Forex analysis review |

- #USDX vs EUR / USD vs GBP / USD vs USD / JPY. Comprehensive analysis of movement options from September 12, 2019 APLs &

- Fractal analysis of the main currency pairs for September 12

- Gold: a great opportunity to buy at the level of $1480-50

- Gold traded in euro: hope for growth

- EUR/USD. September 11. Results of the day. The bulls could not withstand the stress and released the euro

- GBP/USD. September 11. Results of the day. Johnson's fourth defeat: the court recognized the illegality of the suspension

- What exactly and on what scale will the ECB do?

- Pound: first - growth, then - recession

- The Dollar index back tests and respects support at 98

- Time to bounce for Gold

- September 11, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- September 11, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- GBP/USD 09.11.2019 - Support level on the test, watch for buying opportunities

- Gold 09.11.2019 - Bullish divergence on the oscillator and major support on the test

- USD/JPY: Kuroda scared traders: yen loses ground

- BTC 09.11.2019 -Sellers in control, downward target set at $9,350

- GBP/USD: plan for the American session on September 11th. The pound froze amid the lack of new benchmarks

- EUR/USD: plan for the American session on September 11th. Traders are scared of the possibility of a larger decrease in interest

- Technical analysis of AUD/USD for September 11, 2019

- Trading recommendations for EURUSD currency pair – placement of trade orders (September 11)

- Gold lost the battle but won the war

- It's time to wake up for euro on the eve of ECB meeting: the euro is trading in the range, the pound can withstand a bullish

- Trading strategy for Bitcoin on September 11th. The real bitcoin dominance index reaches 95%

- Trading strategy for EUR/USD and GBP/USD on September 11th. Will traders start getting rid of the euro in advance?

- The ECB may never use its last "patron" (We expect continuation of the consolidation of the EUR/USD pair and the prospective

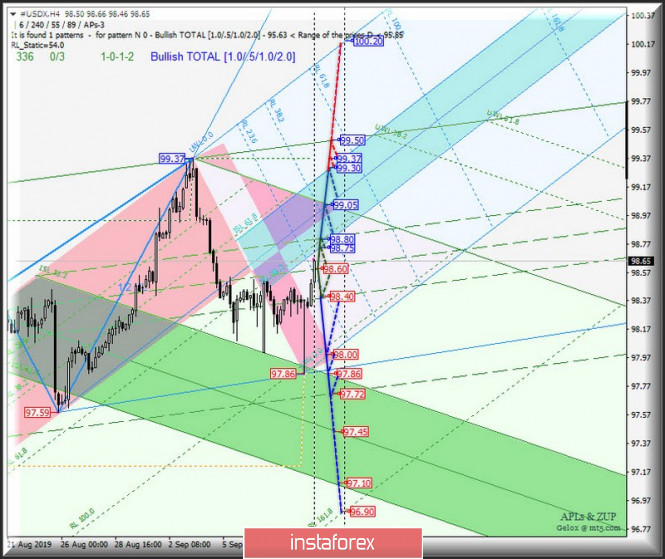

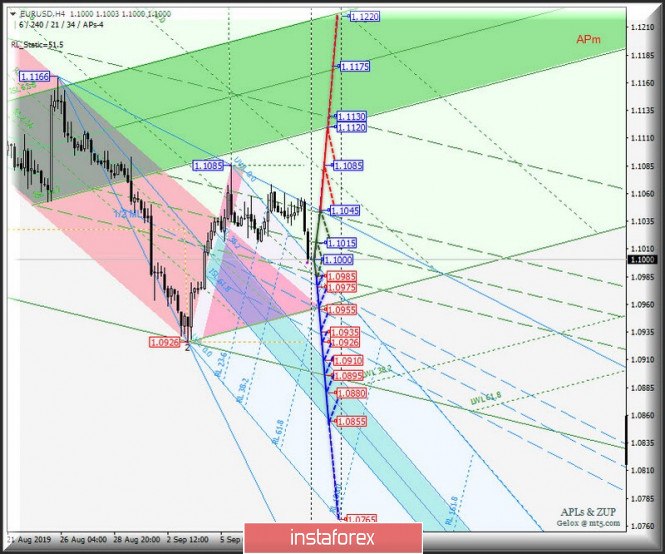

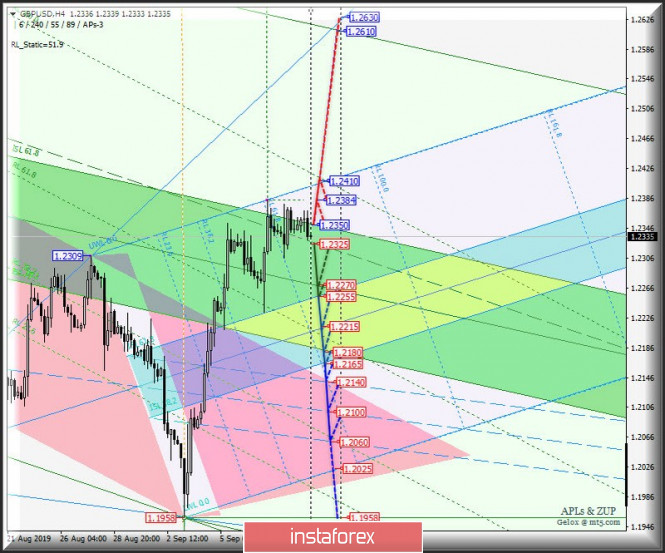

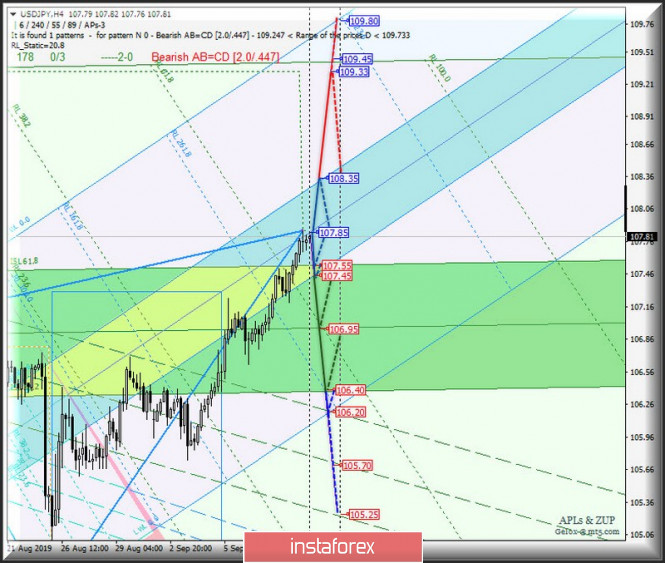

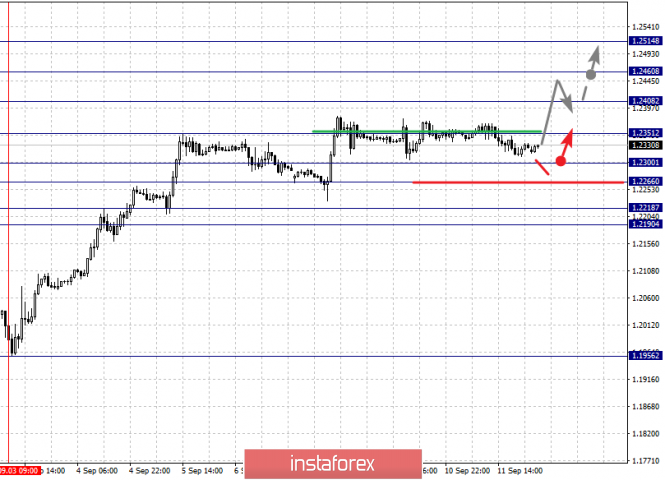

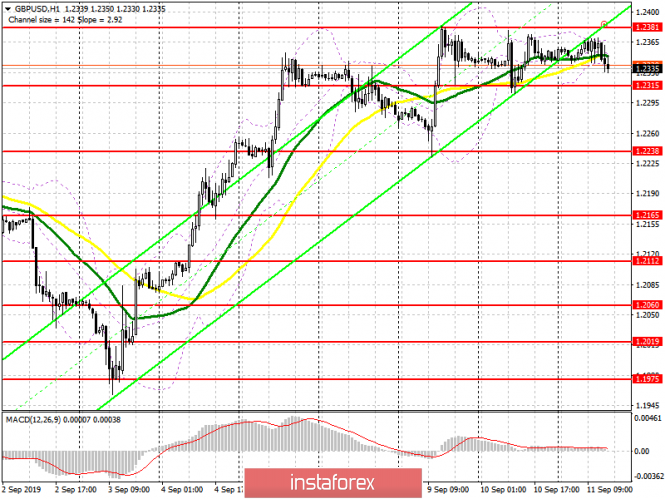

| Posted: 11 Sep 2019 05:21 PM PDT We will consider, in a comprehensive manner, how the development of the movement of currency instruments #USDX, EUR / USD, GBP / USD and USD / JPY will begin to flow from September 12, 2019. Minuette operational scale (H4 time frame) ____________________ US dollar index The dollar index #USDX in 1/2 Median Line channel (98.90 - 98.60 - 98.40) of the Minuette operational scale fork, respectively, further development of the movement of this instrument from September 12, 2019 will be determined by working out and the direction of breakdown of the above levels. We look at the animated chart for details. The breakdown of the upper boundary of the 1/2 Median Line channel (resistance level of 98.80) of the Minuette operational scale fork will confirm the further development of the dollar index movement in the equilibrium zone (98.57 - 99.05 - 99.30) of the Minuette operational scale fork with the prospect of updating maximum 99.37 and reaching the UTL Minuette control line (99.50). If the lower boundary of the 1/2 Median Line Minuette channel (breakdown level of 98.40) is broken, the downward movement of #USDX can be continued to the initial SSL line (98.00) of the Minuette operational scale fork and the boundaries of the equilibrium zone (97.86 (local minimum) - 97.45 - 97.10) Minuette operational scale fork. The details of the #USDX movement are presented in the animated chart. ____________________ Euro vs US dollar The single European currency continues to remain in the 1/2 Median Line channel (1.1045 - 1.1015 - 1.0985) of the Minuette operational scale fork. Therefore, from September 12, 2019, the further development trend of the EUR / USD movement will be determined by the direction of the breakdown of this channel. The details are shown in the animated graphics. With a joint breakdown of the support levels of 1.0985 and 1.0975 (the lower boundary of the 1/2 Median Line channel of the Minuette operational scale fork), the development of the single European currency can continue in the 1/2 Median Line Minuette channel (1.0975 - 1.0955 - 1.0935), and when updating the minimum 1.0926, it will be relevant to achieve at the price of this instrument the boundaries of the equilibrium zone (1.0910 - 1.0880 - 1.0855) of the Minuette operational scale fork. In turn, if the upper boundary of the 1/2 Median Line Minuette channel is broken (resistance level of 1.1045), then there may be a development of the upward movement of EUR / USD to the local maximum of 1.1085 and the boundaries of the equilibrium zone (1.1120 - 1.1175 - 1.1220) of the Minuette operating scale fork. The details of the EUR / USD movement options are shown in the animated chart. ____________________ Great Britain pound vs US dollar The development of Her Majesty's currency movement GBP / USD and from September 12, 2019, will be determined by the direction of the breakdown of the range :

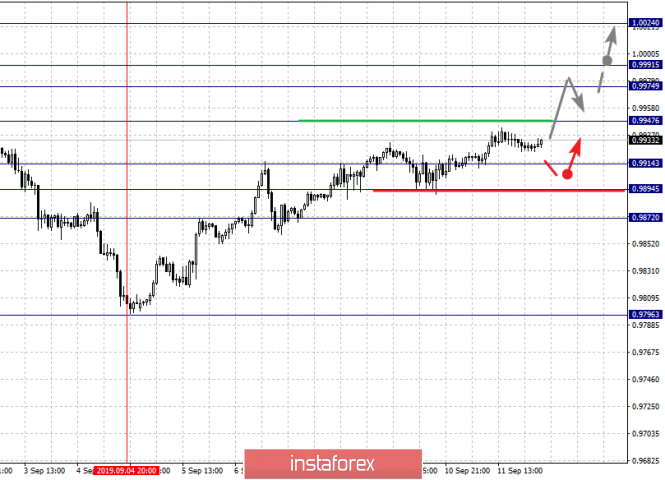

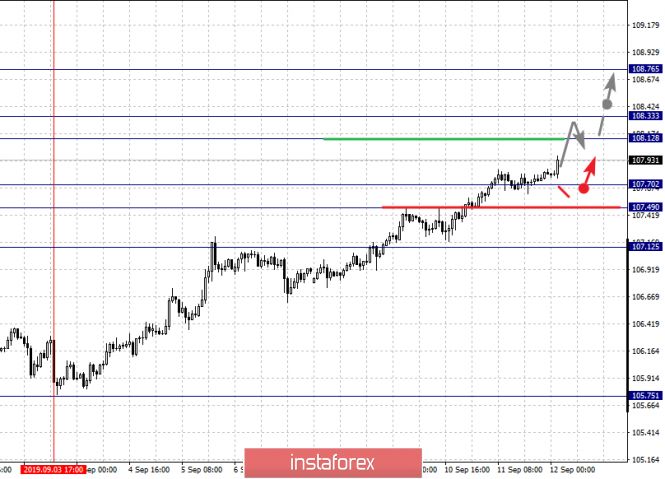

The breakdown of the final Schiff Line Minuette (support level of 1.2325) will make it possible to develop the downward movement of Her Majesty's currency to the goals - the Median Line Minuette (1.2270) - the equilibrium zone (1.2255 - 1.2215 - 1.2165) of the Minuette operational scale fork with the prospect of reaching the a Median Line Minuette channel (1.2140 - 1.2100 - 1.2060). The breakdown of the upper boundary ISL61.8 (resistance level of 1.2350) of the equilibrium zone of the Minuette operational scale fork will direct the development of movement to the local maximum 1.2384, and when it is updated, the upward movement can continue to the final line FSL (1.2410) of the Minuette operational scale fork with the prospect of reaching the final line FSL Minuette (1.2610). The details of the GBP / USD movement can be seen in the animated chart. ____________________ US dollar vs Japanese yen Starting September 12, 2019, the movement of the USD / JPY currency of the "land of the rising sun" will be determined by the development and the direction of the breakdown of the boundaries of the equilibrium zone (108.35 - 107.85 - 107.45) of the Minuette operational scale fork. The development options for this zone are shown in the animation chart. The breakdown of the upper boundary of ISL61.8 (resistance level of 108.35) of the equilibrium zone of the Minuette operational scale fork will direct the development of the currency of the country of the rising sun to maximum 109.33 . In case of breakdown of the lower boundary of ISL38.2 (support level of 107.45) of the equilibrium zone of the Minuette operational scale fork, the development of the USD / JPY movement will continue in the equilibrium zone (107.55 - 106.95 - 106.40) of the Minuette operational scale fork with the possibility of reaching the channel boundaries 1/2 Median Line Minuette (106.20 - 105.70 - 105.25). We look at the details of the USD / JPY movement in the animated chart. ____________________ The review is made without taking into account the news background. The opening of trading sessions of the main financial centers does not serve as a guide to action (placing orders "sell" or "buy"). The formula for calculating the dollar index : USDX = 50.14348112 * USDEUR0.576 * USDJPY0.136 * USDGBP0.119 * USDCAD0.091 * USDSEK0.042 * USDCHF0.036. where the power coefficients correspond to the weights of the currencies in the basket: Euro - 57.6% ; Yen - 13.6% ; Pound Sterling - 11.9% ; Canadian dollar - 9.1%; Swedish Krona - 4.2%; Swiss franc - 3.6%. The first coefficient in the formula leads the index to 100 at the start date of the countdown - March 1973, when the main currencies began to be freely quoted relative to each other. The material has been provided by InstaForex Company - www.instaforex.com |

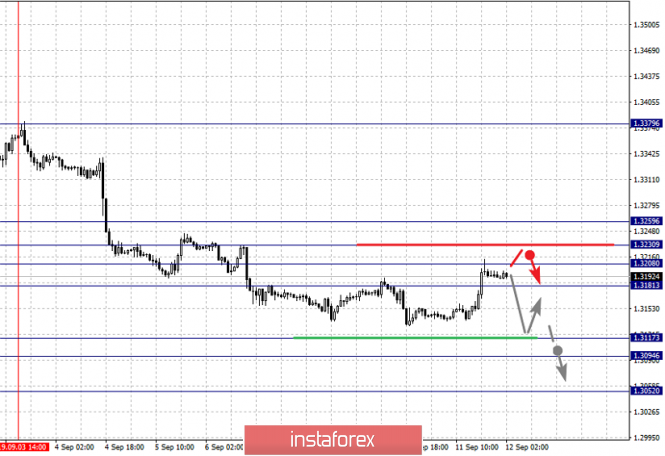

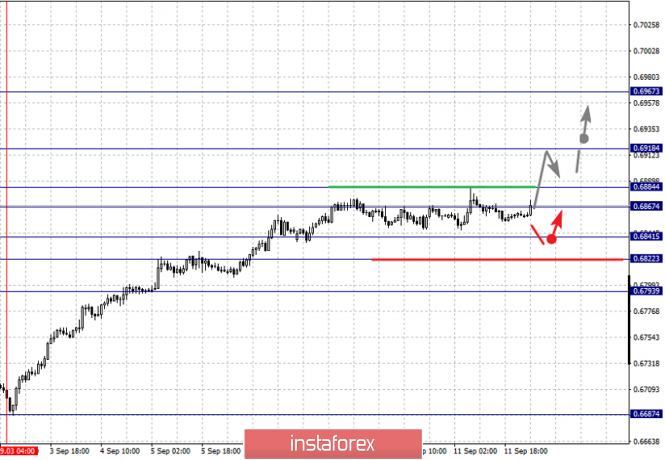

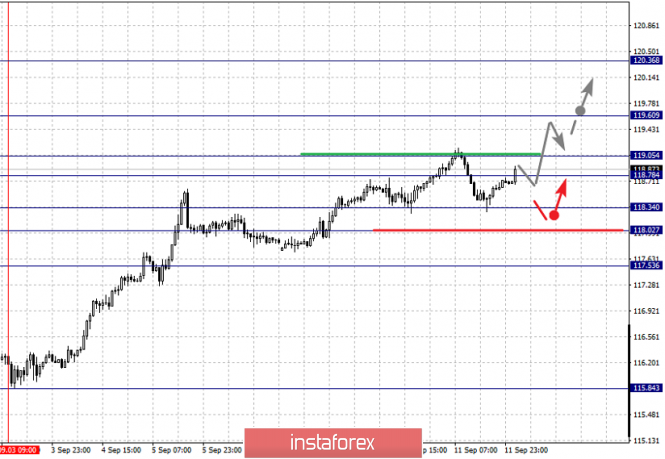

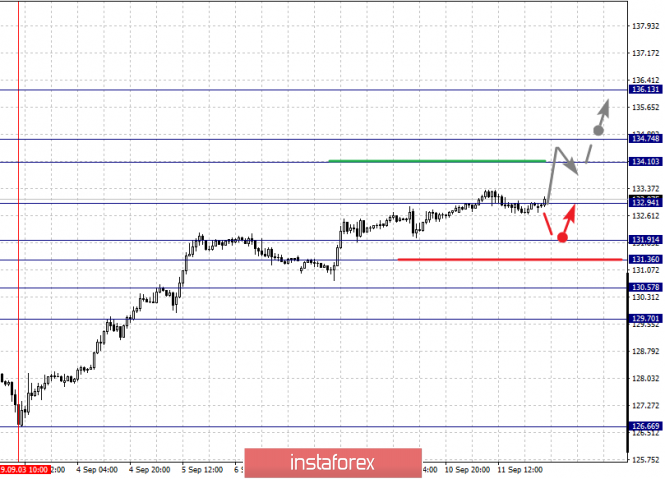

| Fractal analysis of the main currency pairs for September 12 Posted: 11 Sep 2019 05:21 PM PDT Forecast for September 12: Analytical review of currency pairs on the scale of H1: For the euro / dollar pair, the key levels on the H1 scale are: 1.1155, 1.1122, 1.1097, 1.1047, 1.1008, 1.0987, 1.0960 and 1.0926. Here, we continue to monitor the development of the ascending structure of September 3. At the moment, the price is in the correction zone. The continuation of the movement to the top is expected after the breakdown of the level of 1.1047. In this case, the target is 1.1097. Short-term upward movement, as well as consolidation is in the range of 1.1097 - 1.1122. We consider the level of 1.1155 to be a potential value for the upward trend. Upon reaching which, we expect consolidation, as well as a pullback to the bottom. Short-term downward movement is expected in the range of 1.1008 - 1.0987. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.0960. This level is a key support for the upward structure. Its passage at the price will lead to the formation of a local downward structure. In this case, the first goal is 1.0926. The main trend is the ascending structure of September 3, the correction stage. Trading recommendations: Buy: 1.1050 Take profit: 1.1095 Buy 1.1098 Take profit: 1.1120 Sell: 1.1008 Take profit: 1.0988 Sell: 1.0985 Take profit: 1.0960 For the pound / dollar pair, the key levels on the H1 scale are: 1.2460, 1.2408, 1.2351, 1.2300, 1.2266, 1.2218 and 1.2190. Here, we follow the development of the upward cycle of September 3. The continuation of the movement to the top is expected after the breakdown of the level of 1.2351. In this case, the target is 1.2408. The breakdown of which, in turn, will allow us to expect movement to the level of 1.2460, and upon reaching this level, we expect consolidation in the range of 1.2408 - 1.2460. For the potential value for the top, we consider the level of 1.2514. Upon reaching which, we expect a pullback to the bottom. Consolidated movement is expected in the range of 1.2300 - 1.2266. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.2218. The range of 1.2218 - 1.2190 is the key support for the upward cycle. The main trend is the upward cycle of September 3. Trading recommendations: Buy: 1.2351 Take profit: 1.2406 Buy: 1.2409 Take profit: 1.2460 Sell: 1.2300 Take profit: 1.2268 Sell: 1.2264 Take profit: 1.2218 For the dollar / franc pair, the key levels on the H1 scale are: 1.0024, 0.9991, 0.9974, 0.9947, 0.9914, 0.9894 and 0.9872. Here, we follow the development of the ascending structure of September 4. The continuation of the movement to the top is expected after the breakdown of the level 0.9947. In this case, the target is 0.9974. Price consolidation is in the range of 0.9974 - 0.9991. For the potential value for the top, we consider the level of 1.0024. Upon reaching this value, we expect a pullback to the bottom. Short-term downward movement is expected in the range of 0.9914 - 0.9894. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 0.9872. The main trend is the ascending structure of September 4. Trading recommendations: Buy : 0.9948 Take profit: 0.9972 Buy : 0.9991 Take profit: 1.0024 Sell: 0.9914 Take profit: 0.9895 Sell: 0.9892 Take profit: 0.9872 For the dollar / yen pair, the key levels on the scale are : 108.76, 108.33, 108.12, 107.70, 107.49 and 107.12. Here, we are following the development of the ascending structure of September 3. Short-term upward movement is expected in the range of 108.12 - 108.33. The breakdown of the last value will lead to movement to a potential target - 108.76, when this level is reached, we expect a pullback to the bottom. Short-term downward movement is possibly in the range of 107.70 - 107.49. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 107.12. This level is a key support for the top. The main trend is the local upward structure from September 3. Trading recommendations: Buy: 108.12 Take profit: 108.30 Buy : 108.35 Take profit: 108.76 Sell: 107.70 Take profit: 107.50 Sell: 107.46 Take profit: 107.12 For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3259, 1.3230, 1.3208, 1.3181, 1.3117, 1.3094 and 1.3052. Here, we are following the development of the downward structure of September 3. At the moment, the price is in correction. The continuation of movement to the bottom is expected after the price passes the noise range 1.3117 - 1.3094. In this case, the potential target is 1.3052, when this level is reached, we expect a pullback to the top. Consolidated movement is expected in the range of 1.3181 - 1.3208. The breakdown of the latter value will allow us to expect movement to the level of 1.3230. For the potential value for correction, we consider the level of 1.3259, to which we expect the expressed initial conditions for the top. The main trend is the descending structure of September 3, the correction stage. Trading recommendations: Buy: 1.3208 Take profit: 1.3230 Buy : 1.3231 Take profit: 1.3257 Sell: 1.3117 Take profit: 1.3095 Sell: 1.3092 Take profit: 1.3052 For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6967, 0.6918, 0.6884, 0.6867, 0.6841, 0.6822 and 0.6793. Here, we follow the development of the ascending structure of September 3. Short-term upward movement is expected in the range of 0.6867 - 0.6884. The breakdown of the latter value will lead to a movement to the level of 0.6918. Price consolidation is near this value. For the potential value for the top, we consider the level of 0.6967. Upon reaching this level, we expect a pullback to the bottom. Short-term downward movement is possibly in the range 0.6841 - 0.6822. The breakdown of the last value will lead to a long correction. Here, the potential target is 0.6793. This level is a key support for the top. The main trend is the upward structure of September 3. Trading recommendations: Buy: 0.6886 Take profit: 0.6918 Buy: 0.6920 Take profit: 0.6965 Sell : 0.6840 Take profit : 0.6822 Sell: 0.6820 Take profit: 0.6795 For the euro / yen pair, the key levels on the H1 scale are: 120.36, 119.60, 119.05, 118.78, 118.34, 118.02 and 117.53. Here, we continue to monitor the development of the ascending structure of September 3. Short-term upward movement is expected in the range of 118.78 - 119.05. The breakdown of the latter value will lead to a movement to the level - 119.60. Upon reaching this level, we expect consolidation. For the potential value for the top, we consider the level of 120.36. Upon reaching this value, we expect a pullback to the bottom. Short-term downward movement is expected in the range of 118.34 - 118.02. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 117.53. This level is a key support for the upward structure. The main trend is the upward cycle of September 3. Trading recommendations: Buy: 119.07 Take profit: 119.60 Buy: 119.63 Take profit: 120.30 Sell: 118.34 Take profit: 118.04 Sell: 118.00 Take profit: 117.55 For the pound / yen pair, the key levels on the H1 scale are : 136.13, 134.74, 134.10, 132.94, 131.91, 131.36, 130.57 and 129.70. Here, we continue to monitor the development of the upward cycle of September 3. The continuation of the movement to the top is expected after the breakdown of the level of 132.96. In this case, the target is 134.10. Short-term upward movement, as well as consolidation is in the range of 134.10 - 134.74. For the potential value for the top, we consider the level 136.13. Upon reaching which, we expect a pullback to the bottom. Short-term downward movement is possibly in the range 131.91 - 131.36. The breakdown of the last value will lead to an in-depth correction. Here, the target is 130.57. This level is a key support for the upward structure. Its passage in price will lead to the formation of a downward structure. Here, the potential target is 129.70. The main trend is the upward structure of September 3. Trading recommendations: Buy: 132.96 Take profit: 134.10 Buy: 134.10 Take profit: 134.72 Sell: 131.90 Take profit: 131.36 Sell: 131.34 Take profit: 130.58 The material has been provided by InstaForex Company - www.instaforex.com |

| Gold: a great opportunity to buy at the level of $1480-50 Posted: 11 Sep 2019 04:40 PM PDT According to Bart Melek, the head of TD Securities, the strengthening of the dollar, the growth of the value of US stocks and bond yields reflected on the prospects for gold and long positions in the asset. "The yellow metal fell to just below $1,500 an ounce at the beginning of the week, and we think that the price could move to the support level between $1,480–50 if the Fed doesn't weaken the policy at the next meeting," Meleka said. At this stage, the gold market believes that the US central bank will keep rates at the current level without any unconditional commitments to aggressively lower rates in the future. "In our opinion, no matter what central banks do over the next few months, the global economy will decline due to weaker trading activity amid a trade war between the US and China." The largest world markets are under attack. Germany is showing weakness, China continues to disappoint with its performance, and there are signs that the US economy is also slowing. Given these facts and that monetary policy is not very productive, the projected decline in the price of gold should be considered as an excellent buying opportunity, since central banks need to be aggressive in their actions in order to avoid a sharp drop in global activity next year. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold traded in euro: hope for growth Posted: 11 Sep 2019 03:59 PM PDT The yellow metal, traded in euros, fell 4% from it recently marked a record high. After gold has reached the consolidation phase, analysts recommend purchasing precious metals for the European currency. According to analysts, the upward trend in the yellow metal market continues to this day. Amid the growing trend, the price correction is a great chance to increase investment, analysts are certain. The fate of the key support level of gold at $1,500 per ounce will largely depend on the decision of the ECB. On Thursday, September 12, the regulator will announce its new policy. Its decision will be the most important indicator of the precious metal's further dynamics. For the first time since August 22, 2019, world gold prices fell below $1,500 per ounce. On Tuesday, September 10, precious metals were only $1493 per ounce, which corresponds to €1353. Recall that in early September, the price of gold was at €1,409.99, which was a new record high. According to analysts at Citi, in the next year or two, the cost of the yellow metal will increase and reach a new high. This record will be the mark of $2000 per ounce. Interest in precious metals is growing due to the monetary policy of leading regulators (the Fed and the ECB plan to lower interest rates and, if possible, resume monetary stimulus programs), as well as due to the purchase of gold by central banks of developing countries. In the short term, further pricing of precious metals will be significantly affected by the next ECB meeting scheduled for this Thursday. Market participants expect the European Central Bank to reduce the rate on deposits and unveil further incentive measures. If the European regulator continues to pursue a soft monetary policy, then the single euro will depreciate against the US dollar. In such a situation, the cost of yellow metal traded in euros will increase, analysts summarize. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 11 Sep 2019 03:59 PM PDT 4-hour timeframe Amplitude of the last 5 days (high-low): 69p - 68p - 37p - 52p - 29p. Average volatility over the past 5 days: 51p (average). From the very beginning of the week, the bulls on the EUR/USD pair steadfastly held the positions won with great difficulty from the bears, but exactly one day before the announcement of the results of the ECB meeting, they surrendered and weakened their grip. This led to a fall in the euro against the US dollar. Thus, it can be stated with confidence that the downward trend resumed. From a technical point of view, this is a completely expected development of events, as traders had serious problems with overcoming the Ichimoku cloud, and also if you look at the higher timeframe, it is clearly seen that each of the pair's next peak is lower than the previous one. However, everything is also logical from a fundamental point of view. The fact is that no one expects any tightening from tomorrow's ECB meeting, which could cause additional demand for the euro. Moreover, no one even expects the European regulator to leave monetary policy unchanged. But the vast majority of market participants expect a reduction in the deposit rate in the amount of 0.1% to 0.2%, as well as the resumption of the bond redemption program under the QE program. Thus, Mario Draghi and the company can mitigate monetary policy in two directions at once. It is hardly worth saying once again that easing monetary policy is a bearish factor for a currency whose central bank implements this process. The most interesting thing about tomorrow is not the results of the meeting, they are more or less clear to traders right now. The question is what ECB President Mario Draghi will say at the press conference. The fact is that there are less than two months and two central bank meetings remain until the end of his term. Analysts predicted in the summer that Draghi finally wants to "slam the door". Now this period finally come. The question is what will be the actions of Draghi at the next, his final, meeting of the ECB? Will he leave Christine Lagarde a legacy after himself in the form of not just low, but "ultra-low" rates? All this can be understood from the rhetoric of Mario Draghi tomorrow. However, by and large, it is not so important what legacy Draghi will leave Christine Lagarde. It is important that the euro falls, again approaching its two-year lows, updated recently. We just have to mention the ghostly prospects of the euro as there were no serious fundamental factors of growth in the EU currency either. As we have already written many times, the only chance of the euro in the current conditions is to lower the Fed key rate, and the more the better. Euro bulls can only hope that James Bullard's proposal to cut the rate by 0.5% at once will be taken into account by Jerome Powell and to the applause of Trump, the Federal Reserve will announce a serious easing of US monetary policy. Only in this case the bears can calm down, which will give the euro a chance to form at least a short-term upward trend. However, according to many analysts, the United States and the European Union are on the verge of not only a trade, but also a currency war. The governments of the European Union and China realized in time that arguing with Trump makes no sense, and that trade wars are disadvantageous, primarily to China and the EU, as well as the trade deals offered by Trump. That is why the depreciation of the yuan and the euro against the dollar is an effective method of dealing with Trump duties. That is why it does not make any sense for the European Union to "fight" for the euro exchange rate. The technical picture suggests a decrease in the euro/dollar currency pair. Already at the current bar, the pair may gain a foothold below the Ichimoku cloud, and the "dead cross" has already formed. In this case, we expect a fall to at least the support level of 1.0940, unless the ECB presents a surprise tomorrow . Trading recommendations: The EUR/USD pair completed the upward movement. Thus, it is now recommended to re-sell the currency pair with the target of 1.0940. Tomorrow, in anticipation of the announcement of the outcome of the ECB meeting and Draghi's speech, increased caution is advised with any transactions in the market. We advise not to return to purchases at the moment. In addition to the technical picture, fundamental data and the time of their release should also be taken into account. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 11 Sep 2019 03:59 PM PDT 4-hour timeframe Amplitude of the last 5 days (high-low): 176p - 144p - 65p - 151p - 73p. Average volatility over the past 5 days: 122p (high). Just yesterday we wrote that the UK Parliament had gone on a 5-week vacation, and today news was received from the High Civil Court of Scotland, which ruled that the decision of Boris Johnson to suspend the Parliament was illegal, respectively, has no legal force, despite the fact that Queen Elizabeth II approved it. Thus, formally, this means that deputies can return to work in the near future. Most likely, this will happen after September 18, when full hearings will be held in the Supreme Court. After that, a court order will be required to reverse Johnson's decision. Well, the government of Boris Johnson now has about a week to appeal the decision of the court of Scotland. What does this mean for the prime minister of Britain? Game over? It seems that Johnson's great hopes were connected precisely with the vacation of the MPs, so that they would not interfere with his daily meetings, calls for responsibility and reports on his actions. Now, although it is not yet clear when the deputies will return to their work, working sessions in the Parliament should resume, and it will be extremely difficult for Johnson to realize his "backstage games". For example, one of the latest decisions in Parliament was the publication of documents on the so-called "hard" Brexit, which could lead to new questions for the prime minister. In general, from our point of view, this is a complete failure of the prime minister's plans. Meanwhile, another social study was conducted in the UK, which showed that if a referendum on Britain's withdrawal from the EU were held now, 37% would vote "against", 34% would vote "yes", and 18% would abstain from voting. Although these figures do not completely reflect the real state of affairs and the mood of the UK population, it is impossible not to note that a certain part of the citizens are simply tired of Brexit, as it turns out to be somehow endless. We did not receive macroeconomic statistics from the UK today. The only report of the day is the producer price index in the US, which slightly rose in August compared to the previous period and amounted to +1.8% y/y. This report has little hope that inflation in the United States, which will be reported tomorrow, will also accelerate. If this happens, the US dollar may go a little higher against the British pound, as in recent days the bulls have loosened their grip a bit. Of course, for the pound, the Brexit theme remains more important. In the coming days, we may receive new information from Boris Johnson or a statement by Jeremy Corbyn on the decisions of the court of Scotland. All this is very interesting and can affect the British pound. The technical picture reflects the preservation of the upward trend, but it does not deny the readiness of the pound/dollar pair for a downward correction. The MACD indicator has turned down for a long time, but the price is not going down, the pair is in a sideways correction, as evidenced by the Bollinger Bands indicator. A strong inflation report tomorrow could help the bears become active and return the pair to the level of 1.2202. Trading recommendations: The GBP/USD currency pair remains within the upward trend, so long positions remain relevant with a target of the resistance level of 1.2437. To open them, it is recommended to wait for the MACD indicator to turn up, while the price should be above the critical line of Kijun-sen. Pound sales can be seen below the Kijun-sen line with an initial target of 1.2202. In addition to the technical picture, fundamental data and the time of their release should also be taken into account. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| What exactly and on what scale will the ECB do? Posted: 11 Sep 2019 03:59 PM PDT Carsten Brzeski, chief economist at ING, believes the ECB seems to have agreed on what to do, but the recent comments of several hawks indicate that the heated debate is still ongoing. Traditional hawks, such as Jens Weidmann from Germany, Klaas Knot from the Netherlands and Sabina Lautenschlager on the ECB Executive Council, opposed the restart of QE. "In our opinion, even if the group of skeptic hawks has grown, it still looks like a minority. Since inflationary expectations are likely to be far from the ECB's goals, which means that the vast majority will support new incentives. And, even despite the opposition, it is doubtful that this is only a reduction in the rate. In this regard, and for a better understanding of what the ECB is currently thinking of doing, we should pay attention to the speech of the ECB chief economist Philip Lane." According to data provided by Lane, the ECB's unconventional measures since 2014 have boosted economic growth and inflation by about 0.5 percentage points. It is worth noting that almost half of the impact gave QE. However, when the ECB launched QE in 2015, inflation was expected to accelerate from 0.5% in 2014 to 1.3% in 2016. Currently, there is a risk of a serious pullback up to deflation due to actual economic stagnation and low inflation, the likelihood of this is as high as in 2014/5. "Thus, we expect the ECB to launch a "final firework": a 20 bp cut in deposit rates, a revaluation of TLTRO and a restart of QE with a budget of about 30 billion euros per month. At the same time, there is a risk that the opposition, the "hawks", will convince them to slightly delay the launch of QE," Brzeski said. The material has been provided by InstaForex Company - www.instaforex.com |

| Pound: first - growth, then - recession Posted: 11 Sep 2019 03:59 PM PDT The British pound may soon experience the effect of dizzying fluctuations, currency experts at Citi are certain. In the next two to three months, the GBP/USD pair will drop to the level of 1.1700, and then will soar to 1.2500, analysts say. The sharp ups and downs of the pound are largely due to the unstable economic and political situation in the UK. This primarily concerns the high likelihood of a "hard" Brexit, as well as other political risks, such as the formation of a Labour government after the general election. At the same time, macroeconomic statistics in the UK remains weak. Citi believes that only fiscal stimulus can support the pound and mitigate the economic blow in the event of a hard Brexit. The British currency at the moment was between Scylla and Charybdis. There are two political scenarios, the implementation of which does not portend anything good to Great Britain. In the first case, if the Conservative Party, whose leader is Prime Minister Boris Johnson, wins the election, Britain's exit from the EU may occur without an agreement. Johnson's position on this issue has been known for a long time: he is a supporter of withdrawal from the European Union in any situation - with or without an agreement. In the case of the second scenario, there is a lower likelihood of a hard Brexit if the Labour Party wins the election, but the socialist agenda will be in the foreground, Citi said. In the short term, the position of the British pound looks optimistic, analysts emphasize. They forecast active growth. This is confirmed by current quotes of the British currency: on Wednesday, September 11, the pound started at around 1.2353, and then traded in the range of 1.2361–1.2366. However, the rise predicted by Citi experts will not last long. In the long term, the British currency is expected to decline. Citi currency strategists predict a pound decline to 1.1700 over the next three months. In the next 6-12 months, analysts expect the restoration of the British currency to the level of 1.2500. The material has been provided by InstaForex Company - www.instaforex.com |

| The Dollar index back tests and respects support at 98 Posted: 11 Sep 2019 02:19 PM PDT The Dollar index has back tested the very important area of 98 where it was once resistance but now support. Price remains inside a medium-term bullish channel and as long as price is above 98, we should expect a new higher high towards 100.

Red rectangle - support Green rectangle - resistance The Dollar index is bouncing off the support area of 97.80-98. This was once resistance and now support. Price has respected this support at the current pull back and is now bouncing. This is a sign of strength. This increases the chances of price touching and testing the green trend line resistance again.

|

| Posted: 11 Sep 2019 02:10 PM PDT Gold price as expected has reached the lower boundary of the medium-term bullish channel. Price is now shows signs of a reversal and that support is being respected. This could lead even to new 2019 highs.

Green line - major trend line support Gold price has reached $1,484 and has started to bounce. Respecting the channel could lead to a new move higher so bulls need to start seeing higher highs and higher lows. Gold price should stay above $1,484 in order for the move higher to be confirmed. Breaking below $1,484 would be a sign of weakness.

|

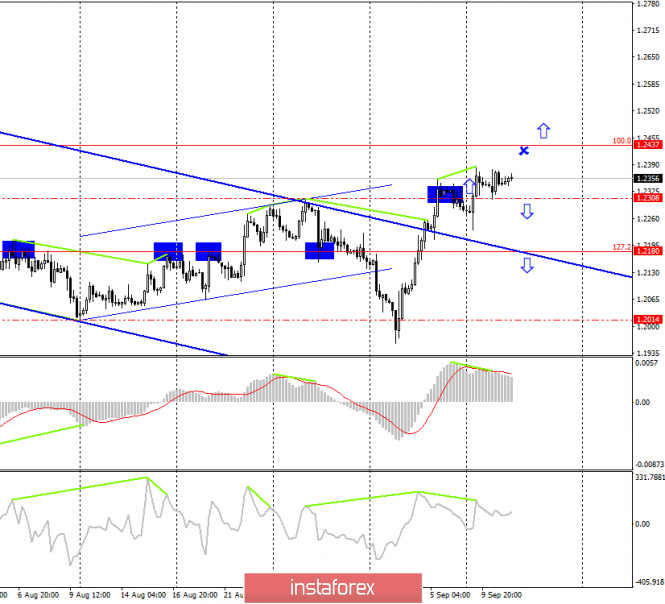

| September 11, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 11 Sep 2019 09:18 AM PDT

On July 26, Bearish breakdown below 1.2385 (Wedge-Pattern Key-Level) facilitated further bearish decline towards 1.2210 and 1.2100 which corresponded to significant key-levels on the Weekly chart. In Early August, another consolidation-range was temporarily established above 1.2100 before August 9 when temporary bearish movement was executed towards 1.2025 (Previous Weekly-Bottom). Recent bullish recovery was demonstrated off the recent bottom (1.2025). This brought the GBP/USD pair back above 1.2100 (Lower limit of the recently established consolidation-zone) within the depicted short-term bullish channel. As expected, further bullish advancement was demonstrated towards 1.2230 then 1.2280 where recent bearish rejection was demonstrated (near the upper limit of the recent movement channel). That's why, another quick bearish decline was demonstrated towards 1.2100 then 1.2000 (corresponding to the previous bottom established on August 9). Last Week, Early signs of bullish recovery (Bullish Engulfing candlesticks) were manifested around 1.1960 bringing the GBPUSD back above 1.2100 and 1.2220 where the GBPUSD pair looked overbought. However, further bullish momentum was demonstrated towards 1.2320 bringing the pair back inside the depicted movement channel again. The Long-term outlook remains bearish as long as the upper limit of the current movement channel around 1.2400 remains defended by the GBPUSD bears. Temporary bullish advancement may be demonstrated towards 1.2400 - 1.2420 where the upper limit of the current movement channel comes to meet the pair. On the other hand, early bearish breakdown below 1.2270 turns the short-term outlook into bearish, thus allowing more bearish decline towards 1.2220 and 1.2100. Trade Recommendations: Conservative traders should wait for the current bullish movement to pursue towards 1.2400-1.2420 (upper limit of the depicted movement channel) for a valid SELL entry. T/P level to be placed around 1.2300, 1.2250 then 1.2220 while S/L should be placed above 1.2450. The material has been provided by InstaForex Company - www.instaforex.com |

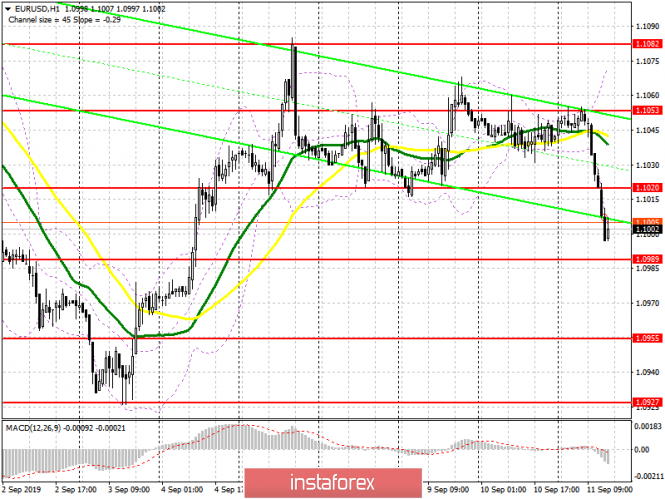

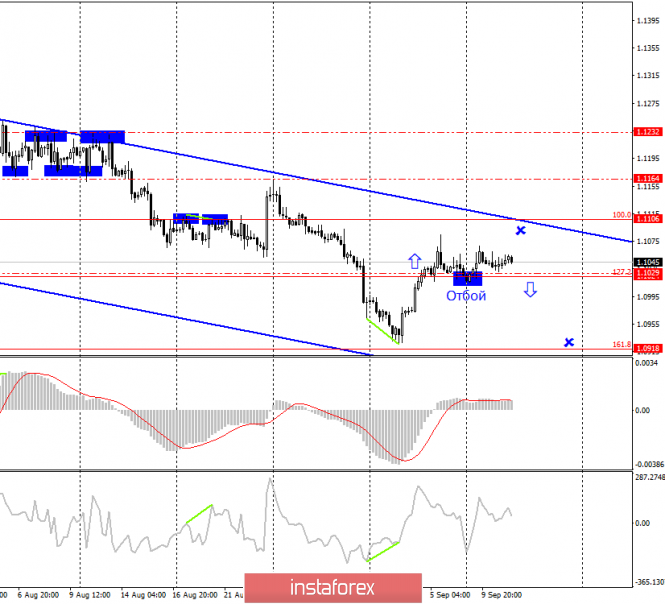

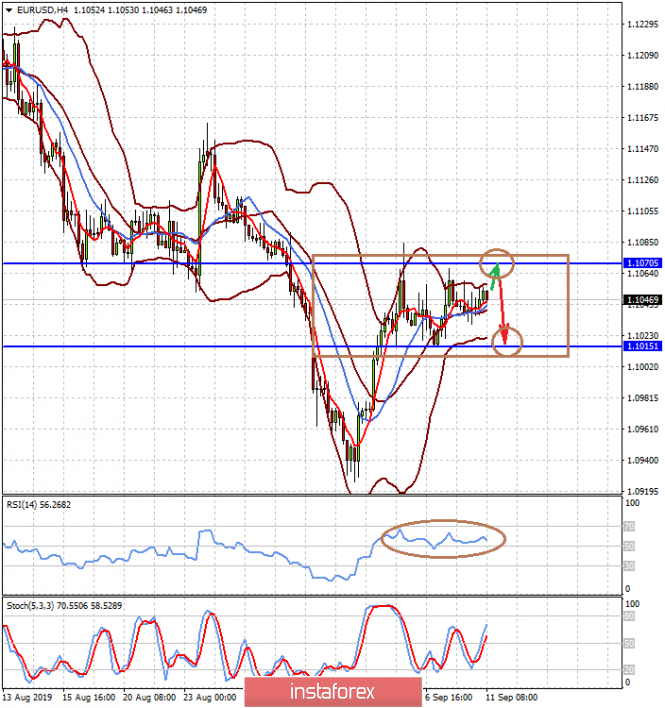

| September 11, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 11 Sep 2019 08:58 AM PDT

In Mid-August, the EUR/USD has been trapped between 1.1235-1.1175 for a few trading sessions until bearish breakout below 1.1175 occurred on August 14. Bearish breakout below 1.1175 promoted further bearish decline towards 1.1075 where the backside of the broken bearish channel has provided temporary bullish demand for sometime (Bullish Triple-Bottom pattern). Bullish persistence above 1.1115 was needed to confirm the short-term trend reversal into bullish. However, the depicted Triple-Bottom pattern was invalidated especially after the EURUSD pair bulls have failed to establish Bullish persistence above 1.1115. Moreover, the recently established short-term uptrend line has been invalidated as well thus rendering the short-term outlook as bearish. Two weeks ago, a quick bearish decline was demonstrated towards 1.0965 - 1.0950 where the backside of the broken channel came to meet the EURUSD pair again. Risky traders were advised to look for a valid BUY entry anywhere around the price levels of 1.0950. All T/p levels were successfully reached within the recent bullish movement during last week's consolidations. Yesterday, the EUR/USD pair was testing the backside of both broken trends around 1.1060-1.1080 where early signs of bearish rejection were demonstrated as expected in previous articles. Bearish Breakdown below the Previous Weekly Bottom (1.0940) is mandatory to enhance further bearish decline towards 1.0900 and 1.0840 (Fibonacci Expansion Key-Levels). Trade recommendations : Conservative traders were advised to have a valid SELL entry around the price levels of (1.1050-1.1070). It's already running in profits. S/L should be lowered to 1.1090 while remaining target levels should be located at 1.0965, 1.0935 and 1.0900. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD 09.11.2019 - Support level on the test, watch for buying opportunities Posted: 11 Sep 2019 06:57 AM PDT GBP is in consolidation phase after the strong movement higher in the background and increasing momentum. Watch for potential long entries near the supports at 1.2325-1.2305 Green lines – Corrective downward channel

I still do expect potential new wave up on the GBP due to strong movement up in the background. Selling near the support levels is not an option in my opinion due to poor trading location. Watch for any reversal pattern on the 5/15 minute time-frame in order to confirm potential rally. Key support levels are set at 1.2325 (Fibonacci expansion 61.8%) and 1.2300 (recent swing low). Upward objective is set at the price of 1.2369. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold 09.11.2019 - Bullish divergence on the oscillator and major support on the test Posted: 11 Sep 2019 06:48 AM PDT Gold price is still holding above our key support at $1,480 and there is bullish divergence on the MACD oscillator in the background, which adds more potential to the upside.

Blue horizontal lines – Important resistance levels and upward objective Yellow rectangle - major support area Green rising line – Expected path I still do expect potential rally on the Gold at least to re-test $1,501 level or $1,518.MACD oscillator is showing bullish divergence and that is good confirmation for our bullish bias. Key support zone is at $1,490-$1,480 and resistance levels at $1,503-$1,518. Bears need to be very cautious as there is strong support on the test and bullish divergence on oscillator. As long as the Gold is holding above $1,480 there is a chance for potential test of $1,523 or higher. The 20-day trend is still bullish... The material has been provided by InstaForex Company - www.instaforex.com |

| USD/JPY: Kuroda scared traders: yen loses ground Posted: 11 Sep 2019 06:46 AM PDT The dollar/yen pair is holding at 1.5-month highs amid weakening anti-risk sentiment in the market, as well as in anticipation of the September meeting of the Bank of Japan, at which the regulator may announce a reduction in interest rates deep into negative territory. Although the meeting of the members of the Japanese regulator will take place only at the end of next week (September 19), the yen "in advance" plays out its possible consequences. Recent comments by Haruhiko Kuroda only added fuel to the fire: the head of the Central Bank of Japan did not rule out easing monetary policy at the next meeting while focusing on the slowdown in the global economy. Thus, the prevailing fundamental background at the moment contributes to the growth of USD/JPY at least to the middle of the 108th figure, especially if the bulls can gain a foothold above the resistance level of 107.90 (the average line of the Bollinger Bands indicator on the weekly chart).

It is worth recalling that in July last year, the Bank of Japan expanded the range, or rather, the limits of long-term interest rates: as a result of this correction, the regulator moved not only the "ceiling", but also the lower limit of -0.2%. In other words, Kuroda had already set the stage for a possible interest rate cut further into the negative. Most experts categorically stated that the focus should be on the lower border of this corridor, and not the upper one, given the dynamics of inflation in the country. More than a year has passed since then, and as you know, the Japanese Central Bank did not take this opportunity, although Kuroda repeated at almost every meeting that the regulator was ready to act "if necessary". Recently, however, traders have become seriously concerned that the Bank of Japan will move from words to deeds. First, despite years of monetary stimulus, Japanese inflation remains well below the two percent target. According to the latest data, core inflation in Japan (in annual terms) remained at the lowest level in the last two years. Excluding fresh food, the July consumer price index came out at 0.6% – the weakest rate of growth since July 2017. In his last interview, which was published last week, the head of the Bank of Japan noted that the situation is not so bad that the regulator resorted to "decisive action" now, especially against the background of steady growth in consumer spending and investment. However, he added that the issue of rate cuts further into the negative area "remains on the agenda." Moreover, Kuroda outlined several possible scenarios. In addition to a direct rate cut, the Central Bank may lower the target for long-term rates, intensify asset purchases, while accelerating the expansion of the monetary base. Also, the head of the Central Bank did not rule out that the above options can be combined. Although Harukiko Kuroda emphasized that the regulator will resort to this scenario only if the situation worsens, we remember January 2016, when the Japanese Central Bank unexpectedly introduced a negative rate on new deposits. Although the week before, Kuroda was convincing parliamentarians that the Central Bank "did not even seriously consider such a scenario." Given this incident, traders should not lose their vigilance: the Bank of Japan may begin to act at the September meeting, despite the seemingly unlikely scenario.

In general, the bulls of the USD/JPY pair have a difficult time: the yen is forced to react not only to the internal fundamental background but also to the external one. As a rule, these factors have the opposite meaning for the yen, so the price dynamics follows the principle of "one step forward – two back". The complexity of the situation is because the northern momentum of the pair ends abruptly and often unexpectedly: for this, for example, it is enough that rumors about the escalation of the US-China trade conflict appear on the market. Now, there is a period of "thaw" in relations between Beijing and Washington. On the eve of the next (13th) round of negotiations to be held in early October, China abolished duties on some goods from the United States: the Chinese government decided to remove additional tariffs of 25% on 16 categories of goods from September 17. Although the list did not include important items of American exports (soybeans, pork, and corn), this "goodwill gesture" was positively perceived by the foreign exchange market: anti-risk sentiment decreased, as did the demand for the Japanese currency. Thus, the USD/JPY pair has the potential for further growth due to optimistic sentiments about the prospects of the US-China talks, as well as due to possible actions of the Japanese regulator at the September meeting. Taking into account these factors, the pair may grow to the Kijun-Sen line on the weekly chart, which corresponds to the level of 108.40. The next resistance level is at 109.50 (the lower limit of the Kumo cloud on the same timeframe). If the 13th round of negotiations is disrupted (including at the preparatory stage), the pair will quickly return to the 106th figure, despite the "dovish intentions" of the Central Bank of Japan. The material has been provided by InstaForex Company - www.instaforex.com |

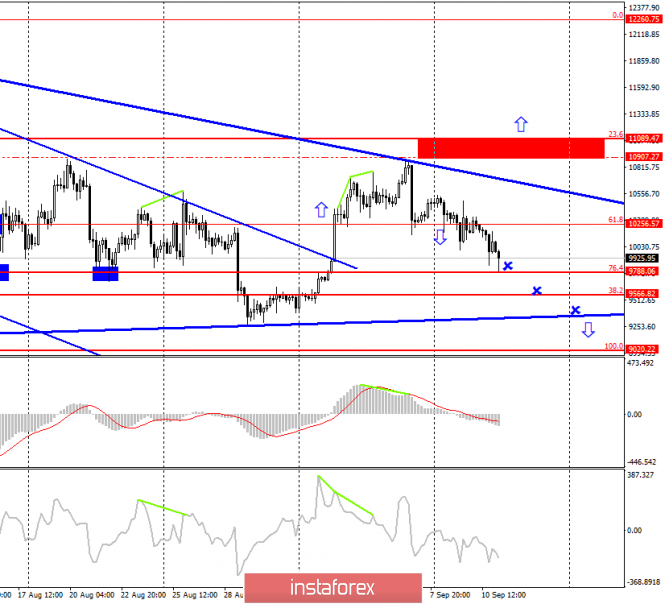

| BTC 09.11.2019 -Sellers in control, downward target set at $9,350 Posted: 11 Sep 2019 06:37 AM PDT Industry news: The intraday polarity in the bias of Gold and Bitcoin showed an uneasiness of investors towards putting money in the latter. Morgan Creek Capital co-founder & partner Anthony Pompliano in June projected monetary easing policies as breeding grounds for bitcoin bulls, stating that a drop in the value of fiat currencies would create demand for non-sovereign assets/currencies like bitcoin. Meanwhile, noted economist Alex Kruger said that only speculators – for now – can drive the price of bitcoin higher, not institutional investors.. Technical view:

Bitcoin did exactly what I expected yesterday and our downward target is still expected at the price of $9.350 Pink lines – Larger symmetrical triangle in play Black lines - Channel Green falling line – Expected path Most recently, I found that there is first lower high and lower low on 4H time-frame, which is indication that short-term down trend is gaining power . There is also rejection of the middle Bollinger band, which adds more potential downside. I still expect potential new wave down for potential fulfill of the lower symmetrical triangle boundary.. Key support is at $9.350 and resistance at $11.000 and $11.200. Bulls need to be very cautious as there is strong aggressive selling from the key resistance. As long as the Bitcoin is trading below $11.200, The level around $10,000 looks like a decent sell zone if you already don't have sell on Bitcoin. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 11 Sep 2019 06:29 AM PDT To open long positions on GBP/USD, you need: Not surprisingly, buyers of the British pound lost interest in it amid the lack of positive fundamental statistics and news on Brexit. At the moment, the task of the bulls is to break through the same resistance at 1.2380, which limited the upward potential yesterday in the second half of the day. Only this will allow the bullish market to resume, the target of which will be the highs of 1.2427 and 1.2460, where I recommend taking the profits. If the bears build a downward correction in the second half of the day, the support will be provided by the level of 1.2315, but you can buy from there only under the scenario of the formation of a false breakdown. It is best to open long positions for a rebound in the minimum area of 1.2238. To open short positions on GBP/USD, you need: Sellers did not let GBP/USD close to the resistance of 1.2380 today, which led to the formation of a downward correction. However, the main target of the bears for the second half of the day will be the support test of 1.2315, the breakdown of which can increase the pressure on the pound, which will lead to a decrease in the minimum area of 1.2238, where I recommend taking the profit. If the bullish momentum in the North American session leads to a breakthrough in the resistance at 1.2380, it is best to consider new short positions after updating the local highs around 1.2427 and 1.2460. However, without news on Brexit, and preferably positive, it will be very problematic to count on a larger increase in GBP/USD. Signals of indicators: Moving Averages Trading around 30 and 50 moving averages, indicating the sideways nature of the market. Bollinger Bands Volatility is very low, which does not give signals to enter the market.

Description of indicators

|

| Posted: 11 Sep 2019 06:29 AM PDT To open long positions on EURUSD, you need: Tomorrow's meeting of the European Central Bank is gradually putting pressure on buyers of the euro, which take profits because of rumors that the regulator may go for a larger reduction in rates than predicted. At the moment, it is best to consider long positions in the euro after the support update of 1.0989, which is now sought by sellers after a good report on inflation in the US. Only a false breakdown scenario at this level will lead to an upward correction of EUR/USD to the maximum area of 1.1020, where I recommend taking the profits. When breaking through the low of 1.0989, it is best to consider new long positions for a rebound from the support of 1.0955. To open short positions on EURUSD, you need: Sellers managed to break below the support of 1.1020, which led to the demolition of several buyers' stop orders. However, the main target is the minimum of 1.0989, the breakthrough of which will provide EUR/USD with a larger bearish impulse, which will lead to the support test of 1.0955, where I recommend taking the profit. In the scenario of an upward correction of the euro in the second half of the day, it is best to count on new short positions after the formation of a false breakdown in the resistance area of 1.1020 or sell immediately on a rebound from the maximum of 1.1053. Signals of indicators: Moving Averages Trading is below 30 and 50 moving averages, indicating a possible return to the market of sellers, however, before tomorrow's decision by the ECB, it is premature to draw such conclusions. Bollinger Bands In the case of euro growth in the second half of the day, it is best to count on short positions when forming a false breakdown near the average border of the indicator 1.1045.

Description of indicators

|

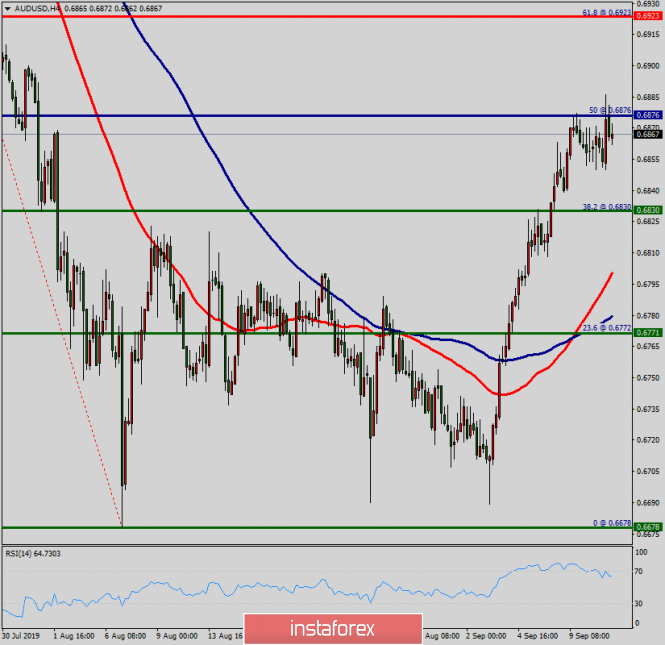

| Technical analysis of AUD/USD for September 11, 2019 Posted: 11 Sep 2019 06:15 AM PDT A daily closure above 0.6830 allows the AUD/USD pair to make a quick bullish movement towards the next resistance level around 0.6876. The bias remains bullish in nearest term testing 0.6923 – 0.6988. Immediate resistance is seen around 0.6876. The bullish outlook remains the same, as long as the 100 and 50 EMAs are pointing to the upside. We still anticipate the bullish trend for the upcoming sessions as long as the price is above 0.6830-0.6800 levels In this area, the trend is challenging a major resistance level. The ascending impulse is strong enough to buy above the support of 0.6830-0.6800 levels. Therefore, the price is expected to reach a high once again. It is rather gainful to buy at 0.6830 with the targets at 0.6923 – 0.6988. So, it is recommended to place take profit at the price of 0.6988 as the second target today. On the contrary, traders should watch for any signs of bearish rejection that occur around 0.6830. The stop loss should be placed at the price of 0.6800 (below the daily support). The material has been provided by InstaForex Company - www.instaforex.com |

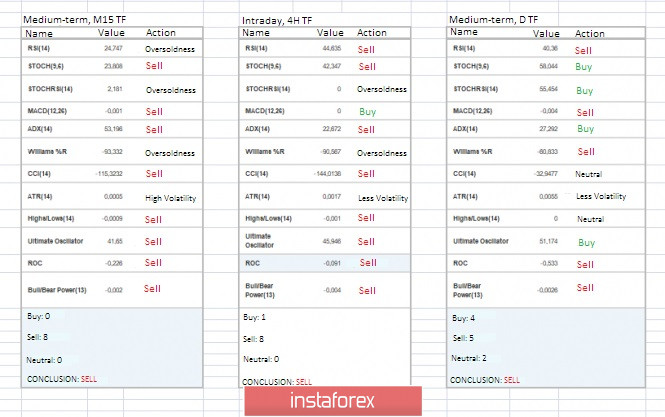

| Trading recommendations for EURUSD currency pair – placement of trade orders (September 11) Posted: 11 Sep 2019 05:28 AM PDT The euro/dollar currency pair showed extremely low volatility of 29 points over the last trading day, as a result of which we received a distinct accumulation. From technical analysis, we see that after the corrective move, the quote drove itself into a sideways movement of 1.1015/1.1065, which is expressed in the phase of wait-and-see accumulation. The wait-and-see attitude of market participants reflects volatility, which tends to be extremely low. In turn, it was noted on the chart that the upper limit of accumulation of 1.1065 coincides with the slowdown on August 16 – 22, where the accumulation process was also going on. As discussed in the previous review, traders have not sought to operate within existing borders for several reasons: the cluster is narrow and carries more risk than profit; the upcoming ECB meeting on Thursday. Thus, the wait-and-see tactics and analysis of price fixation points remained the most optimal trading tactic. Looking at the trading chart in general terms (daily period), we see that the corrective move is going down, the last days are proof of this. The main trend was a downward trend, so it remains, we do not have any prerequisites for changing the direction of the trend yet. The news background of the past day contained only data on open vacancies in the United States labor market (JOLTS), where a decrease was recorded from 7.248M to 7.217M. It should be understood that in this case, the JOLTS job openings did not play the role of some important indicator, and the changes were insignificant, thus somehow the news did not affect the trading chart. The information background smoothly went down, the battles in the United Kingdom led to a crushing defeat of Boris Johnson, where he is now simply obliged to find a solution to the issue of withdrawal from the EU until October 19, otherwise the divorce process will be postponed for at least 3 months. The main forcing background in the market is the upcoming meeting of the ECB, which restrained all actions of traders. So what is planned for the autumn meeting? Everyone is waiting for a reduction in the deposit rate, which Christine Lagarde hinted last month, saying that the ECB is ready for anything, including a rate reduction Today, in terms of the economic calendar, we have data on producer prices in the United States, where they initially projected growth, but the data has been revised and now they are expected to hold at 1.7%. I doubt that this news will somehow react in the market, but the information background, on the contrary, can play a significant role. Earlier, we said that everyone is waiting for tomorrow's meeting of the Board of the European Central Bank, and when everyone is waiting for something, then news releases appear. So, the well-known media source Bloomberg decided to make extra money on their news, throwing out an article with the loud title "The ECB is preparing to do great damage to banks". In the article, former ECB Vice President Vitor Constancio commented on the impact of negative rates on banks. Bloomberg provided information in such a perspective that the upcoming actions of the ECB to reduce deposit rates will have a huge impact on banks, expressed in losses. In such a thin market as now, such emissions are not ignored, and as a result – down. Further development Analyzing the current trade chart, we see the same surge, as described above, which sent the quotation to the lower boundary of the accumulation of 1.1015/1.1065. Traders carefully analyze the behavior of prices for the breakdown of boundaries, which, in principle, against the background of information, surges can occur today. It is likely to assume that the quotation will move closer to the lower border of the corridor of 1.1015, but it is still very early to take action. Let me remind you that under the quote near the accumulation border there is a psychological level of 1.1000, just below it, I would advise considering the downward positions. At the same time, if the noise subsides a little, I do not exclude a decrease in volatility and the preservation of fluctuations within the corridor 1.1015/1.1065 until the end of the day. Based on the above information, we will derive trading recommendations:

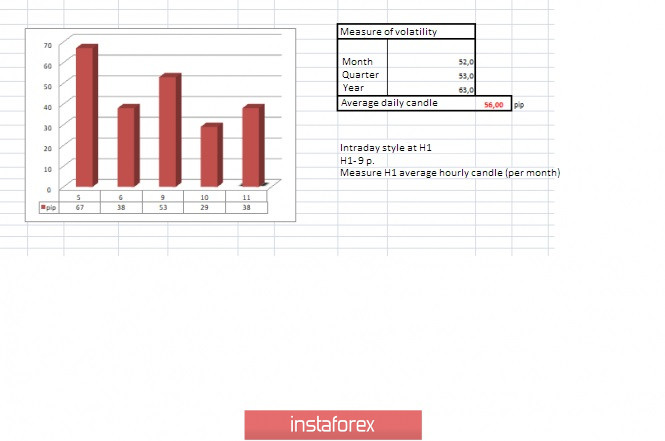

As we can see from the recommendations, the tactic remains the same – work on the breakdown of the boundaries with the identification of the main course. Technical analysis Analyzing different sectors of timeframes (TF), we see that the indicators on all major periods signal the sale. It is worth considering one thing that the price continues to move within the previously formed cluster and the indicators can be changeable. Volatility per week / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year. (September 11 was built taking into account the time of publication of the article) The volatility of the current time is 38 points. We have two options: the first reflects the preservation within the given framework, where volatility will remain at a low level; the second option is aimed at breaking the existing boundaries, where the supply of information background will increase volatility. Key levels Resistance zones: 1.1100**; 1.1180* ; 1.1300**; 1.1450; 1.1550; 1.1650*; 1.1720**; 1.1850**; 1.2100 Support zones: 1.1000***; 1.0850**; 1.0500***; 1.0350**; 1.0000***. * Periodic level ** Range level *** Psychological level **** The article is based on the principle of conducting transactions, with daily adjustments. The material has been provided by InstaForex Company - www.instaforex.com |

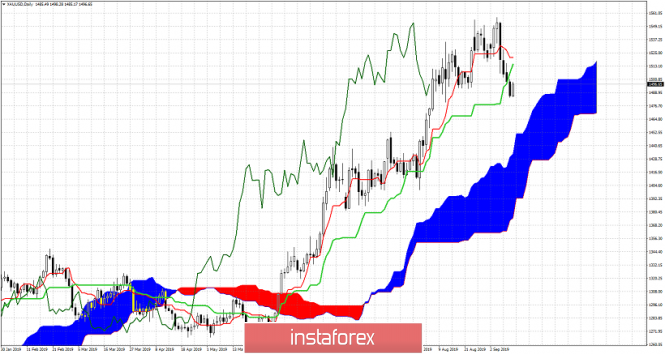

| Gold lost the battle but won the war Posted: 11 Sep 2019 04:44 AM PDT Investors prefer to partially take profits after a violent rally in May-August, which raised gold to 6-year highs. It is not known how the financial markets and the US dollar will respond to the results of meetings of the ECB and the Fed, so it is better to play it safe and get out of some positions. However, even a 4% pullback did not change the overall picture: the external background remains favorable for the XAU/USD bulls, which means that it is too early to talk about a change in the uptrend. Contrary to the desire of speculators to take profits and the associated pullback, ETF fans continue to build up stocks. Thus, the influx of capital into one of the largest specialized exchange funds IShares continues for the 13th week in a row. Although debt market rates are already low, investors believe they will fall even lower. In particular, Deutsche Bank predicts that the Fed will reduce the cost of borrowing by 1 pp by January 2020, and the ECB will delight speculators with a massive monetary stimulus in September. The derivatives market believes that Mario Draghi and his colleagues will reduce the rate on deposits by 0.1-0.2 percentage points and that they will resume bond purchases of €30-40 billion per month. IShares Stock Dynamics Loose monetary policy is a bearish driver for any currency and when major global monetary units are weak, investors prefer to increase the share of gold in portfolios. The current correction looks healthy, as does the majority's desire to buy precious metals on downturns. According to Citi's forecasts, it will rise to $2,000 an ounce thanks to active purchases by central banks. A combination of a slowdown in the US economy, monetary expansion of the Fed and uncertainty around the US presidential election in 2020. America is at the final stage of the economic cycle, and the dollar will weaken along with the recession and strengthened safe-haven assets. Gold can quickly regain lost ground if Mario Draghi cannot give investors what they expect from the Central Bank at the September meeting of the ECB. If Super Mario follows the lead of the Governing Council "hawks", the euro will strengthen. The USD index will tear down while the XAU / USD will resume its northern campaign. A favorable factor for gold is the Fed's position. The regulator is ready to tolerate inflation above the target in order to reverse the downward trend in inflation expectations, stimulate consumer activity and maintain the current path of GDP growth. The precious metal is traditionally perceived as an insurance against inflation, therefore, accelerating the base CPI to 2.3% in August should be considered a "bullish" factor for XAU/USD. Technically, on the weekly chart of gold, there is a pattern of "surge and reversal with acceleration." As long as quotes hold above $1350 per ounce, the situation is controlled by the bulls. A short-term breakdown of the diagonal support at the surge stage near $1480 is possible. However, the precious metal is unlikely to stay below for a long time. It still has goals at the top in the form of targets for 161.8% and 88.6% according to the AB = CD and "Bat" patterns. Gold weekly chart |

| Posted: 11 Sep 2019 02:53 AM PDT The global markets dominate with optimism so far. Stock indices of Asia-Pacific and European countries are trading in the green zone while gold goes below $1,500. Oil makes attempts to rise on expectations of a meeting of the OPEC + monitoring committee and an API report that showed a sharp decline in US oil reserves. Expectations for the resumption of trade negotiations between the US and China are the main positive driver, but things have not yet reached real steps. So, the positive is still rather cautious. EUR/USD pair The ECB's big day on Thursday will finally bring the euro out of sleepiness. According to rumors, the bank intends to lower the rate by 0.1%, but surprises are not excluded. Mizuho Bank noted that the profitability of 10-year-old Bundes has been growing for a week and reached the level of -0.53%. This could mean that the ECB may not meet market expectations and postpone the launch of the QE program in December, satisfied with the rate cut and the announcement of the launch of QE in January. In order to prevent too much hawkish reaction from the market, monthly purchases of at least 40 billion euros can be announced (while the market consensus is at 30 billion) but, as it turned out, there is no urgent need to launch QE tomorrow. Eurozone economic indicators are gradually equalizing. On Tuesday, Sentix noted that economic expectations are improving. No economic data capable of taking the euro out of range before the ECB meeting is expected. Accordingly, the range remains around 1.1025-1.1080. Trader's attempts to exit will be used to enter the opposite direction. There is little hope for an insider that can show the direction before the ECB meeting and the euro remains on standby. GBP/USD pair The latest UK labor market data were unexpectedly better than expected. Unemployment in May-July fell from 3.9% to 3.8% and wages, including bonuses and bonuses, grew by 4.0% against the forecast of 3.7%. However, such strong growth is noticeable only at a distance of recent years. If we compare the current level of real wages adjusted for inflation, even steady growth in recent years is not enough to get out of the hole. The pre-crisis level of 2007 has not yet been achieved. Nevertheless, the pound receives some support from the statistics, which allows it to continue to recover. The political background is also at this stage in favor of continued growth since the short-term effect of Boris Johnson's unsuccessful attempt to persuade parliament to leave the EU on October 31 at any cost did not lead to success. British lawmakers have set a goal to avoid the scenario of "hard Brexit" and, apparently, while winning. A bill passed last week obliging the government to postpone its exit from the EU to January 31, 2020, in the absence of a deal by October 19, definitely plays on the side of the bulls that also support the pound. Moreover, the Laborites, who are in opposition to the ruling conservative party, called for a second referendum. Since the question of the country's exit from the EU was officially approved by the queen in a throne speech on May 27, 2015, such a turn may indicate that the events went according to a completely different scenario and the exit price for Britain was much higher than planned. The effect of the Brexit date transfer is unlikely to be lasting. Uncertainty continues to adjust investment plans in the direction of their reduction. The head of the Bank of England Mark Carney noted that the pound's volatility is at the level of the currencies of developing countries, and risk premiums on the UK stock market increased significantly. In general, the pound still seems to be a favorite in the short term. The chances of updating yesterday's high of 1.2384 are high with the target of 1.2428 and further to 1.2478. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading strategy for Bitcoin on September 11th. The real bitcoin dominance index reaches 95% Posted: 11 Sep 2019 02:29 AM PDT Bitcoin – 4H.

On September 10, the BTC rate fell to the correction level of 76.4% ($9788), which is the first goal on the way to the upward trend line, according to my expectations outlined in previous forecasts. The breakdown of the "cue ball" quotes from the indicated level will allow the number 1 cryptocurrency in the world to rise slightly, however, in general, I expect a fall to the Fibo level of 38.2% ($9566) and the trend line. Today, the divergence is not observed in any indicator. I also remind you that according to the John Bollinger's forecast, "if the bulls fail to significantly improve their positions this week (meaning last week), then Bitcoin will face a serious drop, down to the levels of $4000 - $5000". I believe that the bulls were not able to leap up, the downward trend kept the BTC from strong growth. Now, let's see if the upward trend line of Bitcoin can keep from a strong fall. Meanwhile, Blockstream CEO Adam Back reports that the bitcoin dominance index is currently returning to normal levels of 90%. Back says that until June 2016, this index never dropped below 99%. The real value of the index is now 95% if we exclude from the calculations the stablecoins and USDT (cryptocurrency tied to fiat money). "The brilliant forecast" was made by the Head of ShapeShift crypto exchange Erik Voorhees. He believes that the BTC cryptocurrency will grow above $20000 per coin by the end of the year, but immediately declares that "he usually makes mistakes in forecasts." Voorhees believes that any cryptocurrency is a long-term project and extremely speculative. Thus, Voorhees advises every investor to own bitcoins but to realize that it can completely devalue and the "bubble" will burst. The international interbank system SWIFT does not consider bitcoin and other cryptocurrencies to be competitors. The only cryptocurrency that SWIFT does justice to is Facebook's Libra. All other cryptocurrencies cannot affect the sphere of payments in the short term, according to SWIFT. Overall results: Bitcoin continues to fall in price, although not too fast. Based on the picture in the illustration, the most likely option is a decrease in the area of $9300 - $9400. The BTC rebound from the level of 76.4% allows to expect small growth of quotations, but the untrained goals of about $9566 and $9350 are forced to expect a decrease. If bitcoin, as I expect it, reaches the bottom line of the triangle, then the fate of the cryptocurrency will be decided around it. The Fibo grid is based on the extremes of July 17, 2019, and August 6, 2019. Forecast for Bitcoin and trading recommendations: Bitcoin performed consolidation under the Fibo level of 61.8%. Thus, I recommend selling a cryptocurrency with the targets of $9788 (76.4% of Fibonacci),$9566 (38.2% of Fibonacci) and $ 9400 (the bottom line of the triangle). About the first goal, you can partially take profits or exit transactions and wait for the situation to develop. I do not recommend buying bitcoin now, as the cryptocurrency remains in a narrowing triangle, which implies a drop in the price of the "cue ball". The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 11 Sep 2019 02:29 AM PDT EUR/USD – 4H.

On September 10, the EUR/USD pair continues to trade along with the correction level of 127.2% (1.1029) on the 4 - hour chart. After the quotes of the pound-dollar pair rebound from this Fibo level, traders can still count on growth in the direction of the correctional level of 100.0% (1.1106). However, since the information background for the pair is now completely absent, it is difficult for traders to find reasons for new purchases and promote the pair to the target level. Yesterday, there was no news related to the euro or the US dollar. Thus, traders continue to reflect on what Mario Draghi will announce tomorrow after the ECB meeting, what will be the changes in the monetary policy of the European Union, as well as what forecasts the chairman of the regulator will give. According to the general opinion of traders, to expect any tightening from Mario Draghi is too optimistic. No prerequisites for this. But there are plenty of prerequisites for easing monetary policy. Thus, the question is how much the ECB will soften policy after tomorrow's meeting. Unfortunately for the euro, any easing of the ECB will cause an increase in demand for the US dollar in the EUR/USD pair. Thus, the fall for the European currency in the last two days of this week is highly probable. One can only hope that inflation in America will slow down, which will slightly smooth out the effect of the ECB's rate cuts and other actions aimed at stimulating the economy. What to expect from the euro/dollar currency pair? On September 11, I do not expect any sharp changes in the rate and high activity of traders. The information background will be zero again today. Thus, we can only wait for the ECB meeting tomorrow and look at its results. Today, the consolidation of quotations under the Fibo level of 127.2% will mean that traders expect a negative from the ECB and Mario Draghi and begin to sell the euro in advance. This will allow us to count on the fall of the euro/dollar pair in the direction of the correction level of 161.8% (1.0918). The Fibo grid is based on the extremes of May 23, 2019, and June 25, 2019. Forecast for EUR/USD and trading recommendations: I recommend selling the pair with the target of 1.0918 if the consolidation is made below the level of 1.1024. A stop-loss order above the level of 1.1029. You can buy the pair now, as the rebound from the levels of 1.1024 – 1.1029 with the target of 1.1106 was made. A stop-loss order below the level of 1.1024. Buying a pair, given the information background, is not a priority. GBP/USD – 4H.

While the UK Parliament rests, Boris Johnson continues to feed the public "breakfast", promising to sign a deal with the European Union. The British Prime Minister says that it is still possible to reach an agreement, however, he does not say what are the possible options and how he is going to reach a consensus on the issue of the Northern Irish border? According to many economists, this is impossible because the parties are too far apart in the negotiation process. Moreover, there is not a single real option that could be "implemented tomorrow".The European Union has already stated that London did not make any real proposals to Brussels. Jeremy Corbyn said at a recent parliamentary meeting that there were no negotiations at all with the European Union, and the "Boris Johnson deal" is something ephemeral and fictitious. In this situation, it is difficult to believe Johnson, given his fierce desire to leave the European Union quickly and no matter how. Most likely, the Prime Minister wants to take advantage of the vacation of deputies, which he himself arranged, and create the appearance of activity in the issue of reaching an agreement with the European Union. However, nothing will prevent him from informing the EU leaders about the reluctance to postpone Brexit in an informal letter or, for example, in a telephone conversation. The pound continues to trade above the level of 1.2308, which allows us to expect further growth in the direction of the correction level of 100.0% (1.2437). The bearish divergence in the CCI and MACD indicators is confusing. Nevertheless, a stop-loss order below the level of 1.2308 will protect against possible losses. Wages in the UK, according to yesterday's reports, rose by 4.0%, and unemployment fell to 3.8%. This is good news for the pound. What to expect from the pound/dollar currency pair? The pound/dollar pair has consolidated above the level of 1.2308, however, whether the pair will continue to grow is still a question. The bearish divergence of the CCI indicator has doubled the divergence of the MACD indicator, and both divergences remain valid. The actions of Boris Johnson, who is not going to give up after defeats in Parliament, can once again return traders to the idea of the expediency of selling the pound. Thus, I recommend not to lose sight of any news of a political nature from the UK. The closure of the rate pairs under the level of 1.2308 work in favor of the US dollar and allow you to expect to resume falling towards the correctional level of 127.2% (1.2180). The Fibo grid is based on the extremes of January 3, 2019, and March 13, 2019. Forecast for GBP/USD and trading recommendations: I recommend maintaining the pair's already open purchases with the target of 1.2437 and stop at 1.2308, but I do not recommend opening new purchases due to two bearish divergences. I recommend selling a pair with the target of 1.2180 if the closing is performed under the level of 1.2308, with the stop-loss order above the level of 1.2308. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 11 Sep 2019 01:46 AM PDT After a notable upward rebound over the past few days, the euro has paused in anticipation of the ECB's final monetary policy decision. Before the meeting of the European regulator on monetary policy, which will be held this Thursday, the mood in the expectation that the bank will make an unambiguous decision on new measures to stimulate the economy has changed markedly. The reason for this was the contradictions that opened up at the end of August among the representatives of the regulator regarding the need for these measures. These events have led to the fact that the opinions of market participants on this sensitive issue have radically changed. It seems that a significant number of investors have begun to doubt that the ECB will decide on broad stimulus measures and there are several reasons for this. The first is a recent revival of inflationary pressures. The second is fraught with high risks of Britain's uncontrolled exit from the EU, which really threatens this, while it is not clear. The third reason is the high probability of rising inflation in the long run in the wake of higher customs duties on trade between Europe and the United States. Recently, this topic has fallen into the background, closed by global trade contradictions between Washington and Beijing. However, it did not disappear, neither dissolve or disappear. Assessing the developing tangle of contradictions between the representatives of the European regulator, as well as the influence of the above factors, we believe that the ECB can reduce the deposit interest rate to -0.50% from -0.40%, as expected after the result of its meeting. At the same time, they can also limit to only half measures to stimulate. In our opinion, such a decision is connected not only with the factors listed above but also with the bank's possible desire not to use the entire incentive measure. That is, if the situation in the European economy does not stabilize and does not resume growth, this will cause a deep recession, which the ECB can no longer do anything substantial. The bank may not dare to use its last "patron". If such a decision is made, he should expect a resumption of growth in the euro. Recall that earlier it was the promises of the President of the ECB, M. Draghi, to expand incentive measures that caused the euro to depreciate in the foreign exchange markets. When implementing this scenario, the general sentiment in the markets can change significantly with respect to the total demand for risky assets since it was these prospects that supported and stimulated purchases of government bonds of economically developed countries and stocks of companies. Forecast of the day: The EUR/USD pair continues to consolidate in the range of 1.1015-1.1070 in anticipation of the ECB's final monetary policy decision. We look forward to continuing the consolidation period today. We consider it possible to short sell the pair on growth from the upper limit of the range with the target of 1.1015. . The USD/CAD pair is slightly correcting upward amid falling oil prices and expectations of decisions by the Fed and the ECB on monetary policy. Given the continuing general market sentiment to soften the monetary policies of these global securities, the pair may continue to decline and short sell the pair on growth from about 1.3190 with the target of 1.3100. |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment