Forex analysis review |

- EUR/GBP approaching resistance, potential drop!

- NZD/USD approaching support, potential bounce!

- EUR/JPY near key resistance, a drop is possible!

- Fractal analysis of major currency pairs for June 7

- EURUSD: ECB revised the interest rate forecast. Mario Draghi is pleased with the growth of the economy in the 1st quarter,

- The market for a long time so much did not believe in the dollar's fall

- EUR/USD: Draghi "pardoned" the euro, the dollar is waiting for Nonfarms

- EUR/USD. June 6th. Results of the day. Mario Draghi's dovish rhetoric helped the European currency

- GBP/USD. June 6th. Results of the day. Ford closes UK engine plant in Wales

- Triangle pattern in USDJPY

- Ichimoku cloud indicator analysis of EURUSD for June 7, 2019

- Bitcoin analysis for June, 06.2019

- Analysis of Gold for June 05,.2019

- EUR/USD analysis for June 06,2019

- Technical analysis of USD/CAD for June 06, 2019

- Technical analysis of USD/CHF for June 06, 2019

- GBP/USD: plan for the American session on June 6. The pound is growing due to the weakness of the US dollar

- EUR/USD: plan for the American session on June 6. Weak inflation and retail sales stopped the growth of the euro

- Beige Book Report: What did the Fed say on June 6th?

- The yen and the euro are growing, investors expect the outcome of the ECB meeting

- EUR/USD: Mario Draghi has more reasons to drop the euro rate than to support it and the timing of the instrument movements

- Trading recommendations for the EURUSD currency pair - placement of trading orders (June 6)

- Trading plan for EUR / USD and GBP / USD pairs on 06/06/2019

- Trading recommendations for the currency pair GBPUSD - placement of trading orders (June 6)

- Wave analysis of EUR / USD and GBP / USD for June 6. Mark Carney and Mario Draghi may put pressure on European currencies

| EUR/GBP approaching resistance, potential drop! Posted: 06 Jun 2019 07:20 PM PDT

Price is approaching our first resistance where we might see a drop below this level. Entry : 0.8900 Why it's good : Horizontal swing high resistance, 100% Fibonacci extension Stop Loss : 0.8930 Why it's good : horizontal pullback resistance Take Profit : 0.8805 Why it's good : 23.6% Fibonacci retracement, Horizontal swing low support

|

| NZD/USD approaching support, potential bounce! Posted: 06 Jun 2019 07:17 PM PDT

Price is approaching support where it is expected to bounce to its resistance. We are expected some NZD strength later today due to risk-on sentiment back in the market.. Entry : 0.6603 Why it's good : 38.2% Fibonacci retracement, 100% Fibonacci extension, horizontal pullback resistance Stop Loss : 0.6561 Why it's good : 61.8% Fibonacci retracement, horizontal pullback support Take Profit : 0.6667 Why it's good : Horizontal swing low support, 38.2% Fibonacci retracement

|

| EUR/JPY near key resistance, a drop is possible! Posted: 06 Jun 2019 07:15 PM PDT

EURJPY near key resistance, a drop to 1st support is possible Entry: 122.24 Why it's good : 61.8% Fibonacci extension, 50% Fibonacci retracement, horizontal overlap resistance Stop Loss : 122.76 Why it's good :61.8% Fibonacci retracement, 100% Fibonacci extension, horizontal swing high resistance Take Profit : 121.32 Why it's good: 61.8% Fibonacci retracement, 61.8% Fibonacci extension, horizontal swing low support

|

| Fractal analysis of major currency pairs for June 7 Posted: 06 Jun 2019 06:59 PM PDT Forecast for June 7: Analytical review of H1-scale currency pairs: For the euro/dollar pair, the key levels on the H1 scale are: 1.1363, 1.1331, 1.1305, 1.1259, 1.1238, 1.1214 and 1.1198. Here, the price has issued a local structure from June 5 to continue the movement to the top. The subsequent development of the upward movement is expected after the breakdown of the level of 1.1305. Here, the target is 1.1331, wherein consolidation is near this level. For the potential value for the top, we consider the level of 1.1363, after reaching which, we expect a rollback to the bottom. Short-term downward movement is possible in the range of 1.1259 - 1.1238. The breakdown of the latter value will have the formation of a downward structure. Here, the goal is 1.1214. The noise range is 1.1214 - 1.1198. The main trend is the formation of a local structure for the top of June 5. Trading recommendations: Buy 1.1305 Take profit: 1.1330 Buy 1.1333 Take profit: 1.1362 Sell: 1.1258 Take profit: 1.1240 Sell: 1.1236 Take profit: 1.1216 For the pound/dollar pair, the key levels on the H1 scale are: 1.2808, 1.2789, 1.2754, 1.2727, 1.2687, 1.2667 and 1.2633. Here, we continue to monitor the development of the upward cycle of May 31. At the moment, the price is in the correction area. Continuation of the movement to the top is expected after the breakdown of the level of 1.2727. In this case, the goal is 1.2754, wherein near this level, there is a price consolidation. The breakdown of the level of 1.2755 should be accompanied by a pronounced upward movement. Here, the goal is 1.2808. Meanwhile, in the range of 1.2789 - 1.2808, there is a price consolidation. From here, we expect a rollback to the bottom. Short-term downward movement is possible in the range of 1.2687 - 1.2667. The breakdown of the latter value will lead to a prolonged correction. Here, the target is 1.2633. This level is a key support for the ascending structure. The main trend is the upward cycle of May 31, the stage of correction. Trading recommendations: Buy: 1.2728 Take profit: 1.2752 Buy: 1.2755 Take profit: 1.2787 Sell: 1.2686 Take profit: 1.2668 Sell: 1.2664 Take profit: 1.2638 For the dollar/franc pair, the key levels on the H1 scale are: 1.0048, 1.0024, 0.9987, 0.9970, 0.9954, 0.9925, 0.9903, 0.9876 and 0.9840. Here, the price forms the potential for upward movement from June 5th. Continuation of the movement to the top is expected after the breakdown of the level of 0.9954. In this case, the target is 0.9970, wherein consolidation is near this level. The passage of the price range of 0.9970 - 0.9987 will lead to the development of a pronounced upward movement. In this case, the target is 1.0024. We consider the level of 1.0048 as a potential value for the top. Upon reaching this level, we expect consolidation, as well as a rollback to the bottom. Consolidated movement is possible in the range of 0.9925 - 0.9903. The breakdown of the last value will lead to a prolonged correction. Here, the goal is 0.9876. This level is a key support for the top, while its price passage will lead to the subsequent development of the main trend. Here, the potential goal is 0.9840. The main trend is the downward cycle of May 30, the formation of potential for the top of June 5. Trading recommendations: Buy : 0.9955 Take profit: 0.9970 Buy : 0.9988 Take profit: 1.0024 Sell: 0.9901 Take profit: 0.9878 Sell: 0.9874 Take profit: 0.9840 For the dollar/yen pair, the key levels on the scale are : 108.84, 108.43, 107.76, 107.44 and 106.99. Here, we continue to monitor the downward structure of May 30. Short-term downward movement is expected in the range of 107.76 - 107.44. The breakdown of the last value will lead to the movement to the potential target - 106.99. Upon reaching this level, we expect a rollback to the top. Short-term upward movement, as well as consolidation, are possible in the range of 108.45 - 108.84. The level of 108.84 is a key support for the downward structure. Its price passage will lead to the formation of the initial conditions for the upward cycle. The main trend: the local structure for the bottom of May 30, the stage of correction. Trading recommendations: Buy: 108.45 Take profit: 108.82 Buy: Take profit: Sell: 107.74 Take profit: 107.45 Sell: 107.42 Take profit: 107.00 For the Canadian dollar/US Dollar pair, the key levels on the H1 scale are: 1.3432, 1.3403, 1.3379, 1.3339, 1.3299 and 1.3250. Here, we are following the development of the downward structure of May 31. The continuation of the development of the main trend is expected after the breakdown of the level of 1.3339. In this case, the goal is 1.3299, wherein price consolidation is near this level. For the potential value for the bottom, we consider the level of 1.3250. After reaching which, we expect a rollback to the top. Short-term upward movement is possible in the range of 1.3379 - 1.3403. The breakdown of the latter value will lead to a prolonged correction. Here, the target is 1.3432. This level is a key support for the bottom. The main trend is the downward structure of May 31. Trading recommendations: Buy: 1.3379 Take profit: 1.3403 Buy : 1.3404 Take profit: 1.3432 Sell: 1.3339 Take profit: 1.3300 Sell: 1.3297 Take profit: 1.3250 For the pair Australian dollar/US Dollar, the key levels on the H1 scale are : 0.7058, 0.7042, 0.7013, 0.7003, 0.6987, 0.6953, 0.6941 and 0.6924. Here, we are following the ascending structure of May 23. At the moment, the price is in deep correction. Continuation of the movement to the top is expected after the breakdown of the level of 0.6987. Here, the first target is 0.7003. The passage of the price of the noise range 0.7003 - 0.7013 will lead to the development of a pronounced movement. In this case, the goal is 0.7042. For the potential value for the top, we consider the level of 0.7058. After reaching which, we expect a consolidation, as well as rollback to the bottom. The range of 0.6953 - 0.6941 is a key support for the top. Its price passage will lead to the formation of the initial conditions for the downward cycle. In this case, the potential target is 0.6924. The main trend is the ascending structure of May 23, the stage of deep correction. Trading recommendations: Buy: 0.6988 Take profit: 0.7003 Buy: 0.7014 Take profit: 0.7040 Sell : 0.6953 Take profit : 0.6943 Sell: 0.6939 Take profit: 0.6925 For the euro/yen pair, the key levels on the H1 scale are: 123.47, 123.06, 122.87, 122.54, 122.31, 121.98, 121.71 and 121.37. Here, we continue to monitor the ascending structure of June 3. Continuation of the movement to the top is expected after the price passes the noise range of 122.31 - 122.54. In this case, the goal is 122.87. Meanwhile, in the range of 122.87 - 123.06, there is a price consolidation. For the potential value for the top, we consider the level of 123.47. After reaching which, we expect to go into a correction. Short-term downward movement is expected in the range of 121.98 - 121.71. The breakdown of the last value will lead to a prolonged correction. Here, the goal is 121.37. This level is a key support for the top. The main trend is the ascending cycle of June 3. Trading recommendations: Buy: 122.55 Take profit: 122.87 Buy: 123.06 Take profit: 123.47 Sell: 121.98 Take profit: 121.73 Sell: 121.69 Take profit: 121.40 For the pound/yen pair, the key levels on the H1 scale are : 138.39, 137.83, 137.49, 136.52, 135.98, 135.48 and 134.82. Here, the price is still in the correction zone from the downward trend and forms a small potential for the top of June 4. Continuation of the development of the downward trend of May 21 is expected after the breakdown of the level of 136.50. In this case, the target is 135.98. The breakdown of which, in turn, will allow us to expect to move to the level of 135.48, wherein consolidation is near this value, and also from here, there is a high probability of a reversal in the correction. For the potential value for the bottom, we consider the level of 134.82. Short-term upward movement is expected in the range of 137.49 - 137.83. The breakdown of the last value will lead to a prolonged correction. Here, the target is 138.39. The noise range is 138.39 - 138.76. The main trend is the local downward structure of May 21, the stage of correction. Trading recommendations: Buy: 136.50 Take profit: 136.00 Buy: 135.94 Take profit: 135.50 Sell: 137.46 Take profit: 136.90 Sell: 135.44 Take profit: 134.84 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 06 Jun 2019 03:30 PM PDT The euro ignored data on the growth of the eurozone economy in the 1st quarter of this year, as traders closely followed the ECB report. Even despite the fact that the expected dates for raising interest rates in the eurozone were shifted to the middle of next year, and Mario Draghi signaled a possible decrease in interest rates to a negative level if necessary, the euro held its position and even rose against the US dollar. According to the report, a good increase in consumer spending in the euro area in the 1st quarter of this year contributed to accelerating economic growth. Export has also made a significant contribution. According to the EU statistics agency, the eurozone economy grew by 0.4% in the 1st quarter of this year compared to the 4th quarter. Compared with the 1st quarter of 2018, the economy grew by 1.2%. In annual terms, an increase of 1.6%. However, it is already known from the results of the latest reports that in the 2nd quarter of this year, GDP growth slows down, and, as many experts expect, growth will be the weakest since the beginning of economic recovery in 2014. As I noted above, the attention of traders was focused on the ECB meeting, at which the regulator left the refinancing rate unchanged, at the level of 0.0%. The European Central Bank left the deposit rate unchanged at -0.40%. The central bank revised its forecast, saying that rates would remain at current levels, at least until the end of the first half of 2020. The ECB will continue to completely reinvest the income from the QE program over a long period after the first rate increase. A new TLTRO program was also announced, according to which targeted long-term loans for banks will be offered at a rate of 10 bp above the average refinancing rate. The euro rose during the speech of the ECB President Mario Draghi, although the statements made by in principal were negative. Draghi noted that he is closely following how monetary policy affects banks, and is ready to act. If necessary, the ECB will adjust monetary policy instruments. As for the extension of the forecast period of saving rates, it was quite expected due to the long-term uncertainty, which is now observed in the global economy. First of all, uncertainty is associated with conflicts in international trade and changes in the policies of central banks. Draghi also said that the ECB may lower interest rates if necessary. As for the economy, the head of the ECB is confident that, despite the stronger growth in eurozone GDP in the 1st quarter of this year, the difficulties in the world still put pressure on the prospects for further growth, and the data indicate a slightly weaker growth in the economy 2nd and 3rd blocks. ECB economists forecast GDP growth in 2019 by 1.2% against the previous forecast of growth of 1.1%, while in 2020 it is expected to grow by 1.4% against the previous forecast of growth by 1.6%. The ECB president is confident that the increase in employment and wage growth will continue to support the eurozone economy, but the threat of protectionism and geopolitical factors will slow it down. The material has been provided by InstaForex Company - www.instaforex.com |

| The market for a long time so much did not believe in the dollar's fall Posted: 06 Jun 2019 03:30 PM PDT The slightest hint of a possible interest rate cut by the Fed was enough for the greenback to go down. Judging by the rate of decline in the yield of dollar-denominated assets in the past few days, forex, probably following the derivatives market, began to lay in the Fed's dovish quotes. It is assumed that the narrowing of the differential in interest rates will undermine the position of the US currency. In such conditions, it's time to think about changing the upward trend in the USD to a downward one. At least the options market signals that investors have now formed the strongest bearish sentiment for the dollar since January last year. "We do not know when problems related to trade and other issues will be resolved. However, we are closely following the consequences of these events for the US economy and are ready to take appropriate measures to support economic growth, the labor market and inflation in the country," said Fed Head Jerome Powell last Tuesday. He also noted that the reduction in interest rates to almost zero, which the Fed, the ECB and other central banks issuing reserve currencies "treated" the crisis of 2008, will definitely be required in one form or another in the future. "The Fed may have slightly opened the door for a potential interest rate reduction (once or twice), which the market has already considered this year," believes Chris Rapci from MUFG Union Bank. "Investors are increasingly convinced that the US central bank will lower the rate, the only question is when and how much," said Mark Cabana, a strategist at Bank of America. The market for futures on the Fed rate is already laying in quotes for three declines - in September, December 2019 and March next year. Meanwhile, some experts believe investors' expectations regarding the rate cut are excessively too much. "I think that the market overestimated the scale of interest rate cuts," said Axel Weber, chairman of the board of directors of the Swiss bank UBS. "There are no clear indications of an immediate rate cut in the recent statements by the Fed. There is only a possibility that in case of further deterioration of data in the second half of the year, the central bank may consider the possibility of taking corrective actions, "he added. John Waldron, president and chief operating officer of Goldman Sachs, takes a similar view. "The market lays a fairly significant set of steps on the part of the Fed in the price. I believe that the market is too optimistic about how much and how soon the regulator will change the rate, "he said. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD: Draghi "pardoned" the euro, the dollar is waiting for Nonfarms Posted: 06 Jun 2019 03:30 PM PDT Mario Draghi again disappointed - but not the eur/usd bulls this time, on the contrary it was the bears. The head of the ECB voiced a rather reserved position, maintaining the appropriate balance in his rhetoric. Sellers of the euro-dollar pair, in turn, became the victims of their own high expectations. Judging by previous forecasts, the head of the ECB should have hinted at the resumption of QE and allowed the reduction of interest rates, incidentally trimming the forecasts for GDP growth and inflation. But Mario Draghi only partially met the demands of the market, after which the euro-dollar pair again attempted to assault the 13th figure. Like yesterday, this attempt failed, although traders of the pair still show a bullish attitude. The June meeting of the ECB helped the euro to stay afloat, despite the fact that many of Draghi's remarks were clearly not in favor of the single currency. The main result of today's ECB meeting is that the regulator outlined the algorithms of the baseline scenario and the conditional "plan B". If the first option provides for an increase in the interest rate (albeit not earlier than the second half of 2020), then the second scenario includes the implementation of a set of incentives, ranging from a reduction in the rate and ending with the resumption of QE (or vice versa). Having distinguished between these scenarios, Draghi made it clear that the European Central Bank adheres to the baseline scenario, expecting the growth of inflation indicators and other key economic indicators. This, in fact, is due to the pair's current momentum towards the bottom of the 13th figure. Naturally, the head of the ECB did not rule out that the regulator may have to resort to the implementation of the "plan B", using every available tool to stimulate the economy. However, the current situation in the eurozone economy, according to Draghi, allows you to maintain a wait-and-see position. The position voiced by the head of the ECB was contrary to the expectations of many experts who were confident that the regulator was announcing easing monetary policy. Some central banks of the leading countries of the world have already taken concrete steps in this direction, for example, the Reserve Bank of Australia, the Reserve Bank of New Zealand, the central bank of India. But Draghi decided not to join this "club" so far, as a result of which the pair has shot upwards. But the eur/usd bulls failed to linger within the 13th figure. The single currency still has no strength for its own growth, so it is still focused on the dollar, which, in turn, has frozen in anticipation of tomorrow's Nonfarms. Mario Draghi helped the euro so that it would not plummet in the entire market, but could not boost the currency, because, in addition to optimistic estimates, the head of the ECB also voiced quite unfavorable nuances. First, the European Central Bank revised its forecast for GDP growth this year to the downside - from 1.6% to 1.4%. The regulator made a similar decision relative to 2021, lowering the estimate of economic growth from 1.5% to 1.4%. At the same time, Draghi noted that downside risks continue to prevail, including in relation to inflationary processes. According to the ECB, the general indicator of inflation will decline in the coming months, although at the end of the year it will show a positive trend. The same applies to core inflation - the core consumer price index will be under pressure for the next quarter, but will then give "signs of life." In general, the inflation forecast for this year was revised from 1.2% to 1.3%, and for 2020 - from 1.5% to 1.4%. Thus, the European Central Bank made it possible for the eur/usd pair to continue to show character today. Contrary to the expectations of many experts, Draghi did not pull down the euro, after which the corrective price increase resumed. At the same time, bulls of the pair do not succumb to the 13th level, the "conquest" of which in the future will open the way to 14-15 figures. In this context, the Nonfarms will be the key that will largely determine the fate of the dollar tomorrow. If the official figures are similar to the data of the ADP agency (the report showed an increase in the number of people employed by only 27 thousand), then it will be the third opportunity for buyers of the eur/usd pair to gain a foothold in the 13th figure. In technical point of view, the situation is as follows. On the daily chart, the euro-dollar has crossed the upper line of the Bollinger Bands indicator and the upper limit of the Kumo cloud. The Ichimoku trend indicator has formed a bullish Parade of Lines signal, which warns of a high probability of further price growth. To determine the nearest resistance level, let's move to a weekly chart. On this timeframe, the price can meet resistance only at the 1.1335 mark, that is, on the Kijun-sen line on W1. When overcoming this target, the price can go to the main resistance level - the mark of 1.1450 - this is the upper line of the Bollinger Bands indicator, which coincides with the lower boundary of the Kumo cloud on the weekly chart. On the one hand, such price peaks look unattainable - but if tomorrow's Nonfarms disappoints the market, eur/usd buyers can quickly bring the pair to the specified levels. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. June 6th. Results of the day. Mario Draghi's dovish rhetoric helped the European currency Posted: 06 Jun 2019 03:30 PM PDT 4-hour timeframe The amplitude of the last 5 days (high-low): 27p - 45p - 102p - 50p - 88p. Average amplitude for the last 5 days: 62p (55p). The European currency continues to "fret and fume". As we expected in the morning, the tone of Mario Draghi's speech after the next ECB meeting was negative. Mario Draghi reiterated "the threat of protectionism" and assured market participants that the regulator will not shy away from stimulating the economy if economic growth continues to slow down. The key rate remained predictable at the level of 0.0%, but the terms of the "low rates" are now shifted to mid-2020. In other words, the regulator does not expect an improvement in the economic situation before 2020. According to the forecasts of the European Central Bank, inflation this year will amount to 1.3%, next - 1.4%, in 2021 - 1.6%. Is it worth saying that all these three values are much lower than the target inflation rate of 2.0% y/y? Is it worth it to emphasize once again that with such inflation there can be no tightening of monetary policy? The last meeting of the ECB showed that the attitude of some members of the monetary committee is even more negative than that of its chairman. The issues of reducing the key rate were raised, that is, to a negative level, questions were raised about introducing additional monetary incentives. The program of lending to commercial banks in order to maintain the liquidity of the TLTRO financial system was announced once again. These long-term loans will be issued in September. At the end of his speech, Draghi once again noted that the "period of uncertainty" is already too long and "the light at the end of the tunnel" is not yet visible. Surprisingly, the European currency managed to grow on this absolutely "dovish" rhetoric of the head of the ECB. It is unlikely that traders felt that Powell's rhetoric was more "dovish", and that is why they resumed purchases of the euro. In any case, we should have seen a decline, a moderate drop, no fall, but not a rise in the euro currency. Tomorrow, traders can begin to work out an absolutely illogical reaction of today and start selling the euro. Trading recommendations: The EUR/USD pair resumed its upward movement. Thus, now it is recommended to trade for an increase with targets of 1.1317 and 1.1360 before a downward reversal of the MACD indicator, which signals a new round of correction. Short positions can be considered again if bears manage to gain a foothold back below the critical line. In this case, the nearest target will be the upper boundary of the Ichimoku cloud. In addition to the technical picture also take into account the fundamental data and the time of their release. Explanation of the illustration: Ichimoku indicator: Tenkan-sen - the red line. Kijun-sen - the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dotted line. Chikou Span - green line. Bollinger Bands indicator: 3 yellow lines. MACD Indicator: Red line and histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. June 6th. Results of the day. Ford closes UK engine plant in Wales Posted: 06 Jun 2019 03:30 PM PDT 4-hour timeframe The amplitude of the last 5 days (high-low): 60p - 86p - 63p - 72p - 66p. Average amplitude for the last 5 days: 69p (68p). Well, for a long time there were rumors and concerns that several large companies could leave the UK in the event of a "hard" Brexit. Ford decided not to wait or find out whether it was going to be a hard or orderly Brexit. The automotive giant is closing the production of engines that are used in vehicles produced in the United States, Turkey and Germany. Most likely, sometime later, production facilities will be moved to another country. The speech by Mario Draghi did not concern the pound sterling, so the volatility for the pound/dollar pair remained unchanged on June 6. Mark Carney's speech was boring and uninteresting, and had no effect on the bidding process. There is no news on Brexit, and will unlikely appear in the coming weeks. Tomorrow, Theresa May officially leaves her post as the leader of the Conservative Party, but will continue to be the country's prime minister until the moment when a new one is elected. From a technical point of view, the GBP/USD pair has completed the resistance level of 1.2729 for the second time and again failed to overcome it. Thus, in the coming days, the downward movement of the pair may resume. Participants in the foreign exchange market do not find compelling reasons for critical purchases of the pound sterling, despite a week of failed macroeconomic statistics from overseas. But the continuing uncertainty in the political sphere of the UK can create moderate pressure on the pound sterling in the medium term. Thus, we recommend to wait for a change in the downward trend and resume purchases of the US dollar. Trading recommendations: The pound-dollar currency pair continues a slight upward correction. Formally, it is now possible to consider longs to the level of 1,2776, but the position of the bulls is still very weak. The upward movement may be completed soon. Sell orders can be considered if traders manage to return the GBP/USD pair below the critical line. In this case, the target for the downward movement will be the support level of 1.2540. In addition to the technical picture also take into account the fundamental data and the time of their release. Explanation of the illustration: Ichimoku indicator: Tenkan-sen - the red line. Kijun-sen - the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dotted line. Chikou Span - green line. Bollinger Bands indicator: 3 yellow lines. MACD Indicator: Red line and histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 06 Jun 2019 02:27 PM PDT USDJPY has reached the lower boundary of a huge triangle pattern valid since June 2015. The room to move is getting smaller and a breakout could signal a big move for this pair. For now support remains respected.

The lower triangle boundary is found at 107.90-108 and this week price has touched it. As long as price is above this level, we should expect one more bounce at least towards the upper triangle boundary around 111.50. Risk reward favors bullish positions now as price is just above the support trend line. Bulls have so far respected support and have stopped the declining trend of USDJPY. Short-term resistance is found at 110.40-110.45 and a break above it would open the way for a push towards 111.50-112 The material has been provided by InstaForex Company - www.instaforex.com |

| Ichimoku cloud indicator analysis of EURUSD for June 7, 2019 Posted: 06 Jun 2019 02:14 PM PDT EURUSD bulls are still alive. Despite the double top and initial rejection at 1.1260, price made a pull back towards support area of 1.12 and bounced back up and closed today above 1.1260. Medium-term trend has changed to neutral from bearish.

Black line - major support EURUSD is about to breakout above the Daily Ichimoku cloud. Price has so far given several bullish signals. The bullish RSI divergence, the break out above and out of the red bearish channel, the new higher high above 1.1260, all point to a major trend change. EURUSD is also inside the cloud which means that trend has changed from bearish to neutral. A weekly close above the cloud and near the week highs would be a bullish signal for the next couple of months at least. Support remains key at 1.12. A weekly close below it would be a bearish signal. The material has been provided by InstaForex Company - www.instaforex.com |

| Bitcoin analysis for June, 06.2019 Posted: 06 Jun 2019 08:37 AM PDT BTC price has been trading downwards as we expected. The price tested the level of $7.650. Anyway, we are still expecting more downside on BTC due to strong downward momentum in the background. Our analysis from yesterday didn't change much.

Blue rectangle – support $7.416 Punc rectangle- Downward target and support $7.000 BTC did break of the support trendline and on that way confirmed further downward movement. MACD oscillator again started to increase on the downside, which is another sign of the strong bearish trend. Downward targets are set at the price of $7.416 and $7.000. Resistance levels are set at the price of $7.982 and $8.246.There are still no signs of any reversal and we found only continuation patterns, which is sign of the strong downward trend. The material has been provided by InstaForex Company - www.instaforex.com |

| Analysis of Gold for June 05,.2019 Posted: 06 Jun 2019 08:31 AM PDT Gold has been trading sideways in pat 10 hours but we still see more upside potential. Gold found intraday balance at $1.335 but the break of the $1.337 would confirm further upward continuation

Blue rectangle – Resistance $1.345 Gray rectangle- Resistance 2 ($1.361) White lines – Balance range Strong demand for the Gold caused increase in upward momentum and very stable Gold. Our advice is to watch for buying opportunities. The brekout of the $1.337 would confirm further upward continuation with potential targets at $1.345 and $1.361. Support levels are seen at the price of $1.332 and 1.326. MACD is in positive teritory and Stochastic oscillator did up flip, which are all signs of further upward movement. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD analysis for June 06,2019 Posted: 06 Jun 2019 08:24 AM PDT EUR/USD has been trading upwards as we expected. The EUR rejected exactly from our key support at 1.1215. Our advice is to still watch for buying opportunities on pullbacks.

Yellow rectangle – key short-term support Blue rectangle- Resistance 1 (1.1322) Gray rectangle – Resistance 2 (1.1439) White line – Broken resistance on price and on MACD EUR/USD did strong rejection of support at 1.1215, which is clear sign for us that buyers are strong and that momentum is very bullish. Pat attention on the resistance levels at 1.1322 and 1.1439. Try to buy on any decent intraday pullback with the upward targets at 1.1322 and 1.1439. Stochastic also did flip up from oversold condition. The material has been provided by InstaForex Company - www.instaforex.com |

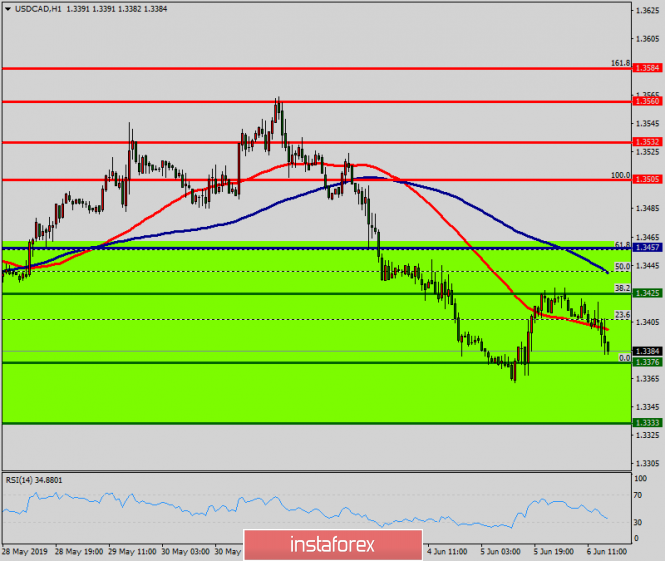

| Technical analysis of USD/CAD for June 06, 2019 Posted: 06 Jun 2019 07:15 AM PDT Overview: The USD/CAD pair continues to move upwards from the level of 1.3457. The pair rose from the level of 1.3457 (the level of 1.3457 coincides with a ratio of 61.8% Fibonacci retracement) to a top around 1.3505. But it rebounded from the top pf 1.3505 to 1.3477. Today, the first support level is seen at 1.3457 followed by 1.3425, while daily resistance 1 is seen at 1.3457. According to the previous events, the USD/CAD pair is still moving between the levels of 1.3505 and 1.3457; for that we expect a range of 48 pips (1.3505 - 1.3457). On the one-hour chart, immediate resistance is seen at 1.3505. Currently, the price is moving in a bullish channel. This is confirmed by the RSI indicator signaling that we are still in a bullish trending market. The price is still above the moving average (100), Therefore, if the trend is able to break out through the first resistance level of 1.3505, we should see the pair climbing towards the daily resistance at the levels of 1.3532 and 1.3560. It would also be wise to consider where to place stop loss; this should be set below the second support of 1.3425. The material has been provided by InstaForex Company - www.instaforex.com |

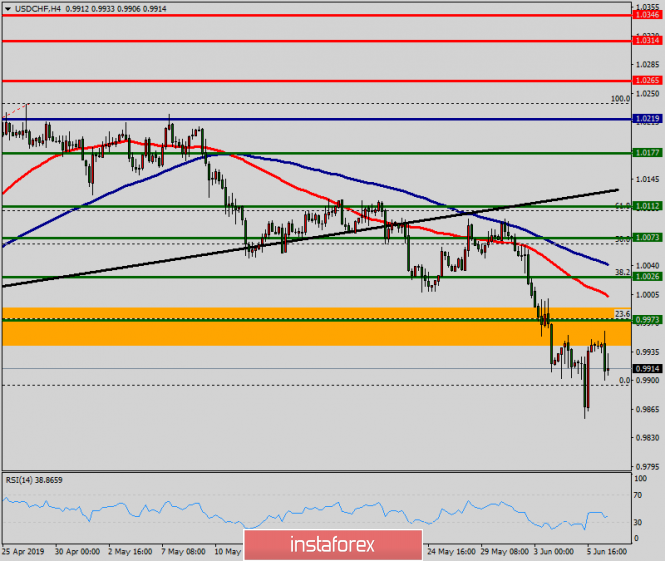

| Technical analysis of USD/CHF for June 06, 2019 Posted: 06 Jun 2019 07:08 AM PDT Overview: The USD/CHF pair continues moving in a bullish trend from the support levels of 1.0123 and 1.0177. Currently, the price is in an upward channel. This is confirmed by the RSI indicator signaling that the pair is still in a bullish trend. As the price is still above the moving average (100), immediate support is seen at 1.0177. Consequently, the first support is set at the level of 1.0177. So, the market is likely to show signs of a bullish trend around 1.0177. In other words, buy orders are recommended above the level of 1.0177 with the first target at the level of 1.0265. Furthermore, if the trend is able to breakout through the first resistance level of 1.0265, we should see the pair climbing towards the point of 1.0314. On the other hand, it would also be wise to consider where to place a stop loss; this should be set below the second support of 1.0126. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 06 Jun 2019 06:43 AM PDT To open long positions on GBP/USD, you need: Buyers of the pound are trying to gain a foothold above the resistance of 1.2713, which will allow to build a new upward trend with an update of the maximum in the area of 1.1257, where the upper limit of the current upward channel passes. In case of an unsuccessful consolidation above 1.2713, it is best to consider new purchases on a false breakout from the low of 1.2669 or on a rebound from a larger support of 1.2615. To open short positions on GBP/USD, you need: The short positions in GBP/USD are best returned from the resistance of 1.2757 or a rebound from the new high of 1.2800. The main task of the bears for the second half of the day will be to consolidate below the resistance of 1.2713, which will quickly push the pound into the area of the minimum of the day 1.2669, where I recommend fixing the profit. Indicator signals: Moving Averages Trading is conducted above 30 and 50 moving averages, which indicates an attempt by bulls to build a new upward trend. Bollinger Bands The breakthrough of the upper limit of the indicator leaves the market on the side of the pound buyers. Description of indicators

|

| Posted: 06 Jun 2019 06:43 AM PDT To open long positions on EURUSD, you need: After the ECB's decision and the statements that followed, the euro fell against the US dollar, but buyers are expected to return from the level of 1.1200, which I drew attention to in my morning forecast. Now, their task will be to break through and consolidate above the resistance of 1.1273, which will lead the euro to new highs in the area of 1.1304 and 1.1336, where I recommend fixing the profit. In case of an unsuccessful breakout of the resistance of 1.1273 and a downward correction in the afternoon, it is best to return to long positions on a false breakout from the level of 1.1241. To open short positions on EURUSD, you need: Sellers are still on the sidelines, as the performance of Mario Draghi can present a lot of surprises. The formation of a false breakout in the resistance area of 1.1304 will be a signal to euro sales. Otherwise, it is better to open short positions on the rebound from the level of 1.1336 and 1.1358. The main task of the bears will be to close the day below the support of 1.1273, which will keep the pair in the side channel and will not allow developing a new upward trend. Indicator signals: Moving Averages Trading is conducted above 30 and 50 moving averages, indicating a return to the market of large buyers of the euro. Bollinger Bands A breakthrough of the upper boundary of the indicator took place and while the trend is developing on the side of euro buyers. Description of indicators

|

| Beige Book Report: What did the Fed say on June 6th? Posted: 06 Jun 2019 05:04 AM PDT From April to mid-May, economic activity grew at a modest pace which somewhat improved compared with the previous period as a whole. In almost all districts, there was some growth and a moderate increase in activity was observed in some of them. Production reports were generally positive but in some districts, there were signs of slower activity and more uncertain prospects among contacts. Both in housing and in real estate, there was a general increase but there were significant differences in both sectors in attitudes in different areas. Consumer spending reports were generally positive but moderate. Tourist activity was stronger, especially in the South-East. However, car sales were lower, according to reporting districts. The demand for loans was mixed but pointed to growth. Overall, agricultural conditions remained weak but some areas reported some improvements. Prospects for the coming months were persistently positive but modest, with only minor differences between the countries that reported. Employment and wages Employment continued to increase throughout the country with most districts reporting modest or moderate employment growth and others showing a slight increase, which was estimated to be similar to the previous reporting period. There was a strong demand for employment in retail trade, business services, technical, manufacturing, and construction work, as well as from recruitment agencies in general. However, stronger employment growth continued to be constrained by tough labor markets, with districts citing a shortage of both highly skilled and low-skilled workers. According to reports of several districts, competition for workers to a certain extent puts pressure on the level of wages in a wide range of occupations and leads to increased benefits in order to attract more workers and improve the retention of existing workers. However, overall wage pressure remained relatively low due to low unemployment. Most districts reported modest or moderate wage growth. Prices Since the last report, prices generally continued to grow at a modest pace in most areas. Although in some areas, there was a faster increase in prices for input resources compared to final sales prices. Firms generally reported an increase in input costs in the range from moderate to moderate. Contacts in several districts reported a rise in freight prices. Producers' input pricing reports were mixed with some counties referring to lower prices for steel and other metals, while contacts with others noted that raw material prices remained high. Prices for building materials, including sawnwood, have also declined in a number of areas. As a rule, retailers report that sales prices hardly increase. The material has been provided by InstaForex Company - www.instaforex.com |

| The yen and the euro are growing, investors expect the outcome of the ECB meeting Posted: 06 Jun 2019 04:20 AM PDT The Japanese yen is preparing to update the five-month high due to lack of progress in trade negotiations between the US and Mexico. Trump's new attack has a negative impact on risky assets, and investor sentiment has shifted to safe-haven currencies. Together with the yen, the euro is growing, which has recently strengthened against the backdrop of the dollar's weakness caused by the high probability of the Fed's interest rate cuts. Today's meeting of ECB officials will show how much the regulator is concerned about the signs of a decline in economic growth in the region. Concerns about the recession are spreading around the world, and Central banks are lowering rates, which could signal the beginning of a global cycle of monetary easing. The Japanese yen has become a major asset that investors consider more secure. The increase was 0.3% to 108.07 yen per dollar. The Mexican peso, already burdened with trade problems, took a hit after the credit rating Agency Fitch downgraded the country's credit rating from BBB + to BBB, just two points above unwanted status. The euro rose 0.05% to $1.1227, after falling 0.3% on Wednesday. This week, the single currency peaked at $ 1.1307. One of the main questions for the ECB meeting is whether the monetary policy Council will adhere to its opinion that the economy will recover in the second half of the year. It is expected that the ECB head Mario Draghi will insist on further stimulation. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 06 Jun 2019 03:20 AM PDT

One of the central events of today is the decision of the European Central Bank (ECB) on monetary policy. The EUR/USD pair strengthened four days in a row, but sellers seem to start returning to the game in anticipation of the ECB's verdict. In the first quarter, the eurozone economy expanded by 0.4% after its previous two quarters grew by 0.2%. This is good news for the European Central Bank, as it confirms its assumption that the slowdown in the region's economy is only a temporary phenomenon and will not go into recession. However, the preliminary inflation data for May were very disappointing. In the annual rate of inflation slowed to 1.2% from April's 1.7%. That is, the ECB has not yet managed to bring the indicator even close to the target level (2%). At the same time, trade negotiations between the United States and China came to a standstill, and the trade war between the two economies of the world broke out with a new force. The parties continue to exchange mutual duties, limiting the activity of companies in both countries and expressing mutual accusations. Thus, the overall picture has deteriorated compared to the previous ECB meeting. How will the regulator respond? Traders do not expect the Central Bank to adjust the interest rate. However, they would like to know how generous the new long-term Bank lending program (TLTRO) would be, how it would be calculated and whether the rate for new loans would be negative, zero or close to zero? The regulator can update forecasts for economic growth and inflation in the EU, as well as hint at further action if these indicators slow down even more. Recently, the euro is inclined to fall following the ECB meeting. However, according to some analysts, the single European currency today can interrupt this trend. According to them, there is a possibility that the position of the regulator may not be as soft as the market expects. "ECB President Mario Draghi may not be such a "dovish" as the market believes. While everyone is focused on external risks, such as trade tensions (to downplay its importance, indeed, it is impossible), in some cases it is not possible to recognize the moderate but important incentive that we continue to see from the domestic sector," said Jeremy Stretch of the Canadian Imperial Bank of Commerce (CIBC). He predicts that the EUR/USD pair will return to the level of 1.1570 dollars by the end of the next quarter, and then continue to grow to 1.18 dollars by the end of the year. Other experts are less optimistic about the euro. They assume that economic activity and inflation in the EU remain depressed, even though business confidence shows signs of recovery. "At the moment, it is difficult to be openly optimistic about the euro. Weak economic growth and inflation in the eurozone are putting pressure on the ECB, which could provide further policy easing on the part of the regulator. Therefore, it is difficult to see too much growth potential for EUR/USD," said Lee Hardman from MUFG Bank. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading recommendations for the EURUSD currency pair - placement of trading orders (June 6) Posted: 06 Jun 2019 02:38 AM PDT Over the last trading day, the euro / dollar currency pair showed a high volatility of 87 points, as a result of having a V-shaped amplitude of oscillation. From the point of view of technical analysis, we see a tremendous movement, where at first the inertial move was maintained, driving the quotation down to the range level of 1.1300, after which there was a sharp movement over 80 points. Considering the trading schedule, in general terms, we see that the picture changes every day, and the fact that the previous "Impulse --- Correction" measures have already gone astray is clear to everyone, but we already have something new. If we consider the second half of the day (June 5), then we see how the quotation promptly returned to the border of the previously passed side channel 1.1265, fixing below it. We turn to the information and news background, which gave us all this wonderful rally. What was the reason - let's sort everything out in order. At first, we had quite positive statistics from Europe regarding business activity in the services sector, where there was a characteristic increase from 52.5 to 52.9. The euro has already been charged on statistics and background for more than one day, and after the data was released, we maintained a bullish interest. In the afternoon, data on the number of people employed in the non-agricultural sector of the United States came out, and here we saw that in May the increase was only 27 thousand, compared to the period of April, where the figure was 275 thousand. Lose positions and quotes reached the range level of 1.1300. After that, we see a sharp draining of the euro by more than 80 points. What is the reason? It was found right in the information background. There were statements by analysts from large European banks saying that a quantitative easing program is expected to resume by the beginning of next year. After that, there has been information pertaining to the demand for futures on lowering the refinancing rate of the ECB which is expected to grow in early 2020. With such a negative background, everyone ran to merge the overbought euro as soon as possible. Today, the focus of all traders, of course, is the ECB meeting followed by a press conference, where our beloved Mario Draghi has a lot to say. Listen to his rhetoric as carefully as possible. Many experts expect him to talk about the future of monetary policy. We'll see. Further development Analyzing the current trading schedule, we see that after such a rapid downward rally, the quotation is trying to roll back, which is quite normal. However, due to the upcoming information background, the decisiveness of the traders is unstable. It is likely to assume that on the eve of the press conference, there may be a temporary stagnation in the form of preparation, but after which, depending on the rhetoric of the ECB, there will be leaps. Where are we going? Everything, of course, is ambiguous, since Mario's rhetoric is unpredictable, many traders take a waiting position outside the market in order not to run into punctures. Speculators are waiting for at least some slowdown on smaller timeframes in order to make a stretch of pending orders and fly into the first impulse. Indicator Analysis Analyzing a different sector of timeframes (TF), we see that indicators in the short, intraday and medium term are prone to upward interest, but due to the massive information background indicators can still be subjected to change. Weekly volatility / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation, based on monthly / quarterly / year. (June 6 was based on the time of publication of the article) The current time volatility is 23 points. Due to the information background, volatility can grow. Key levels Zones of resistance: 1.1300 **; 1.1440; 1.1550; 1.1650 *; 1.1720 **; 1.1850 **; 1.2100. Support areas: 1.1180; 1.1112; 1.1080 *; 1.1000 ***; 1.0850 **. * Periodic level ** Range Level The material has been provided by InstaForex Company - www.instaforex.com |

| Trading plan for EUR / USD and GBP / USD pairs on 06/06/2019 Posted: 06 Jun 2019 02:17 AM PDT The single European currency persistently went up, despite the slowdown in retail sales growth from 2.0% to 1.5%. This is against the background of a significant slowdown in inflation. They showed an increase from 52.8 to 52.9 instead of a decrease to 52.5, although the final data on the business activity index in the service sector pleased investors, as shown by a preliminary assessment. Yet all the same, data on business activity indices raise many questions since the production index decreased from 47.9 to 47.7, while the composite index of business activity rose from 51.5 to 51.8. It is completely incomprehensible how this is possible since it contradicts all the laws of logic, but Markit gave exactly such results. The British business activity index rose from 50.4 to 51.0. But still, business activity indexes are not so significant to have such a significant impact. Thus, it seems that everyone was preparing to publish ADP employment data, since it was at the time of their release that the dollar began to weaken at double speed. After all, these same data showed that employment grew by only some 27 thousand versus 275 thousand in the previous month. However, almost immediately the dollar began to rapidly regain all its losses and it was even able to strengthen itself by the end of the day. Yet, the final data on the business activity index in the service sector confirmed the fact of its decline from 53.0 to 50.9. In this scenario, it is not surprising that the composite index decreased from 53.0 to 50.9. And looking at all this, it is completely incoherent, from which the dollar began to grow so fast in the second half of the day. However, everything falls into place if we remember that a meeting of the European Central Bank will take place today. After which, Mario Draghi will hold a press conference. It is worth noting here that the Federal Reserve System has unambiguously hinted at the possibility of lowering the refinancing rate and a similar opportunity is also being considered by the Bank of Japan. Recently, analysts of one of the largest banks in Europe said they expect the resumption of the quantitative easing program at the very beginning of next year. Moreover, the demand for futures to lower the refinancing rate of the European Central Bank began to grow in early 2020. Thus, Mario Draghi is now waiting for statements about the imminent turn in the policy of the European Central Bank towards easing monetary policy in order to stimulate the European economy, which really didn't perk as a result of an incredibly soft policy combined with the implementation of a large-scale quantitative easing program. It is with such thoughts that everyone is waiting for today's performance of Mario Draghi. Now, everything depends on his words. The head of the European Central Bank can both bring down the single European currency and breathe new life into it. After a sharp descent, the euro/dollar currency pair slowed down around the value of 1.1220, forming a pullback. In analyzing the incoming information background, it is likely to assume a temporary talk in the range of 1.1220/1.1250, where traders occupy a waiting position. The pound/dollar currency pair has drawn a similar picture in the form of a sharp decline in the area of the value of 1.1280. It felt temporary support and slowed down as a fact. It is likely to assume a temporary bumpiness of 1.2675/1.2705, analyzing the existing borders for a breakdown. |

| Trading recommendations for the currency pair GBPUSD - placement of trading orders (June 6) Posted: 06 Jun 2019 01:35 AM PDT Over the last trading day, the pound / dollar currency pair showed an underestimated volatility of 65 pips, a rather interesting picture of price development. From the point of view of technical analysis, we have seen a fairly steady correction movement, having a total of more than 180 points of travel from the fulcrum. Where did the quote go? In the previous review, we discussed possible points of resistance, and it is just the first theoretical point in the face of a local maximum on May 27 (1.2746 - Max correction to H4) which played the role of a ceiling, slowing down the movement and forming a recovery process. Considering the graph in general terms, we see that all is not lost, the clock cleanliness of the "Impulse --- Correction" is still on the market until the coordinates fall 1,2746 (May 27). Theoretically, we can now get the clock frequency of the "Pulse", which we will discuss later. The news background had statistics on business activity in the UK services sector in May, where we saw an increase from 50.4 to 51.0, while the forecast was 50.6. This news supported the British currency, but a more significant movement is waiting for us later. In the afternoon, data on Nonfarm Payrolls USA came out (change in the number of people employed in the non-agricultural sector), where we saw a significant decline in May. Employment grew by only 27 thousand compared to April with 275 thousand. On this regard, the pound continued its rapid growth, reaching a local maximum on May 27. We saw a decline afterwards. What could be the reason? It probably reflected the EURUSD currency pair. According to ancient tradition, we complete the information and news background on Brexit. In previous reviews, we already talked about US President Donald Trump's trip to Britain, where he is quite positive and is inspired by the "divorce" process, arguing that the UK just needs to leave the EU in any outcome. Of course, everything is fine. And on the same positive note, the American automaker Ford is preparing to announce the closure of the plant, which employs two thousand people. Earlier, representatives of the concern said that in case of the so-called tough Brexit, Ford could lose up to $ 1 billion. I think it's not even worth commenting on the above issue because everything is clear yet. Today, in terms of the economic calendar, we, in principle, do not have statistics on Britain and the United States, but the focus of all traders is the ECB press conference, where Mario Draghi can report on the future of monetary policy. It might be interesting for the pound because of the high correlation between the EUR / USD and GBP / USD pairs. Further development Analyzing the current trading chart, we see that the quotation is actively building up the process of restoring the descending move, giving a hint about a possible tact "Impulse". In principle, considering the overall picture of the graph, this theory is possible, but earlier we wrote that today, a press conference of the ECB is held, which can exert pressure and unpredictability in actions. Thus, it is primary and possible that we analyze the behavior of the quotation and the outgoing information background and make a trading decision, since this is a temporary stagnation relative to current values. Indicator Analysis Analyzing a different sector of timeframes (TF), we see that indicators in the short term are set in a downward phase due to the current recovery. Intraday perspective changed interest from rising interest to neutral due to recovery and stagnation. Medium term has a downward interest. Weekly volatility / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation, based on monthly / quarterly / year. (June 6 was based on the time of publication of the article) The current time volatility is 23 points. Volatility due to the recovery process and the information background can possibly grow. Key levels Zones of resistance: 1.2770 **; 1.2880 (1.2865-1.2880) *; 1.2920 * 1.3000 **; 1.3180 *; 1,3300 **; 1.3440; 1.3580 *; 1.3700. Support areas: 1.2620; 1,2500 *; 1.2350 **. * Periodic level ** Range Level The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 06 Jun 2019 12:58 AM PDT EUR / USD Yesterday's trading day for the EUR / USD pair ended with a decrease of 30 basis points. And from the maximum of the day, the instrument lost about 90 bp. Thus, such a decrease can be interpreted as the completion of the construction of the ascending wave. Based on the current wave marking, wave 4 can be completed. If this is true, then from the current positions the pair will continue to decline within wave 5 with targets located under the 11th figure. The news background for the couple has recently been positive due to a series of negative reports from America. However, today, the press conference of Mario Draghi is dedicated to the results of the ECB meeting. It can paint the news background again in a negative color. The fact is that the markets do not expect optimistic rhetoric from Draghi. On the contrary, the chairman of the European regulator will most likely talk about the need to stimulate the economy of the European Union regarding the increased global economic risks, the program of supporting the banking sector and weak inflation. All this can force traders to proceed again to sales of the euro-dollar pair. Purchase goals: 1.1278 - 50.0% Fibonacci 1.1317 - 61.8% Fibonacci Sales targets: 1.1106 - 0.0% Fibonacci General conclusions and trading recommendations: The euro / dollar pair has presumably completed the construction of the correctional wave 4. Thus, now, I recommend to start selling the pair with targets that are under the 11 figure in terms of building wave 5 of the downward trend segment. I recommend placing limit orders above the peak of the supposed wave 4. GBP / USD On June 5, the GBP / USD pair lost a few dozen base points, while failing to update the previous peak, which is now interpreted as wave 2, in s. In any case, if the market fails to update the peak of May 27, the chances of resuming the construction of a downward trend section will increase multiple times. At the same time, in order to identify the readiness of traders to new sales, it is also necessary to wait for a successful attempt to break through the minimum of May 31. Over the past trading day, the news from the UK has come a little. The PMI index for the services sector slightly exceeded forecasts, and the composite PMI index was slightly worse than forecasts. Greater interest in the markets caused similar US indices. And the PMI index for the services sector ISM returned to the game of bears. It's too early to say that the bulls were again defeated in their attempts to start building the upward trend, but this is precisely what is going on. Speech by Bank of England CEO Mark Carney today may further weaken the position of the bulls, if the context of the speech is negative and "dovish." Mark Carney's talk starts at 09:00 UTC+00. Sales targets: 1.2554 - 200.0% Fibonacci 1.2360 - 261.8% Fibonacci Purchase goals: 1.3175 - 0.0% Fibonacci General conclusions and trading recommendations: The wave pattern of the pound / dollar instrument suggests a resumption of the instrument decline within the estimated wave c. Thus, now, I recommend waiting for a breakout level of 200.0% and selling the pound with targets located near the calculated levels of 1.2360 and 1.2176, which corresponds to 261.8% and 323.6% in Fibonacci. An unsuccessful attempt to break through the 200.0% could lead to the completion of the construction of the downward trend, but this hypothesis has not yet been confirmed. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment