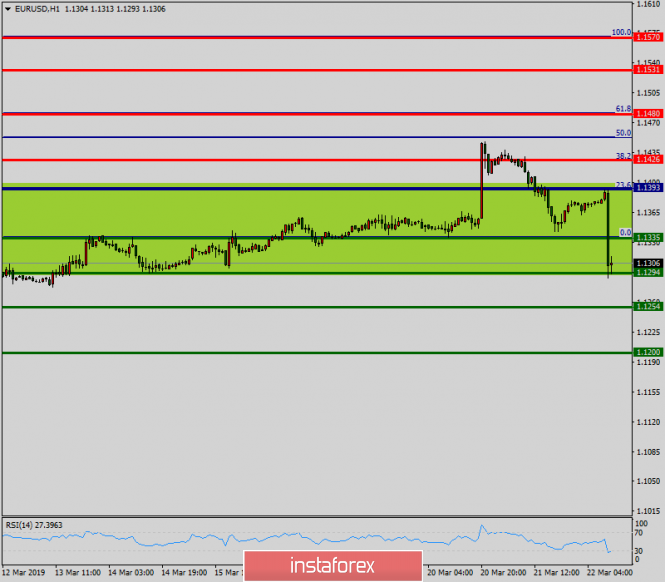

| Technical analysis of EUR/USD for March 22, 2019 Posted: 22 Mar 2019 03:00 AM PDT The EUR/USD pair is trading around the daily pivot point (1.1393). It continued to move downwards from the level of 1.1393 to the bottom around 1.1335. This week, the first resistance level is seen at 1.1393 followed by 1.1426, while the first daily support is seen at 1.1335. Furthermore, the moving average (100) starts signaling a downward trend; therefore, the market is indicating a bearish opportunity below 1.1393. So, it will be good to sell at 1.1393 with the first target at 1.1335. The downtrend is also expected to continue towards 1.1294. The strong daily support is seen at the 1.1254 level. According to the previous events, we anticipate the EUR/USD pair to trade between 1.1393 and 1.1254 in coming hours. The price area of 1.1393 remains a significant resistance zone. Thus, the trend remains bearish as long as the level of 1.1393 is not broken. On the contrary, in case a reversal takes place, and the EUR/USD pair breaks through the resistance level of 1.1393, then a stop loss should be placed at 1.1453. The material has been provided by InstaForex Company - www.instaforex.com |

| Overview of the currency market on 03/22/2019 Posted: 22 Mar 2019 02:17 AM PDT Again, Brexit determines investor sentiment and even the outcome of the meeting of the Bank of England go unnoticed. No one even seems to have read the final press release, which once again spoke of the risks for the British economy that will come true in the event of a "hard" withdrawal from the European Union. But all these goes that Brussels agreed to postpone the resettlement of the United Kingdom from a European hostel but not until June 30, as Teresa May requests, but until May 22. Moreover, that is only if the House of Commons accepts the proposed divorce agreement. The same option that they have twice rejected and yet, the postponement of the subjects of Her Majesty are asked in order to try to agree on the entry in the text of the agreement of the paragraphs relating to trade and the border between Ireland and Northern Ireland. Hence, the decision of Europe is essentially the unequivocal answer of the UK. One ask for a reprieve as much as you like, anyway there will be no other agreement. From this it follows that all the assurances of Jean-Claude Juncker that in the shortest possible time the trade issues will be agreed but supposedly due to lack of time. This will happen only after signing the agreement but these are words about nothing. After all, the United Kingdom is asking for a postponement so that the head of the European Commission can fulfill his promise, and here it is. Hence, it is precisely the "hard" version of Brexit that is now becoming the most realistic scenario, and, given the complete lack of understanding of how this affects not only the United Kingdom but also in Europe. Everything is clear with it and it is not surprising that pound and the single European currency confidently went down. Of course, it wasn't one of them that it showed a slowdown. Expected slowdowns of 36 thousand instead of 10 thousand. In particular, it was repeated, it was repeated, by 27 thousand. Therefore, it's not even strange to notice the situation with Brexit and its postponement. Another thing is that it shouldn't be so strong. Today, the Preliminary data on business indices are coming out in the United States and the forecasts are rather optimistic. Hence, if the index of business activity in the services sector should remain unchanged, then the production index can grow from 53.0 to 53.6. Thus, the composite index of business activity should increase from 55.5 to 55.6. It is also expected that sales of housing in the secondary market will grow by 2.2%. In Europe, the preliminary data on business activity indices are published as well. Although the composite index should grow from 51.9 to 52.0, this should happen only due to an increase in the production index from 49.3 to 49.5. The index of business activity in the services sector is expected to drop from 52.8 to 52.7. Nevertheless, the growth of the composite index will have a beneficial effect on investor sentiment and given the similar tone of output data in both Europe and the United States, the single European currency is likely to remain around 1.1375. The market needs to take a breath after the recent events. In theory, the pound should somewhat weaken under the pressure of US statistics, especially since there is no data in the UK. However, after such a sharp increase and the subsequent decline, market participants need to recover. Thus, similar to the single European currency, the pound will remain in place around 1.3125. |

| Trading recommendations for the GBPUSD currency pair - prospects for further movement Posted: 22 Mar 2019 02:15 AM PDT For the last trading day, the currency pair Pound / Dollar showed ultra-high volatility of 222 points, as a result of drawing out pulsed candles on the market. From the point of view of technical analysis, we continue to observe the feast of speculators, where the quote in a matter of hours, has managed to accelerate from the accumulation of 1.3220 in the direction of the psychological level of 1.3000, after which it instantly forms a rollback on overheating. Naturally, this kind of turbulence was provoked against the information and news background, and now in order. We begin with a key event, the European Union agreed to postpone Brexit, and this is a "victory". Sarcasm, yes, this is it, the leaders of 27 EU countries agreed on a delay and a new release date on May 22, but there is a nuance. The British parliament must approve the deal, otherwise on April 12, Brexit will happen without a deal. Now, we understand why there was such a drain of the English currency, since the risk of a hard Brexit has grown up at times. At the same time, yesterday, there was a meeting of the Bank of England, where, naturally, the rate was left at the same level, 0.75%. What is more interesting is the statement made by the head of the regulator Mark Carney: "The forecast for the economy will continue to depend significantly on the nature and timing of leaving the EU. " Mark, in his speech, duplicated fears if Britain leaves the EU without a deal, since a sharp drop in pound sterling can create inflationary pressure in addition to a wide economic shock. Let me remind you that yesterday, the UK retail sales data also went out, where they waited for a decline from 4.2% to 3.3%. As a result, it received 4.0%, but since there was a strong negative information background, this positive news went nowhere. Today, in terms of the economic calendar, we are waiting for statistics from the United States regarding sales in the secondary market, where growth is expected from 4.94M to 5.10M. The upcoming trading week in terms of the economic calendar is rather calm compared to last week. At the same time, traders are waiting for another vote in the British Parliament regarding an agreement that will decide the fate of the postponement. Tuesday United States 15:30 MSK - Number of building permits issued (Feb): Prev. 1,345M ---> Forecast 1,320M United States 15:30 MSK - The volume of construction of new homes (Feb): Prev. 1.230M ---> Forecast of 1.235M Thursday United States 15:30 MSK - GDP (q / q) (Q4): Prev. 2.6% ---> Forecast 2.6% United States 17:00 MSK - The index of pending sales in the real estate market (m / m) (Feb): Prev. 4.6% ---> Forecast 0.4% Friday United Kingdom 12:30 MSK - GDP (q / q) (Q4): Prev. 1.3% United States 17:00 MSK - Sales of new housing (Feb): Prev. 607K ---> 617K forecast These are preliminary and subject to change. Further development Analyzing the current trading chart, we see a great pullback / correction after a recent rally, where the quote reached the value of 1.3150, after which the attenuation process started in the form of double-digit doji-type candles. It is likely to assume that the descending interest will continue in the medium term, but there are many reasons for this. Based on the available data, it is possible to decompose a number of variations. Let's consider them: - Traders considered buying positions at the moment of price approaching the psychological level of 1.3000. Now, I think, everyone has already fixed it. If we consider long positions, it is in the case of price fixing higher than 1.3180. - Traders consider selling positions at a price lower than 1.3115. Indicator Analysis Analyzing a different sector of timeframes (TF), we see that there is interest in the general market background in the short, intraday and medium term. Weekly volatility / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation, with the calculation for the Month / Quarter / Year. (March 22 was based on the time of publication of the article) The current time volatility is 56 points. It is likely to assume that volatility will remain high due to ambiguity in the information background. Key levels Zones of resistance: 1,3200 *; 1,3300 **; 1.3440; 1.3580 *; 1.3700 Support areas: 1.3000 ** (1.3000 / 1.3050); 1.2920 *; 1.2770 (1.2720 / 1.2770) **; 1.2620; 1.2500 *; 1.2350 **. * Periodic level ** Range Level The material has been provided by InstaForex Company - www.instaforex.com |

| Wave analysis of GBP / USD for March 22. The situation around Brexit gets confusing more and more. Posted: 22 Mar 2019 01:07 AM PDT Wave counting analysis: On March 21, the GBP / USD pair fell by 80 basis points (bp). This is the general reaction to the meetings of the Fed and the Bank of England, as well as to the agreed transfer of Brexit from March 29 to May 22. The wave pattern due to the mass of events, mainly around Brexit, is confusing, but it can get an even more complex as it looks. Since, as before, no one knows how the three-year epic will end with the release of Great Britain from the jurisdiction of Brussels. After all, everything still depends on the British Parliament, which must accept agreements with the EU, which it has already blocked twice. Thus, now, I recommend caution first. Purchase goals: 1.3350 - 100.0% Fibonacci 1.3454 - 127.2% Fibonacci Sales targets: 1.2961 - 0.0% Fibonacci General conclusions and trading recommendations: The wave pattern allows for the construction of an upward wave with targets located near the estimated marks of 1.3350 and 1.3454, which corresponds to 100.0% and 127.2% of Fibonacci. However, the current wave counting is very confusing because of the ambiguous news background. As long as there is no clarity on the Brexit issue, the tool can continue to build ambiguous wave structures. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 22 Mar 2019 01:04 AM PDT On Wednesday, the euro sharply grew above the mark of 1.1425 on the Federal Reserve's decisions, which set an upward trend. However, on Thursday, the euro fell under a sharp selling, now it almost completely blocked the environment's growth. But by Friday morning, we see slow growth. A continuation of the trend is still possible. The reason for the euro's fall is probably the Brexit theme's unexpected return to the market. We keep buying from 1.1340 - but stop at a breakeven, the euro passing below 1.1340 cancels the trend. Buy from 1.1450. Sell from 1.1175. |

| Posted: 22 Mar 2019 12:58 AM PDT The Federal Reserve started the trend against the dollar. However, Brexit unexpectedly returned to the scene. Iron Lady Theresa May is completely tireless in her perseverance - she received a reprieve from the EU only until May 22 - but under strict conditions - to hold an agreement with the EU through Parliament before April 1. The opinion is unrealistic. But there will be another vote. The closing of the week is important for the euro. We keep buying from 1.1340 - but we close positions after a breakthrough of 1.1340. Buy from 1.1450. Selling from 1.1175. |

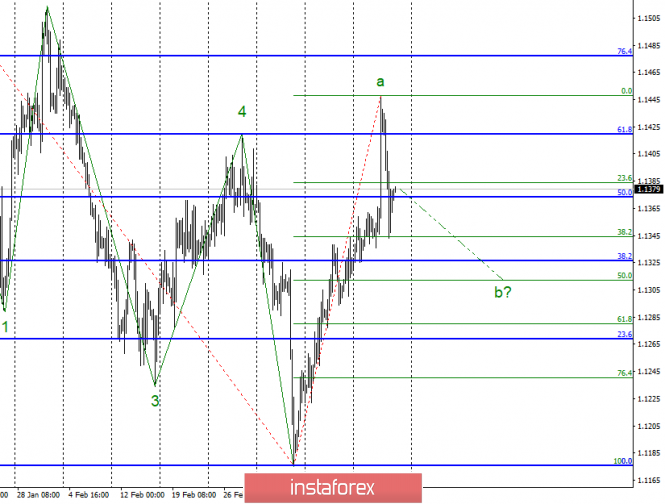

| Wave analysis of EUR / USD for March 22. We are waiting for a couple of about 13 figures.. Posted: 22 Mar 2019 12:57 AM PDT

Wave counting analysis: On Thursday, March 21, trading ended for EUR / USD by 50 bp lower. Thus, the assumption about the completion of the construction of the proposed wave a now looks convincing. If this is indeed the case, the decline in instrument quotes will continue with targets located near 38.2% and 50.0% Fibonacci levels. After the completion of the construction of this wave, the resumption of the upward trend plot construction is expected. The news background remains neutral for the pair, as the Fed's decision to abandon the rate hike in 2019, although it can support the Eurocurrency, but the policy of the ECB also remains a "pigeon". Sales targets: 1.1344 - 38.2% Fibonacci (small grid) 1.1311 - 50.0% Fibonacci (small grid) Purchase goals: 1.1477 - 76.4% Fibonacci General conclusions and trading recommendations: The pair allegedly completed the construction of wave a. Now I recommend short-term sales with targets located around 1.1344 and 1.1311, which corresponds to 38.2% and 50.0% Fibonacci, based on the construction of wave b. Around the levels that suggest the completion of this wave, I recommend to re-prepare to buy a pair with targets above the mark of 1.1450. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 22 Mar 2019 12:49 AM PDT To open long positions on GBP/USD you need: Yesterday, the pound flew into the abyss after EU leaders rejected Theresa May's proposal to postpone the UK's release date to 30 June. At the moment, buyers need to stay above the support level of 1.3120, and the formation of a false breakdown in that area will be a signal to open long positions. A more interesting area for bulls will be the level of 1.3068, where you can buy GBP/USD immediately to rebound. The main task will be to return and consolidate above the resistance of 1.3173, which will lead to an update of the high near 1.3222, where I recommend to lock in the profit. To open short positions on GBP/USD you need: Sellers of the pound will try to form a false breakdown at the resistance area of 1.3173, which will be the first signal to sell the pound, but the main goal will be a breakout and consolidation below the support of 1.3120, which will lead to selling the GBP/USD to the low of 1.3068 and 1.3004, where I recommend to take profit. With growth scenarios above 1.3173, good resistance levels can be seen in the area of 1.3222 and 1.3266, from where you can open short positions immediately to a rebound. Indicator signals: Moving averages Trading is conducted below the 30-day and 50-day moving averages, which indicates the bearish nature of the market. Bollinger bands In case of an attempt to increase the pound's rate, the upward potential of the Bollinger Bands indicator will be limited to around 1.3175. In case the pound decreases, support will be provided by the lower limit in the area of 1.3050. Description of indicators

|

| Control zones of NZD / USD pair on 03/22/19 Posted: 22 Mar 2019 12:38 AM PDT Yesterday's decline allowed the pair to reach 1/2 control zone at 0.6868-0.6861, which determined the appearance of demand. To continue the growth, it is necessary to keep the price above the specified zone. Testing the a CZ of 0.6868-0.6861 gave the opportunity to enter the purchase. As long as the pair is trading above the zones, the probability of updating the weekly maximum is 70%. Working in this direction allows you to take about 70 points of profit. Yesterday's high is outside the current average move, which may cause the position to be postponed over the weekend. The upward movement remains an impetus but the level of 0.6928 is a strong long-term resistance, which the pair cannot overcome this year. Profit fixations at this mark are optimal when working in a long position. In the event that the close of trading this week occurs below the level of 0.6861, an alternative model will be developed. This will allow you to search for sales on Monday. The probability of the implementation of this model is now 30%, which makes it auxiliary. Daily CZ - daily control zone. The area formed by important data from the futures market that change several times a year. Weekly CZ - weekly control zone. The area is formed by marks of important times for the market. Monthly CZ - monthly control zone. The area is a reflection of the average volatility over the past year. The material has been provided by InstaForex Company - www.instaforex.com |

| Indicator analysis. Daily review on March 22, 2019 for the pair GBP / USD Posted: 22 Mar 2019 12:34 AM PDT Trend analysis (Fig. 1). On Friday, there is a high probability of moving up, after testing the support line 1.3023 (yellow thin line). The first upper target 1.3227 is the upper fractal.

Fig. 1 (daily schedule). Comprehensive analysis: - indicator analysis - down; - Fibonacci levels - up; - volumes - up; - candlestick analysis - up; - trend analysis - up; - Bollinger lines - up; - weekly schedule - up. General conclusion: On Friday, there is a high probability of moving up, after testing the support line 1.3023 (yellow thin line). The first upper target 1.3227 is the upper fractal. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment