Forex analysis review |

- Fractal analysis of the main currency pairs for September 6

- Taking profit on USD/JPY and GOLD.

- Pound will rise in price by 6%, a strong drop in the yen is unlikely

- Euro drops to new lows against the pound, but the joy will be short-lived

- Euro remains firm

- Uneven growth predicted for Bitcoin

- Fed rate cuts - springboard for gold

- EURUSD is growing on Lagarde. Shakespearean passions in Britain

- GBP/USD. Johnson's house of cards collapses: pound conquers new heights

- EURUSD: Ignoring the bad statistics on the eurozone is unlikely to be long, as well as the growth of the euro in the medium

- September 5, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- September 5, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- BTC 09.05.2019 -Major resistnace on the test and potential new downward movement

- EUR/USD: plan for the American session on September 5. Euro buyers have broken above the level of 1.1050 and are trying to

- EUR/USD for September 05,2019 - Sell zone at the major resistance on EUR

- USD/JPY analysis for September 05, 2019 - Breakout of the key reistance trendline

- USDCAD bulls unable to capture the major Fibonacci resistance

- The Dollar index reverses after making new highs. New bearish divergence

- EURUSD continues the bounce towards important resistance levels as noted two days ago.

- Gold pulls back after new 2019 highs. Is this a short-term top?

- Technical analysis of GBP/USD for September 05, 2019

- Trading recommendations for GBPUSD currency pair – placement of trading orders (September 5)

- Trading recommendations for EURUSD currency pair – placement of trading orders (September 5)

- AUD was able to overcome an important psychological barrier and now, it can not be stopped

- US Statistics are the center of attention today (There is a possibility of a local reversal in EUR/USD and USD/CAD pairs)

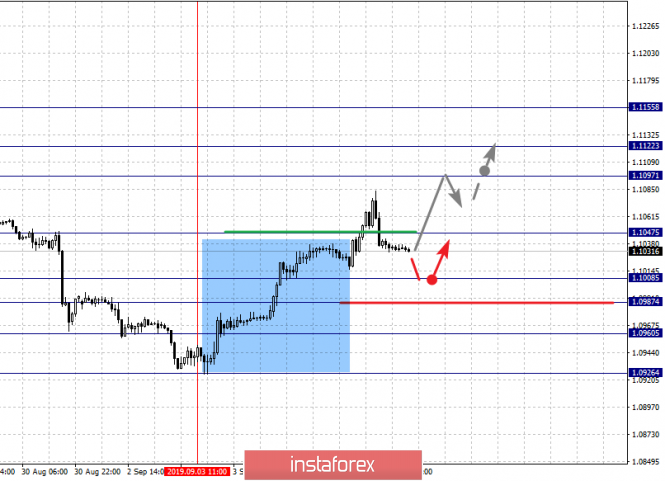

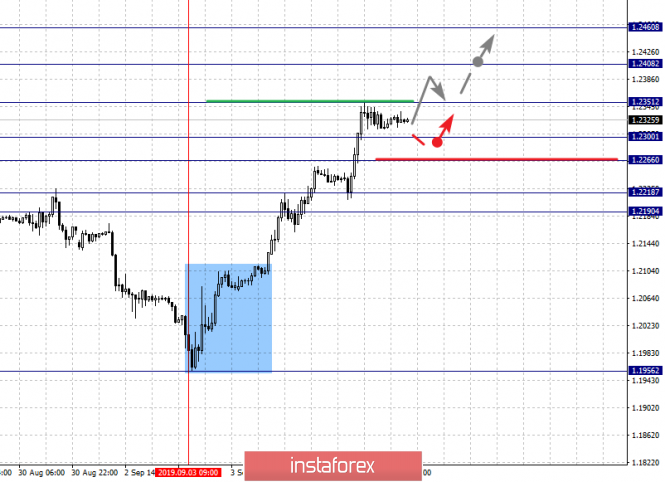

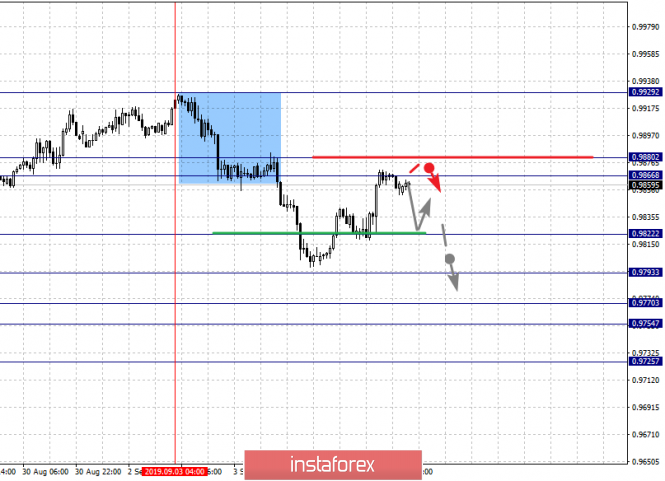

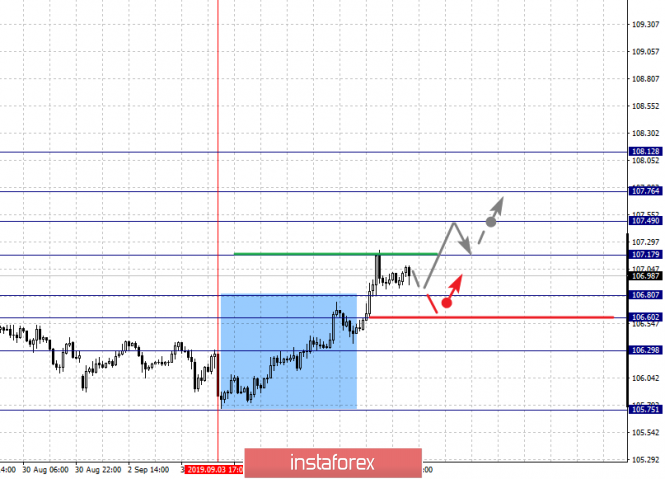

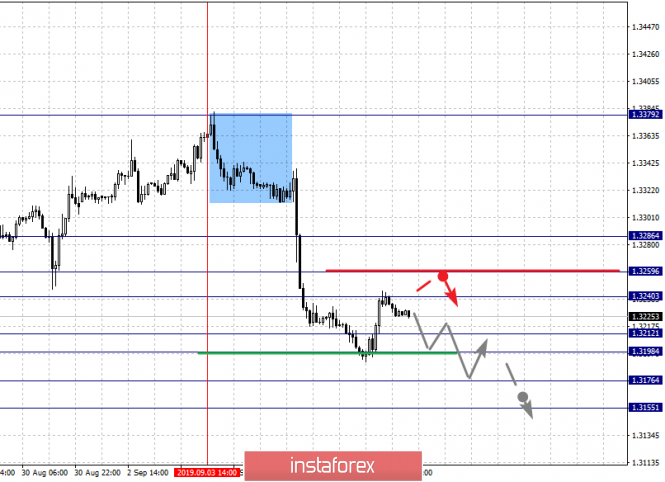

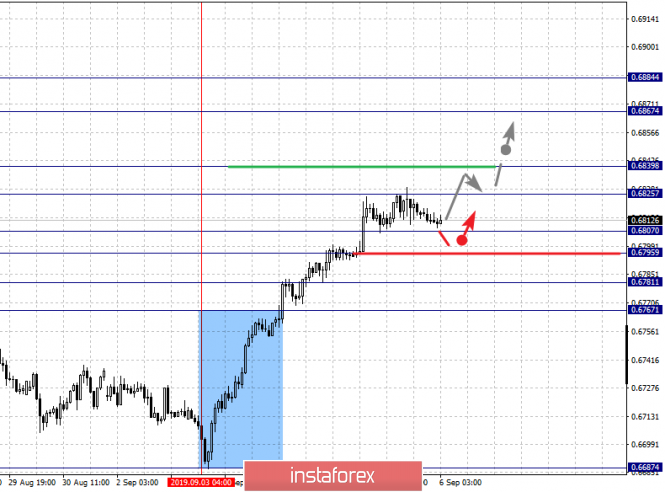

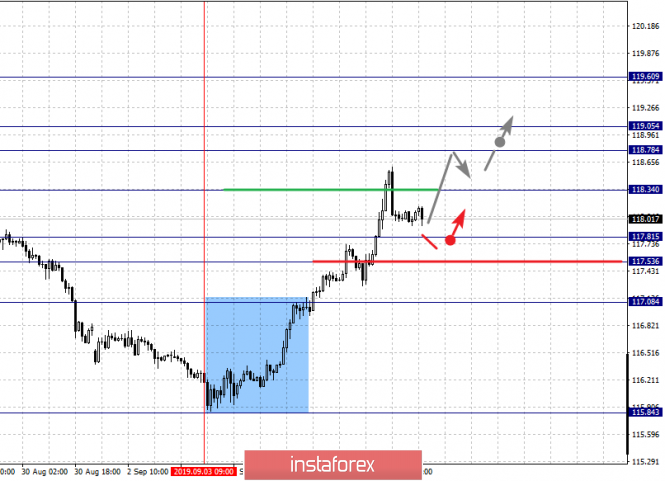

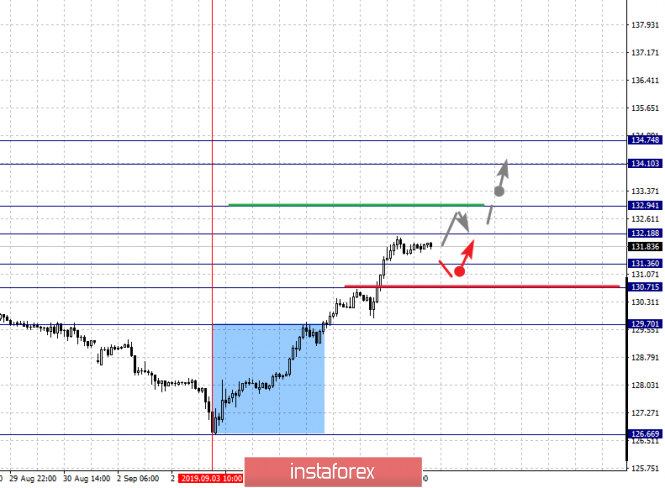

| Fractal analysis of the main currency pairs for September 6 Posted: 05 Sep 2019 06:15 PM PDT Forecast for September 6: Analytical review of currency pairs on the scale of H1: For the euro / dollar pair, the key levels on the H1 scale are: 1.1155, 1.1122, 1.1097, 1.1047, 1.1008, 1.0987, 1.0960 and 1.0926. Here, we follow the development of the ascending structure of September 3. The continuation of the movement to the top is expected after the breakdown of the level of 1.1047. In this case, the target is 1.1097. Short-term upward movement, as well as consolidation is in the range of 1.1097 - 1.1122. For the potential value for the upward trend, we consider the level of 1.1155. Upon reaching which, we expect consolidation, as well as a pullback to the bottom. Short-term downward movement is expected in the range of 1.1008 - 1.0987. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.0960. This level is a key support for the upward structure. Its passage at the price will lead to the formation of a local downward structure. In this case, the first goal is 1.0926 . The main trend is the upward structure of September 3. Trading recommendations: Buy: 1.1047 Take profit: 1.1095 Buy 1.1098 Take profit: 1.1120 Sell: 1.1008 Take profit: 1.0988 Sell: 1.0985 Take profit: 1.0960 For the pound / dollar pair, the key levels on the H1 scale are: 1.2460, 1.2408, 1.2351, 1.2300, 1.2266, 1.2218 and 1.2190. Here, we follow the development of the upward cycle of September 3. The continuation of the movement to the top is expected after the breakdown of the level of 1.2351. In this case, the target is 1.2408. The breakdown of which, in turn, will allow us to count on the movement to the potential target - 1.2460. Upon reaching this level, we expect a pullback to the bottom. Short-term downward movement is expected in the range of 1.2300 - 1.2266. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.2218. The range of 1.2218 - 1.2190 is the key support for the upward cycle. The main trend is the upward cycle of September 3. Trading recommendations: Buy: 1.2351 Take profit: 1.2406 Buy: 1.2409 Take profit: 1.2460 Sell: 1.2300 Take profit: 1.2268 Sell: 1.2264 Take profit: 1.2220 For the dollar / franc pair, the key levels on the H1 scale are: 0.9880, 0.9866, 0.9822, 0.9793, 0.9770, 0.9754 and 0.9725. Here, we are following the development of the downward structure of September 3. At the moment, the price is close to the cancellation of this structure, which requires the passage of the noise range of 0.9866 - 0.9880. The continuation of the movement to the bottom is expected after the breakdown of the level of 0.9822. In this case, the first target 0.9793. The breakdown of which, in turn, will allow you to count on moving to the level of 0.9770. Price consolidation is in the range of 0.9770 - 0.9754. For the potential value for the bottom, we consider the level of 0.9725. The movement to which is expected after the breakdown of the level of 0.9754. The main trend is the descending structure of September 3, the stage of deep correction. Trading recommendations: Buy : 0.9880 Take profit: 0.9915 Buy : Take profit: Sell: 0.9820 Take profit: 0.9795 Sell: 0.9790 Take profit: 0.9770 For the dollar / yen pair, the key levels on the scale are : 108.12, 107.76, 107.49, 107.17, 106.80, 106.60 and 106.29. Here, we determined the subsequent goals for the top from the local ascendant structure on September 3. The continuation of the movement to the top is expected after the breakdown of the level of 107.17. In this case, the target is 107.49. Short-term upward movement, as well as consolidation is in the range of 107.49 - 107.76. For the potential value for the top, we consider the level of 108.12. Upon reaching which, we expect a pullback to the bottom. Short-term downward movement is possibly in the range of 106.80 - 106.60. The breakdown of the last value will lead to a long correction. Here, the goal is 106.29. This level is a key support for the top. Main trend: local upward structure from September 3. Trading recommendations: Buy: 107.17 Take profit: 107.46 Buy : 107.50 Take profit: 107.74 Sell: 106.80 Take profit: 106.62 Sell: 106.58 Take profit: 106.30 For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3286, 1.3259, 1.3240, 1.3212, 1.3176 and 1.3155. Here, the price forms a pronounced medium-term downward structure from September 3. The continuation of the movement to the bottom is expected after the price passes the noise range 1.3212 - 1.3198. In this case, the target is 1.3176. For the potential value for the bottom, we consider the level of 1.3155. Before this value, we expect a pronounced structure of the initial conditions. Short-term upward movement is possibly in the range of 1.3240 - 1.3259. The breakdown of the last value will lead to a long correction. Here, the target is 1.3286. This level is a key support for the upward structure. The main trend is the formation of a medium-term downward structure from September 3. Trading recommendations: Buy: 1.3240 Take profit: 1.3257 Buy : 1.3261 Take profit: 1.3286 Sell: 1.3198 Take profit: 1.3176 Sell: 1.3174 Take profit: 1.3155 For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6884, 0.6867, 0.6839, 0.6825, 0.6807, 0.6795, 0.6781 and 0.6767. Here, we follow the development of the ascending structure of September 3. Short-term upward movement is expected in the range of 0.6825 - 0.6839. The breakdown of the last value should be accompanied by a pronounced upward movement. Here, the target is 0.6867. For the potential value for the top, we consider the level of 0.6884. Upon reaching which, we expect consolidation, as well as a pullback to the bottom. Short-term downward movement is possibly in the range of 0.6807 - 0.6795. The breakdown of the last value will lead to a long correction. Here, the potential target is 0.6781. This level is a key support for the top. Its breakdown will lead to the formation of initial conditions for the downward cycle. In this case, the potential target will be 0.6767. The main trend is the upward structure of September 3. Trading recommendations: Buy: 0.6840 Take profit: 0.6865 Buy: 0.6868 Take profit: 0.6882 Sell : 0.6807 Take profit : 0.6796 Sell: 0.6793 Take profit: 0.6783 For the euro / yen pair, the key levels on the H1 scale are: 119.60, 119.05, 118.78, 118.34, 117.81, 117.53 and 117.08. Here, we follow the development of the ascending structure of September 3. The continuation of the movement to the top is expected after the breakdown of the level of 118.34. In this case, the target is 118.78. Short-term upward movement, as well as consolidation is in the range of 118.78 - 119.05. The breakdown of the level of 119.05 should be accompanied by a pronounced upward movement towards a potential target - 119.60. We expect a pullback from this level to the bottom. Short-term downward movement is expected in the range of 117.81 - 117.53. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 117.08. This level is a key support for the upward structure. The main trend is the upward cycle of September 3. Trading recommendations: Buy: 118.36 Take profit: 118.76 Buy: 118.78 Take profit: 119.05 Sell: 117.80 Take profit: 117.55 Sell: 117.50 Take profit: 117.10 For the pound / yen pair, the key levels on the H1 scale are : 134.74, 134.10, 132.94, 132.18, 131.36, 130.71 and 129.70. Here, we continue to monitor the development of the upward cycle of September 3. Short-term upward movement is expected in the range of 132.18 - 132.94. The breakdown of the last value should be accompanied by a pronounced upward movement. Here, the target is 134.10. For the potential value for the top, we consider the level of 134.74. Upon reaching which, we expect consolidation, as well as a pullback to the bottom. Short-term downward movement is possibly in the range of 131.36 - 130.71. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 129.70. This level is a key support for the upward structure. The main trend is the upward structure of September 3. Trading recommendations: Buy: 132.20 Take profit: 132.90 Buy: 132.98 Take profit: 134.10 Sell: 131.36 Take profit: 130.74 Sell: 130.68 Take profit: 129.80 The material has been provided by InstaForex Company - www.instaforex.com |

| Taking profit on USD/JPY and GOLD. Posted: 05 Sep 2019 04:50 PM PDT This is not a random number, because the method of "hunting for stops" involves work tied to the mistakes of bank traders. The average amount of stops which makes these 100p. And you can easily check it by looking at the open positions of banks online right now. Thus, we still have positions in crosses - which are also all in the "plus". In addition, fix part of the profit from the position on gold left overnight + 430p, and hold the last part at the level of 1500: Tomorrow is an important day for currency traders. I have noticed many times that if you give out before non-game plus - you have to leave, because the news is extremely unpredictable. Therefore, I prefer to trade after news trends, and for this, you need to have patience. The best choice for traders to trade on the USD news (if you are not a stop hunter) is to sit them in crosses. And fortunately, our diversification tactics make this easy to do. We continue to hold positive positions on AUD/CHF or NZD/CHF according to the recommendations given earlier. Good luck in the trading and see you at the next reviews! The material has been provided by InstaForex Company - www.instaforex.com |

| Pound will rise in price by 6%, a strong drop in the yen is unlikely Posted: 05 Sep 2019 04:35 PM PDT Markets currently respond positively to news about upcoming trade negotiations. They like political events in the UK that exclude the "hard" Brexit at the end of October. US and China Chinese and American authorities once again agreed to sit at the negotiating table. Obviously, both sides understand that such an irrational trade war is a thing outside the modern global economy. It causes significant harm not only to the two giants, but to the world as a whole. It seems that the US president will have to make some concessions to China. To procrastinate and look for ways for a better deal is becoming an extremely dangerous business. Time plays against the US. The Chinese have other trading partners. In addition, China's government's reliance on domestic consumption is paying off and bearing fruit. The huge domestic market is quite capable of supporting the national economy. Upbeat traders began to dump defensive assets, the dollar in conjunction with the yen rose sharply. Negotiating news is certainly good. However, it would be nice to see progress. In this regard, the growth of quotations is likely to be limited to 107. Market participants can sell the USD/JPY pair to consolidate profits or create new short positions if the dollar reaches 107 yen, State Street believes. It is premature now to say that the situation in Hong Kong has improved. In addition, Britain is still in chaos due to Brexit. Great Britain Judging by recent events, Brexit may not take place without a deal, as Boris Johnson has lost control of the situation. Legislators have blocked the possibility of leaving the EU without a deal and the general election scenario. There is reason for optimism, especially for pound traders. The British currency is experiencing the best points against the dollar over the past 5 months. But it is not so simple. After losing two fights, the British prime minister may resort to other methods to conduct the election. An attempt to circumvent a law requiring the approval of early elections by a majority vote is not ruled out. It is unlikely, but still, Johnson could declare a vote of no confidence in his government, and then urge his members of Parliament to abstain from voting. If the bill to ban the "hard" Brexit is approved next week, the Labour Party will agree to the elections, which will be held October 15 or before the end of the year, according to J.P. Morgan According to forecasts by Daiwa analysts, Johnson will achieve the repeal of the law on the prohibition of exit without a deal if he wins the election by October 31. It is worth noting that the Conservative Party leads in opinion polls. However, elections can be held in November. With this scenario developing, the new British prime minister will not be able to fulfill his promise to the people of Britain - to leave the EU at the end of October "no matter what." Goldman Sachs raised the estimate of the probability of a hard Brexit from 20% to 25%, and the assessment of its absence was lowered from 35% to 30%. The basic scenario remains, in which a close version of the existing deal will be approved by the House of Commons, bank analysts said. Reuters poll According to the results of the survey conducted before the vote on Tuesday, sterling should grow against the euro within a month after the exit with the conclusion of the deal. On Thursday, the EUR/GBP quotes were located at 89.5, and if the deal is signed, they will fall to 85–88. The British currency should recover after October 31 if it is possible to avoid an exit without a deal. The implementation of a scenario that minimizes the gap with the EU in economic terms is also positive. If Johnson's strategy "shoots" and the "divorce proceedings" ends without a deal, the euro may well reach parity with the pound. In this case, the forecast for the pair is at 95-100. It is worth noting that the two currencies have never reached parity since the introduction of the euro in early 1999. Over the next 6 months, sterling will reach $1.25 against the dollar, respondents said. In a year, the rate will rise to $1.30. |

| Euro drops to new lows against the pound, but the joy will be short-lived Posted: 05 Sep 2019 04:26 PM PDT EUR/GBP fell below a critical level of 0.90. The positive attitude towards the British pound makes the EUR/GBP pair forget about further growth and break through the critical support level of 0.90 in order to move lower to new two-month lows. The euro weakened amid optimism over Brexit and is falling for the third consecutive session in response to an obvious change in sentiment against the British pound. The currency is recovering amid growing optimism, especially after British lawmakers voted to postpone Brexit's deadline and the government did not approve a bill calling for a general election on October 15. Nevertheless, the scenario of a "hard" Brexit without a deal is still under consideration, which means that soon political instability will return to the UK. What to expect from GBP? The renewed growth momentum is pushing the currency to new heights in the light of recent political events in the UK. Nevertheless, according to forecasts, sterling will remain under pressure, as political uncertainty has not disappeared, and the likelihood of general elections is also high, and this is only a matter of time. On the other hand, the Bank of England remains "silent" in relation to Brexit and its potential consequences. It is worth recalling that at its last meeting, the central bank refused to include the likelihood of a "hard divorce" scenario in its forecasts. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 05 Sep 2019 04:20 PM PDT The European currency is trying to hold its positions and continue to rise, but analysts are uncertain whether this is possible. On Wednesday, September 4, the euro was in the black, ending trading growth, but analysts believe that this will be followed by a decline. The single currency was strengthened by a number of factors: a weakening US dollar, a decrease in tensions in Hong Kong, and an improvement in the political situation in Italy and the UK. Factors that are in favor of the euro include the recent comments of Christine Lagarde and a possible contender for the presidency of the ECB. According to her, large-scale and long-term easing of monetary policy is fraught with negative side effects. These comments forced market players to rethink the scope of "dovish" expectations regarding the ECB meeting, scheduled for September 12 this year. On Thursday, September 5, the single European currency slumped moderately against the US currency after a dynamic strengthening the day before. The EUR/USD pair recovered to 1.10399. According to analysts, buyers of the euro are ready to move on - to the levels of 1.10650–1.10700. Currently, the pair has pulled back from the lower boundary of the so-called "descending wedge". The euro traded in the range of $1.10585 to $1.0595, and then reached the level of $ 1.10625. The EUR/USD pair jumped and retains the potential of a rebound in the short term, analysts summarize. The material has been provided by InstaForex Company - www.instaforex.com |

| Uneven growth predicted for Bitcoin Posted: 05 Sep 2019 04:14 PM PDT Many cryptanalysts and digital market enthusiasts are confident that the leading virtual asset is expected to rise. However, this growth will be uneven, similar to price "swings". As a result, Bitcoin will go up, but little by little, and then gradually reduce the height. By the end of trading on Wednesday, September 4, the number one cryptocurrency slowed down slightly, reaching $10700 after three days of strengthening. According to Omkar Godbole, an analyst at CoinDesk Markets, this neutralizes the short-term negative scenario and contributes to further movement to the level of $10956. According to technical analysis, the situation on the cryptocurrency market is not very stable. It is in favor of sales, and sellers of the digital currency may be the loser. To restore a favorable situation for the Bitcoin rally, it is necessary to close the daily candle above $10956. If the price of the number one cryptocurrency consolidates below the level of $10286, this will strengthen the position of sellers and open the way to a fall to $10,000. Analyzing the current situation, some analysts are certain that the leading digital asset may rise in price next week. They believe that the Bitcoin dominance index, which recently soared above 70% for the first time in two years, will inevitably fall below 60%. At the moment, the main virtual asset is frozen at around $10,700. According to current observations, BTC is still on the sidelines, a way out of which is possible only with a jerk above $12,000. Market participants are trying to prevent the fall of bitcoin, actively buying out the crypto asset after each correction, summarize the analytics. The material has been provided by InstaForex Company - www.instaforex.com |

| Fed rate cuts - springboard for gold Posted: 05 Sep 2019 04:04 PM PDT According to analysts at BNP Paribas SA, the upcoming key Fed rate cut will raise the price of gold. The yellow metal can break the bar at $1,600 per ounce, analysts say. Analysts do not rule out that the Federal Reserve will reduce the rate by 0.25% at the upcoming September meeting. This measure is necessary to stop the slowdown in US economic growth and to mitigate the negative effects of the trade war with China. Gold will benefit from the actions of the Fed if they provide a for a four-time rate cut by 25 basis points between September 2019 and June 2020. Analysts predict the active growth of the yellow metal. Recall that this year the precious metal significantly rose amid an escalation of the US and China trade conflict, and as a result, the demand for safe haven assets increased significantly. The end of this protracted war is not expected, and the geopolitical situation in the world remains tense. In this situation, the demand for gold will grow, analysts say. According to the calculations of BNP Paribas SA analysts, the precious metal's price will be at the level of $1560 per ounce next year. The Fed easing monetary policy cycle could push the price of gold to $1,600 per ounce, analysts say. Four rate cuts from September 2019 to June 2020 can lead to the fact that the upper limit of the Fed base rate range will decrease to 1.25%. On Wednesday, September 4, the yellow metal was trading at $1,540 per ounce. This is 20% higher than the current year, analysts notes. Earlier, the cost of precious metals reached $1555 per ounce at the end of August, which is the highest figure since 2013. However, this is not the limit, analysts who offer bold forecasts for 2020, in which the price of gold exceeds $1,600 per ounce, are certain. The material has been provided by InstaForex Company - www.instaforex.com |

| EURUSD is growing on Lagarde. Shakespearean passions in Britain Posted: 05 Sep 2019 04:01 PM PDT Christine Lagarde - the most likely new head of the ECB in November - very cautiously expressed the idea that the aggressively soft policy of the ECB from Draghi could be revised. Britain: Blows raining down on Prime Minister Johnson one by one. Parliament banned him from leaving the EU without an agreement (we remember that Teresa May left because the Parliament did not approve the agreement). Now Parliament has banned Johnson from holding new elections. To top it off, Johnson's brother Joe announced his resignation from the government - due to disagreement with his brother's course. Johnson is going to appeal to the people on Monday and demand new elections. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. Johnson's house of cards collapses: pound conquers new heights Posted: 05 Sep 2019 03:48 PM PDT Newspaper headlines today are full of reports that Boris Johnson was defeated in the British Parliament. Indeed, tonight the deputies of the House of Commons supported the bill, which obliges the Cabinet to postpone the country's withdrawal from the European Union until January 31, 2020. The MPs adopted this law with amazing speed - in just a few hours they approved it in all three readings. Prior to this, the deputies refused the prime minister's request to hold early elections on October 15. Only 298 deputies voted for this initiative with the required 434 votes (i.e. two-thirds of the parliament). The threats of the leadership of the Conservative Party to exclude "dissidents" from their ranks did not affect many Tories: the Parliament knocked Johnson in a single rush. The prime minister accused the Opposition leader - Jeremy Corbyn - of hypocrisy, as the Laborites have insisted on holding early elections over the past two years. But when they had the opportunity, they voted against. Corbyn replied that Opposition forces would support the re-election - but only after a law came into force that prohibits the British government from implementing a "hard" Brexit. The fact is that the corresponding bill was adopted only by the Lower House of Parliament, and now it must pass the millstones of the Upper House. But it is worth noting here that the House of Lords is not an appeal court. Having adopted their amendments, they send the document back to the Lower House of Parliament, where MPs may or may not support it. Afterwards, the bill returns again to the Lords. In other words, the House of Lords can comment, forcing the House of Commons to return to this issue. And since there are no majority of conservatives among the lords, the likelihood of such a scenario cannot be ruled out. However, the current situation is unlikely to significantly change the general situation. According to most analysts, this law will ultimately be approved by the Upper House of Parliament. The only question is the lack of time - the House of Lords can theoretically significantly delay this process. At least, if the Lords will repeatedly return this bill to the House of Commons, then the deputies simply will not have time to agree on it until October 31, given the five-week forced "royal vacation" of MPs. In other words, if the chambers of Parliament play a kind of political "table tennis", this will negatively affect the pound. This is unlikely, but still possible. But if the law comes into force before October 31, the pound will once again receive significant support. It is worth noting that Boris Johnson received a "stab in the back" not only from his party members in Parliament. This afternoon, Joe Johnson, associate minister of universities and science, who is the brother of the current prime minister, announced his intention to resign due to political disagreements. According to him, in recent weeks he "has been torn between loyalty to the family and national interests." And in the end, the scales leaned toward a state position. Joe Johnson has always been a supporter of Brexit - but in its soft performance. In his opinion, withdrawal from the European Union should be carried out only after reaching an agreement with Brussels. And although at one time he voted against Theresa May's deal, he didn't go on about his brother, who led (and is still leading) the country to a chaotic exit from the EU. The demarche of Boris Johnson's younger brother is more indicative, which implies the weakness of his position. The number of Conservatives who somehow left their party this week exceeded 20 people. Earlier this week, MP Phillip Lee went over to the Liberal Democrats, after which the Tories lost a majority in the House of Commons. Yesterday, 20 Conservative deputies voted to introduce a bill to postpone exit from the EU on the agenda. On the same day, Boris Johnson expelled them from the party. Today, the ex-head of the Conservative Party, Caroline Spelman, independently stated that she would not participate in the next election, noting that she also voted for the postponement of Brexit (but for some reason she was not expelled from the party). Thus, the "house of cards" of Johnson's strategy collapses. More recently, the prime minister actually attracted the queen to his side, trying to block the House of Commons' work with her help. But this step only rallied MPs against him: Johnson outplayed himself, trying to get Britain out of the EU at all costs on October 31. The pound reacts to events accordingly, demonstrating an upward impulsive movement in tandem with the dollar. Technically, bulls of the pair need to gain a foothold above the 1.2350 mark (the middle line of the Bollinger Bands indicator on the daily chart, which coincides with the lower boundary of the Kumo cloud). In this case, the pair will easily enter the 24th figure, where the next resistance level of 1.2430 is located. If the House of Lords does not delay the consideration of the above bill, the pound will not only overcome these levels, but also gain a foothold in the new price range, in the region of 25-27 figures. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 05 Sep 2019 03:35 PM PDT Eurozone data continues to come out pretty bad, and the euro ignores them all week. It is unlikely that one expectation that the Fed will lower interest rates will be enough to maintain the upward potential of risky assets, as the European Central Bank is about to announce the resumption of its asset repurchase program. Here, economists will recall the recent series of poor statistics on Germany and the eurozone, which will further aggravate the euro's position in the medium term. According to data, the volume of orders in the manufacturing sector in Germany continued to decline in July. A report by the German Federal Bureau of Statistics indicates that orders fell 2.7% in July from the previous month, while economists had expected a 1.5% drop. Compared to July 2018, orders fell immediately by 5.6%. Considering the fact that at the beginning of the 3rd quarter the influx of new orders remains rather weak, there is no reason to talk about the restoration of the manufacturing sector in Germany amid growing trade conflicts. The Ministry noted that the expectations of companies in the manufacturing sector also remain at a rather low level, and one should not expect improvement in industrial activity in the coming months. A decrease was observed even from the side of domestic orders, which fell by 0.5% in July this year in Germany, and external - by 4.2%. New orders from the eurozone countries grew by 0.3%, while new orders from countries outside the eurozone fell by 6.7%. However, the euro is in demand, as speculative players were pleased with yesterday's speech by the future head of the European Central Bank, Christine Lagarde, as well as the situation around Brexit. She promised to study the positive and negative effects of a policy of negative interest rates, as well as bond purchases. However, Lagarde also made it clear that she does not intend to make changes to the central bank's policy, although all the necessary changes will most likely be made before she takes office this fall, which will necessarily affect the quotes of risky assets. Christine Lagarde also stated that she was ready to heed Germany's fears and other European countries related to aggressive monetary stimulus measures and lower interest rates. Today, news also appeared that trade negotiations between the US and China could resume in October this year, which supported risky assets in the morning. A statement by the Chinese Ministry of Commerce said Beijing was aiming for substantial progress in the October trade talks, and the recent telephone conversation between the US and China was quite good. The ministry also assured that China is strongly opposed to the escalation of the trade war and called on the United States to end the persecution of Huawei. Let me remind you that this morning a telephone conversation took place between Chinese Prime Minister Liu He, US Trade Representative Robert Lighthizer and US Treasury Secretary Stephen Mnuchin. At the same time, new trade duties from the United States worth US $270 billion, as well as from China, which affect the automotive industry, where duties increased from 30% to 35%, began to operate. As for the technical picture of the EURUSD pair, the short-term demand for the euro will still remain, but it is hardly worth counting on a bigger bullish trend. If the bears manage to return the trading instrument to the support level of 1.1050 by the end of the day, a small profit consolidation may begin at the end of the week, and the whole emphasis will be shifted to tomorrow's report by the US Department of Labor on the number of people employed in the non-agricultural sector. If the bulls continue to push the euro up, contrary to all logic, which also cannot be ruled out, then for those who wish to sell higher, larger resistance levels will be visible in the region of 1.1100 and 1.1150. The material has been provided by InstaForex Company - www.instaforex.com |

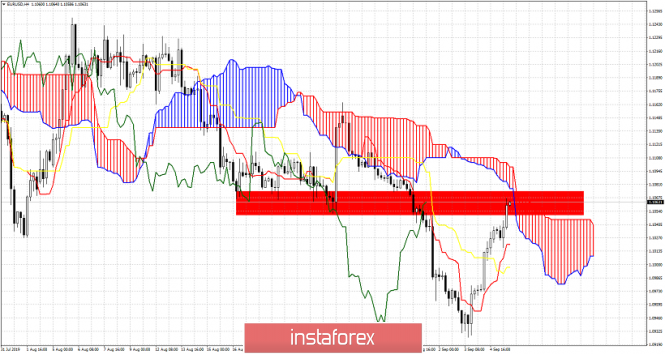

| September 5, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 05 Sep 2019 08:24 AM PDT

On July 5, a consolidation range bearish breakout was demonstrated below 1.2550 corresponding to the lower limit of the depicted consolidation range. Moreover, Bearish breakdown below 1.2385 (Wedge-Pattern Key-Level) facilitated further bearish decline towards 1.2320, 1.2210 and 1.2100 which corresponded to significant key-levels on the Weekly chart. In Early August, another consolidation-range was temporarily established above 1.2100 before August 9 when temporary bearish movement was executed towards 1.2025. Recent bullish recovery was demonstrated off the recent bottom (1.2025). This brought the GBP/USD pair back above 1.2100 (Lower limit of the recently established consolidation-zone) within the depicted short-term bullish channel. As expected, further bullish advancement was demonstrated towards 1.2230 then 1.2280 where recent bearish rejection was demonstrated (near the upper limit of the recent movement channel). Bullish persistence above 1.2160 (the recent consolidation range pivot-point) was needed to enhance further bullish advancement. However, recent bearish rejection was demonstrated around 1.2200-1.2215 (upper limit of the consolidation range). That's why, another quick bearish decline took place towards 1.2100 then 1.2000 (corresponding to a prominent bottom established on August 9). Earlier this week, early signs of bullish recovery (Bullish Engulfing candlesticks) were manifested around 1.1960 bringing the GBPUSD back above 1.2100. As expected, further bullish advancement was demonstrated towards 1.2200. Although the GBPUSD pair looked overbought around (1.2200), further bullish momentum was demonstrated towards 1.2320 bringing the pair back inside the depicted movement channel again. Further bullish advancement should be expected towards 1.2390-1.2400 where the upper limit of the current movement channel comes to meet the pair. Trade Recommendations: Conservative traders should wait for the current bullish movement to pursue towards 1.2390-1.2400 (upper limit of the depicted movement channel) for a valid SELL entry. T/P level to be placed around 1.2300, 1.2250 then 1.2220 while S/L should be placed above 1.2250. The material has been provided by InstaForex Company - www.instaforex.com |

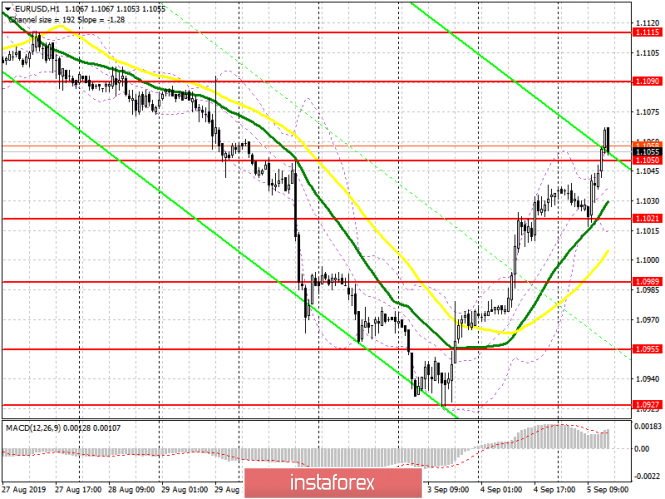

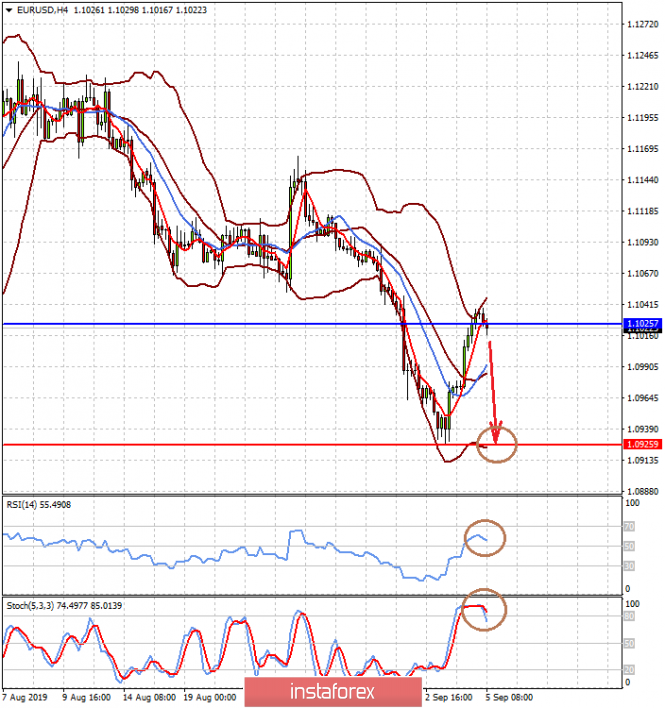

| September 5, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 05 Sep 2019 07:42 AM PDT

Back in June 24, the EURUSD looked overbought around 1.1400 facing a confluence of supply levels which generated significant bearish pressure over the pair. Shortly after, In the period between 8 - 22 July, a sideway consolidation-range was established between 1.1200 - 1.1275 until a triple-top reversal pattern was demonstrated around the upper limit. Then, Evident bearish momentum (bearish engulfing H4 candlestick) could bring the EURUSD below 1.1175. This facilitated further bearish decline towards 1.1115 (Previous Weekly Low) then 1.1025 (the lower limit of the depicted recent bearish channel) where significant signs of bullish recovery were demonstrated. Shortly-After in Mid-August, the EUR/USD has been trapped between 1.1235-1.1175 for a few trading sessions until bearish breakout below 1.1175 occurred on August 14. Bearish breakout below 1.1175 promoted further bearish decline towards 1.1075 where the backside of the broken bearish channel has provided temporary bullish demand for sometime (Bullish Triple-Bottom pattern). Bullish persistence above 1.1115 was needed to confirm the short-term trend reversal into bullish. However, the depicted Triple-Bottom pattern was invalidated especially after the EURUSD pair bulls have failed to establish Bullish persistence above 1.1115. Moreover, the recently established short-term uptrend line has been invalidated as well thus rendering the short-term outlook as bearish. By the end of last week's consolidations, a quick bearish decline was demonstrated towards 1.0965 - 1.0950 where the backside of the broken channel came to meet the EURUSD pair again. Risky traders were advised to look for a valid BUY entry anywhere around the price levels of 1.0950. All T/P levels were successfully reached. Trade recommendations : Conservative traders should be looking for a valid SELL entry around the current price levels (1.1050-1.1070). S/L should be placed just above 1.1115 while target levels to be located at 1.1025, 1.0988 and 1.0935. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC 09.05.2019 -Major resistnace on the test and potential new downward movement Posted: 05 Sep 2019 07:40 AM PDT Bitcoin 4H time-frame:

I found large symmetrical triangle pattern based on the 4H time-frame and the BTC is trading near the resistance now. I think that the growth potential of BTC is now limited. The first reason is cause there is increase demand for the crude oil, which is very attractive for investorsThe trade war is still active and investors are in indecision about the dollar, which indicates limited upside for BTC. I think that overall Bitcoin can go lower due to no big buyers on the market and due to much more attractive markets now like a energy market.I found bearish divergence on the MACD oscillator, which is another indication for lower prices. Bitcoin Forecast and recommendations for traders: Bitcoin is in overall consolidation phase but most recently I found resistance on the test and the potential breakout of $10,350 may confirm lower BTC. Thus, I recommend selling cryptocurrency with a target of $9,453, with a Stop Loss level of $11,000 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 05 Sep 2019 07:28 AM PDT To open long positions on EURUSD, you need: Despite the absence of important fundamental statistics in the first half of the day, the bullish momentum on the euro continued, which allowed getting to the level of 1.1050, which is now quite an important support. As long as trading is above this range, the demand for the euro will continue, which may lead to an update of the highs in the area of 1.1090 and 1.1115, where I recommend fixing the profits. If the bears manage to take control of the market, and the pair returns to the support of 1.1050, it is best to count on new long positions on a false breakdown from the level of 1.1021, or a rebound from a minimum of 1.0990. To open short positions on EURUSD, you need: In the first half of the day, sellers failed to form a false breakdown in the resistance area of 1.1050, but the divergence that has now formed on the MACD indicator on the hourly chart can return EUR/USD to this level of support, which will be the first signal to open short positions. The first intermediate goal will be the area of 1.1021, however, it is best to take profits at a minimum of 1.0990. In the scenario of further growth of the euro according to the trend, it is possible to consider new short positions on a rebound from a maximum of 1.1090. Signals: Signals of indicators: Trading is above 30 and 50 moving averages, indicating a bullish market. Bollinger Bands In the case of a decrease in the euro, the lower limit of the indicator at 1.1015 will limit the downward potential.

Description of indicators

|

| EUR/USD for September 05,2019 - Sell zone at the major resistance on EUR Posted: 05 Sep 2019 07:26 AM PDT EUR/USD has been trading upwards. The price tested the level of 1.1088 but key resistance was found and I do expect tomorrow good sell day.

Yellow rectangle – Important resistance (20SMA) Blue horizontal line – Downward objective Pink line – Expected path .MACD oscillator is still in the negative territory, which is indication that there is still downward trend in the background. Key resistance is at 1.1090 and support at 1.0975. Bulls need to be very cautious as there is strong resistance on the test and potential downward movement. As long as the EUR/USD is holding below 1.1100 there is a chance for downward movement. Watch for selling opportunities on the rallies with potential targets at 1.1016 and 1.0975. The material has been provided by InstaForex Company - www.instaforex.com |

| USD/JPY analysis for September 05, 2019 - Breakout of the key reistance trendline Posted: 05 Sep 2019 07:04 AM PDT USD/JPY has been trading upwards. The price tested the level of 106.95 Anyway, I still expect more upside and at least another upward swing. Key resistance trend line is broken and that is strong sign that buyers are in control.

Red horizontal line – Important resistance and first upward objective Purple horizontal line – Second objective target and Fibonacci 100% Pink rising line – Expected path .MACD oscillator is showing new momentum up, which is good confirmation for upside and I do expect at least another push higher. Key support is at 106.67 and resistance at 107.27 and 107.90. Bears need to be very cautious as there is strong upward momentum in the background and potential buying the deep type of feeling. As long as the USD/JPY is holding above 105.85 there is a chance for new push higher. Weekly bullish divergence on the oscillator is helping further upside. The material has been provided by InstaForex Company - www.instaforex.com |

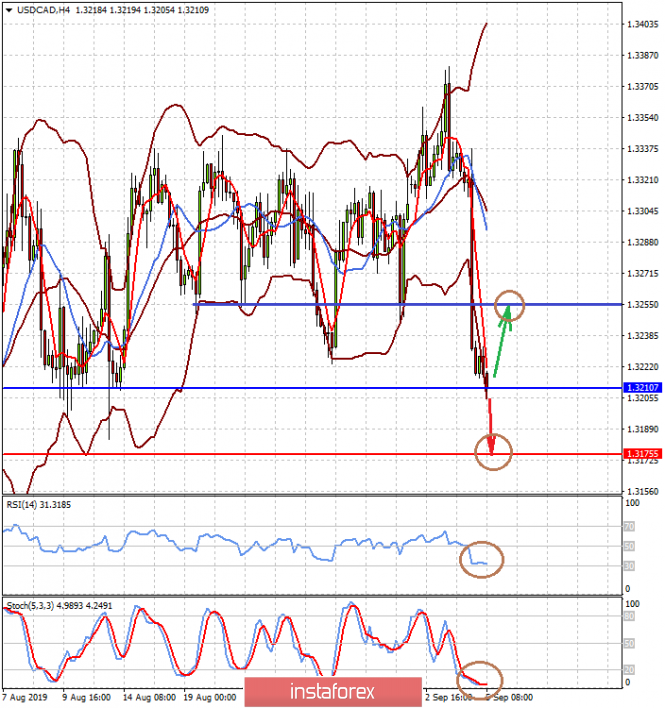

| USDCAD bulls unable to capture the major Fibonacci resistance Posted: 05 Sep 2019 06:42 AM PDT USDCAD made a new higher high above 1.3344 and briefly pushed above the major Fibonacci resistance at 1.3355. However bulls were not strong enough and price got rejected. This Fibonacci rejection is a bearish sign.

USDCAD never managed to produce a daily close above the 61.8% Fibonacci retracement. The long upper candle tails in the daily candlesticks show the strength of the sellers. Price got rejected at the 1.3355 area and is now challenging the 1.32 support. Below 1.32 we look for support at 1.3120 where we find the lower boundary of the long-term bullish channel. Ideally bulls would pull back towards 1.3155 where we find the 61.8% Fibonacci retracement of the last leg up and then reverse to the upside. The material has been provided by InstaForex Company - www.instaforex.com |

| The Dollar index reverses after making new highs. New bearish divergence Posted: 05 Sep 2019 06:38 AM PDT In a previous post we noted that a break above 98.20 would lead the Dollar index towards 99.15 for a final new higher high and a new bearish divergence. Price reversed exactly as we expected and now challenges major support.

Red rectangle - previous resistance now support The Dollar index made a new weekly high but the weekly candle looks like a reversal is on the making. Combined with a bearish weekly divergence bulls need to be very cautious. My key support is at the previous resistance at 98 area. Price is back testing this area which is now support. Holding or bouncing above it is a bullish sign. Breaking below the red rectangle area will open the way for a move much lower. The material has been provided by InstaForex Company - www.instaforex.com |

| EURUSD continues the bounce towards important resistance levels as noted two days ago. Posted: 05 Sep 2019 06:33 AM PDT EURUSD is trading above 1.1050 and has entered the previous support area now resistance. The short-term bounce was anticipated and justified as many indicators were at oversold levels and giving us bullish divergence signs.

Red rectangle- previous support now resistance EURUSD as noted in our last analysis, has broken above the tenkan- and the kijun-sen indicators. This has lead to a move towards cloud resistance. Bulls want to see price break above the cloud and stay above the cloud. As long as price is below the Kumo (cloud) trend remains bearish. There is a cross between the tenkan- and kijun-sen. This is not a strong signal as price and the Chikou span are below the cloud. Therefore we still consider this move higher as a relief bounce. Key resistance ahead is at 1.11. The material has been provided by InstaForex Company - www.instaforex.com |

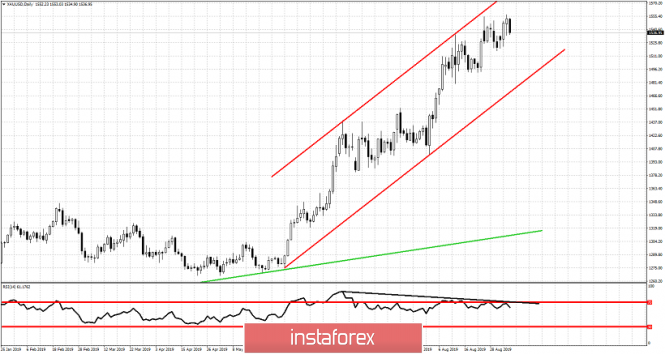

| Gold pulls back after new 2019 highs. Is this a short-term top? Posted: 05 Sep 2019 06:27 AM PDT Gold price is trading again below $1,555. Price broke to new 2019 highs and reached $1,557, but bulls were unable to hold prices near the highs. Gold is now trading near $1,537 and unless we see another upward move above $1,550 then there are a lot of chances of seeing $1,500 area again.

Green rectangle - support Gold price made a move above the resistance area but it now seems this was a fake break out. Gold price has support at $1,515 if this support fails to hold, we should expect Gold price to test $1,500-$1,475 area. Gold remains in a bullish trend but as we noted in previous posts, bulls need to be very cautious. Why? Because there are bearish divergence RSI signs on the Daily chart.

Black line -bearish divergence Green line - major support trend line Gold price could have already topped. If this is the case Gold should at least pull back towards the lower channel boundary near $1,480. Gold has reached very close to our $1,570 target and we are no more looking for any upside as the risk is not worth the reward. The material has been provided by InstaForex Company - www.instaforex.com |

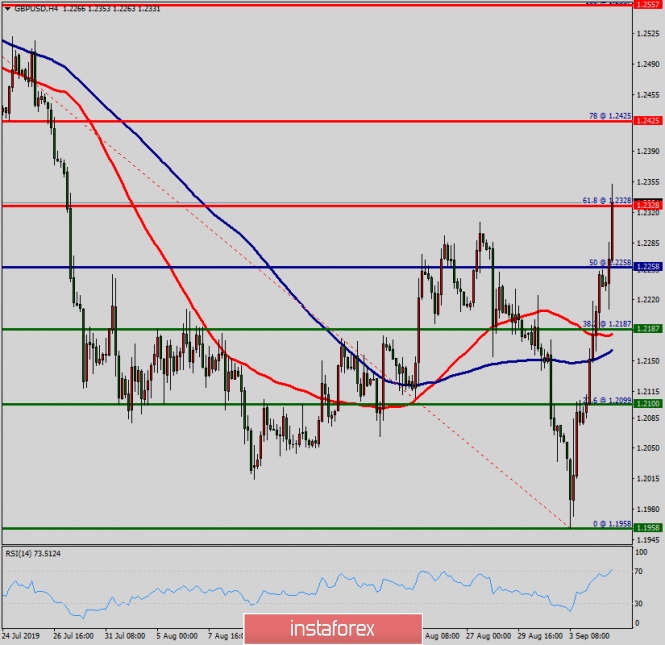

| Technical analysis of GBP/USD for September 05, 2019 Posted: 05 Sep 2019 06:13 AM PDT Pair: GBP/USD We expect the bullish trend for the upcoming sessions as long as the price is above 1.2258 levels in the long term. The GBP/USD pair is now trading back at the upper end of the upward channel it has trended within since August. Immediate support is seen at 1.2258 which coincides with a golden ratio (61.8% of Fibonacci). The depicted support level of 1.2258 acted as a prominent key level offering a valid buy entry. The GBP/USD pair is continuing in a bullish market from the support level of 1.2258 to settle around the area of 1.2328. We foresee the price to move towards the level of 1.2328 and then reach a new maximum again around the price of 1.2425. Please, note that the strong resistance stands at the level of 1.2328. If the price breaks the level of 1.2328, our forecasts potential testing of 1.2425. The current ascending structure implies that the market may reach the level of 1.2557 in coming days. In larger time frames the trend is still bullish as long as the level of 1.2258 is not breached. However, The stop loss should be placed below the low reached near support 1 (1.2187). The material has been provided by InstaForex Company - www.instaforex.com |

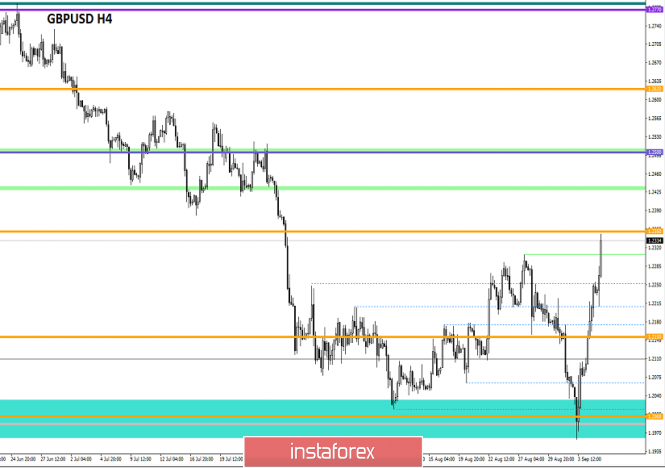

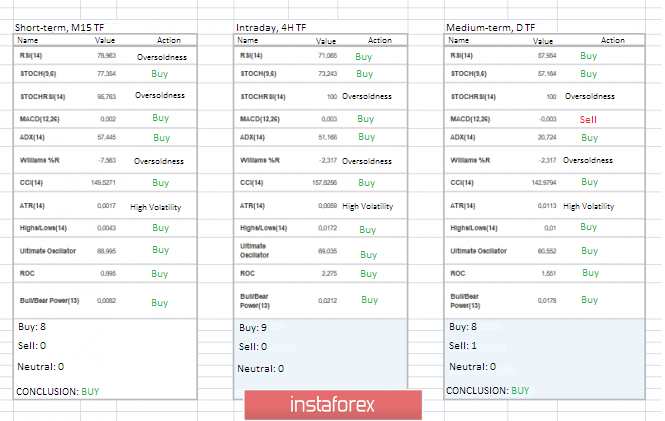

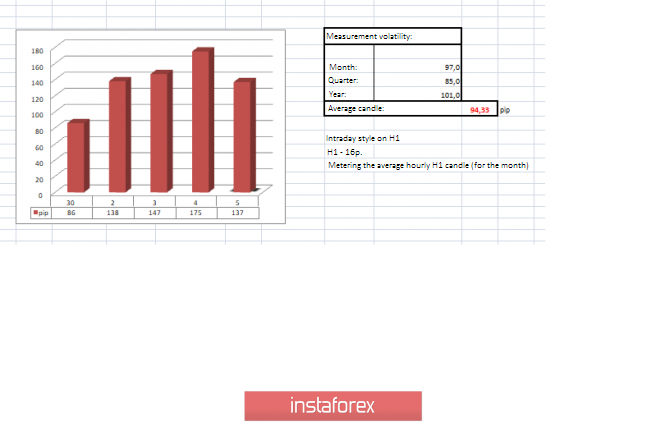

| Trading recommendations for GBPUSD currency pair – placement of trading orders (September 5) Posted: 05 Sep 2019 05:55 AM PDT The pound/dollar currency pair for the last trading day showed ultra-high volatility of 175 points, the most remarkable – all the volatility of the day went into an upward move. From technical analysis, we see not just a rebound from historic lows, but a literal takeoff. More than 300 points of continuous upward movement, and it's only 2.5 days. Madness, I agree, but it's a fact. The result is that the quote has returned to the peak of the recent corrective movement. As discussed in the previous review, the market is ideal for speculators, such as jumps, volatility, panic does not happen every day and, of course, all this can be earned. The tactic was as follows: we switch to a smaller timeframe and begin to study the news feed, identifying whole information as early as possible, and believe me, it was, otherwise there would be no movement. Of course, this tactic did not suit everyone, and the advice – sit out the noise outside the market – was also relevant. Considering the trading chart in general terms ((the daily period), we see that when hitting historic lows, the primary trend was a little down and there is a new theory. So, returning the price to the maximums of the previous correction does not bring anything good, since a slowdown in the main trend is visible. The second – to remove the trading chart (D1) and look at the period, the end of 2016 and the beginning of 2017, there was just a similar plot. The quotation approached the historical minimum and went into a phase of widespread stagnation, I think you caught the message, also – the pressure of the information background there was similar. There was no news background last day, statistics on Britain and the United States were not released, and they were not needed when the entire market was immersed in the information background. Yesterday, the British Parliament, contrary to the calls of the prime minister, supported the idea of postponing Brexit's term if agreement cannot be concluded with the EU by October 31. What can be said about this – this is a stunning defeat for Boris Johnson, 299 opposed the postponement of 327 deputies. Formal approval has now remained in the House of Lords, but we can already say that there will be no hard Brexit this year. Against this background, the British currency continued its growth, forgetting about all the problems that surround the United Kingdom. In such an unexpected development, Boris Johnson decided not to oppose the passage of a bill to postpone Brexit without a deal with the European Union. In turn, in response to the adoption of the bill, the Prime Minister proposed to the deputies to hold early elections on October 15, to which the leader of the British opposition Labor Party Jeremy Corbyn replied: "We are looking forward to the election because we want to throw away this government." The cohesion of the parliament, in this case, was surprising, and, in principle, Johnson no longer had moved in this fast, but action-packed chess game. Today, in terms of the economic calendar, we have an ADP report on the level of employment in the United States private sector, where, according to preliminary forecasts, they expect a slowdown from 156K to 149K, which may put local pressure on the US currency. The news is strong and well reflects the upcoming Friday report of the US Department of Labor, but do not forget that the information background is currently running the GBPUSD pair and the ADP report may not be as noticeable as many would like. US 13: 15 London time – ADP report on the level of employment in the private sector. Further development Analyzing the current trading chart, we see that the joy of the pound has no boundaries, the rapid upward move continues its formation, reaching the level of 1.2345. As a rule, in such a panic movement, market participants do not realize that the growth that we see was formed literally from scratch. The hard Brexit is postponed, and the negotiations are delayed for the fourth year. When the passions subside and everyone understands that they were left with nothing but a bunch of problems, the downward movement will again be restored, and since there was a significant overheating of long positions, we will see impulsive jumps in the opposite direction. In turn, speculators are not asleep, since real money is being made, and so, the hype of the kingdom made it possible to ride the rising waves well yesterday, and today the rides continue. The tactics are the same, we study the news line and work ahead of the curve. If you are not confident in your abilities and are not ready to ride, then it is better to sit on the fence at least until Monday. It is likely to assume that such jumps will remain for some time, wherein the case of overcoming the mark of 1.2350, we can go even higher to 1.2400-1.2450, but as soon as there is a limit to emotions and FOMO reaches the side chapel, a backlash will occur. I expect this development in the next day, perhaps within the levels of 1.2350 or 1.2450 (+/- 30p.). Thus, be ready and operate the optimal trading volume.

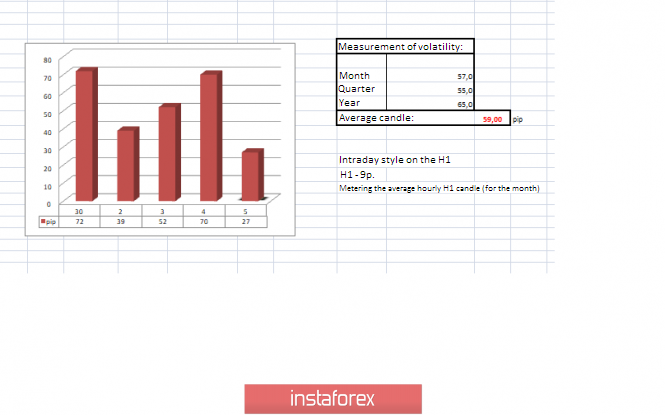

Technical analysis Analyzing the different sectors of timeframes (TF), we see that the indicators at all time intervals signal an upward course, and this is understandable since such a strong inertial course does not allow the indicators to work differently. Volatility per week / Measurement of volatility: Month; Quarter; Year. Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year. (September 5 was built taking into account the time of publication of the article) The current time volatility is 137 points, which already exceeds the average daily indicator by 45%. Now it all depends on the panic mood and how much more speculators are driving the pound into heaven, I do not exclude the possibility that volatility can still grow. Nevertheless, we must pay tribute to the information background, the autumn began with stunning volatility, the average figure exceeds the mark of 149 points. Key levels Resistance zones: 1.2350**; 1.2430; 1.2500; 1.2620; 1.2770**; 1.2880 (1.2865-1.2880)**. Support zones: 1.2150**; 1.2000***; 1.1700; 1.1475**. * Periodic Level ** Range Level *** The article is built on the principle of conducting a transaction, with daily adjustment. The material has been provided by InstaForex Company - www.instaforex.com |

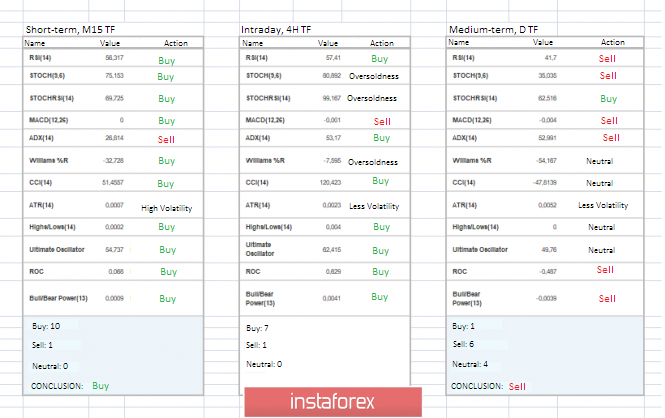

| Trading recommendations for EURUSD currency pair – placement of trading orders (September 5) Posted: 05 Sep 2019 05:52 AM PDT The euro/dollar currency pair showed high volatility of 70 points over the last trading day, as a result of which the initial pullback moved into the correction phase. From technical analysis, we see that the descent of the quote to the area of values in 2017 led to the fact that short positions went into a phase of fatal overheating, and an earlier six-day inertial course contributed to this. Correction is what we see now, fixing the price above the psychological level of 1.1000 indicates this. As discussed in the previous review, traders have fixed their previously opened short positions and are now in a fairly comfortable area, waiting for the end of the corrective move. Speculators, in turn, continue to work, as the correction is a good platform for earnings and fixing the price above the psychological mark of 1.1000, made it possible to once again enter long positions, taking a small, but still a piece of the profit. Looking at the trading chart in general terms (daily period), we see that the last candle drew us across to the top, but it did not change the general picture of the trend, since the downtrend was still a downtrend, so it remains. Advice – to open the daily chart and move it away, analyze the 2015-2017 section, it can help us in understanding the further decline. The news background of the past day contained data on European retail sales, where everything is not as good as we wanted, but there is still a drop of positive. So, the volume of retail sales (y/y) slowed from 2.8% to 2.2%, but previous data was revised in favor of the growth of 2.6% – 2.8% and the actual data came out slightly better than expected 2.0% – 2.2%. Almost simultaneously, the data on business activity in the service sector were released, where we have an increase from 53.4 to 53.5, the composite index also shows an increase to 51.9. Thus, in general, the EU data came out not as bad as expected, and there was an incentive for the euro to grow. The information background again tickled the abscesses of speculators, let's analyze it. We will start with the Federal Reserve System, and there was a fuss about a possible reduction in the base interest rate at the autumn meeting, James Bullard added fuel to the fire. The other day, the head of the St. Louis Federal Reserve expressed his opinion on the rate, calling what is happening so: "We are too high." Bullard meant that the existing target interest rate in the range of 2%-2.25% was higher than the current yield of all US Treasury securities. Normally, the Fed rate should form a baseline for determining other rates, but even 30-year bond yields have fallen below 2%. Market participants perceived these words as a desire to reduce the base rate by 0.5%. Let me remind you that in the summer, James Bullard expressed a different point of view regarding the rate. In turn, the head of the Boston Federal Reserve continues to adhere to the previously set judgment and believes that at this time he does not see the need to reduce the base rate. "As long as we see that consumption and employment are relatively strong, I'm not so worried," Eric Rosengren said Now back to our rams, a typo meant the Brexit. Yesterday, the House of Commons of the British Parliament, contrary to the position of the government, supported the idea of postponing the Brexit term if there is no agreement by October 31. That is, hard Brexit is canceled, we diverge, gentlemen. Prime Minister Boris Johnson will be obliged to sit down at the negotiating table and ask for another delay from the European Union. Against this background, the British pound pulled up but followed by the euro. In general terms, the information and news background now makes clear the reason for the recovery of the market. Today, in terms of the economic calendar, all attention is focused on ADP data on US employment, which reflect preliminary figures ahead of the publication of the report of the United States Department of Labor on Friday. So, according to forecasts, they expect a decrease in growth rates from 156K to 149K, which may put local pressure on the US dollar if the data are confirmed. US 13:15 London time – ADP report on the level of employment in the private sector. Further development Analyzing the current trading chart, we see that the correction already weights more than 100 points, fixed above the psychological level of 1.1000. The current accumulation in the form of stagnation, positioned within the mark of 1.1020/1.1040 carries a temporary character, until the publication of ADP. In turn, speculative traders continue to work in the correction phase, considering the local growth in the range of 1.1070-1.1080. It is likely to assume that the amplitude of the current oscillation can be extended to the limits of 1.1000/1.1050, where it is necessary to analyze the existing boundaries for breakdown and further progress. If the ADP data coincide with the expectation, the quote can grow locally, but then return to the beginning of the current day, that is, to 1.1020, possibly top 1.1000. Based on the above information, we derive trading recommendations:

Technical analysis Analyzing the different sectors of timeframes (TF), we see that the indicators in the short term are variable jump due to the existing stagnation. Intraday indicators focused on the correctional move. Medium-term indicators follow the main market movement. Volatility per week / Measurement of volatility: Month; Quarter; Year The measurement of volatility reflects the average daily fluctuation, with the calculation for the Month / Quarter / Year. (September 5 was built taking into account the time of publication of the article) The current time volatility is 27 points. It is likely to assume that due to the news background, volatility may still increase, exceeding the daily average. Key levels Resistance zones: 1.1100 **; 1.1180 *; 1.1300 **; 1.1450; 1.1550; 1.1650 *; 1.1720 **; 1.1850 **; 1.2100 Support zones: 1.1000***; 1.0850**; 1.0500***; 1.0350**; 1.0000***. * Periodic level ** Range Level *** Psychological level **** The article is based on the principle of conducting transactions, with daily adjustments. The material has been provided by InstaForex Company - www.instaforex.com |

| AUD was able to overcome an important psychological barrier and now, it can not be stopped Posted: 05 Sep 2019 04:36 AM PDT Highlights: China confirmed trade negotiations with the US in October, which is good but the weak data from Australia is not. The AUD/USD pair has maintained its trend and occupies positions above the level of 0.6800. The Aussie rebounded noticeably this week, rising above the 0.6700 mark, and continues to gain momentum for the third consecutive session. News on China confirmed the resumption of trade negotiations with the US in October. With the positive news related to trade, the market rated higher than weak data from Australia. The chart did not reflect changes in the country's trade balance, indicating that the surplus fell to AUD 7.268 million in July from 8.036 million in June (with the forecast of 7,400 million Australian dollars). In addition, an increase in risk appetite provided an additional impetus for risky currencies. In general, the Aussie retains positive dynamics, and the conditions remain favorable. The currency confidently overcame the bar at 0.6800 and now, further growth is considered the most probable. Traders should pay attention to the ADP economic report on private sector employment and ISM non-productive PMI in the US, but the main decisions should be made on the basis of the Friday monthly US Employment Report (NFP). |

| Posted: 05 Sep 2019 03:52 AM PDT Today, the focus of the markets will be on the publication of data on the index of business activity in the non-manufacturing sector in the services of the Institute of Supply Management (ISM), the value of orders for durable goods and employment figures from ADP in the US. All investors will pay attention to the release of the values of American economic statistics after the publication on Wednesday of positive data on the index of business activity in the services sector of China, which added up to 52.1 points in August against 51.6 points in September. Investors will be interested in how the US-China Trade War affects the United States. This is an important point, which will undoubtedly allow either a degree of optimism in the markets to last or not. According to the forecasts, the American economy will receive 148,000 new jobs in August against the July figure of 156,000. Given the emerging general trend of cooling in the US economy, this is a good forecast. If in the case of a decrease in the data of labor market, then the index of business activity in the non-manufacturing sector and in the services sector of the Institute for Supply Management (ISM) is expected to increase to 54.0 points from 53.7 points. These data, together with the values of the volume of orders for durable goods, can have a positive impact on the mood of market participants if they do not let us down and show positive dynamics. On the other hand, if the US statistics come with good values, the dollar may receive support against major currencies, as their positive values will reduce expectations of a more active reduction in interest rates by the US Federal Reserve. Of course, after these values, the attention of the markets will focus on the output of the official values for the number of new jobs in the non-agricultural sector and the unemployment rate in the US, which will be presented tomorrow on Friday. Forecast of the day: The EUR/USD pair demonstrates the likelihood of a local reversal in the wake of expectations of positive data on the US economy, which will be released today. If they do not disappoint and the price remains below the level of 1.1025, there is a possibility of its fall to 1.0925. The USD/CAD pair found support at 1.3210. If data from the United States turns out to be strong and oil prices turn down, we should expect a local recovery of the pair to 1.3255. But if the price consolidates below the level of 1.3210, data from America will be weaker and oil quotes will go up, we should expect the pair to continue its decline to 1.3175. |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment