Forex analysis review |

- GBP/USD near support, a bounce is possible!

- AUD/USD Broke Major Support, Potential Further Drop!

- USD/JPY to test resistance, a drop is possible!

- Fractal analysis of major currency pairs on June 13

- What to buy on the eve of the summit, the dollar or the euro

- EUR/USD. 12 June. Results of the day. US inflation slows again

- GBP/USD. 12 June. Results of the day. Britain will not have time to prepare for a hard Brexit before October 31

- EUR/USD. US inflation disappointed, but today the market is occupied by Italy

- June 12, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- June 12, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

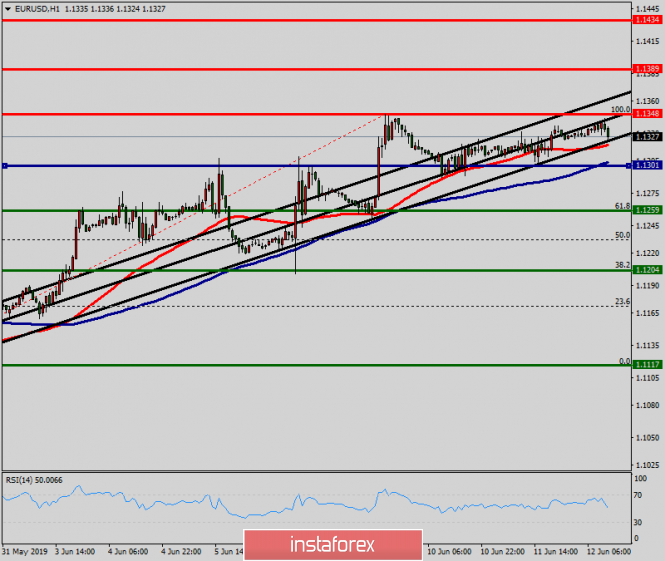

- Technical analysis of EURUSD for June 13, 2019

- Technical analysis of Gold for June 13, 2019

- Bitcoin analysis for June, 12.2019

- Analysis of Gold for June 12,.2019

- GBP/USD analysis for June 12,.2019

- GBP/USD: plan for the US session on June 12. Buyers of the pound continue to push it up

- EUR/USD: plan for the US session on June 12. Draghi's speech has hurt the euro

- EUR/GBP: catch the price on corrective pullbacks

- Gold caught the fair wind

- Simplified wave analysis and forecast for GBP/USD and USD/JPY on June 12

- GBP/USD: Weak UK GDP to help USD regain momentum? June 12, 2019

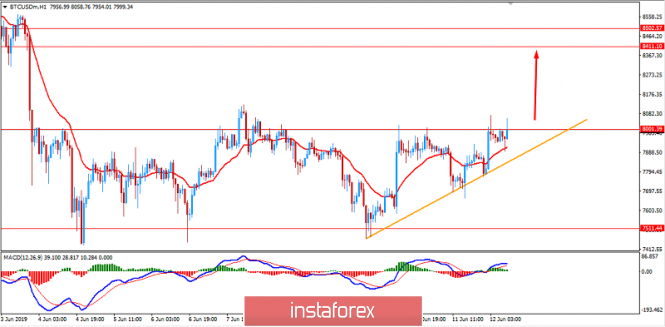

- BITCOIN hovering at around $8,000. June 12, 2019

- Technical analysis of GBP/USD for June 12, 2019

- Technical analysis of EUR/USD for June 12, 2019

- Panic returns: EUR and GBP lose ground for growth

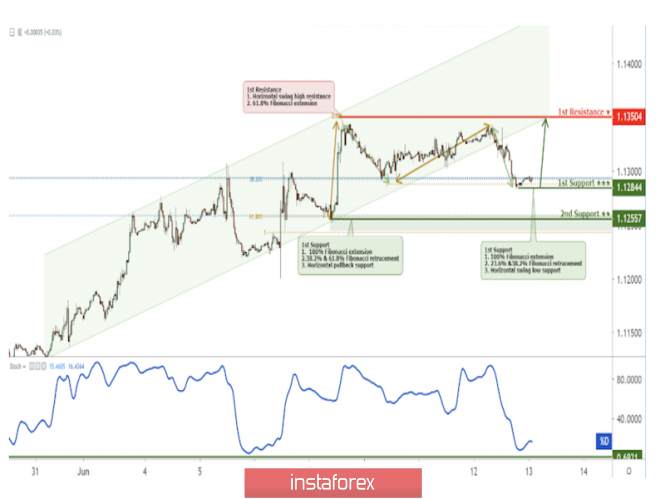

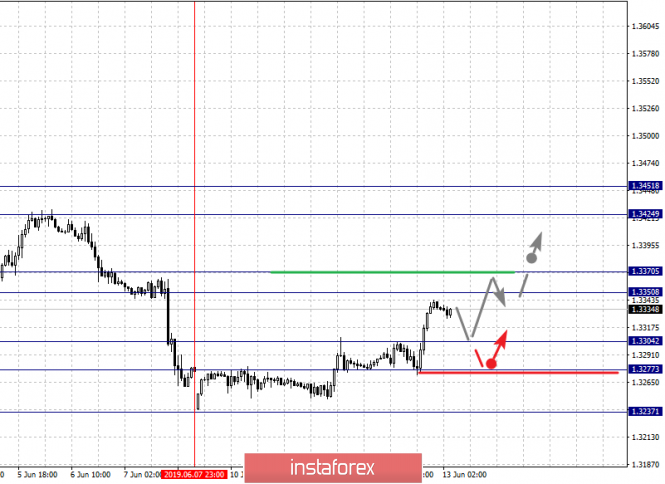

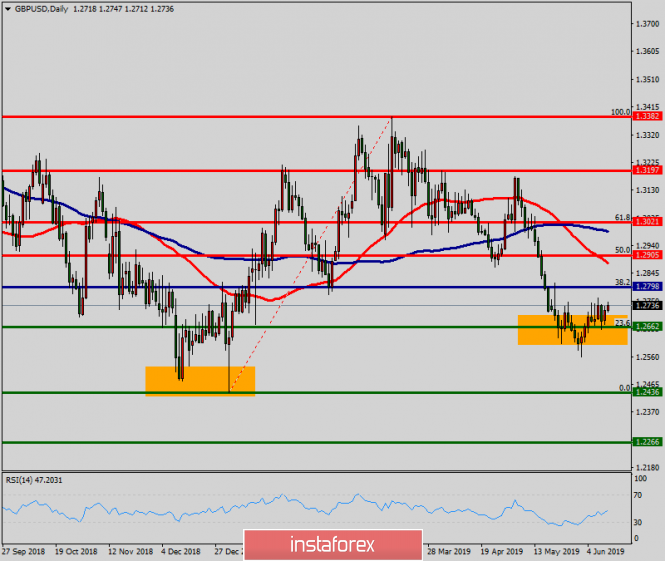

| GBP/USD near support, a bounce is possible! Posted: 12 Jun 2019 07:36 PM PDT

GBPUSD is near support, a bounce to 1st resistance is possible Entry: 1.2844 Why it's good : 100% Fibonacci extension, 38.2% & 23.6% Fibonacci retracement, horizontal swing low support Stop Loss : 1.1256 Why it's good :38.2% & 61.8% Fibonacci retracement,100% Fibonacci extension, horizontal swing low support Take Profit : 1.1342 Why it's good: 100% Fibonacci extension, horizontal swing high resistance

|

| AUD/USD Broke Major Support, Potential Further Drop! Posted: 12 Jun 2019 07:34 PM PDT

Price broke past its major support where we expect to see a further drop to its next support. Entry : 0.6939 Why it's good : 23.6% Fibonacci retracement, horizontal pullback resistance Stop Loss : 0.6963 Why it's good : horizontal pullback resistance Take Profit : 0.6901 Why it's good : Horizontal overlap support, 78.6% Fibonacci retracement, 61.8% Fibonacci extension

|

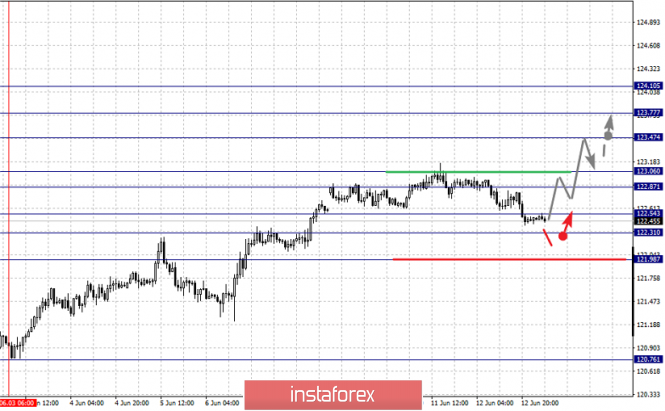

| USD/JPY to test resistance, a drop is possible! Posted: 12 Jun 2019 07:31 PM PDT

USDJPY to test key resistance, a drop to 1st support is possible Entry: 109.012 Why it's good : 61.8% Fibonacci extension, 23.6% Fibonacci retracement, horizontal pullback resistance Stop Loss : 109.914 Why it's good :50% Fibonacci retracement,horizontal swing high resistance Take Profit : 107.854 Why it's good: 61.8% Fibonacci retracement, 100% Fibonacci extension, horizontal swing low support

|

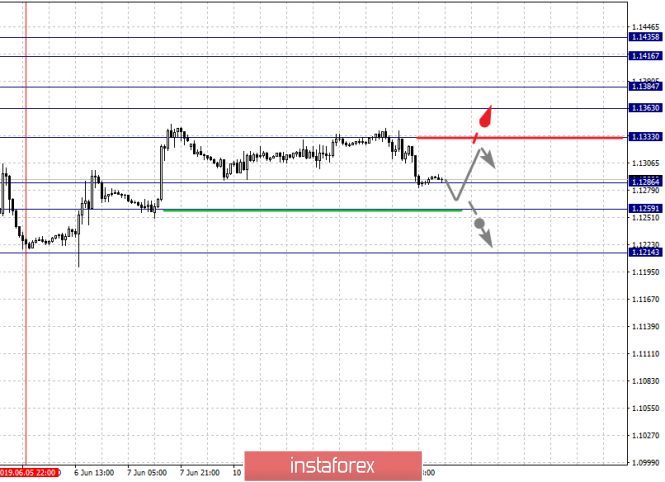

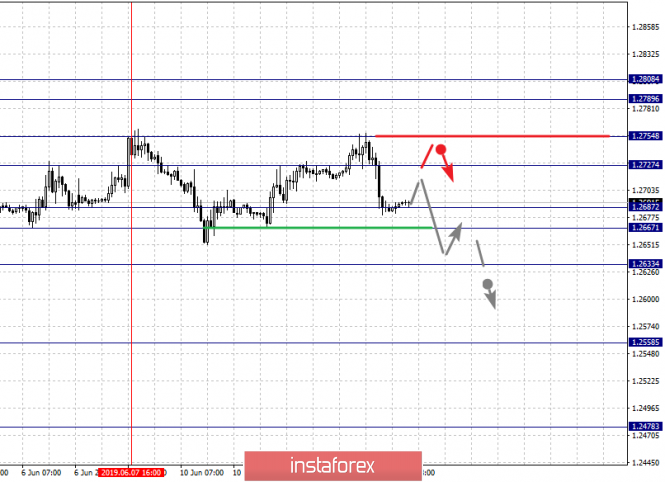

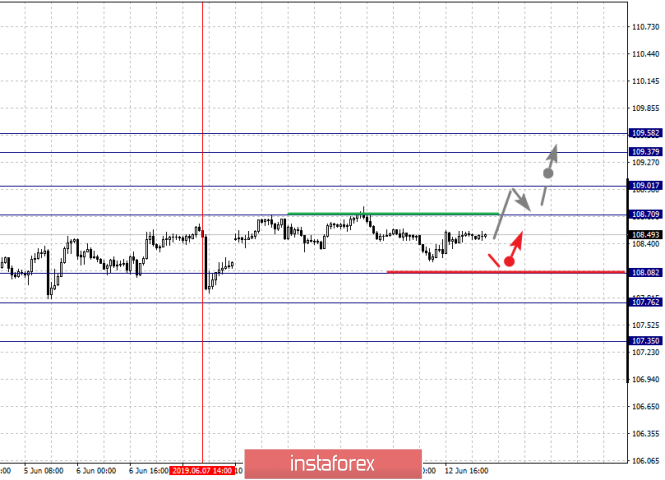

| Fractal analysis of major currency pairs on June 13 Posted: 12 Jun 2019 07:22 PM PDT Forecast for June 13: Analytical review of H1-scale currency pairs:

For the euro / dollar pair, the key levels on the H1 scale are: 1.1435, 1.1416, 1.1384, 1.1363, 1.1333, 1.1286, 1.1259 and 1.1214. Here, we continue to monitor the local ascending structure of June 5. The resumption of the upard trend is possible after the breakdown of 1.1333. In this case, the first target is 1.1363. Short-term upward movement is expected in the corridor 1.1363 - 1.1384. The breakdown of the latter value will lead to a pronounced movement. Here, the target is 1.1416. We consider the level 1.1435 to be a potential value to the top. Upon reaching this level, we expect consolidation in the corridor 1.1416 - 1.1435, as well as a rollback to the correction. Short-term downward movement is possible in the corridor 1.1286 - 1.1259. The breakdown of the latter value will have to form the initial conditions for the downward cycle. Here, the potential target is 1.1214. The main trend is the local structure for the top of June 5. Trading recommendations: Buy 1.1333 Take profit: 1.1363 Buy 1.1386 Take profit: 1.1416 Sell: 1.1284 Take profit: 1.1262 Sell: 1.1257 Take profit: 1.1220

For the pound / dollar pair, the key levels on the H1 scale are: 1.2808, 1.2789, 1.2754, 1.2727, 1.2687, 1.2667 and 1.2633. Here, we continue to follow the development of the upward cycle of May 31. At the moment, the price is in correction and forms the potential for the downward movement of June 7. The continuation of the movement to the top is expected after the breakdown 1.2727. In this case, the goal is 1.2754. Near this level is the price consolidation. Breakdown at 1.2755 should be accompanied by a pronounced upward movement. Here, the goal is 1.2808. Price consolidation is in the corridor 1.2789 - 1.2808 and from here, we expect a rollback to the bottom. Short-term downward movement is possible in the corridor 1.2687 - 1.2667. The breakdown of the latter value will lead to a prolonged correction. Here, the goal is 1.2633. This level is a key support for the upward structure. The main trend is the upward cycle of May 31, the formation of the downward potential of June 7. Trading recommendations: Buy: 1.2728 Take profit: 1.2752 Buy: 1.2755 Take profit: 1.2787 Sell: 1.2686 Take profit: 1.2668 Sell: 1.2664 Take profit: 1.2638

For the dollar / franc pair, the key levels on the H1 scale are: 1.0059, 1.0033, 0.9995, 0.9965, 0.9930, 0.9908, 0.9884 and 0.9858. Here, we are following the formation of the ascending structure of June 7. Continuation of the movement to the top is expected after the breakdown of 0.9965. In this case, the target is 0.9995. Consolidation is near this level. A breakdown at 0.9997 will lead to the development of a pronounced upward movement. Here, the target is 1.0033. For the potential value to the top, we consider the level of 1.0059. After reaching which, we expect a rollback to the bottom. Short-term downward movement is possible in the corridor 0.9930 - 0.9908. Hence, there is a high probability of a reversal to the top. A breakdown of the level of 0.9908 will lead to the development of a protracted correction. Here, the target is 0.9884. This level is a key support to the top. The main trend - the formation of the ascending structure of June 7. Trading recommendations: Buy : 0.9965 Take profit: 0.9995 Buy : 0.9997 Take profit: 1.0033 Sell: 0.9930 Take profit: 0.9910 Sell: 0.9906 Take profit: 0.9886

For the dollar / yen pair, the key levels on the H1 scale are : 109.58, 109.37, 109.01, 108.70, 108.08, 107.76 and 107.35. Here, we mainly expect the development of the ascending structure of June 7. Short-term upward movement is possible in the corridor 108.70 - 109.01. The breakdown of the latter value should be accompanied by a pronounced upward movement. Here, the target is 109.37. Price consolidation is in the corridor 109.37 - 109.58. Level 108.08 is the key support for the ascending structure. Its price passage will lead to the development of a downward trend. Here, the first target is 107.76. For the potential value at the bottom, we consider the level of 107.35. The main trend: the formation of potential for the top of June 7. Trading recommendations: Buy: 108.70 Take profit: 109.00 Buy : 109.03 Take profit: 109.37 Sell: 108.08 Take profit: 107.76 Sell: 107.74 Take profit: 107.37

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3451, 1.3424, 1.3370, 1.3350, 1.3304, 1.3277 and 1.3237. Here, we follow the formation of the ascending structure of June 7. Continuation of the development of an upward trend is expected after the price passes the noise range 1.3350 - 1.3370. In this case, the goal is 1.3424. For the potential value to the top, we consider the level of 1.3451. After reaching which, we expect to go into a correction. Short-term upward movement is possible in the corridor 1.3304 - 1.3277. The breakdown of the latter value will lead to the development of a downward trend. Here, the first potential target is 1.3237. The main trend - the formation of the ascending structure of June 7. Trading recommendations: Buy: 1.3370 Take profit: 1.3424 Buy : 1.3426 Take profit: 1.3450 Sell: 1.3304 Take profit: 1.3280 Sell: 1.3275 Take profit: 1.3240

For the pair Australian dollar / US dollar key levels on the H1 scale are : 0.6974, 0.6964, 0.6944, 0.6933, 0.6912, 0.6897, 0.6875 and 0.6861. Here, we are following the development of the downward cycle of June 7th. Short-term downward movement is expected in the corridor 0.6912 - 0.6897. The breakdown of the last value should be accompanied by a pronounced upward movement. Here, the target is 0.6875. For the potential value at the bottom, we consider the level of 0.6861. After reaching which, we expect consolidation, as well as rollback to the top. Short-term upward movement is possible in the corridor 0.6933 - 0.6944. The breakdown of the latter value will lead to a prolonged correction. Here, the target is 0.6964. The range of 0.6964 - 0.6974 is a key support for the downward structure. Before it, we expect the initial conditions for the upward cycle to be formed. The main trend is the downward cycle of June 7. Trading recommendations: Buy: 0.6933 Take profit: 0.6944 Buy: 0.6946 Take profit: 0.6964 Sell : 0.6912 Take profit : 0.6898 Sell: 0.6895 Take profit: 0.6875

For the euro / yen pair, the key levels on the H1 scale are: 124.10, 123.77, 123.47, 123.06, 122.87, 122.54, 122.31 and 121.98. Here, we continue to monitor the ascending structure of June 3. Continuation of the movement to the top is expected after the price passes the noise range 122.87 - 123.06. In this case, the goal is 123.47. Price consolidation is in the corridor 123.47 - 123.77. For the potential value to the top, we consider the level of 124.10. After reaching which, we expect a departure to the correction. Short-term downward movement is expected in the corridor 122.54 - 122.31. The breakdown of the last value will lead to a prolonged correction. Here, the goal is 121.98. This level is a key support to the top. The main trend is the ascending cycle of June 3. Trading recommendations: Buy: 123.06 Take profit: 123.45 Buy: 123.48 Take profit: 123.75 Sell: 122.54 Take profit: 122.33 Sell: 122.25 Take profit: 122.00

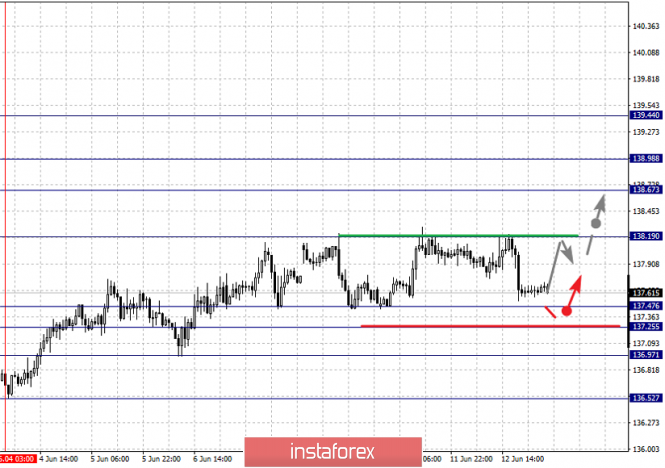

For the pound / yen pair, the key levels on the H1 scale are : 139.44, 138.98, 138.67, 138.19, 137.47, 137.25, 136.97 and 136.52. Here, we are following the development of the ascending structure of June 4. Continuation of the movement to the top is expected after the breakdown of 138.20. In this case, the goal is 138.67. Short-term upward movement, as well as consolidation is in the corridor 138.67 - 138.98. For the potential value to the top, we consider the level of 139.44. After reaching which, we expect a rollback to the bottom. Short-term downward movement is expected in the corridor 137.47 - 137.25. The breakdown of the last value will lead to a prolonged correction. Here, the goal is 136.97. This level is a key support to the top. The main trend is the ascending structure of June 4. Trading recommendations: Buy: 138.20 Take profit: 138.65 Buy: 138.69 Take profit: 138.96 Sell: 137.47 Take profit: 137.27 Sell: 137.20 Take profit: 136.98 The material has been provided by InstaForex Company - www.instaforex.com |

| What to buy on the eve of the summit, the dollar or the euro Posted: 12 Jun 2019 03:35 PM PDT Risk appetite on the eve of the G-20 summit may decline, so it is better to pay attention to the yen and sell the dollar and the euro against the Japanese currency. At least, this opinion is shared by BofAML analysts. The bank entered a short position on the EUR/JPY pair as early as last month, when a trade deal between the US and China fell through. On the eve, Bank of America took a short position in USD/JPY. The risk of a recommendation is that a trade deal can be announced at the summit itself. However, even in this case, the revision by traders of the future actions of Fed officials, implying a softening of the policy, will limit the weakness of the yen. Meanwhile, exchange rate volatility is still very low. Markets show calm, but in vain. It looks like a storm is coming to the currency markets. So, last week the ECB hinted at a willingness to re-launch the incentive program, but market participants preferred not to pay attention to it. The leaders in the race for the prime minister of Great Britain are politicians whose plans are to snatch a country from the EU without any agreements or to paralyze the work of Parliament. At this time, only uncertainty can be seen in the dynamics of sterling, and there is no talk about concern, and especially panic. Everything would be fine, but Donald Trump enters the scene and claims that the policy of the US central bank harms the country. Stubborn officials led by Jerome Powell do not accept smart advice from the US president about the rate cut. "They don't listen to me," Trump complained. What is happening implies the flight of investors into defensive assets, but this does not happen. Why? Because the ECB has lost its ability to influence markets, its policy of perpetual monetary stimulus is already perceived as the norm for all major securities, rather than as an anomaly. As for Britain, everyone believes that the British politicians have another aggravation and this will pass. A serious reason for nervousness was provided by the owner of the White House. Despite the fact that he regularly allows himself such attacks and plays on market sentiment, his recent tweet against the Fed deserves attention. The fact is that at the end of June, the G20 summit, and trade conflicts are on the agenda. The US president may require his administration to do something that weakens the dollar or force China to strengthen the yuan. And better all together. By the way, on Tuesday, the Chinese currency noticeably strengthened against the dollar after a statement by the local regulator about its intention to hold on Wednesday an intervention of 35 billion yuan. It is worth noting that the currency is slowly but surely entering the arsenal of a trade war. The lack of a clear reaction in the market can partly be explained by the fact that the Fed is expected to lower interest rates. However, the situation may worsen after the June summit in Osaka, Japan. Especially if the negotiations on the sidelines of this event will not be entirely successful. The material has been provided by InstaForex Company - www.instaforex.com |

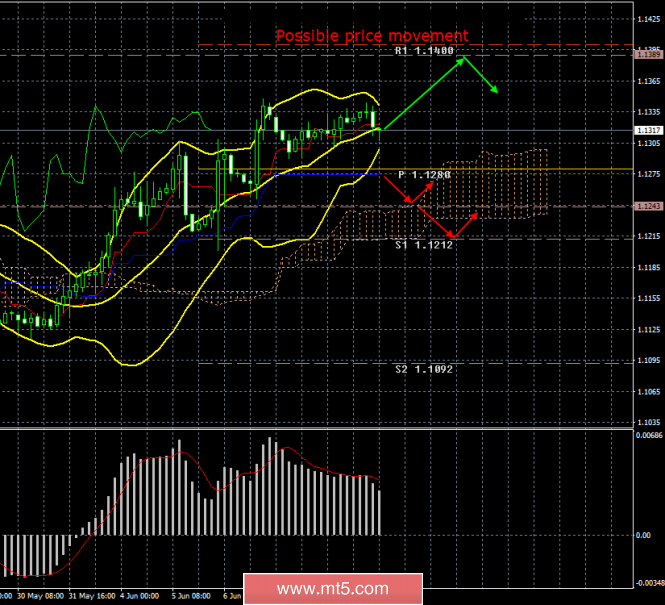

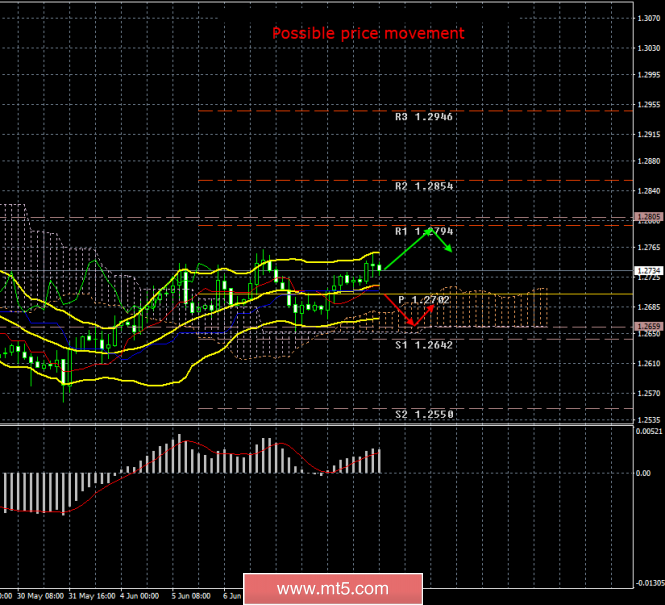

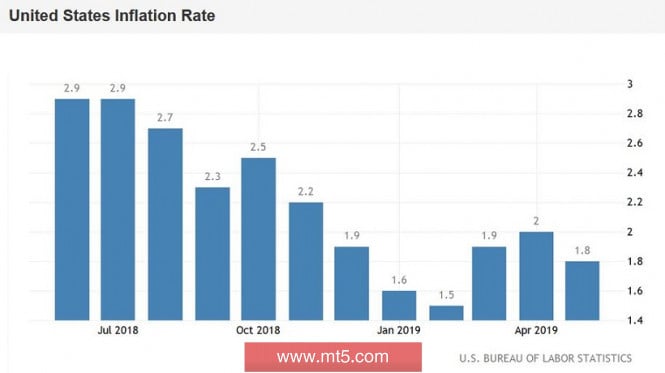

| EUR/USD. 12 June. Results of the day. US inflation slows again Posted: 12 Jun 2019 03:35 PM PDT 4-hour timeframe The amplitude of the last 5 days (high-low): 88p - 108p - 97p - 41p - 37p. Average amplitude for the last 5 days: 74p (77p). The EUR/USD pair held the third trading day of the week in moderate trading with minimal volatility, although today there were already two events that could cause a strong appreciation of one or another currency. First, Mario Draghi, head of the ECB, said that the countries of Central and Eastern Europe are very vulnerable in a global trade war (hint of a trade war with the United States), as they are very dependent on foreign trade and the automotive industry. By and large, Draghi openly declared that the European Union was wary of a trade war with the United States. It is good that Donald Trump's attention is now fully occupied by China and so the European Union is able to trade with America without additional duties. See you again. This speech could have seen a strengthening of the US dollar. Furthermore, the US inflation report for May was published, and this report became the cherry on the cake of failed macroeconomic statistics for the last two weeks. It turned out that the consumer price index dropped to 1.8% y/y, with a forecast of 1.9% and a previous value of 2.0%. On this information, we could already see another strengthening of the European currency. However, instead, the euro/dollar pair is still near local highs and shows no concern. It seems that these two events simply offset each other. Thus, the upward mood among traders remains, and the pair may well continue the upward movement, but from a fundamental point of view, the situation is very subtle, as reports from the US upset the bears, but the bulls have no particular reason for joy. The Bollinger Bands have narrowed to the lowest, which may signal the end of an upward trend. Trading recommendations: The EUR/USD pair is trying to resume an upward trend. Thus, now it is still recommended to trade for an increase with the target resistance level of 1,1400, but after the reversal of the MACD indicator upwards. The euro/dollar pair can be sold in small lots if the bears manage to gain a foothold below the critical line, with the first targets of 1.1243 and 1.1212. In this case, the initiative for the pair will return to the bears. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanation of the illustration: Ichimoku indicator: Tenkan-sen - the red line. Kijun-sen - the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dotted line. Chikou Span - green line. Bollinger Bands indicator: 3 yellow lines. MACD Indicator: Red line and histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 12 Jun 2019 03:35 PM PDT 4-hour timeframe The amplitude of the last 5 days (high-low): 66p - 73p - 74p - 89p - 62p. Average amplitude for the last 5 days: 73p (75p). The British pound sterling shows the lowest volatility in trading on Wednesday, June 12th. The only important macroeconomic report today — inflation in the United States — turned out to be weak, but it did not cause either euro or pound sterling purchases. But there was extremely important information, which in the aggregate with the general fundamental background from the UK could once again start to put pressure on the British currency. The fact is that there was a leak of information from government circles, and this information states that the UK will need at least 5 months to resolve all issues with the pharmaceutical industry and border control in case Brexit follows the "hard" scenario. According to insider information, government agencies involved in preparing for an unorganized Brexit achieved only "minimally viable results." This information greatly reduces the likelihood of Britain leaving the EU in an uncontrolled way, since the country is unlikely to manage to prepare for this option by October 31. In conjunction with the Labour Party's ban on a "hard" Brexit reduces this probability to almost zero. Thus, the options for selecting the next UK prime minister remains few. Also, they all raise many questions. The British pound continues to fear uncertainty and hardly shows growth during a period when this growth would be the most reasonable and logical. Trading recommendations: The pound-dollar currency pair returned to the area above the Kijun-sen line, so now buy orders with a target of 1.2794 are relevant again. However, we recommend that you be careful in buying the pair – the bulls' positions remain extremely weak. It will be possible to sell the pound sterling if traders manage to return the GBP/USD pair below the critical line with the target of 1.2659. In this case, the bears will have a chance to form a new downward trend. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanation of the illustration: Ichimoku indicator: Tenkan-sen - the red line. Kijun-sen - the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dotted line. Chikou Span - green line. Bollinger Bands indicator: 3 yellow lines. MACD Indicator: Red line and histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. US inflation disappointed, but today the market is occupied by Italy Posted: 12 Jun 2019 03:35 PM PDT The US dollar reacted fairly calmly to a weak rise in US inflation. Almost all components of today's release were in the "red zone", that is, worse than the predicted values. The phlegmatic reaction of the market looks atypical - especially now, when rumors are spread among traders about a preparation of the Fed's rate cut. On the one hand, the market was ready for weak CPI figures - even preliminary forecasts spoke of weak inflation dynamics. On the other hand, the real data turned out to be even weaker than the forecasts, which indicates a persistent tendency to weaken the key indicator for the Fed. Thus, core inflation (consumer price index excluding prices for food and energy) on a monthly basis remained at the level of 0.1%. At this level, the indicator has been released for the past four months. In annual terms, the index came out at a two percent level, although experts expected growth to 2.1%. The index went below this value only in February last year. The general consumer price index was also in the "red zone" - both in annual and monthly terms. In May, the consumer price index rose by only 0.1% m/m and 1.8% y/y, while analysts expected to see CPI at 0.2% and 1.9%, respectively. As you can see, the indicators did not reach the lowest predicted values. At the same time, it is already possible to speak about a rather persistent trend of slowing inflation: indicators gradually, but nevertheless systematically slow down their growth. Immediately after the publication, the euro-dollar pair "shot" to the mark of 1.1350. However, the upward impulse almost immediately choked - the price returned to the bottom of the 13th figure, and then lower, updating the daily low. The fact is, the market was ready for such results. To be more precise, traders were not surprised by this trend, given the dynamics of the past months. After Jerome Powell made the rate cut in the foreseeable future, and Nonfarms came out much worse than expected, the dollar significantly fell against a basket of major currencies. Low inflation only added to the overall negative picture, but no more. Even before today's release, the likelihood of a rate cut at the July meeting was almost 60%. At the moment, this probability has increased to 65%, but in the context of general expectations, such an "increase" did not have a significant impact on the dollar. Let me remind you that yesterday Trump again criticized the Fed for a too high rate. He also complained that the euro and other currencies are devalued against the dollar, and in many respects this is the "merit" of members of the US regulator, who, according to Trump, "do not understand anything at all." The US president's criticism increased the likelihood of the Fed easing monetary policy, but did not affect the foreign exchange market. By and large, Trump is helpless regarding the Fed: he cannot dismiss the head of the regulator with a stroke of a pen, as numerous White House officials. Therefore, his criticisms were actually ignored by the market. Thus, traders surprisingly quickly won back today's release, calmly embracing weak inflation data. Having sustained a blow, the eur/usd bears launched a counter-offensive, taking advantage of the weakness of the single currency. It is worth noting here that the euro still does not have its own strength for growth, therefore, the upward dynamics are due, as a rule, to the devaluation of the greenback. Today, the dollar has withstood, but the single currency again came under pressure from Italian problems. Thus, the "League of the North" party, whose members are members of the coalition government, proposed issuing national mini-bills. They plan to use them to repay debt obligations to companies (and residents of the country will be able to use them to pay taxes). By and large, we are talking about the creation of a parallel currency in Italy. In particular, the head of the Ministry of Finance of Italy spoke out against this idea, warning about the negative consequences of such a move. But the ruling parties have long been trapped in their own election promises, so the introduction of this tool is being seriously discussed by the leadership of the League. In general, Rome and Brussels continue to be in tough confrontation with each other, voicing quite harsh accusations. Europe blames Italy for populism and waste, Italy, in turn, blames the EU for slowing the country's economic growth. In addition, the threat of a disciplinary procedure from Brussels hung over Italy. Yesterday, EU ambassadors agreed that penalties against Italy for excessive public debt are "justified". Now the European Commission must decide whether to start a procedure that could lead to financial sanctions against Rome, or give the Italians another chance. Thus, today, the market has virtually ignored the release of weak data on the growth of US inflation. Perhaps this info service is still waiting in the wings, but today traders have shifted the focus to European events. Despite the corrective pullback in price, the eur/usd pair is still in an upward trend. On the daily chart, the price is still between the middle and upper lines of the Bollinger Bands indicator, and the Ichimoku indicator shows a bullish "Parade of Lines" signal. The closest support level is the 1.1280 mark - this is the upper boundary of the Kumo cloud. It should be noted that the upward trend will lose its relevance only with a more significant decrease, namely below the mark of 1.1210 (the middle line of the Bollinger Bands, which coincides with the lower boundary of the Kumo cloud on D1). The material has been provided by InstaForex Company - www.instaforex.com |

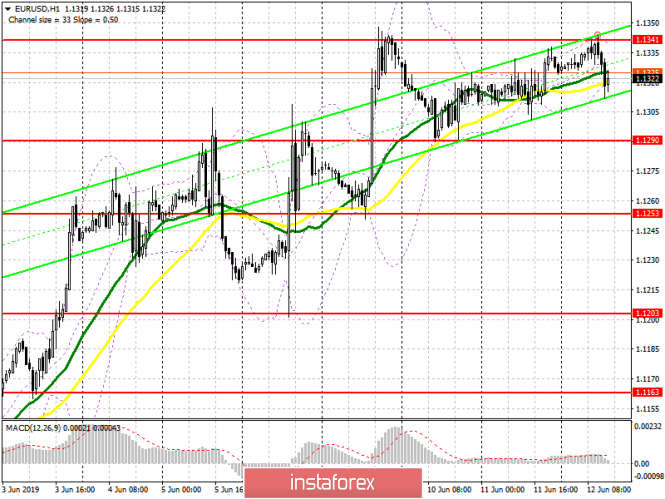

| June 12, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 12 Jun 2019 12:08 PM PDT

Since January 19th, the EURUSD pair has been moving within the depicted channel with slight bearish tendency. For Intraday traders, the price zone around 1.1235 stood as a temporary demand area which paused the ongoing bearish momentum for a while before bearish breakdown could be executed on April 23. Short-term outlook turned to become bearish towards 1.1175 (a previous weekly bottom which has been holding prices above for a while) On the period between May 17th and 20th, a bearish breakdown below 1.1175 was temporarily achieved. As expected, further bearish decline was expected towards 1.1115 where significant bullish recovery was demonstrated bringing the EURUSD pair back above 1.1175. Recently, The EURUSD pair has maintained bullish persistence above the highlighted price levels (1.1175) and (1.1235). That's why, further bullish advancement was expected towards 1.1320 which failed to apply instant bearish pressure on the EURUSD pair on the previous Friday. Recent Bullish breakout above 1.1320 renders it a newly-established demand level to be watched for Bullish rejection. Today, The pair is failing to maintain Bullish persistence above 1.1320 which would probably allow another bearish pullback to occur towards 1.1235 where recent price action should be considered. The material has been provided by InstaForex Company - www.instaforex.com |

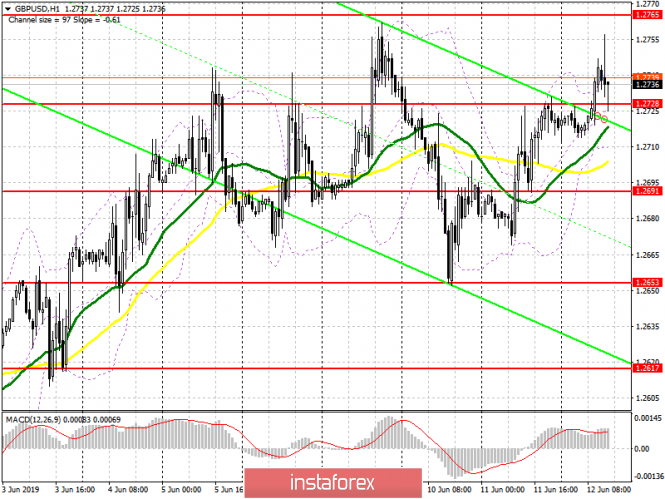

| June 12, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 12 Jun 2019 11:07 AM PDT

On March 29, a visit towards the price levels of 1.2980 (the lower limit of the newly-established bearish movement channel) could bring the GBPUSD pair again towards the upper limit of the minor bearish channel around (1.3160-1.3180). Since then, Short-term outlook has turned into bearish with intermediate-term bearish targets projected towards 1.2900 and 1.2850. On April 26, another bullish pullback was initiated towards the price zone of 1.3130-1.3170 where the depicted bearish Head and Shoulders reversal pattern was demonstrated on the H4 chart with neckline located around 1.2980-1.3020. Hence, Bearish breakdown below 1.2980 allowed the recent significant bearish movement to occur. Initial bearish Targets were already reached around 1.2900-1.2870 (the backside of the broken channel) which failed to provide any bullish support for the GBPUSD pair. Further bearish decline was demonstrated towards the lower limit of the long-term channel around (1.2700-1.2650) where the GBPUSD pair looked oversold obviously. That's why conservative traders were suggested NOT to consider any SELL signals around those low price levels. As anticipated, bullish breakout above 1.2650 has already been achieved. This enhanced the bullish side of the market towards 1.2750 which is preventing further bullish advancement Temporarily. For the bulls to remain dominant, another bullish breakout above 1.2750 is needed to extend potential bullish targets towards 1.2800, 1.2890 and 1.2940 if sufficient bullish momentum is demonstrated. On the other hand, the price level of 1.2650 stood as a prominent demand level offering a valid BUY entry (demonstrating a bullish Head & Shoulders reversal pattern). However, any bearish breakout below 1.2650 invalidates the mentioned bullish scenario. Trade Recommendations: For Intraday traders, A valid BUY entry can be offered upon bullish breakout above 1.2750. T/P level to be located around 1.2820, 1.2900 and 1.2940. S/L should be placed below 1.2690. Conservative traders should wait for an extensive bullish movement towards 1.2870-1.2905 (newly-established supply zone) to look for valid long-term SELL entries. S/L should be placed above 1.2950. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of EURUSD for June 13, 2019 Posted: 12 Jun 2019 08:07 AM PDT EURUSD is not making any important move this far today. Price is consolidating near its recent highs above 1.1320. Trend remains bullish and longer-term target is at 1.17, the start of the falling wedge, as long as price holds above 1.1250.

Green rectangle -support area EURUSD has broken the downward sloping wedge pattern. Price could back test once again the breakout area around 1.1250 but bulls do not want to see a weekly close below 1.1250. Bulls want to see price consolidate and move higher or make a higher low around 1.1250-1.1270 before resuming higher. There are no bearish divergence signals in the Daily chart but only in the 4 hour. So we could see some weakness and a shallow pull back until Friday. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of Gold for June 13, 2019 Posted: 12 Jun 2019 08:03 AM PDT Gold price remains in a short-term bullish trend. After pulling back towards the 38% Fibonacci retracement, price is now challenging the major resistance area of $1,350 once again. Another rejection in the $1,340-50 area will lead to a reversal that will most probably push prices towards the major support at $1,300.

Black line- short-term resistance (broken) Blue line - major resistance Gold price is trading above $1,335 once again just below the major $1,350 resistance. Price respected the 38% Fibonacci retracement and is rising. This is major resistance area and bulls should not get overconfident. A rejection here will most probably bring prices much lower towards $1,300. Support is very important in that area. Breaking below it will open the way for a move towards $1,200. Breaking above $1,350 will open the way for a longer-term bullish move with targets approaching $1,450-$1,500. The material has been provided by InstaForex Company - www.instaforex.com |

| Bitcoin analysis for June, 12.2019 Posted: 12 Jun 2019 07:18 AM PDT Bitcoin went up and did test the strong resistance at the price of $8.011. The 4H trend is still downward and buying at this stage looks very risky. Our advice is still to watch for selling opportunities.

Red downward cloud – Resistance Span B Ichimoku –Top of the cloud resistance $8.108 Red line – Tenkan-sen (Support) $7.866 Blue line – Kijun- sen (Support 2) $7.760 Red rectangle – Support 3 ($7.457) Yellow rectangle – Support 4 ($7.030) Blue rectangle – Important resistance ($8.090) The price did test and reject of the important resistance near $8.000, which is sign that buyers lost interest. We also found that price is inside of the4H Ichimoku Cloud, which is acting like resistance zone. Our advice is to in the direction of the trend. Watch for selling opportunities with downward targets at $7.457 and $7.030. As long as the BTC is trading below the Cloud, we are watching for selling opportunities. The material has been provided by InstaForex Company - www.instaforex.com |

| Analysis of Gold for June 12,.2019 Posted: 12 Jun 2019 07:04 AM PDT Gold has been trading upwards in past 24 hours. The price price almost went to test span A of Ichimoku cloud and it failed, which is a sign that buyers are still alive. The trend is very strong on the upside so you should watch for buying opportunities only

Red line – Tenkan-sen (support1 at $1.328) Span A Ichimoku –Top of the cloud Support 2 ($1.325) . The buyers are still in control on the 4H time-frame and you should only watch for buying opportunities on the dips. The level at $1.328 is providing great support for potential re-buying. The trend is very strong on the upside and you should only watch for upside. The cloud is "fat", which is signal that there is strong demand of the Gold. Additionally, we found that there is potential end of the downawrd correction (abc expanded flat), which is sign that buyers may continue with the upside. Upward targets are set at the price of $1.345 and $1.363. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD analysis for June 12,.2019 Posted: 12 Jun 2019 06:45 AM PDT GBP/USD has been trading upwards as we expected. The price tested the level of 1.2760. The level at 1.2760 is very important resistance. The potential breakout of 1.2760, would confirm further upward continuation.

Blue rectangle - horizontal resistance Red line – Tenkan-sen (support1 at 1.2713) Blue line – Kijun-sen (support2 at 2 1.2706) Our analysis from yesterday is still active and there is no change in trend dynamic. The buyers are still in control on the 4H time-frame and you should only watch for buying opportunities on the dips. Key resistance is set at the price of 1.2760. Breakout of this resistance would confirm test of 1.2810 and 1.2864.The another confirmation that trend is still bullish is that GBP is trading above the Ichimoku cloud (blue cloud). As long as the price is trading above Ichimoku cloud we advice you to watch for buying opportunities. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD: plan for the US session on June 12. Buyers of the pound continue to push it up Posted: 12 Jun 2019 06:24 AM PDT To open long positions on GBP/USD, you need: The weakness of the US dollar is clearly seen in the pair with the British pound, where buyers have coped with the next task, and, despite the emerging divergence on the MACD indicator, fixed above the resistance of 1.2728. While trading is conducted above this level, it is likely that the upward correction will continue to the highs of 1.2765 and 1.2795, where I recommend fixing the profit. In the scenario of a pound decline below the level of 1.2728, for example, on good inflation data in the US, you can count on long positions to rebound from the minimum of 1.2691. To open short positions on GBP/USD, you need: Sellers of the pound will return only after the update of the resistance of 1.2765, and then, under the condition of false breakdown, however, I recommend opening larger short positions on the test of the maximum of 1.2795. The main task of the bears will be to close the day below the support of 1.2728, which will keep the pair in the side channel. Indicator signals: Moving Averages Trading is above 30 and 50 moving averages, which indicates a possible continuation of the pair's growth. Bollinger Bands The downward movement of the pound will be limited by the lower limit of the indicator in the area of 1.2710, while the breakthrough of the upper limit in the area of 1.2760 will lead to a new wave of growth.

Description of indicators

|

| EUR/USD: plan for the US session on June 12. Draghi's speech has hurt the euro Posted: 12 Jun 2019 06:24 AM PDT To open long positions on EURUSD, you need: Euro buyers failed to stay above the important support level of 1.1330 and missed it after the speech of the President of the European Central Bank Mario Draghi. At the moment, it is best to expect a return to the market of buyers after updating the support level of 1.1290, where you can open long positions immediately on the rebound. Weak inflation data in the United States can once again lead to a rise in EUR/USD in the second half of the day. Therefore, the breakout of the resistance of 1.1341 will be a good signal for opening long positions in the calculation of updating the highs in the area of 1.1366 and 1.1392, where I recommend taking the profit. To open short positions on EURUSD, you need: The bears coped with the task and returned to the support level of 1.1330, but this did not lead to the desired sale of the euro, as all attention is now focused on inflation data in the US. The main goal is the support of 1.1290, the repeated test of which will necessarily lead to its breakthrough and the descent of EUR/USD to the area of the minimum 1.1253, where I recommend taking the profit. In the case of growth in the second half of the day above the resistance of 1.1341, it is best to sell the euro on the rebound from the new monthly high at 1.1366 and 1.1392. Indicator signals: Moving Averages Trading is conducted in the area of 30 and 50 moving averages, which indicates the uncertainty of the market before the release of an important report. Bollinger Bands Volatility fell sharply before the US inflation report, which does not give signals to enter the market.

Description of indicators

|

| EUR/GBP: catch the price on corrective pullbacks Posted: 12 Jun 2019 05:08 AM PDT The euro/pound cross-pair rose by almost 500 points in May. Northern dynamics were almost recoilless and was caused primarily by Brexit. Against the background of the British problems, the single currency looks much more attractive, even despite the slowdown in the key economic indicators of the Eurozone (primarily inflation).

But in early June, the EUR/GBP pair slowed its growth and is currently showing a corrective decline. This behavior of the pair is understandable, given the overbought euro and the sluggishness of the "divorce process" of Britain. In my opinion, this situation can be used to open long positions on the price decline: almost all signals of trend indicators suggest that the Northern momentum has not yet exhausted itself. Thus, on almost all "higher" timeframes (namely from D1 and above), the Ichimoku trend indicator shows a bullish "Line Parade" signal, in which all the indicator lines are under the price chart. Also, the pair is located between the upper and middle line (and on W1 – on the upper) of the Bollinger Bands indicator, which also confirms the upward price vector. A temporary pullback in price yet that does not change the configuration of the trend indicators, so with high probability, we can assume that the North trend in the medium term will be continued. From the point of view of the foundation, such a scenario is also quite likely. But first of all, we will deal with the reasons for the corrective decline in EUR/GBP to assess the chances of restoring the cross. By and large, the pair is losing ground for two reasons: first, because of Mario Draghi's rhetoric, and second – because of Boris Johnson's rhetoric. Their performances, let's say, "resonated", putting downward pressure on the euro/pound pair. In particular, the head of the ECB said that the countries of Central and Eastern Europe are the most vulnerable to the global trade war. He noted the high dependence of these countries on foreign trade while focusing on the automotive industry. After these words, the single currency was under certain pressure, despite the fact that it was not the first time when Draghi voiced such thoughts. But in this case, the market has linked these words with the prospects of reducing the interest rate, against the background of recent rumors about this. Draghi himself did not draw such parallels, but his colleague – the head of the Bank of Finland and a member of the ECB Board of Governors Olli Rehn, did it for him. He said that the global trade conflict is unlikely to be completed in the near future, so the European Central Bank is ready to use "any tools" to support the growth of the eurozone economy. He did not specify what it was about, although in this case such clarifications are not required. It is obvious that the regulator, if necessary, will use one of the available tools from the "arsenal" of the ECB: either a reduction in the rate (more likely option) or the resumption of QE (less likely option). Such prospects put the expected pressure on the euro, and together with the pound, it somewhat weakened its position.

But the pound, in turn, strengthened slightly throughout the market after the statement of Boris Johnson that "hard" Brexit is not an end in itself for him. Johnson is still a favorite of the inner-party election race and the main contender for the Premier post, so his comments have a serious impact on the market. He expressed doubt that Britain will leave the Alliance without a deal, as "neither London nor Brussels are not interested in this." He also urged to focus on reaching a compromise, "and not to think constantly about a new delay of Brexit." In general, his rhetoric was quite peaceful (as for him), and this fact supported the British currency. In addition, the pound did not fully play very good data on the labor market, which were published yesterday. First of all, we are talking about the growth rate of wages: the indicator exceeded the expectations of exports, being in the "green zone". Such dynamics allowed us to say that inflation indicators will also please investors with stronger figures, increasing the probability of a rate increase. By the way, one of the representatives of the Bank of England – Michael Saunders – yesterday confirmed that the regulator intends to tighten monetary policy, "if only Brexit will be soft and painless." Despite this fundamental picture, the probability of a long-term southern trend resuming is unlikely. All the fundamental factors that push the cross down are quite shaky. On the one hand, some members of the ECB do admit the possibility of a rate cut – but on the other hand, the European Central Bank at its last meeting declared the preservation of a wait-and-see position. Therefore, it is not advisable to talk about reducing the rate in the foreseeable future.

The "peacefulness" of Boris Johnson should also be treated with caution. Although chaotic Brexit is not an end in itself for him, he still plans to change the terms of the deal, while Brussels abandoned such an idea ahead of time. Therefore, the probability of a hard Brexit still persists and will only grow as the last day of October approaches. All this suggests that the EUR/GBP cross pair will continue the northern offensive after a temporary corrective pullback. The first target of the northern movement is 0.9030 – the upper line of the Bollinger Bands indicator on the monthly chart. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 12 Jun 2019 04:30 AM PDT The weak report on US employment for May and the associated increase in the probability of lowering the federal funds rate by 50 bp in 2019 to more than 80% allowed "bulls" on XAU/USD to return quotes to the area of 13-month highs. The USD index, on the contrary, fell to its lowest level since the end of March, which once again convinces: the main reason for the reluctance of gold to strengthen this year was a strong dollar. Even against the backdrop of the decline in the yield of 10-year US Treasury bonds to the minimum levels since the fall of 2017, gold was in no hurry to go North. It needed a signal, and it was the American currency. Dynamics of gold and US dollar

If in 2018, due to the strength of the US economy, the trade war did not confuse the "bulls" on the USD and S&P 500 index, then in 2019 the situation changed radically. The States said goodbye to both the fiscal stimulus and the Fed's monetary restriction. As a result, the escalation of the trade conflict between Washington and Beijing leads to an increase in the volatility of the stock market and to an increase in the likelihood of weakening the monetary policy of the Fed. Both factors create a favorable wind for the precious metal, which it uses in full. Moreover, the physical asset market is doing well: China is increasing its gold reserves for the 6th month in a row, bringing the figure to 1916 tons (+15.6 tons in May), and the reserves of specialized exchange-traded funds after stabilization in late spring went up in June (+2% or 1.4 million ounces since the beginning of the month, according to BMO Capital Markets). Looking at the confident XAU/USD rally, banks and investment companies do not skimp on "bullish" forecasts. According to INTL FCStone, the precious metal will reach the psychologically important level of $1400 in 2019, as investors will increase its share in portfolios due to the uncertainty of the fate of the major world currencies. TD Securities also speaks to the level of $1,400 an ounce, but already in 2020. The company believes that the States are close to the end of the economic cycle, and the Fed will be forced to reduce rates. Though not as soon as the urgent market expects. The forecast is $1320-1375 in the second half of 2019 followed by a rise to an average price of $1425 per ounce in the fourth quarter of 2020. Gold is supported by criticism of the Fed from Donald Trump and his ultimatum to China: if Xi Jinping does not appear at the G20 meeting, the States will impose duties on all imports of China. Beijing promises to respond harshly, which is regarded as an escalation of the conflict and contributes to the correction of the world stock indices. At the same time, the owner of the White House mercilessly scolds Jerome Powell and his team, which with the help of raising rates and the economy, oxygen is blocked, and create an unfavorable playing field for the war between the US and China. Technically, after the first target on the pattern "Wolfe Waves" near the $1350 per ounce, followed by a natural rollback. "Bulls" on gold intend to implement the following target for $1360-1365. It is located on line 1-4. In general, while the precious metal is above $1,310 per ounce, the situation is controlled by buyers. The material has been provided by InstaForex Company - www.instaforex.com |

| Simplified wave analysis and forecast for GBP/USD and USD/JPY on June 12 Posted: 12 Jun 2019 04:30 AM PDT GBP/USD The upward wave of the British currency from May 31 has no reversal potential and acts as a correction of the previous section of the main trend from May 3. The structure of the wave is not showing completeness. Since June 7, the pound quotes form the middle part (B) of the structure, which lacks the final fragment. Forecast: Today, in the first half of the day, an upward movement vector is expected. In the area of the resistance zone, the probability of a change of course and the beginning of a price decline will increase sharply. Recommendations: The pair's purchases can be claimed at the end of the day after the price moves down. Due to the high probability of counter-rollbacks, pound sales carry a high degree of risk. The best solution is to refrain from trading during the correction and look for the entry signals to long positions at its end. Resistance zone: - 1.2750/1.2780 Support zone: - 1.2680/1.2650

USD/JPY The bullish wave of the Japanese yen, which started on June 3, increased its wave level in the process of development. Preliminary analysis indicates the formation of a correction to the larger bearish trend wave of May 21. The structure of the rising wave lacks the final spurt upwards. In the framework of the last part, a pullback is developing from yesterday. Forecast: In the first half of the day, the price is expected to continue to decline, until its full completion as part of the settlement support. Puncture of its lower boundary is unlikely. By the end of the day, there will be a chance of a reversal and the beginning of the price rise of the pair, which can take a pulse form. Recommendations: Sale has a small capacity and is therefore irrelevant. In the area of the support zone, it is recommended to monitor the reversal signals of your trading systems to find the entrance to long positions. Resistance zone: - 109.00/109.30 Support zone: - 108.20/107.90

Explanations to the figures: Waves in the simplified wave analysis consist of 3 parts (A-B-C). The last unfinished wave is analyzed. Zones show areas with the highest probability of reversal. The arrows indicate the wave marking according to the method used by the author, the solid background is the formed structure, the dotted ones are the expected movements. Note: The wave algorithm does not take into account the duration of tool movements over time. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD: Weak UK GDP to help USD regain momentum? June 12, 2019 Posted: 12 Jun 2019 03:57 AM PDT GBP managed to gain momentum and sustain it quite well over USD recently. After impulsive bearish pressure, the price is making pullbacks. Due to contraction in the UK GDP and a slowdown in the manufacturing sector, GBP is expected to lose momentum in the coming days. Bank of England official Gertjan Vlieghe recently stated that risks to the economy had deteriorated since the British central bank published its most recent forecasts in May and worse-than-expected economic data made the UK economy lose momentum. Mr. Vileghe expressed hopes that the UK economy would gather speed despite global trade tensions and continued uncertainty about Brexit. On the Brexit front, there are still concerns that leaving the European Union on Oct. 31 without any transition deal would be a major economic shock. So, businesses would be unable to prepare for the long-term consequences. Recently Saunders from Monetary Policy Committee stated that there are possibility of interest rates going either way, due to the risk of a weaker pound and a major shock to Britain's supply capacity that would spur inflation. However, financial markets reckon that the BoE is more likely to cut rates to support economic growth after a disruptive no-deal Brexit. Recently, UK Average Cash Earnings report presented a better than expected value of 3.1% versus 3.3% in the previous month. But Claimant Count Change report was published with a negative result of an increase to 23.2k from the previous figure of 19.1k which was expected to decline to 12.3k. Bank of England's Governor Carney is going to speak on Friday. His speech is expected to make a good impact on the upcoming momentum of GBP. On the USD side, the US is due to release a retail sales report on Friday. Analysts have optimistic expectation, so retail sales could have risen to 0.7% from -0.2%. If the forecast comes true, USD could regain momentum over GBP at the end of the week. Recently US PPI report was published with a decrease to 0.1% as expected from the previous value of 0.2% but IBD/TIPP Economic Optimism dropped to 53.2 from the previous figure of 58.6 which was expected to grow to 59.2. There are three weeks to go before US and China's leaders meet for the trade talks. Investors have low expectations for progress toward ending the trade war. The parties have made little preparation for a meeting even under the conditions that the health of the world economy is at stake. US President Donald Trump recently defended the use of tariffs as part of his trade strategy while China pleged to make a tough response if the United States insists on escalating trade tensions. Moreover, President Trump is again taking a dig on Federal Reserve's monetary policy which he believes is to blame for the lack of economic progress in the US. To sum it up, the UK discouraged investors with weak GDP, thus causing negative market sentiment on GBP. The upcoming economic reports from the US will show whether USD can regain and maintain the momentum over GBP. Now let us look at the technical view. The price is currently trading inside the corrective resistance range between 1.2700-50 from where it has greater probability to move lower following the overall bearish trend. The price is currently being held by 20 EMA as resistance. Confluence to the overall price action bearish context is expected to push the price lower towards 1.2500 support area in the coming days as the price remains below 1.30 area with a daily close.

|

| BITCOIN hovering at around $8,000. June 12, 2019 Posted: 12 Jun 2019 03:41 AM PDT Bitcoin managed to gain bullish momentum following a bounce from $7,500 as expected. Now there is a greater probability for the price to continue its climb with a target towards $8,000 in the coming days. A recent poll shows that the majority of crypto investors have never experienced a transition from a bear market into a bull run. So, that's what exactly is going on across the crypto market in recent weeks. BTC price is extending its climb moving away from the bottom reached in December 2018. Now Bitcoin price is rising once again having reversed after a downtrend for the whole year. The asset's 200-week moving average which is an important long-term trend strength indicator is again growing at a rate of 5% month over month. In Bitcoin, the vital indicator acted as support at the lowest points of the bear market. Eventually it prevented the Bitcoin price from falling lower, acting as the fuel that rocketed Bitcoin into a new bull trend. Most crypto analysts remind investors about increasingly longer market cycles in Bitcoin. However, bearing in mind the recent price action and corresponding growth in the 200-week moving average, the Bitcoin price might be ready to go on a full-blown bull run, causing a much shorter market cycle from the bear market low to the peak of the next hype. Meanwhile, the price is currently trading at near an important price area of $8,000 where stronger bearish pressure was observed earlier. History may repeat again. A daily close above $8,000 is expected to lead the price higher towards $9,000 again with an ultimate aim to reach the psychological level of $10,000. SUPPORT: 7,000, 7,500, 7,800 RESISTANCE: 8,000, 8,400-500, 9,000 BIAS: BULLISH MOMENTUM: VOLATILE

|

| Technical analysis of GBP/USD for June 12, 2019 Posted: 12 Jun 2019 02:59 AM PDT Overview: The GBP/USD pair continues to move downwards from the level of 1.2905. This week, the pair rose from the level of 1.2905 to a top around 1.2800 and it set around the spot of 1.2800. The first resistance level is seen at 1.2905 followed by 1.2963 , while daily support 1 is seen at 1.2798 (38.2% Fibonacci retracement). According to the previous events, the GBP/USD pair is still moving between the levels of 1.2700 and 1.2610; so we expect a range of 90 pips in coming hours. Furthermore, if the trend is able to break out through the first support level at 1.2662, we should see the pair climbing towards the double bottom (1.2436) to test it later. Therefore, sell below the level of 1.2800 with the first target at 1.2610 in order to test the daily resistance 1 and further to 1.2436. Also, it might be noted that the level of 1.2436 is a good place to take profit because it will form a double bottom. On the other hand, in case a reversal takes place and the GBP/USD pair breaks through the resistance level of 1.2905, then the stop loss should be placet at 1.2930. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of EUR/USD for June 12, 2019 Posted: 12 Jun 2019 02:48 AM PDT Overview: The EUR/USD pair is set above strong support at the levels of 1.1301 and 1.1259. This support has been rejected four times confirming the uptrend. The major support is seen at the level of 1.1259, because the trend is still showing strength above it. Accordingly, the pair is still in the uptrend in the area of 1.1259 and 1.1301. The EUR/USD pair is trading in the bullish trend from the last support line of 1.1259 towards thae first resistance level of 1.1348 in order to test it. This is confirmed by the RSI indicator signaling that we are still in the bullish trending market. Now, the pair is likely to begin an ascending movement to the point of 1.1348 and further to the level of 1.1389. The level of 1.1389 will act as the major resistance and the double top is already set at the point of 1.1348. At the same time, if there is a breakout at the support levels of 1.1301 and 1.1259, this scenario may be invalidated. The material has been provided by InstaForex Company - www.instaforex.com |

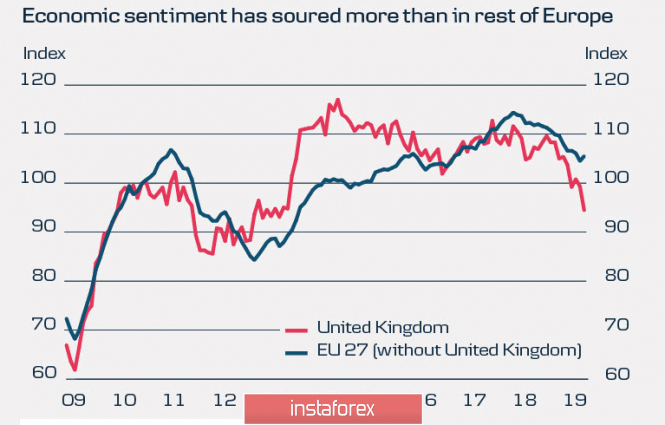

| Panic returns: EUR and GBP lose ground for growth Posted: 12 Jun 2019 01:23 AM PDT The dynamics of producer prices in May was close to forecasts, the growth was only 0.1%, business optimism indices from NFIB and IBD/TIPP gave the opposite results, without adding clarity. Markets traded neutrally, taking advantage of the temporary respite due to the lack of news from the fields of the trade war between the US and China, but the surge of a new wave of panic in the coming days is becoming more likely. China, focusing on changing the rhetoric of the Fed, has already announced new tax incentives aimed at financing infrastructure projects, that is, exactly what Washington is trying to limit. The pause may last until the G20 meeting on June 28-29, but the lack of positive news in itself can return panic and provoke a new wave of demand for protective tools. EURUSD The indicator of investor confidence Sentix fell in June to -3.3 p, falling by 8 points. In Germany, the situation is even more serious, as the overall index for the first time since March 2010 returned to the negative territory, which makes the recession very likely. Moreover, despite the confidence of the US President that he is winning the trade war, this Pyrrhic victory does not support the US economy. The overall US index fell by more than 10 points to its lowest level in February 2016.

The ECB, as expected, changed its rhetoric, extending the period of unchanged interest rate to at least the middle of 2020, so the markets do not expect any changes in connection with the transition of the ECB to the easing regime. If the economic situation continues to deteriorate, which in turn will call into question plans to achieve the target level of core inflation, the expansion of incentives will become inevitable. Already, market inflation expectations are close to historical lows. Today, comments on monetary policy will be addressed to different audiences by Draghi, de Guindos and Coeure, and their task is to try to prevent the euro growth against the background of changing expectations on the rate of the Fed, so the markets can hear something new on the details of the implementation of the incentive program TLTRO3. On Wednesday morning, the euro is trading in the range near 3-month highs, expected growth to 1.1375/85 and further to 1.1448 did not take place due to a very weak Sentix index and the bank holiday, trading in the range with a high probability will continue today. An attempt to update the recent high of 1.1347 is expected, but there is little chance of steady growth. GBPUSD Unemployment in the UK remained at 3.8% in February – April, which is in line with forecasts, the average wage increased by 3.4%, and taking into account premiums – by 3.1%. The pound reacted with a slight increase, but the upward movement is unlikely to develop, as in favor of reducing the grounds much more. On Monday, we predicted the growth of GBPUSD to 1.2762/72 and further to 1.2863, the first goal was achieved, but then the upward movement of the pound was stopped by an extremely weak report on industrial production. The decrease in April was 2.7%, in the manufacturing industry -3.9%, year-on-year indicators also went negative to -1.0% and -0.8%, respectively. Moreover, NIESR lowered its quarterly GDP growth estimate from 0.4% to 0.1%, with markets expecting growth of 0.5%, and such a low estimate means that the UK has only one step left in the recession. In such conditions, it is not necessary to count on the growth of investments. Economic sentiment in the UK business environment remains depressed and looks much worse than in the rest of Europe. The decline in sentiment is largely due to a decline in business confidence and political uncertainty.

Both Labor and Conservatives are losing the trust of voters, yielding to the fast-moving pressure of Nigel Farage's new Brexit party, urgent elections will be a disaster for conservatives who will lose many seats, and three years after the referendum, there is still no clarity on the scenario of the UK's exit from the EU. The pound goes into the side range, the boundaries of which 1.2653 – 1.2762 will restrain volatility, macroeconomic news is not expected until the end of the week. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

.

.

No comments:

Post a Comment