Forex analysis review |

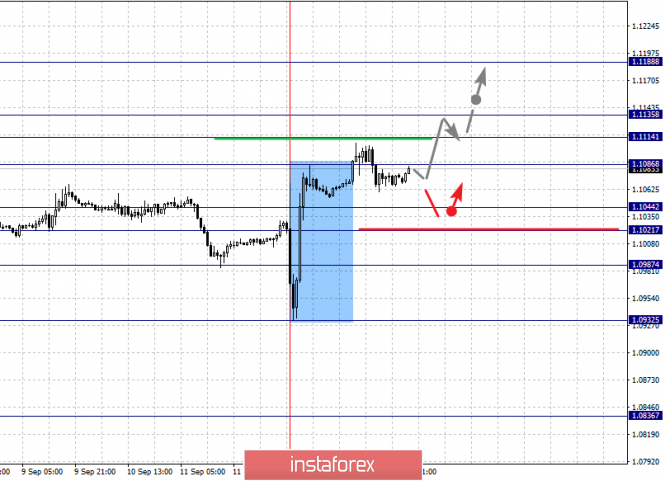

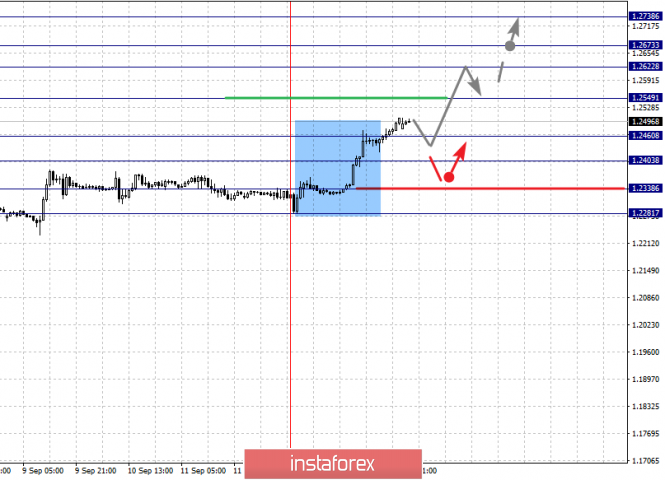

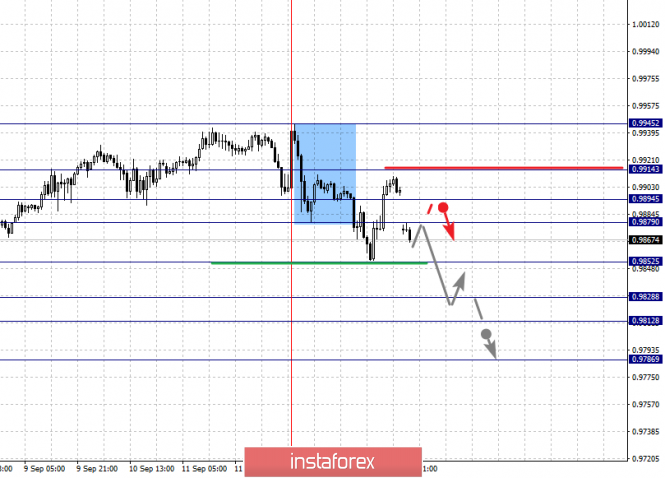

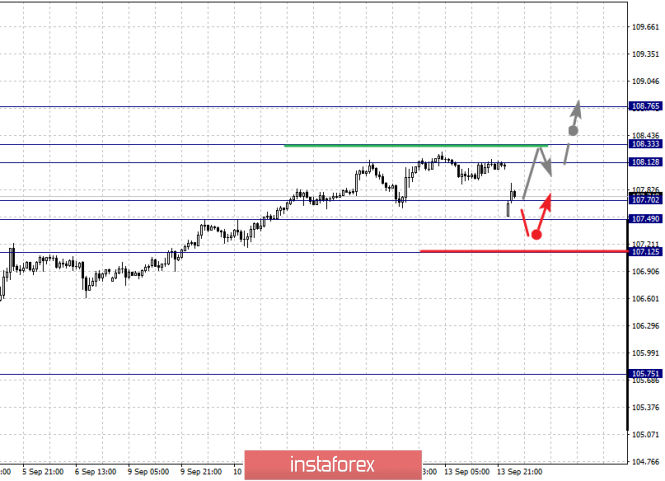

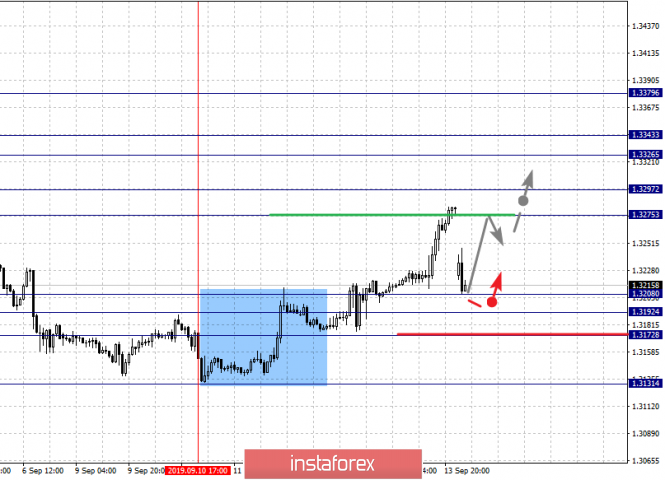

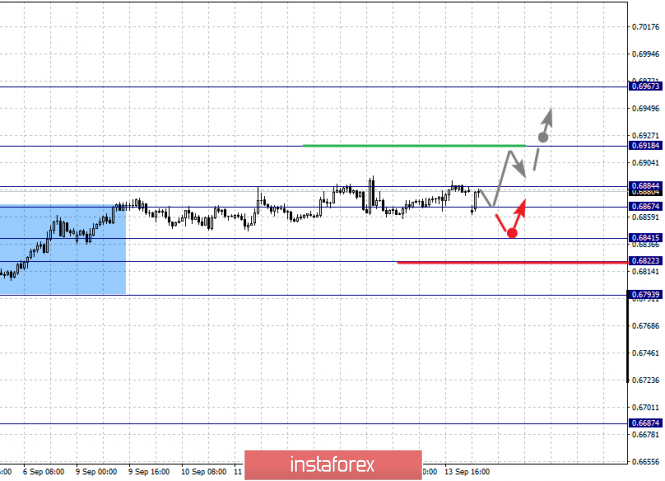

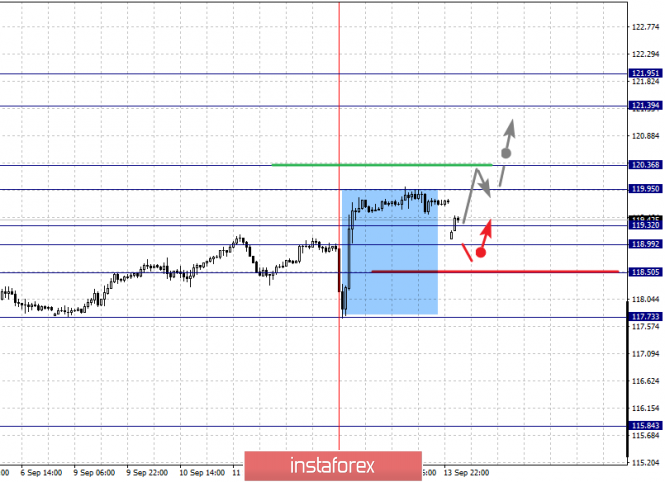

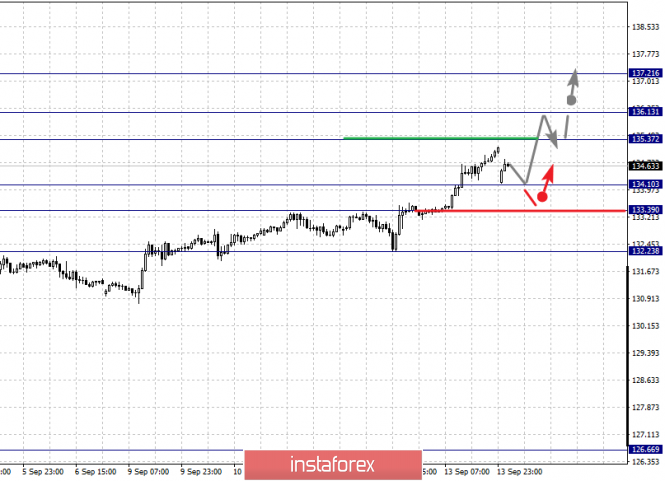

| Fractal analysis of the main currency pairs for September 16 Posted: 15 Sep 2019 05:34 PM PDT Forecast for September 16: Analytical review of currency pairs on the scale of H1: For the euro / dollar pair, the key levels on the H1 scale are: 1.1188, 1.1135, 1.1114, 1.1086, 1.1044, 1.1021 and 1.0987. Here, we determined the subsequent goals for the top from the local ascending structure on September 12. The continuation of the movement to the top is expected after the breakdown of the level of 1.1086. In this case, the target is 1.1114. Short-term upward movement, as well as consolidation is in the range of 1.1114 - 1.1135. For the potential value for the top, we consider the level of 1.1188. The movement to which is expected after the breakdown of the level of 1.1135. Short-term downward movement is expected in the range of 1.1044 - 1.1021. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.0987. This level is a key support for the upward structure. The main trend is the local structure for the top of September 12. Trading recommendations: Buy: 1.1086 Take profit: 1.1114 Buy 1.1136 Take profit: 1.1186 Sell: 1.1044 Take profit: 1.1022 Sell: 1.1018 Take profit: 1.0989 For the pound / dollar pair, the key levels on the H1 scale are: 1.2738, 1.2673, 1.2622, 1.2549, 1.2460, 1.2403, 1.2338 and 1.2281. Here, we determined the subsequent goals for the top from the local ascending structure on September 12. The continuation of the movement to the top is expected after the breakdown of the level of 1.2549. In this case, the target is 1.2622. Price consolidation is in the range of 1.2622 - 1.2673. For the potential value for the top, we consider the level of 1.2738. Upon reaching which, we expect a pullback to the bottom. Short-term downward movement is expected in the range of 1.2460 - 1.2403. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.2338. This level is a key support for the top. Its passage at the price will lead to the development of a downward structure. In this case, the first goal is 1.2281. The main trend is the local ascending structure of September 12. Trading recommendations: Buy: 1.2550 Take profit: 1.2620 Buy: 1.2674 Take profit: 1.2736 Sell: 1.2460 Take profit: 1.2405 Sell: 1.2401 Take profit: 1.2340 For the dollar / franc pair, the key levels on the H1 scale are: 0.9914, 0.9894, 0.9879, 0.9852, 0.9828, 0.9812 and 0.9786. Here, we follow the development of the descending structure of September 12. The continuation of the movement to the bottom is expected after the breakdown of the level of 0.9852. In this case, the target is 0.9828. Short-term downward movement, as well as consolidation is in the range of 0.9828 - 0.9812. For the potential value for the bottom, we consider the level of 0.9786. Upon reaching which, we expect a pullback to the top. Short-term upward movement is expected in the range of 0.9879 - 0.9894. The breakdown of the latter value will lead to an in-depth correction. Here, the goal is 0.9914. This level is a key support for the downward structure. The main trend is the descending structure of September 12. Trading recommendations: Buy : 0.9880 Take profit: 0.9892 Buy : 0.9896 Take profit: 0.9912 Sell: 0.9850 Take profit: 0.9828 Sell: 0.9812 Take profit: 0.9788 For the dollar / yen pair, the key levels on the scale are : 108.76, 108.33, 108.12, 107.70, 107.49 and 107.12. Here, we are following the development of the ascending structure of September 3. At the moment, the price is in correction. Short-term upward movement is expected in the range of 108.12 - 108.33. The breakdown of the last value will lead to movement to a potential target - 108.76, when this level is reached, we expect a pullback to the bottom. Short-term downward movement is possibly in the range of 107.70 - 107.49. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 107.12. This level is a key support for the top. Main trend: local upward structure from September 3. Trading recommendations: Buy: 108.12 Take profit: 108.30 Buy : 108.35 Take profit: 108.76 Sell: 107.70 Take profit: 107.50 Sell: 107.46 Take profit: 107.12 For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3379, 1.3343, 1.3326, 1.3297, 1.3275, 1.3208, 1.3192, 1.3172 and 1.3131. Here, we are following the development of the ascending structure of September 10. Short-term upward movement is expected in the range of 1.3275 - 1.3297. The breakdown of the last value will lead to a pronounced movement. Here, the target is 1.3326. Price consolidation is in the range of 1.3326 - 1.3343. We consider the level of 1.3379 to be a potential value for the top; upon reaching this level, we expect a pullback to the bottom. A short-term downward movement is possibly in the range of 1.3208 - 1.3192. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.3172. This level is a key support for the top. Its breakdown will have the downward structure. In this case, the potential target is 1.3131. The main trend is the ascending structure of September 10. Trading recommendations: Buy: 1.3275 Take profit: 1.3295 Buy : 1.3299 Take profit: 1.3226 Sell: 1.3208 Take profit: 1.3193 Sell: 1.3190 Take profit: 1.3172 For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6967, 0.6918, 0.6884, 0.6867, 0.6841, 0.6822 and 0.6793. Here, we are following the development of the ascending structure of September 3. Short-term upward movement is expected in the range of 0.6867 - 0.6884. The breakdown of the latter value will lead to a movement to the level of 0.6918. Price consolidation is near this value. For the potential value for the top, we consider the level of 0.6967. Upon reaching this level, we expect a pullback to the bottom. Short-term downward movement is possibly in the range of 0.6841 - 0.6822. The breakdown of the last value will lead to a long correction. Here, the potential target is 0.6793. This level is a key support for the top. The main trend is the upward structure of September 3. Trading recommendations: Buy: 0.6886 Take profit: 0.6918 Buy: 0.6920 Take profit: 0.6965 Sell : 0.6840 Take profit : 0.6822 Sell: 0.6820 Take profit: 0.6795 For the euro / yen pair, the key levels on the H1 scale are: 121.95, 121.39, 120.36, 119.95, 119.32, 118.99, 118.50 and 117.73. Here, we are following the ascending structure of September 12. Short-term upward movement is expected in the range of 119.95 - 120.36. The breakdown of the last value should be accompanied by a pronounced upward movement. Here, the target is 121.39. For the potential value for the top, we consider the level of 121.95. Upon reaching which, we expect consolidation, as well as a pullback to the bottom. Short-term downward movement is expected in the range of 119.32 - 118.99. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 118.50. This level is a key support for the upward structure. The main trend is the local structure for the top of September 12. Trading recommendations: Buy: 119.95 Take profit: 120.34 Buy: 120.40 Take profit: 121.30 Sell: 119.32 Take profit: 119.00 Sell: 119.95 Take profit: 118.50 For the pound / yen pair, the key levels on the H1 scale are : 137.21, 136.13, 135.37, 134.10, 133.39 and 132.23. Here, we continue to monitor the development of the upward cycle of September 3. Short-term upward movement is expected in the range of 135.37 - 136.13. The breakdown of the last value will lead to movement to a potential target - 137.21, when this level is reached, we expect a pullback to the bottom. Short-term downward movement is possibly in the range of 134.10 - 133.39. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 132.23. This level is a key support for the upward structure. The main trend is the upward structure of September 3. Trading recommendations: Buy: 135.38 Take profit: 136.10 Buy: 136.15 Take profit: 137.20 Sell: 134.10 Take profit: 133.42 Sell: 133.35 Take profit: 132.30 The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD: traders' castles in the air and the danger of long positions Posted: 15 Sep 2019 04:30 PM PDT The pound closed the trading week at 1.2498, having previously touched the boundaries of the 25th figure. The pair has not seen such a high in a few months, or to be more precise, since July. In mid-summer, when Johnson's victory became apparent, the pair plunged to the area of 21-22 figures, since then it has not risen above the 23rd level. But the Brexit issue still has a strong influence on the pair's traders. As soon as the prospects for a "hard" scenario seriously loomed up on the horizon, the pair collapsed to around 1,1958 (a year-low). But the price immediately soared as soon as the hopes for approval of the transaction appeared on the market. This is despite the fact that the information itself, which served as a reason for strong corrective growth, was refuted by officials. But the pound, as if by inertia, still rose in price, reflecting increased demand. It is worth immediately warning: this price movement should be treated with extreme caution, since there are actually no reliable prerequisites for the restoration of the British currency. The bulls of the GBP/USD pair only took advantage of the latest rumors around the negotiation process. But, as a rule, such rumors are not subsequently confirmed, and high expectations of traders turn against the currency. In this case, the immediate cause for the pound growth was the publication of the influential British newspaper Times. According to journalists, the Democratic Unionist Party (DUP) will soften its demands on the issue of the Irish border - they will agree to Northern Ireland's compliance with some EU rules after the country leaves the European Union, in exchange for the cancellation of the agreement on the Irish border in the old version. And despite the fact that as early as Friday some representatives of the DUP denied this information, the British currency still continued to grow. This can only be explained by general optimism that the parties will either compromise or delay the Brexit date. This optimism is not supported by any objective prerequisites - on the contrary, at the moment, the main players continue to demonstrate an uncompromising and fairly tough position. For example, Irish Prime Minister Leo Varadkar said yesterday that the gap between Britain and the European Union regarding Brexit remains "very large." He recalled that Johnson promised to present alternatives to backstop, "which will suit everyone," however, as the head of the Irish government noted, the proposed scenarios are "far from what is needed." Similar comments were voiced by Michel Barnier, EU chief negotiator. Yesterday, he also commented on the current situation - quite briefly, but succinctly. According to him, "at the moment there is no reason for optimism." As for the rumors regarding the position of the Democratic Unionist Party, here it is necessary to recall the situation almost a year ago. In November 2018, information similarly appeared on the market that the parties had agreed on the Irish issue, avoiding the tight border between Northern Ireland and the Republic of Ireland. This item caused a storm of indignation among the Unionists. They stated that they would terminate the coalition alliance with the conservatives if the territory of Northern Ireland becomes a de facto part of the customs territory of the EU. The complexity of the situation lies in the fact that the unionists have the so-called "golden share" - without the support of their ten deputies, the conservatives lose the majority in parliament. And taking into account the "defectors" and the "dissidents" excluded from the conservative ranks, Johnson needs the votes of not only unionists, but also independent deputies (or representatives of the opposition). In addition, do not forget that if London provides Belfast with special conditions, then the Scots, who traditionally advocate European integration processes, may also make similar demands. Most Scots voted in a referendum to keep Britain within the EU, so after Brexit they will probably demand a second referendum on Scottish independence. Similar statements have repeatedly sounded in the walls of the Scottish Parliament. Thus, the hopes for a historic breakthrough in the negotiations "coexist" with fears about the real actions of politicians. The pound behaves accordingly. And although optimism prevailed in the market on Friday, the pair's movements were abrupt and impulsive. Of course, trading in such conditions is a big risk, since the fundamental background for the pair is too unreliable, and the technique simply "does not work" in the medium and short term. For example, if the leadership of the DUP on Monday once again refutes this information, the pound will instantly collapse throughout the market, despite the signals of technical analysis. To summarize, it is worth recalling that on Monday, September 16, British Prime Minister Boris Johnson will hold his first meeting with European Commission President Jean-Claude Juncker. Although at the moment nothing indicates a possible breakthrough in the border issue in Ireland, their rhetoric may inspire the bulls of the GBP/USD pair to further increase, or turn the pair 180 degrees. In any case, long positions in the pair are risky. It is advisable to make trading decisions following the results of the above meeting: Johnson and Juncker may pleasantly surprise or greatly disappoint the market. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment