Forex analysis review |

- September 13, 2019 : GBP/USD Intraday technical analysis and trade recommendations

- September 13, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- BTC 09.13.2019 -Watch for breakout of the trendline to confirm further downside

- USD/JPY analysis for September 13, 2019 - Bearish divergence on the MACD, selling opportunities preferable

- Euro trapped bears

- GBP/USD 09.13.2019 - Both upward target met, more upside yet to come

- GBP / USD plan for the American session on September 12: The bulls returned to the market, preparing to break the next resistance

- EUR / USD plan for the American session on September 13. Euro rose amid good news and now targets resistance of 1.1115

- Gold record holder: unbeatable metal, long-term growth

- Trading recommendations for the EURUSD currency pair - prospects for further movement

- Trading strategy for EUR / USD and GBP / USD on September 13. The ECB did not surprise the markets, and the US inflation

- Euro is back on horseback: growth continues

- Trading strategy for Bitcoin on September 13. ECB's monetary incentives supported the bitcoin exchange rate.

- Analysis of EUR / USD and GBP / USD for September 13. The euro was able to complete the downward trend.

- Technical analysis of GBP/USD for September 13, 2019

- EUR/USD: Mario Draghi blames the US for slowing down the global economy, US retail sales data will be the key event at the

- No luck with the statistics (A review of EUR / USD and GBP / USD on September 13, 2019)

- Forecast for GBP / USD and USD / JPY pairs on September 13. The uptrend continues, but the rollback is not completed

- Trading plan for EUR/USD pair on 09/13/2019

- Hot forecast for EUR/USD on 09/13/2019 and trading recommendation

- Euro remains in range after ECB meeting, pound takes a break

- EUR / USD: The dollar is not up for inflation and the euro is growing on rumors around the ECB

- GBP/USD: plan for the European session on September 13. An unsuccessful breakthrough of 1.2310 indicated the lack of willingness

- EUR/USD: plan for the European session on September 13. Return to last week's highs and the euro continued to grow

- Trading plan for EUR/USD for September 13, 2019

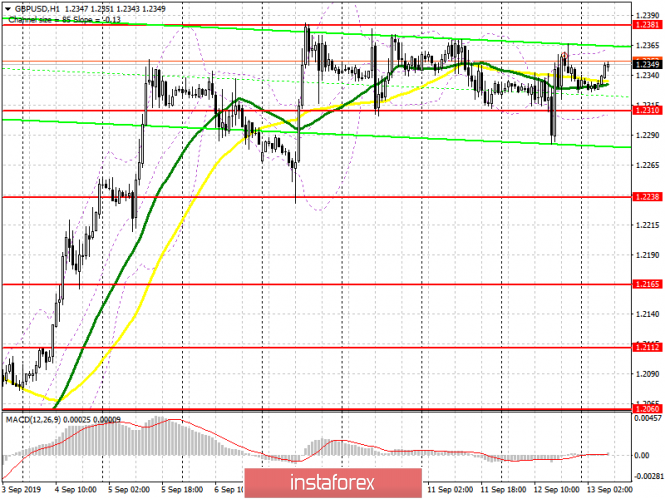

| September 13, 2019 : GBP/USD Intraday technical analysis and trade recommendations Posted: 13 Sep 2019 07:33 AM PDT

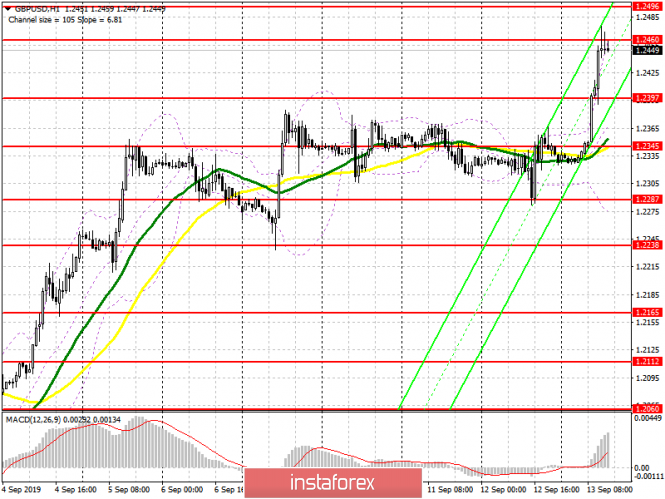

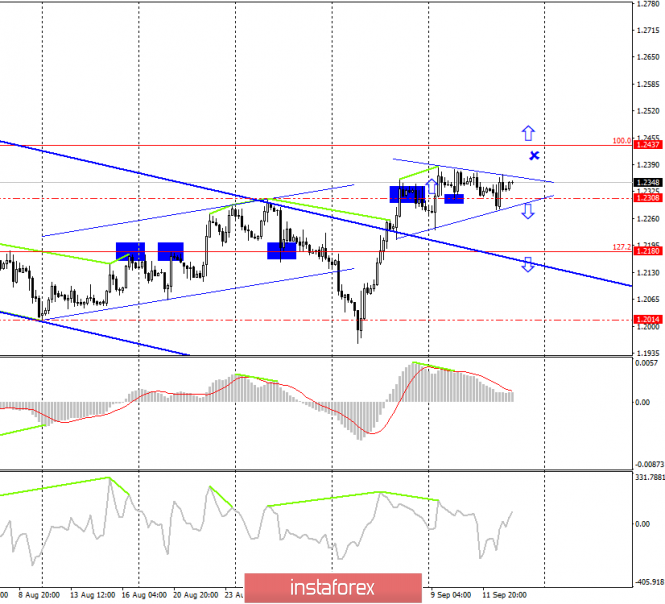

On July 26, Bearish breakdown below 1.2385 (Wedge-Pattern Key-Level) facilitated further bearish decline towards 1.2210 and 1.2100 which corresponded to significant key-levels on the Weekly chart. In Early August, another consolidation-range was temporarily established above 1.2100 before August 9 when temporary bearish movement was executed towards 1.2025 (Previous Weekly-Bottom). Recent bullish recovery was demonstrated off the recent bottom (1.2025). This brought the GBP/USD pair back above 1.2100 (Lower limit of the recently established consolidation-zone) within the depicted short-term bullish channel. As expected, further bullish advancement was demonstrated towards 1.2230 then 1.2280 where recent bearish rejection was demonstrated (near the upper limit of the recent movement channel). That's why, another quick bearish decline was demonstrated towards 1.2100 then 1.2000 (corresponding to the previous bottom established on August 9). Last Week, Early signs of bullish recovery (Bullish Engulfing candlesticks) were manifested around 1.1960 bringing the GBPUSD back above 1.2100 and 1.2220 where the GBPUSD pair looked overbought. However, further bullish momentum was demonstrated towards 1.2320 bringing the pair back inside the depicted movement channel again. As Expected, temporary bullish advancement was demonstrated towards 1.2400 - 1.2450 where the upper limit of the current movement channel comes to meet the pair. The Long-term outlook remains bearish as long as the upper limit of the current movement channel around 1.2450 remains defended by the GBPUSD bears. On the other hand, bearish breakdown below 1.2270 can turn the short-term outlook into bearish, thus allowing more bearish decline towards 1.2220 and 1.2100. Trade Recommendations: Conservative traders can look for a valid SELL entry anywhere around the current price levels (1.2450) for a valid SELL entry. T/P level to be placed around 1.2330, 1.2280 and 1.2220 while S/L should be placed above 1.2520. The material has been provided by InstaForex Company - www.instaforex.com |

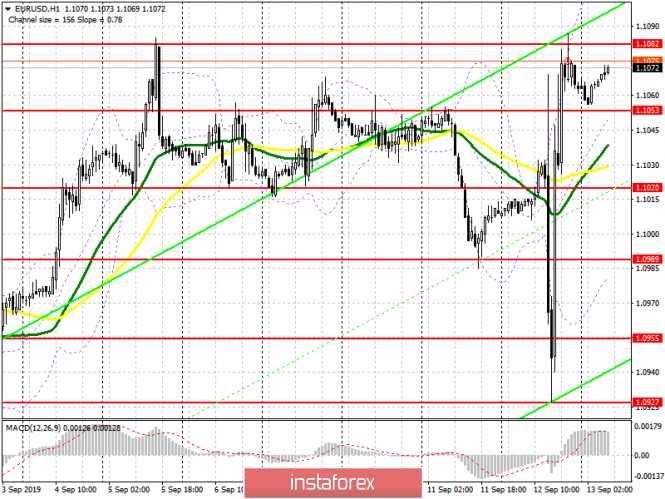

| September 13, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 13 Sep 2019 07:10 AM PDT

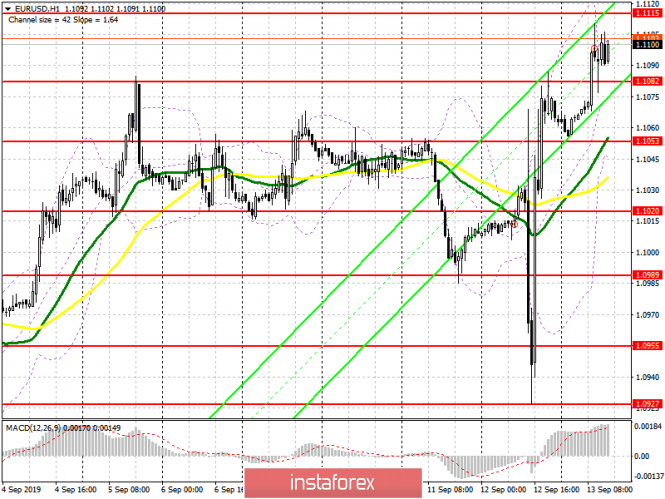

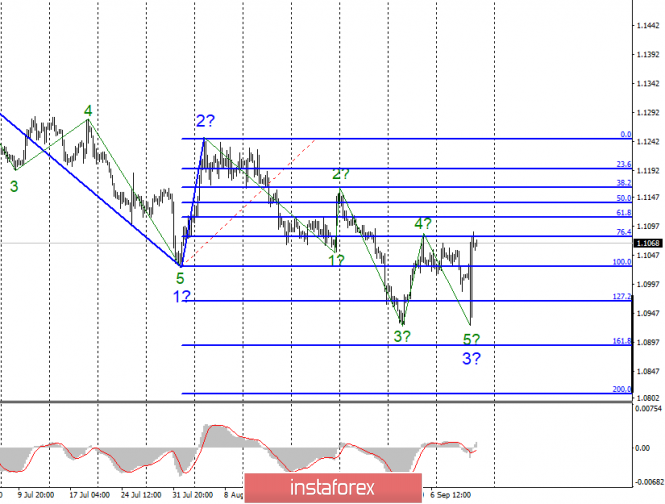

In Mid-August, the EUR/USD has been trapped between 1.1235-1.1175 for a few trading sessions until bearish breakout below 1.1175 occurred on August 14. Bearish breakout below 1.1175 promoted further bearish decline towards 1.1075 where the backside of the broken bearish channel has provided temporary bullish demand for sometime (Bullish Triple-Bottom pattern). However, the depicted Triple-Bottom pattern was invalidated especially after the EURUSD pair bulls have failed to establish Bullish persistence above 1.1115. Moreover, the recently established short-term uptrend line has been invalidated as well thus rendering the short-term outlook as bearish. Two weeks ago, a quick bearish decline was demonstrated towards 1.0965 - 1.0950 where the backside of the broken channel came to meet the EURUSD pair again. Risky traders were advised to look for a valid BUY entry anywhere around the price levels of 1.0950. All T/p levels were successfully reached within the recent bullish movement during last week's consolidations. Earlier this week, the EUR/USD pair was testing the backside of both broken trends around 1.1060-1.1080 where significant bearish pressure pushed the pair directly towards 1.0940 (Prominent Weekly Bottom). Bearish Breakdown below the price level of 1.0940 was needed to enhance further bearish decline towards 1.0900 and 1.0840 (Fibonacci Expansion Key-Levels). However, SIGNIFICANT bullish rejection is being demonstrated as a quick bullish spike towards 1.1100 where cautious watching of price action should be done. Bullish persistence above 1.1080 gives an early signal of short-term bullish reversal possibility as a bullish double-bottom pattern with a projected target towards 1.1175. On the other hand, re-closure below 1.1050 renders the recent bullish spike as a bullish trap, preparing for another bearish decline towards 1.0940. Trade recommendations : Risky traders are advised to have a short-term BUY upon bullish breakout above (1.1090-1.1110). S/L should placed below 1.1050 while target level should be located at 1.1175. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC 09.13.2019 -Watch for breakout of the trendline to confirm further downside Posted: 13 Sep 2019 06:46 AM PDT BTC has been trading sideways at the price of $1.315. Watch for potential downward opportunities if you see the breakout of the $10.260. There is a chance for potential test of $9.885.

Upper purple line – Rising support line Falling trend line – Expected path Red rectangle – Support level and downward objective MACD oscillator is showing decreasing momentum on the upside and bearish divergence. Support levels are seen at the price of $10,264 and $9.886 and resistance levels are found at $10,450 and $11,00. Bulls need to be very cautious as there is bearish divergence on the MACD oscillator and potential downside movement. Selling opportunities are preferable with the first target at $9.886.. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 13 Sep 2019 06:34 AM PDT USD/JPY has been trading sideways in past 24h hours at the price of 108.08. Anyway, I found bearish divergence on the MACD oscillator, which is sign that there is potential for the downside. Be careful with long positions.

Upper green line – Broken support line Purple line – Expected path Blue horizontal lines – Support levels MACD oscillator is showing decreasing momentum on the upside and bearish divergence. Support levels are seen at the price of 107.55 and 107.24 and resistance levels are found at 108.25and 108.50. Bulls need to be very cautious as there is bearish divergence on the MACD oscillator and potential downside movement. Selling opportunities are preferable with the targets at 107.55 and 107.25. The material has been provided by InstaForex Company - www.instaforex.com |

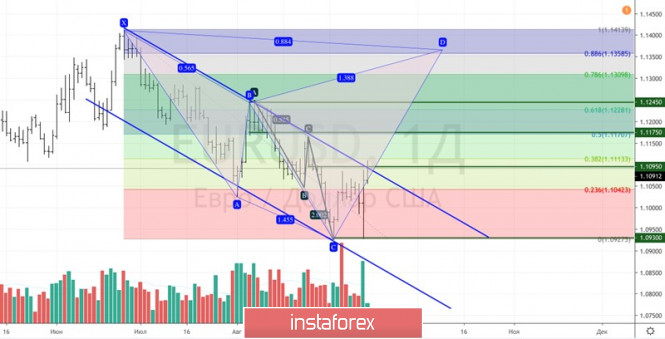

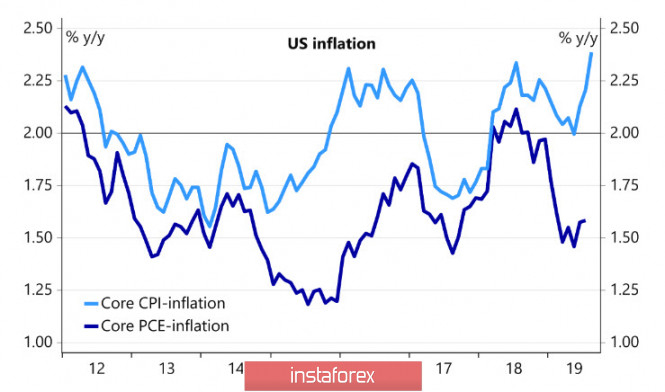

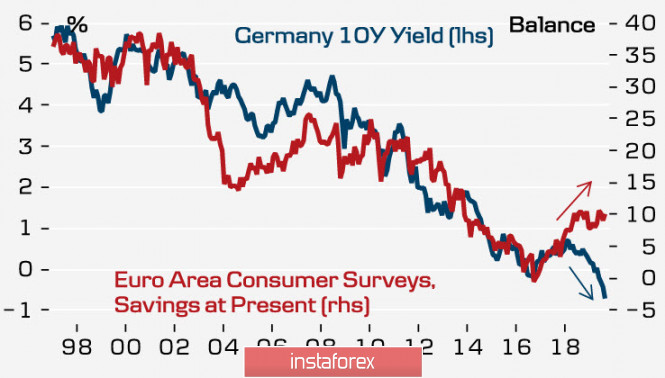

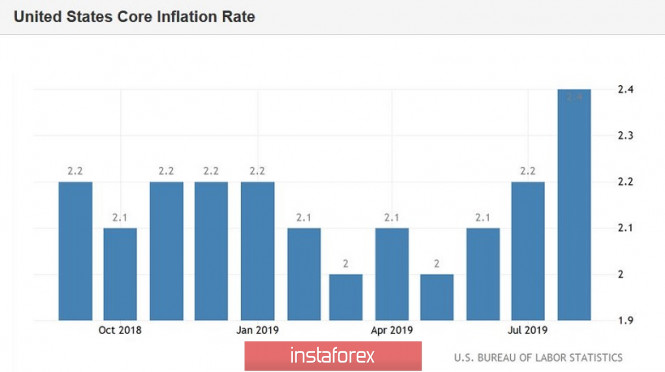

| Posted: 13 Sep 2019 06:22 AM PDT Unlike the first week of the fall, when a key event (a report on the US labor market) left investors indifferent, the September meeting of the ECB made a real sensation on the market. Prior to the Governing Council's meeting, there was much talk of whether the QE should be reanimated, and about the euro's response to a lack of monetary stimulus. A consensus assessment by Bloomberg experts suggested that Mario Draghi and his colleagues would cut their deposit rate from -0.4% to -0.5% and begin buying assets worth €30-40 billion a month. It was all the more surprising to see that with a smaller program of quantitative easing, the euro went to the 9th figure's founding and luring the bears into a trap. Most likely, investors were confused by the indefinite period of validity of QE, although subsequently, the euphoria of euro sellers gave way to disappointment. Starting in November, the ECB will buy assets worth $20 billion a month, which may mean that it did not change its rules. This means that the capabilities of the regulator are limited. He needs support from the governments of the eurozone countries, which should increase government spending and bond issues. Only in this situation will the European Central Bank's "bazooka" operate. Mario Draghi called on Germany and other countries to fiscally stimulate the economy, essentially signaling that the ECB's firepower is running out. The EUR/USD bulls immediately went on the attack. At first glance, optimistic forecasts for the main currency pair look strange. The US GDP is growing faster than its European counterpart. Inflation in the United States is about to exceed the Fed target, and the labor market is strong as half a century ago. However, the interim agreement between Washington and Beijing that Donald Trump spoke about, reducing the risks of promiscuous Brexit, the pro-European government of Italy and, most importantly, the desire of investors to get rid of European bonds bought specifically for QE, can become important "bullish" drivers for the EUR/USD pair. The reaction of the pair in the launching of the quantitative easing program in 2015 serves as evidence. Instead of continuing to peak, German bond yields went up, while the euro strengthened. Yield dynamics of US and German bonds In the week of September 20, all investor attention will be riveted to the Fed meeting. It seems that the American Central Bank has completely turned a blind eye to economic theory and is acting on the orders of the US president. According to a consensus estimate by experts at the Wall Street Journal, GDP in 2019 will grow by 2.2%. Unemployment has been at the bottom since the 1970s, and core inflation in August accelerated to 2.4% y/y. These indicators are in favor - at least in favor of keeping rates at the current level if not tightening monetary policy. Jerome Powell is going to reduce it. The derivatives market is sure of this by 86%, and if the FOMC gives a signal to continue the cycle of monetary expansion, the EUR/USD pair will rush upward. Technically, a breakout of the upper border of the downward trading channel near the resistance of 1.1095 will increase the risk of activating the "Shark" pattern with a target of 88.6%. It is located near 1.1365. EUR / USD daily chart |

| GBP/USD 09.13.2019 - Both upward target met, more upside yet to come Posted: 13 Sep 2019 06:08 AM PDT GBP/USD did exactly what I expected yesterday and both our upward targets at 1.2374 and 1.2430 have been met. Anyway, I see still strong upward momentum in the background, which is sign that there still more upside to come. Next upward target is set at the price of 1.2515 (Fibonacci expansion 161.8%)

Upper green line – Support Rising green line – Expected path MACD oscillator is showing good new momentum up in the background and I do expect at least another push higher. Support levels are seen at the price of 1.2437 and 1.2390 and resistance levels are found at 1.2476 and 1.2515. Bears need to be very cautious as there is strong upward momentum in the background and potential buying the deep type of feeling. As long as the GBP is holding above 1.2383 there is a chance for potential test of 1.2515. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 13 Sep 2019 05:27 AM PDT To open long positions on GBP / USD pair, you need: Yesterday's unsuccessful attempt by the bears to strengthen the downward correction only returned the market new large buyers who made a breakthrough at the resistance of 1.2385 in the morning today and fixed above this range, which was transformed to the level of 1.2397. The task of the bulls in the afternoon will be to break through the maximum of 1.2460, which I paid attention to in my morning review. This will lead to further growth of GBP/USD pair to the area of maximums at 1.2496 and 1.2534, where I recommend taking profits. However, one can count on such a big bullish leap only in the case of weak data on US retail sales. In the scenario of a downward correction at the North American session, it is best to consider long positions after updating support of 1.2397 or on the rebound from the middle of the recent side channel at 1.2345. To open short positions on GBP / USD pair, you need: Sellers defended the level of 1.2460, however, even this maximum does not yet want to open short positions. Only the release of a good report on US retail sales will lead to another false breakdown around this range, which will increase pressure on GBP/USD pair and push the pair to the support area of 1.2397 and possibly to the level of 1.2345, where I recommend taking profit. If the pound continues to grow with the opening of North American trading, then it is best to consider short positions in this scenario after updating the maximum of 1.2496, provided that there is a false breakdown or a rebound from the resistance of 1.2534. Signals of indicators: Moving averages Trading above 30 and 50 moving averages, which indicates a return to the market buyers. Bollinger bands Under the scenario of a pound decline in the afternoon, support will be provided by the lower border of 1.2360. Description of indicators MA (moving average) 50 days - yellow MA (moving average) 30 days - green MACD: Fast EMA 12, Slow EMA 26, SMA 9 Bollinger Bands 20 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 13 Sep 2019 05:11 AM PDT To open long positions on EUR/USD pair, you need: The report on the growth of the positive trade balance led to the strengthening of the euro in the morning, continuing the bullish momentum that was formed yesterday afternoon. At the moment, the bulls have managed to gain a foothold above the resistance of 1.1080, which saves the chance of a repeated return and breakdown of a maximum of 1.1115. Only in this scenario can we expect a larger uptrend to the area of levels 1.1151 and 1.1189, where I recommend taking profits. However, growth will also be associated with a report on retail sales, which will be released before the opening of the North American session. With the downward correction of the EUR/USD pair after the above report and the pair returned to the level of 1.1082, it is best to consider new long positions for a rebound from the lows of 1.1053 and 1.1020. To open short positions on EUR/USD pair, you need: Sellers will hope for good retail sales data that will return demand for the US dollar, and the formation of a false breakdown in the resistance area of 1.1115 will be an additional bearish signal to open short positions. The first goal will be the support of 1.1082 and a breakthrough will increase pressure on EUR/USD pair and will also lead to profit-taking at the end of the week. A downward correction to the minimum area of 1.1053 and 1.0989, where I recommend taking profits. If the demand for the euro continues in the afternoon, it is best to look for short positions in this scenario for a rebound from the highs of 1.1151 and 1.1189. Signals of indicators: Moving averages Trading is above 30 and 50 moving averages, which indicates the continuation of yesterday's bull market. Bollinger bands In case of a downward correction, the lower border of the indicator in the area of 1.1045 will provide good support to the pair. Description of indicators MA (moving average) 50 days - yellow MA (moving average) 30 days - green MACD: Fast EMA 12, Slow EMA 26, SMA 9 Bollinger Bands 20 The material has been provided by InstaForex Company - www.instaforex.com |

| Gold record holder: unbeatable metal, long-term growth Posted: 13 Sep 2019 05:08 AM PDT The yellow metal, having once won a leading position, is not going to descend from the podium. In the future, it will continue to grow, analysts at Citigroup, the largest US bank, are sure. Low interest rates and fears of a possible recession will be key drivers of growth. In the next two years, the cost of the leading precious metal will increase and reach $ 2000 per 1 ounce, according to Citigroup. Experts are sure that the protracted trade conflict between the United States and China will become the catalyst for this recovery. The unstable geo-political situation will increase the risks of the onset of a recession in the US economy, the bank emphasizes. A high level of geo-political uncertainty provides significant support to gold. This external background creates the ideal soil for the growing demand for the yellow metal. In a similar situation, investors will prefer gold and other traditional precious metals as safe assets, Citigroup reminds. The bank's report states that it is highly probable that the yellow metal will test the maximum values again which was recorded in 2011-2013. New price records are expected in 2021–2022 amid a slowdown in economic growth in the United States, especially in the event of a recession. Another driver of gold growth may be the election uncertainty in the United States, which will lead to a rise in the price of precious metals to $ 1800– $ 2000 per 1 ounce. According to Citigroup analysts, the yellow metal, in the short term, will be able to withstand pressure factors. Correction of the value of gold provides an excellent opportunity to increase investment, experts recall. The bank believes that if the Fed rates fall to zero, precious metals will be the most attractive asset for investing. Gold is not afraid of a slowdown in the global economy, experts are sure. Such negative factors are offset by institutional investor policies. First of all, this includes the strategy of leading regulators who periodically buy up yellow metal for their reserves. Therefore, precious metals will always be in price, experts summarize. The material has been provided by InstaForex Company - www.instaforex.com |

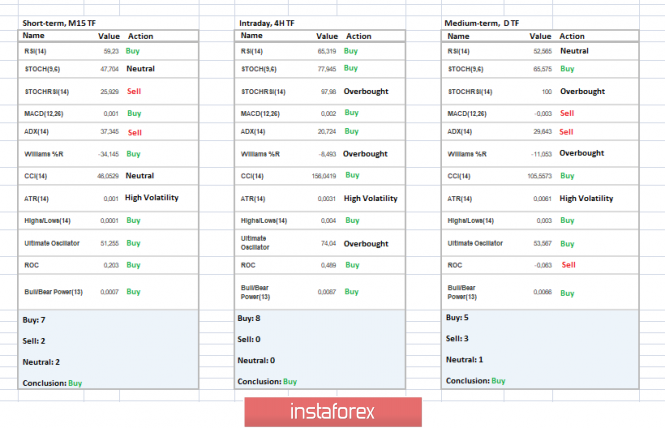

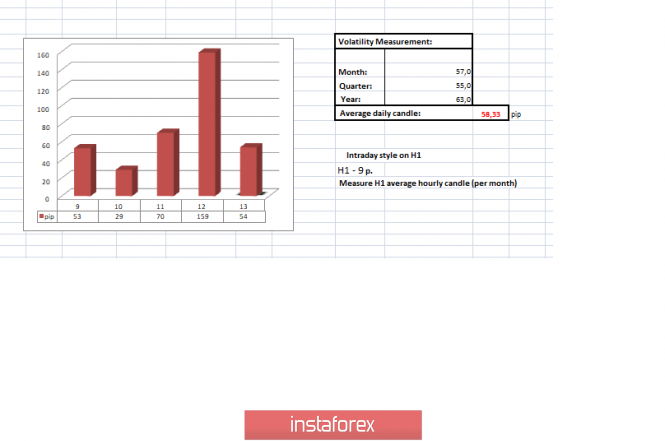

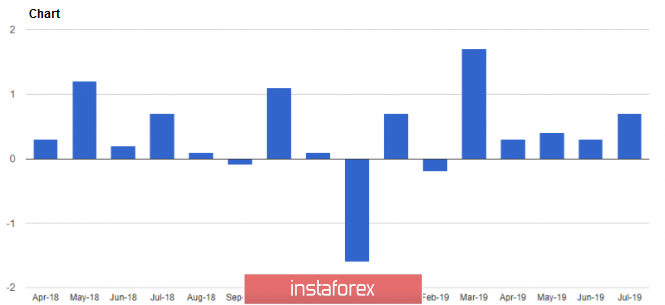

| Trading recommendations for the EURUSD currency pair - prospects for further movement Posted: 13 Sep 2019 04:05 AM PDT Over the past trading day, the EUR / USD currency pair showed an extremely high volatility of 159 points, resulting in a surge of 95 points down and 159 points up. From the point of view of technical analysis, we have a great trading day. I congratulate everyone on a decent profit and the coincidence of the previously set forecast, and now, we will analyze the technical part in detail. Many waited for a downward movement, and the consolidation in the face of the psychological level of 1.1000 was on everyone's ears, as the accumulation of several days prepared the quote for the great procession. Day "X" has come, the price rushed down, the point 1.1000 is behind, and the breakdown was followed by an inertial move, which went straight to the minimum of the current year 1.0926, where the fulcrum was found with surgical accuracy. Profit taken! Further, no one expected such a development, in counting hours, we return back to the starting point and overcome it, resting in the end at the resistance level of 1.1080. Local overheating of short positions in a compartment with an information and news background played a role in restoring the quote, and if you still weren't afraid and took the initiative, you could make money on two vibrations. As discussed in a previous review, speculators were waiting for short positions, and their reporting point was slightly below the psychological level of 1.1000. For some reason, I'm sure that many managed to ride both a decline and an increase. A decline to a minimum of 1.0926, at the same rate as yesterday, said for itself that the market was overheating and was very likely to wait for a correction, but it happened even better - a return. Considering the trading chart in general terms (the daily period), we see that the corrective move is still on the market, and the recent fluctuation confirmed the pivot point of 1.0926, which holds the main downward trend. Now, let's move on to the organizers of this banquet, that is, to the information and news background. Yesterday, the focus of the spotlight was a meeting of the Board of the European Central Bank, followed by a press conference. As expected, the ECB reduced the deposit rate from -0.4% to -0.5%. In addition to everything, they resumed the quantitative easing program with the purchase of assets in the amount of 20 billion euros per month. That is, the Europeans have lived without the QE program for less than a year, and here you go again - come and get it! In turn, the head of the ECB, Mario Draghi, at a subsequent press conference, delighted everyone with a statement that the ECB would not raise rates until inflation approached the target level — a little less than 2%. Now, the inflation rate is 1% per annum. What was left unattended was the fact that Mario Draghi evaded a direct answer regarding the quantitative easing program, without giving specific dates for the QE program. Experts agree that in accordance with the charter of the regulator and the limits on the purchase of securities of one issuer, QE programs can last approximately 12-14 months - no more. In fact, this calculation and the omission of the real QE dates later helped to return the euro position to the market. The next euro recovery factor came to us from the United States, where they published inflation data. So, they were waiting for confirmation of the inflation rate by 1.8%, and as a result, they got a decrease to 1.7%. This indicator automatically activated a panic wave in everyone, regarding the fact that at the upcoming meeting of the Federal Reserve System the refinancing rate will be reduced. It was hard to stop the panic process and if we compare both news, we get the basis for the return of the quotes. Today, in terms of the economic calendar, we have data on retail sales in the United States, where a slowdown is expected from 3.4% to 3.2%. In fact, if the data are confirmed, then in tandem with the US inflation indicators, the mood about lowering the refinancing rate may increase. In terms of informational background, we have another surge, which was provided by everyone's favorite source of Bloomberg media. So Bloomberg published an interview with the head of the central bank of Austria, Robert Holtzmann, who said that the last package of QE of the European Central Bank may have been a mistake and could be changed after the new head of the ECB Christina Lagarde takes office. The news did not go unnoticed, and we almost immediately rushed up. The upcoming trading week in terms of the economic calendar has not just a package of statistical data, but a meeting of the Fed, which many traders have been waiting for. Thus, intrigue, and high volatility, is provided in absentia. Of course, no one forgets about the spontaneous informational background, which will fuel the interest of speculators along the entire path. The most interesting events displayed below ---> Tuesday 17th September USA 13:15 Universal time. - Volume of industrial production Wednesday, September 18 EU 9:00 Universal time. - Consumer Price Index (CPI) (YoY) (Aug): Prev 1.0% ---> Forecast 1.0% USA 12:30 Universal time. - Number of building permits issued (Aug): Prev 1,317M ---> Forecast 1,300M USA 12:30 Universal time. - Volume of construction of new houses (Aug): Prev 1.191M ---> Forecast 1.250M USA 18:00 Universal time - Fed meeting USA 18:30 Universal time - Press conference of the Federal Open Market Committee of the Fed Thursday, September 19 USA 14:00 Universak time - Sales in the secondary housing market (Aug): Prev 5.42M ---> 5.40M forecast Further development Analyzing the current trading chart, we see that the level of 1.1080 did not last long and the departure of the current information background gave acceleration, towards the level of 1.1110 - the cluster limit on August 16-22. In fact, we see that against the background of an already unstable platform, another piece of news flies that continues to unjustifiably push the euro to new heights. Speculators, in turn, are immensely happy. Volatility is high and the information and news background sparkles, we work for our pleasure. It is likely to assume that the information and news background will play a small role in the movement of quotes, where from the point of view of technical analysis everything indicates a correction, or at least a partial recovery. Thus, the value of 1.1110 plays the role of resistance, but if the panic continues, then the upward movement may resume. Another theory is to slow down 1.1080 / 1.1110. Based on the above information, we derive trading recommendations: - Buying positions are considered in case of price fixing higher than 1.1120, with the prospect of a move to 1.1160-1.11180. - Selling positions are considered in the case of fixing the price lower than 1.1066, with the prospect of a move of 1.1050-1.1000. Indicator analysis Analyzing a different sector of timeframes (TF), we see that indicators on the minute, intraday, and medium-term periods signal purchases. In the analysis, it is worth considering such a moment that, due to the high amplitude, the indicators arbitrarily changed their interest. Volatility per week / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year. (September 13 was built taking into account the time of publication of the article) The current time volatility is 54 points, which is almost equal to the average daily indicator. It is likely to suggest that volatility could still increase amid the publication of statistics on the United States. Key levels Resistance zones: 11,1100 ** ;, 1180 *; 1.1300 **; 1.1450; 1.1550; 1.1650 *; 1.1720 **; 1.1850 **; 1,2100 Support Areas: 1,1100 **; 1,1000 ***; 1.0850 **; 1,0500 ***; 1.0350 **; 1,0000 ***. * Periodic level ** Range Level *** Psychological level **** The article is built on the principle of conducting a transaction, with daily adjustment The material has been provided by InstaForex Company - www.instaforex.com |

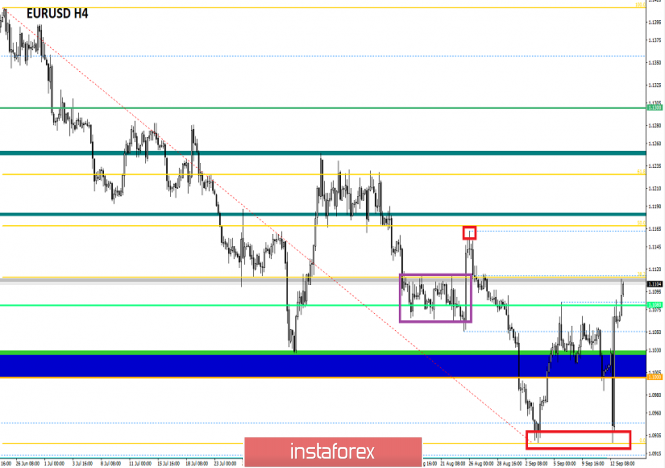

| Posted: 13 Sep 2019 03:50 AM PDT EUR / USD - 4 H. On September 12, the pair EUR / USD on a 4-hour chart worked out all kinds of scenarios at a time. In yesterday's article, I said that the US inflation report could have no less impact on the movement of the couple than the outcome of the ECB meeting. In practice, it turned out that the inflation report was even more important. The actions of the European Central Bank were 100% expected by traders. In short, the regulator lowered the deposit rate by 0.1% (the mildest option) and announced the launch of the incentive program in November 2019, which, like the previous program, will consist of buying out bonds and flooding the economy with cash. The QE program is designed to spur inflation in the eurozone, which in recent months is around 1.0%. However, the decline in inflation in America was an unpleasant surprise for traders, especially in anticipation of the Fed meeting on September 18. The recent speeches of Jerome Powell did not answer the question, is the American regulator set to cut rates in September? But weak inflation could be a good reason to soften the Fed rate. If you add to this the next batch of criticism of the Fed's actions by Donald Trump (immediately after the publication of yesterday's decisions to soften the ECB's monetary policy), the probability of a Fed rate cut becomes very high. Thus, the euro-dollar pair fell to the correction level of 161.8% - 1.0918 yesterday. A reversal in favor of the EU currency and strong growth in the upper region of the downward trend channel with fixing at the Fibo level of 127.2% - 1.1024. Further growth of the pair is now limited by the upper line of the channel, to which it remains to go just a little bit. What to expect today from the euro-dollar currency pair? On September 13, I expect the markets to calm down a bit after a busy Thursday. The information background today will be much weaker than yesterday. Thus, I am waiting for a "technical" solution to the question: where does the euro-dollar pair move on? More so, a rebound in the pair's exchange rate from the channel's line will work again in favor of the US currency, and we can expect a third drop in the direction of the correctional level of 161.8% - 1.0918. Closing quotes over the trend channel will work in favor of the EU currency and significantly increase the chances of the growth of this currency in the coming weeks. The Fibo grid was built at the extremes of May 23, 2019 and June 25, 2019. Forecast on EUR / USD and recommendations to traders: I recommend selling the pair with the target of 1.0927 if another consolidation is performed below the level of 1.1024. Stop Loss - Over 1.1029. You can buy a pair after closing above the level of 1.1106 with the target of 1.1164. Stop Loss - below the level of 100.0% Fibonacci. GBP / USD - 4 H. "Even Michel Barnier, who is negotiating with London, does not believe in concluding a deal with Great Britain." This is the name you can give the section of this article devoted to the British pound. "I can't tell you whether our contacts with the government of Boris Johnson will lead to the signing of an agreement before the summit to be held on October 17-18. I have no reason to be optimistic," said Barnier to the representatives of the European Parliament. If the EU's chief negotiator does not believe in an agreement with Johnson, then ... Although EU leaders have never sung praises to Johnson and did not hide skepticism about his policies and persona. Given the fact that the British Prime Minister has not proposed a single real option how to solve the problem of "back-up", the words of Barnier look absolutely logical. Opposition leader Jeremy Corbin spoke about this earlier. He argued that Johnson did not conduct any negotiations with the European Union, contrary to Johnson's regular statements that "a deal with Brussels is still possible" or "negotiations can yield results". The European Parliament is ready to offer Brexit's postponement to London if Brexit's "No Deal" can be avoided in this way. And the position of Boris Johnson, meanwhile, is slowly "going under the water." Overall, Johnson and his government have not yet implemented a single important point from their election program. Brexit "No Deal" has not yet been implemented. The parliament has been sent on vacation, but the court ruled that Johnson's action was unlawful, parliamentary elections were rejected, and the European Parliament is ready to postpone Brexit to a later date. These are the results of Johnson's almost two-month work. Thanks to all these defeats, the pound has come to life in recent weeks. What to expect today from the pound-dollar currency pair? The pound-dollar pair has consolidated above the level of 1.2308. However, in recent days, it has been squeezed into a tapering triangle. Now, I am waiting for the pair to leave the course, which will determine the trend for the next few days. I still count on the growth of quotations in the direction of the correctional level of 100.0% - 1.2437. On the other hand, upcoming divergence is not observed in any indicator today. Consolidation of the pair under the bottom line of the triangle will work in favor of the US currency and a slight decline in the direction of the correction level of 127.2% - 1.2180. The Fibo grid was built at the extremes of January 3, 2019 and March 13, 2019. GBP / USD Forecast and recommendations for traders: I recommend supporting the pair's already open purchases with the target of 1.2437 and Stop at 1.2308, but I do not recommend opening new purchases due to two bearish divergences, which are still valid. I recommend selling a pair with the target of 1.2180, if closing is performed under the bottom line of the triangle. The material has been provided by InstaForex Company - www.instaforex.com |

| Euro is back on horseback: growth continues Posted: 13 Sep 2019 03:05 AM PDT The European currency regained optimism and showed growth. The reason for this was the commentary by the ECB President, Mario Draghi, regarding the introduction of a stimulus package. The head of the regulator emphasized that the probability of a recession is low at the moment, which also gave confidence to the European currency. After the unveiling of the new stimulus package, it became known that the ECB is cutting rates and restarting the strategy of quantitative easing (QE). According to M. Draghi, this is necessary to combat the economic slowdown. According to experts, the list of incentive measures is very impressive. The decision of the regulator will help stimulate the Eurozone economy and reduce the risk of recession, experts say. Recall that after the statements of the head of the ECB, the European currency collapsed sharply. The EUR/USD pair fell by 0.8% to 1.0926–1.0927, which is a record low lately. After the press conference, M. Draghi, the tandem quickly turned upward, gaining a foothold above 1.1080. The EUR/USD pair soared more than a figure from the low of Thursday, September 12. Currently, she has overcome this mark and is growing steadily, reaching indicators of 1.1100-1.1105. The stimulus package adopted during the ECB meeting includes five key elements. These include: 1. Reduction in interest rates by 10 bp to -0.5%. 2. Refusal of the calendar pegging of market signals. 3. Restarting the asset buyback program. 4. Changes in the TLTRO refinancing program, in particular, the liquidation of the 10 bp spread and providing banks with more favorable credit conditions. 5. The introduction of a two-level system of rates that protects part of bank capital from negative rates. Analysts pay attention to three reasons for the reversal of the European currency. Firstly, it is an appeal to governments by the head of the ECB to strengthen fiscal stimulus. He insists on the gradual but steady implementation of this reform. Draghi is convinced that this is necessary to strengthen the potential for long-term economic growth. Secondly, it is a long-term application of the program of quantitative easing (QE), which will have a positive effect on the economy. Draghi insists on its use on an ongoing basis It is possible that an endless QE program will be of great importance for economic incentives. Thirdly, the current actions of the ECB guarantee a further reduction in the Fed rate, experts say. The rate cut should improve the European economy, and the prospect of a softening Fed policy supports the EUR/USD pair. According to experts, the events of this Thursday marked the bottom of the EUR/USD pair. As a result, one of the largest short-term risks for the European currency was left behind. She is gaining strength and is actively growing. However, external risks remain, which include the actions of US President Donald Trump and the threat of a "tough" Brexit. The American leader considered the ECB's decision to be a "weakening euro", so analysts recommend not to forget about the possible response from the United States, including the introduction of tariffs. |

| Posted: 13 Sep 2019 02:58 AM PDT Bitcoin - 4 H. On September 12, Bitcoin continued the growth process after a rebound from the correctional level of 76.4% - $ 9,788 and returned to the upper region of the narrowing triangle, consolidating along the Fibo level of 61.8% - $ 10,256. Yesterday, the demand for was high yesterday thanks to the introduction of a number of incentive measures from the European Central Bank. The most important are the reduction in the deposit rate and the quantitative easing program (QE). Each month, the EU economy will receive 20 billion euros in the framework of the QE program, and banks will be forced to rid themselves of excess cash in their accounts, as they will have to pay more. All this is designed to increase the money supply in the European Union, which will stimulate increased spending among the population and inflation. This is good news for bitcoin, as it also potentially increases the demand for it. If citizens have more free money, then they can be invested in something, for example, in bitcoin. Also, according to some crypto experts, bitcoin is increasingly being used as a means to diversify risks by investors of all calibers, which also potentially increases the demand for cryptocurrency. It is not known what will happen in November, when the QE program will work, but bitcoin grew yesterday. However, based on the current picture of the situation, it follows that the growth potential of BTC is still limited by the top line of the triangle and the area of $ 10,907 - $ 11,089. Thus, I recommend considering buying bitcoin in this way above this area. At the same time, crypto-expert and one of the founders of Fundstrat Global Advisors Tom Lee said that the administration of Donald Trump could ban Bitcoin. Lee made this conclusion on the basis of the ban on some smoking mixtures for vape, referring to the increasing death among adolescents due to lung diseases. According to Lee, these arguments are not valid; accordingly, Trump can prohibit anything at will. Especially, Lee believes, if the BTC rate grows to $ 100,000 per coin. Earlier, Donald Trump has already spoken negatively about bitcoin and cryptocurrencies. Summary: Bitcoin grew yesterday, but the cryptocurrency market is still in a downward mood. I believe that the probability of a BTC reversal down today is extremely high. The fall may resume with the goals indicated by crosses in the picture. The Fibo grid was built at the extremes of July 17, 2019 and August 6, 2019. Bitcoin Forecast and recommendations for traders: Bitcoin consolidated above the Fibo level of 61.8%. However, I recommend that you still consider sales with goals of $ 9,788 (76.4% Fibo), $ 9,566 (38.2% Fibonacci) and $ 9,400 (bottom line of the triangle). As a signal, I recommend waiting for the close below $ 10,256. I do not recommend buying bitcoin right now, since cryptocurrency remains in a narrowing triangle, which implies a fall in prices. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 13 Sep 2019 02:44 AM PDT EUR / USD Thursday, September 12, ended for the EUR / USD pair with an increase of 55 basis points, despite the fact that the quotes decreased to the minimum of the expected wave 3, 3. Thus, the wave 5 in 3 during the day, although it turned out to be somewhat shortened, but it can be considered complete, as well as the whole wave 3. However, the questions remain: on a global level (waves 1-2-3) are part of the 5-wave structure, or is it another abc formation? In the second case, the construction of the bearish section of the trend is completed, and now, we are expected to build at least three waves up with the prospect of leaving much higher than the level of 1.1250. Thus, the readiness of the euro-dollar pair to further decline can now be determined only by a successful attempt to break through the lows of waves 3 and 5. Fundamental component: On the EUR / USD instrument, all the most interesting news yesterday concerned the ECB meeting and the debriefing of this meeting. As markets expected, Mario Draghi lowered the deposit rate to -0.50% and announced the launch of a new asset repurchase program worth € 20 billion per month. This program will begin in November 2019. It seems to be nothing surprising and the markets began to get rid of the euro in accordance with the plan. However, upon reaching the minimum of wave 3 in 3, there was a sharp upward turn and no less strong growth of the European currency. What could have caused this? Possibly, pending orders for the purchase of large volumes, for example, large players who were located near the level of 1.0926. Perhaps, traders in any case did not expect the pair to fall below this level and began to take profits around it. Also, maybe inflation in the USA, which fell in August to 1.7% yoy, dramatically changed the mood of the foreign exchange market. And most likely, all three factors played simultaneously. Today, I draw attention to only one economic report, which will be released in the afternoon in the USA. And on one index, the University of Michigan Consumer Confidence Index. Retail sales in America should grow by 0.3% in August, and the consumer confidence index may increase slightly after falling by almost 10 points and reach 90.9. Purchase goals: 1.1248 - 0.0% Fibonacci Sales goals: 1.0893 - 161.8% Fibonacci 1.0807 - 200.0% Fibonacci General conclusions and recommendations: The euro-dollar pair supposedly completed the construction of the bearish wave 3. If this is true, the pair expects the construction of an upward set of waves. I recommend buying a pair with targets located about 12 figures, but so far in small volumes. GBP / USD On September 12, the pair GBP / USD gained just a few basic points, and the overall market activity tended to zero. It is not surprising, since all the main attention of the Forex market was paid to a couple of euro-dollars, which had a very strong news background yesterday. The pound-dollar pair remains within the framework of constructing the proposed wave with the composition of the correction section of the trend. Wave c may already be completed, since it has gone beyond the maximum of wave a. However, it can also take a much more extended and complex form. Thus, everything will depend on the news background. Fundamental component: On Friday, the news background for the GBP / USD pair will not be strong. Two US reports may force markets to trade the pair more actively, but if their values are neutral, then activity will remain at the same level. In addition, markets are clearly more interested in Brexit's hot issue, rather than economic reports from America, although Brexit-related news is not much. Boris Johnson defends Jeremy Corbyn from the opposition, but parliament is likely to regain its right to return to work through the courts. Moreover, the European Union is likely to provide a respite for Brexit. Thus, Johnson's plans are crumbling one by one. Sales goals: 1.2016 - 0.0% Fibonacci Purchase goals: 1.2401 - 50.0% Fibonacci 1.2489 - 61.8% Fibonacci General conclusions and recommendations: The downward trend section is still considered completed. Thus, now, it is expected to continue the construction of the rising wave with targets located near the calculated levels of 1.2401 and 1.2489, which corresponds to 50.0% and 61.8% Fibonacci. I recommend buying pounds in small lots, as the wave of c may be completed in the near future. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of GBP/USD for September 13, 2019 Posted: 13 Sep 2019 02:43 AM PDT Overview: The GBP/USD pair (British Pound / US Dollar) continues to strengthen from the area of 1.2303 and 1.2394 in the 4-hour time frame. The price spot of 1.2303 and 1.2394 remains a significant support zone. Therefore, the possibility that the Cable will have an upside momentum is rather convincing and the structure of the fall does not look corrective. The expected trading range for today is between 1.2394 support and 1.2606 resistance. Additionally, the RSI is still calling for a strong bullish market as well as the bullish outlook remains the same, as long as the 100 EMA is pointing to the upside. It should be noted that breaking 1.2394 resistance will press on the price to return to the main bullish channel and attain posistive targets that begin at 1.2517 and extend to 1.2606. It is equally important that it will call for uptrend in order to continue bullish trend towards 1.2606. However, the stop loss should be located above the level of 1.2303. But overall we still prefer a bullish scenario at this phase The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 13 Sep 2019 02:23 AM PDT The euro regained all the positions that it lost after the decision of the European Central Bank to return to the asset repurchase program. During the press conference of the President of the ECB, he directly pointed out that all the blame for the slowdown in global economic growth lies with the United States and the trade war waged by the White House administration with China and other countries. During a press conference, Mario Draghi said that mitigation measures are a response to low inflation and a weak economy, which in the future will provide a significant incentive for growth in the eurozone. Recent data indicate moderate GDP growth in the 3rd quarter of this year. Meanwhile, the growth forecast for 2019 was reduced to 1.1% from 1.2%, and for 2020 was revised to 1.2% from 1.4% Draghi also noted that the balance of risks for the economic prospects of the eurozone is shifted in the negative direction as trade conflicts and geopolitical uncertainty put pressure on economic growth. Therefore, the eurozone economy slowed down more than expected. As for inflation, the forecast in 2019 was reduced to 1.2% from 1.3%, and in 2020 to 1.0% from 1.4%. Data on rising consumer prices in the United States was unlikely to please the Federal Reserve only if it did not seriously think about lowering interest rates next week. If so, then yesterday's report fits well with the committee's plans as low inflation maintains a wide range for manipulating interest rates. According to the report, the growth of the consumer price index in the US remained very low in August due to lower energy prices. Thus, the Consumer price index (CPI) grew by only 0.1% compared with the previous month, coinciding with the forecast of economists. Compared to the same period of 2018, annualized inflation rose by 1.7%. As for core inflation, excluding volatile categories, prices rose by 0.3% compared with July. The base index grew by 2.4% compared to August 2018. The US budget deficit continues to grow, and no one sees the problem. So, in the first 11 months of the fiscal year, the deficit exceeded $1 trillion. According to the US Treasury Department, the overall budget deficit grew to 1.07 trillion and GDP amounted to 4.4%. Between October and August, the budget deficit increased by 10%. Government spending grew by 7% and tax revenue increased by only 3%. At the same time, the US presidential administration expects a 3.2% increase this year, which predicts a recession in US economic growth in the 3rd quarter of this year. In total for the year GDP growth is expected at 2.2% per annum. In 2020, growth will slow to 1.7% and only accelerate to 1.9% in 2021. As for the technical picture of the EUR/USD pair, yesterday's powerful return of the bulls to the market once again indicates the manipulations of large players that are constantly happening. At the moment, the bulls will seek to break through the resistance of 1.1085 and get to new local highs in the area of 1.1120 and 1.1150. If the pressure on risky assets returns in the afternoon, (which can happen after the release of the report on US retail sales), it is best to consider long positions on updating the low of 1.1020, which was a big support during this week. The material has been provided by InstaForex Company - www.instaforex.com |

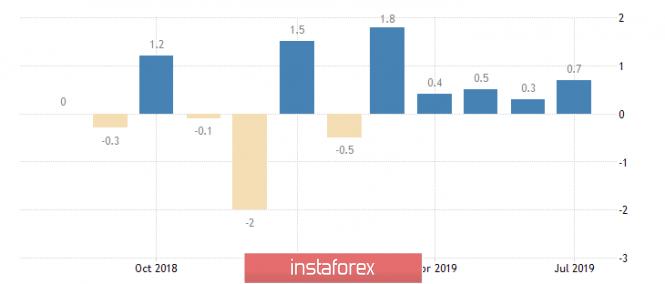

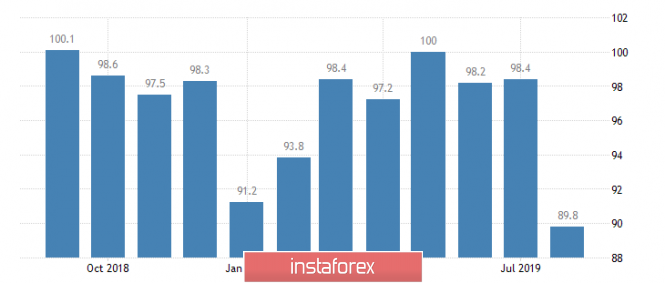

| No luck with the statistics (A review of EUR / USD and GBP / USD on September 13, 2019) Posted: 13 Sep 2019 02:10 AM PDT The European Central Bank has taken a confident step towards what is probably already a super-duper soft monetary policy. Not only that, the deposit rate was lowered from -0.4% to -0.5%, which should completely delight all Europeans who have at least some savings. After all, they will now have to pay banks even more for the fact that these same banks use their money. So another program of repayment of debts in the amount of 20 billion euros per month will now operate until such time as it is necessary. That is as much as the leadership of the European Central Bank pleases. But this is nothing more than the resumption of the quantitative easing program. Moreover, Mario Draghi took another oath on blood that they would not raise rates until inflation stabilizes at 2.0%. To simply put it, inflation should be above the indicated level. In short, we will only see an even greater easing of monetary policy in the future, and the next step will be to lower the refinancing rate. Thus, you should not expect any increase in rates at all. And even Christine Lagarde, who will be the first woman to head the European Central Bank, is unlikely to go down in history as the person who put an end to the era of negative interest rates. It is clear that after such good news, the single European currency resumed its movement in the direction of parity with the dollar. But less than two hours have passed since the announcement of the results of the meeting of the Board of the European Central Bank, the quotes moved in the opposite direction. Although, the fact is that investors only for a second were distracted from worries about the actions of Mario Draghi, and with just one eye looked at America, where inflation data were published. This was enough to change the mood one hundred and eighty degrees. After all, if preliminary data showed that inflation remained unchanged, then the final data showed that it fell from 1.8% to 1.7%. Everyone was reminded by the recent outcry that the Federal Reserve System should immediately reduce the refinancing rate, as an unimaginable recession is approaching. The decrease in inflation against this background was perceived as a signal that Jerome Powell would indeed lower the refinancing rate from day to day. In this case, of course, no one paid attention to the fact that the total number of applications for unemployment benefits decreased by 19 thousand, while it was supposed to increase by 22 thousand. In particular, the number of initial applications for unemployment benefits, instead of decreasing by 4 thousand, decreased by 15 thousand. The number of repeated applications, which was supposed to increase by 26 thousand, decreased by 4 thousand. And the state of the labor market, from the point of view of the monetary authorities, is as important a factor as inflation. In other words, everyone was looking at what they wanted, not what they needed. This means that the emerging weakening of the dollar is due only to emotions. Inflation (USA): Since the movement is largely due to emotions, a return to reality is inevitable. However, it is worth the wait, and today, we are unlikely to see it. The fact is that data on retail sales in the United States is published today, which may show a slowdown in growth from 3.4% to 3.2%. Given the slowdown in inflation, a decrease in consumer activity is an explosive mixture, since it threatens to reduce the profits of American companies. Investors will keep this in mind, as well as use it as an additional argument in appeals to the Federal Reserve to lower the refinancing rate. So if the forecasts come true, then the dollar simply has nothing to grow for now. Dynamics of retail sales (USA): Thus, the most likely development of events is the further growth of the single European currency, is not strong. Nevertheless, it is worth waiting for growth to 1.1125. As long as there is a lull in political battles in the United Kingdom, the pound will be sensitive to American statistics. However, the growth potential of the pound is limited even more than in the single European currency, due to a much greater overbought. Consequently, the pound should expect growth to 1.2425. |

| Posted: 13 Sep 2019 01:46 AM PDT GBP/USD pair On the chart, the development of the rising wave of July 30 continues. Quotes of the British pound form the final phase of the wave since September 3. In the last week, the price runs in a narrow range, forming an intermediate correction. Its structure analysis does not show completeness at the moment. Forecast: An incomplete correction does not allow the pair to further move upward. At the next trading sessions, the completion of the current plane and a return to the main vector of movement is expected. It may look like a short-term drop in the price after the news release. Recommendations: Due to the likely increase in volatility when changing directions, pound sales can be very risky today. It is recommended to pay attention mainly in searching for signals to buy a tool. Resistance Zones: - 1.2460 / 1.2490 - 1.2370 / 1.2400 Support Areas: - 1.2300 / 1.2270 USD/JPY pair The short-term trend direction of the yen is set by the rising wave algorithm of August 6. In the last 3 weeks, the price has been rising, forming the final part (C). Forecast: At the next session, the end of the rollback started yesterday, is likely. In the afternoon, a change in the main rate and the beginning of price growth are expected. Recommendations: Yen sales today are unpromising due to the expected low potential for a down move. It is recommended to start tracking the pair for buy signals when the price reaches the support zone. Resistance Zones: - 108.50 / 108.80 Support Areas: - 107.90 / 107.60 Explanations to the figures: The simplified wave analysis uses waves consisting of 3 parts (A-B-C). Each of these analyzes the last incomplete wave. Zones show calculated areas with the highest probability of reversal. The arrows indicate the wave marking by the method used by the author. The solid background shows the formed structure and the dotted exhibits the expected movement. Note: The wave algorithm does not take into account the duration of tool movements over time. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading plan for EUR/USD pair on 09/13/2019 Posted: 13 Sep 2019 01:30 AM PDT The euro made two big moves after the ECB. First was a sharp drop down to almost the lows of the month at 1.0926, and then an equally rapid growth reaching a new high of the month at 1.1086. This probably indicates strong support for the euro at current levels. The ECB lowered the rate to minus 0.5% and introduced a new liquidity injection program of 20 billion euros per month. Nevertheless, it is much less than the previous such program that reached 60 billion euros per month. EURUSD: We keep purchases from 1.1060 with a possible reduction. The material has been provided by InstaForex Company - www.instaforex.com |

| Hot forecast for EUR/USD on 09/13/2019 and trading recommendation Posted: 13 Sep 2019 12:02 AM PDT Although it was predicted that Mario Draghi would arrange a local catastrophe, the outcome of the meeting of the European Central Bank was not so terrifying. As expected, the deposit rate was reduced from -0.4% to -0.5%. In addition, a debt purchase program of €20 billion per month will continue as long as necessary. That is as much as the European Central Bank decides. In addition, Mario Draghi said that rates will not increase until inflation stabilizes above 2.0%. Frankly, from all this, it follows that the next step of the ECB is to lower the refinancing rate. Most importantly, we still have to wait a long time for at least some tightening of the monetary policy of the ECB. And it is not a fact that Christine Lagarde, who will take the post of head of the ECB on November 1, will become not only the first woman in this post, but also the person who will nevertheless end the era of super-soft monetary policy. However, the single European currency did not decline for a long time, and quickly returned to the values it was at before the announcement of the results of the European Central Bank meeting. The fact is that investors unexpectedly drew attention to inflation in the United States, which suddenly fell from 1.8% to 1.7%. But it had to remain unchanged. This alignment automatically made everyone recall the horror story about the inevitable reduction in the refinancing rate of the Federal Reserve. Moreover, if in addition to declining inflation, the European Central Bank also softens its monetary policy. United States inflation: Today, there are all the prerequisites for the further strengthening of the single European currency. The reason should be the data on retail sales in the United States, the growth rate of which may slow down from 3.4% to 3.2%. If these forecasts come true, it turns out that not only is inflation slowing down, but consumer activity is also declining. This is an explosive mixture, which will inevitably lead to lower profits of US companies. In other words, cries about the fact that the Fed has no choice but to immediately reduce the refinancing rate will seriously put pressure on the psyche of investors. Retail Sales Growth Rate (US): The EUR/USD pair showed really strong fluctuation, where the current year's low was touched (1.0926), and a rapid return to the starting point of the course at 1.1080. What was the reason for such rapid fluctuations, I described above, but few people expected such a spread in the price of 150 points. Considering everything that happens in general terms, we see that conditionally the correction phase has nowhere to go and the price actually continues to be above the psychological mark of 1,1000 with long shadows behind and a desire to further move upward. It is likely to assume that the upward interest will still remain for some time in the market, where traders are considering the move to 1.1110/1.1125, where the peak of the previous accumulation along with the Fibo level of 38.2 is located. Concretizing all of the above into trading signals: • Long positions, we consider in terms of progress to points 1,1110/1,1125. • We consider short positions in case of loss of upward interest in relation to current points and price consolidation lower than 1.1050. From the point of view of a comprehensive indicator analysis, we see that indicators relative to all the main time periods signal a further growth in prices. It is worth considering such a moment that due to sharp price fluctuations, indicators arbitrarily began to change their readings. |

| Euro remains in range after ECB meeting, pound takes a break Posted: 12 Sep 2019 11:59 PM PDT Core inflation in the United States reached 2.4% y/y in August, which was the highest level in 10 years. Growth exceeded forecasts despite the fact that the forecasts were quite optimistic. First of all, the growth of price is supported by the services sector, while commodity components show noticeably weaker dynamics. If we proceed from the fact that Trump's war for higher import tariffs will have the expected effect, then we can assume an increase in commodity prices. These considerations should support inflationary expectations. But the oddity is that Tips' 5-year inflation-protected bond yields are still around a 12-month low, indicating strong business skepticism about inflationary expectations. Apparently, markets do not expect a hawkish bias from the upcoming FOMC meeting. So, the demand for risky assets will continue with high probability next week. EURUSD pair The ECB kept the base rate at zero and at the same time lowered the rate on deposits by 0.1%, which is already expected at the meeting that ended on Thursday. The asset repurchase program has also been resumed, but monthly purchases will total only 20 billion euros per month, while 30 or even 40 billion was expected. The euro reacted to the outcome of the meeting with growth as the ECB's decision looked less dovish as a whole than predicted, but then it went down. After Mario Draghi noted that the likelihood of a recession is low, the euro began to move up, having recovered all the losses. Indeed, despite the fact that the yield of 10-year-old Bundes is below zero, the spread between 2- and 10-year-old bonds is still above zero, unlike American Treasuries, and consumer confidence, although it is in a long-term downtrend, in the last two year shows the reverse dynamics. In fact, the euro did not receive directions to the direction after the ECB meeting. The buyback program has nevertheless been resumed, and relatively small volumes may be increased at any time if circumstances so require. The fears of relatively low inflation are largely due to the low price of energy, Draghi emphasized at a press conference. Meanwhile, core inflation is still high and is predicted to drop to 1.5% in 2021. In general, the ECB gave a neutral characterization of the state of affairs in the eurozone, but most regional banks are preparing for a darker scenario. In particular, Nordea Bank believes that the ECB will reduce the deposit rate by another 10p in December and expand its asset purchase program to 40 billion per month. DanskeBank notes the obvious risks that the market will come to the conclusion that the measures taken are not enough to revive inflationary expectations and growth, which will then proceed from the need to expand the incentive program that confirms the position of Nordea. Well, the head of Deutsche Bank Christian Seving did say that "... in the long term, negative rates lead to the collapse of the financial system ...", European banks will receive losses of hundreds of millions of euros this year only in the reduction of the deposit rate. In general, it is currently necessary to proceed from the fact that the ECB was able to launch an incentive program while maintaining the euro quotes at the same level. Despite the chaotic movements of the euro, it did not go beyond the horizontal boundary of 1.0920-1.1085, and expectations remain neutral as of Friday morning. Before the Fed meeting, the euro will continue to trade in a range and an attempt to go up will most likely be stopped at the border of the long-term channel at 1.11. GBP/USD pair The pause in the political show regarding Brexit and the lack of significant macroeconomic news contribute to reducing the pound's volatility. A weak upward trend remains and the pound will tend to move towards the area of 1.2380/2430. There are no reasons for a downward turn yet. The material has been provided by InstaForex Company - www.instaforex.com |

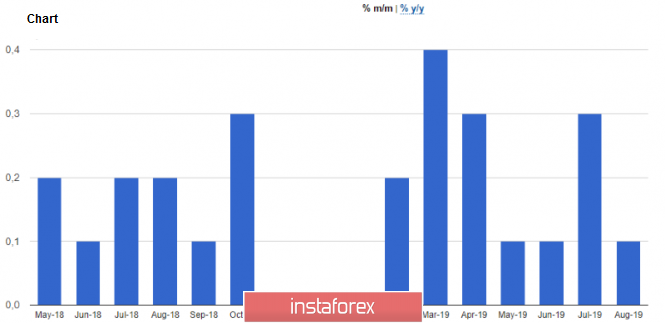

| EUR / USD: The dollar is not up for inflation and the euro is growing on rumors around the ECB Posted: 12 Sep 2019 11:58 PM PDT The results of the September meeting of the ECB overshadowed the remaining fundamental factors relevant to the euro-dollar pair, particularly the data on the growth of American inflation remained in the shadow of high-profile European events. This release is important in itself in the context of the upcoming Fed meeting (which will take place next Wednesday), the published figures are viewed through the prism of monetary policy prospects. However, judging by the reaction of the dollar index, traders are quite pessimistic about the possible decisions of the regulator. August inflation showed a good result, but the dollar reacted with minimal growth. It completely lost its position paired with the euro even if, these were all prerequisites for large-scale growth of the American currency. Despite weak forecasts, the basic consumer price index showed significant growth. On an annualized basis, it has been consistently increasing for the third month in a row and reached 2.4%, which has been the strongest growth rate since July 2018. On a monthly basis, core inflation is steadily reaching 0.3%, although experts expected a decrease to 0.1%. The general consumer price index also showed a relatively good result, being at the forecast level. Against the background of slurred Nonpharms, many of whose components did not reach forecast values. Inflation indicators look good. By the way, according to data published last week, the level of average hourly wages also increased (both on a monthly and an annualized basis(), while experts expected a decline in this indicator. This indicates an increase in price pressure in the country. In fact, this should support the US currency theoretically speaking. But at the moment, the dollar is under pressure from other factors that do not allow it to "spread its wings". First, Donald Trump again called on members of the US regulator to begin "decisive action" in anticipation of the September Fed meeting. Using his usual method of communication - via Twitter - the US president demanded that the basic interest rate be reduced to zero or even to the negative area. The motives of the American leader are obvious: this step by the Fed will reduce the yield of debt obligations and reduce the cost of servicing the public debt accordingly. An additional "bonus" is a weakening of the national currency, as well as feasible assistance to the export sector. Trump has repeatedly put political pressure on the Federal Reserve, even comparing Jerome Powell with China. In his opinion, the head of the Fed is doing more damage to the economy than Beijing. The US Central Bank formally maintains an independent position, but nevertheless, it has been systematically softening its rhetoric since the end of last year. In July, the Federal Reserve decided to lower the rate, but Powell warned that this step is a preventive, "one-time" measure, and not the start of a cycle to mitigate monetary policy. Recently, however, members of the Federal Reserve have hinted at a further reduction in interest rates. In particular, Jerome Powell again recalled the consequences of the trade war during his last speech. He stated that growing uncertainty puts strong pressure on business investment. According to Powell, this factor forces companies to "postpone investment decisions." As for the prospects of monetary policy, here the head of the Fed repeated the phrase that the regulator "will act adequately in the current situation using monetary policy tools to support the country's economy". This is a vague wording that can be interpreted in different ways - both in favor of a wait-and-see attitude and in favor of decisive action. But if we summarize all the voiced positions of the Fed members, we can conclude that the further steps of the regulator will depend mainly on the dynamics of the us-China trade war. Thus, macroeconomic reports now play a secondary role. Market reaction to the release of inflation data eloquently confirms this assumption. In turn, the prospects for resolving the trade conflict are still vague. Yesterday, information appeared on the market that Washington could conclude an interim agreement with Beijing that would delay the increase in duties on certain goods. But today, an official representative of the White House has denied this information. The negotiating teams next week will begin only preliminary consultations, preparing the way for a high-level meeting to be held in early October. In the context of the euro-dollar pair, the US currency is under additional pressure from yesterday's ECB meeting. To be more precise, the results of the meeting themselves were against the euro but the market was still expecting a more "dovish" mood. In addition, according to Bloomberg, there was a split in the regulator's camp, and the Central Bank barely had enough votes to decide on the resumption of the incentive program. According to them, representatives of Germany, France, and Austria opposed QE. Also on their side stood a member of the Board of Governors Benoit Curre. If this information is true, then it will be very difficult for Christine Lagarde to take further steps in mitigating monetary policy. This informational background supports the European currency. Thus, the dollar actually ignored data on the growth of US inflation, focusing on the expectation of the results of the September meeting of the Fed. In turn, the European currency s growing due to "hawkish" rumors around the ECB. In addition, the overestimated expectations of traders played a decisive role for the euro: the European Central Bank did not use the arsenal of available tools to the fullest, and secondly, it made it clear that it did not intend to take the interest rate further into the negative area for the foreseeable future. Summarizing the above, we can conclude that the pair maintains its upside potential to the resistance level of 1.1150, which is the upper line of the Bollinger Bands that coincides with the lower border of the Kumo cloud on the daily chart. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 12 Sep 2019 11:50 PM PDT To open long positions on GBP/USD you need: The British pound again renewed its support near 1.2310 yesterday, however, the bears failed to take control of the market, and after the demolition of a number of stop orders by speculative players, the demand for the pound will return. At the moment, the task of buyers is to break through the same resistance of 1.2381, which limits the upward potential throughout the week. This will make it possible for the bull market to resume, the target of which will be the highs of 1.2427 and 1.2460, where I recommend taking profits. If the bears continue to put pressure on the pound, it is best to open new long positions after the formation of a false breakdown level of 1.2310, or it is best to buy a rebound in the region of a low of 1.2238. To open short positions on GBP/USD you need: Significant changes in the market are unlikely to occur in the morning. Sellers will wait for the publication of a report on US retail sales and, on its basis, will try to build a false breakdown in the resistance area of 1.2381, which will be the first signal to open short positions. However, the main goal is still the test and the breakdown of the support of 1.2310, which will lead to a larger sale of GBP/USD already in the region of lows 1.2238 and 1.2112, where I recommend taking profits. With larger growth in the morning, the pair can test a new high of 1.2427, from where it is possible to open short positions immediately for a rebound. Signals of indicators: Moving averages Trade is conducted in the region of 30 and 50 moving average, which indicates some market uncertainty in the short term. Bollinger bands In case the pound declines, support will be provided by the lower boundary at 1.2305. A break of the upper boundary of the indicator in the area of 1.2370 may lead to a new wave of growth in the pair. Description of indicators

|

| Posted: 12 Sep 2019 11:41 PM PDT To open long positions on EURUSD you need: Yesterday I paid attention to the fact that the euro's fall will be limited in the support area of 1.0925, which was the low of this month, which, in general, happened. The decision to leave the key rate unchanged forced traders to switch to lower interest rates in the US, which is expected next week, which returned demand for the euro. At the moment, the bulls need a breakdown of last week's high in the region of 1.1082, which will lead to the continuation of yesterday's bullish growth and update of new levels 1.1115 and 1.1151, where I recommend taking profit. However, today the Eurogroup meeting will take place, which may limit the upward potential. In the scenario of a downward correction of EUR/USD in the morning, it is best to return to long positions on a false breakdown in the region of 1.1053, or on a rebound from a low of 1.1020. To open short positions on EURUSD you need: Today, sellers will be waiting for signals on the US economy, namely a report on retail sales, which may shed light on a possible interest rate cut in the United States next week. If it comes out good enough, it will limit the upward potential of the euro and return demand for the US dollar. The formation of a false breakdown in the resistance area of 1.1082 in the morning will be a signal to open short positions, however, it is best to sell the euro immediately for a rebound after updating the highs of 1.1115 and 1.1151. The main task of sellers will be to return and consolidate under the support of 1.1053, which will lead to a larger downward correction to the area of 1.1020, where I recommend taking profits. Signals of indicators: Moving averages Trade is conducted above 30 and 50 moving averages, which indicates the bullish nature of the market after yesterday's data from the ECB. Bollinger bands In case the euro decreases in the morning, the average boundary of the indicator in the region of 1.1053 may act as support, but it is best to buy the euro for a rebound from the lower border in the region of 1.0989. The upward trend may be limited by the upper level of the indicator in the area of 1.1120. Description of indicators MA (moving average) 50 days - yellow MA (moving average) 30 days - green MACD: Fast EMA 12, Slow EMA 26, SMA 9 Bollinger Bands 20 The material has been provided by InstaForex Company - www.instaforex.com |

| Trading plan for EUR/USD for September 13, 2019 Posted: 12 Sep 2019 11:37 PM PDT

Technical outlook: The EUR/USD pair dropped slightly more than expected yesterday but managed to stay above 1.0920. The subsequent rally occurred in line with expectation. The rally between 1.0928 and 1.1080 yesterday could be marked as wave i, within Wave c or might have terminated the a-b-c corrective rally. In either cases we can expect a drop lower at least towards 1.1020 before the pair will follow a further trajectory. Please note that a corrective drop would provide yet another opportunity to initiate long positions. Immediate resistance still remains at 1.1165, followed by 1.1250 respectively. It would be too early to presume that EUR/USD is out of woods and only a 5 wave rally here would imply that a meaningful bottom is in place. My trading suggestion is to take profits on the longs initiated yesterday at 1.0950/60 levels and remain flat for a dip again. Trading plan: Take profits on long positions taken earlier and stay flat for now. Good luck! The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment