Forex analysis review |

- Fractal analysis of the main currency pairs on August 28

- USD / JPY vs EUR / JPY vs GBP / JPY. Comprehensive analysis of movement options from August 28, 2019 APLs & ZUP analysis

- Crypto-hamsters drive growth, is Bitcoin worth selling in this case? (August 27)

- GBP/USD. August 27th. Results of the day. Opposition resists Boris Johnson's "recklessness"

- EUR/USD. August 27th. Results of the day. The German locomotive slows down and with it the entire economy of the European

- USD/JPY. Yen - weathervane of Sino-US relations

- USD/JPY: sell the dollar on growth

- Word and deed: markets expect real steps from Washington and Beijing

- EURUSD: Donald Trump trying to manipulate the dollar through China? German economy on the verge of a technical recession

- Brent hit the storm

- August 27, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- August 27, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- Daily analysis of NZD/CHF for 27.08.2019

- Daily analysis of GBP/USD for 27.08.2019

- BTC 08.27.2019 - Broken bear flag in the downward trend, more downside yet to come

- Gold 08.27.2019 - Gold in the buy zone

- EUR/USD for August 27,2019 - Buy zone on EUR at 1.1100

- Technical analysis of EUR/USD for August 27, 2019

- GBP/USD: plan for the US session on August 27. The bulls managed to fight back and regained the level of 1.2235. What to

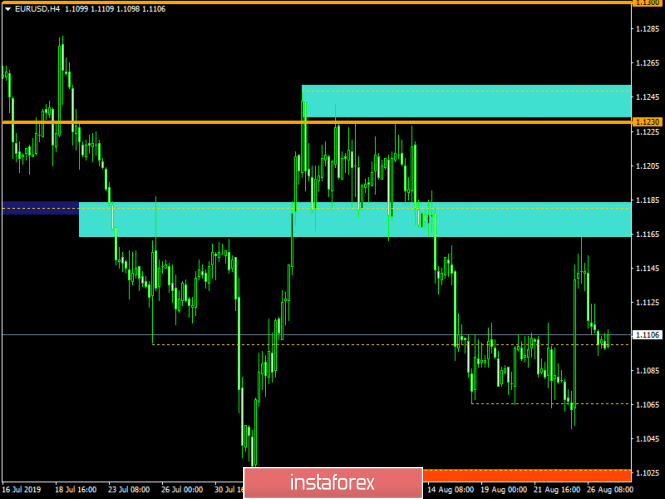

- EUR/USD: plan for the US session on August 27. German data disappointed. Focus shifted to negotiations on Italy's coalition

- EUR/USD ugly contest continues, buy dips

- Gold is in favor: demand will remain at its peak

- Trading plan for EUR / USD and GBP / USD pairs on 08/27/2019

- Trading recommendations for the GBPUSD currency pair - placement of trade orders (August 27)

- Uncertainty makes euro and pound go sideways in anticipation of clearer signals

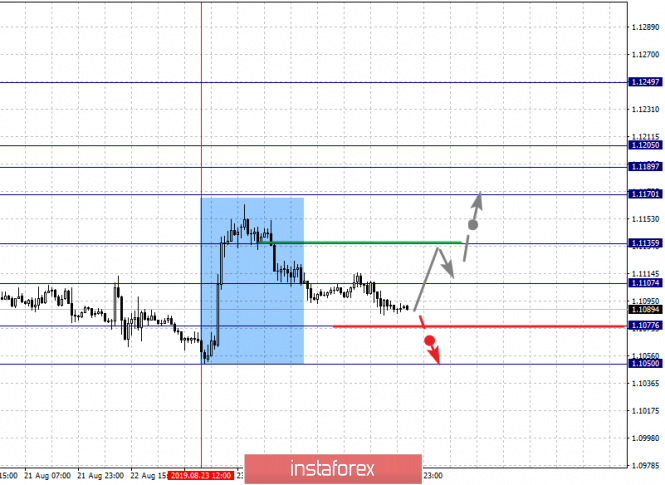

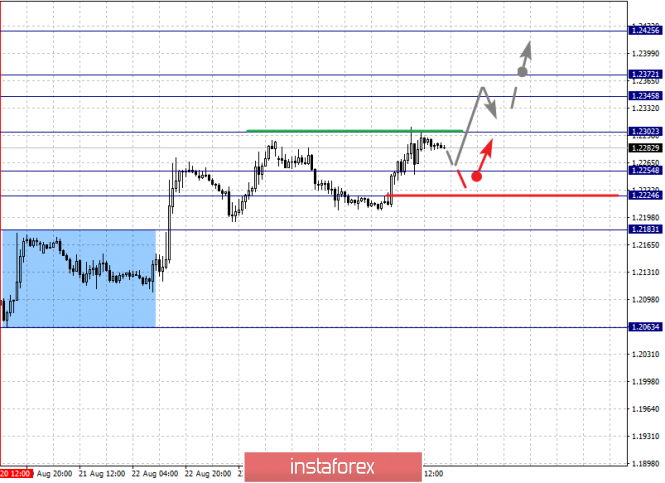

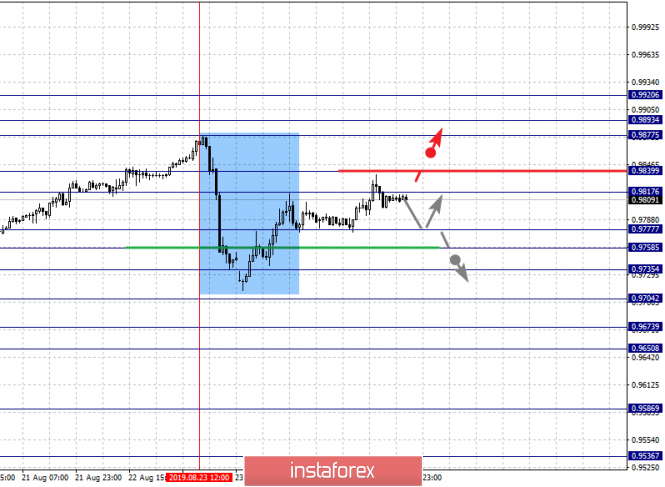

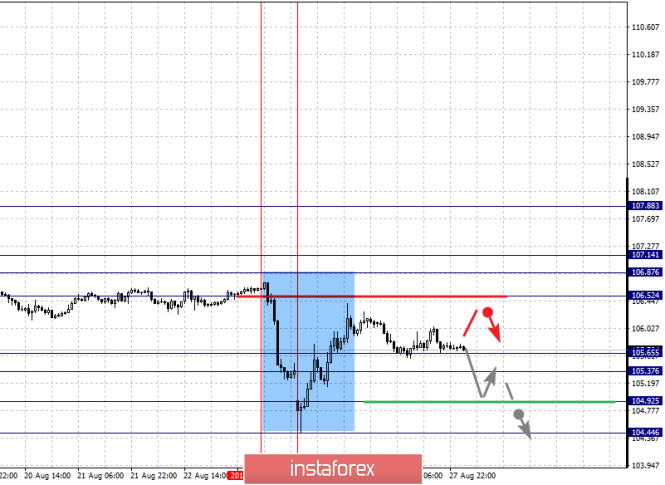

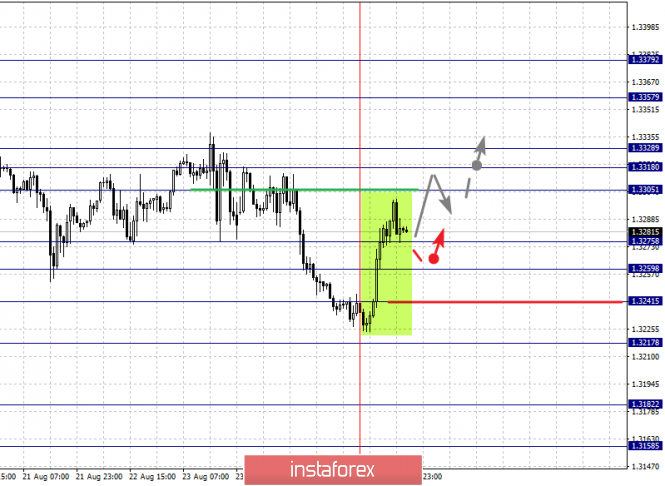

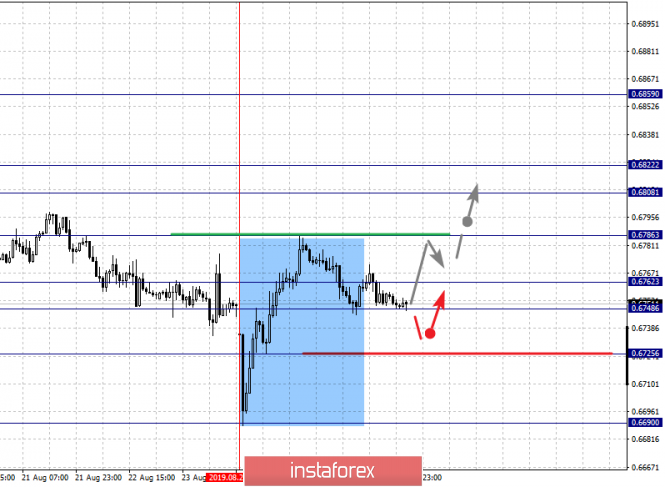

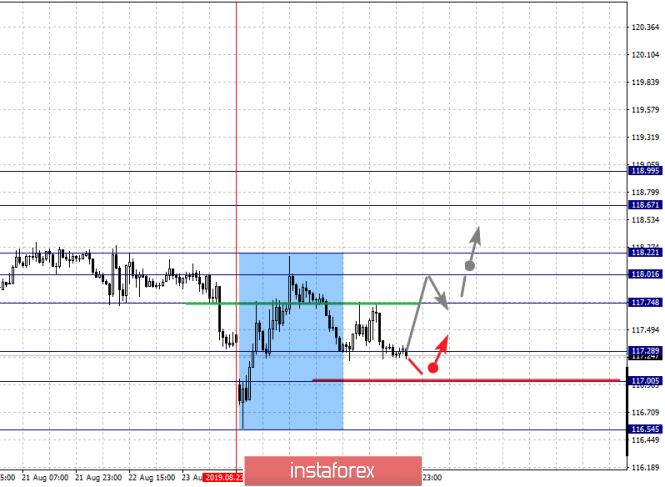

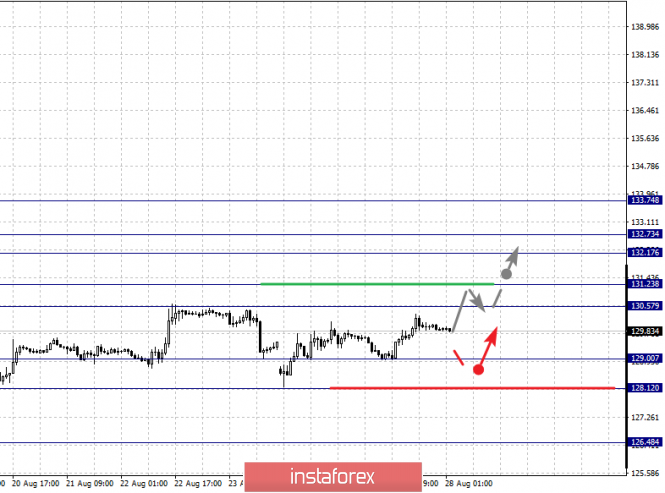

| Fractal analysis of the main currency pairs on August 28 Posted: 27 Aug 2019 05:33 PM PDT Forecast for August 28: Analytical review of currency pairs on the scale of H1: For the euro / dollar pair, the key levels on the H1 scale are: 1.1249, 1.1205, 1.1189, 1.1170, 1.1135, 1.1107, 1.1077 and 1.1050. Here, the price forms a pronounced structure for the top of August 23 and is currently in the correction zone. The continuation of the movement to the top is expected after the breakdown of the level of 1.1135. In this case, the first goal is 1.1170. The breakdown of which will allow us to count on movement to the level of 1.1189, where consolidation is near this value. The passage of the price at the noise range 1.1189 - 1.1205 should be accompanied by a pronounced upward movement. Here, the goal is 1.1249. We expect a pullback to this level from this level. Consolidated movement is expected in the range of 1.1107 - 1.1077. Hence, the probability of a turn to the top is high. The breakdown of the level of 1.1077 will lead to the development of a downward movement. In this case, the target is 1.1050. The main trend is the ascending structure of August 23. Trading recommendations: Buy 1.1135 Take profit: 1.1170 Buy 1.1172 Take profit: 1.1189 Sell: 1.1075 Take profit: 1.1052 For the pound / dollar pair, the key levels on the H1 scale are: 1.2425, 1.2372, 1.2345, 1.2302, 1.2254, 1.2224 and 1.2183. Here, we specified the key objectives for the ascending structure of August 20. The continuation of the movement to the top is expected after the breakdown of the level of 1.2302. In this case, the target is 1.234. Price consolidation is in the range of 1.2345 - 1.2372. For the potential value for the top, we consider the level of 1.2425. Upon reaching this value, we expect a pullback to the bottom. Short-term downward movement is expected in the range of 1.2254 - 1.2224. The breakdown of the latter value will lead to in-depth movement. Here, the target is 1.2183. This level is a key support for the top. The main trend is the local structure for the top of August 20. Trading recommendations: Buy: 1.2302 Take profit: 1.2345 Buy: 1.2372 Take profit: 1.2425 Sell: 1.2253 Take profit: 1.2225 Sell: 1.2222 Take profit: 1.2183 For the dollar / franc pair, the key levels on the H1 scale are: 0.9920, 0.9893, 0.9877, 0.9839, 0.9817, 0.9777, 0.9756, 0.9704, 0.9673, 0.9650 and 0.9586. Here, the price is in equilibrium: the downward structure of August 23, as well as the formation of the potential for the top of August 26. Short-term downward movement is expected in the range of 0.9777 - 0.9758. The breakdown of the latter value will lead to a movement to the level of 0.9735, where consolidation is near this level. The breakdown of the level of 0.9735 will lead to the development of a downward structure from August 23. In this case, the first target is 0.9704. Short-term upward movement is possibly in the range of 0.9817 - 0.9839. The breakdown of the latter value will lead to the development of the ascending structure from August 26. Here, the target is 0.9877. Price consolidation is in the range of 0.9877 - 0.9893. For the potential value for the top, we consider the level of 0.9920. Upon reaching which, we expect a pullback to the bottom. The main trend is the equilibrium situation. Trading recommendations: Buy : 0.9817 Take profit: 0.9836 Buy : 0.9842 Take profit: 0.9875 Sell: 0.9777 Take profit: 0.9760 Sell: 0.9756 Take profit: 0.9735 For the dollar / yen pair, the key levels on the scale are : 107.88, 107.14, 106.87, 106.52, 105.65, 105.37, 104.92 and 104.44. Here, the price is in equilibrium: the descending structure of August 23, as well as the ascending structure of August 26. The continuation of the movement to the top is expected after the breakdown of the level of 106.52. In this case, the target is 106.87, where consolidation is near this level. The passage of the price at the noise range 106.87 - 107.14 should be accompanied by a pronounced upward movement. Here, the potential target is 107.88. Consolidation is near this level. Short-term downward movement is possibly in the range of 105.65 - 105.37. The breakdown of the latter value will lead to the development of a downward structure. In this case, the first goal is 104.92. For the potential value for the bottom, we consider the level of 104.44, where consolidation is near this level. The main trend: the equilibrium situation: the descending structure of August 23, as well as the ascending structure of August 26. Trading recommendations: Buy: 106.52 Take profit: 106.85 Buy : 107.15 Take profit: 107.88 Sell: 105.35 Take profit: 104.94 Sell: 104.90 Take profit: 104.46 For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3379, 1.3357, 1.3328, 1.3318, 1.3305, 1.3275, 1.3259, 1.3241 and 1.3217. Here, the price forms a pronounced potential for the upward movement of August 27. The continuation of the movement to the top is expected after the breakdown of the level of 1.3305. In this case, the target is 1.3318. Consolidation is near this level. The passage of the price at the noise range 1.3318 - 1.3328 should be accompanied by a pronounced upward movement. Here, the target is 1.3357. For the potential value for the top, we consider the level of 1.3379. Upon reaching this level, we expect a pullback to the bottom. Short-term downward movement is possibly in the range of 1.3275 - 1.3259. The breakdown of the last value will lead to a long correction. Here, the target is 1.3241. This level is a key support for the upward structure. Its passage at the price will lead to the development of a downward movement. In this case, the first potential target is 1.3217. The main trend is the formation of potential for the top of August 27. Trading recommendations: Buy: 1.3305 Take profit: 1.3318 Buy : 1.3328 Take profit: 1.3357 Sell: 1.3275 Take profit: 1.3262 Sell: 1.3257 Take profit: 1.3241 For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6859, 0.6822, 0.6808, 0.6786, 0.6762, 0.6748 and 0.6725. Here, we are following the formation of the ascending structure of August 26. The continuation of the movement to the top is expected after the breakdown of the level of 0.6786. In this case, the target is 0.6808. Short-term upward movement, as well as consolidation is in the range of 0.6808 - 0.6822. The breakdown of the level of 0.6822 should be accompanied by a pronounced upward movement. Here, the target is 0.6859, where consolidation is near this level, as well as a pullback to the bottom. Consolidated movement is possibly in the range of 0.6762 - 0.6748. The breakdown of the last value will lead to a long correction. Here, the target is 0.6725. This level is a key support for the ascending structure. The main trend is the formation of the ascending structure of August 21. Trading recommendations: Buy: 0.6786 Take profit: 0.6808 Buy: 0.6809 Take profit: 0.6820 Sell : 0.6745 Take profit : 0.6728 Sell: 0.6722 Take profit: 0.6695 For the euro / yen pair, the key levels on the H1 scale are: 118.99, 118.67, 118.22, 118.01, 117.74, 117.28, 117.00 and 116.54. Here, the price forms the potential for the top of August 23. The continuation of the upward movement is expected after the breakdown of the level of 117.74. In this case, the first target is 118.01. The passage at the price of the noise range 118.01 - 118.22 will lead to a pronounced movement. In this case, the target is 118.67, where consolidation is near this level. For the potential value for the top, we consider the level of 118.99. Upon reaching this level, we expect a pullback to the bottom. The range of 117.28 - 117.00 is a key support for the upward structure. Its passage at the price will favor the development of a downward movement. In this case, the first potential target is 116.54. The main trend is the downward cycle of August 13, the formation of the potential for the top of August 23. Trading recommendations: Buy: 117.75 Take profit: 118.01 Buy: 118.22 Take profit: 118.65 Sell: 117.28 Take profit: 117.05 Sell: 117.00 Take profit: 116.55 For the pound / yen pair, the key levels on the H1 scale are : 133.74, 132.73, 132.17, 131.23, 130.57, 129.00 and 128.12. Here, we follow the development of the ascending structure of August 12. Short-term upward movement is expected in the range of 130.57 - 131.23. The breakdown of the latter value will lead to a pronounced upward movement. Here, the target is 132.17. Short-term upward movement, as well as consolidation is in the range of 132.17 - 132.73. For the potential value for the top, we consider the level of 133.74. Upon reaching which, we expect consolidation, as well as a pullback to the bottom. The range of 129.00 - 128.12 is the key support for the ascending structure of August 12. The breakdown of the level of 128.12 will favor the development of the downward movement. In this case, the first potential target is 126.48. The main trend is the ascending structure of August 12. Trading recommendations: Buy: 130.58 Take profit: 131.23 Buy: 131.26 Take profit: 132.17 Sell: 128.96 Take profit: 128.12 Sell: 128.10 Take profit: 126.55 The material has been provided by InstaForex Company - www.instaforex.com |

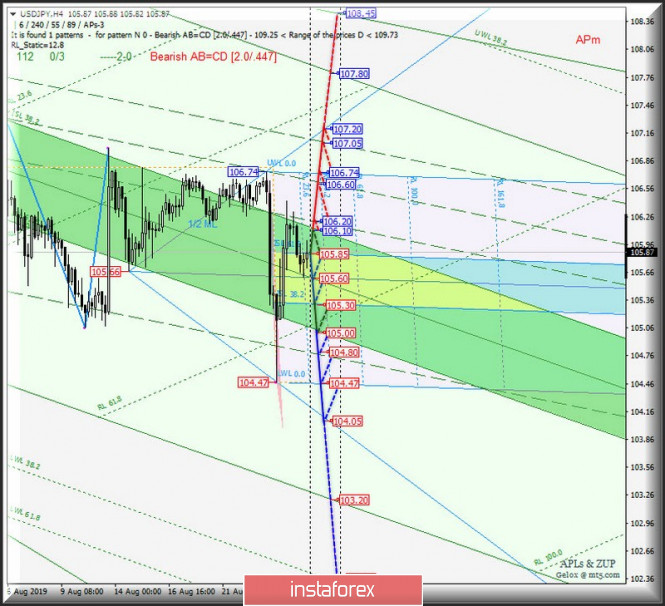

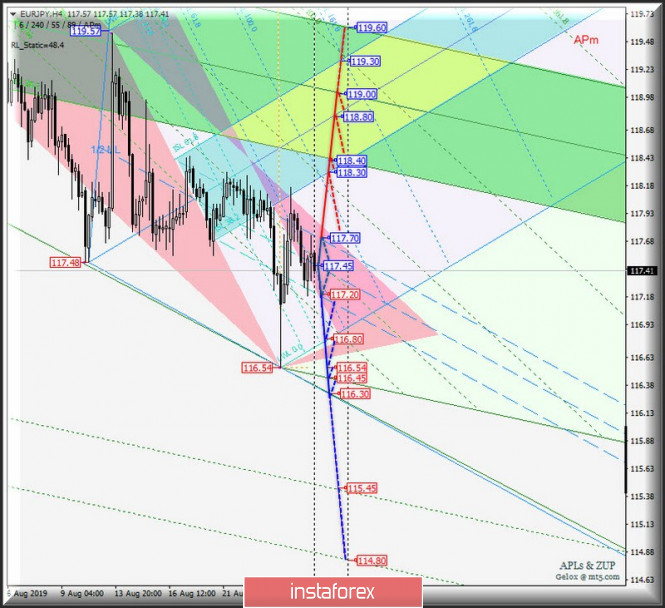

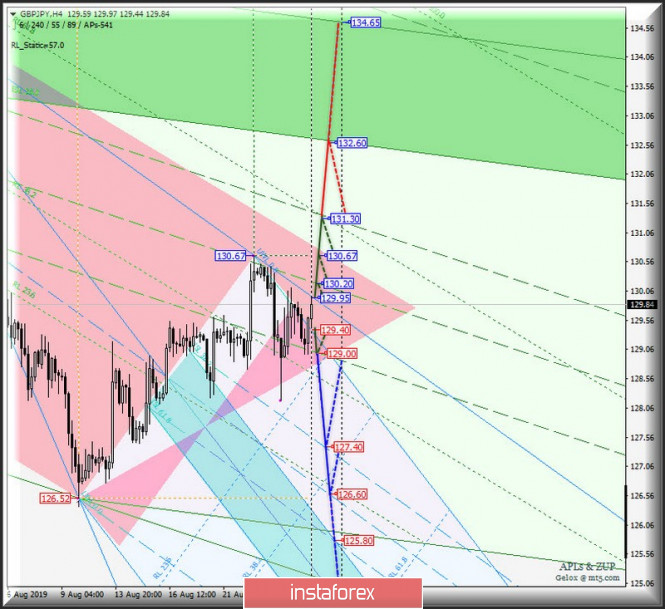

| Posted: 27 Aug 2019 05:33 PM PDT Let's consider the development of the USD / JPY currency movement of the "country of the rising sun" and its cross-instruments EUR / JPY and GBP / JPY will begin to flow from August 28, 2019. Minuette operational scale (H4 timeframe) ____________________ US dollar vs Japanese yen The development of the USD / JPY currency movement of the "country of the rising sun" from August 28, 2019 will be due to the development and direction of the breakdown of the boundaries of the equilibrium zone (105.85 - 105.60 - 105.30) of the Minuette operational scale. The movement markings inside this zone are shown in the animation chart. The breakdown of the lower boundary of ISL61.8 (support level of 105.30) of the equilibrium zone of the Minuette operational scale fork will make it relevant to continue the development of the downward movement of USD / JPY to the targets - the lower boundary of ISL61.8 (105.00) of the equilibrium zone of the Minuette operational scale fork - the final Schiff Line Minuette (104.80) - the starting line of the FSL Minuette (104.47) - the control line of the LTL Minuette (104.05). In case of breakdown of the upper boundary of ISL38.2 (resistance level of 105.85) of the equilibrium zone of the Minuette operational scale fork, the upward movement of the currency of the country of the rising sun can be continued to the upper boundary of ISL38.2 (106.10) of the equilibrium zone of the Minuette operational scale fork and the boundaries of the 1/2 Median Line Minuette channel (106.20 - 106.60 - 107.05). The details of the USD / JPY movement, depending on the breakdown direction of the above equilibrium zone, are shown in the animated chart. ____________________ Euro vs Japanese yen The development of the cross-instrument EUR / JPY movement from August 28, 2019 will be determined by the development and direction of the breakdown of the channel boundaries 1/2 Median Line (117.70 - 117.45 - 117.20) of the Minuette operational scale fork. We look at the markup on the animation chart. In case of breakdown of the upper boundary of the 1/2 Median Line Minuette channel (resistance level of 117.70), the upward movement of EUR / JPY can be directed to the boundaries of the equilibrium zones of the Minuette operational scales fork - (118.30 - 118.80 - 119.30) and Minuette (118.40 - 119.00 - 119.60). On the other hand, the breakdown of the lower boundary of the 1/2 Median Line channel (support level of 117.20) of the Minuette operational scale fork will make it possible to continue the development of the downward movement of this cross-instrument to the targets - SSL start line Minuette (116.80) - local minimum 116.54 - SSL start line (116.45) Minuette operational scale - LTL Minuette control line (116.30). The details of the EUR / JPY movement, depending on the working out of the boundaries of this channel, are presented in the animated chart. ____________________ Great Britain pound vs Japanese yen Meanwhile, the development of the GBP / JPY cross-instrument movement from August 28, 2019 will depend on the direction of the breakdown of the range :

In case of the breakdown of the UTL control line (resistance level of 129.95) of the Minuette operational scale fork, the upward movement of GBP / JPY will continue to the targets - 1/2 Median Line Minuette (130.20) - local maximum 130.67 - upper boundary of the channel 1/2 Median Line Minuette (131.30) - lower boundary ISL38.2 (132.60) of the equilibrium zone of the Minuette operational scale fork. A combined breakdown of the SSL Minuette start line (support level of 129.40) and the lower boundary of the 1/2 Median Line channel (support level of 129.00) of the Minuette operational scale will confirm the continued development of the downward movement of this cross-instrument to the boundaries of the 1/2 Median Line channel (127.40 - 126.60 - 125.80) Minuette operational scale fork. We look at the animated chart for the GBP / JPY movement options, depending on the breakdown direction of the above range. ____________________ The review is made without taking into account the news background. The opening of trading sessions of the main financial centers does not serve as a guide to action (placing orders "sell" or "buy"). The formula for calculating the dollar index: USDX = 50.14348112 * USDEUR0.576 * USDJPY0.136 * USDGBP0.119 * USDCAD0.091 * USDSEK0.042 * USDCHF0.036. where the power coefficients correspond to the weights of the currencies in the basket: Euro - 57.6%; Yen - 13.6% ; Pound Sterling - 11.9%; Canadian dollar - 9.1%; Swedish Krona - 4.2%; Swiss franc - 3.6%. The first coefficient in the formula leads the index to 100 at the start date of the countdown - March 1973, when the main currencies began to be freely quoted relative to each other. The material has been provided by InstaForex Company - www.instaforex.com |

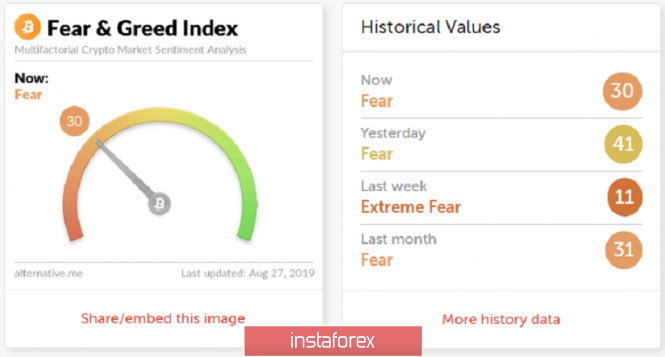

| Crypto-hamsters drive growth, is Bitcoin worth selling in this case? (August 27) Posted: 27 Aug 2019 04:52 PM PDT Greetings, crypto enthusiasts and crypto-hamsters, a week has passed since our last review, and the course of the first cryptocurrency, strictly speaking, remained in the same place. What is the reason for such an attractive platform? A return to the $ 10,000 level was facilitated by a layer of negative information that has been holding us back for more than a week. The large-scale crypto pyramid PlusToken began to move its capital after law enforcement agencies became interested in it. By the way, a considerable amount of funds is involved in the form of moving $ 2 billion, and the fact that they can start to merge them somewhere, leaving customers' deposits empty, certainly scares traders. The second injection factor came from the United States, where Secretary of State Mike Pompeo said cryptocurrencies such as Bitcoin and Libra should be regulated by the same rules as other electronic financial transactions. I can't say that this background exerted tremendous pressure during the intervals of the past week, but the restraint of the leading cryptocurrency is clearly visible. Digest of the past days:

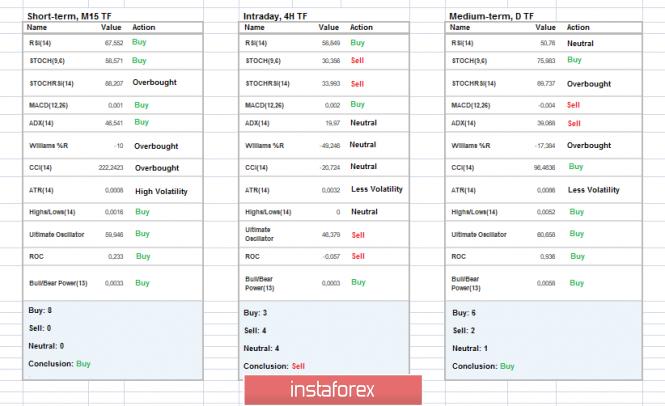

To summarize the information background, what we see is a lot of rich information that is individual and reacts differently to the crypto industry. In general terms, the pressure remains on the market after all, which reflects the market chart, but you should pay tribute to the stability of the leading crypto-currency. What we have now is the amplitude fluctuation around 7.5% BTC, where the quote is concentrated within the psychological level of $ 10,000. What are the assumptions for further development? The bulk of traders is still not ready for growth, maybe the fear factor of last year (2018) plays, when at the same time period, during the end of summer, the round of Bitcoin draining began. At the moment, the limits of 9800/10500 (11000) are retained in the market, whether to work within the range, yes, it is possible, but the risk is high. The most acceptable tactic is still waiting for the breakdown of these boundaries. Key coordinates for the upward course: 12330; 13130; 13970. Key coordinates for the downward course: 10000; 9100; 7500. The general background of the cryptocurrency market Analyzing the general market capitalization, we see that the market volume continues to sluggish fluctuation in the side channel 256-282 ($ billion). Compared with the previous article, capitalization fell by another $ 12.7 billion and currently amounts to $ 263.6 billion. If we consider the volume chart in general terms, then the current ceilings remain the same: $ 355.1 billion and $ 385.2 billion. The index of emotions, aka fear and euphoria of the crypto market, fell from 39p. up to 30p., which reflects the indecision of traders and the fear of decline. That week, the index fell to an extremely low level of 5, which once again confirms the fear of traders in the form of a fear of a repeat of last year. Indicator analysis Analyzing a different sector of timeframes (TF), we see that indicators on all major time periods signal a possible decrease. It is worth taking into account that such a moment now, the quote moves in the side channel, does not fall, and thus, the indicators on the minute and intraday periods can be variable. Now, let's consider this in the analysis: |

| GBP/USD. August 27th. Results of the day. Opposition resists Boris Johnson's "recklessness" Posted: 27 Aug 2019 04:36 PM PDT 4-hour timeframe Amplitude of the last 5 days (high-low): 116p - 63p - 164p - 100p - 78p. Average volatility over the past 5 days: 104p (high). A meeting of the opposing parties of the "hard" Brexit took place today on August 27, to which the United Kingdom is moving with might and main thanks to Boris Johnson. The meeting was convened by Labour leader Jeremy Corbyn, who openly opposes "hard" Brexit and the prime minister's policies. As part of the dialogue, it was decided to try to change the legislation to prevent Johnson from realizing the exit from the EU on October 31. The meeting was attended by representatives of the Scottish National Party, the Liberal Democratic Party, Change UK, the Welsh Plaid Cymru Party and the Green Party. Green Party MP Caroline Lucas called Boris Johnson's desire to leave the EU October 31 no matter what as "recklessness" is and said that changing legislation is the best way to save the country from this "recklessness". In turn, Boris Johnson has already announced via Twitter that the country will leave the EU on time, as "the results of the 2016 referendum must be respected." At the same time, we finally waited for official comments from EU officials regarding Johnson's statement that Britain is not obligated to pay almost $50 billion for leaving the EU if there is no "deal". EU Commissioner for Economic Affairs Pierre Moscovici said that in any case, London must pay the bill for leaving the eurozone, even if an agreement on Brexit is not concluded. Johnson previously said the UK would pay only about $10 billion. Moscovici noted that if London refuses to pay, it will mean sovereign default. Guy Verhofstadt, Brexit coordinator for the European Parliament, said that the UK's refusal to repay the debt would nullify any transitional arrangements already made. Debt repayment will be the first and necessary condition for dialogue on a trade agreement after Brexit. As you can see, the European Union has something to oppose Johnson's "recklessness". Given the current state of the UK economy, the collapse of the pound, the decline in the country's investment attractiveness, as well as the flight of companies from Great Britain, a trade war is clearly not needed. Britain does not need a "hard" Brexit. Thus, in the next two months we expect a fierce struggle with Boris Johnson, which will be waged on the sidelines of the Parliament. Meanwhile, the pound sterling continues to rise again. We continue to believe that the British currency's growth is purely technical. Bears loosened their grip a bit, which is enough for the pound to go a little higher. However, market sentiment remains "bearish", so you can expect a resumption of a downward trend at any time. Trading recommendations: The pound/dollar currency pair continues to adjust. Formally, long positions remain relevant while aiming for a resistance level of 1.2363, but it is recommended to trade with increasing caution with great caution. It is recommended to sell the pound after the formation of a signal from Ichimoku "dead cross". In addition to the technical picture, fundamental data and the time of their release should also be taken into account. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

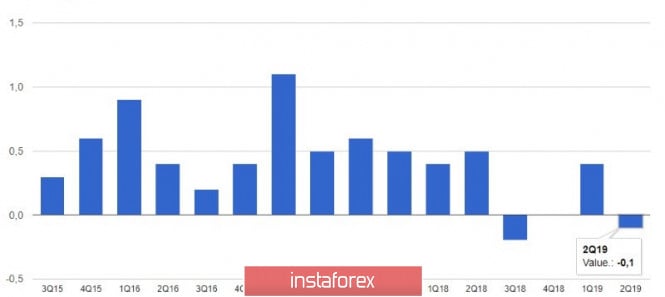

| Posted: 27 Aug 2019 04:22 PM PDT 4-hour timeframe Amplitude of the last 5 days (high-low): 41p - 28p - 49p - 101p - 70p. Average volatility over the past 5 days: 58p (average). It has long been known that Germany is the locomotive of the entire European Union. It is the Germans who are leaders in GDP among the 27 countries participating in the eurozone. If the economic performance of Germany begins to slow down at first, and then decline, this is another reason for discussing the recession in the European Union. The GDP for the second quarter of 2019 in Germany was published today. The indicator grew by 0.4% compared to the previous year, which is not much, but Gross Domestic Product decreased by 0.1% compared to the first quarter of 2019. This is bad news for the euro and the eurozone. Not critical, but bad. Traders almost did not react to this news, although was still an increase in the US currency during the day. At the same time, volatility is very low, which indicates a low interest of traders in German GDP. Thus, this indicator is more interesting to us, as a harbinger of pan-European GDP, which, in our opinion, could also decline in the second quarter of 2019. Naturally, no one is going to buy the euro on such news, and the common currency continues to fall again, although Friday's trading gave hope for an upward trend. But, as we have already said, Friday's growth cannot be called justified, since Powell's speech was absolutely neutral, and by no means "dovish". We believe that traders realized this over the weekend and began to recoup their mistake on Monday. Thus, we are waiting for the continuation of the downward trend with the renewal of two-year lows. Even hypothetically now it is difficult to imagine what should happen to the global "dollar trend" to end. On the one hand, as we wrote earlier, over the past 8 months the euro has fallen in price by only 5 cents, and on the other hand, a steady downward trend is still observed. In the current situation, the fate of the euro is in the hands of the US. It is from the United States that negative information should be expected in order to count on the strengthening of the euro. The US dollar should stop being used as a reserve currency for any occasion, even when it comes to a trade war between China and the United States. It is the trade war with Beijing that could be a good reason to stop buying the dollar. At the moment, we can safely say that duties on Chinese and American goods are very high, they have never been higher. Since the parties are far from a trade agreement, new escalations in the trade conflict can be expected. That is, potentially the parties may begin to suffer even greater losses, GDP will slow down, and macroeconomic indicators will decline. This can lead to the US dollar's loss of its highest attractiveness in the eyes of forex traders. From a technical point of view, the euro/dollar has consolidated below the Kijun-sen critical line, which signals a downward trend in the current trend. In the near future, the formation of the "dead cross" and the influx of bears with new sales of the euro currency is expected. Trading recommendations: EUR/USD continues to correct against a weak upward trend. At the moment, it is already possible to consider short positions with the first goal support level of 1.1078. The second goal is the support level based on the current volatility - 1.1037. Bulls once again showed their weakness, having failed to even overcome the Senkou Span B line. In addition to the technical picture, fundamental data and the time of their release should also be taken into account. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| USD/JPY. Yen - weathervane of Sino-US relations Posted: 27 Aug 2019 04:07 PM PDT Judging by the dynamics of defensive instruments, traders are less and less trusting the words of politicians, preferring more significant fundamental factors. Even the high-profile statements of Donald Trump, designed to reassure investors, do not inspire confidence in market participants - the "safe haven" currencies are still in demand and are in no hurry to depreciate against the dollar. The fact is that the growth of anti-risk sentiment in the market was due to completely "tangible" events, not words. China quite unexpectedly decided to retaliate against the United States by announcing an increase in duties on the 5,000th list of US goods. The market clearly did not expect such a turn, since Trump recently showed a "goodwill gesture", delaying the introduction of additional tariffs on imports of Chinese goods until December 15 (instead of September 1). Outwardly, the situation resembled another "thaw" in relations between the United States and China, especially in light of ongoing preparations for the next round of negotiations, which was supposed to take place in mid-September. But as it turned out, Beijing was just waiting for a convenient moment to declare countermeasures. Trump reacted instantly by "throwing" another 5% on the previously announced duties - that is, duties on $300 billion worth of goods will increase from 10% to 15%, and duties on $250 billion worth of goods will increase from 25% to 30% . Simultaneously with this statement, the US president added that he had two "productive" telephone conversations with the Chinese side. According to him, Chinese authorities have "serious intentions" that could lead to a deal. Trump refused to answer the question of whether he spoke directly with Chinese President Xi Jinping, but at the same time he spoke extremely positively about the Chinese leader several times, and even called him "a great leader." Risk appetite did not return to the market despite such unctuous comments by the US president. The US currency slowed down in almost all pairs, defensive tools lost some price - but in general, there is still a certain wariness on the market. Figuratively speaking, traders are listening to Trump, but at the same time looking at the USD/CNY rate: the yuan continues to become cheaper along with the dollar, updating price highs almost daily (today the pair has reached 7.169). Given the "specifics of the exchange rate formation" of this pair, it can be assumed that Beijing is far from certain about the effectiveness of the next negotiations. Indeed, this is not the first time Trump has demonstrated such behavior: at first he initiates negotiations with optimism (or agrees to them), but then turns around 180 degrees, simultaneously accusing the Chinese of intransigence and other "sins." The current situation can be used when trading the USD/JPY pair. The Japanese currency is completely withdrawn from its "internal" fundamental factors - for example, the yen completely ignored the latest release of inflation data in Japan. The status of a defensive asset allows the Japanese currency to be a kind of weathervane for US-Chinese trade relations. Furthermore, the fact that the yen is paired with the dollar now continues to be traded within the 105th figure, says a lot - above all, about the continuing anti-risk sentiment in the foreign exchange market. In fact, we are seeing a correctional pullback after reaching a three-year price low (104.46). This correction was provoked not only by cautious optimism regarding the prospects for trade negotiations. US macroeconomic reports also played a role. In particular, the indicator of consumer confidence in the US today came out better than expected. Analysts expected a decline of this indicator to 129.3, but it only slightly fell to 135.1 points (the index reached 135.8 points in July). The Fed manufacturing index also contributed to the growth, which rose today to one point with a forecast reduction to -2 points. These reports helped the dollar stay afloat, despite the continued decline in the yield of 10-year Treasuries (the indicator again fell to around 1,501). In my opinion, the prevailing fundamental picture allows USD/JPY traders to open short positions in the pair. If trade negotiations between China and the United States will not be appointed in the near future, then the yen will again gain momentum. It is also worth remembering that in addition to the global trade conflict, there are other reasons for the growth of anti-risk sentiments - for example, the political crisis in Italy and Brexit. Thus, the USD/JPY pair retains the potential to retest the support level of 104.90, which corresponds to the lower line of the Bollinger Bands indicator on the daily chart. The material has been provided by InstaForex Company - www.instaforex.com |

| USD/JPY: sell the dollar on growth Posted: 27 Aug 2019 04:07 PM PDT Whoever said anything about Donald Trump's tweets, but the White House owner still managed to bring the markets out of balance. High volatility was observed in the USD/JPY pair. In a short time, quotes managed to go back and forth. Demand for the defensive yen is increasing on Tuesday, as it is difficult for investors and traders to believe in the words of the US president, who announced that there was a call from China. Beijing aggressively calls him to the negotiating table. In addition, the facts indicate the opposite. A spokesman for the Chinese Foreign Ministry said he did not know what Trump was talking about. If the fact of the call is not confirmed and China does not make concessions (which is unlikely), one should not hope for a recovery of USD/JPY. Bank of America Merrill Lynch calls attempts to raise the dollar in conjunction with the yen an opportunity to sell. According to the forecasts of currency strategists, the pair will stay in the region of 105 until the end of the current quarter, and by the end of the year it will fall to the level of 101. American statistics now look good, but do not flatter yourself about its invulnerability and impenetrable immunity. The global trends, from which the negative blows, will do their job. Banking analysts estimate the chance of a recession in the United States before the end of this year 1 to 3. At the same time, the BAML analytical model signals that the likelihood of such a scenario has increased to 20%. The recession in the global economy is becoming increasingly apparent. New statistical data is expected to continue to support fears about the consequences of a trade war, the end and edge of which is not visible. It is worth noting that Trump regularly plays with the emotions of market participants and with China, included. The analyst community believes that Beijing is ready to tolerate and wait for the US presidential election in 2020 in the hope that Trump will not win. Decrease in the USD/JPY quotes should ensure the Fed rate cut and preservation of soft rhetoric. An additional driver promises to be the stock market. In the second half of the year, the peak on it will finally form, and control will pass to the "bears". According to banking analysts, in the context of a trade war and a global recession, easing the Fed's policy is unlikely to ensure a steady increase in risk appetite. The material has been provided by InstaForex Company - www.instaforex.com |

| Word and deed: markets expect real steps from Washington and Beijing Posted: 27 Aug 2019 03:46 PM PDT

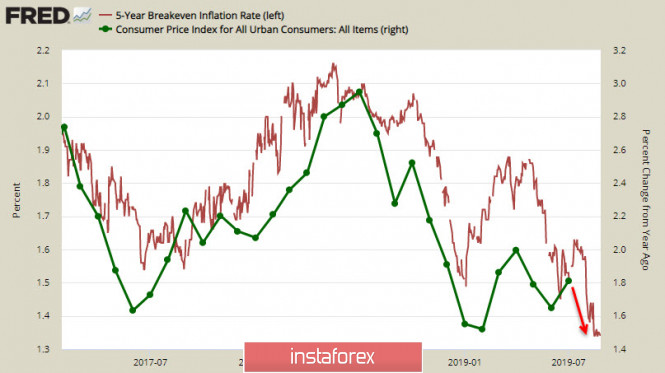

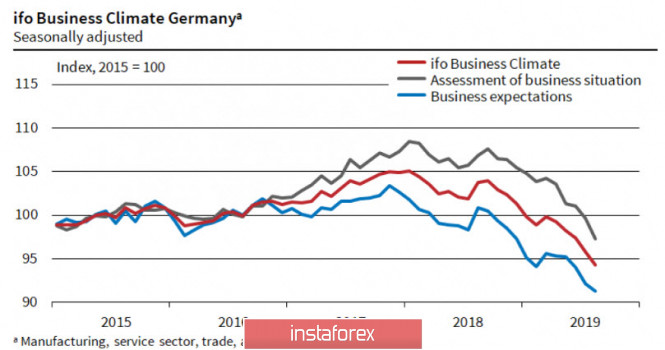

Tensions in the financial markets have eased somewhat amid statements by the United States and China that they are close to concluding a trade agreement. The day before, the head of the White House Donald Trump said that China on Sunday evening asked to resume trade talks. This came after China's chief trade negotiator, Deputy Prime Minister Liu He said that Beijing was ready to continue consultations with the US to resolve trade contradictions.. Intense fluctuations are now observed on stock exchanges: sharp drops are followed by decisive recovery. At the same time, the foreign exchange market gives alarming signals. In general, the current mood of investors can be described as cautious optimism. Yesterday, the USD/JPY pair rose to the level of 106.20, and today plummeted to 105.65. On the eve, the US currency jumped against the yen amid optimism about the prospects for a trade deal between Washington and Beijing, but the market seems to be a little hasty with conclusions. There are still many problems that can provoke an escalation of the conflict between the two largest economies in the world, so some traders chose to take profits at this stage. Since the beginning of the month, the AUD/USD pair has been trading in a rather narrow range of 0.6700-0.6800. The good news for the Australian dollar, which serves as an informal indicator of sentiment regarding the Chinese economy, is that its exchange rate has stopped declining. However, the aussie still cannot find the strength to recover, including due to the lack of significant signals about the US and China. On Monday, the EUR/USD pair returned to 1.1100, having failed to develop the growth that began last week. As soon as the "bulls" raised their heads, the easing of tension in the trade conflict between the US and China and the disappointing statistics on the business climate from the IFO forced them to go on the defensive. The fall in German business sentiment to seven-year lows in August increased concerns about a recession in Europe's largest economy and reinforced expectations of broad stimulus measures by the ECB in September. One of the important indicators for central banks is the level of inflation. Tariffs on Chinese imports spur consumer price growth in the United States, while the European Union, which is suffering from damping demand, is facing a weakening inflation rate of 1%. This state of affairs gives the ECB carte blanche to launch large-scale mitigation, but in the United Stats, such measures may be regarded as premature. If this scenario is realized, the euro runs the risk of increased pressure, and the EUR/USD pair may drop to $1.08 by the end of September. |

| Posted: 27 Aug 2019 03:46 PM PDT Traders continue to ponder yesterday's statements by US President Donald Trump about progress in negotiations with China. If at the end of last week, Trump called Xi almost the main enemy of the United States, yesterday he announced some progress that, in his opinion, would help to conclude a deal. There is no specifics, as usual, but the dollar clearly reacted to this growth against the euro and the pound. If the pound has already regained all positions and is again in demand, again, exclusively speculative, then the euro continued to trade in a narrow channel after the release of the German economic growth report. Let me remind you that in recent weeks, tension in trade relations has overshadowed the prospects for the US economy, which by itself has strengthened expectations of a further reduction in interest rates in the United States to support GDP growth. The chairman of the Federal Reserve spoke about this at the end of last week. Lower rates - weakening dollar. As I noted above, according to official figures, in the 2nd quarter of this year, compared with the 1st quarter, the German economy was expected to contract against the backdrop of worsening trade conflicts and a slowdown in global economic growth. Not surprisingly, the main problem was a sharp decline in foreign trade, while consumption and a slight increase in investment supported the economy. According to data, German GDP fell by 0.1% in the 2nd quarter compared to the 1st quarter. GDP grew by 0.4% compared to the 2nd quarter of last year. As I noted above, personal consumption grew by 0.1%, and government spending increased by 0.5%. The contraction in the economy indicates stagnation in the short term. Recent polls also indicate a decline in German GDP in the 3rd quarter, which would mean a technical recession. Data on the growth of consumer confidence in France did not greatly interest traders. According to the report, the consumer confidence index in France remained unchanged in August at 102 points compared with July, which fully coincided with the forecasts of economists. But the mood in business circles of France improved and rose to 102 points in August against 101 points in July. Economists had expected the index to remain unchanged. As for the technical picture of the EURUSD pair, it remained unchanged compared to the morning forecast. If yesterday it was possible to talk about the likely continuation of the growth of risky assets, then today, after the pair returned to support 1.1120, the prospects worsened. Bulls will need a lot of effort to cope with the level of 1.1120, since it will be possible to again discuss the topic of the euro's continued growth to a high of 1.1160 above this range. A break of support of 1.1080 will provide bears with new forces, which will push the trading instrument into the area of August lows. The material has been provided by InstaForex Company - www.instaforex.com |

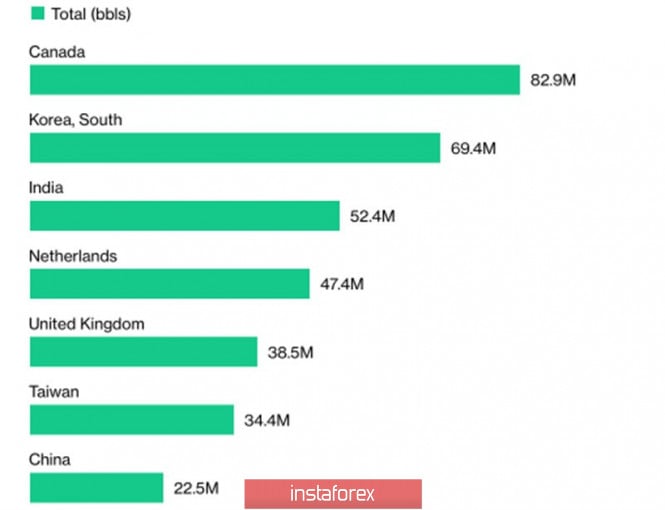

| Posted: 27 Aug 2019 03:46 PM PDT The oil market has been pretty turbulent in the last days of August. But could it be otherwise if China and the United States raise tariffs and then announce their readiness for negotiations and an agreement? Black gold is highly sensitive to the factor of reduction in global demand and turns a blind eye to the decline in OPEC production, sanctions against Iran and Venezuela and weather disasters in the Gulf of Mexico. Bulls are in no hurry to carry out attacks, as they understand that all optimistic statements by the White House may not be worth a penny. The trade conflict seems to be a long-running factor for investors: it is entirely possible that Washington and Beijing will not be able to conclude an agreement until the 2020 presidential election. However, bears also have their own vulnerabilities. China's announcement that it will impose additional tariffs ranging from 5% to 10% on $75 billion in US imports left Brent and WTI in shock. China has repeatedly threatened to answer with an eye for an eye, a tooth for a tooth at Donald Trump's tricks, but few expected this from him! At the same time, Beijing introduced a 5% duty on the purchase of US oil. For local companies, this means + $3 per barrel for a Texas variety, which makes contracts unprofitable. The volume of black gold shipped from the United States declined as the trade conflict developed. Currently, China is the seventh buyer of oil produced in the United States. US Oil Buyers The tariff for the import of black gold from the United States and the growth of other duties will fall on the shoulders of American consumers, which allows us to predict a decrease in demand and a further increase in the already considerable reserves of 438 million barrels. There is an oversupply of oil in the US market, which leaves its mark on the global balance sheet and prices. Fairly unpleasant news for the Brent and WTI bulls came from France, as Donald Trump announced his readiness to negotiate with Tehran during the G7 summit. Tensions in the Middle East, where tankers are seized from time to time, and Iran threatens to block the Strait of Hormuz, is good news for oil fans. If it disappears, OPEC is unlikely to be able to block the factor of reducing the growth in global demand by prolonging the agreement to reduce production. However, it must be understood that the 19% peak of black gold from the highest levels of the current year improves the prospects for demand. The lower the price, the higher the interest in the asset. In this regard, further escalation of the conflict between the United States and China is unlikely to have the same devastating effect as before. Moreover, rumors circulated by Donald Trump about Beijing's readiness to resume negotiations lend a helping hand to Brent and WTI bulls. Technically, on the daily chart of North Sea oil, the "Splash and Shelf" pattern is formed on the basis of 1-2-3. A consolidation range of $57.45-61.35 per barrel is being formed - the "shelf". A breakthrough of its upper boundary will create prerequisites for price growth to $66.25 (target at 88.6% according to the "Bat" model). On the contrary, a successful test of support at $57.45 will increase the risks of continuing the downward course to $54.3 (161.8% target for AB = CD). The material has been provided by InstaForex Company - www.instaforex.com |

| August 27, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 27 Aug 2019 08:52 AM PDT

Back in June 24, the EURUSD looked overbought around 1.1400 facing a confluence of supply levels which generated significant bearish pressure over the pair. Shortly after, In the period between 8 - 22 July, a sideway consolidation-range was established between 1.1200 - 1.1275 until a triple-top reversal pattern was demonstrated around the upper limit. Then, Evident bearish momentum (bearish engulfing H4 candlestick) could bring the EURUSD below 1.1175. This facilitated further bearish decline towards 1.1115 (Previous Weekly Low) then 1.1025 (the lower limit of the depicted recent bearish channel) where significant signs of bullish recovery were demonstrated. Risky traders were advised to look for bullish breakout above 1.1050 as a bullish signal for Intraday BUY entry with bullish targets around (1.1115, 1.1175 and 1.1235). All of which were successfully reached. Shortly-After in Mid-August, the EUR/USD has been trapped between 1.1235-1.1175 for a few trading sessions until bearish breakout below 1.1175 occurred on August 14. Bearish breakout below 1.1175 promoted further bearish decline towards 1.1075 where the backside of the broken bearish channel has been providing significant bullish demand so far (A Bullish Triple-Bottom pattern is in progress). Bullish persistence above 1.1115 is needed to confirm the short-term trend reversal into bullish. This would enhance another bullish spike towards 1.1175 as an initial bullish target. Trade recommendations : Conservative traders can have a valid BUY entry anywhere around 1.1090. Initial T/P levels should be located around 1.1150, 1.1175 and 1.1200. S/L should be placed just below 1.1040 ( the depicted newly-established uptrend line). The material has been provided by InstaForex Company - www.instaforex.com |

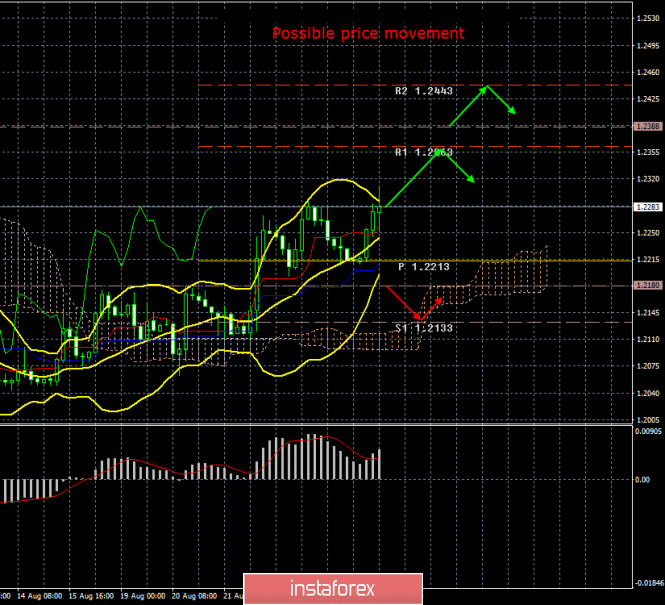

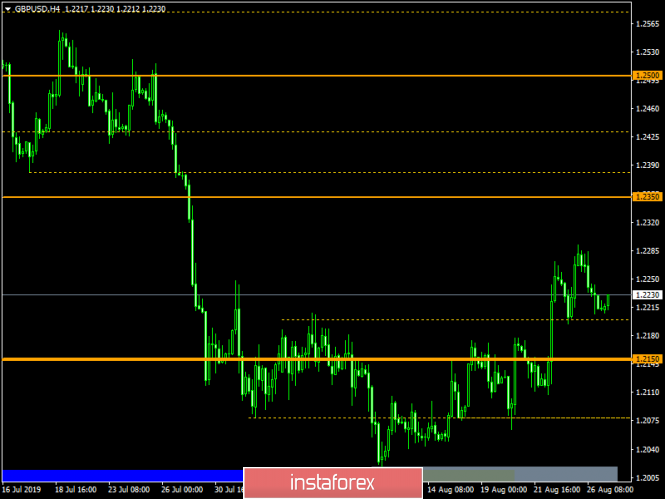

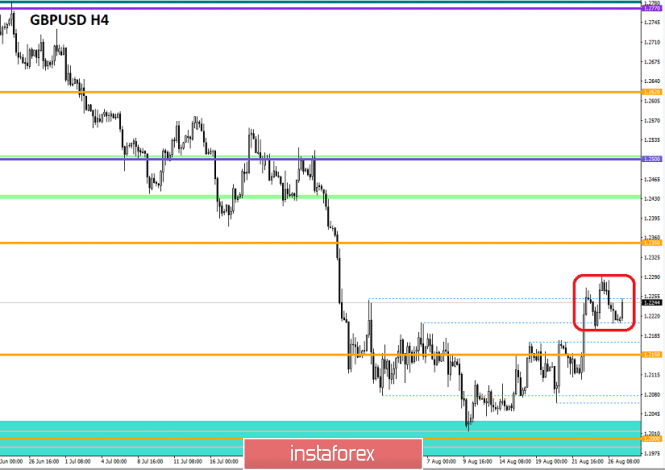

| August 27, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 27 Aug 2019 08:39 AM PDT

On July 5, a bearish consolidation range-breakout was demonstrated below 1.2550 corresponding to the lower limit of the depicted consolidation range. Moreover, Bearish breakdown below 1.2385 (Prominent Bottom) facilitated further bearish decline towards 1.2320, 1.2270 and 1.2100 which corresponded to significant key-levels on the Weekly chart. The previously-mentioned price levels were risky for having new SELL entries. That's why, Long-term SELLERS were advised to have their profits gathered. In Early August, a temporary consolidation-range was established above 1.2100 before August 9 when temporary bearish movement was executed towards 1.2025. Recent bullish recovery was demonstrated off the recent bottom (1.2025). This brought the GBP/USD pair back above 1.2100 (recently-established demand Level). As expected, recent bullish movement was demonstrated towards 1.2230 then 1.2280 where recent bearish rejection was previously manifested towards 1.2215-1.2200. For the intermediate-term, Further bullish advancement is expected to pursue towards 1.2320 then 1.2380 as long as the current bullish momentum above 1.2200 and 1.2160 (the recent consolidation range pivot-point) is maintained on a daily basis. On the other hand, If the current bullish movement pursued further bullish momentum, price action should be watched cautiously around 1.2380 as bearish rejection maybe anticipated around this price level (being a correspondent to a broken Key-Support dating back to July 17). Trade Recommendations: Intraday traders were advised to have a valid bullish entry anywhere around 1.2215-1.2180. It's already running in profits. Next T/P level to be placed around 1.2290, 1.2340 and 1.2385 while S/L should be advanced to 1.2170 to offset the associated risks. The material has been provided by InstaForex Company - www.instaforex.com |

| Daily analysis of NZD/CHF for 27.08.2019 Posted: 27 Aug 2019 08:37 AM PDT

The above picture is the daily chart of NZD/CHF. This currency pair has been in a downtrend from the start of the year. Now the price has stalled near the 0.62000 area. The price is acting as support for NZD/CHF. The green line shows the resistance area from where we can expect some price reaction. The moving average is indicated by a blue line. The price is continuously trading below the blue line, and this proves the dominance of sellers. From a trading point of view, the pair does suggest gainful trading opportunities. However, if you still wish to trade this currency pair, you should wait until the price crosses the blue moving average line and then you can comfortably take a buy. Again, this would be a very aggressive entry. So, your stop loss has to be tight near 0.62000. We recommend you to trade following the trend. This is possible if the price retraces back to our green line and trades below the moving average line. If this happens, you have a good excuse to take the sell with minimum risk. But if we don't get that retracement, do not chase the market by selling at the current market price (CMP). Your stop loss will be above 0.66000 and target will be at the recent low. This could result in 1:3 risk to reward ratio, which is not bad at all. The material has been provided by InstaForex Company - www.instaforex.com |

| Daily analysis of GBP/USD for 27.08.2019 Posted: 27 Aug 2019 08:35 AM PDT

The above picture is the daily chart of GBP/USD. We have represented the resistance area with a green line, and the blue line shows the moving average running through the chart. What we are watching is that the price is trading firmly above the moving average line. You should note that the pair is in a strong downtrend for a few months in a row. Bearing in mind related risks, you should be selling as well. Currently, the price is pulling back, and we see a good bounce back. What we need is to find out is whether the price will sustain or not. There are no signs at the moment for selling. However, it would be a good idea to consider short positions on GBP/USD. If the price continues to trade above the blue moving average line, then you can plan buying GBP/USD. In this case, your target has to be the green resistance line keeping a stop loss below the low near 1.2000. Remember, as you are going against the trend, your stop has to be tight. People with larger risk appetite can buy at the current market price (CMP). If you wish to be on the safer side, we suggest you wait for the price to pull back near 1.24890 area and then look for selling from there. You could keep a stop loss just above 1.26000. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC 08.27.2019 - Broken bear flag in the downward trend, more downside yet to come Posted: 27 Aug 2019 07:20 AM PDT Bitcoin 4H time-frame:

Bitcoin is progressing well since my yesterdays down call and my analysis is still in the play. The 4-hour chart completed bear flag and I do expect more downside to come. I think that the growth potential of BTC is now limited. The first reason is another growth of the US dollar in world currency markets. In my opinion, most of the investors are investing in metals (Silver,Gold) and I don't see any big expansion in the Bitcoin yet. Bitcoin Forecast and recommendations for traders: Bitcoin is in overall consolidation phase but most recently I found bear flag below the downward slopping trendline, which is sign that there is chance for more downside and potential of $9,727 or $9,106. Thus, I recommend selling cryptocurrency with a target of $9,727, with a Stop Loss level of $10,700.The material has been provided by InstaForex Company - www.instaforex.com |

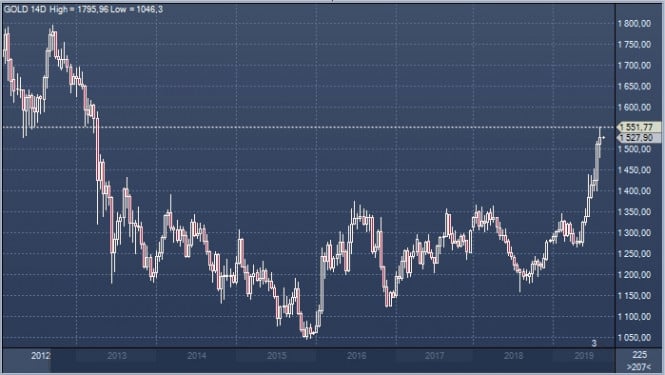

| Gold 08.27.2019 - Gold in the buy zone Posted: 27 Aug 2019 07:05 AM PDT Gold price is still holding well support at the price of $1,525, which is good sign for further upside. I still expect more upside and at least another upward swing.

Red horizontal line – Important resistance and upward objective Yellow rectangle - major support area Purple rising line – Expected path MACD oscillator is showing good new momentum up in the background and the fresh new momentum just started to pick up.I do expect at least another push higher. Key support is at $1,525 and resistance at $1,554. Bears need to be very cautious as there is strong upward momentum in the background and potential buying the deep type of feeling. As long as the Gold is holding above $1,525 there is a chance for potential test of $1,554. Additionally, I found rising support trend line, which is another good sign for further upside. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD for August 27,2019 - Buy zone on EUR at 1.1100 Posted: 27 Aug 2019 06:54 AM PDT EUR price has been trading sideways at the price of 1.1105 but my main long bias didn't change. I still expect more upside and potential re-test of 1.1163.

Red horizontal line – Important resistance and upward objective Yellow rectangle - major support area Middle Bollinger green line – 20SMA support Silver rectangle – Failed breakout of support Purple rising line – Expected path MACD oscillator did show good new momentum up in the background and I do expect at least another push higher. Key support is at 1.1105-1.1100 (round number) and resistance at 1.1164. Bears need to be very cautious as there is strong momentum in the background and potential buying the deep type of feeling. As long as the EUR is holding above 1.1100, there is a chance for potential test of 1.1164. Most recently, the Middle Bollinger 20SMA is holding, which is another sign for potential upward move.The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of EUR/USD for August 27, 2019 Posted: 27 Aug 2019 05:39 AM PDT The EUR/USD pair faced resistance at the level of 1.1166 (61% of Fibonacci retracement levels) in the H4 chart. Minor resistance is seen at 1.1112. The EUR/USD pair is still moving around the key level at 1.1112 , which represents a daily pivot in the H4 time frame at the moment. The RSI indicator is still calling for a strong bearish market as well as the current price is also below the moving average 100 and 50. The EUR/USD pair traded below a broken trend line and swing zone at 1.1112-1.1166. The current rise will remain within a framework of correction. However, if the pair fails to pass through the level of 1.1166, the market will indicate a bearish opportunity below the strong resistance level of 1.1166. Since there is nothing new in this market, it is not bearish yet. Sell deals are recommended below the level of 1.1166 with the first target at 1.1027. If the trend breaks the support level of 1.1027, the pair is likely to move downwards continuing the development of a bearish trend to the level 1.0956 in order to test the daily support 2. Stop loss should always be taken into account, accordingly, it will be of beneficial to set the stop loss above the last top at 1.1250. The material has been provided by InstaForex Company - www.instaforex.com |

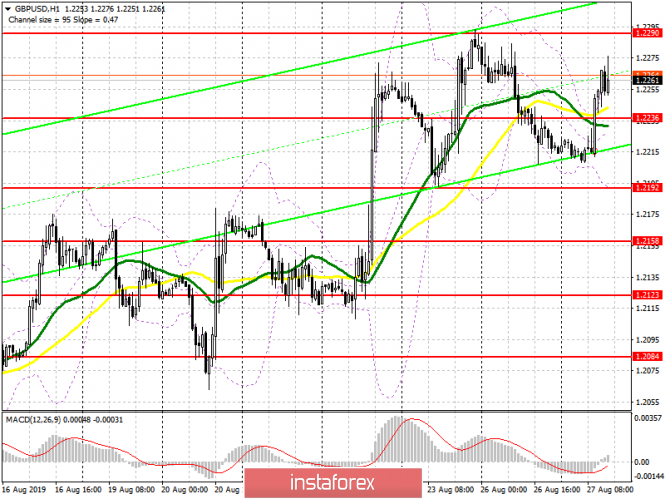

| Posted: 27 Aug 2019 05:32 AM PDT To open long positions on GBP/USD, you need: In the morning, I focused on the resistance of 1.2230, which was necessary for buyers to return to the pound to maintain the upward potential, which happened. Now, the goal is the maximum of the week in the area of 1.2290, the breakthrough of which will provide GBP/USD with a new influx of large players with the demolition of sellers stop orders, which will lead to the update of the levels of 1.2334 and 1.2387, where I recommend taking the profits. If the data on the US economy and consumer confidence will be better than economists' forecasts, it is possible to return the pound under the support of 1.2236. In this scenario, it is best to return to long positions on the rebound from the minimum of 1.2192. To open short positions on GBP/USD, you need: Bears will try to protect the level of 1.2290 in the afternoon, but it is better to open short positions from it only after the formation of a false breakdown, which may occur after the release of the US data. Otherwise, it is best to sell GBP/USD after updating the maximum of 1.2334. The main task of sellers for the second half of the day is a return below the support of 1.2236, which will quickly nullify all the efforts of buyers and lead to an update of the minimum of 1.2192, where I recommend taking the profits. Signals of indicators: Moving Averages Trading is above 30 and 50 moving averages, but the market is still in the side channel. Bollinger Bands If the pair decreases, the lower limit of the indicator in the area of 1.2192 will act as support.

Description of indicators

|

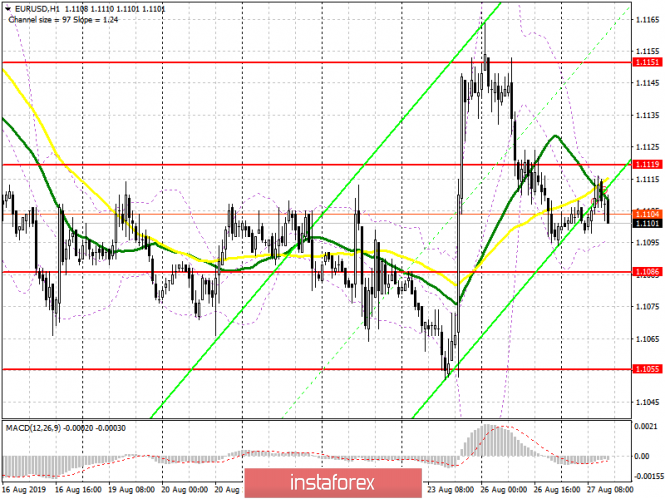

| Posted: 27 Aug 2019 05:19 AM PDT To open long positions on EURUSD, you need: Trade remained in a narrow side channel in the first half of the day after the GDP report in Germany, which coincided with economists' expectations, decreasing by 0.1% in the 2nd quarter compared to the 1st. It is best to open long positions after the support test of 1.1086, provided that a false breakdown is formed there. If there are no active purchases in this range, I recommend postponing long positions until the minimum of 1.1055 is updated. A return to the resistance level of 1.1119 remains an equally important task for buyers, which will allow updating a maximum of 1.1151, where I recommend taking the profits. Data on the US consumer confidence indicator may lead to a surge in volatility, but the focus will still be placed on news from Italy and talks between the two parties about a coalition government. To open short positions on EURUSD, you need: The bears will be counting on a strong report on US consumer confidence, which will lead to a further downward movement in the pair. The formation of a false breakdown in the resistance area of 1.1119 will be an additional signal to open short positions in the euro, and the main goal will be to update the minimum of 1.1086, which sellers did not reach yesterday. Consolidation below this range will further increase the pressure and lead to a further downward trend in the support area of 1.1055, where I recommend fixing the profits. In the scenario of growth above the resistance of 1.1119 on the positive news about the formation of a coalition government in Italy, short positions can be returned immediately to the rebound from the resistance of 1.151. Signals of indicators: Moving Averages Trade is carried out in the range of 30 and 50 moving average, which indicates more market uncertainty with the prospect of a further decline in the euro. Bollinger Bands The break of the lower limit of the indicator in the area of 1.1090 will lead to a further decrease in the euro.

Description of indicators

|

| EUR/USD ugly contest continues, buy dips Posted: 27 Aug 2019 03:58 AM PDT EUR/USD has remained trapped in relatively narrow ranges with the pair resisting losses despite a lack of yield support with consolidation near 1.1100 on Tuesday. The ECB will announce a package of support measures at the September policy meeting, potentially with an interest rate cut and a fresh package of government bond purchases. German benchmark bond yields remain at record lows. The euro will gain some support if the measures are seen as supportive for growth. The Federal Reserve will also cut interest rates at the September meeting with the most likely outcome another 0.25% reduction in rates to 2.00%. US interest rates will remain the highest for a major economy even after a further cut which will provide an element of dollar support. Political factors will also play a key role in the short term with net volatility set to surge, especially as currency values can be driven to a very important extent by sentiment. In this context, persistent attacks on the Federal Reserve by President Trump are likely to have an increasingly corrosive impact onteh US dollar as market sentiment deteriorates. If the Fed eases monetary policy, it will be seen as bowing to political pressure while refusal to cut rates would increase the ferocity of Trump's attacks. The US Administration efforts to push the dollar down are also likely to intensify and any direct intervention would trigger very sharp losses, potentially pushing EUR/USD to near 1.2000. Strong populist gains in this weekend's German state elections could damage the euro initially, although losses for the CDU would tend to galvanise Chancellor Merkel into backing fiscal stimulus. Brexit developments will determine the euro's trajectory. If there is any suggestion of a breakthrough in talks with the UK, the euro will find support, while any no-deal would weaken the single currency. Technically, EUR/USD will need to hold above 1.1050 to neutralise the threat of fresh 2-year lows with strong short-term resistance near 1.1200.

|

| Gold is in favor: demand will remain at its peak Posted: 27 Aug 2019 03:54 AM PDT Most experts agree that the demand for the yellow metal will be high over the next few years. In many respects, factors such as the protracted trade confrontation between China and the United States, a slowdown in global economic growth, general geopolitical instability and unrest in financial markets contributed to this.

According to the analytic company Australia & New Zealand Banking Group (ANZ), the world's leading central banks intend to continue the global purchase of gold. Among such countries, Russia, Turkey, Kazakhstan and China are leading. The volume of purchases of precious metals by these states will exceed 650 tons of gold per year based on the preliminary estimates. According to ANZ, global regulators account for about 10% of global precious metal consumption. Representatives of the World Gold Council emphasize that in the first six months of this year, leading central banks increased their gold reserves by 374.1 tons. ANZ experts are confident that this trend will continue. Not only individual countries, but also most professional investors are actively increasing the share of precious metals in their portfolios. First of all, gold belongs to them. According to experts, the yellow metal accounts for about 40% of investment demand. Against the background of its increase, the cost of precious metals in August reached six-year highs. For several weeks, the growth of "gold" prices was recorded. On Monday, August 26, the price of the yellow metal reached its highest level at $1,551 per 1 troy ounce since April 2013. On Tuesday, the precious metal lost ground, having fallen in price to $1538 per 1 ounce. Gold is currently trading at around $1,530 per ounce. The government of several countries is increasing the share of gold in its reserves due to the high risks of a slowdown in economic growth amid escalation of trade and geopolitical tensions. According to ANZ, some states, acquiring yellow metal, seek to reduce the share of the dollar in their reserves.

|

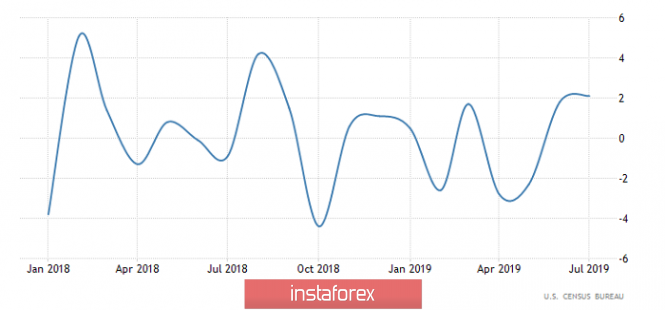

| Trading plan for EUR / USD and GBP / USD pairs on 08/27/2019 Posted: 27 Aug 2019 02:36 AM PDT One can only regret the various media agitation and misinformation that are simply making unthinkable efforts to make everyone believe in the imminent reduction of the Federal Reserve refinancing rate, even justifying the inevitability of this decision in the form of an impending recession, which can be avoided only by reducing the refinancing rate. There is a feeling that they are trying to convince the Federal Reserve System itself. It is as if the owners of these most honest mass media of agitation and misinformation gained loans and now it would be nice for them to reduce the cost of their service. This noble purpose attracted even Donald Trump, who called Jerome Powell the main enemy of America (not the second) after China, and the first. But all their efforts go down the drain. Not only that, in fact, Jerome Powell ordered everyone to relax and have fun as a reduction in the refinancing rate is not yet expected since there are no prerequisites for this banal. After all, the labor market is probably in the best condition in history and if inflation is decreasing, it is not strong but not for long. True, investors took the whole weekend to realize this fact. So even appeal to the impending recession is somehow not with your hands, otherwise you can go for a stupid one. Here the fact is that orders for durable goods showed an increase of as much as 2.1% instead of the expected 1.1%. Well, these same orders indicate future growth in industrial production and retail sales. After all, if the goods are ordered, then they are going to buy them and even make an advance payment. And in order to provide them to the customer, these same goods need to be produced. Well, since orders are growing, then there is simply nothing to wait for a decline in economic activity. And if there is no decline, then recession is nowhere to come from. Here is such universal sadness. Yet, it took investors the whole weekend to realize this fact. It's also a way of appealing to the coming recession, or you can get away with it. The point is that the orders for durables showed growth of as much as 2.1% instead of the expected 1.1%. Well, these same orders indicate the future growth of industrial production and retail sales. After all, if the goods are ordered, then they are going to buy and even make advance payment and in order to provide for the customers, these same goods need to be produced. Well, since orders are growing, then there is simply no reason to wait for a decline in economic activity. But if not reduced, there is nowhere to go but recession -that's the universal sadness. Dynamics of orders for durable goods in the United States: Now, everyone is taking a wait and see attitude since in the next couple of days the macroeconomic calendar is practically empty. Today, you should pay attention only to the data on approved mortgages in the UK. The number of which should increase from 42,653 to 42,800, as well as data from S&P/Case-Shiller on housing prices in the United States. The growth rate of which may remain unchanged. However, both the first and second indicators are not so important and their impact on the markets is extremely limited. In other words, everyone is waiting for Thursday, when the second estimate of the United States GDP in the second quarter will be published. That's when everyone starts whining again about the inevitability of a recession and the need to urgently reduce the Federal Reserve's refinancing rate. After all, even the first assessment showed a slowdown in economic growth. US Gross Domestic Product (GDP) Dynamics: The Euro/Dollar currency pair entered the recovery phase after Friday's jump, returning us to the previously designated 1.1100 accumulation point. It is likely that there will be a temporary amplitude within the level of 1,100, with a deviation of 20points that may remain until the end of the day. The Pound/Dollar currency pair demonstrates a similar mood, returning us to the control point of 1.2200. It is likely to assume that before the breakdown of the level of 1.2200, we will see a temporary fluctuation above this value while aiming at the range of 1.2200/1.2240. |

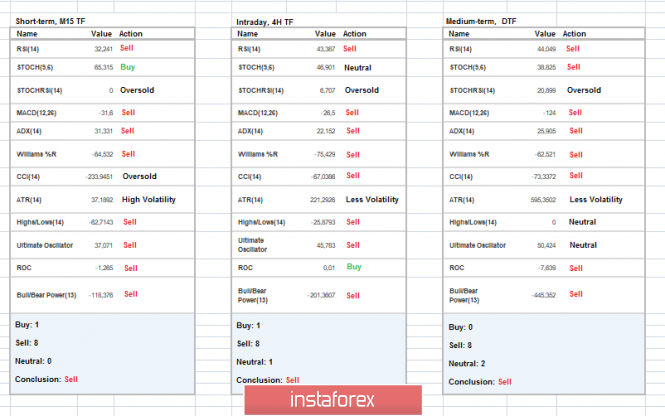

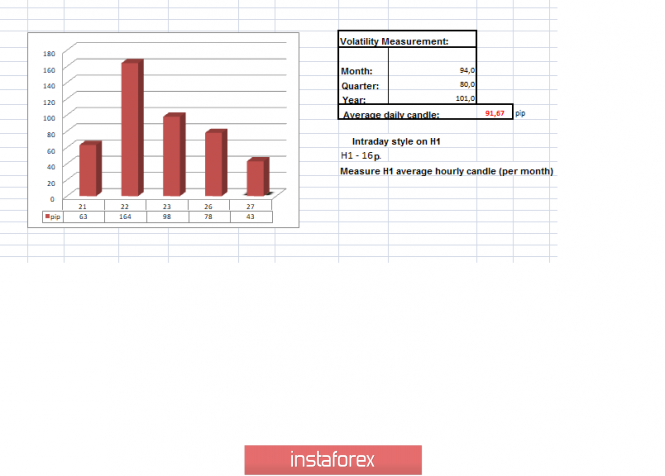

| Trading recommendations for the GBPUSD currency pair - placement of trade orders (August 27) Posted: 27 Aug 2019 01:46 AM PDT Over the past trading day, the pound / dollar currency pair showed a reduced volatility of 78 points, but it is worth paying tribute to the fact that all this fluctuation was directed towards recovery. From the point of view of technical analysis, we see that the rapid upward movement directed to the correction phase reached the coordinate 1.2292, where the quote felt a periodic ceiling in front of itself, and went into the recovery phase, returning us to the previously designated control point 1.2200. If we take a closer look at the measures, we will see that the restoration returned us to the limits of August 23, that is, to the very coordinates where the restoration process was already underway, and the past jumps are local bursts exclusively against the background of the information flow, nothing to do with the general mood they do not have a market. As discussed in the previous review, conservative traders entered the waiting phase again until the quote returned to the limits of accumulation. Speculators, in turn, do not sit still and have already opened short positions in the direction of the level of 1.2200, which turned out to be the right step in terms of restoring quotes. Considering the trading chart in general terms (daily timeframe), we see that the "Correction" beat is still on the market, having about 25% recovery relative to the current beat. The main support point is located within the psychological level of 1.2000 (+/- 20p), restraining the main trend. The news background of the past day contained data on orders for durable goods in the United States, where we have seen growth for the second month in a row, which, of course, is a good sign in terms of the future dynamics of industrial production and retail sales. Relative to the current data, acceleration is up to 2.1%, with a forecast of 1.1%. Whether we like it or not, the positive data for the States supported the dollar in the recovery phase. On the other hand, information background on Monday calmed down in some way after a stormy Friday, and the Fed's head's speech at the Jackson Hole symposium comes to a conclusion. In turn, British Prime Minister Boris Johnson set out to blackmail Europe, saying that in the event of a hard Brexit, Brussels will receive 9 billion pounds of compensation, instead of 39 billion pounds. This, of course, is better than nothing, but Johnson's position of hopelessness is increasingly visible on the world stage. This uncertainty in the actions of the British government is clearly felt in their "skins" by British companies that are already leaving the country in batches. According to the Netherlands Foreign Investment Agency (NFIA), about 100 British companies have already moved to the Netherlands and 325 plan to do so. Information about that investment and business are flowing out of the United Kingdom has been known for more than a month, and the head of the Bank of England, Mark Carney, has repeatedly pointed out this point. Once again, we see signals of an aggravation of the situation in Britain, and the time until day "X" remains less and less. How much support for the pseudo-background is for the pound sterling and whether Mark Carney's forecast of parity will come true. Today, in terms of the economic calendar, we have data on the volume of approved UK mortgage loans, where there is an increase from 42.653K to 42.800K, which may provide temporary support to the pound. This afternoon, S & P / Case-Shiller data on housing prices in the United States, which are projected to remain unchanged, will be released. Further development Analyzing the current trading chart, we see that there is a test price surge in the region of the previously found resistance point, which is most likely, against the background of the next information flow and the return of the British after the weekend, Monday. Traders, in turn, are not eager for hasty action, since in order to assess the upward trend, the quote must go above the local peak on August 23, 1, 2292. It is likely to assume that only the fluctuation is visible within 1.2200 / 1.2260 so far, with a focus on the peak of 1.2292. The quotation can go higher until I'm sure of it, and the information background is still empty to understand the essence of what is happening. In general, there is a very similar maneuver for throwing out weak hands. But in this case, the reverse process of returning the price to 1.2200 should begin in the afternoon. Based on the above information, we derive the following trading recommendations: - We consider buying positions in case of a clear price fixing higher than 1.2300, preferably with the support of the information background. - We consider selling positions in case of price fixing lower than 1.2200, with the prospect of a move to 1.2170-1.2150. Indicator analysis Analyzing a different sector of timeframes (TF), we see that the indicators are quite versatile by themselves. Short-term gaps reflect the current surge in prices, (ascending mood). Intraday, on the contrary, are focused on the recovery phase of quotes, (descending mood). Meanwhile, the medium-term outlook is in the correction phase (ascending mood). Volatility per week / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year. (August 27 was built taking into account the time of publication of the article) The current time volatility is 43 points. It is likely to assume that if the theory of amplitudes is confirmed, the volatility will be clamped within the daily average. At the same time, it's worth a little while to wait for the information background to appear, it will probably help us understand what is happening. Key levels Resistance zones: 1.2350 **; 1.2430; 1.2500; 1.2620; 1.2770 **; 1.2880 (1.2865-1.2880) *; 1.2920 * 1.3000 **; 1.3180 *; 1.3300 Support areas: 1.2150 **; 1,2000; 1.1700; 1.1475 ** * Periodic level ** Range Level *** The article is built on the principle of conducting a transaction, with daily adjustment The material has been provided by InstaForex Company - www.instaforex.com |

| Uncertainty makes euro and pound go sideways in anticipation of clearer signals Posted: 27 Aug 2019 01:07 AM PDT Donald Trump is expanding his markets again. On Monday, the stock exchanges are growing steadily after Trump announced the possibility of introducing a postponement of tariff increases for China. Since China is ready to return to the negotiating table, he added. Nevertheless, it is the states that need the delay because the dollar with high speed loses its main advantage - higher inflation expectations than in the eurozone and, especially, in Japan. We can already see the third wave of falling 5-year bond yields TIPS in 2019, which indicates a growing business confidence that US consumer demand will begin to decline in the very near future. Even before the recession, it's already a hand to fall. Most likely, the dynamics of TIPS bonds is quite expected for the financial authorities, despite public assurances of the strength of the American economy since it indicates that the business does not see prospects for growth in consumer demand and inflation, and therefore it is preparing for reduction. In any case, the Congressional Budget Committee (NWO) reports that higher tariffs increase domestic prices, analyzing the economic consequences of raising tariff rates since January 2018. Thereby, it reduces the purchasing power and increasing the cost of investing in a business and as a result, this leads to a decrease in real US GDP by 0.3% per year. Of course, the NEA rightly notes that reciprocal tariffs from US trading partners reduce US exports, which reduces productivity. As a result, trade barriers lead to both a drop in real production and real household income, which means tax collection will drop. This trend can be traced to the decline in TIPS bond yields, which means it increases the likelihood of two more Fed rate cuts this year and the actual recognition of the approach of the recession. EUR/USD pair The Ifo business climate index fell from 95.8p to 94.3p in August, which was the lowest level since November 2012. The pessimism of company executives is growing, and there are more signs of a recession. The graph speaks for itself and it is difficult to see the positive where it does not exist. For manufacturing companies, the situation looks even worse than the economy as a whole. The last time this level of pessimism was observed in 2009 as trade also went to negative territory, mainly due to wholesale sales. Only the construction sector is more or less stable. On Friday, inflation data will be published in August with neutral expectations but, as rightly noted in Nordea-Bank, Central banks do not understand the nature of inflation. In any case, established monetary policies aimed at achieving the target (usually 2%) fail everywhere. Accordingly, the lower the inflation, the more likely it is that the ECB will present in September the broadest possible easing package. Also on Friday, the data on the base us deflator PCE for July will be released and with a high probability, the direction of the EUR/USD pair will aim in the direction where the difference in inflation expectations will show. While the spread in these expectations is in favor of the dollar, the Euro remains under pressure. However, the rapid decline in the yield of 5-year bonds Tips to a 3-year low indicates that in the US inflation is unlikely to meet expectations. The increase in uncertainty gives the euro a chance for a respite, but in any case, the EUR/USD decline stops at least until Friday. With high probability, the euro will trade in a wide range between 1.1065 and 1.1145. The direction of exit from which will be prompted by Friday data. GBP/USD pair On Friday, the pound updated the local maximum of 1.2270, as we expected. However, the momentum has become noticeably weaker at the moment. The lack of macroeconomic news, except for report on consumer and mortgage lending in July from the Bank of England on Friday, and the market's fatigue from conflicting political statements increase the likelihood of going into the lateral range of 1.2190 - 1.2290. This time, an attempt to update the maximum will most likely be unsuccessful. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

nz

nz

No comments:

Post a Comment