Forex analysis review |

- Control zones Bitcoin 08/19/19

- Control zones USDJPY 08/19/19

- Fractal analysis of the main currency pairs on August 19

- GBP/USD. August 18th. Results of the week. The long-awaited correction for the pound

- EUR/USD. August 18th. Results of the week. The euro in a "coma". Another week of failure for the euro

- EUR/USD. Preview of the week: focus on Fed minutes and Jackson Hole

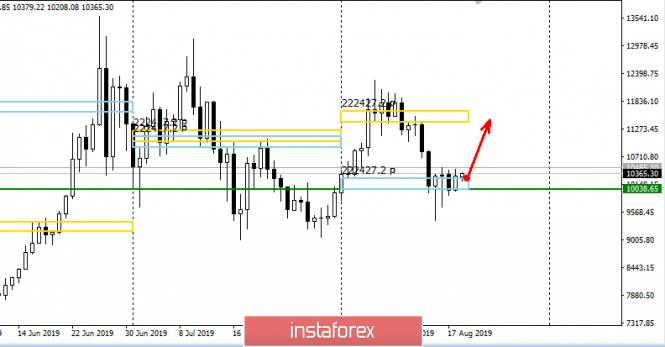

| Control zones Bitcoin 08/19/19 Posted: 18 Aug 2019 07:57 PM PDT Bitcoin is trading above the balance level for the second day. This became possible after stopping the fall during the test of monthly control zone in August. The middle course zone was also tested at the end of last week. The likelihood of an increase in the value of bitcoin increases. You should not expect a sharp increase in the price, however, while the balance marks are below the course, you should keep the purchases open at the end of last week. Sales can be closed completely, since the probability of falling below the level of $10,000 in August is 30%.

Favorable price for the purchase of the instrument will be at any level below $10,000. The first growth goal can be considered at the $10,749 mark. When bitcoin reaches this level, a partial consolidation of purchases and the transfer of the rest to breakeven will be required. An alternative model has a probability of implementation below 30%, which does not make it possible to enter sales. The instrument is trading near the monthly control zone. This makes a further decline unlikely. If the decline occurs below $10,000, then the probability of a return to this mark in August will be at 70%, and in case of exit and closing of the month's trading below this level, the probability will increase to 90%. Daily CZ - daily control zone. The area formed by important data from the futures market, which change several times a year. Weekly CZ - weekly control zone. The zone formed by important marks of the futures market, which change several times a year. Monthly CZ - monthly control zone. The zone, which is a reflection of the average volatility over the past year. The material has been provided by InstaForex Company - www.instaforex.com |

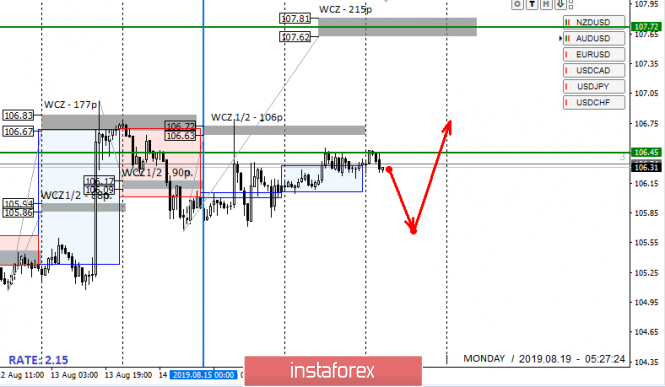

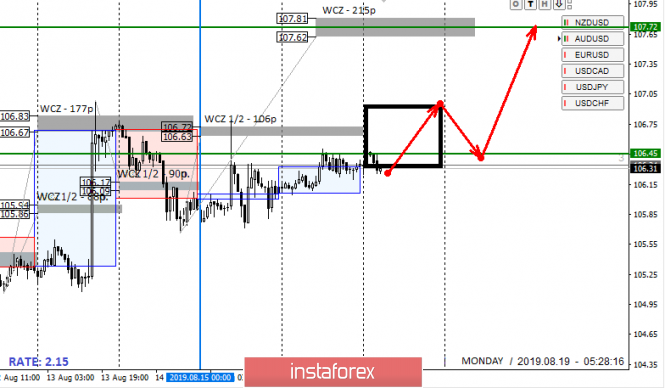

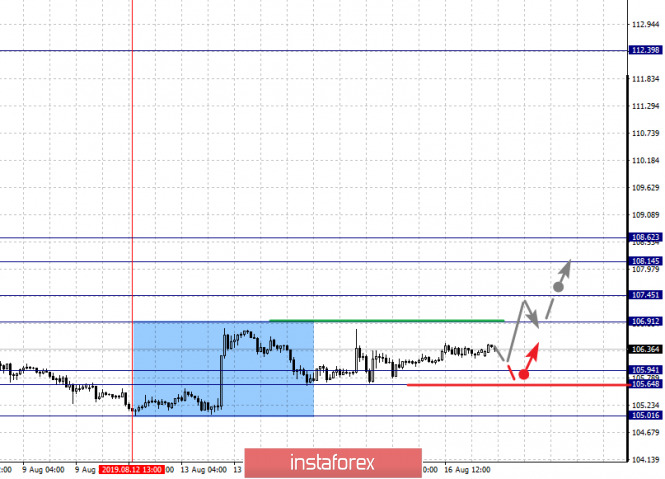

| Posted: 18 Aug 2019 07:34 PM PDT Today, the pair is again trading outside the monthly control zone of August, which makes it possible to use any decline to find favorable prices for purchasing the instrument. The defining resistance is WCZ 1/2 106.72-106.63. While the pair is trading below this zone, the upward movement remains corrective, however, sales will not be profitable, since the probability of moving away from the monthly control zone is 30%. Work in the medium-term flat implies purchases from the lower boundary. The probability of a return to the level of 106.45 is 90%, which makes any transactions profitable in the direction of weakening the Japanese yen. An alternative model will be developed if the closure of today's US session occurs above the level of 106.72. This will make it possible for you to hold purchases and open new positions with the aim of testing the weekly control zone 107.81-107.62. Daily CZ - daily control zone. The area formed by important data from the futures market, which change several times a year. Weekly CZ - weekly control zone. The zone formed by important marks of the futures market, which change several times a year. Monthly CZ - monthly control zone. The zone, which is a reflection of the average volatility over the past year. The material has been provided by InstaForex Company - www.instaforex.com |

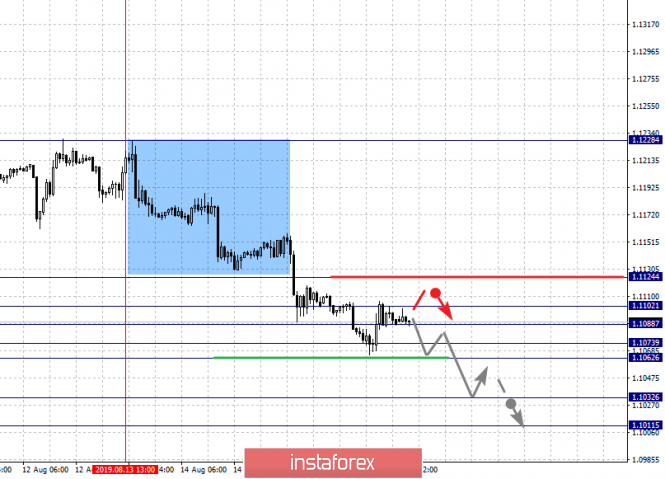

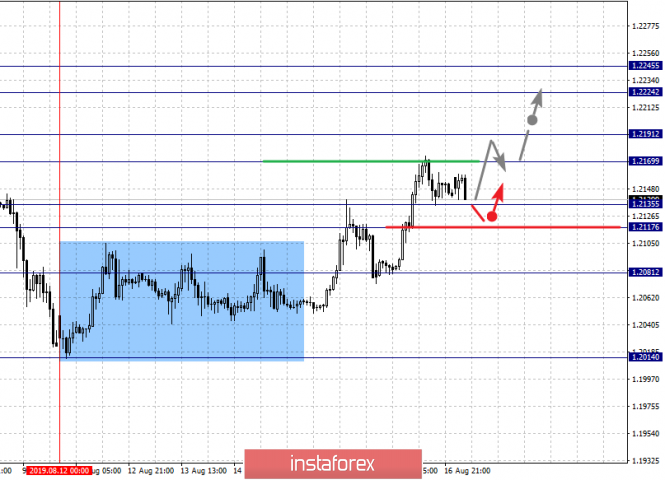

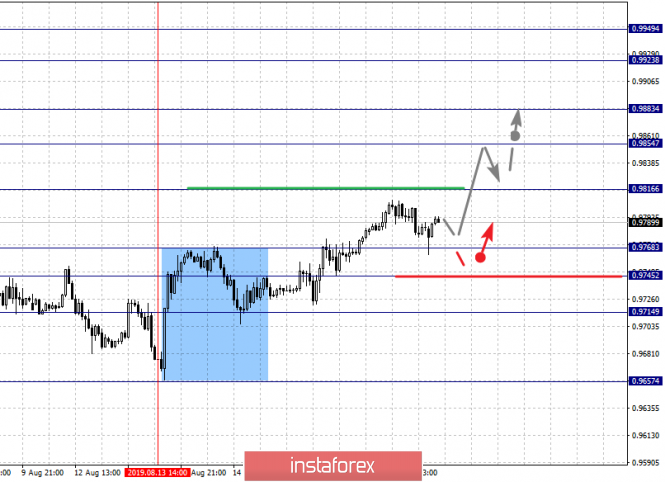

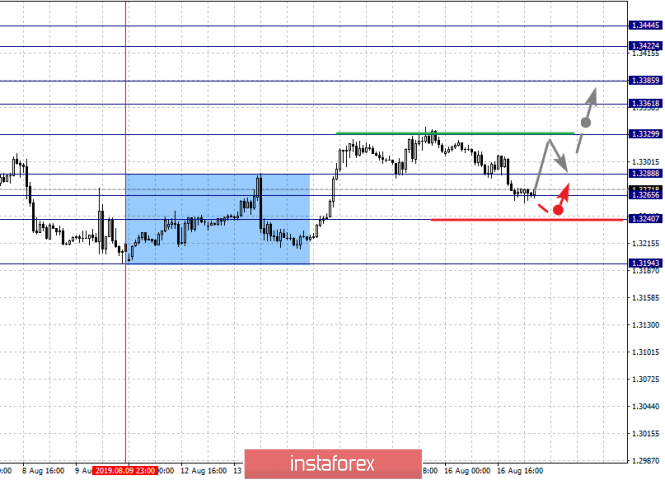

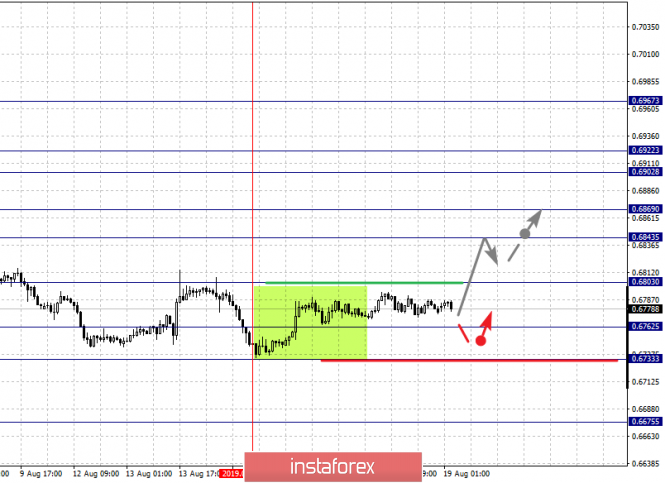

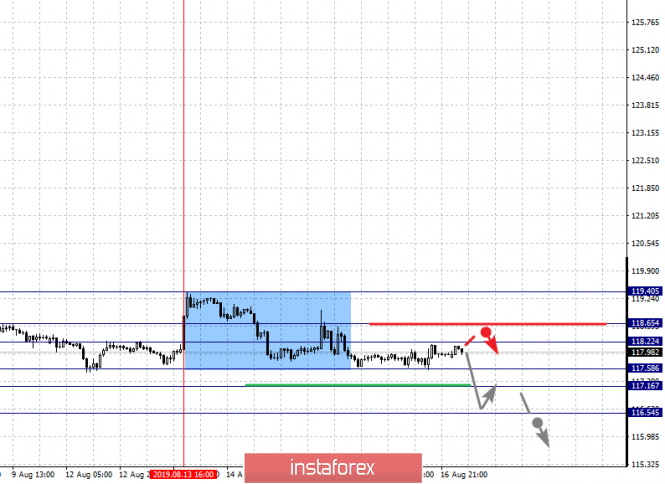

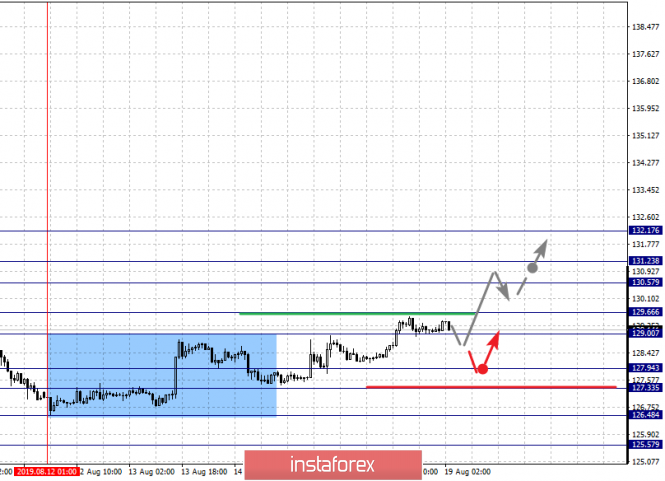

| Fractal analysis of the main currency pairs on August 19 Posted: 18 Aug 2019 06:32 PM PDT Forecast for August 19 : Analytical review of currency pairs on the scale of H1: For the euro / dollar pair, the key levels on the H1 scale are: 1.1124, 1.1102, 1.1073, 1.1062, 1.1032 and 1.1011. Here, we are following the development of the downward structure of August 13. Short-term movement to the bottom is expected in the range of 1.1073 - 1.1062. The breakdown of the latter value will lead to a pronounced movement. Here, the goal is 1.1032. Price consolidation is near this level and hence, the likelihood of a correction. For the potential value for the downward trend, we consider the level of 1.1032. Short-term upward movement is possibly in the range of 1.1088 - 1.1102. The breakdown of the last value will lead to a long correction. Here, the target is 1.1124. This level is a key support for the downward structure. The main trend is the downward cycle of August 13. Trading recommendations: Buy 1.1088 Take profit: 1.1100 Buy 1.1105 Take profit: 1.1122 Sell: 1.1060 Take profit: 1.1035 Sell: 1.1030 Take profit: 1.1011 For the pound / dollar pair, the key levels on the H1 scale are: 1.2245, 1.2224, 1.2191, 1.2169, 1.2135, 1.2117 and 1.2081. Here, we follow the development of the ascending cycle of August 12. Short-term upward movement is expected in the range of 1.2169 - 1.2191. The breakdown of the last value should be accompanied by a pronounced upward movement. In this case, the target is 1.2224. For the potential value for the top, we consider the level of 1.2245. Upon reaching which, we expect consolidation, as well as a pullback to the bottom. Short-term downward movement is possibly in the range of 1.2135 - 1.2117. The breakdown of the last value will lead to a long correction. Here, the target is 1.2081. This level is a key support for the downward structure. The main trend is the downward cycle of July 31. Trading recommendations: Buy: 1.2170 Take profit: 1.2190 Buy: 1.2195 Take profit: 1.2224 Sell: 1.2135 Take profit: 1.2118 Sell: 1.2115 Take profit: 1.2081 For the dollar / franc pair, the key levels on the H1 scale are: 0.9949, 0.9923, 0.9883, 0.9854, 0.9816, 0.9768, 0.9745 and 0.9714. Here, we follow the ascending structure of August 13th. The continuation of the movement to the top is expected after the breakdown of the level of 0.9816. In this case, the target is 0.9854. Short-term upward movement, as well as consolidation is in the range of 0.9854 - 0.9883. The breakdown of the level of 0.9883 should be accompanied by a pronounced upward movement. Here, the target is 0.9923. For the potential value for the top, we consider the level of 0.9949. Upon reaching which, we expect consolidation, as well as a pullback to the bottom. Short-term downward movement is possibly in the range of 0.9768 - 0.9745. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 0.9714. This level is a key support for the top. The main trend is the upward cycle of August 13. Trading recommendations: Buy : 0.9816 Take profit: 0.9854 Buy : 0.9856 Take profit: 0.9881 Sell: 0.9768 Take profit: 0.9747 Sell: 0.9743 Take profit: 0.9715 For the dollar / yen pair, the key levels on the scale are : 108.62, 108.14, 107.45, 106.91, 106.35, 105.94, 105.64 and 105.01. Here, we continue to monitor the ascending structure from August 12. The continuation of the movement to the top is expected after the breakdown of the level of 106.91. In this case, the target is 107.45, wherein consolidation is near this level. The breakdown of the level of 107.45 should be accompanied by a pronounced upward movement. Here, the goal is 108.14. For the potential value for the top, we consider the level of 108.62. Upon reaching which, we expect a pullback to the bottom. The range of 105.94 - 105.64 is a key support for the top. Its passage at the price will lead to the development of a downward movement. In this case, the target is 105.01. The main trend: building potential for the top of August 12. Trading recommendations: Buy: 106.91 Take profit: 107.43 Buy : 107.47 Take profit: 108.14 Sell: Take profit: Sell: 105.62 Take profit: 105.04 For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3445, 1.3422, 1.3385, 1.3361, 1.3329, 1.3288, 1.3265, 1.3240 and 1.3194. Here, we are following the development of the local ascendant structure of August 9. The continuation of the movement to the top is expected after the breakdown of the level of 1.3330. In this case, the target is 1.3361. Consolidation is in the range of 1.3361 - 1.3385. The breakdown of the level of 1.3385 will allow us to count on movement towards a potential target - 1.3422. Upon reaching this level, we expect consolidation in the range of 1.3422 - 1.3444, as well as a pullback to the bottom. A short-term downward movement is possibly in the range of 1.3288 - 1.3265. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.3240. This level is a key support for the top. The main trend is the local ascending structure of August 9. Trading recommendations: Buy: 1.3330 Take profit: 1.3360 Buy : 1.3387 Take profit: 1.3422 Sell: 1.3288 Take profit: 1.3266 Sell: 1.3264 Take profit: 1.3240 For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6967, 0.6922, 0.6902, 0.6869, 0.6843, 0.6803, 0.6762, 0.6733 and 0.6675. Here, we are following the development of the ascending structure of August 7, and the price has formed a small potential for the top of August 14. The continuation of the upward movement is expected after the breakdown of the level of 0.6803. In this case, the first target is 0.6843. Short-term upward movement, as well as consolidation is in the range of 0.6843 - 0.6869. The breakdown of the level of 0.6870 should be accompanied by a pronounced upward movement. Here, the target is 0.6902. Price consolidation is in the range of 0.6902 - 0.6922. For the potential value for the top, we consider the level of 0.6967. Upon reaching which, we expect a pullback to the bottom. Meanwhile, in the range of 0.6762 - 0.6733, a consolidated movement is expected. The breakdown of the level of 0.6733 will lead to the development of a downward structure. In this case, the potential target is 0.6675. The main trend is the ascending structure of August 7, the correction stage. Trading recommendations: Buy: 0.6805 Take profit: 0.6840 Buy: 0.6844 Take profit: 0.6867 Sell : Take profit : Sell: 0.6730 Take profit: 0.6680 For the euro / yen pair, the key levels on the H1 scale are: 119.40, 118.65, 118.22, 117.58, 117.16 and 116.54. Here, we are following the development of local potential for the bottom of August 13. Short-term downward movement is expected in the range of 117.58 - 117.16. The breakdown of the latter value will allow us to expect movement to a potential target - 116.54. Consolidation is near this level. Short-term upward movement is expected in the range of 118.22 - 118.65. The breakdown of the last value will have the formation of an ascending structure for the top. Here, the first goal is 119.40. The main trend is the formation of a local descending structure of August 13. Trading recommendations: Buy: 118.22 Take profit: 118.62 Buy: 118.70 Take profit: 119.40 Sell: 117.56 Take profit: 117.18 Sell: 117.14 Take profit: 116.55 For the pound / yen pair, the key levels on the H1 scale are : 132.17, 131.23, 130.57, 129.66, 127.94, 127.33, 126.48 and 125.57. Here, we follow the development of the ascending structure of August 12. Short-term upward movement is expected in the range of 129.00 - 129.66. The breakdown of the last value will lead to a pronounced upward movement. Here, the target is 130.57. Short-term upward movement, as well as consolidation is in the range of 130.57 - 131.23. For the potential value for the top, we consider the level of 132.17. Upon reaching which, we expect consolidation, as well as a pullback to the bottom. Short-term downward movement is possibly in the range of 127.94 - 127.33. The breakdown of the latter value will favor the development of a downward structure. Here, the first goal is 126.48. As a potential value, we consider the level of 125.57. The main trend is building potential for the top of August 12. Trading recommendations: Buy: 129.67 Take profit: 130.55 Buy: 130.60 Take profit: 131.20 Sell: 127.30 Take profit: 126.50 Sell: 126.44 Take profit: 125.60 The material has been provided by InstaForex Company - www.instaforex.com |

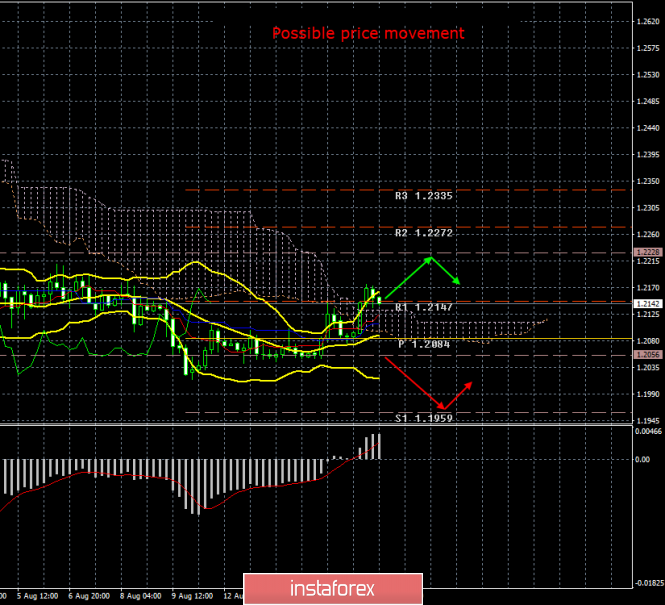

| GBP/USD. August 18th. Results of the week. The long-awaited correction for the pound Posted: 18 Aug 2019 04:17 PM PDT 4-hour timeframe Amplitude of the last 5 days (high-low): 126p - 92p - 56p - 56p - 100p. Average amplitude over the last 5 days: 86p (84p). The strengthening of the British pound at the end of the week is like a gift for the new year. Given the macroeconomic reports received from the UK this week, there could be an impression that the pound sterling's growth is justified. However, from our point of view, there is no connection between reports from the United Kingdom and the British currency's meager growth. The first point in favor of this assumption is the need for a technical correction. Not a single currency can fall or grow constantly, from time to time, traders will take profits, and the pair will retreat against the trend. The second point - inflation in the UK accelerated to 2.1%, retail sales exceeded forecasts, salaries also showed positive dynamics, but the main reason is the fall of the pound in recent weeks, months and years. Since the pound depreciates, this leads to an increase in inflation (the United Kingdom, unlike the United States and the European Union, boasts stable inflation of 2.0%), a forced increase in wages (the so-called inflationary growth), and the growth in retail sales was associated with... Great fears among the British over a "hard" Brexit and life after it. In recent weeks, UK citizens have simply stocked up on food and medicine in case the disordered Brexit does happen, which led to an increase in retail sales. It turns out that all three positive reports from the UK are not so positive. And if you recall that the unemployment report showed an increase from 3.8% to 3.9%, then the fundamental background is already shifting to the "negative" side. Meanwhile, a secret document was released called Yellowhammer, which said that the UK could face serious disruptions in the supply of food, medicine, fuel and their shortages in the case of a hard Brexit. The fears of the authors of this document are connected with the work of ports and customs under the new rules. There are also serious concerns about the riots on the island of Ireland, as in the case of a hard Brexit, a border will appear between Ireland and Northern Ireland, which does not suit very many residents of the island. Well, the British Parliament has its "own series". According to recent reports, the Labour Party can unite as Conservatives to oppose Boris Johnson and his initiative to leave the EU quickly and no matter how. With the Conservatives, who themselves elected Johnson to the post of their leader and prime minister a month ago. With Conservatives who knew very well that Johnson's main election promise was to implement Brexit by October 31st. Now, Corbyn and a company of other MPs want to remove Johnson from work in order to protect the country from economic disaster. Well, the pound, although it has grown from multi-year lows by as much as 150 points, does not look like a currency that is ready to start an upward trend. Trading recommendations: The GBP/USD currency pair continues its upward correction. Thus, formally, it is now recommended to buy the GBP/USD pair with targets at 1.2228 and 1.2272, however, transaction volumes should be minimal. We believe that there are no fundamental factors for the solid strengthening of the pound, and traders will remain absolutely pessimistic over the British pound until October 31. In addition to the technical picture, fundamental data and the time of their release should also be taken into account. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 18 Aug 2019 04:03 PM PDT 4-hour timeframe Amplitude of the last 5 days (high-low): 44p - 69p - 59p - 60p - 68p. Average amplitude over the last 5 days: 60p (58p). The last trading day of the outgoing week, August 15, turned out to be rather boring in terms of macroeconomic events. In the United States, reports were published on the construction segment, from which it became clear that the number of new building permits exceeded forecasts and amounted to +8.4% in July, but the number of laying new foundations, on the contrary, turned out to be worse than expectations of the foreign exchange market and decreased by 4.0%. Thus, it is difficult to say whether this news was in favor of the dollar or not. The University of Michigan consumer sentiment index also turned out to be worse than analysts forecasts (97.2) and amounted to 92.1. However, first of all, the US dollar still rose in price during Friday's trading, and secondly, the more significant and important reports on retail sales and inflation this week were encouraging in the United States. It is reasonable to note that traders paid more attention to these reports, and not to messages from the construction sector. Moreover, now, we can say, the issue is being solved, will there be a new reduction in the Fed key rate, and if so, when? Recall that the solution to this issue will depend entirely on macroeconomic statistics. If the "figures" do not give cause for concern, then the Fed may well keep the key rate unchanged at a meeting in September. And so far, from our point of view, everything is going to this. We also believe that the softening of monetary policy in September will provide strong support for the US currency, since the European Central Bank will most likely lower its rate in September and will also announce the resumption of the quantitative easing program. Now let's analyze the most important factor for determining and forecasting the euro/dollar exchange rate: the Fed and the ECB rates. The Fed lowered the rate, and the US currency is still growing. What happens if the ECB lowers the rate? Correctly, most likely, the bearish mood of the forex market will intensify even more. The pair's rate is 1.1089, and the low for the last two years is 1.1027. As you can see, the pair is not something that has not rebounded from the lowest values, which is typical for the completion of the downward trend, it continues to slowly slide back to these levels, which makes the probability of further downward movement equal to 80-90%. From a technical point of view, the Ichimoku indicator continues to clearly point down. Even the MACD indicator continues to be directed downward, even signalling an absence of correction. Trading recommendations: The EUR/USD pair continues to move down. Thus, on Monday, it is recommended to continue to remain in shorts for the euro/dollar pair with a target of 1.1037 (tomorrow this target will be specified). The bearish mood in the market remains, but the reversal of the MACD indicator will indicate a round of corrective movement. Buying the euro is now impractical, there are no signs of the completion of a downward trend. In addition to the technical picture, fundamental data and the time of their release should also be taken into account. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. Preview of the week: focus on Fed minutes and Jackson Hole Posted: 18 Aug 2019 03:45 PM PDT Despite the strong downward momentum, bears of the euro-dollar pair could not overcome the support level of 1.1070, which corresponds to the lower line of the Bollinger Bands indicator on the daily chart. Although sellers tested this target on Friday, the trading week ended at around 1.1090. Germany unexpectedly came to the aid of the European currency. Representatives of the German government said that Berlin could allow a budget deficit by loosening budget saving rules and abandoning a zero-deficit policy. It is worth noting that the Germans have always been very conservative in this matter, so traders were surprised at Angela Merkel's position, who allowed fiscal stimulation and, as mentioned above, the budget deficit.

It is worth noting here that the German Constitution limits the increase in federal debt to 0.35% of the nominal volume of economic production, subject to GDP growth. However, in crisis situations, the law provides the government with certain agility. After much debate, Berlin nevertheless expressed readiness for action, and this fact provided some support for the euro. The financial impetus from Germany is especially important in the context of the September meeting of the ECB. According to some analysts, this step on the part of the Germans will allow members of the European regulator not to resort to extremely aggressive measures to soften the parameters of monetary policy. However, this fundamental factor will soon lose its influence. The dollar will be in the spotlight again, which in turn will focus on key events of the coming week. First of all, we are talking about the economic symposium, which takes place annually in the small American town of Jackson Hole, in Wyoming. It is no secret that this symposium is called the "barometer" of the sentiment of the central banks of the leading countries of the world. The forum is attended by the heads of the central banks (usually at the level of chairmen or their deputies) of the leading countries of the world, finance ministers, leading economists and analysts, and leaders of major world conglomerates and banking giants. For three days they discuss urgent problems, crystallize certain signals and determine the main dotted lines of further steps. As a rule, the financial world elite discusses the most pressing problems that are currently relevant. For example, in 2015, the number one topic was the collapse on the Shanghai Stock Exchange, in 2016 they talked about the consequences of Brexit, and in 2017 - the expansion of bond spreads and further steps by the Fed and the ECB. Last year, the central theme of the meeting was the trade war between the United States and China (or rather, its consequences). Obviously, this year the topic of global trade conflict will again be in the spotlight, as well as the impending Brexit. But these are all common topics: during the three-day symposium, the heads and representatives of many central banks will speak, who can talk about their future actions in the context of monetary policy prospects. In particular, on Friday, Fed Chairman Jerome Powell is expected to speak - if he takes a dovish position, the US currency will receive an impetus to decline throughout the market, including paired with the euro. However, the latest releases of US statistics retain the intrigue regarding the tonality of the rhetoric of the head of the Federal Reserve. Nonfarm data recovered after the spring slowdown, inflation accelerated, retail sales rose. If Powell focuses on these factors, then the dollar can get significant support, and EUR/USD bears will arrive at the bottom of the 10th figure. Also this week the minutes of the last Fed meeting will be published. Against the backdrop of the Jackson Hole Symposium, this release will be of secondary importance, however, it may also affect the pair's volatility. For example, the minutes of the June meeting of the Federal Reserve showed that regulator members have different opinions on inflation in the country. According to some officials, the growth rate of inflation indicators does not cause concern, according to others, this growth is unstable. The rhetoric of this minutes put pressure on the US dollar until Jerome Powell debunked investors' fears with its optimism about the growth of key inflation indicators in the second half of the year. Apparently, a similar situation is expected this week. If Powell's speech resonates with the rhetoric of the Fed minutes, then the market reaction will only intensify, against the background of other fundamental factors. In any case, the Fed minutes will be seen through the prism of news from Jackson Hole. Thus, the events of this week make it possible to bring the euro-dollar pair from the price band, determining the vector of further movement. The main task of EUR/USD bears is to overcome the "round", psychologically important mark of 1.1000. The task of the pair's bulls is to stay above this target, and for fidelity, to rise to the boundaries of the 12th figure. By and large, many central bank leaders this week will "reveal the cards" regarding their further actions. Against this background, all other fundamental factors (macroeconomic reports and comments of "ordinary" members of the central bank) will be of secondary importance. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment