Forex analysis review |

- EUR/USD: Trump's anger, Treasuries fall and RMB rise

- GBP/USD. August 7. Results of the day. Is Boris Johnson provoking a constitutional crisis in the UK?

- EUR/USD. August 7. Results of the day. Germany's record drop in industrial production

- August 7, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- USDCAD bounce continues as expected towards 1.3335

- EURUSD recaptures key 1.12 resistance area and is eyeing 1.13

- Gold breaks above $1,500 reaching inside our target area

- August 7, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- Bitcoin holds above $12,000. August 7, 2019

- EURUSD: All data indicate a clear slowdown in the German economy in the 2nd quarter of this year. The oil will rise after

- Gold was "in shock": the specter of a trade war fuels the demand for precious metal

- BTC 08.07.2019 - End of the downwad correction, watch for buying opporutnities

- Fractal analysis for major currency pairs as of August 7

- EUR/USD for August 07,2019 - ABC down completed, upward movement is expexted

- Gold 08.07.2019 -First target at $1.490 reached, awaiting for second target

- GBP/USD: plan for the American session on August 7. Bears are trying to return to the level of 1.2140, but few want to sell

- EUR/USD: plan for the American session on August 7. Volatility has decreased, allowing bulls to build good support for continued

- Gold passes to the ladies

- US yields continue to slide, USD/JPY to touch 105.00

- Technical analysis of EUR/USD for August 07, 2019

- Gold continues climbing to $1,500

- Simplified wave analysis and forecast for EUR/USD, USD/JPY, and AUD/USD on August 7

- GBP/USD to fall anytime soon

- Trading recommendations for the GBPUSD currency pair - placement of trade orders (August 7)

- Analysis of EUR / USD and GBP / USD for August 7th. The European Union and the United Kingdom finally quarreled

| EUR/USD: Trump's anger, Treasuries fall and RMB rise Posted: 07 Aug 2019 04:36 PM PDT After a temporary respite, the dollar again came under pressure from problems of a very diverse nature. Trump criticized the Federal Reserve again (and in a rather harsh form), the yuan renewed its 11-year high again, and the yield on 10-year Treasuries collapsed to three-year lows. The dollar index is actively losing its position amid such a negative fundamental picture, reflecting the greenback being sold throughout the market. The euro-dollar pair also follows general trends. After dropping to the 11th figure during the European session, Bulls then more than made up for it, reaching 1.1240. By and large, today EUR/USD traders repeated the price path of Tuesday, however, with one exception: the US currency looks much more vulnerable today, and not only in conjunction with the euro. For example, paired with the yen, the greenback sank to the 105th figure (five-month low), and paired with the franc slumped to the 96th figure (11-month low). In other words, the market is actively getting rid of the dollar and investing in defensive assets - by the way, gold has risen to a 6-year high today, that is, to around 1509. This dynamics is due to several reasons. First of all, the dollar was a victim of the general nervousness of traders. The unexpected move of the Reserve Bank of New Zealand (which suddenly dropped today by 50 bp immediately) unsettled many investors - it became completely clear that the central banks of the leading countries of the world will soften their monetary policy parameters in the foreseeable future, and the Fed is here will not be an exception. Indeed, today, in addition to the RBNZ, the Central Bank of India has reduced the interest rate (by 35 basis points at once, to the lowest level since 2010) and the central bank of Thailand - the regulator has reduced the rate from 1.75% to 1.50%. The Thai central bank also surprised investors, as most analysts expected the rate to remain unchanged. Such a peculiar "domino effect" provided strong support for defensive instruments and equally strong downward pressure on the greenback. Wall Street reacted appropriately to the situation: the main indexes plummeted significantly when trading began. The Dow Jones Industrial Average fell by more than 2%, the S&P 500 by almost 2%, while the Nasdaq Composite by 1.6%. The fundamental background for the dollar is too sharply painted in gloomy tones. Let me remind you that after the July meeting of the Fed (which took place just a week ago), the US currency went up sharply in almost all dollar pairs. Investors were confident that the Fed would limit itself to a "warning shot" in the form of one 25-point rate cut. By and large, Fed members, like Jerome Powell, indirectly confirmed this market assumption, although they did not exclude an alternative scenario. But a week ago, the likelihood of implementing this "alternative" scenario was minimal. However, further events unfolded with such swiftness that in just a few days dollar bulls lost ground. Trump's resonant statement about 300 billion duties, China's response (refusal to purchase American agricultural products), devaluation of the renminbi, a 50-point reduction in the RBNZ rate and easing of the monetary policy of the central bank of India and Thailand are all links in one chain. With a high degree of probability, the Fed will also not be left out in the end, resorting to another round of rate cuts this year. The only question is - 25 or 50 basis points. It is noteworthy that yesterday James Bullard, one of the most prominent representatives of the "dovish" wing of the Fed, said that the regulator should not reflexively react to the actions of the US and China, which operate on the basis of the "tooth by tooth" principle. He noted that interest rates are now at an optimal level, and before deciding on further steps, the Federal Reserve needs to analyze the reaction of the US economy to a trade war. But Donald Trump is still vomiting and mosquing, accusing the Federal Reserve of almost tampering. He said that Fed members still cannot admit their mistake, which was that the regulator began to "tighten monetary policy too soon and too quickly." In his opinion, the Federal Reserve should now actively reduce the interest rate, thereby increasing US competitiveness. "The problem is not even in China, but in our central bank," the president concluded. On the one hand, Jerome Powell has repeatedly stated that such attacks from Trump does not affect the Fed's position. On the other hand, the market again started talking about the fact that the regulator could reduce the interest rate by 50 points in the fall (or resort to a double reduction of 25 bp by the end of the year) - even without taking into account the political pressure of the White House. This fact has a significant impact on the greenback, helping EUR/USD bulls to storm the nearest resistance level of 1.1260 (the lower border of the Kumo cloud on the daily chart). But it is worth noting here that EUR/USD bulls still can't confirm their dominance - for this they need to gain a foothold over the above resistance level, and for fidelity - to overcome the upper border of the cloud, which corresponds to the level of 1.1302. Until then, the price will fluctuate in the range of 1,1140-1,1260 in anticipation of a powerful information driver that will help traders take the pair outside one of the corridor boundaries. The material has been provided by InstaForex Company - www.instaforex.com |

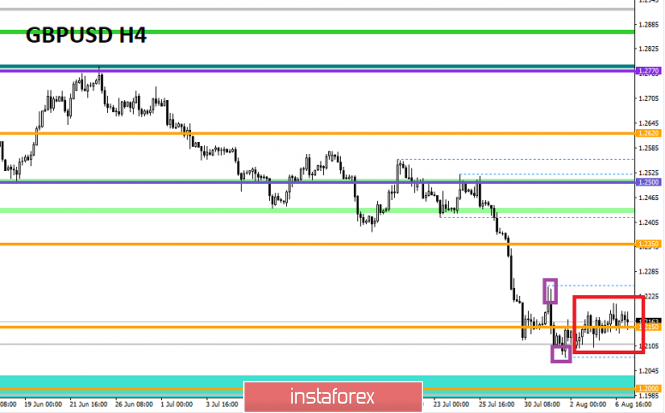

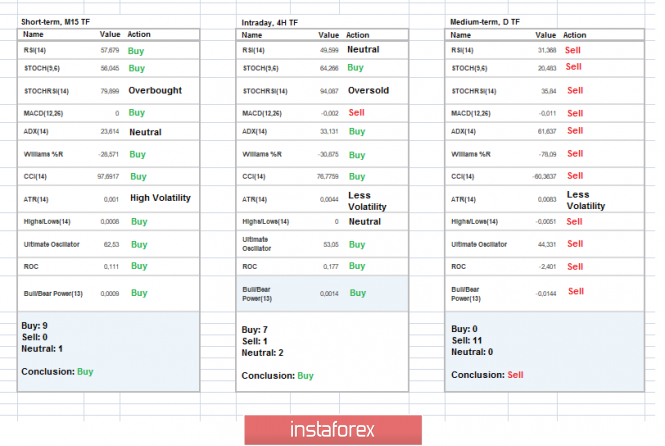

| GBP/USD. August 7. Results of the day. Is Boris Johnson provoking a constitutional crisis in the UK? Posted: 07 Aug 2019 04:22 PM PDT 4-hour timeframe Amplitude of the last 5 days (high-low): 116p - 91p - 80p - 86p - 74p. Average amplitude over the last 5 days: 89p (96p). Boris Johnson, due to the eccentricity of his actions, and often the illogicality, is catching up with Donald Trump by leaps and bounds. Opponents of his policy on the Brexit issue were huge before the election. Firstly, there is the Labour Party. Secondly, it is the Conservatives themselves, among whom there are enough deputies who do not support the "hard" Brexit. And now, after just a few weeks of Johnson's reign, talk of a vote of no confidence has already begun. The reason is simple - absolutely everything, and deputies, and the Bank of England, and ordinary citizens, understand that Brexit will lead the United Kingdom without an agreement with the EU in a long period of crisis. GDP will fall, there will be an outflow of capital, a reduction in investment, an increase in inflation, a depreciation of the pound sterling, and an increase in unemployment. It will take years to recover. However, some members of Parliament are simply ready to take such a step if only to leave the European Union and realize the "will of the people". Boris Johnson is at the head of this movement. However, realizing that opponents could unite in the so-called "unity government", declare a vote of no confidence and vote for Johnson's resignation, the premier already decided to play it safe and announced through his adviser Dominic Cummings that he would not resign. According to British law, even if Parliamentarians vote for Johnson's resignation, he will either have to leave his post or he should be removed from his post by the queen of Great Britain, who appointed him to this post. Thus, the option is not ruled out in which Queen Elizabeth II will have to intervene in the situation. After describing a new potential problem for Great Britain, is it worth mentioning as to why the British currency is not growing? Volatility has declined in recent days, while the pound/dollar is moving mostly sideways. Both bulls and bears are waiting for new data, reports, "numbers". However, in general, it can be said that the Forex market is not yet ready for purchases of the pound sterling. Trading recommendations: The GBP/USD currency pair continues the weakest upward movement, which is interpreted as a side correction. We recommend that you wait until the correction is completed, the Bollinger bands widen to one side, and only after that In addition to the technical picture, fundamental data and the time of their release should also be considered. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

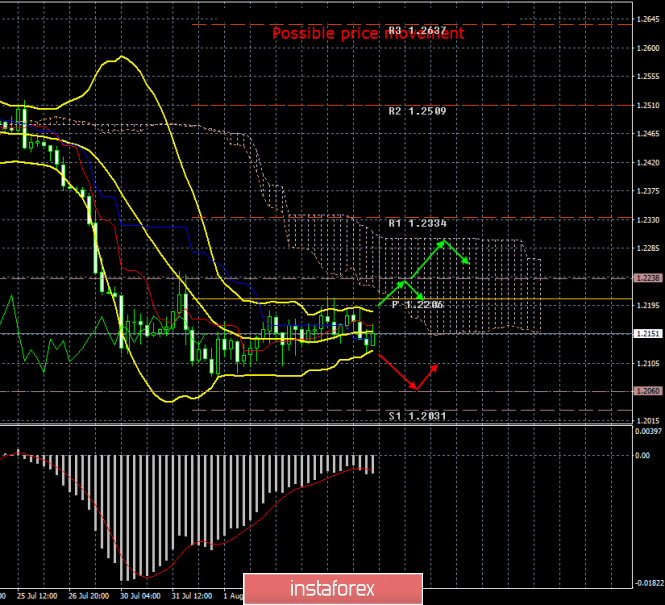

| EUR/USD. August 7. Results of the day. Germany's record drop in industrial production Posted: 07 Aug 2019 03:58 PM PDT 4-hour timeframe Amplitude of the last 5 days (high-low): 102p - 69p - 46p - 110p - 82p. Average amplitude over the last 5 days: 82p (71p). The EUR/USD currency pair is trying to resume the upward movement on Wednesday, August 7, and we cannot say that it does not succeed. The pair returned to the local high of August 6 and in the next few hours can break through and overcome it. The most interesting thing is that the euro did not have any growth catalysts today. Not a single macroeconomic report, single new message from Donald Trump or Mario Draghi or Jerome Powell, in general, from the first persons of the European Union and the US. However, bulls re-energized and began weak purchases of the euro. However, until the euro/dollar pair has not broken the previous high, there remains a high probability that the upward trend will end and a transition to the new downward trend. This option is supported by a fundamental background, which is still very difficult to interpret in favor of the euro. Yes, the Fed lowered the rate; yes, preparing to do it several more times; yes, the trade war between the United States and China is gaining momentum; Indeed, macroeconomic statistics have not been the best in recent months. However, we must consider all this data through the prism of the euro currency. In addition, in our opinion, things in the European Union, which is the issuer of the euro, are worse. The interest rate is already 0.0%, the deposit rate is even at a negative level, and it can be worse at the next ECB meeting, which will create financial problems for commercial banks that will be forced to pay more for placing money on deposits. Moreover, a long-term bank lending program is being prepared to launch in order to support the liquidity of the banking system. Inflation is at a disappointing level, business activity in the manufacturing sector indicates a decline. Today, the indicator of industrial production in Germany - the locomotive of the European economy - qualitatively reflects the state of things. The reduction in annual terms reached 5.2% and 1.5% in monthly terms. Thus, we believe that after the correction, no matter how strong it may be, bears will again take the initiative into their own hands. Trading recommendations: EUR/USD completed a downward correction. Thus, traders are advised to buy the euro while aiming for the resistance level of 1.1305 either after the MACD indicator turns up, or after overcoming the R2 level - 1.1233. In addition to the technical picture, fundamental data and the time of their release should also be considered. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicators window. The material has been provided by InstaForex Company - www.instaforex.com |

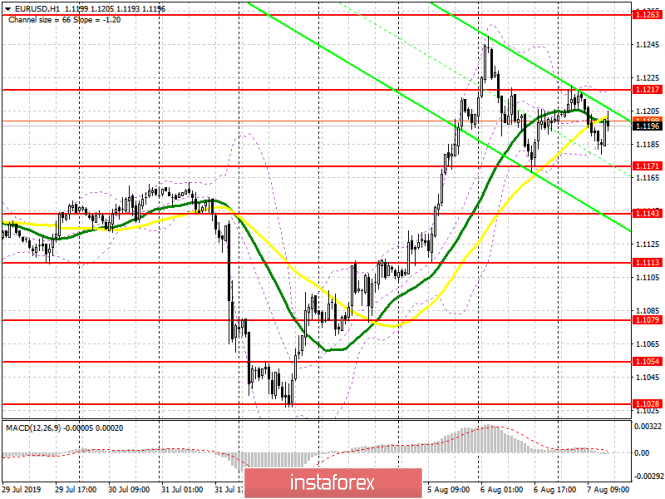

| August 7, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 07 Aug 2019 09:38 AM PDT

Back in June 24, the EURUSD looked overbought around 1.1400 facing a confluence of supply levels. Thus, a bearish movement was initiated towards 1.1275 followed by a deeper bearish decline towards 1.1235 (the lower limit of the previous bullish channel) which failed to provide enough bullish support for the EUR/USD pair. In the period between 8 - 22 July, sideway consolidation range was established between 1.1200 - 1.1275 until a triple-top reversal pattern was demonstrated around the upper limit. Shortly after, evident bearish momentum (bearish engulfing H4 candlestick) could bring the EURUSD back below 1.1235. Early bearish breakdown below 1.1175 facilitated further bearish decline towards 1.1115 (Previous Weekly Low) where temporary bullish rejection was demonstrated before bearish breakdown could take place on July 31. On July 31, Bearish breakdown below 1.1115 allowed further bearish decline towards 1.1025 (lower limit of the depicted recent bearish channel) where significant signs of bullish recovery were demonstrated. Risky traders were advised to look for bullish persistence above 1.1050 as a bullish signal for Intraday BUY entry with bullish target projected towards 1.1115, 1.1175 and 1.1235. It's already running in profits. S/L should be advanced to 1.1160 to secure more profits. Yesterday, the depicted Key-Zone around 1.1235 stood as a prominent Supply Area where a Bearish Engulfing H4 candlestick was demonstrated. Bearish breakdown below 1.1260 was mandatory to allow further bearish decline towards 1.1125-1.1115 where another intermediate-term bullish position can be offered. Today, another bullish visit is being demonstrated towards 1.1235 where bearish rejection should be anticipated. Otherwise, further bullish advancement would be expected towards 1.1275. Trade recommendations : Conservative traders should wait for a deeper bearish movement towards 1.1125-1.1115 for a valid BUY entry. S/L should be placed just below 1.1080 while initial T/P levels should be located around 1.1160 and 1.1200. The material has been provided by InstaForex Company - www.instaforex.com |

| USDCAD bounce continues as expected towards 1.3335 Posted: 07 Aug 2019 09:15 AM PDT Around 1.31 we saw the bounce is USDCAD coming towards 1.32 at first and then towards 1.3335. Now we see price at our second target which is important resistance.

Black line - medium-term resistance trend line USDCAD has respected the lower channel boundary support and reversed higher. Price initially reached our target of 1.32 and now is challenging our last bounce target of 1.3335. Recapturing 1.3340 is important for a continued move higher towards 1.3480-1.35 where we find an important medium-term downward sloping resistance trend line. Support is at the previous resistance area of 1.3230. Breaking below this level would be a bearish sign. The material has been provided by InstaForex Company - www.instaforex.com |

| EURUSD recaptures key 1.12 resistance area and is eyeing 1.13 Posted: 07 Aug 2019 09:10 AM PDT EURUSD has broken out of the bearish short-term channel and after a short-term back test of the channel break out area, we see price remaining above 1.12 which is a bullish sign.

Green rectangle - short-term target Black line - upper wedge boundary Red line - lower wedge boundary Red rectangle- pivot area EURUSD has recaptured 1.12 and is trying to break above recent highs at 1.1250. Resistance is at 1.1270 where we find the 61.8% Fibonacci retracement of the recent decline. Breaking above it will surely push price towards the green rectangle area and the black downward sloping trend line around 1.13. The bounce from 1.10 area is progressing as expected. It remains to be seen now if we see a larger break out above the long-term downward sloping wedge pattern or another rejection around the upper wedge boundary and a new lower low. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold breaks above $1,500 reaching inside our target area Posted: 07 Aug 2019 09:05 AM PDT Gold price was expected to reach $1,500-$1,525 area once it broke above $1,430-45 area. The bearish divergence is now gone but this does not cancel the chances for a pull back. Trend remains bullish.

Black lines - bullish channel Red line- RSI resistance broken Yellow rectangle -pull back target and major support Red rectangle - short-term target Gold price could reach $1,530-35 before pulling back towards $1,450-$1,430. Trend is bullish as price is inside the black bullish channel making higher highs and higher lows. The RSI broke to new highs canceling the bearish divergence. This is an important medium-term bullish signal implying that Gold has much more upside but for the medium-term. So far there is no reversal signal as we pointed out in our last analysis and trend remains bullish. The material has been provided by InstaForex Company - www.instaforex.com |

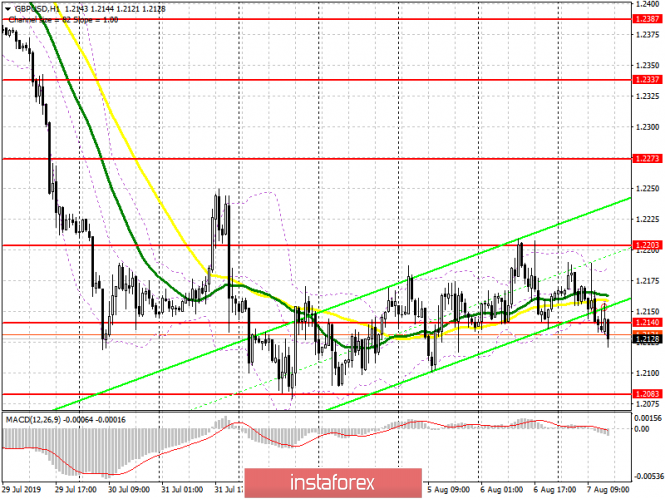

| August 7, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 07 Aug 2019 09:03 AM PDT

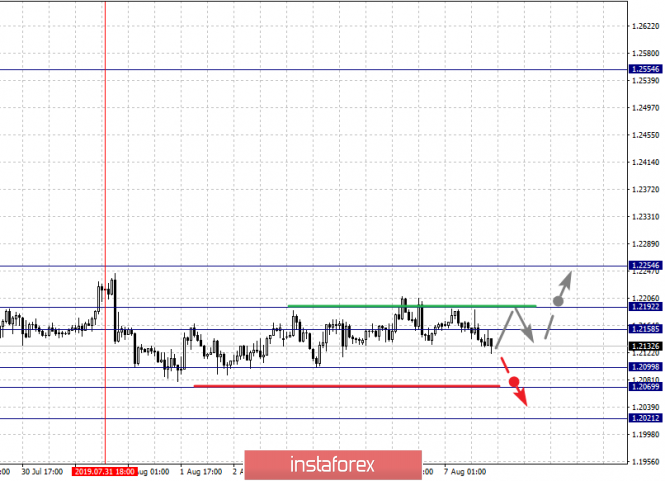

Since May 17, the previous downside movement within the depicted bearish channel came to a pause allowing the recent sideway consolidation range to be established between 1.2750 - 1.2550. On July 5, a bearish range breakout was demonstrated below 1.2550 (the lower limit of the depicted consolidation range). Hence, quick bearish decline was demonstrated towards the price zone of 1.2430-1.2385 (where the lower limit of the movement channel came to meet the GBPUSD pair). On July 18, a recent bullish movement was initiated towards the backside of the broken consolidation range (1.2550) where another valid SELL entry was offered few weeks ago. Moreover, Bearish breakdown below 1.2350 facilitated further bearish decline towards 1.2320, 1.2270 and 1.2125 which correspond to significant key-levels on the Weekly chart. The current price levels are quite risky/low for having new SELL entries. That's why, Previous SELLERS were advised to have their profits gathered. Recently, weak signs of bullish recovery were demonstrated around 1.2100. This may push the GBPUSD to retrace towards 1.2260 then 1.2320 if sufficient bullish momentum is maintained above 1.2230. On the other hand, The price zone of 1.2320 - 1.2350 (backside of the broken channel) stands as a prominent SUPPLY zone to be watched for new SELL positions if the current bullish pullback pursues towards it. Trade Recommendations: Intraday traders are advised to look for early bullish breakout above 1.2230 for a counter-trend BUY entry. Conservative traders should wait for the current bullish pullback to pursue towards 1.2320 - 1.2350 for new valid SELL entries. S/L should be placed above 1.2430. Initial T/P level to be placed around 1.2279 and 1.2130. The material has been provided by InstaForex Company - www.instaforex.com |

| Bitcoin holds above $12,000. August 7, 2019 Posted: 07 Aug 2019 07:06 AM PDT Bitcoin has been quite volatile recently after breaking above the $12,000 area but failed to keep it up and had a major retreat. Though the price drastically fell below $11,500 today, it still managed to climb above $12,000 again. The journey towards the $13,800 area is not going to be an easy one for Bitcoin as it has found strong resistance at $12,000 which is expected to play a vital role in the upcoming rally of the cryptocurrency. Although the price is struggling to break above the $12,000 area, the bullish bias is still quite strong. This, bitcoin is likely to soar above the recent high of $13,800 and reach the psychological price area of $15,000 by the end of August. Besides, Bitcoin's growth has been quite exponential leaving a significant mark on world finance. Currently, it is crowned as the 11th largest money supply in the world. Bitcoin's market capitalization is over $200 billion which is larger than most of the world economies like Australia, Canada, or Brazil. Bitcoin is even competing with gold. The yellow metal has a market capitalization of $8 trillion. However, the growth of Bitcoin is quite impressive, while the technology of decentralized money transaction is assumed to be the future of finance. As for the current scenario, Bitcoin is supported by encouraging fundamentals, and the positive market sentiment is expected to lead to the rise of the cryptocurrency in the coming days. It may reach the $15,000 area in the nearest future if no negative news strikes. TECHNICAL OVERVIEW: Bitcoin is trading above the $12,000 area at the moment, climbing above the Kumo Cloud dynamic resistance area. The dynamic levels are currently crossing over each other, and the bullish signal is quite strong. As far as the price remains above $11,500 with a daily close, the bullish bias is expected to continue and push the price higher towards the $13,800 area and later towards $15,000 in the coming days. TECHNICAL LEVELS: SUPPORT- 10,500 / 11,000 / 11,500 / 12,000 RESISTANCE- 12,500 / 13,300 / 13,800 / 15,000 BIAS- Bullish MOMENTUM- Volatile

|

| Posted: 07 Aug 2019 06:58 AM PDT It is expected that weak data on industrial production in Germany put pressure on the European currency in the morning. The report showed a likely slowdown not only in industrial production but also in the country's economy as a whole. Yesterday's data on the growth of orders in the manufacturing sector did not help either, as the growth of inventories continues to increase, which does not bode well for production in the next few months. The main problem remains trade conflicts and the protracted situation with Brexit. The report also focuses on major structural changes in the automotive industry, which further overshadows the prospects for further growth. All this once again suggests that the German economy will show weaker growth in the 2nd quarter of this year than previously expected. According to the report of the Federal Bureau of Statistics of Germany, industrial production in Germany in June this year decreased more than expected. Thus, industrial production fell by 1.5% in June compared to May, while economists had forecast a decrease of 0.3%. As noted above, the main decrease in activity was noted in mechanical engineering and metallurgy. The growth of production was noted in the construction sector by 0.3%, and a particularly large reduction was recorded in the manufacturing industry, where the decline was 1.8%. Compared to the same period in 2018, production fell by 5.2%. However, closer to the opening of the North American session, the pressure on the euro eased, leaving a fairly good short-term outlook for the growth of risky assets. As for the technical picture of the EURUSD pair, at the moment, the buyers' task is to return to the resistance of 1.1220, the breakdown of which will return to the market players who are betting on strengthening risky assets, and will lead to an update of the monthly highs in the area of 1.1290 and 1.1240. Today, a report on crude oil reserves in the US is expected, which can support oil quotes, which are falling for the third day in a row. Oil reserves in the US are expected to decline last week. Forecasts range from -400,000 barrels to -6.5 million barrels. In the case of a larger, beyond the forecasts of analysts, the reduction of oil reserves on the WTI brand can go back to the area of 53.50 dollars per barrel. Larger support, in the case of a bearish trend, can be seen starting from the level of 51.40 and ending with a minimum of June 12 - 50.70. The material has been provided by InstaForex Company - www.instaforex.com |

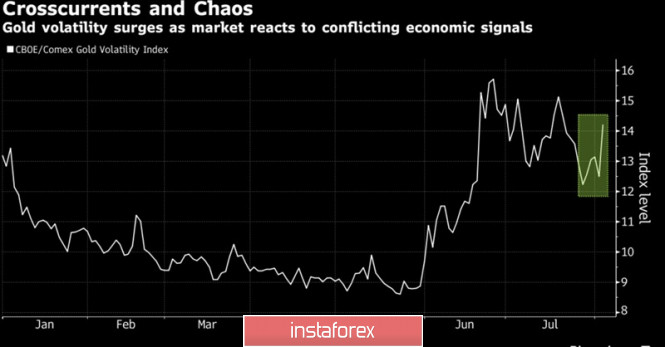

| Gold was "in shock": the specter of a trade war fuels the demand for precious metal Posted: 07 Aug 2019 06:58 AM PDT

The cost of gold is growing steadily and has already overcome the mark of $1500 per 1 ounce. The devaluation of the yuan and the chaos in the markets are pushing investors to more active purchases of precious metals. According to experts, gold retains a good chance to continue the rally. There are a number of reasons for this. First, the Fed closes its eyes to strong statistics on the United States and is ready to stimulate the economy against the backdrop of increased international risks. Secondly, speculators have significant potential to increase long positions in precious metals. This allows Citigroup specialists to forecast an increase in "longs" and an increase in the gold rate to $1,525 per ounce over the next three months. Another point. In the bear market, gold flows tend to go from West to East. Under these conditions, stocks of specialized exchange-traded funds are decreasing, while Asian imports, on the contrary, are expanding. When the market is dominated by "bulls", the process turns in the opposite direction. In this regard, India's reduction in purchases of precious metals in July by 69% to 20.4 tons (the lowest level since March 2016) and the rapid growth of reserves of "gold" ETF indicate that the precious metal has determined the trend. Gold is also supported by the fact that in January-June, Central banks led by Poland, Russia, and China increased purchases of gold to 374 tons. This is the best result in the first half of the year in history. In addition, markets had to adjust to the new reality – the slowdown in global GDP caused by trade wars. The US is raising trade tariffs, which increases investors' concerns about the fate of the global economy and forces them to buy bonds, whose yield has fallen to historic lows, and the volume of debt with negative rates exceeded $13 trillion. Finally, the Celestial Empire signaled that it can release the national currency at will. The People's Bank of China did not put obstacles in the way of "bulls" on USD/CNY. A few decades ago, the markets functioned in the conditions of a tight peg of currencies to gold and the US dollar. As soon as it was decided to abandon the fixed exchange rate regimes, the precious metal sharply jerked up. Currently, in Asia, many national monetary units have close ties with the yuan. If the latter still breaks out of the PBOC cell, the story with the takeoff of XAU/USD may well be repeated. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC 08.07.2019 - End of the downwad correction, watch for buying opporutnities Posted: 07 Aug 2019 06:34 AM PDT Industry news: With a market capitalization of just over $200 billion, Bitcoin is now larger than the money supply of South Korea, Australia, Canada, and Brazil. According to statistics it could soon enter the top ten outpacing the likes of Russia and India. Crypto trader going by the twitter handle 'Rhythm Trader' pointed out that Bitcoin is now the eleventh largest currency in the world. "Bitcoin is now the 11th largest money in the world, and it obtained this with only a nine-page paper created anonymously fueled by a grassroots movement. Millions of people have chosen a bank with no CEO, office or marketing department and it should absolutely blow your mind." Technical view:

Based on the 4H time-frame, I found that downward correction did complete and that there is a chance for testing of resistance levels at $12.300 and in case of the break BTC may try to visit $12.850-$13.100. Both MACD and Stochastic oscillators are showing the new buying flow and there is the flip up on both oscillators, which is positive sign for further rally. Resistance levels to watch: $12.300 – Recent H4 swing high $12.850 – Cluster swing high $13.118 – Swing high Support levels to watch: $11.430 – Recent swing low levels $11.000 – Gap zone Trading recommendation: Due to potential end of the downward correction and underlying upward momentum, my advice is to watch for buying opportunities with the first target at $12.850. The material has been provided by InstaForex Company - www.instaforex.com |

| Fractal analysis for major currency pairs as of August 7 Posted: 07 Aug 2019 06:24 AM PDT Hello, dear colleagues. For the Euro/Dollar pair, the price is in the correction zone from the upward cycle of August 1 and the continuation of the upward movement is expected after the breakdown of 1.1234. For the Pound/Dollar pair, we mainly expect the development of corrective upward movement, as well as the formation of initial conditions for the top. For the Dollar/Franc pair, the price is in the correction zone from the downward cycle on August 1 and the continuation of the downward movement is expected after the breakdown of 0.9735. For the Dollar/Yen pair, the main trend development is expected after the breakdown of 105.71. For the Euro/Yen pair, the price forms the initial conditions for the top of August 5, the development of this structure is expected after the breakdown of 119.45 and the level of 118.22 is the key support. For the Pound/Yen pair, we continue the development of the falling structure from July 31 and it is possible after the price passage of the range of 128.30 – 127.85. Forecast for August 7: Analytical review of the currency pairs in H1 scale:

For the Euro/Dollar pair, the key levels on the H1 scale are: 1.1284, 1.1259, 1.1234, 1.1162, 1.1145 and 1.1120. The price is in the correction zone from the upward structure on August 1. The resumption of the upward trend is possible after the breakdown of 1.1234. In this case, the goal is 1.1259. We consider the level of 1.1284 as a potential value for the top, upon reaching which, we expect consolidation, as well as a rollback to the bottom. The short-term downward movement is possible in the area of 1.1162 – 1.1145 and the breakdown of the last value will lead to a protracted correction. The goal is 1.1120 and this level is the key support for the top. The main trend is the upward structure from August 1, the stage of correction. Trading recommendations: Buy 1.1234 Take profit: 1.1258 Buy 1.1261 Take profit: 1.1284 Sell: 1.1162 Take profit: 1.1146 Sell: 1.1144 Take profit: 1.1122

For the Pound/Dollar pair, the key levels on the H1 scale are: 1.2254, 1.2192, 1.2158, 1.2099, 1.2069 and 1.2021. We follow the downward cycle of July 19, as well as the local downward structure of July 31. The short-term downward movement is expected in the range of 1.2099 – 1.2069 and the breakdown of the last value will allow us to count on the movement to the potential target – 1.2021, from this level, we expect a correction. The short-term upward movement is possible in the area of 1.2158 – 1.2192 and the breakdown of the last value will lead to the formation of initial conditions for the top. The potential target is 1.2254. The main trend is the downward cycle of July 19, the local structure of July 31. Trading recommendations: Buy: 1.2158 Take profit: 1.2191 Buy: 1.2194 Take profit: 1.2254 Sell: 1.2099 Take profit: 1.2070 Sell: 1.2067 Take profit: 1.2025

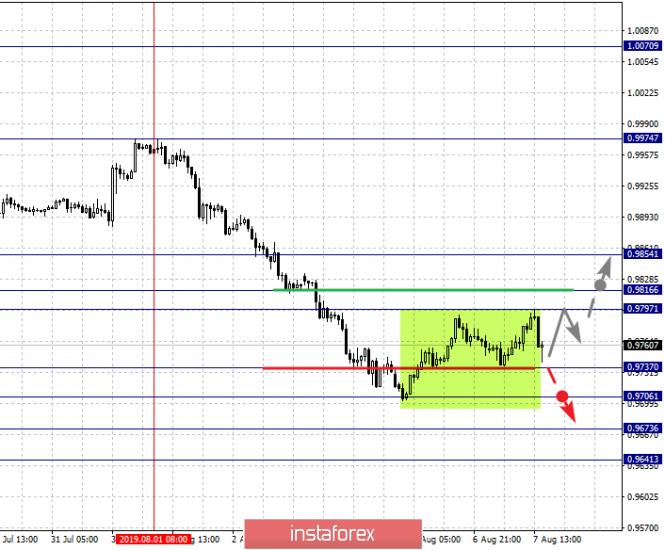

For the Dollar/Franc pair, the key levels in the H1 scale are: 0.9854, 0.9816, 0.9797, 0.9737, 0.9706, 0.9673 and 0.9641. The price is in the adjustment zone from the downward structure on August 1. The resumption of the downward movement is expected after the breakdown of 0.9737. In this case, the target is 0.9706 and in the area of 0.9706 – 9637 is the short-term downward movement, as well as consolidation. The potential value for the bottom is the level of 0.9641, upon reaching which we expect consolidation, as well as a rollback to the top. The short-term upward movement is possible in the area of 0.9797 – 0.9816 and the breakdown of the last value will lead to an in-depth correction. The goal is 0.9854 and this level is the key support for the downward structure from August 1. The main trend is the downward structure from August 1, the stage of correction. Trading recommendations: Buy: 0.9797 take profit: 0.9816 Buy: 0.9818 Take profit: 0.9852 Sell: 0.9736 Take profit: 0.9707 Sell: 0.9704 Take profit: 0.9675

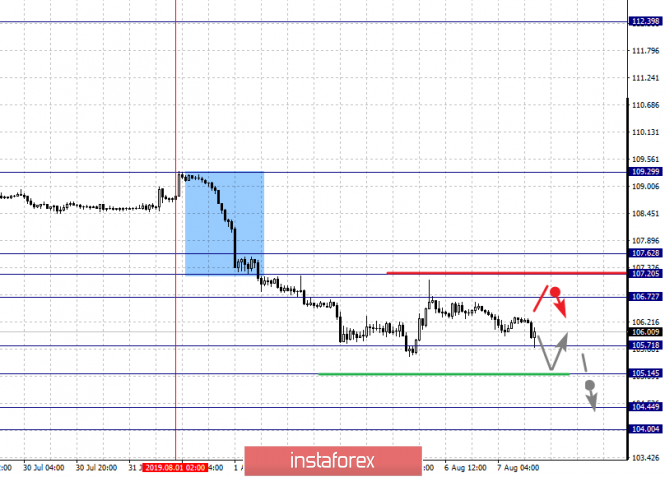

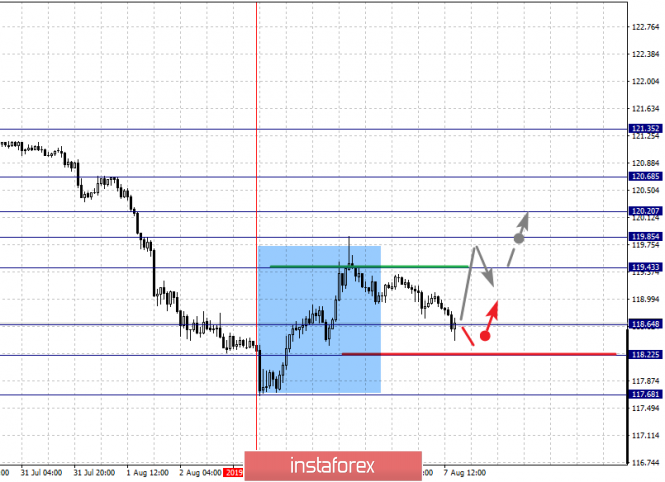

For the Dollar/Yen pair, the key levels in the H1 scale are: 107.62, 107.20, 106.72, 105.71, 105.14, 104.44 and 104.00. We follow the downward structure from August 1. We expect the continuation of the downward movement after the breakdown of 105.71. In this case, the target is 105.14 and near this level is the price consolidation. The breakdown of the level of 105.14 should be accompanied by a pronounced downward movement. The goal is 104.45. We consider the level of 104.00 as a potential value for the bottom, upon reaching which, we expect a correction. Leaving the correction zone is expected after the breakdown of 106.72. The goal is 107.20. The range of 107.20 – 107.62 is the key support for the downward structure. The main trend is the downward structure of August 1. Trading recommendations: Buy: 106.72 Take profit: 107.20 Buy: 107.22 Take profit: 107.62 Sell: 105.69 Take profit: 105.15 Sell: 105.13 Take profit: 104.46

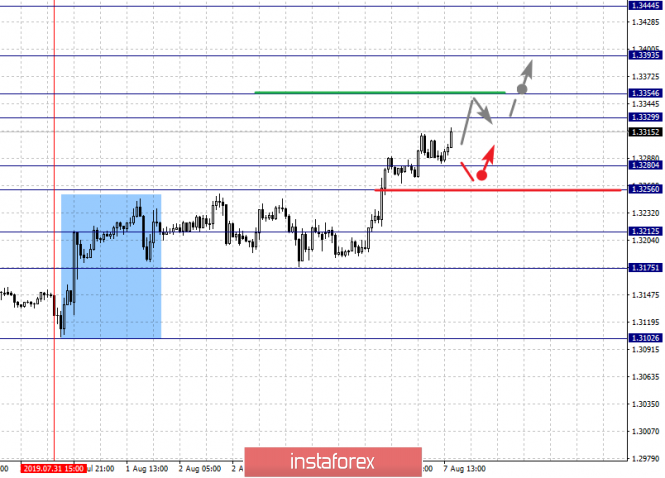

For the Canadian dollar/Dollar pair, the key levels on the H1 scale are: 1.3444, 1.3393, 1.3354, 1.3329, 1.3280, 1.3256, 1.3212 and 1.3175. We continue to monitor the local upward structure from July 31. The short-term upward movement is expected in the range of 1.3329 – 1.3354 and the breakdown of the last value will lead to a movement to the level of 1.3393, upon reaching which, we expect consolidation and a possible rollback to the bottom. The potential value for the top is the level of 1.3444. The short-term downward movement is possible in the area of 1.3280 – 1.3256 and the breakdown of the last value will lead to a protracted correction. The goal is 1.3212 and this level is the key support for the top. Its breakdown will allow us to count on the movement to a potential target – 1.3175. The main trend – local upward structure from July 31. Trading recommendations: Buy: 1.3329 Take profit: 1.3354 Buy: 1.3357 Take profit: 1.3392 Sell: 1.3280 Take profit: 1.3256 Sell: 1.3254 Take profit: 1.3214

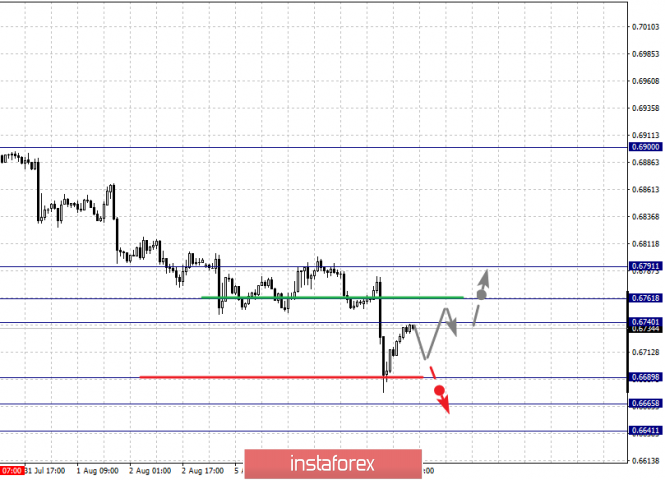

For the Australian dollar/Dollar pair, the key levels on the H1 scale are: 0.6791, 0.6761, 0.6740, 0.6689, 0.6665 and 0.6641. We follow the downward structure from July 31. The continuation of the downward movement is expected after the breakdown of 0.6689. In this case, the goal is 0.6665, from this range, there is a high probability of leaving the market. We consider the level of 0.6641 as a potential value for the bottom, upon reaching which, we expect a rollback. The short-term upward movement is possible in the area of 0.6740 – 0.6761 and the breakdown of the last value will lead to an in-depth correction. The target is 0.6790 and this level is the key support for the downward structure. The main trend is the local downward structure of July 31. Trading recommendations: Buy: 0.6740 Take profit: 0.6760 Buy: 0.6763 Take profit: 0.6790 Sell: 0.6689 Take profit: 0.6667 Sell: 0.6663 Take profit: 0.6642

For the Euro/Yen pair, the key levels on the H1 scale are: 120.68, 120.20, 119.85, 119.43, 118.94, 118.64, 118.22 and 117.68. The price forms the expressed initial conditions for the top from August 5. The continuation of the upward movement is expected after the breakdown of 119.43. In this case, the goal is 119.85 and in the area of 119.85 – 120.20 is the consolidation. The breakdown of the level of 120.20 should be accompanied by a pronounced upward movement. The goal is 120.68. We consider the level of 121.35 as a potential value for the top. The short-term upward movement is possible in the area of 118.64 – 118.22 and the breakdown of the last value will have a downward trend. The first goal is 117.68. The main trend – the initial conditions for the top of August 5. Trading recommendations: Buy: 119.45 Take profit: 119.85 Buy: 120.20 Take profit: 120.68 Sell: 118.62 Take profit: 118.24 Sell: 118.20 Take profit: 117.72

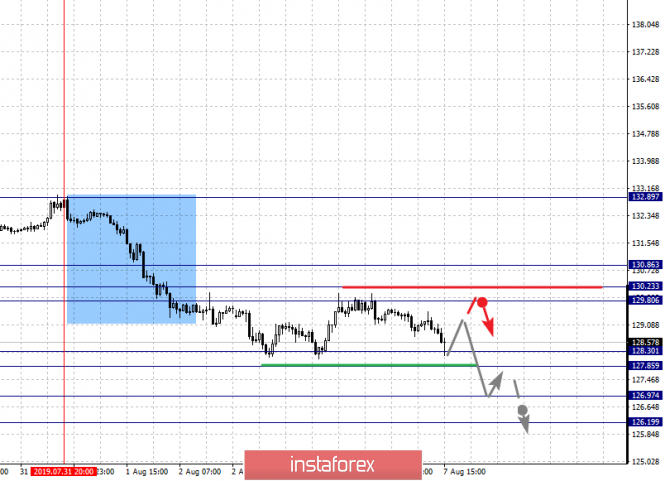

For the Pound/Yen pair, the key levels on the H1 scale are: 130.86, 130.23, 129.80, 128.98, 128.30 and 127.85. We follow the local downward structure from July 31. The continuation of the downward movement is expected after the passage of the price of the range of 128.30 – 127.85. In this case, the goal is 126.97. We consider the level of 126.19 as a potential value for the bottom, upon reaching which, we expect a rollback to the top. The range of 129.80 – 130.23 is the key support. Its breakdown will allow counting on the movement to the level of 130.86, which is the key resistance for the subsequent development of the upward trend. The main trend is the local downward structure of July 31. Trading recommendations: Buy: Take profit: Buy: 130.26 Take profit: 130.84 Sell: 127.85 Take profit: 127.00 Sell: 126.95 Take profit: 126.20 The material has been provided by InstaForex Company - www.instaforex.com |

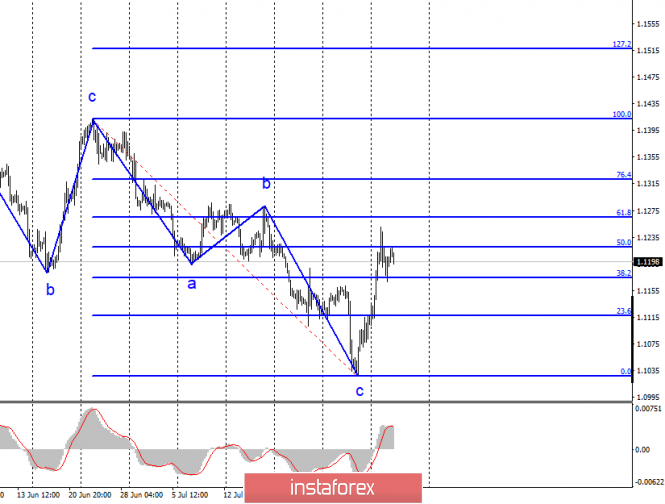

| EUR/USD for August 07,2019 - ABC down completed, upward movement is expexted Posted: 07 Aug 2019 06:20 AM PDT EUR/USD has been trading sideways at the price of 1.1215 but in my opinion there are high odds that EUR finished ABC downward correction and upward movement is expected. The level of 1.1180 did provide a solid support based on 4H time-frame. Resistance levels to watch: 1.1250 – Recent H4 swing high 1.1280 – Cluster swing high Support levels to watch: 1.1180 – Recent swing low levels 1.1150 – Cluster came became support 4H time-frame view:

Based on the 4H time-frame, I found new momentum up on the MACD oscillator in the background, which is sign of the underlying strong bullish pressure. Due to potential completion of the downward correction ABC, I do expect further upside and potential testing of 1.1250-1.1280. As long as the EUR is trading above the 1.1165, I would watch for buying opportunities. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold 08.07.2019 -First target at $1.490 reached, awaiting for second target Posted: 07 Aug 2019 06:10 AM PDT Gold has been trading upwards at the price of $1.496 in the past 24 hours and my first target from yesterday has been reached at the price of $1.490. Anyway, I still expect more upside. Weekly view:

Based on the weekly time-frame, I found breakout of the huge symmetrical triangle pattern and most recently, the breakout of the 6-week trading range. Long term money is bullish together with the funds, which is sign that there is a strong demand for the Gold and I expect further higher price. Key resistance level is set at the price of $1.520. 4H time-frame view:

Based on the 4H time-frame, I found new momentum up on the MACD oscillator, which is sign of the underlying strong bullish pressure. I raised my stop loss to higher level and moved to $1.481 and on that way securing that good profit. Main target is still at the price of $1.520. Watch for intraday dips if you want to scalp on the long side. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 07 Aug 2019 05:46 AM PDT To open long positions on GBP/USD, you need: In the morning, I paid attention to the support level of 1.2140, the formation of a false breakdown at which should have led to a return of demand for the British pound. At the moment, as you can see on the chart, the market remains in the side channel, but there are no people who want to buy a pair of GBP / USD, as well as those who want to sell it. Bulls should try to close the day above the support of 1.2140, which will keep the hope for an upward correction to the resistance area of 1.2203 and to update the new maximum in the area of 1.2273, where I recommend taking the profit. If the pressure on the pound continues, which is more likely against the background of the lack of good news on Brexit, it is best to consider new long positions after the formation of a false breakout in the support area of 1.2083, or buy a rebound from a larger level of 1.2040. To open short positions on GBP/USD, you need: Sellers need a return and consolidation under the level of 1.2140, as only after that it will be possible to talk about their advantage. The absence of news on Brexit is likely to continue to keep the pair in the side channel, but the main task of the bears will be the minimum in the area of 1.2083, the breakthrough of which will strengthen the trend and lead to an update of supports 1.2040 and 1.1985, where I recommend taking the profit. If the demand for the pound returns in the second half of the day, amid the lack of important fundamental data, it is best to consider new short positions after the resistance update of 1.2203, or sell on a rebound from the maximum of 1.2273. Indicator signals: Moving Averages Trading is conducted in the area of 30 and 50 moving averages, which indicates the lateral nature of the market. Bollinger Bands The break of the upper limit of the indicator in the area of 1.2193 may lead to a larger upward correction in the British pound.

Description of indicators

|

| Posted: 07 Aug 2019 05:46 AM PDT To open long positions on EURUSD, you need: The market remains on the side of buyers of the European currency, who managed to keep the pair above the support of 1.1171. The main objective is to break and consolidate above the resistance of 1.1217, which will continue the upward trend in the hope of updating the maximum in the area of 1.1263 and 1.1289, where I recommend taking the profit. However, no less important task is to keep the pair in the side range of 1.1171-1.1217, which will also indicate in favor of the continued growth of the European currency. If the pressure on the euro returns, the new long positions are best seen from the low of 1.1171, on a false breakout, or buy the euro immediately on the rebound from the larger support of 1.1143, where a new lower limit of the upward channel will be formed. To open short positions on EURUSD, you need: I paid attention to the intermediate support around 1.1190 and the probable rebound of the pair from this level. The bears are still in urgent need of a breakthrough low of 1.1171, as in a scenario of side-channel, the demand for the EUR/USD could quickly return. The breakout of the support of 1.1171 will increase the pressure on the pair, which will return a bearish impulse to the market and allow to update the lows of 1.1143 and 1.113, where I recommend taking the profit. If the bulls break above the resistance of 1.1217 in the second half of the day, then it is best to look for short positions on the rebound from the new high of 1.1263, or slightly higher – from the resistance of 1.1289. The lack of important fundamental statistics will continue to keep the market low volatility after the rally, which was observed earlier this week. Indicator signals: Moving Averages Trading is conducted in the area of 30 and 50 moving averages, which indicates the lateral nature of the market. Bollinger Bands In the case of the euro growth, the break of the upper limit of the indicator in the area of 1.1217 will further strengthen demand.

Description of indicators

|

| Posted: 07 Aug 2019 04:41 AM PDT The escalation of the US-China trade conflict allowed gold to rewrite 6-year highs and test the psychologically important mark of $1,500 per ounce. If in 2018, thanks to a large-scale fiscal stimulus, the American economy looked like a monolith, and the trade war did not prevent the Fed from raising the rate on federal funds, then in 2019 the situation radically changed. The fading effect of tax reform and the understanding that tariffs are a double-edged sword make the dollar weaken as the conflict escalates. Precious metal actively uses the weakness of its main competitor. Donald Trump protectionism strengthens the desire of central banks to get rid of dollar dependence and diversify reserves in favor of gold. In January-June, regulators bought 374 tons, which is a new record for the first half of the year. ETF stocks are growing by leaps and bounds, while imports to India are falling amid excessively high prices. Based on these signs, it is safe to say that the bulls dominate the market. The growing risks of the continuation of the Fed's monetary expansion cycle and the increase in the global debt market with negative returns of more than $15 trillion are forcing investors to increase the share of gold in portfolios. A moderate positive from the US labor market in July could somewhat cool the ardor of XAU/USD buyers because the volatility of gold began to grow. But in reality, everything turned out differently. Investors ignore strong macro statistics across the United States, paying attention only to international risks. CME derivatives raised the chances of lowering the federal funds rate in September to 100%, which allowed gold to continue the rally. Gold Volatility Dynamics According to the president of the Federal Reserve Bank of San Francisco, Mary Daly, trade friction is a kind of wind that allows us to understand how the weather vane will behave (the Fed). If this is true, then various issues such as the new duties on Chinese imports, the suspension by Beijing of purchases of American agricultural products and the rise of USD/CNY above psychological mark 7 that practically resolved further easing of monetary policy. Moreover, the slightest signs of deterioration in the health of the US economy will immediately accelerate the correction on the USD index, which will launch a new wave of purchases of precious metals. China is more aggressive and confident than in 2018, when the fall of the Shanghai Composite signaled serious problems in the economy of the Middle Kingdom. Beijing is ready to tolerate further and hopes that the slowdown in the US GDP will become the basis for the Democrats' victory in elections next year. Goldman Sachs predicts that a deal between the United States and China will be concluded no earlier than November 2020. Also, Morgan Stanley warns that a further exchange of blows is fraught with a recession in the global economy in the middle of next year. Against this background, gold feels like a fish in water. The technically confident exit of precious metal quotes beyond the triangle with the subsequent update of the June highs inspires confidence in the bulls to achieve targets by 261.8% and 361.8%, according to the AB = CD pattern. They are located near $1525 and $1550 per ounce. Gold daily chart |

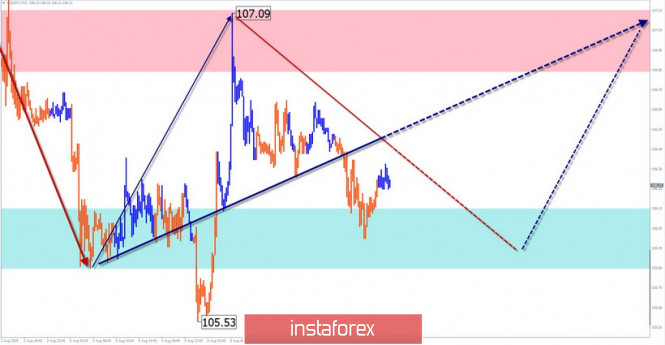

| US yields continue to slide, USD/JPY to touch 105.00 Posted: 07 Aug 2019 04:38 AM PDT US Treasuries have continued to strengthen with the 10-year yield declining to fresh 34-month lows near 1.65%. The 2-year yield has also declined to 1.57%, the lowest level since October 2017. Fed Funds futures have now fully priced in a further rate cut during September meeting with a 75% chance of a further 25 basis-point cut and over 20% chance of a 0.50% cut. USD/JPY found support below 106.00 in the Asian trade, but rallies were held to 106.30 with a fresh retreat ahead of the New York session's opening. The current yield curve will put strong downward pressure on USD/JPY. Global central banks have continued to ease monetary policy with the Reserve Bank of New Zealand cutting rates to a record low of 1.00% from 1.50%, while the Indian and Thai central banks have also delivered rate cuts. Hopes for further global monetary easing will provide some net support to equity markets with US futures making tentative gains. Equity-market gains will curb yen support to some extent. Overall confidence in trade and global growth is, however, liable to weaken further in the short term. It will maintain underlying demand for defensive assets, and net yen demand is likely to increase. President Trump is likely to launch another barrage of criticism over Federal Reserve policies and protest against dollar strength. Accusations of currency manipulation may also intensify. Strong US data releases would ease concerns, but there are no major reports this week. Thus, business confidence is likely to slide given the threat of increased tariffs. Japanese investors will remain extremely wary over US policies, the threat of intervention to weaken the dollar, and sharp currency losses. Capital outflows are likely to remain weak and maintain structural yen demand. If there is a rapid USD/JPY retreat to 105.00, the Bank of Japan is likely to intervene verbally and trigger a sharp corrective bounce.

|

| Technical analysis of EUR/USD for August 07, 2019 Posted: 07 Aug 2019 04:26 AM PDT Overview: The bearish market of the EUR/USD pair turns to bullish market from the 50% of Fibonacci retracement levels (1.1139) towards the pivot point (1.1180). So, TheEUR/USD pair continues to move upwards from the level of 1.1139. Today, the first support level is currently seen at 1.1139, the price is moving in a bullish channel now. The trend is still above the 100 EMA for that the bullish outlook remains the same as long as the 100 EMA is headed to the upside. The market is still in an uptrend. We still prefer the bullish scenario from the spot of 1.1139. As the chart shows below, since the trend is above the 50% Fibonacci retracement on the H1 chart, the market is still in an uptrend. Strong support will be formed at the level of 1.1139 providing a clear signal to buy with the targets seen at 1.1251. If the trend breaks the double top at 1.1251 (first resistance), the pair will move upwards continuing the development of the bullish trend to the level 1.1305 in order to test the daily resistance 2. At the same time frame, resistance is seen at the levels of 1.1251 and 1.1251. The stop loss should always be taken into account for that it will be reasonable to set your stop loss at the level of 1.1138 (below the support 1).

|

| Gold continues climbing to $1,500 Posted: 07 Aug 2019 03:14 AM PDT Fundamental factors remain notably positive for gold given fears over the global trade outlook. With increased expectations of further Fed rate cuts, gold is likely to test $1,500 per ounce. There will be a sharp correction from this level, but strong buying will quickly resume with short-term support near $1,480. Spot gold has continued to move higher with fresh 6-year highs around $1,490 per ounce before correction to $1,487, while December futures have already been traded above $1,500. The global move towards monetary easing has continued with further interest rate cuts over the past 24 hours. The Reserve Bank of New Zealand cut interest rates more aggressively than expected to a record low of 1.00% from 1.50% and promised further action if necessary. At its latest policy meeting, the Indian central bank also cut rates more than expected to 5.40% from 5.75%. Market expectations of a further Fed rate cut at its September meeting have increased as well. The move towards lower rates is being driven by a lack of confidence in the growth outlook which will underpin gold demand. The cost of carry for holding gold has declined, but it cannot move into negative yields. This is a very important factor given that a huge swathe of global bonds trades with a negative yield, the German benchmark 10-year yield, for example, has declined to a fresh record low around -0.55%. There have been no major data releases over the past 24 hours, but risk appetite remains extremely fragile amid fears over the further deterioration in the US-China trade relations. The Chinese yuan slightly weakened on Wednesday with the offshore yuan rate remaining weaker than the key 7.00 level at 7.07. Rhetoric from China's Global Times acting as an unofficial voice of the Chinese authorities warned that China would not yield to the US hegemony and that China was prepared for increased US tariffs. The Chinese response will increase the threat of further aggressive rhetoric from the US Administration. The risk of direct intervention to weaken the dollar has increased despite opposition from the Treasury and any move to weaken the dollar directly would trigger huge dollar buying. There will be tough short-term resistance at the important psychological $1,500 level, but strong buy on dips will continue with a potential move to at least $1,565 this quarter.

|

| Simplified wave analysis and forecast for EUR/USD, USD/JPY, and AUD/USD on August 7 Posted: 07 Aug 2019 01:59 AM PDT EUR/USD On the chart of the major European currency, the main vector of movement was set by the upward wave from August 1. Its wave level indicates that the wave will be at least a correction of the previous short-term wave. Since yesterday, the movement has formed the middle part (B). Forecast: The current correction may take the form of a flat, but a wave zigzag is more likely, with a decrease in the price to the support zone. Movement can drag on all day. Reversal and rise are expected at the end of the day, or tomorrow. Recommendations: When selling the euro today, it's worth lowering the lot and be prepared for sharp price rollbacks. The best option is to refrain from trading during the correction and look for signals to buy the pair at its end. Resistance zone: - 1.1230/1.1260 Support zone: - 1.1160/1.1130

USD/JPY The result of the development of the bearish wave from the end of April, the quotations of the Japanese yen has reached the upper boundary of the zone of a potential reversal of a major scale. The last section of August 1 completed the structure. The upward section, which began on August 5, has a potential reversal wave level. Forecast: After the current decline since yesterday, we should expect the continuation of the price rise and its transition to a larger scale of movement. In the morning, pressure on the support zone is possible. Short-term puncture of the lower boundary of the zone is not excluded. Recommendations: When selling the pair today, caution should be exercised due to the expected low potential of the move. It is recommended to monitor the emerging reversal signals on your vehicle to find the entry point to long positions. Resistance zone: - 106.80/107.10 Support zone: - 106.10/105.80

AUD/USD The main direction of the "Aussie" rate is set by the downward wave of July 19, which is at the end of the medium-term bearish trend. After the internal pullback that ended yesterday, the price pushed a strong price level. Forecast: Before continuing to reduce the price, it is necessary to consolidate the achieved values. In the first half of the day today, we expect a flat attitude of the movement. An upward course is likely, but not further than the calculated resistance. Recommendations: Buying the pair today is possible only on the smallest TF. In the area of the resistance zone, it is recommended to track the rate reversal to find the signals of the instrument sale. Resistance zone: - 0.6750/0.6780 Support zone: - 0.6690/0.6660

Explanations to the figures: Waves in the simplified wave analysis consist of 3 parts (A-B-C). The last unfinished wave is analyzed. Zones show areas with the highest probability of reversal. The arrows indicate the wave marking according to the method used by the author, the solid background is the formed structure, the dotted ones are the expected movements. Attention: The wave algorithm does not take into account the length of time the instrument moves. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 07 Aug 2019 01:53 AM PDT

The pair is still consolidating under the 4/8 Murrey Math Level. Additionally, the one-hour Super Trend Line is acting as resistance, so the price could not fix above this level. Previously, the pair returned below 8/8 MM Level, and Super Trend Lines have formed a 'Bearish Cross' little later on which led to the current decline. 3/8 MM Level stoped the bearish rally, that is why we have got an ongoing sideways price movement. As long as 4/8 MM Level remains unbroken, the bearish scenario will be in force. It is essential that the pair should fix under 3/8 MM Level to confirm the outlook. If it happens, there will be an open door for another decline in the direction of 1/8 MM Level which could act as support. Also, we should watch 2/8 MM Level which could be a starting point for a local upward correction, possibly towards the one-hour Super Trend Line. Furthermore, if the price goes through the 1/8 MM Level, we should be ready for a further decline to the next levels. The bottom line is that GBP/USD remains bearish and there is no bullish signs so far. The one-hour Super Trend Line and 4/8 MM Level are acting as resistance bringing more evidence for this scenario. Therefore, the pair is likely to resume declining anytime soon. The material has been provided by InstaForex Company - www.instaforex.com |

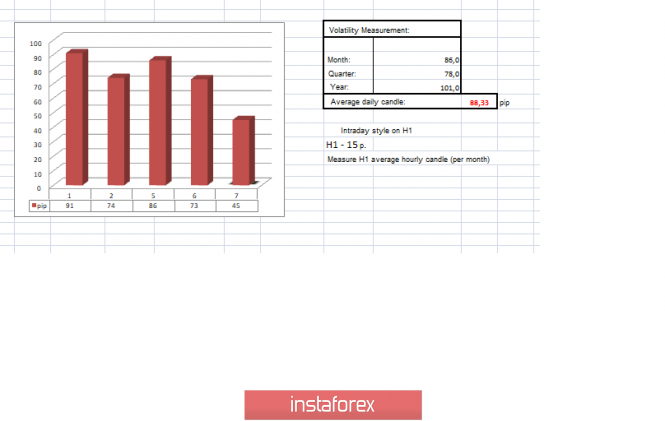

| Trading recommendations for the GBPUSD currency pair - placement of trade orders (August 7) Posted: 07 Aug 2019 01:49 AM PDT Over the past trading day, the pound / dollar currency pair showed a relatively low volatility of 73 points. As a result, it humbly continued the process of accumulation formation. From the point of view of technical analysis, we see that the accumulation process that came to us after a small rollback has been going on for a considerable time, therefore, short positions still prevail in the market, although they had a partial fixation. Otherwise, the rollback would have turned into a significant correction against the background of such a rapid decline, which we saw earlier. As discussed in the previous review, traders continue to hold short positions, having partial fixations in the way. In turn, the theory of further decline, reinforced by the general background of Brexit, gives hope to sat-up sellers. Considering the trading chart in general terms (daily timeframe), we see that the rollback-stagnation phase has not yet violated the "Impulse" clock base, and whether the current fluctuation is a kind of regrouping of trading forces due to the strong overheating of short positions. The information and news background of the past day included statistics on open vacancies in the US labor market, where they expected a reduction from 7.323 thousand to 7.317 thousand, which, in principle, was obtained, but with a review of previous indicators, where as a result, a decrease came out from 7.384 thousand to 7.348 thousand. How did it affected the pound / dollar exchange rate? Frankly nothing, since the pair has been concentrating exclusively on the hype of the UK and EU divorce proceedings for a long time, casting all remaining events and statistics into the background. In this case, the question arises: what is there in the vast battles of England and Brussels? Everything goes on as usual, no one is ready to make concessions. On tuesday, European Commission diplomats said they did not see the reasons and grounds for further negotiations with England, which in fact signals that that a deadlock in the negotiations was successfully found and the scenario for a hard exit is greater than ever. In turn, without giving up, the newly elected Prime Minister Boris Johnson said that he did not intend to resign even in the event of a vote of no confidence, he would achieve his goal. Such a firm position and desire to go out at all costs frighten already frightened investors. Thereby, the clouds over Britain are thickening even more. the newly elected Prime Minister Minister Boris Johnson said that he did not intend to resign even in the event of a vote of no confidence, he would achieve his goal. Such a firm position and desire to go out at all costs frighten already frightened investors. Thereby, the clouds over Britain are thickening even more. the newly elected Prime Minister Minister Boris Johnson said that he did not intend to resign even in the event of a vote of no confidence, he would achieve his goal. Such a firm position and desire to go out at all costs frighten already frightened investors. Thereby, the clouds over Britain are thickening even more. If we were talking about investors and business, then there was news that a full-fledged construction crisis was brewing in Britain, just due to the beloved Brexit. Representatives of the British construction industry said that Brexit, whatever it may be, will greatly affect construction sites, where there will be a strong shortage of labor, as tightening the rules of entry into the country. Let me remind you that about 50% of the workforce are foreigners, and to satisfy the British demand for housing, it is necessary to build at least 250 thousand houses every year. Today, in terms of the economic calendar, we only have a housing price index from Halifax, in the UK, where we see a decline from 5.7% to 4.1%. The main impulse of the market continues to be Brexit's information background, thereby continuing to monitor the information flow. Further development Analyzing the current trading chart, we see that the fluctuation within the boundaries of accumulation is preserved in the market, where there is clearly a certain ambiguity in actions. It seems like they are oversold, but there is nothing to grow at the same time. Traders, in turn, are measured in short positions, partially taking profits and shifting restrictive orders, there will still be an opportunity to replenish the deal. It is likely to assume that the chatterbox within the range of 1.2100-1.2200 (+/- 20p) will remain for some time, but the longer we sit in stagnation, the sharper the splash. Now, the task is to identify a clear informational background, which will lead to a breakthrough of the cluster boundaries, thereby just a puncture is not enough. Based on the available information, it is possible to expand a number of variations, let's specify them: - Positions to buy are considered in the case of price fixing higher than 1.2220. However, a good reason is necessary, since the hope for a technical correction fell last week. - Positions for sale have already been blown away by traders for a long time, topping up will be considered in case of a breakthrough of accumulation and leaving below 1.2090. But again, we need an informational background, which they are likely to expect. Indicator analysis Analyzing a different sector of timeframes (TF), we see that indicators in the short and intraday perspective signal upward interest, but it should be taken into account that congestion and indicators in this case can be volatile. The medium-term outlook, on the other hand, retains an overall downward interest. Volatility per week / Measurement of volatility: Month; Quarter Year Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year. (August 7 was built taking into account the time of publication of the article) The current time volatility is 45 points. Volatility will remain in the framework of the daily average fluctuation, until the moment the cluster is broken. Key levels Resistance zones: 1.2150 **; 1.2350 **; 1.2430; 1.2500; 1.2620; 1.2770 **; 1.2880 (1.2865-1.2880) *; 1.2920 * 1.3000 **; 1.3180 *; 1.3300 Support areas: 1.2150 **; 1,2000; 1.1700; 1.1475 ** * Periodic level ** Range Level *** The article is built on the principle of conducting a transaction, with daily adjustment The material has been provided by InstaForex Company - www.instaforex.com |

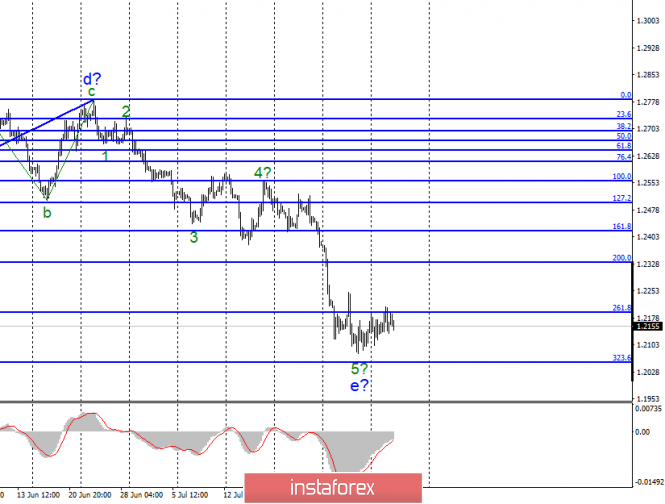

| Posted: 07 Aug 2019 12:50 AM PDT EUR / USD Tuesday, August 6, ended for the EUR / USD pair with the loss of several base points. The deviation of quotations from the reached highs suggests the completion of the first wave of a new upward trend section. If this is true, then the decline in quotations of the euro-dollar pair will continue. Yesterday, the euro stopped being in demand from the markets, as continuous growth lasted 4 days. The time has come for the correctional wave but there is no news background for the instrument now. The markets have already digested all the information about a possible reduction in ECB rates, about a Fed rate cut, about a trade war between Trump and China and are now waiting for new data. The euro, therefore, will need news support in order to continue the increase. However, serious problems can arise with this. It is not a secret that often corrective counter-trend waves are an acceleration of the instrument before a new fall, and now, given the general news background, which remains not in favor of the euro, it is difficult to assume the construction of a stronger trend section than the 3-wave one. Moreover, it is also difficult to imagine the euro currency above 13-14 figures. Purchase goals: 1.1264 - 61.8% Fibonacci 1.1322 - 76.4% Fibonacci Sales goals: 1.1027 - 0.0% Fibonacci General conclusions and trading recommendations: The euro-dollar pair has moved to the construction of an upward trend section. Thus, I recommend buying a pair with targets near the levels of 1.1264 and 1.1322, which equates to 61.8% and 76.4% Fibonacci, for each MACD upward signal, based on the construction of three upward waves. GBP / USD On August 6, the GBP / USD pair gained about 25 base points. However, the wave pattern of the last days looks as if the participants of the vacation market. The pound-dollar pair recovered to the level of 261.8% Fibonacci, but if the market is on vacation, then the bulls have a long vacation. The pound has still no support and is not in demand even in the short term. The news background for the instrument, as before, is not in favor of the British pound. Yesterday, the European Commission said that it sees no reason to continue negotiations on an agreement on Brexit. Thus, the more I do not understand. On the basis of which Boris Johnson believes that the EU should make concessions on the issue of back-stop? And the British Minister, for the preparation for tough Brexit, Michael Gove, accused the European Union of not wanting to enter into new negotiations. In this way, the parties are now at different poles of the planet and are trying to shout to each other. Moreover, it is really not clear what Boris Johnson is guided by when he first declares that he is going to hold new negotiations with the EU publicly, and then accuses the EU of unwillingness to enter into these negotiations? Sales goals: 1.2056 - 323.6% Fibonacci 1.1830 - 423.6% Fibonacci Purchase goals: 1.2783 - 0.0% Fibonacci General conclusions and trading recommendations: The wave picture of the pound-dollar instrument suggests the continuation of the construction of the downward trend section. Thus, I recommend selling the pair on the new MACD signal down with targets located near the calculated levels of 1.2056 and in the case of a successful attempt at a breakthrough - with targets located about 1.1830, which corresponds to 423.6% Fibonacci. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment