Forex analysis review |

- The yen got wings, next stop $ 108.5

- Fractal analysis of major currency pairs on March 26

- Weekly review of the foreign exchange market from 03.25.2019

- USD investors seem to be waiting for a bumpy road in the next two years -Saxo Bank

- Teresa May's proposal will eventually be adopted by Parliament

- GBP/USD. March 25. Results of the day. The EU has completed preparations for a "hard" Brexit. April 12 is the new X date

- EUR/USD. March 25. Results of the day. Trade negotiations between China and the United States could stretch out like Brexit

- EUR/USD: dollar flat, euro follows Brexit

- March 25, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- Bitcoin analysis for March 25, 2019

- Analysis of Gold for March 25, 2019

- March 25, 2019 : GBP/USD demonstrating a Bullish Flag Pattern for Intraday traders.

- Citigroup: What are the prospects for oil in 2019?

- EUR: Reports on German business community improved sentiment

- Yen returns to the game

- GBP / USD plan for the American session on March 25. Pound remains in the side channel before an important vote in the British

- EUR / USD plan for the US session on March 25. Data from the IFO supported the euro

- GBP/USD analysis for March 25, 2019

- Trading recommendations for the GBP / USD pair - placement of trading orders (March 25)

- GBP / USD: Theresa May's resignation talks are getting louder but doesn't clarify Brexit

- Technical analysis of AUD/USD for March 25, 2019

- Analysis of EUR / USD Divergence on March 25. Euro ceded leadership to US dollar

- Technical analysis of GBP/USD for March 25, 2019

- Wave analysis of GBP / USD for March 25. The pound remains in instability due to the lack of specifics on Brexit

| The yen got wings, next stop $ 108.5 Posted: 25 Mar 2019 06:12 PM PDT The fall of the yield curve below zero for the first time since 2007 stirred up the financial markets. The indicator, showing the difference between 10 and 3-year treasuries, is a reliable harbinger of a recession with a time lag of 12-18 months. Its inversion pushed players to active sales of shares. The losses of the S & P 500 amounted to 1.5%, and two new topics appeared on the market, fueling traders' interest in protective assets, such as the yen. The sharp change in the rate of the Federal Reserve at the beginning of the year contributed to the rapid rally of US stock indices. The stock market prepared to close the quarter with the best result in nearly 30 years. However, it looks unnatural when macroeconomic statistics deteriorate and stocks rise. The growth of the US economy in the first quarter, will slowdown to less than 1% according to estimates of the leading indicator from the Atlanta Fed. hus, Morgan Stanley suspects that October-December GDP may be adjusted from 2.6% to 1.8% in quarterly terms. Divergence between economic reports and stock indicators cannot last forever. The situation is similar throughout the world. Thus, the index of purchasing managers in the manufacturing sector of China, Japan, and the eurozone is below the critical level - 50, which indicates a slowdown in global GDP growth. Meanwhile, European stocks are ahead of their American counterparts, and the global MSCI is increasing. The naked eye can see that the market is overheated, which means it's time to pay attention to the safe haven assets. A 1.5% increase in the Japanese yen last week is a further evidence of this. The national currency of Japan was under the "press" for quite some time. Its growth was hindered by such factors as high risk appetite, low rates of the world debt market and volatility. Inversion of the US yield curve provoked carry-traders to close positions, increased demand for funding currencies, and also caused the USDJPY rate to depreciate. Among the most obvious fears of the market is the excessively "soft" position of the Fed. There was a too sharp change of tone. In December, the regulator allowed three series of rate increases, and now it does not plan any policy tightening. Perhaps, officials of the regulator do not agree on something, for example, a speedy recession. That is why the yield curve and went into the red zone. Safe haven assets, as well as the yen, will be supported by the growing risks of the subsequent correction of the S & P 500 and increased volatility. The situation is heightened by rumors about Theresa May's resignation and the possible escalation of trade conflicts. Thus, the USDJPY pair may well move to the level of $ 108.5. The material has been provided by InstaForex Company - www.instaforex.com |

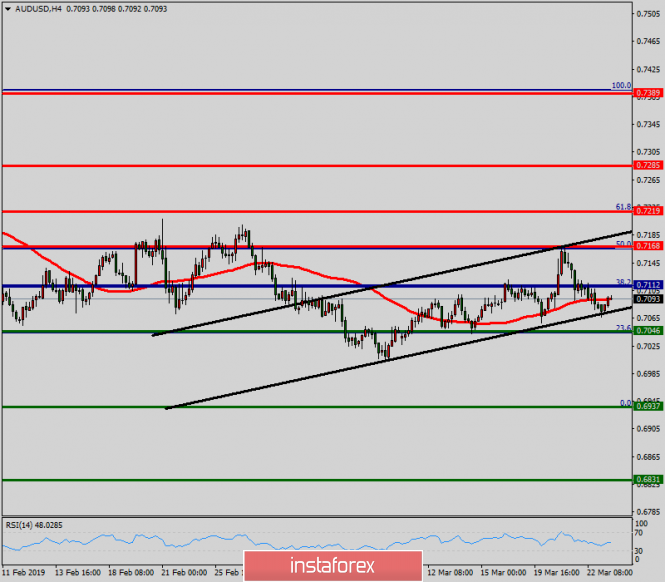

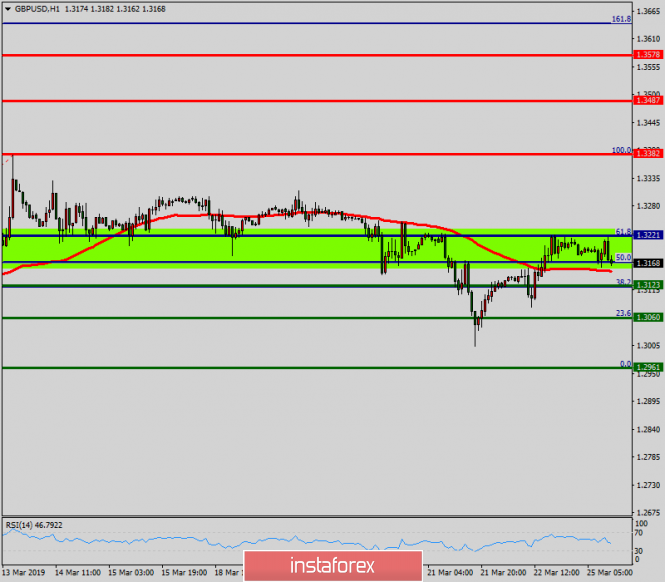

| Fractal analysis of major currency pairs on March 26 Posted: 25 Mar 2019 06:00 PM PDT Forecast for March 26: Analytical review of H1-scale currency pairs: For the Euro / Dollar pair, the key levels on the H1 scale are: 1.1378, 1.1341, 1.1318, 1.1280, 1.1265, 1.1238 and 1.1203. Here, we continue to follow the development of the downward structure of March 20. Continuation of the movement to the bottom is expected after the price passes the noise range of 1.1280 - 1.1265. In this case, the goal is 1.1238. For the potential value for the downward movement, we consider the level of 1.1203, after reaching which, we expect to go into a correction. Short-term upward movement is possible in the range of 1.1318 - 1.1341. The breakdown of the latter value will lead to in-depth movement. Here, the target is 1.1378, this level is a key support for the upward structure. The main trend is the formation of the downward structure of March 20. Trading recommendations: Buy 1.1318 Take profit: 1.1340 Buy 1.1345 Take profit: 1.1376 Sell: 1.1265 Take profit: 1.1240 Sell: 1.1236 Take profit: 1.1205 For the Pound / Dollar pair, the key levels on the H1 scale are 1.3253, 1.3206, 1.3161, 1.3043, 1.3018, 1.2976, 1.2914 and 1.2881. Here, the situation is in equilibrium: the downward structure of March 19 and the upward potential of March 21. Continuation of the movement to the bottom is expected after the breakdown of 1.3112. In this case, the first goal is 1.3043. A passage at the price of the noise range 1.3043 - 1.3018 will lead to the development of a downward trend on the scale of H1. Here, the goal is 1.2976, and consolidation is near this level. The breakdown of the level 1.2976 should be accompanied by a pronounced downward movement. In this case, the target is 1.2914. For the potential value for the downward structure, we consider the level of 1.2881, after reaching which, we expect a rollback to the top. Short-term upward movement, possibly in the corridor 1.3206 - 1.3253, the latter is a key support for the downward structure of March 19, its breakdown will have to develop the upward cycle. Here, the first target is 1.3311. The main trend is the equilibrium situation. Trading recommendations: Buy: 1.3208 Take profit: 1.3250 Buy: 1.3255 Take profit: 1.3310 Sell: 1.3112 Take profit: 1.3045 Sell: 1.3016 Take profit: 1.2978 For the Dollar / Franc pair, the key levels on the H1 scale are: 0.9970, 0.9942, 0.9928, 0.9902, 0.9885, 0.9862 and 0.9845. Here, the price forms a local structure for the downward movement of March 22. Short-term downward movement is possible in the range of 0.9902 - 0.9885. The breakdown of the latter value should be accompanied by a pronounced downward movement. Here, the goal is 0.9862. For the potential value for the bottom, we consider the level of 0.9845, after reaching which, we expect consolidation. Short-term upward movement is possible in the range of 0.9928 - 0.9942. The breakdown of the latter value will have to form an ascending structure. Here, the first potential target is 0.9970. The main trend is the formation of a local structure for the bottom of March 22. Trading recommendations: Buy: 0.9928 Take profit: 0.9941 Buy : 0.9943 Take profit: 0.9970 Sell: 0.9902 Take profit: 0.9886 Sell: 0.9883 Take profit: 0.9862 For the Dollar / Yen pair, the key levels on the scale are: 110.39, 110.09, 109.93, 109.60, 109.31 and 109.05. Here, we continue to follow the development of the downward structure of March 15. At the moment, the price is in the correction. Continuation of the movement to the bottom is expected after the breakdown of 109.60. The goal here is 109.31, consolidation is near this level, and hence the probability of going into correction is high. For the potential value for the downward movement, we consider the level of 109.05. Consolidated movement is possible in the range of 109.93 - 110.09. The breakdown of the latter value will lead to a prolonged correction. ere, the target is 110.39. This level is a key support for the downward structure. The main trend: the downward structure of March 15, the stage of correction. Trading recommendations: Buy: 109.93 Take profit: 110.07 Buy: 110.11 Take profit: 110.36 Sell: 109.60 Take profit: 109.33 Sell: 109.29 Take profit: 109.07 For the Canadian dollar / Dollar pair, the key levels on the H1 scale are: 1.3539, 1.3500, 1.3481, 1.3447, 1.3405, 1.3383 and 1.3348. Here, we are following the development of the ascending structure of March 20. Continuation of the movement to the top is expected after the breakdown of 1.3447. In this case, the goal is 1.3481, in the range of 1.3481 - 1.3500 consolidation. For the potential value for the top, we consider the level of 1.3539, after reaching which, we expect to go into a correction. Short-term downward movement is possible in the range of 1.3405 - 1.3383, breaking the last value will lead to in-depth movement. Here, the target is 1.3348, this level is a key support for the top. The main trend is the ascending structure of March 20. Trading recommendations: Buy: 1.3447 Take profit: 1.3480 Buy : 1.3500 Take profit: 1.3539 Sell: 1.3405 Take profit: 1.3384 Sell: 1.3381 Take profit: 1.3350 For the Australian dollar / Dollar pair, the key levels on the H1 scale are : 0.7168, 0.7137, 0.7119, 0.7083, 0.7059, 0.7031, 0.7011 and 0.6982. Here, we are following the development of the downward structure of March 21. Continuation of the movement to the bottom is expected after the breakdown of 0.7083. In this case, the first goal is 0.7059. The breakdown of which will allow us to expect movement to the level of 0.7031, in the range of 0.7031 - 0.7011 short-term downward movement, as well as consolidation. For a potential value for the bottom, we consider the level of 0.6982, after reaching which, we expect a rollback to the top. Short-term upward movement is possible in the range of 0.7119 - 0.7137. The breakdown of the latter value will have an uptrend development. Here, the goal is 0.7168. Up to this level, we expect the design of a pronounced structure for the upward cycle. The main trend is the downward structure of March 21, the stage of correction. Trading recommendations: Buy: 0.7120 Take profit: 0.7136 Buy: 0.7138 Take profit: 0.7162 Sell : 0.7083 Take profit : 0.7063 Sell: 0.7057 Take profit: 0.7035 For the Euro / Yen pair, the key levels on the H1 scale are: 125.56, 125.01, 124.57, 124.28, 123.83, 123.44 and 123.03. Here, we are following the development of the downward structure from March 20. At the moment, the price is in the correction. Continuation of the movement to the bottom is expected after the breakdown of 123.83. Here, the target is 123.44, in the range of 123.83 - 123.44 price consolidation. For the potential value for the downward movement, we consider the level of 123.03, after reaching which, we expect a rollback to the top. Consolidated movement is possible in the range of 124.28 - 124.57. The breakdown of the latter value will lead to a prolonged correction. Here, the target is 125.01, this level is a key support for the bottom. Its breakdown by price will allow us to count on the movement to the potential target - 125.56. The main trend is the downward structure of March 20, the stage of correction. Trading recommendations: Buy: 124.60 Take profit: 125.00 Buy: 125.05 Take profit: 125.55 Sell: 123.80 Take profit: 123.48 Sell: 123.42 Take profit: 123.06 For the Pound / Yen pair, key levels on the H1 scale are: 146.56, 145.77, 145.28, 144.25, 143.72, 142.84 and 142.24. ere, we continue to follow the development of the downward cycle of March 14. Short-term downward movement is possible in the range of 144.25 - 143.72. The breakdown of the latter value should be accompanied by a pronounced downward movement. Here, the target is 142.84. For the potential value for the bottom, we consider the level of 142.24, after reaching which, we expect a rollback to the top. Short-term upward movement is possible in the range of 145.28 - 145.77. The breakdown of the latter value will lead to a prolonged correction. Here, the target is 146.56. The main trend is the downward structure of March 14. Trading recommendations: Buy: 145.28 Take profit: 145.75 Buy: 145.80 Take profit: 146.55 Sell: 144.25 Take profit: 143.72 Sell: 143.70 Take profit: 142.86 The material has been provided by InstaForex Company - www.instaforex.com |

| Weekly review of the foreign exchange market from 03.25.2019 Posted: 25 Mar 2019 05:55 PM PDT I don't even know how the speculators will live when this whole saga with Brexit comes to its logical end. It gave them so many unforgettable moments. The past week was no exception, although it is becoming clearer that the denouement is just around the corner. At first, Theresa May said that she would not once again put to the vote her version of the divorce agreement, which had already been rejected twice by the House of Commons. At first, she decided to get a reprieve from Brussels so that Jean-Claude Juncker could fulfill his earlier promise to negotiate trade-related items with all countries of the European Union. After all, earlier the head of the European Commission complained that it was precisely these points that had not yet been approved and would not be in time for Brexit. Here, the British prime minister asks the EU to slightly delay the divorce so that it could finally include unfortunate points in the agreement. But it was not there. Not only did Europe refuse to postpone Brexit until June 30, it reiterated that the version of the agreement proposed to London is not subject to revision. That is, no trade agreements will be made even after Brexit. Moreover, Brussels acted quite unpleasantly, saying that it was ready to postpone the divorce until May 22, but only if the House of Commons adopts the version of the agreement imposed on it, which many MPs rightly consider as bonded. Moreover, a number of politicians from Great Britain argue that the adoption of this agreement threatens the territorial integrity of the United Kingdom. If London refuses to accept the agreement for the third time, then they will be asked to exit the EU no later than April 12. Well, Brussels' statement that that London can still cancel the referendum's results, but this should be done before March 29, that is, they are suggesting that the entire British ruling class commit political suicide. As a result, even Her Majesty's subjects could not stand it and on Sunday a huge rally was held on this matter. Brexit supporters stood side by side, and its opponents. Some demanded a repeated referendum, while others were outraged that there is still no agreement that would suit the UK, and did not pursue the economic interests of some kind of Europe. Well, the pound was thrown from side to side with every breath of political wind. But the Federal Reserve did not lag behind London in terms of public entertainment. Even before the results of the meeting of the Federal Commission on Open Market Operations were announced, the dollar became cheaper, since many were worried that the US central bank would seriously hint at monetary easing in the near future. These concerns were justified after the European Central Bank actually announced the easing of its own monetary policy. However, the results of the meeting exceeded all expectations and significantly upset investors. First, the Federal Reserve gave a clear explanation that the next refinancing rate hike will happen no earlier than next year. Secondly, since April, the regulator has reduced the amount of monthly repurchase of assets that it has accumulated on its balance sheet since 2008, when it was necessary to urgently save the US banking system. But what is much more important is that as early as September, the Federal Reserve will stop this heinous event and will keep on its balance this magnificent bag without a handle until better times. That is, the Federal Reserve, following the European Central Bank, announced the easing of its monetary policy. But it is a worthy bit of distraction from the exciting events and look at the boring statistics, which was not much. Thus, home sales in the secondary market of the United States soared by 11.8%. However, preliminary data on business activity indices somewhat spoiled the mood, as the service sector index fell from 56.0 to 54.8, and production, from 53.0 to 52.5. Well, as a result, the composite index of business activity fell from 55.5 to 54.3. But this is preliminary data. But the data on applications for unemployment benefits obviously pleased, as the number of initial applications decreased by 9 thousand, and repeated ones by 27 thousand. In Europe, data on the construction sector was released, which recently grew by 0.7%, and now it is down by 0.7%, which clearly does not add optimism. Yes, and preliminary data on business indices were not pleasing. The index of business activity in the services sector fell from 52.8 to 52.7, while the manufacturing index fell from 49.3 to 47.6, which makes it all very sad. And, of course, the composite index of business activity fell from 51.9 to 51.3. Well, in the UK, Brexit was not the only entertaining thing, because the previous week was also the week of macroeconomic data. First, data on the labor market came out, which, although they showed a decrease in the unemployment rate from 4.0% to 3.9%, as well as the stability of the average wage growth rate without taking into account bonuses, still raise a number of concerns. The number of applications for unemployment benefits amounted to 27.0 thousand versus 15.7 thousand in the previous month. But what worries investors the most is the slowdown in the average wage growth rate, excluding bonuses, from 3.5% to 3.4%. And this suggests that employees, whether they are not fine, are not particularly eager to hunch and work overtime. But the sadness about this dispelled data on inflation, which showed its growth from 1.8% to 1.9%. However, this joy was short-lived, since the growth rate of retail sales slowed down from 4.1% to 4.0%, which completely blocked inflation. But the main disappointment was the outcome of the Bank of England meeting. The regulator once again frightened young children with tales of the night about the terrible future of the British economy in the event of a "hard" Brexit, which, as recent events have shown, is becoming more and more real. In order to build some plans for a new week, first of all you need to take the US data into account, which has the greatest weight for financial markets. The main news will be the data on GDP for the fourth quarter, and the total, and if the preliminary figures showed a slowdown in economic growth from 3.4% to 2.6%, now everyone is waiting for even more cooling, right up to 2.4%. If these fears are justified, then the next loud statements and steps against Brexit will be the only ones that are able to save the dollar from falling. In addition, the number of applications for unemployment benefits should increase by 4 thousand. Also, the number of building permits issued could decline by 0.6%, but what is much more terrible is the number of construction projects starts, which can fall by as much as 28.3%. This is generally more like a catastrophe. The expected growth in sales of new homes by 1.6% is unlikely to somehow change investor sentiment. In the EU, there is practically no macroeconomic data. Attention should be paid only to the data on UK GDP, which should confirm the fact of a slowdown in economic growth from 1.6% to 1.3%. So, in consideration of the US data, both the pound and the single European currency should grow. However, there is a Brexit factor, and if the House of Commons again, for the third time, rejects the "divorce" agreement, the United Kingdom will have to leave the European Union on April 12 without a deal. That is, the "hard" option. However, taking into account the content of the text of the agreement, that with a deal, or without it, there is no difference for the UK. So, most likely, the MPs again rejected it. However, we can not exclude another option, because the signing of the agreement gives at least some hope that it will be possible to supplement it through an economic component. Moreover, standing on the edge of the abyss, British politicians can dramatically change their shoes in the air and change their minds. The option of a repeated referendum is not excluded. You should not ignore the possibility of abandoning Brexit. That is, now the games are over. That is until Brexit's months remain, you can grimace and the like. Now everything is either that or that way. There is no time to think. I had to think before. And considering that earlier no one, from those who should, did not think, but pulled the cat by the tail, anything can happen. The acceptance of the divorce agreement is the only thing that can cause an increase in both the pound and the single European currency. If the House of Commons bends and accepts the agreement, as well as the postponement of the exit date from the European Union, this will be a signal to normalize the situation, and the single European currency will rise to 1.1450. In all other cases, it is worth waiting for its decline to 1,1200. The pound has a similar deal, and if the House of Commons accepts the agreement on the third attempt, it will strengthen to 1.3350. Otherwise, we are waiting for a decline to 1.3025. |

| USD investors seem to be waiting for a bumpy road in the next two years -Saxo Bank Posted: 25 Mar 2019 04:53 PM PDT Last week, at some point, it seemed that a widespread strengthening of currencies against the depreciating greenback would be recorded. However, the "greenback" managed to recover most of its losses in several currency pairs. Meanwhile, according to John Hardy, an analyst from Saxo Bank, it is not necessary to attach great importance to the current reversal, no matter how much one would like to believe in further tactical strengthening of the dollar's position in pairs that unfolded at key levels, for example, the USD/CAD. "Moreover, we have another example of an unsuccessful USD attempt to take a sustainable direction after the onset of an important event. The first such case this year was the attempt of the EUR/USD pair to rise above the mark of 1.15, when the Fed made the first dovish turn. This was followed by the softening of the ECB's policy, which in turn is unable to induce a sustained break below the level of 1.12," – said the expert. "However, if we look more broadly (in the medium and long term), why would the dollar strengthen? The Fed has quickly moved to a more "soft" position, and the positive effects of Donald Trump's tax reform for the US economy and the dollar should come to naught this year, " he added. Last Friday, an alarming signal to the markets was given by the yield curve of US state bonds, which was inverted (turned over) for the first time in 12 years. Recall that the upheaval of the curve occurs when the yield of long-term treasuries is less than short-term. It should be noted that over the past 50 years, this indicator accurately predicted the impending recession in the United States, which occurred on average 311 days after the onset of inversion. At least this was the case in 1990, 2001 and 2008. It is possible that history will repeat itself, especially since the global economy is slowing down, Europe is literally on the verge of recession, and China's GDP is growing at the slowest rate in the past several decades. Most often, a recession in the United States is followed by a global economic crisis. On the one hand, in this case the Fed has at least some room to maneuver, unlike the ECB or the Bank of Japan, which still use all possible incentives. On the other hand, according to J. Hardy, the United States is a country of deficit that requires constant funding, and when the US central bank has more space to lower interest rates and reduce the policy of quantitative tightening, the potential for weakening the dollar increases. According to the Ministry of Finance, the US state budget deficit increased by 8.7% to $233.977 billion in February 2019. This is a record monthly indicator of a negative balance over the entire period of settlement. The previous high was recorded in February 2012 ($231.7 billion). "It is assumed that a stable weak dollar will be in demand when we go through a difficult period, which the US as well as the world economies may have to go through. In the next two years, investors in the USD are most likely waiting for a jolly road with many holes, "J. Hardy noted. The material has been provided by InstaForex Company - www.instaforex.com |

| Teresa May's proposal will eventually be adopted by Parliament Posted: 25 Mar 2019 04:21 PM PDT Traders are overly optimistic about the prospects for a positive resolution of the current chaos - Brexit, which causes concern among experts. Apparently, the market is waiting for Prime Minister Theresa May and the British lawmakers to accept the draft deal or look for ways to postpone Brexit for a longer period. Based on the EU ultimatum, the postponement of Brexit for a period later than May 22 will entail London's participation in the European Parliament elections, which will start on May 23. Such a scenario can be devastating for Brexit. It is possible that the market is expecting this result, keeping the pound stable. Meanwhile, a further delay in the deadline will likely be the cause of the sterling's strongest rally. The new week is more than ever full of uncertainty and is close to clarifying the situation on Brexit. What would Theresa May do? There are two ways: if the speaker allows, she will again offer an unpopular proposal to the Parliament or abandon her idea. The second option is possible if the prime minister suspects that she is doomed to a third defeat. Of course, May could just resign, but in the current circumstances it is difficult to imagine how her Conservative party will choose a new leader. At the moment, the main issues for coordination are the Irish "backstop" and the European elections. Voting in the European Parliament can be avoided which is subject to a "hard" Brexit on April 12 or a May 22 exit in accordance with the terms of the transaction. In this situation, relations between Britain and the EU will remain almost the same as it is now. In addition, this means taking for granted the assurances of European officials that the Irish backstop would not bind Britain to the customs union forever. Although it is quite difficult to understand what the final compromise will be. However, despite all the flaws, the deal should be attractive to Brexit supporters in the Conservative Party and their allies from the Democratic Unionist Party of Northern Ireland. A messy Brexit does not support the Irish "backstop". London Protests Last weekend, a rally of supporters of the referendum was held in London. The number of demonstrators reached a million. However, in 2016, almost 1.3 million people voted for Brexit. In addition, the votes were divided 60/40 in the British capital, so it is not clear as to what extent a mass protest reflects the will of the people. It is possible that the truth is on the side of currency traders, and, despite the storm, the UK will agree to a deal or get an extension, which will lead to a softening of the conditions or even towards rejecting Brexit. Observers, by the way, reduced the chances of a "hard" scenario to 25%. But in 2016 there was a misfire, and the version regarding the referendum's outcome was not justified. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 25 Mar 2019 04:21 PM PDT 4-hour timeframe The amplitude of the last 5 days (high-low): 116p - 70p - 126p - 223p - 143p. Average amplitude for the last 5 days: 135p (126p). The British pound sterling continues to waver from side to side. Traders receive a sufficient amount of macroeconomic information. Today, March 25, it became known that Theresa May promised to resign if the British parliament voted for her Brexit agreement. It is unlikely for Parliament to take such a step. Theresa May is offering an unequal exchange, the main purpose of which is to save her current political career, and for this to happen she needs to push her version of the deal through Parliament by any means. What will happen to the country in the future will no longer be decided by it. Parliament cannot fail to understand this. The information that a third vote will be held tomorrow on the same version of the agreement has not been confirmed. In the meantime, the European Union announced that it had completed preparations for an unorganized Brexit, which should take place on April 12, unless the British Parliament finally accepts the proposed "deal" ahead of this deadline. Thus, once again, Brexit's entire process turns into the finish line. This time, it seems, there will not be any postponements for Britain's release date. So, either the UK will leave the EU on April 12 without a "deal", or on May 23 - with a "deal", or will refuse Brexit altogether. In any case, the first important date is April 12. We can only observe what is happening. In the coming weeks, the pound sterling can often and sharply change direction, reacting to any information concerning the most burning issue for the UK in the last three years. Trading recommendations: The GBP/USD currency pair is currently in an upward movement in the presence of a newly-formed weak golden cross. However, MACD may already turn down on the current bar. A bad time to open new positions. It is recommended to return to sell orders with a target of 1.3045 no earlier than when the price consolidates below the Kijun-Sen line. From a fundamental point of view, this option is still preferable. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanation of illustration: Ichimoku Indicator: Tenkan-sen-red line. Kijun-sen – blue line. Senkou span a – light brown dotted line. Senkou span B – light purple dotted line. Chikou span – green line. Bollinger Bands Indicator: 3 yellow lines. MACD: A red line and a histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 25 Mar 2019 04:21 PM PDT 4-hour timeframe The amplitude of the last 5 days (high-low): 40p - 28p - 112p - 95p - 118p. Average amplitude for the last 5 days: 79p (64p). On the first trading day of the new working week, the EUR/USD currency pair started an upward correction, as we expected in the morning. The correction was suggested after a landslide. The corrective movement's goal is the critical Kijun-sen line. Today's volatility, has certainly decreased, since the macroeconomic event calendar does not contain any important news. Most traders are still closely monitoring the situation around Brexit and the political crisis in the UK, and the EUR/USD pair could start to lose attention. In the meantime, negotiations between the United States and China are continuing on a number of conditions that in the future will merge into a trade agreement that can put an end to all differences between the two countries. However, if a week ago it seemed that the parties would come to an understanding without any problems, and Donald Trump had even managed to shift his attention to the European Union, which, in his opinion, also "unfairly treats the United States", now we can say that the negotiations are progressing slowly. There were new points of misunderstanding between the two parties, in the field of electronic commerce in particular, which is very important for the American side. Washington wants to weaken the legislation of China, which involves the storage of information only in China, thus, "discriminating" American cloud companies that are seeking the Chinese market. Trading recommendations: The EUR/USD pair has started to adjust against the "dead cross". Thus, it is now recommended to wait for the completion of the correction, and then resume trading for a fall with the first target level of 1,1239. Buy positions are recommended to be considered if the pair manages to consolidate above the critical line, with a target at the level of 1.1398. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanation of illustration: Ichimoku Indicator: Tenkan-sen-red line. Kijun-sen – blue line. Senkou span a – light brown dotted line. Senkou span B – light purple dotted line. Chikou span – green line. Bollinger Bands Indicator: 3 yellow lines. MACD: A red line and a histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD: dollar flat, euro follows Brexit Posted: 25 Mar 2019 04:01 PM PDT The euro-dollar pair is showing corrective growth today. Today, although the macroeconomic calendar is nearly empty, the day is filled with events – primarily related to the prospects of Brexit. The single currency follows the pound, which in turn has hopes for a third vote on the draft deal. In addition, the only more or less important economic release for today was in favor of the euro. For the first time in the last six months, the IFO business optimism index showed positive dynamics. And although the growth was minimal, traders were still impressed: after the devastating figures from ZEW last week, today's publication has become a kind of "spoonful of honey in a barrel of tar." However, this fundamental factor did not become a catalyst for the EUR/USD's steady growth. First of all, this index is of secondary importance (and key indicators continue to decline), and secondly, its slight increase is unable to change the overall situation. After a surge in shoppers' activity, the pair froze in anticipation of the news drivers. One such driver could be Theresa May's speech, which is expected tonight. In the course of her speech, she can report her actions and intentions, since the market is currently disoriented by conflicting rumors. Just a few hours ago, according to the press, the third vote for the deal would take place tomorrow, and allegedly, there is an agreement between the Conservatives and the Unionists. Against this background, the pound rose in price across the entire market, pulling the euro-dollar pair with it. But an hour later, on other sources, a refutation of this information appeared: moreover, the DPA representatives allegedly refused to support the deal, destroying the entire negotiating structure. After that, expectations began to grow that Theresa May would announce that she would resign - but only in exchange for approval of an agreement. This scenario has been mentioned for a long time, but now is the moment when May can play her final (but the strongest) trump card. In this case, she can attract some Laborites to her side, although it is impossible to talk about this with any certainty. In any case, today's events in London can be the driving force not only for currency pairs involving the pound, but also for the euro-dollar pair. Against the background of a flat greenback, which is under the weight of its own problems, today's dynamics of the pair will depend on the single currency's behavior, which, in turn, focuses on Brexit due to the nearly empty economic calendar. But the dollar bulls could not maintain last week's pace. The growth of anti-risk sentiment made it possible for the US currency to catch up on lost positions, but the momentum started to fade on Friday, and today it has completely disappeared. The dollar index is near the boundary of 96-96 figures, flat and showing detachment. The fact that major Wall Street indices opened in the red today amid continued flight from risk did not help the dollar. Negotiations between the US and China are going on quite hard - this, in particular, is evidenced by the information vacuum around this issue. Traders are forced to "be content" only with rumors, which, however, also do not make investors happy. So, according to the American press, Beijing did not make concessions to Washington in the field of e-commerce, whereas this topic is among the top priorities for the White House. Another deadlock in the negotiation process worries traders, but the dollar ignores the growth of anti-risk sentiment. Apparently, the greenback is impressed by the strengthening of the "dovish wing" of the Federal Reserve. The news that Trump nominated his longtime associate and the famous "dove" Stephen Moore to the Board of Governors has unpleasantly surprised dollar bulls, who had just moved away from an extremely soft meeting of the regulator in March. Today, it became known that a record monthly budget deficit was recorded in February: expenses went up, while revenues from the collection of corporate income taxes fell by 20%. As a result, the US budget deficit amounted to $234 billion last month, compared with $215 billion a year earlier. This is an absolute record (to be more precise - an anti-record). Another factor that also complements the grim fundamental picture for the dollar is the decline in the Dallas Fed Manufacturing Index. The indicator fell to 8.3 points, contrary to forecasts of growth to 9 points. The index has been falling for the second month in a row. Despite the secondary importance of this indicator, the dollar still reacted to its decline. Thus, the US currency currently has no power and arguments to dominate in dollar pairs. The single currency, in turn, focuses on the Brexit theme. That is why the upward dynamics of EUR/USD is largely dependent on political events in London. If the British are one step closer to the deal's approval, the pair will grow at least to the Tenkan-sen line on the daily chart (1.1360 mark) and further towards 1.1400 (the upper limit of the Kumo cloud on the same timeframe). Otherwise, the price will return to the area of the middle of the 12th figure. The material has been provided by InstaForex Company - www.instaforex.com |

| March 25, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 25 Mar 2019 09:33 AM PDT

On January 10th, the market initiated the depicted bearish channel around 1.1570. The bearish channel's upper limit managed to push price towards 1.1290 then 1.1235 before the EUR/USD pair could come again to meet the channel's upper limit around 1.1420. Shortly after, the recent bearish movement was demonstrated towards 1.1175 (channel's lower limit) where significant bullish recovery was demonstrated on March 7th. Bullish persistence above 1.1270 enhanced further bullish advancement towards 1.1290-1.1315 (the Highlighted-Zone) which failed to provide adequate bearish pressure. Last week, a bullish breakout attempt was executed above 1.1327 (the upper limit of the current demand zone). This enhanced further bullish movement towards 1.1450 demonstrating a false bullish breakout above the upper limit of the depicted movement channel. On the other hand, On Thursday, significant bearish pressure was demonstrated around 1.1380 leading to the current bearish decline towards 1.1290. The short term outlook for EURUSD pair remains bearish. Quick bearish breakout below 1.1280 is mandatory to pursue towards the next bearish target around 1.1235 and 1.1180. The material has been provided by InstaForex Company - www.instaforex.com |

| Bitcoin analysis for March 25, 2019 Posted: 25 Mar 2019 09:08 AM PDT BTC has been trading downwards. The price tested the level of $3.935. More downside is expected.

According to the H4 time – frame, there is the bearish divergence in the progress, which is sign that buying looks risky. Support levels are seen at the price of $3.882 and at the price of $3.861. Key resistance is set at the price of $4.048. The BTC is still in the long -term downward trend. Trading recommendation: We are bearish on the BTC from $3.944 and targets are set at the price of $3.882 and at the price of $3.861. Protective stop is placed at $4.049. The material has been provided by InstaForex Company - www.instaforex.com |

| Analysis of Gold for March 25, 2019 Posted: 25 Mar 2019 08:59 AM PDT Gold has been trading upwards. The price tested the level of $1.322.36. We found strong bullish momentum.

According to the H4 time – frame, there is the completed downward correction (expanded flat) in the background and the key support remains at the price of $1.280.00. Price is respecting the upward trendline and the Gold is heading towards the resistance at $1.345.75. Trading recommendation: We are long on Gold from $1.320.00 and with target at $1.345.75. Protective stop is placed at $1.290.00. The material has been provided by InstaForex Company - www.instaforex.com |

| March 25, 2019 : GBP/USD demonstrating a Bullish Flag Pattern for Intraday traders. Posted: 25 Mar 2019 08:41 AM PDT  On January 2nd, the market initiated the depicted uptrend line around 1.2380. This uptrend line managed to push price towards 1.3200 before the GBP/USD pair came to meet the uptrend again around 1.2775 on February 14. Another bullish wave was demonstrated towards 1.3350 before the bearish pullback brought the pair towards the uptrend again on March 11. A weekly bearish gap pushed the pair slightly below the trend line (almost reaching 1.2960) before the bullish breakout above short-term bearish channel was achieved on March 11. Bullish persistence above 1.3060 allowed the GBPUSD pair to pursue the bullish momentum towards 1.3130, 1.3200 then 1.3360 where the recent bearish pullback was initiated. Bullish persistence above 1.3250 ( 50% Fibonacci expansion level ) was needed for confirmation of a bullish Flag pattern. However, significant bearish pressure was demonstrated below 1.3250. Hence, the short term outlook turned to become bearish towards 1.3120 - 1.3100 where the depicted uptrend line failed to provide any immediate bullish support. Bearish breakout below 1.3100 (23.6% Fibonacci level) allowed quick bearish decline towards 1.3000 where the current bullish momentum that brought the pair back above 1.3200 was initiated (False bearish breakout). Today, The price level around 1.3250 ( 50% Fibonacci expansion level) stands as an Intraday resistance/supply level that needs to be broken to the upside for confirmation of the depicted flag pattern. On the other hand, bearish rejection around 1.3250 may initiate bearish decline towards 1.3180 then 1.3100 thus remainin within the current consoliation range. Trade Recommendations: Intraday traders should wait for a bullish breakout above (1.3250) on H1 chart. Bullish projection target levels to be located around 1.3320 then 1.3420. SL to be placed above 1.3180. The material has been provided by InstaForex Company - www.instaforex.com |

| Citigroup: What are the prospects for oil in 2019? Posted: 25 Mar 2019 07:16 AM PDT Today, Citigroup investment bank analysts have released updated forecasts regarding the prospects for oil prices in the current year. From the updated material, it follows that on average this year the barrel of oil of the Brent reference grade will be valued at $70. According to the results of the second quarter, Brent is expected to cost $69 per barrel, which is $9 more than the previous assumption. Based on the forecast, the barrel will cost $74 in the third quarter and above the previous expectation by 11 dollars. In Q4, the price is expected to decline to $72 and the forecast is $5 above the previous estimate. According to the results of Q1 2020, Brent will be valued at $ 65 per barrel. Explaining the upward revision of the forecast, the experts identified among the reasons for the further decline in oil supply from Iran, Nigeria, Algeria, and Venezuela, as well as the continuing reduction in stocks of raw materials in consuming countries. In Venezuela, where recently a large-scale blackout paralyzed the country's economy, the risks of a repeated power outage remain. In addition, the United States can tighten sanctions on oil exports from Iran. As a result, the cost of futures for May on Brent crude oil sank by 0.18%, amounting to 68.92 dollars per barrel at around 10:25 London time. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR: Reports on German business community improved sentiment Posted: 25 Mar 2019 07:10 AM PDT The euro managed to strengthen its position in tandem with the US dollar after positive data on business sentiment in Germany, which began to gradually improve in March of this year after more than six months of deterioration. According to the Ifo research institute, the German business sentiment index in March 2019 was 99.6 points against the February figure of 98.7 points. The data significantly exceeded the forecast of economists, who expected the index to be 98.3 points. The index was well supported by investors' expectations, while the business climate index for the manufacturing sector continued to decline. Ifo noted that the prospects for the production sphere in March were estimated to be more pessimistic. Considering that the release of more important fundamental statistics is no longer provided today, traders are closely watching the speeches of representatives of the Federal Reserve System. Charles Evans said that the Fed's interest rates may rise, fall or remain unchanged today. Hence, caution on the part of the Fed seems justified and the policy now comes down to risk management. The head of the Federal Reserve Bank of Chicago also noted that the Fed's policy will depend on the data, as downside risks are now felt more than positive. Evans predicts GDP growth of 1.75% -2% in 2019 due to the fact that fundamental US macroeconomic indicators remain good. An interview with Federal Reserve Bank of Philadelphia Patrick Harker also took place today, who said that the outlook for the US economy is still quite good, but the balance of risks is a bit biased in a negative way. Harker predicts one rate hike in 2019 and another one in 2020. Let me remind you that in the last meeting of the committee, they said that they did not plan to raise interest rates this year. The representative of the Fed predicts that US GDP growth will slightly exceed 2% in 2019 and slow down in 2020. As for the technical picture of the EUR/USD pair, it remained unchanged. The trading instrument keeps the intermediate level of 1.1295 from further falling, a breakthrough of which will increase the pressure on risky assets. At the same time, it will lead to the updating of last week's lows in the areas of 1.1270 and 1.1225. With an upward correction, the growth of the euro was already limited by the level of 1.1330. However, a repeated test may lead to a larger upward movement in the area of resistance 1.1355. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 25 Mar 2019 06:58 AM PDT In the background of trade wars and the slowdown of the global economy, there is an increased risk of the American recession in the market. It concerns the development of a correction in global stock indices and rumors about the resignation of Theresa May from the post of British Prime Minister, which heightened the demand for safe-haven assets. Currencies such as the Japanese yen, gold, and the Swiss franc feel like a fish in the water amid a sharp rise in volatility and a deterioration in the global risk appetite. But just a week ago, the positions of these assets seemed very fragile. Dynamics of volatility In 2019, the currency of the Land of the Rising Sun has already managed both to amuse and upset its fans. The flash accident allowed her to execute annual targets within a few minutes, but the following implementation of the bearish forecasts for the USD/JPY pair had to be postponed. The de-escalation of the US-Chinese trade conflict, as well as the change in the Fed's worldview, allowed the "bulls" on the analyzed pair to return its quotes to maximum levels from December 20. Meanwhile, stock indices were rapidly recovering, the cost of borrowing was falling, and interest in developing countries' monetary units and carry trade operations grew by leaps and bounds. Under such conditions, funding currencies fall into disgrace and the yen is no exception. By the end of March, investors began to suspect that both the Fed and Donald Trump are going too far. The US president claims that the duties on $250 billion Chinese imports will remain in force after the conclusion of an agreement with China but Beijing is making concessions in order to cancel them. The inconsistency of interests can be a serious obstacle to the contract signing. At the same time, the yen is likely to benefit more from the escalation of the conflict than in 2018. Last year, all the cream went to the US dollar as the strength of the US economy allowed investors to direct capital to the New World. In 2019, the US is slowing down and the inversion of the yield curve signals growing recession risks. As a result, just as the dollar took the status of a safe-haven from the yen and gold last year, they can return it in the present. The rhetoric of the Fed is becoming more and more "dovish". If the Central Bank is confident of a further slowdown in GDP and is doing everything possible to avoid a recession then the option of lowering the federal funds rate should not be off the table. The derivatives market estimates the chances of such an outcome in 2019 to be more than 50%, which is a strong argument in favor of completing the cycle of normalizing monetary policy and sales of the US dollar. Considering the next stage of trade negotiations between Washington and Beijing, the economic calendar saturated for the United States (including the release of fourth-quarter GDP data and the exacerbation of the political crisis in Britain), these allow the yen to claim the title as the most interesting currency in the last week of March. Technically, the transformation of the Shark pattern is continuing at 5-0 on the daily chart of the USD/JPY pair. A break of support at 109.65 (50% of the CD wave) will increase the risks of continuing the pair's downward rally. USD / JPY daily graph |

| Posted: 25 Mar 2019 06:40 AM PDT To open long positions on the GBP / USD pair, you need: As long as there are no specifics from Theresa May on the voting, the pound remains in a narrow side channel. You can return to purchases only after fixing above the resistance of 1.3222, which will lead to an upward correction in the area of 1.3266 and 1.3316, where I recommend taking profits. In the case of a re-decline on the news on Brexit, long positions are best to consider on the rebound from the lows of 1.3136 and 1.3083. To open short positions on the GBP / USD pair, you need: Bears coped with the task in the first half of the day and did not let the pair to reach above the resistance of 1.3222. As long as trading is conducted below this range, the pressure on the pound will remain, which may lead to a decrease in the support area of 1.3136 and 1.3083, where I recommend taking profits. In the event of a breakthrough of resistance 1.3222 on the positive news on Brexit, short positions in the pound are best to consider at the resistance levels of 1.3266 and 1.3316. More in the video forecast for March 25 Indicator signals: Moving averages Trade is conducted in the area of 30- and 50-medium moving, which indicates the lateral nature of the market. Bollinger bands The upward correction for the pound is limited by the upper limit of the Bollinger Bands indicator in the 1.3222 area. Description of indicators MA (moving average) 50 days - yellow MA (moving average) 30 days - green MACD: fast EMA 12, slow EMA 26, SMA 9 Bollinger Bands 20 The material has been provided by InstaForex Company - www.instaforex.com |

| EUR / USD plan for the US session on March 25. Data from the IFO supported the euro Posted: 25 Mar 2019 06:37 AM PDT To open long positions on EUR / USD pair, you need: The euro has slightly strengthened its position against the US dollar in the morning after a good report from the IFO Institute, which published data on the German economy. At the moment, buyers need to break through the resistance level of 1.1324, where a test was observed during the first half of the day, which will lead to a further upward correction to the area of 1.1358 maximum, where I recommend taking profits. In the scenario of a return to the low of the day to support 1.1294, it is best to consider long positions in the EUR/USD pair on the area of 1.1269 or on the rebound from the support of 1.1247. To open short positions on EURUSD you need: Sellers coped with the task in the morning and did not allow the pair to rise above the resistance of 1.1324. While the trade is conducted below this range, the pressure on the euro will remain. However, the main goal will be to break through and consolidate below support 1.1294, which will lead to the formation of a new downward wave and update weekly lows in areas 1.1269 and 1.1247, where I recommend taking profits. If the growth scenario is higher than 1.1324 in the second half of the day, short positions in EUR / USD pair can only be considered on a rebound from the resistance of 1.1358 and 1.1388. More in the video forecast for March 25 Indicator signals: Moving averages Trade is conducted in the area of 30- and 50-medium moving, which indicates the lateral nature of the market with the advantage of sellers. Bollinger bands In the event of a further decline in the euro, support will be provided by the lower limit of the Bollinger Bands indicator in the 1.1290 area. A breakthrough on the upper boundary of the indicator in the area of 1.1320 will lead to a new wave of growth of the euro. Description of indicators MA (moving average) 50 days - yellow MA (moving average) 30 days - green MACD: fast EMA 12, slow EMA 26, SMA 9 Bollinger Bands 20 The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD analysis for March 25, 2019 Posted: 25 Mar 2019 06:30 AM PDT GBP/USD has been trading upwards. The price tested the level of 1.3244. We found strong bullish momentum.

According to the H1 time – frame, we found confirmed breakout of the inverted head and shoulders pattern, which is sign that GBP/USD may continue with the upward movement. Most recently, there is also breakout of the bullish flag pattern, which is another sign of the strength. Key resistance at the price of 1.3227 is broken so GBP may test the strong resistance at 1.3377. Support levels are seen at the price of 1.3160, 1.3080 and 1.3009. Trading recommendation: We are long on GBP from 1.3230 and with target at 1.3377. Protective stop is placed at 1.3150. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading recommendations for the GBP / USD pair - placement of trading orders (March 25) Posted: 25 Mar 2019 05:49 AM PDT By the end of the last trading week, the GBP/USD currency pair showed high volatility of 140 points, which resulted to a rollback to the previously passed cluster. From the technical analysis point of view, we see a rollback correction in the direction of the accumulation zone at 1.3220, where the quote slowed down the movement and tried to work out this level in the background of continuous rage on Brexit's controversy. This time we have a large-scale demonstration in London itself, where an estimated 1 million people on streets demanding for a second referendum. What we have are options that the Parliament of Great Britain must make a decision until March 29: agree on an agreement, exit without a deal, cancel the Brexit or hold a new referendum. Any option gives speculators the opportunity to see the races on the market, where you can ride. Today, there is silence on the economic calendar but the information on the background will continue to hold the interest of speculators. Further development: In analyzing the current trading chart, we see an attempt to work out the accumulation of 1.3220 giving out short positions. It is likely to assume that the pound may be under pressure, continuing to decline in the medium term against the background of thickening clouds due to Brexit. The pound may be under pressure and continue its decline in the medium-term. Considering the current oscillation, I do not exclude a temporary bump in the range of 1.3170 / 1.3220 and we can consider a decline to 1.3313-1.30.30 in the case of a clear price fixation below 1.3170. Based on the available data, it is possible to deduce a number of variations, let's consider them: - Positions for the purchase of traders consider above fixing the price of 1.3220, with the target of 1.3300. - Positions for sale traders consider after fixing the price lower than 1.3170. Indicator Analysis Analyzing a different timeframe (TF) sector, we can see that there is a downward interest in the short and intraday perspective. Due to uncertainty, the medium-term outlook has changed interest to neutral. Weekly volatility / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation with the calculation for the Month / Quarter / Year. (March 25 report was based on the time of publication of the article) At the current time, the volatility is 59 points. It is likely that the volatility may remain at a high level in the event that an ambiguous information background is preserved. Key levels Zones of resistance: 1.3220 *; 1,3300 **; 1.3440; 1.3580 *; 1.3700 Support areas: 1.3000 ** (1.3000 / 1.3050); 1.2920 *; 1.2770 (1.2720 / 1.2770) **; 1.2620; 1.2500 *; 1.2350 **. * Periodic level ** Range Level The material has been provided by InstaForex Company - www.instaforex.com |

| GBP / USD: Theresa May's resignation talks are getting louder but doesn't clarify Brexit Posted: 25 Mar 2019 05:46 AM PDT Last week, the European Union gave Britain a couple more weeks so that the country could avoid withdrawing from the alliance without entering into any agreement. But will London have enough time to break the deadlock and provide a "soft" Brexit? Today, the GBP/USD pair is trading near the 1.32 mark in anticipation of the next Brexit vote to be held in the British Parliament in the coming days. Recall that the EU leaders rejected London's request to postpone the United Kingdom's withdrawal from the bloc to June 30, declaring its readiness to provide a reprieve until May 22 but in a condition that the divorce agreement will be approved by deputies of the House of Commons this week. However, if the deal fails, an emergency EU summit will be convened, where Britain will have to state their further actions, which means that the country will either leave the EU without a deal or a longer Brexit delay will be required. In turn, Theresa May noted that she would not become the prime minister in which the UK's withdrawal from the EU would be postponed for a long time, which suggests the possible resignation of the head of the cabinet in the absence of ratification of the deal until April 12. According to British media, May's resignation is only a matter of time and the options now range from immediately replacing her with some of the ministers to leaving her post after a couple of months. Of course, the United Kingdom may still withdraw its application for withdrawal from the alliance. Thus, the online petition to cancel Brexit has already gained more than 5 million signatures but it still has a much smaller weight than the 18 million votes cast three years ago for the country to leave the EU. Thus, the upcoming week promises to be tense for the British currency. The downside risks for the pound are the implementation of the "hard" scenario and the holding of early parliamentary elections. However, if parliament takes control of Brexit from the government and the majority of the House of Commons deputies advocate for a repeat referendum, this will lead to an increase in the pound. According to analysts, one of the original decisions is for the legislators to adopt the draft divorce agreement, provided that it is approved by the citizens of the country in a new referendum and three questions are to be raised concerning the vote, either to accept the deal, remain in the EU or leave without deal. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 25 Mar 2019 04:22 AM PDT When supply balances between OPEC production cuts and growth in the United States, oil prices are determined by the dynamics of global demand. In this regard, the fall of Brent and WTI quotes against the background of the collapse of European business activity in the manufacturing sector to the lowest marks in the last 6 years and its American counterpart to the very bottom for 21 months looks logical. Purchasing managers' indices are leading indicators for GDP and its slowdown indicates a further slowdown in the global economy and global demand for black gold. One of the main drivers of almost 30% of the Brent and WTI rally from the December lows was the de-escalation of the US-Chinese trade conflict. Trade negotiations evolved quite successfully. Donald Trump occasionally talked about progress but as they approached the finish line, investors began to doubt the end of the trade war. First, Beijing is unhappy with the preservation of $250 billion in tariffs on its exports to the States and the US president is not going to cancel them. Secondly, the arena of hostilities may shift from Asia to Europe. Both OPEC (the International Energy Agency) and the United States Energy Information Administration take these risks into account and lower oil demand forecasts. Dynamics of oil demand forecasts Adds a negative with the first 2007 drop in the yield curve in the red zone. The differential rates on the 10 and 3-year US Treasury bonds quite clearly predicted recessions in the past. With a time lag of 12-18 months, the American economy may face a recession, which negatively affects domestic demand for black gold and contributes to lower prices. Moreover, interest in safe-haven assets, including the US dollar, has returned in such conditions. Since oil is quoted in this currency, the growth of the USD index contributes to the fall of Brent and WTI quotes. As for the proposal, the market continues to pull the rope between US companies and OPEC. The growth of oil production to 12 million b/s in the US leads to an increase in reserves and exports. On the other hand, the fall of rigs from Baker Hughes to minimum levels over the past 11 months indicates that another round of shale boom is coming to an end. On the opposite side of the rope is the cartel and other producing countries, including Russia. Saudi Arabia's activity is a serious bullish trump for Brent and WTI as it regularly exceeds production cutbacks. Nevertheless, the fact that Russia is satisfied with the current price level and does not want to roll over the contract creates a certain ceiling for black gold. When there is no agreement in the partners, buyers begin to record profits. Technically, the rebound from the level of 50% of the CD wave pattern "Shark" was predicted for a long time. It occurred within the framework of the transformation of the model in 5-0. If the bears manage to lower the Brent quotes below the supports by $ 64.1 and $ 58.7 per barrel, the risks of the downtrend recovery will increase. Brent daily chart The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of AUD/USD for March 25, 2019 Posted: 25 Mar 2019 03:56 AM PDT |

| Analysis of EUR / USD Divergence on March 25. Euro ceded leadership to US dollar Posted: 25 Mar 2019 03:49 AM PDT 4h On the 4-hour chart, the EUR / USD pair declined to23.6% correctional level of 1.1269. Releasing the pair's rate on March 25 from this Fibo level will allow traders to expect a reversal in favor of the EU currency and some growth in the direction of the 38.2% correction level at 1.1328. There is no maturing divergence in any indicator. Closing the pair below the Fibo level of 23.6% will increase the chances of a further fall in the direction of the next 0.0% correction level of 1.1177. The Fib net was formed on boundaries from January 10, 2019 and March 7, 2019. Daily On the 24-hour chart, the pair quotes returned to the correction level of 127.2% - 1.1285. The price quotation from the Fibo level of 127.2% will allow traders to expect a reversal in favor of the European currency and the resumption of growth in the direction of the 100.0% correctional level at 1.1553. Closing the pair below the Fibo level of 127.2% will again work in favor of the US currency and some fall in the direction of the 61.8% correction level at 1.0941. In the last 5 months, the pair is trading between the levels of 100.0% and 127.2%. The Fib net was formed on boundaries from November 7, 2017 and February 16, 2018. Recommendations to traders: Purchases of the EUR/USD pair can be made with the goal of 1.1328 and a Stop Loss order under the correction level of 23.6% if the pair rebounds from the level of 1.1269. Sales of the EUR/USD pair can be carried out with the target of 1.1177 and a Stop Loss order above the Fibo level of 23.6% if the pair closes below the level of 1.1269. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of GBP/USD for March 25, 2019 Posted: 25 Mar 2019 03:49 AM PDT |

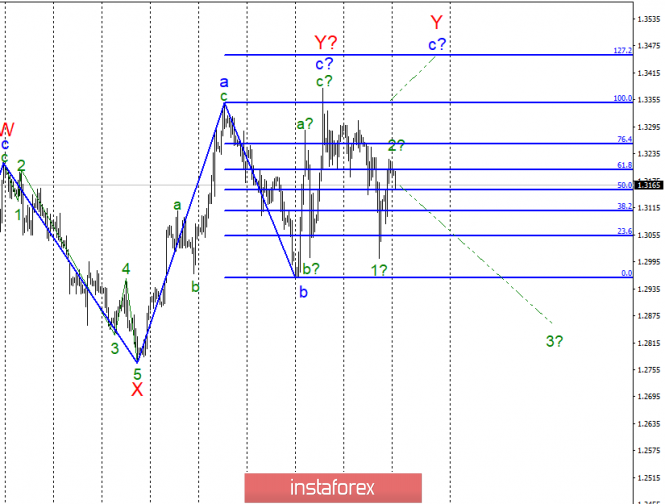

| Posted: 25 Mar 2019 01:50 AM PDT

Wave counting analysis: On March 22, the GBP / USD pair rose by 90 bps. Thus, if the upward trend is completed near the 100.0% Fibonacci level, then the pair has started to build a downward section and has already completed the construction of internal waves 1 and 2. If this is true, then the tool will continue to decline as part of wave 3 with targets located under the 29th figure. Unfortunately, the news background remains unstable. There is still no final decision on Brexit. What awaits the country is a clear indication on whether or not the government will change in the near future. It is still unknown. Whether there will be new negotiations with the European Union is doubtful. Therefore, the pound will remain in the potential "zone of turbulence" until the end of this process. Purchase goals: 1.3350 - 100.0% Fibonacci 1.3454 - 127.2% Fibonacci Sales targets: 1.2961 - 0.0% Fibonacci General conclusions and trading recommendations: The wave pattern allows for the construction of an upward wave with targets located near the estimated level of 1.3454; however, I recommend returning to this option only in case of a successful attempt to break through the level of 100.0%. A more likely development of events is now the construction of a downward wave with targets below 29 figures, thus, I recommend sales in small volumes. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment