Forex analysis review |

- Control areas AUDUSD 08/06/19

- Control zones EURUSD 08/06/19

- Moving up: the Bitcoin exchange rate is gaining momentum

- Washington and Beijing raise rates in a trade war, market volatility promises to be prohibitive

- GBP/USD. 5th of August. Results of the day. The pound ignores any news except for Brexit related messages

- EUR/USD. 5th of August. Results of the day. Donald Trump is losing the trade war with China. Another president may play it

- EUR/USD. China crossed the Rubicon: the dollar falls amid escalating trade war

- Commodity currencies rush into battle

- GBPUSD and EURUSD: The service sector kept the pound from a new downward trend, while the euro was quite lucky

- China responds to Trump

- USDJPY in bearish trend after exiting long-term triangle pattern

- EURUSD challenges short-term channel resistance

- Technical analysis of Gold for August 5th, 2019

- August 5, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- August 5, 2019 : GBP/USD demonstrates a bullish reversal pattern to be considered around 1.2100.

- BTC 08.05.2019 - Strong upward momentum

- EUR/USD for August 05,2019 - New momentum up on the oscillators

- GBP/USD: plan for the American session on August 5. The attempt of the bears to return to the market was not very successful

- EUR/USD: plan for the American session on August 5. Buyers remain in the market as the euro rose even on weak data on the

- Gold 08.05.2019 - New momentum up and breakout of trading range

- Analysis for EUR / USD and GBP / USD pairs on August 5. Business activity in the US, EU and UK services sector will determine

- USD/CAD: confidently rises to 1.3200, approaching weekly highs

- Going to decline: the yuan collapsed and could reach the bottom

- Bears to push GBP/USD even lower

- GBP/USD finds support near the level of 1.2100, for how long?

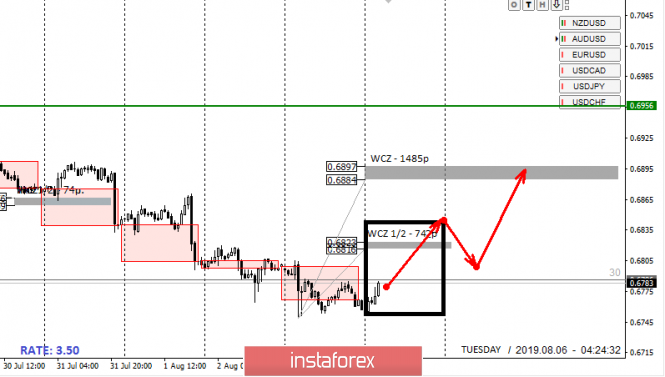

| Posted: 05 Aug 2019 06:50 PM PDT The pair is trading within the medium-term bearish impulse today, therefore, the growth is corrective until the pair absorbs yesterday's movement. If the close of today's trading is below Monday's high, the downward momentum will continue. The probability of updating the weekly low is 70%. Working within the medium-term trend frame always provides an opportunity to search for favorable prices in a prioritized direction, since before the reversal of the momentum, in most cases, there is a false breakout pattern. Changing the direction of trade requires a breakdown of the main resistance of the WCZ 1/2 0.6823-0.6816 and the closure of today's US session above it. In this case, purchases will come to the fore, the goal of which will be the weekly zontrol zone of 0.6897-0.6884. It is important to understand that work in the upward direction remains corrective. Daily CZ - daily control zone. The area formed by important data from the futures market, which change several times a year. Weekly CZ - weekly control zone. The zone formed by important marks of the futures market, which change several times a year. Monthly CZ - monthly control zone. The zone, which is a reflection of the average volatility over the past year. The material has been provided by InstaForex Company - www.instaforex.com |

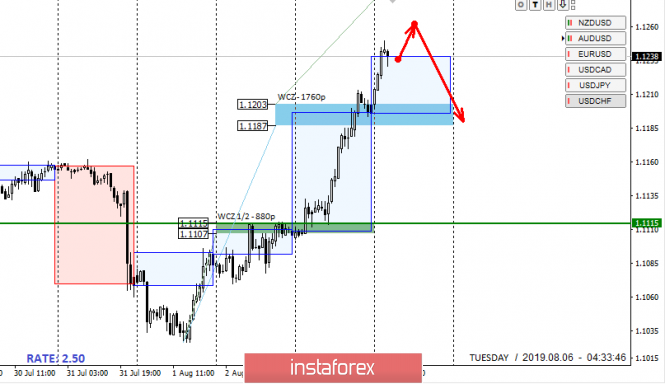

| Posted: 05 Aug 2019 06:50 PM PDT At the beginning of this week, the pair experienced solid growth, which indicates the strength of market buyers. It is important to note that in one day the pair overcame the weekly move. This makes it possible to close all positions for the purchase, since the likelihood of further growth decreased to 30%. Now you need to find a significant level of resistance and track the reaction to it during the test. It is important to understand that stopping growth will not indicate a change in the upward momentum while the pair is trading within the correction range. Purchases from current marks become unprofitable, since the rate is outside the weekly average move, and the monthly control zone of August is within the daily move. This indicates an increase in the likelihood of a stop and the appearance of a strong offer with the formation of a market maker level. Daily CZ - daily control zone. The area formed by important data from the futures market, which change several times a year. Weekly CZ - weekly control zone. The zone formed by important marks of the futures market, which change several times a year. Monthly CZ - monthly control zone. The zone, which is a reflection of the average volatility over the past year. The material has been provided by InstaForex Company - www.instaforex.com |

| Moving up: the Bitcoin exchange rate is gaining momentum Posted: 05 Aug 2019 05:22 PM PDT On Monday, August 5, analysts marked a continuation of Bitcoin activity. The leading crypto asset has shown explosive growth, having risen in price by $600 per day while increasing trading volumes, which may signal the mobilization of bulls. Over the past day, BTC added more than 8%. The number one cryptocurrency is currently trading near the $11,600 mark. Trading volumes have soared 32% over the past two days. After breaking through the upper boundary of the daily trend channel in the range from 9120.00 to 9502.67, Bitcoin's upward movement took the form of a corrective local upward reversal. After the breakthrough of the resistance level, the market restored the upward movement in the short-term trend with the target at 12358.66, analysts say. According to analysts, for a sustainable transition to the Bitcoin rally, it is necessary to gain a foothold above the $11,800 mark, which previously served as the starting point for a powerful correction of the PTS up to $9,300. Analysts believe that the crypto asset was supported by turbulence in the financial markets, in particular in China. As a result, investors actively acquired digital currency, which interacts little with traditional financial markets. At the moment, the cryptocurrency market remains within the upward trend. Bitcoin has proven that there is an unrealized buying potential on the market, which has been actively manifested recently. The material has been provided by InstaForex Company - www.instaforex.com |

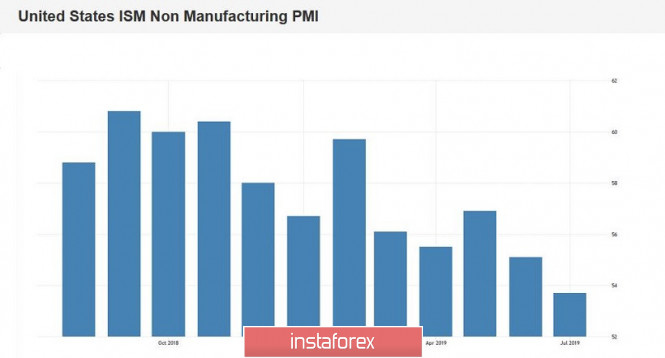

| Washington and Beijing raise rates in a trade war, market volatility promises to be prohibitive Posted: 05 Aug 2019 05:08 PM PDT As soon as markets moved away from the the US central bank's "cold shower", since it made it clear that the decision to lower the interest rate was not the beginning of a cycle of easing monetary policy following the June meeting, US President Donald Trump has then spoiled investors' mood by threatening to introduce additional duties on Chinese imports. China's response was not long in coming. Last weekend, Bloomberg reported that Beijing had ordered its state-owned companies to stop importing agricultural products from the United States. In addition, China has actually begun to devalue its national currency, the rate of which for the first time in 11 years rose above 7 yuan per US dollar. It is noteworthy that this level was unshakable even in the midst of a trade war between the two largest economies in the world last year. The fact that the Chinese authorities let their currency to fall below a key mark suggests that this is a carefully thought-out gambit aimed at mitigating the negative effects of the trade war on the national economy and at the same time preventing the mass exodus of capital from the country. It is also possible that China is signaling to the United States that the conclusion of a trade deal between the countries is unlikely in the near future. According to analysts, despite the fact that it is the White House that is trying to put pressure on Beijing, Donald Trump is in a losing position for a number of points. Thus, the US leader has repeatedly mentioned the need to weaken the greenback, but the latter is now in fact strengthening against the renminbi, which does not add advantages to the United States in a trade war. Also, D. Trump needs a steadily growing stock market in order to count on re-election for a second presidential term, but the last time a strong devaluation of the renminbi shocked almost all world markets. US stock indices are rapidly falling. The S&P 500 index lost about 100 points on Thursday and Friday. It is highly probable that the "turbulence" will last for a rather long time, and we will see something similar to what happened at the end of last year. Recall that back then the collapse of the stock exchanges was so rapid that even the Fed was frightened, which had previously made rather tough statements. Based on the fact that now we are only at the beginning of a powerful market shock, then in the coming weeks, volatility will be prohibitive. The disappointment of investors by the Federal Reserve's decision on monetary policy last week, as well as the aggravation of tension in trade negotiations between the US and China, led to the strengthening of the Japanese currency. The USD/JPY pair significantly approached the low of 2019, which was set on January 3 at 104.85. "This week, economic statistics for China may lead to further weakening of the renminbi. This will ensure that investor demand for the yen will be higher than for the dollar. Accordingly, a further decrease in USD/JPY and testing the psychological mark of 105.00 are potentially possible," said Akira Moroga, a strategist at Aozora Bank. "However, the fall of the USD/JPY pair below 105.00 now seems unlikely. The US economy is not so weak as to justify a more significant weakening of the dollar against the yen," he added. As for the main currency pair, the euro returned to the range of a medium-term consolidation of $1.11-1.14 against the US dollar. The reason for the bears' retreat on EUR/USD was the fact that US employment growth slowed in July. Along with the escalation of trade tensions between Washington and Beijing, this reinforced expectations for the Fed to cut interest rates in September. The disappointing July ISM business activity figures for the US non-manufacturing sector are likely to inspire the EUR/USD bulls to launch new attacks. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 05 Aug 2019 04:52 PM PDT 4-hour timeframe Amplitude of the last 5 days (high-low): 170p - 106p - 116p - 91p - 80p. Average amplitude over the last 5 days: 113p (113p). How much the US-China trade war affects the dollar in pairs with European currencies can be judged using the GBP/USD pair. Unlike the euro/dollar pair, bears did not begin to take profits, as it logically suggests an even greater decline in the pound. Indeed, the most interesting topic for all traders is Brexit, and there is no movement in it, there is no positive news, there is no hope for a favorable outcome. There is only one track along which the train rushes in full steam, and at the end of the track there is a wall with the inscription "hard Brexit". The train has no brakes ... The driver, Boris Johnson, does not even try to find salvation for the locomotive, but, on the contrary, throws even more coal into the furnace. Therefore, there is no reason for the foreign exchange market to stop selling the pound, even despite the escalation of the trade conflict between the United States and China, which could potentially harm the US economy and could force the Fed to cut interest rates in the future. But what does it matter for the pound if the UK can begin to lose gigantic amounts in 3 months? By the way, the pound, according to many analysts, could be cheaper than the dollar as a result of the hard Brexit. Today, the index of business activity in the UK services sector unexpectedly pleased traders, exceeding the forecast value and amounted to 51.4. However, the British currency did not really help. The weak ISM US index of business activity did not help either. In general, a correction for the pair is certainly possible, but has a lower probability of occurrence than the same euro/dollar pair. It will be possible to determine its beginning by overcoming the Kijun-sen line or by Bollinger Bands, which can turn up or to the side (as now). Trading recommendations: The GBP/USD currency pair may start a correction movement. Thus, it is now recommended to wait until the completion of this round and resume selling the pound with a target level of 1.2031. It will be possible to buy the British currency not earlier than consolidating the pair above the critical line, but with extreme caution and in small lots. Ideally, the Bollinger Bands should be directed upwards. The target is 1.2254. In addition to the technical picture, fundamental data and the time of their release should also be taken into account. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 05 Aug 2019 04:40 PM PDT 4-hour timeframe Amplitude of the last 5 days (high-low): 38p - 29p - 102p - 69p - 46p. Average amplitude over the last 5 days: 57p (55p). After today, it is safe to say that the euro bears are sated and are now taking profits in short positions, which leads to the strengthening of the euro/dollar pair. Particularly important news was not available to traders during the day. Indexes of business activity in the services sector and composite in the eurozone were almost neutral. Two out of three similar US indices turned out to be higher than forecasts, but the most significant index of business activity in the ISM services sector turned out to be worse than the expectations of the Forex market. However, at the same time, all three US business activity indexes are confidently staying above 50.0, so there is no talk of a decline at the moment, at most, about a slight slowdown. However, the euro began to grow exactly when trade opened on Monday, August 5, and continuously increased all day. It is this factor that speaks of the technical nature of this movement. Meanwhile, China struck back against Donald Trump. The Chinese government ordered its companies to suspend the purchase of agricultural products in America, and also let the yuan go free float. For the first time in 11 years, the rate went above 7 yuan per dollar. This is also planned, or at least a deliberate step by Beijing to offset the damage from a trade war with the United States. Donald Trump, however, remains to escalate the conflict with China even more, as the parties failed to go along the peaceful path. China frankly expects that a trade war with it will harm Washington itself, and this will be enough to prevent Trump from being re-elected for a second term. And with the new president, perhaps, it will be easier to agree. In this case, what remains with Trump when frankly his plan did not work? It's right to continue to introduce further duties on Chinese imports, increase duties that are already imposed, exert any other pressure on Beijing, impose sanctions and, of course, declare in all media that China "does not want to conclude a trade deal and unfairly treats America. " Trading recommendations: EUR/USD continues to move up. Thus, it is now recommended to buy the euro currency in small lots with a target of 1.1233. A price rebound from the Senkou Span B line or a MACD indicator turn down will indicate a round of correction. It will be possible to sell the euro/dollar pair with the goal of a support level of 1.1035, when bears take the initiative back into their own hands, and the rate consolidates below the critical line. In addition to the technical picture, fundamental data and the time of their release should also be taken into account. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicators window. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. China crossed the Rubicon: the dollar falls amid escalating trade war Posted: 05 Aug 2019 04:21 PM PDT For the first time in 11 years, the Chinese yuan overcame the psychologically important level of 7.00 against the dollar. Over the past years, the USD/CNY pair has come close to this target several times, but only now did the price manage to quickly break a significant mark. Given the People's Bank of China's approach to the exchange rate of the national currency, it can be assumed that the trade war between the United States and China has entered a new phase of confrontation. The yuan has become a weapon in the global trade confrontation, and this fact does not bode well for the global economy. The foreign exchange market reacted accordingly: defensive assets began to be in high demand, while the dollar is actively losing its position in almost all pairs. Events are developing quite rapidly: on Friday the price of USD/CNY fluctuated in its usual range (6.85-6.90), within which the pair has been since May of this year. But today the course has gone up sharply - and not only overcame the target of 7.00, but also consolidated above the indicated level. The US president responded almost immediately to this fact: on his Twitter, he said that China had deliberately devalued its currency to a record low, and there were signs of currency manipulation. Trump warned that this step is a "violation of the rules", and this fact will sooner or later weaken the Chinese economy. In general, the NBK's motives lie on the surface: in light of Trump's recent decisions, the regulator stimulates the export of Chinese products and removes the "heaviness" of the economy's debt burden. This is far from the first time China has resorted to such methods - for example, in August 2015, China's central bank lowered the yuan against the dollar by more than five percent in three days (from 6.209 to 6.447) in order to stimulate reduced exports. It was so unexpected that the indices of Asian and American exchanges fell by 1-2% in one day, responding to such a sharp move by the Chinese regulator. Obviously, in this case we are dealing with countermeasures from Beijing against Donald Trump's decision to introduce additional duties worth $300 billion. In fact, the White House decided to impose additional tariffs on almost all Chinese imports, forcing China to conclude a trade deal with the United States. But as you can see, China decided to take the path of further confrontation: by devaluing the national currency, Beijing also instructed state-owned companies to suspend imports of American agricultural products. According to Bloomberg, state-owned companies of China have already stopped purchasing products from American farms in anticipation of the outcome of trade negotiations. It is worth noting that with this step, the Chinese delivered Trump not only an economic, but also a political blow. In those states of America where agriculture predominates (in particular, Iowa, Illinois, Indiana, the Great Plains region), the electoral position of the incumbent president can noticeably shake. But the devaluation of the Chinese currency will significantly affect the commodity market. Cheap yuan will reduce the purchasing power of Chinese companies. In turn, demand will decrease even more, and this will lead to a reduction in prices. Among the most affected by this scenario will be Australia, Brazil, South Africa and India. Furthermore, this is not an exhaustive list: a decrease in the commodity market will negatively affect the black gold market, the foreign exchange market and the stock market. Again, recall that in August 2015: an unexpected decision by the central bank of China led to a drop in quotations for commodity and steel companies. The imbalance of the global economy and turbulence in the foreign exchange market will again become a decisive factor for the Fed in the context of monetary easing. In this case, domestic economic statistics will fade into the background: even strong GDP figures and rising inflation will remain in the shadow of global shocks. The ISM composite index for the non-productive sphere added fuel to the fire. This indicator was released today in the "red zone", following the ISM manufacturing index. The index reached a three-year low, that is, a mark of 53.7 points. It is noteworthy that this indicator is also declining at an active pace for the second month in a row. Such a fundamental picture exerted strong pressure on the US currency. The dollar index fell to the bottom of 97 points. In addition, the profitability of 10-year-old Treasuries is rapidly decreasing - at the moment the indicator has dropped to 1.775 - the last time it was at this level in October 2016. In turn, the euro-dollar pair shows large-scale correctional growth. Last week, the price was at the bottom of the 10th figure, while today the pair has already tested the 12th price level. At the moment, EUR/USD cannot overcome the resistance level of 1,1201 (Kijun-sen line on the daily chart), but further escalation of the US-China conflict will allow the pair's bulls to move to the next resistance level - that is, to the level of 1.1260 (lower border Kumo clouds on D1). If one of the US Federal Reserve members voting this year mentions the need to lower the interest rate in September, a decline in the greenback will take on an avalanche-like character - in this case, the EUR/USD pair will be able to quickly return to the area of the 13th figure. The material has been provided by InstaForex Company - www.instaforex.com |

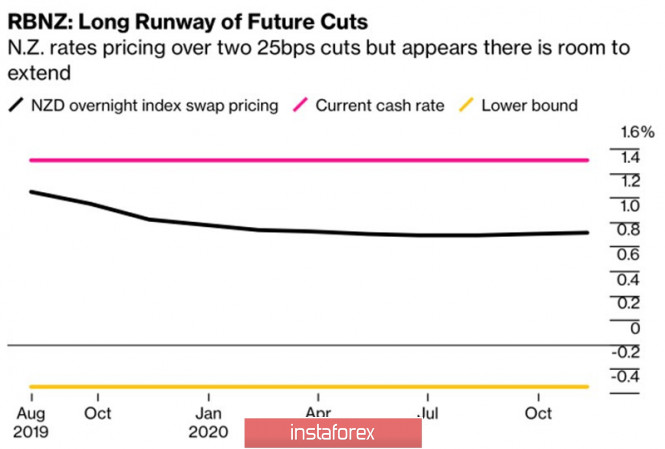

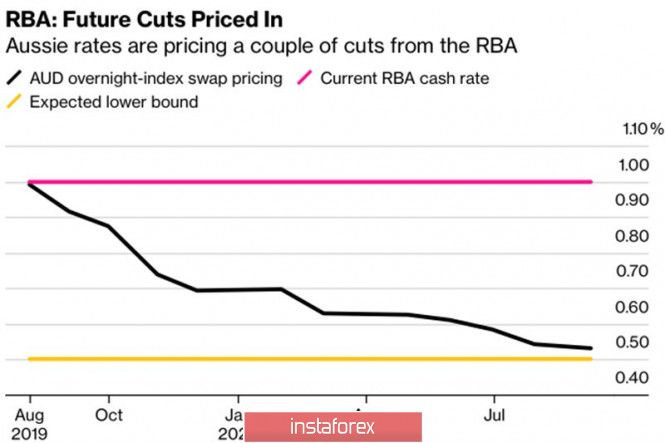

| Commodity currencies rush into battle Posted: 05 Aug 2019 04:06 PM PDT If at the turn of July and August, investor attention was focused on the US dollar and the euro, then the RBA and RBNZ meetings, as well as the release of data on the labor markets of Canada and New Zealand, make markets look at commodity currencies with a bias. The kiwi is of particular interest. According to the indications of interest rate swaps, the Reserve Bank of New Zealand will reduce the cash rate by 25 bp at the August meeting. Another cut will occur a little later in 2019, the next - in April 2020. The bond market, evaluating the prospects of an unconventional monetary policy, believes that the main interest rate may fall to -0.35%. The significant potential of monetary expansion exerts serious pressure on the positions of the bulls in NZD/USD. Dynamics of expected RBNZ interest rates According to Bloomberg Economics, New Zealand is the most dangerous developed country in the world in terms of potential correction of property prices. The destabilization of the financial system, the trade wars and the associated slowdown in economic growth - the main trading partner of Wellington in the face of Beijing, the slowdown in inflation and GDP, and the RBNZ's monetary expansion cycle make fans of the New Zealand dollar very vulnerable. The situation is exacerbated by falling milk prices by 11.7% from May to July, which is a key component of New Zealand exports. The kiwi is not able to take advantage of the support of carry trade, since the rates of the island state's debt market are lower than the US, which forces players by the difference to seek bliss in developing countries. Deprived of the support of its old trump cards, the kiwi drifts lower, and the release of data on the New Zealand's labor market and the RBNZ meeting run the risk of rocking the boat in one direction or another. According to forecasts of Bloomberg analysts, the RBNZ will lower the cash rate from 1.5% to 1.25%, while employment will increase from -0.2% to +0.3% from the previous quarter. The situation in Australia does not look any better: the RBA does not intend to touch the cash rate in August, but the Australian central bank has already reduced it twice in 2019. If you add Philip Lowe's dovish rhetoric, it becomes clear that the slowest in the last 27 years, the growth of Chinese GDP has not bypassed either Wellington or Canberra. In this regard, a drop in the NZD/USD and AUD/USD quotes in response to Donald Trump's introduction of additional duties worth $300 billion to China seems quite appropriate. RBA interest rate forecast Unlike its New Zealand and Australian namesakes, the Canadian dollar continues to attract interest. It competes with the Japanese yen for the title of best performer of G10 and has strengthened since the beginning of the year by more than 3%. Further dynamics of the USD/CAD pair will depend on the release of its labor market data. Technically, a "Shark" pattern is forming on the daily NZD/USD chart. A rebound from resistance levels by 23.6%, 38.2% and 50% of the CD wave will lead to the transformation of the model into 5-0. On the contrary, the inability of bulls to hold quotes above 0.65 will be the first sign of their weakness and will create the prerequisites for continuing the downward trend to 113% of the CD wave. The material has been provided by InstaForex Company - www.instaforex.com |

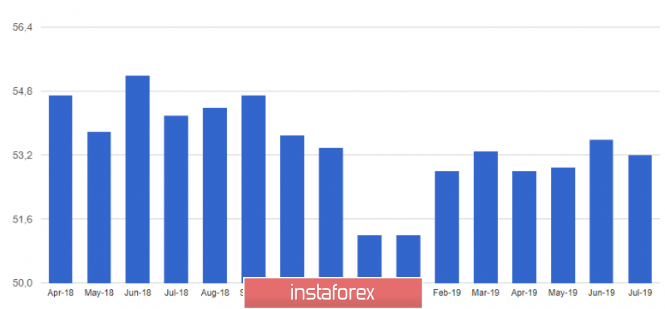

| Posted: 05 Aug 2019 03:53 PM PDT Eurozone data that was released in the first half of the day, although indicated a decrease in activity in the service sector, did not affect purchases of the European currency, which continued after Friday's demand. However, despite the fact that the bulls have already managed to block the entire fall of EURUSD, which, surprisingly, was formed last week after the Federal Reserve lowered interest rates, it is still too early to speak about the formation of a more protracted upward trend. The situation with Brexit and weak economic data on the eurozone are likely to force the European Central Bank to change its monetary policy this September and announce the resumption of the asset repurchase program, which will put pressure on risky assets in the future. If the manufacturing sector has long slipped down, the service sector continues to stay above 50 points, but this, of course, is not enough for the European regulator to change its views on the future prospects of economic growth. According to the data, the PMI procurement managers index for the Italian services sector rose to 51.7 points in July this year, when in June it was at 50.5 points. Italy is perhaps the only country where activity in the service sector continued to grow. Economists had expected the index to be 50.6 points. The PMI procurement managers index for the French services sector fell to 52.6 points in July, when it was 52.9 points in June, and was forecasted at 52.2 points. In Germany, a similar index also fell to 54.5 points in July against 55.8 points in June. Economists had expected the index at 55.4 points. It can be seen that the slowdown in overall economic activity affects the services sector, which in the summer period always shows more powerful growth. So, the general index of PMI procurement managers for the eurozone services sector fell to 53.2 points in July against 53.6 points in June. The index was projected at 53.3. The total composite eurozone PMI, which includes the manufacturing and services sectors, fell to 51.5 points in July against the forecast of 51.5 points. Let me remind you that this index was at the level of 52.2 points in June. As for the technical picture of the EURUSD pair, further growth will be limited by the large resistance of 1.1185, which I noticed in the morning. After testing this range, buyers of risky assets will obviously retreat from the market, which will lead to a downward correction to the support area of 1.1110, from which it will be possible to build a new lower boundary for the current upward channel, which will indicate the formation of a new trend. GBPUSD The British pound continues to stagnate in one place, and data on the UK services sector once again came to the aid of buyers, which did not make it possible for a major bearish trend to resume and to break through the low of the year in the area of 1.2080. According to the data, the index of purchasing managers for the UK services sector rose to 51.4 points in June this year from 50.2 points in June. Economists had expected the index to reach 50.2 points in July. However, given the low performance in the manufacturing sector and the situation with Brexit, so far we can only say that the Bank of England manages to avoid a recession in the economy. But without a real change in the monetary policy course, which many world central banks are now resorting to, it will be extremely difficult to influence the current situation. As for the technical picture of the GBPUSD pair, bulls still have problems with resistance 1.2165, only a breakthrough of which will be able to reach a high of 1.2250. On the other hand, any negative Brexit news will return the pound to a steep downward peak again, and a break of support of 1.2080 will easily provide this. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 05 Aug 2019 03:45 PM PDT Late last week, Trump announced the introduction of new duties against China, a 10% duty on new $300 billion worth of goods from China. The reason is China's lack of concessions in trade negotiations. China responded on Monday August 5: the yuan fell below 7 per dollar for the first time since 2008. China has banned state-owned companies from importing grain from the United States. The material has been provided by InstaForex Company - www.instaforex.com |

| USDJPY in bearish trend after exiting long-term triangle pattern Posted: 05 Aug 2019 09:49 AM PDT USDJPY is trading at 106. In previous posts we noted the importance of 108 as the break below it has given us a bearish signal when price exited the long-term triangle pattern.

USDJPY has broken below the triangle pattern and back tested the break out area and the lower triangle boundary at 109. The rejection was a bearish signal. Price not only got rejected at the lower triangle boundary from below but also got rejected at the weekly Ichimoku cloud. This double rejection is another bearish sign. Trend is bearish and we expect price to continue lower towards 104 and lower. As long as price is below 108 trend will remain bearish. The material has been provided by InstaForex Company - www.instaforex.com |

| EURUSD challenges short-term channel resistance Posted: 05 Aug 2019 09:44 AM PDT EURUSD is challenging the upper boundary of the short-term bearish channel. Recapturing 1.12-1.1210 could lead to a bigger bounce towards 1.13.

Red line - lower wedge boundary Blue lines -bearish channel EURUSD is in bearish trend as price is still inside the blue bearish channel. The longer-term trend remains bearish as price is still inside the long-term downward sloping wedge pattern. Price is now challenging resistance at 1.12. A break above this resistance could push price towards the upper wedge boundary near 1.13. As we said in previous posts the bullish RSI divergence is an important warning for bears. Each time we reach the lower wedge boundary the chances of a bounce increase as long as the bullish divergence remains. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of Gold for August 5th, 2019 Posted: 05 Aug 2019 09:36 AM PDT Gold price is making new higher highs above $1,450. It is important for bulls to hold above the $1,425-$1,440 area in order for the up trend to continue towards $1,500-$1,525.

Red rectangle - major support area Gold price remains in an up trend making new higher highs. The RSI is still lower on daily basis relative the last peak. The bearish divergence is just a warning and not a reversal signal. If Gold bulls manage to hold above $1,425-$1,440 we could then see a new RSI higher high that will maintain this upward momentum towards $1,500. Key support remain at $1,400 area. However breaking below $1,440-$1,425 area will increase the chances of breaking below $1,400. Bulls should be very cautious at current levels. A pull back is highly probable. Bears should be patient as we have no reversal signal yet. The material has been provided by InstaForex Company - www.instaforex.com |

| August 5, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 05 Aug 2019 09:31 AM PDT

Back in June 24, the EURUSD looked overbought around 1.1400 facing a confluence of supply levels. Thus, a bearish movement was initiated towards 1.1275 followed by a deeper bearish decline towards 1.1235 (the lower limit of the previous bullish channel) which failed to provide enough bullish support for the EUR/USD pair. In the period between 8 - 22 July, sideway consolidation range was established between 1.1200 - 1.1275 until a triple-top reversal pattern was demonstrated around the upper limit. Shortly after, evident bearish momentum (bearish engulfing H4 candlestick) could bring the EURUSD back below 1.1235. Early bearish breakdown below 1.1175 facilitated further bearish decline towards 1.1115 (Previous Weekly Low) where temporary bullish rejection was recently demonstrated on July 25. That's why, Intraday bullish pullback was demonstrated towards 1.1175-1.1200 where a valid SELL entry was suggested in a previous article. Earlier last week, bearish persistence below 1.1115 allowed further bearish decline towards 1.1025 where significant signs of bullish recovery were demonstrated. Risky traders were advised to watch for bullish persistence above 1.1050 as a bullish signal for Intraday BUY entry with initial bullish targets projected towards 1.1115 then 1.1175. It's already running in profits. S/L should be advanced to 1.1140 to secure more profits and let the remaining portion open. On the other hand, the current price zone of 1.1175-1.1200 (a cluster of previous bottoms) stands as a prominent SUPPLY zone where signs of bearish rejection and a possible SELL entry should be considered. Trade recommendations : Intraday traders can have a short-term SELL entry anywhere around the current price levels (1.1200). S/L should be tight (above 1.1240). T/P level to be located around 1.1125-1.1115. Conservative traders should wait for a bearish movement towards 1.1125-1.1115 for a valid BUY entry. S/L should be placed just below 1.1080 while initial T/P levels should be located around 1.1160 and 1.1200. The material has been provided by InstaForex Company - www.instaforex.com |

| August 5, 2019 : GBP/USD demonstrates a bullish reversal pattern to be considered around 1.2100. Posted: 05 Aug 2019 08:03 AM PDT  Since May 17, the previous downside movement within the depicted bearish channel came to a pause allowing the recent sideway consolidation range to be established between 1.2750 - 1.2550. On July 5, a bearish range breakout was demonstrated below 1.2550 (the lower limit of the depicted consolidation range). Hence, quick bearish decline was demonstrated towards the price zone of 1.2430-1.2385 (where the lower limit of the movement channel came to meet the GBPUSD pair). On July 18, a recent bullish movement was initiated towards the backside of the broken consolidation range (1.2550) where another valid SELL entry was offered few weeks ago. Moreover, Bearish breakdown below 1.2350 facilitated further bearish decline towards 1.2320, 1.2270 and 1.2125 which correspond to significant key-levels on the Weekly chart. The current price levels are quite risky/low for having new SELL entries. That's why, Previous SELLERS were advised to have their profits gathered. Recently, weak signs of bullish recovery are being demonstrated around 1.2100. This may push the GBPUSD to retrace towards 1.2260 then 1.2320 if sufficient bullish momentum is maintained. On the other hand, The price zone of 1.2320 - 1.2350 (backside of the broken channel) stands as a prominent SUPPLY zone to be watched for new SELL positions if the current bullish pullback pursues towards it. Trade Recommendations: Intraday traders are advised to look for early bullish breakout above 1.2230 for a counter-trend BUY entry. Conservative traders should wait for the current bullish pullback to pursue towards 1.2320 - 1.2350 for new SELL entries. S/L should be placed above 1.2430. Initial T/P level to be placed around 1.2279 and 1.2130. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC 08.05.2019 - Strong upward momentum Posted: 05 Aug 2019 06:06 AM PDT Industry news: Iran's government is close to passing a bill that finalizes regulation for cryptocurrencies. As reported by local news source PressTV, the country's cabinet ratified the bill on Sunday, approving legislation that will formally create a new industry of cryptocurrency mining, as was expected. Mining will be allowed inside Iran as long as participant adhere to conditions listed in the bill, including obtaining industry ministry approval. Mining centres must also not be sited within a 30-kilometer (approximately 19-mile) range of all towns except the capital Tehran and major city of Esfahan where tougher restrictions will be applied, the report says. Daily view:

Based on the daily time-frame, I found that the important resistance level at the price of $11.000 is broken and that there is the strong bullish momentum. There is a chance for more upside and potential test of $12.800-$13.000. Important levels to watch based on daily view: Resistance levels: $12.800 $13.000 Support levels: $11.000 $10.800 4H time-frame view:

Based on the 4H time-frame, I found new momentum up on the MACD oscillator, which is sign of the underlying bullish pressure. I also found consistency in the price action towards the level of $12.000. My advice is to watch only for buying positions on the dips due to very strong upward momentum. Trading recommendation: Watch for buying opportunities with the target at $12.840 The material has been provided by InstaForex Company - www.instaforex.com |

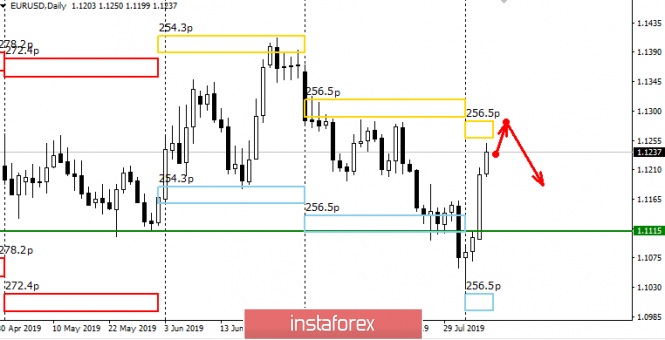

| EUR/USD for August 05,2019 - New momentum up on the oscillators Posted: 05 Aug 2019 05:45 AM PDT EUR did trade upwards, exactly what I expected last week. My upward targets ser met at the price of 1.1135-1.1150. Anyway, there is a strong momentum up and bullish divergence on different oscillator, which is sign for potential more upside to come. Technical picture: Daily view:

Based on the daily time-frame, I found that there was a fake breakout of the 2-year low 1.1040 and strong reaction from buyers, which is sign of aggressive activity. EUR did back into the 20 EMA and there should be critical decision point. Important resistance is set at the price of 1.1200 and if you see potential break of resistance, EUR may even trade higher into 1.1280 areas. Both MACD and Stochastic oscillators are showing bullish divergence, which adds more strength on the EUR. 4H time-frame view:

Based on the 4H time-frame, I found new momentum up on the MACD oscillator, which is sign of the underlying bullish pressure. EUR is testing the upper Bollinger band and in case of the potential close of the candle above the upper band, it will represent more upside continuation. Watch for breakout of the 1.1200 to confirm further upside. Trading recommendation: Pay attention on the 1.1200 level and watch for potential breakout to confirm further upward continuation. Breakout of the 1.1200 level may lead us to 1.1280. The material has been provided by InstaForex Company - www.instaforex.com |

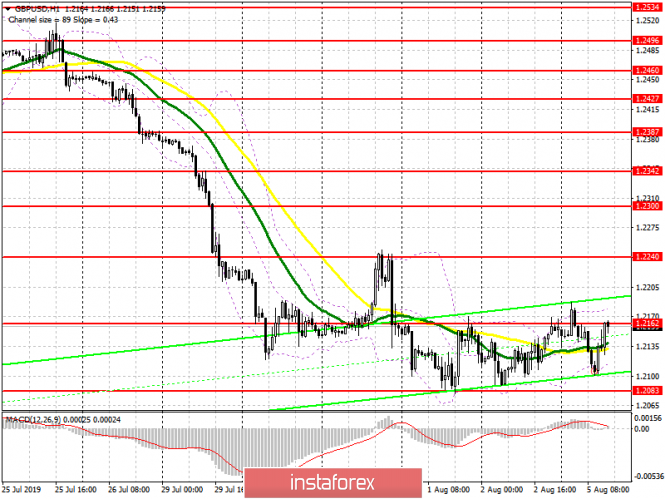

| Posted: 05 Aug 2019 05:43 AM PDT To open long positions on GBP/USD, you need: Buyers of the pound failed to hold the resistance of 1.2162 in the morning, which led to a small movement down to the support area of 1.2083, which was not updated. This suggests that the bulls simply decided to take advantage of lower prices and returned to the market, not letting the pair get to very important support at this year's low. At the moment, given that important reports on the UK are not coming out today, but the ISM data for the non-manufacturing sector of the United States are expected, the bulls will re-test and break the important resistance of 1.2162, which will open a real opportunity to update the maximum of 1.2240, where I recommend fixing the profit. In the scenario of further decline of GBP/USD, it is best to return to long positions if a false breakout is formed in the support area of 1.2083, or already on the rebound from the new lows in the area of 1.2040 and 1.1985. To open short positions on GBP/USD, you need: Sellers made an attempt today to reduce the support test of 1.2083, but they did not manage to reach it. As noted in the morning forecast, only its breakthrough will strengthen the bearish trend and lead to an update of the lows of 1.2040 and 1.1985, where I recommend taking the profit. However, we should not forget that the data on the US service sector may be much worse than the forecasts, which will force to fix the profit in the US dollar, and this will lead to an upward correction in GBP/USD and to a breakthrough in the resistance of 1.2162. In this scenario, it is best to count on short positions after the test of the maximum of 1.2240, which was formed at the beginning of the last week. Indicator signals: Moving Averages Trading is conducted in the area of 30 and 50 moving averages, which indicates the lateral nature of the market. Bollinger Bands The break of the upper limit of the indicator in the area of 1.2175 may lead to a larger upward correction in the British pound.

Description of indicators

|

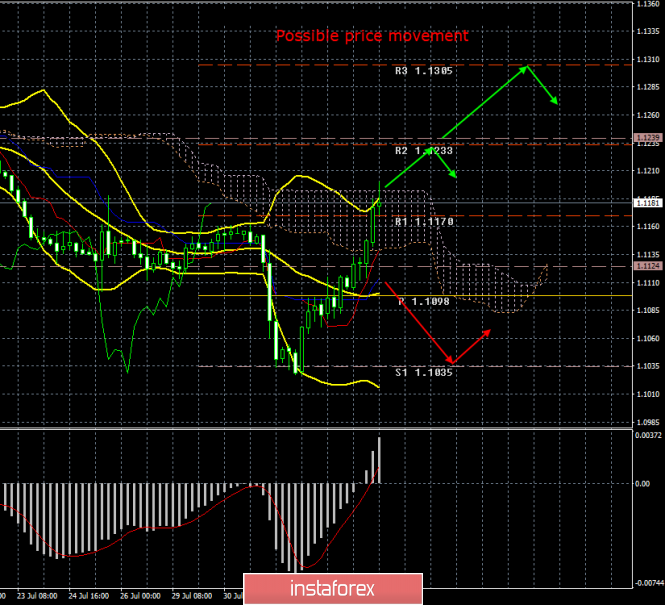

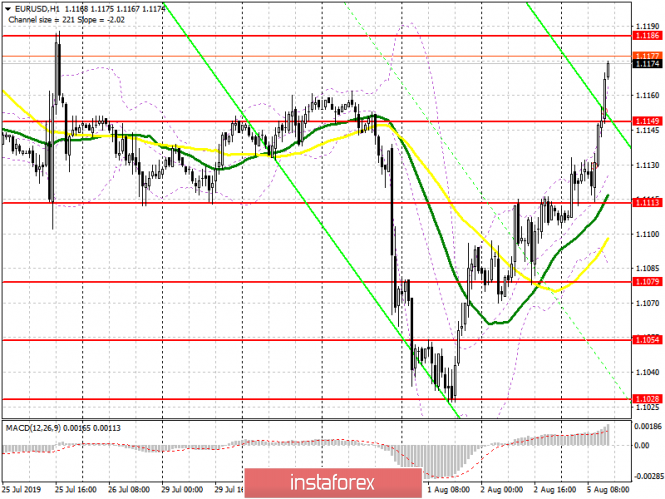

| Posted: 05 Aug 2019 05:43 AM PDT To open long positions on EURUSD, you need: The growth of the European currency continued as expected. I pointed this out in my morning forecast. Even weak reports on the decline in activity in the service sector in Germany and the eurozone failed to put serious pressure on the pair, which indicates the presence of a major player in the market. Now, buyers are seeking the resistance of 1.1186, where today I recommend taking the profit. However, in the scenario of weak data on the ISM index for the non-manufacturing sector in the US, the growth of EUR/USD may continue, which will lead to an update of the maximum of 1.1218. The main task of the bulls for the second half of the day will also be to hold the level of 1.149, the test of which can occur in the case of a good report on the US service sector. However, it is best to open long positions from this level when forming a false breakout. To open short positions on EURUSD, you need: Bears failed to cope and retreated after breaking the resistance level of 1.1152, which led to the demolition of a number of stop orders and further upward trend of the euro, even against the backdrop of weak reports on activity in the service sector of the eurozone. At the moment, the main focus of the sellers will be on holding the resistance level of 1.1186, to which the EUR/USD pair can reach after the ISM report for the non-manufacturing sector of the United States. If the data is better than economists' forecasts, sellers of the euro will try to return to the support level of 1.1149, as well as to gain a foothold below this range, which will be a clear signal for the "collapse" of the upward correction in the short term. With the growth of the euro above the resistance of 1.1186 in the second half of the day, you can open short positions immediately on the rebound from the maximum of 1.1218. Indicator signals: Moving Averages Trading is above 30 and 50 moving averages, which indicates the continuation of the upward correction. Bollinger Bands In the case of a downward movement, support will be provided by the average border of the indicator to the area of 1.1125.

Description of indicators

|

| Gold 08.05.2019 - New momentum up and breakout of trading range Posted: 05 Aug 2019 05:30 AM PDT Gold did trade upwards, exactly what I expected last week. There is a strong new upward momentum and you should watch only for buying opportunities on the dips. More upside is expected. Technical picture: Weekly view:

Based on the weekly time-frame, I found that there is a upward breakout of 6-week balance trading range, which is sign of the new money buying and potential more upside. Based on the weekly time-frame, I found important resistance levels, which will serve us as profit targets. These levels are set at the price of $1.489 and $1.520. 4H time-frame view:

Based on the 4H time-frame, I found broken Ascending triangle in the background and new momentum UP on the MACD oscillator, which is clear sign of the underlying strength on the Gold and potential more upside. Trading recommendation: Watch for buying opportunities on the dips with the targets at $1.489 and $1.520. The material has been provided by InstaForex Company - www.instaforex.com |

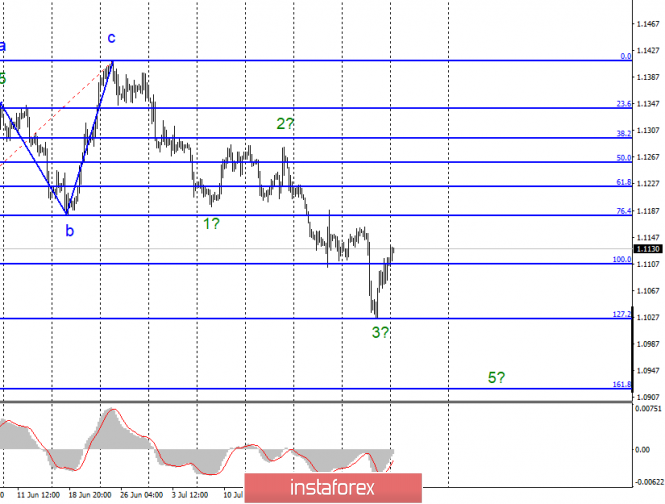

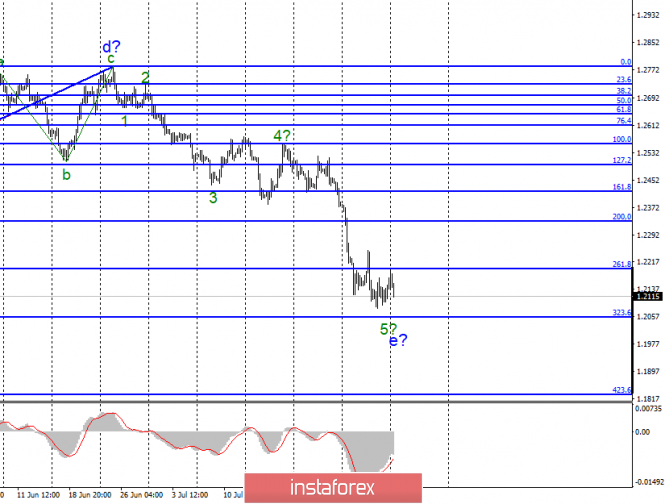

| Posted: 05 Aug 2019 04:53 AM PDT EUR / USD pair On Friday, August 2, the EUR/USD pair ended with an increase of 20 basis points. Thus, the instrument is presumably at the stage of building an internal correctional wave in the composition of the future first wave of a new downward trend. On Friday, the news from Europe about retail sales slightly pleased the euro/dollar bulls. However, in the context of the already announced cut in the ECB rate, this news does not add too much optimism to the traders. The foreign exchange market is still headed downward, which is confirmed by the current currency movement. Trump's message on Twitter about the introduction of new duties against China is interesting, but it must be admitted that the stock market is responding to messages of a similar nature. Currency traders are more interested in economic reports. If the indicators of the state of the US economy will seriously fall as a result of Donald Trump's actions in the international arena, this may lead first to new declines in the dollar and to a new easing of the Fed's monetary policy in the future, which will entail new declines in the US currency. Today, I recommend paying attention in Europe to the index of business activity in the services sector, which since February 2019 feels not bad in principle (being between the values of 52 and 54) and not showing downward dynamics. Purchase targets: 1.1412 - 0.0% Fibonacci Sales targets: 1.1025 - 127.2% Fibonacci 1.0920 - 161.8% Fibonacci General conclusions and trading recommendations: The euro/dollar pair continues to build a downtrend trend. Thus, I recommend selling the pair with targets near the 1.1025 and 1.0920 marks, which equates to 127.2% and 161.8% Fibonacci, according to a new MACD downward signal on the construction of wave 5. GBP / USD pair On August 2, the GBP / USD pair gained about 30 basis points, but in total, it could not go far from the lows reached earlier, which suggests further construction of waves 5 and e. If this is true, then the MACD signal will point down to the new sales of pound pair from the dollar bears. Unfortunately, the news background for the instrument remains a failure, which does not give any reason for markets to buy a pound. The UK rushes at full speed to meet Brexit without an agreement and Boris Johnson is now more busy putting in place conditions for the European Union, trying to force him to make new negotiations on the deal. Since there is no progress so far, there's no hope for a mild Brexit with the agreement. Today, I draw the attention of traders to the index of business activity in the US service sector, which is about 52.2 and experts say that this will not change in July. However, the British business activity in the service sector is in a weak state at 50.2. True, no change for the better or for the worse is expected but this does not mean that they will not. Sales targets: 1.2056 - 323.6% Fibonacci 1.1830 - 423.6% Fibonacci Purchase targets: 1.2783 - 0.0% Fibonacci General conclusions and trading recommendations: The wave pattern of the pound-dollar tool suggests the continuation of the construction of a downward trend segment. Thus, I recommend selling the pair for each MACD down signal with targets located near the estimated mark of 1.2056 and in the case of a successful attempt to break through with targets located at about 1.1830, which corresponds to 423.6% Fibonacci. The material has been provided by InstaForex Company - www.instaforex.com |

| USD/CAD: confidently rises to 1.3200, approaching weekly highs Posted: 05 Aug 2019 04:35 AM PDT The fall in oil prices undermined the loonie's reputation and helped the pair to recover. At the same time, the continuing corrective fall in the dollar can hold back any strong upward movement. Perhaps a strong report on the state of the American ISM, an index of business activity in the non-manufacturing sphere, will become a necessary impetus. The USD/CAD pair first broke through the level of 1.3200 and went further down, but soon bounced back. It is trading within six-week highs. At the beginning of the week, the pair managed to restore some positive dynamics, which was supported by a rebound in oil prices, which, as a rule, undermines the demand for commodity currencies. Despite the aggravation of geopolitical tensions in the Middle East, fears that the trade war between the United States and China could hit the global economy hard has raised concerns about rising oil demand. Recall that oil prices fell by 8%, which was the biggest daily drop in the last four years after the unexpected statement by US President Donald Trump to introduce additional tariffs on Chinese imports since September 1. Meanwhile, renewed concerns about a full-scale trade war between the two largest economies in the world overshadowed the effect of the Fed rate cut and caused a new round of free-fall in US Treasury bond yields, which contributed to the rise in the dollar. |

| Going to decline: the yuan collapsed and could reach the bottom Posted: 05 Aug 2019 04:34 AM PDT On Monday, August 5, the Chinese national currency has updated at least since 2008. Beijing responded with a devaluation of the yuan to Washington's actions that provoked an escalation of the protracted trade war. Recall that on the first day of August, US President Donald Trump caused a shock in financial markets with the promise to introduce 10% tariffs on the remaining $ 300 billion of Chinese imports. It is expected that this decision will come into force on September 1, 2019. At the same time, the American leader does not rule out raising tariffs above 25% in the future. Experts believe that in this way, the head of the White House violates the previous agreement on ending the escalation of the trade conflict reached at the G20 summit. The devaluation of the national Chinese currency was a response to Washington's rhetoric of tightening as the yuan fell to 7.0240 for $1 for the first time since May 2008. Sinking below 7 could be critical for the Chinese currency, analysts say. The People's Bank of China (NBK) set the midpoint for the CNY = PBOC daily trading range at 6.9225 for 1 US dollar. This is the lowest figure since December 2018, experts emphasized. The escalation of trade tensions has raised concerns about the global financial market as to how much China will allow the yuan to weaken. The caution of investors are also caused by the formation of a negative external background at the beginning of a new week. The PRC indices and oil quotes are traded in the red during the Asian session, continuing to regain the deteriorating trade relations between Beijing and Washington. Market participants expect new tariffs for Chinese goods to be introduced, which may provoke a response from the Celestial Empire. Prolonged trade conflict directly affects the rate of economic growth and it will remain a key topic in the near term. Brent crude oil is trading at $61 a barrel and this week may drop to $60, analysts say. Despite the significant reduction in stocks and the tense situation in the Persian Gulf, commodity traders may increase sales because of the threat to demand from China against the background of the trade conflict, as well as because of Iran's activity in the oil market. Not too positive current trends may continue in the near future that makes it difficult for investors to remain optimistic at the present situation. The material has been provided by InstaForex Company - www.instaforex.com |

| Bears to push GBP/USD even lower Posted: 05 Aug 2019 04:26 AM PDT

The pair has been consolidating since a pullback from 2/8 Murrey Math Level happened last week. Meanwhile, the Daily Super Trend Line is acting as resistance, which brings more evidence for the bearish outlook. Additionally, as long as price remains below 4/8 MM Level, the opportunity to have the pair lower will be still on the table. The price fixating under 3/8 MM Level will be a sign that bears are coming back into the market. Previously, the pair formed a couple of pullback from +1/8 MM Level, which led to the current decline. The Super Trend Lines formed a 'Bearish Cross' little later on. That's why the ongoing consolidation might be just a local stop during the rally. However, we should wait for the market returning under Super Trend Lines as confirmation that another leg of the bearish rally is taking place. 1/8 MM Level could act as a support, so it's possible to have a local correction from this line. The bottom line is that GBP/USD remains bearish and there's no any bullish sign so far. Nevertheless, we should wait for a break and the following price fixation under 3/8 MM Level and the one-hour Super Trend Line as essential confirmation for the bearish scenario. The main intraday target is 0/8 MM Level, which could be a departure point for a larger upward correction. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD finds support near the level of 1.2100, for how long? Posted: 05 Aug 2019 04:00 AM PDT The continuing slowdown in US bond yields supported the dollar and helped limit its decline. Optimistic indicators of business activity in the UK services sector helped the pound, but fears of a hard Brexit will continue to restrain any significant growth. The GBP/USD pair quickly turned around and rose to the level of 1.2100 dollars on optimistic macroeconomic data from the UK. The subsequent rollback of the dollar was due to the fall in the yield of US Treasury bonds in the conditions of global flight to a safe haven, this helped the pair to overcome the intraday fall. The British pound received an additional boost at the beginning of the week after the release of a stronger than expected indicator of the British PMI in the service sector, which in July rose to a nine-month high of 51.4 points. However, Brexit's expectations without a deal could keep the bulls on the defensive and stop any serious upswing, at least for the time being. It is worth recalling the words of the senior adviser to British Prime Minister Boris Johnson, Dominic Cummings, that lawmakers can stop the hard Brexit, announcing a vote of no confidence, but it could not ease the concern. The market expects the UK to eventually withdraw from the EU on October 31, and these expectations will continue to negatively affect market sentiment around the sterling. In addition to the news related to Brexit, traders should pay attention to the publication of the non-production index of business activity of ISM in the US, which will definitely affect the dynamics of the dollar. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment