Forex analysis review |

- August 2, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

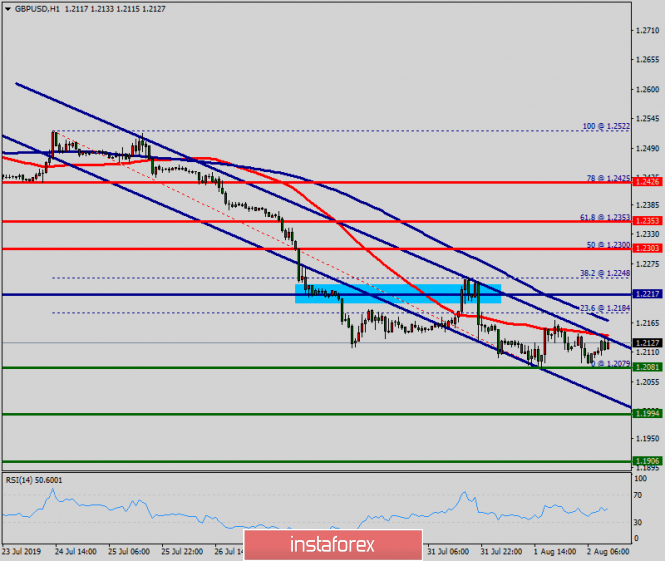

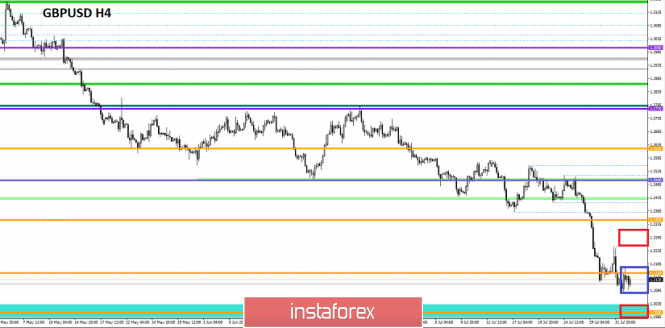

- Bearish rally in GBP/USD to continue soon

- BTC 08.02.2019 - Key resistance at the price of $11.000

- August 2, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- EURUSD: Retail sales alone will not save the ECB from the need to lower rates. China rigidly responded to Trump

- Dollar: faster, higher, stronger!

- GBP/USD: plan for the American session on August 2. The British pound takes a pause before the data on the state of the US

- EUR/USD: plan for the American session on August 2. Data on retail sales supported the euro, but ahead of an important report

- Trump resumes the trade war against China. China promises a tough answer

- Forecast for Bitcoin and US dollar on August 2. Bitcoin grows against the backdrop of falling US dollar

- US Jobs data supports Fed status quo

- EUR/USD for August 02,2019 - Completed ABC downward correction, watch for buying opportuntiies

- USD/JPY analysis for August 02, 2019 - Daily analysis

- Oil prices to rise rapidly

- Bitcoin's aggressive growth: reality or fantasy?

- Difficult period in the relationship of the USD / JPY pair

- Wave analysis of EUR / USD and GBP / USD for August 2. The second most important epic "US-China Trade War" is gaining momentum

- EUR/USD: slowly but surely approaching 1.1100

- Silver in trend: White metal may be "on horseback"

- Technical analysis of GBP/USD for August 02, 2019

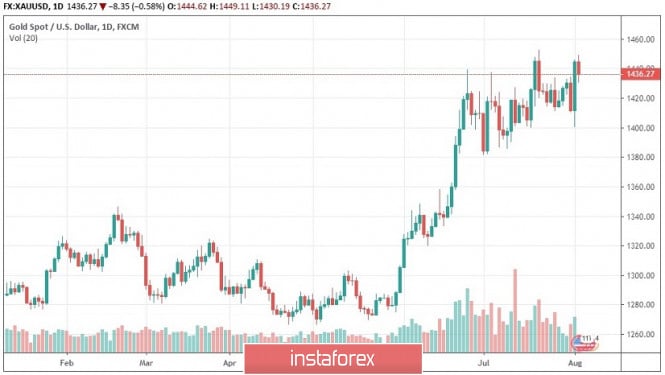

- Trump's tariff threat reinforces bullish gold outlook

- Review of EUR / USD and GBP / USD pairs on 08/02/2019: World renowned name

- Simplified wave analysis and forecast for EUR/USD and AUD/USD on August 2

- Trading recommendations for the GBPUSD currency pair - prospects for further movement

- EUR/AUD approaching resistance, potential drop!

| August 2, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 02 Aug 2019 08:36 AM PDT

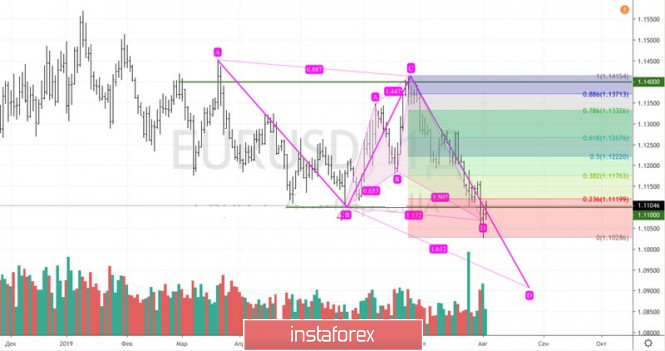

Back in June 24, the EURUSD looked overbought around 1.1400 facing a confluence of supply levels. Thus, a bearish movement was initiated towards 1.1275 followed by a deeper bearish decline towards 1.1235 (the lower limit of the previous bullish channel) which failed to provide enough bullish support for the EUR/USD pair. In the period between 8 - 22 July, sideway consolidation range was established between 1.1200 - 1.1275 until a triple-top reversal pattern was demonstrated around the upper limit. Shortly after, evident bearish momentum (bearish engulfing H4 candlestick) could bring the EURUSD back below 1.1235. Early bearish breakdown below 1.1175 facilitated further bearish decline towards 1.1115 (Previous Weekly Low) where bullish rejection was recently demonstrated on July 25. That's why, Intraday bullish pullback was demonstrated towards 1.1175-1.1200 where a valid SELL entry was suggested in a previous article. Earlier this week, bearish persistence below 1.1115 allowed further bearish decline towards 1.1025 where significant signs of bullish recovery were demonstrated. Risky traders were advised to watch for bullish persistence above 1.1050 as a bullish signal for Intraday BUY entry with bullish target projected towards 1.1115-1.1140. It's already running in profits. S/L should be advanced to entry levels to offset the associated risk. The price zone of 1.1115-1.1140 (confluence of a recent SUPPLY level & the upper limit of the newly-established bearish channel) stands as a prominent SUPPLY zoneto be watched for bearish rejection and a possible SELL entry. Trade recommendations : Conservative traders should wait for a continuation of the current bullish pullback towards 1.1140 for a valid SELL entry. S/L should be placed above 1.1175 while initial T/P level should be located around 1.1025. The material has been provided by InstaForex Company - www.instaforex.com |

| Bearish rally in GBP/USD to continue soon Posted: 02 Aug 2019 07:55 AM PDT

3/8 Murrey Math Level has acted as support, so the market is consolidating. Previously, the pair couldn't fixate above 4/8 MM Level, which has pushed the price lower. Super Trend Lines formed a 'Bearish Cross' at the beginning of July, which led to the current decline. Also, the Daily ST-Line has acted as resistance a few times, which brings more evidence for the bearish forecast. Additionally, the pair has fixated under 4/8 MM Line, that's why the chance of a further decline remains high. Meanwhile, the price may be going to test the H4 ST-Line in the coming hours. If we have a pullback from this line a little later on, that could be a green light for bears to try breaking 3/8 MM Level. The main target is 2/8 MM Level, which could act as support. In case of a pullback from this level, we might have a local upward correction, possibly towards the H4 ST-Line. However, if the pair goes through 2/8 MM Level, all eyes will be on 1/8 MM Level as the next target. The subsequent pullback from this level may lead to a larger bullish correction. The bottom line is that GBP/USD remains bearish and there's been no bullish signs so far. Therefore, as long as the price remains under the H4 Super Trend Line, there'll be an open door for a further decline in the direction of 2/8 or even 1/8 Murrey Math Level. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC 08.02.2019 - Key resistance at the price of $11.000 Posted: 02 Aug 2019 07:49 AM PDT Crypto Industry News: Busan has been declared a "regulation-free" zone for blockchain development by South Korea's national government, a move long expected but now formalized as part of a larger liberalization push. Zug, Switzerland is said to be one of the models for the zone. The Ministry of SMEs and Startups announced on July 24 that the second largest city in the country by population will host a wide range of blockchain offerings related to finance, public safety and tourism, though it stopped short of fully opening the market and allowing for international-level crypto initiatives, according to the Korea Herald. Technical Market Overview:

The BTCU/USD is still trading near the very Important resistance at the price of $10.800-$11.000. In my opinion, this zone will be critical for further movement on BTC. Possible test and reject may lead us to support at $9.050. From other side, if you see the strong breakout of the $11.000 level, there is a chance for test of $12.000-$13.000 Important resistance levels to watch: $10,800 $11.000 Important support levels to watch: $10.500 $10.100 Trading Recommendations: The best strategy in the current market conditions is to watch how the price will react near the critical resistance zone and act according to reaction. In case of the test-reject, you should watch for selling opportunities but in case of the up-break, buying opportunities will be preferable. The material has been provided by InstaForex Company - www.instaforex.com |

| August 2, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 02 Aug 2019 07:33 AM PDT

Since May 17, the previous downside movement within the depicted bearish channel came to a pause allowing the recent sideway consolidation range to be established between 1.2750 - 1.2550 with a prominent key-level around 1.2650. On July 5, a bearish range breakout was demonstrated below 1.2550 (the lower limit of the depicted consolidation range). Hence, quick bearish decline was demonstrated towards the price zone of 1.2430-1.2385 (where the lower limit of the movement channel came to meet the GBPUSD pair). In July 18, a recent bullish movement was initiated towards the backside of the broken consolidation range (1.2550) where another valid SELL entry was offered two weeks ago. Moreover, Bearish breakdown below 1.2350 facilitated further bearish decline towards 1.2320, 1.2270 and 1.2125 which correspond to significant key-levels on the Weekly chart. The current price levels are quite risky/low for having new SELL entries. That's why, Previous SELLERS were advised to have their profits gathered. Recently, weak signs of bullish recovery are being demonstrated around 1.2100. This may push the GBPUSD to retrace towards 1.2260 then 1.2320 if sufficient bullish momentum is maintained. On the other hand, The price zone of 1.2320 - 1.2350 now stands as a prominent SUPPLY zone to be watched for new SELL positions if the current bullish pullback pursues towards it. Trade Recommendations: Intraday traders are advised to look for early bullish breakout above 1.2230 for a counter-trend BUY entry. Conservative traders should wait for the current bullish pullback to pursue towards 1.2320 - 1.2350 for new SELL entries. S/L should be placed above 1.2430. Initial T/P level to be placed around 1.2279 and 1.2130. The material has been provided by InstaForex Company - www.instaforex.com |

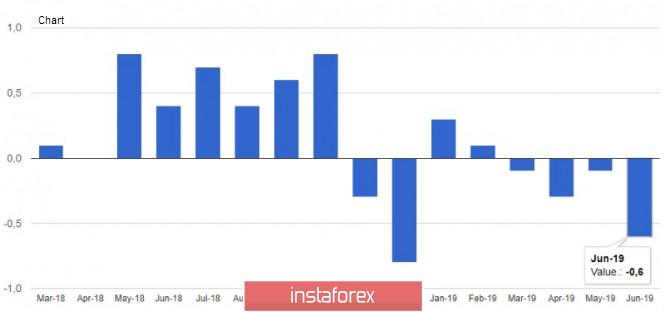

| Posted: 02 Aug 2019 07:11 AM PDT The euro managed to strengthen its position against the US dollar in the morning after a good report on retail sales in the eurozone, which rose sharply. Retail sales in the eurozone rose in June, which will certainly support economic growth in the 2nd quarter of this year. The increase in household expenditure also indicates a continued level of confidence among the population and an optimistic outlook for the future. However, a number of uncertainties, especially with Brexit and the US-China trade conflict, which is only getting worse, remain the main deterrent for consumers. According to the data, retail sales in the euro area in June this year increased by 1.1% compared to the previous month, which is the strongest growth since November 2017. Compared to the same period in 2018, sales increased by 2.6%. Data for May were revised for the worse, as initially reported a drop in sales by 0.3%, and the actual value was -0.6%. However, the positive report on retail sales moved to the background, and the growth of the euro slowed after it became known that producer prices in the eurozone fell sharply. According to the Eurostat Bureau of statistics, the eurozone producer price index (PPI) in June of this year decreased by 0.6% compared to the previous month, while compared to the same period of the previous year, prices rose by only 0.7%. Such news, of course, is a very bad signal for the European Central Bank, which is struggling to return to the target level of the value in the area of 2.0%. However, without monetary easing and the launch of an asset repurchase program, this goal will remain elusive next year, not to mention this one. This morning, I said that Donald Trump has approved new additional duties of 10% on goods from China in the amount of 300 billion dollars. Closer to lunch, the Ministry of Foreign Affairs of China made a number of statements in this regard. The Department noted that they will take all necessary measures if the US imposes new duties, and said that if the US wants a trade war, they would receive it, and Beijing would easily take part in it. The ministry also drew attention to the fact that some words from the US President about good relations with China are not enough, and now, it is the turn of the White House to confirm the words with deeds. Thus, China has made it clear that it is categorically against the new US duties, as they will violate the consensus between Xi and trump. So far, there have been no other statements on this score from the American president. The British pound remained under pressure after the release of the report on the purchasing managers' index (PMI) for the construction sector in the UK, which in July this year remained below 50 points, indicating a reduction. According to the company Markit, PMI for the construction sector amounted to 45.3 points against a minimum of 43.1 points in June this year. The construction sector remains under pressure against the background of low demand, as well as due to the prevailing economic uncertainties, primarily related to Brexit. The material has been provided by InstaForex Company - www.instaforex.com |

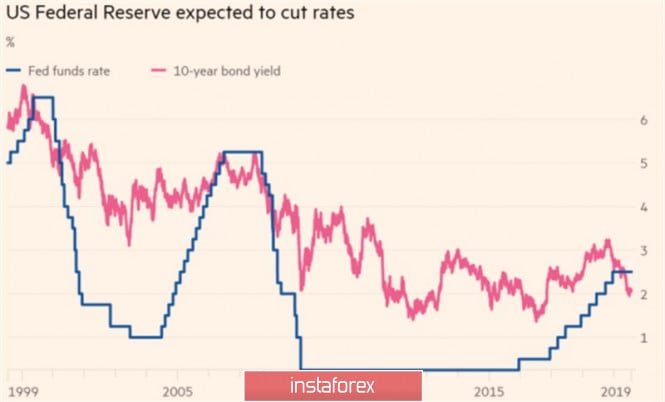

| Dollar: faster, higher, stronger! Posted: 02 Aug 2019 07:11 AM PDT By hook or by crook. Looking at how Jerome Powell ignored criticism, Donald Trump decided to change tactics. He announced the introduction of a 10% tariff on Chinese imports of $300 billion, pushing the Fed to further reduce the rate. The owner of the White House believes that it should be 1.5%, which is 0.75 percentage points below the current level. If the Central Bank justifies its July decision on monetary expansion with growing international risks, why not increase them even more? Trump would like to see a 3% GDP growth, some weakening of the US dollar, lower compared to the current cost of borrowing and not tired of rewriting the historical highs of the S&P 500. In fact, the US stock index is developing a correction that started after the announcement of the results of the FOMC meeting. Contrary to the rate cut, the US dollar rose and the shares fell, as investors did not receive what was expected from Jerome Powell: "dovish" rhetoric and the door open for further monetary expansion. Furthermore. The debt market reacted to the introduction of additional duties on Chinese imports by falling the yield of 10-year Treasury bonds to the lowest level since 2016. The indicator is below the federal funds rate, which indicates that the debt market requires the Fed to continue weakening its monetary policy. CME derivatives raised the chances of rate cuts by 25 bps at the September FOMC meeting from 60% to more than 90%. Dynamics of the yield of US bonds and the Fed rate The US economy looks significantly better than the European one. In the second quarter, it expanded by 2.1%, while the eurozone GDP increased by a modest 0.8% y/y. The yield of US bonds is higher than the German, French and other European counterparts, but the potential of the ECB's monetary expansion looks limited, and the Fed's capabilities are wider. This circumstance leaves the EUR/USD bulls with a chance for revenge. The US labor market report for July did not give any special hints to the main currency pair. Actual employment growth outside the agricultural sector +164 thousand striking way meets the consensus experts Bloomberg. As, however, the unemployment rate of 3.7%. Average wages rose slightly faster (+0.3%) than expected, but this did not cause the EUR/USD to swing in one direction or another. Week to August 9 in terms of the economic calendar is presented as a kind of calm after the storm. Investors' attention will be focused on commodity currencies and the release of data on American business activity in the service sector. Perhaps the most interesting question of the five-day period will be whether China will answer Donald Trump's increase in tariffs. Technically, the update of the August minimum will allow the bears to continue the attack in the direction of the target by 161.8% according to the pattern AB=CD. On the contrary, the rebound of quotations from the convergence zone near the target by 113% according to the Shark model will create conditions for correction in the direction of 23.6%, 38.2% and 50% of the CD wave. EUR/USD, the daily chart |

| Posted: 02 Aug 2019 07:11 AM PDT To open long positions on GBP/USD, you need: The situation in the pair has not changed compared to the morning forecast and much will depend on the US labor market report. Bulls still need to keep the level of 1.2083, the formation of a false breakdown on which will allow them to count on a re-upward correction to the resistance area of 1.2160, where I recommend taking the profits. Only the consolidation above this range, after weak data on the unemployment rate in the US, will allow us to start a conversation on the continuation of the pound's growth in the area of the maximum of 1.2240. In the scenario of further decline of GBP/USD, it is best to look at long positions from the lows of 1.2040 and 1.1985. To open short positions on GBP/USD, you need: Sellers still need the support of 1.2083, the breakthrough of which will only strengthen the bearish trend and lead to an update of the lows of 1.2083 and 1.2040, where I recommend taking the profit. However, we should not forget that the data on the US labor market can affect traders, and a weak report on the number of employed in the non-agricultural sector will force to fix the profit in the US dollar, which will lead to an upward correction in GBP/USD. In this scenario, it is better to count on short positions after the formation of a false breakout in the resistance area of 1.2160, or to sell the pound from the maximum of 1.2240, which was formed at the beginning of this week. Indicator signals: Moving Averages Trading is below 30 and 50 moving averages, indicating a further decline in the pound. Bollinger Bands Volatility has decreased, which does not give signals to enter the market.

Description of indicators

|

| Posted: 02 Aug 2019 07:11 AM PDT To open long positions on EURUSD, you need: A good report on the sharp rise in retail sales in the eurozone led to a strengthening of the European currency in the morning, even though producer prices fell sharply, which is another sign of a slowdown in inflation. Buyers formed a new support level of 1.1090, but the further movement will depend on the report on the US labor market. Weak indicators of growth in the number of employed in the non-agricultural sector will lead to a further strengthening of EUR/USD in the resistance area of 1.1137, where I recommend taking the profit. If the report will move down below the level of 1.1090, then it is best to look at long positions on a false breakdown in the area of 1.1060, where buyers will try to form the lower limit of the new upward channel or buy the euro to rebound from the minimum of 1.1028. To open short positions on EURUSD, you need: Bears will count on a good report on the US labor market and on the return of EUR/USD to the support level of 1.1090, which will be the first signal for the opening of short positions in the area of the minimum of 1.1060, where I recommend taking the profit. However, the main goal of the sellers will be the support around 1.1028, which will indicate the continuation of the bearish trend in the short term. If the report on the United States does not surprise traders, the next fixation of profits and the growth of the euro to the resistance of 1.1137 are not excluded, from which I recommend to open short positions immediately on the rebound. Indicator signals: Moving Averages Trading is above 30 and 50 moving averages, but it will be possible to talk about the continuation of the bullish correction only after the data. Bollinger Bands In the case of a downward movement, the lower limit of the indicator will support the area of 1.1065.

Description of indicators

|

| Trump resumes the trade war against China. China promises a tough answer Posted: 02 Aug 2019 07:10 AM PDT On Thursday, Trump said that from September 1, he will introduce a new tax of 10% on those goods from China that are not yet subject to an additional tariff. These are the products that are most in-demand by consumers in the US - smartphones, laptops, and baby clothes. The reason for the new tariffs is the lack of progress in the US-China trade negotiations. The answer of Chinese officials - China will not allow a unilateral deterioration for itself - China will respond to US actions. The US stock market declined significantly on Thursday after falling on Wednesday. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 02 Aug 2019 07:10 AM PDT Bitcoin – 4H.

As seen on the 4-hour chart, Bitcoin performed growth to the corrective level of 76.4% ($10478), despite the formation of bearish divergence in the CCI indicator. Despite the fact that many economists continue to be skeptical about bitcoin, it should be noted that the demand for it remains consistently high. Many investors, analysts, and experts express their opinion on the prospects of BTC. Many agree that bitcoin will continue to rise in price. But based on what? Based on the same reason why there was the first major increase to $20,000. Based on the demand for the asset. But why is it formed, given that bitcoin is not confirmed by anything? The answer is also simple: the influx of investors who want to get rich quickly begins again. The more bitcoin becomes more expensive, the more people want to buy it, which causes a new increase in the value of bitcoin. And the forecasts of the world-famous cryptocurrencies and economic circles of individuals that bitcoin will grow to $20000 or to $55000, only warm up the interest of small investors. And now, the head of the cryptocurrency bank of Galaxy Digital Mike Novogratz believes that "cue" will never return to the level of $5000. Financial expert Peter Schiff regrets that he did not buy BTC when it cost $10. And co-founder of the Fundstrat Global Advisors Tom Lee believes that the Fed's rate cut will help bitcoin reach the value of $20,000 in 2019. In addition, if the Fed continues to reduce the key rate, it will have a negative impact on the dollar and increase the demand for alternative investment instruments. The Fibo grid is based on the extremes of July 2, 2019, and July 10, 2019. Forecast for Bitcoin and trading recommendations: Bitcoin performed growth to the correction level of 76.4% ($10478). Thus, I recommend selling the cryptocurrency with the target of $9679, with the stop-loss order above the level of 76.4%, if the rebound from the level of $ 10478 is executed. I recommend buying Bitcoin with a target of $10991, and with a stop-loss order under the level of $10478, if the closing above the correction level of 76.4% is performed. The material has been provided by InstaForex Company - www.instaforex.com |

| US Jobs data supports Fed status quo Posted: 02 Aug 2019 07:03 AM PDT The US employment data was close to expectations and it certainly has not increased pressure for a further Fed rate cut which is a marginally positive sign for the dollar although trade and risk conditions are going to dominate the forex markets for now. Short-term EUR/USD selling is likely near 1.1100 Headline US non-farm payrolls increased 164,000 for July, in line with consensus forecasts while the June figure was revised lower to 193,000 from 224,000 reported previously. Manufacturing jobs increased 16,000 for the month with a further small decline in retail employment. Unemployment held at 3.7% which was in line with market expectations and also unchanged from the previous figure. Average hourly wages increased 0.3% for the month, above consensus forecasts of 0.2% with an annual increase of 3.2% from 3.1%, although weekly hours declined slightly. The household survey recorded a small rise in the participation rate with a recorded employment increase of 283,000. There were no market fireworks on release which is not surprising given that the data was close to consensus forecasts. Treasuries initially edged higher with the 10-year yield at 1.87%, but selling then emerged while equity futures moved into positive territory and USD/JPY moved back above 107.00. There were no red flags in the data from the Fed's point of view with a solid labour market and slight increase in earnings growth. At the margin, the data should slightly lessen the case for any further cut in interest rates, which will limit scope for dollar selling. Trade and risk conditions are likely to dominate in the short term following President Trump's announcement of further tariffs on Chinese exports. EUR/USD is likely to hit further near-term selling interest close to 1.1100. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD for August 02,2019 - Completed ABC downward correction, watch for buying opportuntiies Posted: 02 Aug 2019 06:50 AM PDT EUR/USD has been trading sideways at the price of 1.1100 in past 20 hours. Anyway, in my opinion there is potential for upside movement in the future. I found that there is potential completion of the ABC downward correction and on the hourly we got higher highs and higher lows, which is indication of the upward trend. Technical picture:

On the daily time-frame I found that USD/JPY did test and reject of the key support at 1.1083, which is for me sign that selling at this stage looks extremely risky. Additionally, I found that there is potential for more upside movement due to completion of the abc downward correction and short-term upward trend. Important upward levels are set at 1.1135 and 1.1150. Key support is seen at the price of 1.1070. Important resistance levels: Yellow rectangle – 1.1135 Yellow rectangle – 1.1150 Important support levels: Orange horizontal line – 1.1083 Orange horizontal line – 1.1070 Watch for buying opportunities with the targets at 1.1135 and 1.1150. The material has been provided by InstaForex Company - www.instaforex.com |

| USD/JPY analysis for August 02, 2019 - Daily analysis Posted: 02 Aug 2019 06:28 AM PDT USD/JPY did strong sell off from yesterday but the key support at the price of 106.79 held successfully, which is sign that there is a chance for potential rally. Technical picture:

On the daily time-frame I found that USD/JPY did test and reject of the key support 106.79, which is for me sign that selling at this stage looks extremely risky. Due to potential oversold condition and fail breakout of the support, my advice is to watch for buying opportunities with the potential targets at 107.22 and 107.54. Important resistance levels: Yellow rectangle – 107.22 Yellow rectangle – 107.54 Important support levels: Orange horizontal line - 106.79 Daily low – 106.6 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 02 Aug 2019 06:19 AM PDT

Oil is getting bullish because of a Wolfe Wave pattern, which is pushing the price higher. 1-3 line acted as support yesterday, that's why the market is moving up. Additionally, the price hasn't fixated below the 0.618 retracement level of the previous upward price movement, which brings more evidence for the bullish outlook. However, the market might test 0.618 level once again. If the second pullback in a row happens from this level, this scenario will be even stronger. As usual for Wolfe Wave patterns, the main target is 1-4 Line, which could be a departure point for another decline. It seems like 0.786 retracement level of the last drop from the high of wave 2 at 59.33 might act as a strong resistance. Thus, we should focus on this level as a potential bullish target, which could stop the bullish rally. 2-4 line is far away from the current price so that we couldn't rely on this line as the confirmation for the pattern. The bottom line is that there's a bullish opportunity on oil because of the Wolfe Wave pattern. As long as the market remains above the 0.618 retracement level (54.54) this scenario will be valid. Therefore, bulls are likely to push the price higher and higher rapidly. The material has been provided by InstaForex Company - www.instaforex.com |

| Bitcoin's aggressive growth: reality or fantasy? Posted: 02 Aug 2019 04:39 AM PDT Many experts agree that sooner or later the No. 1 cryptocurrency will show itself by demonstrating a powerful spurt to new price heights. They believe that Bitcoin will be the future and you need to invest in a digital asset now. However, the strong volatility of the general crypto-market, and particularly, Bitcoin scares off potential participants in the digital race. Bitcoin rises in price for several days in a row, adding about $800. On Thursday, August 1, for the BTC they gave $10,300. During the past week, Bitcoin showed signs of uncertainty as the bulls sought to contain pressure on the market. Market players are hoping that, after easing the pressure, BTC will begin a reversal of the short-term trend and exceed key resistance levels in the $11,000 area. Some participants in the cryptographic market, such as Tom Lee, consider the Fed's decision to lower the rate as the reason why Bitcoin is becoming more expensive. A crypto enthusiast is confident that the cut in the Fed rate will help BTC to reach $20,000 by the end of the year. He believes that such aggressive growth leading cryptocurrency is quite possible. According to some experts, Bitcoin can rise to the level of $10,500 (50-day MA) in the near future. However, if the asset is fixed at a level above $11,120, the bulls will be able to seize control of the market. Currently, traders remain neutral with respect to the short-term trend for the benchmark cryptocurrency. Some of them believe in the next rise of bitcoin prices but many are skeptical. Experts record the weakening of pressure from BTC vendors and pay attention to the formation of space for a new trend reversal. The material has been provided by InstaForex Company - www.instaforex.com |

| Difficult period in the relationship of the USD / JPY pair Posted: 02 Aug 2019 04:31 AM PDT If the USD/JPY pair closes below 107.00 yen, it should enter the "negative phase". While market participants expected by and large that a rally above 109 yen would be unsustainable, the fall in the end to a minimum of 107.25 yen still became a big surprise. A sharp move is likely to push the dollar to new lower trading ranges, although a strong recession, resembling the recent one, is unlikely. There is a reason to expect a wider and lower range at 106.80 / 108.00 yen per dollar. What to expect in the next one to three weeks? A sharp sell-off of the dollar overnight is likely to stimulate reposition to further reduce the USD/JPY pair. While it seems that in this case, the advantage is on the side of a further decline. The recent July minimum of 107.20 yen will be "easy to overcome" but the main test will be to 107.00 yen. In order to understand how much the dollar can fall against the yen, it is necessary to track performance and any delay in this range means that the dollar has entered the "negative phase" after falling to 107.00 yen. On the other hand, resistance is expected at around 107.70 yen and only the recovery of their positions above 08.20 yen will indicate a weakening of pressure on the dollar. |

| Posted: 02 Aug 2019 04:11 AM PDT EUR / USD

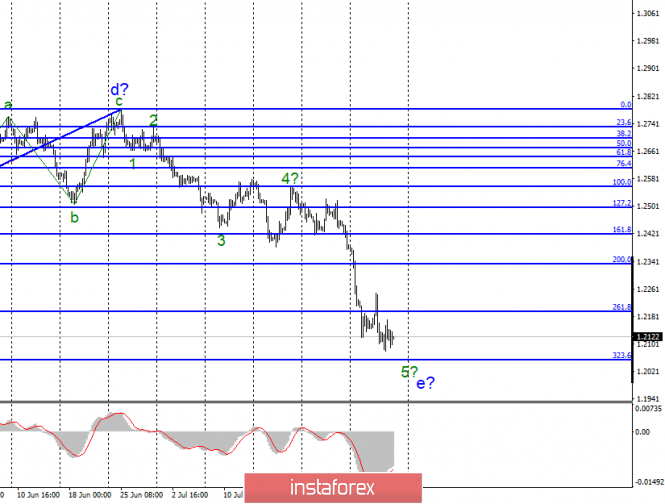

On Thursday, August 1, trading ended with an increase of 10 basis points for the EUR / USD pair, although during the day the pair went much lower to the level of 127.2% Fibonacci, but then it recovered. The temporary weakening of the dollar is due, firstly, not to the most favorable index of business activity in the US manufacturing sector ISM (this index is the most important), and secondly, to the escalation of the trade conflict between the United States and China. Now the euro-dollar pair has its own "Indian series", which can drag on for many years, just like Brexit for the pound-dollar pair. The situation between Beijing and Washington is about the same as between Brussels and London. Washington provokes a conflict and demands that a trade agreement be signed on terms beneficial to it in the first place. China does not accept concessions and is subject to trade duties, which strongly beat on its economy, as the total amount of exports to America is more than 500 billion dollars a year. So Donald Trump just plays what he already holds in his arms. Indeed, why not bargain for the best conditions for yourself, if there is such an opportunity. Beijing, realizing who it is dealing with, is eager for a change of power in America and is unlikely to rush to negotiations or concessions to Donald Trump. Purchase goals: 1.1412 - 0.0% Fibonacci Sales targets: 1.1025 - 127.2% Fibonacci 1.0920 - 161.8% Fibonacci General conclusions and trading recommendations: The euro-dollar pair continues to build a downward trend. Downward mood in the Forex market remains. Thus, I recommend selling the pair with targets near the 1.1025 and 1.0920 marks, which equates to 127.2% and 161.8% Fibonacci when the MACD signal is down. GBP / USD

The GBP / USD pair on August 1 lost about 25 basis points. The wave pattern of the instrument does not change and still involves the construction of a downward trend, which, given the news background, may become even more complicated. So far, everything looks as if the pound-dollar pair is preparing to complete the construction of wave 5 in e. If this is true, then an unsuccessful attempt to break through the 323.6% Fibonacci level could lead to the beginning of the construction of the upward trend. But at the same time, the situation with Brexit does not allow us to expect a serious strengthening of the pound. Of course, the currency cannot fall all the time. Time will come for a correction, during which, there may also be no reason to buy the pound. However, the news background remains completely negative for the couple. Sales targets: 1.2056 - 323.6% Fibonacci 1.1830 - 423.6% Fibonacci Purchase goals: 1.2783 - 0.0% Fibonacci General conclusions and trading recommendations: The wave pattern of the pound-dollar tool suggests the continuation of the construction of a downward trend segment. Thus, I recommend selling the pair for each MACD down signal with targets located near the estimated mark of 1.2056. And in the case of a successful attempt to break through - with targets located at about 1.1830, which corresponds to 423.6% Fibonacci. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD: slowly but surely approaching 1.1100 Posted: 02 Aug 2019 03:41 AM PDT Highlights: Trump announced additional tariffs for Chinese imports, the Non-Farm Payrolls index is expected to rise in the US, the euro is positive and currently the EUR/USD pair is preparing to overcome the barrier at around 1.1100 dollars. The pair managed to survive the pessimism after the FOMC decision, having rebounded from the lows of the beginning of the year within the limits of 1.1120 dollars. The dollar retreated from recent highs after US President Donald Trump unexpectedly announced new tariffs worth $300 billion on Chinese goods. While trade wars came to the fore and became the main driving force behind asset price changes, investors are advised to pay attention to the US labor market report, where Payrolls reached nearly 170,000 in July and unemployment is likely to remain without change - 3.7%. This is the reason why the sale of the euro will continue in favor of this decision of the Fed and the preparation of the ECB to a new wave of incentives, including the potential reduction in interest rates and the restart of the QE program. The head of the ECB said that rates would remain at the "current or lower-level", at least until mid-2020. The worsening economic outlook in the region and the lack of control over inflation currently limit the bullish sentiment towards the euro, as well as reinforce the ECB's dovish sentiment. Currently, the pair has shifted by 0.06% to $ 1.1090 and a breakthrough at the level of 1.1101 will aim for 1.1187 and further to 1,1229. On the other hand, the next support is noticeable at the level of 1.1026 dollars from 1.1021 and, finally, 1.0839 dollars. The material has been provided by InstaForex Company - www.instaforex.com |

| Silver in trend: White metal may be "on horseback" Posted: 02 Aug 2019 03:30 AM PDT According to analysts, silver quotes show a tendency to increase at the moment. Like gold, white metal gradually becomes more expensive but experts find it difficult to answer how long this trend will last. On Thursday, August 1, silver quotes (XAG / USD) continued to grow within the ascending channel. White metal was trading at $15.96 and analysts point to a short-term uptrend in relation to the precious metal. Currently, silver is trading at 16.34. The XAG/USD quotes are moving inside the cloud of Ichimoku Kinko Hyo. This indicates the presence of a side trend in precious metals. Experts expect testing of the lower boundary of the Ichimoku Kinko Hyo Cloud near the level of 16.10. After that, it is possible to continue the growth of "silver" prices to the level of 17.20. Testing the support level will be an additional signal in favor of increasing quotes XAG/USD, experts believed. Accelerating the growth of XAG/USD quotes is possible in case of a breakdown of the resistance area and closing above the level of 16.70, analysts summarized. Experts consider the current state of the precious metals market to be fairly stable. They fix the upward trend, which is favorable for investors in precious metals and other market players. |

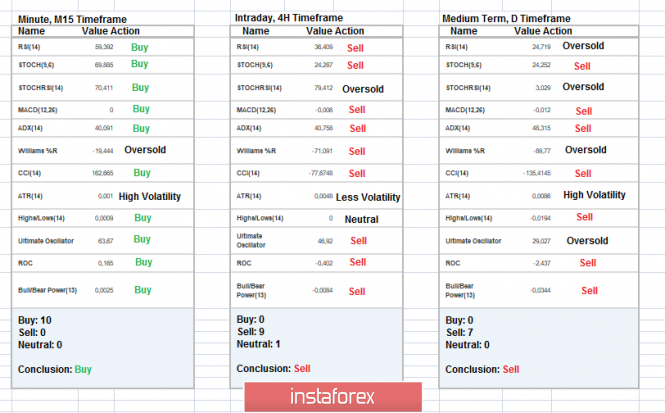

| Technical analysis of GBP/USD for August 02, 2019 Posted: 02 Aug 2019 03:26 AM PDT

Overview:

Trading recommandations:

Comments:

|

| Trump's tariff threat reinforces bullish gold outlook Posted: 02 Aug 2019 02:45 AM PDT Fresh fears over the global outlook following President Trump's latest tariff threat on China will support gold, especially with expectations of global monetary easing and currency wars. Buying pressure will also intensify if confidence in the dollar slides and gold has the potential to move to $1,500 per ounce this quarter. If strong US employment data on Friday triggers immediate dollar gains, look to buy gold on any dips to the $1,425 per ounce area. President Trump announced that the US Administration would levy a 10% tariff on all remaining $300bn of Chinese exports from September 1st. He also warned that the tariffs could subsequently be increased to 25%. According to Trump, Chinese President Xi wants a deal, but is moving too slowly. The tactic is clearly designed to increase pressure on China, although the Beijing response was inevitably frosty. Risk appetite deteriorated following the announcement with a sharp decline in equities and strong gains in Treasuries with the 10-year yield at 33-month lows below 1.90%. Weaker risk appetite will boost demand for defensive assets and underpin gold in the short term, especially if equity markets continue to lose ground. The threat of a further increase in tariffs will also trigger renewed concerns over the global manufacturing sector. Trump's continued willingness to use the tariffs weapon will also increase the risk of action against Europe given his accusation of European exchange rate manipulation and unfair trade practices. Latest US ISM manufacturing data weakened to the lowest level since August 2016 with fears over further tariff-related disruption liable to increase short-term stresses across the industrial sector. Further weakness in US manufacturing and the deterioration in global confidence will increase the potential for further Federal Reserve rate cuts and USD/JPY slid to 5-week lows near 107.00. Trump is also likely to increase his rhetoric against a strong US dollar and, at some point, markets are likely to listen and push the US currency sharply lower. Global central banks will maintain an easing bias with the ECB likely to cut rates in September and the Bank of Japan will also consider fresh easing. The Chinese yuan weakened sharply and the risks of a global currency war have increased further. The combination of risk aversion, central bank easing and currency wars will provide strong underlying gold support. Gold found support close to $1,400 per ounce on Thursday with a sharp recovery improving the technical outlook. Gold traded around $1,435 per ounce in early Europe on Friday with short-term resistance at $1,450.

|

| Review of EUR / USD and GBP / USD pairs on 08/02/2019: World renowned name Posted: 02 Aug 2019 02:39 AM PDT Indeed, the outcome of the last meeting of the Federal Commission on Open Market Operations seriously discouraged market participants. We can say that many have not recovered from the psychological trauma. This is indicated by the complete indifference of the market to yesterday's macroeconomic data, which turned out to be rather curious. Thus, the final data on the business activity index in the manufacturing sector of Europe showed that it fell from 47.6 not to 46.4, but to 46.5. Similar data in the United States also showed a decline from 50.6 to 50.4, while a preliminary assessment indicated a decrease to 50.0. Yet, the number of applications for unemployment benefits, which was supposed to increase by 8 thousand, unexpectedly increased by 30 thousand. In particular, the number of initial applications increased by 8 thousand instead of increasing by 1 thousand. The number of repeated applications increased by 22 thousand instead of the expected 7 thousand. This is in anticipation of the publication of the report of the United States Department of Labor. However, all of these had no effect on the market. As if all this data were not there. Just as the market ignored the results of the meeting of the Board of the Bank of England, which, however, did not bring anything new. Mark Carney once again talked about his nightmares about Brexit, which is most likely to happen without any agreement. No one can predict the consequences of such a development. It's just that all oracles cannot agree at all. It will be very bad or it will become a banal catastrophe. Investors, who were disoriented by the recent statements of Jerome Powell, have left all this unaddressed. Contemplating the complete apathy of market participants, it was urgently necessary to seek help from the world luminaries in the field of parapsychology, which could for a few moments escape from under the care of orderlies and get to its smartphone. Just one phrase of Donald Trump on Twitter was enough to bring everyone to life. The team of Trump announced that from September 1, the United States imposes a 10% customs duty on Chinese goods worth $ 300 billion. With this decision, the United States imposed import duties on all remaining imports from the Middle Kingdom. Stock indexes immediately flew down and the dollar, albeit not sure, but began to give up their positions. Everyone was really impressed by such a demonstration of the principles of free trade that the United States is preaching with religious fervor throughout the world. Although once again, we were only explained that free trade implies unhindered access of American goods to any markets. Goods and services of other countries should not compete with the US in accordance with the principles of free trade. This is what provoked a decline in stock market indices, just as the fact that the American manufacturers themselves collect their products not in the United States, but in China. But the most amusing in everything is that Donald Trump, who tirelessly scolds the Federal Reserve System for sabotage in the form of unwillingness to actively lower the refinancing rate, does everything so that Jerome Powell and the company periodically reflect on the topic of its increase. Indeed, one of the main factors in deciding on the level of the refinancing rate is inflation. The United States itself imports a huge amount of goods and it is from China. if import duties are introduced on these goods, then sellers instantly raise prices on them. Consequently, the actions of Donald Trump contribute to rising inflation well or do not allow it to decline. Also, the fact that the situation is truly paradoxical is indicated by the fact that the decision to lower the refinancing rate was not unanimous. Two members of the Federal Commission on Open Market Operations voted to keep it at the same level, then sellers instantly raise their prices. A little cheered up market participants are now clearly looking forward with great interest to the publication of the report of the United States Department of Labor, which will be published tonight. True, its content can be extremely boring. On the one hand, the unemployment rate, as well as the average workweek, should remain unchanged. On the other hand, the growth rate of the average hourly wage can accelerate from 3.1% to 3.2%. Thus, Americans earn a little more and this should lead to an increase in retail sales, as well as inflation. But the joy in this regard will be moderate since 164 thousand new jobs should be created outside Agriculture against 224 thousand in the previous month. overall, the report's content expectations are moderately positive. Yes, and production orders can grow by 0.8%, while they fell by 0.7% in the previous month. So again, statistics to some extent favors moderate dollar growth. But Europe will have nothing to answer again, as the growth rates of producer prices should slow down from 1.6% to 0.8%, while retail sales may remain unchanged. That is, this means that the profits of companies will decline. Consequently, it is worth waiting for a further decline in the single European currency to 1.1050. Once again, the Bank of England disappointed market participants who are already tired of contemplating the eternal posture of an ostrich with their heads in the sand, and the pound simply has no reason to grow. Yes, and no macroeconomic data comes out, so he will be guided by the behavior of his continental neighbor. Thus, the pound will continue a fascinating journey towards historic lows and the current benchmark is 1.2050. |

| Simplified wave analysis and forecast for EUR/USD and AUD/USD on August 2 Posted: 02 Aug 2019 02:24 AM PDT EUR/USD In the last 2 months, the main trend of the euro movement is set by the bearish wave of June 25. Since yesterday, the price forms a counter wave structure, which in its scale has not yet exceeded the level of correction of the last section of the main wave. Forecast: Today, the formation of the upward movement that began yesterday is expected, until its completion in the resistance zone. At the next trading session, flat is not excluded, with the price rollback down. The final phase of recovery is most likely at the end of the day. Recommendations: Trading on the European pair today can be recommended only to intraday supporters, according to the described algorithm. Until the current upswing is completed, sales can be risky. When the price reaches the resistance zone, you should start tracking the sell signals of the instrument. Resistance zone: - 1.1130/1.1160 Support zone: - 1.1070/1.1040

AUD/USD The last, unfinished bearish wave of July 19 reached the upper limit of the potential reversal zone. Since yesterday, the beginning of a correctional area has formed in the flat. Forecast: In the near future, the formation of an upward correction is expected, which will give the opportunity to continue the main trend at a new level. With high probability, it will take the form of a flat channel. Recommendations: Aussie sales today are premature. Purchases can be justified only with intra-session trading. The most reasonable solution would be to refrain from entering the market of the pair at the time of the rollback and to look for the sell signals of the instrument at its end. Resistance zone: - 0.6850/0.6880 Support zone: - 0.6800/0.6770

Explanations to the figures: Waves in the simplified wave analysis consist of 3 parts (A-B-C). The last unfinished wave is analyzed. Zones show areas with the highest probability of reversal. The arrows indicate the wave marking according to the method used by the author, the solid background is the formed structure, the dotted ones are the expected movements. Note: The wave algorithm does not take into account the duration of tool movements over time. The material has been provided by InstaForex Company - www.instaforex.com |

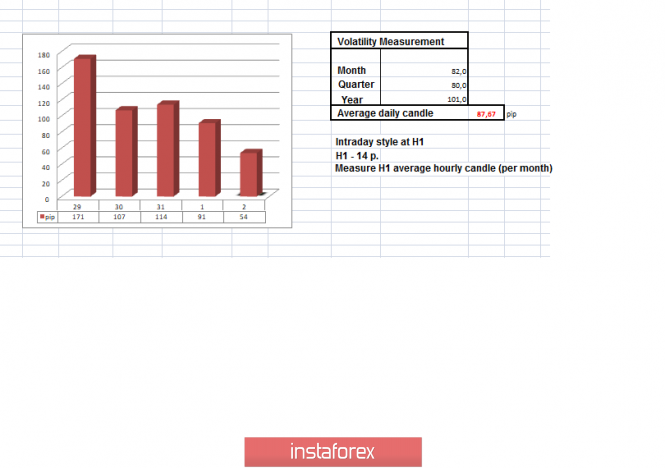

| Trading recommendations for the GBPUSD currency pair - prospects for further movement Posted: 02 Aug 2019 01:56 AM PDT For the previous trading day, the pound / dollar currency pair showed a high volatility of 91 points, as a result of having an amplitude fluctuation with the preservation of bearish interest. From the point of view of technical analysis, we see a restrained downward interest, where already almost close to us is a strong psychological level of 1.2000. As discussed in a previous review, traders set about short positions as soon as the quotation broke the level of 1.2150. Now, their goal is in the psychological level of 1.2000, but nobody has forgotten about the feet, as overheating is clearly observed. Considering the trading chart in general terms (day timeframe), we see that the global downward trend is developing on the values of January 2017, while the clock purity is already in the "Impulse" phase as 11 days, which makes us even more late. The focus of the previous day, in terms of the news background, was the meeting of the Bank of England, where, in principle, we heard nothing new, for this very reason the pound remained, conditionally speaking, in one place. But what did it sound like? The head of the Bank of England, Mark Carney, said that the banking sector is ready for any scenario of a country's exit from the EU, but at the same time noted that forecasts for GDP growth rates fell for the next two years from 1.5% and 1.6% for 2019 and 2020, respectively, up to 1.3%. The head of the Bank of England stressed that the recession is directly related to the uncertainty in matters of Brexit. Let me remind you that at the June meeting, the Head of the Bank of England himself called for a reduction in the interest rate to 0%, even though the rate was left at the current level of 0.75%, but in the published report on August 1, the market expectation of a reduction in the interest rate was reflected. Of the most powerful events of the past day, we can highlight the statement by US President Donald Trump, who tweeted on September 1 about his intentions to increase tariffs on Chinese imports by 10% totaling $ 300 billion. The reaction from Beijing has not yet followed. Today, in terms of the economic calendar, all attention is focused on the report of the United States Department of Labor. In general terms, there are no changes. The unemployment rate is at around 3.7%, but the average hourly wage shows an acceleration from 3.1% to 3.2%. What is more interesting is the change in the number of people employed in the non-agricultural sector, where compared to the previous reporting period, there is a decrease from 224K to 164K. The upcoming trading week in terms of the economic calendar and events is more moderate in comparison with the past week. The main body of statistics on Britain is waiting for us on Friday, but the information background regarding Brexit can spontaneously fly out on any day of the week. The most interesting events are displayed below ---> Monday, August 5 United Kingdom 08:30 UTC+00. - The index of business activity in the services sector (July): Prev. 50.2 ---> Forecast 51.0 United States 14:00 UTC+00 - Non-manufacturing Business PMI (PMI) from ISM (July): Prev. 55.1 ---> Forecast 55.5 Tuesday, August 6 United States 14:00 UTC+00 - Number of vacancies in the JOLTS labor market (June): Prev. 7.323M ---> Forecast 7.268M Friday, August 9 United Kingdom 08:30 UTC+00. - Business investment (q / q) (Q2): Prev. 0.4% ---> -0.6% forecast United Kingdom 08:30 UTC+00. - GDP (y / y) (Q2): Prev. 1.8% United Kingdom 08:30 UTC+00 - Production volume in the manufacturing industry (y / y) (June): Prev. -1.0% ---> Forecast 1.0% United States 12:30 UTC+00 - Producer Price Index (PPI) (y / y) (July): Prev. 1.7% ---> Forecast 1.8% These are preliminary and subject to change. Further development Analyzing the current trading chart, we see a sluggish amplitude oscillation 1.2090 / 1.2150, signaling some accumulation, due to overheating of short positions, in simple terms - a market pause. Traders, in turn, continue to hold downward sentiment, and this is understandable, because in a strategic plan, the pound still has room to fall. At the same time, the risk of the onset of the "Correction" phase forces traders to tighten restrictive stops so as not to run into idle position. It is likely to assume that the fluctuation in the given limits will still be maintained, where the pivot point remains in the form of a psychological level of 1.2000, which already indirectly plays the role of a pillar, slowing down the quote. For the alignment of the next period, we analyze fixation points relative to the existing boundaries, where a deeper downward move will be considered after fixing the price lower than 1.2000, but the sellers clearly need a regrouping, thereby not losing sight of the theory of correction. Based on the available information, it is possible to decompose a number of variations, let's specify them: - Positions for purchase are considered in the case of price fixing higher than 1.2180. - If we already have positions for sale, then we shift the restrictive orders to zero relative to the borders. The primary perspective of the downward course remains in the psychological level of 1.2000. Indicator Analysis Analyzing a different sector of timeframes (TF), we see that indicators in the short-term perspective have alternately changed to the ascending side due to the current stagnation. Intraday and mid-term perspectives still retain downward interest due to the general inertial movement. Weekly volatility / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation, based on monthly / quarterly / year. (August 2 was based on the time of publication of the article) The current time volatility is 54 points. It is likely to assume that gun powder is still present and current accumulation, in case of its breakdown, can lead to an acceleration in the market. Key levels Zones of resistance: 1.2150 **; 1.2350 **; 1.2430; 1.2500; 1.2620; 1.2770 **; 1.2880 (1.2865-1.2880) *; 1.2920 * 1.3000 **; 1.3180 *; 1,3300 Support areas: 1.2000; 1.1700; 1.1475 ** * Periodic level ** Range Level *** The article is based on the principle of conducting a transaction, with daily adjustment The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/AUD approaching resistance, potential drop! Posted: 02 Aug 2019 12:59 AM PDT EURAUD is approaching our first resistance at 1.6330 where we might be seeing a drop below this level. Stochastic is also seeing a bearish divergence. Entry: 1.6330 Why it's good : 61.8% Fibonacci extension, 78.6% Fibonacci retracement Stop Loss : 1.6421 Why it's good : horizontal swing high resistance Take Profit : 1.6227 Why it's good: Horizontal pullback support, 23.6% Fibonacci retracement

|

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment