Forex analysis review |

- Control zones USDCHF 08/07/19

- Control zones USDCAD 08/07/19

- #USDX vs GBP / USD h4 vs EUR / USD h4. Comprehensive analysis of movement options from August 07, 2019 APLs & ZUP analysis

- The greenback receives a "black mark" from Trump

- Oil under pressure: the market is balancing near $60

- GBP/USD. August 6th. Results of the day. The European Union has come to the conclusion that Johnson has no other plan than

- EUR/USD. August 6th. Results of the day. Traders are tired of Donald Trump's angry accusations

- EUR/USD. Heavy Monday is behind us, but the dollar remains under heavy pressure

- AUDUSD weekly analysis

- EURUSD stuck at the 1.12 resistance

- Gold gives short-term warning signs for bulls

- Fractal analysis of the main currency pairs as of August 6

- August 6, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- August 6, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- BTC 08.06.2019 - Ovebought conditon, porential downward movement

- GBP/USD 08.06.2019 - Potential rally is on the way

- Euro rises, dollar falls

- EURUSD: One increase in orders in the manufacturing sector in Germany is clearly not enough. Fed officials continue to hint

- GBP/USD: plan for the American session on August 6. Bulls are trying to return to the market, but it needs a serious reason

- EUR/USD: plan for the American session on August 6. The euro will remain under pressure

- Simplified wave analysis and forecast for GBP/USD and USD/CHF on August 6

- EURUSD: Trade conflict and fears of another US rate cut put pressure on US dollar

- Gold 08.06.2019 - Multi-timeframe analysis

- Technical analysis of AUD/USD for August 06, 2019

- Bullish reverse happened in EUR/USD

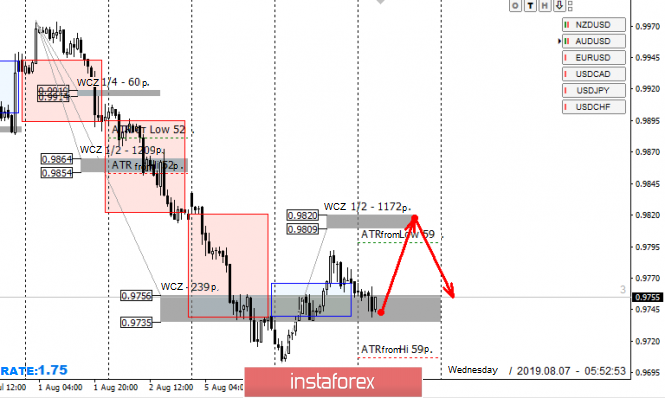

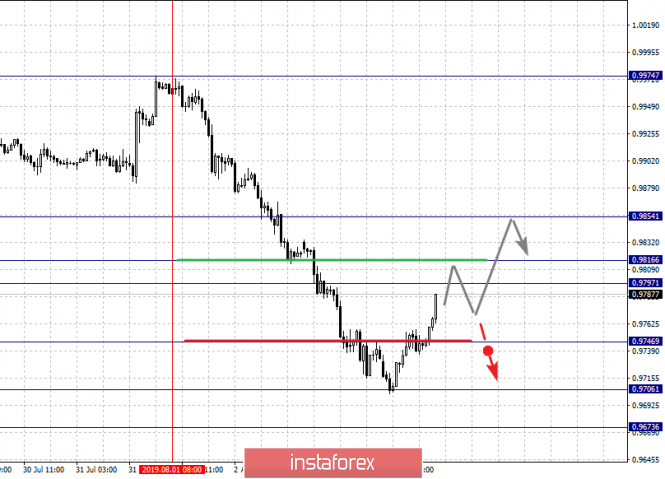

| Posted: 06 Aug 2019 08:02 PM PDT Yesterday's growth became natural, as the pair tested the monthly short-term of August. Further growth is a priority, and it is better to refuse sales. Previously opened sales can be completely closed, since the probability of a strong further decline is 30%. The zone of the weekly average move was also tested earlier this week. The first upward target is the Weekly Control Zone 1/2 level of 0.9820-0.9809. Testing this zone will partially close yesterday's purchases, and the rest will be transferred to breakeven. The reversal model will be developed if the closure of today's US session will occur above the level of 0.9820. This will indicate an increase in the probability of further growth to 70%. The search for the pattern for sale with the testing of WCZ 1/2 is also possible because this zone is crucial for corrective upward movement. Daily CZ - daily control zone. An area formed by important data from the futures market that changes several times a year. Weekly CZ - weekly control zone. An area formed by the important marks of the futures market, which change several times a year. Monthly CZ - monthly control zone. An area that reflects the average volatility over the past year. The material has been provided by InstaForex Company - www.instaforex.com |

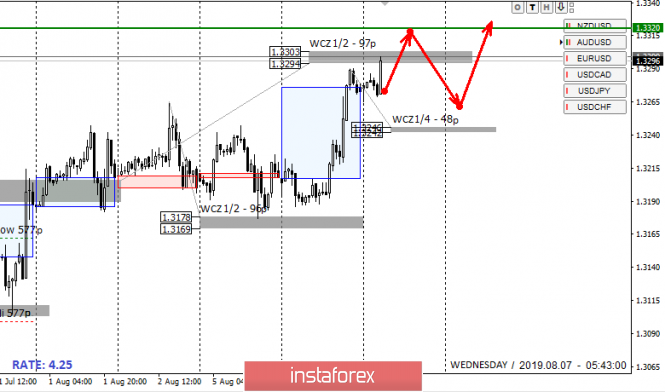

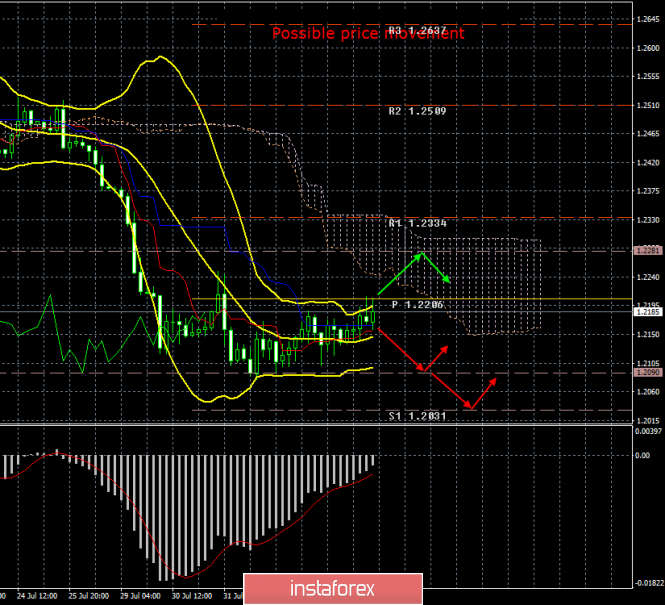

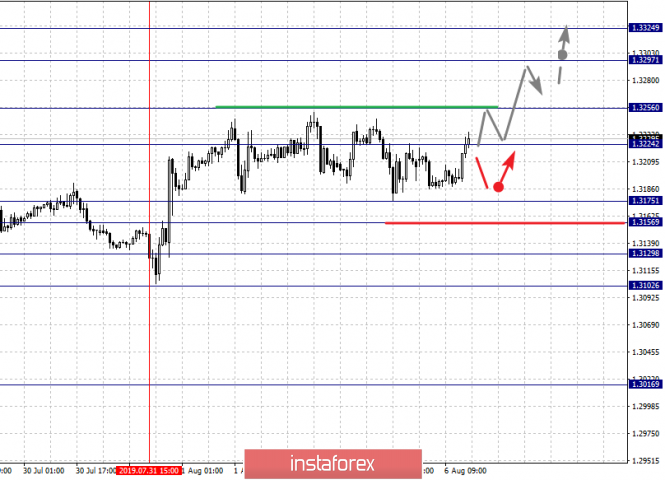

| Posted: 06 Aug 2019 07:57 PM PDT Today, a priority upward model has been implemented, as the pair tested the WCZ 1/2 target zone 1.3303-1.3294. Further growth will depend on whether the pair can gain a foothold above the specified zone. If the close of US trading occurs above the level of 1.3303, then the upward priority will remain in the second half of the week. It is important to note that there is a zone of the average weekly move at the level of 1.3320. A test of this level and going beyond it requires you to close all purchases and begin to consider a pattern for selling. The second model that needs to be considered will be developed after the pair reaches the value of the average weekly move. This will allow us to consider the false breakdown pattern for entering the correctional downward model. Daily CZ - daily control zone. The area formed by important data from the futures market, which change several times a year. Weekly CZ - weekly control zone. The zone formed by important marks of the futures market, which change several times a year. Monthly CZ - monthly control zone. The zone, which is a reflection of the average volatility over the past year. The material has been provided by InstaForex Company - www.instaforex.com |

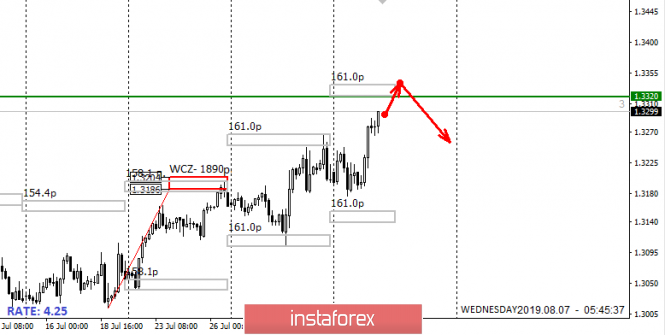

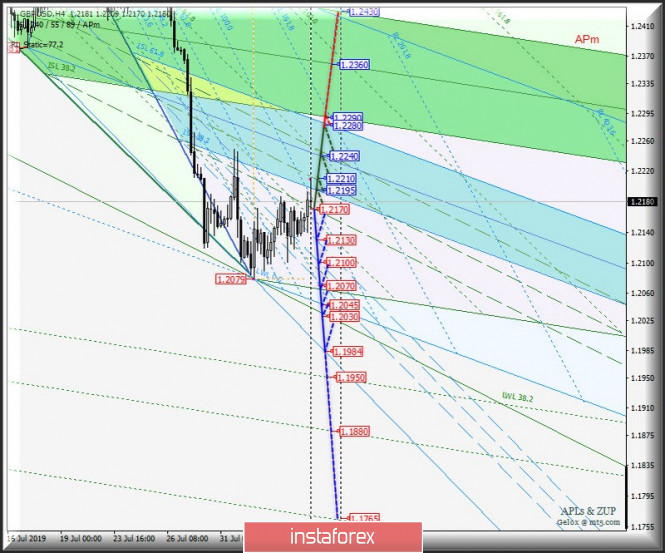

| Posted: 06 Aug 2019 05:36 PM PDT We will comprehensively consider the development options for the movement of currency instruments #USDX vs EUR / USD vs GBP / USD on Wednesday, August 7, 2019. Minuette operational scale (H4) ____________________ US dollar index We have here currently is the #USDX in 1/2 Median Line channel (97.25 - 97.55 - 97.90) of the Minuette operational scale fork. Respectively, the direction of breakdown of the above levels will begin to determine the further development of the movement of the US dollar index from Wednesday, August 7, 2019. Markup of options movements within the 1 / 2 Median Line channel of the Minuette are shown in the animated graph. If there will be a breakdown of the upper boundary of the 1/2 Median Line channel (resistance level of 97.90) of the Minuette operational scale fork, then the upward movement #USDX can be continued to the equilibrium zone (98.10 - 98.40 - 98.60) of the Minuette operational scale fork. On the other hand, the breakdown of the lower boundary of the l 1/2 Median Line channel of the Minuette operational scale fork (support level of 97.25) will confirm that further the development of the movement of the dollar index will continue in the equilibrium zone (97.40 - 96.90 - 96.45) of the Minuette operational scale fork. The details of the #USDX movement are presented in the animated chart. ____________________ Euro vs US dollar Further development of the movement of the single European currency EUR / USD from August 7, 2019 will be due to the direction of the breakdown of the range :

The breakdown of the support level of 1.1170 will determine the development of the movement of the single European currency within the 1/2 Median Line channel of the Minuette (1.1170 - 1.1140 - 1.1110) and the equilibrium zone (1.1140 - 1.1110 - 1.1075) of the Minuette operational scale fork. Meanwhile, the breakdown of the resistance level of 1.1200 (ISL38.2 Minuette) will confirm that the development of the EUR / USD movement will begin again to occur in the equilibrium zone (1.1200 - 1.1255 - 1.1305) of the Minuette operational scale fork. The details of the movement are shown in the animation chart. ____________________ Great Britain pound vs US dollar The development of Her Majesty's currency movement GBP / USD from Wednesday, August 7, 2019, will be determined by the development and direction of the breakdown of the boundaries of the 1/2 Median Line channel (1.2170 - 1.2210 - 1.2240) of the Minuette operational scale fork. Let's look at the animated chart for the options for this movement. On the other hand, the return of GBP / USD below the support level of 1.2170 (the lower boundary of the 1/2 Median Line Minuette channel) will make it relevant to resume the downward movement of GBP / USD to the targets - 1/2 Median Line channel (1.2130 - 1.2100 - 1.2070) of the Minuette operational scale fork - the initial line SSL Minuette (1.2045) - control line LTL (1.2030) Minuette operational scale fork - control line LTL Minuette (1.1984). On the contrary, considering that the resistance level of 1.2240 is broken (the upper boundary of the channel is 1/2 Median Line Minuette), then it will be possible to continue the development of the upward movement of Her Majesty's currency to the upper boundary of the ISL61.8 (1.2280) zone of equilibrium of the Minuette operational scale fork and to the zone of equilibrium ( .2290 - 1.2360 - 1.2430 of the Minuette operational scale fork. The details of the GBP / USD movement are presented on the animated chart. ____________________ The review is made without taking into account the news background. The opening of trading sessions of the main financial centers does not serve as a guide to action (placing orders "sell" or "buy"). The formula for calculating the dollar index : USDX = 50.14348112 * USDEUR0.576 * USDJPY0.136 * USDGBP0.119 * USDCAD0.091 * USDSEK0.042 * USDCHF0.036. where power factors correspond to the weights of the currencies in the basket: Euro - 57.6% ; Yen - 13.6%; Pound Sterling - 11.9% ; Canadian dollar - 9.1%; Swedish Krona - 4.2%; Swiss franc - 3.6%. The first coefficient in the formula leads the index to 100 at the start date of the countdown - March 1973, when the main currencies began to be freely quoted relative to each other. The material has been provided by InstaForex Company - www.instaforex.com |

| The greenback receives a "black mark" from Trump Posted: 06 Aug 2019 04:44 PM PDT Last week, the United States announced the introduction of new tariffs on Chinese imports, in response to which China has allowed its national currency to fall to record lows. Washington's reaction was not slow. The US administration has officially recognized China as a currency manipulator. "The goal of China's devaluation of the national currency is to gain an unfair competitive advantage in international trade," the US Treasury said. China has rejected all the accusations against it. "This stigma is completely inconsistent with the criteria set by the US Treasury for countries engaged in manipulating the exchange rate. Action from the United States is a one-sided and protectionist act that seriously violates international standards. This will have a serious impact on the global economy," according to a statement from the People's Bank of China. According to analysts, the decision of the US Ministry of Finance to classify China as currency manipulators could lead to the outbreak of a currency war between the two countries. "The implications of China's recognition of the currency manipulator could be colossal. The United States may use this decision as a pretext for introducing additional unilateral prohibitive duties. This will lead to the closure of all imports from China, " warns professor of Cornell University Esvar Prasad. It is assumed that if Donald Trump feels that the US economy will slow down against the backdrop of current events, the possibility of conducting currency interventions with the aim of weakening the dollar will again be on the agenda. Serious pressure on the greenback is currently being exerted by recent expectations that the Fed will aggressively weaken monetary policy. The probability of a federal funds rate cut by 25 basis points at the September meeting is now estimated at more than 75%. It is noteworthy that a week ago the chances of an additional round of rate cuts were only 60%. "The US central bank seems to be held hostage by markets for which the expectation of cheap money is the only argument in favor of growth," Raiffeisenbank analysts said. "There is another important factor - the pressure from the US president, who desperately needs economic growth to be re-elected for a second term and who has been raining tweets on the Fed for more than a year, calling the leadership of the US central bank incompetent and demanding a weaker dollar to win the trade war with China," said MUFG economist Chris Rupkey. Citigroup believes that if the Federal Reserve cuts rates in an attempt to smooth out the impact of the global GDP slowdown on the US economy, the monetary policy created by protectionism will not solve the problems. According to Judy Shelton, who was recently nominated by D. Trump as an official of the FOMC, monetary stimulation is more effective for manipulating currencies than for accelerating economic growth. This is again an argument in favor of the fact that by increasing tariffs on Chinese imports, the owner of the White House provokes an escalation of not only trade, but also currency war. Apparently, the head of the US administration decided to raise rates at the same time both in discussions with the Federal Reserve and with Beijing. However, for strong EUR/USD growth, just wanting to weaken the greenback is clearly not enough, and buying the euro should be considered only in the event of breaking resistance at 1.133 and 1.137, while a return to support at 1.1175 and 1.112 will create the prerequisites for opening shorts. The material has been provided by InstaForex Company - www.instaforex.com |

| Oil under pressure: the market is balancing near $60 Posted: 06 Aug 2019 04:36 PM PDT On Tuesday, August 6, the price of Brent crude oil futures increased by 0.4% to $60.06 per barrel. The black gold market remains under pressure, despite frequent attempts at a corrective rebound, thanks to which oil prices are close to $60.5. Pressure on the black gold market is exerted by foreign trade uncertainty and the risks associated with a possible drop in energy demand. The United States threatened to introduce 10% duties on Chinese goods worth $300 billion a year starting on September 1, 2019, in this process. Donald Trump's statement on the introduction of restrictions on goods from China produced the effect of an exploding bomb, analysts say. A similar situation knocked the ground out from under the feet of investors. "Suddenly caught between the escalation of the US trade war and promises of Chinese retaliation, investors have come up with nothing better than to pull down the stock market and oil quotes," analysts say with bitter irony. Another significant factor creating a threat to the global economy was the decision of Chinese authorities to depreciate the national currency. As a result, the US dollar rose above 7 yuan to a high of more than 10 years. A day earlier, on Monday, analysts marked an increase in Brent oil quotes during Asian trading in response to a demonstration of strength by Iran and growing tensions with the West. At the same time, WTI crude oil fell in price due to concerns about a decrease in demand in China, which remains one of the leading buyers of US oil. Weak quarterly data from many US mining companies also put pressure on WTI quotes. For example, papers of Concho Resources Corporation sank by an impressive 22% last Thursday. The company's management plans to reduce costs and abandon the drilling of new wells in the second half of 2019 in order to stabilize oil prices. According to analysts, exports of raw materials from the United States grew by 260 thousand barrels in June, reaching a record 3.16 million barrels per day. According to analysts, this indicates a high offer. However, the overall picture of the black gold market is not very positive. Analysts at the largest Goldman Sachs bank believe that oil demand in 2019 did not live up to expectations. This year, demand for black gold has disappointed market participants due to weak economic activity and tensions in world trade, Goldman Sachs emphasizes. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 06 Aug 2019 04:20 PM PDT 4-hour timeframe Amplitude of the last 5 days (high-low): 106p - 116p - 91p - 80p - 86p. Average amplitude over the last 5 days: 96p (113p). The last few trading days can be called uniquely positive for the pound because new losses against the US dollar were avoided. There have been no particularly important messages in recent days regarding Brexit, nevertheless, the European Union has come to a very important conclusion for itself that Boris Johnson has no other plan than a "hard" Brexit. EU leaders are surprised that the new British prime minister has not yet contacted them and has not tried to make an appointment for dialogue on the new Brexit agreement. According to the European Union, Johnson wants serious concessions from Brussels, but he does not intend to make any concessions. Also, EU diplomats fear that this time the British Parliament will not be able to stop the implementation of the hard Brexit scenario. It was not reported as to how the Parliament deviates from its ideas. Thus, we are forced to state once again the fact: Great Britain is rushing at full speed towards the disordered Brexit, and the most ridiculous and paradoxical, it may not happen again if the Parliament blocks it. The British currency can only wish good luck. The pound will remain under pressure from traders until October 31, since the hard Brexit does not bode well for the UK economy. After October 31, everything will depend on whether the "divorce" between London and Brussels finally takes place or whether it will take another couple of years. In any case, three months is enough to make the pound drop more than once against the US currency. The pound/dollar is now in an open flat. Trading recommendations: The GBP/USD currency pair continues a corrective movement. Thus, it is now recommended to wait until a correction is completed and resume selling the pound with targets at levels of 1.2090 and 1.2031. It will be possible to buy the British currency not earlier than when the pair consolidates above the critical line, but with extreme caution and in small lots. Ideally, the Bollinger Bands should be directed upwards. The target is 1.2281. In addition to the technical picture, fundamental data and the time of their release should also be taken into account. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. August 6th. Results of the day. Traders are tired of Donald Trump's angry accusations Posted: 06 Aug 2019 04:08 PM PDT 4-hour timeframe Amplitude of the last 5 days (high-low): 29p - 102p - 69p - 46p - 110p. Average amplitude over the last 5 days: 71p (57p). The European currency managed to successfully recover to the level of 1.1250, after which a rebound occurred and the euro/dollar began to fall. However, it is now unclear whether the upward movement has ended or whether the currency market has observed a banal correction during the day. The fundamental factor does not provide any clues at the moment, since, following it, there is only one suggested conclusion: the euro will continue to fall. However, recent days have shown that bears are ready for a timeout and correction. Now the question remains: how strong and long will this correction be, given that in the near future extra-important messages from the European Union and the United States are not expected. Both meetings of the central bank have already passed, Nonfarms and GDP have been published. We believe that since the euro's current growth was more technical than fundamental, then first we need to pay attention to technical factors. The technique will speak in favor of the resumption of the downward trend until the pair updates the high of July 19 - 1.1282. From a fundamental point of view, there is simply nothing to be noted on August 6, since not a single macroeconomic report has been published in the United States and the European Union today. The public continues to discuss the escalation of the trade conflict between Beijing and Washington, as well as prospects for further easing of the monetary policy of the Fed. However, in terms of exchange relations between the dollar and the euro, this does not really matter, as traders do not pay attention to Trump's angry statements about Powell or Xi Jinping, but to the Fed's economic indicators and actions. In addition, since the ECB is also preparing to ease monetary policy, there may not be a special profit for the euro from lowering the Fed rate. Trading recommendations: The EUR/USD pair started to correct against the short-term upward trend. Thus, it is now recommended to buy the euro in small lots with the target at the level of 1.1233, after the MACD has turned up or when the price has rebounded from the Kijun-sen line. It will be possible to sell the euro/dollar pair while aiming for a support level of 1.1035, when bears take the initiative back into their own hands, and the rate consolidates below the critical line. In addition to the technical picture, fundamental data and the time of their release should also be taken into account. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. Heavy Monday is behind us, but the dollar remains under heavy pressure Posted: 06 Aug 2019 03:48 PM PDT "Heavy Monday" was left behind: the markets are slowly recovering after yesterday's shakeup, which was provoked by China. At a special meeting, officials of the Chinese regulator tried to bring foreign exporters to their senses: senior NBK officials assured representatives of large business that Beijing would not use the yuan as a weapon in a trade war, and that companies could continue to freely acquire and sell the US currency . By an amazing "coincidence", the USD/CNY rate began to gradually slide down on Tuesday, returning the risk appetite to the foreign exchange market. The soothing rhetoric of the Chinese regulator's members helped the US dollar in slightly regaining its position in almost all the major pairs, except, perhaps, AUD/USD and GBP/USD, but there are different reasons in each case - the pound reacts to the news background regarding Brexit's prospects, and the aussie adjusted after a relatively neutral meeting of the RBA. But the US currency completely dominates the euro-dollar pair: today, the dollar index rose from a local low of 97.047 to the current value of 97.480 points. The single currency still does not have its own arguments for growth or resistance to the greenback, so the day's events have had a significant impact on EUR/USD. However, it is too early to draw final conclusions. Against the background of an almost empty economic calendar, traders of the pair react quite sharply to the "reports from the front" of the trade war. It is a coincidence or not, but today the markets tried to calm both sides of the Pacific at the same time. Following a statement by the People's Bank of China, Trump's economic adviser Larry Kudlow also provided a comment. He immediately declared that the introduction of additional duties worth 300 billion was not yet resolved, and everything would depend on China's position in trade negotiations. It is worth recalling that the next round of negotiations should take place in mid-September, while the US president announced that new duties would be introduced on September 1. With a high degree of probability, it can be assumed that Trump decided only to "raise rates" in the upcoming negotiations - on the eve of the first day of autumn, he will probably deign to delay the introduction of additional tariffs until the completion of the next stage of negotiations. In this case, a peculiar sword of Damocles in the form of 300 billion duties will hang over the Chinese side. The US president has repeatedly done a similar maneuver with the Chinese, and in the first half of this year - with the Mexicans. If Mexico almost backtracked, then China turned out to be a "tough nut": Beijing responded to verbal threats with concrete actions as it "released" the yuan to the level of 7,057 and froze the purchase of American agricultural products. After the United States and China "showed their teeth" in the trade war, their representatives tried to smooth the corners so as not to repeat August 2015. And although yesterday's stock markets in the US and Asia did not collapse (but nevertheless significantly slumped), the Chinese hastened to extinguish the excessive turbulence that they themselves had provoked. In part, they did it, given the dynamics of defensive instruments and the US dollar. But how long will this "sedative effect" last? In my opinion, the greenback will remain under the background pressure of the US-China conflict, which (hypothetically) entails a further easing of monetary policy by the Fed. That is why the decline in EUR/USD was limited today. Bulls of the pair were able to touch the lower boundary of the Kumo cloud on the daily chart (1.1260 mark) and plummeted from there. But the mark of 1.1180 (the middle line of the Bollinger Bands indicator on D1, which coincides with the Kijun-sen line), unexpectedly appeared as a support level, in which the pair is currently being traded. Given the inability of EUR/USD bears to go lower, the pair's bulls can seize the initiative and test an important resistance level of 1.1260 once again. After all, by and large, the overall situation remains tense, despite the fact that the parties have somewhat smoothed out the most acute angles. China promised that it would not continue to weaken the renminbi, but at the same time did not take any "conciliatory" steps toward Washington. In turn, the White House also reacted rather ambiguously to what was happening. On the one hand, Kudlow said that new duties would be introduced following the results of trade negotiations, but on the other hand, he reminded Beijing that if there is no progress in the dialogue, then "tariffs may become even worse." He also said that the United States is in a better and stronger position than China, whose economy is exhausted by the trade war. In other words, the economic adviser "extended a hand of friendship" in a rather peculiar way inherent in the head of the White House. Thus, the euro-dollar pair retains the potential for further corrective growth. If EUR/USD bulls overcome the 1.1260 mark, the next resistance level will be the price of 1.1301 - at this price point, the upper border of the Kumo cloud on the daily chart coincides with the upper line of the Bollinger Bands indicator. The material has been provided by InstaForex Company - www.instaforex.com |

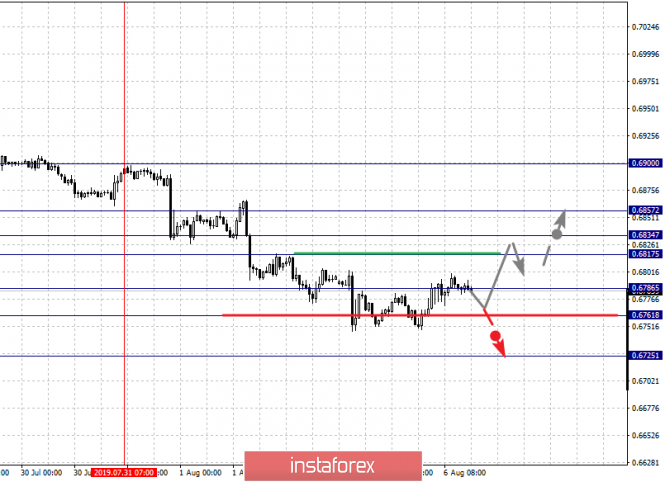

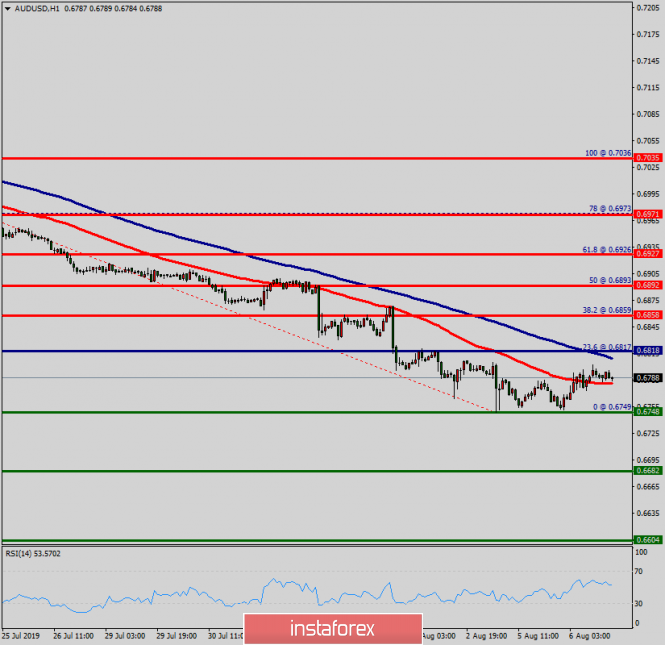

| Posted: 06 Aug 2019 12:28 PM PDT AUDUSD is in a long-term downtrend since 2017. Price has formed a downward sloping wedge pattern while price now is at the lower wedge boundary with high chances of reversing to the upside.

Black line - resistance Red lines - bullish divergence AUDUSD is making lower lows and lower highs. Trend is clearly bearish on a weekly basis. There is no reversal sign yet, but the chances of this happening increase as long as the RSI does not break below the upward sloping red trend line. The bullish divergence on the weekly chart of the RSI is an important warning for bears. A bounce of the 0.6750 area could reach 0.70 easily. So bears need to be very cautious. The first important sign for such a reversal would be if price recaptured 0.68. The material has been provided by InstaForex Company - www.instaforex.com |

| EURUSD stuck at the 1.12 resistance Posted: 06 Aug 2019 12:20 PM PDT EURUSD has stopped its rise at the 1.12 resistance which was previous support and now resistance. Although price moved a bit higher than 1.12, we are still not confident of this break out.

Blue lines - bearish channel Black line -upper wedge boundary Red rectangle - resistance (previous support) EURUSD is trying to break out of the short-term bearish channel for a move towards 1.13. Price is testing the 1.12 resistance that was once support. A rejection here will open the way for a move back towards 1.10. Short-term support is at 1.1165. Breaking below it will push price towards 1.11 or lower. Resistance is at 1.1210-1.1250. Breaking above it will push price towards 1.13 or higher. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold gives short-term warning signs for bulls Posted: 06 Aug 2019 12:15 PM PDT Gold price is at 2019 highs just $30 from $1,500. The risk reward for a bullish position in the short-term or to open new position now is not good. Traders should be patient for long positions as there are some warning signs for an imminent pull back.

Yellow rectangles - higher highs with divergence Black line -support Red line - bearish divergence The RSI is challenging trend line resistance. Gold price despite making a new higher high is vulnerable to a correction. The bearish divergence is a warning for bulls. This is not a reversal sign. Just a warning. Short-term support is at $1,450 and next at $1,425. If support fails to hold we should expect Gold price to move towards the red rectangle. Gold's upside is limited. Gold bulls should be patient and wait for a deep pull back than chase long positions now. The material has been provided by InstaForex Company - www.instaforex.com |

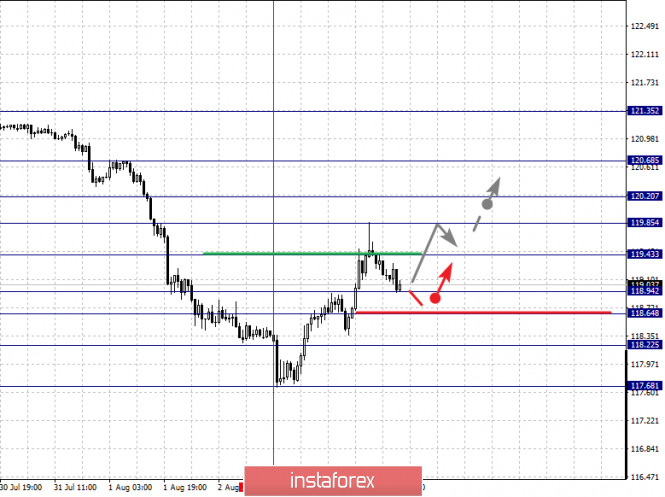

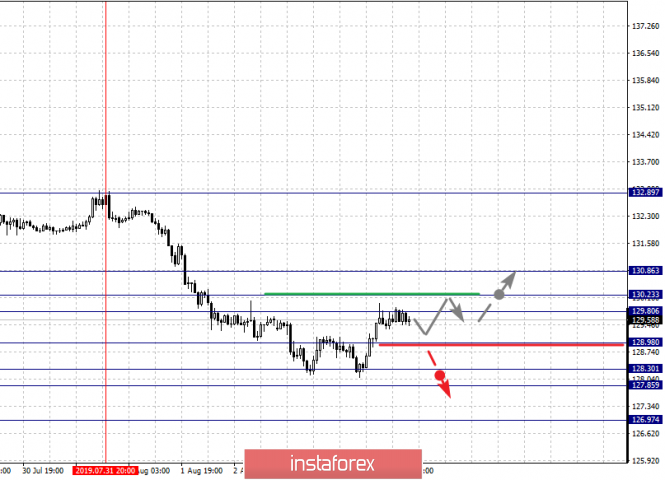

| Fractal analysis of the main currency pairs as of August 6 Posted: 06 Aug 2019 08:52 AM PDT Hello, dear colleagues. For the Euro/Dollar pair, the price is in the correction zone from the upward cycle of August 1. For the Pound/Dollar pair, we mainly expect the development of corrective upward movement, as well as the formation of initial conditions for the top. For the Dollar/Franc pair, the price is in the correction zone from the downward cycle on August 1 and the level of 0.9816 is the key resistance for the top. For the Dollar/Yen pair, the main trend development is expected after the breakdown of 105.71. For the Euro/Yen pair, the price forms the initial conditions for the top from August 5 and the development of this structure is expected after the breakdown of 119.85. For the Pound/Yen pair, the price is in the correction zone from the downward structure on July 31, forming the potential for the top and the level of 130.23 is the key resistance. Forecast for August 6: Analytical review of the currency pairs in H1 scale:

For the Euro/Dollar pair, the key levels on the H1 scale are: 1.1284, 1.1259, 1.1234, 1.1162, 1.1145 and 1.1120. The price is in the correction zone from the upward structure on August 1. The upward trend may resume after the breakdown of 1.134. In this case, the target is 1.1259. The potential value for the top is the level of 1.1284, upon reaching which we expect consolidation, as well as a rollback to the bottom. The short-term downward movement is possible in the area of 1.1162 – 1.1145 and the breakdown of the last value will lead to a protracted correction. The goal is 1.1120 and this level is the key support for the top. The main trend is the upward structure from August 1, the stage of correction. Trading recommendations: Buy 1.1234 Take profit: 1.1258 Buy 1.1261 Take profit: 1.1284 Sell: 1.1162 Take profit: 1.1146 Sell: 1.1144 Take profit: 1.1122

For the Pound/Dollar pair, the key levels on the H1 scale are: 1.2254, 1.2192, 1.2158, 1.2099, 1.2069 and 1.2021. We follow the downward cycle of July 19, as well as the local downward structure of July 31. The short-term downward movement is expected in the range of 1.2099 – 1.2069 and the breakdown of the last value will allow us to count on the movement to the potential target – 1.2021, from this level, we expect a correction. The short-term upward movement is possible in the area of 1.2158 – 1.2192 and the breakdown of the last value will lead to the formation of initial conditions for the top. The potential target is 1.2254. The main trend is the downward cycle of July 19, the local structure of July 31. Trading recommendations: Buy: 1.2158 Take profit: 1.2191 Buy: 1.2194 Take profit: 1.2254 Sell: 1.2099 Take profit: 1.2070 Sell: 1.2067 Take profit: 1.2025

For the Dollar/Franc pair, the key levels on the H1 scale are: 0.9854, 0.9816, 0.9797, 0.9746, 0.9706 and 0.9673. The price is in the correction zone from the downward structure on August 1. The resumption of the downward movement is expected after the breakdown of 0.9746. In this case, the target is 0.9706. The potential value for the bottom is the level of 0.9673, upon reaching which we expect consolidation, as well as a rollback up. The short-term upward movement is possible in the area of 0.9797 – 0.9816 and the breakdown of the last value will lead to an in-depth correction. The goal is 0.9854 and this level is the key support for the downward structure from August 1. The main trend is the downward structure from August 1, the stage of correction. Trading recommendations: Buy: 0.9797 Take profit: 0.9816 Buy: 0.9818 Take profit: 0.9852 Sell: 0.9744 Take profit: 0.9708 Sell: 0.9704 Take profit: 0.9675

For the Dollar/Yen pair, the key levels in the scale of H1 are: 107.98, 107.62, 107.20, 106.48, 105.71, 105.14, 104.44 and 104.00. We follow the formation of a downward structure from August 1. We expect the continuation of the downward movement after the breakdown of 106.48. In this case, the target is 105.71 and the range of 105.71 – 105.14 is the short-term downward movements, as well as consolidation. The breakdown of the level of 105.14 should be accompanied by a pronounced downward movement. The goal is 104.45. The potential value for the bottom is the level of 104.00, upon reaching which we expect a correction. We expect departure to the correction zone after the breakdown of 107.20. The target is 107.62. The range of 107.62 – 107.98 is the key support for the downward structure. The main trend is the formation of a downward structure from August 1. Trading recommendations: Buy: 107.20 Take profit: 107.60 Buy: 107.62 Take profit: 107.98 Sell: 106.45 Take profit: 105.71 Sell: 105.69 Take profit: 105.20

For the Canadian dollar/Dollar pair, the key levels on the H1 scale are: 1.3324, 1.3297, 1.3256, 1.3224, 1.3175, 1.3156, and 1.3129 1.3102. We continue to monitor the local upward structure of July 31. We expect the upward movement to continue after the breakdown of 1.3224. The target is 1.3256 and near this level is the consolidation. The breakout of the level of 1.3257 should be accompanied by a pronounced upward movement. The goal is 1.3297. The potential value for the top is the level of 1.3324, upon reaching which we expect consolidation, as well as a rollback downwards. The short-term downward movement is possible in the area of 1.3175 – 1.3156 and the breakdown of the last value will lead to a protracted correction. The goal is 1.3129 and this level is the key support for the top. The main trend – local upward structure from July 31. Trading recommendations: Buy: 1.3225 Take profit: 1.3255 Buy: 1.3257 Take profit: 1.3295 Sell: 1.3175 Take profit: 1.3156 Sell: 1.3153 Take profit: 1.3130

For the Australian dollar/Dollar pair, the key levels on the H1 scale are: 0.6857, 0.6834, 0.6817, 0.6786, 0.6761 and 0.6725. We follow the downward structure of July 31. The short-term downward movement is expected in the range of 0.6786 – 0.6761. The potential value for the downward structure of July 31 is the level of 0.6725, the movement to which is expected after the breakdown of 0.6760. The short-term upward movement is possible in the area of 0.6817 – 0.6834 and the breakdown of the last value will lead to an in-depth correction. The goal is 0.6857 and this level is the key support for the downward structure. The main trend is the local downward structure of July 31. Trading recommendations: Buy: 0.6817 Take profit: 0.6832 Buy: 0.6835 Take profit: 0.6855 Sell: 0.6786 Take profit: 0.6764 Sell: 0.6760 Take profit: 0.6725

For the Euro/Yen pair, the key levels on the H1 scale are: 120.68, 120.20, 119.85, 119.43, 118.94, 118.64, 118.22 and 117.68. The price forms the expressed initial conditions for the top from August 5. The continuation of the the upward movement is expected after the breakdown of 119.43. In this case, the goal is 119.85 and in the area of 119.85 – 120.20 is the consolidation. The breakdown of the level of 120.20 should be accompanied by a pronounced upward movement. The goal is 120.68. The potential value for the top is the level of 121.35. The short-term upward movement is possible in the area of 118.94 – 118.64 and the breakdown of the last value will lead to a protracted correction. The goal is 118.22 and this level is the key support for the upward structure. The main trend – the initial conditions for the top of August 5. Trading recommendations: Buy: 119.45 Take profit: 119.85 Buy: 120.20 Take profit: 120.68 Sell: 118.94 Take profit: 118.66 Sell: 118.62 Take profit: 118.24

The short-term upward movement is possible in the area of 129.80 – 130.23 and the breakdown of the last value will lead to a protracted correction. The goal is 130.86 and this level is the key support for the bottom. The main trend is the local downward structure of July 31, the stage of correction. Trading recommendations: Buy: 129.80 Take profit: 130.20 Buy: 130.26 Take profit: 130.84 Sell: 128.95 Take profit: 128.30 Sell: 128.28 Take profit: 127.85 The material has been provided by InstaForex Company - www.instaforex.com |

| August 6, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 06 Aug 2019 08:32 AM PDT Since May 17, the previous downside movement within the depicted bearish channel came to a pause allowing the recent sideway consolidation range to be established between 1.2750 - 1.2550. On July 5, a bearish range breakout was demonstrated below 1.2550 (the lower limit of the depicted consolidation range). Hence, quick bearish decline was demonstrated towards the price zone of 1.2430-1.2385 (where the lower limit of the movement channel came to meet the GBPUSD pair). On July 18, a recent bullish movement was initiated towards the backside of the broken consolidation range (1.2550) where another valid SELL entry was offered few weeks ago. Moreover, Bearish breakdown below 1.2350 facilitated further bearish decline towards 1.2320, 1.2270 and 1.2125 which correspond to significant key-levels on the Weekly chart. The current price levels are quite risky/low for having new SELL entries. That's why, Previous SELLERS were advised to have their profits gathered. Recently, weak signs of bullish recovery were demonstrated around 1.2100. This may push the GBPUSD to retrace towards 1.2260 then 1.2320 if sufficient bullish momentum is demonstrated above 1.2230. On the other hand, The price zone of 1.2320 - 1.2350 (backside of the broken channel) stands as a prominent SUPPLY zone to be watched for new SELL positions if the current bullish pullback pursues towards it. Trade Recommendations: Intraday traders are advised to look for early bullish breakout above 1.2230 for a counter-trend BUY entry. Conservative traders should wait for the current bullish pullback to pursue towards 1.2320 - 1.2350 for new SELL entries. S/L should be placed above 1.2430. Initial T/P level to be placed around 1.2279 and 1.2130. The material has been provided by InstaForex Company - www.instaforex.com |

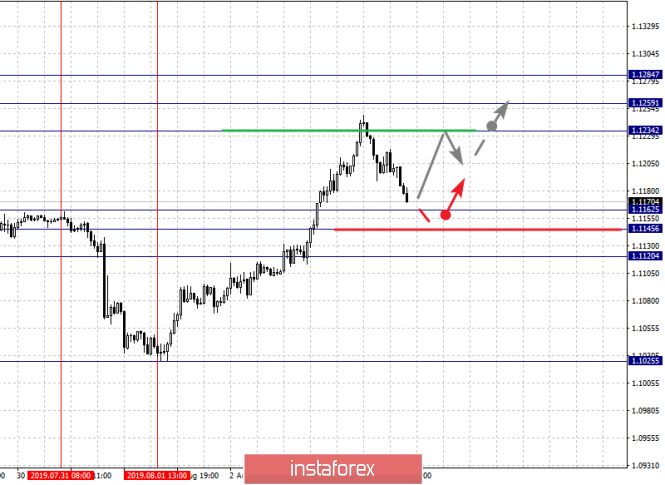

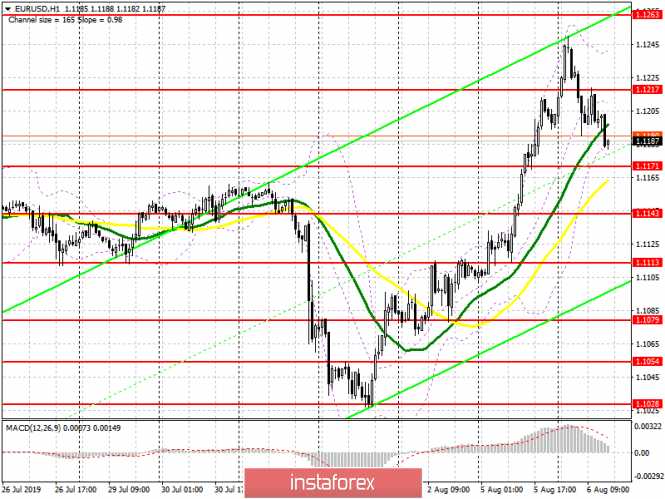

| August 6, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 06 Aug 2019 07:51 AM PDT

Back in June 24, the EURUSD looked overbought around 1.1400 facing a confluence of supply levels. Thus, a bearish movement was initiated towards 1.1275 followed by a deeper bearish decline towards 1.1235 (the lower limit of the previous bullish channel) which failed to provide enough bullish support for the EUR/USD pair. In the period between 8 - 22 July, sideway consolidation range was established between 1.1200 - 1.1275 until a triple-top reversal pattern was demonstrated around the upper limit. Shortly after, evident bearish momentum (bearish engulfing H4 candlestick) could bring the EURUSD back below 1.1235. Early bearish breakdown below 1.1175 facilitated further bearish decline towards 1.1115 (Previous Weekly Low) where temporary bullish rejection was recently demonstrated on July 25. Shortly after, An Intraday bullish pullback was demonstrated towards 1.1175-1.1200 where a previous SELL entry was suggested in a previous article. Last week, bearish persistence below 1.1115 allowed further bearish decline towards 1.1025 (lower limit of the depicted recent bearish channel) where significant signs of bullish recovery were demonstrated. Risky traders were advised to look for bullish persistence above 1.1050 as a bullish signal for Intraday BUY entry with bullish target projected towards 1.1115, 1.1175 and 1.1235. It's already running in profits. S/L should be advanced to 1.1160 to secure more profits. Earlier Today, the depicted Key-Zone around 1.1235 stood as a prominent Supply Area where significant bearish rejection (Bearish Engulfing H4 candlestick) was demonstrated few hours ago. Bearish breakout below 1.1260 is mandatory to allow further bearish decline towards 1.1125-1.1115 where another intermediate-term bullish position can be offered. Trade recommendations : Conservative traders should wait for a bearish movement towards 1.1125-1.1115 for a valid BUY entry. S/L should be placed just below 1.1080 while initial T/P levels should be located around 1.1160 and 1.1200. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC 08.06.2019 - Ovebought conditon, porential downward movement Posted: 06 Aug 2019 07:37 AM PDT Industry news: HM Revenue & Customs, the British tax authority, is pressuring cryptocurrency exchanges to reveal customers' names and transaction histories, in a bid to claw back unpaid taxes, industry sources said. Letters requesting lists of customers and transaction data have landed on the doorsteps of at least three exchanges doing business in the U.K. – Coinbase, eToro and CEX.IO – in the last week or so, the sources said. None of the three firms would comment by press time. "HMRC is looking to work with exchanges when it comes to finding information on people who have been buying and selling crypto. I think they will only go back a couple of years, two or three years," said one industry insider. Daily view:

Based on the hourly time-frame, I found bearish divergence on the MACD oscillator, which is sign of potential downward movement and buyers exhaustion. I also found a strong supply in the background and rejection of 20EMA, which adds more weakness on BTC. Trading recommendation: According to current market condition, my advice is to watch for selling opportunities with the first target at $11,000. The material has been provided by InstaForex Company - www.instaforex.com |

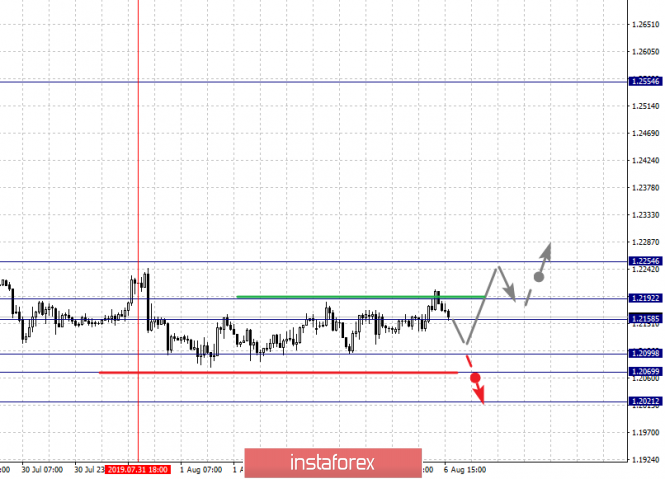

| GBP/USD 08.06.2019 - Potential rally is on the way Posted: 06 Aug 2019 07:04 AM PDT Daily view:

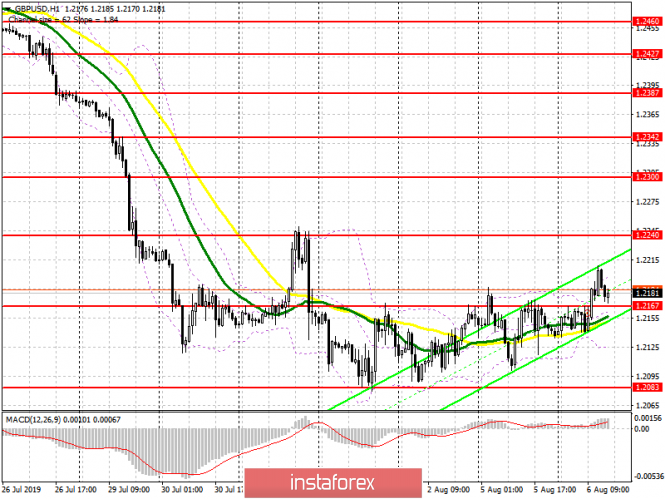

GBP found the strong support at the price of 1.2100 and I saw multiply successful tests of that support, which is sign that there is no power to break and that rally Is expected. Today, the price and value are moving higher and I see higher high and higher low based on the daily candles, which is another sign of the underlying short-term uptrend. Important resistance levels are set at 1.1250 and 1.2275. Hourly time-frame view:

Based on the hourly time-frame, I found new momentum up on the MACD oscillator, which is sign of the underlying bullish pressure. I also found a successful test of the key intraday support at 1.2165 (previous swing high zone). Additionally, there is the rejection of the 20 EMA, which gives more confirmation to my bullish view. Trading recommendation: According to current market condition, my advice is to trade in the direction of the up momentum. Watch for buying positions. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 06 Aug 2019 06:59 AM PDT

The EURUSD rate rose on a general decline in the dollar against the yen and franc. The reason is the new round of Trump-China trade war. The parties have already exchanged blows. Trump introduces new duties of 10% on goods from China to $300 billion. China, in response, introduces a ban on the purchase of grain (soy) from the United States. EURUSD: Buy from a rollback from 1.1200 and below, or break of 1.1250. The material has been provided by InstaForex Company - www.instaforex.com |

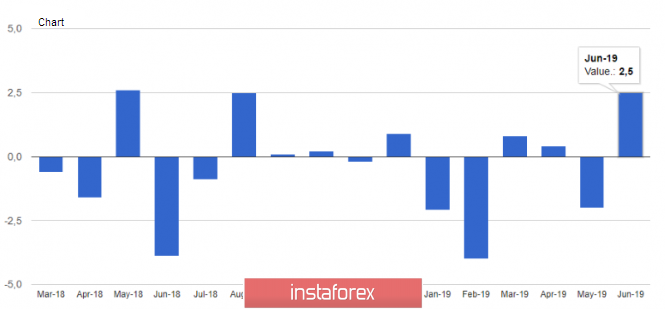

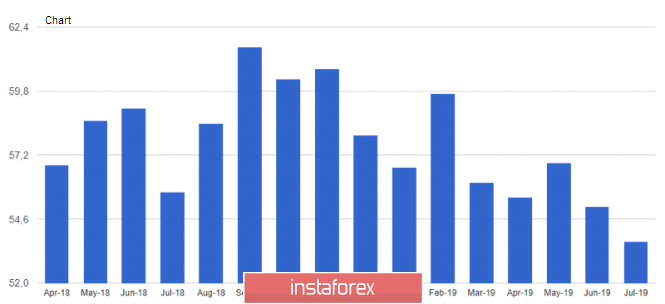

| Posted: 06 Aug 2019 06:44 AM PDT The euro is falling, now ignoring the good statistics on Germany, which was published in the morning. It is possible that such a sharp increase in risky assets was a campaign for stop orders before the next wave of the bear market on the eve of lowering interest rates from the European Central Bank, which has nowhere to lower them, only to make it negative. The trade conflict, which continues to intensify between the US and China, which I discussed in more detail in my morning review, will continue to maintain fairly high volatility in the markets. As noted above, the growth of orders in Germany's manufacturing sector in June exceeded the forecast of economists, which is a good signal for the economy. According to official figures, in June this year, compared with May, orders rose immediately by 2.5%, while a number of economists expected their increase to be only 0.3%. However, compared with June last year, orders fell by 3.6%. The difficulties for the production sector in Germany and the eurozone remain, and to talk about a change of rate to a favorite in the current conditions of slowing global economic growth and the height of the next trade conflict is unlikely. The German Ministry of Economics, of course, is pleased that the downward trend of incoming orders in the manufacturing sector has slowed noticeably in the second quarter of this year, but it is still very far from the turning point in the industry. Despite the fact that domestic orders decreased by 1.0% in June, while initially, the main support came from them, export orders grew by 5% at once. New orders from the eurozone declined by 0.6%, while orders from other countries rose by 8.6%. Today, there will be a number of speeches by representatives of the Federal Reserve System, which may have some impact on the markets. Today, the President of the Federal Reserve Bank of San Francisco, Mary Daly, has already spoken, who said that the problems of the world economy justify the decrease in the interest rate that occurred last week, but further pressure from the problems in trade, lower rates of other Central banks may be the basis for continuing the Fed's rate adjustment. The President of the Fed-San Francisco does not believe that the world economy is moving to a recession, but, in her opinion, the uncertainty in trade has increased, which can cool the investment of companies, which, by the way, have recently slowed down so much in the United States. Mary Daly also believes that there is no need for aggressive rate cuts, as consumer confidence and spending are at high levels, and the labor market continues to show strength. However, as we can remember from the recent statements of Fed Chairman Jerome Powell, this is clearly not enough to achieve a key inflation rate of about 2.0%, which retains a high chance of further easing monetary policy. If after the rate decrease last week, the probability of the next decline was estimated at only 20%, then today, according to the futures quotes for the Fed rates, investors estimate this probability at more than 40%. As for the technical picture of the EURUSD pair, as noted in the morning review, the correction of the euro will last to a large support level of 1.1170, and a larger sale will lead to a minimum area of 1.1140, where the lower limit of the upward price channel will be built. The task of buyers this week will be to return to the resistance of 1.1220 and its breakdown, which will return to the market players who put on strengthening risky assets and will lead to an update of the monthly highs in the area of 1.1290 and 1.1240. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 06 Aug 2019 06:44 AM PDT To open long positions on GBP/USD, you need: Buyers of the pound managed to cling to the resistance of 1.2167 in the first half of the day, which led to a small upward movement, but it was not possible to get to the resistance of 1.2240. While trade is maintained above this range, it is possible to expect the further growth of the pound to a high of 1.2240, however, the key target will be the resistance of 1.2300, where I recommend taking the profit. If the pair returns to the support of 1.2167 in the second half of the day, the pressure on the pound will return, which will lead to another attempt to reduce to the low of 1.2083, where you can open long positions immediately on the rebound. To open short positions on GBP/USD, you need: Sellers need to return to the level of 1.2167, as only after that it will be possible to talk about their advantage. The absence of news on Brexit, most likely, will continue to keep the pair in the side channel, but the main task of the bears is the minimum in the area of 1.2083, the breakthrough of which will strengthen the trend and lead to an update of the supports of 1.2040 and 1.1985, where I recommend taking the profit. If the demand for the pound continues in the second half of the day, the demolition of a number of stop orders will lead to an update of the resistance of 1.2240, from which short positions can be considered if a false breakout is formed. Sell on the rebound pound is best in the area of the maximum of 1.2300. Indicator signals: Moving Averages Trading is conducted in the area of 30 and 50 moving averages, which indicates the lateral nature of the market. Bollinger Bands The break of the upper limit of the indicator in the area of 1.2193 may lead to a larger upward correction in the British pound.

Description of indicators

|

| EUR/USD: plan for the American session on August 6. The euro will remain under pressure Posted: 06 Aug 2019 06:44 AM PDT To open long positions on EURUSD, you need: Buyers of the European currency failed to cope with the resistance level of 1.1217, which I drew attention to in my morning review, which helped sellers to continue the downward correction. At the moment, given the lack of important fundamental statistics on the US, we can expect the further movement of the euro down to the support area of 1.1171, where the formation of a false breakout will be the first signal for the opening of long positions. However, a more acceptable level for euro purchases is located in the area of the minimum of 1.1143, where the lower limit of the new upward channel will be formed. The main task of the bulls for the second half of the day is the resistance of 1.1217, the consolidation above which will continue the upward bullish trend to the area of the maximum of 1.123, where I recommend fixing the profits. To open short positions on EURUSD, you need: The signal to open short positions in the resistance area of 1.1217, which I paid attention to in the morning review, has fully worked itself out, and the first goal of sellers is still the support of 1.1171. With more active sales of the euro in the afternoon, the downward correction may lead to an update of the support level of 1.1143, where I recommend taking the profit. If the bulls try to return to the market against the background of comments of representatives of the Federal Reserve System, whose speeches are scheduled for the North American session, then you can count on short positions again after the update of the resistance of 1.1217. Selling EUR/USD immediately on the rebound is best at a maximum of 1.1263. Indicator signals: Moving Averages Trading is above 30 and 50 moving averages, which indicates the continuation of the upward correction. Bollinger Bands In the case of further downward movement, the lower limit of the indicator will support the area of 1.1180.

Description of indicators

|

| Simplified wave analysis and forecast for GBP/USD and USD/CHF on August 6 Posted: 06 Aug 2019 06:44 AM PDT GBP/USD The bearish trend of the English currency is medium-term, set by a wave from mid-March. Its final section has been counting since June 25. By the current day, the wave structure looks complete. The price reached the upper limit of the support zone of a large TF. Forecast: In the coming days, it is expected to form a corrective phase of the movement, which is necessary both to continue the current trend and to change its course. The preliminary target level is in the area of 125th of the price chart. Today, a flat is likely between the nearest oncoming zones. Before the price rise in the morning, a decline is possible. Recommendations: For long trades, it is safest to wait until the current correction is completed and look for sell signals at its end. In the case of intra-session style of trading, short-term purchases of the instrument are possible. Resistance zone: - 1.2210/1.2240 Support zone: - 1.2130/1.2100

USD/CHF The unfinished wave structure on the chart of the Swiss franc is ascending, with a benchmark on June 25. The counter wave of July 9 does not go beyond the correctional part (B). The price has reached a wide support area of a large scale chart. Forecast: The structural features of the current wave make it possible to wait for a puncture of the starting point of the entire model. At the next sessions, the completion of the rollback is expected, the formation of a reversal and the beginning of the price move down. Recommendations: When buying a pair today, you should be careful because of the limited lifting potential. In the area of the resistance zone, it is recommended to monitor the signals of the instrument sale. Resistance zone: - 0.9770/0.9800 Support zone: - 0.9700/0.9670

Explanations to the figures: Waves in the simplified wave analysis consist of 3 parts (A-B-C). The last unfinished wave is analyzed. Zones show areas with the highest probability of reversal. The arrows indicate the wave marking according to the method used by the author, the solid background is the formed structure, the dotted ones are the expected movements. Attention: The wave algorithm does not take into account the length of time the instrument moves. The material has been provided by InstaForex Company - www.instaforex.com |

| EURUSD: Trade conflict and fears of another US rate cut put pressure on US dollar Posted: 06 Aug 2019 06:44 AM PDT The aggravation of the US-China trade conflict, as well as the growth of disagreements along with weak economic statistics, all this led to the weakening of the US dollar, as many traders and investors again started talking about the continuation of a series of interest rate cuts in the US in the autumn of this year. As noted above, Xi and Trump continue to exchange unflattering statements about each other. Yesterday, the escalation of the trade conflict took a new turn. First of all, the White House's indignation caused yesterday's sharp weakening of the yuan against the US dollar. On this account, the American President immediately spoke, saying that the fall of the yuan is a manipulation of the Chinese currency, and this is a serious violation, which in time will greatly weaken China. Let me remind you that last week Donald Trump accused China that it does not comply with the agreement and does not buy agricultural machinery and products in the United States. China said yesterday that Chinese authorities are unable to buy agricultural products from the United States due to uncompetitive prices, completely denying all the accusations of the US. It should be noted that the stronger the trade conflict between the United States and China, the more investors will grow confident that the Fed will go to another reduction in interest rates. If after the rate decrease last week, the probability of the next decline was estimated at only 20%, then yesterday, according to the Fed's futures quotes, investors estimated this probability at more than 40%. There are also concerns about the third decline before the end of this year, while the probability of at least two rate cuts before the end of the year is estimated at about 75%. Yesterday's data on the weaker growth of activity in the US services sector confirm the slowdown in the economy. According to the report of the Institute of supply management, activity in the service sector grew slowly in July. The ISM-calculated PMI purchasing managers index for the US non-manufacturing sector fell to 53.7 points in July from 55.1 points in June. Economists had expected the index to rise to 55.7 points. Let me remind you that the values above 50 points indicate an increase in activity. It is worth noting that the sharp slowdown in the production sector is gradually spreading to the service sector, which is a bad signal for the economy. The subindex of business activity in July fell sharply, to 53.1 points from 58.2 points in June. But according to IHS Markit, the PMI index for the US service sector in July rose slightly, amounting to 53.0 points against 51.5 points in June. The growth was due to the increase in employment. As noted above, yesterday's speeches by Fed representatives only confirmed traders' concerns about the further easing of monetary policy in the United States. During the interview, member of the Board of Governors of the Federal Reserve System Leil Brainard said that the Fed continues to monitor the situation in the markets and seeks to extend the period of economic growth in the United States. She also insisted on achieving the target annual inflation rate of 2.0%, noting the weak growth rate. In her opinion, this will require greater support for the economy. As for the technical picture of the EURUSD pair, the sharp growth of risky assets slowed down in the area of a large resistance of 1.1250, which I previously drew attention to in my reviews. At the moment, it is best to look for new long positions in the trading instrument after updating the support of 1.1170 or from the minimum of 1.1140, where the lower limit of the ascending channel will pass. The trend to the north will clearly continue to form, and the breakout of the range of 1.1110-1.1170 is clearly a bullish signal for the market. The target of buyers of risky assets will be highs in the area of 1.1290 and 1.1340. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold 08.06.2019 - Multi-timeframe analysis Posted: 06 Aug 2019 06:41 AM PDT Weekly view:

As I mentioned yesterday, there is the upside breakout of the 6-week trading range and new momentum on the MACD oscillator, which is sign for me that buying pressure is very strong. I found important resistance levels based on the price action on the Weekly chart at the price of $1.490 and $1.520 (orange horizontal lines). Conclusion based on the Weekly chart is that long term money became active and that bullish movement on lower frames got support from long term money. 4H time-frame view:

Based on the 4H time-frame, I found new momentum up on the MACD oscillator, which is sign of the underlying bullish pressure. I also found broken Ascending triangle in the background, which is another sign of the strength. Important support levels and good levels to load long positions are set at $1.452 and $1.450. Trading recommendation: According to current market condition and strong upward trend in the background, my advice is to watch for buying opportunities on the dips with the first target at the price of $1.489. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of AUD/USD for August 06, 2019 Posted: 06 Aug 2019 06:35 AM PDT Overview:

Forecast:

|

| Bullish reverse happened in EUR/USD Posted: 06 Aug 2019 05:57 AM PDT

1/8 Murrey Math Level has acted as support pushing the price higher. Super Trend Lines have formed a 'Bullish Cross' which bring more evidence that reverse has occurred. However, the price hasn't break 4/8 MM Level, so there's an ongoing local downward correction. The price is likely going to test Super Trend Lines in the coming hours which both could stop the correction. If this happens, there'll be a green light for another bullish rally. The main intraday target is 6/8 MM Level which could be a starting point for a larget bearish correction. It's essential that the price should break 4/8 MM Level as confirmation for this scenario. If this level acts as resistance again, there'll be an option to have a local decline in the direction of 3/8 MM Level. However, if the pair fixates above 4/8 MM Level instead, there'll be an open door for bulls to achieve 6/8 MM Level. Additionally, if 6/8 MM Level turns out to be broken, we should watch 7/8 MM Level as the next target. The bottom line is that a bullish reverse has happened in EUR/USD. Thus, after a short break, the market is going to continue moving up towards 6/8 or even 7/8 MM Levels. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

For the Pound/Yen pair, the key levels on the H1 scale are: 130.86, 130.23, 129.80, 128.98, 128.30 and 127.85. We follow the local downward structure from July 31. At the moment, the price is in the correction zone and forms the potential for the top. We expect the continuation of the downward movement after the breakdown of 128.98. In this case, the target – 128.30 and in the area of 128.30 – 127.85 is the consolidation.

For the Pound/Yen pair, the key levels on the H1 scale are: 130.86, 130.23, 129.80, 128.98, 128.30 and 127.85. We follow the local downward structure from July 31. At the moment, the price is in the correction zone and forms the potential for the top. We expect the continuation of the downward movement after the breakdown of 128.98. In this case, the target – 128.30 and in the area of 128.30 – 127.85 is the consolidation.

No comments:

Post a Comment