Forex analysis review |

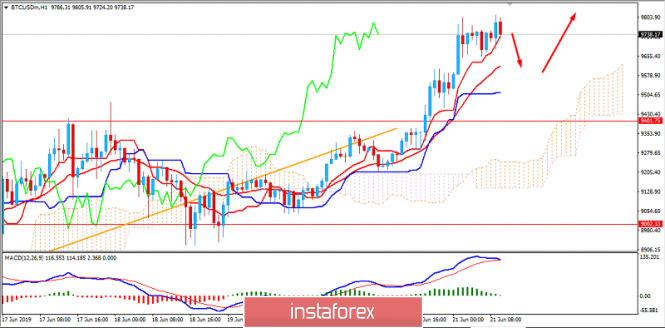

- BTC 06.21.2019 - Median Pitchfork line on the test

- Gold 06.20.2019 - Big domination of bulls continues

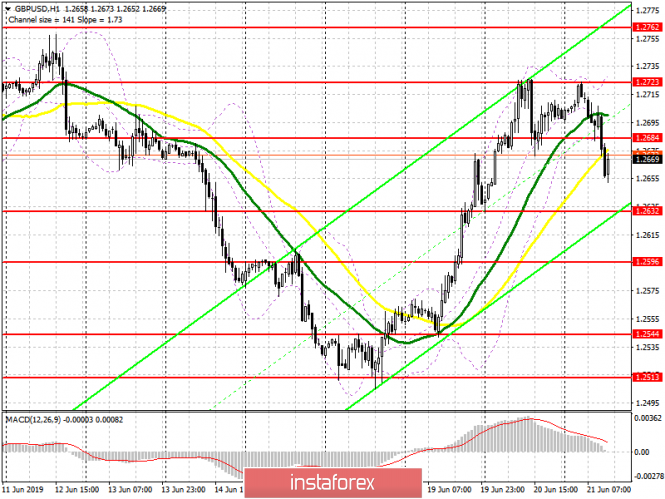

- GBP/USD analysis for June 21,.2019

- GBP / USD plan for the US session on June 21: Buyers failed to drag a pound to new weekly highs

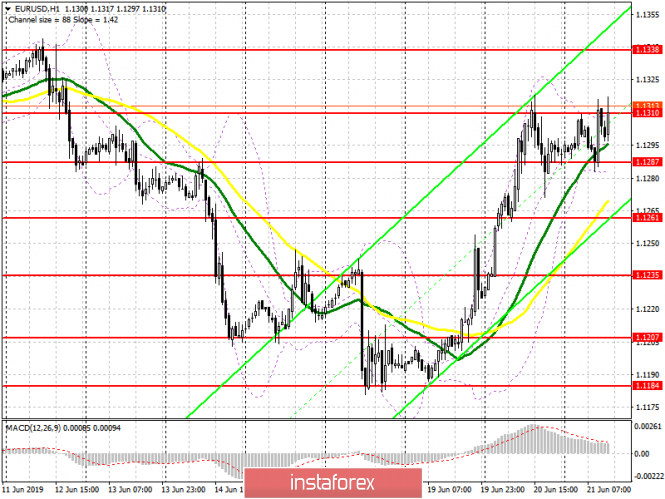

- EUR / USD plan for the US session on June 21. One attempt of euro buyers is not enough

- BITCOIN to reach $10,000 today? June 21, 2019

- EUR/GBP: EUR to assert strength over GBP? June 21, 2019

- Gold: the price of the yellow metal is rising at the maximum

- Trading Plan 06/21/2019 EURUSD

- GBP/USD: USD to regain momentum over GBP despite obstacles? June 21, 2019

- Simplified wave analysis and forecast for GBP / USD and USD / CHF pairs on June 21

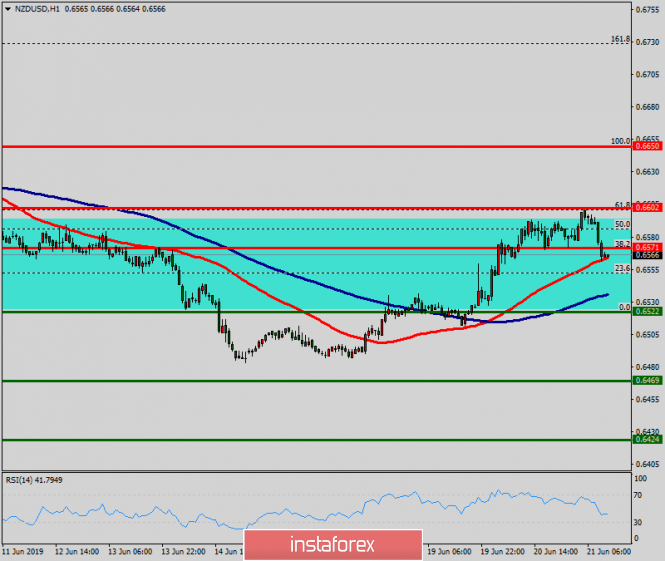

- Technical analysis of NZD/USD for May 21, 2019

- EUR and GBP: Euro and Pound may maintain upward momentum

- Technical analysis of AUD/USD for June 21, 2019

- Trading recommendations for the EURUSD currency pair - prospects for further movement

- Long queue (review of EUR / USD and GBP / USD on 06/21/2019)

- Wave analysis of EUR / USD and GBP / USD for June 21. The Bank of England will "go with the flow" in determining monetary

- Burning forecast 06.21.2019 EURUSD and trading recommendation

- USD / JPY. The American drone shot down by the Iranians helped the yen to become a favorite of the foreign exchange market

- Forecast for EUR / USD and GBP / USD pairs on June 21. Both pairs are preparing for a new fall

- Review of GBP / USD pair on June 21. The forecast for the "Regression Channels" system. Boris Johnson and Jeremy Hunt will

- Trading recommendations for the GBPUSD currency pair - prospects for further movement

- GBP/USD: plan for the European session on June 21. Demand for the pound will return after a slight downward correction

- Bitcoin. 9 800 it is! We are waiting for 10,000 and a downward correction

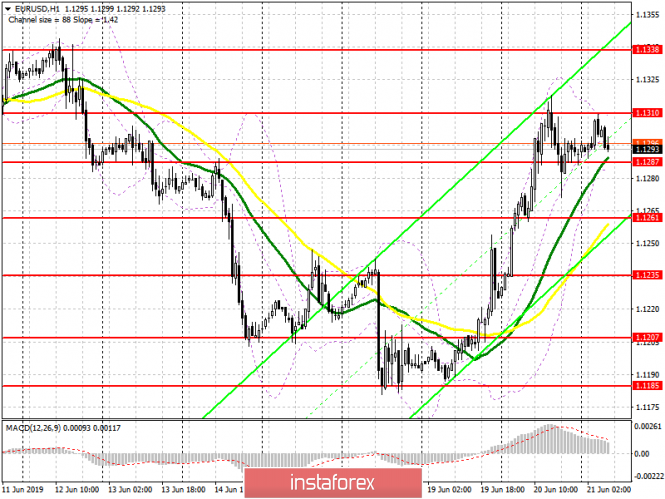

- EUR/USD: plan for the European session on June 21. Euro growth will be limited by a resistance of 1.1338

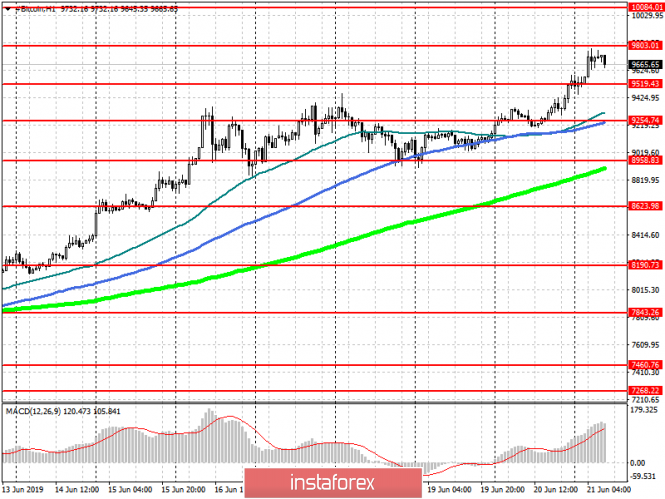

| BTC 06.21.2019 - Median Pitchfork line on the test Posted: 21 Jun 2019 07:27 AM PDT Median Pitchfork line at $9.856 held successfully, which is sign that BTC found resistance there and I expect potential downside at least to test lower diagonal of Pitchfork channel at $9.530. There is also potential that BTC test support at $9.443.

ML – Median Pitchfork line (acting like resistance) Blue rectangle - Support Black lines- Upward Pitchfork channel I found that ML held nicely at $9.856, which is sign for me that there is potential downside incoming on the BTC. There is that Stochastic bearish divergence as well in the background, which is another sign of the potential downside. As long as the BTC is trading below the $9.887, I will focus on the downside with the target at $9.433. Only in case of the strong break of the ML on the upside, my focus will be on long side with the potential targets at $10.000-$11.000.The material has been provided by InstaForex Company - www.instaforex.com |

| Gold 06.20.2019 - Big domination of bulls continues Posted: 21 Jun 2019 06:04 AM PDT Gold did push higher as I expected yesterday. The price tested the level of $1.410. I still expect more upside due to new momentum up on the MACD oscillator and Gold is the extended UP run.

Blue rectangle – Important weekly resistance Orange rectangle – Resistance became support Black lines- Upward Pitchfork channel My analysis didn't change much since yesterday.Gold did breakout of the major resistance at $1.346 and that action did set the bullish tone that we are seeing now. Price has reached and broke the Pitchfork median line and confirmed that Gold has entered into strong bullish environment .RSI and MACD are showing overbought condition but this is due to very strong bulls on the market. As long as the Gold is trading above the level $1.356, we will look for buying signals. Watch for buying on dips with target around $1.433.The material has been provided by InstaForex Company - www.instaforex.com |

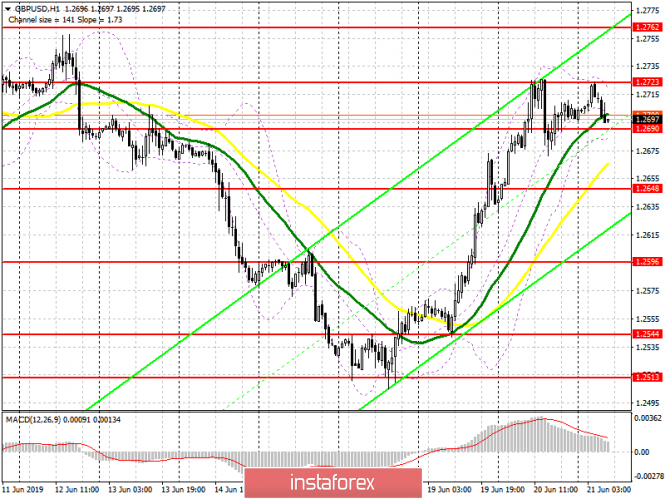

| GBP/USD analysis for June 21,.2019 Posted: 21 Jun 2019 05:24 AM PDT GBPUSD has been trading downwards during the Asia and Europe session and it is unlikely that US session will also be bearish. My advice is to watch for buying opportunities. I expect that GBP trades towards the levels of 1.2722 and 1.2760.

Orange rectangle – swing high resistance Blue rectangle- Cluster resistance Blue channel – Keltner channel Orange line – 20EMA I found that GBP fail to penetrate the 20EMA on the H4 time-frame, which is sign that the level around 1.2640 acting likes support. The Fibonacci retracement 38.2% is also set at the price of 1.2640. There is also potential ABC downward correction completion, which is another sign of the potential strength incoming on the GBP. In case of the potential breakout of 1.2640, next downward support will be set at the price of 1.2590 (Fibonacci retracement 61.8%). Upward targets and resistance levels are set at 1.2722 and 1.2760. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP / USD plan for the US session on June 21: Buyers failed to drag a pound to new weekly highs Posted: 21 Jun 2019 04:38 AM PDT To open long positions on GBP / USD pair, you need: Buyers failed to drag the pound to new weekly highs, which led to the formation of a downward correction in the morning. At the moment, it is best to return to long positions immediately to rebound from large support of 1.2632 or after growth and consolidation above the resistance of 1.2684, which will allow bulls to tighten the GBP/USD pair until the end of the day to a maximum of 1.2723 and retain the upward trend. To open short positions on GBP / USD pair, you need: An unsuccessful consolidation and return under the resistance level of 1.2684 will be another signal to open short positions in the pound, which will lead to an update of the minimum of 1.2632, where I recommend taking profits. Under the growth scenario of the pair above 1.2684 (for example, after the release of a weak report on the American economy), it is best to sell the pound to rebound from a local maximum of 1.2723. Indicator signals: Moving averages Trade is conducted in the region of 30 and 50 moving averages, which indicates the formation of a downward correction. Bollinger bands If the pair grows, the average border of the indicator in the area of 1.2695 will act as resistance. Description of indicators MA (moving average) 50 days - yellow MA (moving average) 30 days - green MACD: fast EMA 12, slow EMA 26, SMA 9 Bollinger Bands 20 The material has been provided by InstaForex Company - www.instaforex.com |

| EUR / USD plan for the US session on June 21. One attempt of euro buyers is not enough Posted: 21 Jun 2019 04:37 AM PDT To open long positions on EUR/USD pair, you need: Euro buyers did not cope with the first attempt at resistance level 1.1310, which I paid attention to in the morning review, but the potential for growth remains. While trading is above the support of 1.1287, the bulls will storm the resistance of 1.1310 and a breakthrough will lead the EUR/USD pair to the area of the new maximum of 1.1338. Possibly, this will allow updating the area of 1.1366, where I recommend taking profits. Weak reports on the US economy can help. In the case of a re-decline scenario to the support area of 1.1287, it is better to ignore this level and return to long positions to rebound from a minimum of 1.1261. To open short positions on EUR/USD pair, you need: European currency sellers will try not to let bulls above the resistance of 1.1310. Another false breakdown, together with good fundamental statistics for the US, will be a signal to open short positions in euro with the main goal of fixing below the support of 1.1287. This will allow the resumption of the downward correction in the afternoon at the area of 1.1261 minimum, where I recommend fixing the profit. If the bulls find the strength and try to break through the resistance of 1.1310, it is best to consider short positions for a rebound from the maximum of 1.1338. Indicator signals: Moving averages Trading is above 30 and 50 moving averages, which indicates a continuation of the bullish scenario. Bollinger bands If the euro falls, support will be provided by the lower boundary of the indicator in the region of 1.1287. Description of indicators MA (moving average) 50 days - yellow MA (moving average) 30 days - green MACD: fast EMA 12, slow EMA 26, SMA 9 Bollinger Bands 20 The material has been provided by InstaForex Company - www.instaforex.com |

| BITCOIN to reach $10,000 today? June 21, 2019 Posted: 21 Jun 2019 04:05 AM PDT Bitcoin managed to extend strength without deeper pullbacks along the way after the price had broken above $9,400 with a daily close. Though the price may turn a bit volatile, it is held by the dynamic support levels along the way. Thus, it has a greater chance to climb higher towards $10,000 by the weekend. Markets have hit a new high of the year. As usual, Bitcoin is a pacesetter. A total market cap top of $300 billion was touched a few hours ago as Bitcoin broke through resistance once again surging to a new 13-month high. The move came a few hours ago during the early Asian trade. We are watching gradual upward momentum through the resistance at $9,400 and on towards an intraday high of $9,800. Since then, gains have mostly held as Bitcoin remained around $9,700 with high expectations for a further move to $10,000 today or over the weekend. Over the past week, Bitcoin surged the whopping 18% from $8,200 to its current level. Since the beginning of the year, the price is up 158% looking to make further gains. Many speculators and analysts are confident that the big $10,000 price will be hit soon, maybe even today. However, certain corrections along the way may delay this jump until the weekend. If the price manages to break successfully above $10,000 with a daily close, it is expected to reach the resistance point up to Bitcoin's previous all-time high of $20,000. From the technical veiwpoint, the price has almost approached the psychological level of $10,000 from where certain volatility and corrections may be observed. Though the price moved higher with consistency, BTC might face bearish pressure at $9,400-500 while being carried by the dynamic levels as support. A daily close above $10,000 will indicate further upward movement along the way. As the price remains above $9,000, this reinforces the bullish bias in the coming days. SUPPORT: 9,000, 9,400-500 RESISTANCE: 10,000, 10,300, 10,500 BIAS: BULLISH MOMENTUM: NON-VOLATILE

|

| EUR/GBP: EUR to assert strength over GBP? June 21, 2019 Posted: 21 Jun 2019 03:39 AM PDT EUR has been the dominant currency in the pair while GBP is struggling to regain momentum. Though the eurozone released a series of weak fundamental data, EUR managed to assert strength over GBP. The ECB has been making efforts to improve the economic infrastructure due to swelling public debt in Italy. The ECB is currently desperate to boost economic growth in the eurozone. Mr. Rehn, the possible successor of current ECB president Draghi, stated that the eurozone's economy is battling with low inflation and weak growth. Such a situation is quite worrisome and alarming for the economy if no steps are taken soon. The ECB can resort even to rate cuts in the coming days if needed. European Central Bank Vice President Luis de Guindos recently said that the outlook for the euro area economy has deteriorated and policy makers are ready to provide additional monetary stimulus if needed. Additionally, Italian Prime Minister recently claimed that the European Union's fiscal rules should be revised and focus on growth rather than on financial stability. Under current rules, EU states with large public debts should gradually reduce them, but Rome's debt increased last year and is forecast to expand further until 2020. Today economic reports from the eurozone were published better than expected which includes French, German and Eurozone's Manufacturing & Services PMI reports. The data helped EUR to regain further momentum over GBP. On the other hand, the UK reported on a larger-than-expected budget deficit last month as government spending rose. It reminds the market that the next finance minister may have limited options to support any Brexit impact on the economy. As for the National Statistics, the budget deficit widened to 5.115 billion pounds. For the first two months of the 2019/20 financial year, the deficit was 18% larger than a year earlier at just under 12 billion pounds. An increase in government borrowing this year after a steady fall in the size of the deficit from around 10% of economic output in 2010 to just above 1% last year. Recently UK Retail Sales report was published with contraction to -0.5% as expected from the previous value of -0.1%. Besides, the Bank of England kept the key interest rate unchanged at 0.75% as expected. While the UK central bank maintained the volume of the asset purchase facility and monetary policy. Today UK Public Sector Net Borrowing report was published with a decrease to 4.5B from the previous figure of 6.2B which failed to meet the expected reading of a decrease to 3.3B. So, the worse-than-expected result affected sustainable GBP gains at the current price formation. To sum it up, GBP is unable to gain ground. EUR seems to be more optimistic despite the challenges being faced. Today EUR found support from solid PMIs from leading EU countries. Now let us look at the technical view. The price is being held by the dynamic level of 20 EMA. The pair is now trading below 0.8950-0.90 with a daily close which indicates higher volatility. I expect a strong counter-move with a target towards 0.8850 and later towards 0.8700 support area in the coming days. As the price remains below 0.90 area, the bearish bias is expected to continue further.

|

| Gold: the price of the yellow metal is rising at the maximum Posted: 21 Jun 2019 03:08 AM PDT According to experts, the yellow metal market has shown an upward trend over the course of several weeks. The long-term key level of price resistance was overcome, which allowed investors to actively invest in precious metals. This opened up opportunities for rising gold value. The situation was also influenced by the actions of the world's leading central banks, following the policy of lowering interest rates. Recall the next Fed meeting on monetary policy on Wednesday, June 19, it was decided to keep rates at the same level but eight members of the committee admitted the possibility of reducing them in the near future. According to analysts, low interest rates increase the attractiveness of non-interest-generating assets, which include the yellow metal. Most global regulators have a low or negative interest rate policy. As a result, the gold rate received significant support from leading central banks, lowering their interest rates. Recall that for 1 ounce of gold they gave $1343 recently. However, on Thursday, June 20, the yellow metal rose in price by 2.6%, reaching a six-year high of $1,394 dollars per ounce. As a result, the value of gold turned out to be very close to the psychologically important mark of $1,400. For several years, the course of the precious metal could not overcome the level of $1,350 per ounce but now it has exceeded the six-year resistance line as a result of a sharp rise. This allowed gold to come close to the next level of $1,400 per ounce, experts say. At present, the volume of shares of gold exchange-traded funds has reached the highest monthly figure since January 2019, according to Bloomberg. Analysts say, the gold exchange rate may exceed $1,400 in the event of increased economic and political instability and further escalation of the trade war. One of the important catalysts for the appreciation of the yellow metal is the decline in real interest rates in 2019, experts sum up. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading Plan 06/21/2019 EURUSD Posted: 21 Jun 2019 03:04 AM PDT

The euro is ready to continue to grow on easing expectations of Fed based on the outcome of the Fed meeting on June 18. Tensions around Iran subsided in the morning of June 21 - it became known that the United States was preparing a military strike on Iran in response to the crashed US drone - but Trump canceled the strike. On the trade war Trump - China: The market is awaiting negotiations at the G-20 Trump summit - Xi Jin Ping next week. We expect that the negotiations will be successful. EURUSD : We hold purchases from 1.1250. Possible purchases for a breakthrough at 1.1350. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD: USD to regain momentum over GBP despite obstacles? June 21, 2019 Posted: 21 Jun 2019 03:03 AM PDT GBP managed to gain momentum over USD recently which lead the price to reside at about 1.2700 with a daily close. Despite weak economic reports, gains on the GBP side indicate that USD is losing momentum. The UK posted a larger-than-expected budget deficit last month as government spending rose. It reminds the market that the next finance minister may have limited options to support any Brexit impact on the economy. As for the National Statistics, the budget deficit widened to 5.115 billion pounds. For the first two months of the 2019/20 financial year, the deficit was 18% larger than a year earlier at just under 12 billion pounds. An increase in government borrowing this year after a steady fall in the size of the deficit from around 10% of economic output in 2010 to just above 1% last year. Recently UK released a retail sales data with contraction to -0.5% as expected from the previous value of -0.1%. Besides, the Bank of England kept the key interest rate unchanged at 0.75% as expected. The UK's central bank put on hold the volume of the asset prchase facility and monetary policy. GBP lost momentum against USD recently. Today the UK Public Sector Net Borrowing report was published with a decrease to 4.5B from the previous figure of 6.2B which failed to meet the expected decline to 3.3B. The worse-than-expected reading affected sustainable GBP gains. On the other hand, the US economy is struggling amid the trade wars and the Fed's rhetoric in favor of a rate cut. Poor economic data from the US boosted GBP gains recently. Despite the obstacles, today due to tepid UK economic report, USD managed to put pressure on GBP. According to the US Chief Economist, the Fed may leave the interest rate unchanged throughout 2019. On the other hand, the market is betting on the rate cut in the coming months. US President Donald Trump recently targeted Federal Reserve Chairman Jerome Powell. The US leader advocates for cutting interest rates. A day after at the policy meeting central bankers signaled they would likely do so later this year to prop up economic growth and boost sluggish inflation. Today US Flash Manufacturing PMI report is going to be published which is expected to be unchanged at 50.5 and Flash Services PMI is expected to decrease to 51.0 from the previous figure of 50.9. Additionally, Existing Home Sales report is expected to increase to 5.29M from the previous figure of 5.19M. To sum it up, the downbeat economic reports from the UK already put pressure on GBP gains over USD. Now let us look at the technical view. The price is currently going lower quite impulsively after rejecting off the 1.2700 area with a daily close which is expected to result in further bearish pressure with a target towards 1.2500 again in the coming days. As the price remains below 1.2750 area with a daily close, further bearish momentum is expected in this pair.

|

| Simplified wave analysis and forecast for GBP / USD and USD / CHF pairs on June 21 Posted: 21 Jun 2019 02:47 AM PDT GBP / USD pair Since the beginning of the year, the British pound dominates the bearish trend on the chart. From the strong support zone of large scale from June 18, a bullish wave is formed. The potential of which is sufficient to continue the begun movement at a higher level. Since yesterday, a correctional zigzag has been forming within this wave. Forecast: A descending vector is expected today in the morning. Right up to the completion of the entire downward price movement, then you can count on the turn and the beginning of the price rise. When changing course, volatility can increase dramatically. Recommendations: When selling pounds today, you should reduce the lot and be ready for sharp pullbacks. When the price reaches the support zone, it is recommended to track long entry signals. Resistance zones: - 1.2730 / 1.2760 Support areas: - 1.2660 / 1.2630 USD / CHF pair On the chart of the Swiss franc, the formation of the bearish trend continues, starting from April 24th. The structure of the wave completed the first 2 parts (A + B). Since June 19, the final part (C) has been developed, which has a pronounced pulsed form. The upper boundary of the target zone is located approximately in the price figure from the current rate. Since yesterday, the price rolls back upward. Forecast: The overall flat mood of the franc price movements is expected today. In the morning, the price will mainly move upward. Rise beyond the boundaries of resistance is unlikely. By the end of the day, the chance of a reversal and a return to the trend rate increases. Recommendations: Purchases of the pair are possible today only within the framework of trading sessions with a minimum lot. It is necessary to consider the high probability of counter kickbacks. At the end of the price rise, it is recommended to track the sale signals of the instrument. Resistance zones: - 0.9850 / 0.9880 Support areas: - 0.9800 / 0.9770 Explanations to the figures: The simplified wave analysis uses waves consisting of 3 parts (A – B – C). Each of these analyzes the last incomplete wave. Zones show calculated areas with the highest probability of reversal. The arrows indicate the wave marking by the method used by the author. The solid background shows the formed structure and the dotted exhibits the expected movement. Note: The wave algorithm does not take into account the duration of tool movements over time. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of NZD/USD for May 21, 2019 Posted: 21 Jun 2019 02:09 AM PDT The NZD/USD pair is showing signs of weakness following a breakout of the lowest level of 0.6571. On the H1 chart, the level of 0.6571 coincides with 38.2% of Fibonacci, which is expected to act as minor resistance today. Since the trend is below the 38.2% Fibonacci level, the market is still in a downtrend. However, the resistance is seen at the level of 0.6571. Furthermore, the trend is still showing strength above the moving average (100). Thus, the market is indicating a bearish opportunity below the above-mentioned support levels, for that the bearish outlook remains the same as long as the 100 EMA is headed to the downside. Therefore, resistance will be found at the level of 0.6571 providing a clear signal to buy with a target seen at 0.6500. If the trend breaks the first supprt at 0.6500, the pair is likely to move downwards continuing the bearish trend development to the levels 0.6469 and 0.6420. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR and GBP: Euro and Pound may maintain upward momentum Posted: 21 Jun 2019 01:48 AM PDT The data for the United States, which came out yesterday in the second half of the day, only confirmed the fact that the Fed may seriously consider the option of lowering interest rates in the fall of this year. Apparently, the only thing that pleased me was that the President of the United States Donald Trump, including the report on the current account deficit of the balance of payments, which shows trade and financial flows between the United States and other countries. According to the US Department of Commerce, the deficit decreased to 130.40 billion US dollar, in the first quarter of this year compared to the deficit of 143.93 billion dollars in the fourth quarter of 2018, according to the revised data. Economists expected the deficit to shrink to $122.0 billion in the first quarter. The report also noted that the current account deficit in the balance of payments in the first quarter was 2.5% of the country's real GDP. The main reduction was due to a reduction in the trade deficit in goods. Data from the US Department of Labor Labor Market did not greatly help the US dollar. According to the report, the number of Americans who first applied for unemployment benefits declined last week. Thus, the number of initial claims for unemployment benefits fell by 6,000 in the week from June 9 to June 15, to 216,000. Economists had expected that the number of new claims to be at the level of 220,000. The moving average rose to 218,750 in four weeks. Overall, the US labor market continues to show strength, even though a slight increase in unemployment is expected in the second half of the year. The report also states that the secondary bids for the week from June 2 to 8 were reduced by 37,000, amounting to 1,662,000. On the contrary, the report on the index of business activity in the area of responsibility of the Fed-Philadelphia was unpleasant, which fell sharply in June. According to the data, the general index of business activity dropped immediately to 0.3 points versus 16.6 points in May. A number of sub-indices changed in different directions but the largest drop was noted in the purchasing price index as it fell to 0.6 points in June against 17.5 points in May. This is another sign of a slowdown in US inflation in the 2nd quarter of this year. As for the technical picture of the EUR/USD pair, further movement will depend on the level of 1.1285. If the bulls manage to hold it in the first half of the day, another attempt to break through the resistance of 1.1310 is not excluded, above of which, there are real prospects for updating the weekly highs in the areas of 1.1340 and 1.1370. A downward correction, which may be formed at the end of the week, will be limited by a large support level of 1.1260. The British pound remains to bargain in the channel, forming a psychological figure on the continuation of the uptrend. The news that Boris Johnson continues to strengthen his position in the elections for the post of Prime Minister of Great Britain has not yet put serious pressure on the pair since this option was won back by the bears last week. Let me remind you that yesterday, the former mayor of London Johnson received 157 of the 313 votes of members of parliament representing the Conservative Party. The material has been provided by InstaForex Company - www.instaforex.com |

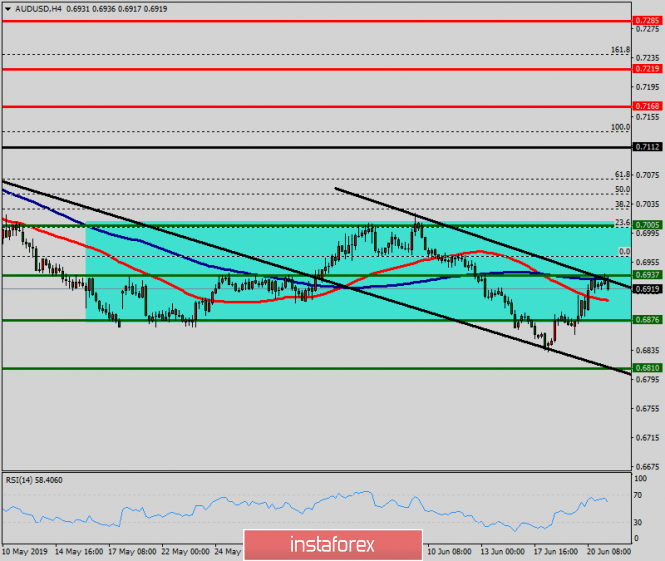

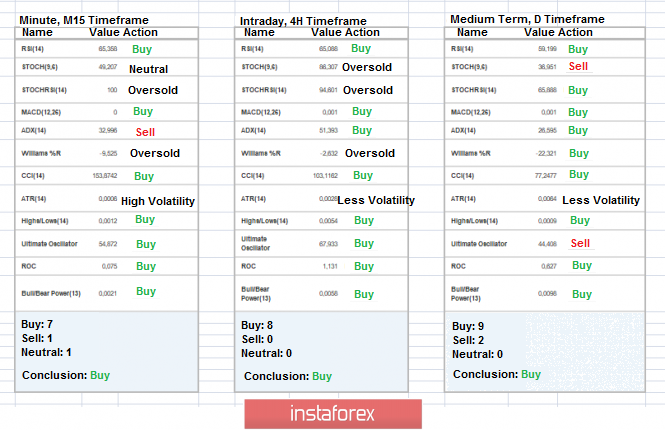

| Technical analysis of AUD/USD for June 21, 2019 Posted: 21 Jun 2019 01:40 AM PDT Overview: The AUD/USD pair is set above strong support at the levels of 0.6876 and 0.6810. This support has been rejected four times confirming the uptrend. The major support is seen at the level of 0.6810, because the trend is still showing strength above it. Accordingly, the pair is still in the uptrend in the area of 0.6810 and 0.6876. The AUD/USD pair is trading in the bullish trend from the last support line of 0.6876 towards thae first resistance level of 0.6937 in order to test it. This is confirmed by the RSI indicator signaling that we are still in the bullish trending market. Now, the pair is likely to begin an ascending movement to the point of 0.6937 and further to the level of 0.7005. The level of 0.7005 will act as the major resistance and the double top is already set at the point of 0.7005. At the same time, if there is a breakout at the support level 0.6810, this scenario may be invalidated. The material has been provided by InstaForex Company - www.instaforex.com |

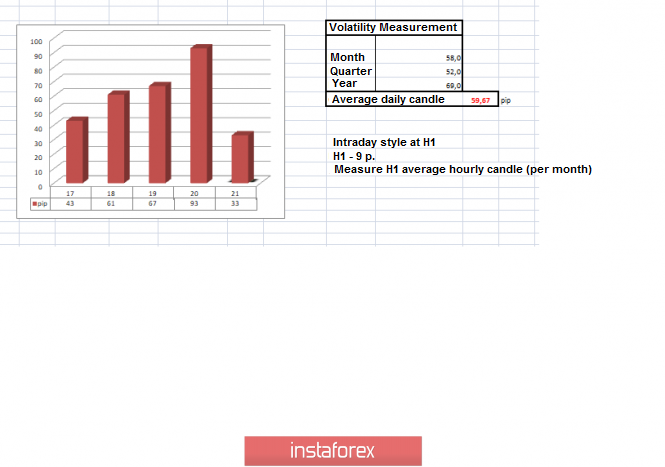

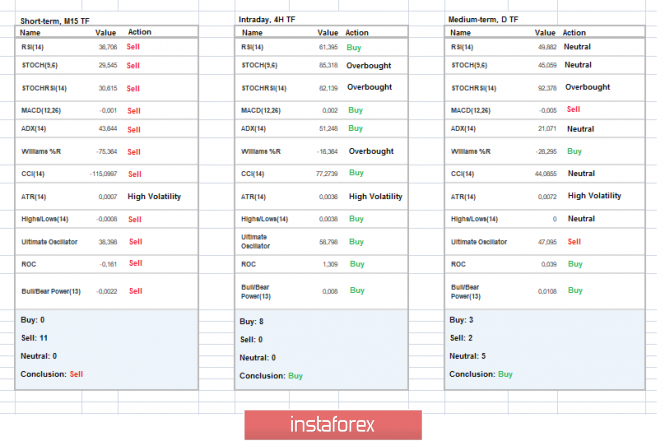

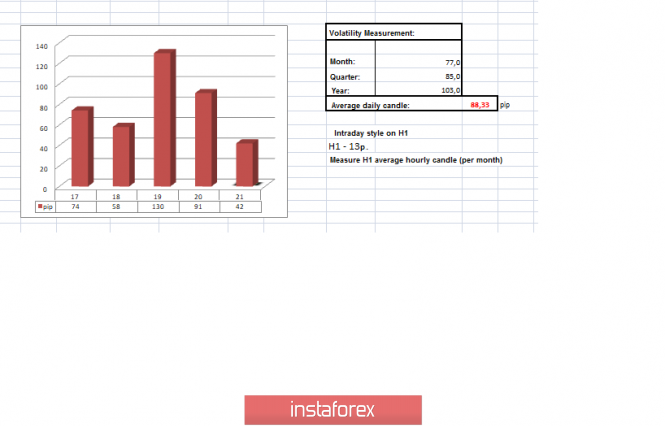

| Trading recommendations for the EURUSD currency pair - prospects for further movement Posted: 21 Jun 2019 01:20 AM PDT For the last trading day, the euro / dollar currency pair again showed high volatility of 93 points, where, as a result, the inertial move persisted, returning the quote to the levels that had been completed earlier. From the point of view of technical analysis, we see a significant gulf of long positions, and the total jump from the point of support 1.1180 is already more than 130 points, I note without any significant recoils or corrections. For a speculative interest, this is the only theory of experts, which in principle justifies this kind of movement. Considering the trading chart in general terms, we see that the global downward trend is still on the market and the quotation is within its upper limit. We turn to the informational - news background and we see that yesterday there were no significant statistics on Europe and the US. The only thing that could have been identified was this number of initial claims for receiving unemployment benefits in the US, where there was no significant decrease from 222K to 216K. News, in principle, did not respond to the market. Today, in terms of the economic calendar, we have data on PMI in Europe and the United States, where, in principle, we do not expect any major changes. At the same time, there are data on sales in the secondary US housing market in May, but even so, the change is not significant: Prev. 5.19M ---> Prog. 5.29M. The upcoming trading week in terms of the economic calendar is less saturated with statistics in comparison with the past week. The most interesting events are displayed below ---> Tuesday, June 18 United States 14:00 UTC+00 - Sales of new housing (May): Prev. 673K ---> 680K forecast Wednesday, June 19 United States 12:00 UTC+00 - Basic orders for durable goods (m / m) (May): Prev. 0.0% ---> Forecast 0.2% Thursday, June 20 United States 12:00 UTC+00 - GDP (q / q) (Q1): Prev. 3.1% United States 14:00 UTC+00 - Index of pending sales in the real estate market: Prev. -2.0% ---> Forecast -2.6% Friday, June 21 EU 09:00 UTC+00 - Consumer Price Index (CPI) (y / y) (June): Prev. 1.2% ---> Forecast 1.3% United States 12:00 UTC+00 - Basic price index for personal consumption expenditure (y / y) (May): Prev. 1.6% These are preliminary and subject to change. Further development Analyzing the current trading chart, we see that the quotation fluctuates within the level of 1.1300, forming versatile candles of the "doji" type, signaling some uncertainty. The speculative bay, which has already been mentioned several times, leads to sharp overheating and ambiguous fluctuations. Traders who have long positions from the environment have already actively fixed profits. It is likely to assume that this overheating is looking for a point of resistance, which is probably already on the nose. In the form of analysis, values in the form of stagnation within 1.1300 are considered, which we now have. The second point is the maximum of the previous upward stroke 1.1350. Based on the available information, it is possible to decompose a number of variations, let's consider them: - Positions for purchase, as I wrote earlier, have been going on for several days and now the process of taking profits is underway. Flying into the position for a possible move to 1.1350, it makes no sense because of the high risk. Any further moves in this direction will be considered already after correction and price fixing higher than 1.1350. - Positions for sale are considered in several stages: first, relative to the current points, in case of fluctuation, the input is lower than 1.1270. If the price is still able to push to the level of 1.1350, then we are looking for stagnation and enter into the deal with it. Indicator Analysis Analyzing a different sector of timeframes (TF), we see that indicators in the short, intraday and medium term, retain an upward interest against the background of the inertial course. Weekly volatility / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation, based on monthly / quarterly / year. (June 21 was based on the time of publication of the article) The current time volatility is 33 points. It is likely to assume that volatility can still grow within the average daily indicator. Key levels Zones of resistance: 1.1450; 1.1550; 1.1650 *; 1.1720 **; 1.1850 **; 1.2100 Support areas: 1.1300 **; 1.1180 *; 1.1112; 1.1080 *; 1.1000 ***; 1,0850 ** * Periodic level ** Range Level The material has been provided by InstaForex Company - www.instaforex.com |

| Long queue (review of EUR / USD and GBP / USD on 06/21/2019) Posted: 21 Jun 2019 01:19 AM PDT

The results of this very meeting became known quite late, even by European standards, and the details that were voiced at the press conference by Jerome Powell, were shown later still. That is, many simply did not have time to respond to what happened. So on Thursday, a cheerful and joyful sale of portraits of deceased presidents of the United States continued with a vengeance, which is perfectly visible from the dynamics of the single European currency. The rebound, of course, suggested itself yesterday, and many were waiting for it, but one should not underestimate how much the prospect of a change in the Federal Reserve System's policy influences the plans of investors who have long since laid the foundation for a further monetary policy tightening. Changing the course of the regulator requires a review of all investment plans.

The pound ran for some time after its continental neighbor, but at some point it just stood up. Of course, the answer suggests itself - Brexit is to blame for everything, or rather, the prospect of seeing Boris Johnson as Prime Minister of Great Britain. Quite expectedly, he won the primary election of the head of the Conservative Party, quite seriously ahead of all his opponents. Now, all members of the Conservative Party must make the final choice between Boris Johnson and current Foreign Secretary Jeremy Hunt. Given that the Conservative Party has about 160,000 members, the elections will be stretched for almost a month, since they will all be voting by mail. For the new head of the Conservative Party, she has is part of the majority in the House of Commons. And for the new prime minister, we only learned about him last July 22. In any case, there is little doubt that Boris Johnson will win, who has a rather interesting position on Brexit and calls for an immediate withdrawal from the European Union, not only without an agreement, but also without any penalties. He is satisfied only with such an agreement, which implies either the absence of any payments, or that Europe shall pay. So it is Brexit that is unregulated, with all its unpredictable consequences for both the United Kingdom and the European Union. However, all this, of course, is extremely interesting, but the growth of the pound stopped much earlier than the results of the primary elections became known. The pound rose in his tracks just when the data on retail sales became known, the growth rates of which collapsed from 5.1% to 2, 3%. The Bank of England also poured oil on the fire, which continues to perform a sketch called "the posture of an ostrich" and once again left unchanged the parameters of monetary policy. There is no doubt that until the end of the epic with the three-time-damned Brexit, the Bank of England will continue to pose as an ostrich hiding its head in the sand. And this is understandable, since it is not worth taking any drastic steps, for it is not yet clear under what scenario will events develop in the future.

Finally, the fall in the dollar stopped only at the time of publication of data on claims for unemployment benefits in the United States, which turned out to be quite good. The total number of applications decreased by 43 thousand, while the forecast was 13 thousand. In particular, the number of repeated applications decreased not by 11 thousand, but by 37 thousand. The number of initial applications, instead of decreasing by 2 thousand, decreased by 6 thousand.

We can say that the potential weakening of the dollar has already been exhausted, so it is worth waiting for a rebound and a local correction. Truth be told, this requires at least some excuse, but with this we have to be cautious today. Only preliminary data on business activity indices in Europe and the United States are published, and in both cases all indicators should remain virtually unchanged. However, in the United States, they are waiting for growth in sales of housing in the secondary market, and at once by 1.2%, so that, albeit slightly, the dollar can somewhat improve its position.

So the single European currency today, may slowly slide to 1.1275.

The pound may end the week at 1.2650.

|

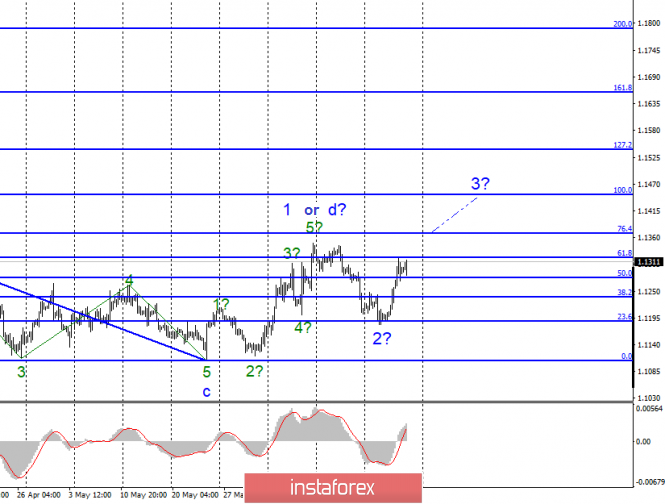

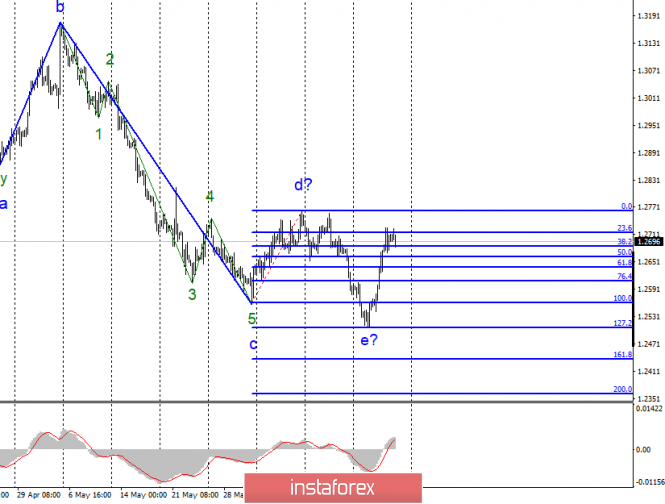

| Posted: 21 Jun 2019 01:15 AM PDT EUR / USD On Thursday, June 20, trading ended with an increase of 65 basis points for the pair EUR / USD. Thus, the main wave marking remains the same which involves the construction of an upward wave 3 as part of a new upward trend with targets located above the 14th figure. However, the news background is still of great importance in the course formation. In recent weeks, the euro found support from traders who made purchases precisely because of the favorable background. But will this support come next week? If not, will markets continue to buy euros by inertia? An alternative is the markup, at which wave 1 will be interpreted as wave d, and from this maximum, in this case, the construction of the downward e, within which waves 1 and 2 have already been constructed, has already started. This is a backup option. Purchase goals: 1.1367 - 76.4% Fibonacci 1.1447 - 100.0% Fibonacci Sales targets: 1.1106 - 0.0% Fibonacci General conclusions and trading recommendations: The euro / dollar pair completed the second wave of the upward trend. I recommend buying Eurocurrencies with targets located near the estimated marks of 1.1367 and 1.1447, which equates to 76.4% and 100.0% of Fibonacci, since an unsuccessful attempt to break through the level of 23.6% indicates the pair's readiness to build rising wave. A down MACD signal may indicate a market transition to an alternative. Purchases, in this case, we close or keep them very carefully. GBP / USD

The pair GBP / USD gained about 60 bp in the evening. Bank of England meeting was the last in a series of meetings of the Central Bank. And, perhaps, the greatest amount of uncertainty was associated with it. Unresolved Brexit is fully reflected in the monetary policy of the Bank of England, which simply is uncertain on how it will end, and does not want to change anything in its monetary policy until the moment when it is known exactly which version of Brexit will be implemented. Thus, the Bank of England and Mark Carney did not report anything interesting to the markets yesterday. Wave counting implies the completion of the construction of the downward trend section, but there are doubts about this, since the pound, like the euro, will need a news background that will cause buying the instrument. If this is not the background, and it is very likely in the case of the pound, the pair may then return to a fall, complicating the downward trend. A successful attempt to break through the maximum of the alleged wave d will indicate that the market is ready to continue the increase. Sales targets: 1.2434 - 161.8% Fibonacci 1.2359 - 200.0% Fibonacci Purchase goals: 1.2767 - 0.0% Fibonacci General conclusions and trading recommendations: The wave pattern of the pound / dollar instrument has changed and is now suggesting the construction of a new upward trend. At the same time, I recommend waiting for a successful attempt to break through the maximum of wave d, which confirms the willingness of markets to further increase, and build a correctional wave against the first impulse wave and only then buy the instrument. The material has been provided by InstaForex Company - www.instaforex.com |

| Burning forecast 06.21.2019 EURUSD and trading recommendation Posted: 21 Jun 2019 12:53 AM PDT The EURUSD rate holds the growth impetus set by the Federal Reserve's decisions and statements at a meeting on June 18. Now analysts expect the Fed to cut rates by the end of the year. From the point of view of technical analysis, the euro gave a signal for growth after a breakthrough above 1.1250 and consolidation above. Further, for the upward movement's development, it is of fundamental importance to go above 1.1350 and gain a foothold. EURUSD: In terms of technical analysis, you can buy the euro from 1.1280 - and then buy for a breakthrough of 1.1350 In case of a full turn downwards, you can sell at a break below 1.1180. The material has been provided by InstaForex Company - www.instaforex.com |

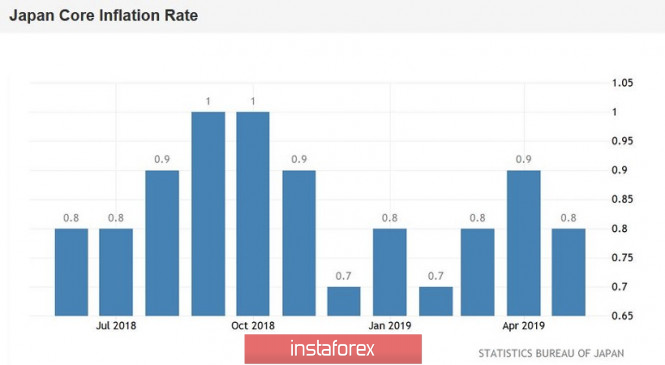

| Posted: 21 Jun 2019 12:47 AM PDT The dollar-yen pair updates the minimum price of the year: During the last time, the price was at the base of the 107th figure in April 2018. The growth of anti-risk sentiment amid the weakness of the US currency allowed the bears USD/JPY to open new price horizons. Relatively good data on the growth of Japanese inflation, as well as, the low profile of the Bank of Japan only strengthened the downward movement. However, first things first. Increased interest in defensive assets began to emerge after the Iranian authorities announced that they had shot down an American drone that allegedly spied on Iranian airspace. The States did not initially comment on this statement, but then they recognized this fact. However, with one, rather important caveat: according to the American military, the drone was in international airspace, not crossing the borders of the Islamic state. Trump reacted quite sharply to the incident, after which the market concluded that another round of political conflict could lead to war. In particular, the American president responded evasively to the question of whether Washington was planning a strike on Iran. "Soon, you will find out about this." Trump said. Against the background of such prospects, the yen paired with the dollar strengthened by more than 150 points. Meanwhile, the franc against the dollar increased by almost 200 points, and gold jumped from 1337 to 1410. In other words, the defensive instruments "snapped up like fresh cakes", reflecting the general mood of the investors. The dollar this time was unable to join them, as the Fed's recent position diminished interest in the US currency. The Fed is preparing to lower interest rates (the likelihood of such a move at the July meeting has already reached 100%), while according to some experts, the regulator will not stop at a one-time step - for example, the possibility of a double rate cut this year is estimated by the market at 80%. Moreover, according to TD Securities currency strategists, the Fed will reduce the total rate to 1.5% if the US and China do not agree on a trade deal. According to their forecasts, the Fed will cut rates by 50 basis points this year, and next year, by 100 basis points. And although such forecasts today look too ambitious, do not forget, that at the beginning of this year, almost no one allowed the option of easing monetary policy, and in December last year, the Fed voiced plans to double the rate increase in the framework of 2019. In other words, the dovish intentions of the Fed and accompanying market rumors do not allow the dollar to be a safe haven against the background of the escalating political conflict in the Middle East. By the way, Trump unexpectedly decided to reduce the degree of tension in US relations with Iran last night. He expressed doubt that the Iranians had deliberately shot down an American military drone. Trump also said that the incident is a "fly in the ointment" in relations between countries. At the same time, he clarified that if there were people on board of the aircraft, his assessment of the situation would be "radically different." For this reason, the yen today has suspended its growth, unfolding from a mark of 107.06. However, the potential for reducing USD/JPY is preserved, since the next support level is located only at around 106.05 (the bottom line of the BB indicator coincides with the lower boundary of the Kumo cloud on the monthly chart). If the pair overcomes this price target, the reaction of the Japanese authorities, which are already concerned about the dynamics of the USD/JPY, of course, will follow. Thus, according to the American press, a joint meeting of the Ministry of Finance, the Financial Services Agency and the Bank of Japan will take place today. The topic of discussion will be the revaluation of the Japanese currency against the background of the escalation of the geopolitical conflict in the Middle East. It is worth recalling here that following the June meeting, the head of the Japanese Central Bank, Haruhiko Kuroda, announced his readiness to ease monetary policy "in case of such a need". He clarified that the regulator will resort to additional stimulation, "if he sees any threat" for inflation growth to the two-percent target indicator. Obviously, further strengthening of the yen will put pressure on inflation indicators, which already show a rather weak growth. According to the data published today, the consumer price index fell to 0.7% (from the previous value of 0.9%). Without taking into account the prices for fresh food products, this indicator dropped to 0.8% (with the forecast of decline to 0.7%), and without taking into account the prices for food and energy carriers - to 0.5% (the forecasts came true). As we can see, Japanese inflation, in general, is in line with the consensus forecast. But if the yen continues to gain momentum, inflation indicators will slow down their growth, causing the Bank of Japan to respond. Thus, at the moment, short positions on the USD/JPY pair look risky, at least until the bears overcome the 107.00 mark. But if the situation in the Middle East continues to worsen, even the risk of a response from the Japanese regulator will not deter the yen from further strengthening - at least to the base of the 106th figure. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for EUR / USD and GBP / USD pairs on June 21. Both pairs are preparing for a new fall Posted: 21 Jun 2019 12:45 AM PDT EUR / USD pair (4H) The EUR/USD pair completed growth to a correctional level of 61.8% at 1.1318 and bounced off from it. As a result, on June 21, the pair reversed in favor of the American dollar and began the process of falling in the direction of the level of correction 50.0% at 1.1277. A bearish divergence was also formed in the CCI indicator, which significantly helped traders to make a decision on the start of sales of the euro-dollar pair. There was little news from Europe yesterday. Traders remained impressed by the information from the Fed meeting and continued to trade in accordance with it. Now the most important question is: is there enough momentum in the last two days to still manage to transfer the pair to an uptrend, or is the hegemony of the US dollar on the foreign exchange market just paused and resumed soon? One can speak with certainty below 1.1348 to talk about further strengthening the euro is meaningless. Today, there will be reports on business activity for June in America and the European Union. Recently, all these data have been inexorably decreasing. The business activity in the manufacturing sector of Europe has even gone into the "negative" area. It is possible that we will see another deterioration in these indicators today and this applies to European indices and the US. The Fib net formed on extremums from March 20, 2019 and May 23, 2019. Forecast for EUR/USD pair and recommendations for traders: The EUR/USD pair fulfilled a rebound from the Fibo level of 61.8%. Thus, I recommend selling today the euro with targets at 1.1277 and 1.1237, with a protective order above the Fibo level of 61.8%. I recommend buying the EUR/USD pair after the end of quotes from the level of 50.0% for the purpose of a correction level of 1.1318 and a Stop Loss order at 1.1277. GBP / USD pair (4H) The GBP/USD pair consolidated above the correction level of 76.4% at 1.2661 on June 20, but now, two bearish divergences are active at the CCI and MACD indicators, which allow traders to expect a reversal in favor of the US dollar and expect the pair to fall. Closing quotes below the Fibo level of 76.4% will significantly increase the chances of resuming a fall in the direction of the correction level 100.0% at 1.2437. The Bank of England held a monetary policy meeting yesterday and, one might say, they disappointed traders with the paucity of information provided. The rate remained unchanged and the volume of the buy-out of assets from the free market was unchanged. Not a single member of the monetary committee voted to change the monetary policy, no hints were given to change it in the near future. This event again shifted the market focus to Brexit but there is nothing special to note here. Yes, Boris Johnson won the 5th round of elections yesterday, the second winner was Jeremy Hunt. Now there is only one, the longest tour, we will know the name of the new prime minister in a month. But so far this information has nothing to do with Brexit, which, like many traders, just stocked up on popcorn while waiting for a denouement. Before the moment of the official change of the leader of Great Britain, it's not worth waiting for any progress in Brexit. The GBP/USD pair consolidated on June 20 above the correction level of 76.4% at 1.2661. But now, two bearish divergences are active at the CCI and MACD indicators, which allow traders to expect a reversal in favor of the US dollar and expect the pair to fall. The Fib net formed on extremums from January 3, 2019 and March 13, 2019. GBP / USD (1H) On the hourly chart, the pound-dollar pair re-consolidated below the correction level of 76.4% at 1.2701. Thus, we can expect today a continuation of the fall in the direction of the correctional level of 61.8% at 1.2663. aturing divergences in the current chart are not observed in any indicator. Any bullish divergence can be automatically weak. It is recommended to pay more attention to the behavior of the pair near the correction level of 76.4% on the 4-hour chart. It is precisely the closing below this level that will allow us to expect a new growth in the American currency. The Fib net formed on extremums from June 7, 2019 and June 18, 2019. Forecast for GBP/USD pair and recommendations for traders: The GBP/USD pair consolidated below the correction level of 76.4%. I recommend selling a pair with a target of 1.2437 and Stop Loss level above 1.2661 if you close below 76.4% (4-hour chart). I recommend buying a pair with a view to 1.2762 if the closing above the Fibo level is 76.4% and the Stop Loss level under 1.2701 on the hourly chart. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 21 Jun 2019 12:45 AM PDT 4-hour timeframe Technical details: Older linear regression channel: direction - down. Younger linear regression channel: direction - down. Moving average (20; smoothed) - up. CCI: 108.9764 The British pound stopped yesterday like the euro currency on June 20 in its defense during the American trading session. A corrective movement has not yet begun and the previous local maxima are not updated. Therefore, we can say that there is every chance to see in the near future not only a downward correction but also a resumption of the downtrend for the GBP/USD pair. The outcome of yesterday's meeting of the Bank of England, by and large, comes down to: "since it's not known how Brexit will end, we'll not change anything and wait. As we said earlier, it is Brexit that makes the pound. The Bank of England and the whole of Great Britain remain in limbo. In the case of a "tough" scenario, the British regulator does not rule out easing of monetary policy. Yesterday, the second place was taken by the current foreign minister, Jeremy Hunt, in the last round of elections for the post of leader of the Conservative Party, wherein Boris Johnson won again. Now, there will be a final vote, where 160,000 party members will take part, and it will be known around July 20–22 who won. It is after this date that Brexit becomes active again and the new prime minister will begin work in this direction. What exactly will make the new prime minister, it is difficult to say. In general, all the complexity in the situation with Brexit remains the same. Nearest support levels: S1 - 1,2695 S2 - 1.2634 S3 - 1.2573 Nearest resistance levels: R1 - 1.2756 R2 - 1.2817 Trading recommendations: The GBP/USD pair has overcome the moving but can now start to be adjusted. Given the weakness of the bulls in any case, we recommend extremely cautious purchases of the sterling pound, which should be closed when the Heiken Ashi indicator turns down. Selling the pound/dollar pair will be possible not earlier than the reverse consolidation below the movement with the targets at 1.2573 and 1.2512. In this case, a resumption of the downward trend is likely. In addition to the technical picture, traders should also take into account the fundamental data and the time of their release. Explanations for illustrations: The older linear regression channel is the blue lines of unidirectional movement. The junior linear channel is the purple lines of unidirectional movement. CCI is the blue line in the indicator regression window. The moving average (20; smoothed) is the blue line on the price chart. Murray levels - multi-colored horizontal stripes. Heiken Ashi is an indicator that colors bars in blue or purple. The material has been provided by InstaForex Company - www.instaforex.com |

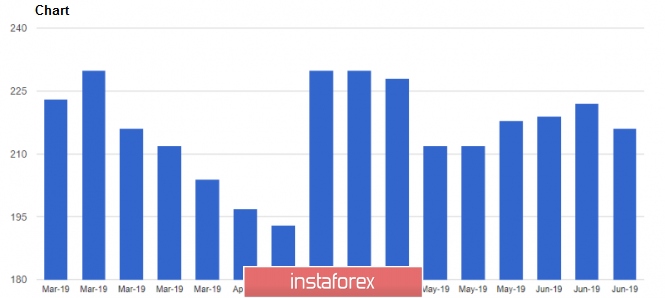

| Trading recommendations for the GBPUSD currency pair - prospects for further movement Posted: 21 Jun 2019 12:32 AM PDT Over the past trading day, the currency pair pound / dollar showed volatility just above the average daily 91 points. As a result, the quote managed to grow a little more. From the point of view of technical analysis, we see that the inertial move has managed to push the British currency a little more, thereby warming up even longer positions. Considering the graph in general terms, we see that speculative interest did not give rest and the quotation returned to the frame of the previously completed flat education 1.2670 / 1.2750. What we have is the overheating of long positions. This is more of a fact than a theory, and now, traders carefully analyze the possible stagnation and quotes behavior for placing trading orders. The information and news background of the past day had statistics on retail sales in the United Kingdom, where they saw a significant decline from 5.1% to 2.3%. The British currency did not immediately react to the statistics, but a little later it went into drain, although, probably, the players were still not completely cold from speculative growth against the background of the FOMC meeting. Then we had a meeting of the Bank of England with a subsequent press release, where we did not hear anything new. The regulator directly depends on the decision on Brexit, thus, until it takes place, there will be silence with the absence of any actions. Finally, as always, news from the Old World, where he passed another round for the post of head of the British conservatives and the prime minister of the country. As always, Boris Johnson won. This time he heaved 157 votes from members of the House of Commons, which is more than 14 in the previous round. There are two candidates left - the former head of the British Foreign Ministry and the current head of the Foreign Ministry. Now, there is a general party vote, of which the leader of the Tories and the prime minister of the country will be chosen. The announcement of the winner should take place on July 22. Today, in terms of the economic calendar, we have data on PMI in the United States, where, in principle, no changes are expected. At the same time, there are data on sales in the secondary housing market for May. But even there, the change is not significant: Prev. 5.19M ---> Prog. 5.29M. Probably, the dollar against the general background of oversold may simply grow. The upcoming trading week in terms of the economic calendar is less saturated with statistics in comparison with the past week. The most interesting events displayed below ---> Tuesday, June 18 United States 14:00 UTC+00 - Sales of new housing (May): Prev. 673K ---> 680K forecast Wednesday, June 19 United States 12:30 UTC+00 - Basic orders for durable goods (m / m) (May): Prev. 0.0% ---> Forecast 0.2% Thursday, June 20 United States 12:30 UTC+00 - GDP (q / q) (Q1): Prev. 3.1% United States 14:00 UTC+00 - Index of pending sales in the real estate market: Prev. -2.0% ---> Forecast -2.6% Friday, June 21 United Kingdom 8:30 Universal time. - GDP (y / y) (Q1): Prev. 1.8% ---> Forecast 1.3% United States 12:30 UTC+00 - Basic price index for personal consumption expenditure (y / y) (May): Prev. 1.6% These are preliminary and subject to change. Further development Analyzing the current trading chart, we see a characteristic slowdown in the range of 1.2670 / 1.2725. It is likely to assume that overheating of long positions is already close and the current stagnation signals this to us. Traders, in turn, produce the final fixation of previously held long positions and wait for clear price fixations lower than 1.2670 for laying short positions. Based on the available information, it is possible to decompose a number of variations, let's consider them: - Positions for purchase, as previously discussed, were conducted from Wednesday after the announcement of the FOMC maneuvers. Profit-taking is either already done or will happen in the near future. It's risky to enter the buy position now, and there is a significant overheating. - Sell positions are considered in the case of price fixing lower than 1.2670. Indicator Analysis Analyzing a different sector of timeframes (TF), we see that indicators in the short term changed their interest to descending due to stagnation. Intraday and mid-term prospects are focused on an earlier upward course. Weekly volatility / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation, based on monthly / quarterly / year. (June 21 was based on the time of publication of the article) The current time volatility is 42 points. It is likely to assume that in the case of the recovery process, the volatility may still increase towards the daily average. Key levels Zones of resistance: 1.2770 **; 1.2880 (1.2865-1.2880) *; 1.2920 * 1.3000 **; 1.3180 *; 1,3300 **; 1.3440; 1.3580 *; 1.3700. Support areas: 1.2620; 1.2500; 1.2350 **. * Periodic level ** Range Level The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 21 Jun 2019 12:21 AM PDT To open long positions on GBP/USD you need: Buyers of the pound are optimistic and continue to open long positions. The best scenario for buying will be when a false breakdown is formed in the first half of the day in the support area of 1.2690, which will lead to the preservation of the upward impulse and a retest of the level of 1.2723, consolidating above which will open the prospect of good movement to the highs of 1.2762 and 1.2786, where I recommend to take profit. With the GBP/USD decline scenario, long positions can be returned to the rebound from the support of 1.2648. To open short positions on GBP/USD you need: Sellers of the pound can only expect a decline below 1.2690, which will lead to a larger downward correction to the area of a 1.2648 low, where I recommend taking profits. If demand for GBP/USD remains in the first half of the day, as well as movement along the trend, it is best to consider short positions after updating major resistances of 1.2762 and 1.2786. Indicator signals: Moving averages Trading is above 30 and 50 moving averages, which indicates the bullish nature of the market. Bollinger bands In case the pound decreases, support will be provided by the lower boundary of the indicator in the area of 1.2685, while a breakthrough of the upper boundary in the area of 1.2725 will lead to the continuation of the upward trend. Description of indicators

|

| Bitcoin. 9 800 it is! We are waiting for 10,000 and a downward correction Posted: 21 Jun 2019 12:14 AM PDT The exchange rate of bitcoin quite expectedly continued its growth and updated the resistance of 9,800. Only the level of 10,000 USD is ahead. After the test of which, there will be a large profit-taking. However, an update of a maximum of 10,000 USD will also indicate a gradual entry of large players into the market, which will retain the long-term upward potential. Bitcoin (BTC) buy signal: Buyers will probably try to break through above $ 9,800 today and get to the psychological level of 10,084, where I recommend taking profits. An unsuccessful breakdown of 9,800 will also lead to a dramatic decrease in bitcoin. In such a scenario, it is best to consider buying on a false breakdown from 9,520, or to rebound from 9,250. Bitcoin Sales Signal (BTC) Bears will operate in the region of 9,800, and an unsuccessful breakdown of this range will provoke a sharp closure of long positions with a decrease in cryptocurrency in the area of the minimums of 5,520 and 9,250, where I recommend taking profits. With further growth above 9,800, the maximum resistance will be the highs of 10,084 and 10,330, from where you can try to sell Bitcoin to the rebound immediately.

|

| Posted: 21 Jun 2019 12:00 AM PDT To open long positions on EURUSD you need: Despite the bullish trend, the euro's growth will be limited by the resistance of 1.1338, where I recommend that you lock in the profit. Good data on the eurozone economy can help buyers maintain the trend. Under the decline scenario, the first buy signal will be the formation of a false breakdown in the support area of 1.1287, however, it is best to open long positions to rebound immediately in the area of a 1.1261 low. To open short positions on EURUSD you need: Sellers of the European currency will focus on the level of 1.1287, and a consolidation below this range closer to the afternoon can lead to a downward correction to the area of 1.1261 low, where I recommend taking profits. If the bulls find the strength in themselves and try to break through the resistance of 1.1310 in the first half of the day, it is best to consider short positions if there is a false breakdown in this range or to rebound from a high of 1.1338. Indicator signals: Moving averages Trade is conducted above 30 and 50 moving averages, which indicates the formation of a bull market. Bollinger bands Breaking the lower boundary of the indicator in the region of 1.1280 may increase pressure on the euro. Growth will be limited to the upper limit in the 1.1310 area. Description of indicators

|

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment