Forex analysis review |

- Bitcoin analysis for May, 31.2019

- Analysis of Gold for May, 31.2019

- GBP/USD analysis for May, 31.05.2019

- GBP/USD. May 31. Results of the day. Brexit party can seize power in Britain in case of dissolution of Parliament

- EUR/USD. May 31. Results of the day. The fall of the euro slows down in the long run. Possible reversal of the global trend

- GBP/USD: plan for the American session on May 31. Pound updates monthly lows

- EUR/USD: plan for the American session on May 31. Euro buyers coped with the level of 1.1143 and now under 1.1170

- Euro opens the card

- Euro risks falling to $1.10

- Technical analysis of EUR/USD for May 31, 2019

- Technical analysis of AUD/USD for May 31, 2019

- Review of oil on May 31. Donald Trump said, "dialogue with Iran is possible, but first the country must abandon nuclear weapons"

- Trading recommendations for the EURUSD currency pair - prospects for further movement

- Consolidation after the fall: cryptocurrencies can grow

- Trading Plan for EUR/USD pair on 05/31/2019

- Wave analysis of EUR / USD and GBP / USD for May 31. The idea of the Labor Party about the referendum is not supported by

- EUR and GBP: Growth prospects for the euro and the pound are very vague

- Trade wars will lead the world economy into a new recession: We expect a continuation of the fall in oil prices and the growth

- Trading recommendations for the GBPUSD currency pair - prospects for further movement

- Burning forecast EURUSD 05/31/2019

- Review of EUR / USD and GBP / USD from 05/31/2019: Great standing still

- Bitcoin. 9000 USD turned out to be very expensive for bitcoin buyers

- GBP/USD: plan for the European session on May 31. The bears did not have the strength to break 1.2603

- EUR/USD: plan for the European session on May 31. The upward correction of the euro requires a breakdown of 1.1143

- Indicator analysis. Daily review as of May 31, 2019 for EUR / USD and GBP / USD currency pairs

| Bitcoin analysis for May, 31.2019 Posted: 31 May 2019 10:55 AM PDT BTC has been trading sideways at the price of $8.364. Anyway, we fund strong down break in the backgorund and the movement that we got now looks very corrective. Watch for selling opportunities.

White lines – bear flag White rectangle- strong resistance Red horizontal line – swing low (support) After the strong down break, we found that corrctive structure, which is sign that we might expect downside continuation. Our advice is to watch for selling opportunities on the potential break of the bear flag. Downward reference is set at the price of $8.000. Resistance levels are set at $8.435 and $9.077. Stochastic went into overbought condition and BTC did setup for nice drop. The material has been provided by InstaForex Company - www.instaforex.com |

| Analysis of Gold for May, 31.2019 Posted: 31 May 2019 10:48 AM PDT Gold did extacly how we planned yesterday. Our targets from yesterday were met. Gold is in strong upward momentum and you should only focus on buying opportuntiies on the pullbacks.

Red rectangle – target 1 Red rectangle- target 2 Strong upward momentum on the Gold. The price did break the resistance level at $1.284, which was the clear sign of the upward continuation. Our advice is to watch for potential upward contination but on the pullbacks. Intraday support is seen at the price of $1.298. Upward references are seen at the price of $1.310 and $1.322. Stochastic made new momentum high, which is another sign of the strong upward momentum. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD analysis for May, 31.05.2019 Posted: 31 May 2019 10:34 AM PDT GBP/USD has been trading upwards as we expected. The price did break the supply trendline and downward channel, which is sign of the strength. Watch for bull flag to confirm further upside.

White lines – downward channel White rectangle- key support Red horizontal line – Important resistance We found strong break of the downward channel in the background. This is strong confirmation of the future rally. Also, the double bottom is confirmed on the H1 time-frame, which is another sign of the strength. The important swing high is broken at 1.2625 and you should watch for buying opportuntiies. The upward references is set at 1.2700. Downward references are set at 1.2600 and 1.2557. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 31 May 2019 08:17 AM PDT 4-hour timeframe The amplitude of the last 5 days (high-low): 86p – 81p – 54p – 59p – 60p. The average amplitude over the last 5 days: 68p (72p). As for the pound/dollar pair, the bears did not even want to reduce the "dollar" positions at the end of the month, so great is the desire to sell the pound further. Well, given the serious political crisis in the UK, the resignation of Prime Minister May, the complete uncertainty with the prospects of Brexit, traders can understand. At the end of May, the pound fell to the US dollar by 4.5 cents. The pair has approached the 1.5-year lows, and if the situation in Britain does not improve in the near future, it risks the continuation of the fall. Only the early selection of a new Prime Minister and the unity of the Parliament on Brexit (current or new composition) can save the pound. Traders need clarity on the question: what awaits the country in the future? We are talking not only about private traders but also about major institutional players, banks and Central banks. It is no secret that the pound is used by many large financial institutions as the currency of reserve storage. Given how much the pound fell over the past three years, the share of reserves in the pound declined. It can be reduced in the future, provoking even greater collapses of the British currency. Thus, the Parliament urgently needs to elect a new Prime Minister and begin to agree on the final version of Brexit or re-elect parliamentarians. Given the sharp drop in the popularity of the Labor party and the Conservatives, it is possible that Nigel Farage's party will win in the new parliamentary elections. Trading recommendations: The pound/dollar currency pair may start the correction at the end of the month, but has not yet begun. If the MACD indicator turns up, it is recommended to reduce short positions and wait for the correction to be completed for new sales of the pound sterling. Buy orders can be considered very small lots not earlier than fixing the price above the Kijun-Sen line with the first goal of the Senkou Span B line. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanation of illustration: Ichimoku Indicator: Tenkan-Sen – red line. Kijun-Sen – blue line. Senkou Span A – light brown dotted line. Senkou Span B – light purple dotted line. Chinkou Span – green line. Bollinger Bands Indicator: 3 yellow lines. MACD Indicator: A red line and a histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 31 May 2019 08:17 AM PDT 4-hour timeframe The amplitude of the last 5 days (high-low): 38p – 29p – 39p – 49p – 27p. Average amplitude over the last 5 days: 36p (47p). As we expected in the evening review yesterday, the euro/dollar pair began to adjust on the last trading day of the week and month. Correction – purely technical, associated with the desire of traders to fix part of the profit at the end of the month and week. No strong data from Europe has been received today to provoke the strengthening of the European currency. America received data on personal expenses and income of Americans in April. Both indicators exceeded the forecast values, so it would be more logical to see the strengthening of the US dollar. However, as we have already noted, the desire of traders to close some short positions was stronger. Thus, the European currency closes the month of May near the lows of the year. In terms of the Foundation, we can sum up some results: Donald Trump's trade wars have a very indirect impact on the EUR/USD pair, the problems of the eurozone are more important in the eyes of traders, weak statistics from America in recent weeks only pressed the US currency for a while. Thus, in general, we can say that the mood of traders remains bearish. Next month, we expect to overcome the lows of this month with a further fall of the euro. We also note that the average volatility for the last 5 days was 36 points, which indicates not too much desire of bears to sell the pair at such low price levels. Theoretically, the 1.11 point can become a reversal for the pair. However, the fundamental component gives a high probability for the continuation of the formation of the downward trend. Trading recommendations: The pair EUR/USD started to adjust at the end of the month. Thus, if the pair remains below the critical line, then on Monday, it is recommended to wait for the MACD indicator to turn down and resume selling the euro with the target of 1.1122. Long positions can be considered if traders manage to gain a foothold above the critical line. In this case, the nearest target for bulls will be the resistance level of 1.1194 (very short target). In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanation of illustration: Ichimoku indicator: Tenkan-Sen – red line. Kijun-Sen – blue line. Senkou Span A – light brown dotted line. Senkou Span B – light purple dotted line. Chinkou Span – green line. Bollinger Bands indicator: 3 yellow lines. MACD indicator: A red line and a histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD: plan for the American session on May 31. Pound updates monthly lows Posted: 31 May 2019 08:17 AM PDT To open long positions on GBP/USD, you need: Problems with Brexit and the increase in the probability of the UK leaving the EU without an agreement led to a decrease in the British pound again, which indicates a continuation of the downward trend. However, the fall in GBP/USD in the first half of the day was restrained by the level of 1.2560, to which I paid attention in my morning review. At the moment, it is best to return to purchases after a repeated test and the formation of a false breakdown at a minimum of 1.2560 or to rebound from a larger level of 1.2500. The main task of the bulls will be to update the maximum of 1.2623 and consolidate on it. To open short positions on GBP/USD, you need: The bears reached the next support level of 1.2560, where the expected profit-taking began at the end of the month. At the moment, short positions can be returned after updating THE resistance of 1.2623, provided that a false breakdown is formed, or to rebound from a maximum of 1.2686. The main purpose of the bears will be a breakout and consolidation below 1.2559, which will keep the downward trend in pair and lead to a test of 1.2500. Indicator signals: Moving Averages Trading is below 30 and 50 moving averages, which indicates a return to the market of sellers pound. Bollinger Bands The pound growth in the second half of the day will be limited by the upper limit of the indicator around 1.2625. Description of indicators

|

| Posted: 31 May 2019 08:17 AM PDT To open long positions on EURUSD, you need: Despite the weak inflation in Germany, euro buyers managed to return to the resistance level of 1.1143 in the first half of the day, which I mentioned in my morning review. The next target is the area of 1.1170, where today I recommend fixing the profits. When the decline scenario is supported by 1.1143, it is best to take a closer look at purchases after updating the minimum of 1.1117. To open short positions on EURUSD, you need: Weak data on Germany was calmly received by traders, once again emphasizing the likely slowdown in economic growth. Bears will manifest themselves only after the update of the maximum of 1.1170, from where I recommend to open short positions under the condition of forming a false breakdown. You can immediately sell the euro to rebound from a higher level of 1.1196. The main task of sellers in the afternoon will be the return under the support of 1.1143, which will keep the market in a downward trend. Indicator signals: Moving Averages Trading is conducted above 30 and 50 moving averages, which indicates the formation of a correction in the market. Bollinger Bands In the event of a decline in the euro in the afternoon, the support will be provided by the average border of the indicator around 1.1143. Description of indicators

|

| Posted: 31 May 2019 08:17 AM PDT The single European currency fell against the US dollar for four consecutive months and four of the last five days, but managed to do the main thing – to stay within the trading range of 1.113-1.1265. Despite disappointing statistics on German retail sales (-2% with a forecast of +0.4% m/m) and inflation (+1.4% with a forecast of +1.6% y/y), the bulls managed to counterattack on EUR/USD at the end of spring. Of course, one of the reasons for the growth of the pair was the profit taking on short positions, however, it is possible that the market's attention switched to the June meeting of the ECB. The European Central Bank promised to reveal the details of the long-term refinancing program in early summer. The main question – at what rates will the money be provided? Most experts surveyed by Bloomberg believe that under -0.2% and below. However, will this suit borrowers? If we were talking about -2%, then at 1.5% margin, banks would subsidize their customers investing in the real sector of the economy. At the same time, the ECB could afford to raise the rate on deposits, thus attracting new depositors. As a result, LTRO would have a better chance of becoming a more effective program than QE. Neither the American, nor the Japanese, nor the European programs of quantitative easing of special laurels didn't gain. Forecasts of interest rates on LTRO Of course, any hint of the ECB to raise rates can be perceived as a "bullish" signal for the euro. Bloomberg experts expect that the Central Bank will take such a step not earlier than April 2020. If expectations shift to an earlier period, EUR/USD quotes will soar upwards. The governing board needs to be very careful, because it is well aware that the revaluation will block the oxygen and not so bright inflation. The slowdown in consumer prices in Germany in May from 2% to 1.4% y/y indicates that the April surge in CPI was a temporary phenomenon. It seems that the "doves" of the ECB is right: companies absorb rising wages by reducing profits. No one wants to raise prices and lose their market share. "Bulls" on the euro from this is not easier. In 2018, they entered with optimism, but the US-China trade war almost sent the German economy into recession in the second half of last year. At the beginning of 2019, optimism returned due to the Fed's desire to make a long pause in the process of normalizing monetary policy and belief in the imminent end of the trade war. Alas, but May made its own adjustments. The mutual exchange of duties between Washington and Beijing returned uncertainty to the markets and worsened the prospects of the export-oriented economy of the currency bloc. It is unlikely until the end of June, when the meeting of Donald Trump and Xi Jinping is to take place at the G20 summit in Japan, the situation will become clearer. Technically, the inability of the EUR/USD bears to storm support at 1.113 is the first sign of their weakness. In order to seize the initiative, they need to raise the pair's quotes above 1.12 and 1.1265. As a result, the "expanding wedge" reversal pattern will be activated. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 31 May 2019 06:14 AM PDT What is happening on Forex causes a feeling of deja vu more and more. The beginning of this year was marked by a sharp change in the tone of the Fed statements, which increased the risk of breaking the uptrend in USD. However, the "dovish" rhetoric of other leading central banks sent the greenback competitors to the knockdown already in February. The slowdown in the growth of the European economy includes the reduction in external demand as a reason, knocked on the ground under the feet of EUR/USD bulls in March. Only in April had they began to recover as it turned out that in May, it was still too early to put an end to the trade wars of Washington and Beijing. Trade contradictions between the two largest economies in the world are still far from resolution and now, the main question is who will surrender first. Donald Trump is confident that the United States will cope with the PRC since it imports about five times more Chinese goods than the Middle Kingdom from America. While some analysts agree with this statement, others believe that it also simplifies the real state of affairs. According to an economist, Gary Shilling, the US president Donald Trump will not only win the seemingly endless trade war with China but will also improve the position of the United States in the long term. "Advantage and absolute power, as a rule, are in the hands of the buyer, not the seller. In this case, the buyer is the United States, and the Celestial is the seller", he said. It is assumed that for China, it will be difficult to find buyers for its consumer products if it loses the US market. Meanwhile, the greenback seems to care about how the trade relations between Washington and Beijing are developing. The US currency strengthened for the fourth month in a row. Despite the fact that the chances of interest rate cuts by the Fed are growing, and the yield curve of treasuries overturned, the demand for USD remains high, signaling an increased risk of a recession in the US. Of course, the Fed is well aware that revaluation is harmful for exports and inflation but there are always two currencies in any pair. The likelihood that the ECB will soon replace the "dovish" rhetoric with the "hawkish" one is extremely low. According to the latest survey of experts from Bloomberg, the regulator will increase the rate of deposits only by April 2020. At the same time, the May release on business activity in China's manufacturing sector indicates that the world's largest economy continues to slow down. This does not add optimism to the EUR/USD bulls. After the third breakdown of the level of 1.12 over the year, the conditions for a further weakening of the euro against the US dollar have developed. However, the downward movement stopped near the 1.11 mark. Not even the newly aggravated trade conflict between Washington and Beijing or the increased risks of implementing the "tough" Brexit scenario or the elections to the European Parliament became a catalyst for a stronger decline in the single European currency. Since April, the EUR/USD pair has been trading in the range of 1.1120 - 1.1260. The pair's exit beyond its borders will apparently depend on whether the United States and the Middle Kingdom can put an end to the trade war. It is possible that investors may proceed to a larger sale on the stock market in the event of a systematic escalation, which will lead to further growth of the greenback and weakening of the euro. "The EUR/USD pair is still holding above the level of 1.11, but the threat of updating the annual lows around 1.10 is becoming more and more real," said Westpac currency strategists. According to them, the reasons for the fall in the euro could be differences between the government of Italy and the EU, as well as weak data on inflation in the eurozone, which will be released next week. In addition, experts noted that investors again began to pay attention to the spread of two- and five-year bonds of the United States and Germany. "The returning importance of the spread to currency investors can only mean one thing - the risk of further reducing EUR/USD," believe at Westpac. The material has been provided by InstaForex Company - www.instaforex.com |

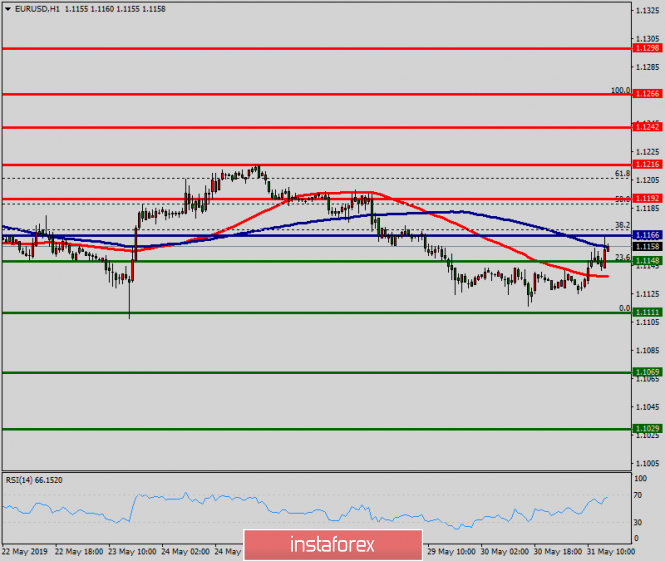

| Technical analysis of EUR/USD for May 31, 2019 Posted: 31 May 2019 06:08 AM PDT Pivot: 1.1166. The EUR/USD pair continues to move downwards from the level of 1.1192. Last week, the pair dropped from the level of 1.1192 to the bottom around 1.1111. Today, the first resistance level is seen at 1.1192 followed by 1.1216, while daily support 1 is seen at 1.1111. According to the previous events, the EUR/USD pair is still moving between the levels of 1.1192 and 1.1111; for that we expect a range of 81 pips. If the EUR/USD pair fails to break through the resistance level of 1.1111, the market will decline further to 1.1069. This would suggest a bearish market because the RSI indicator is still in a positive area and does not show any trend-reversal signs. The pair is expected to drop lower towards at least 1.1069 with a view to test the second support. However, if a breakout takes place at the resistance level of 1.1192 (major resistance), then this scenario may become invalidated. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of AUD/USD for May 31, 2019 Posted: 31 May 2019 06:05 AM PDT The Aussie (AUD/USD) pair is set above strong support at the levels of 0.7046 and 0.7168. This support has been rejected four times confirming the uptrend. The major support is seen at the level of 0.7046, because the trend is still showing strength above it. Accordingly, the pair is still in the uptrend in the area of 0.7046 and 0.7168. The AUD/USD pair is trading in the bullish trend from the last support line of 0.7112 towards thae first resistance level of 0.7168 in order to test it. This is confirmed by the RSI indicator signaling that we are still in the bullish trending market. Now, the pair is likely to begin an ascending movement to the point of 0.7168 and further to the level of 0.7290. The level of 0.7389 will act as the major resistance and the double top is already set at the point of 0.7389. At the same time, if there is a breakout at the support levels of 0.7112 and 0.7046, this scenario may be invalidated. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 31 May 2019 04:54 AM PDT 4 hour timeframe There are a lot of factors affecting the price of all types of oil and in most cases, they are contradictory. For example, the US sanctions against Iran and Venezuela clearly reduce the supply on the oil market. The trade war between China and the States could potentially reduce energy demand. Oil reserves in America are growing, despite the record demand for gasoline among motorists since the holiday season began. Meanwhile, Donald Trump expressed his confidence that Iran wants to make a deal with the United States. Also, the US leader noted that the States are not going to change the existing regime in Iran. They just want to completely abandon the development of nuclear weapons. We believe that such a large number of factors only confuse all cards to traders. By and large, the price depends mainly on supply and demand. Moreover, whatever geopolitical risks are considered by the market, the price of oil will fall if demand is lower than supply. Official figures say that oil reserves in the United States are growing that makes all other factors to be secondary. Thus, we recommend that market participants now pay more attention to technical factors that clearly indicate a downtrend. The closest report on the change in crude oil reserves in the United States may change the current trend, as there are also prerequisites for a shortage of oil in the market, which clearly indicate a downtrend. he closest report on the change in crude oil reserves in the United States may change the current trend as there are also prerequisites for a shortage of oil in the market, which clearly indicates a downtrend. The closest report on the change in crude oil reserves in the United States may change the current trend as there are also prerequisites for a shortage of oil in the market. Trading recommendations: At the moment, the #CL tool is in a downward movement with the target support level of $53.57 per barrel. An upward turn of the MACD indicator will be a signal to reduce short positions and signal at least the beginning of the upward correction. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanation of the illustration: Ichimoku indicator: Tenkan-sen - the red line. Kijun-sen - the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dotted line. Chikou Span - green line. Bollinger Bands indicator: 3 yellow lines. MACD Indicator: Red line and histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading recommendations for the EURUSD currency pair - prospects for further movement Posted: 31 May 2019 03:50 AM PDT For the previous day, the euro / dollar currency pair showed the smallest volatility since Monday - 27 points, as a result of having the maximum convergence with the fulcrum and the subsequent slowdown. From the point of view of technical analysis, we see that after reaching the pivot point, which is already in the form of a range level of 1,1100 / 1,1120, there was a sharp slowdown with the formation of a clear cluster. Considering the trading chart in general terms, we see that the pulse of the impulse has not yet managed to overcome the reference point in the form of a range level, and so far this is reminiscent of a possible refinement, but theoretically we can face a temporary rearrangement of trading forces. The news background had statistics on the United States, where they published the second estimate of GDP for the first quarter, and, as expected, there was a slowdown in economic growth to 3.1%. At the same time, data on applications for unemployment benefits was published in the United States, where they waited for a reduction of applications by 10 thousand, as a result they received just 22 thousand, which, after all, supported the dollar. In Europe, most countries celebrated the "Day of the Ascension of the Lord", thereby trading volumes were reduced. On the information background, everything is unchanged, the UK & EU "divorce" process retains a log of ambiguity, thus investors are more restrained in their actions. Today, in terms of the economic calendar, we do not have any statistics for Europe. Only at the second half of the day, there will be data on personal expenses and incomes in the United States, where they expect growth of 0.3% and 0.2%. From the background information, we have only a statement by US President Donald Trump, who threatened Mexico that if within 10 days it does not stop the flow of migrants moving north, the US will impose duties on all goods. "On June 10, the United States will impose a 5 percent duty on all goods entering our country from Mexico, until such time as illegal immigrants entering our country through Mexico are stopped," wrote Trump, adding that duties will increase each month and by October 1, it will reach 25 percent, if "the problem of illegal immigration is not resolved". Perhaps, just this news indirectly won back on a pair of euro / dollar, from the resulting cluster. The upcoming trading week in terms of the economic calendar is extremely saturated with statistics and events, in comparison with the past week. If we select only events, then we have: the speech of the Fed Chairman, Mr. Powell; voting in the Parliament of the United Kingdom; ECB meeting followed by a press conference; Theresa May's resignation and possible receiver. I think we should not even say that we are waiting for an extremely volatile week. The most interesting events are displayed below ---> Monday, June 3 United States 17:00 MSK - Manufacturing PMI from ISM (May): Prev. 52.8 ---> Forecast 53.3 Tuesday, June 4 EU 12:00 MSK - Consumer Price Index (CPI) (y / y) (May): Prev. 1.7% ---> Forecast 1.4% United States 16:45 MSK - Speech by Fed Chairman Mr. Powell Voting in the Parliament of Great Britain under the Brexit Agreement Wednesday, June 5 EU 12:00 MSK - Producer Price Index (PPI) (y / y) (Apr): Prev. 2.9% ---> Forecast 3.0% EU 12:00 MSK - Retail Sales (YoY) (Apr): Prev. 1.9% United States 15:15 MSK - Change in the number of people employed in the non-farm sector from ADP (May): Prev. 275K ---> 190K forecast United States 17:00 MSK - Non-manufacturing Business PMI (PMI) from ISM (May): Prev. 55.5 ---> Forecast 56.0 Thursday, June 6 ECB meeting EU 14:45 MSK - ECB Monetary Policy Statement EU 15:30 MSK - ECB Press Conference Friday, June 7 United States 15:30 MSK - Change in the number of people employed in the non-agricultural sector (May): Prev. 263K ---> 190K forecast United States 15: 30msk. - Unemployment rate (May): Prev. 3.6% ---> Forecast 3.7% Theresa May's Resignation These are preliminary and subject to change. Further development Analyzing the current trading chart, we see that the accumulation we saw earlier has broken up, but after a small impulse, a slight slowdown began. I do not exclude that many traders have already flown into these positions, which, in principle, is not bad, but you should be aware that if this impulse took place in the form of a background, then its movement may be short-term and short-lived. For this reason, drag your feet and be prepared to take profits. If we consider short positions, the judgment remains the same as last time, we wait for a clear price fixing lower than 1,1100 and then we make an entry. Indicator Analysis Analyzing a different sector of timeframes (TF), we see that the indicators in the short term have changed from a downward interest to an upward interest, due to the current jump. Intraday and mid-term outlook and maintains a downward mood on the general background of the market. Weekly volatility / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation, based on monthly / quarterly / year. (May 31 was based on the time of publication of the article) The current time volatility is 31 points, if the prerequisites increase volatility due to the background. And if, of course, the quotation does not return back to the area of the cluster and it will remain there. Key levels Zones of resistance: 1.1180; 1,1300 **; 1.1440; 1.1550; 1.1650 *; 1.1720 **; 1.1850 **; 1.2100 Support areas: 1.1112; 1.1080 *; 1.1000 ***; 1,0850 ** * Periodic level ** Range Level The material has been provided by InstaForex Company - www.instaforex.com |

| Consolidation after the fall: cryptocurrencies can grow Posted: 31 May 2019 03:38 AM PDT According to analysts, leading digital currencies stabilized after a fall on Thursday, May 30. Now they are ready to move on and for this, they have all the opportunities, experts say. The growth rate of Bitcoin amounted to 0.72% up to $8,664over the past day. The market capitalization of the leading virtual currency reached $154.8 billion. Ethereum cryptocurrency strengthened by 5.2% to $282.6. Its capitalization was $30 billion. Ripple (XRP) rose by 4.35% to $0.46. The market capitalization of this digital asset amounted to $19.5 billion. Litecoin cryptocurrency has risen over the day by 2.39% to $117.3. Its capitalization amounted to $7.3 billion. The total capitalization of the crypto market reached $279.9 billion. Currently, the price of Bitcoin is consolidating, forming a continuation of the "bullish" trend, analysts say. According to a leading expert in the digital assets market, Thomas Lee, breaking the $10,000 key mark for Bitcoin will lead to massive purchases. This is possible in the event that market participants will be afraid to miss the rapid increase in the price of cryptocurrency number 1. According to analysts, among the possible reasons for the rise of the leading digital currency is the escalation of the US-China trade opposition. This conflict poses a threat to the global recession, which is why investors are transferring funds from traditional assets to alternative ones. Experts believe that another reason for the rise in the price of Bitcoin is the imminent reduction in the miners' remuneration for one mined block. It is expected that this premium will be halved in 2020, which will limit the supply of the cryptocurrency. According to technical analysis, the immediate goal of the upward movement of the bitcoin price is $9100. A breakdown of which will open the way to an important psychological mark of $10,000. In the case of a refund below $ 8,300, experts assume a cost reduction to $7,700. On Friday morning, May 31, the bulls of the crypto market decided to conquer the bitcoin price peak of $9000 after a brief consolidation. The maximum value of cryptocurrency number 1 was fixed at $9109 and then the decline began. After a deep correction, the value of the leading virtual currency fixed at $8,300. Experts do not exclude the further fall of the main digital asset. According to financial market strategists, the virtual currency market will continue to consolidate at the achieved levels in the near future. The price of bitcoin can drop to $7400 and the cost of XRP can roll back to $0.39 after today's rise to $ 0.47. Now, it is testing the level of $0.42. After the current breakthrough to $289 and the subsequent pullback to $240, the cost of Ethereum may soon fall to $222, experts predict. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading Plan for EUR/USD pair on 05/31/2019 Posted: 31 May 2019 03:24 AM PDT News on US GDP for the first quarter (second reading) is expected. The GDP growth decreased to 3.1% from 3.2% and deflator reduced from + 0.9% to 0.8. The Fed made it clear that the Fed should not expect an increase in interest rates. It should be noted that the yield of treasuries decreased to 2% at the beginning of the decline in the stock market. EUR/USD: Possible upward reversal. We are ready to buy euros from 1.1220. |

| Posted: 31 May 2019 02:57 AM PDT EUR / USD On May 30, Thursday, trading ended with a loss of just a few basis points for the EUR / USD currency pair. Thus, the wave marking has not changed over the previous day. In general, it is also worth noting that the market activity for the euro / dollar pair is now low. Bearish sentiment prevails among traders, which are based on the unfavorable news background for the euro. By and large, the background concerns the trade wars of America with China and, possibly, the future of the EU, as well as the problems of the European Union with Great Britain and Italy. Positive information from Europe has not been received by the traders. Recent reports from the United States also leave much to be desired, but the foreign exchange market preferred to "close" its eyes to this news. As a result, we have the third tool reduction in the 1.1115 area. So far, it cannot be said that the attempt to break through this area was unsuccessful, but at the same time, the further construction of the downward wave, presumably 3, 3, 3, depends precisely on the breakthrough of this area. The third unsuccessful attempt to breakthrough is likely to change the current wave counting. Sales targets: 1.1097 - 161.8% Fibonacci 1.1045 - 200.0% Fibonacci Purchase goals: 1.1324 - 0.0% Fibonacci General conclusions and trading recommendations: The euro / dollar pair remains at the stage of building a downward trend. The MACD indicator gave a signal to the top, so I recommend resuming sales of the euro with targets of 1.1097 and 1.1045, which corresponds to 161.8% and 200.0% Fibonacci, after rolling back up. I recommend placing a restrictive order above the Fibonacci level of 76.4%. GBP / USD On May 30, the GBP / USD pair lost another 20 basis points. Donald Trump introduces trade sanctions against Mexico since June 10, as he considers the issue of control over Mexican immigrants to America which is a problem of the Mexican authorities. In UK, various high-ranking officials give interviews about the prospects for Brexit with the new prime minister. Opinions differ in the same way as on parliamentary ballots. Some politicians believe that the best option is a new referendum. Someone is re-elected to parliament. Someone is still confident that Theresa May's deal is the best solution. Fact one: There is no unity in the government of Great Britain either. One conclusion: the pound will continue to be sold to traders, banks and large funds, since no one is interested in the currency of a country whose government cannot solve an extremely important issue. Sales targets: 1.2554 - 200.0% Fibonacci 1.2360 - 261.8% Fibonacci Purchase goals: 1.3175 - 0.0% Fibonacci General conclusions and trading recommendations: The wave pattern of the pound / dollar instrument implies a continuation of the instrument decline within the framework of the supposed wave c. Thus, now I still recommend selling the pound with targets located near the calculated levels of 1.2554 and 1.2360, which corresponds to 200.0% and 261.8% Fibonacci and with a restrictive order over the maximum of wave 2 . An unsuccessful attempt to break through the 200.0% mark will warn about the pair's readiness to roll back. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR and GBP: Growth prospects for the euro and the pound are very vague Posted: 31 May 2019 02:53 AM PDT The euro remains in the side channel in tandem with the US dollar after yesterday's data on the American economy, whose growth in the 1st quarter of this year was revised down. But even despite this, the US economy in the 1st quarter grew at a fairly high pace. According to the US Department of Commerce, GDP grew at an annualized rate of 3.1% in the first quarter of 2019, while it was originally stated at 3.2%. Economists had expected a revision of GDP growth to 3.0%. Let me remind you that back in the 4th quarter of 2018, the growth of the American economy was 2.2%. Compared to the same period last year, GDP in the 1st quarter grew by 3.2%. Despite the fact that consumer spending and export growth has been revised upwards, data on company spending and inventory investment have been revised downward. Consumer spending in the 1st quarter increased by 1.3%, while exports increased to 4.8%. Weekly data on the labor market did not worry traders much. According to a report by the US Department of Labor, the number of initial claims for unemployment benefits rose by 3,000 in the week from May 19 to May 25, reaching 215,000. Economists had expected the number of applications to be 215,000. The moving average in the reporting week fell to 216,750. The number of secondary claims for the week from May 12 to 18 fell by 26,000 to 1,657,000. Weakness in the US housing market continues to persist. This is evidenced by yesterday's report on the number of signed contracts for the sale of housing, which in April of this year has decreased. According to the National Association of Realtors, the index of signed contracts for the sale of housing in April fell by 1.5% compared with the previous month, reaching 104.3 points. Compared with April 2018, the index fell by 2%. Economists had expected the index to grow by 0.9% in April. As for the technical picture of the EURUSD pair, it remained unchanged. Buyers of risky assets still need a break of 1.1143 resistance, which will allow them to count on an upward correction in the area of highs 1.1170 and 1.1200. Under the scenario of a breakthrough of yesterday's minimum in the area of 1.1117, the pressure on the trading instrument will increase, which will lead to the test of support 1.1080 and 1.1030. The British pound remains in a narrow price channel with the prospect of further decline. After the British Prime Minister Theresa May announced her resignation last week, the risk of a British exit from the European Union without an agreement increased significantly. This "ties the hands" to the Bank of England, which may refuse to further increase interest rates this year, even despite the possibility of inflation going beyond the target level. According to a number of experts, the probability of a UK leaving without an agreement has increased to 40%. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 31 May 2019 01:14 AM PDT Tension in global markets continues to increase. Events such as the escalation of the trade crisis between America and China, the growth of tension with Europe and the announcement of the introduction of 5% duties on all Mexican imports from June 10, with the prospect of raising them in the coming months to 25% indicates that investors are unlikely to hope for change for the better in the near foreseeable future. Trump does not seem to calm down until he breaks all the old trade unions and agreements and does not finish off new ones with shifted preferences in favor of Washington. On this wave, the quotes of "black gold" collapsed amid the continued growth in oil production in America on Thursday for the second time this month. This really contributed to their increase and stimulated oil production in the United States at the same time, which successfully occupied opening niches. This week, Russian Finance Minister Siluanov has already expressed concern about this fact, which may be the reason for Russia's withdrawal from the OPEC + agreement to reduce oil production. By the way, it is quite likely that the collapse of quotations was caused not only by a drop in hopes that Washington and Beijing will agree on trade, as well as an increase in shale and common oil production in the United States in the foreseeable future, but also a likely change in Russia's position. The fact that tension is growing clearly demonstrates the growing demand for government debt bonds of economically developed countries, including the USA. Yield benchmark 10-year Treasuries continues to "fall" down. Over the last week, it fell from 2.431% to 2.178%. The yen and the Swiss franc also receive support for the safe haven currency and the US dollar also tries to keep up with them. Today, markets will focus on the publication of baseline personal consumption index (RFE) data in the United States and the values for income and expenditure of Americans. If the indicators show a positive trend, it will noticeably lower the expectations that the Fed may in the near future go to lower interest rates. These data can be a catalyst for a new wave of growth of the dollar, reducing the demand for risky assets. Forecast of the day: Oil prices confidently entered the bear phase. A decrease in WTI quotes below 55.80 could lead to their further fall to 54.50. The USD/CAD pair is above the support level of 1.3500. It can be adjusted in anticipation of the publication of data from the United States. If they turn out to be no worse than forecasts and the pair holds above this level, there is a chance that its growth will resume by 1.3600. |

| Trading recommendations for the GBPUSD currency pair - prospects for further movement Posted: 31 May 2019 01:11 AM PDT For the last trading day, the currency pair pound / dollar showed a low volatility of 59 points again, as a result of forming a low amplitude within the pivot point. From the point of view of technical analysis, we see that the quote has come up to the level of 1.2620, forming a narrow amplitude of 1.2600 / 1.2620, which we talked about in the previous review. Looking at the graph in general terms, we see that the "Impulse" tact is still on the market and only the 1.2600 / 1.2620 range stands before us. If we step back a bit from the bars, then we see that during the whole trading week, we saw an extremely low volatility, although there was some purposeful movement. The reason is fear and uncertainty caused by the "divorce" process of Brexit. Although investors try to stand aside, but they clearly understand that the business of Britain may be in great danger. On the other hand, the news background had statistics on the United States, where they published the second estimate of GDP for the first quarter, and, as expected, there was a slowdown in economic growth to 3.1%. At the same time, data on applications for unemployment benefits will be published in the United States, where they waited for a reduction of applications by 10 thousand, and as a result, they received only 22 thousand, which, by the way, supported the dollar. On the information background, in general, everything is the same, floundering in Brexit, but without abrupt actions. Thus, we are waiting for the new prime minister, and there will be an action. Today, in terms of the economic calendar, we have data on the lending market in the UK, where the volume of consumer lending is growing from 0.549B to 0.978B in comparison with the previous months of calculation. Approved applications for mortgage also show growth from 62341 to 63250. In general, the news is positive for the pound, but not the fact that it will help it. In the afternoon, there will be data on personal expenses and income in the United States, where growth is also expected. The upcoming trading week in terms of the economic calendar is extremely saturated with statistics and events. If we select only events, then we have: the speech of the Fed Chairman, Mr. Powell; voting in the UK Parliament; Theresa May's resignation and possible receiver. Are you already looking forward to good volatility? The most interesting events displayed below ---> Monday, June 3 United Kingdom 8:30 Universal time - Manufacturing Business Index (PMI) (May): Prev. 53.1 ---> Forecast 53.0 United States 14:00 UTC+00 - Manufacturing PMI from ISM (May): Prev. 52.8 ---> Forecast 53.3 Tuesday, June 4 United Kingdom 8:30 Universal time - Business activity index in the construction sector (May): Prev. 50.5 United States 13:45 UTC+00 - Speech by Fed Chairman Mr. Powell Voting in the Parliament of Great Britain under the Brexit Agreement Wednesday, June 5 United Kingdom 8:30 Universal time - Business Services Index (May): Prev. 50.4 ---> Forecast 50.5 United States 12:15 UTC+00 - Change in the number of people employed in the non-farm sector from ADP (May): Prev. 275K ---> 190K forecast United States 14:00 UTC+00 - Non-manufacturing Business PMI (PMI) from ISM (May): Prev. 55.5 ---> Forecast 56.0 Friday, June 7 United States 12:30 UTC+00 - Change in the number of people employed in the non-agricultural sector (May): Prev. 263K ---> 190K forecast United States 12:30 UTC+00. - Unemployment rate (May): Prev. 3.6% ---> Forecast 3.7% Theresa May's Resignation These are preliminary and subject to change. Further development Analyzing the current trading schedule, we see bumpiness in the range of 1.2600-1.2620, which reflects a certain indecision, and at the same time, a possible regrouping of trading forces. It is possible to assume that the oscillation amplitude will slightly increase 1.2600 / 1.2640, but then we are working on breaking the boundaries, monitoring the price fixing points. Based on the available information, it is possible to decompose a number of variations. Let's consider them: - We consider buy positions in case of price fixing higher than 1.2640, with the primary prospect of a move to 1.2680. - We consider selling positions in the case of a clear price fixing lower than 1.2570, with the prospect of a move to 1.2500-1.2430. Indicator Analysis Analyzing a different sector of timeframes (TF), we see that indicators in the short term have changed from a downward to an upward one, due to the current stagnation. Meanwhile, intraday and mid-term perspective preserves downward interest against the general background of the market. Weekly volatility / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation, based on monthly / quarterly / year. (May 31 was based on the time of publication of the article) The current time volatility is 21 points. Volatility will remain low if the quotation continues sluggish fluctuation within 1.2620. The only breakthrough may be in the event of a fracture of the current stagnation. Key levels Zones of resistance: 1.2620; 1.2770 **; 1.2880 (1.2865-1.2880) *; 1.2920 * 1.3000 **; 1.3180 *; 1,3300 **; 1.3440; 1.3580 *; 1.3700. Support areas: 1.2620; 1,2500 *; 1.2350 **. * Periodic level ** Range Level The material has been provided by InstaForex Company - www.instaforex.com |

| Burning forecast EURUSD 05/31/2019 Posted: 31 May 2019 01:05 AM PDT On Thursday, the deputy head of the Fed said that the Fed should be ready to lower the rate if the forecasts of the economic situation deteriorate. The reason for the deterioration is Trump's trade wars against US trading partners in the first place. This puts an end to the possibility of increasing the Fed rate until the end of the year for sure. This message has stopped the decline of the euro. EURUSD: Range. We are ready to sell the euro from 1.1105. We are ready to buy the euro from 1.1220. |

| Review of EUR / USD and GBP / USD from 05/31/2019: Great standing still Posted: 31 May 2019 12:59 AM PDT Although the second estimate of United States GDP in the first quarter showed that the pace of economic growth accelerated from 3.0%, not to 3.2%. But if it is to 3.1%, it would have no effect on the dollar. In theory, investors who had previously pledged a slightly more rapid acceleration of the US economy into the dollar would have to revise their plans. However, nothing like that happened. Of course, I would like to say that the whole thing is in the data on applications for unemployment benefits and the total number of which decreased by 23 thousand. But then, how about commodity stocks in wholesalers, which increased by 0.7%? That is for good but the American statistics were rather negative. Thus, the confident position of the dollar is more likely due to the fear of the unregulated Brexit, whose consequences no one can predict. More precisely, it may happen but all these predictions are painfully sad not only for the UK but for Europe as a whole. In respect to continental Europe, it is likely that they just exaggerate. However, this will not get any easier. Today, first of all, a pound will have the opportunity to somehow improve its position. To help in this should data on the credit market in the United Kingdom, which can show that the volume of consumer lending amounted to 1.0 billion pounds, against 0.6 billion pounds in the previous month. Also, the number of approved mortgage applications should increase from 62,341 to 63,250. In the United States, personal income and expenditure data are coming out, which should grow by 0.3% and 0.2%, respectively. Usually, outstripping revenue growth implies a decline in consumer activity, which may adversely affect sales. However, given the fact that in the previous month, income and expenses increased by 0.1% and 0.9%, respectively, today's data will simply show the alignment of family budgets, which is an absolutely normal situation. So it will have no effect on the market. First of all, the single European currency will continue to stand still as it was yesterday. Hence, we continue to observe minor fluctuations in the region of 1.1150. The pound will have the opportunity to somehow improve its position. To help in this situation, data on the credit market in the United Kingdom can show that the volume of consumer lending amounted to 1.0 billion pounds against 0.6 billion pounds in the previous month. The pound immediately rushed towards 1.2650 - 1.2675 under the influence of at least some good news. |

| Bitcoin. 9000 USD turned out to be very expensive for bitcoin buyers Posted: 31 May 2019 12:40 AM PDT Yesterday's test of the level of 9000 USD led to profit-taking and a sharp depreciation of bitcoin to the support area of 8120, which I talked about all week. The bulls failed to break above the high of the year, but there is no need to panic. A good downward correction will only attract new cryptocurrency buyers to the market and will soon allow us to count on new local highs in the area of 10000 USD. Signal to buy Bitcoin (BTC): Buyers managed to keep Bitcoin in the support area of 8120, and the formation of a false breakdown on it will be a signal to open long positions in order to return and fix above the maximum of 8540. Under the breakdown scenario and further downward correction, which is more likely, the area of 7640 will be a good level for opening long positions. Signal to sell Bitcoin (BTC): Today, sellers need to try to break through the support of 8120, which will only increase the pressure on speculative traders and force them to close long positions. This will lead Bitcoin to an area of minimum 7640, where I recommend fixing the profits. In the scenario of cryptocurrency growth, a good signal to sell will be an unsuccessful consolidation above the resistance of 8540. |

| Posted: 31 May 2019 12:40 AM PDT To open long positions on GBP/USD, you need: Yesterday, the bulls managed to keep the support level of 1.2603, which is a good signal for a change in the downward trend. Today, in the first half of the day, a return and consolidation above the resistance of 1.2950 are required, which will allow us to count on rapid growth to a maximum of 1.2696 and an update of the resistance of 1.2744, where I recommend fixing the profits. With a further decrease in the pound, you can open long positions on a false breakdown from a minimum of 1.2603 or on a rebound from the support of 1.2564. To open short positions on GBP/USD, you need: As long as trading will be below the resistance of 1.2650, pressure on the pound will remain, and the formation of a false breakdown in the first half of the day will be a signal to sell the pound. The main task of the bears is the breakthrough of support at 1.2603, which may lead to the resumption of the downward trend and update the minimum of 1.2564, where I recommend fixing the profits. When the growth scenario is above 1.2650 in the first half of the day, you can return to sales of the pound immediately to rebound from a maximum of 1.2696. Indicator signals: Moving Averages Trading is conducted below 30 and 50 moving averages, which indicates a possible return to the market of large sellers. Bollinger Bands Volatility is very low, which does not give signals to enter the market. Description of indicators

|

| Posted: 31 May 2019 12:39 AM PDT To open long positions on EURUSD, you need: The technical picture has not changed, and the volatility continues to be very low. Buyers need to return to the resistance level of 1.1143, from which it will be possible to see an upward correction to the maximum area of 1.1170, where I recommend fixing the profits. In the morning, a number of important data on inflation in Germany and Italy are published, which may put pressure on the euro. In this scenario, it is best to look for purchases on the minimum update in the area of 1.1117, provided that a false breakdown is formed, or to open long positions for a rebound from the new support of 1.1079. To open short positions on EURUSD, you need: The release of important fundamental data in the first half of the day for the euro area may lead to a decline in the euro. A false breakdown and return under the resistance level of 1.1143 will be a signal to open short positions in the euro, and the main task for the first half of the day will be a test of a large support level of 1.1117, which will increase the pressure on the pair and will lead to an update of the minimum in the area of 1.1079, where I recommend fixing the profits. Under the scenario of the growth of the euro above 1.1143, it is best to return to short positions in EUR/USD after updating the high of 1.1170 or to rebound from a larger level of 1.1196. Indicator signals: Moving Averages Trading is conducted in the area of 30 and 50 moving averages, which indicates the lateral nature of the market. Bollinger Bands Volatility is very low, which does not give signals to enter the market. Description of indicators

|

| Indicator analysis. Daily review as of May 31, 2019 for EUR / USD and GBP / USD currency pairs Posted: 31 May 2019 12:23 AM PDT On Wednesday, the market in both currencies was moving down. The GBP / USD pair, while moving down, reached the lower fractal of 1.2605 (red dotted line), but closed above this level. The EUR / USD pair, while moving down, tested the pullback level of 76.4% - 1.1134 (yellow dotted line) and closed slightly lower. On Friday, strong calendar news is not expected. Trend analysis (Fig. 1) Today, the price will start a pullback upward movement with the first target of 1.1155 - the pullback level of 38.2% (blue dashed line). Fig. 2 (daily schedule). Comprehensive analysis: - indicator analysis - up; - Fibonacci levels - up; - volumes - up; - candlestick analysis - up; - trend analysis - up; - Bollinger lines - up; - weekly schedule - down. General conclusion: On Friday, we are waiting for the start of the upward movement with the first goal of 1.2668 - a pullback level of 14.6% (yellow dotted line). The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment