Forex analysis review |

- Fractal analysis of the main currency pairs for October 15

- #USDX vs EUR / USD vs GBP / USD vs USD / JPY - H4. Comprehensive analysis of movement options from October 15, 2019 APLs

- USD/CAD - Heading downwards

- QE program - a mine for the dollar and a chance for the euro?

- GBP/USD. October 14. Results of the day. Queen of Great Britain confirms desire to leave the EU on October 31

- EUR/USD. October 14. Results of the day. Eurozone industrial production expectedly falls

- GBP/USD. Steep turns: the pound is too sensitive to rumors around Brexit

- Gold is unlikely to "sit out" in a narrow range, hiding behind the safe haven status

- Gold is once again at around $1,500, but is unlikely to rise above

- Sisyphean task for the pound: rise vs fall

- Pound saw the light at the end of the tunnel

- The market is waiting for change, but so far has little faith in it

- October 14, 2019 : EUR/USD Intraday technical outlook turned into bullish. Further bullish advancement to be anticipated.

- October 14, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- Gold 10.14.2019 - Sell zone on the Gold

- Trading recommendations for the EURUSD currency pair – placement of trade orders (October 14)

- EUR/USD for October 14,2019 - Broken upward channel whithin larger upward channel

- BTC 10.14.2019 - Sell zone for Bitcoin, bearish flag in play

- GBP/USD: plan for the American session on October 14th. The downward correction on the pound approached important support

- EUR/USD: plan for the American session on October 14th. Volatility will remain low in the second half of the day

- Gold is growing

- Technical analysis of EUR/USD for October 14, 2019

- Trading recommendations for the GBPUSD currency pair – placement of trade orders (October 14)

- Trading strategy for EUR/USD on October 14th. US-China talks. What do they give the US dollar?

- Trading strategy for GBP/USD on October 14th. Boris Johnson needs to do the impossible in time to reach an agreement with

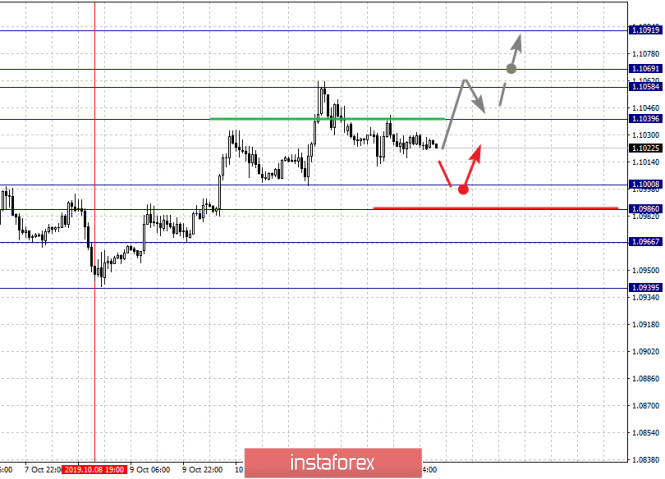

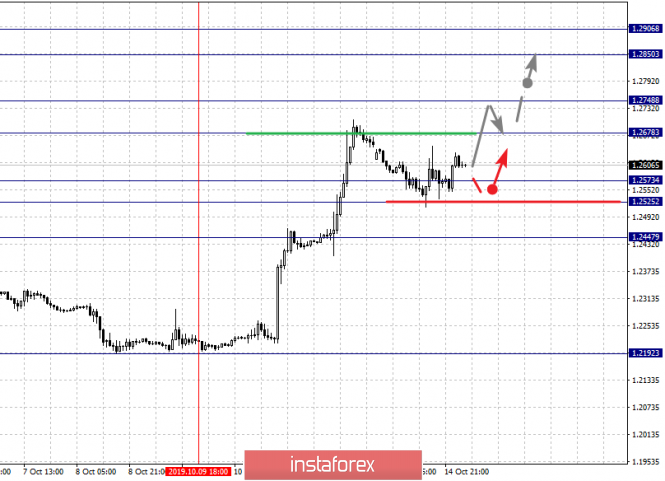

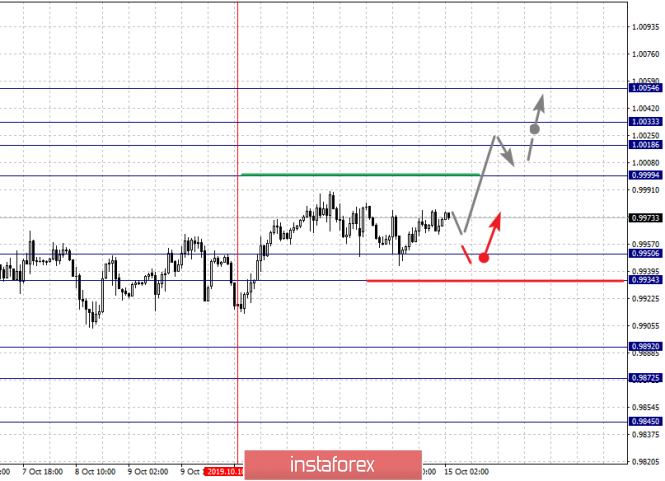

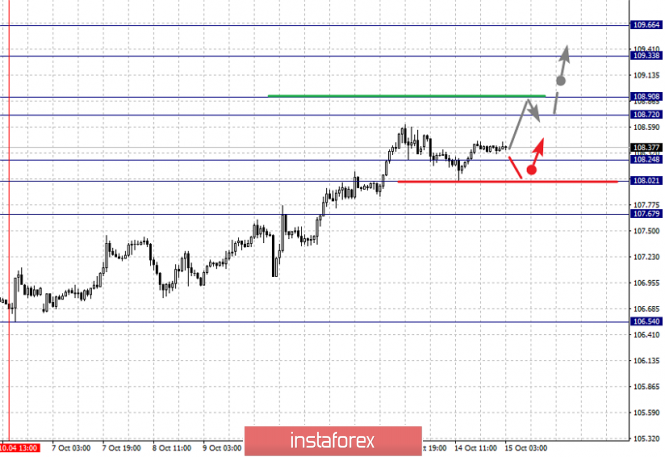

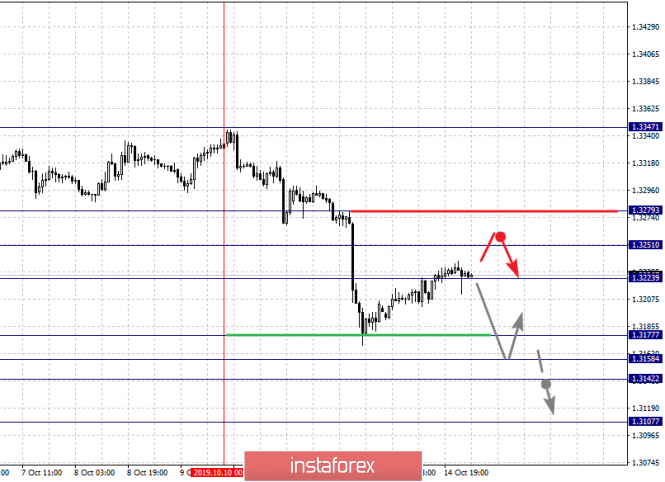

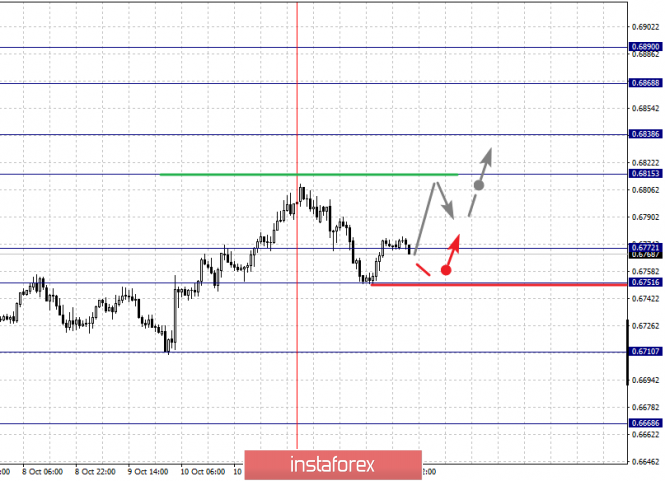

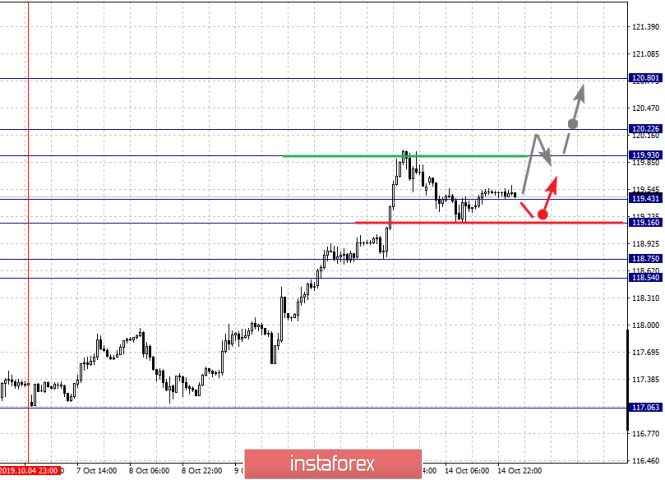

| Fractal analysis of the main currency pairs for October 15 Posted: 14 Oct 2019 06:10 PM PDT Forecast for October 5: Analytical review of currency pairs on the scale of H1: For the euro / dollar pair, the key levels on the H1 scale are: 1.1091, 1.1069, 1.1058, 1.1039, 1.1000, 1.0986, 1.0966 and 1.0939. Here, we continue to consider the local ascending structure of October 8 as a reference. The continuation of the movement to the top is expected after the breakdown of the level of 1.1039. In this case, the target is 1.1058. Price consolidation is in the range of 1.1058 - 1.1069. We consider the level of 1.1091 to be a potential value for the top; upon reaching this level, we expect a pullback to the bottom. Short-term downward movement is possibly in the range 1.1000 - 1.0986. The breakdown of the last value will lead to a long correction. Here, the target is 1.0966. This level is a key support for the top. Its passage at the price will lead to the development of a downward movement. In this case, the target is 1.0939. The main trend is the medium-term upward structure from October 1, the local structure from October 8. Trading recommendations: Buy: 1.1040 Take profit: 1.1058 Buy 1.1070 Take profit: 1.1090 Sell: 1.1000 Take profit: 1.0987 Sell: 1.0984 Take profit: 1.0966 For the pound / dollar pair, the key levels on the H1 scale are: 1.2906, 1.2850, 1.2748, 1.2678, 1.2573, 1.2525 and 1.2447. Here, we are following the development of the upward cycle of October 9. The continuation of the movement to the top is expected after the breakdown of the level of 1.2678. In this case, the target is 1.2748. Price consolidation is near this level. The breakdown of the level of 1.2750 should be accompanied by a pronounced upward movement to the level of 1.2850. For the potential value for the top, we consider the level of 1.2906. Upon reaching which, we expect consolidation, as well as a pullback to the bottom. Short-term downward movement is expected in the range of 1.2573 - 1.2525. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.2447. This level is a key support for the top. The main trend is the upward structure of October 9. Trading recommendations: Buy: 1.2678 Take profit: 1.2744 Buy: 1.2750 Take profit: 1.2850 Sell: 1.2573 Take profit: 1.2527 Sell: 1.2523 Take profit: 1.2450 For the dollar / franc pair, the key levels on the H1 scale are: 1.0054, 1.0033, 1.0018, 0.9999, 0.9950, 0.9934, 0.9892 and 0.9872. Here, the price registered a small potential for the top of October 10. The development of this structure is expected after the breakdown of the level of 0.9999. In this case, the target is -1.0018. Price consolidation is in the range of 1.0018 - 1.0033. For the potential value for the top, we consider the level of 1.0054. Upon reaching which, we expect a pullback to the bottom. Short-term downward movement, as well as consolidation, are possible in the range of 0.9950 - 0.9934. The breakdown of the latter value will favor the development of a downward structure from October 3. In this case, the first goal is 0.9892. The main trend is the descending structure of October 3, the formation of potential for the top of October 10. Trading recommendations: Buy : 0.9999 Take profit: 1.0018 Buy : 1.0035 Take profit: 1.0054 Sell: 0.9950 Take profit: 0.9936 Sell: 0.9931 Take profit: 0.9894 For the dollar / yen pair, the key levels on the scale are : 109.66, 109.33, 108.90, 108.72, 108.24, 108.02 and 107.67. Here, we are following the development of the upward cycle of October 4. Short-term upward movement is expected in the range 108.72 - 108.90. The breakdown of the latter value will lead to a movement to the level of 109.33. Price consolidation is near this level. For the potential value for the top, we consider the level of 109.66. Upon reaching this level, we expect a consolidated movement, as well as a pullback to the bottom. Short-term downward movement is expected in the range of 108.24 - 108.02. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 107.67. This level is a key support for the top. The main trend: the upward cycle of October 4. Trading recommendations: Buy: 108.90 Take profit: 109.30 Buy : 109.34 Take profit: 109.65 Sell: 108.24 Take profit: 108.03 Sell: 108.00 Take profit: 107.70 For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3251, 1.3223, 1.3209, 1.3177, 1.3158, 1.3142 and 1.3107. Here, we are following the development of the downward cycle of October 10. The continuation of movement to the bottom is expected after the breakdown of the level of 1.3177. In this case, the target is 1.3158. Price consolidation is in the range of 1.3158 - 1.3142. For the potential value for the bottom, we consider the level of 1.3107. The movement to which is expected after the breakdown of the level of 1.3140. Short-term upward movement is possibly in the range of 1.3209 - 1.3223. The breakdown of the latter value will lead to the formation of initial conditions for the upward cycle. In this case, the first potential target is 1.3279. The main trend is the downward cycle of October 10. Trading recommendations: Buy: 1.3226 Take profit: 1.3250 Buy : 1.3253 Take profit: 1.3276 Sell: 1.3177 Take profit: 1.3158 Sell: 1.3140 Take profit: 1.3110 For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6890, 0.6868, 0.6838, 0.6815, 0.6782, 0.6772 and 0.6751. Here, we are following the development of the upward cycle of October 2. The continuation of the movement to the top is expected after the breakdown of the level of 0.6815. In this case, the target is 0.6838. Price consolidation is near this level. The breakdown of the level of 0.6840 should be accompanied by a pronounced upward movement. Here, the target is 0.6868. Price consolidation is near this level. For the potential value for the top, we consider the level of 0.6890. Upon reaching which, we expect a pullback to the bottom. Consolidated movement is possibly in the range of 0.6772 - 0.6751. The breakdown of the latter value will lead to the development of a downward potential of October 11. In this case, the first target is 0.6710. Price consolidation is near this level. The main trend is the upward structure of October 2, the formation of potential for the downward movement of October 11. Trading recommendations: Buy: 0.6815 Take profit: 0.6836 Buy: 0.6840 Take profit: 0.6866 Sell : Take profit : Sell: 0.6746 Take profit: 0.6710 For the euro / yen pair, the key levels on the H1 scale are: 120.80, 120.22, 119.93, 119.43, 119.16, 118.75 and 118.54. Here, we are following the development of the upward cycle of October 4. At the moment, the price is near the limit values and, mainly, we expect the movement to correction. Short-term upward movement is possibly in the range of 119.93 - 120.22. The breakdown of the latter value will allow you to count on the movement to a potential target - 120.80, but we consider the movement to this level as unstable. Short-term downward movement is possibly in the range of 119.43 - 119.16. The breakdown of the last value will lead to an in-depth correction. Here, the target is 118.75. The range 118.75 - 118.54 is a key support for the top. Trading recommendations: Buy: 119.95 Take profit: 120.20 Buy: 120.25 Take profit: 120.80 Sell: 119.40 Take profit: 119.16 Sell: 119.14 Take profit: 118.80 For the Pound / Yen pair, the key levels on the H1 scale are : 141.05, 140.17, 138.71, 137.79, 136.20, 135.47 and 134.55. Here, we are following the development of the upward cycle of October 8. The continuation of the movement to the top is expected after the breakdown of the level of 137.80. In this case, the target is 138.71. Price consolidation is near this level. The breakdown of the level of 138.71 will lead to the development of pronounced movement. In this case, the goal is 140.17. For the potential value for the top, we consider the level of 141.05. Upon reaching which, we expect consolidation, as well as a pullback to the bottom. Short-term downward movement is possibly in the range of 136.20 - 135.47. The breakdown of the last value will lead to a long correction. Here, the target is 134.55. This level is a key support for the top. The main trend is the medium-term upward structure of October 8. Trading recommendations: Buy: 137.80 Take profit: 138.70 Buy: 138.75 Take profit: 140.10 Sell: 136.20 Take profit: 135.50 Sell: 135.45 Take profit: 134.55 The material has been provided by InstaForex Company - www.instaforex.com |

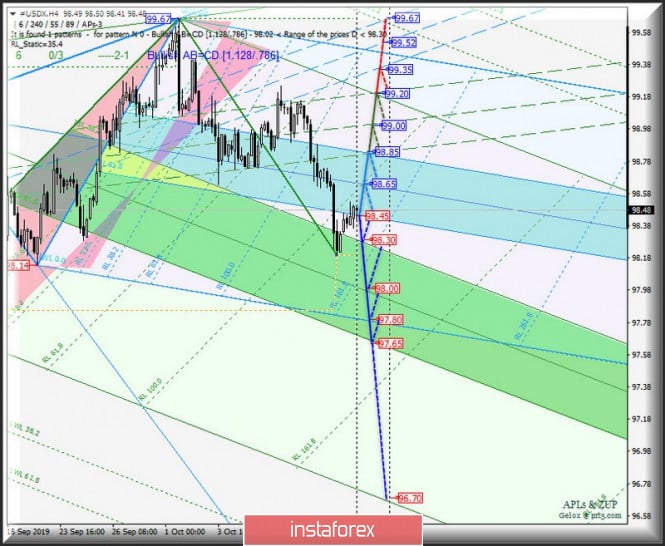

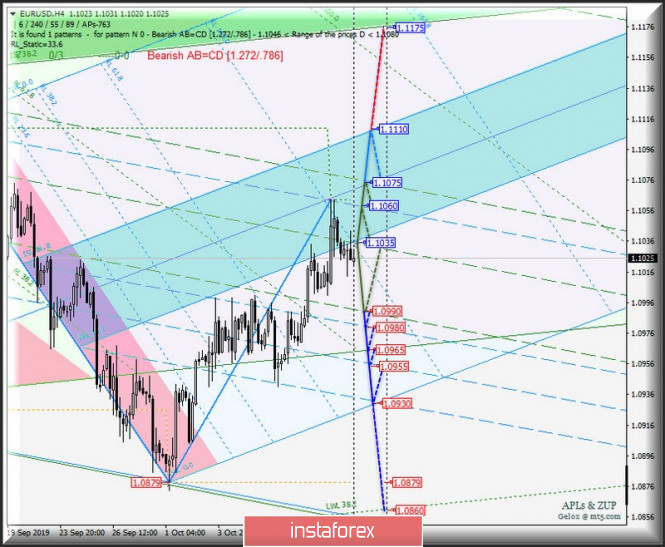

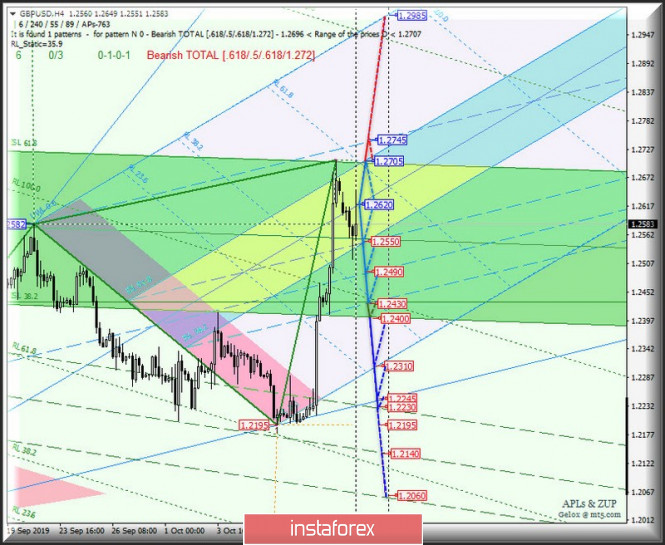

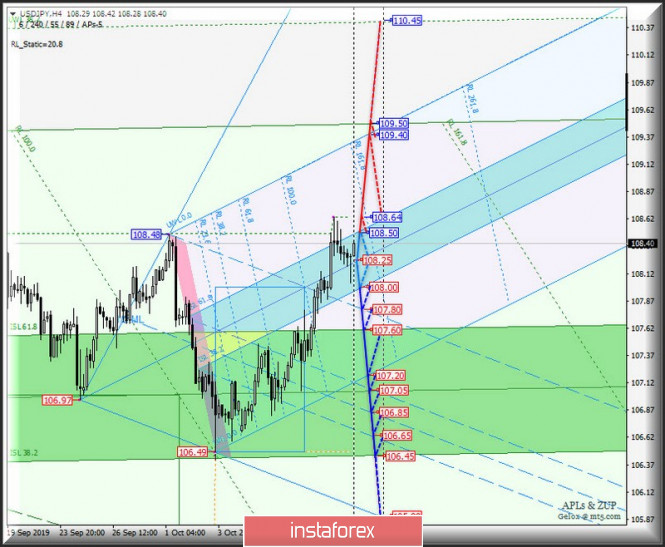

| Posted: 14 Oct 2019 05:23 PM PDT Waking in a dream and in reality - what will happen next to the development of the movement of currency instruments in #USDX, EUR / USD, GBP / USD and USD / JPY (H4) from October 15, 2019? - A comprehensive analysis of movement options. Minuette (H4 time frame) ____________________ US dollar Index The movement of #USDX from October 15, 2019 will continue to be determined by the development and the direction of the breakdown of the boundaries of the equilibrium zone (98.45 - 98.65 - 98.85) of the Minuette operational scale fork. The details are shown in the animated chart. The breakdown of the upper boundary of ISL38.2 (resistance level 98.85) of the Minuette operational scale fork will determine the development of the movement of the dollar index in the 1/2 channel Median Line (98.85 - 99.00 - 99.20) of the Minuette operational scale fork with the prospect of reaching the 1/2 Median Line Minuette channel (99.35 - 99.52 - 99.67). On the contrary, if the lower boundary of ISL61.8 (support level 98.45) is broken down, the equilibrium zone of the Minuette operational scale fork is the option of continuing the downward movement #USDX to the equilibrium zone (98.30 - 98.00 - 97.65) of the Minuette operational scale. The details of the movement of #USDX are presented in the animated chart. ____________________ Euro vs US dollar The single European currency will continue to develop movement within the 1/2 Median Line channel (1.1075 - 1.1035 - 1.0990) of the Minuette operational scale fork. The breakdown direction of which will determine the further development of the EUR / USD movement from October 15, 2019. The markup of movement inside the 1/2 Median Line channel are shown in the animated chart. The breakdown of the lower boundary of the 1/2 Median Line channel (support level 1.0990) of the Minuette operational scale fork - the development of the downward movement of the single European currency can be continued towards the goals - to the boundaries of the 1/2 Median Line channel (1.0980 - 1.0955 - 1.0930)of the Minuette operational scale fork with the prospect of reaching a minimum of 1.0879. On the contrary, the breakdown of the upper boundary of the 1/2 Median Line channel (resistance level 1.1075) of the Minuette operational scale fork will make it relevant to continue the development of the upward movement of EUR / USD to the targets - the upper boundary of the ISL61.8 (1.1110 - local maximum) equilibrium zone of the Minuette operational scale fork - the lower boundary of the ISL38.2 (1.1175) equilibrium zone of the Minuette operational scale fork. The movement details of EUR / USD are shown in the animated chart. ____________________ Great Britain Pound vs US Dollar The movement of Her Majesty's GBP / USD currency from October 15, 2019 will depend on the development and direction of the breakdown of the boundaries of the equilibrium zone (1.2550 - 1.2620 - 1.2705) of the Minuette operational scale fork. Look at the animated chart for details. . The breakdown of the lower boundary ISL38.2 (support level 1.2550) of the equilibrium zone of the Minuette operational scale fork - further development of the GBP / USD movement will begin to occur in the 1/2 Median Line Minuette channel (1.2550 - 1.2490 - 1.2430), and with a combined breakdown the lower boundary (1.2430) of this channel and the lower boundary of the ISL38.2 (1.2400) equilibrium zone of the Minuette operational scale fork - the downward movement of this currency instrument will be directed to the targets - the initial line SSL Minuette (1.2310) - the control line LTL Minuette (1.2245) with the prospect of reaching the 1/2 Median Line Minuette channel (1.2330 - 1.2140 - 1.2060). On the contrary, the breakdown of the upper boundary of ISL61.8 (resistance level 1.2750) of the equilibrium zone of the Minuette operational scale fork, followed by breakdown of the final Schiff Line Minuette (1.2745) determine the option of continuing the upward movement of Her Majesty's currency to the final line of the FSL Minuette (1.2985). The details of the GBP / USD movement can be seen in the animated chart. ____________________ US dollar vs Japanese yen As in the previous case, the movement of the USD / JPY currency of the country of the rising sun from October 15, 2019 will depend on the development and direction of the breakdown of the boundaries of the equilibrium zone (108.00 - 108.25 - 108.50) of the Minuette operational scale. The details are shown in the animated chart. The breakdown of the upper boundary of ISL61.8 (resistance level 108.50) of the equilibrium zone of the Minuette operational scale fork with the subsequent update of the local maximum (108.64) - continuation of the development of the upward movement USD / JPY to the final line of the FSL Minuette (109.40) and FSL Minuette (109.50) operational scale fork. On the contrary, the breakdown of the support level of 108.00 on the lower boundary of the equilibrium zone of the Minuette operational scale fork - the downward movement of the currency of the country of the rising sun can continue to the final Schiff Line Minuette (107.80) and the boundaries of the equilibrium zone (107.60 - 107.05 - 106.45) of the Minuette operating scale. We look at the details of the USD / JPY movement in the animated chart. ____________________ The review is made without taking into account the news background. Thus, the opening of trading sessions of the main financial centers does not serve as a guide to action (placing orders "sell" or "buy"). The formula for calculating the dollar index : USDX = 50.14348112 * USDEUR0.576 * USDJPY0.136 * USDGBP0.119 * USDCAD0.091 * USDSEK0.042 * USDCHF0.036. where the power coefficients correspond to the weights of the currencies in the basket: Euro - 57.6% ; Yen - 13.6% ; Pound Sterling - 11.9% ; Canadian dollar - 9.1%; Swedish Krona - 4.2%; Swiss franc - 3.6%. The first coefficient in the formula leads the index to 100 at the start date of the countdown - March 1973, when the main currencies began to be freely quoted relative to each other. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 14 Oct 2019 05:16 PM PDT Greetings, dear traders. This time, I will show you a long-term recommendation on an instrument such as USD / CAD. What is interesting in this instrument now? First of all, the data on unemployment from Canada came out last Friday. Typically, these reports come out simultaneously with American Non-farm (NFP), but this time, the publication was separate. With this impulse, the Canadian dollar strengthened strongly against the US dollar, completely absorbing the abnormal growth a week earlier. At the moment, this indicates a very strong seller in the market. Since the plan is long-term, its implementation can take from several days to several weeks. Thus, it makes sense to wait for a rollback and consider selling on smaller TFs. It's important to understand that a lot of data will be released on Wednesday, such as the base index of retail sales for the American dollar and inflation for the Canadian one. Moreover, regular oil reserves will also affect the Canadian dollar. What is more reasonable here would be to expect the continuation of decline precisely after the release of all these news on Wednesday. I wish you success in trading and big profits! The material has been provided by InstaForex Company - www.instaforex.com |

| QE program - a mine for the dollar and a chance for the euro? Posted: 14 Oct 2019 04:51 PM PDT At the end of last week, the market was excited by the decision of the US Federal Reserve. According to the regulator, from October 15, that is, from tomorrow, it will begin to buy short-term Treasury bonds worth $ 60 billion per month. Many experts believe that the implementation of this strategy will lead to a weakening of the US currency. The urgency of the situation is given by the statement of the Federal Reserve that this measure is not a quantitative easing program (QE). A number of analysts do not agree with this, since all signs point to the opposite. It is expected that operations will last until the end of the second quarter of 2020, and their total volume will be $ 510 billion. At the same time, the Fed intends to reinvest in treasury bonds the proceeds from mortgage-backed securities that it keeps on its balance sheet. According to experts, this will add an additional $ 20 billion per month to purchases. As a result, the following picture emerges: the regulator will monthly "pump" the market with liquidity of $ 80 billion, of which $ 60 billion is a direct cash issue. Experts call this process "patching the holes" liquidity. They are sure that the essence of this strategy is the launch of a printing press, since the market constantly needs a dollar supply. On the other hand, currency experts at Goldman Sachs, the largest bank, believe that in connection with the gigantic US government debt placements worth about a trillion dollars, an extension of QE should be expected annually. The repurchase of bonds may continue until at least the end of 2022, the bank said. According to experts, the actions of the Federal Reserve were aimed at weakening the American currency. Some analysts believe that the de facto regulator follows the wishes of U.S. President Donald Trump, who called on the Fed to devalue the national currency and lower interest rates to zero back in May 2019. Most currency strategists are confident that the Fed's current policy, which is similar to QE and is not considered to be such, carries significant risks for the US currency. Such a "non-QE" may become a time bomb for the US dollar, and the blast waves from this process will hurt the US economy, experts say. Although, there is an opposite opinion that the new QE can beneficially affect all financial assets. However, a strong dollar also carries risks for the global economy. First, in addition to the protracted US trade conflict with China, it threatens the development of a currency war with other states. Secondly, the further strengthening of the American currency provokes harsh criticism of the Fed from the administration of Donald Trump and undermines the confidence of the markets in the Central Bank. Thirdly, a strong dollar can destabilize emerging markets with large differences in exchange rates. After analyzing the current state of affairs, the Fed decided to take a course on the weakening of the national currency, analysts summarize. Many market participants are confident that the fall of the dollar will inevitably lead to the strengthening of other world currencies. Experts warn against this error, urging to carefully analyze the situation in the financial market. When considering the EUR / USD pair, it turns out that the weakening of the American currency does not always lead to a strengthening of the European one. For example, to further strengthen the euro, sustained growth in the European economy and a strong regulator position are required. However, a month ago, the ECB lowered the rate to a new historic low (-0.5%), while launching a quantitative easing program worth 20 billion euros per month. The problems of Europe are complicated by geopolitics, in particular the issue of the "hard" Brexit, which is becoming more and more real. This could hit both the British pound and the euro, analysts emphasize. Currently, experts recorded the strengthening of the "European" to a three-week high in the pair EUR / USD. This was facilitated by an increase in appetite for risky assets. At the moment, the pair is trading in the range of 1.1034–1.1036. An hour earlier, the values did not exceed 1.1020–1.1023. Experts are sure that the key level for the EUR / USD pair will be the value of 1.1050. The breakdown of this level suggests a further increase to 1.1160. Taking into account current factors, experts expect the EUR / USD pair to recover, where the euro plays the role of the "first violin". Another short-term goal after taking the level of 1.1160 may be a record level of 1.1300, analysts summarize. |

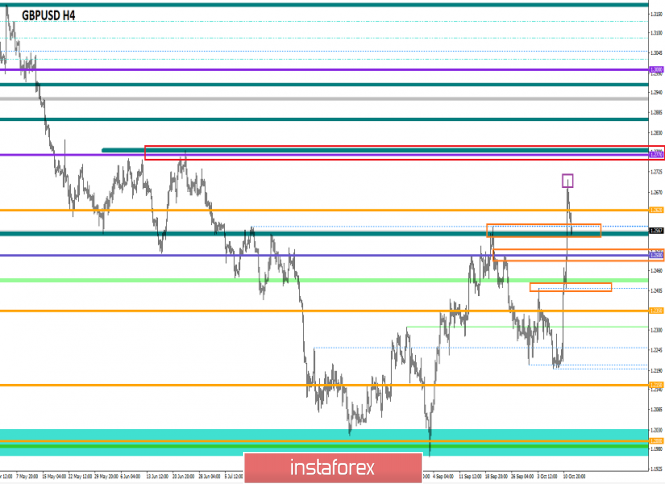

| Posted: 14 Oct 2019 04:31 PM PDT 4-hour timeframe Amplitude of the last 5 days (high-low): 49p - 107p - 93p - 264p - 298p. Average volatility over the past 5 days: 162p (high). If you do not know the fact that Queen Elizabeth II of Great Britain is very far from politics, as well as from the real approval or rejection of any political decisions of her government, then you might think that the fate of Brexit has already been decided. After all, the Queen of Great Britain herself at her 65th throne speech at the opening of the next session of the Parliament said that the priority is to leave the EU on October 31. However, during Boris Johnson's reign of the UK, traders have already figured out many political nuances and now many people already know that the Queen usually fulfills all the requests of her prime minister. It was at the request of the prime minister that the Queen approved the prorogation of the work of Parliament, which was later declared illegal by the Supreme Court. Thus, the fact that Queen Elizabeth II declared the priority of leaving the EU on October 31, in fact, does not mean anything. In addition, Elizabeth II noted that her government wants to build a new system of relations with the European Union, built on the principles of mutually beneficial cooperation and free trade. No new information regarding Brexit was received on Monday, October 14th. And this is alarming. Either the parties are working tirelessly on drafting a new deal and they do not have time to distribute interviews, or negotiations are no longer being conducted (or are being conducted for show), as the parties understand that in 4 days they will come to an agreement to which they could not reach in a few years, unrealistic. One way or another, but the EU summit will still be held on October 17-18, and in theory we are waiting for Boris Johnson to ask Brussels for another postponement. It is difficult to say how such a step would affect his political career. We have repeatedly listed all the defeats of Johnson as prime minister, but the list of his victories is short. Now, if Johnson asks to postpone Brexit, it will mean that his words "it is better to die in a ditch than to ask for a Brexit delay" were just words, and the prime minister does not value his own word too much. We also recall that in addition to colorful and artistic phrases and epithets, the prime minister has repeatedly stated that he will not ask the European Union to postpone Brexit. In the meantime, the pound began to adjust against a two-day rally up, during which it managed to rise by almost 5 cents. From our point of view, this growth was completely unjustified, but it already has a place to be, so now we are waiting for a downward correction to the Kijun-sen line, but we assume that under certain circumstances the pound may even continue to grow. These circumstances are very simple: the deal with the European Union until October 19, Parliament gives the go-ahead on October 19 and the UK leaves the EU according to a "soft" scenario on October 31. What is the probability of the execution of this option, you decide, dear traders. By the way, tomorrow, in the UK, quite important macroeconomic data on the average wage for August, as well as on the unemployment rate, will be published. However, we believe that traders will ignore these reports, as they are now completely and completely absorbed in the Brexit theme. Trading recommendations: The GBP/USD currency pair has started a downward correction. Thus, we recommend now to wait until the correction is completed in order to be able to resume trading on the rise, however, we warn that this week high pound/dollar volatility is possible, as well as sharp and frequent reversals. In addition to the technical picture, fundamental data and the time of their release should also be taken into account. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. October 14. Results of the day. Eurozone industrial production expectedly falls Posted: 14 Oct 2019 04:17 PM PDT 4-hour timeframe Amplitude of the last 5 days (high-low): 39p - 55p - 37p - 64p - 62p. Average volatility over the past 5 days: 51p (average). The first trading day of the week passed, as is often the case, in quiet corrective trading. The EUR/USD currency pair has been adjusting all day to the Kijun-sen critical line, which it has not yet worked out at the moment. Thus, the volatility on Monday, October 14, leaves much to be desired. On the other hand, what can traders expect on a day when no important macroeconomic publications were planned either in the US or in the European Union? A single report on industrial production in the eurozone in August showed an even greater drop in the indicator than was recorded months earlier and than predicted by the forecast values. -2.8% y/y. Strange, but in monthly terms, an increase of 0.4% was recorded. However, all traders are well aware that now industrial production in the EU is in decline. For several months now, absolutely failed indicators of business activity in the manufacturing sector have been indicating this. Thus, a reduction in industrial production was expected. Meanwhile, traders still need to resolve the question: is there any reason to continue buying the European currency? In recent weeks, the euro has slightly rebounded against the dollar, but we have repeatedly said that the fundamental reasons for this growth are not too many, and most of the fundamental factors came not from the EU, but from the United States. That is, the euro is growing on the negative from the United States, and not on the positive from Europe. From our point of view, there are no reasons for new purchases. We have several times listed the advantages of the US dollar over the euro and the US economy over the eurozone economy. Since then, nothing has changed in the balance of power. Latest news that the United States and China have advanced very much in the negotiations on a trade agreement are again playing for the US dollar. In theory, the end of the US-Chinese conflict will be in the hands of the US economy and, accordingly, the US dollar. And although traders did not particularly react to any news about the escalation of the Beijing-Washington conflict, any news that signifies a reconciliation of the parties will potentially have a positive impact on the desire of traders to invest in the dollar. Donald Trump will have to put pressure on the Federal Reserve and Jerome Powell again, since the US president does not have other methods of influencing the dollar. The national currency is indeed under the authority of the central bank, and it is most convenient for it to manage its course. It is this management that Trump needs in order to reduce the dollar exchange rate in the foreign exchange market as much as possible, so that American goods are more competitive in world markets, and it is easier for the United States themselves to service their huge public debt. Thus, we are waiting for new criticism against the Fed. The euro's chances for further growth lies in the Fed's rate cut. The technical picture continues to signal an upward trend. If the euro/dollar pair remains above the Kijun-sen line, then the upward movement will be able to resume tomorrow. Otherwise, traders will take a step towards the resumption of a downward trend. Trading recommendations: The EUR/USD pair began to adjust. Thus, it is recommended that traders now wait for the correction to complete and resume buying the euro with a target of 1.1080 if the pair remains above the critical line. It will be possible to return to US currency purchases in case of overcoming the Kijun-sen line with the first target of 1.0978. In addition to the technical picture, fundamental data and the time of their release should also be taken into account. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. Steep turns: the pound is too sensitive to rumors around Brexit Posted: 14 Oct 2019 03:46 PM PDT The pound continues to show fighting abilities: despite a significant decrease at the opening of the trading week, the sterling was able not only to regain lost positions, but also to update the daily high, returning to the framework of the 26th figure. The GBP/USD pair demonstrates strong volatility for the third day in a row, which is due to a contradictory fundamental background regarding the prospects of the "divorce proceedings" of Britain and the EU. Today's price fluctuations have served as an additional confirmation of one obvious fact: Brexit can instantly raise the British currency to multi-month highs and return it to the levels of multi-year lows with the same speed. Every day, the volatility of the pair will only increase: after all, in just a few days, a summit of the European Union countries will be held in Brussels, at which the fate of the historical transaction will be decided. In general, today's GBP/USD price fluctuations should be seen in the context of the events of the past week. Following talks between Boris Johnson and Leo Varadkar, the parties issued an unexpectedly optimistic statement. The Irish prime minister said that his British counterpart made him a "quite interesting proposal" that could lead to a deal before October 31. According to the British press, Johnson suggested that Varadkar conclude a truncated free trade deal, which, firstly, avoids the "hard" Brexit, and secondly, will become the basis for a wider agreement that can be concluded later, before the end of the transition period . At the moment, there are not enough details of the truncated deal. It is known that the proposed free trade agreement between Britain and the EU is likely to cancel all tariffs on imported and exported goods. At the same time, Johnson still insists on introducing a regime of "translucent" border in any of its execution (in particular, we are talking about customs checks). But apparently, these points of the deal belong to the category of to be discussed and adjusted. In other words, Johnson and Vardakar took a serious step towards resolving the main Brexit problem. For the first time in the entire negotiation process, the British initiative was supported by the Irish prime minister. If he becomes an ally of London at the EU summit, then the chances of concluding a deal (even if in a truncated version) will increase in many ways. But in any case, now the prospects of Brexit depend on the position of the leadership of the European Union and in the future - on the position of deputies of the British Parliament. After the first emotions came to naught, traders had quite reasonable doubts that these puzzles would eventually form a single picture. In particular, today Irish Foreign Minister Simon Coveney stated that, despite certain positive shifts, "the parties are still far from concluding a deal." Then there was information that the EU representatives had tightened their position in the negotiations: according to them, the EU now expects "more concessions along the Irish border," adding that the deal is unlikely to take place this week (the EU summit starts on October 17) . In addition, according to an insider from the Reuters news agency, the EU leadership doubts that Johnson is able to conduct a coordinated (updated) deal through the millstones of the House of Commons - at least in its current composition, where the prime minister does not have "his" majority. Actually, some members of the British Parliament have already expressed their skepticism regarding the prospects for approving the deal. In particular, the leader of the Democratic Unionist Party, Arlene Foster, said that her political force would not support proposals that would actually "trap" Northern Ireland into the trap of the European Union. According to her, Belfast should not remain within the framework of a single market or the customs union while the rest of the country leaves the regulatory orbit of the EU. In other words, the unionists, who in this composition of the British Parliament are temporary allies of the Conservatives, have already declared their negative position regarding the Johnson's deal. Representatives of several other political forces expressed a similar opinion - however, they expressed their personal opinion, and not the position of the represented parties. What, then, is the secret to the "stress resistance" of the British currency, if Johnson, in fact, can follow the path of Theresa May? In my opinion, this is due to several reasons. Firstly, the likelihood of the implementation of a hard Brexit has in any case decreased: even if deputies in the House of Commons fail the Johnson-proposed deal, the prime minister will most likely ask Brussels to postpone Brexit until the beginning of the year (whereas the EU has already expressed their willingness to postpone it until next summer ) Given the current ratings of Conservatives, Johnson may initiate early parliamentary elections by trying to form an independent majority in Parliament. In this case, the agreed draft deal will be agreed in the House of Commons without any problems. Theresa May once took a similar step, but was defeated: she not only did not strengthen her position in Parliament, but also lost the majority (after which the Conservatives entered into a forced alliance with the DUP). After the arrival of Johnson, Tory ratings went up, so the current prime minister can take advantage of this. In addition, the throne speech of Queen Elizabeth II provided some support for the pound. Opening a new session of Parliament today, she stated that the British government's priority is the implementation of Brexit by October 31 this year - "based on new partnerships based on the principles of free trade and good neighborly cooperation." Although the Cabinet of Ministers is preparing this speech, rhetoric in favor of "good neighborliness" provided additional support for the British currency. Thus, in the near future, the pound will be subject to increased volatility throughout the market, including paired with the dollar. It is difficult to predict the direction of price movement: everything will depend on the rhetoric of key political players in Britain. If the likelihood of a "soft" Brexit or prolongation of the negotiation process grows, the GBP/USD pair may jump to the next resistance level - 1.2850 (the upper line of the Bollinger Bands indicator on the weekly chart). Otherwise, the pair will return to the area of the 24th figure. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold is unlikely to "sit out" in a narrow range, hiding behind the safe haven status Posted: 14 Oct 2019 03:46 PM PDT As a rule, yellow precious metals rapidly rise in price during periods of increased market volatility. One such case occurred last week, when a 1.5% drop in US stock indices was accompanied by a 1% jump in gold. However, the cost of precious metals often returns to about the same levels from where it began to grow, as soon as the markets begin to discharge after periods of heightened fears. The status of a defensive asset implies the use of gold as a safe haven where investors can wait out the storm in the financial markets. At the same time, the precious metal reacts to the incoming information, sharply adding to the price on the same news about the escalation of trade tension and decreasing in response to an increase in the chances of a US-China trade deal. Gold is now trading near $1,500 per ounce, that is, quotes, having clearly lost their craving for growth, returned to where they were two months ago. According to analysts, this partly deprives gold of the status of a safe haven asset, completely giving it to the power of market storms. However, precious metals have significantly increased in price since the beginning of the year, and this is only partially due to trade conflicts. Gold is also aided in growing by the change in the direction of the monetary policy of leading central banks, and this relationship already puts precious metals on one side with the stock markets. Gold and the S&P 500 received an impressive boost for growth in June, when the Federal Reserve saw a reduction in interest rates. The easing of monetary policy increases the attractiveness of precious metals and stocks as opposed to debt markets, where rates in the summer reached multi-year lows. Another source of long-term growth for gold is the acceleration of inflation, which is a consequence of the policy of lowering interest rates. Inflation is undermining the purchasing power of the US dollar, which plays in favor of precious metals and stocks. It should be recalled that the large-scale rally of gold in recent years was associated not so much with the collapse of the markets of 2007–2008 as with the period of the end of 2008–2011. Then it became clear that the global financial system had survived, and the central banks managed to flood the "fire" with massive injections of liquidity. Precious metal has tripled in price over this time (to levels above $1,920). In the case of a repeat of this scenario, gold may well rise in price to $3,000 per ounce. However, the reverse side of this connection is the fact that precious metals are vulnerable to decline if global politicians are able to regain confidence in the markets. Then the issue of normalizing monetary policy may return to the agenda, and this could already result in a drop in quotations to the $1,300 area by the end of the first quarter of 2020. Thus, gold is unlikely to be able to "sit out" in a narrow trading range, hiding behind the status of a safe haven asset. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold is once again at around $1,500, but is unlikely to rise above Posted: 14 Oct 2019 03:46 PM PDT Gold rose at the beginning of the European session and is currently at the top of the daily trading range, around $1,495. After falling to the level of $1483 at the beginning of the new week, the precious metal managed to return to growth, due to which gold managed to rebound from weekly lows. The fact that the United States and China closed an interim trade deal on Friday had a big impact on investors' appetite for riskier assets, which ultimately led to the loss of safe haven assets, including gold. However, trade optimism quickly faded away, which instantly reflected on world markets. The rise in the value of gold is gaining momentum amid a recovery in demand for safe assets. A slight worsening of sentiment regarding global risk was enough, this was one of the key factors underlying the rise in prices for precious metals. Nevertheless, this jump did not have enough momentum amid strong growth in demand for the dollar, which tends to put pressure on goods denominated in dollars, such as gold. Now it remains to be seen whether gold can "develop" the received positive impulse or face some new resistance at higher levels amid the absence of other growth drivers. In any case, caution will not hurt in this situation, while you should refrain from any aggressive actions. The material has been provided by InstaForex Company - www.instaforex.com |

| Sisyphean task for the pound: rise vs fall Posted: 14 Oct 2019 03:46 PM PDT The efforts of the British currency to overcome price peaks, unfortunately, were in vain. The pound could not hold previously won positions and retreated to the lows. However, market participants do not lose hope for the restoration of sterling. At the end of last week, the British currency with truly English equanimity prepared a solid foundation for its strengthening. The reason for optimism was signals from Leo Varadkar, the Prime Minister of Ireland, regarding a possible agreement on Brexit. The market seized on this news as if drowning in a straw, evaluating the received signals as "promising". The misinterpretation was facilitated by the comments of Donald Tusk, head of the European Council, who also succumbed to general optimism regarding a possible "soft" Brexit. The start of the new week was disappointing to traders and investors, although it left a glimmer of hope. The pound, actively moving to the heights, was forced to interrupt the flight. Experts do not exclude that in the near future sterling will again begin to climb, but at the moment they record its retreat from the highs over the past three months. Having almost reached an impressive level of 1.2700 at the end of last week, the pound was exhausted by the beginning of this Monday. The reason for the next decline in the British currency was a slip in the negotiations on Britain's exit from the EU. The strategy of UK Prime Minister Boris Johnson in the euro bloc is considered unacceptable, despite the reaction of the Irish side. His proposal for a border with Ireland threatens the entire European market, Brussels said. The current situation put the pound on the bandwagon, bringing down its rate by about 0.7%. Earlier, at the end of last week, the pound rose in price against the US dollar by 3.8%, but the current situation has brought all of the pound's efforts into nothing. According to analysts at the leading Goldman Sachs bank, in the near future the British currency may strengthen from current levels by an additional 2.6%. Currently, the GBP/USD pair is trading in the range 1.2557–1.2559. Experts fear that the British pound might significantly tumble, while maintaining a weak hope for a solution to the situation. The lifeline for the pound, which at the moment was raising the GBP/USD pair to 1.2577–1.2579, could be the conclusion of a limited free trade agreement, which would help Britain leave the European Union without tough measures by October 31, 2019. Such an agreement would nullify all tariffs between the United Kingdom and the countries of the eurozone, although the question of the Irish border still remains open. Current problems can trigger a downward pound rally, which will be difficult to control, analysts conclude. |

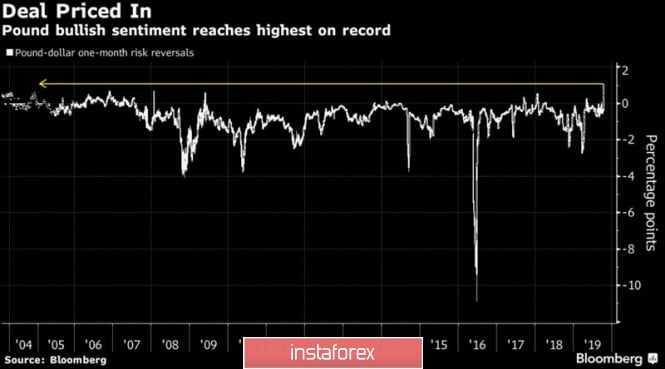

| Pound saw the light at the end of the tunnel Posted: 14 Oct 2019 03:46 PM PDT The British pound marked its best 2-day rally since 2009 after Michel Barnier announced the EU's return to divorce negotiations with Britain, and the meeting between the prime ministers of Great Britain and Ireland was very constructive. Boris Johnson is trying to pull the country out of the European Union on the falling flag. He wants the deal to be approved by Brussels at the summit on October 17-18. In this situation, the head of the Cabinet will have time for ratification by the Parliament. However, sterling fans have another option in stock: the EU can organize an extraordinary summit in the second half of the month to prevent a disorderly Brexit after October 31. The British prime minister must solve the seemingly impossible task: how to avoid the tight border between Ireland and Northern Ireland in the name of peace, and how to maintain the integrity of the single EU market for a deal with Brussels. At a meeting with his Irish counterpart, Johnson discussed how Northern Ireland should remain de facto in the customs area of the European Union and de jure beyond. Judging by the optimism of the official from Dublin, ways have been found. The dialogue was held behind closed doors, the details of the upcoming potential deal with Brussels were not disclosed, so the press dubbed the negotiations "tunnel". Judging by the rapid pound rally, the market believes that a disorderly Brexit can be avoided. Deutsche Bank, an ardent "bear" in sterling, has crossed over into the "bulls" camp and recommends buying the currency of Great Britain with a target of $1.3. Goldman Sachs and Mizuho Bank gave the same recommendation, and Credit Agricole believes that the London-Brussels deal will push GBP/USD to 1.35. The derivatives market is almost certain: the ratio of premiums on call and put options to the British pound (reversal risks) has never climbed as high as it is now. Pound reversal risk dynamics Thus, the policy continues to rule the ball in the market of currencies and other assets of Great Britain. The week of October 18 may be decisive for sterling, while few people remember that the British economic calendar is very saturated. Releases of data on the labor market, inflation and retail sales in any other situation would simply have to attract the attention of investors to GBP/USD, because the decisions of the Bank of England on the rate, as a rule, depend on the dynamics of the main macroeconomic indicators. This time, Mark Carney and his colleagues will act depending on how the situation with Brexit develops, and only then they will remember the state of the economy of Great Britain. No matter how bad it looks now, the agreement between London and Brussels will change everything for the better. And vice versa. Technically, after the clear implementation of the 5-0 pattern, when the rebound from the supports by 61.8% and 50% of the CD wave of the "Shark" model made it possible to form long positions on GBP/USD, the bulls managed to rewrite the September high and activate the AB = CD pattern . The probability of reaching its target by 161.8% is quite high. It corresponds to the mark of 1,275. The material has been provided by InstaForex Company - www.instaforex.com |

| The market is waiting for change, but so far has little faith in it Posted: 14 Oct 2019 03:46 PM PDT The market was enthusiastic about reports that the next round of trade negotiations between Washington and Beijing was a positive one and culminated in an interim agreement. However, soon euphoria gave way to cautious optimism, since the parties are still far from concluding a final agreement. China pledged to increase purchases of agricultural products from the United States to $50 billion. This is almost 2.5 times more than before the trade conflict between the two largest economies in the world. In turn, the White House has not yet begun to raise tariffs from 25% to 30% on Chinese goods worth $250 billion. Although Donald Trump failed to accelerate the US economy to the promised 3%, he is quite capable of improving the state of US foreign trade. The country's deficit in trade with China is gradually decreasing, and the growth of agricultural exports from the United States to China will only contribute to this. At the same time, about $360 billion of Chinese imports are still under US duties. Washington does not say anything about the cancellation of the planned increase in tariffs for goods from China worth $160 billion planned for December 15, as well as about the extension of the grace period for American sellers of components for the Chinese technological giant Huawei. However, Beijing managed to gain time. It will take at least several weeks to bring to mind the interim agreement signed in October. Focus will then shift to the meeting between Donald Trump and Xi Jinping on the sidelines of the APEC summit in Chile (November 16-17). And there and before the presidential elections of 2020 in the United States at hand. If they are won by a representative of the Democrats, then China's position could seriously change. Considering that Washington and Beijing concluded a truce in the trade war, there have been some shifts in the negotiations between Britain and the EU regarding Brexit, and the Fed announced the purchase of treasury bills by $60 billion per month until the end of the second quarter of next year to increase the balance, it would seem bulls on EUR/USD had to easily overcome the resistance levels at 1.1045 and 1.1065. However, this did not happen, which primarily indicates the internal weakness of the single European currency. Tomorrow, the IMF may publish disappointing forecasts for global GDP, and at the end of the week, China with upset weak data on the country's economic growth in the third quarter. In this case, the demand for defensive assets will increase, which will create serious difficulties for the continuation of the main currency pair's upward movement. Support for the "bulls" on EUR/USD can have positive news on Brexit and the disappointing release on US retail sales for September. GBP/USD was unable to develop last week's active growth and plunged to 1.2550 from the highest levels reached on Friday since late June. As it turned out, it's too early to rejoice at the successful completion of Brexit. Even if the UK Prime Minister Boris Johnson manages to agree on the conditions for the country to leave the alliance with the EU, the deal will still have to be approved by the local Parliament. Recall that the last four times rejected the "divorce" agreement proposed by the previous head of the British Cabinet Theresa May. Negotiations between Great Britain and Ireland have not yet ended. In addition, a summit of the European Council on Brexit will be held this week on Thursday and Friday. Each of these steps can slow down the process of concluding an agreement between London and Brussels or even become an insurmountable obstacle in its path. In this case, the EU can provide the UK with a new deferral of Brexit until the summer of 2020. While some analysts believe that the above difficulties can cause the pound to fall to $1.22, others expect it to strengthen to $1.28, believing that a major breakthrough in the Brexit negotiations, not to mention the signing of the agreement, will lead to pushing the British currency to cosmic heights. The material has been provided by InstaForex Company - www.instaforex.com |

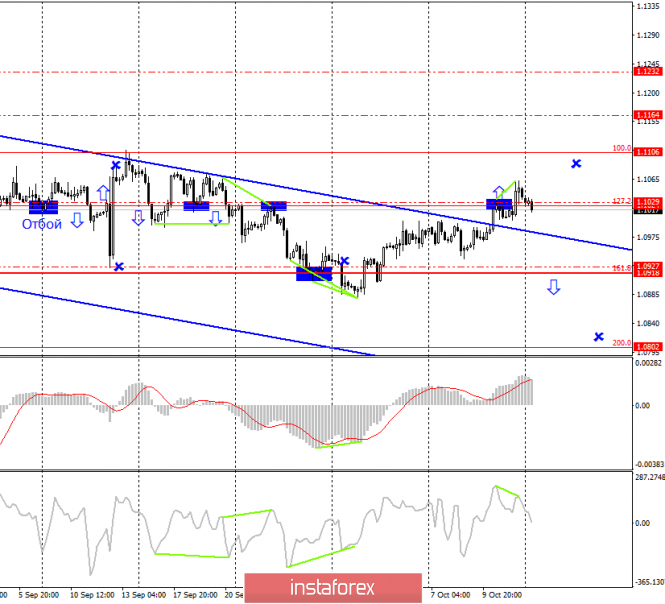

| Posted: 14 Oct 2019 09:41 AM PDT

Recent Descending-Tops were established around the price levels of 1.1060-1.1075 where the backside of a recently-broken trend was retested. Shortly-After, the EUR/USD has been trending-down within the depicted short-term bearish channel until recent signs of bullish recovery were demonstrated around 1.0880 (Inverted Head & Shoulders Pattern). Shortly After, a bullish breakout above 1.0960 confirmed the mentioned reversal Pattern which opened the way for further bullish advancement towards (1.1000 -1.1020) where another episode of bearish rejection was expected on October 7. That's why, initial Intraday bearish pullback was expected towards 1.0940-10915 where another bullish swing was initiated as expected. The intermediate-term outlook remains bullish as long as the EURUSD pair pursues its current movement above 1.0980 (recent ascending bottom). Moreover, the current bullish breakout above 1.1030 (0% Fibonacci Expansion) should be maintained. Thus, the short-term projection target remains projected towards 1.1065 and 1.1115. Bullish persistence above 1.1065 is mandatory to enhance further bullish movement towards 1.1115. Otherwise, sideway consolidations may be demonstrated until bullish breakout is achieved. Trade recommendations : Intraday BUY entry was suggested upon the recent bearish pullback towards 1.1000 (Backside of the broken bullish uptrend). It's already running in profits. Remaining T/P levels to be located at 1.1065 then 1.1115. S/L should be placed below 1.0960. The material has been provided by InstaForex Company - www.instaforex.com |

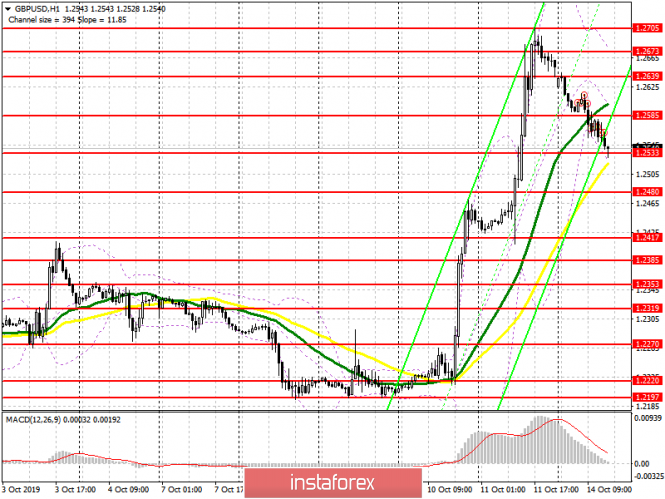

| October 14, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 14 Oct 2019 09:26 AM PDT

On September 20, Recent episode of bullish advancement was demonstrated towards 1.2550 where a short-term reversal channel was demonstrated. As anticipated, the reversal pattern was confirmed to the downside on September 23 demonstrating a successful bearish closure below 1.2450. On September 25, the depicted bullish channel was finally terminated with significant full-body bearish candlesticks which managed to achieve bearish closure below 1.2395. Bearish persistence below 1.2400-1.2440 (Reversal-Pattern Neckline) allowed more bearish decline to occur towards the price levels of 1.2210 where a recent Double-Bottom reversal pattern was originated with neckline located around 1.2400. Last week, the price zone of 1.2400-1.2415 (reversal pattern neckline) was breached to the upside allowing further bullish advancement to occur towards 1.2485, 1.2620 then 1.2680. Bullish breakout above 1.2680 was needed to bring further bullish advancement towards 1.2840 (1.61% Fibonacci Expansion). However, By the end of last week, signs of bearish rejection were demonstrated around 1.2680 (100% Fibonacci Expansion) That's why, sideway consolidations may be demonstrated between 1.2680-1.2620 until breakout occurs in either directions (More probably to the downside). Bearish closure below 1.2620 will probably bring further bearish decline towards 1.2470 and 1.2400 where bullish rejection and another long-term bullish swing should be expected. Trade Recommendations: Intraday traders are advised to wait for a bullish pullback towards 1.2680 for a valid SELL entry. T/P levels to be placed around 1.2620, 1.2550 and 1.2470 while S/L should be placed above 1.2720. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold 10.14.2019 - Sell zone on the Gold Posted: 14 Oct 2019 06:35 AM PDT Gold is still trading in the channel that we defined days ago. I still expect more downside and potential test of 1,460. Most recently, I found bearish flag in creation on the 4H time-frame.

Yellow rectangle – Important support level Down parallel line – Downward channel Purple falling line – Expected path Watch for potential selling opportunities if you see the breakout of the bear flag. MACD is still in the negative territory and there is potential for new momentum down on the oscillator. Selling opportunities are preferable with the target at 1.460. Resistance level is found at the price of 1.497. As long as the Gold is trading inside of the downward channel, I would watch for selling opportunities. The material has been provided by InstaForex Company - www.instaforex.com |

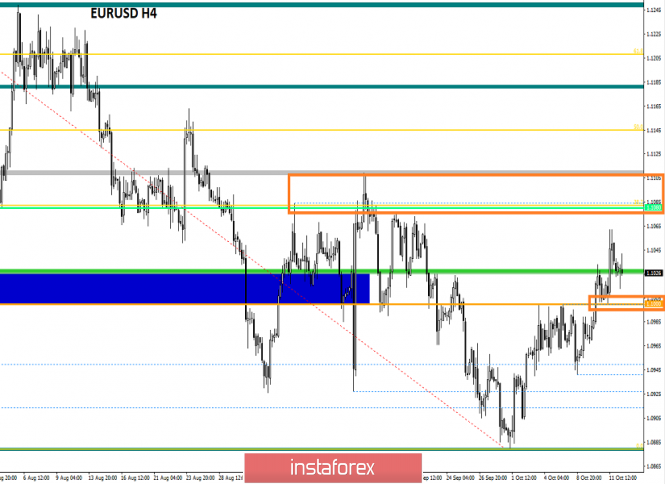

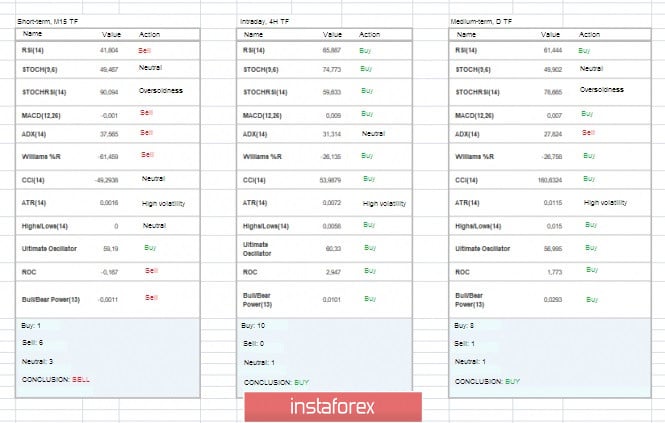

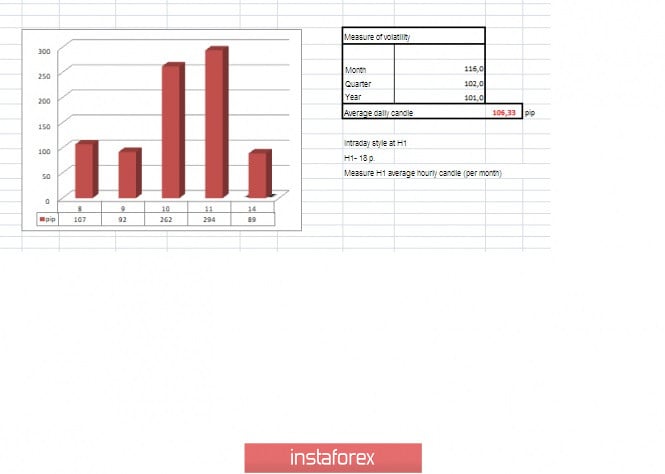

| Trading recommendations for the EURUSD currency pair – placement of trade orders (October 14) Posted: 14 Oct 2019 06:20 AM PDT At the end of the last trading week, the EUR/USD currency pair showed high volatility of 61 points, the quotation resumed the upward movement and followed towards the next control point. From technical analysis, we see that after the breakdown of the psychological level of 1.1000, the well-known trading pattern "Breakdown/Rollback" was formed, which in this case played 100%, forming a rebound from the level of 1.1000. We saw a momentum move, returning buyers to the market, where a little more – and the peak of the previous correction of 1.1109 would have been reached, which reflects a range level of 1.1080/1.1110. Analyzing the hourly Friday day, we see that the main movement came for the period 12:00-14:00 (time on the trading terminal), where the quote found a point of resistance in the face of the value of 1.1062 and then the recovery process began until the end of the day. As discussed in the previous review, traders were actively working on the purchase at the time of working out the pattern "Breakdown/Rollback", where, in principle, enough profit was taken, and waiting for further progress is extremely risky due to the location of key coordinates. Considering the trading chart in general terms (daily period), we see a real risk of the formation of the so-called oblong correction, if the range level (1.1080/1.1110), representing the peak of the previous correction, falls under the pressure of buyers. In the case of such a scenario, the main downward trend may be delayed for more than one month. Friday's news background had no worthwhile statistics on Europe and the United States, but no one was upset, as all attention was focused on the information background. The main event at the end of the week can rightly be called Brexit. The hope for a bright future in this protracted process was stirred by the statement that not all is lost and Britain and Ireland still have a solution. The pound flew first, and we described its results in a separate article. The euro, with a slight delay, also rushed up, not so actively, but nevertheless, the average daily indicator was broken. The incentive for further growth was the accompanying statement by the head of the European Council, Donald Tusk, who was optimistic about the negotiations and believes that there is still little chance of reaching an agreement between Britain and the EU. At this, the hysterical behavior of the market ends and a rollback occurs. During the partial recovery and the weekend, the information background did not stop and continued to produce quite interesting noises. The meeting of Brexit negotiators Michel Barnier (EU) and Steve Barclay (UK) ended, in principle, nothing. Barnier said that the British Prime Minister's proposal could jeopardize the European market, as it does not contain specifics. In turn, German Chancellor Angela Merkel believes that the EU and the UK are in a crucial phase of the exit process. At the same time, Merkel added that the French and German sides will once again agree on their positions on Brexit. Let's move a little away from the trailed Brexit process and take a look at the West, and so, there the Federal Reserve decided to launch a printing press with a monthly redemption of Treasury bonds worth $ 60 billion. About 510 billion dollars will be printed in such a maneuver, but the Fed does not consider this to be the launch of the new QE series. In turn, US President Donald Trump once again did not ignore the Fed, calling to lower the interest rate and noting that the economy is excellent. "The Fed should lower the rate regardless of how good the deal with China will be. We have a great economy, but we have the Fed, which does not keep up with the rest of the world. I think they should keep up with the rest of the world, despite the deal with China. The deal with China is much more important than the interest rate," Donald Trump spoke to reporters following two-day US-China talks. Today, in terms of the economic calendar, we had data on industrial production in Europe, where we were waiting for a deepening recession from -2.1% to -2.5%, and got an even worse picture, a decline to -2.8%. The reaction of the single currency to what is happening is surprisingly no, even a small local growth is possible on monthly data on industrial production volumes, which increased by 0.4%, but this is nothing compared to annual indicators. Further development Analyzing the current trading chart, we see a sluggish recovery process, where the quote froze in the area of 1.1030, forming versatile Doji candles. In turn, speculators are trying to work on the recovery stage, where the maximum target is the level of 1.1000. It is likely to assume that the fluctuation within the available values will remain, but if the recovery process continues, we may be lowered again to the psychological level of 1.1000. Further actions are already considered depending on the points of price-fixing. Based on the above information, we derive trading recommendations:

Indicator analysis Analyzing different sector timeframes (TF), we see that the indicators in the short term signal a recovery process, which cannot be said about the intraday and medium-term period, where the interest of recent impulses is maintained. Volatility per week / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year. (October 14 was built taking into account the time of publication of the article) The volatility of the current time is 29 points, which is quite small for this period. It is likely to assume that in the case of a slowdown within the available coordinates, volatility will remain within the daily average. Key levels Resistance zones: 1.1100**; 1.1180*; 1.1300**; 1.1450; 1.1550; 1.1650*; 1.1720**; 1.1850**; 1.2100 Support zones: 1.1000***; 1.0900/1.0950**; 1.0850**; 1.0500***; 1.0350**; 1.0000***. * Periodic level ** Range level *** Psychological level **** The article is based on the principle of conducting transactions, with daily adjustments. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD for October 14,2019 - Broken upward channel whithin larger upward channel Posted: 14 Oct 2019 06:19 AM PDT EUR/USD has been trading sideways at the price of 1.1025. I do expect downside and potential test of the support at 1.1007. Watch for potential selling opportunities.

Yellow rectangle – Important support levels Upper parallel line – Upward trend channels Purple falling line – Expected path I see that there is potential for down move and potential test of the 1.1000 level. The overall trend is still bullish but there is chance for downward correction first. Important resistance is set at the price of 1.1062. My advice is to watch for selling opportunities with the target 1.1000. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC 10.14.2019 - Sell zone for Bitcoin, bearish flag in play Posted: 14 Oct 2019 06:04 AM PDT BTC has been trading lower exactly what I expected last week. I still expect that BTC trades more downside towards our down targets at 8,052 and 7,742.

Red rectangle – Important resistance levels Green rectangle – Important support and objective Purple falling line – Expected path I see that watching the larger structure, BTC potentially finished ABC expanded flat upward correction. I found series of the lower lows and lower highs in recent 2 days, which his sign that sellers are in control. Important support levels are set at 8,052 and 7,742. Resistance levels is found at 8,362. The material has been provided by InstaForex Company - www.instaforex.com |

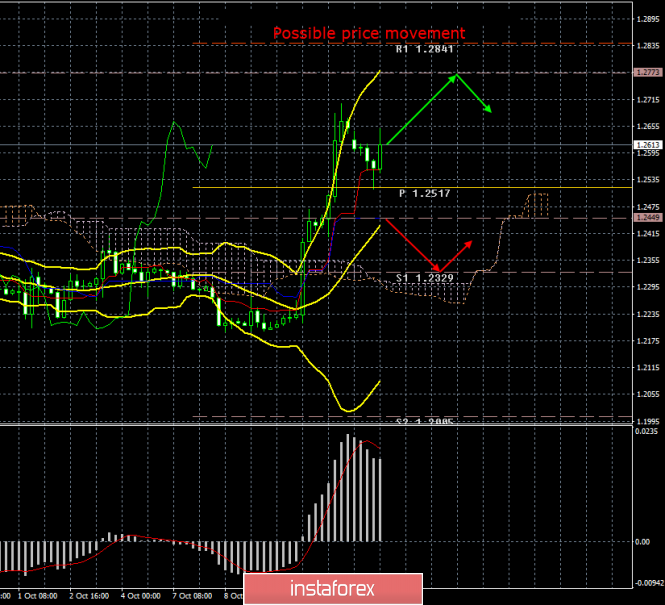

| Posted: 14 Oct 2019 05:47 AM PDT To open long positions on GBP/USD, you need: Almost half of Friday's growth of the pound is already blocked by a downward correction. However, it is too early for buyers to worry. On the contrary, if we take a large two-day growth of the pair, the first real support is now seen in the area of 1.2530, just below which there is another good level of 1.2480, from where you can open long positions immediately on the rebound. Another task for the bulls will be the return of GBP/USD to the resistance of 1.2585, consolidation above which can lead to stronger demand and further growth of the pair to the highs of 1.2639 and 1.2673, where I recommend taking the profits. However, given that today is Columbus Day in the US and many markets are closed, volatility is unlikely to be high. To open short positions on GBP/USD, you need: I do not recommend selling the pound at current levels. The optimal scenario will be a re-return and update of resistance in the area of 1.2639 and 1.2673, where you can see the first short positions. However, the more important task of the bears will be to break the support of 1.2530 and close the day below this level, which should push the pair to a minimum of 1.2480, where I recommend taking the profits. Any positive news related to Brexit will immediately bring back new buyers of the pound, so do not forget about stop orders in such a volatile market. Indicator signals: Moving Averages Trading is conducted around the 30 and 50 daily averages, which indicates the possible completion of a downward correction in the pound. Bollinger Bands The pound is supported by the lower border of the indicator in the area of 1.2520, but the growth in the second half of the day will be limited to the average level in the area of 1.2590.

Description of indicators

|

| Posted: 14 Oct 2019 05:36 AM PDT To open long positions on EURUSD, you need: From a technical point of view, the situation has not changed compared to the morning forecast after a failed attempt to increase the euro on the background of a good report on the volume of industrial production in the eurozone. Today is Columbus Day in the US, so volatility will be very low in the afternoon. It is best to open long positions in EUR/USD after a downward correction to the support of 1.1008, or immediately on the rebound from the larger minimum of 1.0975. However, the main task of the bulls will be to return to the resistance of 1.1033, which was not possible to do in the first half of the day. Only above this level, the bulls will try to update the highs of last week in the area of 1.1061, where I recommend taking the profit. However, given the day off in many markets, it is possible to trade around the level of 1.1033. To open short positions on EURUSD, you need: The main task of the bears will be the return of EUR/USD to the support of 1.1008 and the breakdown of this level, which will provide the euro with new pressure that can push it to a minimum of 1.0975, where I recommend taking the profits. In the first half of the day, an unsuccessful consolidation above the resistance of 1.1033, after the release of a good report on industrial production in the eurozone, returned sellers to the market, which are now aimed at a minimum of 1.0975. If the bulls try again to regain the level of 1.1033, it is possible to open short positions immediately on the rebound from the maximum of 1.1061, but the direction in the pair will depend on further negotiations between the US and China. Indicator signals: Moving Averages Trading is conducted around 30 and 50 moving averages, which indicates further market uncertainty. Bollinger Bands In the case of a decline in the euro, support will be provided by the lower line of the indicator in the area of 1.1015, and sales are best viewed after the upper boundary test in the area of 1.1050.

Description of indicators

|

| Posted: 14 Oct 2019 04:27 AM PDT Good afternoon, dear traders! I present to your attention a trading idea for gold. At the last review on Friday, I recommended careful buying on the false breakdown of 1485 and further track the dynamics of the US session. As you can see, the Americans closed higher. This pattern is called a V-shaped buy-off and is a standard model in the world of trading. The market reaction to this buy-off also showed a positive direction in the European session. Now, it remains to wait for confirmation in the market, and if the opportunity presents itself – to continue to gain a logical position with a great goal and profit-taking at the level of 1519. The fundamental background is also favorable – the probability of lowering the interest rate on the USD is growing every day, and in this case, work on the weakening of the dollar in gold – as they say. Good luck with trading and see you at the evening review! The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of EUR/USD for October 14, 2019 Posted: 14 Oct 2019 03:48 AM PDT |

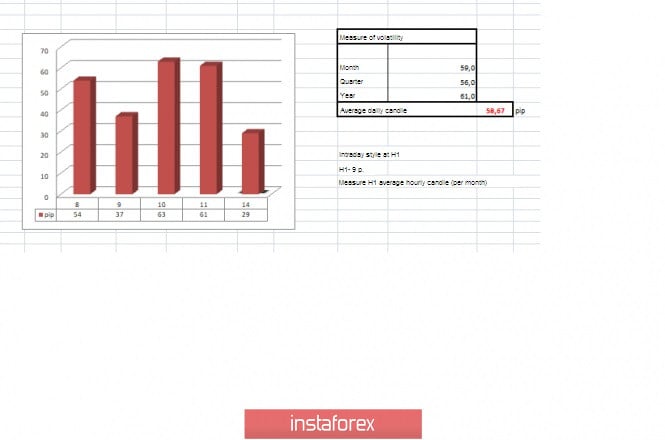

| Trading recommendations for the GBPUSD currency pair – placement of trade orders (October 14) Posted: 14 Oct 2019 03:29 AM PDT By the end of the last trading week, the pound/dollar currency pair showed even greater volatility of 294 points than the day before, resulting in an almost vertical movement. From technical analysis, we see a stunning upward move, where on average for two trading days, the quote flew almost 500 points. All the price levels on the way fell, including the correction peak of 1.2580. Parsing hourly Friday, we see that the inertial course came in the period 11:00 – 17:00 (time on the trading terminal), where all the movement of the day (294 points) was created. After that, there was a partial recovery process in the form of a small rollback of 66 points. As discussed in the previous review, speculators could not get enough of such an intensive course for the second day in a row, where one of the most difficult tasks was in terms of fixing previously received profits. The expected resistance levels broke through under the onslaught of the inertial move, where most traders switched to the sliding stop method. Considering the trading chart in general terms (daily period), we see that the height of the oblong correction is even greater, having from the pivot point (1.1957), already more than 700 points. The quote reached the second correction in order (1.2770 – 25.06.19), wherein the case of a move higher, the conversation could have started about a trend change, but this did not happen and the quotation started a reversal in advance. In the analysis of price behavior, it is worth taking into account such a moment that the past two days were strongly prone to panic on the background of the information flow, which in some sense could locally make a failure in the clock process of the trend. Friday's news background did not include statistics on the UK and the United States, and they were not needed when there was such a strong information background. So what led the quote to such a strong upward move? I hope for a bright future. The main round of hope was born on Thursday, when at the meeting of the two leaders of Britain and Ireland, hopes of agreeing appeared. At this stage, the pound began its growth, and it is more on the emotions, but on Friday began to receive subsequent hopes. The head of the European Council Donald Tusk noted positive signals from Irish Prime Minister Leo Varadkar, against this background, the pound accelerated even more. Then came the more technical pullback as this information background is not over. Protracted negotiations between Brexit envoys Michel Barnier and Steve Barclay, in principle, have not yielded results, the EU side said that the latest proposals of Johnson could jeopardize the European market, as they do not have specifics. In turn, British Prime Minister Boris Johnson during a government meeting on Sunday expressed hope for a deal with the European Union in the deadline set for October 31. Simultaneously with Johnson, there was news from Europe, where German Chancellor Angela Merkel during talks with French President Emmanuel Macron said: "We are in a decisive phase in the issue of Britain's exit from the European Union." At the same time, politicians stressed that Germany and France have yet to agree on their positions. That's the stormy background that kept us going last week, but I think that's just the beginning. Today, in terms of the economic calendar, we do not have statistics, and in the United States, the day off. In terms of information background, further outbursts regarding Brexit are possible, also today Queen Elizabeth II will open a new session of the British Parliament with a throne speech. Further development Analyzing the current trading chart, we see that the market is sluggish but still started the recovery process, going down just below the maximum of 1.2580. We see a significant overheating of long positions, which occurred due to the surge of Thursday and Friday last week. Technical correction/rollback/recovery, in this case, is necessary, unless, of course, a massive information background comes again. Detailing the beginning of the day hourly, we see that it all started with a small gap, after which a gradual downward course began, without sharp fluctuations. In turn, speculators rolled so hard on these impulses that even sitting on the fence, in this case, is a good task, but not for everyone. The recovery process was expected by many, and, obviously, it can be earned, since the recovery in the area of 35%-50% relative to the two-day momentum is a frequent picture in this scenario. It is likely to assume that in this case the first pivot point has already been reached, it is a peak of 1.2580, at this stage, there will be a statement of the price, perhaps in the form of a small stagnation. After that, it is worth watching the behavior of the quote and fixing points, as further recovery is possible in the direction of 1.2500 – 1.2450. Based on the above information, we concretize trading recommendations:

Indicator analysis Analyzing different sector timeframes (TF), we see that indicators in the intraday and medium-term areas signal purchases due to the earlier inertial course. The short-term gap signals a recovery process that is happening at the moment. Volatility per week / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year. (October 14 was built taking into account the time of publication of the article) The volatility of the current time is 89 points, which is already quite good for this period. It is likely to assume that in the event of a continuation of the recovery process and a drop of background and emotions, volatility may continue to rise. Key levels Resistance zones: 1.2620; 1.2770**; 1.2880 (1.2865 – 1.2880)**. Support zones: 1.2580*; 1.2500**; 1.2350**; 1.2205(+/-10p.)*; 1.2150**; 1.2000***; 1.1700; 1.1475**. * Periodic level ** Range level *** The article is based on the principle of conducting transactions, with daily adjustments. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading strategy for EUR/USD on October 14th. US-China talks. What do they give the US dollar? Posted: 14 Oct 2019 02:17 AM PDT EUR/USD – 4H.