Forex analysis review |

- USD / JPY vs EUR / JPY vs GBP / JPY. Comprehensive analysis (H4) of movement options from September 25, 2019 APLs & ZUP

- The rate of decline: where the euro will "land"

- EUR/USD: the dollar is back on the horse and the euro may resume its peak

- GBP/USD: Johnson lost the fight, but the fight for Brexit at any cost continues

- GBP/USD. September 24. Results of the day. Fifth defeat of Boris Johnson

- EUR/USD. September 24. Results of the day. The gap between the Fed and the ECB rates does not allow the euro to strengthen

- GBPUSD and EURUSD: UK Supreme Court ruled suspension of Parliament is unlawful. The latest data on Germany scare away buyers

- September 24, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- September 24, 2019 : The GBP/USD outlook indicates further bearish decline by demonstrating a reversal wedge pattern.

- BTC 09.24.2019 -New momentum down on the MACD oscillator, selling opportunities preferable

- USD/JPY analysis for September 24, 2019 - Potential bullish flag on the daily time-frame

- Pause in oil

- Gold 09.24.2019 - Bull flag pattern is forming on the 240 minute time-frame

- GBP/USD: plan for the American session on September 24th. Bulls are trying to break above the level of 1.2460 and regain

- EUR/USD: plan for the American session on September 24th. The euro managed to maintain its morning position after reports

- Technical analysis of GBP/USD for September 24, 2019

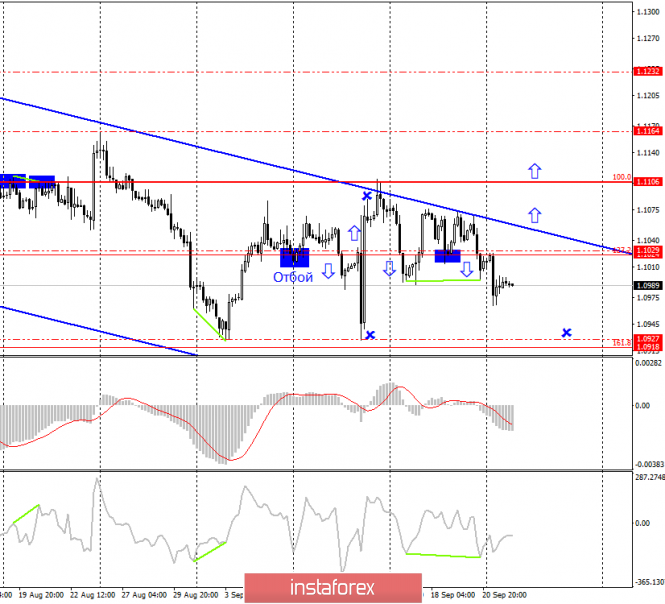

- Trading recommendations for the EURUSD currency pair – placement of trade orders (September 24)

- GBPUSD: Boris Johnson completely lost in the Supreme Court. Brexit in doubt

- GBP / USD: The Supreme Court of Great Britain adopted a "historical" decision that does not affect anything

- Trading strategy for EUR/USD on September 24th. European business activity was no better than German

- Trading strategy for GBP/USD on September 24th. Donald Trump and Boris Johnson intend to conclude the largest trade deal

- Up for grabs again: is the yen almost equal to gold?

- Fractal analysis of major currency pairs as of September 24

- Trading plan for EUR / USD and GBP / USD pairs on 09.24.2019

- Simplified wave analysis as of September 24th. USD/JPY: correction continues; GBP/USD: bulls – get ready

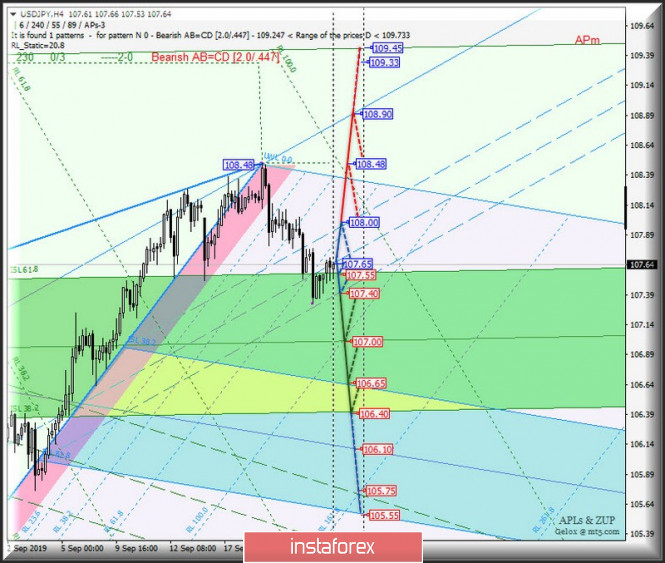

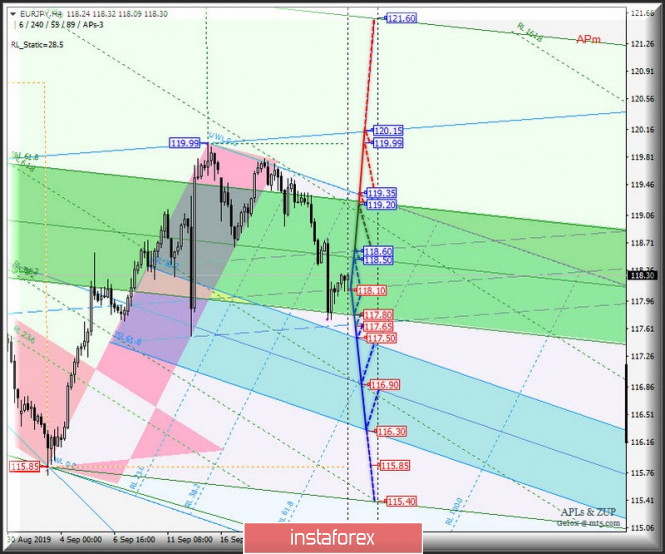

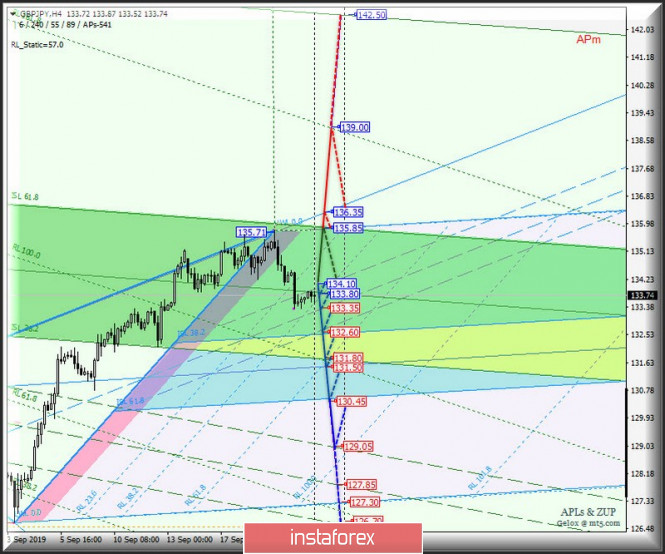

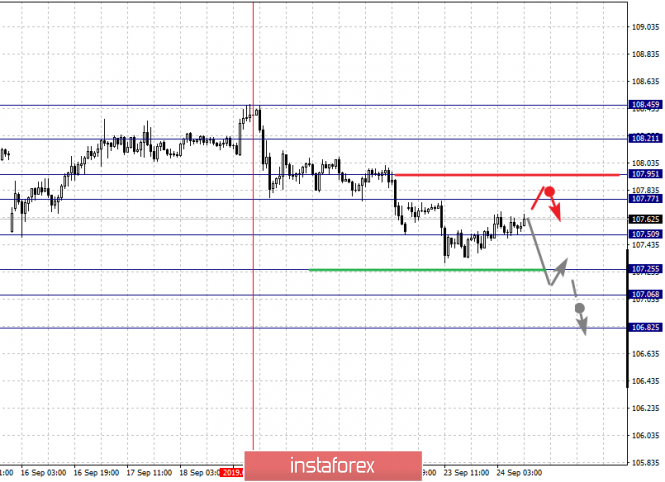

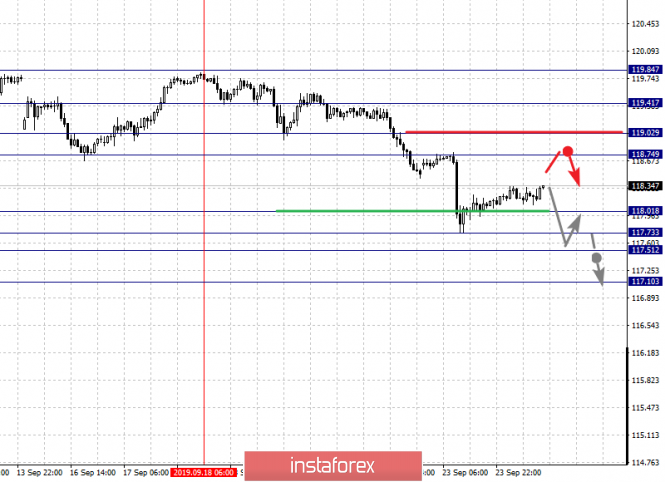

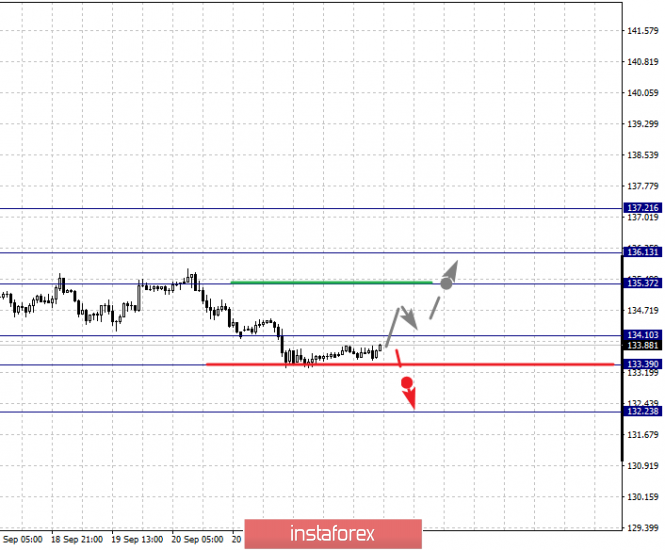

| Posted: 24 Sep 2019 05:04 PM PDT Let me bring to your attention a comprehensive analysis (H4) of the movement of the cross-instruments EUR / JPY and GBP / JPY, as well as the currency of the "land of the rising sun" USD / JPY from September 25, 2019. Minuette operational scale (H4 time frame) ____________________ US dollar vs Japanese yen The currency of the "country of the rising sun" in the 1/2 Median Line channel of the Minuette operational scale fork, respectively, the further development of the USD / JPY movement from September 25, 2019 will be due to the development and direction of the breakdown of boundaries of the levels (108.00 - 107.65 - 107.40) of this 1/2 Median Line channel. The movement markup is shown in the animated chart. The breakdown of the support level of 107.40 on the lower boundary of the 1/2 Median Line Minuette channel will determine the continued development of the downward movement of the currency of the "land of the rising sun" to the goals - Median Line Minuette (107.00) - the upper boundary of the ISL38.2 (106.65) equilibrium zone of the Minuette operational scale fork, then the lower boundary of the ISL61.8 (106.40) equilibrium zone of the Minuette operational scale fork, with the prospect of reaching the Median Line Minuette (106.10). On the contrary, in case that the upper boundary of the channel 1/2 Median Line (resistance level 108.00) is broken, the upward movement of USD / JPY can be continued to the local maximum of 108.48 and the UTL Minuette control line (108.90). The details of the USD / JPY movement, depending on the breakdown direction of the 1/2 Median Line channel mentioned above, are shown in the animated chart. ____________________ Euro vs Japanese yen The development of the EUR / JPY cross-instrument movement from September 25, 2019 will also be due to the development and direction of the breakdown of the boundaries of the 1/2 Median Line channel (118.60 - 118.10 - 117.65) of the Minuette operational scale fork. Look at the animated chart for the details of the markup options. The breakdown of the lower boundary of the 1/2 Median Line Minuette channel (support level of 117.65) will direct the movement of EUR / JPY to the boundaries of the equilibrium zone (117.50 - 116.90 - 116.30) of the Minuette operational scale fork. In case of breakdown of the upper boundary of the 1/2 Median Line channel (resistance level of 118.60) of the Minuette operational scale fork, the upward movement of this cross-instrument can be continued to the targets - the upper boundary of the ISL61.8 (119.20) equilibrium zone of the Minuette operational scale fork - the initial SSL line Minuette (119.35) - local maximum 119.99 - control line UTL Minuette (120.15). The details of the EUR / JPY movement, depending on the development of the 1/2 Median Line Minuette channel mentioned above, are presented in the animated chart. ____________________ Great Britain pound vs Japanese yen As with the currency instruments studied above, the development of the GBP / JPY cross-instrument movement from September 25, 2019 will be determined by the development and direction of the breakdown of the boundaries of 1/2 Median Line channel (134.10 - 133.35 - 132.60) of the Minuette operational scale fork. The markup movements in this channel are shown in the animated chart. The breakdown of the lower boundary of the 1/2 Median Line Minuette channel (support level of 132.60) will confirm that further the movement of this cross-instrument will begin to occur in the equilibrium zone (132.60 - 131.50 - 130.45) of the Minuette operational scale fork with the prospect of reaching the upper boundary of the 1/2 Median Line channel (129.50) Minuette operational scale fork. In case of a reversal above the upper boundary of the 1/2 Median Line channel (resistance level of 134.10) of the Minuette operational scale fork, it will make it relevant to continue the development of the upward movement of GBP / JPY to the targets - the upper boundary of the ISL61.8 (135.85) equilibrium zone of the Minuette operational scale fork - control line UTL Minuette (136.35) - reaction line RL161.8 (139.00) of the Minuette operational scale fork. We look at the animated chart for the GBP / JPY movement options, depending on the direction of the breakdown of the 1/2 Median Line Minuette channel. ____________________ The review is made without taking into account the news background. Thus, the opening of trading sessions of major financial centers does not serve as guide to action (placing orders "sell" or "buy"). The formula for calculating the dollar index: USDX = 50.14348112 * USDEUR0.576 * USDJPY0.136 * USDGBP0.119 * USDCAD0.091 * USDSEK0.042 * USDCHF0.036. where the power coefficients correspond to the weights of the currencies in the basket: Euro - 57.6%; Yen - 13.6% ; Pound Sterling - 11.9%; Canadian dollar - 9.1%; Swedish Krona - 4.2%; Swiss franc - 3.6%. The first coefficient in the formula leads the index to 100 at the start date of the countdown - March 1973, when the main currencies began to be freely quoted relative to each other. The material has been provided by InstaForex Company - www.instaforex.com |

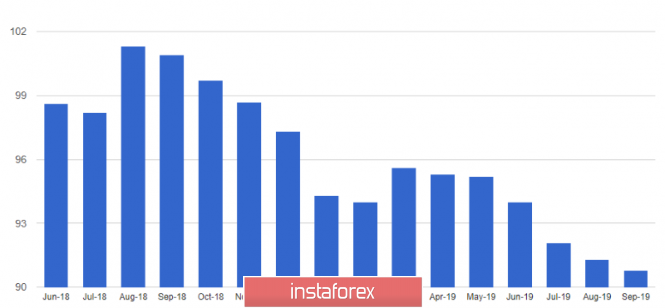

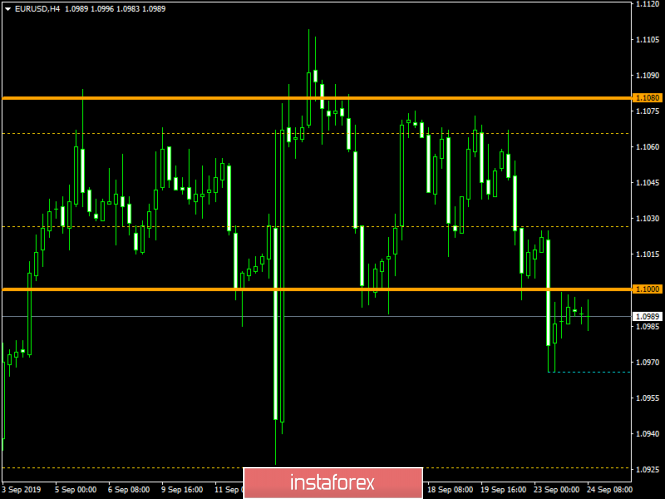

| The rate of decline: where the euro will "land" Posted: 24 Sep 2019 04:48 PM PDT The European currency is showing a decline, and analysts find it difficult to answer how strong and long it will be. The impulse of this fall was yesterday's negative data on the industrial sector in Germany. Experts consider protracted trade conflicts to be the reason for the "subsidence" of German statistics. Recall that the German economy is very strongly tied to Chinese demand, and the escalation of the trade war disrupted the traditional supply chain. This has had an extremely negative impact on Europe's leading economy, analysts emphasize. Weak statistics from Germany had negatively affected global stock markets and raised the fears of investors. As a result, the market froze in suspense, and the European currency began to decline. On Monday, September 23, the EUR / USD pair fell 0.4%, reaching a minimum of 1.0973. A number of market players believe that the pair may approach 1.1000. However, experts do not lose hope for a further recovery of the EUR / USD pair. Currently, it is trading in the range of 1.0988–1.0993. Last week, the pair tried to break through the resistance level of 1.1071. Now, experts are recording a gradual change in trend from downward to upward. It is possible that in the coming week, the level at 1.10715 will be overcome and there will be a movement towards the target levels of 1.11450 and 1.12155. In the case of updating the support level of 1.0968, a new downward trend will form with a decrease to 1.0835, analysts warn. Currently, experts note positive signals indicating the recovery of the EUR / USD pair. This gives the market hope for a possible change in the monetary policy of Germany. Germany previously assumed the likelihood of fiscal stimulus, and it is possible that the German authorities will take appropriate measures in the near future. On Tuesday, September 24, market participants are waiting for the IFO report, which presents the dynamics of the German business climate index. If the statistics published in this report are "soft", like the country's monetary policy, this will help restore the German economy and reduce negative market sentiment. However, while fiscal stimulus measures have not been announced, the movement of the EUR / USD pair remains downward, with the possibility of a breakdown of 1.0900 and a further fall, experts conclude. The material has been provided by InstaForex Company - www.instaforex.com |

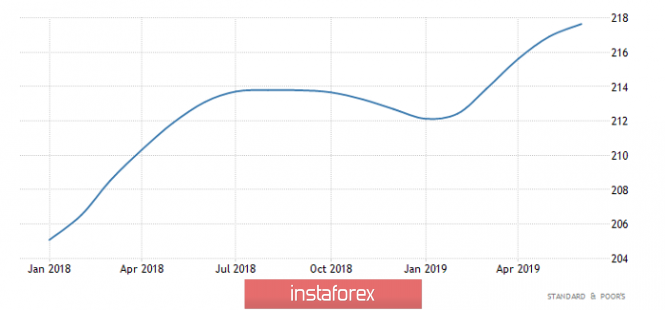

| EUR/USD: the dollar is back on the horse and the euro may resume its peak Posted: 24 Sep 2019 04:19 PM PDT The divergence in the economic growth of the United States and the eurozone made it possible for the EUR/USD pair to test the lower boundary of the short-term consolidation range of 1.0995-1.1095. The index of business activity in the US manufacturing sector reached a five-month high in September, while its European counterpart fell from 47 to 45.6, which is the lowest level in almost seven years. Speaking on the eve of the European Parliament, ECB President Mario Draghi warned that a downturn in the eurozone manufacturing sector risks spreading to other sectors of the region's economy. He sees the need to stimulate it and says that the ECB is ready to use all available tools, which implies the possibility of further easing the policy of the central bank. It should be noted that this was the last speech of Draghi in the European Parliament: his eight-year term comes to an end on October 31. His successor to the presidency of the ECB - Christine Lagarde - believes that the US-China trade war poses the greatest threat to the global economy. According to her, the mutual duties of Washington and Beijing will reduce global GDP growth by 0.8% in 2020. Obviously, trade conflicts hinder the economies of any state, and central banks are trying to counter this by easing monetary policy. In this regard, the ECB should not be surprised at the large-scale monetary stimulus. Indeed, the eurozone is one of the most affected by the trade conflict of the United States and China. The strengthening of the greenback in response to another Fed rate cut by 25 basis points does not seem paradoxical. While other central banks will seek to smooth out the negativity from trade wars, easing monetary policy, the currencies issued by them will weaken. This view is held by many large banks, including MUFG. According to Morgan Stanley, the "bearish" factor for the greenback will be the growth of US excess reserves. In this regard, the renewed Federal Reserve Bank of New York for the first time since 2008, repo operations may play a cruel joke with sellers of EUR/USD. While the current head of the Federal Reserve Bank of New York, John Williams, praises the Federal Reserve for developing the right plan and its implementation (recall, the central bank offered to buy securities with an obligation to repurchase them in the amount of up to $75 billion daily until October 10), former head of the financial institution William Dudley believes that the regulator has no choice but to build a balance with the help of reviving QE. However, while the bears in EUR/USD are set to continue the downward movement. It is assumed that the pair may retreat to annual lows near the 1.0920 mark if in the near future the bulls will not be able to take the 1.10 mark and gain a foothold above it. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD: Johnson lost the fight, but the fight for Brexit at any cost continues Posted: 24 Sep 2019 04:18 PM PDT The pound against the US dollar grew by 0.4%, rising above 1.2480, amid the fact that the British Supreme Court declared the suspension of the work of the national Parliament initiated by Prime Minister Boris Johnson as unlawful and unreasonable. However, analysts do not expect a strong change in quotes, since the uncertainty around Brexit remains. Recall that in late August, B. Johnson received the consent of the Queen of England to close the Parliament from September 10 to October 14. He explained his decision by saying that the Cabinet of Ministers needs to present its new agenda and begin to implement the domestic political program. Many lawmakers then accused the prime minister of intending to withdraw the country from the EU on October 31 without concluding an agreement, as well as of misinforming the queen in order to obtain authorization to suspend Parliament. Back in early September, a Scottish court declared B. Johnson's actions unlawful. Today, the Supreme Court of Great Britain also noted a truly historic decision. Eleven judges unanimously declared the suspension of Parliament illegal. At the same time, the court focused on the fact that the prime minister did not provide reasonable arguments for his decision to suspend the work of the legislative body for five weeks with an acceptable norm of several days. Experts point out that this is an extraordinary constitutional moment and an unprecedented political crisis for the United Kingdom. The country's highest court ruled that the prime minister gave unlawful advice to the queen. In normal times, the prime minister would have to resign immediately. Joanna Cherry, an official representative of the Scottish National Party, urged B. Johnson "to find the courage to do at least one worthy thing - to resign." "I accept the verdict of the Supreme Court, although I strongly disagree with it. Britain anyway, under any circumstances, will leave the EU on October 31. I intend to get a deal with the EU on Brexit up to this point. The mood of the Parliament and the courts does not simplify this task at all," said the British Prime Minister, commenting on the decision of the Supreme Court. According to analysts, despite the decision of the UK Supreme Court, the uncertainty surrounding Brexit remains high, which will greatly limit the ability of the GBP/USD pair to recover. It is still not clear whether the country will exit the EU with or without an agreement on October 31. If it approaches this date without a deal, is it possible to extend the Brexit deadline again? It is expected that in the near future the GBP/USD pair will continue to trade in the range of 1.2400-1.2500. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. September 24. Results of the day. Fifth defeat of Boris Johnson Posted: 24 Sep 2019 04:09 PM PDT 4-hour timeframe Amplitude of the last 5 days (high-low): 134p - 73p - 122p - 124p - 78p. Average volatility over the past 5 days: 106p (high). Well, from our point of view, Boris Johnson suffered a significant defeat today. By and large, the Supreme Court of Great Britain today recognized that the prime minister abused power, and also deliberately misled Queen Elizabeth II, who, in fact, approved Johnson's request to suspend Parliament. The court decision was unanimous; all 11 judges ruled that Johnson's decision was unlawful. We would like to focus the attention of traders on the fact that this is an abuse of power by the head of state. That is now what Boris Johnson can be accused of. And if you add to this all his previous defeats, wars, confrontations, backstage games and attempts to circumvent the laws of the UK, a very unpleasant picture emerges. For the prime minister, of course. It is still difficult to say whether this defeat in court will affect the ratings of the Conservative Party and personally of Boris Johnson. According to the latest sociological research, at least 30% of voters are ready to cast their votes for Conservatives. The remaining parties will be content with fewer votes. However, the situation may change for the worse for Conservatives. Opposition leader Jeremy Corbyn has already urged Boris Johnson to resign, as well as to immediately resume Parliament. Corbyn also said that he urged Johnson to "weigh his position" and "become the prime minister who was least in power." Boris Johnson, who is in New York at the UN General Assembly session, managed to give his comments. He stated that he deeply respects the UK judicial system and will comply with a court order. At the same time, Johnson said that he "strongly disagrees with the decision of the Supreme Court." "I don't think it was the right decision," Johnson summed up. Thus, in the near future, the Parliament should resume its work, and the deputies will continue to struggle with Boris Johnson. The Speaker of the House of Commons, John Bercow, has already welcomed the court ruling: "The House of Commons, which represents our parliamentary democracy, must assemble without delay," he said. We want to note that if in the beginning of summer deputies simply fought against the "hard" Brexit, now the prime minister will have to deal with angry deputies who are eager for his resignation. Frank disappointment is already observed in the camp of Conservatives. Conservative Party member Andrew Bridgen called the court ruling "the worst for democracy." According to Bridgen, the Parliament will now "hold democracy hostage", and "the speaker of the House of Commons will actually control the Parliament." Bridgen preferred not to mention that it was precisely the principle of democracy that Boris Johnson bypassed when he initiated the prorogation of Parliament. Well, what about the pound? Today, the UK currency has received very reasonable support. The pound increased by 60 points and recovered to the Kijun-sen critical line. However, it is too early to talk about the resumption of an upward trend. Now we need to wait for the moment when Parliament will officially resume work, and wait for the development of events in the war for Brexit. But if the pound/dollar pair manages to gain a foothold back above the Kijun-sen line, this will be a heavy bid by the bulls for new hikes up. Trading recommendations: The GBP/USD currency pair has now returned to the critical line. Thus, it is now recommended to wait until the correction against the downward trend is completed and resume small sales of the pair with the target of 1.2382. If the bulls manage to overcome the Kijun-sen line, then pound purchases with the first target of 1.2572 will become relevant. In addition to the technical picture, fundamental data and the time of their release should also be taken into account. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 24 Sep 2019 03:55 PM PDT 4-hour timeframe Amplitude of the last 5 days (high-low): 85p - 62p - 51p - 72p - 60p. Average volatility over the past 5 days: 66p (average). The second trading day of the week for the EUR/USD pair passed in a correctional movement after a rebound from the first support level of 1.0976. Thus, there are still chances that an upward trend will form if the current upward correction develops into a full movement of growth. For this, it is necessary for traders to consolidate the pair above the Ichimoku cloud, which will automatically mean overcoming all the indicator lines. If a rebound follows from the Kijun-sen critical line, then the downward movement is likely to resume. If the downward movement resumes, then we have the right to count on a new test of the level of 1.0926 in the near future, from which the price fought back twice in the past, thus forming a "double bottom" pattern. From a fundamental point of view, there is practically nothing to say about today. Not a single important macroeconomic report, not a single important speech or interview from senior EU or US officials. All the attention of traders was shifted today towards the GBP/USD pair, according to which there is much more news. As a result, volatility during the day is quite low, only 26 points at the moment, and exclusively corrective mood of traders. If you look at the lower timeframe, it becomes clear that it is very difficult to pass the area near the level of 1.0950. In fact, the euro/dollar spent the last thirteen trading days between the levels of 1.1000 and 1.1080, that is, in a very narrow price range. At the moment, the Bollinger bands on the 24-hour timeframe are narrowing, which indicates a weakening downward trend in the long term. A more detailed consideration is required in this moment. If the long-term trend is weakening, then this is the first sign of its completion soon. However, the bulls for the euro/dollar pair remain extremely weak, as the economic situation in the eurozone remains sluggish and continues to deteriorate. Over the past three months, the euro has fallen in price against the dollar by 3-4 cents, this is not a lot, but also not a little. Since the state of the EU economy does not change for the better, and even stabilization is far, we believe that the systematic decline in the European currency will continue. The US economy will now try to "catch up" with the European one. Some signs of a slowdown are also observed in the United States, Jerome Powell announced some risks and threats of a recession, and the Federal Reserve has already lowered its key rate twice. By the way, it is in US rates that it will also try to "catch up" with the European Union, but here the Fed has much more room to maneuver. The current Fed rate is 2.00%. That is, up to zero can be followed by eight more reductions. But with the current interest rate on loans of 0.0% and a deposit rate of -0.50%, it would not accelerate much. Thus, we believe that only as the gap between the rates decreases, will the euro gradually grab the initiative from the US dollar. Not earlier. Adjustments to this hypothesis can be made by a trade war between the United States and the European Union, but since America has not taken official statements and concrete actions, it is too early to talk about it. Trading recommendations: The EUR/USD pair continues the upward correction with the target Kijun-sen line. A price rebound from this line could trigger a resumption of the downward movement with targets at 1.0976 and 1.0939. In order for purchase orders to become relevant, it is recommended to wait that the Ichimoku cloud be overcome. In this case, the longs can be considered while aiming for 1.1071. In addition to the technical picture, fundamental data and the time of their release should also be taken into account. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 24 Sep 2019 03:42 PM PDT The euro continued to trade in a very narrow price range after the German business sentiment index came out slightly above forecasts, while the expectations index fell even lower. This suggests that Germany continues to move towards a technical recession. Yesterday's data on the manufacturing sector proved this again. Now all opponents of a softer monetary policy in Berlin should once again think about whether it makes sense to push. According to the data, the Ifo business sentiment index in September 2019 increased to 94.6 points against 94.3 points in August. Growth is directly related to a positive assessment of the current situation. But expectations for future prospects have become much worse. Economists had expected the business climate index to reach 94.4 points in September. As I noted above, the index of company expectations in September fell to 90.8 points, against 91.3 points in August, while economists predicted that the index would rise to 92.0 points. Regular data on the German economy once again prove that ECB President Mario Draghi's actions to soften the fiscal policy are correct and rational, but whether it will be enough will become clear later on. As for the technical picture of the EURUSD pair, it has not changed at all in comparison with the morning forecast. Buyers of risky assets will attempt to return to a resistance of 1.1000, above which the demand for the euro may increase short-term, which will lead to an update of the high of 1.1030. If the trading instrument continues to decline, the key support may be the low of this month in the region of 1.0925. GBPUSD The British pound rose after the decision of the Supreme Court of Great Britain. The decision said that Prime Minister Boris Johnson suspended the Parliament unlawfully, and the Speaker of the House of Commons of the British Parliament called on Parliament to begin its work without delay. Such news was received positively, as they fit into a series of defeats for the government led by Boris Johnson. Let me remind you that the prime minister's goal is to exit Great Britain from the EU on October 31, and it doesn't matter if this withdrawal is with or without an agreement. But opponents of this scenario are trying to do everything possible to limit the government's ability to seek Britain's exit from the EU without close cooperation with Parliament. UK public sector net borrowing growth showed little support for the pound in the morning. Amid problems with economic growth, an increase in borrowing does not look like such a bad scenario. According to the report, net borrowing grew by 6.4 billion pounds in August against 6.9 billion pounds the previous year. Economists have forecast a growth of loans of the public sector in the UK at the level of 6.8 billion pounds Regarding the technical picture of the GBPUSD pair, the return of pound buyers to a resistance of 1.2460 may provide the market with additional support, which will lead to the resumption of the upward trend, which has been observed since the beginning of this month. However, one piece of news to write off the lack of, in fact, good news on Brexit is also not worth it. Any response from the UK government on the agreement could lead to increased pressure on the trading instrument, and a breakthrough of support in the area of 1.2420 will lead to the demolition of a number of bull stop orders and a larger reduction of the pound in the short term to the lows of 1.2320 and 1.2240. The material has been provided by InstaForex Company - www.instaforex.com |

| September 24, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 24 Sep 2019 09:32 AM PDT  Few weeks ago, a quick bearish decline was demonstrated towards 1.0965 - 1.0950 where the backside of the broken channel came to meet the EURUSD pair again. Intraday traders were advised to search for a valid BUY entry anywhere around the price levels of 1.0950. Target levels were successfully reached within the recent bullish movement during last weeks' consolidations. Shortly After, the EUR/USD pair was testing the backside of both broken trends around 1.1060-1.1080 where significant bearish pressure pushed the pair directly towards 1.0940 (Prominent Weekly Bottom). Bearish Breakout below the price level of 1.0940 was needed to enhance further bearish decline towards 1.0900 and 1.0840 (Fibonacci Expansion Key-Levels). However, considerable bullish rejection was demonstrated as a quick bullish spike towards 1.1100 where another episode of bearish rejection was expressed. Currently, the EUR/USD is trapped within a narrow consolidation range extending between (1.0990 - 1.1090) until breakout occurs in either directions. By the end of last week's consolidations, Bearish Breakout below 1.1025 was demonstrated. This renders the recent bullish spike as a bullish trap. That's why, initial bearish decline was expected towards 1.0940-1.0920 while the price levels around 1.1030 remain significant supply levels to be watched for bearish rejection. Any bullish pullback towards the price level of 1.1030 should be considered as a valid SELL entry. On the other hand, Bullish breakout above 1.1080 gives an early signal of short-term bullish reversal possibility as a bullish double-bottom pattern with a projected target towards 1.1175 (Low probability). Trade recommendations : Intraday traders are advised to wait for a continuation of the current bullish pullback towards the price level of 1.1030 for a valid SELL entry. S/L should placed above 1.1090. Initial Target levels should be located at 1.0965 and 1.0930. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 24 Sep 2019 09:23 AM PDT

On July 26, Bearish breakdown below 1.2385 (Wedge-Pattern Key-Level) facilitated further bearish decline towards 1.2210 and 1.2100 which corresponded to significant key-levels on the Weekly chart. In Early August, another consolidation-range was temporarily established between the price levels of (1.2100 - 1.2220) except on August 9 when temporary bearish decline below 1.2100 was executed towards 1.2025 (Previous Weekly-Bottom). Since then, the GBP/USD pair has been trending-up within the depicted bullish channel except on September 3 when a temporary bearish breakout was demonstrated towards 1.1960. Around the price level of 1.1960, aggressive signs of bullish recovery (Bullish Engulfing candlesticks) brought the GBPUSD back above 1.2230 where the pair looked overbought. However, further bullish momentum was demonstrated towards 1.2320 maintaining the bullish movement inside the depicted movement channel. As Expected, Temporary bullish advancement was demonstrated towards 1.2500 where the upper limit of the current movement channel has been applying considerable bearish rejection since September 13. Last week, recent bullish trials were expressed towards 1.2500 - 1.2550 where bearish rejection and a reversal wedge pattern was established there. The Long-term outlook remains bearish as long as the upper limit of the current movement channel around 1.2500 - 1.2550 remains defended by the GBP/USD bears. Earlier this week, a reversal wedge pattern has been established around the mentioned Supply Levels (1.2500 - 1.2550) which was confirmed by the end of Yesterday's consolidations. Today, the backside of the confirmed reversal wedge is being re-tested where a new episode of bearish rejection is anticipated. Moreover, Bearish persistence below 1.2440-1.2400 (Reversal-Pattern Neckline) is needed to turn the short-term outlook into bearish, thus allowing more bearish decline to occur towards the lower limit of the movement channel around 1.2330. Trade Recommendations: Conservative traders can look for a valid SELL entry around the current price levels of 1.2480-1.2550. T/P level to be placed around 1.2330, 1.2280 and 1.2220 while S/L should be set as a H4 candlestick closure above 1.2550. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC 09.24.2019 -New momentum down on the MACD oscillator, selling opportunities preferable Posted: 24 Sep 2019 06:58 AM PDT Bitcoin has been trading downwards in the past 24h as I expected yesterday. The BTC tested the level of $9.593 again and is trying to break it. Momentum is still on the downside and my advice is to watch for selling opportunities on the rallies.

Blue line – Support became resistance Yellow rectangle – Support cluster and downward objective Purple falling line – Expected path MACD oscillator is showing new momentum down, which is sign that sellers are still present and strong. Bollinger band is expanding bands, which is another confirmation that volatility is increasing. Support levels are seen at the price of $9,250 and $9,050 and the resistance levels at $9,795. The material has been provided by InstaForex Company - www.instaforex.com |

| USD/JPY analysis for September 24, 2019 - Potential bullish flag on the daily time-frame Posted: 24 Sep 2019 06:48 AM PDT USD/JPY has been trading sideways in the past 24hours at the price of 107.70. I found very interesting to be on the long side due to re-test of the middle Bollinger band (20SMA) and there is potential more upside yet to come. I do expect potential test of 108.40.

Blue lines – Important support levels Pink rectangle – Resistance and upward objective Purple rising line – Expected path MACD oscillator is decreasing on the downside momentum and there is expectation for more upside to come and potential new momentum up. USD/JPY is trying to created 3-bar balance, which may lead to potential next direction move. Support levels are found at 107.20 and 106.92 and resistance at 108.40.The material has been provided by InstaForex Company - www.instaforex.com |

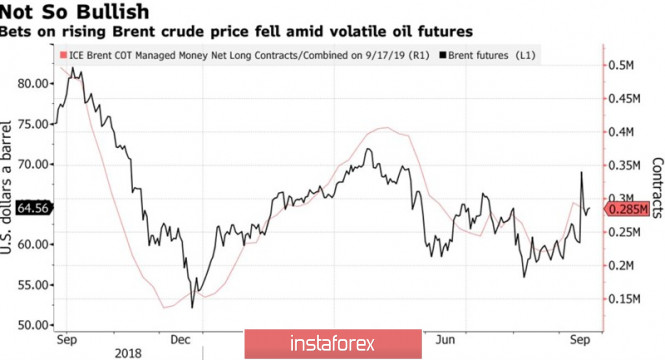

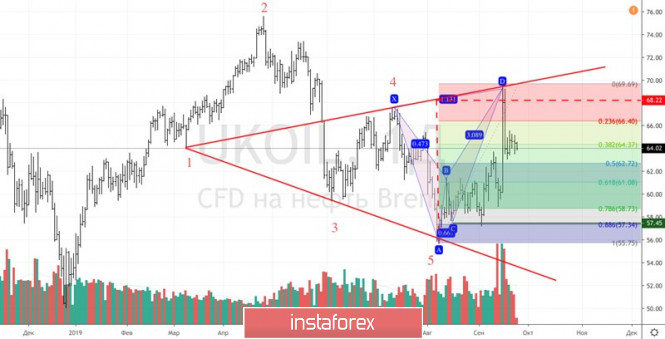

| Posted: 24 Sep 2019 06:17 AM PDT After serious shocks in mid-September, the oil market stabilized. The Bulls are surprised at the low-risk premium, since, in their opinion, attacks on Saudi Arabia can be repeated at any time. "Bears" pay attention to the fact that prices are far from April highs and nobody canceled the factor of a slowdown in global demand. Opponents are sensitive to reports from Riyadh, which promises to quickly restore damaged production. However, according to insider information of the Wall Street Journal, this may take several months, not several weeks. The oil market as a self-regulatory mechanism: the higher price rises, the lower the demand from importing countries, especially if their economies are damaged by trade wars. In this regard, the fall in business activity in the German manufacturing sector to the lowest level in September for more than a decade is an alarming signal for the Brent and WTI bulls. Europe and China are the largest consumers of black gold and the growing risks of a slowdown in their economies cannot but affect global demand. The decrease in growth forecasts for this indicator has served oil sellers in April-August. Therefore, a decrease in long speculative positions by 2.5% after a sharp take-off for looks logical Brent. Financial managers are not sure about the continuation of the rally and prefer to take profits. Net longs by the end of the week by September 17 decreased by 3.1% to 284,653 contracts, while short positions increased by 0.2%. Oil dynamics and speculative positions In contrast, the Bulls are convinced that the crisis in the Middle East is far from being resolved. The United States, Britain, and Saudi Arabia accuse Iran of financing the attack on industrial facilities, and each of them has its own reasons. The states intend to punish Tehran for failure to comply with nuclear agreements, Foggy Albion avenges tankers captured in the Strait of Hormuz (one of them released Iran recently), and Riyadh itself may be involved in the attack. As a result, the situation is heating up: the White House imposed sanctions against the central bank of the Islamic state and sent troops to the Allied camps in the Middle East while Tehran replied that the US president closed the door for further dialogue. If we take into account the possible repetition of attacks on Saudi Arabia or other black gold producing countries in this region, as well as possible military operations against Iran, the premium for geopolitical risk really looks insignificant. According to BofA Merrill Lynch, these factors and the delay in Riyadh's restoration of damaged facilities can push North Sea prices up to $70 per barrel. Technically, after reaching the targets for the "Wolfe Waves" and "Bat" patterns, regular rollback and consolidation in the range of $ 63-65.5 per barrel followed. A break of its lower border with the subsequent assault on support at $62.7 will increase the risks of a downward recovery. On the contrary, a successful resistance test of $65.5 will allow the bulls to continue their upward campaign. Brent daily chart |

| Gold 09.24.2019 - Bull flag pattern is forming on the 240 minute time-frame Posted: 24 Sep 2019 06:00 AM PDT Gold price has been trading sideways in the consolidation mode but I do expect more upside yet to come since the Gold is on the 4H time-frame bull flag formation. My advice is to watch for potential buying opportunities with the first target at $1,533.

Pink rectangle – Important resistance and first upward objective Red rectangle – Second objective target and resistance Purple rising line – Expected path MACD oscillator is showing positive reading above the zero the background and I do expect at least another push higher. Key support is at $1,486 and resistance at $1,553. Bears need to be very cautious as there is strong upward momentum in the background and the breakout of the symmetrical triangle pattern. As long as the Gold is holding above $1,486 there is a chance for potential test of $1,553.The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 24 Sep 2019 05:34 AM PDT To open long positions on GBP/USD, you need: The lack of guidance on Brexit and a weak fundamental background repel large sellers from the market, which buyers of the pound decided to take in the morning, having attempted to return to the resistance of 1.2460. Only after fixing above this range, we can again expect a re-jump to the high of 1.2522 and update the larger resistance of 1.2586, where I recommend taking the profit. If bears return to the market and continue to put pressure on GBP/USD, it is best to expect long positions after the support update to 1.2393 or immediately to rebound from the larger minimum of 1.2323. To open short positions on GBP/USD, you need: Bears need to protect the level of 1.2460 and urgently return the pair to this range. A good report on the growth of the UK public sector borrowings, which at other times would have a negative assessment, but during the crisis, Brexit can further stimulate the economy, led to the growth of the pound above the resistance of 1.2460. The first signal to open short positions on the pound will be a return to the level of 1.2460, which may occur after the report on consumer confidence in the United States. This will lead to a repeated decrease of the pair to the support area of 1.2393. However, the longer-term goal of the bears will be a minimum of 1.2323, where I recommend fixing the profits. If buyers continue to push the pound up, it is best to count on short positions in the second half of the day from the maximum of 1.2522. Signals: Moving Averages Trading is conducted around 30 and 50-day averages, which indicates some bullish correction in the pair. Bollinger Bands In the case the pound falls in the second half of the day, the lower limit of the indicator around 1.2400 will provide support.

Description of indicators

|

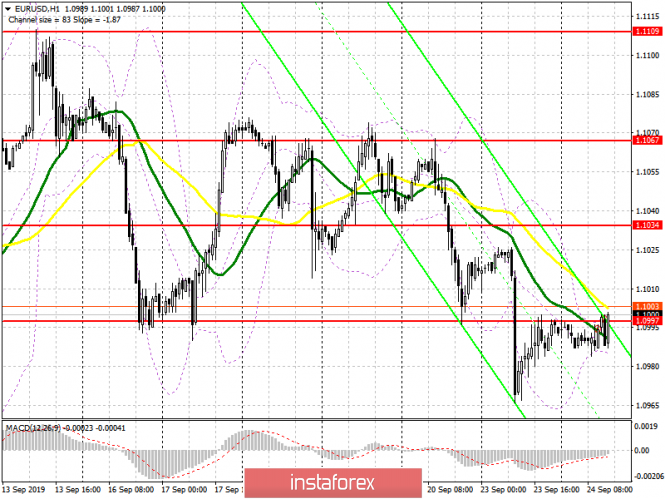

| Posted: 24 Sep 2019 05:34 AM PDT To open long positions on EURUSD, you need: Data on the conditions of the German business environment supported the euro in the first half of the day, not allowing the bears to continue the downward trend. However, as we can see from the chart, volatility is very low, and the technical picture has not changed at all. Buyers today only have to rely on a false breakdown in the support area of 1.0960 and recommend to open long positions immediately for a rebound at the minimum of a month in the area of 1.0927. A more important task for the bulls to break the current short-term downward trend will be to consolidate above the resistance of 1.0997, which can lead to an upward correction to the high of 1.1034, where I recommend taking the profit. To open short positions on EURUSD, you need: Sellers of the euro will count on a good report on consumer confidence in the US, which will return the market to bearish momentum and lead to a return to the minimum area of 1.0960. However, only the breakdown of this range will increase the pressure on the pair, which will lead to the renewal of larger support in the area of 1.0927, where I recommend taking the profit. If the data turn out to be worse than economists' forecasts, the bulls can take advantage of this moment and return to the resistance of 1.1034, from where I recommend opening short positions immediately for a rebound. Signals: Moving Averages Trading is conducted in the area of 30 and 50 moving averages, which indicates the possible formation of a bullish correction. Bollinger Bands Volatility is very low, which does not give signals to enter the market.

Description of indicators

|

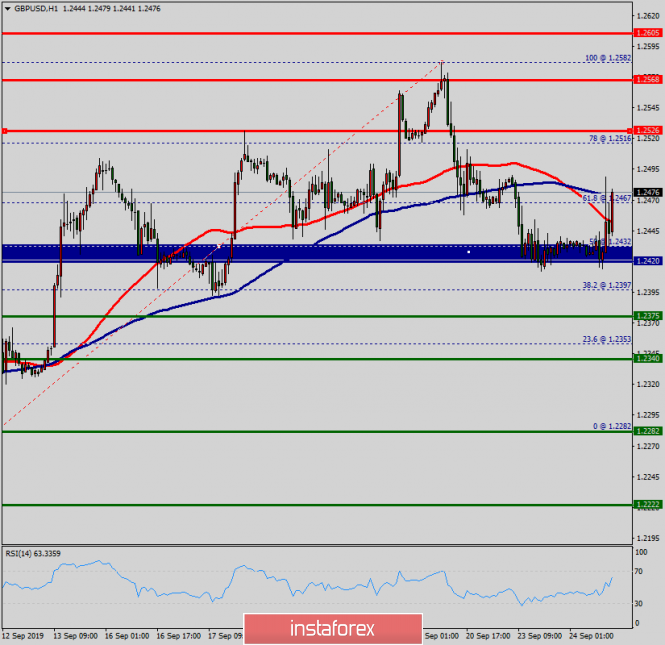

| Technical analysis of GBP/USD for September 24, 2019 Posted: 24 Sep 2019 04:54 AM PDT The GBP/USD pair is calling for bullish trend as long as the price is above the 1.2420 level. A upward impulse is anticipated to persist up to a area high at the 1.2526 at least. Note that intraday resistance level seen is at the 1.2526 price. Major resistance is seen at 1.2568, while immediate support is found at 1.2420 . The depicted support level of 1.2420 acted as a prominent key level offering a valid buy entry. The signal for entering the market is formed to buy again. The RSI shows an increase in the volume of long positions and 100 and 50-moving avergae are directed upwards. Further close above the high end may cause a rally towards 1.2420. Nonetheless, the daily resistance level and zone should be considered. Accordingly, the USD/CHF pair is showing signs of strength following a breakout of a high at 1.2420. So, buy above the level of 1.2420 with the first target at 1.2526 in order to test the daily resistance 1 and move further to 1.2568. Also, the level of 1.2568 is a good place to take profit because it will form the second resistance today. Amid the previous events, the pair is still in an uptrend; for that we foresee the GBP/USD pair to climb from 1.2420 to 1.2605 in coming hours. However, in case a reversal takes place and the GBP/USD pair breaks down the support level of 1.2420, then a stop loss should be placed at 1.2370. The material has been provided by InstaForex Company - www.instaforex.com |

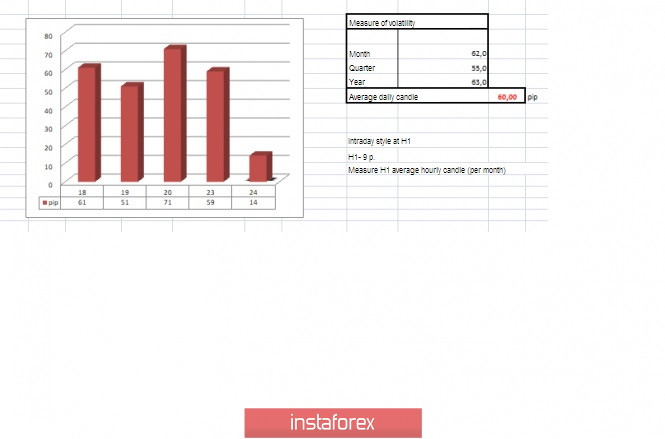

| Trading recommendations for the EURUSD currency pair – placement of trade orders (September 24) Posted: 24 Sep 2019 04:49 AM PDT The euro/dollar currency pair for the last trading day showed volatility equal to the daily average of 59, resulting in the formation of a local cross with a subsequent rollback. From technical analysis, we see that the local surge led to the fact that the quote managed to break through the psychological level of 1.1000, but then the recovery process began, rolling the quotation back to the previously passed level. There is a judgment among traders that such an oscillation is probably a pattern of "Breakout/Rollback", which may result in amplification followed by the resumption of the move. As discussed in the previous review, speculators last week were calculating the options for an impulse flight within the level of 1.1000, where positions for sale were probably exposed to many, followed by profit-taking. Further actions and consequences are described yesterday, and, in principle, expectations came true. Stagnation/rollback – this is what we were waiting for after the impulse move, a maneuver of accumulation, which is not a bad sign in the market. Looking at the trading chart in general terms (daily period), we see that the quote is trying hard to restore the downward interest, being within 75% of working out the entire width of the protracted correction. The oscillation of the past three weeks began as a systematic corrective movement, but the process was delayed so much that in the end, we got a kind of horizontal movement with points: 1.0927 – base; 1.1000 – psychological/mirror coordinates; 1.1080 (1.1115) – ceiling. The news background of the last day was really strong and the defeat of the single currency began in the morning when the preliminary data of the German PMI came out. The index of business activity in the manufacturing sector from Markit came out with a stunning decline of 43.5 – 41.5, then finished off the index of business activity in the services sector from Markit, where it fell from 54.8 to 52.5. When the European PMI totals were published, everything was clear and the euro was already at the bottom. Then came similar PMI data, but for the United States, where it was the opposite. The indices came out very well, the composite index of business activity shows an increase from 50.7 to 51.0 and the services sector growth from 50.7 to 50.9. The question arises about which recession in the States everyone is afraid of when such positive data comes out. In turn, US President Donald Trump tweeted criticism of the Federal Reserve, calling for interest rates to be reduced to below zero. "We always have to pay less than others!", – Twitter @realDonaldTrump The information background managed to support the interest of speculators. Yesterday, ECB head Mario Draghi spoke in the European Parliament, where he warned that the decline in the manufacturing sector of the eurozone risks spreading to other sectors of the economy if it continues. "While the eurozone's services sector remains resilient, we should not be complacent about its ability to remain resilient to negative impacts," the ECB chief said. At the same time, Mario Draghi veiled that the regulator is ready for further rate cuts – "We are still ready to adjust our instruments if it is justified by the prospect of inflation." Today, in terms of the economic calendar, there is a clear lack of news, there are no strong statistics, the only thing you can pay attention to is the composite index of housing costs S&P/CS Composite-20, which is expected to accelerate from 2.1% to 2.2%. Statistical data for Europe is not expected, a variable information background regarding Brexit is possible. Further development Analyzing the current trading chart, we see that the pullback returned the quote to the psychological level of 1.1000, where a stagnation was formed within 1.0980/1.1000. The theory of the "Breakout/Rollback" method is still preserved, and many traders hope for it. Speculators, in turn, lay low, tracking the behavior of quotes in the existing stagnation, as in the case of fixing the price below 1.0980, we quickly go down to the level of 1.0966, and another picture of actions is already possible there. It is likely to assume that for some time the turbulence in the narrow range of 1.0980/1.1000 will persist, but I assume that today the boundaries will fall. We will see a local surge or a full-fledged incipient move. Based on the above information, we will derive trading recommendations:

Technical analysis Analyzing different sector timeframes (TF), we see that the indicators, in general, signal the prevailing downward interest. The short-term period is under the interaction of the current accumulation, exhibit variable interest. Volatility per week / Measurement of volatility: Month; Quarter; Year. Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year. (September 24 was built taking into account the time of publication of the article) The volatility of the current time is 14 points, which is extremely low for this period. It is likely to assume that the quote has yet to accelerate, but whether the forces of market participants to disperse us beyond the daily average remains a question. Key level Resistance zones: 1.1000***; 1.1100**; 1.1180*; 1.1300**; 1.1450; 1.1550; 1.1650*; 1.1720**; 1.1850**; 1.2100 Support zones: 1.0926*; 1.0850**; 1.0500***; 1.0350**; 1.0000***. * Periodic level ** Range level *** Psychological level **** The article is based on the principle of conducting transactions, with daily adjustments. The material has been provided by InstaForex Company - www.instaforex.com |

| GBPUSD: Boris Johnson completely lost in the Supreme Court. Brexit in doubt Posted: 24 Sep 2019 04:49 AM PDT

The British Supreme Court called the suspension of parliament illegal. The decision is unanimous. According to the BBC, the Supreme Court found Prime Minister Boris Johnson guilty of abuse of power. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 24 Sep 2019 04:21 AM PDT The Supreme Court of Great Britain ruled that the recent suspension of the work of the House of Commons was declared "illegal" and unfounded. This fact provoked increased volatility for the GBP/USD pair due to it being unprecedented. Indeed, having granted the request of Prime Minister Johnson, the final decision "de jure" on this issue was made by Queen Elizabeth II of England. Considering today's court decision, we can conclude that the head of government misled the monarch in seeking the conquest of parliament. In other words, the opponents of the current prime minister have additional political trump cards. But speaking directly about Brexit, the indicated court verdict essentially does not change anything. If the deputies resume the session, depending on the speaker of the House of Commons, they will have more time to take appropriate legislative initiatives regarding the prospects of Brexit. However, among parliamentarians, certain disagreements arise on the eve of the court decision that could negatively affect the coordination of the opposition. This is not about conflicts between parties - even within the framework of a single political force, politicians cannot agree on a common position on the Brexit issue. This applies to both conservatives and Labor. Therefore, according to the results of the conference of the Labor Party, its members will no longer defend the idea of abolishing Brexit. This decision was preceded by a stormy and lengthy debate that culminated in the actual victory of Jeremy Corbin. The Labor leader actively urged his colleagues not to play the "Brexit cancellation" card directly. In his opinion, the party should first get early elections, win the majority, agree with Brussels on "acceptable" conditions for leaving the EU and only then put Brexit's issue to a referendum. In other words, Corbin wants to ask the British people: are they suitable for the conditions that they could agree with the Europeans? If not, then Brexit's question will disappear "automatically". As you can see, Corbin chose a rather complicated and difficult road, given the current rating of the Labor Party. According to the results of recent sociological studies, conservatives can not only maintain their positions in parliament but also form an independent majority. They are now constrained by a coalition alliance with unionists. If the Conservative Party now has a rating of more than 30%, then no more than 25% of British citizens surveyed are willing to vote for Labor. I note that the position of the conservatives has grown significantly after Boris Johnson came to power, and especially after his decisive action to prepare the country for a "tough" Brexit. On the contrary, the position of the Laborites is gradually declining, especially against the background of strife within the party and lack a common position about the prospects of "divorce process" with Brussels. The fact is that many of the same party members of Corbin advocate the abolition of Brexit as such, relying on the support of a significant number of Britons who voted against the country's withdrawal from the Alliance. After three years of exhausting uncertainty and fruitless negotiations, there were practically no "undecided" citizens in the country. Some are in favor of an early exit from the EU, including without a deal, while others are actively opposing this step. The opponents of Corbin inside the Labor Party are counting on the votes of the latter. It is worth noting that other opposition parties, for example, liberal democrats, Scottish and Welsh nationalists, also advocate the abolition of Brexit. Thus, the position of Jeremy Corbin complicates the situation for the British currency in general and particularly for GBP/USD traders. Despite the rare "bursts of optimism" among European and British officials, the negotiation process between London and Brussels is virtually frozen. Last week, representatives of the British government submitted written proposals to members of the European Commission regarding alternative options for certain provisions of the transaction, and the situation froze again. Only the German Foreign Minister, Heiko Maas, sparingly commented on these proposals of London. According to him, the ideas presented are a "step forward". But then he added that the border with Ireland should be "in any case open." Although Johnson has repeatedly stated that he will not allow a "transparent" border regime after Brexit. In other words, no breakthrough should be mentioned. To summarize, it should be noted that GBP/USD traders should be wary of upward price impulses. On the one hand, today's court decision allows deputies to take advantage of the situation and continue the confrontation with the Johnson government. But will the opposition be able to consolidate their position? This question remains open so far. The material has been provided by InstaForex Company - www.instaforex.com |

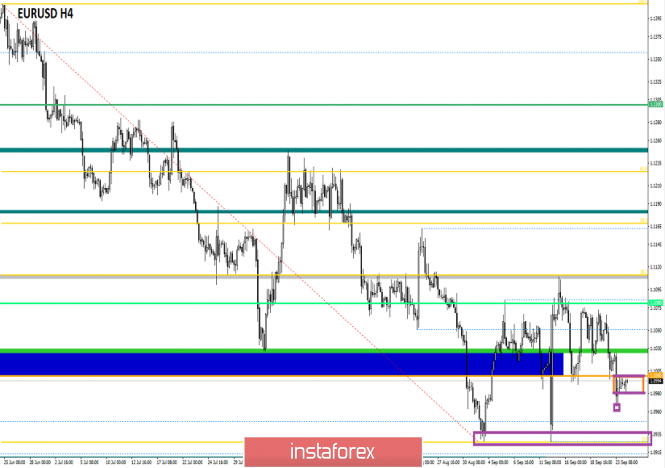

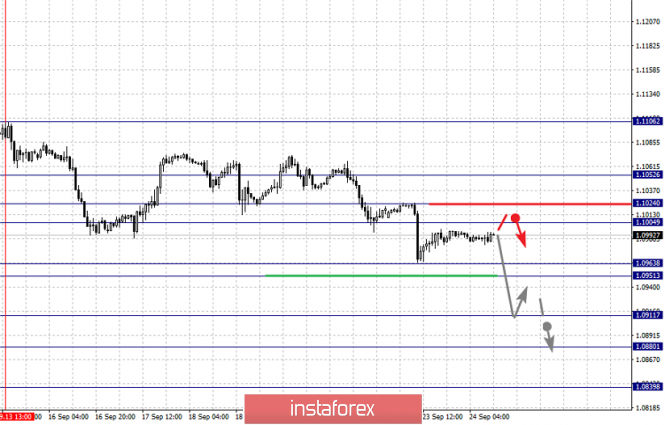

| Trading strategy for EUR/USD on September 24th. European business activity was no better than German Posted: 24 Sep 2019 03:49 AM PDT EUR/USD – 4H.

As seen on the 4-hour chart, the EUR/USD pair secured under the correction level of 127.2% (1.1024), after which it closed under the low of the bullish divergence, which led to its cancellation. Thus, there are no visible obstacles for the pair to continue its fall towards the next correction level of 161.8% (1.0918) (or slightly above 1.0927). Several rebounds of the euro/dollar pair quotes from the upper line of the trend channel leave a very high chance of continuing the fall. The information background implies the same development of events. Economic reports from the European Union and Germany on business activity just "killed" the euro the day before. I wrote about the German indices of business activity yesterday, but we will dwell on the European ones in more detail. The most significant and important index – for the manufacturing sector – instead of growing to 47.6, it dropped to 45.6. In the services sector, the decline was recorded from 53.5 to 52.0. The composite PMI fell to 50.4. Thus, although these are preliminary values for September, it is already possible to declare an even greater deterioration in the economic situation of the European Union. By the way, this was later reported by Mario Draghi, who spoke before the European Parliament Committee on economic and monetary issues. Draghi said that there are no signals to improve the economic situation in the eurozone, inflation remains at its very weak levels, the slowdown in the industry can have a negative impact on other sectors of the economy, and on the service sector, Draghi said that it is also subject to the negative impact of external and internal factors. The ECB chairman also announced that he was ready to continue to use all the necessary tools to stimulate the EU economy. However, he has only one chance because he will be replaced by former IMF head Christine Lagarde as Chairman of the ECB on October 31. This is a summary of yesterday's events. What can be said? The situation in the eurozone remains extremely tense. All economic indicators are slowing down and decreasing, which greatly hinders economic growth. Threats of a global recession are not just words; it is the European Union that may be one of the first to face this problem. As for the solution to this situation, it can only be one thing: stimulating the economy by injecting cash through the purchase of securities, as well as further reducing rates. There are no other options. For the euro, this is another package of negative news. Today, I recommend paying attention only to the indicator of consumer confidence in America. Even so, it is not a very important indicator of the state of the economy, although its decline will reflect a deterioration in household confidence in the current state of the economy and its prospects. Thus, the indicator is interesting, but no more. What to expect today from the euro/dollar currency pair? On September 24, I expect the euro/dollar pair to fall further in the direction of the correction level of 161.8% (1.0918). Since the information background, today will be absent, but the activity of traders may not be on top. However, the euro is likely to remain under pressure, as the latest news from the European Union does not give reason to buy the euro/dollar pair. No new emerging divergences are observed in any indicator today. The Fibo grid is based on the extremes of May 23, 2019, and June 25, 2019. Forecast for EUR/USD and trading recommendations: I recommend selling the pair today (or staying close to previously opened sales) at 1.0927 as a new hold has been made at 1.1024. A stop-loss order above the level of 1.1029. It will be possible to buy a pair after closing above a downward trend channel, but it is better to wait until it also consolidates above the correction level of 100.0% (1.1106). The material has been provided by InstaForex Company - www.instaforex.com |

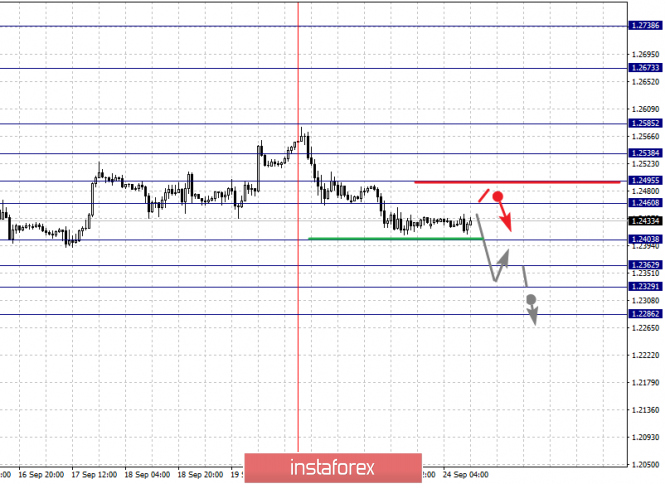

| Posted: 24 Sep 2019 03:49 AM PDT GBP/USD – 4H.

The British pound has completed the first closing under the retracement level of 38.2% (1.2501), and under a weak upward channel, which allows traders to expect a continued fall in quotations in the direction of the initial target correction level of 23.6% (1.2293 or 1.2308). At the moment, there is a brewing divergence in the CCI indicator, but the second price low does not look convincing. Yesterday, the pound/dollar pair cannot be entered either in the asset or in the liability. The pair fell slightly during the day, but it can only be a pullback movement. As before, everything for the pound/dollar pair will depend on the information background. And on September 24, two urgent topics need to be analyzed. The first topic: the media found that US President Donald Trump and Prime Minister Boris Johnson agreed to conclude a volume trade agreement until July 2020. No details were given. Earlier, there were rumors of a trade agreement between the UK and the US, but they were served under the sauce of Donald Trump's promises to conclude a similar deal as soon as Britain completes its exit from the EU. Does this mean that Boris Johnson has promised Trump an exit from the European Union in the coming months? After all, as we all know, the UK Parliament has blocked the possibility of Brexit "No Deal" without its consent. It turns out that if the information is correct, Boris Johnson is not worried about this and in any case, intends to withdraw Britain from the EU on October 31. Accordingly, it has several jokers up its sleeve. The second topic: this morning, the British Supreme Court is due to rule on the legality of Boris Johnson's actions when he suspended Parliament for 5 weeks. Earlier, the Scottish Court had already issued its decision, which said that Johnson's actions were illegal. But now it's up to the highest authority. The decision of the court on September 24 will determine how soon the war between parliamentarians and the Prime Minister will resume. And the outcome of Brexit directly depends on this, since, as discussed in the previous paragraph, there are serious reasons to assume that Boris Johnson has a surprise for deputies on the implementation of his version of Brexit. It is the figure of Boris Johnson that causes the greatest concern for the pound. You don't know what to expect from the leader of the Conservative Party. He can calmly disobey the will of parliament and is not afraid to go against the opinion of the majority. It seems that he has even more influential people behind him than himself. Too zealous desire of the prime minister to withdraw the UK from the EU, no matter what. What to expect from the pound/dollar currency pair today? The pound/dollar pair closed below the Fibo level of 38.2% (1.2501) and under the channel. Thus, today I expect a further fall in the direction of the correction level of 23.6% (1.2293). There will be no economic reports in the UK today, but the information background may still be saturated. The Fibo grid is based on the extremes of March 13, 2019, and September 3, 2019. Forecast for GBP/USD and trading recommendations: I recommend buying the pair with the target of 1.2668 and a stop-loss below the level of 1.2501 if a new close is performed above the Fibo level of 38.2%. I recommend considering selling a pair with a target of 1.2308 now with targets in the range of 1.2308 – 1.2293, with a stop-loss level of 38.2% Fibo. The material has been provided by InstaForex Company - www.instaforex.com |

| Up for grabs again: is the yen almost equal to gold? Posted: 24 Sep 2019 03:40 AM PDT The Japanese currency is consistently popular with investors and traders. It is not too volatile, and many see the yen as a protective asset along with the yellow metal. Experts of the largest American bank, Goldman Sachs, offered a new look at the currency of the Land of the Rising Sun, almost equating it with gold. Goldman Sachs currency strategists recommend investors to buy Japanese currency, calling it the "best opportunity" for investing. Experts are confident that in anticipation of the UN General Assembly meeting, as well as the release of Richmond Federal Reserve Bank data and the US consumer confidence index, the yen will strengthen. Goldman Sachs is confident that the Bank of Japan will not be able to keep the growth of the national currency. Currently, the USD/JPY pair is trading in the range 107.71-107.73. Experts allow the correction of the pair up to 107.50. In the future, the yen is assumed to rise towards 108.12. According to analysts, the yellow metal and currency of the Land of the Rising Sun will remain reliable safe havens that will help minimize risks from the upcoming crisis. At the same time, the yen may become more attractive to investors since it is cheaper than gold, which has grown significantly in price over the past few months. Some bank specialists are almost ready to equalize the yellow metal and the Japanese currency. However, it is better for market participants to weigh all the risks and choose the most suitable strategy for saving capital. The recent incident in Saudi Arabia testifies in favor of rising gold prices, which is why investors are again interested in the yellow metal. They actively acquired it as a protective asset. In connection, the precious metal rose in price. Another supporting factor for gold is the trade standoff between the US and China. Experts are sure that such a situation will drag on for a long time and this conflict has already acquired a "chronic" form. Goldman Sachs believes that the current price volatility in the gold market, due to the Fed rate cut, has increased the yen's attractiveness. Hence, it is the best option for saving capital. Experts are sure that the Japanese currency is more reliable insurance in case of another financial crisis than gold. It is possible that one of the factors of the inspirational forecast of Goldman Sachs analysts was a fairly quick recovery of the yen after yesterday's fall. The currency of the Land of the Rising Sun survived it relatively painlessly and seems to be able to cope with other risks in a similar way. The material has been provided by InstaForex Company - www.instaforex.com |

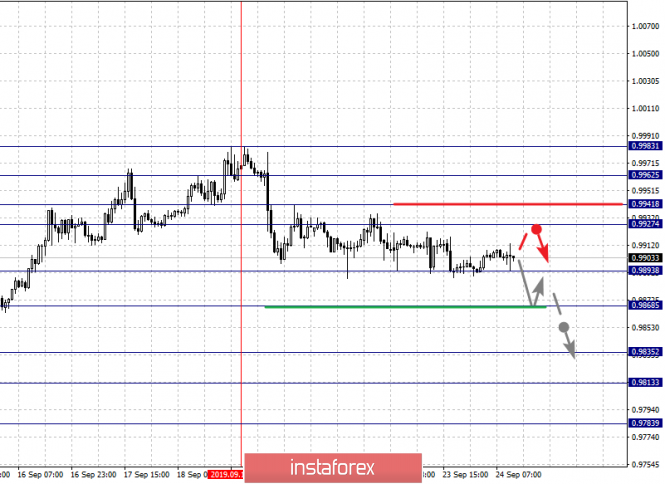

| Fractal analysis of major currency pairs as of September 24 Posted: 24 Sep 2019 03:22 AM PDT Hello, dear colleagues. For the Euro/Dollar pair, we follow the development of the downward structure from September 13 and the continuation of the downward movement is expected after the breakdown of 1.0951. For the Pound/Dollar pair, the price forms a potential structure for the bottom of September 20. For the Dollar/Franc pair, we expect the development of the downward structure from September 19 and the level of 0.9890 is the key resistance for the bottom. For the Dollar/Yen pair, we expect the continuation of the movement to the bottom after the breakdown of 107.50. For the Euro/Yen pair, we follow the downward structure of September 18 and the level of 118.01 is the key resistance. For the Pound/Yen pair, the price is in the key range of 134.10 – 133.39 for the upward structure from September 12. Forecast for September 24: Analytical review of currency pairs on the H1 scale:

For the Euro/Dollar pair, the key levels in the H1 scale are 1.1052, 1.1024, 1.1004, 1.0963, 1.0951, 1.0911, 1.0880 and 1.0839. We follow the development of the downward structure of September 13. We expect the continuation of the downward movement after the price passes the range of 1.0963 – 1.0951. In this case, the target is 1.0911 and near this level is the price consolidation. The breakdown of 1.0911 will lead to a movement to the level of 1.0880, from which we expect a pullback to the top. We consider the level of 1.0839 as a potential value for the bottom. The short-term upward movement is possible in the area of 1.1004 – 1.1024 and the breakdown of the last value will lead to an in-depth correction. The target is 1.1052 and this level is the key support for the bottom. The main trend is the downward structure of September 13. Trading recommendations: Buy: 1.1004 Take profit: 1.1024 Buy 1.1026 Take profit: 1.1050 Sell: 1.0950 Take profit: 1.0916 Sell: 1.0908 Take profit: 1.0884

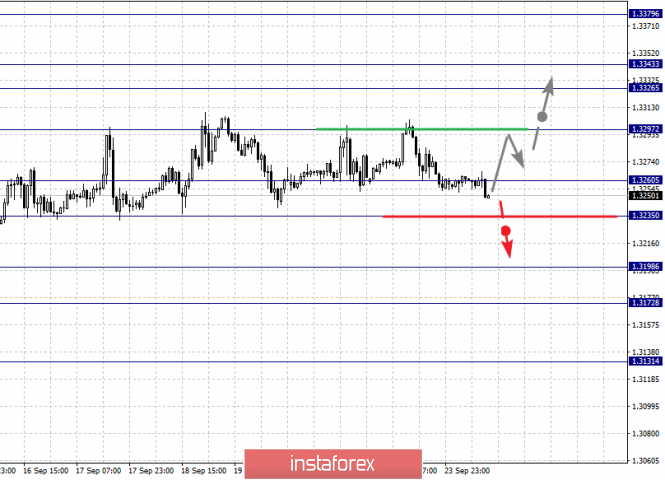

For the Pound/Dollar pair, the key levels in the H1 scale are 1.2585, 1.2538, 1.2495, 1.2460, 1.2403, 1.2362, 1.2329 and 1.2286. The price forms the potential for a downward movement from September 20. The continuation of the downward movement is expected after the breakdown of 1.2403. In this case, the target is 1.2362 and in the area of 1.2362 – 1.2329 is the price consolidation. We consider the level of 1.2286 as a potential value for the bottom, upon reaching this value, we expect a rollback to the top. The short-term upward movement is expected in the range of 1.2460 – 1.2495 and the breakdown of the last value will lead to an in-depth correction. The target is 1.2538 and this level is the key support for the downward structure. Its passage by the price will have to develop an upward movement. In this case, the first target is 1.2585. The main trend is the local upward structure of September 12, the formation of the potential for the bottom of September 20. Trading recommendations: Buy: 1.2460 Take profit: 1.2495 Buy: 1.2497 Take profit: 1.2536 Sell: 1.2403 Take profit: 1.2362 Sell: 1.2360 Take profit: 1.2330

For the Dollar/Franc pair, the key levels in the H1 scale are 0.9983, 0.9962, 0.9941, 0.9927, 0.9893, 0.9868, 0.9835, 0.9813 and 0.9783. We expect the development of a downward structure from September 19. We expect the continuation of the downward movement after the breakdown of 0.9893. In this case, the target is 0.9868 and near this level is the price consolidation. The breakdown of the level of 0.9868 must be accompanied by a strong downward movement. The target is 0.9835 and in the area of 0.9835 – 0.9813 is the short-term downward movement, as well as consolidation. We consider the level of 0.9783 as a potential value for the bottom, upon reaching this level, we expect a rollback to the correction. The short-term upward movement is possible in the area of 0.9927 – 0.9941 and the breakdown of the last value will lead to an in-depth correction. The target is 0.9962 and this level is the key support for the downward structure from September 19. The main trend is the formation of the downward potential of September 19. Trading recommendations: Buy: 0.9927 Take profit: 0.9940 Buy: 0.9942 Take profit: 0.9960 Sell: 0.9893 Take profit: 0.9870 Sell: 0.9866 Take profit: 0.9835

For the Dollar/Yen pair, the key levels in the H1 scale are 108.21, 107.95, 107.77, 107.50, 107.25, 107.06 and 106.82. We follow the development of the downward structure of September 19. The continuation of the downward movement is expected after the breakdown of 107.50. In this case, the target is 107.25 and in the area of 107.25 – 107.06 is the short-term downward movement, as well as consolidation. We consider the level of 106.82 as a potential value for the bottom, upon reaching this level, we expect a rollback to the top. The short-term upward movement is possible in the range of 107.77 – 107.95 and the breakdown of the last value will lead to an in-depth correction. The target is 108.21 and this level is the key support for the downward structure from September 19. The main trend is the formation of the downward structure from September 19. Trading recommendations: Buy: 107.77 Take profit: 107.93 Buy: 107.97 Take profit: 108.20 Sell: 107.50 Take profit: 107.27 Sell: 107.23 Take profit: 107.08

For the Canadian dollar/Dollar pair, the key levels in the H1 scale are 1.3379, 1.3343, 1.3326, 1.3297, 1.3260, 1.3235, 1.3198 and 1.3172. We continue to follow the development of the upward structure from September 10. The continuation of the upward movement is expected after the breakdown of 1.3297. The target is 1.3326 and in the area of 1.3326 – 1.3343 is the consolidation. We consider the level of 1.3379 as a potential value for the top, upon reaching this level, we expect a rollback to the bottom. The short-term downward movement, as well as consolidation, are possible in the area of 1.3260 – 1.3235 and the breakdown of the last value will lead to an in-depth correction. The target is 1.3198 and this level is the key support for the top. Its breakdown will have to develop a downward structure. In this case, the potential target – 1.3172. The main trend is the upward structure of September 10, the stage of correction. Trading recommendations: Buy: 1.3299 Take profit: 1.3226 Buy: 1.3344 Take profit: 1.3378 Sell: 1.3260 Take profit: 1.3237 Sell: 1.3233 Take profit: 1.3200

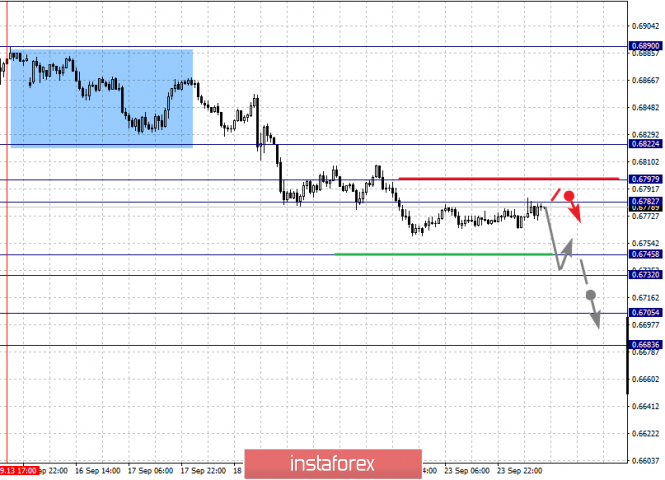

For the Australian dollar/Dollar pair, the key levels in the H1 scale are 0.6822, 0.6797, 0.6782, 0.6745, 0.6732, 0.6705 and 0.6683. We follow the development of the downward cycle from September 13. At the moment, we expect a move to the level of 0.6745. The short-term downward movement is possible in the range of 0.6745 – 0.6732 and the breakdown of the last value should be accompanied by a pronounced downward movement. The target is 0.6705 and near this value is the consolidation. We consider the level of 0.6683 as a potential value for the bottom, at which we expect to go into correction. The short-term upward movement is possible in the area of 0.6782 – 0.6797 and the breakdown of the last value will lead to a prolonged correction. The potential target is 0.6822 and this level is the key support for the downward structure. The main trend is a downward cycle from September 13. Trading recommendations: Buy: 0.6782 Take profit: 0.6795 Buy: 0.6800 Take profit: 0.6822 Sell: 0.6745 Take profit: 0.6734 Sell: 0.6730 Take profit: 0.6707

For the Euro/Yen pair, the key levels in the H1 scale are 119.41, 119.02, 118.74, 118.01, 117.73, 117.51 and 117.10. We follow the development of the downward structure of September 18. The continuation of the downward movement is expected after the breakdown of 118.01. In this case, the first target is 117.73 and in the area of 117.73 – 117.51 is the price consolidation. We consider the level of 117.10 as a potential value for the bottom, from this level, we expect a rollback to the top. The short-term upward movement is possible in the range of 118.74 – 119.02 and the breakdown of the last value will lead to an in-depth movement. The target is 119.41 and this level is the key support for the downward structure. The main trend is the downward structure of September 18. Trading recommendations: Buy: 118.75 Take profit: 119.00 Buy: 119.04 Take profit: 119.40 Sell: 118.00 Take profit: 117.74 Sell: 117.50 Take profit: 117.10

For the Pound/Yen pair, the key levels in the H1 scale are 137.21, 136.13, 135.37, 134.10, 133.39 and 132.23. We follow the local upward structure of September 12. At the moment, the price is close to the abolition of the upward structure, which requires a breakdown of the level of 113.39. The first potential target is 132.23. The short-term upward movement is expected in the area of 135.37 – 136.13 and the breakdown of the last value will lead to a movement to the potential target – 137.21, upon reaching this level, we expect a rollback to the bottom. The main trend is the upward structure of September 12, the stage of deep correction. Trading recommendations: Buy: 135.38 Take profit: 136.10 Buy: 136.15 Take profit: 137.20 Sell: 134.10 Take profit: 133.42 Sell: 133.35 Take profit: 132.30 The material has been provided by InstaForex Company - www.instaforex.com |

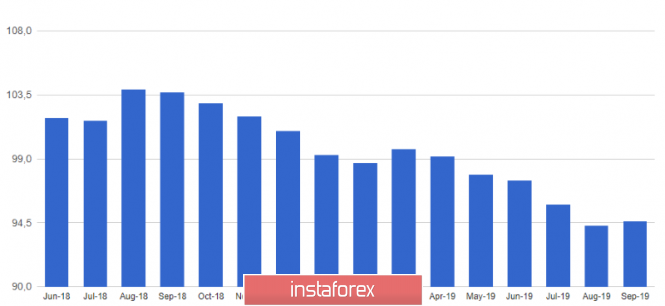

| Trading plan for EUR / USD and GBP / USD pairs on 09.24.2019 Posted: 24 Sep 2019 02:34 AM PDT Countless mass media agitation and misinformation are only engaged in what they say on the approaching recession in the American economy, arguing the need for a continued easing of the monetary policy of the Federal Reserve System. Here, it demonstrates from the point of view of Europe, where the European Central Bank holds just super soft monetary policy, that shows unprecedented signs -at least they showed preliminary data on indexes of business activity. In particular, the index of business activity in the manufacturing sector, which is an indicator that shows the possibility of a recession, declined from 47.0 to 45.6. It should be noted that in case the figure is below 50.0 points, then the recession, if it has not begun, should be expected in the near future. Moreover, the index of business activity in the services sector decreased from 53.5 to 52.0, which ultimately led to the decline in the composite PMI to 50.4 from 51.9. Yet, no one shouts about the risks of a recession in Europe. On the contrary, they set the Old World as an example of stimulating economic growth through soft monetary policy. However, the results are somewhat different from those predicted in theory. Meanwhile, the United States, where the Federal Reserve holds a completely wrong and destructive monetary policy, demonstrate just awful result as we are constantly talking to media propaganda and misinformation. What's more important is the index of service activity, which rose from 50.7 to 50.9. But even worse, the index of manufacturing activity has risen from 50.3 to 51.0, moving horribly in the opposite direction of recession. Hence, it is not surprising that the composite index of business activity has grown from 50.7 to 51.0. It is obvious that Jerome Powell will need to take urgent action on the worsening economic situation that the actual data has already shown a different result. Otherwise, all media campaigns and disinformation will look complete, empty windbags. Composite Business Activity Index (United States): Today, the macroeconomic calendar is almost empty. The only thing you can at least somehow pay attention to is the S&P/Case-Shiller index of housing prices in the United States, which by the way, its growth rate should increase from 2.1% to 2.2%. In other words, there is no reason to weaken the dollar. However, growth will be limited due to the not so important published data. S & P / Case-Shiller (United States) Housing Price Index: The Euro/Dollar currency pair pleased traders with a local cross as it has broken the psychological level of 1.1000, but in the end, it still formed a rollback to the previously traversed point. It is likely that a temporary fluctuation within 1.1066/1.1000, where it is necessary to work on the breakdown of boundaries. The Pound/Dollar currency pair has steadily returned to the previously formed accumulation at 1.2430/1.2500, where it focused within the lower border. We can assume that the current stagnation will not last long. Also, it is worthwhile to carefully monitor the fixing of the points relative to the values of 1.2412 and 1.2460 as it is clear whether the accumulation will continue or the recovery process relative to the available coordinates. |

| Posted: 24 Sep 2019 01:23 AM PDT GBP/USD Analysis: The upward wave of the British pound counts down from July 30. The last section from September 3 develops as an impulse. Within its framework, since the end of last week, a correction is formed in the form of a stretched plane. There are no reversal signals on the chart Forecast: The preliminary calculation of the wave target indicates the beginning of the 128th figure as a reference point. The completion of the current correction is likely in the current day. In the coming sessions, the formation of a reversal and the beginning of price growth is expected. Potential reversal zones Resistance: - 1.2490/1.2520 Support: - 1.2420/1.2390 Recommendations: Sales of the pound today have very limited potential. It is optimal to wait for the completion of the entire correction and start searching for entry points into long positions for this pair.

USD/JPY Analysis: The direction of the short-term trend of the yen is set by the upward wave from August 6. The wave completes the larger bullish wave construction of the daily TF. Forecast: The preliminary potential of price growth is estimated at least 2 price figures from the current rate. The general downward vector of movement is expected in the next sessions. In the first half of the day, the pressure on the resistance zone is likely. Potential reversal zones Resistance: - 107.70/108.00 Support: - 107.00/106.70 Recommendations: Today, yen purchases have little potential. It is safer to lower the lot and close the deal at the first sign of a reversal. The main attention is recommended to be paid to the search of the instrument sale signals.

Explanations: In the simplified wave analysis (UVA), the waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of the arrows shows the formed structure for determining the expected movement. Attention: The wave algorithm does not take into account the length of time the tool moves! The material has been provided by InstaForex Company - www.instaforex.com |