Forex analysis review |

- October 18, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- October 18, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- BTC 10.18.2019 -Sellers in control, downward target set at 7.738

- GBP/USD 10.18.2019 - Rising wedge in creation

- EUR/USD for October 18,2019 - Resistance on the test, upward target reached

- The dollar continues to disappoint statistics from the US, the euro welcomes the Brexit agreement

- Trading recommendations for the EURUSD currency pair – prospects for further movement

- USD/CAD - take profits!

- GBP/USD. What has changed in the Brexit agreement?

- GBP/USD: plan for the American session on October 18th. The bulls returned to the level of 1.2916, but further movement depends

- EUR/USD: plan for the American session on October 18th. A false breakdown in the area of 1.123 will allow us to count on

- Trading strategy for EUR/USD on October 18th. The euro is in the shadow of Brexit and enjoys the opportunity provided

- Trading strategy for GBP/USD on October 18th. A meaningless agreement between Johnson and Juncker on Brexit

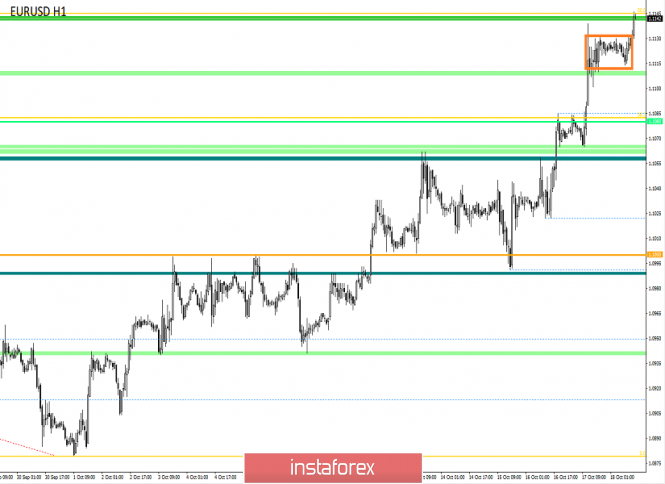

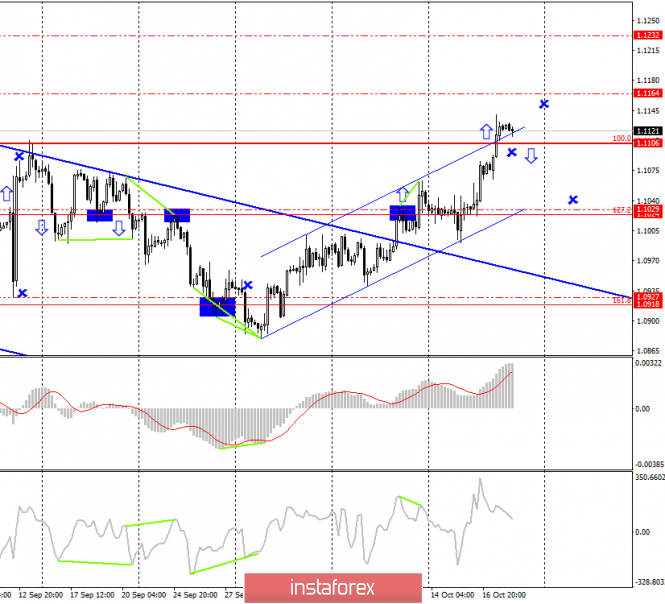

| October 18, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 18 Oct 2019 10:19 AM PDT

Since September 13, the EUR/USD has been trending-down within the depicted short-term bearish channel until signs of trend reversal were demonstrated around 1.0880 (Inverted Head & Shoulders Pattern). Shortly After, a bullish breakout above 1.0940 confirmed the mentioned reversal Pattern which opened the way for further bullish advancement towards (1.1000 -1.1020) maintaining bullish movement above the recent bullish trend. Temporary bearish rejection and a sideway consolidation Range were demonstrated after hitting the price zone of (1.1000 -1.1020) on October 7. That's why, initial Intraday bearish pullback was demonstrated towards 1.0940-10915 where another bullish swing was initiated. The intermediate-term outlook remains bullish as long as the EUR/USD pair pursues its current movement above 1.0980 (Last Prominent Bottom). Moreover, the current bullish breakout above 1.1120 (100% Fibonacci Expansion) should be maintained on a daily basis to ensure further bullish advancement towards 1.1175 and 1.1195. Otherwise, any bearish closure below 1.1120 brings sideway consolidations even a bearish pullback towards 1.1065. Trade recommendations : Recent Intraday BUY entry was suggested around the price levels of 1.1000 (the depicted short-term bullish uptrend). All T/P levels were successfully reached. Another valid BUY entry can be offered upon any bearish pullback towards 1.1065 where the depicted recent uptrend comes to meet the pair. T/P levels to be located at 1.1120 then 1.1175. S/L should be placed below 1.1020. The material has been provided by InstaForex Company - www.instaforex.com |

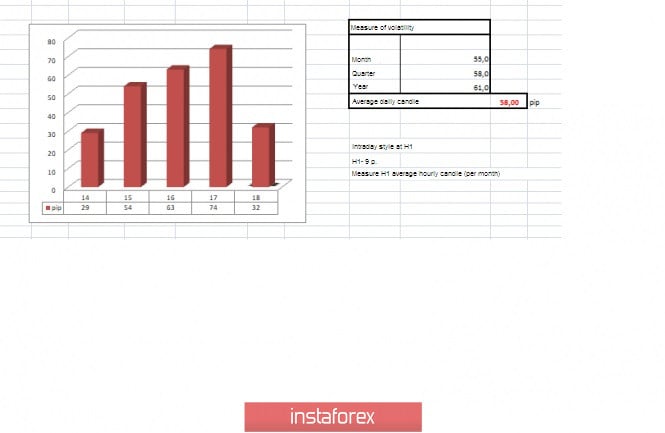

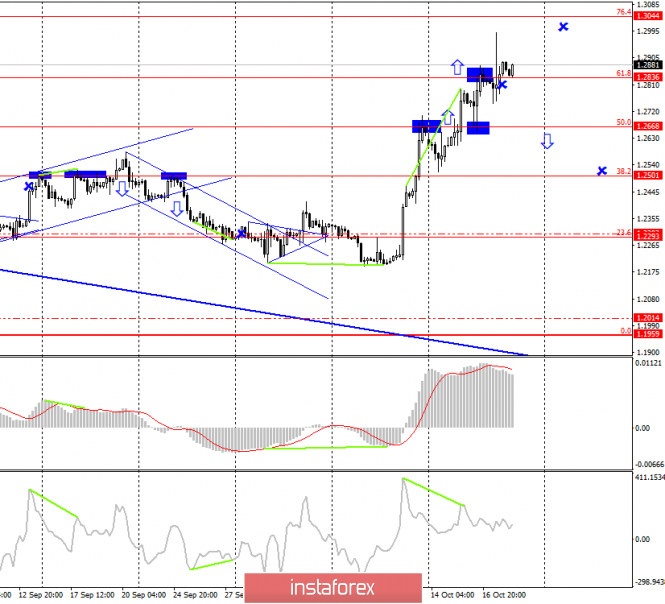

| October 18, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 18 Oct 2019 08:46 AM PDT

On September 12, another episode of bullish advancement was expressed inside the depicted bullish channel towards 1.2550 where a short-term Wedge-Pattern was demonstrated. The reversal wedge-pattern was confirmed to the downside on September 23 demonstrating a successful bearish closure below 1.2450. On September 25, the depicted bullish channel was invalidated as well with significant full-body bearish candlesticks which managed to achieve bearish closure below 1.2400. Bearish persistence below 1.2400-1.2440 (Reversal-Pattern Neckline) allowed more bearish decline to occur towards the price levels of 1.2210 where a recent Double-Bottom reversal pattern was originated with neckline located around 1.2400. Last week, the price zone of 1.2400-1.2415 (double-bottom pattern neckline) was breached to the upside allowing further bullish advancement to occur towards 1.2680 then 1.2846 where 161% Fibonacci Expansion level is located. However, This week, signs of bearish rejection are being demonstrated around 1.2850-1.2900 (upper limit of the depicted movement channel) where the GBP/USD pair is failing to achieve a successful bullish breakout outside the channel. That's why, sideway consolidations are expected to be demonstrated around the current price levels down to 1.2680-1.2620 until breakout occurs in either directions (More probably to the downside). Initially, Bearish persistence below 1.2850 is needed to bring further bearish decline towards 1.2680-1.2620 where the lower limit of the current bullish movement comes to meet the pair. Trade Recommendations: Intraday traders are advised to wait for a bearish breakout below 1.2780 (Intraday Key-Level) for a valid SELL entry. T/P levels to be placed around 1.2680 and 1.2620 while S/L should be placed above 1.2920. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC 10.18.2019 -Sellers in control, downward target set at 7.738 Posted: 18 Oct 2019 07:07 AM PDT BTC has been trading exactly what I expected yesterday. The price did test the level of 1.779 and almost reached our target. Anyway, due to strong drop in the background, there is still chance for more downside.

Green rectangles – Support levels Purple rising lines – Broken bearish flag Falling purple line – Expected path .My advice is to watch for selling opportunities on the rallies with the downward target at the price of 7.738. MACD is still in negative territory below the zero, which is good sign that sellers are in control. The potential breakout of support at 7.700 may lead us for potential test of 7.745. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD 10.18.2019 - Rising wedge in creation Posted: 18 Oct 2019 06:53 AM PDT GBP/USD has been trading sideways at the price of 1.2870. Rising wedge is in creation and there be huge down move in case of the down break. Be very careful with carrying any position over the weakened due to important meeting about Brexit on October 19.

Orange rectangles – Important support levels (swing lows) Purple rising lines – Rising wedge pattern in creation Falling purple line – Expected path .GBP seems very tired near the 1.2900 level and there is a chance for the down breakout of the rising wedge pattern, which may signal strong downward wave. The support levels are set at 1.2795, 1.2705 and 1.2540. Resistance levels are set at 1.2900 and 1.3000. Watch for potential down breakout of the rising wedge. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD for October 18,2019 - Resistance on the test, upward target reached Posted: 18 Oct 2019 06:36 AM PDT EUR/USD has been trading upwards exactly what I expected yesterday. My first upward target at the price of 1.1160 has been met. There is still overall upward trend and you should still watch for buying opportunities on the dips.

Orange rectangles – Important resistance levels Purple falling lines – Broken falling wedge pattern Resistance is on the test at 1.1160 and you should watch careful the potential reaction there. There is a chance today that price can do sideways and potential downward. The level of 1.1115 is the support and the current day low. In case of the strong upward breakout of 1.1160, watch for next upward target at 1.1240. The material has been provided by InstaForex Company - www.instaforex.com |

| The dollar continues to disappoint statistics from the US, the euro welcomes the Brexit agreement Posted: 18 Oct 2019 06:04 AM PDT

After it became known that London and Brussels agreed on Brexit, not only the pound came into motion. As the whole of Europe could suffer in the event of Foggy Albion's disorderly exit from the alliance, the euro also received support. Thanks to the improvement of the political landscape in the United Kingdom, the EUR/USD was able to gain a foothold above 1.11. In January-September, the euro fell against the US dollar by more than 5% amid a slowdown in the eurozone economy, the reasons for which lie in trade conflicts and Brexit. The divorce process is expensive for the UK, however, the EU also feels pain from the disruption of economic relations. Germany is on the verge of recession, and the government is not tired of reducing the growth forecasts of national GDP. It is expected that in 2020, the indicator will increase not by 1.5%, but by 1%. Due to the high share of exports in GDP, the eurozone is among the regions most affected by trade wars. The reduction of external demand primarily from China worsens the position of export-oriented European companies. In this regard, the news about the slowdown of the Chinese economy to 6% in the third quarter (the worst indicator in the last three decades) is negative for the euro. At the same time, in September, Chinese retail sales and industrial production were pleased, and progress in trade negotiations between Washington and Beijing gives hope for a settlement of disputes. Due to the weakening of political and trade risks in Europe, Asia, and America, the bulls on the euro received a green light. At the same time, investors continue to get rid of the dollar due to disappointing statistics in the United States. In September, US industrial production in annual terms for the first time since 2016 went into negative territory, which increases the chances of easing the monetary policy of the Federal Reserve in October. It is noteworthy that interest in the options of the Chicago Mercantile Exchange (CME), which suggests a reduction in the Fed interest rate to zero and lower by the end of 2021 – 2022, is constantly growing. Since September last year, the number of such contracts has increased from 132 thousand to 1200 thousand. If the British Parliament approves the draft agreement with the EU on Brexit, the EUR/USD pair can easily reach the area of 1.117 – 1.119. Otherwise, we expect a rollback to 1.1110. The material has been provided by InstaForex Company - www.instaforex.com |

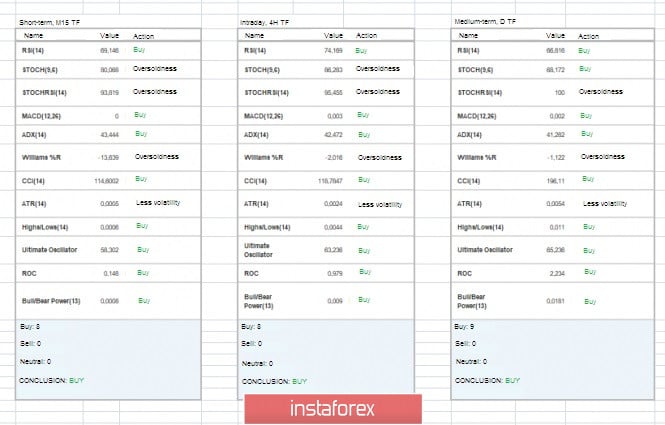

| Trading recommendations for the EURUSD currency pair – prospects for further movement Posted: 18 Oct 2019 06:04 AM PDT The euro/dollar currency pair in the euphoric stage has drawn an impulse upward move, having 74 points of volatility at the end of the trading day, which is good news. From technical analysis, we see an intensive upward move, where the quote is not just in the correction stage, but already has an oblong status. The inertial movement led to the fact that the quotation managed to overcome the second-order correction, rising to the level of 1.1140 and turning a blind eye to the characteristic overbought. We see a light version of the dynamics of the GBPUSD currency pair, where the upward move was expressed in the size of 1000 points, thus the emotional component of market participants reached the single currency. Analyzing the past day hourly, we see that the sluggish accumulation in the range of 1.1065/1.1085 led to a clear regrouping of trading forces and already in the period of 10:00 – 12:00 hours (time on the trading terminal), there was a surge in the price of 74 points. The subsequent development was in a sluggish lateral oscillation, with an amplitude of just over 15 points. As discussed in the previous review, speculators all won in terms of profitability. The entry into long positions from 1.1065 (16.10.19) and topping up from 1.1090 (17.10.19) made it possible to form such a profitable position that the exit is not even at the top, it could please even the most fastidious trader. Looking at the trading chart in general terms (daily period), we see that the 1.0879 quotes managed to bounce off by more than 250 points from the fulcrum, eventually having a phase of oblong correction and pulling the quote into a long wandering process. So, is it worth discussing a trend change already? I believe that no since in global terms a year and a half – the change is insignificant. The news background of the past day had a package of data on the United States. In the construction sector, we saw an amazing picture in terms of decline. The number of new buildings decreased by 9.4% with the forecast of -8.4%, but the number of building permits pleased with some space data: they predicted a decline of 26%, as a result of the decline was 2.7%. In turn, the number of repeated applications for unemployment benefits is reduced by 10 thousand, and primary applications are growing by 4 thousand. The point in terms of state statistics is industrial production, where there is a 0.1% decline. Frankly speaking, the data on the United States of America is very bad, but in the current development of the quote, the news background played a secondary role. What happened in terms of background information? Brexit happened in European. The EU summit on the first day of its beginning blessed the previously worked out agreement on Britain's exit from the European Union. In this case, we are talking about an addition to the agreement, but concerning the vital document "Back-stop" – the border on the island of Ireland, divided between the EU, the Republic of Ireland and the part of the United Kingdom, Northern Ireland. The solution was to prevent the island from having a physical border. On such a positive outcome, comments of high-ranking EU members rained down, which, from a positive point of view, appreciated the existing result. Digest from comments: • "We have a deal. This means that a new extension of Brexit will not be required in any form. This agreement creates confidence where Brexit creates uncertainty and instability. Of course, now the EU and the UK parliaments must approve this document," – European Commission President Jean-Claude Juncker. • "The document that we have is a compromise on all sides, which, however, can be supported on our part because it implements important conditions, primarily the integrity of the EU internal market, as well as the fact that the Irish Prime Minister for its part, an uncertain compromise was made, thanks to which Ireland can guarantee its interests and at the same time implement and maintain the Good Friday Agreement, that is, there will be no control on the border between Northern Ireland and the Republic of Ireland," – German Chancellor Angela Merkel • "I am satisfied that we were able to find an agreement," – French President Emmanuel Macron • "The European Council approved it, and it looks like we are close to the last part of the path," – European Council President Donald Tusk =========== The result of the immense information noise is already known to us, a single currency rushed into the upward procession. =========== Today, in terms of the economic calendar, we do not have any statistics on Europe and the United States, thus close attention will be paid to the information background and possible comments of politicians. I remind you that an emergency meeting will be held tomorrow in the British Parliament, where the Brexit issue will be resolved in terms of approval or rejection of an agreement. Thus, Monday can begin with colorful impulse steps and naturally the gap. The upcoming trading week in terms of the economic calendar begins rather boring, but by the end of the week, that is, from Thursday, a revival is expected. Of the most remarkable, we have a meeting of the ECB followed by a press conference, where Mario Draghi will hold his last meeting. In terms of informational background, I do not exclude that pressure on the currency market will continue. The most interesting events displayed below: On Tuesday, October 22nd USA 15:00 London time – Sales in the secondary housing market (September): Prev 5.49M – Forecast 5.45M On Thursday, October 24th 09:30 London time – German Manufacturing PMI (Oct): Prev 41.7 – Forecast 44.0 EU 09:30 London time – Markit Composite Business Activity Index (PMI) (Oct): Prev 50.1 – Forecast 51.9 EU 12:45 London time – The ECB meeting EU 13:30 London time – Press conference of the ECB USA 13:30 London time – Orders for durable goods (Sep): Prev 0.2% – Forecast -1.0% USA 13:30 London time – Applications for unemployment benefits, primary and repeated US 15:00 London time – New Home Sales (Sep): Prev 713K – Forecast 691K Further development Analyzing the current trading chart, we see a characteristic stagnation in the form of accumulation of 1.1110/1.1130, which led to a clear regrouping of trading forces, as the fact of border breaks. By detailing the hourly available day, we see that the surge came at the start of the European session, which to this day remains on the market. In turn, speculators, having rested and fixed on the accumulation point, returned to the market again, just working on the breakdown of the boundaries of 1.1110/1.1130, locally having another long position. It is likely to assume that the variable upward interest will remain in the market, where it is not necessary to be too greedy, since leaving positions for the weekend, you can get trapped in the event of a negative verdict of the UK Parliament on the agreement. That is, locally working on the increase in the direction of 1.1160 – 1.1180, forget about the partial exit and the sliding stop. On Monday, we are working on the situation, fortunately, we will already know the outcome of the meeting in Britain, and depending on the decision, you can locally earn on impulses. I think this is an excellent technique for speculators. Based on the above information, we derive trading recommendations:

Indicator analysis Analyzing different sector timeframes (TF), we see that the indicators on all major time intervals retain an upward mood. We see a reflection of the information background and emotional leaving of market participants. Volatility per week / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year. (October 18 was built taking into account the time of publication of the article) The current time volatility is 32 points, which is the average for this time section. It is likely to assume a convergence with the daily average in terms of volatility, but I do not see any excess of this value or sharp fluctuations, and perhaps they will not. Key levels Resistance zones: 1.1180*; 1.1300**; 1.1450; 1.1550; 1.1650*; 1.1720**; 1.1850**; 1.2100. Support zones: 1.1100**; 1.1000***; 1.0900/1.0950**;1.0850**; 1.0500***; 1.0350**; 1.0000***. * Periodic level ** Range level *** Psychological level **** The article is based on the principle of conducting transactions, with daily adjustments. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 18 Oct 2019 05:19 AM PDT Good afternoon, dear traders! Already tonight, we recorded a profit on USD/CAD, which I recommended to sell in the previous recommendation of 10/14/2019. Let me remind you that I recommended to take position in sales after a strong strengthening of CAD against the background of news of unemployment. As expected, the main movement to update the minimum of September began on Wednesday, as written earlier. This was, of course, connected with the abundance of dollar, Canadian and oil news. The main driver, of course, was inflation in Canada itself, after which our medium-term plan was fully implemented, with which I want to congratulate those who were in sales. Working out a trading recommendation: Profit amounted to 1000p for 5zn. I can only wish you a good weekend! The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. What has changed in the Brexit agreement? Posted: 18 Oct 2019 05:19 AM PDT Recent data from the EU summit suggest that Boris Johnson and Jean-Claude Juncker agreed on a "deal" on Brexit. However, for a long time, traders, and many politicians, did not know what exactly, in fact, the EU and Britain agreed on? The answer to this question is interesting even in the context of tomorrow's vote in the British Parliament on the "deal". In addition, although we already know now that representatives of at least three parties in Great Britain, DUP, Labor and Scottish, opposed Johnson's version of the agreement, we still offer to figure out how the current version of the agreement differs from Theresa May's agreement and which was rejected three times Parliament? It can be recalled that the main stumbling block in the negotiations between London and Brussels was the so-called "back-stop" mechanism, which obliged Northern Ireland to remain in a single customs zone until the parties found a way to maintain the transparency of the border between Ireland and Northern Ireland. Accordingly, Belfast should continue to live according to the rules of the European Union, and Great Britain could not fully conduct its own trade policy. The new version of the agreement provides that the EU and Britain will remain in their previous economic relations throughout the transition period, after which the Kingdom will begin to move slightly away from the Bloc, restoring full independence in the areas of migration and trade. With respect to Northern Ireland, a number of changes have been adopted regarding UK-EU trade, which will pass through the country, and the procedure for taxation. Also, after 4 years, it is the Parliament of Northern Ireland that will decide whether to keep the current rules for border transparency or to abandon them. In the second case, the EU and Great Britain will have to offer an alternative within two years. However, the current version of the Brexit agreement also has many shortcomings, on the basis of which many politicians have already refused to accept this agreement. The main reason is the same UK dependence on the European Union. The European Union, in turn, will be able to set duties on any goods, and the amount of VAT for Northern Ireland will not be established in accordance with the rules of the Kingdom. For residents of Northern Ireland, the cost of many goods can rise. In fact, the new version of the agreement also provides for a certain dependence of Great Britain on the European Union through Northern Ireland. Yes, the borders will remain transparent, as London wants, but many EU rules will continue to operate in Northern Ireland, which does not give complete independence and freedom to action on the international stage of London. Based on these considerations - Brexit seems to be there, but the UK will remain dependent on the EU - three parties have already refused to accept the current agreement and the probability of the failure of the "Johnson deal" tomorrow is very high. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 18 Oct 2019 05:00 AM PDT To open long positions on GBP/USD, you need: Buyers of the pound got close to the level of 1.2916, which I paid attention to in my morning forecast, but it was not possible to break above this range yet. Further movement will directly depend on the negotiations of Boris Johnson with the Labor and the Democratic Union Party of Great Britain. If Johnson enters support, demand for the pound will return, and a break and consolidation above the resistance of 1.2916 will lead the pair to new local highs around 1.2997, 1.3037 and 1.3074, where I recommend taking the profits. Any negative background will put pressure on GBP/USD, therefore, when reduced, only the formation of a false breakdown in the support area of 1.2833 will be a signal to buy the pound. If the pair falls below the support of 1.2833, long positions can be returned to the rebound from the lows of 1.2757 and 1.2664. To open short positions on GBP/USD, you need: From a technical point of view, nothing has changed. Sellers need bad news on Brexit, and the formation of a false breakdown in the resistance area of 1.2916 will be an additional signal to sell the pound. However, the more important task of the bears today is to return and consolidate the pair below the support of 1.2833, which will push the pound to the lows of 1.2757 and 1.2664, where I recommend taking the profits. However, such a downward movement will only be possible if the Labor Party refuses to support the Brexit agreement, which will greatly complicate Boris Johnson's "life" before tomorrow's parliamentary vote. In the scenario of further growth of the pound above the resistance of 1.2916, one can look at short positions after testing the highs of 1.2997 and 1.3074. Indicator signals: Moving Averages Trading is just above the 30 and 50 daily averages, but the upward potential of the pound is limited due to the lack of news. Bollinger Bands The growth of the pound is limited by the upper level of the indicator around 1.2895, a breakthrough of which may lead to a new upward wave.

Description of indicators

|

| Posted: 18 Oct 2019 05:00 AM PDT To open long positions on EURUSD, you need: Even in the morning forecast, I paid attention to the false breakdown in the resistance area of 1.123, which allows us to count on further growth of the euro. Now, the main task of the bulls is to update the maximum in the area of 1.1151, and exit to a larger resistance of 1.1189, where I recommend taking the profits. Given that only speeches by representatives of the Federal Reserve System are planned for the afternoon, who have recently been constantly talking about the need to further lower interest rates in the United States, pressure on the US dollar may increase, which will lead to a larger increase in the euro. In the scenario of a return to the support level of 1.123, it is best to postpone purchases until the test of a larger minimum of 1.1090. To open short positions on EURUSD, you need: The sellers did not cope with the morning task, and now all attention will be focused on the resistance level of 1.1151, from which I recommend opening short positions only if there is a false breakdown. A more acceptable level for sales is seen slightly higher, at a new one-month high at 1.1189. If the pressure on the EUR/USD pair returns, and this happens only on condition of negative Brexit news from the British Parliament, a return to the level of 1.1123 will increase the pressure on the pair, which will lead to an update of the minimum of 1.1090, where I recommend taking the profit today. Indicator signals: Moving Averages Trading is above the 30 and 50 moving averages, which indicates the continuation of the bullish market. Bollinger Bands A breakthrough of the upper border of the indicator in the area of 1.1130 provided the market with new buyers.

Description of indicators

|

| Posted: 18 Oct 2019 02:39 AM PDT EUR/USD – 4H.

As seen on the 4-hour chart, the EUR/USD pair closed above the correction level of 100.0% (1.1106), indicating the intention to continue the growth on Friday. Together with this closure, the pair also "overtook" the upward trend channel, which rises a little slower. One way or another, a new buy signal has been received and now traders can count on further quotes growth in the direction of the level of 1.1164. Emerging divergences are not observed today in any indicator, and the consolidation of the euro/dollar pair under the Fibo level of 100.0% will work in favor of the US dollar and some fall in the direction of the correction level of 127.2% (1.1024). While the US Congress is in full swing investigating the possible pressure of Donald Trump on the presidents of some countries (Ukraine, Australia) in order to remove his main rival Joe Biden from the election race, and Trump himself is in conflict with Turkish President Erdogan because of the military conflict in Syria, the euro currency is lulling in economic informational background from the USA and the European Union. There is almost no news related to the euro/dollar pair now, and traders even have to pay attention to Brexit, which over the past three years has been reflected mainly on the chart of the GBP/USD currency pair to find reasons to open deals. Since so far everything has been going smoothly regarding Brexit, London and Brussels have been able to agree, which was confirmed by Johnson and Juncker, the euro also rose slightly on this news. Also yesterday, a strong drop in industrial production in America was recorded, which could not but affect the US dollar. However, constantly on the optimism of traders, the euro currency will not be able to grow. Shortly, regular meetings of the Central Banks of the EU and the United States will be held, at which the issues of reducing key rates will again be on the agenda. Moreover, according to many economists, reducing the rate in America is practically a settled matter. Given yesterday's report on industrial production, I also believe that the rate will again be lowered by 0.25%. Since this will be the third rate reduction, the global downtrend may continue to show signs of a reversal in favor of the European currency. And the more the Fed will lower the rate, it can reach 0% in the future, as Donald Trump wants, the better the euro will feel. In the eurozone, things are frankly bad, but at his last meeting, Mario Draghi is unlikely to go for a new easing of monetary policy. Most likely, changes in it should be expected already with Christine Lagarde at the head of the organization. What to expect from the euro/dollar currency pair today? On October 18, traders may well expect the pair to continue growing towards the level of 1.1164, which is the maximum from August 26. The information background is unlikely to support one of the currencies today, thus, the closing of quotations under the level of 100.0% will be regarded by me as the entry of traders for correction at the end of the week and will expect a fall in the direction of 1.1024. The Fibo grid is based on the extremes of May 23, 2019, and June 25, 2019. Forecast for EUR/USD and trading recommendations: I recommend selling the pair with a target of 1.1024 if the close is made below the level of 1.1106 (100.0% Fibonacci). A stop-loss order above the level of 1.1106. I recommend holding the pair's already open purchases with a target of 1.1164. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 18 Oct 2019 02:39 AM PDT GBP/USD – 4H.

As seen on the 4-hour chart, the GBP/USD pair performed a consolidation above the correction level of 61.8% (1.2836). Thus, today traders have the right to expect continued growth of quotations in the direction of the next correction level of 76.4% (1.3044). However, the informational background makes us wonder more and more whether the pound will fall already on Monday? It is the information background, which will be discussed a little below, that can put everything in its place since the insane growth of the British currency in the last week still looks strange. What would be the movement of the pound/dollar currency pair if traders did not try to predict the outcome of negotiations at the EU summit? Probably not. That is, the GBP/USD pair would remain where it began its ascent of the last week, near the level of 1.2200. Even taking into account the fact that Juncker and Johnson have agreed, it can even be said that the governments of the EU and Great Britain have agreed, the pound should not have grown significantly since this does not matter until the Parliaments of the European Union and Great Britain ratify the agreement. However, traders thought that Brexit "with Deal" is possible as ever, and for some reason the Parliament this time will not put a stick in the wheel for Boris Johnson, and zealously rushed to buy a pound. However, we believe that it is Boris Johnson who will be most likely to be deprived by the deputies to implement his version of the deal. And Boris Johnson himself is to blame for this, who by all means and almost openly wanted to remove Parliament from his affairs so that it would not stop him from implementing Brexit as the Prime Minister himself considers it necessary. As a result, the parliament was angry, through the Court it managed to cancel the suspension of its work, legally obliged Johnson to ask for a postponement if the deal was not reached or if it didn't fit the Parliament. And now, all the participants in the Action have come close to the point where everything will depend on the Parliament of Great Britain. According to rough estimates, Johnson's deal no longer passes through Parliament, as the Labor, Unionists and Democratic Scots refused to support it. Thus, for the transaction to pass on the sidelines of the Parliament, all conservatives and some opposition MPs, for example, Labor, must vote for it. Labor spokesman John McDonnell said: "I do not believe that the agreement will pass, I think it will be rejected, but the numbers will be fairly close." This statement perfectly reflects the mood of the Labor Party, whose leader called the deal "corrupt". And the European Parliament generally refused to vote for the agreement until the results of the vote in Britain are known, I understand very well that the likelihood of an agreement is not very high. What to expect from the pound/dollar currency pair today? The pound/dollar pair completed the close above the Fibo level of 61.8%, so I expect today to continue the growth, which is still difficult to explain. Traders' optimism continues to cause surprise, but if Parliament passes a deal tomorrow, it will turn out that the pound's rise was justified. Otherwise, I will wait for the strongest fall in the British currency. The Fibo grid is based on the extremes of March 13, 2019, and September 3, 2019. Forecast for GBP/USD and trading recommendations: I recommend buying the pair with a target of 1.3044, as it was closed above the Fibo level of 61.8% with the stop-loss order below the level of 1.2836. I recommend considering sales of the pair with the target of 1.2668 today if consolidation below the Fibo level of 61.8% is completed. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment