Forex analysis review |

- Forecast for EUR/USD on October 22, 2019

- Forecast for GBP/USD on October 22, 2019

- Forecast for USD/JPY on October 22, 2019

- GBPUSD approaching resistance, potential for big drop!

- USDNOK pull back below resistance

- #USDX vs EUR / USD vs GBP / USD vs USD / JPY (H4). Comprehensive analysis of movement options from October 21, 2019 APLs

- Fractal analysis of the main currency pairs for October 22

- Insidious dollar: easing, not weakening

- Pound rushes to the clouds

- EUR/USD. October 21. Results of the day. Euro shows readiness to go into a correction after several weeks of growth

- GBP/USD. October 21. Results of the day. Everything goes to the sixth defeat of Boris Johnson

- GBP/USD. Brexit endgame: Johnson and Parliament prepare for decisive battle

- October 21, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- October 21, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- BTC 10.21.2019 - Gap area is holding so far, bulls in control

- GBP/USD 10.21.2019 - Watch for potential break of the rising wedge pattern

- Gold 10.21.2019 - Watch for breakout of the symmetrical triangle

- Trading recommendations for the EURUSD currency pair – placement of trade orders (October 21)

- GBP/USD: plan for the American session on October 21st. The European Commission is ready to give Britain a delay of three

- EUR/USD: plan for the American session on October 21st. Further growth of the euro depends on the situation with Brexit

- Technical analysis of EUR/USD for October 21, 2019

- GBP/USD: The House of Commons has made a knight's move, but Johnson continues to stand his ground

- Trading idea for oil

- Trading recommendations for the GBPUSD currency pair – placement of trade orders (October 21)

- Trading strategy for EUR/USD on October 21st. The last ECB meeting under Mario Draghi

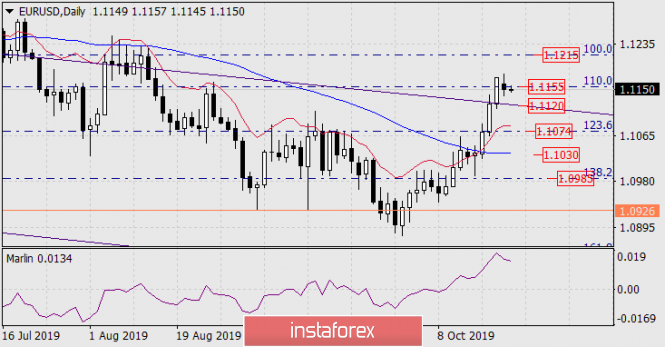

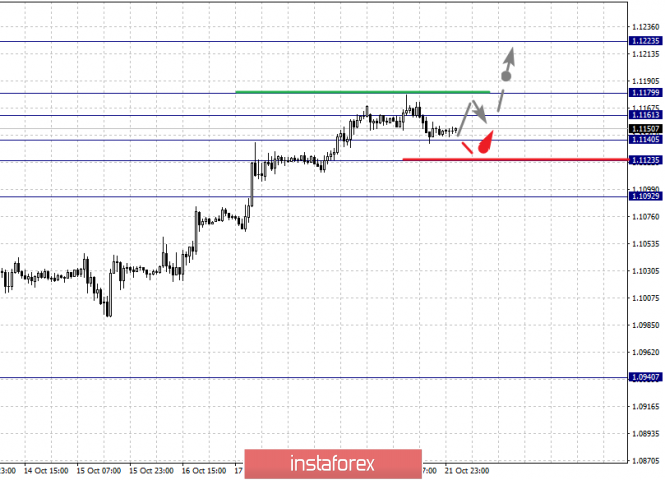

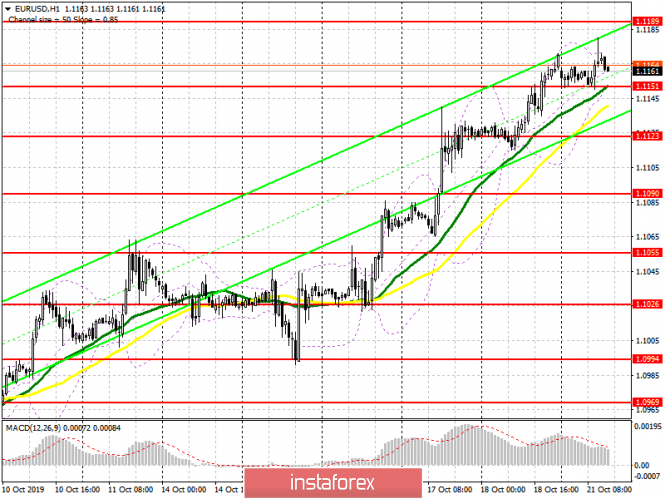

| Forecast for EUR/USD on October 22, 2019 Posted: 21 Oct 2019 09:30 PM PDT EUR/USD The Brexit situation has stalled since the beginning of the new week, and the currency market along with it. The British Parliament refused to vote on the same version of the deal several times. The euro stopped at a Fibonacci level of 110.0%, on a wider story this is the resistance zone of the end of April-the first half of early May, the first half of June 2017, September 2016, etc. The indicators are growing on the daily chart. The main scenario for further events is the euro's fall to the price channel line to the area of 1.1120 and the resumption of growth to the Fibonacci level of 100.0% at the price of 1.1215. Here it is possible to ease the indicators and prepare the market for a decline in the phase of accurate profit taking. Profit-taking will be the main sign of a turnaround, as the volume of purchases has been the largest since the beginning of September. Forecasts on economic indicators are also not in favor of the dollar: home sales in the US secondary real estate market in September are expected to be 5.45 million compared to 5.49 million a month earlier, European PMIs for October will come out on Thursday, which are projected to increase. On the four-hour chart, the Marlin oscillator went down sharply, but it still remains in the growing trend zone. The material has been provided by InstaForex Company - www.instaforex.com |

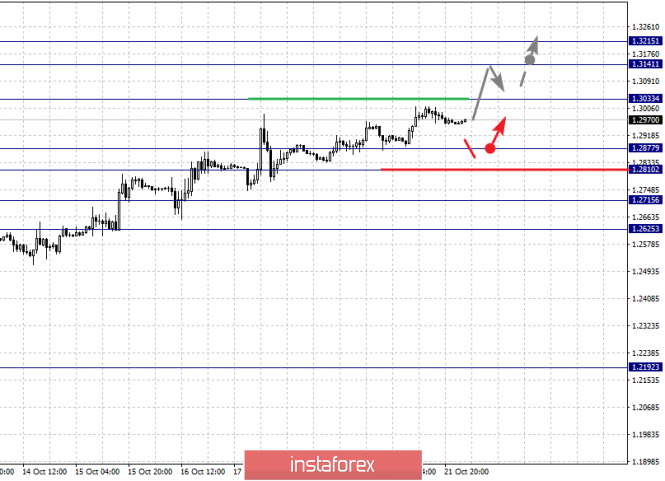

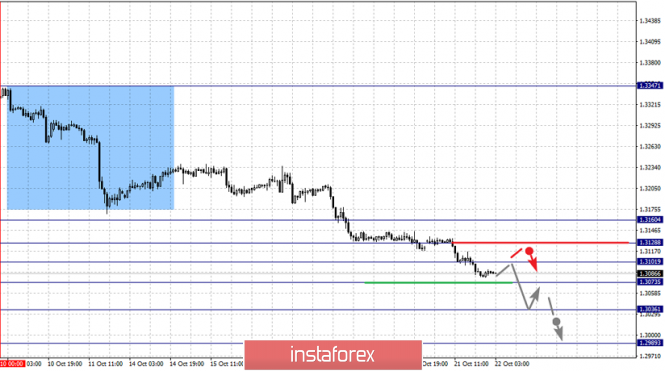

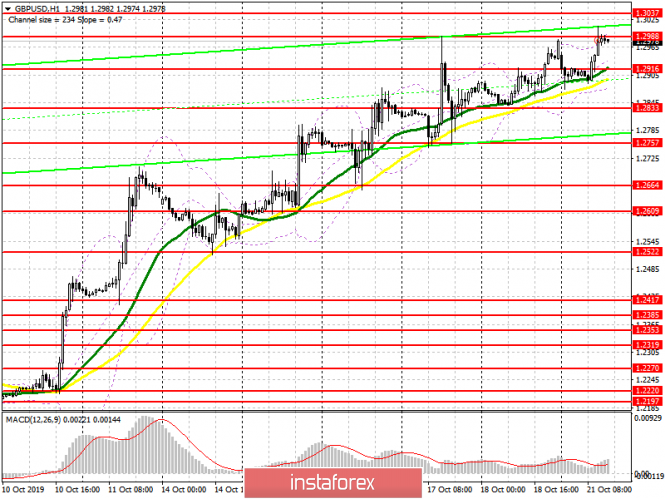

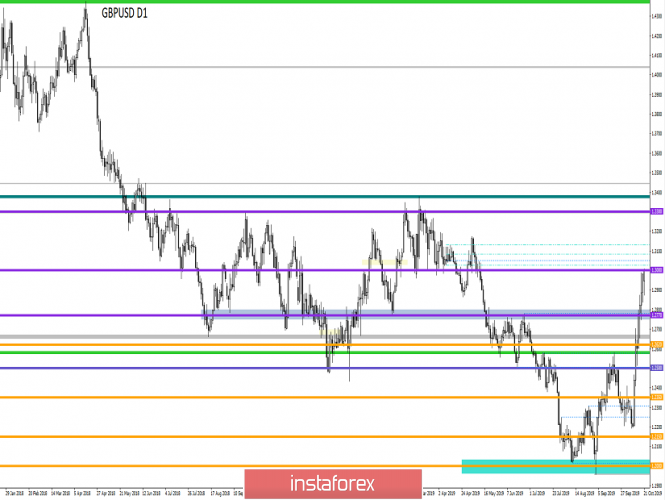

| Forecast for GBP/USD on October 22, 2019 Posted: 21 Oct 2019 09:24 PM PDT GBP/USD The pound traded in a wide range of 140 points on Monday, but against the background of the last two weeks, such dynamics can be called moderate. The situation around Brexit calmed down, the British Parliament refused to vote on the same Johnson proposal several times, work is underway on the changes. Technically, the probability of a reversal has increased - the leading indicator Marlin is turning down from the overbought zone. The growth potential is seen at the Fibonacci level of 61.8% at the price of 1.3062. On the four-hour chart, multiple divergence according to Marlin continues to form, the signal line of the indicator has almost reached the boundary of the transition to the decline zone. Leaving the line in this zone may not allow the pound to grow to a promising target of 1.3062. Consolidating the price under the level of 1.2864 (coincides with the low of yesterday) opens the subsequent targets 1.2814 and 1.2744. The current situation is neutral. The material has been provided by InstaForex Company - www.instaforex.com |

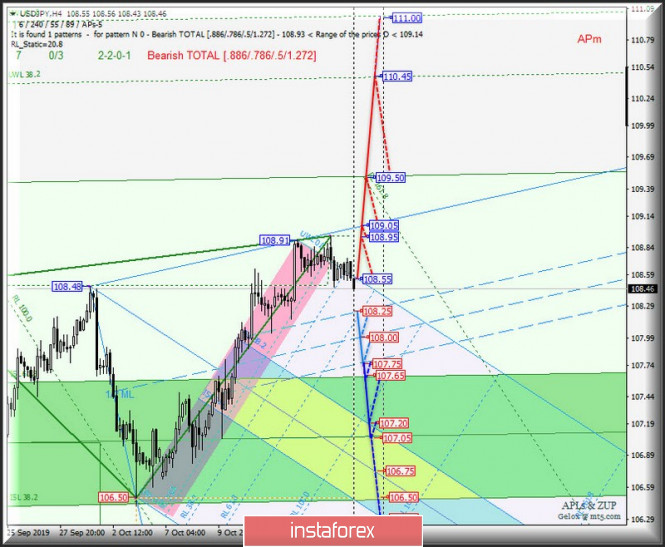

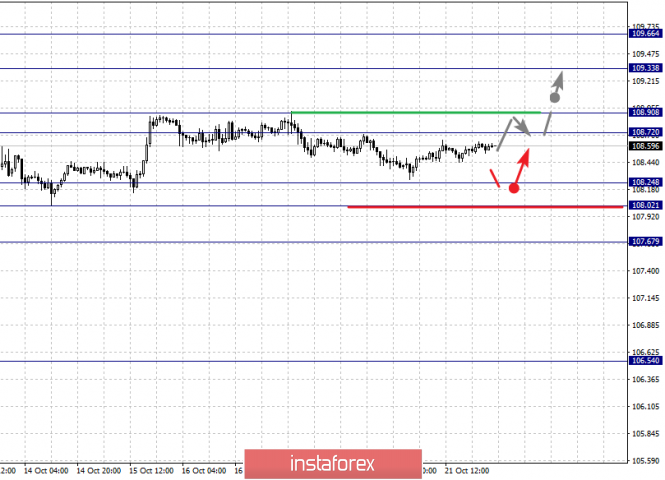

| Forecast for USD/JPY on October 22, 2019 Posted: 21 Oct 2019 08:59 PM PDT USD/JPY Yesterday, the dollar against the yen once again showed approximate stability in the market. External support for the pair still came from the stock market (S&P 500 0.69%), which, in turn, grew due to optimism regarding trade negotiations between the US and China. The risk of further development of a reversal divergence remains on the daily chart. Only a price move above the resistance of the red price channel 108.90 can remove this risk. |

| GBPUSD approaching resistance, potential for big drop! Posted: 21 Oct 2019 07:50 PM PDT 1st resistance level: 1.3406Why is it good: 61.8%, 100% fibonacci extension, 76.4% fibonacci retracement 1st support level: 1.2788Why is it good: horizontal overlap support, 100% fibonacci extension, 23.6% Fibonacci retracement The material has been provided by InstaForex Company - www.instaforex.com |

| USDNOK pull back below resistance Posted: 21 Oct 2019 07:23 PM PDT

50% Fibonacci retracement and 100% Fibonacci extension Take Profit :9.0908176.4% Fibonacci Retracement The material has been provided by InstaForex Company - www.instaforex.com |

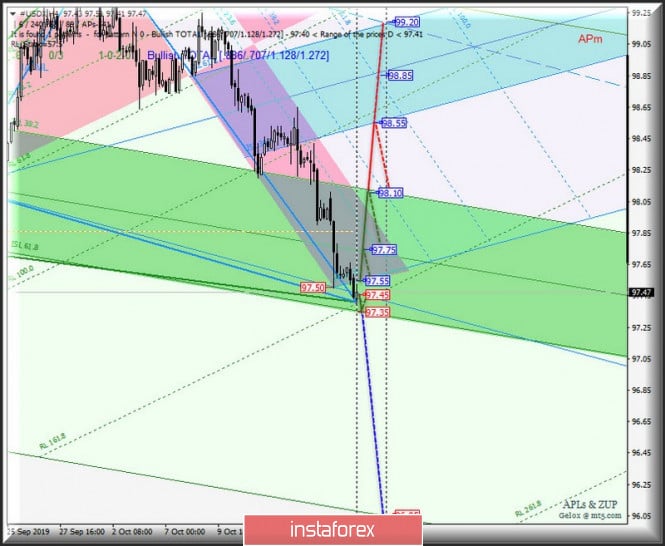

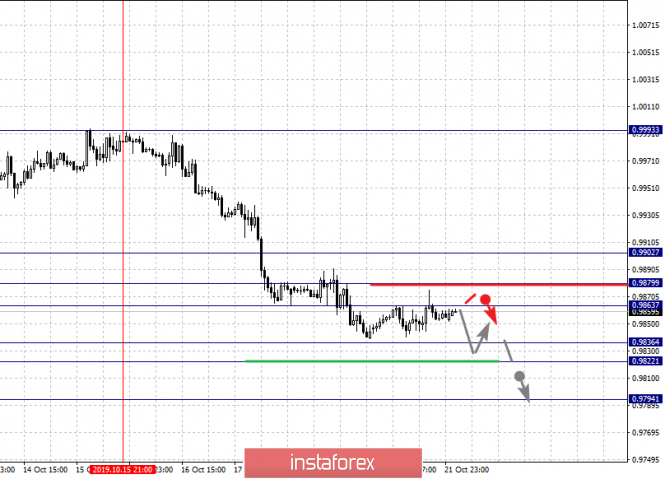

| Posted: 21 Oct 2019 06:28 PM PDT What did Monday, October 21, 2019 prepared for us in the market? Here's a comprehensive analysis of movement options of #USDX, EUR / USD, GBP / USD and USD / JPY (H4) Minuette (H4 time frame) ___________________ US dollar Index From October 21, 2019 the movement of the dollar index #USDX will continue depending on the direction of the breakdown of the range :

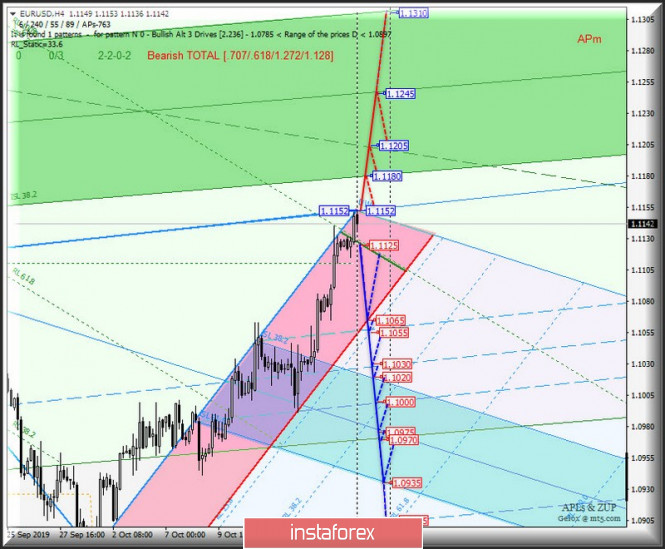

In case of breakdown of the LTL control line Minuette operational scale fork (support level of 97.45) together with the lower boundary of the ISL61.8 (support level of 97.35) equilibrium zone of the Minuette operational scale fork, the downward movement of the dollar index can continue to the FSL Minuette end line (96.05). The breakdown of the SSL Minuette initial line (resistance level of 97.55) will determine the development of movement towards the goals - the Median Line Minuette channel (97.75) - the upper boundary of the ISL38.2 (98.10) equilibrium zone of the Minuette operational scale fork with the prospect of reaching #USDX of the boundaries of the equilibrium zone (98.55 - 98.85 - 99.20) of the Minuette operational scale fork. The details of the #USDX movement are presented in the animated chart. ____________________ Euro vs US dollar The single European currency EUR / USD from October 21, 2019 will begin to develop its movement depending on mining and the direction of breakdown of the range :

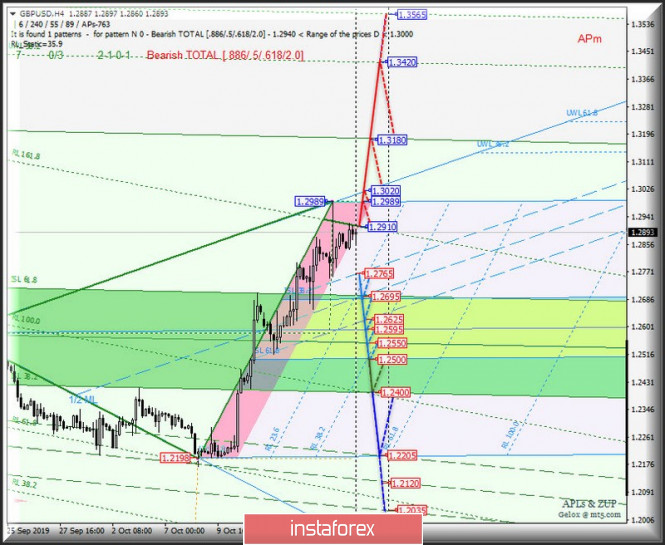

Updating the local maximum - breakdown of the UTL control line (resistance level of 1.1152) of the Minuette operational scale fork - continuation of the upward movement of the single European currency towards the targets - lower boundary of the ISL38.2 (1.1180) equilibrium zone of the Minuette operational scale fork - final Schiff Line Minuette (1.1205) - the median line channel of the Minuette (1.1245). The breakdown of the reaction line RL100.0 (support level of 1.1125) of the Minuette operational scale fork will direct the development of the EUR / USD movement towards the goals - the boundary of the red zone (1.1065) Minuette operational scale fork - the boundaries of the 1/2 Median Line channel (1.1055 - 1.1030 - 1.1000) and the equilibrium zone (1.1020 - 1.0975 - 1.0935) of the Minuette operational scale fork. The details of the EUR / USD movement options are shown in the animated chart. ____________________ Great Britain pound vs US dollar Her Majesty's GBP / USD currency from Monday, October 21, 2019, will begin to develop its movement depending on the development and direction of the breakdown range :

The breakdown of the reaction line RL161.8 (resistance level of 1.2190) of the Minuette operational scale with a consistent breakdown of the initial SSL (1.2989 - local maximum) and control UTL (1.3020) of the lines of the Minuette operational scale fork will determine the continuation of the development of the upward movement of Her Majesty's currency to the final FSL (1.3180) and the warning UWL38.2 (1.3420) lines of the Minuette operational scale fork. The breakdown of the support level of 1.2765 - continuation of the development of the GBP / USD movement within the 1/2 Median Line Minuette (1.2765 - 1.2695 - 1.2625) and equilibrium zones of the Minuette operational scales fork (1.2695 - 1.2595 - 1.2500) and Minuette (1.2695 - 1.2550 - 1.2400) with the prospect of reaching the final line FSL Minuette (1.2205). The details of the GBP / USD movement can be seen in the animated chart. ____________________ US dollar vs Japanese yen As in previous cases, the movement of the currency of the "country of the rising sun" USD / JPY from October 21, 2019 will also be determined by the direction of the breakdown of the range :

The breakdown of the support level of 108.25 - the development of the currency of the "country of the rising sun" will begin to occur in the 1/2 channel Median Line Minuette (108.25 - 108.00 - 107.75) with the prospect of reaching the boundaries of the equilibrium zones of the Minuette operational scale fork (107.65 - 107.05 - 106.50) and Minuette (107.20 - 106.75 - 106.30). The breakdown of the SSL start line (resistance level of 108.55) of the Minuette operational scale fork will make the development of the USD / JPY upward movement towards the targets relevant - local maximum 108.95 - UTL Minuette control line (109.05) - final line FSL (109.50) of the Minuette operational scale fork - warning line UWL38.2 Minuette (110.45). We look at the details of the USD / JPY movement in the animated chart. ____________________ The review is made without taking into account the news background. Thus, the opening of trading sessions of the main financial centers does not serve as a guide to action (placing orders "sell" or "buy"). The formula for calculating the dollar index : USDX = 50.14348112 * USDEUR0.576 * USDJPY0.136 * USDGBP0.119 * USDCAD0.091 * USDSEK0.042 * USDCHF0.036. where power factors correspond to the weights of the currencies in the basket: Euro - 57.6% ; Yen - 13.6% ; Pound Sterling - 11.9% ; Canadian dollar - 9.1%; Swedish Krona - 4.2%; Swiss franc - 3.6%. The first coefficient in the formula leads the index to 100 at the start date of the countdown - March 1973, when the main currencies began to be freely quoted relative to each other. The material has been provided by InstaForex Company - www.instaforex.com |

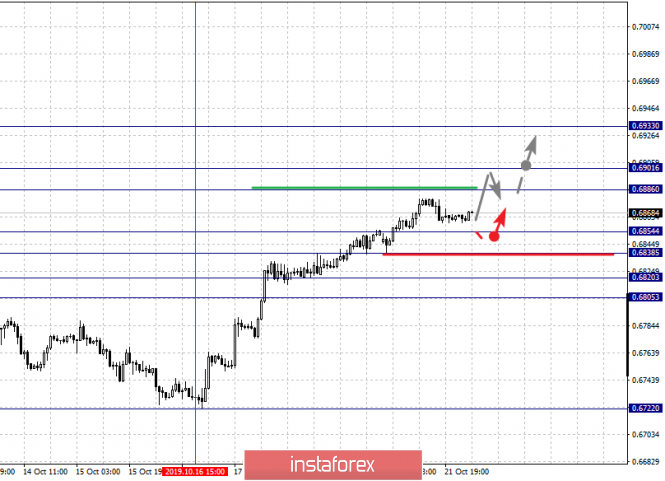

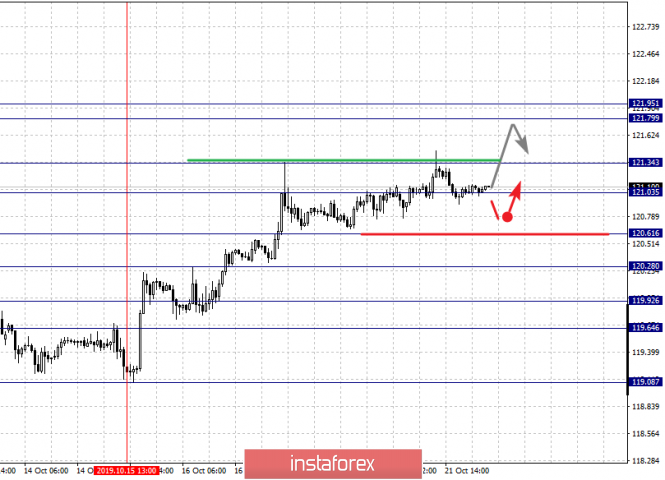

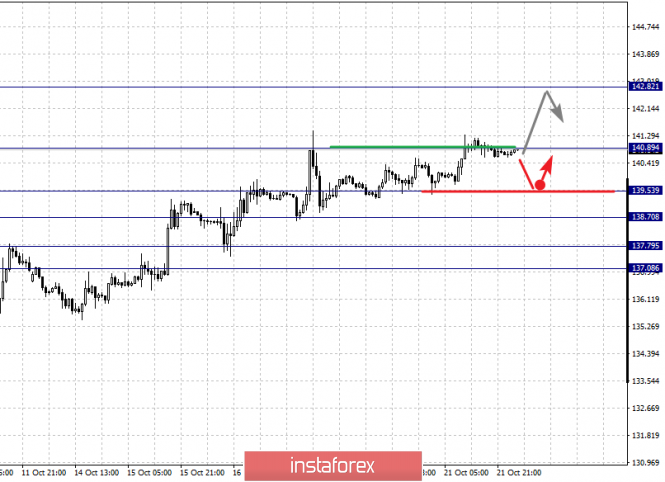

| Fractal analysis of the main currency pairs for October 22 Posted: 21 Oct 2019 05:37 PM PDT Forecast for October 22 : Analytical review of currency pairs on the scale of H1: For the euro / dollar pair, the key levels on the H1 scale are: 1.1223, 1.1179, 1.1161, 1.1140, 1.1123 and 1.1092. Here, we continue to monitor the development of the upward cycle of October 9. Short-term upward movement is expected in the range 1.1161 - 1.1179. The breakdown of the last value will lead to a movement to a potential target - 1.1223, when this level is reached, we expect a pullback to the bottom. Short-term downward movement is possibly in the range 1.1140 - 1.1123. The breakdown of the last value will lead to a long correction. Here, the goal is 1.1092. This level is a key support for the top. The main trend is the local ascending structure of October 8. Trading recommendations: Buy: 1.1162 Take profit: 1.1175 Buy 1.1181 Take profit: 1.1220 Sell: 1.1140 Take profit: 1.1124 Sell: 1.1121 Take profit: 1.1093 For the pound / dollar pair, the key levels on the H1 scale are: 1.3215, 1.3141, 1.3033, 1.2939, 1.2810, 1.2734 and 1.2625. Here, we are following the development of the upward cycle of October 9. The continuation of the movement to the top is expected after the breakdown of the level of 1.3035. Here, the potential target is 1.3141. Price consolidation is in the range of 1.3141 - 1.3215. Short-term downward movement is expected in the range of 1.2877 - 1.2810. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.2715. This level is a key support for the top. Its breakdown will lead to the formation of potential for the downward cycle. Here, the target is 1.2625. The main trend is the upward structure of October 9. Trading recommendations: Buy: 1.3035 Take profit: 1.3140 Buy: 1.3143 Take profit: 1.3215 Sell: 1.2877 Take profit: 1.2813 Sell: 1.2808 Take profit: 1.2717 For the dollar / franc pair, the key levels on the H1 scale are: 0.9902, 0.9879, 0.9863, 0.9836, 0.9822 and 0.9794. Here, we are following the development of the local descending structure of October 15. Short-term downward movement is expected in the range 0.9836 - 0.9822. The breakdown of the latter value will lead to a pronounced movement to a potential target - 0.9794. We expect a pullback to the top from this level. Short-term upward movement is possibly in the range of 0.9863 - 0.9879. The breakdown of the latter value will lead to an in-depth correction. Here, the goal is 0.9902. This level is a key support for the downward structure. The main trend is the local descending structure of October 15. Trading recommendations: Buy : 0.9863 Take profit: 0.9875 Buy : 0.9881 Take profit: 0.9900 Sell: 0.9836 Take profit: 0.9822 Sell: 0.9820 Take profit: 0.9796 For the dollar / yen pair, the key levels on the scale are : 109.66, 109.33, 108.90, 108.72, 108.24, 108.02 and 107.67. Here, we are following the development of the upward cycle of October 4. Short-term upward movement is expected in the range 108.72 - 108.90. The breakdown of the latter value will lead to a movement to the level of 109.33. Price consolidation is near this level. For the potential value for the top, we consider the level of 109.66. Upon reaching this level, we expect a consolidated movement, as well as a pullback to the bottom. Short-term downward movement is expected in the range of 108.24 - 108.02. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 107.67. This level is a key support for the top. The main trend: the upward cycle of October 4. Trading recommendations: Buy: 108.90 Take profit: 109.30 Buy : 109.34 Take profit: 109.65 Sell: 108.24 Take profit: 108.03 Sell: 108.00 Take profit: 107.70 For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3160, 1.3128, 1.3101, 1.3073, 1.3036 and 1.2989. Here, we consider the descending structure of October 10 as a medium-term initial condition. The continuation of movement to the bottom is expected after the breakdown of the level of 1.3073. In this case, the target is 1.3036. Price consolidation is near this level. For the potential value for the bottom, we consider the level of 1.2989. Upon reaching this level, we expect a pullback to the top. Short-term upward movement is possibly in the range of 1.3101 - 1.3128. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.3160. This level is a key support for the downward structure. The main trend is the downward cycle of October 10. Trading recommendations: Buy: 1.3101 Take profit: 1.3126 Buy : 1.3130 Take profit: 1.3160 Sell: 1.3073 Take profit: 1.3038 Sell: 1.3034 Take profit: 1.3000 For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6933, 0.6901, 0.6886, 0.6854, 0.6838, 0.6820 and 0.6805. Here, we are following the development of the ascending structure of October 16. Short-term upward movement is expected in the range of 0.6886 - 0.6901. The breakdown of the latter value will lead to the development of pronounced movement to a potential target - 0.6933. From this level, we expect a pullback to the bottom. Short-term downward movement is possibly in the range of 0.6854 - 0.6838. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 0.6820. The range of 0.6820 - 0.6805 is the key support for the upward structure. The main trend is the upward structure of October 16. Trading recommendations: Buy: 0.6887 Take profit: 0.6900 Buy: 0.6904 Take profit: 0.6930 Sell : 0.6854 Take profit : 0.6840 Sell: 0.6836 Take profit: 0.6820 For the euro / yen pair, the key levels on the H1 scale are: 121.95, 121.79, 121.34, 121.03, 120.61, 120.28, 119.92 and 119.64. Here, we are following the development of the local ascendant structure of October 15. Short-term upward movement is expected in the range 121.03 - 121.34. The breakdown of the level of 121.35 should be accompanied by a pronounced upward movement. Here, the target is 121.79. Price consolidation is in the range of 121.79 - 121.95. From here, we expect a correction. Short-term downward movement is possibly in the range of 120.61 - 120.28. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 119.92. This level is a key support for the top. Its passage at the price will lead to the formation of initial conditions for the downward cycle. In this case, the first goal - 119.64. The main trend is the upward structure of October 15. Trading recommendations: Buy: 121.05 Take profit: 121.34 Buy: 121.36 Take profit: 121.76 Sell: 120.60 Take profit: 120.33 Sell: 120.25 Take profit: 119.94 For the pound / yen pair, the key levels on the H1 scale are : 142.82, 140.89, 139.53, 138.70, 137.79 and 137.08. Here, we are following the development of the upward cycle of October 8. The continuation of movement to the top is expected after the breakdown of the level of 140.90. In this case, the potential target is 142.82. Upon reaching which, we expect consolidation, as well as a pullback to the bottom. Short-term downward movement is possibly in the range of 139.53 - 138.70. The breakdown of the last value will lead to a long correction. Here, the target is 137.79. The range of 137.79 - 137.08 is the key support for the top. The main trend is the medium-term upward structure of October 8. Trading recommendations: Buy: 141.00 Take profit: 142.80 Sell: 139.50 Take profit: 138.75 Sell: 138.65 Take profit: 137.80 The material has been provided by InstaForex Company - www.instaforex.com |

| Insidious dollar: easing, not weakening Posted: 21 Oct 2019 03:49 PM PDT The US currency, despite many years of stability and high demand, is going through difficult times. It is under pressure due to both external factors and internal ones, to which the dollar stubbornly resists. Analysts are certain that a strong greenback will be weakened by force in the near future. Among the reasons that weaken the position of the US dollar, analysts call negative trends in the US economy and the unstable political situation in Europe associated with Brexit. Such factors have a negative impact on the EUR/USD exchange rate, preventing it from stabilizing. Last week, the pair reached seven-week highs, approaching the impressive mark of 1.1170. The market's response was an increase in the number of "bullish" forecasts, which have not yet lost their relevance. Many analysts doubt that the US dollar will retain its long-standing status as a safe haven currency in the near future. They are certain that it is actively on the heels of the European currency. However, a number of analysts urge not to rush to conclusions, as the situation around Brexit plays against the euro. At the end of last week, giving hope for a speedy resolution of this protracted issue, it left the market with its nose. It is possible that the topic of Brexit will be rebooted, which will negatively affect not only the British pound, but also the dollar against the euro. In the last few weeks, experts have recorded a noticeable slump of the US currency. Some analysts put forward a version that the American elite is trying to artificially weaken the greenback. Experts came to such conclusions, observing the bickering of US President Donald Trump with the Federal Reserve and attempts to pressure the regulator. The head of the White House has repeatedly stated that it is the policy of the Fed that makes the national currency too strong.If the dollar strengthens its position, the market will have to artificially weaken it, analysts said. One of the current key tasks, experts believe, is to prevent a possible collapse of the US stock market. In this regard, a slight weakening of the US currency plays an important role. To prevent a financial disaster, the Fed has taken to eliminate the deficit of dollar liquidity, filling the economy with "live" money with the help of quantitative easing (QE). Simply put, the Fed has turned on the printing press. Recall, the previous round of pumping the US economy with "fresh" money took place in 2013. At the same time, Fed Chairman Jerome Powell plays with words, not calling the current build-up of the balance sheet a program of QE, but the essence does not change: rates are reduced, dollars are printed, and the greenback gradually subsides. According to Scotiabank, the US currency will continue to weaken until the beginning of next year. The reason for this, experts believe, is a decrease in investor interest in safe haven assets. Earlier, the US currency managed to maintain this status, but now the situation has changed. Progress in the US-China trade talks and small but positive developments regarding Brexit added to the dollar's negativity. Earlier, the escalation of conflicts provoked an increase in Treasury purchases by non-residents, contributing to the flow of capital to the United States. Currently, it's problems are exacerbated by negative macro statistics, as well as an excessive number of short positions in the euro and the pound, which market players intend to close. A similar situation provokes the EUR/USD rally, analysts said. The pair was trading in the range of 1.1177–1.1178 on Monday morning, October 21. Analysts warned of its fall in the near future. The calculation turned out to be correct: the further decline in the EUR/USD pair really took place. In the moment, the pair fell to 1.1156–1.1157. It later crossed that threshold. Currently, the EUR/USD pair is in the range 1.1168–1.1169. After a sharp subsidence, it gained momentum and successfully won back the lost positions. Last Friday, the euro strengthened amid a weakening US dollar, which came under pressure amid positive Brexit news. Experts associate the US currency with a persistent tin soldier who is not afraid of difficulties and is tempered in the fight against them. The greenback is really trying to maintain and strengthen its gains, despite opposing factors. Two ex-heads of the Commodity Futures Trading Commission (CFTC) tried to help the greenback. They were Christopher Giancarlo, chairman of CFTC, and Daniel Gorfine, head of LabCFTC. They proposed to the US authorities a plan to save the global hegemony of the national currency. It consists in introducing a digital dollar based on blockchain technology. According to financiers, the digital format will help the US currency maintain high competitiveness in the future. According to the calculations of C. Giancarlo and D. Gorfine, the virtual dollar can be used for financial transactions both in the United States and abroad. Specialists note that the new payment system has several advantages over the existing one. These include an almost instantaneous transaction speed, the ability to conduct micropayments, a high level of security and transparency. The catalyst for this initiative was concern over the possible loss of the dominant role of the dollar in the global financial system. The loss of greenback leadership in the global economy will lead to disastrous consequences, C. Giancarlo and D. Gorfin said. If this scenario is realized, the financial and exchange markets may suffer, and the global demand for US debt will substantially subside, financiers conclude. The material has been provided by InstaForex Company - www.instaforex.com |

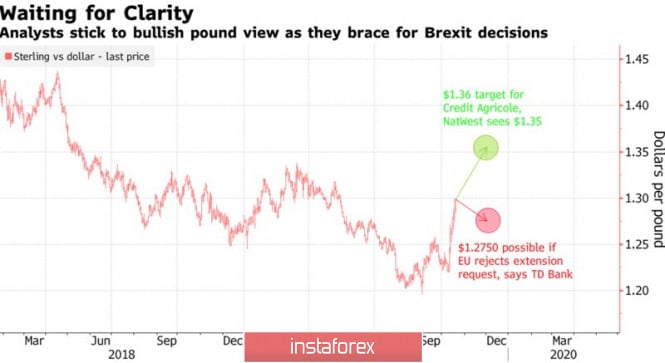

| Posted: 21 Oct 2019 03:49 PM PDT Despite the almost bare economic calendar, all the attention of investors on forex is focused on the British pound. According to Mark Carney, Great Britain marked the beginning of global uncertainty in 2016, which slowed business activity and GDP in most countries of the world. It can put an end to this by voting for a draft dissolution agreement with the EU. Boris Johnson also called for support of the document, arguing that any delay would harm the interests of the United Kingdom, its EU partners and relations between them. However, the British Parliament may have a different opinion. The sterling has not responded to macro statistics for a long time and is calling for political news. In this regard, an increase in unemployment from 3.8% to 3.9% and disappointing inflation statistics (fact +1.7%, forecast + 1.8% YOY) remained almost unnoticed by investors. All their attention has shifted to Brexit. The prime minister of Great Britain managed to find a common language with the EU. Now he needs 320 votes in Parliament to enter, and not get into the story. In fact, the head of the Cabinet of Ministers needs to lure 61 opponents to his side, which does not seem unrealistic. According to Goldman Sachs, the chance of a disorderly Brexit dropped to 5%. This circumstance makes the correction potential of GBP/USD limited. MUFG expects the pound to find haven in the range of $1.3-1.35 if lawmakers approve the deal. UBS Global Wealth Management also talks about the $1.35 level. TD-Bank believes that the pair is able to rewrite the May high near 1.3185, however, the contract rejected by the Parliament will trigger a wave of correction to 1.264-1.266. Robobank sees an even deeper low at around 1.22. Pound Forecasts The fact that the bulls continue to dominate the market was shown by the sterling reaction to the decision of MPs to vote for the proposal to postpone the approval of the deal. As a result, Boris Johnson, in order to obey the law, was forced to write a letter to the EU asking that they prolong the transition period. The prime minister did not sign this document and sent another to Donald Tusk, in which he expressed confidence that Britain would leave the EU on October 31. The opposition party believes that the head of the Cabinet of Ministers behaves childishly and threatens him with court in the event of a disorderly Brexit. In my opinion, everything goes to the point that the deal will be approved by the British Parliament on the falling flag. The bulls on GBP/USD believe this, pushing the pair to the psychologically important mark of 1.3. The fact that they managed to gain a foothold above 1.29 indicates the seriousness of the intentions of sterling buyers. Technically, after a clear combination of patterns "Shark" and 5-0, the upward trend of the analyzed pair is directed to the target of 261.8% on the AB = CD model. It is located near 1.309. A necessary condition for maintaining control over the pound by the bulls and continuing the rally is to consolidate GBP/USD quotes above the Pivot level of 1.29. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 21 Oct 2019 03:49 PM PDT 4-hour timeframe Amplitude of the last 5 days (high-low): 30p - 55p - 64p - 75p - 56p. Average volatility over the past 5 days: 56p (average). The first trading day of the week for the EUR/USD pair was held in absolutely neutral trading without strong exchange rate changes. The pair only began to decline during the US trading session, which could develop into a downward correction. Unfortunately, no important and interesting macroeconomic reports and other news were available to traders today. Thus, market participants were deprived of fundamental influence. Brexit, which miraculously began to influence the movement of the euro/dollar pair in the last week, can once again be put on hold. The trade war between the United States and the European Union seems to be paused before it even begins. In such a situation, traders can only think about what will happen this Thursday, and whether something will happen at all. Recall that this day is the only one this week when there will be important macroeconomic events. The ECB meeting with the announcement of the results and press conference of Mario Draghi, indexes of business activity in the services and manufacturing sectors of the US and Europe, orders for durable goods in the US. Apart from this list, of course, is the ECB meeting, the last ECB meeting for Mario Draghi. However, firstly, he still has two days to go. Secondly, judging by analyst forecasts, this time no changes in the monetary policy of the European Union will follow. The Federal Reserve will hold a meeting next, next week, where changes in monetary policy may just follow, namely the third consecutive reduction in the key rate. If this happens, the imbalance between the Fed and the ECB rates will continue to decline, which will definitely be in favor of the euro. The faster the difference in rates decreases, the more chances the euro has on the formation of a full-fledged upward trend. At the moment, despite several weeks of euro growth, it is impossible to say that the hegemony of the US dollar is complete. We believe that the EUR/USD pair will be prone to a downward correction until Thursday, despite any news regarding Brexit. The last week, when there was a correlation between the pound and the dollar, we consider to some extent an accident. Thus, in order to continue strengthening, the euro needs new fundamental foundations. At least some hint of stabilization of the situation in the eurozone by Mario Draghi, improving business activity indexes in the EU, rising wages and retail sales. If this does not happen, then it will be difficult for the euro to continue to show growth against the dollar. From a technical point of view, the MACD indicator shows that a downward correction has already begun. Thus, the immediate goal for this correction is the Kijun-sen line, which is located near the level of 1.1089, built on the basis of the average volatility of the currency pair. By the way, if the pound shows just fantastic volatility, then the euro is quite mediocre. 56 points a day is not much. The difference in the movements of the two main pairs remains quite high, from our point of view. Trading recommendations: EUR/USD may begin to adjust. Thus, traders are advised to wait until the completion of the current correction and only after that resume trading on the increase with the goals of 1.1200 and 1.1230. It is recommended to return to euro sales not earlier than when the bears overcome the critical line of Kijun-sen, which will be the first signal of a change in trend. In addition to the technical picture, fundamental data and the time of their release should also be taken into account. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. October 21. Results of the day. Everything goes to the sixth defeat of Boris Johnson Posted: 21 Oct 2019 03:49 PM PDT 4-hour timeframe Amplitude of the last 5 days (high-low): 134p - 198p - 221p - 241p - 142p. Average volatility over the past 5 days: 187p (high). The pound continues to feel just fine, while in the "coffin" of Boris Johnson's political career, the Parliament continues to hammer in the last nails. Not one! Boris Johnson did not win a single victory as prime minister of Great Britain. From the very beginning of his reign, and even up to this point, Boris Johnson insisted on Brexit in any scenario, most importantly, no later than October 31. For several months he was preparing the country for a "hard" exit, spending millions of pounds from the budget to inform all sectors of the population, a Yellowhammer plan was being developed for the case of an irregular "divorce", Johnson himself was giving out interviews at all angles, stating that he'd rather "die in a ditch" than delay Brexit again (this phrase has already become a byword). And all this ended with the fact that the Parliament at the most crucial moment, when Johnson agreed with the EU on a deal, did not even vote for this bill, but instead immediately adopted another one, which obliges Johnson to ask for an extension from the European Union. Theoretically, this whole pun could still end with Britain leaving Johnson's "deal", as the prime minister will probably demand a vote for the agreement, which he has long and tediously discussed with EU leaders. However, this will not change anything at the moment. Brexit will be rescheduled unless the European Union refuses to do so. And the European Union has already stated that, in principle, it is ready to provide a new respite to London. The only question is the timing of this very delay. If the UK Parliament nevertheless accepts Johnson's "deal," then the delay can be very short, from two weeks to three months. If Parliament rejects the "deal" with the European Union for the fourth time, some countries of the EU will insist on a longer postponement of the Brexit date. Johnson himself is to blame for the fact that the Parliament dislikes him. Perhaps if he did not expel the members of his own party to the left and right, but tried to establish a dialogue with them, if he did not arrange for a completely stupid prorogation of Parliament, did not conflict openly with the deputies, then he would collect an extra 10-20 votes in his favor at the polls. For example, Saturday's vote to postpone Brexit garnered just 20 more votes for than against. By the way, we also do not see any special chances that Parliament will give Johnson the "deal" a go-ahead. Most likely, all the same members of Parliament who voted "for" the postponement on Saturday will vote "against" the deal on Monday or Tuesday. The problem with Brexit from the very beginning was that it was not a majority opinion in the classical sense. Indeed, the ratio of votes 99% - 1% and 51% - 49%, in fact, both cases have a certain majority. It is only almost unanimous in the first version, and in the second it is practically absent. In the situation with the 2016 referendum - the second option. Accordingly, the British Parliament was divided into just two parts, and immediately into several parts, opponents and simply supporting Brexit, "hard" Brexit, "soft" Brexit and a bunch of different options for Britain to exit and absent from Brussels jurisdiction. And since, in order to leave the EU, one needs at least half of the votes of the Parliament, this is precisely where problems arise. Moreover, 48% of the inhabitants of the United Kingdom are against any Brexit. This applies not only to different segments of the population, but also to entire countries. For example, Scotland almost completely voted against, and if any Brexit scenario is implemented, it is preparing to hold its own referendum on independence. Thus, any delay in Brexit will continue to have a beneficial effect on the British currency, which today, unlike the euro, has not even begun to adjust. Trading recommendations: The GBP/USD currency pair continues its upward movement with the goal of a first resistance level of 1.3140. In recent weeks, the MACD has often turned down, as it has nowhere to go up. The upward movement itself is almost recoilless. Thus, long positions remain relevant, especially for those who are already in them. In addition to the technical picture, fundamental data and the time of their release should also be taken into account. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. Brexit endgame: Johnson and Parliament prepare for decisive battle Posted: 21 Oct 2019 03:49 PM PDT The information hype around Brexit is gaining momentum every day, however, today there were more and more headlines in the form of a question. If you narrow down the entire information flow as much as possible, then the message of all the news is inherently opposite: "agreed" or "did not agree". The context of these words is already clear to many without further explanation: Johnson's renewed deal, which is currently being tested by the British Parliament, is at stake. Here it is necessary to recall the five pillars of the new deal on which the relationship between London and Brussels will be based (unless, of course, the Parliament approves the deal). Firstly, the parties agreed that Great Britain leaves the jurisdiction of all the laws of the European Union, closing in on the action of the national legal field. Secondly, Britain leaves the jurisdiction of the European Court. Thirdly, the tax policy of Britain is controlled and determined exclusively by London. Fourth, Britain will now have the right to conclude its own free trade agreements (being in the orbit of the EU, London could not act as a separate party). Fifthly, Northern Ireland remains the customs territory of Britain, however, the "secret" (or "translucent") customs border will nevertheless pass along the Irish Sea, that is, between Northern Ireland and Great Britain, but not between Northern Ireland and the Republic of Ireland . In practice, this means that merchant ships will be forced to undergo customs checks in the Northern Irish ports, and in some cases, the British authorities will levy customs duties - if goods from third countries do not enter the EU internal market. But in those cases when the goods will go to the European market, "British law" will not "work", but the EU customs rules. Following this pattern, Northern Ireland will remain de jure within the customs territory of Great Britain, and de facto (when it comes to goods entering the European market) in the customs union of the European Union. The most heated debate flared up around the last two points of the deal. In the first half of the day, information appeared that the DUP representatives would support the Labour amendment, which in turn would actually block the draft deal (in terms of implementing its own trade policy). But later, official representatives of the Unionists announced that they would not support the Labour Party in this matter. After that, the pound paired with the dollar again approached the boundary of the 30th figure. In general, the market continues to react violently to completely unverified information. Positive signals are enthusiastically picked up by traders and the pound is rapidly gaining momentum, but then doubts about the prospects of approving the deal return to the market. As a result, the GBP/USD pair throughout Monday has been trying to impulse to break through the 30th figure and gain a foothold over this target, but the contradictory fundamental background does not allow this. This morning, rumors were circulating in the market that Johnson would make a deal for the so-called "preliminary vote", which was designed to answer the question: are the deputies ready in principle to support the proposed deal or not? But the speaker of the British Parliament, John Bercow, did not allow this to be done. He said that this issue should not be put to the vote again, as this is the same proposal that was submitted for consideration on Saturday (and the law prohibits voting twice on the same issue without significant changes in substance). Johnson's supporters tried to convince the speaker of the Parliament, arguing that the prime minister sent letters to Brussels asking for a postponement - and this supposedly is the necessary "new circumstances". But the speaker called these arguments unconvincing: there will be no repeat vote on Brexit today. However, this fact did not upset the bulls of the GBP/USD pair: as one member of Johnson's cabinet assured, the process of discussing Brexit's prospects in any case entered the "endgame" stage (the so-called final part of a chess or checkers game). According to the government, the party being played is ending in accordance with the main points of the prime minister's scenario, contrary to the protests of many British politicians. Is this so - we will find out over the next few days when the vote on the amendments should take place, and in fact, on the draft deal. Given the prevailing fundamental background, the pound will "keep the defense" in any political situation. If MPs nevertheless approve the deal, the pair will jump by a few figures, otherwise Brexit's issue will most likely be postponed for several months - either for early parliamentary elections or for technical purposes in order to bring national legislation into line with the provisions of the updated deal . According to the British press, European Council President Donald Tusk and German Chancellor Angela Merkel have already agreed on a postponement option, and the European Parliament is ready to vote for this issue next Thursday. In other words, the pound is "protected" from hard Brexit from all sides - both from the side of the British Parliament and from the supportive position of Brussels. Therefore, in the near future, the British currency will demonstrate a fighting spirit, in anticipation of the key stages of voting within the walls of the House of Commons. The material has been provided by InstaForex Company - www.instaforex.com |

| October 21, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 21 Oct 2019 09:04 AM PDT

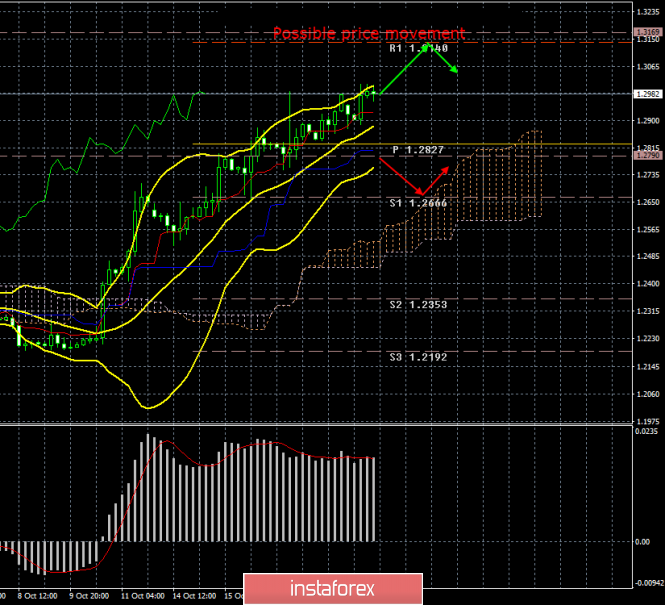

In the period between September 13 - 20, a short-term Wedge-Pattern was demonstrated around 1.2550. Shortly after, the reversal wedge-pattern was confirmed to the downside on September 23 demonstrating a successful bearish closure below 1.2450. On September 25, the depicted bullish channel was invalidated as well with significant full-body bearish candlesticks which managed to achieve bearish closure below 1.2400. Bearish persistence below 1.2400-1.2440 allowed more bearish decline to occur towards the price levels of 1.2210 where a recent Double-Bottom reversal pattern was originated with neckline located around 1.2400. Two weeks ago, the price zone of 1.2400-1.2415 (reversal pattern neckline) was breached to the upside allowing further bullish advancement to occur towards 1.2800 then 1.300 where the GBP/USD looks overbought outside the depicted bullish channel. This week, the GBP/USD pair is failing to achieve a successful bullish breakout above the depicted SUPPLY-zone (1.2980-1.3000) which corresponds to a previous Prominent TOP that goes back to May 2019. That's why, sideway consolidations are expected to be demonstrated around the current price levels down to 1.2780 (Key-Level) until breakout occurs in either directions (More probably to the downside). Initially, Bearish persistence below 1.2870 is needed to bring further bearish decline towards 1.2780 where an Intraday Key-Level comes to meet the pair. Trade Recommendations: Intraday traders are advised to wait for a bearish breakout below 1.2870 for a valid SELL entry. T/P level to be placed around 1.2780 while S/L should be placed above 1.2920. The material has been provided by InstaForex Company - www.instaforex.com |

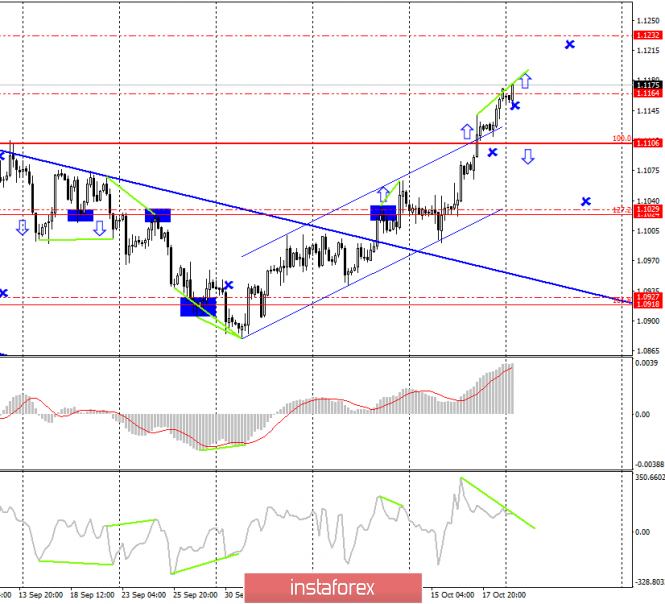

| October 21, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 21 Oct 2019 08:17 AM PDT

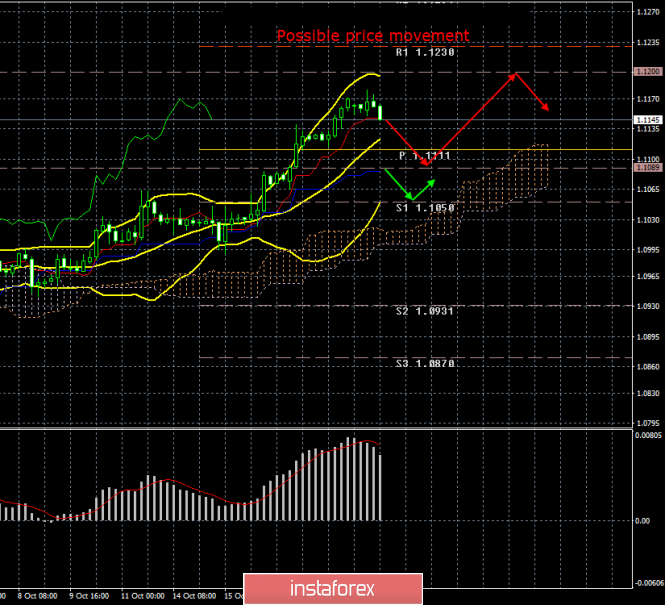

Since September 13, the EUR/USD has been trending-down within the depicted short-term bearish channel until signs of trend reversal were demonstrated around 1.0880 (Inverted Head & Shoulders Pattern). Shortly After, a bullish breakout above 1.0940 confirmed the mentioned reversal Pattern which opened the way for further bullish advancement towards (1.1000 -1.1020) maintaining bullish movement above the recent bullish trend. Temporary bearish rejection and a sideway consolidation range were demonstrated after hitting the price zone of (1.1000 -1.1020) on October 7. That's why, initial Intraday bearish pullback was demonstrated towards 1.0940-10915 where another bullish swing was initiated. The intermediate-term outlook remains bullish as long as the EUR/USD pair pursues its current movement above 1.0990 (Last Prominent Bottom). Moreover, the recent bullish breakout above 1.1120 (100% Fibonacci Expansion) enhanced further bullish advancement towards the price zone of (1.1175-1.1195) where early signs of bearish rejection is currently being demonstrated. That's why, a bearish pullback will probably be expressed towards the depicted Keyzone (1.1090-1.1120) where another valid BUY entry can be offered. Trade recommendations : Intraday traders can have a valid SELL entry around the current price levels (1.1175-1.1195). T/P levels to be located at 1.1135 and 1.1120. S/L should be placed above 1.1195. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC 10.21.2019 - Gap area is holding so far, bulls in control Posted: 21 Oct 2019 07:14 AM PDT To open long positions on Bitcoin you need: At the moment, the task of the bulls is to keep trading above the gap area 7.960 and try to go towards the resistance levels at 8.447 and 8.900. To open short positions on Gold you need: Main task for bears will be to fill the gap at 7.950 and then eventually break the support 7.777. The first goal will be the potential test of 7.441 where I recommend profit taking. Signals of indicators: MACD – Momentum is not that big the still overall on positive side above the zero. Bollinger bands: The upper boundary of the indicator in the area of 8.270 will act as resistance.

|

| GBP/USD 10.21.2019 - Watch for potential break of the rising wedge pattern Posted: 21 Oct 2019 07:02 AM PDT To open long positions on GBP/USD you need: At the moment, the task of the bulls is to break the resistance at 1.2997, above which we can expect continued growth towards 1.3173, where I recommend taking profits. Even after the Brexit vote, the GBP remained inside of the channel, which is indication of the indecision of investors. To open short positions on Gold you need: You will need the breakout of the support at the price of 1.2870. The first goal will be to return to support at 1.2790. However, a more important task will be updating the low of 1.2700-1.2540, where I recommend profit taking. Signals of indicators: MACD – Momentum is very slowing down even the price is trying to go higher, which might be first indication of the potential sell off. Bollinger bands: The upper boundary of the indicator in the area of 1.3000 will act as resistance.

|

| Gold 10.21.2019 - Watch for breakout of the symmetrical triangle Posted: 21 Oct 2019 06:49 AM PDT To open long positions on Gold you need: At the moment, the task of the bulls is to break the resistance at 1.498, above which we can expect continued growth towards 1.519, where I recommend taking profits. There are no high impact events tomorrow and the market would need fresh new money in order to get out of the defined symmetrical triangle. You can also try to buy first pullback if you see the breakout of the resistance. To open short positions on Gold you need: You will need the breakout of the support at the price of 1.484. The first goal will be to return to support at 1.477. However, a more important task will be updating the low of 1.460, where I recommend profit taking. Signals of indicators: MACD – Momentum is very low and it is confirming sideways market activity, which usually proceeds before the breakout Bollinger bands In case the Gold declines, support will be provided by the lower boundary of the indicator around 1.485. The upper boundary of the indicator in the area of 1.494 will act as resistance.

|

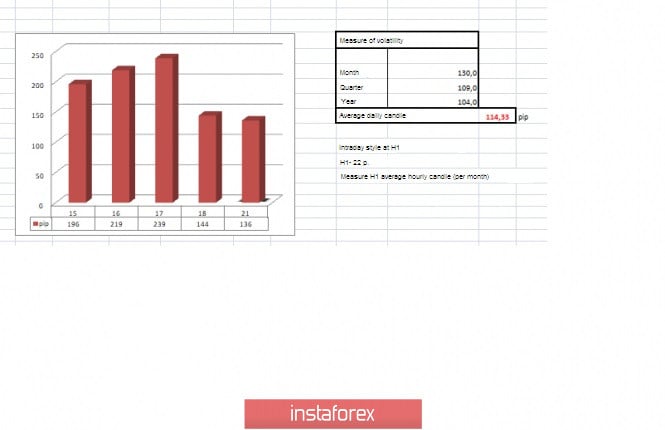

| Trading recommendations for the EURUSD currency pair – placement of trade orders (October 21) Posted: 21 Oct 2019 06:24 AM PDT The euro/dollar currency pair failed to slow down the upward trend, and as a result, the last week ended with a new local peak. From technical analysis, we see an almost unchanged picture in the form of an inertial upward move, where there were no corrections and rollbacks. The existing move drew a vertical growth line in the market with small stops in the form of consolidation, where temporary regrouping of trading forces took place. The characteristic overbought has been hanging on the market for several days, and it does not frighten the market participants a bit, thereby once again confirming the effect of the emotional mood. Analyzing the hourly Friday day, we see that after a slight accumulation in the area of 1.1110/1.1130, during the Pacific and Asian trading sessions, there was a characteristic regrouping of trading forces, followed by a surge of buyers in the period of 10:00-23:00 hours (time on the trading terminal). As discussed in the previous review, speculators had the best profitability among all traders, therefore, is even outside the market, they felt comfortable. Of course, not all traders decided to take a short vacation, as the remarkable morning accumulation of 1.1110/1.1130 provided an excellent platform to enter the market. Thus, the method of working on the breakdown of existing boundaries was an excellent tactic, which as a result brought profit. Looking at the trading chart in general terms (daily period), we see a vertical move, which is difficult to call even a correction. Thus, is it true that the status of the current movement is an oblong correction, and not just screwed on the emotions of the euro? There is no definite answer in this judgment, since each side, whether it is technical or emotional, has its facts and evidence, so you should wait a little longer to clear the main market tacts. Friday's news background didn't have any statistical data for Europe and the United States, thereby once again leading its march to the information background, giving out a proportionally new part of the noise. After the European Union agreed on a new version of the agreement, the turn went to the side of Britain, which on Saturday (October 19) held an emergency meeting in parliament, whereas a result it rejected the agreement for the fourth time in a row. This amazing, long-running series "Brexit" is striking in its scale and, most importantly, patience, as more than three years of going nowhere is worth a lot. So, this time we have another request to delay Brexit for 3 months, for which the British MPs voted for the majority. The absurdity of sending as many as three letters to the EU is striking, but we have already described this in more detail in the article on the pound. Now it's another matter, the EU, represented by the head of the European Council, Donald Tusk, has confirmed receipt of a letter requesting a postponement, and it seems that referring to diplomatic sources, the EU is ready to postpone Britain's exit from the EU if Boris Johnson fails to push through this week agreement through parliament. Today, in terms of the economic calendar, we do not have data on Europe and the United States, which cannot be said about the background of Brexit. Today, the UK Parliament will re-introduce the Brexit agreement to the vote. Further development Analyzing the current trading chart, we see an attempt to resume the upward move after a small stop, where the maximum of the last week was already pierced by the quote, having a new value in the face of the mark of 1.1179. Detailing the hourly available day, we see that with the entry of Europeans, there was a surge in the market, but it was short-lived, and then again there was a slowdown. The burst period is 10:00 – 11:00 hours (trading terminal time). In turn, speculators fixed previously open positions from 1.1130 with exit points of 1.1160 – 1.1180. A wait-and-see position is being made for the most optimal entry into the market. It is likely to assume that in the case of a moderate information background, a temporary compression may occur within 1.1145/1.1180, where further work will be carried out relative to the specified framework by the method-boundary breakdown. At the same time, the tactics of monitoring the news feed and alternative sources of information (Twitter) are preserved when analyzing the behavior of the quote. Based on the above information, we derive trading recommendations:

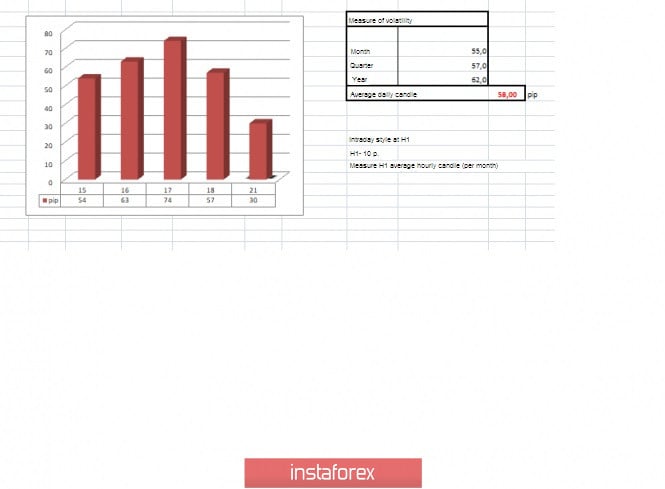

Indicator analysis Analyzing different sectors of timeframes (TF), we see that the indicators, in general, signal a continuing upward trend due to a massive inertial movement. Indicators in the short term took a variable position in terms of downward interest due to temporary accumulation. Volatility per week / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year. (October 21 was built taking into account the time of publication of the article) The volatility of the current time is 30 points, which is the average for this period. It is likely to assume that due to the information background, volatility may still increase, unless, of course, there is a characteristic slowdown. Key levels Resistance zones: 1.1180*; 1.1300**; 1.1450; 1.1550; 1.1650*; 1.1720**; 1.1850**; 1.2100. Support zones: 1.1100**; 1.1000***; 1.0900/1.0950**; 1.0850**; 1.0500***; 1.0350**; 1.0000***. * Periodic level ** Range level *** Psychological level **** The article is based on the principle of conducting transactions, with daily adjustments. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 21 Oct 2019 05:17 AM PDT To open long positions on GBP/USD, you need: Buyers of the pound returned to the market today and managed to gain a foothold above the resistance of 1.2916, which led to an update of the maximum of 1.2988. I paid attention to all this in my morning review. Growth was boosted by news that the European Commission is ready to grant the UK a three-month exit delay, but Boris Johnson's main fight in parliament is not yet over. Bulls should now count on the breakdown of the resistance of 1.2988, which will strengthen the demand for the pound and lead to the renewal of the next monthly highs in the area of 1.3037, 1.3074 and 1.3125, where I recommend taking the profits. However, such a large increase will only happen on the news of the UK Parliament's approval of the Prime Minister's deal. In the scenario of GBP/USD decline in the second half of the day, long positions can be looked at after a correction and a false breakdown from the minimum of 1.2916, or a rebound from the larger supports of 1.2833 and 1.2757. To open short positions on GBP/USD, you need: Sellers are still holding resistance at 1.2988, however, the main movement will be built on Brexit news. Another failure of Boris Johnson may lead to the formation of a false breakdown at the maximum of 1.2988, which will act as a signal to sell the pound and lead the pair to the support of 1.2916. However, only the breakdown of this range will force buyers to take profits and leave the market for a while, which will collapse GBP/USD to a minimum of 1.2833 and 1.2757, where I recommend taking the profits. In the scenario of further growth of the pound on the trend and positive news on the vote, I do not recommend considering short positions in the pair above the resistance of 1.3037. Indicator signals: Moving Averages Trading is above the 30 and 50 daily averages, which indicates the upward potential of the British pound. Bollinger Bands If the pound falls, the lower border of the indicator around 1.2845 will provide support.

Description of indicators

|

| Posted: 21 Oct 2019 05:17 AM PDT To open long positions on EURUSD, you need: Data on German producer prices pleased traders in the first half of the day, which led to a slight increase in the pair, but further strengthening depends on the situation with Brexit. From a technical point of view, the overall picture in the pair remained the same. To continue the growth of the euro, it is necessary to hold the level of 1.1151, as well as the formation of a false breakdown on it, which will update the highs in the area of 1.1189 and 1.1226, where I recommend taking the profits. However, without good news on Brexit, it is unlikely to succeed. Another failed attempt by Johnson to advance his agreement could put pressure on the pair. Therefore, in the scenario of a decline under the level of 1.1151 in the second half of the day, you can count on buying from the minimum of 1.11123, as well as a rebound from the larger support of 1.1090. To open short positions on EURUSD, you need: The main task of the bears today will be the return of the pair under the support level of 1.1151, which was not done in the first half of the day. Only this will increase the pressure on the euro and lead to lows in the area of 1.123 and 1.1090, where I recommend taking the profits. However, all this can be expected only after the news of another failure of Boris Johnson, or the failure of the vote on the agreement. The divergence, which I paid attention to in my morning review, has worked itself out, and as long as the trade is below the resistance of 1.1189, there is a possibility of a larger bearish correction. In the scenario of EUR/USD growth above this level, it is possible to sell immediately on the rebound from the maximum of 1.1226. Indicator signals: Moving Averages Trading is above the 30 and 50 moving averages, which indicates the continuation of the bullish market. Bollinger Bands The breakthrough of the lower border of the indicator in the area of 1.1151 will provide the market with new sellers of the euro.

Description of indicators

|

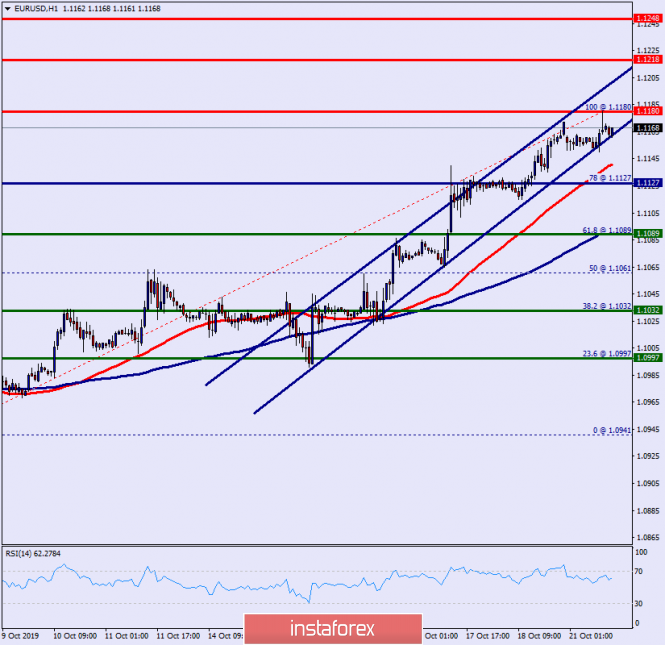

| Technical analysis of EUR/USD for October 21, 2019 Posted: 21 Oct 2019 04:34 AM PDT Overview: The EUR/USD pair is consolidating the weekly gains above the 1.1127 support as bears remain in control. So, the major support has already set at the level of 1.1127 which coincides withe the ratio of 78% Fibonacci retracement levels. The Euro is trading above the main EMAs, suggesting bullish momentum in the near term. Support is seen at the 1.1127 zone and the 1.1089 price level. The price is moving in a bullish channel now. Furthermore, the price has been set above the strong support at the level of 1.1127. This support has been rejected several times confirming the veracity of a uptrend. Amid the previous events, the price is still moving between the levels of 1.1127 and 1.1218. Additionally, the RSI starts signaling an upward trend. As a result, if the EUR/USD pair is able to break out the first resistance at 1.1180, the market will riase further to 1.1218 in order to test the weekly resistance 2. Consequently, the market is likely to show signs of a bullish trend. Hence, it will be good to buy above the level of 1.1127 with the first target at 1.1180 and further to 1.1218. However, stop loss is to be placed below the level of 1.1089. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD: The House of Commons has made a knight's move, but Johnson continues to stand his ground Posted: 21 Oct 2019 03:54 AM PDT

The story of Britain's exit from the European Union more resembles a soap opera: the characters change, the conditions change, and when it seems that the end is near, there are some twists and turns again. Last Thursday, London and Brussels agreed on a Brexit deal. The House of Commons was due to hold an emergency meeting on Saturday to decide whether or not to approve the agreement. However, parliamentarians – instead of approving the document – obliged the head of the government of the country, Boris Johnson, to ask the EU for a new delay of Brexit – this time, until January 31, 2020. On October 19, three letters were sent from the office of the British Prime Minister to Brussels: Benn's statutory motion for three months postponement without the Prime Minister's signature, clarification from the UK Ambassador to the EU and a personal letter already signed by B. Johnson, in which he expresses his disagreement with the extension of the release of Misty Albion from the alliance. "The decision to accept the petition, the sending of which is dictated by the parliament, remains at the discretion of the European Council, as well as the proposal of an alternative period of delay. However, my position and the position of the government, which I made clear from the moment I took the post of Prime Minister and made it clear to Parliament today, is that a further delay will harm the interests of the United Kingdom and our EU partners, as well as our relations," – B. Johnson wrote. He called on the EU to bring the "divorce" process to an end and move on to the next stage of relations, building them based on a long history of friendship and good neighborliness. The EU will postpone the UK exit from the bloc until February if the country's parliament does not approve the deal this week, The Times reports, citing its sources. Meanwhile, the British government is still preparing to leave the EU without a deal. "This is our firm position. We have the capacity and the means to do it," said Michael Gove, who was appointed by B. Johnson to be responsible for preparing this scenario. Shadow Brexit Minister Keir Starmer, in turn, said that the Labor Party will support this week's proposal to hold a second referendum on the United Kingdom's exit from the EU. "This transaction, or any other, must be taken over by the people, who must decide whether we accept this transaction and leave the EU or reject it and remain," he explained. The GBP/USD pair started the new trading week with a decline of 0.5% amid the continuing uncertainty around Brexit but quickly managed to recover to 1.30. The reason for increased optimism was the recent statements of representatives of the Democratic Union Party of Northern Ireland (DUP), according to which they refused to support amendments to the customs union. Previously, the DUP had intended to unite with the Labor Party and vote for these amendments, which would block B. Johnson's draft deal and prevent the UK from implementing its trade policy. Credit Agricole specialists expect that in the medium term, the pair GBP/USD will rise to 1.36. At the same time, they recommend using any attempts to drop the British currency to buy it at more favorable levels. "Brexit postponement news should reassure investors since the risk of Misty Albion leaving the EU without a deal would be minimized in this case," Credit Agricole said. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 21 Oct 2019 03:53 AM PDT Good afternoon, dear traders, I present to your attention a trading idea for oil. On Friday, there was an excellent short initiative on the American session starting from the level of 54.7. The Americans were selling oil the entire session. I remind you that the increase in oil production in the United States is not the first, or even the third, week in a row. As mentioned earlier, this production will eventually lead to an oversupply of oil in the oil storage facilities, which, with constant demand, will lead to a fall in the price of black gold. I remind you that oil has a very important old psychological level of $50.5 – $50 per barrel, which we have already approached several times. In this regard, I recommend taking short positions in order to update the quote of $50. The breakdown itself can be both true and false, but the price of 50 will be very likely in the coming weeks. And all who buy oil the last few months, are forced to hide their risks for this quote. This trap of buyers will close sooner or later – a matter of time. Thank you for your attention and success in trading! The material has been provided by InstaForex Company - www.instaforex.com |

| Trading recommendations for the GBPUSD currency pair – placement of trade orders (October 21) Posted: 21 Oct 2019 03:53 AM PDT By the end of the last trading week, the pound/dollar currency pair once again showed high volatility of 144 points, resulting in bringing the quotation closer to the control level. From technical analysis, we see a steady upward interest, where the quote once again approached the psychological level of 1.3000, where the trading week closed. In addition to the vertical growth of 783 points – it is a strong emotional mood of market participants, which pushes the quote up. Emotions in the composition with information background created what we have now in the form of a bullish rally. It is also worth considering that as part of the entire array of the move (03.09.19 – 18.10.19), pa long downward move played with touching historical lows (1.19570, wherein the primary correction an injection informational background turned into an emotional and, as a fact, in what we have now. Analyzing the hourly Friday day, we see a two-stage upward move: First 09:00-11:00; the second is 19:00-23:00 (time on the trading terminal), which is divided by a short consolidation of versatile "Doji" candles. As discussed in a previous review, speculators have earned enough profit to afford for a while, but are out of the market. Of course, not all market participants adhere to this position and local inputs relative to the established boundaries of 1.2830/1.2940 were still made. Looking at the trading chart in general terms (daily period), we see a frightening vertical move, without any rollbacks or corrections. Naturally, he did not remain without attention, and everyone unanimously started talking about a trend change as soon as the quotation went through the second correction in order. Is this the case? – in terms of technical analysis, there are signals of changing trends, if you focus on the period of the history of 2.5-3 years. If the emphasis is put on deeper time intervals of 10-11 years, then it is not so critical here, the current price change and the trend change is too early to speak. In this discussion, there is another theory, but we have already talked about it above, the emotional composition of market participants. Friday's news background did not include statistics on the UK and the United States, which cannot be said about the information background. So, the main background fell on Saturday and Sunday, where for the first time in 40 years, the British Parliament decided to work on a day off. The agenda, of course, was the Brexit process, where deputies rejected the agreement for the fourth time but approved an amendment that obliges Prime Minister Boris Johnson to request another delay from the EU. Is it not revenge on the part of the deputies whom Johnson had previously sent on vacation, but the fact of the delay was a fact, Brexit continues to be in the zone of uncertainty. Forced request. This is how you can characterize the request for a delay, which was sent by Boris Johnson to the European Union, or rather there were three letters. So, the first message was about postponing Brexit from October 31, 2019, to January 31, 2020, without the signature of Boris Johnson. The second letter, already signed by Johnson, is in terms of justification that the postponement is a mistake and the government will not abandon attempts to conduct a transaction agreed upon with the EU through parliament and the prime minister is confident that everything will be done by October 31. In a third letter, a note was sent to Brussels signed by Sir Tim Barrow, the representative of Britain in the European Union. It explains that the first letter was sent solely to enforce the law. Johnson himself, before sending him, phoned European leaders and warned that it was not from him, but from the parliament. We have such a show with clowns, on the European side in the person of the head of the European Council Donald Tusk, it is confirmed that letters have been received with a request for a postponement, and now consultation with EU leaders is required. Later news came that the European Union did not mind postponing the exit if Johnson did not manage to close the deal by the end of the month. Today, in terms of the economic calendar, we do not have statistics on Britain and the United States, thus the information background will continue its march. So, the UK government on Monday will re-submit the Brexit agreement to the Parliament, the deputies have prepared several amendments to it, including such radical as a possible repeat of the referendum. Further development Analyzing the current trading chart, we see the characteristic hopes of market participants for a possible agreement in the British Parliament and at the same time for a fairly positive reaction of the European Union regarding the delay. The next emotions that the market reflects on a spontaneous background are nothing more. By detailing the fluctuations, we see that during the period of the Pacific and Asian trading sessions, there was a sluggish pullback within 70 points, but already with the release of Europeans to the market, regular leaps occurred. (09:00 current hour, time at the trading terminal) In turn, speculators actively monitoring the news flow and the price-fixing point above the psychological level of 1.3000. Relative to the night and morning time interval, the points of local stagnation were in the area of 1.2874/1.2920. It is possible to assume that the characteristic price spikes will continue to please speculators, where positions are built due to the direction of incoming information regarding Brexit. That is, any positive rumors, facts, comments on Brexit will continue to push the pound up, as you know, with a mirror background and vice versa. In terms of technical analysis, we already have a breakdown of the local peak on October 17 (1.2988), where the characteristic overbought is not even discussed when emotions rule the ball. Thus, a breakdown of the psychological level is just a point in time. Based on the above information, we concretize trading recommendations:

Indicator analysis Analyzing different sector timeframes (TF), we see that due to the next surge of long positions, the indicators took a single upward position, which reflects the overall background of the market. It is worth considering that due to strong emotions, paired with the background of information, indicators can change arbitrarily, misleading. Volatility per week / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year. (October 21 was built taking into account the time of publication of the article) The volatility of the current time is 136 points, which already exceeds the daily average by 19%. It is probable to assume that in case of preservation of a forcing information background volatility still can grow. Key levels Resistance zones: 1.3000; 1.3170**; 1.3300**. Support zones: 1.2770**; 1.2700*; 1.2620; 1.2580*; 1.2500**; 1.2350**; 1.2205(+/- 10p.)*; 1.2150**; 1.2000***; 1.1700; 1.1475**. * Periodic level ** Range level *** The article is based on the principle of conducting transactions, with daily adjustments. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading strategy for EUR/USD on October 21st. The last ECB meeting under Mario Draghi Posted: 21 Oct 2019 02:28 AM PDT EUR/USD – 4H.

As seen on the 4-hour chart, the EUR/USD pair performed an increase to the level of 1.1164 and can perform a close over it in the next few hours. This will allow traders to count on the continuation of growth in the direction of the next maximum level from August 13 – 1.1232. The upward trend channel remains valid, however, the quotes of the euro/dollar pair have already flown much higher than it. A bearish divergence is brewing in the CCI indicator, the formation of which will allow us to expect some drop in quotations, but it should be understood that this divergence will be corrective, that is, a strong fall should not be expected, and I would not recommend opening sales on this signal. The key event for traders this week will undoubtedly be the meeting of the European Central Bank. This meeting is noteworthy for being the last in Mario Draghi to lead the organization. Further, on November 1, his post will be taken by Christine Lagarde, who will "rake the Augean stables." The key question now is whether there will be another lowering of the ECB key rate, or will Ms. Lagarde deal with this issue already? Most expert agencies agree that Draghi will not lower the rate for the second time in a row. But the economic reports of the last month from the eurozone hint at the opposite. The effect of a net reduction in the deposit rate to -0.5% has not yet been observed. Inflation continues to slow, industrial production to decline, and the index of business activity is falling. Along the chain, these indicators will also pull down other equally important indices. For example, GDP. Thus, the EU economy still needs to be stimulated, and it's quite serious. The fact that a new round of the quantitative easing program announced at the last meeting of the regulator, will also begin to operate in favor of not reducing the rate. That is, most likely, the ECB will not be in a hurry with new stimulus measures since you need to first evaluate the effect of the QE program. No less important and significant event will be the press conference of Mario Draghi. Over the past few years, the euro currency has finally started to grow against the US dollar. The reasons are different, but how will the ECB Chairman react to this phenomenon? Will he react at all? Also, Mario Draghi's assessment of the current economic situation, his risk assessment, and forecasts for the main economic indicators of the European Union are important. Until Thursday, traders will continue to monitor any information relating to Brexit, because what is happening in the UK is again very reminiscent of the word "chaos". There is even reason to believe that the euro is growing for the company with the pound sterling, positively meeting the news about the possible transfer of Brexit to 2020. What to expect from the euro/dollar currency pair today? On October 21, traders can expect the pair to continue growing towards the level of 1.1232, which is the maximum from August 13. The information background is unlikely to support one of the currencies today, but the mood of traders is bullish. Thus, further growth of quotations is more preferable. The Fibo grid is based on the extremes of May 23, 2019, and June 25, 2019. Forecast for EUR/USD and trading recommendations: I recommend selling the pair with a target of 1.1024 if the close is made below the level of 1.1106 (100.0% Fibonacci). A stop-loss order above the level of 1.1106. I recommend holding open purchases of the pair with the target of 1.1232 with the transfer of the stop-loss order below the level of 1.1164. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Entry: 9.13967

Entry: 9.13967

No comments:

Post a Comment