Forex analysis review |

- Control zones USDCAD 04/02/19

- Control zones NZDUSD 04/02/19

- NZD/USD approaching support, potential bounce!

- AUD/USD approaching resistance, potential drop!

- XAU/USD approaching support, potential bounce!

- Fractal analysis of major currency pairs on April 2

- It is difficult to be a "greenback"-bear, if it's not in a hurry to decline

- EUR/USD. April 1st. Results of the day. The first day of the week and month again remained behind the US currency

- GBP/USD. April 1st. Results of the day. London is losing huge sums every day due to its desire to leave the EU

- April 1, 2019 : EUR/USD intraday technical levels and trade recommendations.

- April1, 2019 : GBP/USD approaching a confluence of supply levels to be watched

- Elliott wave analysis of GBP/JPY for April 1, 2019

- Elliott wave analysis of EUR/JPY for April 1, 2019

- The task of the bulls EUR/USD is to keep 1.1180

- BITCOIN Analysis for April 1, 2019

- Bitcoin analysis for April 01, 2019

- Analysis of Gold for April 01, 2019

- EUR: Weak reports on manufacturing activity and inflation in the euro area did not hurt the euro

- GBP/USD: plan for the American session on April 1. The pound regained a number of positions after falling last Friday

- EUR/USD: plan for the American session on April 1. Weak activity in the manufacturing sector has limited the upward correction

- EUR and GBP: The UK has a little less than two weeks. US dollar growth may slow down

- USD/JPY analysis for April 01, 2019

- GBP/USD. April 1. The trading system. "Regression Channels". The patience of the EU in the matter of Brexit runs out

- EUR / USD. April 1. The trading system. "Regression Channels". The euro cannot decide which way to go next

- Will the Reserve Bank scare the "Australian"?

| Posted: 01 Apr 2019 07:27 PM PDT A reversal pattern was formed at the beginning of this week, which determines the bearish direction as a priority. The decline's target is the weekly short-circuits of 1.3245-1.3226. The probability of reaching this zone is 70%. Selling requires a better price, so any growth must be used to enter a short position. Returning to the range of yesterday's Asian session can provide favorable prices for selling that you would need to use to enter the position. Sales from current grades do not look profitable, since the size of the stop relative to the potential profit is not profitable. An absorption of yesterday's fall will be required in order to stop the downward impulse and head into the flat. This will not disrupt the bearish movement, however, it will make it possible to form a local accumulation zone, where the upper range will become the defining resistance, the test of which will allow you to get the most favorable prices for selling. Work towards strengthening the Canadian dollar will bring profit in 70% of cases, so it is better to abandon purchases. Daily KZ - daily control zone. The zone formed by important data from the futures market, which change several times a year. Weekly KZ - weekly control zone. The zone formed by the important marks of the futures market, which change several times a year. Monthly KZ - monthly control zone. The zone, which is a reflection of the average volatility over the past year. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 01 Apr 2019 07:21 PM PDT The pair is trading within the accumulation zone for the third day. The lower limit is at the previous week's low. To increase the resistance, the NKZ 1/2 0.6845-0.6838 will act as resistance. While the pair is trading below this zone, the bearish momentum will continue. Sales are profitable from the upper flat range. Purchases from the lower level will be directed against the turn, so the probability of making money on this is close to 30%. For those who are already holding a sale from the top of the flat, it is necessary to move the position to breakeven, since the resumption of growth can lead to an update of the weekly high and a more favorable price for selling. To violate the downward movement, it will require the absorption of yesterday's decline and the closure of the US session above the level of 0.6845. This will eliminate sales and consider buying tomorrow. The probability of implementing this model is at 30%, which makes it a support. Work in a downward direction has a higher potential, however, selling from current grades is no longer profitable. Daily KZ - daily control zone. The zone formed by important data from the futures market, which change several times a year. Weekly KZ - weekly control zone. The zone formed by the important marks of the futures market, which change several times a year. Monthly KZ - monthly control zone. The zone, which is a reflection of the average volatility over the past year. The material has been provided by InstaForex Company - www.instaforex.com |

| NZD/USD approaching support, potential bounce! Posted: 01 Apr 2019 06:55 PM PDT NZDUSD is approaching our first support at 0.67556 (long term ascending support line, horizontal swing low support, 50% Fibonacci retracement , 100% Fibonacci extension ) where a strong bounce might occur above this level to our major resistance at 0.6866 (horizontal overlap resistance, 61.8% Fibonacci retracement ). Stochastic is also approaching support. Trading CFDs on margin carries high risk. Losses can exceed the initial investment so please ensure you fully understand the risks.

|

| AUD/USD approaching resistance, potential drop! Posted: 01 Apr 2019 06:52 PM PDT AUDUSD is approaching our first resistance at 0.7146 (horizontal swing high resistance, 100% Fibonacci extension , 78.6% Fibonacci retracement ) where we might see a drop to our major support at 0.70968 (61.8% Fibonacci extension , 61.8% Fibonacci retracement ). Stochastic (34,5,3) is also approaching resistance. Trading CFDs on margin carries high risk. Losses can exceed the initial investment so please ensure you fully understand the risks.

|

| XAU/USD approaching support, potential bounce! Posted: 01 Apr 2019 06:51 PM PDT XAUUSD is approaching our first support at 1283.58 (horizontal swing low support, 61.8% Fibonacci extension ) where a strong bounce to our major resistance at 1299.29 (horizontal pullback resistance, 38.2%Fibonacci retracement ) might occur. Stochastic is also approaching support where we might see a corresponding bounce in price. Trading CFDs on margin carries high risk. Losses can exceed the initial investment so please ensure you fully understand the risks.

|

| Fractal analysis of major currency pairs on April 2 Posted: 01 Apr 2019 06:35 PM PDT Forecast for April 2: Analytical review of H1-scale currency pairs: For the euro / dollar pair, the key levels on the H1 scale are: 1.1318, 1.1285, 1.1265, 1.1238, 1.1203, 1.1180 and 1.1134. Here, we continue to follow the development of the downward structure of March 20. Short-term movement to the bottom is expected in the range of 1.1203 - 1.1180. We consider the level 1.1134 to be a potential value for the bottom, after reaching this level, we expect a rollback to the top. Care in the correction is expected after the breakdown 1.1238. Here, the first goal is 1.1265. Short-term upward movement is possible in the range of 1.1265 - 1.1285. The breakdown of the latter value will have to form the initial conditions for the upward cycle. Here, the potential target is 1.1318. The main trend is the downward structure of March 20. Trading recommendations: Buy 1.1238 Take profit: 1.1265 Buy 1.1287 Take profit: 1.1318 Sell: 1.1203 Take profit: 1.1181 Sell: 1.1178 Take profit: 1.1135 For the pound / dollar pair, the key levels on the H1 scale are 1.3153, 1.3092, 1.3051, 1.2984, 1.2948, 1.2892, 1.2859 and 1.2797. Here, we are following the downward structure of March 27. Continuation of the movement to the bottom is expected after the price passes the noise range 1.2984 - 1.2948. In this case, the goal is 1.2892. Meanwhile, in the range of 1.2892 - 1.2859, there is a price consolidation. For the potential value for the bottom, we consider the level of 1.2797, after reaching which, we expect a rollback to the top. Consolidated movement is possible in the range of 1.3051 - 1.3092. The breakdown of the latter value will lead to a prolonged correction. Here, the target is 1.3153. This level is a key resistance for the development of the ascending structure. Its breakdown will allow to expect movement to level 1.3271, as well as the formation of pronounced initial conditions for top. The main trend is the downward structure of March 27, the stage of correction. Trading recommendations: Buy: 1.3094 Take profit: 1.3150 Buy: 1.3160 Take profit: 1.3235 Sell: 1.2984 Take profit: 1.2948 Sell: 1.2946 Take profit: 1.2892 For the dollar / franc pair, the key levels on the H1 scale are: 1.0065, 1.0040, 1.0023, 0.9996, 0.9975, 0.9961 and 0.9938. Here, we are following the development of the ascending structure of March 27. Continuation of the movement to the top is expected after the breakdown of 0.9996. In this case, the goal is 1.0023. In the range of 1.0023 - 1.0040, there is a short-term upward movement, as well as consolidation. For the potential value for the top, we consider the level of 1.0065. After reaching which, we expect consolidation, as well as a rollback to the bottom. Short-term downward movement is possible in the range of 0.9975 - 0.9961. The breakdown of the last value will lead to a prolonged correction. Here, the target is 0.9938. This level is a key support for the top. The main trend - the ascending structure of March 27. Trading recommendations: Buy: 0.9998 Take profit: 1.0020 Buy: 1.0025 Take profit: 1.0038 Sell: 0.9975 Take profit: 0.9964 Sell: 0.9958 Take profit: 0.9942 For the dollar / yen pair, the key levels on the scale are: 112.69, 112.26, 112.05, 111.69, 111.45, 111.19, 111.00 and 110.67. Here, we are following the development of the ascending structure of March 25. Short-term upward movement is expected in the range of 111.45 - 111.69. The breakdown of the last value should be accompanied by a pronounced upward movement. Here, the goal is 112.05. Meanwhile, in the range of 112.05 - 112.26, there is a consolidation. For the potential value for the top, we consider the level of 112.69, after reaching which, we expect a rollback to the bottom. Short-term downward movement is possible in the range of 111.19 - 111.00. The breakdown of the latter value will lead to a prolonged correction. Here, the goal is 110.67. This level is a key support for the upward structure. The main trend: the ascending structure of March 25. Trading recommendations: Buy: 111.47 Take profit: 111.66 Buy: 111.72 Take profit: 112.05 Sell: 111.19 Take profit: 111.03 Sell: 110.98 Take profit: 110.70 For the Canadian dollar / US dollar pair , the key levels on the H1 scale are: 1.3381, 1.3349, 1.3329, 1.3300, 1.3257, 1.3229 and 1.3189. Here, we continue to follow the development of the downward structure of March 28. Continuation of the movement to the bottom as an impulse is expected after the breakdown 1.3300. In this case, the target is 1.3257. Meanwhile, in the range of 1.3257 - 1.3229, there is a short-term downward movement, as well as consolidation. For the potential value for the bottom, we consider the level of 1.3189, after reaching this level, we expect a rollback to the top. Short-term upward movement is possible in the range of 1.3329 - 1.3349. The breakdown of the latter value will lead to a prolonged correction. Here, the target is 1.3381. This level is a key support for the downward structure of March 28. The main trend is the downward structure of March 28. Trading recommendations: Buy: 1.3330 Take profit: 1.3347 Buy: 1.3351 Take profit: 1.3380 Sell: 1.3300 Take profit: 1.3260 Sell: 1.3255 Take profit: 1.3230 For the pair Australian dollar / US dollar , key levels on the H1 scale are: 0.7183, 0.7155, 0.7131, 0.7096, 0.7081 and 0.7061. Here, the situation is in equilibrium. The development of the ascending structure of March 28 is expected after the breakdown of 0.7131. In this case, the goal is 0.7155, wherein a consolidation is near this level. For the potential value for the top, we consider the level of 0.7183. Short-term downward movement is possible in the range of 0.7096 - 0.7081. Hence, there is a probability of a reversal to the top. A breakdown of the level of 0.7081 will have to develop the downward structure. Here, the first target is 0.7061. The main trend is the equilibrium situation, mainly we expect a movement to the top. Trading recommendations: Buy: 0.7131 Take profit: 0.7155 Buy: 0.7757 Take profit: 0.7180 Sell: 0.7096 Take profit: 0.7082 Sell: 0.7078 Take profit: 0.7062 For the euro / yen pair, the key levels on the H1 scale are: 125.93, 125.43, 125.01, 124.39, 124.06, 123.59 and 123.03. Here, we are following the formation of the ascending structure of March 28. Continuation of the movement to the top is expected after the breakdown of 125.01. In this case, the goal is 125.43. There is a consolidation is near this level and we are waiting for clearance of the expressed initial conditions for the upward cycle. For the potential value for the top, we consider the level of 125.93. Short-term downward movement is possible in the range of 124.39 - 124.06. The breakdown of the latter value will have to the development of the downward movement. Here, the first goal is 123.59. The main trend is the formation of the ascending structure of March 28. Trading recommendations: Buy: 125.01 Take profit: 125.40 Buy: 125.50 Take profit: 125.90 Sell: 124.39 Take profit: 124.10 Sell: 124.00 Take profit: 123.70 For the pound / yen pair, key levels on the H1 scale are: 148.20, 147.24, 146.51, 145.17, 144.76, 144.29 and 143.83. Here, we are following the formation of the ascending structure of March 29. Continuation of the movement to the top is expected after the breakdown of 146.51. In this case, the goal is 147.24, and near this level is a price consolidation. For the potential value for the top, we consider the level of 148.20, from which we expect a rollback. Short-term downward movement is possible in the range of 145.17 - 144.76. The breakdown of the latter value will lead to a prolonged correction. Here, the target is 144.29. This level is a key support for the upward structure. The main trend is the formation of the ascending structure of March 29. Trading recommendations: Buy: 146.51 Take profit: 147.20 Buy: 147.30 Take profit: 148.20 Sell: 145.17 Take profit: 144.78 Sell: 144.73 Take profit: 144.32 The material has been provided by InstaForex Company - www.instaforex.com |

| It is difficult to be a "greenback"-bear, if it's not in a hurry to decline Posted: 01 Apr 2019 03:48 PM PDT Even despite the Federal Reserve's softening of its rhetoric, over the past two months, the greenback was able to strengthen by more than 1.9%, which put serious pressure on the G10 currencies, including the euro. According to Bank of America experts, factors such as the uncertain situation around Brexit, as well as the prolonged negotiations to resolve trade disputes between Washington and Beijing, support the US currency. "The market is going through a long period of uncertainty, which does not allow the dollar to weaken," representatives of the financial institute noted. At the same time, the strengthening of the dollar has a negative effect on US exports and GDP, as well as on the incomes of US corporations. If economic growth in the country continues to slow down, the White House will once again start to look for the guilty one. And that may well be the Fed. Larry Kudlow, the chief economic adviser to the US president, believes that the regulator should lower the interest rate from 2.5% to 2% in order to smooth out the consequences associated with a slowdown in global GDP growth. In the second half of last year, Donald Trump has repeatedly stated that the US central bank needs to stop the process of tightening monetary policy, which the latter implemented in 2019. Should the regulator once again obey the head of the White House? Formally, the Fed has reasons for this. The US economy began to slow down, because the effects of incentives in the form of tax cuts, as well as increased government spending are gradually fading. In the fourth quarter, US GDP grew by 2.2% yoy, after rising 3.4% in July-September. A leading indicator from the Atlanta Federal Reserve Bank indicates that the figure in January-March has increased by only 1.5%. Meanwhile, the Fed believes that the US economy's loss of momentum is a temporary phenomenon. In particular, the President of the Federal Reserve Bank of Dallas, Robert Kaplan, noted that the dynamics of GDP in the first quarter is usually a noise, so it should not be given increased attention. He expects an improvement in the economy during the remainder of the year. Vice Chairman for Supervision of the Fed Randal Quarles, in turn, believes that the regulator will still have the opportunity to raise the interest rate. However, as the example of the European Central Bank shows, restrained optimism can easily turn into pessimism if the statistics do not meet expectations. Despite the fact that neither the US president nor the Fed does not want a strong dollar, the greenback-bears are in no hurry to go on the attack. Recently, the dollar has strengthened mainly due to the weakness of the global economy, protectionism and trade wars, however, if the White House realizes its mistake and treats its trading partners and competitors more mildly, the fate of the USD can change radically. According to Bank of America, by the end of 2019, the EUR/USD pair might increase to the level of 1.20. "We expect that while the dollar continues to be in great demand among investors, its weakening is possible under the condition of steady growth of the global economy," said the bank representatives. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 01 Apr 2019 03:48 PM PDT 4-hour timeframe The amplitude of the last 5 days (high-low): 43p - 63p - 44p - 48p - 37p. Average amplitude for the last 5 days: 47p (63p). On Monday, April 1, the European currency resumed its decline following a slight correction during the US trading session. Today's news from the eurozone disappointed traders, which did not allow the European currency to continue a recovery. Although it should be recognized that the importance of macroeconomic reports from Europe was lower than reports from the United States. However, the preliminary value of the consumer price index for March was below the forecast of 1.4% y/y. Core inflation slowed down from 1.0% to 0.8% y/y and the unemployment rate remained unchanged at -7.8%. That was enough for the euro to again fall under traders' sales. Macroeconomic statistics from the United States also did not please. Retail sales fell by 0.2% m/m in February instead of a growth of 0.3%. Without car sales, the indicator lost 0.4% instead of a gain of 0.4%, while the retail control group lost 0.2%. Markit Manufacturing PMI fell to 52.4. However, the situation was slightly saved by the ISM business activity index, which rose to 55.3 in March. In general, thus, the advantage remains on the side of the US currency. We also note that instrument volatility has again decreased to almost minimal values and today is unlikely to be an exception. The MACD indicator, which did not have time to discharge properly, did not even have time to react to the correction's completion. Thus, a new round of correctional movement towards the critical Kijun-Sen line is still possible. Trading recommendations: The EUR/USD pair continues a sideways correction, since the previous price low has not been updated, and the MACD has not turned down. Thus, it is recommended to open new shorts no earlier than the completion of the current correction with a target of 1.1175. Long positions in small lots are recommended to be considered if the pair manages to overcome the Kijun-Sen line, with targets at the resistance level of 1.1295 and the Senkou Span B. line. This was enough to get the euro under traders' sales. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanation of illustration: Ichimoku Indicator: Tenkan-sen – red line. Kijun-sen – blue line. Senkou span a – light brown dotted line. Senkou span B – light purple dotted line. Chikou span – green line. Bollinger Bands Indicator: 3 yellow lines. MACD: A red line and a histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 01 Apr 2019 03:47 PM PDT 4-hour timeframe The amplitude of the last 5 days (high-low): 86p - 104p - 115p - 164p - 159p. Average amplitude for the last 5 days: 126p (122p). On Monday, April 1, the British pound is recovering and has already completed the critical line. The index of business activity in the manufacturing sector Markit UK was at 55.1, which was significantly higher than the forecast value, which, perhaps, supported the British pound. The rest of the news from Britain still has a "black" color. Today it became known how much Brexit has cost the UK every day. According to calculations of one of the largest investment banks, the country is about to lose 600 million pounds on the day. This figure may significantly increase in case of a disordered Brexit due to an even greater depreciation of the pound sterling. Meanwhile, Britain's Ministry of Finance Head Elizabeth Truss said that the country is ready to leave the EU without a "deal". The minister also believes that it will be much worse if Brexit does not take place in the end. Well, it was known a few months ago that both sides were preparing for a "divorce" without an agreement. However, both sides still want to avoid the "hard" scenario, and the UK should want this more. On the technical side, a price rebound from the critical line may trigger a resumption of the downward movement. At the same time, complete uncertainty in the Brexit process can cause absolutely any and, most importantly, unpredictable market reaction. Therefore, a hike upwards also needs to be prepared. Trading recommendations: The GBP/USD currency pair has started to adjust, and this correction looks illogical. Short positions are still relevant, but to open them with the target of 1.3013, you should wait for the MACD indicator to turn down or rebound from the Kijun-Sen line. Buy orders are recommended to open in small lots, if the bulls manage to overcome the critical line with targets at 1.3207 and 1.3262. However, we still would not recommend that you count on a strong upward movement. In addition to the technical picture, one should also take into account the fundamental data and the time of their release. Explanation of illustration: Ichimoku Indicator: Tenkan-sen – red line. Kijun-sen – blue line. Senkou span a – light brown dotted line. Senkou span B – light purple dotted line. Chikou span – green line. Bollinger Bands Indicator: 3 yellow lines. MACD: A red line and a histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| April 1, 2019 : EUR/USD intraday technical levels and trade recommendations. Posted: 01 Apr 2019 09:52 AM PDT

On January 10th, the market initiated the depicted bearish channel around 1.1570. The bearish channel's upper limit managed to push price towards 1.1290 then 1.1235 before the EUR/USD pair could come again to meet the channel's upper limit around 1.1420. Shortly after, the recent bearish movement was demonstrated towards 1.1175 (channel's lower limit) where significant bullish recovery was demonstrated on March 7th. Bullish persistence above 1.1270 enhanced further bullish advancement towards 1.1290-1.1315 (the Highlighted-Zone) which failed to provide adequate bearish pressure. On March 18, a bullish breakout attempt was executed above 1.1327 (the upper limit of the Highlighted-zone). This enhanced further bullish movement towards 1.1450 demonstrating a false bullish breakout above the upper limit of the depicted movement channel. On the other hand, On March 22, significant bearish pressure was demonstrated around 1.1380 leading to the current bearish decline towards 1.1220 then 1.1220. The short term outlook for EURUSD pair remains bearish towards 1.1170 and 1.1120. Bearish persistence below 1.1235 (Fibonacci 78.6%) is mandatory to pursue towards the next mentioned bearish targets. Otherwise, a bullish breakout above 1.1235 would initiate another bullish pullback towards 1.1280-1.1320 where a better SELL entry can be offered. Trade recommendations : Conservative traders should wait for abullish pullback towards 1.1280-1.1320 for a low-risk SELL entry. TP levels to be located around 1.1200, 1.1170 and 1.1120. SL to be located above 1.1350. The material has been provided by InstaForex Company - www.instaforex.com |

| April1, 2019 : GBP/USD approaching a confluence of supply levels to be watched Posted: 01 Apr 2019 09:28 AM PDT

On January 2nd, the market initiated the depicted uptrend line around 1.2380. This uptrend line managed to push price towards 1.3200 before the GBP/USD pair came to meet the uptrend again around 1.2775 on February 14. Another bullish wave was demonstrated towards 1.3350 before the bearish pullback brought the pair towards the uptrend again on March 11. A weekly bearish gap pushed the pair slightly below the trend line (almost reaching 1.2960) before the bullish breakout above short-term bearish channel was achieved on March 11. Bullish persistence above 1.3060 allowed the GBPUSD pair to pursue the bullish momentum towards 1.3130, 1.3200 then 1.3360 where the recent bearish pullback was initiated. Bullish persistence above 1.3250 was needed for confirmation of a bullish Flag pattern. However, significant bearish pressure was demonstrated below 1.3250 demonstrating a false bullish breakout above 1.3200 (the upper limit of the depicted bearish channel). Hence, the short term outlook turned to become bearish towards 1.3150 - 1.3120 where the depicted uptrend line failed to provide any immediate bullish support. By the end of last week, the price levels of 1.3020-1.3000 (the lower limit of the depicted movement channel) demonstrated significant bullish rejection which pushed the pair up towards the price zone of (1.3150-1.3160) where the backside of the broken uptrend line is located. Trade Recommendations: Intraday traders can have a valid SELL entry around the upper limit of the movement channel as well as the backside of the broken uptrend line (1.3160-1.3180). SL to be located above 1.3200. TP levels to be located around 1.3100 and 1.3020. The material has been provided by InstaForex Company - www.instaforex.com |

| Elliott wave analysis of GBP/JPY for April 1, 2019 Posted: 01 Apr 2019 08:58 AM PDT

The break above above 145.50 has confused our bearish outlook. At this point, we have to take a neutral stand and await a more clear count before engaging again. A break above resistance at 146.47 will shift the short-term bias towards the upside for a new rally towards 148.50 and 151.50 as the next targets. On the other hand, a break below 143.79 will confirm more downside pressure towards 141.00 before a corrective low should be in place. R3: 148.03 R2: 147.38 R1: 146.47 Pivot: 145.55 S1: 145.13 S2: 144.85 S3: 144.36 Trading recommendation: Our stop at 145.50 was hit for a loss and we has taken a neutral stand for now. The material has been provided by InstaForex Company - www.instaforex.com |

| Elliott wave analysis of EUR/JPY for April 1, 2019 Posted: 01 Apr 2019 08:51 AM PDT

EUR/JPY has broken above minor resistance at 124.74, which indicates the corrective consolidation from 123.82 is still developing and likely will cause a minor pop to 125.27 before turning around again towards the downside. It will take an unexpected break above resistance at 126.18 to shift the bias towards the upside again. R3: 125.27 R2: 129.95 R1: 124.74 Pivot: 124.56 S1: 124.12 S2: 123.75 S3: 123.37 Trading recommendation: We are short EUR from 124.25 with our stop placed at 126.20. The material has been provided by InstaForex Company - www.instaforex.com |

| The task of the bulls EUR/USD is to keep 1.1180 Posted: 01 Apr 2019 08:22 AM PDT The general fundamental background of Monday is very different from the fundamental picture of Friday. The panic subsided, risk appetite increased, the configuration of many currency pairs has changed. Events of a global nature still have priority over macroeconomic reports – and this fact today actually "saved" the single currency from the next downward turn. Despite the extremely weak data on the growth of European inflation, the EUR/USD pair showed modest corrective growth, following external fundamental factors. Inflation in the eurozone has indeed disappointed. After a slight increase in February, the consumer price index returned to the January level, that is, at 1.4%. Core inflation fell even more than forecasts: most experts expected a decline to 0.9% (from the level of 1%), while the release came out at 0.8%. This is the weakest indicator growth rate since April 2018. On the one hand, this result did not come as a surprise after the extremely disappointing data from Germany. Let me remind you that in January, the German consumer price index in annual terms showed a positive trend (+ 1.5%), after a strong decline in January. However, in March, the indicators slowed down again, being at the level of 1.3%. European inflation actually repeats this trajectory. On the other hand, today's release served as another reminder that the European Central Bank will not soon recall tightening monetary policy, at least not this year. But if such rates of reduction in core inflation continue to persist, then the option of mitigating the parameters of monetary policy is not excluded. However, the market actually ignored the most important release, focusing today on larger-scale events. First, there are prospects for ending the trade war between the United States and China. For several weeks, the parties remained silent, which provoked rather alarming rumors about the failure of the negotiation process. But at the weekend, it became known that Beijing did not renew the effect of retaliatory duties on American goods (namely, cars and automotive components from the United States at a rate of 25%), thereby extending the "pause" in effect from January 1. This suggests that China still intends to find a compromise with Washington because such a significant step was made on the eve of the next round of talks to be held this week in the US capital. The experts also noted the fact that representatives of the Middle Kingdom responded quickly responded to the concerns of the American side about the prospects for the negotiation process. There is another example of a "curves" on the part of Beijing. Thus, the US authorities have repeatedly demanded that the government of the People's Republic of China limit the turnover of fentanyl - the strongest opioid analgesic, which is usually used in medicine as an anesthetic. Americans have long complained about the fact that China is the largest supplier of fentanyl to the US market, while this drug causes addiction, which often leads to an overdose, and often – to death. This issue, which has little to do with the trade war, was discussed for a long time and was resolved unexpectedly this week: just before the next round of China-US negotiations. The Chinese have significantly tightened control over the turnover of fentanyl and its derivatives – in fact, meeting the demands of the Americans. In other words, traders once again had the hope of concluding a broad trade deal that would put an end to a trade war and — perhaps — slow the decline of the global economy. This fact weakened anti-risk sentiment and halted the growth of the dollar, which gained momentum last week. In addition, the single currency is closely monitoring the pound, or rather – for Brexit. Tonight in the British Parliament will be held "signal voting", the results of which will allow understanding – whether soft Brexit is real in principle or not. A considerable number of rumors proliferate around this topic, most of which, surprisingly, is positive. Thus, according to one of the versions, during today's vote, Labor can support the so-called "Single Market Amendment 2.0". This amendment implies a "soft" version of Brexit and implies free movement in the region. If the interests of the Labor Party and the Conservatives converge on this option, then the chances for approval of the transaction will increase significantly in the near future. And although the market is already tired of being disappointed by the British Parliament, optimism over the pound today prevails. Partly due to this factor, the euro is also kept afloat, especially on the background of indecision of dollar bulls. Thus, all the factors listed above allow the EUR/USD pair to keep within the 12th figure, thereby maintaining the potential for corrective growth towards the middle line of the Bollinger Bands indicator on the daily chart, which corresponds to 1.1290. The task of the EUR/USD bears has not changed since last week: they need to break through the lower line of the Bollinger Bands (1.1180), thereby entrenched in the 11th figure. Only in this case, it will be possible to talk about a more large-scale movement down to the main support level of 1.10. The material has been provided by InstaForex Company - www.instaforex.com |

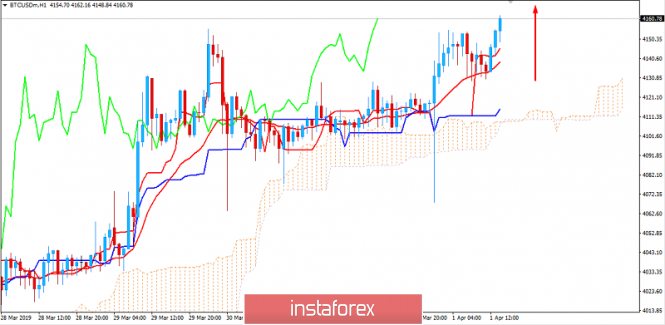

| BITCOIN Analysis for April 1, 2019 Posted: 01 Apr 2019 07:38 AM PDT Bitcoin managed to sustain the bullish momentum despite the volatile situation and sudden spikes along the way. The price consolidated for a certain period at around $4,000. However, with strong bearish rejection it managed to set clear momentum with upward pressure. The price is currently breaching above the recent high of $4,150 and expected to rally higher towards $4,250 resistance area without any further consolidation along the way. The dynamic level of 20 EMA, Tenkan and Kijun line have been carrying the price higher. BTC price is still able to push towards $4,250. The Chikou Span has also cleared above the price line area. BTC is likely to find support along the way and reinforce upward pressure in the market. As for the current price formation, the 3rd Wave formation is on the way and it is expected to reach $4,250 before it consolidates and corrects itself. As the price remains above $4,000, BTC is going to trade under the impulsive bullish momentum. SUPPORT: 3,800-80, 4,000 RESISTANCE: 4,250, 4,500 BIAS: BULLISH MOMENTUM: NON-VOLATILE

|

| Bitcoin analysis for April 01, 2019 Posted: 01 Apr 2019 07:05 AM PDT BTC has been trading upwards. The price tested the level of $4.125 with the strong momentum. We expect upward continuation.

According to the H4 time – frame, we found that there is the successful rejection of the 20-exponential moving average (yellow line), which is sign that buyers supporting the Bitcoin. ADX is reading is about 40 level, which suggests strong trend condition. Resistance levels are seen at the price of $4.159 and $4.212. Short-term support is seen at the price of $4.020. Trading recommendation: We are still holding long position from $4.070. Now, we moved our SL on breakeven so we got risk free position. Main targets are set at the price of $4.159 and $4.212. The material has been provided by InstaForex Company - www.instaforex.com |

| Analysis of Gold for April 01, 2019 Posted: 01 Apr 2019 06:48 AM PDT Gold has been trading sideways at the price of $1.295.00. The short-term trend is still bearish and we expect more downside in the next period.

According to the H4 time – frame, we found that price is trying to test the downward sloping 20 exponential moving average (yellow line) but so far without success. The ADX read of 25 is suggesting us that Gold is in the modest downward trend. Key resistance levels are seen at $1.295.50 and $1.300.00. Key short-term support is seen at the price of $1.280.80. Trading recommendation: We are neutral to bearish on the Gold. Watch for selling opportunities on the rally with target at $1.280.80. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR: Weak reports on manufacturing activity and inflation in the euro area did not hurt the euro Posted: 01 Apr 2019 06:47 AM PDT Surprisingly, the euro ignored very weak reports on manufacturing activity in the eurozone, as well as a slowdown in inflation. All this once again confirms the fact that the European Central Bank is acting in the right direction, keeping monetary policy at the current level, while continuing to stimulate the economy. According to the data, the PMI purchasing managers index for the manufacturing sector in Italy in March fell to the level of 47.4 points, which fully coincided with economists' forecasts. Back in February, the index was at the level of 47.7 points. In France, the same index also moved below the level of 50 points and amounted to 39.7 points, while economists had expected this figure to be 49.8 points. Back in February, the PMI for the manufacturing sector was 51.5 points. A value above 50 points indicates an increase in activity, and lower - a slowdown. The manufacturing sector in Germany continues to experience a downturn, and the situation in March deteriorated even further. According to the data, PMI Purchasing Managers Index for Germany's manufacturing sector in March dropped to 44.1 points, while it was forecast at 44.7 points. In February, the index was 47.6 points. As for the eurozone as a whole, according to the Markit agency report, the PMI purchasing managers' index for the manufacturing sector of the eurozone in March was 47.5 points, while it was predicted to be 47.6 points. Back in February, the index was 49.3 points. Markit said that the decline was due to the decline in new orders and export sales. Not without uncertainty around Brexit, as more and more companies reported a decrease in demand associated with Brexit and foreign trade. As noted above, a weak report on inflation was also not news for the market. According to the EU Statistics Agency, the annual inflation in the eurozone in March continued to fall and move away from the target level of the European Central Bank by about 2.0%. Thus, consumer prices in the eurozone in March this year increased by 1.4% compared with the same period last year. In February, an increase of 1.5%. Core inflation, which ignores volatile categories, has fallen even further. In March, it grew by only 0.8% after rising by 1% in February. As for the technical picture of the EURUSD pair, the uncertainty around the further direction remains. Bulls have problems with resistance 1.1250, a breakthrough of which will return the trading tool to levels 1.1270 and 1.1300. With the scenario of further falling of the euro along the trend, especially after such weak data, a break of support at 1.1210 will only increase pressure on risky assets, which will lead EURUSD to the area of 1.1170 and 1.1120 lows. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 01 Apr 2019 06:46 AM PDT To open long positions on GBP/USD you need: Buyers have reached a large resistance of 1.3119, which I paid attention to in my morning review. In the second half of the day, breakdown and consolidation above the range of 1.1319 are required, which will lead to a new demand for the pound and an update of the highs of 1.3162 and 1.3212, where I recommend fixing the profits. In the case of a downward correction scenario, the support will be at 1.3061. You can also look at the long positions on the rebound from the minimum 1.3011. To open short positions on GBP/USD you need: The bears showed themselves after the test of resistance 1.3119, to which I paid attention in the morning. Now, the sellers' first goal is to return to the support area of 1.3061, which was formed in the morning. Its breakdown will lead to a larger downward movement in the area of minimum 1.3011, where I recommend fixing the profits. When the growth scenario is above the high of 1.3119, it is best to rely on new sales to rebound from the resistance of 1.3162. Indicator signals: Moving Averages Trade is conducted above 30-day and 50-moving averages, which indicates the formation of an upward correction in the pound. Bollinger bands In the case of a decline, support will be provided by the average Bollinger Bands indicator around 1.3040. Description of indicators

|

| Posted: 01 Apr 2019 06:46 AM PDT To open long positions on EURUSD you need: Buyers of the euro attempted to rise above the resistance of 1.1240, but weak reports indicating a drop in manufacturing activity in various eurozone countries limited the upside potential. For the bulls, a repeated return and consolidation above the level of 1.1240 is required, which will open up the possibility of further correction to the highs of 1.1269 and 1.1294, where I recommend fixing the profits. In the case of a further decline in the euro in the second half of the day, which may occur against the background of a good report on US retail, it is best to return to long positions on a false breakdown from the lower border of the side channel 1.1211 or on a rebound from a minimum of 1.1176. To open short positions on EURUSD you need: The bears coped with the task for the first half of the day and formed a false breakdown in the area of resistance 1.1240. While trading is below the 1.1240 range, pressure on the euro will continue, and the bearish target will again be at least around 1.1208, a breakthrough of which will lead to a larger EUR/USD sale to the support area of 1.1176, where I recommend fixing the profits. In the scenario of EUR/USD returns to the resistance level of 1.1240 in the second half of the day, it is best to consider short positions on a rebound from the maximum of 1.1269 and 1.1294. Indicator signals: Moving Averages Trade is conducted in the area of 30-day and 50-medium moving, which indicates the lateral nature of the market. Bollinger bands An upward correction on the euro will be formed in case of a break of the upper border of the Bollinger Bands indicator in the region of 1.1250. A break of the lower border in the 1.1211 area will lead to a new wave of EUR / USD decline. Description of indicators

|

| EUR and GBP: The UK has a little less than two weeks. US dollar growth may slow down Posted: 01 Apr 2019 06:46 AM PDT The British pound fell against the US dollar on Friday, while the European currency continued to trade in a narrow side channel. The downward movement on the pound was resumed after it became known that the British Parliament voted against the Brexit agreement proposed by Theresa May - 344 votes against, 286 votes in favor. This means that the chance of a British exit from the EU without a deal has increased significantly. Now the UK will have to formulate an alternative proposal by April 12. Already on April 10 will appoint another EU summit, where European leaders will discuss further actions related to Brexit. The more uncertainty will hang with Brexit, the more pressure will be exerted on the pound. Weak data on the US economy, which came out on Friday afternoon, did not allow the US dollar to continue its upward trend against the European currency. According to the report, US consumers increased their spending quite slighty in January 2019, indicating caution that households save at the beginning of the year. According to the US Department of Commerce, personal expenses of Americans in January increased by only 0.1% compared with the previous month, while in December there was a decrease in expenses by 0.6%. Revenues rose a little more. The report indicates that personal incomes of American households in February increased by 0.2%, after falling by 0.1% in January of this year. Economists had forecast growth in spending in January by 0.3%, while revenue growth in February by 0.2%. The weak report on the slowdown in the PMI Purchasing Managers Index Chicago also did not appeal to buyers of the dollar. According to the data, in March of this year, the index dropped to 58.7 points from 64.7 points in February. I recall that values above 50 indicate an increase in activity. The report on the growth of sales of new homes in the United States did not support the dollar, although it indicated a slight recovery in the market after a long period of weakness. According to the US Department of Commerce, sales of single-family homes on the primary housing market in February 2019 increased by 4.9% to 667,000 homes per year. Economists had expected sales of 620,000. Compared to the same period in the previous year, sales grew by 0.6%. The speech of the representative of the Federal Reserve Robert Kaplan on Friday evening was left unattended by traders. Kaplan said he did not expect a rate hike in 2019, but his opinion may change, as the main thing is that the Fed should show patience and flexibility. Currently, Fed policy is moderately soft. The representative of the Fed also noted that if GDP growth is below potential, then inflation may continue to slow down, and this will necessarily affect the timing of further increases in interest rates. The material has been provided by InstaForex Company - www.instaforex.com |

| USD/JPY analysis for April 01, 2019 Posted: 01 Apr 2019 06:22 AM PDT USD/JPY did sell off after the bad data from Retail sales m/m. USD/JPY did test of the 110.81. Anyway, we expect upward movement and potential shakeout of the sellers.

According to the H4 time – frame, we found that short-term trend is bullish. The bad data from Retail Sales m/m, in our opinion only shacked the weak traders but we expect the trend to resume. The ADX is reading is above 30, which is sign that trend is strong and that you should watch for buying opportunities on the pullbacks. Additionally, there is confirmed inverted head and shoulders pattern, which is another strong sign of the potential bullish movement. Resistance levels are seen at the price of 111.70 and 111.90. Support levels are seen at 110.80 and 110.54. Trading recommendation: We are long USD/JPY from 110.95 and with targets at 111.70 and 111.90. Protective stop is placed at 110.50. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 01 Apr 2019 05:49 AM PDT 4-hour timeframe Technical details: The upper linear regression channel: direction - up. The lower linear regression channel: direction - sideways. Moving average (20; smoothed) - down. CCI: -73.5422 The GBP/USD currency pair began to adjust after the collapse last week. As for the prospects of the pound sterling, there is a new date for it X – April 12. On this day, the UK officially has to leave the EU in a "hard" scenario. But there are several "but". First, the UK together with the EU can postpone the release dates again. Then Britain will have to participate in the elections to the European Parliament, but these are trifles. Secondly, in theory, the British Parliament can vote for Theresa May's "deal" at least every day. It would not be more absurd than three rejections of the same agreement. Thus, three full months of 2019 have passed, and "things are still there". We still believe that in the current conditions, there is only one way at the pound sterling – down. More questions are raised by the fact why the pound is not lower than 1.2500? Perhaps market participants are still hoping that the parties (London and Brussels) will still be able to avoid a "tough divorce." However, the chances of this option are melting every day. There were also rumors that a new series of dismissals of ministers disagreeing with the policy of Theresa May could follow in the British Parliament. In addition, there is information that Theresa May is under pressure from the "tough" Brexit scenario. Nearest support levels: S1 - 1.3000 S2 - 1.2939 S3 - 1.2878 Nearest resistance levels R1 - 1.3062 R2 - 1.3123 R3 - 1.3184 Trading recommendations: The pair GBP/USD has started an upward correction. Since the trend is downward, traders are advised to wait for the color of 1-2 bars in blue and trade again for a fall with targets at 1.3000 and 1.2939. Long positions will become relevant only after overcoming the moving average by traders. In this case, the tendency for the instrument to change again is upward, but from a fundamental point of view, there is little reason for this option. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanations for illustrations: The upper linear regression channel is the blue lines of the unidirectional movement. The lower linear channel is the purple lines of the unidirectional movement. CCI is the blue line in the indicator regression window. The moving average (20; smoothed) is the blue line on the price chart. Murray levels - multi-colored horizontal stripes. Heikin Ashi is an indicator that colors bars in blue or purple. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 01 Apr 2019 05:49 AM PDT 4-hour timeframe Technical details: The upper linear regression channel: direction - down. The lower linear regression channel: direction - down. Moving average (20; smoothed) - down. CCI: -56.6422 On Monday, April 1, the currency pair EUR/USD stopped falling. It stopped near its minimum values for a year and a half. Now, the pair is at the fork of two roads. One direction – up, which will be justified from a technical point of view, since the area of 1.1200 – 1.1270 has been tested for strength several times. The second direction is the breakthrough of this area and further down, up to price parity. Unfortunately, the fundamental component is not on the side of the euro. More precisely, there are some positive moments, but market participants do not react to them, or react, but very restrained. On the first trading day of the week in the eurozone, the publication of a preliminary consumer price index for March is scheduled, and in the States there will be reports on retail sales and business activity indices in the sectors of production and services of ISM and Markit. Both inflation in the EU and business activity indices in the US may disappoint. Thus, today traders will have something to pay attention to. From a technical point of view, the intraday has now begun a round of correction, which at the moment looks like a side one. Nevertheless, it can turn into ascending. In any case, while Heikin Ashi is directed up, it is not recommended to open new short positions. Nearest support levels: S1 - 1.1230 S2 - 1.1200 S3 - 1.1169 Nearest resistance levels: R1 - 1.1261 R2 - 1.1292 R3 - 1.1322 Trading recommendations: The EUR/USD currency pair has begun to adjust. Thus, it is now recommended to wait for the completion of this correction and the Heikin Ashi indicator turning down, then short positions with targets at 1.1200 and 1.1169 will become relevant. Buy positions are recommended to be considered no earlier than fixing the pair above the moving average line with targets at 1.1292 and 1.1322. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanations for illustrations: The upper linear regression channel is the blue lines of the unidirectional movement. The lower linear regression channel is the purple lines of the unidirectional movement. CCI - blue line in the indicator window. The moving average (20; smoothed) is the blue line on the price chart. Murray levels - multi-colored horizontal stripes. Heikin Ashi is an indicator that colors bars in blue or purple. The material has been provided by InstaForex Company - www.instaforex.com |

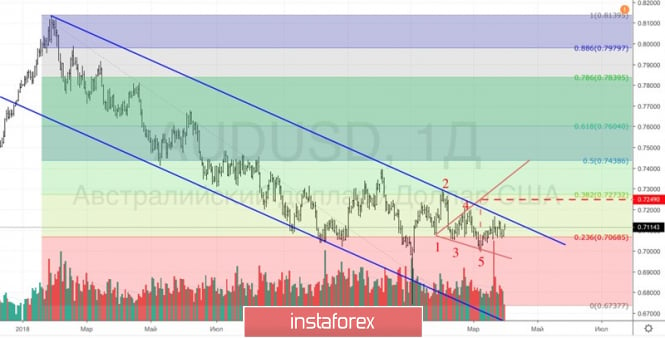

| Will the Reserve Bank scare the "Australian"? Posted: 01 Apr 2019 05:13 AM PDT Looking at the unexpected growth of the March business activity in the manufacturing sector of China above the critical level of 50, the Australian dollar came to its senses. The slowdown of the economy of the Middle Kingdom and the GDP of the Green continent in the second half of 2018 were the main drivers for the weakening of the Aussie. If Beijing puts the country on the path of V-shaped recovery with the help of incentives, the bulls at AUD / USD have good chances to develop an attack. At the same time, the meeting of the Reserve Bank, statistics on retail sales, business activity, the real estate market, as well as news about relations between the USA and China, allow the Australian dollar to claim the most interesting currency for the first week of April. While US stock indexes are marked by the best quarter since September 2009 and the best start since 1998, the volatility of financial markets remains low. And since the market conditions for raw materials are favorable for the currencies of the countries of exporters, it is rather unexpected to see Aussie among the outsiders. The divergence in the dynamics of AUD / USD and iron ore prices, one of the key components of the sovereign exports of the Green continent, suggests that the "Australian" is an undervalued currency. In such circumstances, encouraged by the devaluation and the "bullish" commodity market, exports should go up. Alas, the weakness of external demand does not allow him to spread his wings. Dynamics of AUD / USD and iron ore prices

Canberra problems are not limited to a shrinking market. The Middle Kingdom makes a high demand for Australian real estate, and the slowdown of its economy contributes to falling prices. The population is starting to spend less and save more in order to purchase cheaper apartments, which translates into a slowdown in GDP and inflation. As a result, rumors of a decline in the basic interest rate of RBA are growing by leaps and bounds. It would be beneficial for the Central Bank to support them, since otherwise, an external background favorable for carry-traders could increase the demand for the Australian dollar. In this regard, investor attentiveness to the April meeting of the Reserve Bank is quite appropriate. Firstly, in March, Philip Lowe, saying that the cash rate could be either increased or lowered, dropped Aussie. Secondly, at the end of the first month of spring, colleagues from RBNZ even knocked out their currency with the help of a phrase about easing monetary policy under the influence of increased international risks. Concerns about the repetition of the New Zealand scenario are holding back the attacks of the bulls at AUD / USD. In my opinion, if Beijing and Washington, nevertheless, would able to sign an agreement on ending the trade war, and the economy of the Middle Kingdom begins to recover; the chances of a gradual strengthening of the Australian dollar will grow. Much will depend on the position of his American namesake. When both the White House and the Fed are interested in devaluation, it is difficult for the market to buy the USD index. Technically, the "bulls" breakthrough on AUD / USD of the upper border of the downward long-term trading channel will increase the risks of implementing the first target of the "Wolfe Waves" pattern. It corresponds to the mark of 0.725. AUD / USD daily chart

|

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment