Forex analysis review |

- Fractal analysis of major currency pairs on June 27

- Technical analysis of ETH/USD for 27/06/2019:

- Technical analysis of BTC/USD for 27/06/2019:

- Technical analysis of GBP/USD for 27/06/2019:

- Technical analysis of EUR/USD for 27/06/2019:

- EUR / USD. June 26th. Results of the day. The next macroeconomic report from the States failed

- GBP / USD. June 26th. Results of the day. Boris Johnson sets an ultimatum to the European Union

- Technical analysis of EURUSD for June 27

- Technical analysis of Gold for June 27

- June 26, 2019 : GBP/JPY Intraday technical analysis and trade recommendations.

- BTC 06.26.2019 - Total control from buyers

- June 26, 2019 : The GBP/USD pair remains trapped between 1.2650 and 1.2750.

- GBP/USD 06.26.2019 - Upward movement very possible

- Gold 06.26.2019 -20 EMA test on the 4H timeframe

- Oil. June 26th. Oil of all grades is still subject to a whole group of risks

- Technical analysis of AUD/USD for June 26, 2019

- Experts fear correction in the gold market

- Technical analysis of USD/CAD for June 26, 2019

- Oil will continue to go up at least for these two reasons

- EURUSD: Consumer confidence in Germany is declining, but traders are waiting for important US statistics

- GBP/USD: plan for the US session on June 26. The pound strengthened slightly after the parliamentary hearings on inflation

- EUR/USD: plan for the US session on June 26. The decline in the euro slowed, but the correction is not yet complete

- Gold escaped from the cell

- A step up from the Fed immobilized the euro for a short time

- The dollar is expected to return to growth, but will it last long?

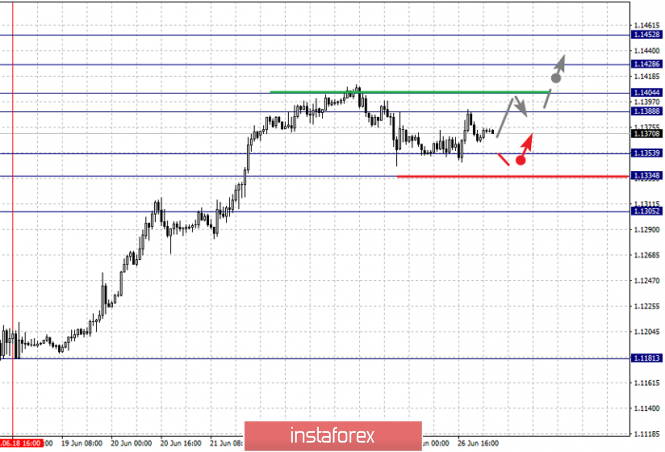

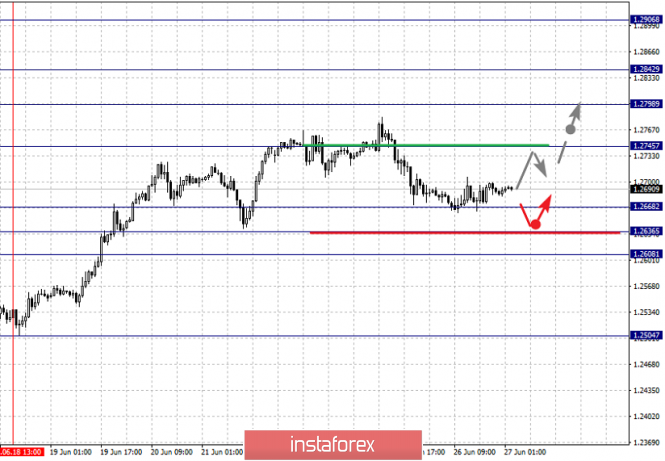

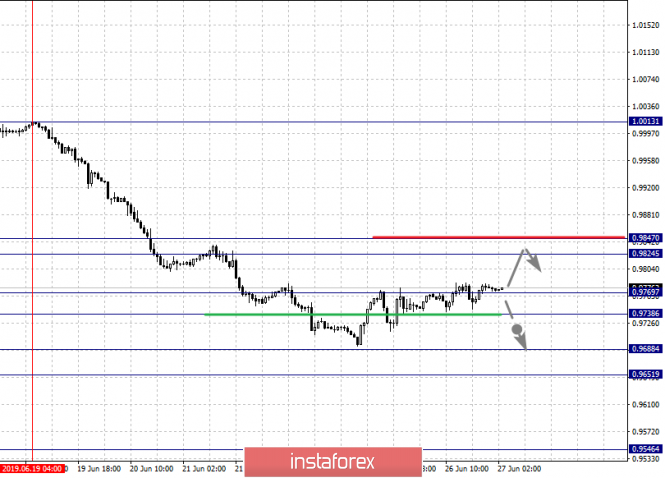

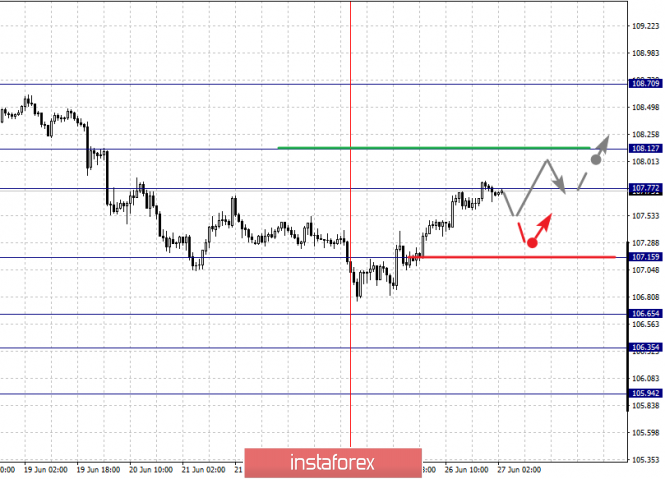

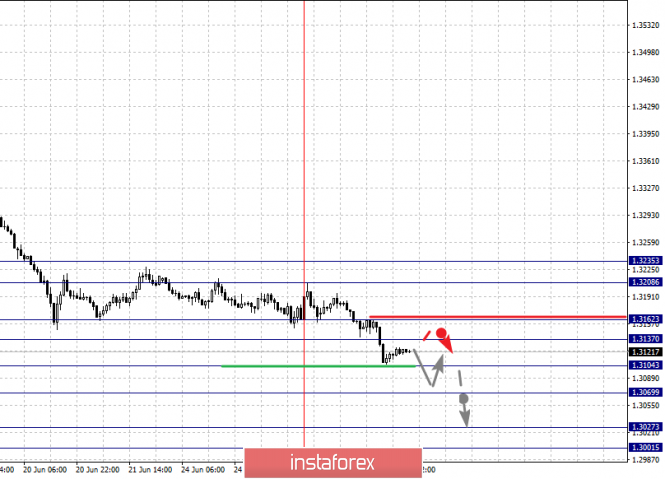

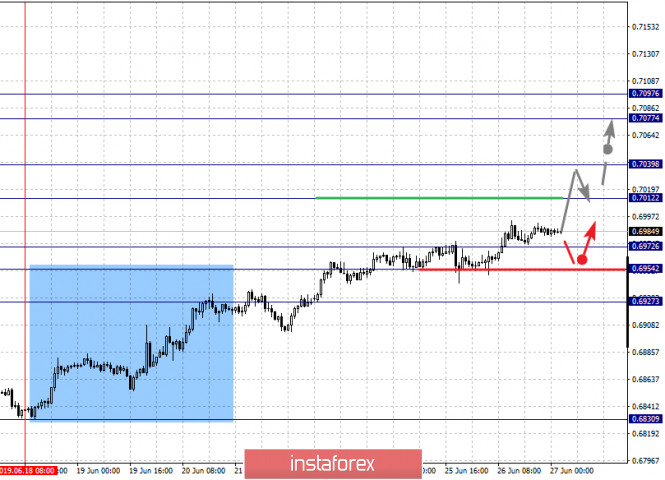

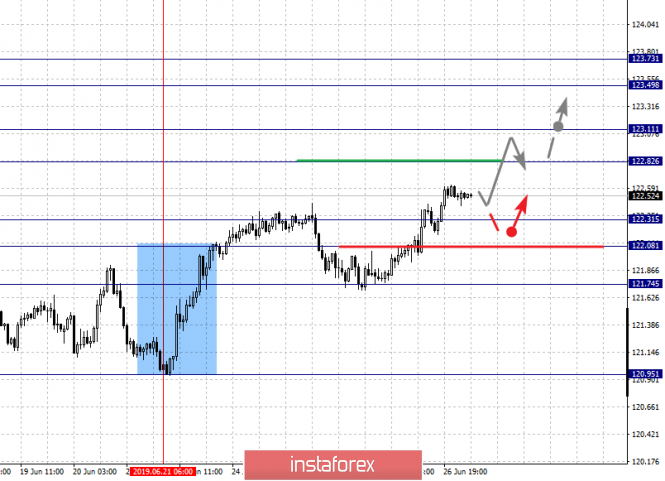

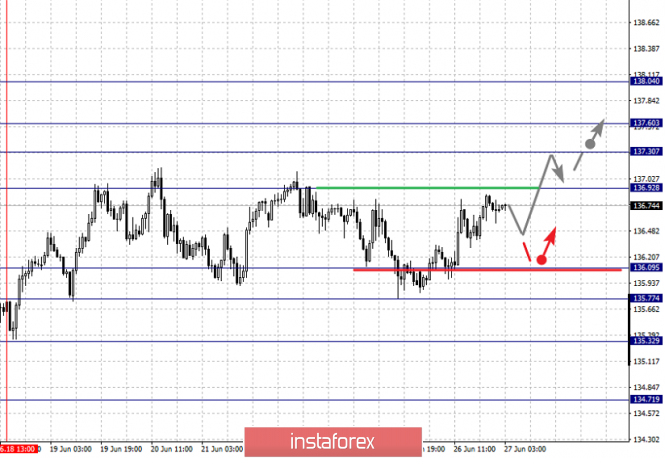

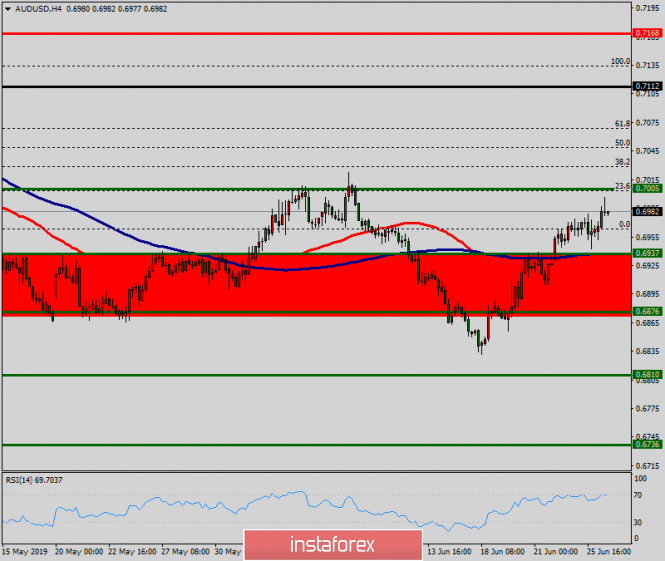

| Fractal analysis of major currency pairs on June 27 Posted: 26 Jun 2019 05:38 PM PDT Forecast for June 27: Analytical review of H1-scale currency pairs: For the euro / dollar pair, the key levels on the H1 scale are: 1.1452, 1.1428, 1.1404, 1.1388, 1.1353, 1.1334 and 1.1305. Here, we continue to follow the development of the ascending structure of June 18. The continuation of the movement to the top, is expected after the passage of the price of the noise range 1.1388 - 1.1404. In this case, the target is 1.1428, wherein consolidation is near this level. For the potential value for the top, we consider the level of 1.1452. After reaching which, we expect a departure to the correction. Short-term downward movement is possible in the range of 1.1353 - 1.1334. The breakdown of the latter value will lead to in-depth correction. Here, the goal is 1.1305. This level is a key support for the top. The main trend is the upward structure of June 18, the stage of correction. Trading recommendations: Buy 1.1405 Take profit: 1.1428 Buy 1.1430 Take profit: 1.1452 Sell: 1.1353 Take profit: 1.1335 Sell: 1.1332 Take profit: 1.1305 For the pound / dollar pair, the key levels on the H1 scale are: 1.2906, 1.2842, 1.2798, 1.2745, 1.2668, 1.2636 and 1.2608. Here, we are following the development of the ascending structure of June 18. We expect a continuation of the upward movement after the breakdown of the level of 1.2745. In this case, the first target is 1.2798. Short-term upward movement is possible in the range 1.2798 - 1.2842. The breakdown of the latter value will lead to movement to the potential target - 1.2906. Upon reaching this level, we expect a rollback to the bottom. Short-term downward movement is expected in the range of 1.2668 - 1.2636. The breakdown of the last value will lead to a prolonged correction. Here, the target is 1.2608. This level is a key support for the top. The main trend is the ascending structure of June 18. Trading recommendations: Buy: 1.2745 Take profit: 1.2798 Buy: 1.2800 Take profit: 1.2842 Sell: 1.2668 Take profit: 1.2636 Sell: 1.2634 Take profit: 1.2608 For the dollar / franc pair, the key levels on the H1 scale are: 0.9847, 0.9824, 0.9769, 0.9738, 0.9688 and 0.9651. Here, we are following the development of the downward cycle of June 19. At the moment, the price is in the correction zone. The continuation of the movement to the bottom is expected after the breakdown of the level of 0.9688. Here, the potential target is 0.9651. From the range of 0.9688 - 0.9651, we expect to go to the correction zone. Consolidated movement is possible in the range of 0.9738 - 0.9769. The breakdown of the latter value will lead to the development of a protracted correction. Here, the goal is 0.9824. The range 0.9824 - 0.9847 is a key support for the downward structure. Before it, we expect the initial conditions for the upward cycle. The main trend is the downward cycle of June 19, the stage of correction. Trading recommendations: Buy : 0.9738 Take profit: 0.9767 Buy : 0.9773 Take profit: 0.9824 Sell: Take profit: Sell: 0.9686 Take profit: 0.9653 For the dollar / yen pair, the key levels on the scale are : 108.12, 107.77, 107.15, 106.65, 106.35 and 105.94. Here, the price is in deep correction and forms the potential for the top of June 25. The expected initial conditions for the top are expected to level 108.12. The continuation of the movement to the bottom is expected after the breakdown of the level of 107.15. Here, the target is 106.65. The breakdown of which, in turn, will allow us to count on the movement to the level 106.35, where consolidation is near this value. For now, the potential value for the bottom, we considered the level of 105.94. After reaching which, we expect to go into correction. The main trend: the downward cycle of June 17, the stage of deep correction. Trading recommendations: Buy: 107.78 Take profit: 108.10 Sell: 107.15 Take profit: 106.67 Sell: 106.62 Take profit: 106.37 For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3235, 1.3208, 1.3162, 1.3137, 1.3104, 1.3069, 1.3027 and 1.3001. Here, the next targets for the downward movement we determined from the local structure on June 25th. Short-term movement to the bottom is expected in the range of 1.3104 - 1.3069. The breakdown of the latter value should be accompanied by a pronounced downward movement. Here, the target is 1.3027. Consolidation is in the range of 1.3027 - 1.3001. Short-term upward trend is possible in the range of 1.3137 - 1.3162. The breakdown of the latter value will lead to a prolonged correction. Here, the target is 1.3208. Before the noise range of 1.3208 - 1.3235, we expect clearance of the expressed initial conditions for the upward cycle. The main trend is a local downward structure from June 25. Trading recommendations: Buy: 1.3137 Take profit: 1.3162 Buy : 1.3164 Take profit: 1.3208 Sell: 1.3104 Take profit: 1.3070 Sell: 1.3067 Take profit: 1.3027 For the pair Australian dollar / US dollar, the key levels on the H1 scale are : 0.7097, 0.7077, 0.7039, 0.7012, 0.6972, 0.6954 and 0.6927. Here, we are following the development of the ascending structure of June 18. The continuation of the movement to the top is expected after the breakdown of the level of 0.7012. In this case, the goal is 0.7039, near this level is a price consolidation. The breakdown of the level of 0.7040 must be accompanied by a pronounced upward movement. Here, the goal is 0.7077. For the potential value for the top, we consider the level of 0.7097. Upon reaching this level, we expect a consolidated movement in the range of of 0.7077 - 0.7097, as well as a rollback to the bottom. Short-term downward movement is possible in the range of 0.6972 - 0.6954. The breakdown of the latter value will lead to a prolonged correction. Here, the target is 0.6927. This level is a key support for the top. The main trend is the upward structure on June 18. Trading recommendations: Buy: 0.7012 Take profit: 0.7037 Buy: 0.7041 Take profit: 0.7077 Sell : 0.6972 Take profit : 0.6955 Sell: 0.6952 Take profit: 0.6930 For the euro / yen pair, the key levels on the H1 scale are: 123.73, 123.49, 123.11, 122.82, 122.31, 122.08 and 121.74. Here, we clarified the key objectives for the ascending structure of June 21. The continuation of the movement to the top is expected after the breakdown of the level of 122.82. In this case, the goal is 123.11, near this level is a price consolidation. The breakdown of the level of 123.11 should be accompanied by a pronounced upward movement to the level of 123.49. We consider the level 123.73 to be a potential value for the top. After reaching which, we expect consolidation, as well as a rollback to the bottom. Short-term downward movement is expected in the corridor 122.31 - 122.08. The breakdown of the last value will lead to a prolonged correction. Here, the goal is 121.74. This level is a key support for the upward structure. The main trend is the ascending structure of June 21. Trading recommendations: Buy: 122.82 Take profit: 123.10 Buy: 123.14 Take profit: 123.49 Sell: 122.30 Take profit: 122.10 Sell: 122.06 Take profit: 121.76 For the pound / yen pair, the key levels on the H1 scale are : 138.04, 137.60, 137.30, 136.92, 136.09, 135.77 and 135.32. Here, we continue to monitor the formation of the potential for the top of June 18. The continuation of the movement to the top, is expected after the breakdown of 136.92. In this case, the first goal is 137.30. Short-term upward movement, as well as consolidation is in the corridor 137.30 – 137.60. For the potential value for the top, we consider the level of 138.04. The movement to which is expected after the breakdown of the level of 137.60. Short-term downward movement is possible in the range of 136.09 - 135.77. The breakdown of the latter value will have to the formation of a downward structure. Here, the potential target is 135.32. The main trend - the formation of potential for the top of June 18. Trading recommendations: Buy: 136.92 Take profit: 137.30 Buy: 137.32 Take profit: 137.60 Sell: 136.09 Take profit: 135.77 Sell: 135.76 Take profit: 135.34 The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of ETH/USD for 27/06/2019: Posted: 26 Jun 2019 05:27 PM PDT Crypto Industry News: The recent Firefox vulnerability has been exploited in the attacks on the leading cryptographic exchange and Coinbase portfolio service, according to a published Tweet by Philip Martin, a Coinbase security researcher. As Martin discovered, the critical gap of the so-called zero-day in the Mozilla Firefox browser, which was announced on June 18, appeared along with another zero-day vulnerability, through which Coinbase employees became the target of the hackers. "On Monday, the Coinbase stock market detected and blocked an attacker's attempt to use a zero-day vulnerability, along with a separate vulnerability that allowed attacks targeting Coinbase employees "- we read in the Coinbase Security Expert Tweet. Martin also reported that Coinbase is not the only cryptographic company to which these attacks relate, adding that the stock market is working on passing information to other companies, which in its opinion were also the target of hackers. He stressed that the security team found no evidence of any impact of attacks on Coinbase customers. Technical Overview: The ETH/USD pair might have completed now the impulsive cycle in wave (3) at the level of $362.60 and the market might have started the corrective wave (4). The key level now is the technical support and the top of the wave (1) at the level of $278.14, because any violation of this level will invalidate the bullish impulsive count. The short-term key technical support is located at the level of $315.49. Please notice the clear bearish divergence between the price and the momentum oscillator, which is the first clue that supports the bearish outlook. Weekly Pivot Points: WR3 - $399.14 WR2 - $359.00 WR1 - $340.76 Weekly Pivot - $299.53 WS1 - $285.30 WS2 - $243.70 WS3 - $227.28 Trading Recommendations: The best strategy in the current market conditions is to trade with the larger timeframe trend, which is still up. All the shorter timeframe moves are being treated as a correction inside of the uptrend. The current cycle is wave 4, which is a corrective wave and after is completed, the uptrend should resume

|

| Technical analysis of BTC/USD for 27/06/2019: Posted: 26 Jun 2019 05:15 PM PDT Crypto Industry News: The potential reduction in interest rates by the US central bank is clearly one of the reasons for the recent rise of Bitcoin, said Jim Reid, a board member of Deutsche Bank in a TV interview. Reid, the head of global core credit strategy at Deutsche Bank, stated: "If central banks are so aggressive, alternative currencies will start to be a bit more attractive'. Reid referred to the recent Fed chairman, Jerome Powell, who said yesterday that the central bank is considering a rate cut under the conditions of current economic uncertainty and inflationary risk. As a result, the US dollar fell yesterday in comparison to large fiat currencies, noting a three-month drop in relation to the euro, which was allegedly triggered by expectations for repeated interest rate cuts by the Fed. Reid also noted that the recent cryptocurrency price jump is partly caused by the upcoming Facebook crypto project - Libra. Technical Overview: The BTC/USD pair might have completed the upward impulsive cycle at the level of $13,698 as the top of the wave 5 of the lesser degree was made there. The pair then had made a 13% correction within a matter of minutes and now it is possible the wave A of the corrective cycle is done as well, with the low at the level of $11,714. The overall trend is still up and there are no signs or any trend reversal yet. Weekly Pivot Points: WR3 - $14,368 WR2 - $12,738 WR1 - $12,143 Weekly Pivot - $10,500 WS1 - $9,956 WS2 - $8,295 WS3 - $7,678 Trading Recommendations: The best strategy in the current market conditions is to trade with the larger timeframe trend, which is still up. All the shorter timeframe moves are being treated as a correction inside of the uptrend. The larget correction is just around the corner, as all the major impulsive waves have been completed.

|

| Technical analysis of GBP/USD for 27/06/2019: Posted: 26 Jun 2019 05:09 PM PDT Technical Overview: The GBP/USD pair has moved lower to test the support at the level of 1.2668 as the market conditions were overbought and bounced a little from the support. The local high was made at the level of 1.2706, but it is not enough for the bulls to continue the move up. Please notice, that any violation of the support level will lead to an even deeper correction towards the support seen at the level of 1.2605. The larget time frame trend is still down. Weekly Pivot Points: WR3 - 1.3080 WR2 - 1.2903 WR1 - 1.2852 Weekly Pivot - 1.2673 WS1 - 1.2612 WS2 - 1.2435 WS3 - 1.2368 Trading Recommendations: The current move up might the beginning of a larger impulsive breakout, so only the buy orders should be opened. The best strategy for this market is to open the buy orders during the local pull-back or larger corrections. Nevertheless, please notice that the larget time frame trend is down, so all the shorter timeframe moves are being treated as a correction inside of the downtrend.

|

| Technical analysis of EUR/USD for 27/06/2019: Posted: 26 Jun 2019 05:04 PM PDT Technical Overview: The EUR/USD pair has moved down to test the technical support located at the level of 1.1347 due to the overbought market conditions and weaker than before momentum oscillator. There is still a chance for a move up if the support holds but if it will not, then the next support is seen at the level of 1.1268. So far the bounce high was made at the level of 1.1390 and the volatility is very low. Weekly Pivot Points: WR3 - 1.1662 WR2 - 1.1520 WR1 - 1.1459 Weekly Pivot - 1.1309 WS1 - 1.1258 WS2 - 1.1120 WS3 - 1.1064 Trading Recommendations: The current move up might the beginning of a larger impulsive breakout, so only the buy orders should be opened. The best strategy for this market is to open the buy orders during the local pull-back or larger corrections.

|

| EUR / USD. June 26th. Results of the day. The next macroeconomic report from the States failed Posted: 26 Jun 2019 04:49 PM PDT 4 hour timeframe The amplitude of the last 5 days (high-low): 67p - 92p - 95p - 37p - 68p. Average amplitude for the last 5 days: 72p (71p). Most of Wednesday, June 26, the EUR / USD currency pair was trading in a narrow price range. However, with the opening of the US trading session and the publication of the only important report today, traders became a bit more active and started modest purchases of the US dollar. Orders for durable goods in May decreased by 1.3%, with a forecast of -0.1%. Excluding defense orders - by 0.6%. Without transport, an increase of 0.3% was observed, and while excluding defense and aviation orders, the figure rose by 0.4%. However, from our point of view, the most important indicator fell by 1.3% and turned out to be much worse than forecast, which explains the fall in US currency after lunch. Moreover, purchases of euros are very sluggish. It seems that traders want to forget this report as soon as possible and go back to buying American currency, despite that Jerome Powell's rhetoric remains "dovish". The likelihood of a Fed rate cut at the next meeting is already 90%, and macroeconomic reports from overseas continue to disappoint. In addition, FOMC member James Bullard gave a speech yesterday, and he said that "the time has come for a reinsurance reduction of the key rate". However, according to Bullard, reducing the rate by 0.5% immediately is a lot. Most likely, FOMC members will approve a decline of 0.25%. Well, this is another bad news for the US dollar, but most importantly, as traders interpret it, and especially bears. After all, even a reduction in the rate to 2.25% still leaves the Fed as the leader, since the ECB rate is 0%, and in the coming months, it may go into the negative area. Therefore, in any case, monetary easing should have a negative impact on the dollar. Trading recommendations: The EUR / USD pair continues to adjust Thus, long positions remain relevant for the euro / dollar pair with the target of 1.1438. On the other hand, the reversal upwards or a rebound of the MACD from the Kijun-Sen line will indicate the completion of the downward correction. It will be possible to sell a pair of euro / dollar in small lots, if the bears will be able to gain a foothold below the critical line, with targets 1,1296 and 1,1241. In this case, the initiative for the pair EUR / USD may return to the hands of bears. In addition to the technical picture, we should also take into account the fundamental data and the time of their release. Explanation of the illustration: Ichimoku indicator: Tenkan-sen - the red line. Kijun-sen - the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dotted line. Chinkou Span - green line. Bollinger Bands indicator: 3 yellow lines. MACD Indicator: Red line and histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

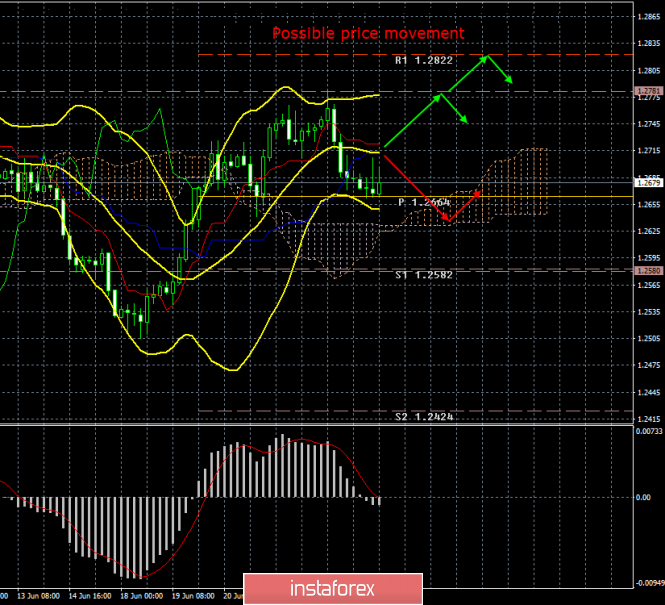

| GBP / USD. June 26th. Results of the day. Boris Johnson sets an ultimatum to the European Union Posted: 26 Jun 2019 04:49 PM PDT 4 hour timeframe The amplitude of the last 5 days (high-low): 131p - 96p - 104p - 59p - 112p. Average amplitude for the last 5 days: 100p (90p). The British pound sterling on Wednesday, June 26, continued a slight downward movement for most of the day, and only during the American trading session the pound began to do a slight growth, as the US failed another macroeconomic report, this time on orders for long-term goods. However, the most interesting information today was related to Boris Johnson, who is the main candidate for the post of prime minister of the country. Johnson, who, incidentally, has not yet won the election, made an official statement in which he urged the European Union to abandon its tough position on the North Irish border. Johnson also said that the UK will not pay 50 billion euros to Brussels unless a new trade agreement is signed. If Brussels does not agree with the requirements of London, then Johnson promised to lead the country according to a "hard" scenario and "come what may", he added. Moreover, this speech by Johnson eclipsed the speech of Mark Carney, who spoke about the monetary policy of the Bank of England. Thus, his speech was much more important for traders than the next attack by Johnson on the EU. Carney said that in the case of "tough" Brexit, all forecasts of economic indicators will be revised, and the regulator will have to stimulate the economy, that is, reduce the key rate. True, the pound sterling also ignored this information, but from a technical point of view, the pound / dollar pair strengthened below the Kijun-Sen line, so the trend for the pair changed to a bearish one. With this reason, the pound has a high chance of heading downwards again. Trading recommendations: The currency pair pound / dollar overcame the critical line. Thus, sales of pound sterling with targets are now again relevant to the Senkou Span B line and the support level of 1.2582, but so far, in small lots. It will be possible to buy the British currency when the pair is fixed above the Kijun-sen line. In this case, the upward trend may resume with the first goal level of 1.2781. In addition to the technical picture, we should also take into account the fundamental data and the time of their release. Explanation of the illustration: Ichimoku indicator: Tenkan-sen - the red line. Kijun-sen - the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dotted line. Chinkou Span - green line. Bollinger Bands indicator: 3 yellow lines. MACD Indicator: Red line and histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of EURUSD for June 27 Posted: 26 Jun 2019 12:41 PM PDT As expected and shown by our latest analysis on EURUSD, price was expected to pull back towards 1.1350-1.1330 at least. This is shown by the red rectangle in the following chart. Yesterday and today price touched this target area.

EURUSD has entered the red rectangle area which is support and bulls pushed prices higher once again. I was expecting a move towards the 38% Fibonacci retracement but price so far has only managed to back test the previous highs at 1.1350-1.1330 which is now support, previously resistance. I believe we could see another leg lower towards 1.13 before the up trend resumes. Medium-term trend remains bullish. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of Gold for June 27 Posted: 26 Jun 2019 12:36 PM PDT Gold price has pulled back towards $1,400 as expected and noted in our previous posts. The risk reward ratio did not favor bulls and as the RSI was giving bearish divergence signs, we said that we prefer to take profits and stay neutral when price was above $1,430.

Blue lines - bearish divergence Green line - support trend line Gold price has pulled back from $1,439 towards $1,400. The bearish divergence warnings by the RSI have been fulfilled. Price has made the minimum required pull back. Price could continue lower towards $1,380-90 area before resuming its up trend. Short-term support is found at $1,410 and resistance at $1.425. Medium-term trend remains bullish. Gold bears will need to break below $1,270-$1,300 area in order to cancel the importance of this bullish breakout. The material has been provided by InstaForex Company - www.instaforex.com |

| June 26, 2019 : GBP/JPY Intraday technical analysis and trade recommendations. Posted: 26 Jun 2019 09:47 AM PDT

On May 3rd, the GBPJPY pair initiated the depicted bearish movement channel around 146.45 On March 21st, another visit towards the upper limit of the same channel (141.70) was demonstrated. Since then, the depicted downtrend/channel has been intact until June 4 when the pair failed to achieve a new low below 136.50. This was followed by a bullish breakout off the depicted bearish channel. Moreover, a short-term uptrend line was established around the same Price levels (136.50) until June 12 when the latest bearish pullback was initiated towards 136.50 (23.6% Fibonacci Expansion) then 135.44 (78.6% Fibonacci Expansion). Recently, obvious bullish recovery has been manifested. Bullish persistence above 136.50 is currently being demonstrated on the H4 chart. Technically, a quick bullish advancement should be expected towards 138.00 initially where the backside of the broken uptrend is currently located. On the other hand, H4 re-closure below 136.50 enhances the bearish side of the market towards 135.44 and probably 135.03 for further retesting. Trade Recommendations: Short-term outlook remains bullish as long as bullish persistence above 136.50 is maintained on the H4 chart. Conservative traders can wait for bullish breakout above 136.95 for further confirmation. Initial Target levels should be located around 137.80 and 138.50. Any bearish breakdown below 136.00 invalidates the mentioned bullish scenario. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC 06.26.2019 - Total control from buyers Posted: 26 Jun 2019 09:31 AM PDT BTC has been trading upwards as I expected. My yesterday's target at the price of $12.000 has been met and broken. New formation suggests more upside to come and potential test of $13.400. Watch for buying opportunities.

Gray rectangle – Resistance broken Orange rectangle- Target projection Both Stochastic and RSI are in the overbought condition but this is the case because of the strong upward trend. Most recently there is the breakout of smaller ascending triangle in the background, which is another sign of the strong BTC. The projected target is set at the price of $13.400. As long as the BTC is trading above the $12.284, I would watch for long positions. MACD oscillator is showing the new momentum UP and it is confirming buyers domination. The material has been provided by InstaForex Company - www.instaforex.com |

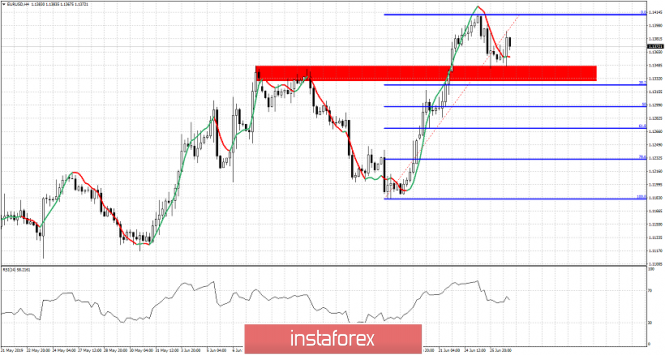

| June 26, 2019 : The GBP/USD pair remains trapped between 1.2650 and 1.2750. Posted: 26 Jun 2019 09:15 AM PDT

On April 26, another bullish pullback was initiated towards the price zone of 1.3130-1.3170 (the upper limit of the movement channel) where the depicted bearish Head and Shoulders reversal pattern was demonstrated on the H4 chart with neckline located around 1.2980-1.3020. Bearish breakdown below 1.2980 allowed the recent significant bearish movement to occur towards the lower limit of the long-term channel around (1.2700-1.2650) where temporary bullish rejection was expressed. Shortly after, temporary bullish breakout above 1.2650 was demonstrated for a few trading sessions. This enhanced the bullish side of the market towards 1.2750 which prevented further bullish advancement. However, On June 14, recent temporary bearish decline was demonstrated below 1.2600 hindering the mentioned bullish scenario for some time before bullish breakout could be achieved earlier last week. For the bullish side of the market to remain dominant, bullish persistence above 1.2750 (consolidation range upper limit ) should be achieved by the bulls. Bullish breakout above 1.2750 is mandatory to bring further bullish advancement towards 1.2840 and 1.2900. Recently, the GBP/USD failed to establish a successful bullish breakout above 1.2750. Instead, early signs of bearish rejection have been manifested (Bearish Engulfing H4 candlestick). A quick bearish pullback towards 1.2650 was expected shortly. For conservative traders, SELL positions shouldn't be considered around the current price levels unless bearish breakout below 1.2570 becomes confirmed on higher timeframes (which is low probability). Trade Recommendations: Intraday traders can have a valid BUY Entry upon bullish breakout above 1.2750. T/P levels to be located around 1.2840, 1.2900 and 1.2940. S/L should be placed below 1.2680. The material has been provided by InstaForex Company - www.instaforex.com |

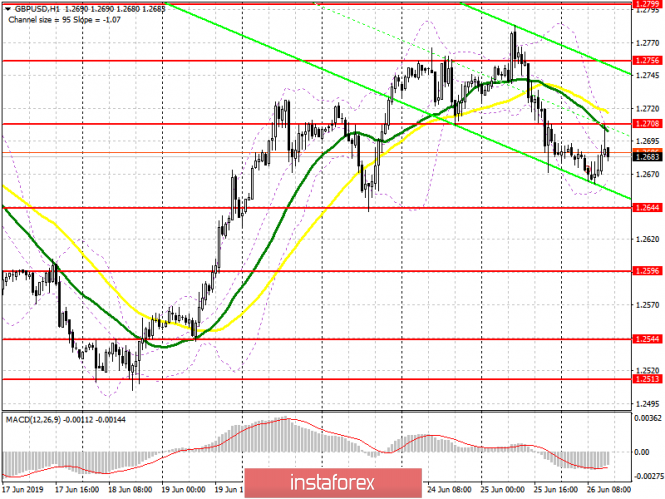

| GBP/USD 06.26.2019 - Upward movement very possible Posted: 26 Jun 2019 09:07 AM PDT GBP/USD has been trading downwards in past 24 hours but I found potential end of the downward correction and new wave up. Strong support has been seen at the price of 1.2660. Watch for buying opportunities.

Gray rectangle - support Yellow rectangle- Resistance Blue rectangle - Resistance Middle red line – 20 EMA The Stochastic oscillator is showing the oversold condition and flip up, which are signs that selling looks risky and that new buying may come. The level of 1.2660 is acting like a strong support and as long as the GBP is trading above that support, I would watch for buying opportunities. RSI oscillator is trying to go again above 50 level, which is another bullish sign. My advice is to watch for buying opportunities since I expect that GBP trade towards the resistance at 1.2766. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold 06.26.2019 -20 EMA test on the 4H timeframe Posted: 26 Jun 2019 08:48 AM PDT Gold has been trading lower in past 24 hours. Anyway, I found that there is the potential end of the downward correction and that buyers might establish new buying positions. Support is found at the price of $1.401. Watch for buying opportunities.

Gray rectangle - support Second gray rectangle- Support 2 Blue rectangle - Resistance Middle red line – 20 EMA support The 20 exponential moving average at the price of $1.404 held successfully, which is sign that sellers got exhausted there and that buyers may join. The Stochastic oscillator is showing us that there is the oversold condition and flip up, which is good sign for further strength on the Gold. Upward target is set at the price of $1.435. Support levels are found at $1.401 and $1.381. As long as the Gold is trading in upward channel, I would watch only for buying opportunities on the dips. The material has been provided by InstaForex Company - www.instaforex.com |

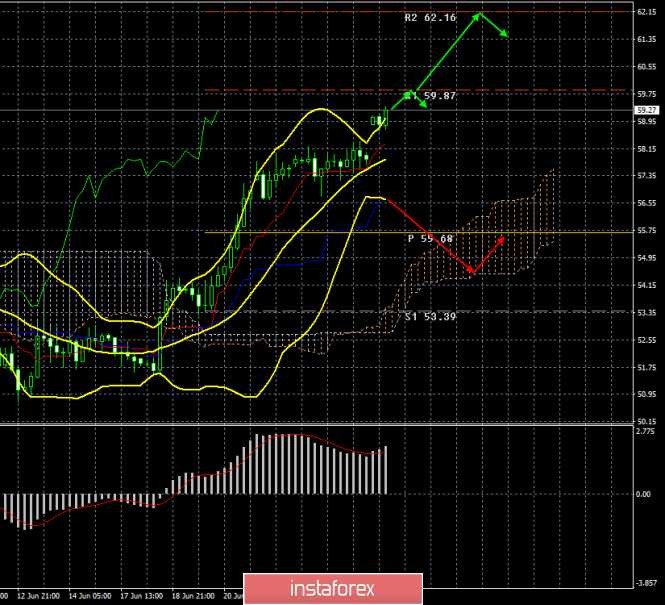

| Oil. June 26th. Oil of all grades is still subject to a whole group of risks Posted: 26 Jun 2019 07:04 AM PDT 4-hour timeframe

Oil is now the most controversial and unstable asset. Almost at any time, the quotes of "black gold" can jerk in any direction. Factors such as geopolitical tensions in the Middle East and the conflict between the US and Iran speak in favor of further growth in the cost of a barrel of oil. In favor of the fall – trade tensions between China and the United States, as a result of which the price of Chinese imports to the United States can grow by 10-25%, which will reduce the volume of production of goods in China and thus reduce the demand for oil. Over the past day, the cost of "black gold" jumped up on the information about the possible closure of the refinery of PES (America), as it was caused major damage as a result of a large-scale fire. This potentially reduces the supply of oil on the world market and can reduce the reserves of oil and gasoline in the United States. Meanwhile, the OPEC meeting was postponed to July 1-2, as the participants want to wait for the results of the G20 summit and find out whether Trump will agree with his Chinese counterpart on a trade agreement, or at least whether the parties will make any progress in the negotiations. This will depend on whether the OPEC countries will prolong the agreement, according to which oil production is reduced by 1.2 million barrels per day and which expires on June 30. In the case of prolongation of the agreement by OPEC to reduce production to the end of the year, oil prices may further rise, and data on changes in the volume of crude oil reserves in the vaults of the United States will be known on Friday, their reduction may lead again to the growth of quotations. Trading recommendations: At the moment, the #CL tool has resumed its upward movement. Thus, it is recommended to trade for an increase with the goals of 59.87 and 62.16 to a new reversal of the MACD indicator down, which will indicate a new round of the downward correction. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanation of illustration: Ichimoku Indicator: Tenkan-Sen – red line. Kijun-Sen – blue line. Senkou Span A – light brown dotted line. Senkou Span B – light purple dotted line. Chinkou Span – green line. Bollinger Bands Indicator: 3 yellow lines. MACD Indicator: A red line and a histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of AUD/USD for June 26, 2019 Posted: 26 Jun 2019 06:24 AM PDT |

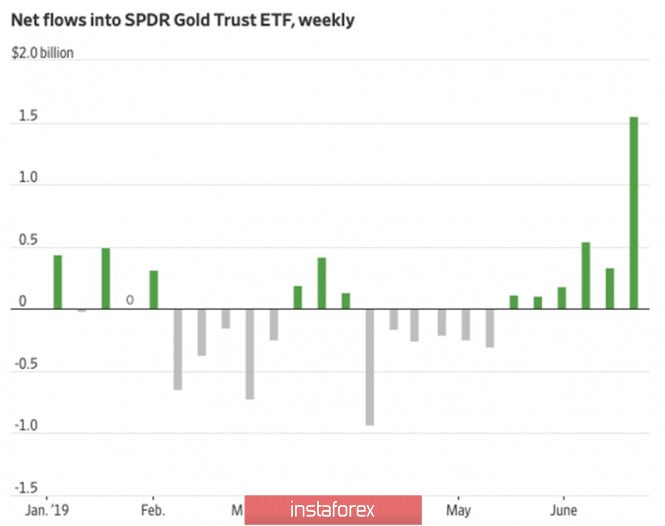

| Experts fear correction in the gold market Posted: 26 Jun 2019 06:16 AM PDT Currently, the value of the yellow metal has exceeded the psychologically important level of $1,430 per ounce. According to experts, the precious metal promises a growth extravaganza in the near future. Experts are sure that he has enough resources for further growth, however, they warn investors against a possible short-term correction. In the current situation, the price of gold continued its growth as it has moved passed the resistance level of $1,350 for ounce. On Wednesday morning, June 26, an ounce of the precious metal was priced at $1,430. After some time, experts recorded the achievement of a long-term level of $1,436.60 per ounce. According to analysts, in just one week the cost of the yellow metal increased by 7%. At the same time, the likelihood of price consolidation is growing, but this does not frighten new investors who are actively exploring the gold market. Investors should not forget that sooner or later the price correction will begin on the yellow metal market, after which long-term players will be able to purchase new positions in the precious metal. Currently, gold has excellent potential for growth, experts emphasize. The precious metal price is higher than one of the previous resistance levels recorded in 2013 and currently, the price was $1,417 per ounce. According to the calculations of specialists, the next resistance level will be $1,475. Experts do not exclude short-term overheating of the market, which will allow the yellow metal to reach this level. Analysts warn about the possibility of a sharp fall in the price of gold before such a take-off and recommend monitoring the changes in the market for precious metals. The material has been provided by InstaForex Company - www.instaforex.com |

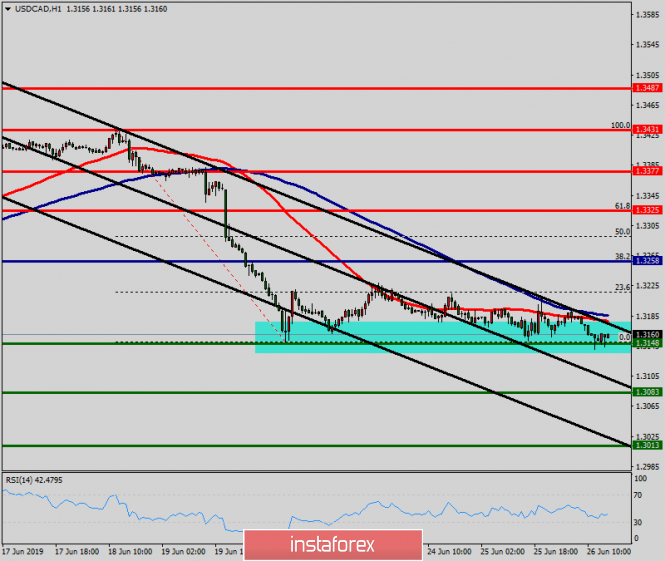

| Technical analysis of USD/CAD for June 26, 2019 Posted: 26 Jun 2019 06:16 AM PDT The USD/CAD pair continues to move downwards from the level of 1.3258. Last week, the pair dropped from the level of 1.3258 (this level of 0.9965 coincides with the double top) to the bottom around 1.3148. Today, the first resistance level is seen at 1.3258 followed by 1.3325, while daily support 1 is found at 1.3148. Also, the level of 1.3258 represents a weekly pivot point for that it is acting as major resistance/support this week. Amid the previous events, the pair is still in a downtrend, because the USD/CAD pair is trading in a bearish trend from the new resistance line of 1.3258 towards the first support level at 1.3038 in order to test it. If the pair succeeds to pass through the level of 1.3038, the market will indicate a bearish opportunity below the level of 1.3038 in order to continue towards the point of 1.3013. However, if a breakout happens at the resistance level of 1.3325, then this scenario may be invalidated. The material has been provided by InstaForex Company - www.instaforex.com |

| Oil will continue to go up at least for these two reasons Posted: 26 Jun 2019 05:43 AM PDT The cost of oil reached its highest level in almost a month, helped by disruptions in a large refinery on the east coast of the United States and industry data. This shows that oil reserves in the United States declined more than expected. Brent went up by $1.03 per barrel to $66.08 per barrel and the session high was at $66.25 per barrel. The American WTI rose by 1.13 dollars and was trading at 58.96 dollars per barrel with a maximum of 59.13 dollars per barrel. It is expected that Philadelphia Energy Solutions (PES) will close its refinery forever after a major fire caused significant damage to the complex, according to two sources familiar with the plans said on Tuesday. PES has already announced force majeure in relation to the supply of gasoline after a fire. Futures on gasoline in the United States reached the highest level since the end of May. "Oil is growing in response to API data, combined with interruptions in refineries on the east coast of the United States. The possible shortage of gasoline helps to maintain the rising cost of oil," said Olivier Jacob of Petromatrix. Oil reserves in the United States for the week ending June 21 fell by 7.5 million barrels to 474.5 million compared with analysts' expectations of a reduction of 2.5 million barrels. The fall in oil reserves and the breaks in the refineries occurred just at the moment when the conflict between Washington and Tehran raised fears that the supply through the Strait of Hormuz, the world's busiest oil supply route, could be interrupted. US President Donald Trump threatened to destroy part of Iran if he attacks "at least something American." Bilateral tensions rose again after Iran hit a US drone last week in the Persian Gulf. Relationships were already tense as Washington accused Iran of attacks on oil tankers in May and June, while Tehran denied any involvement. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 Jun 2019 04:59 AM PDT The euro remained in a narrow side channel after data that indicated a decline in sentiment among German consumers. However, a similar figure in France, on the contrary, showed growth. All attention in the afternoon will be focused on data for the United States, where the volume of orders for durable goods is expected to be released. This is a kind of indicator of consumer sentiment and expectations, as the decline in orders signals that Americans are more resorting to savings and reduce spending, which in the future has a negative impact on the economy. As noted above, the release of the report from the GfK study group put pressure on the euro. According to the data, the mood of German consumers in July 2019 will deteriorate. The data are leading. The decline in sentiment is directly related to the weakening of expectations for income. Thus, the leading index of consumer confidence GfK for July fell to 9.8 points from 10.1 points in June. Economists predicted that the indicator in July will be 10.0 points. The agency noted that the slowdown in the labor market directly affected the expectation of income growth. Thus, the indicator of expectations for income in June fell to 45.5 points, while in May it was still 57.7 points. Let me remind you that in May this year, the unemployment rate in Germany increased. A similar figure in France rose, as consumers in June were very positive. According to the statistics agency Insee, the consumer confidence index rose to 101 points in June against 99 points in May. The increase in the index was due to the prospect of growth in the standard of living of the French. Economists had forecast the index to fall to 98 points. The report also indicates that a number of households are set up for large purchases, which will lead to an increase in private consumption and support the economy in a bad time. Today's statements by US Treasury Secretary Steven Mnuchin were ignored by the market, as they were not specific. Mnuchin once again reiterated that the trade agreement with China will be presented in the near future, as the degree of its readiness is 90%. The Minister of Finance also noted that the agreement is being prepared not for the sake of the agreement itself, but what will be the way to achieve it and sign it by the two parties - time will tell. As for the technical picture of the EURUSD pair, the further short-term downward correction will tend to the levels of 1.1320 and 1.1280, where larger buyers will declare themselves in the market. Without a good decline in the euro, it is unlikely to get a major continuation of the upward trend in the area of highs 1.1430 and 1.1500. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 Jun 2019 04:45 AM PDT To open long positions on GBP/USD, you need: Parliamentary hearings on inflation did not greatly help the buyers of the pound but allowed them to get to the resistance of 1.2708. The main task of the bulls for the second half of the day will be to consolidate above this range, which will lead to an update of the maximum of 1.2756, where I recommend taking the profit. In the scenario of the pair's decline in the second half of the day against the background of a good report on the US economy, it is best to consider new long positions on the rebound from the low of 1.2644. To open short positions on GBP/USD, you need: A repeated unsuccessful breakout of the resistance of 1.2708 in the second half of the day after the US data will be a clear signal to open short positions on the pound, which will lead to a further downward correction to the support area of 1.2644 and 1.2596, where I recommend taking the profit. If the bulls cope with their task and return to the resistance of 1.2708, you can count on short positions immediately on the rebound from the maximum of 1.2756. Indicator signals: Moving Averages Trading is below 30 and 50 moving averages, which indicates the formation of a downward correction. Bollinger Bands The breakthrough of the lower boundary of the indicator in the area of 1.2670 will increase the chance of a bearish market.

Description of indicators

|

| Posted: 26 Jun 2019 04:28 AM PDT To open long positions on EURUSD, you need: The situation has not changed compared to the morning forecast. It is best to return to long positions on a false breakout from the level of 1.1348, after updating the low of yesterday, or on a rebound from larger support of 1.1317. The main task of buyers will be to return to the resistance of 1.1374, which will keep the lower limit of the current upward channel and continue the growth of the euro in the area of the highs of 1.1400 and 1.1430, where I recommend taking the profit. To open short positions on EURUSD, you need: Data on the US economy may make changes in the market. However, it is best to consider short positions after the formation of a false breakout in the resistance area of 1.1374, as it was in the first half of the day, or after a successful breakout and consolidation below the support of 1.1348, which will lead EUR/USD to new lows of 1.1317 and 1.1286, where I recommend taking the profit. In the case of growth above 1.1374, the area of 1.1400 will be a good level for opening short positions. Indicator signals: Moving Averages Trading is below 30 and 50 moving averages, indicating a possible correction of the euro in the afternoon. Bollinger Bands The breakthrough of the lower limit of the indicator in the area of 1.1348 will lead to a larger fall of the euro.

Description of indicators

|

| Posted: 26 Jun 2019 03:28 AM PDT Markets are arranged as trends are replaced by consolidations and consolidations give way to new trends. Gold has clearly lagged behind in the $1100-1350 trading range per ounce, hence the exit from it became the logical realization of the nature of the market. Since the beginning of May, the 10% rally of the precious metal coincided with an increase in geopolitical tensions. The negotiations between the US and China suddenly broke down. Meanwhile, the US increased the size of the import-related imports of the Middle Kingdom and the confrontation between Washington and Tehran aggravated after an attack by oil tankers and a downed US drone. As a result, the XAU/USD quotes soared to the maximum mark for the last 6 years and the rally may well continue. According to Goldman Sachs, gold can grow to $1,600 per ounce against the background of the completion of the economic cycle in the United States and the associated weakening of the dollar. Yes, the Fed will not necessarily be led by Donald Trump and will lower the federal funds rate in July. But due to the slowdown in the American economy, this will have to be done sooner or later. The derivatives market is 100% sure of the easing of monetary policy at the next FOMC meeting and gives a 40% chance of a 50 bp drop in interest rates. The Fed is responding to a potential slowdown in the global economy, while central banks, not wanting to strengthen their own currencies, are competing to do the same. As a result, the rate on monetary units looks losing and investors increase the share of precious metals in portfolios. By the end of the week on July 18, financial managers had increased their net longs in gold to the maximum value since February 2018. At the auction on June 21, capital inflows into the largest specialized exchange fund SPDR Gold Shares amounted to $1.6 billion, which is a record figure since the creation of this ETF in 2003. SPDR Gold Shares Capital Flows Along with the gradual refusal of investors from the dollar and other currencies, the support for the XAU/USD "bulls" has a fall in bond yields. For the first time since 2016, the rates on 10-year US Treasury bonds fell below 2% and their German and Japanese counterparts are negative. In general, the capitalization of the global debt market with a yield below zero jumped to $13 trillion. Gold is not in a position to compete with bonds if the rates on them grow as it does not bring interest to income. On the contrary, if the rates fall, the precious metal begins to enjoy increased popularity. Thus, the economic events including the depreciation of the US dollar, the weakness of its main competitors due to the ultra-soft monetary policy of central issuers, the fall in rates on the global debt market and the growth of geopolitical tensions create a favorable environment for gold. Its ability to continue the rally will depend on the results of the Donald Trump-Xi Jinping meeting. A breakthrough in the negotiations will boost the yield of US bonds and strengthen the dollar, which will result in a correction of XAU/USD. Other scenarios will allow the bulls to increase their advantage. Technically, a regular rollback followed after reaching the target for the "Wolfe Waves" and AB = CD (200%) patterns. While the precious metal quotes are holding above $1,398 per ounce (23.6% of the CD wave), buyers are in complete control of the situation. Gold daily chart |

| A step up from the Fed immobilized the euro for a short time Posted: 26 Jun 2019 03:28 AM PDT Eurobucks failed to gain a foothold above $1.14 on the first attempt as they stumbled over the comments of the main FOMC pigeon. The head of the Federal Reserve Bank of St. Louis, James Bullard, noted that the reduction in the rate in July by half a percentage point is unfounded. In his opinion, the monetary policy will become too accommodative. Federal Reserve officials need to observe the dynamics of inflation expectations and the yield curve. Thus, Bullard, who strongly supported a softer monetary policy, gave a shoulder to a falling dollar. Meanwhile, the market immediately revised its expectations for a 0.5% rate cut. If yesterday those were 40%, today it becomes 25%. At the same time, the softening by 0.25% in July is still estimated at 100%. Note that Bullard is in the center of attention not only because of the pronounced "soft" position. His is interested in the White House. Donald Trump needs to fill two more vacant armchairs of FOMC officials who have a permanent right to vote. They should certainly be "dovish", supporting his opinion about the need to relax monetary policy in order to stimulate the economy and the devaluation of the dollar. It is not the first day that there is talk that the American president needs a weaker dollar. Trump was extremely dissatisfied with the promises of Mario Draghi about a possible reduction in the ECB rate and recovery of the European QE as this will weaken the euro. It is expected that the topic of currency wars will be one of the most important and intense at the G20 summit. The market is increasingly talking about intervention, with which the object will be the US dollar. In BCA Research, it is noted that the leading dynamics of gold over US government bonds is a frightening sign for the US currency. Earlier in this situation, the dollar index has invariably dropped. As for the EUR/USD pair, its inability to go beyond the upper limit of the previously designated $1.11-1.14 trading range is probably related to the closing of long positions after a spectacular four-day rally. To clarify the situation with both the trade wars and the Fed rate will help the hotly anticipated market meeting of Donald Trump and Xi Jinping. Now it would be reasonable not to force events but wait for the outcome of the G20 summit. The main pair can go around $1.13 at this time. Senior White House officials told Reuters in an interview that Washington is not ready to soften its position and will demand Beijing to return to the previously agreed terms of the deal. According to Celestial, the parties must make concessions to each other. Goldman's opinion on EUR / USD pair The euro is still the favorite despite the fact that the market lays in prices a possible reduction in the ECB rate. Investors close the previously opened short positions in the euro and this increases the rate of growth of the single currency. According to Goldman Sachs, the exit from the short positions on the euro will stimulate the upward trend of the EUR/USD pair in the near future. In recent weeks, traders have reduced the long position on the US dollar. However, the balanced position is not yet short. In the short term, the process will continue and the dollar will again depreciate against the euro. The material has been provided by InstaForex Company - www.instaforex.com |

| The dollar is expected to return to growth, but will it last long? Posted: 26 Jun 2019 03:23 AM PDT As expected, the dollar rose against the background of aggressive comments of representatives of the Federal Reserve System. The head of the Fed Jerome Powell stressed the independence of the Central Bank from the opinion of US President Donald Trump, who insists on lowering rates. The President of the Fed of St. Louis James Bullard, who is considered one of the leaders of the "dovish", surprised investors, saying that the reduction of rates by 50 basis points "will be premature". Recall, the dollar fell last week after officials started talking about lowering rates in the coming months. Some traders thought that the Fed could cut rates by 50 basis points next month. However, yesterday's comments brought down these expectations, pushing the dollar up from three-month lows against a basket of major currencies. The greenback rose 0.1% to 96,273 points. But the rebound will probably be short-lived. There is every reason to believe that the markets are ready for a weaker dollar. For example, against the Japanese yen, traders make large volume option bets between 107.50 and 107.00 yen. The New Zealand dollar was the strongest player against the US dollar. Kiwi rose 0.4% to $0.6661, after the Reserve Bank of New Zealand left rates unchanged at 1.5%, although it signaled a possible decline. At the same time, the pound remains near five-month lows at the level of 1.2669 dollars, after Boris Johnson, the leader of the race for the post of British Prime Minister, confirmed his commitment to leave the European Union with or without the agreement by October 31. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment